#demand for deposit of fees by 10 July

Explore tagged Tumblr posts

Text

Highlights of the 53rd GST Council Meeting: Key Updates and Outcomes

Highlights of the 53rd GST Council Meeting: Key Updates and Outcomes. The 53rd GST Council meeting, held on June 22, 2024, in New Delhi, marked the first meeting after the 2024 Lok Sabha elections. Chaired by the newly appointed Union Finance Minister, Nirmala Sitharaman, the meeting addressed several critical issues to streamline GST compliance and enhance the tax structure. This blog provides a comprehensive overview of the meeting’s highlights, updates, outcomes, and the latest news. GST Registration.

Key Decisions and Updates from the 53rd GST Council Meeting

Ease of Compliance Burden for Taxpayers

1. Changes in GSTR-1 Filing:

Introduction of GSTR-1A: Taxpayers can now add or amend particulars in GSTR-1 of the current tax period/IFF for the 1st and 2nd month of the quarter before filing GSTR-3B.

Reporting B2C Supplies: The threshold for reporting Business-to-Consumer (B2C) interstate supplies invoice-wise in Table 5 of GSTR-1 has been reduced from ₹2.5 lakh to ₹1 lakh.

2. GSTR-4 Due Date Revised:

The due date for filing GSTR-4 by composition taxable persons has been extended from April 30 to June 30, starting from the fiscal year 2024-25.

3. TCS Rate Reduction:

The Tax Collected at Source (TCS) rate for Electronic Commerce Operators (ECOs) has been reduced from 1% to 0.5% (0.25% each under CGST and SGST/UTGST or 0.5% under IGST).

4. Compulsory Filing of GSTR-7:

GSTR-7 must be filed mandatorily even if no Tax Deducted at Source (TDS) is deducted. No late fee will be charged for nil filing. GST Filing.

5. GSTR-9/9A Filing Exemption:

Taxpayers with an aggregate annual turnover up to ₹2 crore will be exempt from filing the annual return in GSTR-9/9A for the fiscal year 2023-24.

Modifications to Sections and Rules

1. Modification to Section 16(4):

The time limit to avail Input Tax Credit (ITC) for invoices or debit notes in any GSTR-3B filed up to November 30, 2021, is deemed to be November 30, 2021. This applies retrospectively from July 1, 2017. Section 16(4) shall be relaxed for returns filed within 30 days of the order of revocation.

2. Amendment to CGST Rule 88B:

No interest will be charged on the amount available in the electronic cash ledger on the due date of filing GSTR-3B, debited while filing the return in cases of delayed filing.

3. New Section 128A:

Waives interest and penalties for demand notices issued under Section 73 of CGST for fiscal years 2017-18, 2018-19, and 2019-20 in cases not involving fraud, suppression, and misstatement. This applies if the taxpayer pays the full amount in the notice by March 31, 2025.

4. Changes in Sections 73 and 74:

A common time limit will be set for issuing demand notices and orders. The time limit for taxpayers to claim the benefit of reduced penalty, by paying the tax demanded along with interest, is increased from 30 to 60 days.

https://www.finvertoassociates.com/wp-content/uploads/2024/07/Designer-5.jpeg

Monetary Limits and Appeals

1. Monetary Limits for GST Appeals:

Recommended monetary limits for filing appeals: ₹20 lakh for GST Appellate Tribunal, ₹1 crore for High Court, and ₹2 crore for Supreme Court.

2. Amending Sections 107 and 112:

The maximum amount for pre-deposit for filing an appeal before appellate authorities is reduced from ₹25 crore to ₹20 crore under both CGST and SGST. For appeals before the GST Appellate Tribunal, the pre-deposit is reduced from 20% with a maximum amount of ₹50 crores to 10% with a maximum of ₹20 crores under both CGST and SGST.

Additional Key Decisions

1. Sunset Clause for Anti-Profiteering Cases:

A sunset clause will be added for pending anti-profiteering cases. The hearing panel will shift from CCI to the principal bench of GSTAT. The sunset date for receiving new applications regarding anti-profiteering is set for April 1, 2025.

2. Time Limit for GSTAT Appeals:

Modifying Section 112 to provide a 3-month time frame for filing appeals before the GST Appellate Tribunal. The timeline will commence from a date yet to be notified, likely by August 5, 2024.

3. New Section 11A:

Allows regularization of non-levy or short levy of GST due to common trade practices.

4. IGST Refunds and Adjustments:

Mechanism introduced for claiming refunds of additional IGST paid due to upward price revisions after exports. No IGST refund will be allowed where export duty is payable.

5. Biometric-based Aadhaar Authentication:

Implementation of biometric-based Aadhaar authentication for GST registration will be rolled out nationwide in a phased manner.

6. DRC-03 Circular:

A circular will prescribe a mechanism for adjusting any demand amount paid through DRC-03 against the amount payable as a pre-deposit for filing a GST appeal.

7. Amendment to Section 122(1B):

Clarification that the penal provision is applicable only for those e-commerce operators required to collect TCS under Section 52 and not for other e-commerce operators.

The 53rd GST Council meeting has brought significant changes aimed at simplifying compliance, reducing the tax burden, and enhancing the efficiency of the GST system. These updates reflect the government’s ongoing efforts to create a more robust and taxpayer-friendly GST framework. Keep an eye on official announcements for further details and implementation guidelines.

Stay tuned for the latest updates and insights on GST and other financial regulations.

1 note

·

View note

Text

Ethereum ICO Whales Unload ETH: Is a Market Downturn Imminent?

Key Points

Ethereum ICO whales are reportedly selling their ETH holdings as the price hovers around $2,638.

A significant whale associated with the ICO has reportedly dumped 5,000 ETH, worth $13.2 million, to crypto exchange OKX.

According to the latest on-chain data, large holders of Ethereum, often referred to as whales, have been selling their ETH holdings. This comes as the price of Ethereum continues to linger around the $2,638 mark.

Data from Spot on Chain suggests that a significant whale, associated with the Initial Coin Offering (ICO), has sold a total of 5,000 ETH. This amount equates to a value of $13.2 million, which was transferred to the crypto exchange OKX.

Whale’s Remaining Holdings

The data also indicates that since the 8th of July, this particular whale has deposited a total of 48,501 ETH. This amount is valued at $154 million and was also transferred to OKX at an average price of $3,173.

This whale still holds a significant amount of Ethereum. The on-chain data shows that the whale has a total of 303.5K Ethereum, worth $750 million, spread across two wallets. The wallet that frequently deposits ETH to OKX still holds a total of 15.6K ETH, valued at $39.8 million.

Ethereum’s Gas Price

In other news related to Ethereum, the median gas price for the cryptocurrency dropped to a five-year low of under 2 gwei on Saturday, August 10. This represents a 98% decrease from the year-to-date high of 83.1 gwei.

