#energy-efficient PSUs

Explore tagged Tumblr posts

Text

Upgrading Your Gaming Rig with the Latest Computer Parts

In the rapidly evolving world of PC gaming, staying ahead of the curve is essential for an immersive and competitive experience. Upgrading your gaming rig with the latest computer parts not only boosts your system’s performance but also ensures that you’re getting the most out of your gaming sessions. This comprehensive guide will walk you through the key components to consider when upgrading…

View On WordPress

#cooling systems#CPU upgrades#cutting-edge gaming technology#DIY PC upgrades#energy-efficient PSUs#future-proofing components#gaming experience#gaming rig upgrades#GPU enhancements#high-resolution gaming#immersive gaming setup#latest computer parts#motherboard compatibility#NVMe SSD#PC gaming advancements#PC performance boost#power supply units#professional PC building#quality computer components#RAM optimization#ray tracing#SSD technology#system compatibility#thermal management

1 note

·

View note

Text

The Ultimate Guide to Choosing the Right Power Supply for Your Needs

When it comes to building or upgrading a computer, one of the most critical components you need to consider is the power supply. Often overlooked, the power supply is the backbone of your system, ensuring that all other components receive the necessary power to function correctly. In this comprehensive guide, we’ll explore everything you need to know about power supply units (PSUs), including how to choose the right one for your needs, the different types available, and why it’s essential to invest in a high-quality power supply.

Why is a Power Supply Important?

The power supply is responsible for converting the alternating current (AC) from your wall outlet into direct current (DC) that your computer’s components can use. Without a reliable power supply, your system could experience instability, crashes, or even permanent damage to its components. A high-quality power supply ensures that your computer runs smoothly, efficiently, and safely.

Key Functions of a Power Supply

Voltage Regulation: A good power supply maintains a consistent voltage level, preventing fluctuations that could harm your components.

Efficiency: Efficient PSUs convert more of the AC power into DC power, reducing energy waste and lowering your electricity bills.

Protection Features: Modern power supply units come with built-in protections such as over-voltage, under-voltage, over-current, and short-circuit protection to safeguard your system.

Types of Power Supply Units

There are several types of power supply units available, each designed for specific needs and applications. Understanding the differences between them can help you make an informed decision.

1. ATX Power Supplies

ATX (Advanced Technology Extended) power supply units are the most common type used in desktop computers. They come in various wattages and form factors, making them suitable for a wide range of systems, from basic office PCs to high-end gaming rigs.

2. SFX Power Supplies

SFX (Small Form Factor) power supply units are designed for compact PCs, such as mini-ITX builds. Despite their smaller size, they still offer sufficient power for most components, making them ideal for space-constrained setups.

3. Modular Power Supplies

Modular power supply units allow you to connect only the cables you need, reducing clutter and improving airflow within your case. This type of PSU is particularly popular among enthusiasts who prioritize cable management and aesthetics.

4. Non-Modular Power Supplies

Non-modular power supply units come with all cables permanently attached. While they are generally more affordable, they can be challenging to manage, especially in smaller cases.

5. Semi-Modular Power Supplies

Semi-modular power supply units offer a middle ground between modular and non-modular PSUs. They come with essential cables permanently attached, while additional cables can be connected as needed.

How to Choose the Right Power Supply

Selecting the right power supply for your system involves considering several factors, including wattage, efficiency, form factor, and additional features. Here’s a step-by-step guide to help you make the best choice.

1. Determine Your Power Requirements

The first step in choosing a power supply is to determine how much power your system needs. You can use online PSU calculators to estimate the wattage required based on your components. It’s essential to choose a PSU with a wattage rating that exceeds your system’s requirements to ensure stability and allow for future upgrades.

2. Consider Efficiency Ratings

Power supply efficiency is measured by its 80 PLUS certification, which indicates how effectively the PSU converts AC power to DC power. The higher the certification (e.g., 80 PLUS Bronze, Silver, Gold, Platinum, Titanium), the more efficient the PSU. A more efficient power supply not only reduces energy consumption but also generates less heat, leading to a quieter and cooler system.

3. Choose the Right Form Factor

Ensure that the power supply you choose fits your case. Most standard ATX cases accommodate ATX PSUs, but smaller cases may require SFX or other form factors. Always check your case’s specifications before purchasing a PSU.

4. Look for Additional Features

Modern power supply units come with various features that can enhance your system’s performance and longevity. Some of these features include:

Modular Cabling: As mentioned earlier, modular PSUs allow for better cable management and improved airflow.

Silent Operation: Some PSUs are designed to operate quietly, making them ideal for noise-sensitive environments.

High-Quality Components: PSUs with high-quality capacitors and other components tend to be more reliable and durable.

5. Consider Future Upgrades

If you plan to upgrade your system in the future, it’s wise to choose a power supply with a higher wattage than you currently need. This will ensure that your PSU can handle additional components, such as a more powerful GPU or extra storage drives.

Common Power Supply Mistakes to Avoid

When selecting a power supply, it’s easy to make mistakes that could compromise your system’s performance or even cause damage. Here are some common pitfalls to avoid:

1. Underpowered PSU

Choosing a power supply with insufficient wattage can lead to system instability, crashes, and even hardware failure. Always ensure that your PSU can handle your system’s power requirements.

2. Overlooking Efficiency

While it may be tempting to save money by opting for a less efficient PSU, doing so can result in higher energy bills and increased heat output. Investing in a more efficient power supply can save you money in the long run.

3. Ignoring Cable Management

Poor cable management can obstruct airflow, leading to higher temperatures and reduced system performance. Modular or semi-modular PSUs can help you keep your cables organized and improve airflow.

4. Skipping Research

Not all power supply units are created equal. Some brands and models are more reliable than others. Take the time to read reviews and research different PSUs before making a purchase.

Conclusion

Choosing the right power supply is crucial for the stability, efficiency, and longevity of your computer system. By understanding the different types of PSUs, considering your power requirements, and avoiding common mistakes, you can select a power supply that meets your needs and ensures optimal performance. Remember, a high-quality power supply is an investment in your system’s future, so don’t cut corners when it comes to this essential component.

Whether you’re building a new PC or upgrading an existing one, taking the time to choose the right power supply will pay off in the long run. With the right PSU, you can enjoy a stable, efficient, and reliable system that meets your computing needs for years to come.

2 notes

·

View notes

Text

Skytech Gaming Prism II Gaming PC: Unleashing Power

I use the Skytech Gaming Prism II Gaming PC, equipped with the mighty INTEL Core i9 12900K processor clocked at 3.2 GHz, an RTX 3090 graphics card, a spacious 1TB NVME Gen4 SSD, and a robust 32GB DDR5 RGB RAM. The package also includes an 850W GOLD PSU, a 360mm AIO cooler, AC Wi-Fi, and comes pre-installed with Windows 10 Home 64-bit. Let me share my experience with this powerhouse.

Performance Beyond Expectations

The Intel Core i9 12900K is an absolute beast, effortlessly handling resource-intensive tasks and demanding games. The synergy with the RTX 3090 is evident in the seamless gaming experience with ultra-settings. Whether it's rendering, gaming, or multitasking, this PC delivers exceptional performance, surpassing my expectations.

Graphics Prowess and Immersive Experience

The RTX 3090 is a graphics powerhouse, providing stunning visuals and real-time ray tracing. Gaming on this machine is an immersive experience, with smooth frame rates and jaw-dropping graphics. The 32GB DDR5 RGB RAM complements the GPU, ensuring seamless transitions between applications and minimizing lag.

Storage Speed and Capacity

The 1TB NVME Gen4 SSD significantly enhances system responsiveness and speeds up data transfer. Games load swiftly, and the overall system boot time is impressive. The ample storage space caters to a vast game library, eliminating concerns about running out of space.

Robust Cooling System

The inclusion of a 360mm AIO cooler ensures that the system remains cool even during prolonged gaming sessions. It effectively dissipates heat, maintaining optimal temperatures for both the CPU and GPU. This attention to cooling enhances the system's longevity and ensures consistent performance.

Powerful and Efficient PSU

The 850W GOLD PSU is more than capable of handling the power demands of the Core i9 12900K and RTX 3090. It provides a stable power supply, contributing to the overall efficiency and reliability of the system. The gold-rated efficiency ensures energy is utilized optimally, reflecting a commitment to sustainability.

