#dividend frequency

Explore tagged Tumblr posts

Text

A Comprehensive Guide to Understanding Dividends

Understanding dividends is a crucial aspect of investing that can significantly impact your financial success. Dividends represent a portion of a company’s profits distributed to shareholders, typically as cash payments. By learning how dividends work, investors can better evaluate the income and growth potential of their investments. This guide will cover essential concepts such as dividend…

#analyzing dividend history#annual dividend#annual dividend yield#annual income from dividends#average dividend yield#best dividend growth investments#best dividend growth stocks#best dividend history#best dividend history records#best dividend stocks#best dividend yield stocks#best high dividend yield#calculating dividend yield example#company dividend history#company dividend history analysis#comparing dividend yields#consistent dividend growth#consistent dividend growth rate#consistent dividend history#consistent dividend history stocks#consistent dividends#declare date#dividend analysis#dividend announcements#dividend calculator#dividend earnings#dividend frequency#dividend growth#dividend growth analysis#dividend growth and stability

0 notes

Text

"In an unprecedented transformation of China’s arid landscapes, large-scale solar installations are turning barren deserts into unexpected havens of biodiversity, according to groundbreaking research from the Chinese Academy of Sciences. The study reveals that solar farms are not only generating clean energy but also catalyzing remarkable ecological restoration in some of the country’s most inhospitable regions.

The research, examining 40 photovoltaic (PV) plants across northern China’s deserts, found that vegetation cover increased by up to 74% in areas with solar installations, even in locations using only natural restoration measures. This unexpected environmental dividend comes as China cements its position as the global leader in solar energy, having added 106 gigawatts of new installations in 2022 alone.

“Artificial ecological measures in the PV plants can reduce environmental damage and promote the condition of fragile desert ecosystems,” says Dr. Benli Liu, lead researcher from the Chinese Academy of Sciences. “This yields both ecological and economic benefits.”

The economic implications are substantial. “We’re witnessing a paradigm shift in how we view desert solar installations,” says Professor Zhang Wei, environmental economist at Beijing Normal University. “Our cost-benefit analysis shows that while initial ecological construction costs average $1.5 million per square kilometer, the long-term environmental benefits outweigh these investments by a factor of six within just a decade.” ...

“Soil organic carbon content increased by 37.2% in areas under solar panels, and nitrogen levels rose by 24.8%,” reports Dr. Sarah Chen, soil scientist involved in the project. “These improvements are crucial indicators of ecosystem health and sustainability.”

...Climate data from the study sites reveals significant microclimate modifications:

Average wind speeds reduced by 41.3% under panel arrays

Soil moisture retention increased by 32.7%

Ground surface temperature fluctuations decreased by 85%

Dust storm frequency reduced by 52% in solar farm areas...

The scale of China’s desert solar initiative is staggering. As of 2023, the country has installed over 350 gigawatts of solar capacity, with 30% located in desert regions. These installations cover approximately 6,000 square kilometers of desert terrain, an area larger than Delaware.

“The most surprising finding,” notes Dr. Wang Liu of the Desert Research Institute, “is the exponential increase in insect and bird species. We’ve documented a 312% increase in arthropod diversity and identified 27 new bird species nesting within the solar farms between 2020 and 2023.”

Dr. Yimeng Wang, the study’s lead author, emphasizes the broader implications: “This study provides evidence for evaluating the ecological benefit and planning of large-scale PV farms in deserts.”

The solar installations’ positive impact stems from several factors. The panels act as windbreaks, reducing erosion and creating microhabitats with lower evaporation rates. Perhaps most surprisingly, the routine maintenance of these facilities plays a crucial role in the ecosystem’s revival.

“The periodic cleaning of solar panels, occurring 7-8 times annually, creates consistent water drip lines beneath the panels,” explains Wang. “This inadvertent irrigation system promotes vegetation growth and the development of biological soil crusts, essential for soil stability.” ...

Recent economic analysis reveals broader benefits:

Job creation: 4.7 local jobs per megawatt of installed capacity

Tourism potential: 12 desert solar sites now offer educational tours

Agricultural integration: 23% of sites successfully pilot desert agriculture beneath panels

Carbon reduction: 1.2 million tons CO2 equivalent avoided per gigawatt annually

Dr. Maya Patel, visiting researcher from the International Renewable Energy Agency, emphasizes the global implications: “China’s desert solar model could be replicated in similar environments worldwide. The Sahara alone could theoretically host enough solar capacity to meet global electricity demand four times over while potentially greening up to 20% of the desert.”

The Chinese government has responded by implementing policies promoting “solar energy + sand control” and “solar energy + ecological restoration” initiatives. These efforts have shown promising results, with over 92% of PV plants constructed since 2017 incorporating at least one ecological construction mode.

Studies at facilities like the Qinghai Gonghe Photovoltaic Park demonstrate that areas under solar panels score significantly better in environmental assessments compared to surrounding regions, indicating positive effects on local microclimates.

As the world grapples with dual climate and biodiversity crises, China’s desert solar experiment offers a compelling model for sustainable development. The findings suggest that renewable energy infrastructure, when thoughtfully implemented, can serve as a catalyst for environmental regeneration, potentially transforming the world’s deserts from barren wastelands into productive, life-supporting ecosystems.

“This is no longer just about energy production,” concludes Dr. Liu. “We’re witnessing the birth of a new approach to ecosystem rehabilitation that could transform how we think about desert landscapes globally. The next decade will be crucial as we scale these solutions to meet both our climate and biodiversity goals.”"

-via Green Fingers, January 13, 2025

#solar#solar power#solar panel#solar energy#solar farms#china#asia#ecosystem#ecology#ecosystem restoration#renewables#biodiversity#climate change#climate action#good news#hope

2K notes

·

View notes

Text

This universe is certainly interesting, fascinating even. Beryl made the right choice to actually travel here directly. So much to learn, so much to know. After all, uncharted places would have all their sorts of mysteries, and just like she always does, she would unearth them, no matter the cost.

One thing that she had taken interest of in particular would be the sparse information about a fallen nation called Glamoth, and how their Iron Cavalry is able to fend off the Swarm, yet another thing she had taken interest in due to their innate biological ability to undergo rapid mitosis.

Now, she did understood that gaining information about the nation and said Iron Cavalry would be difficult, considering what little remained from it, though she did managed to at least get key information about them, which also paved way to a certain... discovery.

That amidst the remains of steel and chitin, there's still a rumored remnant out there, an ember, if one would put it that way. Again, substantial information, yes, however still inefficient, as no lead on said remnant's whereabouts would mean that said information wouldn't really amount much.

Yet she still persisted on searching, multitasking through it even amidst her research on other things this universe has to offer.

After all, this Iron Cavalry remnant would make a fine... subject, so to speak.

And it would seem that her persistence on her search would pay dividend soon.

A planet that she had found herself in, while looking normal on surface, is actually a dormant nest for for the Swarm.

