#emergency personal loan online

Explore tagged Tumblr posts

Text

In the realm of modern finance, the concept of instant personal loans has revolutionized the way individuals access much-needed funds. This paradigm shift is attributed to the seamless online application process, which allows borrowers to submit their loan requests from the comfort of their homes. Gone are the days of tedious paperwork and long waiting times.

#quick loan service#best instant loan#genuine personal loan app#need personal loan urgent#emergency personal loan online#cheapest personal loan

0 notes

Text

At 15MFinance.us, we take pride in our journey of growth and the impact we've made on countless lives. Since our founding in 2016, we’ve consistently worked to expand access to quick and reliable loan solutions for consumers across the United States. Here's a look at some key milestones that define our progress:

2016 - The Beginning

We launched 15MFinance.us with a vision to simplify the lending process and help Americans access emergency funds quickly. Starting as a small team, we committed to making financial solutions accessible to all, regardless of credit challenges.

2017 - Expanding Our Reach

Within our first year, we partnered with a range of reputable direct lenders, enhancing our ability to offer personalized loan products. Our network quickly grew, allowing us to serve more customers in need of fast, no-hassle financial assistance.

2018 - User-Friendly Platform

To better serve our clients, we launched a more intuitive online platform. This made it easier and faster for customers to apply for loans, further enhancing the customer experience and cementing our position as a trusted resource in the personal loan space.

2019 - Strengthening Partnerships

As our customer base continued to grow, so did our network of lending partners. We expanded our offerings to ensure a broader range of loan products, tailored to fit various financial needs and credit profiles.

2020 - Resilience in Crisis

In the face of the global pandemic, 15MFinance.us remained steadfast in helping over 300,000 Americans secure the financial support they needed. We continued to provide quick approvals and flexible loan options despite the challenges, reinforcing our commitment to supporting customers through difficult times.

2021 - Saving Customers Millions

Our dedication to transparency and low fees paid off as we saved our customers millions of dollars in unnecessary costs. We solidified our place as a go-to platform for borrowers seeking fast, reliable, and affordable loan options, especially for those with credit struggles.

2022 - Enhanced Security

To safeguard our growing customer base, we implemented advanced security measures to ensure the protection of all personal and financial information. Additionally, we introduced new features to enhance the overall customer experience.

2023 - Widening Our Impact

We made it our mission to assist even more families across the nation by expanding our services and improving access to loans for those with limited credit history. Through our efforts, we've helped numerous households regain financial stability.

2024 - A Leader in Loan Solutions

Today, 15MFinance.us is recognized as a leader in the personal loan industry, having helped over 685,000 Americans access essential funds. With over $289 million saved in loan fees, we continue to drive financial empowerment and aim to help even more individuals achieve their financial goals.

These milestones reflect our unwavering commitment to providing quick, secure, and accessible loan options to Americans in need. As we look toward the future, we remain dedicated to expanding our services and continuing to be a trusted financial partner for those seeking fast and affordable loans.

Official Website Of 15M Finance: CLICK HERE

#15MFinance#15M Finance#15MFinance Official Website#15M Finance Loans#Loans In California#Loans In Texas#Loans In Florida#Loans In Ohio#Loans In Missouri#Loans In New Jersey#No Credit Check Loans#Bad Credit Loans#Emergency Loans#Payday Loans#Personal Loans#Online Loans#Installment Loans

2 notes

·

View notes

Text

Rupee112 is a leading financial institution committed to empowering individuals in their financial journey. As a trusted lender, Rupee112 specializes in providing Instant Personal Loans to individuals facing various financial needs and challenges.

