#e application until 2 days before the deadline when part of the requirement was a 10 page essay

Explore tagged Tumblr posts

Text

I think it was because lf something I tagged earlier (a poll?) but I had Big Feeling™ about how much my high school screwed me over and I hate that. I'm 32; I wish I could spend my energy on other things. I wish I'd had the energy then to follow through on my plan to fuck them over via refusal to give them permission to publish my image.

#i fucking said every time that i hadn't signed the permission sheet and every time it was 'oh you gotta do that' like!#if it was an accident i wouldn't know to tell you in advance!!! moron! why do i gotta stand in a line to have my picture taken when i hurt?!#small magnet schools are fine until admin finds a way to hire a 'guidance cousilor' who has no training talking to children#for a high stress low retension school#im allowed to be a little bit mad that she screwed me out of a full ride scholarship to the ivy league of my choice by waiting to give me th#e application until 2 days before the deadline when part of the requirement was a 10 page essay#and she shamed me for not being happy enough as i read that :)#as an adult i realize that i could have tried to ask for an extension because i literally just got it but#like she called my dad to school for a special trip. it was a whole thing. and i just.#i probably still would have burned out but i burned out a whole year and a half sooner with all that#like wtf was the fucking point?#anyway i WAS gonna sue so hard but doing like 5 english classes while already burned tf out and adhd was a lot actually

0 notes

Text

FAQ

What is a zine?

A zine is short for magazine or fanzine!

The Kinderzine is a fanzine produced for the game Kindergarten 2 by SmashGames, a non-official non-professional project by some dedicated, talented people in this fandom.

It will feature art and stories, and other content about the game + a small portion of fun fandom content like AUs, non-canon ships, and OCs. It will not be spoiler-free.

Overall, it functions mostly as an art book with some stories mixed in.

Will this be free or will I have to buy this zine?

It's completely free! There will be no money earned from this project in any way, and the link will be publicly posted on the intended release date for no cost at all.

What will contributors get out of this?

The satisfaction of doing a fun activity with wonderful people in the fandom! /hj

No but really, you get to take part in creating something really cool that you, me, and all of us can be proud of. You get to have your own finished work when this is all over, along with everyone else's!

No one will be getting paid in money, as this is a volunteer project and the zine is free. But all contributors will get access to the PDF link earlier than the public, and we all generally get to have fun together!

And I hear the skills it takes to work on a zine is a good thing to put on your resume /j

Is this zine digital or will there be physical copies?

Only digital. It will be a PDF on Google Drive, available to view and download at anyone's discretion.

There will be no printing of the Kinderzine, and no shipping of physical copies. There will be no merch (buttons, stickers, keychains, etc) available either; only this zine.

What are the zine specs?

1 full page (and front or back cover): 8.5 x 11 inches 1 half page: 8.5 x 5.5 inches 2 page spread: 17 x 11 inches 2 page connecting cover: 17 x 11 inches + 0.75 inch bleed (a bleed is a border around the image where that area will be cut off from the final (usually printed) product)

300 DPI | RGB (not CMYK) | Horizontal or vertical | you can add a bleed or not, but it's not going to be printed either way

You won't be yelled at or anything if you don't follow the DPI or colour guidelines, but it just makes it easier to put it into the editing software. Full-colour finished artwork is preferred (shading is not mandatory; flat colour is acceptable).

Will there be NSFW content?

This zine is PG13. Content of sexual nature is absolutely not permitted in any form.

Following the canon Kindergarten 2 game, there maybe be things like canon-typical blood, death, violence, or dark humour. These things along with anything else others may find to be 'sensitive topics' will be prefaced with appropriate trigger warnings.

How old do I have to be to apply?

As I said, the zine is PG13. Please be 13 years old or older, if you wish to apply.

If you are almost 13 in a few months or even a few days after the time of the application period, then you are still 12 during the application period and cannot apply. Sorry. If you lie about your age to get in, you will be kicked from the project immediately.

Can I apply for multiple roles?

Absolutely! But please note that the more roles you have, the less work you may have to do on one specific role, as your workload will be distributed across your other roles.