See, it was through Beryl's study and research into them that she managed to craft a device that would send out frequencies, frequencies that would aggravate the Stings that would be nearby or present in an area. And with the press of a button...

The loud, buzzing drones of wingbeats can be heard from a distance.

With the device having served its purpose, she would then callously dispose of it, discarding it from her being and leaving no trace of it.

And now, she waits.

She only really needed just one living specimen of the Swarm, but seeing that she awakened a dormant nest of them? Well, its not her problem to deal with the rest.

Of course, unless said 'remnant' of the Iron Cavalry is here as well, then this incident would be resolved in no time.

But alas, that's a shot in the dark.

Yet her gut feeling tells her that it would be a shot aimed true this time.

@doloniaxdiegesis

8 notes

·

View notes

Text

Navigating the Markets: Unveiling the Diverse Landscape of Types of Traders in the Stock Market

The stock market is a dynamic arena where various players engage in buying and selling securities, aiming to capitalize on market movements and generate profits. Understanding the diverse Types of Traders in Stock Market operating in this financial landscape is crucial for both novice investors and seasoned professionals alike. In this article, we will delve into the intricacies of the stock market and explore the distinct roles played by different types of traders.

Day Traders:

Day traders are individuals who execute multiple trades within a single day, taking advantage of short-term price fluctuations. Their primary goal is to capitalize on intraday price movements and avoid overnight exposure to market risks. Day trading requires quick decision-making, technical analysis skills, and a deep understanding of market trends. ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ

Swing Traders:

Swing traders aim to capture price "swings" or short to medium-term trends within a specific stock or market. Unlike day traders, swing traders may hold positions for several days or even weeks. They rely on both technical and fundamental analysis to identify potential entry and exit points, attempting to profit from market momentum.

Position Traders:

Position traders take a longer-term approach, holding positions for weeks, months, or even years. They base their decisions on fundamental analysis, macroeconomic trends, and company performance. Position trading requires a patient mindset and the ability to weather short-term market fluctuations while keeping an eye on the broader market landscape.

Scalpers:

Scalpers are ultra-short-term traders who focus on making small profits from very quick trades, often holding positions for just seconds to a few minutes. Their strategy involves taking advantage of small price changes and relying on high-frequency trading systems. Scalping requires precision and the ability to execute trades swiftly.

Algorithmic Traders:

Algorithmic or algo traders utilize computer algorithms to execute trades automatically based on predefined criteria. These traders employ complex mathematical models and statistical analysis to identify trading opportunities and execute orders at optimal times. Algorithmic trading has become increasingly prevalent in modern financial markets.

Trend Followers:

Trend followers identify and capitalize on existing market trends, either upward or downward. They use technical analysis to spot patterns and indicators that suggest the continuation of a trend. Trend-following strategies aim to ride the momentum of a trend until signs of a reversal appear.

Click here for more information :-

Upcoming Dividend Dates Nse

Bank Nifty Chart Pattern

2 notes

·

View notes

Text

IDCW in Mutual Funds: Meaning, Taxation, Pros, Cons, and Strategy

Mutual fund investors often come across the term IDCW, which replaced the older term Dividend Option. IDCW stands for Income Distribution cum Capital Withdrawal, and understanding it is crucial for anyone investing in mutual funds for regular income or cash flow.

This detailed guide will help you understand what IDCW means, how it works, tax implications, and whether it’s suitable for you.

What is IDCW in Mutual Funds?

IDCW (Income Distribution cum Capital Withdrawal) is a payout option in mutual funds where the fund distributes part of the income and/or capital gains to investors at regular intervals.

Earlier known as the Dividend Option, SEBI mandated a change in terminology in 2021 to reflect that such payouts may come not just from the profits but also by redeeming part of the investor’s own capital.

How Does IDCW Work?

In an IDCW plan:

The mutual fund declares IDCW based on surplus cash (dividends received, interest, gains).

The amount is paid to the investor on a regular basis (monthly, quarterly, or annually).

The NAV of the fund falls after payout because that amount is taken out of the scheme's assets.

The payout is not guaranteed and is subject to fund performance and discretion of the fund manager.

Let’s say you invest ₹1,00,000 in an IDCW plan. If the AMC declares ₹1,000 as IDCW, it will be deducted from the fund’s NAV and credited to your bank account.

Types of IDCW Options

IDCW – Regular Plan

Suitable for those looking for monthly or quarterly payouts.

Preferred by retirees or income-seeking individuals.

IDCW – Reinvestment Option

IDCW amount is not paid in cash, but reinvested to buy more units.

Functions similarly to growth plans but with different tax treatment.

Taxation on IDCW

The biggest change in recent years is the taxation on IDCW. Before 2020, dividends were tax-free in the hands of investors, with the AMC deducting a Dividend Distribution Tax (DDT).

Since April 1, 2020:

IDCW payouts are added to the investor’s income.

Taxed as per individual’s income tax slab.

If IDCW exceeds ₹5,000 in a financial year, TDS at 10% is applicable.

Example:

If you are in the 30% tax slab and receive ₹10,000 as IDCW, you will pay ₹3,000 in tax, making the net return much lower than it appears.

Advantages of IDCW in Mutual Funds

✅ Regular Income: Good for retirees or those who want periodic cash flow.

✅ Ease of Access: IDCW is directly credited to your bank account.

✅ Flexibility: No need to redeem units manually for income.

Disadvantages of IDCW in Mutual Funds

❌ Not Guaranteed: Payouts depend on the fund’s surplus and are not fixed.

❌ NAV Erosion: IDCW reduces the NAV, potentially hurting long-term gains.

❌ Tax Inefficiency: IDCW is taxed at slab rate, unlike growth option where LTCG is taxed at 10%.

❌ Capital Withdrawal: You may be receiving your own capital as IDCW, not profits.

Who Should Invest in IDCW Option?

IDCW is suitable for:

Retired individuals needing regular income.

Investors with low income tax liability (in lower tax slabs).

People who don’t want to manually redeem units for cash.

It is not suitable for:

Long-term wealth creators.

High-income earners (due to high tax on IDCW).

Investors comfortable with SWP or Growth plans.

How to Check IDCW History of a Mutual Fund

To evaluate a mutual fund’s IDCW performance:

Visit the AMC website or platforms like Moneycontrol, Value Research, or Groww.

Search for the scheme name and select IDCW option.

Check the IDCW payout history – amount, frequency, and dates.

Analyze consistency and sustainability of payouts.

Remember, past IDCW does not guarantee future payouts.

Should You Choose IDCW or Growth Option?

Choose IDCW if:

You want regular income.

You are in a lower tax bracket.

You prefer passive cash flows.

Choose Growth Option if:

You aim for maximum capital appreciation.

You are in a high tax bracket.

You have a long investment horizon.

