#efile online

Text

What is E-filing

How to file ITR online? Refer this guide on tax filing online where we explain step-by-step income tax filing process for you. Read more!

What is E-filing? E-filing is an abbreviation for electronic income tax filing. E-filing is the process of electronically filing your income tax returns online for a specific year. This means you no longer need to physically visit the nearest Income Tax Department office to file your returns.

0 notes

Text

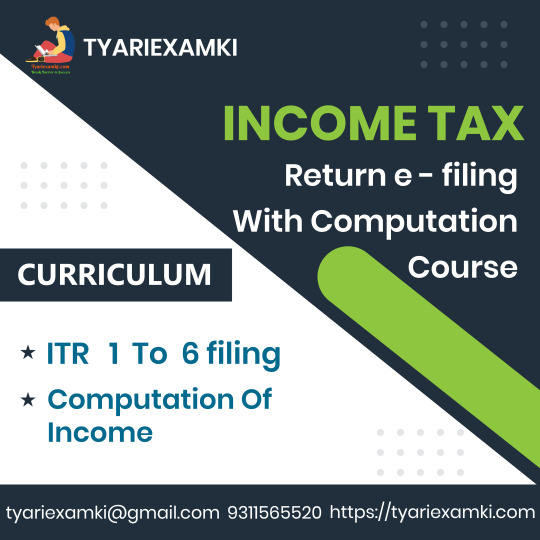

Income Tax e - filing Online Course. Upgrade your Tax e filing Practice through tyariexamki.com. Job Oriented Course

For more information

Visit us:- https://www.tyariexamki.com/.../Income-Tax-Return-E...

2 notes

·

View notes

Text

#custom truck#taxfilinghelp#taxi service#truck#truckers#truckinglife#form 2290#efile#efile form#form 2290 online#tax

0 notes

Text

Comprehensive GST Filing and Registration Services in Hyderabad by KVRTaxServices

Navigating the complexities of GST can be challenging for businesses, especially in a dynamic city like Hyderabad. KVRTaxServices is committed to simplifying this process by offering comprehensive gst filing services in Hyderabad. Our expertise ensures that businesses can focus on growth while we handle their GST requirements efficiently and accurately.

Seamless GST Return Filing

At KVRTaxServices, we understand the importance of timely and accurate GST return filing. Our dedicated team offers specialized gst return in hyderabad services, ensuring compliance with the latest regulations. Whether you're a small business or a large corporation, our gst efiling in hyderabad service caters to all your needs. We provide an end-to-end solution, from data collection to the final submission of returns, ensuring accuracy and adherence to deadlines.

Online GST Return Filing

In today’s digital age, the convenience of online services cannot be overstated. KVRTaxServices offers GST Return Filing Service in hyderabad that leverages the latest technology for efficient processing. Our GST Return Filing online in hyderabad service is designed to save you time and effort. By using our user-friendly platform, you can easily upload your documents, track the status of your filings, and receive instant notifications about your GST returns.

Expert Assistance for GST Registration

Starting a new business or expanding an existing one requires proper GST registration. KVRTaxServices provides comprehensive support throughout the GST Return Filing in hyderabad. Our team of experts guides you through every step, ensuring that all necessary documents are prepared and submitted correctly. We offer gst registration online in Hyderabad to make the process as convenient as possible, allowing you to complete your registration from the comfort of your office or home.

Once your registration is complete, you will receive your gst registration certificate in hyderabad. This certificate is crucial for legal compliance and enables you to operate your business without any hindrance. KVRTaxServices ensures that you receive your certificate promptly and without any complications.

Simplifying New GST Registrations

For new businesses, understanding and completing the gst new registration process in hyderabad can be daunting. KVRTaxServices is here to simplify this for you. Our team provides step-by-step guidance to ensure that you understand each requirement and complete your registration smoothly. With our support, obtaining your GST registration becomes a hassle-free experience.

Specialized Services for Companies

Companies have unique GST needs, and our services are tailored to meet these requirements. We offer company gst registration in hyderabad, ensuring that your business is compliant with all GST regulations from the outset. Our expert team handles all the intricate details, allowing you to focus on your core business activities.

Why Choose KVRTaxServices?

KVRTaxServices stands out in Hyderabad for several reasons:

Expertise: Our team comprises seasoned professionals with extensive experience in GST-related matters.