For example: if you are a mod and contributor, you might only be able to draw/write 1-2 things maximum depending on your mod position. Whereas someone who is only a contributor might be able to draw/write 2-3 things maximum, if they wish to do so.

How many contributors will be accepted?

Currently there isn't a specific amount of slots we need for artists or writers!

The amount of contributors required to make this zine happen at all, at the minimum is 11 applicants, regardless of artist or writer. But we would be incredibly happy to have more than that join this project. If there are way more applicants than needed, we may either try to find a way to fit you in, or have to unfortunately exclude some people. Only time will tell :’)

What is the schedule?

The current schedule can be found in [this link]! Dates may be changed in the future, and will be announced to contributors.

What if I need to drop out?

That's perfectly okay! Just please be sure to let one of the mods know as soon as possible so we have time to prepare any rearranging/reorganizing of zine content that might occur after your absence.

Can I post my WIPs/sketches/writing/finished pieces even if the zine isn't published yet?

Yeah that's fine! You own your content and are free to do what you want with it if you're that excited about it.

Can my piece include a ship/AU/OC/headcanon?

If it's one of the main mission/character pieces, then no.

Small headcanons are alright but if they're more obvious and non-canon-based you should talk to me about it first. Canon ships are allowed (Bob x Applegate, Lily x Nugget, Monty x Carla (even if it's kind of unrequited), etc). OCs can be in the background as a cameo, but they can't be the main focus of your work.

If you're doing an additional piece, then yes absolutely! Keep in mind, however, there will be limited slots for these additional pieces.

Can I submit older work created before the production of this zine?

Yes, as long as it fits the page specs, or you don't mind cropping the art so it fits the page specs to a smaller page size!

Older fanfics are fine as is, provided it's canon-based unless you're submitting it as an additional work.

Can I draw/write a different character/mission?

Please ask a mod about this. If we can find someone willing to switch with you, you can.

Don't switch with people more than once, and don't do it without talking to a mod first. If you are going to switch with anyone, you're only allowed to do that before the 2nd check-in date. Anything past that date is not allowed.

What exactly can we draw/write once we're assigned a specific character/mission?

Contributors have the creative freedom to make anything they want within the characters/missions that get assigned.

If that's too broad and you can't think of anything to draw/write, let one of the mods know and we can give you a more specific prompt.

Will there be extensions if I can't finish by the deadline?

Yes! Just let one of the mods know so we can expect your final work at a later date.

Your piece will still need to be finished before the graphics team finishes the early-access PDF. It's greatly preferred that you do finish by the deadline to make this easier for them to finish their job, but if you really can't, that option is available.

If you're unable to finish before the graphics team finishes the final public-ready PDF, your work will, unfortunately, not be included in the zine at that point.

What if I'm a traditional or phone artist and don't know how to keep my art to the page specs?

Traditional artists should be able to either scan their art in high quality, or if taking a picture, take the picture as clear as possible with only/mostly your art within frame; the graphics team will try to take care of sizing.

Phone artists (or really any digital artists) can have canvas templates that are the correct specs, available to copy or download to draw over that I can personally provide for you (though I don't know yet how well this method will work).

If there are any more questions or you need more help, please contact a mod.

If your art is too small, you can try using http://waifu2x.udp.jp/ to enlarge it without hurting the quality too bad.

If it still doesn't fit the aspect ratios, the graphics team can still make it work so don't worry! We really, really prefer that everyone follow the page sizings as much as you can though, unless it's really impossible for you to do so.

Wait, there’s a Discord server? Can I join?

Only if you’re one of the artists or writers who is directly contributing to the zine! Sorry! It’s a private server where those who are directly involved in the zine will be invited.

If you’ve already sent in an application, you will be invited to the server on, or a few days before, the date that applications close. Which will be March 13th, as of writing this, so please be patient until then. The date that invites will be sent out may change, so keep an eye out for that too.

What if I don't have a Discord and can't join the Discord server?

That's perfectly fine! You don't have to make an account or join the server if you don't want to either.

