#eToro copy trading

Explore tagged Tumblr posts

Text

CASABLEND

CasaBlend Your Home, Our Expertise CasaBlend is a company specialized in housing and hospitality, excelling in providing top-notch hospitality experiences. Expertise in property management, we ensure impeccable management and care of properties for a comprehensive and high-quality service. Excellence in Housing and Property Management CasaBlend stands as a leader in the housing and property…

View On WordPress

#copy trading etoro#copytrading#etoro#etoro bitcoin#etoro copy trading#etoro fee#etoro italy#etoro login#etoro popular investor#etoro porfolio#etoro reviews#where invest money

0 notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

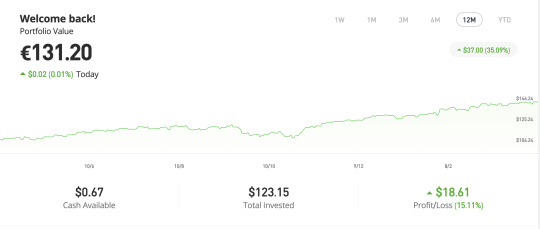

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

59 notes

·

View notes

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

the beginner's guide to making money by investing in stocks (part 2)

After discussing some basics in part 1, I will now run you through everything you need to know when making an investment. Please be aware that my posts are meant as education not as investment advice! Always inform yourself thoroughly before making investments. I will start by showing you what it looks like in eToro when I make a new investment:

As you can see, you can specify an amount you want to invest - often there is a minimum. The app also shows you how many shares you can buy for the money.

Stop-loss

Many online brokers allow you to determine a stop-loss when you buy stock. This is the maximum amount your stock can lose in value before it is automatically sold. The purpose of a stop-loss is to minimize your losses - it means you can't lose all of your money in case a stock plummets because the broker will sell the stock before.

A stop-loss may also backfire, though - for example when a stock goes through extremes a lot. The broker might then sell your stock which means you lose money even though the stock may recover at a later point.

Leverage

Leverage allows you to borrow money to increase the potential profit you make from an investment. You can set the leverage in your broker app. If you invest $ 100 with a leverage of x5, the money behaves as if you invested $ 500 which means all gains, but also all losses you make are multiplied by 5. This means you can ake money faster if a stock gains value but you can potentially loose a lot of money as well.

Take profit

Similar to stop-loss, you can also determine at which amount you want to sell a stock if it makes profit. So when the stock crosses a threshold value it is automatically sold to 'lock in' the gains.

Short-selling

Short-selling is a practice that has gained notoriety during the past few years - see the Gamestop saga or the Wirecard case. Opposed to 'normal' investing or long-selling, where you hope a stock gains value, short-selling means that you speculate that a stock will lose value. Now you may wonder how you could make money off of that and that is a bit complicated but bear with me:

The way investors make money off short-selling is by buying a stock and selling it to a third party for a fixed time period. After this time period passes, the investor buys back the stock. Ideally, if the stock has lost value, the investor buys it back for less than they sold it for. The difference is what they make in profit.

A simple example: I have bought stocks for $ 1000 and I believe the company will lose value within the next six months. I sell the stock to you for $ 1000. Over the period of 6 months, the stock loses 30% of its value. I buy back the stocks for $ 700 and have made $ 300 profit.

You can short stocks in most online broker apps but short-selling is more risky than long-selling. If the company gains value you can technically lose more money than you have invested. Nonetheless, people have made a lot of money off short-selling so I thought I'd mention it.

Copy-trading

Copy-trading is a service that some online brokers offer. It means that you directly copy the investments of a (more experienced) investor. Instead of picking stocks yourself, you set a fixed amount and the app automatically invests that amount in the same way that the person you copy invests. This can be a nice option if you don't want to spend a lot of time informing yourself about what to buy.

Hope you learned something!

Best,

Em

6 notes

·

View notes

Text

How to Find the Best Trading Platform

As more and more people are turning towards online trading, the demand for trading platforms is increasing rapidly. With the plethora of options available, it can be challenging to choose the right trading platform that suits your needs. In this article, we will guide you through the process of finding the best trading platform that meets your requirements.

Understanding Trading Platforms

Before we dive into how to choose the best trading platform, it is essential to understand what trading platforms are and what they offer. Trading platforms are software applications that enable traders to buy and sell financial instruments, such as stocks, bonds, options, and currencies. They provide a range of features, including real-time market data, charting tools, research, and trading automation.

Factors to Consider When Choosing a Trading Platform

When selecting a trading platform, it is crucial to consider various factors, including:

Security

Security is one of the most critical factors to consider when selecting a trading platform. Make sure the platform you choose is secure and employs robust security measures to protect your data and assets. Look for platforms that offer two-factor authentication and encryption to secure your account.

User Interface

A user-friendly interface is essential when it comes to trading platforms. The platform should be easy to navigate and use, with clear and concise menus and options. A cluttered or complicated interface can make trading difficult and time-consuming.

Fees and Commissions

Fees and commissions can vary significantly between trading platforms. Make sure to choose a platform that offers transparent and competitive pricing. Consider the fees for trading, account maintenance, deposits, and withdrawals.

Available Markets

Different trading platforms offer access to different markets. Some platforms specialize in specific markets, such as stocks or cryptocurrencies. Make sure to choose a platform that offers the markets you are interested in trading.

Customer Support

Customer support is another essential factor to consider when choosing a trading platform. Ensure the platform provides responsive and helpful customer support through various channels, such as email, phone, and chat.

Mobile App

Having a mobile app for trading platforms is a significant advantage. It allows traders to trade on the go and monitor their investments at any time. Choose a platform that offers a mobile app compatible with your device.

Types of Trading Platforms

There are different types of trading platforms available, each with its features and advantages. The three most common types of trading platforms are:

Web-based Trading Platforms

Web-based trading platforms are accessible through a web browser and do not require any installation. They offer a range of features, including real-time data, charting tools, and research. The advantage of web-based platforms is their accessibility from any device with an internet connection.

Desktop Trading Platforms

Desktop trading platforms are software applications that need to be installed on your computer. They provide advanced features, including customization options and trading automation. The advantage of desktop platforms is their speed and reliability.

Mobile Trading Platforms

Mobile trading platforms are mobile apps that allow traders to trade and monitor their investments from their mobile devices. They offer a range of features, including real-time data, charting tools, and research. The advantage of mobile platforms is their accessibility and convenience.