Aesthetically Pleasing Design

Apart from the raw power, the Skytech Gaming Prism II stands out with its visually striking design. The RGB lighting on the DDR5 RAM adds a touch of flair, creating a visually pleasing gaming setup. The attention to aesthetics extends to the cable management, contributing to a clean and organized look.

User-Friendly Setup and Windows 10 Integration

The pre-installed Windows 10 Home 64-bit operating system streamlines the setup process, allowing users to dive into their gaming or productivity tasks swiftly. The inclusion of AC Wi-Fi ensures a reliable and fast internet connection, further enhancing the overall user experience.

Conclusion: A Premium Gaming Powerhouse

In conclusion, the Skytech Gaming Prism II Gaming PC is a premium gaming powerhouse that exceeds expectations in performance, design, and efficiency. The combination of the Intel Core i9 12900K and RTX 3090, coupled with ample storage and robust cooling, makes it a top-tier choice for gamers and content creators alike. The attention to detail in design and the user-friendly setup further solidify its position as a stellar gaming desktop. If you're in the market for a high-end gaming PC, the Skytech Gaming Prism II is a compelling choice that delivers on both power and aesthetics.

3 notes

·

View notes

Text

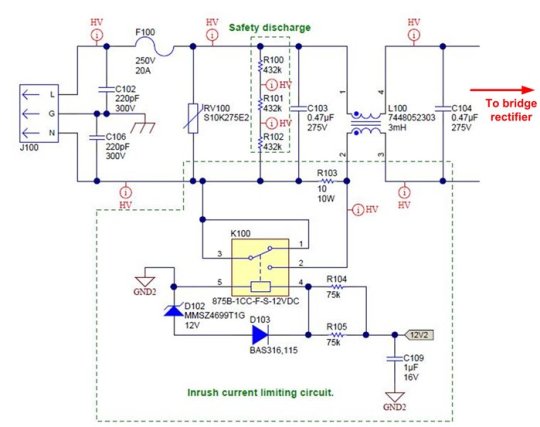

Reading more about inrush current control techniques now, all I knew before this was that you use Negative Temperature Coefficient parts to control it without affecting overall efficiency too much.

I've never had to design a board that drew much power, or didn't just use an off the shelf power supply. Power supply design is black magic so even major companies usually just buy certified open frame units to avoid redoing a ton of regulatory work, it's what's best for everyone. All the appliances at First Job just had a 24V Great Wall open frame units jammed in there, plus consumer 12V supplies for the network gear.

You can do some clever things involving having the NTC take itself out of the loop with a relay and a zener diode if you have really high efficiency targets to hit or you don't want to fry your NTC as the current picks up. I love these kinds of self-contained feedback tricks, they're super handy. And of course there's digital current controllers for high precision applications.

Figure 5 shows the relay circuit for a 1kW power supply. The relay is initially turned off. During power up, the input current flows through a 10Ω/10W cement resistor. Once the power supply is energized, a regulated bias voltage, 12V2, turns on the relay to minimize the power dissipation on the current-limiting circuit during normal operation.

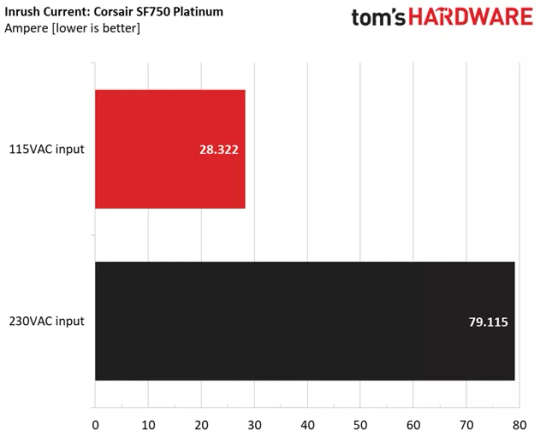

Anyway. Reading specs it looks like there's a systematically higher inrush current in computer PSU's when you connect them to 230V, which is probably just Ohm's Law at work. A lot of supplies with really good 110V inrush limiting have utterly dogshit 230V inrush limiting.

An interesting problem I realize this might cause is that, because most tech reviewers are Americans with 110V, they won't pick this up as often. E.g. the highly recommended SF750 from Corsair has fantastic 120V inrush of ~30A but on 230W it's almost 80A, which would definitely trip a lot of home breakers.

10 notes

·

View notes

Text

Understanding the Power Supply Unit (PSU) of a Computer

The Power Supply Unit (PSU) is one of the most essential yet often overlooked components of a computer. It acts as the heart of the system, converting electrical energy into the usable power that fuels every part of the machine. Without a reliable power supply, even the most advanced hardware won’t function correctly or safely.

💡 What Is a Power Supply Unit?

The PSU is a hardware component that converts the AC (Alternating Current) from your wall outlet into DC (Direct Current), which is required by computer components such as the motherboard, processor, graphics card, hard drives, and other peripherals.

⚙️ How Does It Work?

Here’s a simplified breakdown of how a PSU operates:

AC to DC Conversion: Takes 220V or 110V AC and converts it into lower-voltage DC power.

Voltage Regulation: Ensures the output voltage remains stable and within safe limits.

Power Distribution: Supplies power through connectors to the CPU, GPU, storage devices, and more.

Protection Mechanisms: Most modern PSUs include protections like OVP (Over Voltage Protection), OCP (Over Current Protection), and SCP (Short Circuit Protection).

🔧 Key Components of a PSU

Transformer: Changes the voltage levels.

Rectifier: Converts AC to DC.

Filter: Smoothens out the voltage.

Regulator: Maintains consistent output voltage.

Cooling Fan: Prevents overheating during operation.

⚠️ Why Is a Good PSU Important?

Choosing a quality power supply is crucial for the following reasons:

System Stability: Prevents unexpected shutdowns, freezes, or reboots.

Component Protection: Shields expensive parts like your CPU and GPU from electrical damage.

Energy Efficiency: Higher-efficiency PSUs waste less electricity and produce less heat.

Future Upgrades: A powerful PSU ensures compatibility with new hardware in the future.

🔍 How to Choose the Right Power Supply

Wattage: Match the PSU’s wattage to your system's total power requirement.

Certification: Look for 80 PLUS ratings (Bronze, Silver, Gold, etc.) for better efficiency.

Modularity:

Modular: Allows you to connect only the cables you need.

Semi-modular: Some fixed cables, rest optional.

Non-modular: All cables are attached.

Connector Types: Ensure compatibility with CPU, GPU, and storage connectors.

Brand Reputation: Stick to reliable brands known for safety and quality.

🛠️ Common PSU Problems

Burning Smell or Noise: Could indicate overheating or component failure.

PC Not Powering On: A faulty PSU is a common cause.

Random Restarts: Might be due to power fluctuations or insufficient wattage.

🔄 Maintenance Tips

Keep the PSU clean and dust-free.

Ensure proper airflow in your cabinet.

Don’t overload the power supply beyond its rated wattage.

📝 Conclusion

The Power Supply Unit may not be the most glamorous part of a computer, but it's absolutely vital. A high-quality, well-maintained PSU ensures that your computer runs efficiently, safely, and reliably. Whether you're building a gaming rig or maintaining an office PC, never underestimate the importance of investing in a good power supply.

For expert advice, repairs, and chip-level service, trust Grace IT Solutions—your reliable partner for laptop and computer service in Kochi and Ernakulam.

0 notes

Text

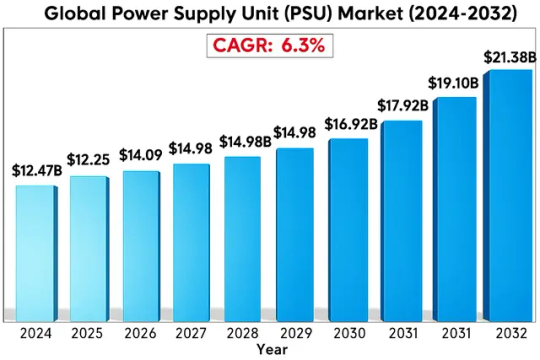

Global Power Supply Unit (PSU) Market : Forecast to 2032

Global Power Supply Unit (PSU) Market size was valued at US$ 12.47 billion in 2024 and is projected to reach US$ 21.38 billion by 2032, at a CAGR of 6.3% during the forecast period 2025-2032. This growth is driven by increasing demand for energy-efficient computing solutions and expansion of data centers worldwide.

