#documents required to sell on amazon

Explore tagged Tumblr posts

Text

How to Sell on Noon.com and Amazon.ae [2023 Guide]

Are you looking to expand your e-commerce business in 2023? Selling your products on major Middle Eastern platforms like Noon and Amazon in the UAE can be a game-changer. In this comprehensive guide, we’ll walk you through the process of becoming a seller on these popular online marketplaces.

1. Benefits of Becoming a Seller on Noon and Amazon

Selling on Noon and Amazon offers numerous advantages. You gain access to a vast customer base, established logistics, and payment systems. Both platforms provide exposure to the thriving Middle Eastern e-commerce market, with a strong focus on customer satisfaction.

2. Documents Required to Become a Seller on Noon and Amazon

To get started as a seller, you’ll need to provide essential documents. These include your business registration details, proof of identity, and tax information. Be prepared to share your company’s legal structure, a trade license, and a bank account for payments.

3. Documents Required for Noon:

Business Registration (Company’s Legal Structure)

Trade License

Bank Account Details

Proof of Identity (e.g., Passport or National ID)

Tax Information (if applicable)

4. Documents Required for Amazon.ae:

Business Registration (Company’s Legal Structure)

Trade License

Bank Account Details

Proof of Identity (e.g., Passport or National ID)

Tax Information (if applicable)

5. Learning More About Noon and Amazon

It’s crucial to familiarize yourself with each platform’s seller policies, fees, and listing requirements. You can explore online resources, attend webinars, or reach out to their support teams for assistance.

6. How Long Will It Take to Open My Store on Noon and Amazon

The time it takes to open your store varies but typically ranges from a few days to several weeks. Your application’s approval process depends on the accuracy of your provided documents and their verification. Be prepared to follow up with the marketplace representatives to expedite the process if necessary.

7. Working with Company Formation Specialists

If you find the document submission and store setup process overwhelming, consider enlisting the services of company formation specialists. They can provide invaluable guidance, ensuring that your business complies with local regulations and market requirements. These specialists can streamline the entire process, from registering your business to getting your products listed on the platforms.

In summary, selling on Noon and Amazon in the UAE in 2023 offers an array of opportunities for e-commerce businesses. By understanding the document requirements, learning about the marketplaces, and potentially seeking expert assistance, you can navigate the process smoothly and leverage the immense potential of the Middle Eastern e-commerce landscape. Start your journey as a seller on Noon and Amazon and tap into a world of online retail possibilities.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#documents required to sell on amazon#documents required to sell on noon#how to sell on amazon#how to sell on amazon & noon 2023 guide#how to sell on amazon in dubai#how to sell on amazon in uae#how to sell on noon#how to sell on noon in dubai#how to sell on noon in uae

0 notes

Text

Trying to make sense of the Nanowrimo statement to the best of my abilities and fuck, man. It's hard.

It's hard because it seems to me that, first and foremost, the organization itself has forgotten the fucking point.

Nanowrimo was never about the words themselves. It was never about having fifty thousand marketable words to sell to publishing companies and then to the masses. It was a challenge, and it was hard, and it is hard, and it's supposed to be. The point is that it's hard. It's hard to sit down and carve out time and create a world and create characters and turn these things into a coherent plot with themes and emotional impact and an ending that's satisfying. It's hard to go back and make changes and edit those into something likable, something that feels worth reading. It's hard to find a beautifully-written scene in your document and have to make the decision that it's beautiful but it doesn't work in the broader context. It's fucking hard.

Writing and editing are skills. You build them and you hone them. Writing the way the challenge initially encouraged--don't listen to that voice in your head that's nitpicking every word on the page, put off the criticism for a later date, for now just let go and get your thoughts out--is even a different skill from writing in general. Some people don't particularly care about refining that skill to some end goal or another, and simply want to play. Some people sit down and try to improve and improve and improve because that is meaningful to them. Some are in a weird in-between where they don't really know what they want, and some have always liked the idea of writing and wanted a place to start. The challenge was a good place for this--sit down, put your butt in a chair, open a blank document, and by the end of the month, try to put fifty thousand words in that document.

How does it make you feel to try? Your wrists ache and you don't feel like any of the words were any good, but didn't you learn something about the process? Re-reading it, don't you think it sounds better if you swap these two sentences, if you replace this word, if you take out this comma? Maybe you didn't hit 50k words. Maybe you only wrote 10k. But isn't it cool, that you wrote ten thousand words? Doesn't it feel nice that you did something? We can try again. We can keep getting better, or just throwing ourselves into it for fun or whatever, and we can do it again and again.

I guess I don't completely know where I'm going with this post. If you've followed me or many tumblr users for any amount of time, you've probably already heard a thousand times about how generative AI hurts the environment so many of us have been so desperately trying to save, about how generative AI is again and again used to exploit big authors, little authors, up-and-coming authors, first time authors, people posting on Ao3 as a hobby, people self-publishing e-books on Amazon, traditionally published authors, and everyone in between. You've probably seen the statements from developers of these "tools", things like how being required to obtain permission for everything in the database used to train the language model would destroy the tool entirely. You've seen posts about new AI tools scraping Ao3 so they can make money off someone else's hobby and putting the legality of the site itself at risk. For an organization that used to dedicate itself to making writing more accessible for people and for creating a community of writers, Nanowrimo has spent the past several years systematically cracking that community to bits, and now, it's made an official statement claiming that the exploitation of writers in its community is okay, because otherwise, someone might find it too hard to complete a challenge that's meant to be hard to begin with.

I couldn't thank Nanowrimo enough for what it did for me when I started out. I don't know how to find community in the same way. But you can bet that I've deleted my account, and I'll be finding my own path forward without it. Thanks for the fucking memories, I guess.

440 notes

·

View notes

Text

BY PARK MACDOUGALD

The “movement,” in turn, while it recruits from among students and other self-motivated radicals willing to put their bodies on the line, relies heavily on the funding of progressive donors and nonprofits connected to the upper reaches of the Democratic Party. Take the epicenter of the nationwide protest movement, Columbia University. According to reporting in the New York Post, the Columbia encampment was principally organized by three groups: Students for Justice in Palestine (SJP), Jewish Voice for Peace (JVP), and Within Our Lifetime (WOL). Let’s take each in turn.

JVP is, in essence, the “Jewish”-branch of the Boycott, Divestment and Sanctions movement, backed by the usual big-money progressive donors—including some, like the Rockefeller Brothers Fund, that were instrumental in selling Obama’s Iran Deal to the public. JVP and its affiliated political action arm, JVP Action, have received at least $650,000 from various branches of George Soros’ philanthropic empire since 2017, $441,510 from the Kaphan Foundation (founded by early Amazon employee Sheldon Kaphan), $340,000 from the Rockefeller Brothers Fund, and smaller amounts from progressive donors such as the Quitiplas Foundation, according to reporting from the New York Post and NGO Monitor, a pro-Israel research institute. JVP has also received nearly $1.5 million from various donor-advised funds—which allow wealthy clients to give anonymously through their financial institutions—run through the charitable giving arms of Fidelity Investments, Charles Schwab, Morgan Stanley, Vanguard, and TIAA, according to NGO Monitor’s review of those institutions’ tax documents.

SJP, by contrast, is an outgrowth of the Islamist networks dissolved during the U.S. government’s prosecution of the Holy Land Foundation (HLF) and related charities for fundraising for Hamas. SJP is a subsidiary of an organization called American Muslims for Palestine (AMP); SJP in fact has no “formal corporate structure of its own but operates as AMP’s campus brand,” according to a lawsuit filed last week against AJP Educational Fund, the parent nonprofit of AMP. Both AMP and SJP were founded by the same man, Hatem Bazian, a Palestinian academic who formerly fundraised for KindHearts, an Islamic charity dissolved in 2012 pursuant to a settlement with the U.S. Treasury, which froze the group’s assets for fundraising for Hamas (KindHearts did not admit wrongdoing in the settlement). And several of AMP’s senior leaders are former fundraisers for HLF and related charities, according to November congressional testimony from former U.S. Treasury official Jonathan Schanzer. An ongoing federal lawsuit by the family of David Boim, an American teenager killed in a Hamas terrorist attack in 1996, goes so far as to allege that AMP is a “disguised continuance” and “legal alter-ego” of the Islamic Association for Palestine, was founded with startup money from current Hamas official Musa Abu Marzook and dissolved alongside HLF. AMP has denied it is a continuation of IAP.

