#edward jones financial advisor

Explore tagged Tumblr posts

Text

Written for @corrodedcoffinfest.

Rough and Rowdy Ways

Day #22 - AU | Word Count: 1000 | Rating: T | CW: Language | POV: Eddie | Pairing: Steddie | Tags: Van Tour, Known Destroyers of Hotels, Motel Desk Clerk Steve Harrington, Meet Cute

One more dingy room, one more motel that's just a little more rundown than the last. It's been a long few years on the road, each one getting harder and harder. They have upswings, and downswings, and right now, they're definitely down. Playing smaller venues in the middle of fucking nowhere, more often than not.

They aren't famous, more infamous than anything, because there's been a few incidents over the years that have put them in the papers for less than flattering reasons.

Damages, lawsuits.

Rough and rowdy.

Assholes.

That's the name they've made for themselves. Gareth is still on probation from the last hotel trashing, and that was the straw that broke the camel's back, making all the major chains put the kibosh on them staying anywhere decent for the near future.

Most of them have their pictures hanging up, like they're outlaws.

Eddie sees an old, falling apart neon sign with an arrow promising a motel. He's not sure it'll still be there. It's a toss-up, for sure, as shitty as that sign looks.

But when they see the gravel turn-off, there is a solitary car sitting in the parking lot. Something that looks too nice, too expensive, for a place like this.

But, they'll have to try their luck and see if they can slide under the radar, pay cash, give fake names, and go unnoticed. Move on down the road tomorrow.

There's a guy sitting behind the desk, and he looks out of place in this shitty, unkempt place. He's very kempt. The most kempt person Eddie's seen in days.

Gareth immediately rings the bell, and Eddie wants to throttle him. That's never a good way to make a first impression. And they are the ones needing something here.

"One room, please," Gareth says.

The guy looks them up and down, and then shrugs. Pulling two sets of keys off a peg behind the desk.

He has pretty eyes. Very pretty eyes, pretty everything, really.

"Twenty dollars. Room four," he offers, like he doesn't give a shit if they burn the place down. Maybe he doesn't care. "Name?"

"Edward Jones," Gareth says, mashing their names together.

"Sure you are," the guy says, and they both look at each other, "just sign here."

"What's that mean?" Gareth asks.

"Edward D. Jones? The financial advisors?"

It's not ringing a bell. They carry their money in a duffle bag. They definitely don't have any advisors.

"Coincidence," Gareth says, and Eddie thinks it might actually be, because he's not sure Gareth would know that either.

"Checkout is at noon," he says, and then picks back up the book he was reading.

Transaction over.

Eddie paces the room, and the rest of them are getting annoyed. Goodie has already kicked him twice as he's walked by, and Gareth is sassing him.

Just. That guy. Steve, his name tag said, but that might have been as fake as Edward Jones.

"I'm gonna go get ice," Eddie declares, and the rest of them all seem to sigh in relief that he and his nervous energy are leaving the room.

Eddie carries the cheap plastic ice bucket up to the counter, "Steve?"

Steve looks up, so maybe that is his real name.

"Where's the ice machine?"

"It's broken," Steve answers.

"Oh. Damn," Eddie says, leaning up on the counter, trying to encroach on his personal space, just a little. Steve doesn't back up, not an inch, which is impressive. This usually works to make people uncomfortable. "I really need some ice. It's so hot."

Steve is looking at him, straight in the eyes, "Is that so?"

Eddie smiles, and isn't sure what he expects might happen, but he'll shoot his shot. There's no harm in it, he'll never see this guy again, come tomorrow.

"I have an ice machine in the back, if you want me to get you some. It's not really for the guests."

"Well, I appreciate that. I won't tell any of the other guests," Eddie says, a little sarcastic, because he's pretty sure nobody else is here.

Steve rolls his eyes, and grabs the brown bucket, pulling it across the counter and disappears through the open door behind him.

Eddie follows.