Earlier this year in March, the Ethereum Dencun upgrade saw nine Ethereum Improvement Proposals (EIPs) go live. One of these proposals catered to data blobs or proto-danksharding that aims to decrease the transaction costs on the Cardano blockchain.

However, this drop in transaction fee is not entirely positive as it indicates a significant amount of inactivity on the Ethereum blockchain. Gnosis co-founder Martin Köppelmann has expressed concern that current gas fees, which need to be at least 23.9 gwei, are essential for funding staking rewards.

Ethereum’s Price Action

The price of Ethereum has been under substantial selling pressure amid the broader market volatility in recent weeks. As the Ethereum price fell under $2,000 earlier this month, it led to the liquidation of major leveraged long positions.

According to data from CryptoQuant, these liquidations are at a level not seen since November 2022. This has contributed to a significant cooling of the futures market. CryptoQuant reports, “With the futures market potentially reset, if demand returns, Ethereum could be poised for another impulsive bullish surge in the longer term. The cooling of the futures market may attract new buyers and stabilize the market, leading to a potential recovery from the recent downturn.”

0 notes

Text

RGCB Masters Degree in Biotechnology Admission Rajiv Gandhi Centre for Biotechnology (RGCB) invites applications for its prestigious MSc Biotechnology program for the 2024-2026 academic cycle. This innovative two-year program offers specializations in Disease Biology and Genetic Engineering, providing students with a comprehensive education and hands-on research experience. Affiliated with the Regional Centre for Biotechnology, an Institution of National Importance under the Department of Biotechnology, Government of India, RGCB is located in Thiruvananthapuram. About the MSc Biotechnology Program In July 2019, RGCB launched its highly innovative MSc Biotechnology program, designed to offer students a unique blend of theoretical knowledge and practical experience. The program spans four semesters over two years, with specializations available in Disease Biology and Genetic Engineering. Students benefit from training in a vibrant research environment, preparing them for careers in scientific research, development, innovation, and teaching. Specializations: Disease Biology: Focuses on understanding the molecular and cellular mechanisms of diseases, providing insights into the development of novel therapeutic strategies. Genetic Engineering: Emphasizes the manipulation of genetic material to understand gene function and develop new biotechnological applications. MSc in Biotechnology Eligibility Criteria: All candidates must have a valid GAT-B score. Applicants must have a Bachelor's degree in any branch of Science, Engineering, or Medicine with a minimum of 60% aggregate marks (5% relaxation for SC, ST, OBC, and PWD categories). Final year students are eligible to apply but must produce proof of required marks at the time of admission. Admission Process for MSc Biotechnology: Selection is based on GAT-B rank/score and RGCB's cutoff marks for each category. The MSc Biotechnology program has 20 seats per academic year, with 10 seats each for Disease Biology and Genetic Engineering. Specialization allotment is based on marks secured in the first two semesters if the demand exceeds available seats. Course Duration and Structure: The MSc Biotechnology program is structured over two years, divided into four semesters. The first year covers core sciences, while the second year focuses on the chosen specialization. Stipend: First Year: ₹ 6000 per month Second Year: ₹ 8000 per month Reservation: Seats are reserved for SC, ST, OBC, PWD, and Economically Weaker Sections as per Government of India regulations. Documents Required for MSc Biotechnology Admission: Transfer Certificate and Conduct Certificate Migration Certificate Birth Certificate Degree Semester Mark Sheet Degree Certificate/Provisional Certificate Valid Reservation Certificate Hostel Facilities: RGCB offers twin, shared bedroom accommodations with amenities including a shared en suite bathroom, laundry, TV lounge, and common cooking facilities. The maximum tenure in the hostel is two years. Meals are available at the RGCB Cafeteria. Fee Structure for MSc Biotechnology: General/OBC: ₹67,700 (inclusive of one-time admission fee, tuition fee, medical insurance, university application fee, exam fees, refundable deposit, and hostel utility charges) SC/ST/PWD: ₹27,700 (excluding tuition fee) EWS: ₹41,033 (reduced tuition fee) How to Apply for MSc Biotechnology: Interested candidates can apply online through the RGCB MSc 2024 Online Application Submission Portal. Ensure to upload all required documents, including the previous semester/year mark sheet of your Bachelor's degree. Apply Now

0 notes

Text

November 6, 2023

The Unification Church plans to propose a system in which it entrusts up to ¥10 billion to the government to compensate former followers for the damage they claim to have suffered, sources close to the controversial religious group said Monday.

Tomihiro Tanaka, head of the group's Japanese branch, will announce the plan at a news conference to be held in Tokyo on Tuesday afternoon, the sources said. Tanaka is expected to admit the group's moral responsibility and apologize while not accepting legal liability.

In October, the education ministry asked Tokyo District Court to issue an order to dissolve the Unification Church. Currently, a parliamentary debate is underway over the proposed preservation of the group's assets on the grounds that the group could transfer them to South Korea or other countries before the dissolution order is issued.

The proposal for the deposit system is apparently aimed at countering such moves in parliament. The group has claimed that a bill on asset preservation submitted by opposition parties to the ongoing parliamentary session seriously violates the freedom of religious activities and is unconstitutional and illegal.

According to the sources, the group plans to entrust ¥6 billion to ¥10 billion to the government as a source of funds to pay settlement fees to former followers in case the dissolution order is finalized. It plans to ask the government to create a related deposit system.

When requesting the dissolution order, the ministry claimed that the Unification Church's persistent unlawful acts, such as demanding massive donations from followers by inciting anxiety, had resulted in about 1,550 victims losing some ¥20.4 billion in total.

On Thursday, a group of lawyers told a meeting of a project team of the ruling Liberal Democratic Party and its coalition partner, Komeito, that the total potential damage inflicted by the Unification Church is estimated to reach some ¥120 billion and called for new legislation regarding property preservation.

Tuesday's news conference will be Tanaka's third since the religious body came under renewed scrutiny due to the assassination of former Prime Minister Shinzo Abe in July last year.

The shooter, whose mother made large donations as a follower of the Unification Church, has said he was upset with the religious group's perceived connections with Abe.

In an interview in March, Tanaka admitted that the organization accepted some large donations without giving enough consideration to their potential impact on the lives of donors' family members.

Regarding allegations that the church scared its followers into making donations, Tanaka said he is sorry if such conduct took place.