Top Trading Platforms

Here are some of the top trading platforms that you can consider:

eToro

eToro is a social trading platform that allows users to copy the trades of successful traders. It offers a range of markets, including stocks, cryptocurrencies, and commodities. The platform is user-friendly and has a social network-like interface.

Robinhood

Robinhood is a commission-free trading platform that offers a range of markets, including stocks, options, and cryptocurrencies. The platform is mobile-first and has a simple and easy-to-use interface.

TD Ameritrade

TD Ameritrade is a comprehensive trading platform that offers a range of markets, including stocks, bonds, options, and futures. It has a user-friendly interface and provides a range of research and educational resources.

Interactive Brokers

Interactive Brokers is a professional-grade trading platform that offers a range of markets, including stocks, options, and futures. It provides advanced trading tools, such as algorithmic trading and trading automation.

Plus500

Plus500 is a CFD trading platform that offers a range of markets, including stocks, cryptocurrencies, and commodities. It is user-friendly and offers competitive pricing.

2 notes

·

View notes

Text

What is Forextrading For Beginners Online

Forex Trading for Beginners Online refers to the process of learning how to trade currencies on the foreign exchange (forex) market via online platforms. Forex trading involves buying and selling currency pairs, like EUR/USD (Euro/US Dollar), and attempting to profit from the changes in their exchange rates. For beginners, online platforms provide access to the global forex market, offering educational tools, demo accounts, and trading resources to help users understand how forex works and gain experience before risking real money.

Key Points of Forex Trading for Beginners:

What is Forex Trading?

Forex trading involves the exchange of one currency for another, with the goal of profiting from the price changes between currency pairs. The market is open 24 hours a day, 5 days a week, allowing traders to make trades at any time.

Currency Pairs:

In forex, currencies are traded in pairs. For example:

EUR/USD: Buy the Euro and sell the US Dollar.

GBP/JPY: Buy the British Pound and sell the Japanese Yen.

The value of the first currency in the pair is quoted against the second.

How Does Forex Trading Work for Beginners?

When you trade forex, you speculate on whether the value of a currency will rise or fall. For instance, if you believe the Euro will strengthen against the US Dollar, you would buy EUR/USD. If the Euro rises, you profit. Conversely, if the Euro weakens, you may incur a loss.

Leverage:

Leverage is the ability to control a large position with a smaller amount of capital. Forex brokers offer leverage to amplify potential profits, but it also increases risk. Beginners should use leverage cautiously.

Using Online Platforms:

To begin forex trading, you need an online platform (e.g., MetaTrader 4 (MT4), MetaTrader 5 (MT5), or eToro). These platforms provide charting tools, real-time market data, and access to various currency pairs.

Demo accounts are available to practice without using real money.

Risk Management:

Risk management is essential for success in forex trading. Set stop-loss orders to automatically close a position when the market moves against you. This helps protect your capital.

Beginners should risk only a small percentage of their capital on each trade, typically 1-2%.

Developing a Trading Strategy:

Successful traders use strategies based on technical analysis (chart patterns, indicators) or fundamental analysis (economic data, news).

It's important to start with a simple strategy and gradually refine it as you gain experience.

Steps to Start Forex Trading for Beginners Online:

Learn the Basics: Understand key terms like pips, spreads, leverage, and margin before trading.

Choose a Reliable Broker: Select a broker that offers a regulated trading environment, user-friendly platforms, and educational resources.

Open a Trading Account: After selecting a broker, you’ll need to open an account by providing personal identification documents.

Practice with a Demo Account: Use a demo account to get familiar with the platform and practice trading without risking real money.

Start Small: Begin trading with a small amount of money and increase your investment as you gain more experience.

Use Risk Management Tools: Always set stop-loss and take-profit orders to minimize risk.

Stay Informed: Keep up with global news and events that affect currency prices, such as interest rate decisions or geopolitical developments.

Popular Forex Platforms for Beginners:

MetaTrader 4 (MT4): A widely used platform with advanced charting tools, customizable features, and the ability to automate trades using expert advisors.

MetaTrader 5 (MT5): The newer version of MT4, with additional features for multi-asset trading.

eToro: A social trading platform that allows beginners to copy successful traders.

cTrader: Known for its fast execution and user-friendly interface.

Conclusion:

Forex trading for beginners online offers the opportunity to learn and trade in a vast global market. By using demo accounts, practicing risk management, and starting with a solid strategy, beginners can gain the experience and knowledge needed to become successful traders.

Contact Us WinProfx 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia. +971 4 447 1894 [email protected] https://winprofx.com/ Find Us Online Facebook

0 notes

Text

10 Best United States Forex Brokers in 2025

The U.S. Forex market is highly regulated, ensuring a secure trading environment. With numerous brokers available, choosing the right one is crucial for your trading success. Here are the top 10 U.S. Forex brokers in 2025.

Key Factors to Consider in a Forex Broker

Regulation & Security – Ensure the broker is regulated by the CFTC and NFA.

Spreads & Fees – Low spreads and transparent fees maximize profitability.

Leverage & Margin – U.S. brokers offer up to 50:1 leverage for major currency pairs.

Trading Platforms – Look for MT4, MT5, or proprietary platforms with advanced tools.

Customer Support – Reliable 24/7 support is essential for smooth trading.

Top 10 U.S. Forex Brokers in 2025

The U.S. Forex market is highly regulated, providing a secure environment for traders. Here are the top 10 brokers in 2025, known for their strengths in various trading aspects:

FOREX.com - Best Overall Offering comprehensive tools, educational resources, and robust platforms, FOREX.com stands out for its strong regulatory compliance and suitability for all trader levels.

OANDA - Best for Beginners With a user-friendly interface, no minimum deposit, and transparent pricing, OANDA is ideal for new traders looking to start their Forex journey.

IG US - Best for High Leverage Known for offering leverage up to 50:1, IG US is a great choice for experienced traders who need advanced tools and high leverage.

NinjaTrader - Best for Algorithmic Trading This broker excels in algorithmic and automated trading with customizable strategies and advanced charting tools.