Today, however, National SJP is legally a “fiscal sponsorship” of another nonprofit: a White Plains, New York, 501(c)(3) called the WESPAC Foundation. A fiscal sponsorship is a legal arrangement in which a larger nonprofit “sponsors” a smaller group, essentially lending it the sponsor’s tax-exempt status and providing back-office support in exchange for fees and influence over the sponsorship’s operations. For legal and tax purposes, the sponsor and the sponsorship are the same entity, meaning that the sponsorship is relieved of the requirement to independently disclose its donors or file a Form 990 with the IRS. This makes fiscal sponsorships a “convenient way to mask links between donors and controversial causes,” according to the Capital Research Center. Donors, in other words, can effectively use nonprofits such as WESPAC to obscure their direct connections to controversial causes.

Something of the sort appears to be happening with WESPAC. Run by the market researcher Howard Horowitz, WESPAC reveals very little about its donors, although scattered reporting and public disclosures suggest that the group is used as a pass-through between larger institutions and pro-Palestinian radicals. Since 2006, for instance, WESPAC has received more than half a million in donations from the Elias Foundation, a family foundation run by the private equity investor James Mann and his wife. WESPAC has also received smaller amounts from Grassroots International (an “environmental” group heavily funded by Thousand Currents), the Sparkplug Foundation (a far-left group funded by the Wall Street fortune of Felice and Yoram Gelman), and the Bafrayung Fund, run by Rachel Gelman, an heir to the Levi Strauss fortune and the sister of Democratic Rep. Dan Goldman. (A self-described “abolitionist,” Gelman was featured in a 2020 New York Times feature on “The Rich Kids Who Want to Tear Down Capitalism.”) In 2022, WESPAC also received $97,000 from the Tides Foundation, the grant-making arm of the Tides Nexus.

WESPAC, however, is not merely the fiscal sponsor of the Hamas-linked SJP but also the fiscal sponsor of the third group involved in organizing the Columbia protests, Within Our Lifetime (WOL), formerly known as New York City SJP. Founded by the Palestinian American lawyer Nerdeen Kiswani, a former activist with the Hunter College and CUNY chapters of SJP, WOL has emerged over the past seven months as perhaps the most notorious antisemitic group in the country, and has been banned from Facebook and Instagram for glorifying Hamas. A full list of the group’s provocations would take thousands of words, but it has been the central organizing force in the series of “Flood”-themed protests in New York City since Oct. 7, including multiple bridge and highway blockades, a November riot at Grand Central Station, the vandalism of the New York Public Library, and protests at the Rockefeller Center Christmas-tree lighting. In addition to their confrontational tactics, WOL-led protests tend to have a few other hallmarks. These include eliminationist rhetoric directed at the Jewish state—such as Arabic chants of “strike, strike, Tel Aviv”; the prominent display of Hezbollah flags and other insignia of explicitly Islamist resistance; the presence of masked Arab street muscle; and the antisemitic intimidation of counterprotesters by said masked Arab street muscle.

WOL’s role appears to be that of shock troops, akin to the role played by black block militants on the anarchist side of the ledger. WOL is, however, connected to more seemingly “mainstream” elements of the anti-Israel movement. Abdullah Akl, a prominent WOL leader—indeed, the man leading the “strike Tel Aviv” chants in the video linked above—is also listed as a “field organizer” on the website of MPower Change, the “advocacy project” led by Linda Sarsour. MPower Change, in turn, is a fiscal sponsorship of NEO Philanthropy, another large progressive clearinghouse. NEO Philanthropy and its 501(c)(4) “sister,” NEO Philanthropy Action Fund, have received more than $37 million from Soros’ Open Society Foundations since 2021 alone, as well as substantial funding from the Rockefeller Brothers Fund, the Ford Foundation, and the Tides Foundation.

#tides foundation#national lawyers guild#within our lifetime#jewish voice for peace#students for justice in palestine#dark money#rockefeller brothers fund#funding for terrorism#lisa fithian#occupy

24 notes

·

View notes

Note

I want to publish a book someday, but I'm not sure where to start. What was your experience like publishing The Heart of the World? How did you format it for printing? Did you have to hire someone? How did you find a cover artist? Was it expensive?

I bought the hardcover as soon as I could. I love the story, and I loved the story in its fanfic form, too.

I hope one day to be as good of a writer as you.

(P.s. Have you considered selling signed copies?)

The Heart of the World by me (@janedoewrites)

Thank you, anon! Glad you like the book and the original fic! I always love to hear from people who've a) read it b) enjoyed it. Always nice to know it's not just me.

And I'm sure you'll get there if you're not there already. I didn't start out nearly as good as I am today, it just takes time and practice.

As for the publishing stuff most of this is discussed here.

Publishing, Was it Expensive, How You Do?

Self-publishing was very simple, stupid simple really. Hardest part is writing and editing and then, if you're trying to make decent money/a living, marketing which is the hardest of all.

Now for your questions.

There are word document templates you can use that have the specifications required for print books (both hard and soft). This is what I used for the print versions. For the electronic version I used software to render it as an e-pub and make sure the chapter titles and sections were all correct. This software is freely available and is easy to use/has tutorials.

I had friends help edit the book through various drafts and didn't have to hire anyone for editing. However, hiring a professional is absolutely something you could do, but I have no experience in how much that would cost.

I was lucky for cover artists in that @sunnyfish0-0, who is amazing and a great artist, volunteered because they were a fan of the fic series and were very excited about the story. They also wanted a chance to add something like this to their portfolio. They were very kind in that, so long as they retained copyright of the image (this is very normal/should be the case, as you as the author are then granted use of the image but don't own it) and were able to use it in their portfolio, I was not charged. I'm still so happy about it, because it turned out absolutely fantastic and really captured the vibe of the story.

If it hadn't been for that, I probably would have drawn the cover myself (and it wouldn't have been nearly as good and would likely have been quite different). To create the cover, there are specifications of the exact dimensions the cover requires based on the number of pages in the book/the paper being used/the size of the page. For Amazon, what I went through for hard printing, these dimensions and templates were provided to me.

There are also tools that can help you generate covers from stock images for free as well.

If you want to hire an artist, there are artists all around on tumblr who will do so for commission. See if they're accepting commissions, see what their pricing is, look at their style and see if it matches what you're looking for, then talk to them about the project. I've seen artists saying that sometimes they get manuscripts, sometimes they don't and are just told "vibes of the story/main trends/themes and things that are important to portray". Prices will vary based on the experience of the artist, the complication of the scene you're asking for, the size of the cover, cost of materials/software, and really depends on who you're looking for and what you're doing.

Might also be worth reaching out to friends and such/people excited in the project and see who is willing to help out with what and for what if any price.

So, for me, it was extremely inexpensive, the only thing publishing cost me was my free time (which I was spending writing anyway). Because I chose a route where printing is on demand, printing and shipping is slow but does get there eventually and it means I don't pay out of pocket to have 50 books I may or may not sell on hand. I also don't have to ship them myself which helps a lot.

Now, all this changes if you're getting published by a publishing company, in which they will likely handle the cover art and editing for you, but that's not something I have familiarity with.

Signed Copies

Alas, one of the downsides of not having print copies on hand is I don't have print copies on hand. I can get authors copies for the price of printing and then there comes the problem of shipping.

Shipping, especially for readers who span across the globe, is expensive even for something as relatively light as a small paperback/hardcover book.