Conclusion: IDCW is Income, Not Bonus

IDCW in mutual funds is not “extra money” — it is a withdrawal from your investment. While it can be useful for regular income, it reduces your invested capital and can be tax-inefficient. For most investors, especially those in higher tax slabs or with long-term goals, growth or SWP options offer better efficiency and returns.

0 notes

Text

A Closer Look At The Highest Yield Investments In The Income-Producing Asset Sector

Highlights:

Focuses on income-generating assets such as dividend equities and structured funds.

Includes sectors like real estate, infrastructure, and energy.

Yield measurement plays a key role in identifying strong income sources.

The highest yield investments are generally associated with the income-producing asset sector, which includes a broad range of instruments designed to generate regular income. These may encompass dividend-paying equities, real estate-focused vehicles, and structured financial products. Assets labeled under highest yield investments are commonly evaluated based on their historical and current income distributions relative to their valuation.

Defining Yield Within Income Assets

Yield refers to the income returned from an asset over a specific period, expressed as a percentage of its market price. For income-focused holdings, this often includes dividends or interest distributions. In the case of dividend stocks, yield is calculated by dividing the total annual dividends by the current share price. This percentage helps in assessing the income-generating efficiency of the asset.

Key Sectors with Elevated Yields

Multiple sectors are frequently associated with high-income output. Real estate vehicles, particularly those focused on rental income or commercial leasing, tend to allocate a significant portion of earnings through distributions. Energy and utility companies, with stable infrastructure and recurring billing models, may also be part of this category. In addition, financial products structured for fixed-income returns are sometimes included under highest yield investments.

Distribution Frequency and Structure

Income-generating assets vary in their distribution schedules. Some provide quarterly payments, while others distribute earnings monthly or annually. The structure of the payout is often determined by the type of asset and the cash flow mechanism supporting it. The nature of these payments is usually consistent with corporate earnings policies or contractual terms embedded within the asset design.

Measuring Performance Through Yield Metrics

One of the primary metrics used in evaluating income-producing assets is the yield figure itself. This can be influenced by market pricing, payout levels, and frequency of distributions. A higher yield may arise from a reduced market valuation or from increased income issuance. However, maintaining a balanced yield is typically linked to financial consistency and sustainable earnings practices over time.

Historical Patterns of Yield-Based Returns

Tracking historical yield trends can reveal patterns in income distribution. Some assets demonstrate long-standing records of maintaining or increasing yields over extended periods. These records are often used to observe income behavior through various market environments. Long-term consistency in yield can reflect structural strength within the underlying business or asset framework.

Market Factors Affecting Yield Outputs

Economic variables can influence yield levels across the sector. Interest rate changes, inflationary trends, and sector-specific developments may affect income payouts or asset valuations. For example, a shift in interest rates can impact the relative attractiveness of fixed-income instruments compared to other income-generating assets. These external conditions are routinely monitored in relation to yield changes.

Diversification Within High Yield Categories

Assets grouped under the highest yield investments often differ in composition and source of income. Some are equity-based, while others focus on fixed payments or cash flow from physical assets. This diversification within the category provides exposure to various industries and structural designs, offering a wide perspective on income generation across economic sectors.

0 notes

Text

Dividend Stocks TSX Showing Growth in Digital Property Operations

A growing category of Canadian-listed firms is focused on building and managing hybrid infrastructure solutions. These businesses deliver services to companies navigating remote work and distributed collaboration.

Instead of traditional office leasing, this segment provides high-functionality environments with embedded digital services—such as secured cloud access, modular layouts, and automated climate systems. These companies operate under usage contracts and access tiers, offering structured cash cycles and long-term retention models. Their operating framework is now being recognized among emerging dividend stocks TSX for its consistency and recurring delivery structure.

Integration Providers Supporting Enterprise Backbone

TSX firms supporting enterprise connectivity—through real-time data synchronization, application bridging, and system command layers—have gained relevance in operationally stable revenue tracking. These platforms help organizations streamline procurement, document controls, and output reporting.

Their models are rooted in user-based contracts or workflow capacity billing. The continuity created by critical system dependency helps maintain structured output, which aligns with what’s now observed in dividend reliability metrics for modern market participants.

Supply Chain Design Services and Long-Term Movement Models

Firms focusing on supply chain architecture—not just transport—now provide vertically integrated solutions. This includes network planning, terminal placement, predictive route mapping, and shipping frequency stabilization.

Canadian companies in this space work with retailers, manufacturers, and pharmaceuticals to stabilize distribution. Their service contracts are often multi-year and usage-based, contributing to consistent financial delivery patterns across operating cycles. These firms are increasingly reflected in structured performance reviews for dividend stocks TSX screening models.

Operational Hardware on Subscription-Based Schedules

Beyond software, physical systems—like scanning tools, robotics units, and access verification kiosks—are now being delivered through operating lease contracts. Canadian providers design, install, and maintain smart devices with lifecycle warranties, periodic upgrades, and integrated support.

Because equipment remains provider-owned, the financial model emphasizes duration, continuity, and multi-client scalability. These service contracts generate consistent outputs independent of single-sale activity, which makes their revenue structure relevant in dividend trend analysis.

Platform Maintenance Firms with Environmental Compliance Cycles

Several TSX companies focus on maintaining industrial platforms—like air quality monitors, emissions tracking panels, and water flow systems—through scheduled maintenance and compliance logging.

These firms are embedded in energy transition efforts, food processing facilities, and public infrastructure projects. Their agreements are structured around site monitoring windows and outcome reporting. Since these functions are mandatory in regulated industries, billing timelines and task execution are reliably fixed, contributing to yield analysis continuity.

Digital Archiving and Business History Custodianship

Data-focused firms that manage document backup, lifecycle audits, and digital archiving are gaining visibility. These TSX-listed names offer archival environments for sectors that require records spanning decades—such as legal, government, and healthcare.

Their contracts are structured with multi-year custodianship terms, licensing thresholds, and access auditing. As the cost of noncompliance rises, demand for secure history access increases, which stabilizes revenue frequency and supports inclusion in dividend sustainability screens.

Evolving Composition of Yield Generators Across TSX

The understanding of what constitutes dividend stability is shifting. Rather than relying on fixed-asset sectors, current payout strength is increasingly linked to delivery consistency, client retention, and scheduled outcomes.

Modern platforms with structured operations, embedded compliance roles, and service-linked billing are emerging as reliable contributors in current models tracking dividend stocks TSX.

0 notes

Text

5 Mistakes to Avoid When Buying DJ Equipment Online

Buying DJ equipment on the web, in comparison, may look like you would simply click a several fancy gadgets into your cart and check out— but everyone who’s done it before also knows that it is rarely as easy as that. Either you are just starting to mix tracks or upgrading your gear, online shopping ease can be transformed fast enough if you do not take warnings.