Interactive Brokers (IBKR) - Best for Advanced Traders Providing access to a wide range of instruments and low commissions, IBKR is perfect for professional traders looking for comprehensive research tools and advanced trading options.

eToro USA - Best for Copy Trading eToro’s innovative copy trading features allow beginners to mirror successful traders, making it an excellent platform for those who prefer a hands-off approach.

ATC Brokers - Best for ECN Trading ATC Brokers offers direct market access and transparent pricing, ideal for traders seeking efficient execution speeds and no hidden fees.

ThinkMarkets - Best for Both Beginners and Professionals Combining competitive pricing, advanced tools, and fast execution, ThinkMarkets suits both novice and seasoned traders.

Trading.com - Best for Fast Execution Specializing in ultra-fast execution with low latency, Trading.com is perfect for traders who prioritize speed and efficiency.

TD Ameritrade (Charles Schwab) - Best for Professional Traders With access to over 70 currency pairs and powerful tools like Thinkorswim, TD Ameritrade offers an excellent platform for serious traders.

#SureShotFX#SSF#Forex Broker#Forex Broker USA#Forex Broker Reviews#forex#forextrading#forex education#currency markets

0 notes

Text

10 Best Crypto Copy Trading Platform in 2025

Searching for the top cryptocurrency copy trading platforms? Here's a 2025 guide to the top 10 cryptocurrency copy trading platforms based on user volume and trading methods.

What is crypto copy trading?

Crypto copy trading is an investment method in which traders mimic experienced or professional traders' trades on a cryptocurrency trading platform. It enables new or inexperienced investors to participate in the cryptocurrency market by automatically imitating the activities of seasoned traders.

Features of Crypto Copy Trading

Automated Trading

Trader Selection

Real-Time Tracking

Risk Management Tools

Customizable Investment

Multi-Strategy Options

Diversification

Transparent Performance

And more

Top Crypto Copy Trading Website on User Count

Bitget

A user-friendly platform known for high performance and strong liquidity, supporting a wide range of cryptocurrencies including popular cryptos like Bitcoin, Ethereum, BNB, USDT and more

Users: 8+ million globally.

Trading Volume: $12 billion+ monthly.

Key Features:

Real-time trade execution.

Advanced risk management (e.g., stop-loss and take-profit).

Multilingual support for worldwide traders.

Deep liquidity allows for smooth trading.

Benefits:

Beginner-friendly interface.

High-performing trader profiles for users to follow.

Binance

Binance is well-known for its diverse array of digital assets and strong liquidity, as well as its highly user-friendly interface, making it ideal for real-time strategy imitation.

There are more than 150 million users.

Trading volume exceeds $65 billion each day.

Key features:

High liquidity across hundreds of trading pairings.

Detailed analytics for trader evaluations.

Integration with Binance Earn provides passive income opportunities.

Benefits:

The most diverse variety of cryptocurrency.

Industry-leading security protocols.

eToro

eToro, a pioneer in social trading, offers a user-friendly interface with extensive performance analytics, making it ideal for newbies looking to emulate experienced traders.

There are more than 30 million users.

Trading volume averages $1.5 billion each day.

Key features

Detailed trader performance statistics.

Social feed for trader engagement.

Integrated with both cryptocurrency and traditional assets.

Benefits

Intuitive UI makes it ideal for novices.

Diverse portfolio possibilities include a variety of asset categories.

Bybit

Bybit is well-known for its user-friendly interface and extensive list of traders to copy. It also provides adjustable preferences and fund allocation choices.

There are more than 10 million users.

Trading volume exceeds $12 billion each day.

Key features

Adjustable copy trading preferences.

Demo accounts are ideal for beginners.

Multi-currency support at competitive rates.

Benefits

Access to expert traders with proven track histories.

Quick onboarding and platform setup.

Phemex

A prominent cryptocurrency and derivatives exchange that provides extensive copy trading capabilities, adaptable copy order conditions, and thorough performance information to traders.

There are more than 1.5 million users.

Trading volume: $3 billion every month.

Key Features

Margin trading and copy trading are included.

Performance tracking using rank-based leaderboards.

Provides trading in cryptocurrency, FX, and commodities.

Advantages

Advanced traders can use high leverage options.

Secure platform with two-factor authentication.

PrimeXBT

PrimeXBT combines social trading with cryptocurrency exchange services, providing margin trading, cheap fees, and a demo account for practice.

There are more than 5 million users.

Trading volume averages $1.5 billion each day.

Key features

Flexible profit-sharing options for traders and followers.

Transparent trader statistics and real-time replication.

Free demo accounts for strategy testing.

Benefits

A community-driven platform for social commerce.

Supports both futures and spot trading.

BingX

BingX, a new cryptocurrency exchange with a simple and flexible copy trading feature, encourages an active social trading community and offers demo accounts for practice.

There are more than 20 million users.

Trading volume averages $11 billion each day.

Key features

high-frequency trading support.

Integrated instructional materials for traders.

Multi-device support (web and mobile).

Benefits

Emphasis on user education and skill development.

Incentives for active traders and followers.

WunderTrading

A social trading platform which values community engagement while also providing access to professional information and automated trading tools.

There are more than one million users.

Trading volume exceeds $500 million every month.

Key features

Automated trading bots with copy trading options.

Access to trader success data and analytics.

Advanced trading strategy customisation.

Benefits

Suitable for both novice and advanced users.

Concentrate on community collaboration and learning.

OKX

A well-known exchange that provides a variety of trading options, including copy trading, has a user-friendly interface and supports many cryptocurrencies.

Globally, there are more than 20 million users.

Trading volume averages $11 billion each day.

Key features:

Diverse Strategies: Provides high-frequency, scalping, and swing trading alternatives.

Performance Metrics: Real-time statistics on trader profitability and risk levels.

Multi-Device Compatibility: Works with mobile, desktop, and web applications.

Benefits

transparent trader analytics for followers.

Activity-based rewards are provided to both traders and followers.

Advanced security features include multi-layer encryption.

3Commas

A platform that provides advanced trading bots and copy trading tools, allowing users to replicate successful traders and automate their trading techniques.

There are more than 700,000 users.

Trading volume: $150 million or more per month.

Key features

Smart trading bots for automated tactics.

Tools for keeping track of your portfolio are comprehensive.

Integration with leading cryptocurrency exchanges.

Advantages

Highly adjustable bot strategies.

Real-time analytics enable informed decision-making.