Reference Link:-https://in.pinterest.com/pin/1118089044977730177/

#Payday Loans for Salaried Employees faridabad#emergency personal loan app Ahmedabad#Urgent Personal Loans Ghaziabad#emergency personal loan approval gurgaon#urgent payday loans Kolkata#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#instant personal loan low cibil chennai#Immediate personal loans faridabad#Online personal loans faridabad#Salary-Based Loans Mumbai#instant payday loans Bengaluru#instant personal loan for salaried gurgaon#best instant loan app kolkata#instant loan for salaried employee Hyderabad

2 notes

·

View notes

Text

How to Use a Personal Loan for Medical Emergencies

Medical emergencies can occur unexpectedly, and the financial burden of treatment can often be overwhelming. Whether it's a sudden illness, an accident, or a major surgery, medical bills can quickly pile up, especially if the treatment requires immediate attention or involves costly procedures. In such situations, having access to quick and flexible financial solutions, like a personal loan, can provide much-needed relief.

A personal loan for medical emergencies can be an ideal solution, as it offers quick disbursal, flexibility in repayment, and doesn’t require any collateral. This guide will walk you through how to use a personal loan for medical emergencies, the benefits, and important factors to consider before applying.

Why Choose a Personal Loan for Medical Emergencies?

Quick Access to Funds: One of the biggest advantages of a personal loan is that it can be processed quickly. Unlike other loans, personal loans do not require a lengthy approval process, and funds are typically disbursed in a matter of hours or days. This makes them ideal for urgent medical needs, where time is of the essence.

Unsecured Loan: Personal loans are typically unsecured, meaning they do not require collateral like a home or car. This makes them accessible to a wide range of individuals, even those who may not have assets to pledge. You can access the loan amount based on your creditworthiness and income.

No Restrictions on Usage: Unlike medical loans, which may only cover specific expenses related to treatment, personal loans can be used for any medical-related expense. Whether it's for hospitalization, surgery, medical tests, post-surgery care, or even transportation, the flexibility of personal loans allows you to cover all aspects of your medical emergency.

Flexible Repayment Options: Personal loans come with flexible repayment terms, allowing you to choose a tenure that suits your financial situation. This makes it easier to manage your monthly EMI without feeling overwhelmed by large payments.

Lower Interest Rates for Eligible Borrowers: If you have a good credit score, you may qualify for a personal loan with a lower interest rate. This can significantly reduce the overall cost of the loan, making it easier to repay without burdening your finances.

How to Use a Personal Loan for Medical Emergencies

Using a personal loan for medical emergencies involves several simple steps. Here’s a breakdown of the process:

Step 1: Assess Your Medical Expenses

Before applying for a personal loan, it’s essential to understand the full extent of your medical expenses. Make sure to account for:

Hospitalization costs: This includes room charges, doctor’s fees, and medical equipment.

Surgical expenses: Surgeons, anesthesia, operating room charges, etc.

Medication: Medicines prescribed during the treatment and post-surgery care.

Tests and diagnostics: Blood tests, X-rays, MRIs, or other diagnostic procedures.

Other related expenses: Transportation, ambulance services, and follow-up appointments.

Once you have a clear picture of your expenses, you can determine how much money you need and choose the right loan amount.

Step 2: Research Lenders and Loan Options

Different lenders offer personal loans with varying terms, interest rates, and eligibility requirements. Researching your options is essential to ensure you choose the best loan for your needs.

Some key points to consider while comparing lenders include:

Interest Rates: Compare the interest rates offered by different lenders. A lower interest rate can help reduce your overall repayment burden.

Processing Fees: Check if the lender charges a processing fee, and if so, evaluate how much it adds to the overall cost of the loan.

Repayment Terms: Choose a loan with a repayment tenure that matches your financial ability. A longer tenure may lower your EMI but increase the total interest paid over time.

Approval Time: Given the urgent nature of medical emergencies, choose a lender that offers quick approval and disbursal of funds.

Some lenders to consider for personal loans for medical emergencies include:

IDFC First Bank: Known for quick processing and competitive interest rates.

Bajaj Finserv: Offers personal loans with minimal documentation and fast approval.