A Power Supply Unit (PSU) is a critical hardware component that converts alternating current (AC) to direct current (DC) while regulating voltage for computer systems. Modern PSUs feature modular designs, 80 PLUS certification for energy efficiency, and advanced thermal management systems. The market offers two primary variants: AC power supplies (for general computing applications) and DC power supplies (specialized for industrial equipment and telecom infrastructure).

Key growth drivers include the rapid expansion of cloud computing infrastructure and increasing adoption of high-performance computing solutions. However, the market faces challenges from alternative power solutions and supply chain disruptions affecting semiconductor availability. Recent technological advancements focus on improving energy efficiency – with leading manufacturers like Corsair and Seasonic introducing PSUs achieving 94% conversion efficiency under Titanium certification standards. The competitive landscape features established players including Thermaltake, FSP Group, and Cooler Master, who collectively hold over 45% of the global market share through continuous product innovation and strategic partnerships with OEMs.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-power-supply-unit-psu-market/

Segment Analysis:

By Type

AC Power Supply Segment Leads the Market Owing to Widespread Adoption in Industrial Applications

The market is segmented based on type into:

AC Power Supply

DC Power Supply

By Application

PC Computers Segment Dominates Due to Increasing Demand for Gaming and High-Performance PCs

The market is segmented based on application into:

PC Computers

Mobile Devices

Industrial Equipment

Telecommunications

Others

By Power Rating

300W-500W Segment Holds Major Share for Mid-Range Computing Needs

The market is segmented based on power rating into:

Below 300W

300W-500W

500W-800W

Above 800W

By Form Factor

ATX Segment Dominates Compatibility With Standard Desktop Configurations

The market is segmented based on form factor into:

ATX

SFX

TFX

Flex ATX

Others

Regional Analysis: Global Power Supply Unit (PSU) Market

North America The North American PSU market is characterized by high technological adoption and stringent energy efficiency standards. The region’s mature PC gaming industry and data center expansion are key growth drivers, with the U.S. accounting for over 60% of regional demand. 80 PLUS certification requirements have pushed manufacturers toward modular, high-efficiency (90%+) units. However, market saturation in desktop PC segments has led vendors to focus on premium gaming PSUs and server-grade solutions. The Canadian market shows steady growth, fueled by increasing investments in hyperscale data centers.

Europe Europe’s PSU market is shaped by the EU Ecodesign Directive and energy labeling regulations, driving innovation in low-power consumption units. Germany and France lead in industrial and commercial applications, while the UK gaming sector sustains demand for high-wattage modular PSUs. The region has seen a 12% CAGR in server PSU demand, with increased cloud computing investments. A significant trend is the shift toward fanless and silent PSUs in residential and office environments. Eastern Europe presents emerging opportunities as PC component manufacturing expands to countries like Poland and Hungary.

Asia-Pacific As the largest and fastest-growing PSU market, Asia-Pacific benefits from concentrated electronics manufacturing in China, Taiwan, and South Korea. China’s DIY PC culture and esports boom have created a $2.1 billion PSU segment, while India shows the highest growth potential (18% YoY) due to increasing PC penetration. Japan maintains demand for high-reliability industrial PSUs, and Southeast Asian countries prioritize cost-effective solutions. The region faces challenges with counterfeit products but leads in OEM production, supplying 75% of global PSU units. Recent developments include GaN (Gallium Nitride) technology adoption among premium brands.

South America Market growth in South America is constrained by economic instability but shows pockets of opportunity in Brazil and Chile. The Brazilian gaming market, valued at $1.3 billion, drives demand for entry-level to mid-range PSUs. Argentina’s import restrictions have encouraged local assembly operations, though component quality remains inconsistent. A key trend is the growing second-hand PSU market, accounting for nearly 30% of transactions. Internet cafe expansions in Colombia and Peru provide steady commercial demand, while voltage stability issues necessitate robust surge protection features in consumer units.

Middle East & Africa This emerging market is bifurcated between high-end demand in GCC countries and price-sensitive segments across Africa. The UAE and Saudi Arabia show strong preference for branded 80 PLUS Gold/Platinum units, aligned with data center expansions. In contrast, African markets prioritize durability under unstable power conditions, making hybrid ATX units popular. South Africa leads in regional distribution, while North African countries see growing OEM partnerships. Challenges include counterfeit imports and low consumer awareness about efficiency ratings, though infrastructure development projects promise long-term growth.

MARKET OPPORTUNITIES

Edge Computing Expansion Opens New Markets for Rugged PSUs

The rapid deployment of edge computing infrastructure presents significant opportunities for PSU manufacturers specializing in ruggedized, reliable power solutions. As computing moves closer to data sources, demand grows for PSUs capable of operating in harsh environments with minimal maintenance. This market segment is particularly attractive, with projected CAGR of 18% through 2030. Leading manufacturers are already introducing new product lines featuring extended temperature ranges and enhanced protection against power fluctuations.

Integration of Smart Monitoring Features Creates Value-Added Opportunities

The incorporation of IoT connectivity and predictive maintenance capabilities into PSU designs represents a growing revenue stream. Smart PSUs capable of monitoring load conditions, predicting failures, and optimizing power delivery are gaining traction in data center and industrial applications. These advanced units typically command 50-75% premium over conventional models while delivering significant operational savings through improved reliability and energy management.

POWER SUPPLY UNIT (PSU) MARKET TRENDS

Rising Demand for High-Efficiency Power Supplies

The global Power Supply Unit (PSU) market is witnessing a significant shift toward high-efficiency, low-power consumption solutions, driven by increasing energy regulations and consumer demand for sustainable technology. With the growing emphasis on 80 PLUS certification standards, manufacturers are prioritizing units with higher efficiency ratings, such as Titanium and Platinum, which offer over 90% efficiency under typical loads. Furthermore, advancements in semiconductor technologies, including gallium nitride (GaN) and silicon carbide (SiC), are enabling compact, lightweight power supplies with superior thermal management and reduced energy wastage. These innovations are particularly crucial for data centers and high-performance computing applications, where energy costs and heat dissipation are major concerns.

Other Trends

Modular and Semi-Modular PSU Adoption

The growing preference for modular and semi-modular power supplies is reshaping the market, especially among PC enthusiasts and system builders. Unlike traditional PSUs, modular variants allow users to detach unnecessary cables, improving airflow and reducing clutter in custom-built systems. This trend aligns with the increasing popularity of small-form-factor (SFF) PCs and gaming rigs, where cable management is critical for thermal performance and aesthetics. Additionally, the rise of RGB customization in high-end builds has spurred demand for PSUs with integrated lighting and digital monitoring features.

Expansion of AI and Data Center Applications

Artificial Intelligence (AI) workloads and hyperscale data centers are fueling demand for robust, scalable power supply solutions. As enterprises deploy more AI-driven infrastructure, the need for stable, high-wattage PSUs capable of sustaining continuous heavy loads has surged. The data center PSU market alone is projected to grow significantly, driven by cloud computing expansion and the rollout of 5G networks. Innovations such as digital power management and redundant power supply (RPS) configurations are becoming standard in enterprise environments, ensuring reliability and uptime for mission-critical operations. Furthermore, edge computing deployments are creating opportunities for compact, high-efficiency PSUs designed for distributed IT architectures.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading PSU Manufacturers Focus on Efficiency and Innovation to Capture Market Share

The global power supply unit (PSU) market features a diverse competitive landscape with both established electronics giants and specialized power solution providers vying for dominance. Seasonic and Corsair currently lead the premium segment, capturing nearly 28% of the high-wattage PSU market combined as of Q2 2024. Their success stems from patented modular designs and 80 PLUS Titanium certified products that achieve up to 96% energy efficiency.

The mid-range segment shows particularly fierce competition, with Cooler Master and Thermaltake leveraging strong distribution networks across Asia-Pacific and Europe. Both companies have recently expanded their product lines to address the growing demand for SFX-L form factors in compact gaming PCs.

Meanwhile, Taiwanese manufacturer FSP continues to dominate the OEM supply market, providing power solutions for 30% of major desktop brands. Their vertically integrated production capabilities allow competitive pricing while maintaining 80 PLUS Gold efficiency standards.

The competitive landscape continues to evolve with strategic movements from key players:

SilverStone Technology recently acquired a German power electronics firm to enhance their R&D capabilities

Antec partnered with NVIDIA to develop ATX 3.0 compatible power supplies ahead of competitors

XFX committed $120M to expand production capacity for their high-performance PSU line

List of Key Power Supply Unit Manufacturers Profiled

Seasonic (Taiwan)

Corsair (U.S.)