Final Thoughts

The cryptocurrency market appears to be bullish, and these patterns will influence how traders approach crypto copy trading. The current trends, like as huge transaction volumes, cross-chain interoperability, and AI, will add a new dimension to crypto copy trade. Entrepreneurs who have chosen to invest in crypto copy trading platforms will experience tremendous growth in the coming year. Businesses wishing to diversify their crypto investment can contact Plurance, a well-known crypto copy trading software development company that provides comprehensive crypto solutions. We provide scalable white-label crypto copy trading solutions based on tried-and-true trading techniques. Collaborate with us to dominate the crypto sector.

#Best Crypto Copy Trading Platform in 2025#Best Crypto Copy Trading websites#Crypto Copy Trading Software#Crypto Copy Trading Software development

0 notes

Text

Top 2024 Growth Strategy Unveiled!

EM Investment High Yields, Select Investments EM Investment represents an investment strategy primarily focused on Long Equity, curated by eToro Popular Investor Elio Ministeri. The strategy is crafted to attain significant long-term capital growth by strategically investing in undervalued securities globally. MORE Top 2024 Growth Strategy Unveiled Unlocking Growth: A Glance into the 2024…

View On WordPress

#Annual Gain#copy trading etoro#copytrading#Diversification#Earnings Valuation Model#etoro#etoro bitcoin#etoro copy trading#etoro italy#etoro login#etoro popular investor#etoro porfolio#Financial Resilience#Investment Strategy#Large-Cap Companies#Long-Term Growth Prospects#Market Opportunities#Monthly Performance#Portfolio Growth#Resilient Balance Sheets#Russell 1000 Growth Index#Stock Selection

0 notes

Text

Is Copy Trading Profitable? Evaluating the Risks and Rewards

Copy trading has emerged as a popular investment strategy for those looking to enter the financial markets without extensive knowledge or experience. With platforms like PrimeTrader, eToro, and others making the process more accessible, copy trading appeals to beginners and seasoned traders alike. But the critical question remains: Is copy trading truly profitable?

In this blog, we’ll dive into how copy trading works, explore its benefits and risks, and provide actionable tips to help you make informed decisions.

How Copy Trading Works

Copy trading allows investors to mirror the trades of experienced traders. Here’s how it works:

Choose a Trader: Select a professional or highly-rated trader on platforms like PrimeTrader.

Allocate Funds: Decide how much of your portfolio you want to dedicate to copying their trades.

Mirror Trades: Automatically replicate their trades, either manually or using automated systems.

Platforms like PrimeTrader simplify this process by providing detailed insights into traders’ performance, strategies, and risk levels, ensuring you can make informed choices.

Factors That Influence Copy Trading Profitability

While copy trading has the potential to be profitable, several factors come into play:

Trader Selection

The profitability of copy trading heavily depends on the trader you choose to follow. Assess their:

Historical performance.

Risk tolerance.

Long-term consistency.

Market Volatility

Market conditions can significantly affect trading outcomes. Even experienced traders can face losses during volatile periods.

Fees and Costs

Platforms like PrimeTrader often charge fees, spreads, or commissions that can eat into your profits. Always review the cost structure before diving in.

Trading Strategy Alignment

Your chosen trader’s strategy should align with your financial goals. For instance, aggressive strategies may not suit those seeking stable, long-term growth.

Benefits of Copy Trading

Copy trading offers several advantages, particularly for beginners:

Accessibility for Beginners: You don’t need extensive trading knowledge to start earning. Platforms like PrimeTrader provide intuitive interfaces and guidance.

Time Efficiency: Copy trading eliminates the need for constant market monitoring, making it ideal for busy individuals.

Diverse Opportunities: Gain access to strategies and markets that you might not explore independently.

Lower Entry Barriers: Start trading with minimal expertise and leverage the experience of top traders.

Risks and Challenges of Copy Trading

Despite its benefits, copy trading comes with its share of challenges:

Over-Reliance on Others

Blindly following traders without understanding their strategies can lead to losses.

Market Unpredictability

Even the best traders can’t guarantee profits. Market conditions often impact results.

Loss Amplification

If you copy a high-risk trader, your losses could multiply just as quickly as your gains.

Platform Dependency

Technical issues like system downtime or delayed trade execution can impact profitability.

Real-Life Examples: Success Stories vs. Cautionary Tales

Success Stories

Some traders have achieved significant profits by carefully selecting consistent and risk-averse professionals on platforms like PrimeTrader. For example, users who diversified their investments across multiple traders and regularly monitored their performance reported steady gains.

Cautionary Tales

Conversely, there are cases where traders suffered heavy losses due to poor choices. For instance, users who blindly followed traders with unrealistic promises of high returns often found themselves caught in high-risk trades that wiped out their investments.

Tips to Maximize Profitability in Copy Trading

To make the most of your copy trading experience:

Research Traders: Use platforms like PrimeTrader to find traders with consistent, long-term performance.

Avoid Overly Aggressive Strategies: Be cautious of traders promising unrealistic returns.

Diversify Your Portfolio: Don’t put all your funds into copying a single trader. Spread your investments to minimize risks.

Leverage Risk Management Tools: Platforms like PrimeTrader offer features such as stop-loss settings to protect your investments.

Regular Monitoring: Periodically review your copied trades to ensure they align with your goals.

Is Copy Trading Profitable for Everyone?

Profitability in copy trading varies based on individual circumstances. Here’s what you should consider:

Suitable Scenarios: Copy trading works well for those seeking a hands-off investment approach or who lack the time and expertise to trade manually.

Less Ideal Scenarios: Traders who want full control over their strategies or have highly specific goals may find copy trading less suitable.

Ultimately, profitability depends on the trader you follow, your risk tolerance, and your ability to adapt to changing market conditions.

Conclusion:

Weighing the Risks and Rewards

Copy trading offers a promising way to participate in the financial markets, especially for beginners. By leveraging the expertise of experienced traders on platforms like PrimeTrader, you can potentially earn profits while learning about trading strategies.

However, success isn’t guaranteed. It requires careful research, a clear understanding of the risks, and proactive monitoring. Treat copy trading as a complement to your broader investment strategy, and always manage your expectations.

0 notes

Text

Top Accurate Forex Signals Service Providers for Bulgaria.