0 notes

Text

Bitcoin Could Reach $180,000 In 2024: Fundstrat

Bitcoin (BTC)’s supply and demand dynamics suggest that the asset could surge as high as $180,000 by April 2024, according to a research note from Fundstrat on Monday. The forecast – which precedes the U.S. central bank’s next meeting – largely rests on a Bitcoin spot ETF being approved in the United States, which the markets research firm suspects will blow apart BTC’s current price equilibrium. The Impact Of A Bitcoin ETF At present, Fundstrat finds that Bitcoin experiences roughly $25 million in daily demand – about the same value of new coins brought into circulation by miners each day. “This would bring daily demand to $125 million, while daily supply is only $25 million,” wrote Tom Lee, Fundstrat’s Head of Research. “The implied equilibrium price would need to rise so daily supply matches daily demand.” “Equilibrium analysis suggests that a clearing price is $140,000 to $180,000, before the April 2024 halving,” Fundstrat continued. The “halvening” (another way to refer to the Bitcoin halving) is when the Bitcoin network slashes its BTC emissions per block in half. The event occurs once every four years, and has consistently been followed by major crypto market bull runs in the following year. The next halving will take Bitcoin’s emissions from 6.25 BTC to 3.125 BTC every ten minutes. Though researchers at Coinbase have suggested it may not cause another bull run, Fundstrat’s analysis suggests the halving won’t even be necessary for reaching a new all-time high. This bullish outlook is largely shared by Standard Chartered Bank, whose analysts predicted that Bitcoin will touch $120,000 before 2025, thanks to miners hoarding their newly minted coins in the medium term. Meanwhile, Bloomberg ETF analysts Athanasios Psarofagis and James Seyffart estimated this month that a Bitcoin spot ETF could accrue $54 billion in capital over time, based on the success of Canada’s much smaller market. The Fed’s Upcoming Meeting Fundstrat’s prediction comes days before the next Federal Open Markets Committee Meeting (FOMC) when the Federal Reserve is largely expected to raise its target interest rate by another 25 basis points. Despite the Fed’s persistent rate hikes, both stocks and Bitcoin are up year to date, and expectations of an incoming recession are on the decline. It is surprising to me that every time the market wobbled this year, our institutional clients are ready to short👇 – there is no “buy the dip” – likely happens when drop in inflationary pressures more evident– because #Fed can eventually relent @fs_insight https://t.co/6wxrS6zalW — Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) July 25, 2023 Fundstrat’s Lee predicts that tomorrow’s announcement will move stock prices by 1%, and believes institutions shouldn’t expect a major market correction anytime soon. “We’re still in a position where people are bearish and ready to sell,” said Lee to CNBC’s Squawk Box. “No one is really embracing this as an upward new bull market.” SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms). PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits. Source link Read the full article

0 notes

Photo

परेशानी : 10 जुलाई तक फीस न देने पर नाम काटने की चेतावनी हरियाणा के दादरी स्थित निजी स्कूलों ने चेतावनी दी है कि 10 जुलाई तक मासिक शुल्क नहीं जमा करने वाले बच्चों की ऑनलाइन कक्षाएं बंद कर दी जाएंगी और उनके नाम स्कूल से काट दिए जाएंगे एवं कोई अन्य दूसरा... Source link

#10 जुलाई तक फीस जमा कराने की मांग#Corona Virus#Dadri Haryan#Dadri Haryana#demand for deposit of fees by 10 July#education department#Hindi News#Hindustan#lockdadan school fees#News in Hindi#private school association#private schools fees#school fees 2020#School name warning#warning of private schools#कोरोना वायरस#दादरी हरियाण#दादरी हरियाणा#प्राइवेट स्कूल एस��सिएशन#प्राइवेट स्कूलों की चेतावनी#प्राइवेट स्कूलों की फीस#लॉकडाडन स्कूल फीस#शिक्षा विभाग#स्कूल फीस 2020#स्कूल से नाम काटने की चेतावनी#हिन्दुस्तान

0 notes

Text

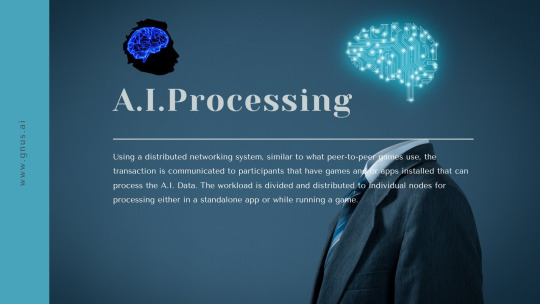

Genius Tokens Cryptotoken A.I. Processing

Genius Tokens Cryptotoken A.I. Processing

More than a CryptoToken. Genius tokens are at the heart of a unique blockchain and software system.

https://www.gnus.ai/ #Genius #GNUS #Geniusventures #ICO #cryptotoken

Introduction:

Every day, more advanced technologies emerge across the business landscape. They bring innovation and disruption that continue to drive growth. Over the past few years, cloud service providers have helped businesses transform their extensive processes. Cloud solutions are a powerful industry that is rapidly maturing and becoming mainstream. But over time technology advances and developers need better tools and methods to handle the additional processing required for high volume data processing, which has increased the need for advanced computing and performance. Although cloud computing resources can support global applications, the centralized architecture introduces scalability problems.

Distributed computing solves the problem of scalability by spreading the demand for compute processes across multiple high-powered machines. To solve this problem, Genius Ventures is here.

How to Take Part in the $80 Billion AI/ML Industry Using Crypto | Machine Learning and Blockchain.

https://youtu.be/2cBU1mM0DWk

What is Genius Ventures?

The Genius Ventures system infrastructure serves as a distributed multi-purpose service with a cryptographic payment system that allocates computing resources and integrates them into real-world projects.

Genius Ventures utilizing unused cycles of Compute Devices on computers, mobile devices, and IoT devices, the system processes Artificial Intelligence and Machine Learning data on an end-user device. The end-user is then paid in Genius Crytpotokens that can be reused for In-App purchases or converted back to other currencies. In addition, the entire system easily integrates into Computer and mobile games and applications.

Aim of Genius Ventures

Genius Ventures seeks to implement a scalable, high-performance, secure, and a manageable infrastructure side chain that promotes a new form of distributed management, which includes key leaders in computing, large data, and cloud industries.

Genius Ventures aims at providing a system and method for distributed general-purpose computing with a crypto token payment system. This payment system integrates a slow blockchain crypto token with a fast DAG-based crypto token. This technology is based on smart contracts “Genius Tokens” from Ethereum and allows the creation of a virtual cloud infrastructure that provides high-performance computing services on demand.

Genius Tokens Blockchain

Utilizing unused cycles of Compute Devices on computers, mobile devices, and IoT devices, the system processes Artificial Intelligence and Machine Learning data on an end-user device. The end-user is then paid in Genius Crytpotokens that can be reused for In-App purchases or converted back to other currencies. In addition, the entire system easily integrates into Computer and mobile games and applications.