Convenience: From gst registration online in hyderabad to gst efiling in Hyderabad, our services are designed to offer maximum convenience.

Accuracy: We ensure that all filings and registrations are accurate and compliant with the latest regulations.

Support: We provide continuous support, answering all your queries and guiding you through every step of the process.

Conclusion :

KVRTaxServices is your trusted partner for all GST-related services in Hyderabad. Whether you need assistance with gst filing services in hyderabad or guidance through the gst registration process in hyderabad, we are here to help. Contact us today to streamline your GST compliance and focus on growing your business.

#gst filing services in hyderabad#gst return in hyderabad#gst efiling in hyderabad#GST Return Filing Service in hyderabad#GST Return Filing online in hyderabad#GST Return Filing in hyderabad#gst registration process in hyderabad#gst registration online in hyderabad#gst registration certificate in hyderabad#gst new registration process in hyderabad#company gst registration in hyderabad

0 notes

Text

Understanding the GST Registration Process in Hyderabad

Navigating the GST registration process can be daunting, especially if you're a business owner in Hyderabad looking to ensure compliance while focusing on growth. At KVRTaxServices, we specialize in simplifying the GST registration process in Hyderabad, offering comprehensive support and guidance to help you obtain your GST registration certificate efficiently. Here's how we can assist you with your GST needs.

GST Registration Online: A Seamless Experience

Applying for GST registration online in Hyderabad can save you significant time and effort. Our team at KVRTaxServices ensures that the GST new registration process in Hyderabad is straightforward and hassle free. We guide you through every step, from filling out the necessary forms to submitting required documents, ensuring that you can focus on running your business.

Goods and Services Tax Registration in Hyderabad: Why It’s Essential

It is essential to acquire a current GST registration certificate if you operate any company in Hyderabad. It not only gives your company legitimacy, but it also enables you to bill clients for GST and obtain input tax credits. Our professionals can assist you if you need to renew your current registration or are wanting to apply for a GST registration online in Hyderabad for the first time.

Comprehensive GST Registration Services in Hyderabad

Company GST Registration Tailored Solutions

Every business is unique, and so are its GST requirements. Our company, we provides tailored company GST registration in Hyderabad, ensuring that your business meets all legal requirements and avoids potential penalties. Our personalized approach guarantees that your registration process aligns with your specific business needs.

New GST Registration Online Quick and Efficient

If you’re starting a new business or expanding your operations, getting a new GST registration online in Hyderabad is a crucial step. Our efficient services ensure that you receive your GST registration certificate without unnecessary delays, allowing you to commence your business activities promptly.

Expert GST Filing Services in Hyderabad

GST Filing Services: Stay Compliant

Once you have your GST registration, staying compliant with regular filings is essential. Our GST filing services in Hyderabad are designed to help you stay on top of your obligations, avoiding hefty fines and penalties. We manage everything from GST e-filing to ensuring accurate and timely submissions of your GST returns.

GST Return Filing Service Hassle Free Management

Managing GST return filings can be complex and time consuming. With our GST return filing service in Hyderabad, we take the burden off your shoulders. Our experts ensure that all your GST returns are filed accurately and on time, helping you stay compliant and focus on your core business activities.

Why Choose KVRTaxServices for GST Registration and Filing in Hyderabad?

Expertise and Experience

At KVRTaxServices, we pride ourselves on our deep understanding of the GST registration process in Hyderabad. Our team of experienced professionals stays updated with the latest regulations and ensures that your business is always compliant with GST laws.

Customer Centric Approach

Our customer centric approach sets us apart as a leading GST registration service provider in Hyderabad. We believe in building long term relationships with our clients by offering personalized services and dedicated support.

End to End Solutions

From the initial application to ongoing filing requirements, we provide end to end GST solutions for businesses of all sizes. Our comprehensive services ensure that you never have to worry about GST compliance again.

Provide Necessary Information

Share the required documents and information with us. We’ll handle the rest, ensuring a smooth and efficient GST registration process.

Receive Your GST Registration Certificate

Once your application is processed, you’ll receive your GST registration certificate. We’ll also assist you with any subsequent filings to keep your business compliant.