And since it's not something I really want to offer to some versus others, and don't want to cut off at a few lucky people who get a signed copy, it's pretty much a "if you know who I am in the real world and can meet me in person with a book". I also don't want to offer signed copies only for exorbitant prices of "make up printing and shipping plz".

Maybe that will change someday, but for now, I sign only in spirit.

If it's any consolation, my handwriting's garbage.

2 notes

·

View notes

Text

How to Prevent Amazon from Ruining Your Life

(a.k.a. how to sell ebooks on places that aren’t Kindle)

Let’s face it, Amazon has a history of screwing people over. Especially those people who depend on Amazon to make a living. If you sell ebooks on Kindle and you want to insulate yourself from whatever raw deal those maniacs come up with next, you should make sure your ebook is also being sold elsewhere. And by “elsewhere” I mean “everywhere.”

Please note: following this guide will make you ineligible for KDP Select. If you’re mostly dependent on revenue from KDP Select, this guide will not be helpful to you. But Amazon will ruin your life someday.

Step 1: Make an EPUB

KDP, and certain other services like it, allow you to upload a Word document and automatically convert it to an eBook. If you really want to sell your ebook everywhere, though, you’ll need an EPUB file.

EPUB is a near-universal ebook file standard. Most ebook apps and eReaders can read EPUBs, and every vendor will accept an EPUB file for upload. You can even use an EPUB instead of a Word document on KDP.

You can create an EPUB file for your ebook using Sigil, which is a free and open-source ebook editor with extensive documentation. EPUB files are formatted in XHTML, so a quick education on HTML basics from W3C would serve you well here.

Don’t forget to include a cover and table of contents within your EPUB, as well as metadata tags for your book’s title and your name. Most vendors require them.

Optional: Convert to MOBI and PDF

Newer Kindles can apparently read EPUBs. Older Kindles might not. In the event someone with a Kindle wants to buy your book from a vendor that isn’t Amazon, you can package your EPUB with a MOBI file.

You can convert your EPUB to MOBI using Calibre. Calibre can also help you convert your ebook to a PDF, although I wouldn’t recommend using a Calibre-generated PDF for any print-on-demand services.

Step 2: Upload Everywhere

Here’s a list of vendors I upload my ebooks to:

DriveThruFiction (also does print-on-demand)

Gumroad

itch.io

Ko-fi (using the Shop feature)

Payhip

Smashwords (will, if you meet certain formatting standards, automatically distribute your book to Apple, Barnes & Noble, and Kobo, among others)

None of these sites have exclusivity agreements, meaning you can upload your ebook to all of them at once. Remember to check whether a vendor has submission guidelines for ebooks, and make sure yours fits those guidelines.

Once your ebook is uploaded to these other vendors, you can use Books2Read’s Universal Link feature to centralize most of your book’s URLs into one link.

And now, the next time Amazon nukes an entire department or shadowbans an entire genre, you can send your readers elsewhere to buy your books.

53 notes

·

View notes

Text

Trying harder to make life easier with Alexa

A little over a year ago I read a Bloomberg article that Alexa use had stalled and that users weren't adopting/integrating Alexa as quickly as Amazon hoped. The article cited internal Amazon data stating, "There have been years when 15% to 25% of new Alexa users were no longer active in their second week with the device." Another Amazon document said that new Alexa users discover half the features they will ever use within 3 hours of activating the device. Beth and I fall into that category... we mostly ask Alexa to tells us the weather forecast and occasionally ask other questions which she occasionally answers correctly. We also have an Echo device in the pantry and use Alexa to add items to a shopping list. When we lived in the apartment we used smart plugs and Alexa voice commands to control a few lamps. I also used smart plugs and Alexa routines to schedule/automate the Christmas lights at our old house.

When building our new house I tried to make it as future proof as possible. We have robust wifi to connect smart appliances (range, microwave, refrigerator, dishwasher, washer, and dryer) as well as Liftmaster garage doors, Moen shower valves, a Ring security system and Lutron lighting. When we moved in, I took the time to connect about half of these items to their 'brand' app but didn't bother with many others. According to the WSJ, I'm not alone. In a WSJ article last month LG Electronics said that less than half their smart appliances stay connected to the internet; Whirlpool said that more than half remain connected but declined to be more specific. This shouldn't be surprising because the process of connecting an appliance isn't very intuitive and it differs from one brand to the next.

The ROI on the effort to connect the devices isn't strong, especially if it is difficult to to do. For most appliances (washer, dryer, refrigerator, etc.) the primary benefit is notification of required maintenance, faults or malfunctions and limited diagnostic abilities. The refrigerator will also inform me if the door is left open, the dishwasher will remind me that the rinse agent is low, the dryer will tell me if the exhaust is clogged and I like seeing the notifications about my oven timer because I usually can't hear it.

Using Alexa to do things is even more difficult. First you have to add the appropriate 'Skill', oAuth into the app of the appliance, then discover the devices and build a routine. Creating the routine frequently requires an additional step of creating a 'Scene' in the subsidiary app, then discovering this scene in Alexa when you connect the skill. This isn't insurmountable for a Gen-Xr or younger, but again it isn't always clear that the juice is worth the squeeze. I made the effort, however and now I can start the dishwasher from my bed before I go to sleep (provided I already added detergent) and find out how much time is left on the dryer. Surprisingly, my life doesn't feel that much richer.

There are opportunities for complex, higher value Alexa routines but these are even more difficult. Leaving the house is a good example. With a great deal of effort, I've enabled the following:

"Alexa, we are leaving in the Subaru"

Open Liftmaster Center garage door

Execute Lutron Garage Lights Scene - On

Execute Lutron Goodbye Lights Scene (all house lights off)

Wait 5 minutes

Execute Lutron Garage Lights Scene - Off

Arm Ring Security System - Away

Arm Alexa Guard - Away

This was difficult because Liftmaster is trying to sell their own Alexa -type hardware so they refuse to integrate with Alexa. Likewise, Alexa refuses to disarm or change armed mode of Ring with a routine (even though they are sister companies). Solving both those problems required use of an intermediary Simple Commands/IFFT skill to backdoor the solution. I think this routine could get even better if I add a command to turn down the heat/ac and turn off recirc of the tankless water heaters but I will need to add wireless control to the Rinnai water heaters.

Having said that the Alexa Leaving and Arriving routines really are helpful and I like scheduling Alexa to automatically close the garage doors every night at 10 in case they've accidentally been left open.

When my Dad died last year I bought several Echos, smart plugs and a Ring system and installed them for my Mom. She loves being able to tell Alexa to turn on lights, show her who is at the front door and play Spotify. She couldn't have set up the system, but she is good at using it and that's what counts.

22 notes

·

View notes

Text

Online Entrepreneurship: Mastering the Art of Digital Success

Entrepreneurship is a field that has gained significant attention in recent years. With the advent of the internet, there has been a growing demand for online courses and educational resources related to entrepreneurship. This document aims to provide an overview of entrepreneurship online, highlighting its benefits, popular platforms, and key factors to consider before embarking on an online entrepreneurial journey. Benefits of Online Entrepreneurship 1. Flexibility: One of the main advantages of online entrepreneurship is the ability to work from anywhere. With an internet connection, entrepreneurs can conduct business remotely, eliminating the constraints of traditional brick-and-mortar offices. 2. Global Reach: The internet acts as a global platform, allowing entrepreneurs to connect with customers, business partners, and suppliers from all over the world. This opens up new opportunities for expansion, market penetration, and cross-cultural collaborations. 3. Reduced Overheads: Online businesses often have a lower startup cost compared to traditional brick-and-mortar businesses. Entrepreneurs can avoid the physical infrastructure expenses, such as rent, utilities, and employees. Additionally, digital products and services often have lower production and distribution costs. 4. 24/7 Accessibility: The internet provides entrepreneurs with round-the-clock access to their business. Whether it's managing administrative tasks, communicating with customers, or promoting products or services, entrepreneurs have the freedom to work whenever it suits them.