He's pretty sure he's not supposed to, but Steve didn't tell him to wait at the counter.

Steve lifts the lid and grabs the metal scoop, filling the bucket. When he turns, he catches sight of Eddie and the bucket goes flying, ice spilling all over the floor.

"Oh shit, I'm sorry!" Eddie says, holding his hands up, just realizing that he may look threatening. He forgets that sometimes. "I'm not, I won't. Fuck. I'm sorry."

And then Steve laughs, a nervous giggle that makes Eddie smile, "I didn't mean to make you uncomfortable. I wasn't thinking. I'm a musician. Eddie."

"Jones?"

Eddie laughs, "Munson. That's my best friend, Gareth Jones. A coincidence, I think."

And Steve smiles, just a little, "Okay, just. This place brings in the freaks and weirdos," Steve says.

And Eddie points at himself, eyebrows raised.

"Little bit," Steve teases, and Eddie grins.

"Let me help you pick up the ice," Eddie offers, getting down on his hands and knees, swiping it all towards himself. Then Steve is standing over him with a broom.

"This might be more efficient," Steve says, sarcastically and Eddie laughs as Steve sweeps up the mess.

Eddie's palms are black from the floor. And somehow it's not the dirtiest place they've ever stayed.

"Is there a sink?" Eddie asks, showing Steve his palms, and Steve nods towards the little bathroom off the breakroom.

There are personal items all over the sink, and a small, corner shower. Does Steve live here? Eddie suspects someone does, if it isn't him.

Steve is leaning in the open doorway, watching him, but in a curious way, not in a suspicious way, Eddie thinks. Which is good. Great.

"Do you live here?" Eddie asks.

"Unfortunately," Steve says, smirking.

"Wanna run away and be a roadie?"

If you want to write your own, or see more entries for this challenge, pop on over to @corrodedcoffinfest and follow along with the fun! 🦇

#corrodedcoffinfest#prompt twenty-two: au#steve harrington#eddie munson#steddie au#goodie (unnamed freak) stranger things#gareth stranger things#freak stranger things#corroded coffin fic#ccf day twenty-two: au#thisapplepielife: corrodedcoffinfest#thisapplepielife: short fic

82 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

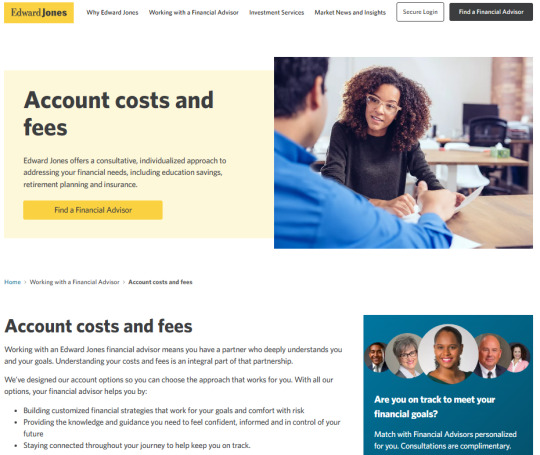

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Text

Rex Securities Law Investment Fraud Attorney Investigates LPL Financial Broker Daniel Hamlet

Last Updated: March 2025 – Fairmont, MN Here’s what you need to know about Fairmont, MN, stockbroker Daniel Edward Hamlet: Name: Mr. Daniel Edward Hamlet Current Employer: LPL Financial LLC, Convergence Financial Prior Employer: Edward Jones Function: Stockbroker / Financial Advisor/ Registered Investment Advisor DBA: 360 Integrated Financial Primary Location: Fairmont, MN CRD#: 4408819 Can…

0 notes

Text

PRESS RELEASE:

Financial Advisor Jonathan Mintle of Edward Jones Receives CERTIFIED FINANCIAL PLANNER™ Certification

0 notes

Text

The Literary LEGOs class got creative this week. They created mosaic art using LEGO blocks and base plates!