Tata Capital: Known for flexible repayment options and quick disbursal.

Axis Finance: Offers personal loans with lower interest rates for medical needs.

Axis Bank: Provides competitive rates and quick loan approval.

Incred Personal Loan: Known for its fast application process and efficient disbursement.

Step 3: Check Your Eligibility

Before applying for a personal loan, check the lender’s eligibility criteria to ensure you meet their requirements. While personal loans are generally easier to qualify for than secured loans, lenders may still look at:

Credit Score: A good credit score (typically 750 or above) increases your chances of getting approved for a loan with favorable terms.

Income: Lenders will assess your income to ensure that you can comfortably repay the loan.

Employment Status: Having a stable job with a steady income is important when applying for a personal loan.

Existing Debt: Lenders may check your debt-to-income ratio to assess whether you are overburdened by existing loans.

If your credit score is not ideal, you may still qualify for a loan but at a higher interest rate. You can also consider applying with a co-signer if needed.

Step 4: Apply for the Loan

Once you’ve chosen a lender, you can apply for the loan online or by visiting the lender’s branch. The online application process is typically fast and easy, requiring minimal documentation. Some lenders may require:

Proof of identity (Aadhaar card, passport, etc.)

Proof of address (electricity bill, rental agreement, etc.)

Income proof (salary slips, bank statements, etc.)

Medical documents related to your treatment (hospital bills, medical reports, etc.)

Step 5: Loan Disbursal and Use

After your loan is approved, the lender will disburse the funds, usually into your bank account. You can then use the loan to pay for medical expenses, such as hospital bills, medications, or surgical fees. Since personal loans are unsecured, you do not need to worry about using the funds for a specific purpose, making it easier to handle any medical-related costs.

Make sure to keep track of your expenses and use the funds wisely to cover all essential costs related to your medical treatment.

Step 6: Repay the Loan

Once the treatment is over, you’ll begin repaying the loan as per the agreed-upon EMI schedule. You can make monthly payments through auto-debit from your bank account to avoid missing any deadlines. If you receive a financial windfall, you may consider making a prepayment to reduce the principal and the overall interest.

Important Considerations Before Taking a Personal Loan for Medical Emergencies

Emergency Fund: If you don’t already have an emergency fund, this might be a good time to start one. Personal loans can be helpful in urgent situations, but it’s always better to have a financial cushion for unforeseen circumstances.

Interest Rates: Interest rates on personal loans can vary greatly depending on your credit score and the lender. Try to secure a loan with the lowest possible interest rate to reduce your overall repayment amount.

Loan Terms: Carefully read the terms and conditions of the loan, especially regarding prepayment penalties, fees, and the interest structure. Some loans may have hidden fees that could add up over time.

Borrow What You Need: Only borrow the amount you actually need for medical expenses. Borrowing more than necessary can lead to higher repayments, which can become a burden in the long run.

A personal loan for medical emergencies is a flexible and efficient way to cover unexpected medical expenses. Whether it’s a sudden illness, surgery, or medical treatment, personal loans can provide quick access to funds, allowing you to focus on recovery instead of financial stress. By following the steps outlined above and carefully considering your options, you can secure a loan that suits your needs and helps you manage your medical expenses effectively.

To explore personal loan options for medical emergencies, visit FinCrif Personal Loan, where you can compare offers from top lenders like IDFC First Bank, Bajaj Finserv, Tata Capital, Axis Finance, Axis Bank, and Incred. This way, you can ensure that you are getting the best terms and rates for your medical needs.