Online Entrepreneurship: Mastering the Art of Digital Success

Photo by Content Pixie Popular Platforms for Online Entrepreneurship 1. Websites: Building a professional website is essential for online entrepreneurship. It allows entrepreneurs to showcase their products or services, engage with customers, and establish a strong online presence. 2. Social Media: Social media platforms have become powerful tools for entrepreneurs. By leveraging platforms like Facebook, Instagram, and Twitter, entrepreneurs can reach a wide audience, build brand awareness, and drive traffic to their websites. 3. E-commerce: Selling products or services online through e-commerce platforms like Amazon, eBay, and Etsy provides entrepreneurs with a convenient and efficient way to reach customers. 4. Online Course Platforms: Entrepreneurs can leverage online course platforms to share their knowledge, skills, and experiences. platforms such as Udemy, Teachable, and Coursera offer a platform for creating and monetizing online courses. Key Factors to Consider 1. Market Demand: Before embarking on an online entrepreneurial journey, it is crucial to conduct market research to identify if there is a genuine demand for your product or service. Understanding your target audience's needs and preferences will help you create a successful online venture. 2. Competitiveness: Evaluate the level of competition in the chosen niche or industry. Identify unique selling points and differentiate your business to stand out in the market. 3. Digital Marketing Strategy: Develop a well-crafted digital marketing strategy to promote your products or services. This includes SEO, social media marketing, content marketing, and other online channels to reach your target audience effectively. 4. Financial Projections: Have a clear understanding of your financial projections and projected revenue streams. This will help you make informed decisions and manage your business finances effectively. 5. Continuous Learning: Entrepreneurship is a journey that requires continuous learning and adaptation. Stay updated with the latest industry trends, emerging technologies, and best practices to make informed decisions and stay ahead of the competition. Conclusion Online entrepreneurship offers numerous benefits, including flexibility, global reach, and reduced overheads. Popular platforms include websites, social media, e-commerce, and online course platforms. To ensure success, entrepreneurs should consider market demand, competitiveness, digital marketing strategy, and financial projections. Continuous learning and staying updated is crucial for long-term success in the online world. Read the full article

#businessgrowth#businesssuccess#digitalbusiness#digitalentrepreneur#digitalgrowth#digitalmarketing#digitalmarketingtips#digitalstrategy#digitalsuccess#digitalsuccessstrategy#entrepreneurlifestyle#entrepreneurmindset#entrepreneurmotivation#entrepreneurship#OnlineEntrepreneurship:MasteringtheArtofDigitalSuccess#onlinebusiness#onlineentrepreneurship#onlinemarketing#onlinesuccess#successcoach#successmindset

4 notes

·

View notes

Text

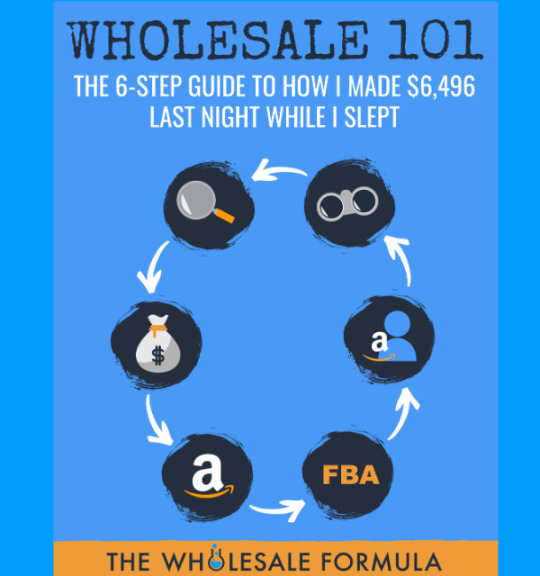

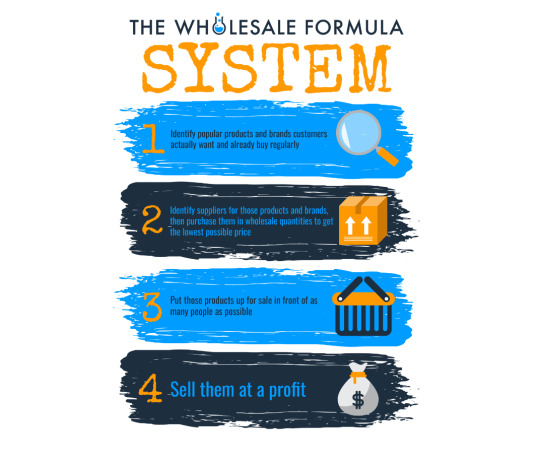

Start a Profitable Wholesale Business with The Wholesale Formula

How to Start Wholesale Business on Amazon

Selling wholesale on Amazon is a popular and viable way for entrepreneurs to start their own online business. It is a bit different from retail arbitrage or private labelling, as you are not sourcing your own products but instead purchasing inventory from a supplier to sell. This model can be less risky than other options as it requires a lower upfront investment but still comes with many of the same challenges, including sourcing profitable products and managing inventory.

To start a wholesale business on Amazon, you must first be approved to do so by the manufacturer or brand that you wish to purchase products from. This is usually done by submitting your business details and a tax ID number, which you can get from the IRS website. Some brands may also require a business license or other documents that verify your ability to do business in your jurisdiction.

Once you have been approved, you can start reaching out to suppliers and manufacturers to inquire about their product offerings. Some will have minimum order quantities that you must meet in order to qualify for discounted prices, while others may require a certain level of buying experience or proof of success with other sellers before they will agree to work with you. It is important to research the catalogs of various suppliers carefully and make decisions based on data, such as average customer reviews, sales history, and profit margins.

In addition to researching the catalogs of various suppliers, you will need to spend a considerable amount of time cold-calling and emailing brands in order to get approval to do business with them. It is important to present yourself as a knowledgeable and professional seller, and to show the brands that you have the experience and expertise necessary to grow their brand. You can do this by highlighting your past experience and demonstrating that you will be able to deliver a high volume of sales to their company.

Once you've made some initial connections with manufacturers and suppliers, you'll want to negotiate the best deal possible. This is where your research and experience will pay off. If you can show the brands that you are a valuable partner, they will be more likely to offer you reduced buy box competition and exclusive selling rights on Amazon.

Keeping your inventory at a healthy level is key when starting a wholesale business on Amazon. Running out of stock will prevent you from making sales and can impact your Amazon rankings. To avoid this, it is essential to track your inventory closely and plan ahead when placing orders with suppliers.

Wholesale selling on Amazon can be a very profitable business model, but it is important to do your homework and prepare properly before making any significant investments. By following the steps outlined in this article, you can minimize your risk and ensure that you are investing in a profitable and sustainable business. By using the tools that are available, such as Jungle Scout, you can ensure that you are maximizing your profits and avoiding any costly mistakes.

Learn more about the Amazon Wholesale Method by checking out The Wholesale Formula Review.

youtube

2 notes

·

View notes

Text

The best ways to start a business

A tough period is necessary when starting any firm. You must first put time and money into starting a business. Do you realize that in order to perform any activity, you must first generate income through investments?

The process of launching a business is among the craziest. Self-reflection and confidence are necessary while starting a business. You're looking for inexpensive business startup ideas. The best approaches to launch a business are covered in detail below, including selecting the best business model, creating a strong business plan, opening a business bank account, and selecting the appropriate accounting software.

Business opportunities depending on skills.

There are several business concepts that can be launched with no financial outlay. We put such concepts into practice for you that you won't require any starting money. I wish you ease in handling any subject.

Service industry

If you have artistic talent, you can make money by offering this service online as a graphic designer.

Currently, there is a lot of demand for video editing services. The demand for video editing is gradually rising.

Independent author: Writing for clients independently is a profession. This demand is significantly rising right now. The need for content is enormous when launching any kind of online business.

Social media manager: The need for any online business is growing as a result of the rise in online usage. You may make money quite simply by doing this if you know how to construct marketing campaigns for social media networks.