This program is sponsored in part by This class is sponsored in part by Edward Jones - Financial Advisor: Lee Russell Edward Jones Financial Advisor: Lee Russell and the Friends of Cooke County Public Library Friends of Cooke County Library.

#CCLliterarylegos

0 notes

Text

Frank Lloyd Wright Houses in the Minneapolis Area

On Thursday evening, we didn't work late on this work trip so I drove around to see some sights.

I had mapped out a route of stops in a particular order using Google Maps on my laptop and sent the link to my phone. Only when I left the car rental place, did I find that the link did not work properly on my phone so I had to wing it. I ended up visiting everything in the wrong order. And it took maybe twice as long because I think I have the "Avoid highways" setting on the phone.

Note that three of these are private residences and I was careful not to trespass.

Henry Neil House, Minneapolis, Minnesota

Paul Olfelt House, Saint Louis Park, Minnesota

Malcolm Willey House, Minneapolis, Minnesota

And it was night time when I finally made it to the former Fasbender Medical Clinic in Hastings, Minnesota. It's currently an office for Edward Jones financial advisors.

I attempted to see another house in Stillwater but it was just way too dark.

This was my planned route.

And this is what I actually did.

1 note

·

View note

Text

Edward Jones Investments

What is Edward Jones Investments?

Edward Jones Investments is a complete investment management company with locations in both the United States & Canada. It was established in St. Louis in 1922. Throughout the twentieth century, the company established an excellent reputation as one of the most renowned portfolio managers by investing extensively in all of its customers.

Edward Jones Investments began its business in the United States without moving into Canada. The company presently professes to have approximately 15,000 sites & roughly 19,000 highly skilled and knowledgeable financial analysts. This firm presently serves roughly 7 million clients & has nearly $1.7 trillion in AUM (Assets Under Management). The firm concentrates mostly on investments with long-term prospects. The founder, Edward Jones, became a well-known figure in the field of personal investment in money, as well as he is largely responsible for the company's continued success after decades of operation. For more detailed information, visit the Edward Jones Gold IRA Reviews

People Behind Edward Jones Investment: CEO, Owner, Co-Founders & More

Edward Jones, founder of Edward Jones Investment employs around 19,000 advisors in total and includes a management team, writing approximately individuals thoroughly is difficult, therefore these are some of the prominent employees of the organization.

Penny Pennington: Managing Partner

Edward Jones Investment's chief executive officer is Penny Pennington. Pennington, the firm's sixth operating spouse, is guiding the business via an organizational rejuvenation and strategic shift that is driven by purpose, leader-led, and collaborative as Edward Jones enters the second half of the decade. Pennington joined Edward Jones in 2000 as an advisor to investors and rose to principal in 2006. She performed various managerial duties in the firm's St. Louis office until becoming a managing partner in 2019. She holds a bachelor's degree from the University of Virginia and also an MBA from the Kellogg School of Management at Northwestern University.

Lisa Dolan: Principal, Chief Operating Officer

Lisa Dolan is the COO of Edward Jones Investments, where she oversees the company's Operations and Management section, along with Firm Data analysis, Strategic Enabling, Organizing, as well as Workforce Resources.

Why Are Investors Diversifying Their Portfolio?

Experts agree that the financial market is now even more fragile than pre-2008. Will your retirement portfolio weather the imminent financial crisis? Threats are many. Pick your poison..

The financial system would be in great peril if one or more big banks fail. "When we get to a downturn, banks won't have the cushion to absorb the losses. Without a cushion, we will have 2008 and 2009 again."