#Personal loan for medical emergencies#Medical emergency loan options#Quick personal loans for medical expenses#Unsecured personal loan for health expenses#Best personal loans for medical bills#Personal loan for hospitalization#Medical loan without collateral#How to apply for a medical emergency loan#Low-interest medical emergency loans#Personal loan for surgery expenses#Fast approval medical loans#Flexible repayment loans for medical emergencies#Personal loan for health treatment#Medical loan eligibility#Personal loan for medical expenses India#Emergency loan for urgent medical care#Medical loans with quick disbursal#Personal loan for medical treatment costs#Apply for personal loan for medical emergencies#Best lenders for personal loans for medical expenses#loan apps#finance#fincrif#loan services#personal loans#personal loan online#nbfc personal loan#personal laon#personal loan#fincrif india

0 notes

Text

What is the Easiest Loan to Get Online?

#Cash Advances#Title Loans#Payday Loans#Personal Loans#Peer-to-Peer Loans#Online Loans#Bad Credit Loans#Fast Loan Approval#No Credit Check Loans#Best Online Loans#Easy Loans#Quick Loans#Emergency Loans

0 notes

Text

Plain Green Loans: Emergency Cash When You Need It offers fast, reliable financial solutions during unexpected situations. Discover how Plain Green Loans can provide you with the emergency cash you need, precisely when you need it most. Explore the benefits, application process, and why Plain Green Loans is a trusted choice for quick financial relief.

#Quick cash loans online#Fast emergency loans#No credit check loans#Instant approval loans#Online payday loans#Same day cash loans#Emergency money lender#Short term personal loans#Bad credit emergency loans#Fast personal loans online

0 notes

Text

What is the difference between Traditional and Digital Lending?

Imagine yourself living in your old good days. Your father is heading to a local bank with a pile of papers, praying for the Instant Approval of the loan. Do you know for what purpose? Of course, to borrow some cash for the next BIG THING.

Fast-forward to 2024. You are sitting at your home, and with a few taps and swipes, you're applying for a loan and getting one, too. Do you know how? Of course, Digitally.

The financial sector has undergone significant changes in the past few decades. Hereby, Digital Lending Companies like Chinmay Finlease Limited welcome you to the world of Digital Lending Services, where the only paperwork you might encounter is the receipt of your prepaid phone bills. Let’s explore what has caused the difference in the past decades and how people have turned their tables towards digital lending systems.

Traditional Lending: The Old Classical Approach

Traditional lending was the rock and will always be the bedrock of finances. It is synonymous with a well-established financial institution like a bank. The traditional model comprises in-person interactions, paper-based processes, and relatively extended decision periods. The core image is of a borrower walking into a bank branch, filling out lengthy forms, providing collateral, having long conversations with the bank manager, and waiting days or weeks for the loan to be approved.

WHEREAS

Digital Lending: The New Classic Approach

Digital lending is born from the digital revolution. It is the modern way of lending digital loans. It uses digital platforms like websites and mobile apps that integrate AI technology throughout lending. Moreover, this model is successfully driven by a Fintech Company like Chinmay Finlease Limited, which provides personalised financial services to its customers.

–wrapping up!

The lending landscape is rich and varied, offering options from traditional finance to digital platforms. Wholly and solely, the choice between traditional lending and digital lending depends on the borrower's preferences, needs, and circumstances.

Chinmay Finlease Limited is among the best digital lenders and a premier choice for those seeking financial solutions. We provide quick online Personal Loans, Consumer Durable loans, and Emergency Loans with minimal paperwork. With us, you're not just obtaining a loan but partnering with a trusted and dedicated company to help you achieve financial success.

Source Link: Difference Between Traditional and Digital Lending

#loan app#personal loan app#perosnal loan#instant loan#loan#instant loan app#online loan#quick loan#emergency loan

0 notes

Text

Securing Financial Support: Navigating the Need for a Medical Emergency Loan

Life's uncertainties often manifest in unexpected ways, and one such unpredictable aspect is a medical emergency. When faced with urgent health needs, the last thing anyone wants to worry about is financial strain. In these critical moments, a medical emergency loan can serve as a crucial lifeline, providing immediate access to funds to address healthcare needs without unnecessary delays.