Forex trading has emerged as a popular investment opportunity worldwide, and Bulgaria is no exception. For traders in Bulgaria, accurate forex signals are vital for making informed decisions and maximizing profits. Reliable signals provide insights into market trends, enabling traders to act quickly and efficiently. In this article, we’ll explore the top forex signal service providers catering to the Bulgarian market. Among them, Forex Bank Liquidity stands out as the premier choice for consistent and high-accuracy signals.

1. Forex Bank Liquidity

When it comes to top-tier forex signal services, Forex Bank Liquidity leads the way. This platform is renowned for its 90–95% signal accuracy, helping traders achieve consistent profits. Catering to both beginners and experienced traders, Forex Bank Liquidity offers:

Real-Time Signals: Instant notifications with actionable data.

Comprehensive Analysis: In-depth insights to guide trading decisions.

Support Across All Platforms: Compatible with MT4, MT5, and mobile trading apps.

Dedicated Customer Support: 24/7 assistance for all trading queries.

Forex Bank Liquidity has built a reputation for reliability, making it the best choice for traders in Bulgaria. Whether you’re just starting or aiming to scale your trading, this service ensures you stay ahead of market trends.

2. Learn2Trade

Learn2Trade is a trusted forex signal provider known for its educational approach. It offers:

Free and premium signal options.

Real-time alerts covering various currency pairs.

A user-friendly interface with tutorials for new traders.

This platform is ideal for Bulgarian traders looking for both knowledge and profitability.

3. 1000pip Builder

1000pip Builder has earned global recognition for its consistently accurate signals. Key features include:

Long-term and short-term trading opportunities.

Support for multiple time zones.

Regular updates via email and SMS.

Its reputation for delivering on its promises makes it a reliable option for Bulgarian traders.

4. FX Leaders

FX Leaders provides comprehensive forex trading tools, including:

Free and paid signal packages.

Trade suggestions for forex, commodities, and indices.

Real-time alerts through a dedicated app.

This platform is a good fit for traders looking for an all-in-one solution.

5. ZuluTrade

ZuluTrade is a copy trading platform that also offers reliable forex signals. It stands out with:

Automated trade execution.

A global network of expert signal providers.

Easy integration with trading accounts.

Bulgarian traders can benefit from its user-friendly interface and automated trading capabilities.

6. Pips Alert

Pips Alert is another well-regarded forex signal provider, offering:

Daily updates and market analysis.

Flexible subscription plans.

Signals tailored to individual trading styles.

Their straightforward approach makes them an excellent choice for traders of all skill levels.

7. ForexSignals.com

ForexSignals.com provides a community-driven approach to forex trading. Features include:

Live trading rooms for shared learning experiences.

Educational resources for skill enhancement.

Accurate signals for major currency pairs.

This platform is highly recommended for Bulgarian traders who value collaboration and learning.

8. MegaFX Signals

MegaFX Signals specializes in high-accuracy trading signals. Their services include:

Scalping and swing trading signals.

Coverage of forex, crypto, and commodities.

Real-time alerts via Telegram and email.

Bulgarian traders seeking diversification will find this service beneficial.

9. ETORO Copy Trading

ETORO is a well-known social trading platform that allows users to copy the trades of successful investors. Benefits include:

Access to a vast network of traders.

Automated execution of copied trades.

Real-time performance tracking.

Its innovative approach makes it a popular choice for beginners in Bulgaria.

10. MQL5 Signals

MQL5 is a marketplace for forex signals that connects traders with professional signal providers. It offers:

A wide range of subscription-based signals.

Automated integration with MT4 and MT5 platforms.

Verified performance records.

MQL5 provides Bulgarian traders with flexibility and access to a global community of experts.

Choosing the Best Forex Signal Provider

When selecting a forex signal provider, Bulgarian traders should consider:

Accuracy: High accuracy is crucial for minimizing losses.

Real-Time Updates: Instant alerts ensure you never miss an opportunity.

Platform Compatibility: Look for services that integrate with MT4, MT5, or mobile platforms.

Customer Support: Reliable support is essential for resolving issues promptly.

Among the options listed, Forex Bank Liquidity stands out for its unmatched accuracy, advanced analysis, and user-friendly platform.

Why Forex Bank Liquidity Is the Top Choice for Bulgaria

Forex Bank Liquidity not only delivers exceptional accuracy but also provides a seamless experience for traders. Here’s why it’s the best in the market:

Proven Track Record: A consistent success rate of 90–95%.

Real-Time Alerts: Quick notifications to capitalize on market opportunities.

Tailored Support: Assistance for all trading levels, from novice to expert.

Transparent Pricing: Affordable packages with no hidden fees.

For Bulgarian traders aiming to achieve consistent profits, Forex Bank Liquidity is the ultimate solution.

Final Thoughts

The forex market offers immense opportunities for those equipped with the right tools. Accurate signals are the cornerstone of successful trading, and finding the best service provider is essential. The options listed above cater to the diverse needs of Bulgarian traders, but Forex Bank Liquidity remains the top recommendation for its proven reliability and exceptional features.

Take the first step towards financial freedom by choosing a signal provider that aligns with your trading goals. Start your journey today with Forex Bank Liquidity and experience the difference!

#forex education#forexsignals#forex robot#forexbankliquidity#forex#forex expert advisor#digital marketing#forex market#forextrading#bankliquidity

0 notes

Text

Find the Best Recommended Forex Brokers for Trading Success

If you’re considering trading in the forex market, you’re not alone. With trillions of dollars traded daily, forex is the world’s largest and most exciting financial market. But let’s face it—your success in trading largely depends on one key factor: choosing the right broker.

With so many options out there, finding a broker that fits your trading style, budget, and needs can feel overwhelming. That’s why we’ve put together this guide to highlight the recommended forex brokers for 2024 and help you navigate the decision-making process like a pro.

Why Picking the Right Forex Broker Is So Important

Think of a forex broker as your trading partner. A good broker provides the tools and resources to help you make better trading decisions while ensuring your money is safe. On the flip side, a bad broker can lead to unnecessary costs, frustrating delays, or worse—expose you to scams.

Here’s what a reliable forex broker offers:

Safety and Regulation: Your money is protected under strict laws and standards.

Low Costs: Tight spreads and low commissions that keep trading affordable.

Easy-to-Use Platforms: User-friendly software to analyze charts and make trades.

Educational Resources: Tutorials, webinars, and tools to help you grow as a trader.