As long as you have an e-mail, or a social media account that one of the mods have + the ability for us to private message you, we will keep you updated on anything Kinderzine related!

The server is really just a way for us all to communicate with each other, mods and contributors alike, and keep in touch with the mods more accessibly. But the important stuff will still be communicated with you, and if you contact a mod somewhere other than Discord, we'll get to your message as soon as possible.

Please direct any other questions not on the FAQ to either the Discord server’s #zine-questions channel, or this blog’s/my main blog’s ask box or private messages.

Inbox | @kg2hub Inbox

2 notes

·

View notes

Text

Casting Calls, Jobs, Interns and Ushers at the San Francisco Playhouse

Jobs

2 Stage Managers for 2 plays.

Accountant/Payroll Specialist

To apply:

Please send a thoughtful cover letter, resume, and three references to [email protected]

No phone calls, please. Due to the high volume of applicants, only those selected for the interview process will be contacted.

International Applicants: San Francisco Playhouse cannot sponsor or assist applicants in the visa application process. For more information, please contact the United States embassy in your country.

Casting Calls

Seeking video submissions from diverse Equity actors of all backgrounds for the 2020-21 season. Actors submitting for general auditions may be considered for the World Premiere of "Shoot Me When," commissioned by SF Playhouse, future readings, and future productions. "Shoot Me When" synopsis: When Jackie’s health takes a turn for the worse, her daughters take her to Tahoe for one last romp. Everything is going perfectly until Jackie picks up a lonely widower at a casino bar, shaking up the party and her own future plans.

All professional actors who are interested in working at SFPH are welcome to

submit digital headshots and resumes at any time to the SFPH casting department at [email protected].

Save the trees! No hard copy resumes via snail mail please.

Following the EPA, invited auditions are held on a per show basis by invitation only. SFPH accepts recorded auditions from out of town actors also by invitation only. If you have auditioned for a production but have not been called back, there is no additional notification sent from the casting department.

The casting department does its best to keep all called-back actors notified of casting timelines. Any called-back actor not cast will receive notification of release as soon as possible.

SFPH is committed to equity, diversity, and inclusion in casting and uses a color and culturally conscious approach to casting. Actors of every race, ethnicity, gender, sex, sexual orientation, age, and ability are encouraged to submit their materials and audition.

If you have any questions about SFPH’s casting approach, please e-mail [email protected].

Paid Internships

SFPH Internships provide students with an opportunity to gain a comprehensive understanding of the day-to-day and seasonal operations of a professional theater company. Interns are treated as part of the Playhouse family which operates under the company’s values of Empathy, Excellence, Innovation, Collaboration and the ever important Yes! All interns leave the program with new connections, strong skills and real life experiences to add to their education.

As a non-profit 501(c) 3 organization, SFPH internships are volunteer positions. Interns will receive a small stipend to cover transportation costs at $150.00 per month. SFPH cannot arrange housing in the Bay Area. SFPH is happy to work educational institutions to arrange for academic credit.

Internships are 12 – 20 hours per week during the school year and 15 – 30 hours per week during the summer. Evening and weekend availability is required depending on department. All interns with have the opportunity to assist with special events, Mainstage and Sandbox first rehearsals, Sandbox Load-Ins and Strikes and other events as necessary.

SCHEDULE

Fall – September through December (application deadline: July 31)

Winter – For students on the quarter system

Spring – January thru April (application deadline: November 30)

Summer – May thru August (application deadline: March 31)

Full Season – September through August (application deadline: July 31). Note: this internship changes departments throughout the year in order to gain an understanding of the seasonal operations of the company.

HOW TO APPLY

Please Submit a Cover Letter and Resume to [email protected] with subject line – INTERN POSITION – YOUR NAME (i.e. Production Intern – Joe Smith):

No phone calls, please. Due to the high volume of applicants, only those selected for the interview process will be contacted.

International Applicants: San Francisco Playhouse cannot sponsor or assist applicants in the visa application process. For more information, please contact your school’s International Programs office, or the United States embassy in your country.