Handmade enterprise

A project with a service focus can plan. As you hone your abilities, you consider starting a company where you may market the outcomes of your abilities. You might work as a house cleaner, furniture salesperson, grocer, etc.

Also, it is relatively simple to produce digital goods and sell them online. e-books, online classes, and website templates, for instance. You can sell the things you've manufactured on a variety of websites, including Etsy, Amazon, Facebook Marketplace, and Shopify.

Build a dropshipping store

You can generate money by starting an online drop shipping store if you want to launch an online business but don't want to handle the manufacturing, warehousing, and shipping of your own products.

You can receive the goods from the producers and deliver them to your prospective clients in this business exchange. You can deliver an order to your manufacturer after you get one. Who will manage all of your shipping tasks and deliver the ordered item to your customer directly? There is no inventory to handle.

Also read

To create a business plan

A business plan is a comprehensive document that details the objectives, plans, and financial forecasts for a startup or an established company. Any entrepreneur or business owner must create a business plan because it clarifies the organization's vision and objective, identifies potential obstacles, and establishes a road map for success.

There are some steps to create a business plan:

Business Description:

The company's history, sector, and target market should all be covered in detail in the business description. Also, you want to mention the goods and services you provide, your USP, and any benefits you have over rival businesses in terms of competition.

Market research:

An in-depth examination of your industry and target market should be provided through the market analysis. Information on market size, growth patterns, demographics, and purchasing patterns should be included. In this area, you should also analyze your rivals' advantages and disadvantages as well as how you intend to set your company apart from theirs.

Marketing and Sales Strategies:

Describe your marketing and sales tactics in this section. This should contain details about your strategies for promoting your company, identifying your ideal clientele, and generating sales. Include any market research that you've done, such as focus groups or surveys.

Examine your rivals.

Any business strategy should include competitive research. You may learn a lot about the market by looking at what your competitors are doing. You are capable of choosing how to position your own brand. These are some steps to think about when investigating your rivals:

1. Determine who your rivals are.

2. Examine their social media and website.

3. Assess their marketing approaches.

4. Examine the feedback from their clients.

5. Evaluate their effectiveness..

Create a powerful brand

It's crucial to first think about the kind of brand you're building as well as your principles and goals. You can begin generating name ideas once you have a firm grasp of your brand concept. Observe the following advice:

Be straightforward and simple to remember: In order for consumers to remember your brand name, it needs to be memorable and simple to say.

Be original by avoiding names that are too similar to those of already established companies. Your brand should distinguish itself from the competitors.

Consider your audience: Take into account the characteristics and hobbies of your intended market. They should be drawn to and identify with your brand name's core principles.

Funding develop your business

A business's ability to develop and expand depends on funding. While some business owners may begin with their own money or loans from family and friends, it's crucial to look into additional funding alternatives if you want to grow and scale your enterprise. In this post, we'll go through several options for raising money for your company's expansion.

Angel investors:

Wealthy people known as angel investors make equity-based investments in early-stage enterprises. Together with offering financial assistance, they also share their skills and experience. They are typically seasoned business owners who may provide the company founders with invaluable advice. Angel investors can be a fantastic source of investment if you have a compelling business concept and a compelling business strategy.

Venture capital:

Investment companies known as venture capitalists finance start-ups in return for stock. They often make investments in fast-growing businesses with strong potential for profit. For startups, venture capital funding is frequently seen as the most important source of finance.

Crowdfunding:

Crowdfunding is a technique for getting money from lots of people, usually through internet platforms. It's a fantastic technique to evaluate the market's interest before launching your goods and present your business concept to a broad audience. Crowdfunding can be equity- or reward-based, so it's important to carefully select the platform that best suits your financial objectives.

Small business loans:

Banks and other financial organizations offer small company loans to help businesses grow and expand. The interest rates on these loans might change based on the lender and the type of loan, and they can be secured or unsecured. Small company loans are a terrific method to obtain financing, but they demand a strong business plan and a decent credit score.

Also, learn more about click here

#how to start a business#start a business#passive income#digitalmarketing#make money online#online jobs#how to start a business online

2 notes

·

View notes

Text

* more adept at exploitation

I want to know how much of that produce sounds cheap because it's picked by slave labor.

Victim testimonies, news media, and think tanks report that factories, including for tomato products, frequently engage in coercive recruitment; limit workers’ freedom of movement and communication; and subject workers to constant surveillance, retribution for religious beliefs, exclusion from community and social life, and isolation. More broadly, according to varied estimates, at least 100,000 to hundreds of thousands of Uyghurs, ethnic Kazakhs, and other Muslim minorities are being subjected to forced labor in China following detention in re-education camps. In addition to this, poor workers in rural areas may also experience coercion without detention.

There are over 10,000 workers on Chinese squid jiggers, and reports indicate that a high percentage of them are in forced labor. The crew typically spends over a year, and sometimes up to 3 years, at sea without stopping at a port of call and have limited ability to communicate with the outside world. Employers take advantage of the vulnerability of the workers, many of whom are migrants from Southeast Asia. Many have been subjects of deceptive recruitment, identity documents are often confiscated, and reports indicate that workers are often prevented from leaving the vessel or ending their contracts. Workers are subjected to abusive working and living conditions, including inadequate nutrition and potable water. Some workers have died due to preventable and easily treated medical conditions, such as beriberi, a vitamin deficiency. Workers are subjected to excessive hours, physical violence, verbal abuse, threats and intimidation, and withheld wages. Some workers are subjected to debt bondage or are unable to leave due to large penalties for ending contracts early. Workers are also subjected to forced labor in squid processing facilities in mainland China as a result of state sponsored labor transfer programs. Since 2020, more than 1,000 Uyghurs and members of other persecuted ethnic minority groups from China’s Xinjiang Province have been transferred to work in squid processing facilities, primarily in Shandong Province. Furthermore, workers from North Korea have also been transferred to work at squid processing facilities. Squid processing companies and government entities frequently engage in coercive recruitment, limit workers’ freedom of movement and communication, and subjected workers to constant surveillance.

Research indicates that Uyghurs, ethnic Kazakhs, and other Muslim minorities are subjected to forced labor in jujube harvesting and processing while being held as prisoners and as a result of state-sponsored labor transfer programs. China is the world’s largest producer of jujubes, and more than 50% of production takes place in Xinjiang. Jujube producers work with the Chinese government to make use of ethnic minority groups for exploitative labor, often receiving financial incentives. Academic researchers, media, and think tanks report that companies and government entities frequently engage in coercive recruitment, limit workers’ freedom of movement and communication, and subjected workers to constant surveillance, exclusion from community and social life, physical violence, and threats to family members.

The majority of the crew on board China's fishing vessels are migrant workers from Indonesia and the Philippines, who are particularly vulnerable to forced labor. It is estimated that there are tens of thousands of workers who are sometimes recruited by agencies that deceive workers with false information regarding their wages and the terms of the contracts, and require the workers to pay recruitment fees and sign debt contracts. According to various sources, numerous incidents of forced labor have been reported on Chinese fishing vessels. While on board the vessels, workers’ identity documents are often confiscated, the crew spends months at sea without stopping at a port of call, and they are forced to work 18 to 22 hours a day with little rest. Workers face hunger and dehydration, live in degrading and unhygienic conditions, are subjected to physical violence and verbal abuse, are prevented from leaving the vessel or ending their contracts, and are frequently not paid their promised wages.

That's just the stuff that gets exported and has been investigated. How much more is there?

Apparently in mainland China there's also apples, grapes, pears, raisins, peppers, and walnuts, just for a start.

I FULLY AGREE WITH OP that there's no excuse for the American health insurance system. There's no excuse for what the United States has done to medication prices.

There are lots of fascinating studies and articles about how we pay more than any other country - and the things we fucked up along the way to that.

Also, it's illogical to compare prices without insurance to whatever they're paying. They have health insurance too. You have to compare the prices WITH insurance.

