#derivatives trading

Explore tagged Tumblr posts

Text

Gain valuable insights into trading strategies with comprehensive analysis of markets, industries, and individual companies. Wealthspikes will teach you how to make informed decisions, understanding the nuances of buying, selling, and profiting across diverse financial markets.

You'll explore methods to assess market trends, evaluate industry growth, and analyze corporate performance, giving you the skills needed to navigate complex financial landscapes confidently. Whether you're interested in stocks, forex, commodities, or other markets, this course covers the essential strategies and tools to trade effectively and maximize your profits with clarity and ease.

#Trading strategies#Financial instruments#Currencies trading#Derivatives trading#Day trading#Swing trading#investing#investing strategies#make money daily#trading consultation#trading services#wealth growth

1 note

·

View note

Text

What is Open Interest in Stock Market?

#investing#stock market#stock trading#financial literacy#paper trading#equity trading#virtual trading#learn stock market trading#finance#derivatives trading#open interest

0 notes

Text

Comprehensive Guide to Butterfly Options Trading Strategies

Butterfly options trading strategies are sophisticated approaches that combine multiple options contracts to create a single strategy aimed at achieving specific profit and risk objectives. These strategies can be particularly effective in various market conditions, including volatile markets, bull markets, bear markets, and markets in consolidation phases. This comprehensive guide will…

#Advanced trading techniques#Bear Market Trading#Broken Wing Butterfly#Bull Market Trading#Butterfly Options Trading#Derivatives Trading#Financial Markets#Investment Strategies#Iron Butterfly Strategy#Long Butterfly Spread#Options Spreads#Options Trading in Consolidation#Options Trading Strategies#Profit Maximization#Reverse Iron Butterfly#Risk Management#Stock market strategies#Stock Options#Trading in Volatile Markets#trading tips

0 notes

Text

vimeo

0 notes

Text

What are the key steps traders should follow when using price and Open Interest (OI) ranges to implement a trading strategy in derivatives trading?

When the open interest is moving in ranges, along with price action, Open Interest percentile, with price percentile, is a useful tool for traders as it provides them with insights into the sentiment of the market. In order to understand, we firstly start with OI, Open interest. It refers to the total number of outstanding contracts that have not been settled in a particular market or exchange.

Percentile: An Easy Indicator that explains Placement of Current OI / Price compared to recent History.

As the percentile of the referenced data set is

Tending to 100 >> implies>> At Recent High

Tending to 0 >> implies>> At Recent Low

Using ranges or range positioning how to go about formulating trade ideas, needs more clarity now.

I think there is a video which does justice to this, awesome approach mentioned there. Let’s view it and learn the concept and apply.

Get 20+ Free Option Trading Tools

Signup here: https://web.quantsapp.com/?s=y

Download App: https://app.quantsapp.com/sr

youtube

0 notes

Link

Nothing to see

#SVB#collapse#Germany#Peter Thiel#derivatives trading#Credit Suisse#instability#looting#unaccountability