Ushers

Volunteer ushers are a very important part of the San Francisco Playhouse family. It costs nothing but time to become a volunteer usher, and in exchange you get to see the show for free!

Arrive 1 hour and 15 minutes before curtain, check in with the Box Office or Front of House manager.

You’ll receive a quick briefing regarding how full the house will be, whether we’ll be using the balcony, special groups etc.

Then you’ll be assigned to one of a number of stations:

Lobby Greeter- Pass out programs and welcome patrons just inside the lobby doors, assist patrons with finding restrooms, water fountain, bar, etc.

Theatre Door- Check patron’s tickets as they enter the auditorium. Make sure they’re in the right place/date, etc. Then direct to appropriate aisles.

Usher- Assist guests with finding their seats in either the orchestra or mezzanine sections.

VIP Lounge- Stand by the VIP doors to ensure that only invited guests enter the lounge. Also provide assistance to Lobby Greeters.

Other positions as required.

After assisting at your assigned position for approximately one hour, you’ll be directed to find available seats in the theatre. Seating is at the discretion of house management. Enjoy the show!

If there is an intermission- we will ask you to return to your assigned posts to answer questions, etc. You can coordinate with your fellow ushers to take a restroom break.

Following the performance, we’ll ask you to assist with cleaning up the auditorium and you’ll be released for the evening by the Bartender/House Manager.

If you are interested in ushering, please email [email protected] or use the form below to join our mailing list.

#stage manager wanted#stage manager jobs#casting theatre play#casting call for theatre#casting actors for stage#casting actresses for stage#theatre interns wanted#paid entertainment internships#paid internships in theatre#theatre accounting jobs#entertainment accounting jobs

0 notes

Video

youtube

paper help

About me

Expert Reaction To Paper And Editorial Looking At Clinical Characteristics And Viral Rna Detection In Children With Covid

Expert Reaction To Paper And Editorial Looking At Clinical Characteristics And Viral Rna Detection In Children With Covid As soon because the order is accomplished, you can download it out of your Customer’s space or get it delivered to your e mail. 2 weeks of free revisions will make sure that every thing in your paper is just the way in which you need it to be. As with any on-line company, the knowledge security is a quite essential matter. Look at bibliographies in the back of useful books for more sources. Careful notice-taking will prevent quite a lot of time when you write your paper. Ambiguous notes would require more digging to verify your info, which is probably not easy to find the second time round. Have a agency grasp of your major sources earlier than turning to secondary commentaries or criticisms. In other words, read Pride and Prejudice first, after which write down a few of your individual impressions and ideas related to your essay subject. Research other individuals's opinions on the guide after wanting at the primary sources. Gain no less than a fundamental familiarity along with your subject before beginning in-depth analysis. This information is used just for the desired application and is never revealed to unauthorized persons. You can ensure that your personal information is completely safe with us. In essay writing business, adhering to deadlines is among the cornerstones. Therefore, we take solely these orders which we can deliver on time to ensure that no false hopes are fostered. If you place an order for a voluminous paper, then a supervisor will be additionally assigned to watch your author’s work and basic project standing. The subsequent stage is just ready in your analysis paper to be completed by the author. This must be accomplished and given to you on the due date. This includes free formatting and the entire analysis and ultimate pages. If you want to discover out the price of the required document, you should use our online calculator for it. Choose your tutorial stage, kind of paper, length , and deadline. The price is calculated mechanically so you possibly can learn it before approaching service. I looked for an skilled company to write down my paper. The Dictionary of Literary Themes and Motifs, however, has a superb 15-page historical past of nihilism in modern fiction. The abstract is presumably an important part of your paper, and also most likely the hardest to put in writing. Leave it until final, when you've a clear idea of your paper’s content material and outcomes.Most ought to be phrases, however check your journal’s pointers. There is more info on writing an abstract right here. We at all times make sure that customers are fully pleased with their topic and the educational work that has been offered. We provide a money-back assure to make sure that you at all times receive quality work from certainly one of our consultants. Some of the instructed paper subjects will elicit completely different styles or genres of writing. However, it may be more challenging to adopt various types and genres. If you wish to pursue totally different avenues of writing however are not sure about how to do that, samples can be found in your perusal. Luckily, I got here across this web site and positioned an order. My English essay was ready in 3 hours as I needed to hand it on the same day. I work and examine at the same time, so don't have time for challenging tasks like History project. I determined to pay someone to put in writing my paper and it was one of the best decision in my life. Thanks to the messaging board, you possibly can supervise your writer and express your requests in terms of the content material of your custom piece. The right reference e-book, or perhaps a course text-e-book, could offer you a nicely-written overview of a subject to guide your research course of. You might have understood the e-book, however still do not know what nihilism is. When it involves ordering custom made essays on-line, the situation turns into much more delicate. PaperHelp is fully aware of the fact that correct dealing with of the confidential information is what differs us from the various other services online. At our firm we request purchasers to supply only that knowledge which is important for fee verification and successful order completion.