Cooler Master (Taiwan)

Thermaltake (Taiwan)

FSP Group (Taiwan)

SilverStone Technology (Taiwan)

Antec (U.S.)

XFX (Hong Kong)

New Japan Radio (Japan)

Gigabyte (Taiwan)

Learn more about Competitive Analysis, and Forecast of Global Power Supply Unit (PSU) Market : https://semiconductorinsight.com/download-sample-report/?product_id=95800

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Power Supply Unit (PSU) Market?

-> Power Supply Unit (PSU) Market size was valued at US$ 12.47 billion in 2024 and is projected to reach US$ 21.38 billion by 2032, at a CAGR of 6.3% during the forecast period 2025-2032.

Which key companies operate in Global PSU Market?

-> Key players include Corsair, Cooler Master, Seasonic, Thermaltake, FSP, Antec, and SilverStone Technology, among others.

What are the key growth drivers?

-> Key growth drivers include rising gaming PC demand, data center expansion, and increasing adoption of high-efficiency PSUs.

Which region dominates the market?

-> Asia-Pacific holds the largest market share (42%), driven by strong manufacturing presence in China and Taiwan.

What are the emerging trends?

-> Emerging trends include digital PSUs with monitoring capabilities, higher efficiency standards (80+ Titanium), and modular cable designs.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes

Text

Computer Power Supplies Market: Revenue Projections and Strategic Insights 2025–2032

Global Computer Power Supplies Market Research Report 2025(Status and Outlook)

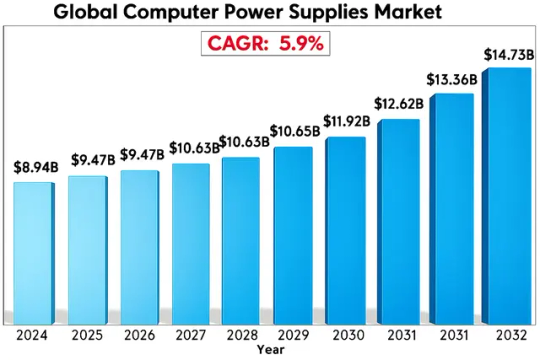

Computer Power Supplies Market size was valued at US$ 8.94 billion in 2024 and is projected to reach US$ 14.73 billion by 2032, at a CAGR of 5.9% during the forecast period 2025-2032.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=95801

MARKET INSIGHTS

The global Computer Power Supplies Market size was valued at US$ 8.94 billion in 2024 and is projected to reach US$ 14.73 billion by 2032, at a CAGR of 5.9% during the forecast period 2025-2032.

Computer power supplies are critical components that convert alternating current (AC) from wall outlets into direct current (DC) required by computer components. These units regulate voltage to ensure stable power delivery to sensitive electronics like CPUs, GPUs, and storage devices. The market includes both internal power supply units (PSUs) for desktop computers and external adapters for laptops, with variations in wattage, efficiency ratings (80 PLUS certified), and form factors (ATX, SFX, TFX).

The market growth is driven by increasing PC shipments, rising demand for high-performance computing in gaming and data centers, and technological advancements in energy-efficient designs. The shift towards modular PSUs and the growing adoption of liquid-cooled power supplies in premium systems are notable trends. Major manufacturers are focusing on developing compact, high-wattage units to support next-generation GPUs and AI workloads, with Corsair’s recent launch of 1600W ATX 3.0 compliant PSUs in Q1 2024 demonstrating this innovation push.

List of Key Computer Power Supply Companies Profiled

Seasonic Electronics (Taiwan)

Corsair (U.S.)

Thermaltake (Taiwan)

Cooler Master (Taiwan)

SilverStone Technology (Taiwan)

Antec (U.S.)

New Japan Radio (Japan)

FSP Group (Taiwan)

Gigabyte (Taiwan)

Segment Analysis:

By Type

AC Power Supply Segment Leads the Market With Widespread Adoption Across Consumer Electronics

The market is segmented based on type into:

AC Power Supply

DC Power Supply

Modular Power Supply

Non-modular Power Supply

Others

By Application

PC Computers Segment Dominates Due to High Demand for Gaming and Workstation Setups

The market is segmented based on application into:

PC Computers

Laptops

Servers

Industrial Computers

Others

By End User

Consumer Electronics Sector Captures Largest Share With Growing Household Device Penetration

The market is segmented based on end user into:

Consumer Electronics

Commercial

Industrial

Others

By Power Rating

500W-1000W Segment Shows Strong Growth Catering to High-performance Computing Needs

The market is segmented based on power rating into:

Below 500W

500W-1000W

Above 1000W

Regional Analysis: Global Computer Power Supplies Market

North America The North American computer power supply market is characterized by high demand for energy-efficient and modular units, driven by stringent energy regulations (such as 80 PLUS certification requirements) and a mature gaming/PC enthusiast culture. The United States accounts for over 85% of regional demand, with major players like Corsair and Thermaltake dominating the premium segment. Data center expansions – projected to grow at 4.5% annually through 2025 – are additionally fueling demand for redundant server power supplies. While replacement cycles are slowing in consumer markets, the commercial sector shows steady growth due to cloud computing infrastructure investments.

Europe Europe’s market emphasizes environmental compliance with EU ErP Lot 6/7 regulations pushing adoption of high-efficiency (90%+) PSUs. Germany and the UK collectively hold 60% market share, with industrial applications showing particular strength. The region has seen consolidation among manufacturers, with Seasonic and be quiet! leading through technical innovation. Though laptop adoption has reduced desktop PSU demand, the DIY PC market remains robust, especially in Eastern Europe where cost sensitivity drives demand for mid-range 500-750W units. Renewable energy integration into power grids is creating niche opportunities for adaptive power supply designs.

Asia-Pacific As the largest volume market (45% global share), APAC is bifurcated between Japan/South Korea’s premium segments and emerging markets’ price-driven demand. China’s dominance in manufacturing has created intense price competition, with FSP and Great Wall supplying 70% of OEM units. India represents the fastest growing market (11.2% CAGR) as PC penetration increases. While gaming PC adoption rises in metropolitan areas, low- wattage PSUs dominate rural markets. Taiwan serves as the innovation hub, with companies like SilverStone developing compact form factors for space-constrained urban environments.

South America Market growth in South America is constrained by economic volatility but shows pockets of opportunity. Brazil accounts for 60% of regional demand, with gaming PCs driving premium PSU sales in major cities. However, gray market imports comprising 35% of sales create pricing pressures for legitimate manufacturers. Argentina and Chile show stronger commercial demand linked to digital infrastructure projects. Political instability and import restrictions in Venezuela and Colombia hinder market development. Manufacturers focus on durable, surge-protected units to accommodate inconsistent power grids.

Middle East & Africa This emerging market is divided between GCC nations’ high-end demand and African price sensitivity. The UAE and Saudi Arabia demonstrate strong gaming/enthusiast segments, with liquid-cooled PSUs gaining traction. South Africa serves as the regional hub, with major distributors servicing neighboring countries. Power instability across Sub-Saharan Africa drives demand for uninterruptible power supply (UPS)-compatible units. While market penetration remains low (under 15% household PC ownership in most African nations), mobile internet growth is creating downstream demand for laptop power adapters and charging solutions.

MARKET DYNAMICS

Implementing increasingly stringent global energy efficiency standards presents one of the most pressing challenges for power supply manufacturers. The shift from 80 Plus Bronze to Platinum and Titanium certification requirements has forced companies to completely redesign their power delivery architectures. Achieving higher efficiency ratings requires advanced components and sophisticated circuitry that can add 20-30% to production costs while shrinking already tight profit margins. These technical hurdles are compounded by the need to maintain competitive pricing in a market where many consumers prioritize upfront cost over long-term energy savings.

The fast-paced evolution of computer hardware creates constant pressure to develop compatible power solutions. New GPU and CPU architectures often require updated power delivery specifications, forcing manufacturers to continually adapt their product lines.As power densities increase, effectively dissipating heat becomes more difficult. Pushing efficiency boundaries while maintaining acceptable thermal performance requires innovative cooling solutions that can drive up product costs.

Developing economies represent significant growth opportunities as PC penetration rates continue rising in regions with previously limited access to technology. Countries in Southeast Asia and Africa are experiencing annual PC market growth rates exceeding 15%, creating substantial demand for affordable yet reliable power solutions. Manufacturers that can develop cost-optimized products for these price-sensitive markets while maintaining quality standards stand to gain considerable market share. Strategic partnerships with local distributors and assembly facilities can provide crucial competitive advantages in these emerging territories.