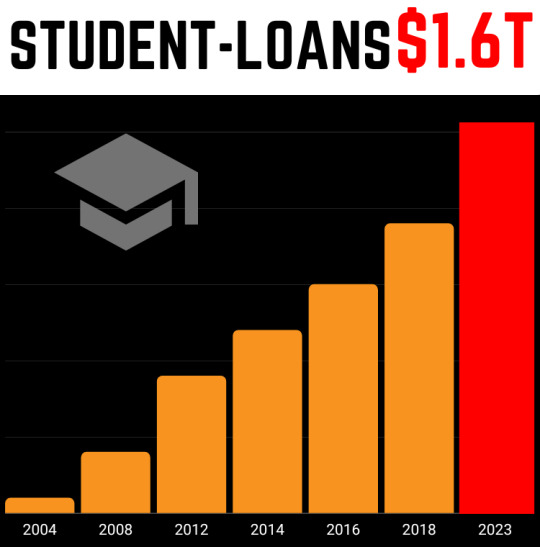

Student debt, which has been on a steep rise for years, could figure greatly in the next credit downturn. "There are parallels to 2008: There are massive amounts of unaffordable loans being made to people who can't pay them"

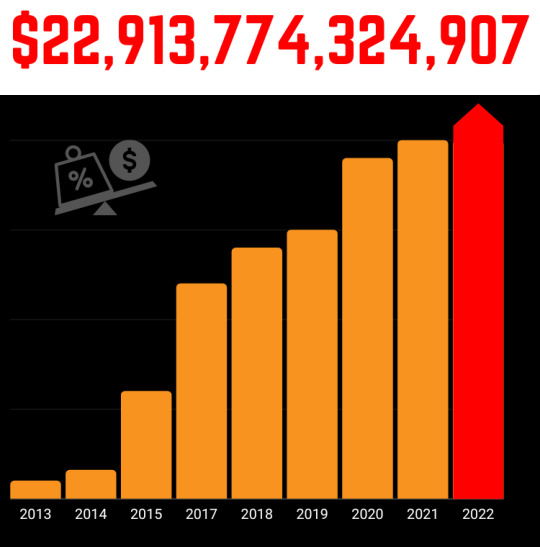

The US national debt has spiked $1 trillion in less than 6 months! "If we keep throwing gas on flames with deficit spending, I worry about how severe the next downturn is going to be--and whether we have enough bullets left ,"

Total household debt rose to an all-time high of $13.67 trillion at year-end 2019. "Any type of secured lending backed by an asset that is overvalued should be a concern… that is what happened with housing." Get in touch with an expert using the button down below:

Edward Jones Investments Products: All products offered by Edward Jones Investements

Independent Gold IRAs or another sort of self-directed account are not available from Edward Jones Investments. This means you won't be able to contribute to your IRA with physical metals that are precious via Edward Jones. Yet, the corporation has a choice of investing in gold mining companies or in metal-related traded funds.

Paper Gold

Edward Jones Investments claims to have one kind of investment referred to as Paper Gold. This primarily entails not purchasing gold bullion or any other kind of precious metals such as palladium, platinum, & silver. In reality, if somebody is interested in acquiring a paper-based picture of the desired precious metals. So it is assumed that an individual is selling you gold coins in a safe setting with rigorous restrictions in place to prevent fraud. Apart from an immediate paper trail to gold or other types of precious metals, mutual funds are another option. Custodians administer the metals that are precious for the brokers of the fund. Edward Jones provides Roth and standard IRAs, along with a variety of other fundamental investing alternatives such as: - Bonds - Stocks - Mutual Funds - Commodities - Units Investment Trusts

Additional Services provided by Edward Jones InvestmentsAll services offered by Edward Jones Investments

- Planning for Retirements - Wealth Strategies - Education Savings - Planning you Estate - Savings, Cash and Credit - Insurance Annuities - Business Solutions

For a detailed overview of the company, read: Edward Jones review.

Edward Jones Investments Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

Portfolio Strategy Fees These fees are computed based on the level of risk in your portfolio and the sum that you decide to invest in stocks or other types of investments. Therefore, for greater-value investors, the company's investment management fees may vary from 0.09% in the case of the Advisor Solutions Fund Plan to an additional 0.19 percent for the Advisory Solutions Universal Market Access (UMA) Plan.