0 notes

Text

I shouldn’t be telling you how I strive as a public relations practitioner.

If you are a graduate from Mass Communications, you probably still uncertain what are the responsibilities underlying in the job titles as a Public Relations (PR) or Marketing Communications (Marcom) practitioners, some even called it Corporate Communications. First, to answer the question of whether are they the same, it actually has no difference to what the job would challenge you, and for you to grow as a people person beautifully inside out. So in this article, I’m going to call it PR.

I have been working as a PR practitioner in the hotel industry for 6 years in a row since 2014 from a chain hotel to an independent hotel. It has given me the opportunity to grow and climb the corporate ladder, and I enjoy both the challenges and rewards it brings to my career, which I am truly grateful for.

Many people think that PR practitioners are the ones who always get to meet with some big shots such as celebrities, always dress up nicely every day to go to work like a model, always entertaining people with great food and drinks and seem to be enjoying the time of their life. What an ideal job that people sought after. Partially true, however, many people may not know the core job functions of the PR and the hard work behind these glams.

I have received some questions from family, friends, college students and even colleagues that ask me what do I do, why am I so stressed out sometimes and they could see me being busy but not sure what am I really busying with.

Let’s break it down. I’m going to share based on my personal work experience and it may or may not apply to other PR practitioners’ job requirements in the hotel industry or from other industries, but we all can relate.

1. What are the core job functions of a PR?

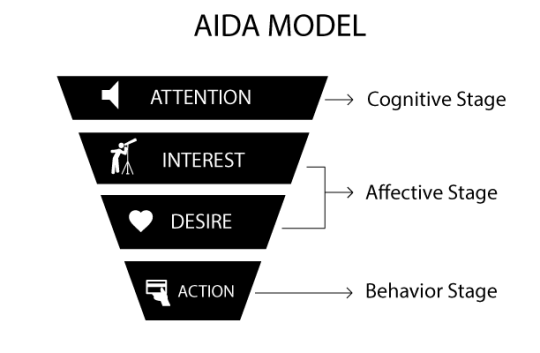

PR works on advertising and marketing the brand and product of the company. Both job functions are a very broad subject to discuss. Often times, people think that we are also responsible for the sales of the company, but actually, sales and marketing still have a very thin line in between to differentiate the job functions. I always like to think that PR casts the net (advertisement) into the sea (media channels) and catches the fish (clients/audiences) and pass the fish to the sales personnel to follow up with them. Hope this makes sense to you. It’s also obvious that we are a department that spends money the most, however, the stress and pressure come when the budget has been cut or no allocation at all but we are expected to perform miracle out of it. But without advertising the brand, products or services, the company cannot go through the AIDA process as below which may result in having very little sales, no new market and no revenue growth. The power of advertisement is very real, instant and desirable, I cannot stress that enough. In other words, PR has to work really hard in order to bring in sales, whatever the method is.

Other responsibilities that fall under the PR are crisis management, award applications, guarding the brand’s identity and reputation, corporate social responsibility (CSR) and sponsorship.