The growing emphasis on sustainable computing solutions is driving innovation in power supply designs that integrate with renewable energy systems. Solar-powered data centers and hybrid energy computer systems require specialized power conversion units capable of handling variable input sources. This niche segment currently represents less than 5% of the total market but is projected to grow at a compound annual growth rate of over 20% as environmental regulations tighten and corporate sustainability initiatives expand. Companies investing in R&D for these applications position themselves favorably for future market shifts toward greener computing solutions.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=95801

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Computer Power Supplies Market?

Which key companies operate in this market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv_2.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-industrial-force-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-smart-temperature-monitoring.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-extreme-ultraviolet-euv.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-non-tactile-membrane-switches.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-semiconductor-alcohol-sensors.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-healthcare-biometric-systems.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-class-d-audio-power-amplifiers.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-usb-31-flash-drive-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-optical-fiber-development-tools.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-chips-3d-ic-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-3d-acoustic-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wired-network-connectivity-3d.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-lens-antenna-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-millimeter-wave-antennas-and.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Downhole Control Lines Market to Reach $12.9 Bn by 2034: Key Drivers and Trends

The global downhole control lines market is undergoing a significant transformation, backed by a surge in oil and gas exploration and the rapid advancement of intelligent well technologies. Valued at US$ 5.2 Bn in 2023, the market is projected to grow at a compound annual growth rate (CAGR) of 8.7%, reaching US$ 12.9 Bn by 2034.

Market Overview and Functionality

Downhole control lines are essential for operating downhole equipment in oil and gas wells. They enable real-time control and monitoring of processes such as chemical injection, well monitoring, gas venting, and Surface-controlled Subsurface Safety Valves (SCSSVs). These lines are made to endure high pressures, corrosive environments, and extreme temperatures, making material strength and corrosion resistance critical to their performance.

The market is segmented by product type—welded and seamless control lines. Welded control lines are cost-efficient and readily available in long lengths, ideal for large-scale deployment. Seamless control lines, on the other hand, offer superior performance in terms of pressure and corrosion resistance.

Growth Drivers: Oil & Gas Exploration and Smart Well Technologies

One of the primary drivers of market growth is the global increase in investment in oil and gas exploration. Governments and private companies are ramping up activities to secure long-term energy supplies. For instance, South Korea approved an exploratory drilling project in June 2024, estimating potential reserves of 14 billion barrels. Similarly, Condor Energies Inc. committed US$ 582 Mn for hydrocarbon extraction in Uzbekistan.

Another major catalyst is the R&D of smart wells, which incorporate real-time sensors, automation, and data analytics to enhance production and safety. These intelligent systems rely heavily on robust and responsive downhole control lines to transmit data and operational commands. Permanent downhole gauges and interval control valves are increasingly being used to monitor reservoir pressure and temperature, ensuring optimal output and safety.

Regional Insights: Asia Pacific Leads the Charge

Asia Pacific emerged as the leading region in the downhole control lines market in 2023. The region’s dominance is attributed to large-scale investments in energy infrastructure. For example, Indian Oil PSUs, including ONGC and IOCL, plan to invest US$ 143.6 Bn in the 2024–2025 fiscal year across exploration, refining, petrochemicals, and pipelines.

Meanwhile, China continues to accelerate its offshore energy initiatives. In May 2024, CNOOC Ltd. launched a new gas project in the Bohai Sea, expected to yield 5,800 barrels of oil equivalent per day (boepd). These developments reflect growing energy demands across Asia and the need for high-performance downhole equipment.

Technology and Material Innovations

To meet the demands of modern exploration projects, manufacturers are focusing on high-performance materials. Most control lines are now manufactured using nickel alloys and high-strength stainless steel, designed to resist corrosion and mechanical fatigue. Additionally, companies are offering pre-tested lines that exceed ASTM standards, ensuring consistent performance across both onshore and offshore environments.

Leading players such as Prysmian Group, SLB (Schlumberger), AMETEK Inc., and ATI are pushing the boundaries of technology. These firms are not only enhancing product durability but also aligning with automation trends. For example, the collaboration between SLB and NOV focuses on integrating surface and downhole automation to streamline well construction.

Competitive Landscape

The market features a dynamic mix of global players, with strategies focused on innovation, reliability, and regional expansion. Companies like MID-SOUTH CONTROL LINE and Novomet have tailored solutions for extreme environments, while Prysmian’s new brand strategy, launched in February 2024, signifies its long-term commitment to oil & gas infrastructure.

Market segmentation reveals a balanced distribution of demand across onshore and offshore applications, with offshore exploration witnessing heightened focus due to larger reserves and emerging technologies.

Future Outlook

As exploration shifts toward deeper, more complex reservoirs, the need for intelligent and resilient control systems will only grow. Downhole control lines—whether welded or seamless—will continue to serve as the lifelines of modern wells, enabling operators to maintain safety, maximize efficiency, and extend the productive life of wells.

With innovation accelerating and energy investments booming across key regions, the downhole control lines market is poised for robust growth, supported by both technological advancements and strategic energy initiatives.

Conclusion

The period through 2034 represents a pivotal growth window for the downhole control lines industry. As the energy sector embraces digitalization and intelligent infrastructure, the role of advanced downhole systems will become increasingly vital. Stakeholders who align with emerging trends and invest in robust, future-ready technologies stand to gain the most in this rapidly evolving landscape.

0 notes

Text

**Why Your BJT Might Be Holding Back Your Project (And Why MOSFETs Are Low-Key Changing the Game) 🔌

** hey fellow electronics nerds, tinkerers, and anyone who’s ever stared at a fried transistor like “*why* tho” — let’s geek out. ever notice how the cool kids in engineering circles are quietly ditching BJTs for MOSFETs in push-pull circuits? it’s not just hype. it’s a vibe shift. let’s break it down, with zero jargon (okay, *some* jargon, but we’ll make it cozy). ### **first off: BJT vs MOSFET = stick shift vs automatic. fight me. 🚗** remember when you first learned to drive stick? clutch, gas, *don’t stall* — stressful, right? that’s BJT energy. - **BJTs (the stick shifts of semiconductors)**: they need *constant current* to stay on. like, you gotta keep feeding that base pin, or it’s gonna flake out. want more juice? cram more current in! but here’s the tea: that current turns into heat. a basic NPN BJT? Vce(sat) is ~0.7V. at 10A? that’s 7W of “why is my breadboard smoking” heat 🔥. not cute.

- **MOSFETs (the automatic luxury cars)**: these bad boys run on *voltage*. hit the gate with 10V, and it’s like flipping a light switch — stays on, no drama. no need to baby it with constant current. the secret sauce? Rds(on) (drain-source resistance) that’s *insanely* low — we’re talking under 10mΩ. at 10A? that’s 1W of heat. 1W! your project will thank you. 🎉 ### **efficiency? MOSFETs are out here flexing. 📊** let’s get real with numbers (but chill, i’ll do the math). say you’re running a 12V push-pull setup at 5A: - **with a BJT**: total loss = 0.7V x 5A x 2 (upper + lower tubes) = 7W. efficiency? ~90%. not *terrible*, but like, why waste that power? - **with a MOSFET**: swap in VBsemi’s VBGQA1401 (a 40V SGT MOSFET, fancy but worth it). its Qgd (gate-drain charge) is tiny (5nC), so it sips power. total loss? under 1W. efficiency? 98.3%. that’s the kind of number that makes your oscilloscope do a little happy dance. 🎶 ### **speed? BJT’s “hold on” vs MOSFET’s “brb, done” ⚡** BJTs are like that friend who takes 20 minutes to get ready — switching them on/off needs charge to build up/dissipate. above 100kHz? half your power gets wasted just *switching*. MOSFETs? they’re controlled by electric fields, not clunky charge piles. switching time? nanoseconds. ever run a 1MHz circuit?