Understanding the Urgency

Medical emergencies can be physically, emotionally, and financially draining. The pressing need for immediate medical attention can lead to unforeseen expenses, catching individuals off guard. It's during these times that the importance of having quick access to funds becomes apparent.

The Role of Medical Emergency Loans

In recent years, financial institutions and online platforms have recognized the need for swift and efficient solutions to address medical emergencies. Medical emergency loans are designed to bridge the gap between the urgency of healthcare needs and the availability of funds. These loans are tailored to provide individuals with the financial support required to cover medical expenses promptly.

Key Features of Medical Emergency Loans

Quick Approval and Disbursal: Unlike traditional loan processes that may take days or weeks, medical emergency loans are designed for rapid approval and disbursal. Platforms like MyMeds247 ensure that the funds reach the borrower as quickly as possible, acknowledging the time-sensitive nature of medical crises.

Minimal Documentation: Recognizing the urgency of the situation, medical emergency loans often come with simplified documentation requirements. Basic documents such as identification proof, address proof, and income statements are typically sufficient, streamlining the application process.

Flexible Usage: Medical emergency loans offer flexibility in how the funds can be utilized. Whether it's covering hospital bills, diagnostic tests, surgeries, or purchasing necessary medications, borrowers have the freedom to allocate the funds as per their specific medical needs.

How to Apply for a Medical Emergency Loan?

Applying for a medical emergency loan is a straightforward process, especially with online platforms. Here are the general steps:

Research and Choose a Reliable Lender: Look for reputable lenders or platforms like MyMeds247 that specialize in medical emergency loans.

Check Eligibility: Ensure that you meet the eligibility criteria, which may include factors like age, employment, and income.

Online Application: Fill out the online application form with the required details.

Document Submission: Submit the necessary documents, typically including identification proof, address proof, and income statements.

Approval and Disbursal: Upon approval, the loan amount is swiftly disbursed to your bank account, providing the financial support needed during the medical emergency.

Conclusion

When a medical emergency strikes, having access to immediate financial assistance can make all the difference. Medical emergency loans are designed to alleviate the stress associated with unexpected healthcare expenses, offering a timely solution for individuals in need. By exploring reliable platforms and understanding the straightforward application process, individuals can ensure they have a financial safety net when faced with medical emergencies. Remember, prompt action in securing a medical emergency loan can contribute to a smoother and more focused journey towards recovery.

0 notes

Text

Catch Rupee provides you best personal loans services in Pune. Apply for a personal loan online, get instant approval, and avail of various other benefits. Call Us Today 8956235976 / 9175674659

#Personal Loan Finance Companies#Finance Companies providing Personal Loan#Best Personal Loan Finance Companies#Apply education loan online#Personal loan interest rates#Medical emergency loan in Pune#Apply for Educational Loan Online in Pune#Apply for a personal loan online#Best personal loans services in Pune

0 notes

Text

Apply for an instant personal loan

Rupee112 is an instant personal loan service provided by our customers. It is very reliable for instant loans. Those are quick service providers and easy ways. For more information visit our site.

#apply online for emergency loan Ghaziabad#Short Term Loans Online gurgaon#instant payday loan noida#Same Day Loan for Salaried Employees Bengaluru#Short term loan without CIBIL kolkata#short term loan for salaried employees Hyderabad#instant emergency loan Ghaziabad#Payday Loans for Salaried Employees faridabad#emergency loan online noida#Short Term Personal Loan in Gurgaon#instant personal loan for low cibil score noida#instant payday loan gurgaon

0 notes

Text

Emergencies can come up anytime, with Rupee112 you will get a chance to experience a seamless emergency personal loan process giving funds to your account within minutes. Visit here-

0 notes

Text

Digital approval for personal loan within 15 minutes for vacation and home renovation

Get quick digital approval for personal loans in just 15 minutes! Finance your dream vacation or home renovation hassle-free. Apply now for fast, easy funding

#onlinepsbloans#psbloansin59minutes#loans#digitalloanapproval#digital approval#personal loan#personal loan online#emergency loan#instant loan#apply for personal loan

0 notes

Text

TW // mental issues, mental absue, harassment, surgery/blood

I'm sorry this one is so long, but please carry on reading. It's a chance for me to not only speak about the situation but let out some steam too. It is unfortunate this announcement comes at the same time the flood occurs on the south of my home country (Poland) and I'm in the endangered zone, luckily so far safe, as I feel my head can't handle more stress.