2. What do I really do to execute the job functions of a PR as mentioned above?

- Digital Marketing management. We handle all the social media channels from posting the engaging contents to yielding followers, answering all the enquiries, replying to the comments on the posts, boosting (advertising) the posts effectively and even organizing the online contests.

- Organizing events that benefit the brand & are newsworthy such as CSR programmes, food reviews and hotel stay reviews by the media and etc. Here’s where the hard work and challenges come behind the glams that we put forward. We will first have to think of the concept of the event, which direction do we want to focus on and then approach the beneficiary organization (in terms of CSR) or department (F&B or Rooms) and initiate the plans. Then, we will have to gather all the info and write a press release. Come to the event day, we will have to take photos and videos while executing the plan. Media members are usually invited to attend the event, this is where you’ll see us entertaining them with food and drinks as a gesture of welcoming them and extending our hospitality to them, this is very important. But not all invited media will attend, so the press release and supporting media contents are important for post-event and follow-ups. The project will only be considered complete after receiving the return of media coverages and the desired results that we want. The stress and pressure come when there is more than 1 project running in a month itself, or having a very short time to plan something out but still ought to have that wow effect from our PR initiatives. You don’t want your effort goes to waste.

- Creative copywriting and designing the advertisement. We have to be timely and relevant to the festive celebrations or occasions, stay in trend with the latest advertisement designing style as well as the marketing’s directions and use the right keywords to attract attention in order to achieve the sales conversion. Advertisement can be put up anywhere. It can be displayed on the TV screen, in-room TV channel, LED signages, posters around the visible areas or right outside of the F&B outlets, banners by the roadside, tent card on the dining tables, flyers, on the website, email footer, EDM or e-newsletter, on the newspaper, magazine, and some other digital platforms. So, thinking about the number of artworks to produce for different promotions in different sizes and languages is enough to drown you out. In terms of copywriting, I have a key takeaway point for you - The creativity in the context that’ll make people do something about it, whether they share it for you or become your earned audience because they find it interesting, is so much more important than your command of English or whatever language you’re using. So, keeping it simple and understandable by the general public rather than using the bombastic words and implicit contents that’ll make people puzzled at what you’re trying to tell them is more effective.

- Establish a good relationship with the media members that are mutually supportive. Know your target market and understand the media’s strength so that you can allocate your budget properly for advertising to achieve your desired goals and results. If you first show your support to the media, they will certainly be kind and appreciative enough to write for you and feature you in the next article whenever they need some content contributions from you. Media range from the newspaper, magazine, online platforms, blogger, Instagrammer, celebrity, public figure and etc that are highly influential. We are always open for discussion for collaboration, and we always state clear of what we can give and what we expect in return from the collaboration. You can also negotiate for a better advertising rate, half barter or full barter term to ease on your marketing cost. We also receive a good amount of stay review requests from travelling bloggers all around the world and we are open to this. Carefully review their platforms and know what you’ll get in return for hosting them the stay.

- Graphic designing. I do know a bit of Photoshop, Illustrator, and even Premier Pro. But I’m more lucky to have graphic designers in the department. So I’ll just watch over their design to make sure it fits the brand identity and proofreading on the copies before sent to print.

There are a lot more tasks to do but I’ll just share especially the core of the job functions. And I’ll leave the last one as below.

- Sponsorship. Be generous to sponsor those who are willing to give you credit mention in their event. It’s another form of putting your brand out there to their confirm attending audiences. And since it’s their community that they attract, you’ll never know that a buffet voucher for 2 persons could actually bring you revenue of a group of people when they decided to celebrate with more people for their winning prizes or lucky draw prizes. We always sponsor some charity and fundraising events, student projects and other considerable projects that we want to associate with.

3. What are the challenges faced as a PR?

Deadlines after deadlines. There are many enquiries, projects, plannings and unexpected assignments thrown in as you’re working on the current project because the company will always look for ways to make sales and you’ll have to market them all.

Working within the limited advertising budget.

Extending working hours beyond the official work hours.

Eating and drinking more than you should as part of the entertainment.

Staying on top and be updated with the latest market trend.