VBsemi’s VBGQA1602 (60V/3mΩ, tiny DFN5×6 package) cuts switching loss by 80% vs BJTs. and it does 0.1%-100% dimming like it’s nothing. high-frequency projects, rejoice. 🙌 ### **but MOSFETs aren’t perfect (sorry, no heroes here) 😅** their kryptonite? parasitic capacitance (Cgd, aka Miller capacitance). think of it as a tiny sponge that soaks up drive current when switching: - **delays**: 100pF Cgd at 10V needs 1A to switch fast. most drivers can’t keep up, so your waveform gets a sad little tail. 🐢 - **spikes**: at high frequencies, it vibes with wire inductance, shooting voltages up to *twice* your supply. saw this in a 300kHz test — my multimeter did a double-take. 😱 **fix it**: use a totem-pole driver + a 10Ω gate resistor (kills the chaos). and grab low-Cgd MOSFETs, like VBsemi’s VBG series (50pF — smooth as butter). ✨ ### **pro tips for swapping (so you don’t cry into your soldering iron) 🛠️** 1. **voltage matters more than you think**: MOSFETs turn on at 3-5V, but to get that *low Rds(on)*? you need 10V+. VBTA1220N goes from 80mΩ (10V) to 20mΩ (20V). big difference. 2. **heatsinks? downsize ‘em**: MOSFETs run 30℃ cooler than BJTs. your project’s gonna look sleeker, i promise. ❄️ 3. **yes, they cost more — but trust the grind**: 2-3x pricier upfront, but less heat = longer life = lower electric bills. a 100W PSU with VBsemi’s MOSFETs saved $500/year in tests. worth it. 💰 alright, spill: have you swapped BJT for MOSFET? did it go great, or did you learn a *very* expensive lesson? 👀 drop your story in the tags or comments — i’m living for the tea. if this blows up, next we’ll dive into bootstrap driving for P-top/N-bottom setups (it’s cooler than it sounds, i swear). #ElectronicsHacks #MOSFETMagic #EngineeringChaos #TinkererTips — *VBsemi: making your projects run smoother than your favorite playlist. ⚡*

1 note

·

View note

Text

Sensex, Nifty open in inexperienced with marginal features

Sensex, Nifty open in inexperienced with marginal features Indian inventory markets opened on a constructive observe on Tuesday, persevering with their upward pattern. A lady walks previous the Bombay Stock Exchange (BSE) constructing, in Mumbai(PTI/File) Both benchmark indices posted early features, though investor sentiment stays cautious as markets await readability on main world developments, notably the Trump administration's proposed tax cuts invoice within the US. The Nifty 50 index opened at 25,551.35, registering a acquire of 34.30 factors or 0.13 per cent. The BSE Sensex rose by 79.20 factors or 0.09 per cent to open at 83,685.66. Despite the early features, the general market tone stays watchful. Ajay Bagga, Banking and Market Expert, advised ANI, "Asian markets are sideways, waiting for clarity on the Trump Tax cuts bill, trade deals and the US Jobs report. Indian markets saw FPIs selling on Monday and are expected to be sideways in a consolidating phase, waiting for global clarity." One of the important thing world elements affecting market sentiment is the numerous fall within the US greenback. The greenback index, which measures the buck's energy towards a basket of six main currencies together with the pound, euro, and yen, has dropped greater than 10 per cent within the first half of 2025. This marks the worst begin to a yr for the US greenback since 1973, when it had fallen 15 per cent following the collapse of the Bretton Woods system. It can be the weakest six-month efficiency since 2009. Bagga added, "The One Big Beautiful Bill of tax cuts and deregulation of Trump 2.0 is at present being debated in the US Senate. It is expected to be passed before July 4th, though it may need to be sent back to the House of Representatives to endorse the Senate's changes. That and the June US Non Farm Payrolls report this week will be the two market-moving catalysts, along with the expected announcement of trade deals with some major trading partners." In broader market indices on the NSE, Nifty 100 gained 0.09 per cent, Nifty Midcap 100 rose by 0.27 per cent, whereas Nifty Smallcap 100 surged 0.37 per cent. Among sectoral indices, a blended pattern was noticed. Nifty FMCG rose 0.10 per cent, Nifty Media gained 0.16 per cent, and Nifty Realty superior by 0.77 per cent. On the draw back, Nifty Auto slipped 0.04 per cent, Nifty Metal dropped 0.23 per cent, and Nifty PSU Bank was down by 0.20 per cent. Shrikant Chouhan, Head of Equity Research at Kotak Securities, commented, "A bearish candle on the daily chart indicates temporary weakness. We believe 25,450/83,500 would act as a crucial level. Below 25,450/83,500, we may see a further correction towards 25,375-25,300/83,200-83,000. On the other hand, a sustained move above 25,450/83,500 may take the market to 25,600/83,900. The uptrend may continue further, potentially taking the market towards 25,670/84,100." As world cues stay unsure, the specialists famous that Indian markets are prone to commerce in a range-bound method, with traders carefully monitoring developments within the US Senate and key financial knowledge releases. (ANI) Read More: https://news.unicaus.in/business/sensex-nifty-open-in-inexperienced-with-marginal-features/

0 notes

Text

Behind the Maharatna: How ONGC’s HR Strategy is Evolving with Its People.

The People-First Shift in HR Philosophy

In a world defined by digital disruption, climate consciousness, and workforce expectations, ONGC is reimagining HR beyond policy and payroll. The organization is shifting from a process-driven HR model to a people-centric philosophy.

Building Careers, Not Just Jobs

One of the most significant changes in ONGC’s HR strategy is the move toward career pathing and capability building. This includes:

Structured learning and development programs tailored to each role.

Cross-functional exposure and project rotations for holistic growth.

Focused leadership development through collaboration with premier institutes like IIMs and ISBs.

The goal is clear: to empower employees to grow within ONGC, rather than seek opportunities elsewhere.

Driving Cultural Transformation from Within

The HR leadership at ONGC understands that culture cannot be imposed — it has to be cultivated. Therefore, there is a concerted focus on:

Internal communication platforms to encourage bottom-up feedback.

Recognition and reward frameworks that highlight both performance and values.

A shift toward digital engagement, especially for a geographically dispersed workforce.

By aligning the organizational culture with employee aspirations, ONGC is fostering a more inclusive and motivated work environment.

Diversity, Equity, and Inclusion (DEI) Takes Center Stage

As a public sector enterprise, ONGC has always emphasized diversity. However, recent HR interventions have taken a strategic and measurable approach to inclusion — including:

Gender diversity initiatives in technical and leadership roles.

Wellness and mental health programs.

Supportive policies for different life stages, including parental leave and elder care.

Leveraging Technology for HR Transformation

Digital transformation is a cornerstone of ONGC’s broader strategy — and HR is no exception. ONGC is deploying:

AI-driven talent analytics to optimize workforce planning.

HR portals for seamless employee services.

Virtual learning environments to drive continuous upskilling.

These technological upgrades not only improve efficiency but also personalize the employee experience, creating a more agile and future-ready workforce.

Nurturing the Next Generation of Energy Leaders

With a significant part of the workforce approaching retirement, ONGC has identified succession planning and youth engagement as mission-critical. Their strategy includes:

Early identification of high-potential talent.

Mentorship programs pairing young professionals with seasoned experts.

University collaborations to attract top-tier technical talent.

The aim is to build a leadership pipeline that can carry ONGC’s legacy forward while embracing innovation and sustainability.

Conclusion: Human Capital is the True Fuel

ONGC’s evolution from a traditional PSU to a people-powered Maharatna is a case study in strategic HR leadership. By placing its people at the core of its transformation, ONGC isn’t just future-proofing its business — it’s redefining what it means to be a modern, mission-driven employer in India’s public sector.

As ONGC continues to navigate the challenges of the global energy transition, it is clear that the human energy behind the scenes will be its most valuable and enduring resource.

0 notes

Text

Event Management Tenders Delhi

Expert Event Management Tenders Delhi — Hitkari Productions Services

Securing and executing an Event Management Tender in Delhi requires more than event planning—it demands transparency, compliance, and unmatched execution. At Hitkari Productions, we stand as top-rated experts in Event Management Tenders Delhi with 44 years of delivery excellence. Whether it’s government RFPs, PSU tenders, or corporate bids, our proven processes and turnkey solutions ensure seamless tender fulfillment and extraordinary event outcomes across Delhi NCR.

Why Choose Hitkari for Event Management Tenders Delhi?

Navigating tender requirements in Delhi’s event ecosystem can be complex, requiring compliance, cost-efficiency, and quality. As a leading provider of Event Management Tenders Delhi, we offer:

Professional tender submission support, ensuring bid compliance

Cost-effective, modular event packages matched to tender specifications

End-to-end execution, from stage design to AV, logistics, safety, and post-event reporting

Government-approved vendor credentials and PSU experience

Integrated in-house production, allowing centralized control, speed, and quality assurance

We align our services to match every criterion—timelines, budgets, service SLAs—so you receive both compliance and elevated event execution.