Ongoing Support and Filing Services

Continue to benefit from our expert GST filing services in Hyderabad. We'll make sure your GST returns are correctly submitted on schedule, allowing you to concentrate on expanding your company.

Conclusion

Navigating the GST registration process in Hyderabad doesn’t have to be a challenge. With KVRTaxServices, you get expert guidance, efficient service, and ongoing support to keep your business compliant with GST laws. Contact us today to learn more about our GST registration and filing services in Hyderabad and let us help you simplify your GST journey.

Whether you're applying for GST registration online in Hyderabad or need assistance with GST return filing, KVRTaxServices is your trusted partner for all your GST needs.

For more information, please contact.www.kvrtaxservices.in

#gst registration process in hyderabad#gst registration online in hyderabad#gst registration certificate in hyderabad#goods and service tax registration in hyderabad#apply for gst number online in hyderabad#gst new registration process in hyderabad#company gst registration in hyderabad#new gst registration online in hyderabad#gst registration service provider in hyderabad#gst filing services in hyderabad#gst return in hyderabad#gst efiling in hyderabad#GST Return Filing Service in hyderabad#GST Return Filing online in hyderabad#GST Return Filing in hyderabad

0 notes

Text

Every individual whose income exceeds the basic exemption limit has to compulsorily file Income Tax Return. Every company on the other hand has to file its Income Tax Return irrespective of its Total Income. Those individuals whose total income includes any income generated from foreign assets or who are beneficial owners of a foreign asset or has any interest in an entity located outside India also has to file their return of income irrespective of their basic exemption limit.

File your Income Tax hassle free with EazyBahi Solutuions.

0 notes

Text

Step-by-Step Guide to Trademark Registration: A Beginner's Handbook

Trademark registration is a critical step for protecting your brand identity and intellectual property. Whether you're a small business owner, entrepreneur, or creator, understanding the process of trademark registration is essential for safeguarding your unique brand elements. In this beginner's handbook, we'll provide a comprehensive step-by-step guide to walk you through the trademark registration process, from initial research to filing your application.

Understanding Trademarks:

Define what trademarks are and their importance in protecting brand identity.

Differentiate between trademarks, copyrights, and patents to clarify their distinct purposes.

Conducting a Trademark Search:

Explain the significance of conducting a thorough trademark search to ensure your mark is unique.

Provide guidance on how to perform a trademark search using online databases and professional services.

Choosing a Strong Trademark:

Discuss the characteristics of a strong trademark, such as distinctiveness and non-generic nature.

Offer tips for selecting a memorable and legally protectable mark for your business or product.

Preparing Your Trademark Application:

Outline the information and documentation required for completing a trademark application.

Provide instructions on filling out the application form accurately and comprehensively.

Filing Your Trademark Application:

Explain the process of submitting your trademark application to the appropriate trademark office.

Discuss the options for filing electronically or through traditional mail and their respective benefits.

Responding to Office Actions:

Educate readers on what to expect after filing their trademark application, including potential office actions.

Offer guidance on how to respond effectively to office actions, such as objections or requests for clarification.

Monitoring and Maintaining Your Trademark:

Emphasize the importance of monitoring your trademark for potential infringement or misuse.

Provide information on the ongoing maintenance requirements, including renewal filings and use declarations.

Enforcing Your Trademark Rights:

Discuss strategies for enforcing your trademark rights against infringers or unauthorized users.

Explain the legal remedies available for addressing trademark infringement and protecting your brand reputation.

Conclusion: Trademark registration is a vital legal process that offers valuable protection for your brand assets. By following this step-by-step guide, beginners can navigate the complexities of trademark registration with confidence and ensure their brand is safeguarded against unauthorized use. Remember, securing your trademark is an investment in the long-term success and integrity of your business or creative endeavors.

0 notes

Text

Considerations for Filing Form 1099-NEC Reports

Filing Form 1099-NEC (Nonemployee Compensation) is an important tax reporting requirement for businesses that have paid $600 or more to a nonemployee for services performed during the tax year. The purpose of this form is to report payments made to independent contractors, freelancers, and other nonemployee service providers. These payments are considered "nonemployee compensation," and they need to be reported to both the IRS and the recipient for tax purposes.