The plethora of instruments—controllers, mixers, speakers, software—is at your disposal, all the same, selecting the best setup is not as easy as going through reviews or checking the hottest deals. You may face a lot of problems in future due to seemingly unimportant factors such as using incompatibilities or mismatched components. When you are buying from a screen rather than from a sound booth it is also e.difficult to focus on important details.

The following are five common mistakes to avoid when buying DJ equipment on the internet –and how you can be wiser and more confident in your judgments.

1. Not Knowing Your Setup Needs

Cleanly maps out gear progression from all-in-one controllers to pro-grade modular rigs.

Just because a DJ controller is more sophisticated doesn't necessarily mean you should go for it, especially when you might just need to use what the pros are using. However, as far as your laptop can’t run the software or you’re playing casual sets at house parties then that top-tier controller won’t be of much importance— and will be less useful to you than you think.

Before you buy anything, decide why you need it.

Do you play live? Make music at home? Just practise your skills?

Knowing the purpose of what you are looking for caters for all that is necessary and not necessarily just popular.

To beginners, it’s generally better advised to start with the all-in-one controller that embodies a pult, jog wheels and some basic effects. You do not have to go get the full gear straight away you can as well build your proficiency stage wise upgrade.

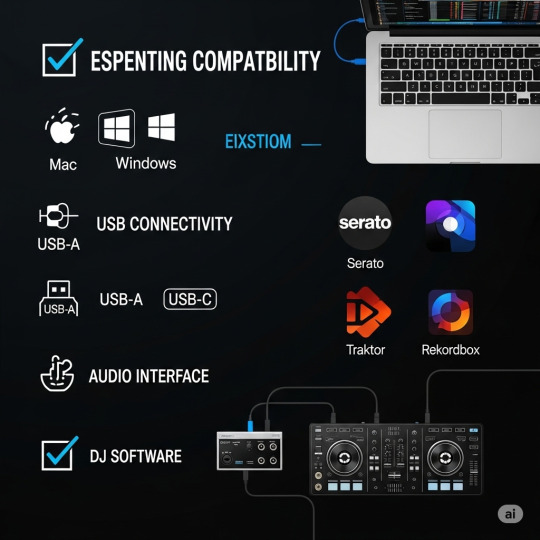

2. Ignoring Compatibility and Connectivity

It might seem an insignificant issue, however it is one of the most important: not all DJ equipment function properly with every laptop; software or operating system. You could stop your progress at a very early stage if you buy a controller which is incompatible with your dj software (e.g. Serato, Traktor or Rekordbox) – and returning gear due to technical mismatch is not an easy task nor cheap.

Don’t get caught in the mix—double-check these essential compatibility specs before buying any DJ gear online.

Always double-check:

• The operating system (Mac or Windows) your gear supports

• Required ports (USB-C, USB-A, audio outputs)

• Audio interface requirements (built-in or external)

In addition, you have to be sure that your computer is up to the minimum specs for using the software without any lags or crashes. It is not pleasant at all to prepare everything for a photoshoot only to see your systems freeze in the middle of a transition.

3. Underestimating the Significance of Audio Quality

It's tempting to become engrossed in the visual aspect of DJ equipment—RGB pads, smooth touchscreens, and large jog wheels—but if your audio output isn't sharp, your set won't impact as much as it should. A good audio interface, solid speakers, and good headphones are every bit as significant as your mixer or controller.

When buying online, search for gear with good reviews regarding sound quality, particularly frequency response and signal-to-noise ratio. Also, be cautious of equipment that is "too good to be true" at a price that's low. Many affordable speakers and headphones sacrifice immensely on clarity and longevity.

This is an area where purchasing from a quality audio store can actually pay dividends—they tend to offer superior quality control and assistance, particularly when dealing with sound-related equipment.

Looks cool in the ad... until it’s tangled in your living room. Shop smart, not shiny.

4. Getting Duped by Flashy Advertising (and Forgetting to Research)

It's one thing to be smitten with a product video. It's another to spend hundreds of dollars on it. The DJ equipment market is brimming with well-made ads, but production value does not necessarily translate to quality performance.

Most shoppers make impulse purchases over brand buzz, influencer endorsement, or flash sales without fact-checking. Real user feedback, comparison videos, and professional analysis are critical in getting an accurate view of how equipment handles across different conditions.

Sites such as DJ TechTools, Reddit's r/DJs, and YouTube critiques from live DJs give you raw opinions that you're not going to find on shiny product pages. Take a bit more time to read and view before buying—and be sure to review the return policy just in case.

5. Overlooking Workflow and Hands-On Feel

It's simple to get swept up in specs and spec sheet features, but the way gear feels under your fingertips is equally as crucial as what it can accomplish. DJing is a hands-on craft—how you transition between knobs, faders, jog wheels, and effects is more crucial than you might imagine. Some systems may be technically brilliant but feel clumsy or unintuitive in use.

When shopping online, look for in-depth product demos or tutorials that reveal how the gear is set up and performed on actual sets. A comfortable setup invites creativity and flow, while an awkward setup—one that may be powerful, but awkward nonetheless—can throw off your rhythm and restrict your expression.

Rather than look solely at features, try to picture the actual usage. Would that controller's design work in the middle of a performance? Can you naturally locate your filters, hot cues, or EQs without questioning?

Final Thoughts

Purchasing DJ gear online needn't be a risk—but it does take some consideration. Having an idea of what you require, researching your purchases, and being aware of technical details can avoid expensive mistakes and annoying setups.

And while online deals can be tempting, there’s real peace of mind in purchasing from professional audio retailers who know their gear and can help if something goes wrong. Sometimes, that kind of support and quality assurance makes all the difference—especially when you’re just starting out or upgrading with purpose.

Whether it's your first home setup or upgrading for live shows, investing the time to do it right will pay dividends in smoother performances, improved sound, and a heck of a lot more enjoyable DJ experience

1 note

·

View note

Text

Low‑Maintenance Luxury: Caring for Techstone Quartz Surfaces

Introduction

Techstone Quartz offers stunning beauty and exceptional durability—but maintaining its pristine appearance is effortless. In this article, we explore detailed care guidelines, daily routines, and best practices to keep your quartz surfaces looking flawless for years.

1. What Makes Quartz Surfaces Low‑Maintenance?

Engineered quartz rebuffs many issues that plague natural stone:

Non‑porous surface: Resists stains, spills don’t seep in.

High hardness: Minimizes scratching and chipping.

No sealing needed: Unlike granite or marble, quartz doesn’t require regular resealing .

This sturdy yet stylish solution demands little upkeep—only mindful maintenance.

2. Daily Cleaning Routine

Keep your surface gleaming with these simple steps:

Mild soap + warm water: Use a soft cloth or sponge.

Rinse thoroughly: Removes soap residue.

Dry gently: Prevents streaks or water spots—avoid letting water sit .

Pro Tip: For eco-friendly touch-ups, a 1:1 vinegar-water mist works wonders—no harsh chemicals needed.