What to Look for in a Forex Broker

To make your life easier, here are some critical factors to keep in mind when choosing a forex broker:

1. Regulation and Trustworthiness

A regulated broker is like having a security net. Look for brokers licensed by reputable organizations like:

The FCA (UK)

The ASIC (Australia)

The CySEC (Cyprus)

The NFA (USA)

2. A Great Trading Platform

Your trading platform should feel like a breeze to use. Popular ones include:

MetaTrader 4 (MT4): Classic and reliable.

MetaTrader 5 (MT5): Packed with advanced features.

Proprietary Platforms: Custom-built tools designed by brokers.

3. Competitive Costs

Nobody likes paying more than they have to. Tight spreads and low commissions can make a huge difference, especially for frequent traders.

4. Leverage Options

Leverage lets you trade more with less, but be careful—it’s a double-edged sword. Choose a broker offering leverage levels that fit your comfort zone.

5. Variety of Assets

While forex pairs might be your main focus, many brokers also let you trade stocks, commodities, indices, and even cryptocurrencies. This flexibility is great for diversifying your trades.

6. Responsive Customer Support

Problems happen, and when they do, you want quick answers. Look for brokers with 24/7 support that can assist in your language.

Top Recommended Forex Brokers for 2024

1. blackbull – Best for Social Trading

Why It Stands Out: eToro is perfect if you’re new to trading or enjoy learning from others. Its social trading feature allows you to copy top-performing traders.

Regulated By: FCA, CySEC, ASIC

What You’ll Love:

Simple and beginner-friendly interface

Commission-free trading

Access to a global community of traders

Perfect For: Learning while you trade.

2. XM – Best for Low Costs

Why It Stands Out: Known for its tight spreads and transparent fees, XM keeps costs low while delivering a seamless experience.

Regulated By: ASIC, CySEC, FCA

What You’ll Love:

No hidden fees

Great for forex pairs and CFDs

Excellent educational resources

Perfect For: Traders who want low costs without sacrificing quality.

3. IC – Ideal for Advanced Traders

Why It Stands Out: IG offers sophisticated tools and access to over 17,000 markets, making it a favorite among experienced traders.

Regulated By: FCA, ASIC, NFA

What You’ll Love:

Advanced charting and analytics

Industry-leading market access

Top-tier reputation and reliability

Perfect For: Pros who need cutting-edge tools.

4. FP Markets – Great for Scalpers and Day Traders

Why It Stands Out: FP Markets offers lightning-fast execution, which is essential for traders making quick moves.

Regulated By: ASIC, CySEC

What You’ll Love:

Low latency for faster trades

Tight spreads and high leverage options

Support for MT4 and MT5

Perfect For: Scalpers and active traders.

5. Eightcap – Best for Automation

Why It Stands Out: If you love the idea of automated trading, AvaTrade has got you covered with tools for algorithmic trading and expert advisors (EAs).

Regulated By: Central Bank of Ireland, ASIC, FSCA

What You’ll Love:

Multiple platforms, including AvaTradeGO

Great support for automated strategies

A low minimum deposit requirement

Perfect For: Traders interested in hands-off strategies.

How to Get Started with a Forex Broker

If you’re ready to start trading, follow these simple steps:

Pick a BrokerReview our list and choose one that suits your goals and preferences.

Sign UpFill out the broker’s online registration form.

Verify Your IdentityUpload your ID and proof of address (e.g., a utility bill).

Fund Your AccountDeposit funds using your preferred method, such as bank transfer, card, or e-wallet.

Start TradingLog in to the trading platform, analyze the market, and place your first trade!

Tips for Successful Forex Trading

Forex trading can be challenging, but these tips will help you stay on track:

Educate Yourself: Learn the basics of forex, market analysis, and trading strategies.

Start Small: Use a demo account or trade with small amounts until you feel confident.

Manage Risk: Use stop-loss orders and never risk more than you can afford to lose.

Diversify: Don’t put all your eggs in one basket—explore different currency pairs.

Stay Informed: Keep up with news and events that can affect the forex market.

Final Thoughts

Choosing the right recommended forex broker is one of the most important steps toward becoming a successful trader. Whether you’re a beginner looking for simplicity or an advanced trader seeking powerful tools, there’s a broker out there for you. For 2025, brokers like FXPro, XM, IC, FP Markets, and Eightcap stand out for their reliability, user-friendly platforms, and commitment to customer satisfaction. Take your time, compare your options, and pick a broker that aligns with your trading goals. The forex market is waiting—why not start your journey today?

0 notes

Text

FiatVisions · Company Summary

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

What is FiatVisions?

FiatVisions is a brokerage firm that offers a variety of trading instruments across different asset classes, including Forex pairs, commodities, indices, and stocks. It provides a proprietary trading platform bundled with features like raw pricing, fast order execution, market depth, multiple execution modes, and a broad product offering. FiatVisions provides various types of accounts, including BEGINNERS, BASIC, SILVER, GOLD, and VIP accounts, each with different minimum deposit requirements. The brokerage firm also offers different levels of leverage depending on the type of asset being traded.

We will examine this broker's attributes from a variety of angles in the following post, giving you clear and organized information. Please continue reading if you're curious. To help you quickly comprehend the broker's qualities, we will also provide a concise conclusion at the end of the piece.

FiatVisions Alternative Brokers

There are many alternative brokers to FiatVisions depending on the specific needs and preferences of the trader. Some popular options include:

Plus500 - Known for offering a wide range of CFD products, Plus500 is an attractive choice for traders looking for exposure to various global markets.

Degiro - Particularly popular in Europe, Degiro offers low-cost trading and a user-friendly platform, making it a good choice for cost-conscious investors in the European market.

eToro - Renowned for pioneering social trading, eToro is an excellent choice for those interested in leveraging the knowledge of other successful traders through copy trading.

Is FiatVisions Safe or Scam?

It appears that FiatVisions has no valid regulation. Regulatory oversight is a significant aspect of ensuring the safety and reliability of a brokerage firm. Lack of regulation can be a red flag because it means the broker isn't held to any specific standards of conduct set by regulatory bodies, which are designed to protect traders.