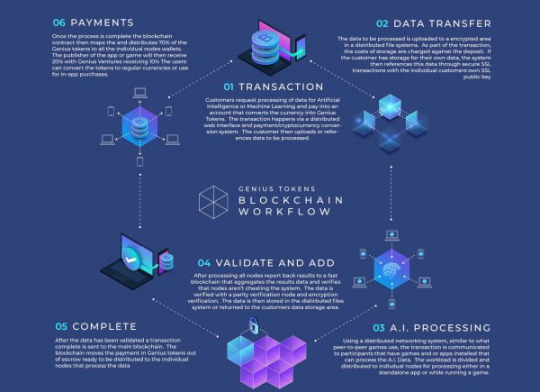

01 TRANSACTION

Customers request processing of data for Artificial Intelligence or Machine Learning and pay into an account that converts the currency into Genius Tokens. The transaction happens via a distributed web interface and payment / cryptocurrency conversion system. The customer then uploads or references data to be processed.

02 DATA TRANSFER

The data to be processed is uploaded to a encrypted area in a distributed file systems. As part of the transaction, the costs of storage are charged against the deposit. If the customer has storage for their own data, the system then references this data through secure SSL transactions with the individual customers own SSL public key

03 A.I.PROCESSING

Using a distributed networking system, similar to what peer-to-peer games use, the transaction is communicated to participants that have games and or apps installed that can process the A.I. Data. The workload is divided and distributed to indivdual nodes for processing either in a standalone app or while running a game.

04 VALIDATE AND ADD

After processing ,all nodes report back results to a fast blockchain that aggregates the results data and verifies that nodes aren’t cheating the system. The data is verified with a parity verification node and encryption verification. The data is then stored in the distributed files system or returned to the customers data storage area.

05 COMPLETE

After the data has been validated, a transaction complete is sent to the main blockchain. The blockchain moves the payment in Genius tokens out of escrow ready to be distributed to the individual nodes that processed the data

06 PAYMENTS

Once the process is complete the blockchain contract then distributes 70% of the Genius tokens to all the individual nodes wallets. The publisher of the app or game will then receive 20% with Genius Ventures receiving 10% The users can convert the tokens to regular currencies or use for in-app purchases.

FEATURES

The Genius Ventures system is truly cross-platform and can be integrated into most devices.

Works everywhere:

Code and SDK works on all devices, including Windows, OSX, iOS, Android, Linux, Windows Mobile, XBOX, Playstation, Nintendo, and IoT Devices

Customizable

A.I. or Machine learning algorithms can be selected by the customer through a customer portal and data can be uploaded or on customers secure servers

Fast

The hybrid Cryptotoken system uses a fast internal Directed Acyclic Graph (DAG) based blockchain that executes transactions in microseconds.

Always available

Stand-alone applications, embedded systems, or games with the SDK integrated can run the processing.

Organic

Growth is organic in two ways

1, User Acquisition costs are almost zero

2, Users get paid to process data, enticing them to use your game or app more.

Mobile-first

Development of the SDK is targeted for Mobile devices first and uses the compute devices on any system.

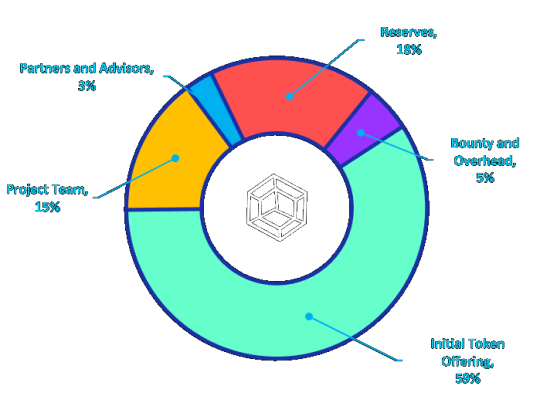

GNUS TOKENS

Token Sale & Values

Genius (GNUS) system is a hybrid token system with the GNUS token being released on the Ethereum network and the internal fast SGNUS token using a proprietary internal blockchain for fast processing

Start: July 15, 2021 (12:00AM PST)

Number of tokens for sale: 29,252,000 (59%)

First 12,500 ETH: Receives 1000 GNUS Tokens per ETH

2nd 12,500 ETH: Receives 800 GNUS Tokens per ETH

3rd 12,500 ETH: Receives 640 GNUS Tokens per ETH

4th 12,500 ETH: Receives 512 GNUS Tokens per ETH

Token Allocation

Funds Allocation

ROADMAP

The official Genius Ventures site features a roadmap with everything the team did so far with the platform.

It started with game development back in 2018, when the idea about this project was born. More than two years later, in October 2020, the team began developing a fast blockchain solution. In 2021, the team concludes working on a slow blockchain solution and connecting it to Ethereum’s dapps.

All in all, the stage is set for this ambitious project to take off, and the ongoing ICO is just one of the many planned stages for the future. If all goes well, Genius Ventures might become the next big thing in the AI and blockchain spheres, as it features some world-changing ideas, especially for gamers worldwide, who would get an opportunity to earn tokens doing what they love.

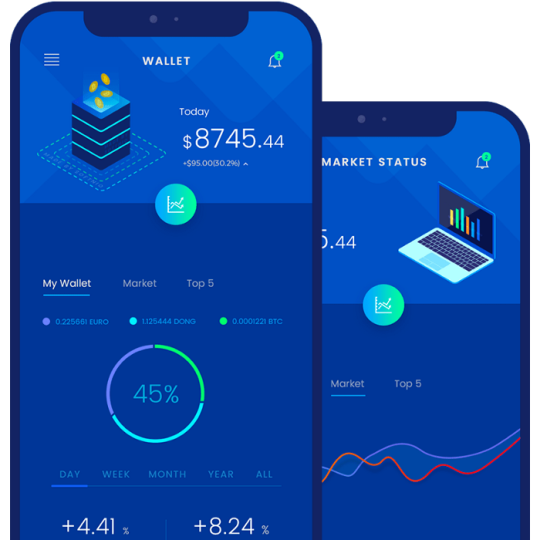

Genius Mobile App

Once you’ve entered our ecosystem, you can manage everything. Anyone with a smartphone. Computer, IoT devices, and an internet connection can participate in the global system.

Out Genius Wallet acts not only as an ERC20 Wallet, but it also acts as an independent DAPP built right in. This allows you to participate in the AI/ML global Processing and collect fees.

See your earnings in the App

Charts showing GPU Processing power

Transfer GNUS <-> SGNUS directly

Transfer GNUS tokens to another wallet

No more expensive fees

The Leadership Team

The ICO Crypto Team combines a passion for esports, industry expertise & a proven record in finance, development, marketing & licensing.