3. Tackling Tough Spills & Residues

Quartz resists stains—but what about sticky or hardened messes?

Hardened spills (gum, paint): Let soften; gently scrape with a plastic putty knife.

Remaining residue: Use a soft non‑abrasive pad (e.g., Scotch‑Brite) with mild soap .

Tip: Avoid metal blades—they can scratch despite quartz’s hardness.

4. Maintaining Large & High‑Traffic Areas

For floors, walls, or tabletops:

Dust-mop daily or use microfiber mops.

Clean weekly with low-pH stone cleaner.

Buff/seal via machine for gloss—rinse well afterward.

This prevents dust buildup and maintains sheen.

5. Protecting Against Heat & Sharp Impact

Although quartz is heat-resistant:

Always use trivets or hot pads for hot pans or appliances.

Cutting boards only—avoid direct knife contact to prevent dulling or scratches.

6. Products to Avoid

Never use:

Harsh chemicals like oven cleaners, bleach, paint strippers.

High-pH cleaners (>11), including strong alkaline floor polishers.

Abrasive scrubbers like steel wool—opt for non-scratch pads only.

When contact happens, rinse thoroughly to neutralize.

7. Stain Prevention Tips

Wipe spills fast, especially coffee, wine, turmeric, or oil.

Seal edges and seams professionally during installation to keep moisture out.

Clean common kitchen items immediately to prevent ghost stains.

8. Periodic Inspection & Repairs

During deep cleans, do:

Inspect seams for gaps or lift.

Check edges for chips—most can be buffed or repaired on-site.

Minor chip repair kits are available through dealers. Larger damage may require professional resurfacing.

9. Real‑Life Maintenance Plan

Frequency

Task

Daily

Wipe and rinse with mild soap + water

Weekly

Dust-mop or spray with vinegar solution

Monthly

Inspect seams and edges for wear

Quarterly

Buff large areas and inspect high-use zones

This routine maintains techstone surfaces with minimal effort.

Conclusion

Techstone Quartz delivers a beautiful, durable surface requiring simple yet effective care. With daily gentle cleaning, periodic buffing, prompt spill response, and heat/impact precautions, your space will retain that showroom shine for decades. A proper maintenance plan pays dividends in longevity and aesthetics.

0 notes

Text

How to Transform Your Garden with Premium Mulch for Sale

Are you looking to give your garden a stunning makeover while boosting its health and longevity? The secret might be simpler than you think: mulch! Specifically, understanding the benefits of readily available "mulch for sale" can revolutionize your landscape. For homeowners, landscapers, and gardeners across North Carolina, finding the right landscape mulches is crucial.

🌳 The Magic of Mulch: More Than Just Decoration

Mulch is not just about aesthetics; it is a powerhouse for your plants and soil. Think of it as a protective blanket that shields your garden from the elements and provides a host of incredible benefits. When you invest in quality mulch, you are investing in the future of your green spaces.

Here is why incorporating mulch into your gardening routine is a game-changer:

💧 Superior Moisture Retention: Mulch acts like a sponge, dramatically reducing water evaporation from the soil. This means less frequent watering for you, saving time and precious resources, especially during North Carolina's warmer months.

🌱 Weed Suppression Extraordinaire: Tired of battling stubborn weeds? A good layer of mulch smothers weed seeds and prevents new ones from sprouting. This translates to less weeding work and more time enjoying your beautiful garden.

🌿 Soil Enrichment Superhero: As organic mulches decompose, they slowly release vital nutrients back into the soil, improving its structure and fertility.

🛡️ Erosion Control Champion: Mulch helps prevent soil erosion caused by wind and rain, particularly on slopes or exposed areas, keeping your valuable topsoil in place.

✨ Enhanced Aesthetics: Beyond its practical benefits, mulch provides a clean, finished look to your garden beds, making pathways pop and plants stand out beautifully.

📦 Discovering Premium Mulch Pine Bark and More

When you are searching for "mulch for sale," you will encounter a variety of options, each with its unique advantages. Among the most popular and effective are pine bark mulch and other high-quality landscape mulches.

Its rich color, appealing texture, and excellent decomposition properties make it a top choice. Whether you are looking for fine-textured pine bark for a polished look or larger nuggets for a more rustic feel, the right pine bark mulch can truly elevate your garden's appeal and health. Wholesale manufacturers of potting media and mulches in North Carolina offer a wide range of options, ensuring you can find the perfect fit for your specific needs.

✅ Why Choose Quality "Mulch for Sale" from Local Suppliers?

Opting for "mulch for sale" from reputable wholesale manufacturers in North Carolina brings several advantages. You benefit from fresh, locally sourced materials that are specifically suited to the region's climate and soil conditions. These suppliers often have extensive knowledge and can guide you toward the best landscape mulches for your projects, whether you are creating a new flower bed or refreshing an existing one.

Conclusion

Do not underestimate the power of a good layer of mulch. It is an investment that pays dividends in plant health, reduced maintenance, and stunning visual appeal. When you are ready to transform your garden, remember that quality "mulch for sale," including excellent pine bark mulch, is just a step away. Embrace the benefits and watch your garden thrive like never before!

FAQs

How much mulch do I need for our garden?

The amount of mulch you need depends on the area you want to cover and the desired depth. A general rule of thumb is to apply a layer 2-4 inches deep.

Which kind of mulch works best for controlling weeds?

Both organic mulches like wood chips and inorganic mulches like landscape fabric can be effective for weed control. Organic mulches also offer the added benefit of enriching the soil as they decompose.

How often should I reapply mulch?

Organic mulches generally need to be reapplied every 1-2 years as they break down. The exact frequency depends on the type of mulch and local conditions.

Can I use too much mulch?

Yes, applying too thick a layer of mulch (more than 4-6 inches) can suffocate plants, trap excessive moisture, and create an ideal environment for pests or diseases.Ready to see the difference quality mulch can make? Find the perfect landscape mulches for your garden today!

#mulch for sale#landscape mulches#pine bark mulch#GardenMulch#LandscapeDesign#HealthyGarden#NorthCarolinaGardening

1 note

·

View note

Text

Tsx 60 Drives Portfolio Analysis And Benchmarking Tools

The tsx 60 offers a streamlined lens into the performance of Canada's most prominent publicly traded corporations. Focusing on a curated group of 60 large and highly liquid stocks listed on the Toronto Stock Exchange, the index delivers insight into the financial direction of key sectors driving the national economy.

Developed by S&P Dow Jones Indices, the tsx 60 intentionally excludes smaller, less-traded firms to emphasize those with established market dominance. Its concentrated design enables more targeted analysis of Canada’s most influential companies.

Constructing the Index: Methodology and Relevance

Constituents of the tsx 60 are selected based on clear, rules-based criteria, which include float-adjusted market value, trading frequency, and balanced sector representation. The result is a lineup of corporations with considerable influence in their industries and proven market activity.