Our Scope Under Event Management Tenders Delhi

👥 Pre-Tender Consultation & Proposal Design

As specialists in Event Management Tenders Delhi, we assist in drafting winning proposals—covering resource planning, vendor empowerment, site layouts, cost estimates, and risk management—all structured to satisfy tender graders.

🎪 Full-Scale Event Infrastructure

Our services include complete venue fit-out per tender norms: AC Swiss tents, modular stages, seating zones, traffic management, sanitation, accessibility, and environmental compliance arrangements.

🎧 Audio-Visual & Technology Integration

We deploy certified audio-visual and IT infrastructure, including lighting, projection, live streaming, presentation clickers, interpreter booths, and backup systems, meeting the technical criteria laid out in tenders.

🌐 Logistics, Security, & Compliance

We coordinate with Delhi Police, civic bodies, and fire departments for necessary permissions, crowd control, emergency plans, and safety certifications explicitly required under most Event Management Tenders Delhi.

📝 Reporting & Post‑Event Documentation

Tender guidelines often stipulate post-event deliverables. We supply detailed asset lists, timelines, attendee logs, incident reports, and digital media content for transparent tender closure.

Our Experience in Executing Event Management Tenders Delhi

Our tender track record spans across Delhi NCR, with notable projects such as:

PSU annual meets at Noida and Gurugram campuses

Ministry policy rollouts at central Delhi venues

Public outreach initiatives at India Gate and sector-based blocks

Trade fairs and commercial expos, secured through Delhi Police-approved tenders

Health awareness camps with strict regulatory compliance

Every tender completed by Hitkari stands as proof of our meticulous execution and adherence to tender terms.

Differentiators in Event Management Tenders Delhi by Hitkari

✅ Dedicated Tender Coordination Cell

Our in-house tender specialists oversee submission, follow-up, compliance checks, and vendor due diligence to eliminate delays or non-conformities.

✅ Transparent Budgeting & Cost Control

We abide by tender-defined budgets, with structured procurement and audit trails that satisfy official evaluations.

✅ Modular Execution Teams

Our trained teams—logistics, AV, hospitality, security, stage & fabrication—are mobilized based on tender parameters, ensuring prompt and efficient deployment.

✅ Sustainable & Green Deliveries

We incorporate eco-friendly materials, energy-efficient setups, and waste management protocols aligned with Delhi’s green tender norms.

✅ Real-Time Monitoring & Reporting

Live dashboards, onsite incident logs, photo-videographic timelines, and compliance certifications ensure tender evaluators receive reliable documentation.

Get Started with Hitkari on Your Event Management Tender Delhi

If you’re preparing an event management tender in Delhi—be it for government, PSU, or a corporate franchise—partner with Hitkari Productions to translate RFP requirements into flawless delivery. Our method synchronizes your bid objectives with elevated live experiences and measurable KPIs.

🎯 Consult our Tender Advisory Team for initial bid review 🧾 Receive a preliminary execution draft aligned to your tender SOP 🔐 Lock in service bundles and pricing before your submission date

#guest management#corporate events#cottage#swiss cottage#wedding decorations#marriage#wedding photography#event management#wedding planning

0 notes

Text

Indian transmission project contacts

The latest water treatment plant (WTP) tender, floated by a leading PSU’s renewable arm, marks a significant step forward for any Green hydrogen project in India. This comprehensive EPC+O&M bid calls for a 10 million litres per day (MLD) capacity, specifically engineered to support a green hydrogen production hub. The scope of work emphasizes a 25-year lifecycle performance, which is becoming a new benchmark for reliability in any major Green hydrogen project in India. Unique to this tender are stringent technical requirements—such as supplying 2 MLD of high- purity demineralized (DM) water and 1 KLD of potable water that meets WHO standards—demonstrating the precision needed for large-scale electrolysis. Contractors must construct a nitrogen-capped DM water tank and deploy advanced electrodeionization (EDI) systems, a specification rarely seen outside the context of a Green hydrogen project in India. These details reflect the integration of process-driven water quality demands vital for efficient hydrogen production. Furthermore, the WTP will connect to a 500NB underground HDPE/DI pipeline, less than 2.5 km in length and with minimal excavation depth, optimizing both capital costs and construction logistics. Such design innovations are increasingly standard for each new Green hydrogen project in India, aligning with global best practices and local sustainability goals. As India accelerates its renewable energy transition, the successful execution of this WTP tender will set a precedent for future Green hydrogen projects in India, showcasing how technical excellence and robust infrastructure planning can shape the country’s hydrogen economy, Indian transmission project contacts, Transmission Projects India, Power Transmission India, Transmission Lines India, Grid India, Energylineindia.

0 notes

Text

NALCO Share Price Target 2025-30 : Analysis

NALCO Share Price Target : Although there are lakhs of shares listed in the stock market, today we are going to tell you about such a stock which can go up a lot in the coming time. This article will provide more details about the National Aluminium Share Price Target 2025, 2026 to 2030.

National Aluminium : About Company

National Aluminium Company Limited is an India-based company primarily engaged in the business of manufacturing and selling alumina and aluminium. The company’s segments include Chemicals and Aluminium. The Chemicals segment includes Calcined Alumina, Alumina Hydrate and other related products.

The Aluminium segment includes aluminium ingots, wire rods, billets, strips, rolled and other related products. The company is operating an over 22.75 lakh tonne per annum (TPA) alumina refinery plant located at Damanjodi in Koraput district of Odisha and an approximately 4.60 TPA aluminium smelter located at Angul, Odisha. It also has a captive thermal power plant of over 1200 megawatt (MW) adjacent to the smelter plant.

NALCO Share Price Target 2025-30

Now let’s take a look at NALCO Share Price Target And Prediction 2025-30

Year — — — — — — — — — — — — — — — Target 2025 — — — — — — — — — — — — — — — 300 2026 — — — — — — — — — — — — — — — 325 2027 — — — — — — — — — — — — — — — 350 2028 — — — — — — — — — — — — — — — 375 2029 — — — — — — — — — — — — — — — 400 2030 — — — — — — — — — — — — — — — 425

NALCO Share Price Target : Strengths And Limitations

The company has shown good profit growth of 16.60% in the last 3 years.

The company has been maintaining a healthy ROCE of 23.16% for the last 3 years.

The cash conversion cycle of the company is efficient at -136.01 days.

The cash flow management of the company is good; CFO/PAT is 1.19.

The company has a high promoter holding of 51.28%.

The interest coverage ratio of the company is 162.74.

The PEG ratio of the company is 0.21.

The company is virtually debt free.

NALCO Target Share Price : Investment Considerations

Now take a look at NALCO Share Price Target 2025 Investment Considerations…

Strong Assets & Low Cost Position

National Aluminium Company is one of the world’s lowest cost alumina producers and based on lowest cost bauxite.

Diversified Revenues

NALCO does not earn revenue from just one place but it has multiple sources which include revenue from mining, smelting, refining, captive power, port operations and renewable energy.

Healthy Dividend Payouts

National Aluminium Company represents a good dividend payout. Interim dividend of ₹4/share (~80% of FV ₹5) reflects robust cash flow.

NALCO Target Share Price : Factors Influencing

Now take a look at factors affecting NALCO Share Price Target 2025…

Alumina & Aluminum Price Cycles

The Company’s continued control over the alumina and aluminium price cycle through tight global supply and captive mines is expected to significantly expand margins.

Global Aluminum Demand

Improvements in infrastructure along with green energy and supply constraints from China have significantly increased the demand for commodities which directly impacts the company’s stock price.

Margin & Profit Volatility

Operating margins (10-37%) fluctuate with cyclical fluctuations which gives rise to stable profit valuations and impacts the company’s stock price.

NALCO Target Share Price : Conclusion

NALCO Share Price Target And Prediction 2025-30 blog, National Aluminium Company Limited (NALCO) is a government‑owned (51% GOI) integrated mining and metals PSU, leading in alumina, bauxite, aluminum, and renewable energy production.

The company has shown good profit growth of 16.60% in the last 3 years. The company has been maintaining a healthy ROCE of 23.16% for the last 3 years. The company’s cash conversion cycle is efficient at -136.01 days. The company has good cash flow management; CFO/PAT is 1.19.