It's been so long since I've been this personal online. I realized how I didn't feel the urge to vent for 3-4 years by now which is a sign of improving mental health. But my healing is still a process, and I'm afraid it's too hard to carry this rock alone at this point. I fought my thoughts if I should do this and I think just as deeply as I write right now. Yet, I know it's better late than never and I thank deeply my friends for helping me out recently as well as in the past in my lowest. I wholeheartedly owe my life to you.

I couldn't ask for better friends. As years verified, even long lasting relationships might be nothing but a mask and I had to learn the hard way. I ended a friendship of 13 years at the time over a misunderstanding. Other person I put my trust on was nothing but a groomer with morally corrupted sexual tendencies who would take advange of a group of minors while being the only adult among them, yet acting like a person much younger than all of them and pressuring all their mental issues on children instead of seeking help. The latter, I might speak of more in detail when I'm ready.

Long time ago I tried calling out for help but back then, the intrusive thoughts won; "Others have it worse, just work harder.", "No one will give you anything for free, no one will care.", "What people will think of you?". and I would only speak about these things in a closed circle of my friends.

I tried my best in silence by not giving up on my creative passion, working restlessly for years, improving. Hoping I could reach the point I can sustain myself purely on what I make.

But the problem is not being self-sufficient. And it's not about my art...

All of my life it has been me, my momma and my granny. The other two important figures weren't there for us, by choice. (which is hard to say if losing someone you loved is worse than not being cared for in the first place) My rather young self at the time didn't put much thought about it as I didn't understand it but something always felt wrong; my only issues at the time was being "that weird, quiet kid with little to no friends". But despite the hardships, my momma has always been my hero, working without a time for a break or rest so we could live happily, to afford something special from time to time.

However in 2014 my momma has been hospitalised and almost lost her life to wrongly treated ovarian cyst (cyst rapture), with enough blood loss to require emergency surgery...

From that point on things went downhill and the result of that we feel to this very day. To stay afloat we fell into a severe dept. (We didn't have any savings, could only rely on borrowing money or loans) And since I was a child as all of this happened, I've only learned about it all throughfully as I entered adulthood, so I wouldn't need to worry about anything and "just be a kid". Which I really understand, but it doesn't make it easier to handle.

And by now, for several years I keep on trying to earn money, so I could free my momma from this chain and let her live, not survive. I always wanted to get through this quietly, because I never, ever wanted to burden anyone with my home problems. But it grew to a point I might need to grab anything to climb towards the light

The goal is $10 000... which is scarily large number.

I list all the options but Kofi is preferred to keep track of the funds!

My commissions are HERE! (the sheet will receive a slight update in upcoming days) My Kofi is HERE! (Level 4 Tea is free headshot drawing every month!) HERE's other services I do (adopts, brushes, etc) I plan to do paid requests for my friday streams on occasion! Anything else I come up with I hope to include in here! Every person who donates will be part of "Thank you" list where I hope to shoutout everybody, cause every penny matters. I want this situation to end...