I know, it's more dramatic to highlight the fact that you can have no health insurance here and then you'd have to pay $400.

But you can also have no health insurance in China. So unless you have those numbers for China, it's not an equal comparison.

I also fully agree that 30 minutes for lunch is garbage, and so is having to work two jobs.

But I also think that the worst case scenarios in China are much worse than the ones here.

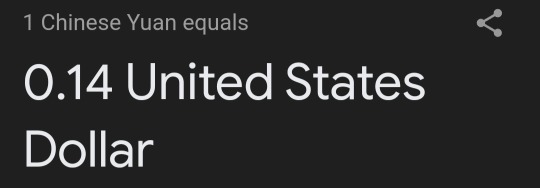

Hi I'm one of the Americans that transferred to Rednote as word of Tiktok shutdown got around. I just wanted to drop by and show everyone a comparison that is WILD to me.

These are all in Yuan, the local currency. A buck, two bucks, six bucks... that seems really nice.

And then you pop it in U.S dollars.

14 cents. 14 cents for food.

So seeing the difference there, I got curious and made a post asking the netizens how much they typically pay for things, and I asked for how much my meds would cost. These answers are eye opening.

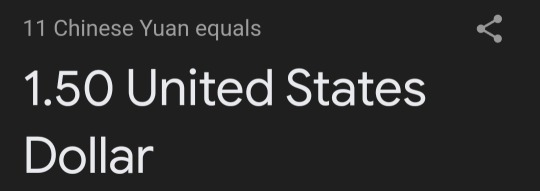

Eleven Yuan.

A dollar and two quarters.

Without insurance, my meds are 400 bucks in U.S currency.

There's no excuses for this. No excuse for why anyone should have to live like this.

#food tw#slavery#that's what i should be tagging these with to find them again#wall of words#fellas is it possible that communism doesn't actually work

9K notes

·

View notes

Text

Account Launch: Your Gateway to E-commerce Success with EcomExpert

You want to start selling online, which is quite an overwhelming process for a first-timer, more so when dealing with the big markets of India, Delhi, and Noida. Fear not; we are here to guide you step by step to successfully launch your account with the guidance of EcomExpert, the partner you trust in this ever-changing e-commerce world.

Why Account Launch Matters

Account launching is not just signing up on an e-commerce platform. It is more about laying a strong foundation for your business. Whether you are selling handmade goods or bulk items, the initial setup can determine your long-term success. For sellers in India, especially in booming business cities like Delhi and Noida, a well-managed launch can be the difference between standing out in a crowded marketplace and getting lost in the crowd.

How EcomExpert Makes Account Launch Easy

EcomExpert specializes in letting e-commerce firms launch their e-commerce accounts without any hassle. For years, the company has deep experience in Indian markets, Delhi, and Noida, and understands the requirements of each different platform such as Amazon, Flipkart, and Shopify. Here is how EcomExpert can assist you:

Platform Selection: Not all platforms are created equal. EcomExpert helps one to pick the right based on product, target audience, and objectives.

Account Setup: From filling up the basic details to verifying your credentials, EcomExpert makes sure that the account setup process is smooth and error-free.

Compliance: It is a tough task to understand tax regulations and documentation in India, but with EcomExpert's expertise in Delhi and Noida, you will never be out of compliance.

Creating the Perfect Product Listings

Your product listings are your digital storefront. They need to be appealing, informative, and SEO-friendly so as to attract traffic and convert. Ecom Expert's team excels at creating:

Delightful photographs that capture your products from all angles.

Captivating descriptions that bring to limelight what makes your products special and unique in their usage and functioning.

Clever keyword optimization, which will include location-specific phrases like "Delhi" and "Noida" when targeting that geography. The Role of Local Expertise

Delhi and Noida are the bustling commerce hubs in India. Local market trends, customer behavior, and competition will decide the success of the launch. EcomExpert brings local insights that help you tailor your strategies for maximum impact. For example, they'll guide you on popular product categories and pricing trends specific to Delhi and Noida. Advertising Your Store Like a Pro

Launching your account is only the beginning. To get sales going, you will need good advertising strategies. EcomExpert can help in:

Setting sponsored ads across platforms such as Amazon and Flipkart.

Using social media for running targeted ads in Delhi and Noida for proximity businesses.

Analyzing the performance of ads to run more effective and target-specific campaigns.

Why Choose EcomExpert?

EcomExpert is a partner in your e-commerce success. They are not another service provider. Here's why businesses in India, including Delhi and Noida, consider them as part of their team:

Years of expertise in India's e-commerce landscape. Tailored Solutions-Customized strategies based on business needs. Local Insights: Deep understanding of the Delhi and Noida market. End-to-End Support: From account launch to scaling your business, EcomExpert is here with you. Scaling Your Business Post-Launch

The journey doesn’t end after your account launch. With EcomExpert, you’ll have the tools and guidance to scale your business. From inventory management to advanced analytics, their services ensure sustained growth and profitability.

Conclusion

Launching an e-commerce account can seem scary, but with the proper expertise and support, it can be something extraordinary. EcomExpert is your solution for succeeding in India, Delhi, and Noida. Partner with EcomExpert and watch your e-commerce dreams come to life!

1 note

·

View note

Text

Step by step guide to securing Category Approval

That is how they maintain the quality of products and ensure customer satisfaction while staying in line with local laws. Without proper category approval, your dreams of becoming an e-commerce powerhouse can come to a screeching halt. That's why having the right ecom expert by your side in cities like Delhi and Noida can make all the difference. Steps to Obtain Category Approval Category approval from a platform includes some essential steps that might change from platform to product type. Let's get down to breaking it. 1. Researching Requirements

The rules are always different on various platforms. For example, Amazon India can require an invoice, GST details, or even brand authorization on specific categories. You are either selling in Delhi's markets or targeting the increasingly larger customer base in Noida, understanding the specifics makes a big difference.

2. Obtain the Required Documents For avoidance of delays, ensure that all required documents are ready at hand. Examples of commonly required documents include: Certificate of GST Trade licenses Product test reports for categories like electronics Brand authorization letters The ecom expert who is also well-versed with the regulations of the city can help an individual seller of Delhi and Noida.

3. Submission

Typically, submission processes are structured by the platforms in such a way that they sort out pretty well. It simply requires logging into your seller account, clicking into the approval section, and then uploading all the necessary documents.

Regulatory Updates: Most e-commerce platforms update their policies regularly. Trying to keep track of all these updates can be a challenge in itself. Competition: E-commerce businesses are on the rise in Delhi and Noida. Therefore, it's not easy to create a niche for yourself with just category approval How Ecom Expert Can Help If the process seems too overwhelming, then hiring an ecom expert will be a game-changer. This is how he could help Process Simplification: The Ecom experts in Delhi and Noida understand the fine nuances of category approval and guide you step by step in that process. Assurance of Compliance: They will ensure your application is perfect, reducing chances of rejection by the platform With the right knowledge, preparation, and support from an ecom expert, sellers in Delhi and Noida can unlock new opportunities and thrive in India’s competitive online marketplace.

So, if you’re ready to take your e-commerce business to the next level, start by mastering category approval—and remember, local expertise goes a long way. Whether it’s the bustling streets of Delhi or the innovative corridors of Noida, your journey to success begins here.

0 notes

Text

How to Get GST Registration in Chennai Online

Chennai, the capital of Tamil Nadu, is a thriving business hub. It is home to a range of industries, from IT and manufacturing to textiles and retail. To operate legally and benefit from the tax system, businesses in Chennai must adhere to the Goods and Services Tax (GST) regulations. This article offers a comprehensive guide to GST Registration in Chennai, explaining its benefits, process, eligibility, and requirements.

What is GST?

The Goods and Services Tax (GST) is an indirect tax system introduced in India in July 2017. It subsumes multiple taxes like VAT, service tax, and excise duty into one unified tax, simplifying compliance and promoting ease of doing business. GST applies to the supply of goods and services and is mandatory for companies that exceed specific turnover limits.