Studying the market’s behaviour and always be flexible to shapeshift.

Putting on a fake smile even when you don’t feel like it while meeting with people. Maybe you’re having a bad day, but still, please act professional and just put your self aside for a couple of minutes until the meeting is over.

First impression matters. You might need to spend some money shopping for new clothes and shoes if your company doesn’t provide you with a uniform.

Other unknown assignments will suddenly become a PR’s job. People seem to see PR as multitalented and are capable of doing any job since we possess both soft skills and technical skills.

4. What are the personalities and characteristics of a successful PR?

What kind of person do you like to work with? List them all out and it should be the same expectation from others to you as a PR.

But these traits below you must have in order to strive as a PR:

Approachable. Be sociable and friendly. Always stay low and humble no matter how high your position is or what the job rewards you with, such as the opportunity to meet with celebrities or you’re being published on the news along with your marketing initiatives.

Helpful. When media members came to ask for some info for their content creation, give it to them.

Possessing Good Communication Skills and Writing Skills. Always sharpen your sword and work on your creativity.

Flexible and Adaptable. Cultural fit is so important, you have to be so sensitive to the changes in today’s marketing trend. When ‘video’ plays the centre stage of Facebook content, for instance, you’ll need to pick up videography and editing skill in order to catch the attention of the online audiences.

Be willing to Learn. Either register for short courses, attending conferences or get tutorials online, self-initiative is very much encouraged. Don’t say no to assignments that sounds impossible to you, accept it and push your envelope. You need growth!

Innovative and Motivative. Always challenge yourself to come out with something different or something better than the project you did, like a better tagline or copywriting, a better way of selling your products and etc. Make sure you watch and follow your deadline too! Have some sense of urgency.

Good Internet Expert. You must be able to find info or content that you want and need to help you in your career. We always need a reference point to spark new creativity.

Knowledgable. At least, know your brand and product and be able to pitch the unique selling points. Know your competitors’ strength and weaknesses.

Attention to details. You can’t afford to reprint the A&P materials once they are out. You don’t want to always say ‘sorry, there’s a mistake in my previous email and here’s the revised version’. So, be meticulous, always check your work and be willing to change to make sure the final artwork, proposal or email is completed, even if you’re missing out a comma or a full stop.

Trustworthy. Be honest. Don’t ever tell lies in your service, product, your brand nor overpromise/oversell what your company can’t do. This is even more crucial when you’re handling crisis management.

* BONUS if you have a heart and mindset of an entrepreneur. You’ll be able to learn to see your job as your own company, you’ll see your boss like your client, you’ll always want to do more and dare to take the risk to drive for certain results.

Just like the title of this article says “I shouldn’t be telling you how I strive as a public relations practitioner” but I’ve decided to let my secrets out. Though many of you might be surprised to know this because my primary impression is a singer and to some, an emcee.

As long as you do what you love, and you’ll never work another day in your life.

I’m open to invitation by college and university to share my working experience and knowledge in this Mass Communications field.

Just hit me up at [email protected] and I look forward to sparking that Mr/Ms PR in you.

24.3.19

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

from Michael Anderson https://www.ascentlawfirm.com/tax-extension-law/ from Divorce Lawyer Sandy Utah https://divorcelawyersandyutah.tumblr.com/post/183507570573

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

from Michael Anderson https://www.ascentlawfirm.com/tax-extension-law/ from Best Utah Attorneys https://bestutahattorneys.tumblr.com/post/183507551204

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

https://www.ascentlawfirm.com/tax-extension-law/

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

from https://www.ascentlawfirm.com/tax-extension-law/

from Criminal Defense Lawyer West Jordan Utah - Blog http://criminaldefenselawyerwestjordanutah.weebly.com/blog/tax-extension-law

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

via Michael Anderson https://www.ascentlawfirm.com/tax-extension-law/

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

Source: https://www.ascentlawfirm.com/tax-extension-law/

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube

If you ask for a tax extension by phone or computer, you can also choose to pay any expected balance due by authorizing an electronic funds withdrawal from a checking or savings account. You will need the appropriate bank routing and account numbers. You must also provide the adjusted gross income amount from your previous year’s federal income tax return to verify your identity.