Kenneth Hurley: CEO

Brent Arias: CTO

Denis Trofimov: Director of Software Development

For more information please follow the link below:

Website: https://www.gnus.ai/

Whitepaper: https://www.gnus.ai/wp-content/uploads/2021/08/Genius-Tokens-Whitepaper-1.0_Final.pdf

Telegram: https://t.me/geniustokenschat

Twitter: https://twitter.com/VenturesGenius

Facebook: https://www.facebook.com/geniusventures.io/

Linkedin: https://www.linkedin.com/company/geniusventuresio

Author:

Bitcointalk Username: Manuel Akanji

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

ETH Address: 0x176a48a2Eb8FF8dfa46e58741E4A7b642C90F512

1 note

·

View note

Text

corporate america and the legal scam of nonrefundable airline tickets

Nonrefundable airfares are a bona fide, yet entirely goddamn legal, scam. You might ask, “What would prompt you to say that?” Well, let me explain.

A few weeks back, I was summoned to take photos at my good friend Anthony Birchak’s MMA fight with the Combate Americas promotion on October 11 in Tucson, and I required a flight ticket. The only carrier that services my current location of Wichita Falls, Texas, is American Airlines, and the cheapest rates thereof were through American Airlines��� website. On September 21, I booked a round-trip ticket from October 7 to the 15th.

In July, I flew to Phoenix to photograph a previous bout of Tony’s with the Legacy Fighting Alliance. Of course, he won. He doesn’t have a choice but to win if I’m there.

Pictured: Tony doing the aforementioned winning thing against Raphael Montini at LFA 72.

During my time there, I spent time exploring the Phoenix area, and visited and trained at numerous fight gyms, including the renowned Fight Ready in Scottsdale. I had initially planned to stay in Phoenix for 4 days, enough to cover all of the events leading up to the fight, but soon realised that four days was not nearly enough time for me to maximise my productivity and to expand my network.

Thus, I spent a few more dollars and delayed my departure for two more days. It paid off in a big way, and I even found time to train at Tony’s 10th Planet Jiu-Jitsu gym in Tucson.

Fast-forward to the present: after some deliberation and some checks on the ol’ bank account, I quickly became cognizant of the fact that I need to be bit more conservative with my funds. Through American Airlines’ website, I shifted the flight dates to October 10-15 (for a minuscule fee, of course) in order to cut down on hotel and car rental fees. However, after even more thinking, I considered the situation in Phoenix and arrived at the conclusion that perhaps five days was still a bit too short, despite financial considerations.

I deferred to Tony for an assessment of how long would most productive. From this discussion, a period from October 10 to October 20 was decided. This conclusion led me to ascertain that cutting the flight and rental fees entirely would save me a few hundred extra duckets (or so I thought).

I would just drive 12 long hours to Tucson instead.

During my ticket purchase, I saw nothing concerning refund policy, and as a result, I thought it in my best interest to cancel the ticket in an attempt to receive a refund. I had even purchased “flight insurance” through American Airlines affiliate Allianz to shield myself from any potential changes. I noticed a bit about nonrefundable tickets on some subsequent pages during the cancellation process, but I assumed that since it was relatively close to the date of purchase and well in advance of the flight, I had a significant chance at getting my money back.

You know what they say about people who assume? Yeah, they get effed in the AA.

Pictured: Shitting fuck.

It took them eight fucking days to produce this less-than-favourable response to my inquiry. I also received this lovely message after attempting to reach Customer Relations:

Well, not only was I not going to get any of my money back, but I was not going to make any headway anywhere else ... despite the fact that they clearly already decided to not give me my motherfucking money. Thankfully, they were so nice as to provide Allianz’ customer service phone number in the rejection letter so I didn’t have to scour the internet for it. Whoopee.

I called, and the heavily accented Allianz representative on the other end parroted the exact same policy as the airline regarding refunds. Effectively, I had to be a corpse, someone else had to be a corpse, or myself or someone else had to be well on their way to becoming a corpse in order for me to get my money back. Either that, or the airline itself would have had to have fucked up in a big way. (Perhaps I should I have told them I was dead, and they would have been scared into depositing money into my bank account.)

In response to this disappointing correspondence, I issued a scathing email to American detailing my debacle. In the message, I demanded either a refund or the option to change my flight ticket to something more feasible without exorbitant change fees (hell, if I wasn’t going to get my money back, then at least let me use the damn money for something else).

I got the following response:

Pictured: “goodwill”

I called the number provided in the latest email for rebooking flights. The representative explained to me that, since I requested a refund, my flight was locked in the Refunds Department’s coffers, and that I would have to contact them during business hours to get it released. Only then would I be able to initiate the process of changing my flight information to suit my needs.

The final correspondence itself illustrates the problem. In carefully worded “corporatese”, the Customer Relations rep explains that different types of tickets are offered “for [their] customers’ convenience” and that fully refundable tickets with more “flexibility” are offered at higher rates (though they fail to mention just how much more expensive said refundable tickets are, which is a lot more). The latter portion of that paragraph is the truly damning bit.

“We also offer lower fares for our budget conscious [sic] passengers. These fares are offered at a lower price[.] [H]owever[,] they are nonrefundable and have a charge associated with any change.”

What does that mean, really? In short, if you have lots of money to throw around (and are aware of the refundable status of the flight, which is not always clearly delineated), then you have no worries, and the airline also profits massively from your extra investment. If you’re budget-conscious (like the vast majority of airline passengers), you’re completely fucked if you don’t cancel your booking within 24 hours or if you don’t have a dire emergency (yes, they demand paperwork). As a result, the carrier essentially gets free money, and you will get charged for changes.

Nonrefundable tickets are legal motherfucking robbery.

Honestly, I can understand change and cancellation fees (the airline does have to book you, after all), but the fact that the carrier can legally retain the entirety of your purchase without providing you actual flight service is deplorable and should not be allowed to exist. This is only one thing: for example, if flying with American and you have a checked bag, like most people do, your bag fare shoots from a mere $30 to a full C-note if it reaches 51 pounds.

And that, my friends, is the problem with corporate America in a nutshell. In many corporations in America, from airliners to insurance companies and other types of creditors, practices predatory to the populace are allowed, and worse, encouraged. Everything, to include a person’s life, has a price tag. While I understand that the very point of having a business is to obtain profit, ethically speaking, your business should not seek to prey on people, especially those who are already at a disadvantage.