Who Should Register for GST in Chennai?

GST registration is mandatory for businesses and individuals who meet the following criteria:

Turnover Threshold:

Businesses with an annual turnover exceeding ₹40 lakhs (₹10 lakhs for particular category states) must register for GST.

For service providers, the turnover threshold is ₹20 lakhs.

Interstate Business:

If your business involves the supply of goods or services between states, GST registration is mandatory, irrespective of turnover.

E-Commerce Sellers:

GST registration is required if you sell products or services through e-commerce platforms like Amazon, Flipkart, or your website.

Voluntary Registration:

Even if you don't meet the turnover threshold, you can voluntarily register for GST to avail of input tax credit and appear more credible to your customers.

Benefits of GST Registration

Legal Compliance:

GST registration ensures that your business operates legally and avoids any penalties or fines for non-compliance.

Input Tax Credit:

Businesses can claim input tax credits on purchases, allowing them to reduce their tax liability.

Expansion Opportunities:

Registered businesses can expand their operations across India without worrying about state-specific tax laws.

Enhanced Credibility:

Having a GST registration number adds to your business credibility, especially when dealing with larger enterprises or government contracts.

Documents Required for GST Registration in Chennai

The following documents are required to complete GST registration in Chennai:

PAN Card of the business or applicant

The Aadhaar Card of the applicant

Proof of business address: This could be a rent agreement, electricity bill, or property tax receipt.

Bank account details: A copy of a cancelled cheque or the first page of your bank passbook.

Digital Signature Certificate (DSC) for companies and LLPs

Incorporation certificate or partnership deed for businesses

Passport-size photograph of the applicant

Step-by-Step Process for GST Registration in Chennai

Follow these steps to complete GST registration in Chennai:

Step 1: Visit the GST Portal

Go to the official GST website https://www.gst.gov.in and click on the ‘Services’ tab. Under ‘Registration,’ choose ‘New Registration.’

Step 2: Fill in the Application

You’ll be asked to provide the following details:

PAN card number

Email ID and mobile number (to receive OTPs)

State and district where your business is located After filling in these details, click ‘Proceed.’

Step 3: Verification of Contact Details

You will receive OTPs on the mobile number and email address you provided. Enter the OTP to verify your contact details.

Step 4: Provide Business Details

Fill in details such as the trade name, constitution of the business, principal place of business, and additional place of business, if applicable.

Step 5: Upload Documents

Upload the required documents, such as proof of business address, PAN card, Aadhaar card, and bank details.

Step 6: Submit the Application

After reviewing the information you provided, apply to individuals using Digital Signature (DSC) or Electronic Verification Code (EVC).

Step 7: Receive ARN

Once the application is submitted, an Application Reference Number (ARN) will be generated. You can use this number to track the status of your application.

Step 8: Approval and GSTIN

If the authorities find your application in order, your GST Registration will be approved, and you will receive your GST Identification Number (GSTIN).

GST Registration Fees in Chennai

GST registration is free of government fee. However, if you prefer to seek the assistance of professionals, they may charge a fee.

Penalties for Non-Compliance

Failure to register for GST when required can result in penalties. The penalty for not registering is 10% of the tax due, subject to a minimum of ₹10,000. In cases of deliberate evasion, the penalty can go up to 100% of the tax due.

Conclusion

Registering for GST is a crucial step for businesses operating in Chennai. It ensures compliance with the law, offers tax benefits, and enhances credibility. The process is straightforward and can be done online, making it convenient for businesses of all sizes. Whether you are starting a new business or expanding an existing one, GST registration is an essential step towards success in the competitive Chennai market.

0 notes

Text

What Is the Process of GST Registration in Gurgaon for New Startups

Starting a new business comes with its share of challenges, and one of the key legal requirements for businesses in India is GST registration. For new startups in Gurgaon, understanding the process of GST registration in Gurgaon is essential to ensure legal compliance and avoid penalties. With the rise of digital solutions, online GST registration in Gurgaon has become a popular and efficient way to complete the process, making it easier for startups to get their GST registration done without much hassle.

In this article, we will discuss the step-by-step process of GST registration in Gurgaon for new startups, including the online process, and how Adya Financial can assist in ensuring a smooth registration experience.

What Is GST Registration and Why Is It Important for Startups

For startups, GST registration in Gurgaon is important for several reasons:

Legal Compliance: Businesses need to comply with GST laws to avoid penalties or legal issues.

Eligibility for Input Tax Credit (ITC): GST-registered businesses can claim ITC on purchases, which can help reduce the cost of production.

Boosts Credibility: GST registration adds legitimacy to your business in the eyes of suppliers and customers.

Expansion Opportunities: GST registration is essential if you plan to expand your business to other states or engage in inter-state trade.

When Should a New Startup in Gurgaon Apply for GST Registration

A new startup in Gurgaon should apply for GST registration if:

Its turnover exceeds the prescribed limit (currently ₹40 lakhs for goods and ₹20 lakhs for services).

It plans to operate in multiple states.

It is engaged in inter-state supply of goods or services.

It wants to claim input tax credit on purchases.

It intends to sell goods or services on online platforms like Amazon or Flipkart.

If your startup doesn’t meet the turnover criteria but wants to benefit from GST, you can still opt for voluntary registration. This will allow your business to avail of tax credits and enhance its professional image.

What Are the Steps for GST Registration in Gurgaon for New Startups

The GST registration process in Gurgaon is simple and can be completed online through the official GST portal.

Here’s a breakdown of the steps:

Step 1: Gather the Required Documents

Before starting the online GST registration in Gurgaon make sure you have the following documents:

PAN Card: A valid PAN card of the business or owner.

Aadhaar Card: Aadhaar card of the business owner or authorized signatory.

Proof of Business Address: A rental agreement, utility bill, or property tax receipt as proof of the business address.

Bank Account Details: A cancelled cheque or bank statement for the business’s bank account.

Photographs: Passport-sized photographs of the business owner and authorized signatories.

Step 2: Visit the GST Portal

The next step is to visit the official GST portal.Here, you will find the option to apply for GST registration. You need to create a new user ID and password to access the portal. If you already have a user ID, you can log in directly.

Step 3: Fill in the GST Registration Application

Once logged in, go to the “Services” tab and select “Registration” followed by “New Registration.” You will be asked to fill in details about your business, such as:

Legal name of the business

Type of business (proprietorship, partnership, LLP, etc.)

PAN details

Business address and contact details

Nature of the business (goods or services)

Bank account details

This information is essential for the GST registration process. Make sure to fill it out accurately to avoid delays.

Step 4: Upload the Required Documents

After filling in the necessary details, you will be required to upload the documents you gathered in Step 1. Make sure the documents are in the specified format and size as required by the portal.

Step 5: Submit the Application

Once all the details and documents are in place, submit the application. After submission, the portal will generate an Application Reference Number (ARN). You can use this ARN to track the status of your application.

Step 6: GST Officer Verification

Once your application is submitted, a GST officer will verify the details provided. This process can take working days. In case any discrepancies are found or additional information is required, the GST officer will send you a notice requesting clarification.

Step 7: GSTIN Issuance

If everything is in order, the GST officer will approve your application and issue a GSTIN (Goods and Services Tax Identification Number) to your business. You will receive an official GST registration certificate, and your business will be considered GST-registered.

How to Apply for Online GST Registration in Gurgaon

The process of online GST registration in Gurgaon is almost the same as the one described above. The advantage of the online process is that it can be done from the comfort of your home or office, without the need to visit any government office. Here’s a recap of the online process.With the online process, you can also check the status of your application at any time and receive notifications when your GSTIN is issued.

How Can Adya Financial Help in GST Registration for Startups

While the process of GST registration in Gurgaon is straightforward, it can sometimes become overwhelming for new startups. This is where Adya Financial, a leading financial consultancy firm, can help.