By including a cross-section of sectors — such as finance, energy, industrial production, consumer markets, and communications — the index presents a diverse snapshot of the country’s economic backbone, capturing broad business engagement in a concise format.

Sector Composition and Macroeconomic Sensitivity

The tsx 60 carries substantial weight in the financial and energy sectors, aligning with Canada’s economic DNA. With heavy representation from major banks, insurers, and oil companies, these areas often account for a dominant share of the index’s overall valuation.

Consequently, developments like oil price shifts or monetary decisions from the Bank of Canada tend to move the index sharply. Such macroeconomic variables feed directly into the performance of the index's key constituents, reinforcing its value as a timely economic indicator.

Strategic Use in Institutional Finance

Investment professionals regularly refer to the tsx 60 as a benchmark for evaluating large-cap equity strategies within Canada. Because of its strict selection process and focused scope, it provides a reliable frame for measuring portfolio performance against the market’s upper tier.

Many ETFs and derivatives mirror this index, allowing institutional and retail investors to access top-tier Canadian stocks through passive instruments. Its consistency makes it ideal for building, comparing, or tracking large-cap positions.

International Reach and External Influence

Although the tsx 60 centers on Canadian companies, many of its members have extensive international operations. Particularly in industries like energy, finance, and natural resources, firms maintain significant exposure to foreign markets.

This outward-facing activity means the index responds not only to domestic trends, but also to international variables such as currency movement, trade disputes, and shifts in global demand. As a result, the index serves as a conduit for understanding how global forces intersect with Canadian corporate outcomes.

Sector Leadership Across Market Phases

The tsx 60 is a practical tool for observing sector rotation and macroeconomic patterns. As growth accelerates, sectors like industrials and discretionary goods may rise to the forefront. When uncertainty emerges, defensive industries — including utilities and telecoms — often provide support.

These sector shifts allow analysts to monitor risk sentiment and economic transitions, offering predictive cues about where capital is moving across different stages of the business cycle.

Dividend Consistency and Yield Profile

A defining feature of the tsx 60 is its concentration of companies with established dividend payment records. Financial institutions, telecom providers, and utility companies form the backbone of its yield-generating structure.

These consistent payouts enhance the index’s total return potential and highlight its role as a stable reflection of long-term value. For many investors, the dividend strength embedded in the index contributes to its appeal during periods of volatility.

A Reliable Compass for Canadian Equity

The tsx 60 offers a precise and well-balanced reflection of Canada's corporate heavyweights. Its emphasis on liquidity, sector diversity, and operational scale makes it an essential tool for assessing market health, tracking economic leadership, and navigating changes in both local and global business climates.

With its disciplined methodology and consistent focus on top-performing firms, the tsx 60 remains a trusted indicator of Canada’s financial resilience and strategic capital flow.

0 notes

Text

NSE Unlisted Share Surge as IPO Buzz Heats Up

India’s premier stock exchange, the National Stock Exchange (NSE), is back in the spotlight as its NSE unlisted share price hits ₹2,100, reflecting heightened investor anticipation of a long-awaited NSE IPO. With significant regulatory developments and strong market momentum, the NSE grey market stock that has been in demand for years may finally see a public listing.

Investor Sentiment Strengthens on Upcoming IPO Expectations

After two weeks of steady gains, NSE pre-IPO share have surged from ₹1,680 to ₹2,100. This sharp increase reflects growing confidence that the SEBI IPO approval might soon come through. Retail and institutional investors are closely tracking NSE stock price in the grey market as the possibility of India’s biggest IPO grows stronger. Regulatory Settlement: The Turning Point 1. Co-Location Controversy & SEBI Scrutiny The NSE co-location case from 2015 alleged that certain high-frequency traders received preferential access to servers, sparking regulatory action. Though penalties were imposed, the IPO delay due to SEBI investigation stemmed from broader compliance concerns.

2. ₹1,000 Crore Settlement in Progress

As reported by The Economic Times, the NSE has proposed a record ₹10 billion regulatory settlement to resolve the matter. With a prior ₹6.4 billion already paid in October 2024, the final approval from SEBI could unlock the path to the NSE IPO listing date.

SEBI’s Green Signal Expected Soon

At the ASSOCHAM Capital Market Conference, SEBI Chairman Tuhin Kanta Pandey stated:

“The remaining issues are being resolved between NSE and SEBI. I hope it gets cleared soon so we can proceed.”

This direct confirmation is being seen as a strong signal that the NSE IPO launch date could be near.

Market Response and Shareholder Trends

Supply Crunch Fueling Share Price Growth

According to Narinder Wadhwa (MD, SKI Capital Services): We’ve seen rising demand for NSE shares in the grey market. With limited supply and growing excitement about the IPO, prices have surged. Investors seeking top unlisted shares to buy in India are now targeting NSE, as large stakeholders are reportedly holding onto their shares, creating a supply shortage.

NSE Financials Inspire Confidence

March Quarter Snapshot 1. Operating Margin: Increased from 66% to 74% YoY

Operating Profi Margin: ₹2,799 crore (down 8% YoY) Despite a slight dip, the margin growth underlines strong financial performance of NSE.

Despite being India’s largest stock exchange, NSE’s unlisted shares valuation is still conservative:

NSE P/E Ratio: 35x (projected earnings)

BSE P/E Ratio: 52.75x

This valuation gap makes NSE one of the best unlisted stocks in India right now. The recent ₹35 dividend per share only strengthens the bullish sentiment among long-term investors.

Final Thoughts: Due Diligence Matters

While interest is surging, experts like Wadhwa warn against speculative buying.

NSE unlisted share price may be driven by hype. Thorough research is essential before investing in unlisted equity shares.

Conclusion

The upcoming NSE IPO 2025 is shaping up to be a milestone for India’s stock market. With NSE share price today reaching new highs in the unlisted market, investors are gearing up for what could be the biggest public offering in years. If regulatory clearance is granted, NSE’s listing will unlock new opportunities for those already invested in its unlisted equity.

#NSE unlisted shares#NSE IPO 2025#SEBI approval#grey market premium#National Stock Exchange#pre-IPO stocks#NSE share price#co-location case#unlisted equities#investment opportunities#Rits Capital#NSEIPO2025#NSEUnlistedShares#GreyMarketUpdate#RitsCapital#MakeAssetsGrowAgain#MAGA#RiseWithRits#UnlistedEquity#SEBISettlement#IndiaIPO#StockMarketNews#TopUnlistedShares#InvestSmart#WealthManagement#CapitalMarketsIndia#IPOAlert#FinancialNews#LongTermInvestment#PrivateMarketInsights

0 notes

Text

What is IDCW in Mutual Funds? A Complete Guide for Investors

Investors in India have long considered mutual funds as a reliable vehicle for building wealth. Among the various terms associated with mutual fund investments, one that often raises questions is IDCW, formerly known as Dividend Option. In this detailed guide, we break down everything you need to know about IDCW in mutual funds, how it works, its types, tax implications, and when it may be suitable for your investment strategy.