#digitalart#artdigital#artwork#digitalartist#digitalartwork#digitaldrawing#artillustration#artworkdigital#artwork digital#artistsondeviantart#kofi#ventart#helpneeded#help#donations#ko_fi#vent#pleasedonate#emergencycommissions#emergency#fundraising#funds#crowdfunding#vent artwork#commissions#commission#commish

102 notes

·

View notes

Text

**not cutesy sad girl blogging, feel free to scroll on if ur not interested !!

i know there are a lot of people on here who are in their young/mid teens and might be seeking help for the first time (or doing so soon) so i just wanted to put this out there- misdiagnosis is possible and extremely, extremely common. this is specifically tailored to bpd because i know most of us here have it

i completely understand wanting a diagnosis to understand why you do the things you do and feel the way that you do and that is 100% completely fine. but please, please be careful that you don’t become so desperate for answers that you end up accepting an inaccurate or unethical label. if you’re under 18 and early in therapy (less than a year) or not in inpatient care and receive a formal bpd diagnosis, please be careful. it’s often not a misdiagnosis and is likely to be correct but it goes against ethical standards and is a massive red flag of your provider. minors can have bpd (and do!! it starts developing super young) but the diagnostic process is very different to when you’re an adult and should only be made in an emergency or after long term observation. this doesn’t mean you don’t have bpd, it just means that your psych has not gone through the proper process and that can have implications for the rest of your care. being medically recognised is a completely different story and not a bad thing. but when your personality is technically still developing, your provider needs to be 100% sure without a doubt that it is disordered and not caused by anything else before putting a formal diagnosis on your file. not doing that is unethical even if the diagnosis is correct. the amount of teenage girls who have been misdiagnosed with bpd and ended up actually having autism, adhd or cptsd that goes untreated until their 30s is astounding. you probably do have bpd but you should not get a bpd diagnosis put on your record at fifteen years old after seeing your psychologist for three sessions.

in that same vein, if you receive a diagnosis (of any disorder, at any age) and it doesn’t feel right, PLEASE CHALLENGE IT. please seek a second opinion if you have concerns. being treated for the wrong diagnosis can make your condition worse. being viewed with the stigma of a disorder that you don’t have can make your condition worse. up until this year i spent seven years of my life receiving misdiagnosis after misdiagnosis. trust me when i say you’re better off getting no diagnosis at all than getting the wrong one. this is especially true if you think you have bpd but end up getting a bipolar diagnosis- most medications have an inverse effect on us and being prescribed a cocktail of atypicals because they think you’re just not responding to the meds will fuck you up.

there’s a lot of fearmongering online, especially on tiktok, about getting a formal bpd diagnosis so i also just wanted to clear up that no, you will not be rejected entry from countries, you will not be rejected for loans or home ownership and you will not be rejected from career opportunities. the only people who have access to your medical records without a subpoena are your doctors. you are not legally obligated to tell anybody and nobody outside of your care team is allowed to access or request your info outside of a court setting. being diagnosed does not ruin your life as long as you have good medical professionals around you.

if you want to seek help, PLEASE DO. but please advocate for yourself whenever necessary. you deserve help and you deserve a team who listens to your concerns and diagnoses you responsibly. most professionals will leave a diagnosis off your record if you request it (usually unless it’s schizophrenia or bipolar, literally only because it’s important for everybody providing you any form of treatment in any context to know). good psychs will allow you to question a diagnosis and a lot will let you reject it or ask for extra consideration.

#probably definitely won’t get many notes which is so fair it’s not relatable sad girl post#but i just felt like this needed to be said#jirai kei#jiraiblogging#jiraiblr#landmineposting#jirai#jirai girl#landmine girl#landmineblr#actually bpd#bpd#cluster b#actually cluster b