Here are the key steps and considerations when filing Form 1099-NEC:

Determine Who Should Receive a 1099-NEC: You need to determine which individuals or businesses you made payments to that meet the criteria for 1099-NEC reporting. Generally, this includes payments of $600 or more made for services rendered, including freelance work, contract labor, and professional fees.

Obtain W-9 Forms: Before making payments to nonemployees, it's a good practice to collect W-9 forms from these individuals or entities. A W-9 form provides the necessary information, including the recipient's name, address, and taxpayer identification number (TIN). This information will be used to complete the 1099-NEC.

Complete Form 1099-NEC: You will need to fill out the Form 1099-NEC for each recipient to report their nonemployee compensation. This form includes the payer's information, recipient's information, and payment details. Make sure to double-check all information for accuracy.

File with the IRS: You must file Form 1099-NEC with the IRS. The due date for filing with the IRS is typically the end of January for the previous tax year, but it can vary. Check the current tax year's instructions for the exact due date.

Provide Copies to Recipients: You are also required to provide a copy of Form 1099-NEC to each recipient by the same due date for filing with the IRS. This allows the recipients to report the income on their own tax returns.

Penalties: Failure to file Form 1099-NEC or to provide it to the recipients on time can result in penalties imposed by the IRS.

Keep Records: It's essential to keep accurate records of the 1099-NEC forms you've filed and copies provided to recipients for at least four years.

Electronic Filing: The IRS encourages electronic filing of Form 1099-NEC. There are various online platforms and software programs that can help with this process.

State Reporting: In addition to federal reporting, some states also require you to report nonemployee compensation. Be sure to check your state's requirements and deadlines.

It's important to stay up to date with the current IRS guidelines and requirements for Form 1099-NEC, as regulations can change from year to year. To ensure compliance, you may want to consult with a tax professional or use tax preparation software to assist with the filing process.

#1099 online#1099 nec#1099 nec form#1099 nec online#file 1099 nec form#efile 1099 nec form#irs 1099 nec form

0 notes

Text

Understanding IRS Form 940: A Comprehensive Guide for Employers

It's time for businesses to start thinking about their tax returns as tax season approaches. Form 940 is one important form that they should be aware of. In this blog, we'll define Form 940 and talk about its importance. Get ready to understand how this form relates to your business taxes and why you shouldn't forget about it when filing your taxes.

Know What's Form 940?

Form 940- "Employer’s Annual FUTA Tax Return"

Federal Unemployment Tax Act(FUTA)- Raises funds to compensate people with unemployment benefits who have lost their jobs. The FUTA tax rate is 6% of the first $7,000 paid to each employee every year.

Should you File Form 940?

Employers should file their 940 Form annually to report unemployment taxes to the IRS, and importantly these taxes are not withheld from the employee's wages and are solely paid by employers.

If you are an employer, who comes under any one of these categories, you must file Form 940 to the IRS:

If the employer has paid a total of $1500 or more to all the employees during any quarter of the current or previous tax year.

If an employer has employees working for 20 weeks of the tax year. These include full-time, part-time, or seasonal/temporary employment.

Special cases

For Employers of Household Employees:

If you are an employer of household employees, you must pay FUTA tax only on paid wages as cash of $1,000 or more.

For Agricultural Employers:

Have you paid cash wages of $20,000 or more to farmworkers during any calendar quarter in 2021 or 2022?

Have you employed 10 or more farm workers during some part of the day for 20 or more different weeks in 2021, and 2022?

If you come under any one of these conditions, then you must File Form 940.

For Indian Tribal Governments:

Services rendered by employees of a federally recognized Indian tribal government employer (including any subdivision, subsidiary, or business enterprise wholly owned by the tribe) are exempt from FUTA tax and hence they are excluded from filing Form 940.

For Tax-Exempt Organizations:

Religious, educational, scientific, charitable, and other organizations described in section 501(c)(3) and exempt from tax under section 501(a) generally aren't subject to FUTA tax.

For State or Local Government Employers:

Services by employees of a state, or a political subdivision or instrumentality of the state, are exempt from FUTA tax, and Form 940 is not required.

Form 940 Changes for 2023 Tax Year :

The IRS has released a few changes to Form 940 for the Tax Year 2023.

Credit reduction states for 2023:

A state that has not repaid money that it borrowed from the federal government to pay unemployment benefits is considered a credit reduction state.