0 notes

Text

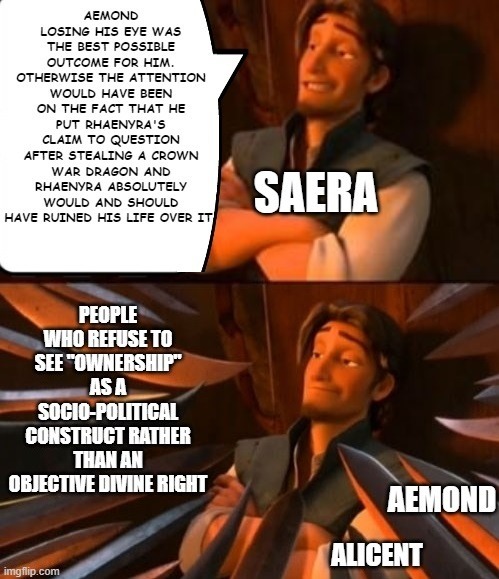

#hotd#asoiaf#hotd critical#team black#fire and blood#anti team green#asoiaf fandom#these people love to cite daenerys this one time#as if “a dragon is not a slave” doesn't just mean you can't FORCE a bond#not that it's a fucking free-for-all game of finders keepers#targs derive their power from their monopoly over dragons because they have the power to enforce that monopoly#that's how ownership works#Rhaenyra was not just the heir to the throne she was also the future head of the family + highest ranking dragonrider#If she didn't want Aemond to have Vhagar and if she would have had Viserys say NO had Aemond asked then yes he did indeed “STEAL” Vhagar#again because he knew he would be told NO#a non-misogynistic jaehaerys would have sent his ass to the wall#the whole point of that scene in F&B was the important matter (vhagar) was pushed aside because viserys didn't want to deal with 'drama'#and because of aemond's eye rhaenyra was not in a position to push#So yes actually it was a pretty good trade for aemond

88 notes

·

View notes

Text

EWAN McGREGOR as NICHOLAS "NICK" LEESON in Rogue Trader (1999)

#Rogue Trader#James Dearden#Nick Leeson#Nicholas Leeson#Ewan McGregor#arkygifs#there's definitely a quote i could put here to explain the person a bit but i'm a bit burnt out from looking at the footage#something about the highs and lows of derivatives trading

38 notes

·

View notes

Text

other things i need to map during the next playthrough of crabgame: Food. its interesting to me because of the fact crabs are, Broadly, scavengers, and we have very few references to prepared meals in this game (what i can remember both pertaining to kelp/heartkelp? in kelp benedict and heartkelp gnocci) this doesnt even really have lore or theme implications i just think its fun that yeah the crabs probably wouldnt have much of a concept of cuisine huh. there were those crabs who caught a damn fish...

#crabgame#and esp the prepared meals being referenced both likely being derived from Heartkelp specifically#a food item that used to be scavenged and could be used for trade

9 notes

·

View notes

Text

I would never stop taking my bipolar meds just to get it back, but I miss the ability to slam out 10,000 words in a weekend or 30,000 in a week now and then. It's been two years and I'm still re-teaching myself how to write without it :<

#i also tend to feel like nothing i've written since has been as good#and again. wouldn't trade it for the benefits of the meds.#but i decided 2024 was the year i could write whatever cringe and tired tropes i wanted in part as a ward against that#if it's not as good then i will derive my creative satisfaction by cranking up the self-indulgence until i hit an equal level of fun

9 notes

·

View notes

Text

anyways my friends activated my conlang brain and I've made smth insane as usual

red is influences, blue is Elezen-family languages, green is like a mix bc I see the Alliance cities as having a trade language (that critically is limited to them).

I see Duskwight as a separate language from Black Shroud Elezen (but sharing a lot - easy enough to learn for those speakers). Coerthan and all its derivatives are a whole different language under the Elezen umbrella and isn't mutually intelligible with BSE. Because they split so early, they probably don't share much more than root words and etymologies; within the same family so not difficult to learn for other speakers of Elezen languages, but very distinctly different.

(also I'm not listing them but the branches extend to include other diaspora Elezen languages)

#saint.txt#long post#ishgardposting#I'm sorry this is so hard to see lmfao I told you people you would regret activating the unhinged part of my brain#anyways additional notes:#Duskwight is to Old Elezen what Icelandic is to Old Norse; It's the closest language to Old Elezen.#Old Ishgardian was probably heavily influenced by Dravanian but the church post-Ratatoskr probably tried to purge a lot of it.#Ysayle and the heretic faction probably use Dravanian-derived words on purpose and may have restored a lot of the old words as slang#and as shibboleths.#Liturgical Ishgardian as you'd expect is spoken in churches and by clergy. It's their version of liturgical Latin.#Proto-Ishgardian *probably* wasn't using Old Hyur as a prestige language so its influence was probably limited#(it probably wasn't like English with French)#Alliance Trade Standard is a prestige language in Ishgard for nobility but proficiency varies. Most Ishgardians prob. don't speak it well.#imo Ishgardian and Duskwight both use different alphabets derived from the Old Elezen ones#w/ BSE either adopting the ATS one or having two scripts (the new ATS and the old Elezen one). Probably dialect-dependent.#Duskwight derived theirs from Golmorran and Ishgard from Old/Liturgical Ishgardian bc that's what the Enchiridion is written in.#the friend I'm building this with posits that BSE uses a lot of obtuse speech (verlan basically) for cultural reasons re: elementals.#Ishgardian forms dialects like crazy bc of the geography but there's a lot more interplay and movement of speech around than#you'd think bc of the movement of soldiers from different High Houses and places around the Holy See constantly#High Houses each have their own specific slang and jargon and you can get surprisingly specific placing where in Coerthas someone is from#and what High House he works for based on his accent and what military slang he uses.#the Coerthas-Shroud pidgin/creole refers to the zone between North Shroud and Coerthas where the two languages intersect for trade reasons#and mix together.#BSE mixes with a LOT (padjali / duskwight / coerthan in the north / thanalan languages in the south /#moon mi'qote languages / hyur in general) depending on region and thus has a *really* broad array of variation.#City Ishgardian as a dialect is facing huge change atm bc of the massive influx of Coerthan refugees.#bc of the Calamity and the Horde a lot of local Coerthan dialects went extinct very quickly.