75 notes

·

View notes

Text

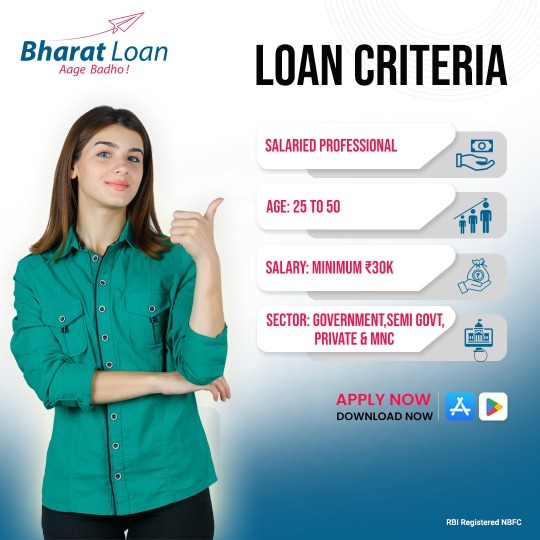

Redefining Financial Solution - Personal loan in Faridabad

Everyone is in the pursuit of achieving more; it can be getting a new car, a salary hike, a new job that pays more, starting a business, etc. While making sure every need and want is fulfilled, what if financial emergencies arise and you are left with nothing? When such situations arise, anyone, especially salaried employees, can access support from Bharat Loan, offering short-term loans ranging from ₹5k to ₹1Lakh. Visit the blog to read more.

Visit- Redefining Financial Solution - Personal loan in Faridabad

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad

0 notes

Text

Leveling up during Chaos.

To some leveling up may be a conversation that feels a bit vapid and unnecessary given the events happening globally especially in the US. I would disagree because leveling up will be necessary to survive the upcoming economic climate. Here's some tips I believe everyone should be implementing in order to survive and also thrive.

Save money - I know that all the finance bros constantly downplay savings and mostly focus on investing, but savings is STILL RELEVANT! Having savins can prevent you having to take payday loans, replace a car vs a car part, and help you feel more at ease during emergency. Whether you are saving $25, $50, or more every paycheck, please, set some money aside

Build your network - LinkedIn is great! Meeting people in person is BETTER. It's time to join groups, go to local meetups for people in your current or desired field because this is going to be how people get job opportunities. Also focus on sustaining those relationships, so NOT just a LinkedIn hit it and quit it, but instead please focus on building long term mutually beneficial relationships with people that you like and who know more than you!

education, Education, EDUCATION! - If you are afraid that your job could be at risk, you want to explore a new career, or feel like you need more education, DO IT! But when you do it please be smart. Focus on grants, scholarships, transferring credit from lower cost institutions, interships, bootcamps. Do your research! Check websites like will a robot take my job, career trajectory, and need for that particular job/career in your area. Be smart while getting smart. Do NOT believe these people online telling you that degrees don't matter! In these next 4 years they will not only matter, they will be the reason many people get left out of the new economy.

B-U-D-G-E-T - I know this is hard to do in this economy for some right now, but now more than ever you need to know where your money is going. If you're in debt and want to get out first assess that you are able to meet your basic needs (housing, food, etc.) then work out a sustainable debt pay back plan. If you can help don't allow things to go into default, but if the do, or have, focus on paying the most important bills first, save, and then of course focus on debt.

Do NOT DOOMSPEND - I know it may seem tempting to spend like there's no tomorrow and that everyday the news and government can make it easier to become more and more nihilistic, but maxing out affirm, Klarna and Afterpay will NOT help. Set a little cash aside for guiltless, mindless "joy spending" and then STOP. Think about creating community instead of spending all the time. Set up a home paint and sip, go the local coffee shop and read a good book, check out some new pieces at the Museum. Research low-cost hobbies and lean on those when you're anxious instead of spending.

Have your own $$$ - Yes even if your partner has money, set some aside that you don't touch of your own. You never know when you, or both you and your partner might need it.

I hope this helps!

#femininity#black women#black women in femininity#levelup#black luxury#next level#soft black women#soft black girls#feminine black women#leveling up#survive 2025#money monday#money in the bank#black beauty#blackwoman#dei initiatives#feminine#hyper feminine#black femininity#traditional femininity#divine feminine#feminine beauty#feminism#end of an era#project 2025

25 notes

·

View notes