Management Fees Management fees at Edward Jones vary depending on the kind of account and strategy for investing. This fee is determined by the total value of assets handled. The bigger the value associated with these investments, the smaller the proportion of charges payable.

Social Media Presence of Edward Jones Investments:Twitter, Facebook, & Instagram

Twitter Handle of Edward Jones The organization has a Twitter account. They have 193,000 followers along with 107 accounts. In 2009, Edward Jones joined Twitter.

Facebook Page of Edward Jones Edward Jones Investments has 83K followers on its Facebook account.

LinkedIn Page of Edward Jones The company has a LinkedIn profile with 231,244 followers.

Youtube Page of Edward Jones The company has 9.44K subscribers on its Youtube channel and they have posted around 54 videos.

Is Edward Jones Investments Legit? Should You Invest With Them?Is Edward Jones Investments a scam or legit? Are they worth it?

Edward Jones Investments, in my opinion, is not a legitimate company. It is entirely up to you whether or not to invest. Edward Jones Investments is a widely recognized investing firm that strives to give outstanding client service while charging hefty fees. Its target market is affluent people, and the approach to gathering is clearly long-term. Although the organization does not offer true Gold IRAs, it does offer a basic range of financial services that the majority of consumers ought to be acquainted with. If you're interested in Find the best Gold IRA company in your state Read the full article

0 notes

Text

The Generation That's Most Likely to Experience Financial Hardship, According to Edward Jones

edward jones survey While no one is immune to financial hardships, new research from financial services firm Edward Jones suggests that perhaps those in the millennial generation are particularly vulnerable. In a survey of financial advisors, 43% of the experts polled said that those in the generation born between the early 80s and the mid 90s were the most susceptible to financial issues. Gen Z…

View On WordPress

0 notes

Text

Edward Jones says this generation is most likely to experience financial difficulties

Edward Jones survey While no one is immune to financial problems, new research from financial services firm Edward Jones suggests that the millennial generation may be particularly vulnerable. In a survey of financial advisors, 43% of experts surveyed said those in the generation born between the early 1980s and mid-1990s were most prone to financial problems. Gen Z came next, followed by Gen X…

View On WordPress

0 notes

Text

Best Financial Advice Books Everyone Should Read

Advice Only Financial Advice

Rich Dad Poor Dad - Robert Kiyosaki

This book was written by Robert Kiyosaki after his father passed away. He took what he learned about money and business and created a book that would teach others how to become rich. He talks about the importance of education and learning about money early on. He then goes onto explain how to find work you enjoy and make money off of things you already do.

The Millionaire Fastlane - MJ DeMarco

MJ DeMarco talks about how to start making money at any age and how to build wealth. He explains how to change careers without having to go back to college, how to invest money for retirement, and how to travel the world almost forever.

How To Be A Full-Time Wealthy Person - JL Collins

JL Collins writes about how to achieve financial freedom if have a high income. He talks about many different ways to increase earnings and create passive income.

The Richest Man In Babylon - George S Clason

George S Clason talks about how to inherit money and turn it into billions. He teaches people how to invest their money in ways they might not have thought about.

The $100 Startup - Ryan Carson

Ryan Carson talks about how to launch a company and earn over $100,000 in just 2 years. Through trial and error, he has been able to perfect the system and offers insight on how to start a profitable and successful company.

The Cashflow Quadrant - Robert Kiyosaki

Robert Kiyosaki talks about how to use cash flow to make money, pay debts, save money, and plan for long-term goals.

The Art Of Travel - Rick Steves

Rick Steves writes about how to travel the world and experience everything we never had time for before.