Thus, given the lack of regulation and multiple reports of withdrawal issues and potential scams, it's difficult to confidently deem FiatVisions a safe broker at this time. It's critical for potential clients to thoroughly research any brokerage they consider using, ensuring they are appropriately regulated and have a history of reliable, transparent operations. It would also be wise to consider user reviews and any reported issues seriously.

Market Instruments

FiatVisions offers a variety of forex pairs for trading. This involves the simultaneous buying of one currency and selling of another. The pairs could include major, minor, and exotic currency pairs.

FiatVisions also offers trading involving commodities such as gold, oil and agricultural products. Such trades usually involve futures contracts, where you agree to buy or sell a commodity at a specific price at a future date.

There are probably several index-based trading products available through FiatVisions. A group of equities called an index serve to represent a certain market or sector of a market. Investors can purchase these through exchange-traded funds (ETFs) or index funds.

And, FiatVisions allows traders to buy and sell stocks of individual companies. Profits can come from dividends (profit distribution) and capital gains (selling shares at a price higher than the purchase price).

0 notes

Text

What is Best Online Forex Brokers

Best Online Forex Brokers are platforms that facilitate the buying and selling of currencies in the foreign exchange (forex) market. These brokers provide traders with the necessary tools, trading platforms, and resources to trade forex effectively. The best brokers are often defined by factors such as regulation, fees, spreads, customer support, platform features, and educational resources.

Here are some of the best online forex brokers in the industry, known for their reliability, strong regulatory frameworks, and competitive trading conditions:

1. IG Group

Overview: IG Group is one of the most established forex brokers, offering a variety of trading tools and platforms. It is highly regulated and provides access to a large number of currency pairs.

Key Features:

80+ currency pairs for trading

Low spreads starting from 0.6 pips

MetaTrader 4 (MT4) and IG Trading platform

Extensive market research and educational resources

Regulated by FCA, ASIC, and other top authorities

Ideal For: Traders looking for a trusted, highly regulated broker with extensive educational and research tools.

2. OANDA

Overview: OANDA is a reliable broker offering a user-friendly platform with low spreads and extensive research tools.

Key Features:

70+ currency pairs

Low spreads starting from 1.4 pips

Access to MT4, Proprietary Trading Platform, and mobile apps

Comprehensive market analysis tools

Regulated by CFTC, FCA, ASIC, and others

Ideal For: Traders looking for low spreads and a platform with advanced research tools.

3. eToro

Overview: eToro is best known for its social trading feature, which allows traders to copy the trades of others. It's a great platform for beginners.

Key Features:

50+ currency pairs

No commissions on forex trading

Copy Trading and social trading features

User-friendly interface with mobile app access

Regulated by FCA, ASIC, and others

Ideal For: Beginner traders or those interested in copy trading and social features.

4. XM

Overview: XM offers a wide range of currency pairs and trading platforms, with competitive pricing and educational tools.

Key Features:

55+ currency pairs

Leverage up to 888:1 (depending on country)

MT4 and MT5 platforms

Educational resources and webinars for traders

Regulated by CySEC, IFSC, and others

Ideal For: Traders looking for high leverage and educational resources.

5. Forex.com

Overview: Forex.com is a popular broker with an easy-to-use platform and access to global forex markets.

Key Features:

80+ currency pairs

Competitive spreads with no commission fees

MT4 integration and custom trading platform

Access to advanced charting tools and market research

Regulated by CFTC, FCA, and ASIC

Ideal For: Traders seeking a comprehensive and reliable broker with competitive pricing.

6. AvaTrade

Overview: AvaTrade offers a wide selection of trading platforms, including MetaTrader 4 (MT4), MT5, and its proprietary platform, AvaTradeGO.

Key Features:

Over 50+ currency pairs

Low spreads and competitive leverage

Platforms: MT4, MT5, and AvaTradeGO

Copy trading and automated trading tools

Regulated by FCA, ASIC, and other global authorities

Ideal For: Traders interested in copy trading, automated trading, and those seeking a variety of platforms.

7. Interactive Brokers

Overview: Known for its low commissions and robust trading platforms, Interactive Brokers offers forex trading with a wide selection of assets and tools.

Key Features:

70+ currency pairs

Commission-based pricing with low spreads

Platforms: Trader Workstation (TWS) and IBKR mobile app

Advanced charting tools and market research

Regulated by CFTC, SEC, FCA, and others

Ideal For: Experienced traders seeking low fees, advanced tools, and access to multiple asset classes.

8. Plus500

Overview: Plus500 is a user-friendly platform known for offering a wide range of forex pairs, CFDs, and other assets. It’s ideal for beginners.

Key Features:

60+ currency pairs

No commission fees—profit is made from the spread

Risk management tools like stop-loss and guaranteed stop

Highly regulated (FCA, ASIC)

Ideal For: Beginners who want an easy-to-use platform with no commission fees.

9. Saxo Bank

Overview: Saxo Bank offers a premium trading experience with high-end tools, research, and a robust trading platform.

Key Features:

Over 180 currency pairs and other assets

Premium platforms: SaxoTraderGO, SaxoTraderPRO

Comprehensive research tools and market insights

Low spreads with commission-based pricing

Regulated by FCA, ASIC, and other financial authorities

Ideal For: Professional traders seeking a premium trading experience and comprehensive research.

10. FXTM (ForexTime)

Overview: FXTM offers a range of services with competitive leverage and educational tools, making it suitable for both beginners and experienced traders.

Key Features:

Wide range of currency pairs

Leverage up to 1000:1

Platforms: MT4, MT5, FXTM Trader

Educational webinars, guides, and videos

Regulated by CySEC, FCA, and others

Ideal For: Traders seeking high leverage and strong educational support.

Key Factors to Consider When Choosing the Best Forex Broker:

Regulation: Ensure the broker is regulated by reputable authorities (e.g., FCA, ASIC, CFTC) for safety and security.

Spreads and Fees: Low spreads and no hidden fees help reduce your overall trading costs.

Leverage: Understand the leverage options available, as high leverage can amplify both potential profits and risks.

Platforms and Tools: Choose brokers that offer popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and provide charting and analysis tools.

Customer Support: A responsive customer support team ensures that any issues you encounter are addressed promptly.

Educational Resources: For beginner traders, brokers that provide comprehensive educational materials (webinars, guides, videos) are beneficial.