Ordinarily, I would encourage these people to fix their shit, but it won’t happen, since it’s legal and it’s rewarded. The show will go on.

|the kid|

#corporate america#essay#writers on tumblr#writers#business ethics#predatory behavior#predatory business#corporation#american airlines#nonrefundable ticket

1 note

·

View note

Text

How To Chose An E-currency Exchanger

A powered by Argentine bank deposits took place 2001. The natives were understandably restless with the continued failure inside their government's economic policies. People wanted to leave the Argentine peso for your refuge among the USD. Because you might expect, the government froze bank accounts for Bitcoin Lifestyle Login to around a year and limited customer distributions. Recently we had something similar occur in Cyprus when rumors began swirling about deposit confiscation in order to deal with the poor financial state of banks in a country. In similar fashion, the government of that country took measures to limit withdrawals and the rumors became fact. Depositors did lose cash though the term used was the more euphemistic "tax". The alleged problem undeniable fact that when Bitcoin surges in value people stop consuming. What kind of sense can it make to waste $10 equity Bitcoin Lifestyle on beef jerky today if those Bitcoins will be worth $20 tomorrow? It's exactly is the situation problem of hyperinflation. What sense that make to save $10 today if the dollar buys half as often tomorrow? We possess all seen phony websites available in the market that have links that go nowhere and don't look right, so when making option make sure their email address works so you get an answer in micro niche espionage reviewed manner from. If they have a contact number you can call, give them a engagement ring. Check the WHOIS details of locations as a back in. Also check how long they are developing business since this is one of the greatest signs connected with a good exchanger. Scammers do not last for an extended time. In July of 2001, Standard and Poor's (S&P) cut the credit rating of Argentina. S&P did Bitcoin Mining which you can purchase to the U.S. rating 10 years later (2011). There was uproar ultimately halls of Congress regarding it even though arguably, reduced credit rating could have fallen much quicker. To make matters worse, You.S. credit agencies granted pristine ratings to mortgage-backed securities within their heyday. Fitch, another credit agency, is warning of further action against the U.S. this year. We went into debt though less for projects and more towards entitlements. Our wars were less against countries and Bitcoin Lifestyles more towards combating terrorism though the costs weren't any less crucial. We have certainly had our share of state takeover of private debts. The bailouts of 2008-2009 moved private debt towards the public. More surreptitiously, the unofficial financial arm among the government (the Fed), has undertaken a massive acquisition of public and debt since 2008 on the tune of trillions. Via a tunnel the private debt is the form of home home mortgages. This Fed action does not allow rational pricing in sales and is likely distort stock market. Register with a pool. To mine within a pool you'll need to work having a group of other miners on available blocks. Common Cryptocurrency popular is Slush's Swimming. You can additionally try guilds like BTC Guild aside from variety of other prospects. Each of the pools is defined mostly via fees they demand per block - two percent for Slush's pool, for example - and the amount of users. Pools with less individuals can also have a slower discovery period but pools generally people normally produce smaller payments. 12/19: Interview with Robert Turner, inventor of Omaha (originally called "Nugget Hold'em" after the Golden Nugget where it debuted) in 1981/1982. SCBig and Gunner have a talk with Robert Turner about recreation of Omaha. [Visit Website] [Download MP3].

1 note

·

View note

Text

Major Swedish Bank Orders Negative Interest Rate on Euro Deposits

Sub-zero interest rates have become the norm in some countries, especially in Europe. Nordic nations such as Sweden and Denmark have been in negative territory for a while and a growing number of banks in the region are now charging depositors for keeping their money. Saving in fiat right now, unlike cryptocurrencies lately, leads to losses, although loans and mortgages aren’t free of charge per se. A leading Swedish bank has imposed a negative interest rate of -0.40% on euro accounts, while the ECB is reportedly preparing for a new rate cut.

Also read: As US Expands Subprime Mortgage Program, Is a New Crisis Looming?

Your Euro Savings Will Cost You Money in Sweden

Sveriges Riksbank, the central bank of Sweden which is the largest economy in Scandinavia, cut its interest rate to 0% in late 2014 and introduced negative rates in early 2015. It has kept them there ever since with the aim of fighting deflationary pressures. The Swedish krona, among other currencies in the periphery of the Eurozone, has been appreciating with dangerously low inflation, from a traditional standpoint.

After going down to a record low -0.5% in February 2016, and staying there for a while, Riksbank increased the interest rate to -0.25% towards the end of last year. This July, Riksbank kept its key repo rate at that level. Despite the relatively strong economic activity in the country and inflation staying close to the 2% target, the financial regulator noted the need to proceed with a cautious monetary policy, given the risks to the global outlook.

Skandinaviska Enskilda Banken (SEB), a major Swedish lender, has recently lowered its long-term mortgage rates. Interest on five-year loans has been decreased in July by 0.35% to 1.95% and by 0.41% to 2.99% for the 10-year mortgages. Rates on all savings accounts, except investment accounts, remain at 0%. The same applies to most regular business accounts.

However, SEB recently delivered аn unpleasant surprise to some of its clients. The interest on foreign currency accounts is already in the subzero territory. To be precise, that’s -0.40% on euro holdings, according to correspondence from the bank acquired by news.Bitcoin.com. “…the loan fee on business currency accounts in euro is currently -0.40% per year on the deposited amount,” reads an email sent to a customer.

To a certain degree, calling the interest rate ‘loan fee’ is closer to what it has actually become. When a depositor gives their money to a financial institution, they are no longer the owner of the asset, but only retain the right to withdraw under the terms and conditions described in the contract. Nowadays, instead of earning interest on the amount you’ve deposited, you are often paying a fee to lend your funds to the bank. Does that make any sense from a market economy point of view?

Sweden’s commercial banks have been forced to adapt to the continuously negative benchmark rate and have started passing the burden to their clients. Swedbank, the country’s largest lender, offers private customers various opportunities to save but rates are currently set at 0% for several of its products like private, e-savings, and youth accounts. No interest is paid on cash in an investment savings account either. The situation with corporate accounts looks pretty much the same. Current mortgage rates, however, reach over 3% for longer loans.

Danish Bank to Impose -0.60% Rate on €1M Deposits

Denmark, another important economy in the region, was actually the first country on the Old Continent to adopt negative interest rates after the global financial crisis of 2008. Its central bank, Danmarks Nationalbank, introduced them back in 2012 when it lowered its benchmark rate to -0.2%. The institution has consistently kept it around and below zero during the following seven years and it’s currently set at -0.65%.

Banks in the country have had to take its policy into account when deciding about the parameters of their own offers. For some time now, they have been resisting the pressure to pass the losses on to their clients. The largest of them, Danske Bank, recently announced it does not plan to impose negative rates on personal savings or current accounts and vowed not to introduce additional fees for its wealthy account holders. The bank, which is struggling with the consequences of its involvement in a large money laundering scandal, fears that could lead to people withdrawing cash from the banking system.

But according to recent publications, not all banks in the country are managing to avert such a development. Jyske Bank, another leading financial institution in Denmark, is now preparing to impose a negative interest rate of -0.6% on personal accounts holding funds in excess of 7.5 million Danish kroner, or €1 million ($1.12 million). That’s according to the bank’s report for the second quarter of 2019. The measure comes in response to persistently negative interest rates that are affecting its earnings.

Lately, it has become impossible to buy Danish government bonds with a positive interest rate and the market indicates that negative rates will be a fact for several years to come, commented Jyske CEO Anders Dam, quoted by the Swedish business outlet Dagens Industri. Luckily, personal accounts with smaller investments will not be affected by the change. The interest rate on the funds in these accounts will remain at 0%.