0 notes

Text

Clean Energy Shift Sparks Massive Growth in Silicon Carbide MOSFETs Market

Silicon carbide (SiC) MOSFETs are revolutionizing power semiconductor applications with their superior efficiency, high-temperature tolerance, and compact design advantages over traditional silicon MOSFETs. SiC MOSFETs enable higher voltage capabilities, reduced switching losses, and smaller form factors—making them highly suitable for electric vehicles (EVs), renewable energy systems, and industrial applications.

As global energy infrastructure undergoes rapid electrification and decarbonization, SiC MOSFETs are becoming integral to this transformation, facilitating higher power density, better efficiency, and system miniaturization across sectors.

Market Drivers & Trends

The key factors fueling the growth of the silicon carbide MOSFETs market include:

Accelerated adoption of electric vehicles: EVs increasingly use SiC MOSFETs in on-board chargers (OBCs), inverters, and battery management systems to optimize energy efficiency and performance.

Rapid deployment of renewable energy systems: The demand for solar PV inverters and energy storage systems that utilize SiC MOSFETs continues to surge.

Increased focus on energy efficiency: SiC MOSFETs' ability to handle high frequencies and temperatures supports the miniaturization and optimization of power electronic systems.

Cost reduction due to scale and innovation: As production volumes rise and competition intensifies, the costs of SiC devices have declined significantly, further driving adoption.

Latest Market Trends

Recent market trends emphasize the growing importance of WBG semiconductors, particularly in the EV and power grid sectors:

Widespread use of 1200 V – 1700 V breakdown voltage SiC MOSFETs: These are gaining momentum for applications in solar PV, HVAC systems, motor drives, and charging infrastructure.

High-performance traction inverters: Automakers are adopting SiC-based inverters to extend driving range and improve energy efficiency.

Solar and energy storage integrations: Utility-scale installations are increasingly relying on SiC MOSFETs to enhance inverter efficiency and reduce system size.

Access important conclusions and data points from our Report in this sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=81899

Key Players and Industry Leaders

The market is characterized by innovation-driven competition. Key players include:

STMicroelectronics N.V.

WOLFSPEED, INC.

Infineon Technologies AG

ROHM CO., LTD.

Toshiba Electronic Devices & Storage Corporation

Microchip Technology Inc.

Diodes Incorporated

Littelfuse, Inc.

SemiQ, Inc.

Sansha Electric Manufacturing Co., Ltd.

These companies are heavily investing in R&D, launching new product lines, and expanding their global footprint through strategic collaborations and acquisitions.

Recent Developments

September 2022: SemiQ launched a 1200V 40mΩ second-generation SiC MOSFET offering better switching efficiency for broad applications.

August 2022: Toshiba introduced its TWxxNxxxC SiC MOSFET series, with 650V and 1200V variants, targeting EVs, industrial equipment, and renewable energy solutions.

Wolfspeed and STMicroelectronics have announced expansion of their SiC production capacity to meet the rising global demand.

Market Opportunities

The expanding demand for efficient power electronics across sectors opens new avenues:

EV Infrastructure: Growing installation of EV fast-charging stations is boosting SiC MOSFET demand for high-power and reliable converters.

Data Centers: Increased use of SiC MOSFETs in UPS systems and server PSUs to reduce energy consumption and thermal footprint.

Industrial Automation: SiC MOSFETs are being adopted in motor drives and factory equipment for better operational control and efficiency.

Energy Storage: Integration of SiC in battery management and grid-level storage systems to enhance scalability and response time.

Future Outlook

The silicon carbide MOSFETs market is set to experience exponential growth over the next decade. Analysts expect advancements in 8-inch SiC wafer production and vertical integration strategies to bring further cost efficiencies. Increased collaboration between automotive OEMs and SiC component manufacturers is likely to catalyze mass adoption across electric mobility platforms.

By 2031, widespread electrification, renewable energy commitments, and stringent energy efficiency standards will solidify SiC MOSFETs' position as a cornerstone technology in global power electronics.

Market Segmentation

By Breakdown Voltage:

650 V – 900 V

900 V – 1200 V

1200 V – 1700 V (Largest segment)

Above 1700 V

By Application:

Inverters (Highest CAGR – 30.4%)

On Board Chargers (OBC)

Uninterruptible Power Supply (UPS)

Motor Drives

Energy Storage Systems

Others (Server, Switch Mode Power Supply)

By End-use Industry:

Automotive

Energy & Power

Industrial

Consumer Electronics

Others (Telecommunication, Healthcare)

Regional Insights

Asia Pacific held the largest market share in 2022 at 33.2%, led by China, India, Japan, and South Korea. Government incentives, booming EV sales, and rapid solar PV deployment are key growth factors.

North America emerged as the second-largest market, with strong contributions from the U.S. Renewable energy incentives, EV policy support, and increasing solar energy adoption are spurring demand.

Europe is also seeing significant adoption due to climate goals, automotive electrification, and innovation-led demand in industrial sectors.

Why Buy This Report?

In-depth Industry Analysis: Detailed segmentation by voltage, application, end-use, and geography.

Forecasts up to 2031: Market size, volume, and growth projections.

Competitive Intelligence: Profiles of leading players with insights into strategy and innovation.

Technology Trends: Analysis of emerging technologies, product developments, and market disruptors.

Regional Forecasts: Insights into major regional markets and country-level growth drivers.

This report serves as a comprehensive tool for decision-makers, investors, and businesses to understand market dynamics, identify opportunities, and stay ahead in the rapidly evolving SiC MOSFET landscape.

0 notes

Text

Global Computer Power Supplies Market : Industry Size, Share Trends, Growth, Demand, Opportunities and Forecast

Global Computer Power Supplies Market size was valued at US$ 8.94 billion in 2024 and is projected to reach US$ 14.73 billion by 2032, at a CAGR of 5.9% during the forecast period 2025-2032.

Computer power supplies are critical components that convert alternating current (AC) from wall outlets into direct current (DC) required by computer components. These units regulate voltage to ensure stable power delivery to sensitive electronics like CPUs, GPUs, and storage devices. The market includes both internal power supply units (PSUs) for desktop computers and external adapters for laptops, with variations in wattage, efficiency ratings (80 PLUS certified), and form factors (ATX, SFX, TFX).

The market growth is driven by increasing PC shipments, rising demand for high-performance computing in gaming and data centers, and technological advancements in energy-efficient designs. The shift towards modular PSUs and the growing adoption of liquid-cooled power supplies in premium systems are notable trends. Major manufacturers are focusing on developing compact, high-wattage units to support next-generation GPUs and AI workloads, with Corsair’s recent launch of 1600W ATX 3.0 compliant PSUs in Q1 2024 demonstrating this innovation push.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-computer-power-supplies-market/

Segment Analysis:

By Type

AC Power Supply Segment Leads the Market With Widespread Adoption Across Consumer Electronics

The market is segmented based on type into:

AC Power Supply

DC Power Supply

Modular Power Supply

Non-modular Power Supply

Others

By Application

PC Computers Segment Dominates Due to High Demand for Gaming and Workstation Setups

The market is segmented based on application into:

PC Computers

Laptops

Servers

Industrial Computers

Others

By End User

Consumer Electronics Sector Captures Largest Share With Growing Household Device Penetration

The market is segmented based on end user into:

Consumer Electronics

Commercial

Industrial

Others

By Power Rating

500W-1000W Segment Shows Strong Growth Catering to High-performance Computing Needs

The market is segmented based on power rating into:

Below 500W

500W-1000W

Above 1000W

Regional Analysis: Global Computer Power Supplies Market

North America The North American computer power supply market is characterized by high demand for energy-efficient and modular units, driven by stringent energy regulations (such as 80 PLUS certification requirements) and a mature gaming/PC enthusiast culture. The United States accounts for over 85% of regional demand, with major players like Corsair and Thermaltake dominating the premium segment. Data center expansions – projected to grow at 4.5% annually through 2025 – are additionally fueling demand for redundant server power supplies. While replacement cycles are slowing in consumer markets, the commercial sector shows steady growth due to cloud computing infrastructure investments.

Europe Europe’s market emphasizes environmental compliance with EU ErP Lot 6/7 regulations pushing adoption of high-efficiency (90%+) PSUs. Germany and the UK collectively hold 60% market share, with industrial applications showing particular strength. The region has seen consolidation among manufacturers, with Seasonic and be quiet! leading through technical innovation. Though laptop adoption has reduced desktop PSU demand, the DIY PC market remains robust, especially in Eastern Europe where cost sensitivity drives demand for mid-range 500-750W units. Renewable energy integration into power grids is creating niche opportunities for adaptive power supply designs.