Conclusion:

The best online forex brokers offer a combination of reliable platforms, competitive pricing, strong regulation, and quality customer service. Brokers like IG Group, OANDA, eToro, and Forex.com provide excellent conditions for both beginners and experienced traders. Choose a broker based on your trading style, risk tolerance, and platform preference.

Contact Us WinProfx 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia. +971 4 447 1894 [email protected] https://winprofx.com/ Find Us Online Facebook

0 notes

Text

eToro Có Hỗ Trợ Nhà Đầu Tư Việt Nam Trong Giao Dịch Forex Không?

eToro, nền tảng giao dịch nổi tiếng toàn cầu, ngày càng thu hút sự quan tâm của các nhà đầu tư tại Việt Nam. Với những tính năng nổi bật và hệ thống hỗ trợ chuyên nghiệp, eToro tạo điều kiện thuận lợi để người dùng Việt Nam tham gia giao dịch Forex một cách hiệu quả.

đánh giá eToro về dịch vụ hỗ trợ tại Việt Nam Một trong những ưu điểm lớn của eToro là khả năng cung cấp giao diện tiếng Việt, giúp người dùng dễ dàng tiếp cận và sử dụng các công cụ giao dịch. Ngoài ra, nền tảng này cũng có đội ngũ hỗ trợ khách hàng qua email và các kênh trực tuyến, đảm bảo giải quyết nhanh chóng các vấn đề phát sinh.

Tính năng nổi bật của eToro dành cho nhà đầu tư Việt Nam eToro mang đến nhiều lợi ích cho nhà đầu tư Việt Nam trong lĩnh vực Forex. Tính năng Copy Trading cho phép người dùng sao chép chiến lược từ các trader thành công, mở ra cơ hội học hỏi và kiếm lợi nhuận ngay cả khi thiếu kinh nghiệm. Hơn nữa, với mức đầu tư tối thiểu thấp, eToro phù hợp với mọi cấp độ nhà đầu tư.

Một điểm đáng chú ý khác là eToro cung cấp đa dạng các cặp tiền tệ, từ cặp chính như EUR/USD đến các cặp hiếm hơn. Điều này giúp nhà đầu tư Việt Nam có nhiều lựa chọn để tối ưu hóa danh mục đầu tư của mình.

Kết luận Dựa trên đánh giá eToro, đây là nền tảng giao dịch Forex đáng tin cậy và phù hợp với nhà đầu tư Việt Nam. Với hệ thống hỗ trợ tốt, giao diện thân thiện, và tính năng giao dịch vượt trội, eToro là một lựa chọn lý tưởng cho những ai muốn tham gia vào thị trường ngoại hối toàn cầu.

0 notes

Text

Best Online Platforms for Safe and Smart Trading

In today’s fast-paced digital age, the best online trading platforms in israel have revolutionized the way people invest in financial markets. With convenience, accessibility, and advanced tools at your fingertips, finding the right platform can significantly enhance your trading experience. However, choosing a platform that offers both safety and smart trading features is crucial. One such trusted platform is Apextraderfunding, known for its reliability and innovative trading solutions.

What Makes a Trading Platform Safe and Smart?

Security Features

A secure platform is the foundation of safe trading. Look for online trading platforms in Israel with encryption, two-factor authentication (2FA), and reliable regulatory oversight. Platforms like Apextraderfunding excel in providing robust security measures to protect traders.

User-Friendly Interface

A smart platform should be intuitive and easy to navigate. Whether you’re a beginner or an experienced trader, a seamless interface ensures efficient trading and minimizes errors. Apextraderfunding delivers a user-friendly experience that caters to traders of all levels.

Comprehensive Tools and Resources

Access to real-time market data, analytical tools, and educational resources empowers traders to make informed decisions. Smart platforms integrate these features for better trading strategies. Apextraderfunding goes a step further by offering advanced tools tailored to individual trading goals.

Customer Support

Responsive customer service adds a layer of reliability, ensuring users can resolve issues promptly. Look for platforms with 24/7 support, like Apextraderfunding, which prides itself on excellent customer assistance.

Top Online Platforms for Safe and Smart Trading

eToro

Known for its innovative social trading features, eToro allows users to follow and copy successful traders. Its robust security measures, including SSL encryption and regulatory compliance, make it a safe choice for beginners and pros alike. It’s also one of the best trading websites in israel for beginners.

TD Ameritrade

This platform is highly regarded for its powerful trading tools, such as thinkorswim, which offers advanced charting and analysis options. It also prioritizes safety with high-grade encryption and regulatory approvals. Many traders use this platform for stock trading platforms in israel.

Robinhood

Robinhood offers commission-free trading and a straightforward interface, making it ideal for new traders. While its simplicity is a plus, the platform also ensures safety with robust data protection measures. It is also rated among the best trading apps in israel.

Interactive Brokers

For seasoned traders, Interactive Brokers stands out with its wide range of investment options and low fees. It adheres to stringent regulatory standards, ensuring a secure trading environment. Traders looking for funded trading accounts in israel also find this platform useful.

Zerodha

Popular in emerging markets, Zerodha combines affordability with an easy-to-use platform. Its focus on transparency and data security makes it a trusted choice for safe trading. Many use it as the best trading platform in israel, especially for beginners seeking an online trading platform in israel. For those looking for innovative solutions, Zerodha also stands out as an instant funding prop firm in israel and is highly regarded among traders as part of the fundedtrader in israel community.

Tips for Safe and Smart Trading

Diversify Investments: Avoid putting all your funds into a single asset to minimize risks.

Set Limits: Use stop-loss and take-profit orders to manage risks effectively

.

Practice Discipline: Avoid emotional decisions; stick to your trading strategy.

Conclusion:

The best trading platforms in Israel combine safety with smart tools, ensuring a seamless experience for traders of all levels. Platforms like eToro, TD Ameritrade, and Interactive Brokers stand out for their reliability, security, and user-friendly features. When choosing a platform, prioritize your trading needs and assess key features like security, tools, and customer support. With the right platform, you can navigate the financial markets with confidence and achieve your investment goals.

Start your trading journey today with a platform trading in israel that offers both safety and smart solutions!

#funded trading accounts in israel#instant funding prop firm in israel#the fundedtrader in israel#best online trading platforms in israel#best trading platform in israel#stock trading platforms in israel#best trading app for beginners in israel#best trading websites in israel#platform trading in israel#best trading apps in israel#online trading platform in israel

0 notes