The move also follows the announcement of some worrying financial results. For instance, Jyske’s net interest income fell by around 6% year-on-year in the first half of 2019. The decline was registered despite the increase in the bank’s business operations. And in Q2 of 2019, the net interest income was 1.34 million Danish kroner (approx. $200,000), which is only slightly above the expected 1.33 million kroner.

At the same time, profit before tax in the second quarter was 633 million kroner ($94 million), which is below the forecasted 714 million kroner ($106 million). And the core revenue, according to the quarterly report, was 1,948 million kroner, or almost $290 million, below the average estimate of 1.978 million kroner ($295 million). Core profit was 683 million Danish kroner ($101 million), again failing to reach the expected 694 million kroner, or $103 million target.

ECB to Cut Interest Rate to All-Time Low

Other prominent banks in the region include Helsinki-headquartered Nordea, which is also very active in the Baltic States. As of August 2019, its interest rates in Denmark are as low as -0.65%, depending on the product. According to a near-term forecast published on its Danish website, the financial institution believes most of them will remain in negative territory throughout the next year.

Nordea is based in Finland, the only Nordic nation which is a member state of the Eurozone, the club of countries using the common European currency. In its home country, the bank still maintains positive interest rates on both deposits and loans. That’s despite reports that the European Central Bank (ECB) is preparing to further reduce its key rates next month.

With inflation in the Eurozone remaining below the target of 2%, ECB is expected to cut its deposit rate by 10 basis points to -0.5% following its meeting in September. This will be an all-time low for the deposit facility rate which determines the interest banks receive when depositing funds with Europe’s central bank. It’s currently set at -0.4% and it has been negative since the summer of 2014. Analysts quoted by mainstream media think ECB may also resume its quantitative easing efforts in October by buying out assets worth 15 billion euros ($16.6 billion).

But with decentralized alternatives on the table, you are not limited to keeping your money in a fiat currency account. Cryptocurrencies, whose value does not depend on benchmark interest rates set by central banks, offer an opportunity to store value and to profit from the generally positive market trends of late, as demand for these deflationary assets increases. And for those who prefer a more traditional way of saving, keeping your coins with a platform like Cred, a partner of Bitcoin.com, will earn you much higher interest of up to 10% on your BTC and BCH holdings.

Do you think we are going to see more negative interest rates in the Nordic region and Europe as a whole? Share your expectations in the comments section below.

Images courtesy of Shutterstock.

The post Major Swedish Bank Orders Negative Interest Rate on Euro Deposits appeared first on Bitcoin News.

https://cryptoveins.com/2019/08/major-swedish-bank-orders-negative-interest-rate-on-euro-deposits/

1 note

·

View note

Photo

New Post has been published on https://primorcoin.com/blockfi-shows-top-growth-among-u-s-companies-the-u-k-posts-over-10-inflation-and-bitgo-plans-to-bring-a-lawsuit-against-galaxy-digital/

BlockFi shows top growth among U.S. companies, the U.K. posts over 10% inflation and BitGo plans to bring a lawsuit against Galaxy Digital.

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Fed to issue long-awaited guidelines for granting master accounts to crypto banks

Crypto’s continued journey into the mainstream has come with various levels of regulatory action across the globe. This week brought clarity in terms of expectations for crypto-focused banks seeking accounts with the United States Federal Reserve. A framework released by the Federal Reserve Board details expectations for such applicant banks, including the level of due diligence to be provided based on each applicant’s risk level. Giving crypto-focused banks access to the Fed’s so-called “master accounts” has been a slow process, but it suggests that regulators are gradually integrating digital assets into mainstream finance.

BlockFi tops the Inc. 5000 list with almost 250,000% revenue growth in three years

Centralized finance player BlockFi topped Inc. magazine’s 2022 list of U.S. companies showing the highest revenue growth over the past three years. Although the list showcases 5,000 companies posting revenue growth, making it into consideration for the list requires paying a small fee and submitting an application. Be that as it may, BlockFi has tallied a 245,616% increase in revenue — substantially higher than the company holding second place on the list.

Ethereum Foundation clarifies that the upcoming Merge upgrade will not reduce gas fees

Ethereum’s highly anticipated Merge, which involves a shift to proof-of-stake from the current proof-of-work consensus mechanism, should arrive before 2022 is over — possibly in September, according to expectations. The move is a significant piece of the puzzle regarding Ethereum’s forward progression. Although the Merge means lessened energy required for running the Ethereum blockchain, that does not mean the network’s gas fees will fall, according to the Ethereum Foundation.

“Gas fees are a product of network demand relative to the network’s capacity,” the foundation specified this week. “The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.”

UK hits double-digit inflation for the first time in 40 years

Inflation currently affects billions of people across the globe. The United Kingdom, specifically, has now entered double-digit territory for inflation, according to the latest consumer price index (CPI) reading. July’s CPI came in at 10.1% year-over-year, up from 9.4% in June and the highest since February 1982. A sharp rise in the price of gas, food and other goods contributed to the high inflation print.

BitGo to sue Galaxy Digital for $100M over dropped acquisition

Digital asset custody firm BitGo intends to pursue legal action against crypto firm Galaxy Digital to the tune of more than $100 million. Galaxy canceled its move to acquire BitGo, stating that BitGo missed its deadline to provide certain financial documents. Legal representation for BitGo alleged that Galaxy is obligated to pay $100 million as a termination cost or an equivalent or greater amount in damages, while a Galaxy spokesperson stated the company’s choice to cancel the deal was within its contractual rights based on BitGo’s missed deadline.

FTX US among 5 companies to receive cease and desist letters from FDIC

The U.S. Federal Deposit Insurance Corporation (FDIC) has issued cease and desist letters to five companies, including FTX US, for allegedly making false representations about deposit insurance related to digital assets. The government agency claims FTX US and four other companies involved in crypto-related publications misrepresented the FDIC’s deposit insurance protection by claiming that it also applies to certain digital asset products. The FDIC has asked the companies to “take immediate corrective action to address these false or misleading statements.”

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $21,394, Ether (ETH) at $1,700 and XRP at $0.33. The total market cap is at $1.02 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Chiliz (CHZ) at 26.90%, UNUS SED LEO (LEO) at 12.13% and Shiba Inu (SHIB) at 8.01%.

The top three altcoin losers of the week are Convex Finance (CVX) at -26.39%, Oasis Network (ROSE) at -25.56% and THORChain (RUNE) at -24.77%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“Achieving a balance requires law enforcement to give up on unrealistic assumptions about unfettered access to everyone’s data on a silver platter.”

Ahmed Ghappour, general counsel at Nym Technologies

“As soon as you start to say to energy companies, ‘Oh, you can do this with your power, but not this,’ then they’ll start to tell you which networks you can mine, or you can mine this coin but not that coin.”