Understanding IDCW: Income Distribution cum Capital Withdrawal

IDCW stands for Income Distribution cum Capital Withdrawal. It is a mutual fund plan in which the fund house distributes a portion of the scheme’s profits (or capital, if needed) to its investors at periodic intervals.

The term "IDCW" replaced the earlier term "Dividend Option" after a regulatory change by SEBI to better reflect the actual mechanism—since mutual fund dividends are not paid from profits alone, but may include a withdrawal from the investor's own capital as well.

How Does IDCW Work in Mutual Funds?

When you invest in a mutual fund IDCW plan, you are eligible to receive payouts as and when declared by the fund house. These payouts are not guaranteed, and both the amount and frequency are subject to the availability of distributable surplus and fund manager discretion.

When the IDCW is declared:

The Net Asset Value (NAV) of the mutual fund reduces by the amount distributed.

The number of units you hold remains unchanged.

Your overall investment value may decrease due to capital withdrawal.

For example, if the NAV before IDCW is ₹25 and the AMC declares an IDCW of ₹2, the NAV will drop to ₹23 post-distribution.

Types of IDCW Options

Mutual funds usually offer two sub-options under the IDCW category:

1. IDCW – Payout Option

Under this option, the declared amount is paid out to the investor via bank transfer. This is suitable for those looking for periodic income, such as retirees or individuals who rely on investments for cash flow.

2. IDCW – Reinvestment Option

In this case, instead of paying the IDCW amount to the investor, the mutual fund reinvests the same amount back into the fund and allocates additional units to the investor. The total value remains largely the same, but the number of units increases.

Tax Implications of IDCW in Mutual Funds

One of the critical aspects of IDCW is the tax treatment, which changed significantly after 2020.

1. Taxation on IDCW

From April 1, 2020, IDCW is taxed in the hands of investors.

The distributed amount is added to your total income and taxed according to your income tax slab.

Mutual funds deduct TDS (Tax Deducted at Source) at 10% if the IDCW exceeds ₹5,000 in a financial year.

2. No Indexation or Capital Gains Benefit

Unlike growth option redemptions, there is no benefit of long-term capital gains or indexation with IDCW. Hence, it can be tax-inefficient, especially for those in higher tax brackets.

When Should You Choose IDCW Option?

The IDCW option is suitable in the following scenarios:

Need for Regular Income: Ideal for retired individuals or those needing supplementary income.

Short-Term Horizon: If you’re investing for a shorter period and prefer cash in hand rather than waiting for capital appreciation.

Low Tax Bracket: If your total income is within the exemption limit or falls in the lower slab.

However, for most investors, especially those in higher tax slabs, the Growth Option is more efficient due to the power of compounding and capital gains tax benefits.

Drawbacks of IDCW Option in Mutual Funds

While IDCW may appear attractive, especially with regular payouts, it carries several downsides:

1. NAV Reduction

Every IDCW payout reduces the NAV of your investment, directly impacting growth.

2. Tax Inefficiency

Since payouts are added to your taxable income, they may increase your tax liability significantly.

3. Uncertain Cash Flow

IDCW is not guaranteed. Fund houses may skip distribution if the fund does not have sufficient distributable surplus.

4. Loss of Compounding

Periodic payouts break the compounding chain. Growth option allows your money to work for you uninterrupted over time.

Regulatory Changes Around IDCW

SEBI’s renaming of "Dividend" to IDCW in 2021 aimed to bring transparency and align terminology with the actual functioning. It helped clear the misconception that mutual fund dividends are similar to company dividends. In reality, IDCW often includes the capital of the investor, not just profit.

Further, SEBI has mandated that mutual fund advertisements must carry appropriate disclosures clarifying that IDCW reduces NAV and is not assured.

Conclusion: Should You Opt for IDCW in Mutual Funds?

While the IDCW option may seem lucrative due to its payout feature, it may not be suitable for all. If your goal is wealth creation, minimizing tax, and benefitting from compounding, then the Growth Option is the better choice.

However, if you're looking for stable income, are in a lower tax bracket, or have short-term financial goals, IDCW could serve a purpose. Always assess your financial needs, risk profile, and consult with a mutual fund advisor before making a decision.

0 notes

Text

Examining The Highest Paying Dividend Stocks In The Equity Income Sector

Highlights:

Includes companies with consistent dividend distributions across diverse industries.

Features sectors such as energy, utilities, and real estate with established cash flows.

Focuses on dividend yield as a primary metric of income generation.

The highest paying dividend stocks are commonly associated with the equity income sector, where companies generate consistent cash flows and distribute a portion of earnings through dividends. This sector includes a range of industries such as real estate, telecommunications, energy, financials, and consumer staples. Firms categorized under the highest paying dividend stocks typically demonstrate a record of issuing substantial dividend payouts over extended periods.

Key Characteristics of Dividend-Paying Firms

Companies that distribute significant dividends often share a few structural traits. These include stable revenue sources, mature business models, and the ability to sustain cash distributions through varying market conditions. Firms may allocate earnings toward shareholder payments after addressing capital expenditures and operational costs. Dividend consistency is commonly linked to financial durability and long-standing business practices.

Sector Representation in High Dividend Categories

A number of sectors are frequently represented among the highest paying dividend stocks. Utility companies often maintain structured payout schedules due to predictable demand and regulatory oversight. Real estate entities, particularly those classified as income-focused trusts, are known for distributing a large portion of net income through dividends. Energy and telecommunications firms may also exhibit high dividend output tied to long-term contracts or subscription-based models.

Dividend Yield and Payout Metrics

The dividend yield is a core metric used when reviewing these stocks. It represents the annual dividend as a percentage of the share price. High yields can arise from elevated dividend levels or lower equity prices. Another critical factor is the payout ratio, which reflects the proportion of earnings used for dividend distributions. A stable payout ratio, when compared with historical averages, may indicate consistency in dividend performance.

Evaluation Through Historical Payout Trends

Stocks recognized for consistent high dividend payments are often tracked using historical dividend trends. Some firms have sustained or increased distributions over extended periods without interruptions. Historical payout records serve as a reference for assessing how companies manage earnings and dividends across economic cycles. These records may highlight patterns in dividend behavior under different business environments.

Market Conditions and Dividend Distributions

Broader market conditions may influence the behavior of the highest paying dividend stocks. Economic cycles, interest rate environments, and sector-specific developments can all affect dividend policies. While payout decisions are made at the corporate level, external market factors may play a role in shaping those outcomes. Monitoring such dynamics helps in understanding broader trends within dividend-paying categories.