6 notes

·

View notes

Text

The Cardinal Rule in stock trading..!

#investing#stock market#stock trading#financial literacy#learn stock market trading#equity trading#virtual trading#derivatives trading#paper trading#finance

0 notes

Text

Effective Trading Strategies Using Call Backspread Options

The Call Backspread Options Trading Strategy is a sophisticated yet powerful tool for traders looking to capitalize on market volatility. This strategy involves selling a lower strike call option and buying a higher number of higher strike call options. It is primarily used when traders expect a significant upward movement in the underlying asset. Below, we explore various effective trading…

#Advanced trading strategies#Bear Market#Bull Market#Call Backspread Strategy#Derivatives Trading#Financial Markets#Investment Strategies#Market Consolidation#Options Trading#Options Trading Examples#Options Trading Techniques#Profit Maximization#Risk Management#stock market#Stock Options#technical analysis#Trading Education#Trading Strategies#trading tips#Volatile Market

0 notes

Text

art trade for @vexcupidedits on tiktok

oc isnt mine its theirs!!

#this is actually the first time i do a fullbody fullcolor funfact#really derives from my usual artstyle because i didnt have the energy to render the face#so its just color slapped over the sketch#and my clip studio paint ran out so I cant risk getting too into render </3#splatoon#splatoon oc#splatoon 3#splatoon fanart#octoling#octoling girl#octoling oc#art trade

44 notes

·

View notes

Text

oh yeah i'm finally finishing off detective pikachu returns rn bc i got. very bored of it when i started it months ago and was planning to trade it in. but actually, turns out i stopped right where it started getting (relatively) better, i'm enjoying myself with it again

#clai speaks#still not really that good of a game but i'm a 21 year old playing a mystery game for kids yknow i cant judge it too harshly#(something a lot of pkmn fans could learn to take into account. them making the main games ''easier'' is not the issue lmao)#its just that when i played the first detective pikachu it didnt feel like as much of a slog as this one?#returns tends to repeat itself and beat around the bush a Lot more. i assume to make sure kids were understanding the plot tho#i might have enjoyed the game as a whole a lot more if i wasnt. yknow. Twenty when i bought it HDJBFHF#i'm still gonna trade it in i dont see myself ever replaying this or the original but at least i dont think it was a waste of my time#you can slap the pkmn label on anything and i'll derive Some sort of enjoyment from it HEJBFHF#overall i still like detective pikachu a lot :) its no black and white or explorers of sky but yknow its a fun little novelty

2 notes

·

View notes

Text

How can open interest in futures/options be used to identify trends in stocks or overall indexes?

Open interest in futures/options can be used as a tool to identify trends in stocks or overall indexes by analyzing the change in open interest over time.

Increasing open interest in the same direction as price movement: If the open interest in a particular futures/options contract is increasing while the price of the underlying asset is also increasing, this may indicate a bullish trend is forming. Similarly when the open interest is increasing but prices are collapsing, suggest or may indicate a bearish trend is forming.

Get 20+ Free Option Trading Tools

Signup here: https://web.quantsapp.com/?s=y

Download App: https://app.quantsapp.com/sr

Now the intensity of that move is dependent on relative positioning of open interest and price in percentile terms. How did I learn this? Many don’t like to share their secrets. But I would like to mention that I learnt from this video.

youtube

0 notes