You can also get an extension by making an extension-related credit card payment by phone or through the Internet. Contact one of the service providers below. The processor will charge you a convenience fee for the credit card payment. See the instructions for Form 4868 for more information on how to make an extension-related electronic payment. If your return is completed but you are unable to pay the tax due, do not request a tax extension. File your return on time and pay as much as you can. The IRS will send you a bill or notice for the balance due. Special rules apply to U.S. citizens, resident aliens and members of the armed forces whose home and main place of business or post of duty are outside of the United States. For more information about these provisions, see Publication 54, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and Publication 3, Armed Forces’ Tax Guide.

Free Consultation with a Utah Tax Attorney

If you are here, you probably have a tax law issue you need help with, call Ascent Law for your free tax law consultation (801) 676-5506. We want to help you.

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Parental Kidnapping

Depositions in Divorce

Insurance During Divorce

Utah Motorcycle Attorney

Timeshare Law

Domestic Partnership Law

https://www.ascentlawfirm.com/tax-extension-law/

0 notes

Text

Tax Extension Law

If you can’t meet the deadline to file your tax return, you can get an automatic four-month tax extension of time to file from the IRS. The extension will give you extra time to get the paperwork in to the IRS, but it does not extend the time you have to pay any tax due.

You must make an accurate estimate of any tax due when you request an extension. You will owe interest on any amounts not paid by the April deadline, plus a late payment penalty if you have paid less than 90 percent of your total tax by that date. You may send a payment for the expected balance due, but this is not required to obtain the extension.

youtube

If you cannot file your tax return by the due date, you may be able to get an automatic 6-month extension of time to file. For example, if your return is due on April 15, you will have until October 15 to file. You can get the automatic extension by:

1. Using IRS e-file (electronic filing), or 2. Filing a paper form

E-filing Options. There are two ways you can use e-file to get an extension of time to file. Complete Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, to use as a worksheet. If you think you may owe tax when you file your return, use Part II of the form to estimate your balance due. If you e-file Form 4868 to the IRS, do not also send a paper Form 4868. You can use a tax software package with your personal computer or a tax professional to file Form 4868 electronically. You will need to provide certain information from your tax return from the previous tax year.

E-file and Pay by Credit Card. You can get a tax extension by paying part or all of your estimate of tax due by using a credit card. You can do this by phone or over the Internet. You do not file Form 4868.

Filing a paper form (Form 4868). You can get an extension of time to file by filing a paper Form 4868. Mail it to the address shown in the form instructions. If you want to make a payment with the form, make your check or money order payable to the “United States Treasury.” Write your SSN, daytime phone number, and “2005 Form 4868” on your check or money order.

You must request the automatic tax extension by the due date for your return. You can file your return any time before the 6-month extension period ends.

Enter any payment you made related to the extension of time to file on Form 1040, line 69. If you file Form 1040EZ or Form 1040A, include that payment in your total payments on Form 1040EZ, line 9, or Form 1040A, line 43. Also enter “Form 4868” and the amount paid in the space to the left of line 9 or line 43.

youtube

To get the automatic extension, file Form 4868, Application for Extension of Time to File U.S. Individual Income Tax Return, with the IRS by the April 15 deadline, or make an extension-related electronic payment. You can file your extension request by phone or by computer, or mail the paper Form 4868 to the IRS.

You can file Form 4868 by phone anytime through April 15 (or the following business day, if on a weekend or holiday). The special toll-free phone number is 1-888-796-1074. Use Form 4868 as a worksheet to prepare for the call and have a copy of your previous year’s federal income tax return available.

The system will give you a confirmation number to verify that the extension request has been accepted. Put this confirmation number on your copy of Form 4868 and keep it for your records. Do not send the form to the IRS. You can also e-file an extension request using tax preparation software on your own computer or by going to an authorized e-file tax professional. The IRS will acknowledge receipt of the extension request if you file by computer.

youtube