Adya Financial offers expert guidance for GST registration in Gurgaon, ensuring that all paperwork is filed correctly, and the registration process is completed without any delays.

Here’s how Adya Financial can help:

Expert Assistance: Adya Financial has a team of tax professionals and consultants who specialize in GST registration. They can guide you through every step of the process, ensuring that your application is accurate and complete.

Documentation Support: Adya Financial will assist you in gathering and organizing the necessary documents required for GST registration.

Timely Filing: With Adya Financial, you won’t have to worry about missing deadlines or submitting incomplete forms. They ensure that your GST registration is filed on time.

GST Compliance: Beyond registration, Adya Financial can help your startup remain compliant with all GST regulations, including filing GST returns and maintaining records.

What Are the Benefits of GST Registration for New Startups

Getting your business GST registered offers several advantages:

Credibility: GST registration adds credibility to your business, helping you build trust with clients and suppliers.

Input Tax Credit: You can claim input tax credit on your business’s purchases, which can reduce the cost of your products or services.

Access to Larger Markets: GST registration allows you to expand your business across state borders without any restrictions.

E-commerce Selling: If you plan to sell products on e-commerce platforms, having a GSTIN is mandatory.

Conclusion

In conclusion, GST registration in Gurgaon is a necessary step for any new startup, ensuring legal compliance and providing various benefits. The online process makes it easy and accessible for entrepreneurs, and with the help of experts like Adya Financial, the process can be completed smoothly and efficiently. By following the steps outlined in this article, new startups can ensure that they are GST-compliant and ready to grow their businesses with the support of this essential tax system.

0 notes

Note

Did you self-publish? If yes, what was it like? Any advise for writers looking to publish?

I did self-publish, yes.

How I Did It

It was easier than I thought it'd be, at least, the way I approached it. Caveat that I went through KDP (i.e. Amazon) for a number of reasons that basically came down to a) ease of publishing b) availability of hard copies c) the shipping of hard copies on a global scale (not all countries are available but it's a decent amount) d) it's a place people often go to for books period e) the cost of publishing (the way it works is that print is done "on-demand" it's slower but I don't have to pay out of pocket for X print copies that I then have to sell to make the money back). f) fairly good royalties g) the general terms and conditions and 'ownership' of my material.

There are downsides in that it's through Amazon, whom nobody likes, and that there's return shenanigans in that if I get money from a purchase and if someone chooses to then return the book then that money gets taken away from me personally. (This has gotten better, recently, with ebook purchases as now if a reader reads past a certain percentage they're considered as having 'bought' it where before a lot of people treated it like a library and didn't realize it was the author they were fucking over and not Amazon who makes sure they're not the ones taking the cut).

And look, to those who want to give me flack, we live in a society and people buy books on Amazon. Them's the breaks.

There are other ways to self-publish and platforms you can pay to be a part of where they'll work to not only get you listed on Amazon but bookstores such as Barnes and Noble but it's a little more complicated/does cost some amount to do.

What Was it Like

It's a fairly simple process through KDP at least. What you do is set up an account with tax information/agree to terms of service/so on and so forth. You can then manage your books through a profile and the manuscripts you can write in pre-provided document templates that have the print structure for whatever size book you want to write (e.g. 6"x9").

When you're finished and have your page count in the formatted text, you go and see what size covers are required for hard copies (if you're interested) and can either use stock images to generate covers or else cover images that you own (e.g. you do it yourself or commission it as a book cover by an artist). For e-books they give specifications on the quality your cover should be for the best resolution/results.

You then submit your manuscript/cover art for copyright review, get an ISBN (KDP provides this for free for hard copies if you use them), and decide on digital rights management, promotion options, and pricing structure (where you're told up front the cost of printing/the amount you get after KDP's cut of the royalties).

It sits in reviews for up to 72 hours and provided all goes well you're then live, you get an author page and links to your works, and you can distribute how you want/tell the world to buy your book.

In other words, it was stupid easy.

Should You Self-Publish

There are pros and cons to self-publishing vs. publishing in general.

One great pro is nobody tells you what to do and so long as you follow terms of service (which hopefully you do as it's things like: don't write about the glorification of violence, glorification of sexual violence, so on and so forth) you can publish what you like without having to necessarily be 'marketable'.

Remember that published books are intended to sell and they generally either target extremely niche markets in a very deep way or else try to cast a very wide net with a book everyone can enjoy. One thing you'll see a lot of if you go the publishing route is "I as an agent enjoy unique stories. Now, tell me at least five books that are exactly like yours that were published in the last five years." There are exceptions, but it's generally not a field that likes risk or shaking the boat. They want to be able to sell books.

Another great pro is you're depending only on yourself. You can publish the book as soon as you're finished editing without having to convince someone else it's great stuff.

And of course, there's the pro that you don't have to get an agent or publisher to say yes. The way it typically works is if you want the big or prestigious publishers, you have to have an agent and that agent usually has to have some in roads with that publisher. Which means you have to submit a few pages of a manuscript/a summary and other things to them and hope they get back to you on that. This can be very time consuming (as they generally allow a window of 4-6 weeks) and annoying.

The cons is that you have to market yourself and you don't have the leg up that publishing would otherwise get you (where you are associated with whatever books they already have published just by being published by them, they may or may not run marketing campaigns and advertising for your material, and they can get your books distributed on a much wider scale). What this means is that if you don't have a large-ish platform already and care about sales/intend to make a living on this then you're going to have a very rough time getting a foot up.

The other part of this is that obviously you don't get a forward/amount of money before any books are sold as you otherwise might with a publishing agency. You only get the royalties you earn through sales.

Any Advice?

The self-publishing bit is easy enough that the hardest part is the writing and the editing. Obviously, I haven't gotten far in at this point, and I'm also not all that concerned about sales (I have no intentions of quitting my day job and becoming an auteur any time soon) so I'm perhaps not the person to ask at this point in time.

If you go Amazon worth thinking about is if you want to go the Kindle Unlimited route or not. I haven't as of yet, because I'm not feeling the burn for promotion.

What it is for those not familiar is that Amazon will market your book much more internally (e.g. that stuff that pops up on your kindle when you turn it on), run sales and promotions on it, but your ebook version can be read for free/lent to others for free with you getting a small amount of money depending how far readers make it into the book. The idea being that as you reach a much larger audience, you get more money than you otherwise would have. It's a good way to market if you have no platform/following already and a good way to proliferate the book but you lose out on people actually buying it.

19 notes

·

View notes

Text

bird breeders in US

When it comes to finding the perfect feathered companion, choosing a reputable bird breeder is crucial to ensure the health, temperament, and overall well-being of the bird. Whether you're looking for a playful parrot, a colorful canary, or a quiet budgie, responsible breeders in the U.S. focus on breeding birds that are healthy, socialized, and well-cared for. In this article, we will explore what to look for in a responsible bird breeder and highlight some of the top Bird breeders in U.S. who specialize in a variety of bird species.

What Makes a Responsible Bird Breeder?

A responsible bird breeder ensures that their birds are raised in an environment that promotes their health, well-being, and proper socialization. When looking for a bird breeder, it’s important to consider the following factors:

Health and Welfare: A reputable breeder will prioritize the health of their birds. They should conduct regular health checks, provide appropriate diets, and maintain a clean, safe living environment for their birds. A responsible breeder will also provide potential buyers with a health guarantee.

Socialization: Birds, especially parrots, require early socialization to develop friendly, confident, and well-adjusted personalities. A good breeder will expose the birds to various people, sounds, and environments, so they grow up comfortable and tame.

Transparency and Communication: A responsible breeder will be transparent about the breeding practices, the bird’s lineage, and any health issues that may arise. They will be willing to answer questions, offer advice, and provide ongoing support to buyers after the sale.

Ethical Breeding Practices: Look for breeders who follow ethical breeding practices, ensuring that they do not over-breed or engage in harmful practices. They should have a genuine passion for the birds they breed and a focus on improving the species.