Credit reduction rates of California (CA), Connecticut (CT), Illinois (IL), and New York (NY) is 0.6% and the U.S Virgin Islands (VI) is 3.6% for Tax year 2023.

New Form 940 (sp) available in Spanish for Tax Year 2023:

All employers, including employers in Puerto Rico and the U.S. Virgin Islands, have the option to file new Form 940 (sp) for tax year 2023 as Form 940-PR may no longer be available to file for tax years beginning after December 31, 2022.

Electronically filing an amended Form 940:

Till date there is only paper filing option for all the amendment forms. Now IRS has come up with the update of electronically filing Form 940, beginning sometime in 2024.

NOTE: If you are a Multi state employer (Check the box on Line 1b in Form 940) or Paid wages subjected to the Unemployment tax laws in credit reduction states(Check the box on Line 2 in Form 940)

You must file Form 940 Schedule A along with Form 940

Information to Know Before You File Form 940:

Business Details

Total payment made to all employees

FUTA Tax and Adjustments If credit reduction is applied.

Balance Due or Overpayment

FUTA liability deposits

When should you file?

The due date to file Form 940 for the 2023 tax year is January 31, 2024.

If FUTA taxes were deposited on the correct deadlines, Form 940 isn’t due until February 10, 2024.

The deadline is based on when the FUTA taxes are deposited:

If the FUTA tax liability is more than $500 for the calendar year, then the payments should be deposited at least for one quarter.

If the liability is less than $500 in a quarter, it can be carried over to the next quarter.

Complete your 940 filing before due!

What will happen if you fail to file within the deadline?

Employers will be imposed with penalties if the payment is not made or the 940 is not submitted by the due date.

The penalty for Form 940 late filing will be increased on a daily basis for amounts that were not deposited properly on time.

If the deposits are made 1 to 5 days late, a 2% penalty will be charged.

This penalty can be increased to 15% if the amounts remain due more than 10 days following the IRS notice.

Employers can either file paper copies or e-file their Form 940 to the IRS. The IRS has revised its threshold rate. According to this, it is mandatory to e-file if there are 10 or more returns in a calendar year beginning in 2024, tax year 2023.

To reduce the risk of rejection from the IRS, and also to file your return safely and easily use an IRS-authorized e-file provider TaxBandits which provides you the best solution to File your Form 940 online.

Some exclusive features that TaxBandits provides its users to File Form 940:

Secure Filing and get Instant IRS Updates

Supports to file Form 940 Schedule A

Bulk Upload Options for Tax Pros

Supports Prior year tax filings

API Solution for Service Providers

#form 940#940 form#IRS Form 940#940 Filing#efile 940#what is form 940#what is a 940 tax form#file form 940#file form 940 online#file 940 online

1 note

·

View note

Text

Security Considerations for eFiling Court Documents

In recent years, the legal industry has undergone a considerable transformation in terms of how court documents are managed and submitted. While eFiling of court documents offers convenience and efficiency, it also introduces various security risks which must be addressed to protect sensitive information. This post will explain the potential security concerns associated with eFiling and provide strategies to minimize these risks. This will ensure the integrity and confidentiality of legal documents.

Understanding eFiling and Its Advantages

It is possible for attorneys, self-represented litigants, and other legal professionals to electronically file court documents. By eliminating physical paper submissions, this process streamlines case management and reduces administrative burdens. eRrecording services have greatly enhanced this process by enabling the electronic submission of documents for recording in public records, greatly simplifying the management of real estate cases and other public records

Potential Security Risks in eFiling

Despite its advantages, eFiling presents several security risks that must be carefully managed:

Data Breaches and Unauthorized Access

Risk: Unauthorized individuals gaining access to sensitive information.

Impact: Compromised personal information, legal strategies, and confidential case details.

Mitigation: Implement strong encryption protocols, multi-factor authentication, and regular security audits to ensure only authorized personnel can access eFiled documents.

Phishing and Social Engineering Attacks

Risk: Attackers tricking users into divulging login credentials or other sensitive information.

Impact: Unauthorized access to eFiling systems, leading to potential data breaches.

Mitigation: Educate users on recognizing phishing attempts and implement email filtering solutions to reduce the likelihood of successful attacks.