Advice Only Financial Advice

#financial advisor#edward jones financial advisor#financial advisor salary#financial advisor near me#fiduciary financial advisor#how to become a financial advisor#what does a financial advisor do#what is a financial advisor#financial advisor jobs#fiduciary financial advisor near me#how much does a financial advisor cost#morgan stanley financial advisor#financial advice#financial submission#financial technology#personal finance#financial planning#financial freedom#retirement planning#financialadvisor#financial market news#business

7 notes

·

View notes

Text

Rex Securities Law Investment Fraud Attorney Investigates Edward Jones Former Broker Daniel Countiss

Last Updated: March 2025 (Flowood, MS) Here’s what you need to know about Flowood, MS, stockbroker Daniel Countiss: Name: Mr. Daniel Dee Countiss Current Employer: LPL Financial LLC Prior Employer: Edward Jones DBA: Countiss Wealth Management Function: Stockbroker / Financial Advisor Primary Location: Flowood, MS CRD#: 5732620 Can Daniel Countiss be sued in FINRA arbitration? Yes Sanctioned by…

0 notes

Text

Local Competition

There are two main regions that I operate; the County of Huron and the City of Burlington. For the purpose of this post, I will focus on the smaller of the two regions.

Huron County is an agricultural area situated on the shores of Lake Huron. The total population, based on the 2016 census, is approximately 60,000 people.

In terms of wealth management all of the major banks are represented along with brokers and dealerships such as Edward Jones, IG, and Investia Financial Services. All of these businesses provide investment advice. However, they are limited in their tax planning advice, preparation, and strategies.

Regarding tax advice, come competitors in my immediate area are Christina Feeney, Megan Ashburn, and H&R Block. None of these individuals/companies offer investment advice.

I’m attempting to snuggle in somewhere between the two. As an independent advisor the product offering I have available is not limited to proprietary products, such as the banks. I also have the necessary designations and licenses to provide additional services than the tax service providers.

The clear advantage that my competitors have is size and scale. Where I have the advantage is that I can be more nimble and cater to a more personalized relationship. My goal is to have a practice that services the needs of approximately 150 households. We all have a web presence and the ability to provide teleconferencing to maintain social distancing. From conversations with the owners, I conclude that pricing is in a similar range.

1 note

·

View note

Text

Session 3 of Literary LEGO had a blast building their creations. Look at their hard work!

This class is sponsored in part by Edward Jones Financial Advisor: Lee Russell and the Friends of Cooke County Library

#cclliterarylegos

0 notes

Link

Based in Sand Springs, Oklahoma, Frank Mamola serves as a financial advisor at Edward Jones, where he manages investments for more than 350 households. Frank Mamola helps clients with investments, retirement planning, and college planning, among other considerations.

1 note

·

View note

Text

Jeff Nero shares his Top Ten Investing Rules for the Road - 5.13.21

Jeff Nero shares his Top Ten Investing Rules for the Road – 5.13.21

Jeff Nero of Edward Jones is our Financial Advisor and today he talked about the current overheated investing environment and 10 sensible strategies to safe invest money while earning, and KEEPING, reasonable increases in value. If you need help investing or have questions about BitCoin, GameStop or any of the other investments in the news give Jeff a call. Jeffrey D. Nero | Edward Jones |…

View On WordPress

1 note

·

View note

Text

Greg Patton

I bring more than 25 years of experience in strategic planning, creative development and account management to every client engagement. I have executed campaigns and implemented strategic initiatives across a wide range of media and budgets, including websites, email marketing, digital ad campaigns, corporate collateral, B2C and B2B, direct mail, radio, public relations and outdoor. I am able to work under pressure and meet tight deadlines as well as work independently or as part of a team.

My experience includes working with such clients as Wells Fargo Advisors, Edward Jones, Umpqua Bank, Morgan Stanley, Chase Park Financial, First Bank, TIAA, Securities Training Corporation, United Industries, Express Scripts, AB InBev, Panera Bread, Maritz Travel, Luxco, Peabody Energy, Enterprise Rent-A-Car, Ranken Technical College, Royal Canin, Tenet Healthcare, Sigma-Aldrich and White Castle.

3 notes

·

View notes