Performance Metrics in Dividend-Paying Categories

Beyond yield and payout ratio, other performance metrics include dividend per share and dividend growth over time. These indicators provide quantitative context on the scale and evolution of distributions. The consistency and frequency of payments are also monitored to distinguish between regular and irregular dividend issuances. Some firms distribute dividends quarterly, semiannually, or annually, based on internal scheduling and cash flow planning.

0 notes

Text

The selection of industrial lighting transcends mere functionality; it represents a strategic decision impacting operational continuity, workforce safety, and corporate responsibility. Environments like cold storage facilities, chemical plants, and busy loading docks subject luminaires to relentless challenges – moisture ingress, dust accumulation, physical impacts, and aggressive cleaning regimes. While the core purpose remains delivering reliable, safe illumination, the modern market demands solutions reflecting broader ethical and environmental considerations. This shift places the Triproof Led Fixture at the forefront, evolving from a purely protective solution into a symbol of responsible business practice, demonstrating that resilience and responsibility are inherently interconnected.

Integrating sustainability into durable product design involves addressing the complete lifecycle impact. A truly responsible Triproof Led Fixture starts with transparency. Manufacturers committed to this path provide clear documentation on material origins, ensuring conflict-free minerals and ethically sourced components. Production facilities adhere to stringent environmental management systems, minimizing water usage, treating waste streams effectively, and harnessing renewable energy where feasible. The focus extends to the social dimension, ensuring safe labor practices and fair working conditions throughout the supply chain. This ethical foundation is as crucial as the physical robustness of the fixture itself. Furthermore, the exceptional energy efficiency of modern LED technology, inherent in these fixtures, delivers ongoing environmental dividends. By consuming significantly less power than legacy lighting over their extended lifespan, they substantially reduce operational carbon emissions and energy costs, contributing directly to climate change mitigation efforts for the businesses that deploy them.

The culmination of this responsible approach is the creation of long-term value for all stakeholders. Durable, energy-efficient lighting enhances workplace safety and productivity, reducing accident risks and operational downtime. Lower energy consumption and reduced maintenance frequency translate into tangible cost savings. Simultaneously, the demonstrable commitment to sustainable sourcing and manufacturing embodied in choosing a responsibly produced Triproof Led Fixture strengthens a company's brand reputation and aligns with the growing expectations of customers, investors, and regulatory bodies focused on Environmental, Social, and Governance (ESG) criteria. Pioneering firms like Cigelighting understand this multifaceted value proposition. They integrate rigorous sustainability audits and ethical sourcing policies into their core operations, ensuring every Fixture they deliver meets the highest standards of both physical performance and corporate citizenship. Their dedication provides businesses with lighting solutions that protect their operations and reflect their commitment to building a more responsible and sustainable industrial future. Partnering with such manufacturers empowers organizations to illuminate their facilities with integrity.Click https://www.cigelighting.com/product/led-triproof-light/cg7043-led-triproof-fixture.html to reading more information

0 notes

Text

Kalkine: Top Dividend ETF Mapping Consistent Equity Payout Strategies

In the broader landscape of equity markets, dividend-focused strategies remain a central feature of disciplined capital distribution. While individual companies may be selected based on their payout consistency or sector alignment, exchange-traded funds (ETFs) offer a bundled approach to this concept. The top dividend ETF category comprises funds that track diversified sets of dividend-paying equities with a focus on structured disbursement and stability.

These ETFs are constructed using carefully defined criteria, and they serve as tools for accessing a broad basket of companies known for consistent shareholder payments. Their performance, sector composition, and payout trends provide valuable insight into equity behavior across market cycles.

Understanding the Top Dividend ETF Concept

The defining characteristic of a top dividend ETF lies in its methodology. Rather than simply grouping high-yield stocks, these ETFs often screen for payout history, distribution growth, balance sheet stability, and sector diversification. As a result, they include equities that demonstrate long-term disbursement reliability rather than short-term payout spikes.

A typical fund in this category includes exposure across sectors such as financial services, utilities, consumer staples, telecommunications, and industrials. Some ETFs further filter for companies that have increased distributions annually over several years, while others focus on firms with low payout ratios and strong operational frameworks.

Sectoral Composition and Market Breadth

One of the strengths of a top dividend ETF is its cross-sector diversification. While certain industries like banking, energy infrastructure, and consumer goods dominate in terms of dividend history, the best-performing funds often balance exposure to avoid concentration risks.

Technology companies with emerging payout strategies have also found inclusion in recent ETF iterations. This highlights how the space continues to evolve beyond traditional sectors, capturing a broader spectrum of payout-oriented companies that align with modern market themes.

Factors Driving ETF Performance

Several metrics influence the behavior of a top dividend ETF, including sector trends, rebalancing frequency, and market capitalization weighting. Funds that follow an equal-weighted structure may offer more balanced exposure compared to those heavily tilted toward large-cap names.

In addition, ETFs that focus on distribution growth over static yield tend to show stronger consistency during periods of market volatility. Screening for disbursement sustainability, rather than absolute yield level, helps these funds maintain alignment with stable business models and capital frameworks.

Regional and Global Variations

ETFs focused on Canadian equities differ from global dividend ETFs in composition and currency exposure. A top dividend ETF in the Canadian market may emphasize sectors like energy, financials, and real estate, which have historically contributed to domestic payout structures. In contrast, global ETFs can include companies from Europe, Asia-Pacific, and the U.S., where payout policies vary based on regional practices.

These differences also affect rebalancing schedules, currency distribution policies, and geographic risk considerations. Understanding how these ETFs are structured by region adds depth to the broader analysis of dividend-focused equity baskets.

Rebalancing Strategies and Index Alignment

Top-performing funds regularly adjust their holdings to remain in sync with index requirements or proprietary methodologies. A top dividend ETF may rebalance quarterly, semi-annually, or annually based on eligibility updates and payout changes across its holdings.

This process ensures that only companies meeting the established dividend criteria remain in the fund, while those with payout reductions or operational shifts are removed. Transparency in rebalancing schedules and selection rules enhances clarity for those observing long-term ETF performance.

Evaluating Fund Methodologies

Each top dividend ETF applies unique selection standards. Some are driven by distribution history, requiring consecutive years of increases. Others emphasize payout ratios and earnings coverage. A few also screen for financial metrics like return on equity or free cash strength to reinforce overall quality.

Understanding these filters is key to interpreting ETF behavior, especially when two funds may appear similar but are built on different strategic foundations. Comparing sector weightings, yield strategies, and constituent turnover provides a clearer view of how each ETF achieves its stated goals.

Thematic Relevance and Long-Term Focus

As themes such as sustainability, capital discipline, and shareholder return gain prominence, the presence of a top dividend ETF in various asset allocation models has expanded. These ETFs align with broader goals such as portfolio stability, long-term alignment with cash-return strategies, and sector-neutral participation.

While short-term market conditions influence all equities, the methodology behind these ETFs provides a degree of structural discipline. This makes them well suited for tracking equity groups that demonstrate resilience across varying economic conditions.

0 notes