Ransomware and Malware Attacks

Risk: Malicious software infecting eFiling systems and encrypting data.

Impact: Disruption of court operations and potential loss of sensitive information.

Mitigation: Regularly update and patch software, use advanced threat detection tools, and maintain secure backups to restore data if an attack occurs.

Integrity of Electronic Documents

Risk: Alteration or tampering of eFiled documents.

Impact: Legal disputes over the authenticity of documents and potential miscarriage of justice.

Mitigation: Use digital signatures and blockchain technology to ensure the integrity and authenticity of eFiled documents.

Specific Concerns for Abstracts of Judgement

Since abstracts of judgments contain detailed personal and financial information, they are especially sensitive since they are used as public records. These documents must be secure, as unauthorized access could lead to identity theft or financial fraud. Using strong access controls and encryption measures is essential to prevent unauthorized access and alteration of these documents.

Best Practices for Secure eFiling

To enhance the security of eFiling systems, legal professionals and court administrators should adopt the following best practices:

Robust Authentication Mechanisms: Utilize multi-factor authentication and strong password policies to ensure only authorized users can access the eFiling system.

Encryption of Data: Encrypt data both in transit and at rest to protect sensitive information from unauthorized access.

Regular Security Audits: Conduct frequent security audits and vulnerability assessments to identify and mitigate potential security risks.

User Education and Training: Train all users on security best practices and the importance of safeguarding login credentials and sensitive information.

Incident Response Planning: Develop and regularly update an incident response plan to quickly address and mitigate the impact of any security breaches.

Conclusion

While eFiling court documents offers numerous benefits, it also comes with significant security challenges. By understanding and addressing potential risks, legal professionals and court systems can ensure that eFiling remains a secure and efficient method for managing court documents. Emphasizing strong security measures and best practices will help protect sensitive information and maintain the integrity of the legal process in the digital age.

There are numerous benefits associated with eFiling court documents, but it also poses significant security challenges. By understanding potential risks and addressing them, legal professionals and court systems can ensure that eFiling remains a secure and efficient method for managing court documents. A strong emphasis on security measures and best practices will help protect sensitive information and maintain the integrity of the legal system in the digital age.

0 notes

Text

E file income

E-filing is an abbreviation for electronic income tax filing. E-File income is the process of electronically filing your income tax returns online for a specific year. This means you no longer need to physically visit the nearest Income Tax Department office to file your returns. Instead, you log on to the internet and complete the task.

0 notes

Photo

ITR Filing Online

Effortlessly file your Income Tax Returns (ITR) online with the help of professional guidance from experts. Streamline your tax filing process and ensure compliance with tax regulations. Trust the experienced team at Legal Pillers for seamless and efficient online ITR filing services, making your tax management convenient and hassle-free.

#income tax efiling#itr filing#itr filing online#income tax india e filing#file income tax return online india#online ITR filing

0 notes

Text

Top Best Business Accounting Firm in india - IndianSalahkar

Business accounting firms offer a range of services like business valuation, track assets depreciation and auditing to assist clients in their business. We are the best Business Accounting Firm in india providing Professional accounting service.

#accounting audit services#business setup#business advisory#taxation and support services#Trademark Registration Services#Brand Registration#best accounting firm in India#GST registration service provider#company registration in India#Income tax efiling#india#best#brand registration#trademark registration#online

0 notes

Text

#patent e filing#e filing patent#how to apply for patent in india#indian patent e filing#indian patent office efiling#how to apply for patent in india online#efiling patent#how to file patent in india online#file patent online india#apply for patent online#patent#patent filing

0 notes

Text

The organizations with gross receipts of less than $200,000 and total assets of less than $500,000 at the end of their tax year should file form 990-EZ

#fileform990ez#form 990ez#form990ez electronically#efile form 990ez#who must file form 990-ez#file form 990-ez online

0 notes

Photo

Pro-rated form 2290 truck taxes for February used heavy vehicles and trucks are due on March 31, 2023. E-file form 2290 and stay ahead of the deadline at Tax2290.com! More Visit at: https://blog.tax2290.com/tax2290-com-is-the-convenient-platform-to-e-file-form-2290-online/

#Tax2290.com#form 2290#efile form 2290#e-file form 2290 online#form 2290 truck taxes#schedule 1 copy#prorated tax

0 notes