Andy Long, CEO of White Rock

“Right now, staking on the Beacon Chain carries the risk that the Merge doesn’t happen. But once it does, participation in staking is more accessible and has less technical risk.”

Lex Sokolin, head economist at ConsenSys

“Predicting a stock crash is a lot like predicting an earthquake. You know one will happen every so often but you can never tell exactly when or how severe it will be.”

Mati Greenspan, CEO and founder of Quantum Economics

“Those involved in illicit activity would be wise to steer clear of blockchain-related assets and stick to the tried and tested dollar. The United States dollar is still the most utilized and preferred currency for money laundering.”

Durgham Mushtaha, business development manager for Coinfirm

“While consumers tend to attribute high importance to privacy in surveys, they tend to give away their data for free, or in exchange for very small rewards in practice.”

European Central Bank Working Paper Series

Prediction of the Week

Bitcoin price dives pre-FOMC amid warning $17.6K low was not the bottom

Bitcoin’s price took a downward turn on Friday as the crypto market continues wading through a macro bearish backdrop. The asset fell below $22,000 mere days after briefly crossing the $25,000 mark, according to Cointelegraph’s BTC price index.

In a Wednesday tweet, Crypto Academy founder Justin Bennett compared S&P 500 chart activity to what was seen in 2008. “This is mind-blowing,” Bennett said, adding:

“The S&P 500 is mimicking the 2008 crash. Even the timing since the ATH [all-time high] is nearly identical. The bottom is NOT in for stocks or crypto.”

FUD of the Week

Network and token freeze after Acala exploit raises questions

Another stablecoin depeg occurred this week — this time, the result of a hacker exploiting a bug connected to decentralized finance solution Acala. The aUSD stablecoin, which aims to keep value on par with the U.S. dollar, plummeted to $0.01 after the hacker created 1.2 billion aUSD tokens using no collateral. Acala’s team turned on maintenance mode, which paused the function of several activities, including freezing the illegitimately created assets.

Study: Insider trading occurs in 10% to 25% of cryptocurrency listings

A draft of a study from the University of Technology Sydney dove into the topic of insider trading — trading based on non-public information. Evaluating specific Coinbase asset listings between Sept. 25, 2018, and May 1, 2022, the university estimated that between 10% and 25% of crypto listings are tainted by insider trading. The conclusion was reached, in part, by comparing data to past examples of insider trading on the stock market as a baseline. Definitive determination of foul play, however, is often difficult to prove.

2017 ICOs aren’t over yet: SEC files suit against Dragonchain and its founder

The U.S. Securities and Exchange Commission (SEC) is still apparently sorting out crypto-related issues from 2017. Dragonchain and multiple related parties face action from the SEC, as per a complaint filed by the government agency and publicized on Tuesday. The commission faults Dragonchain and certain parties for using an initial coin offering and presale to accumulate $16.5 million without registering with the SEC.

Best Cointelegraph Features

Court filings reveal Celsius will run out of money by October

Celsius Network has been heading down a slippery slope since it filed for bankruptcy in July.

Optimism fading? Regulatory discussion on stablecoins postponed until fall

While there is no shortage of legislative initiatives to regulate stablecoins, the idea of a U.S. CBDC remains problematic.

Another depeg: Acala trace report reveals 3B aUSD erroneously minted

As the dust settles on another decentralized finance exploit, Acala continues to trace erroneously minted tokens after a misconfiguration in a newly launched liquidity pool.

Source link

#Blockchain #Coinbase #CoinbaseNews #Crypto #CryptoNews #SHIB #Shibaswap #ShibaToken #TraedndingCrypto

#Blockchain#Coinbase#coinbaseNews#Crypto#CryptoNews#SHIB#Shibaswap#ShibaToken#TraedndingCrypto#CryptoPress#Trending Cryptos

0 notes

Text

Procedure To File Complaint Under Consumer Protection (Amendment) Act

The Consumer Protection Act of 2019 ("New Act") received presidential assent on August 9, 2019, and took effect on July 20, 2020, amending the previous Consumer Protection Act of 1986. ("Old Act"). The act's purpose is to protect customers' interests while also ensuring the effective and speedy resolution of consumer disputes. The New Act made it possible to file complaints and mediation proceedings online in order to expedite and effectively resolve consumer matters.Complaint is characterized as any allegation in writing produced by a complainant for the purpose of gaining the relaxation provided by the act in cases of unfair trade practices, defects in goods, deficiency in service, excess price of goods and services, and the sale of hazardous goods under Section 2 of the New Act. The complainant can also sue the manufacturer or service provider for warranties.The New Act includes a "Product Liability" clause, under which a manufacturer or service provider is responsible for compensating consumers who are injured as a result of a manufacturing flaw or poor service.

It is important to establish who exactly can file a complaint under consumer Protection(Amendment) Act.(1)A consumer;(2)Any volunteer consumer organisation that is currently registered at all under the applicable law;(3)If it's the federal government or a state government;(4)The Central Authority;(5)When there are many consumers with the same interest, one or more consumers;(6)If a consumer dies, his legal heir or representative takes over;(7)In the case of a minor, his parent or legal guardian is responsible.All of these people are eligible to file a consumer complaint.

The process of making a complaint should be done in writing and addressed to a District Forum. The complaint can be written on plain paper and filed by the consumer or by an authorized representative. This complaint must also be notarized and sent by registered or normal mail. It must be submitted within two years of the occurrence of the issue. The complainant must file four copies of the complaint, as well as extra copies for each opposing party.

The consumer complaint should provide the complainant's and opposing party's contact information, as well as the details of the dispute and the redress sought. The complaint must also include copies of any relevant documents needed to prove the claim made in the complaint. To file a consumer complaint, you do not need to contact an advocate. The charge is payable to the President, Consumer Disputes Redressal Forum, (name of) district, via demand draught.

If the value of the goods or services exceeds Rs 1 crore but is less than Rs 10 crore, a consumer complaint can be brought in the State Forum. Following 45 days of the date of the ruling, one can appeal the decision with the State Commission against the District Forum's decision. 2. The application must be accompanied by the required fee, which must be paid by demand draught to the Registrar, (name of) State Commission in the applicable state.The documents to be attached in state consumer complaint are as follows-

1. Documents of record containing all parties' accurate names and addresses.

2. A certified copy of the District Forum order that is the subject of the appeal.

3. Each respondent should receive more than four additional copies of the appeal.

4. Any conditional stay order, interim order, or other petitions with an affidavit.

5. Opposing parties or the appellant must make a statutory deposit of Rs 25,000 or 50% of the claimed amount, whichever is less.

Cases that involve consumer complaints worth more than Rs 10 crore should be submitted directly with the National Consumer Dispute Resolution Commission. A consumer who is dissatisfied with a State Commission decision can apply to the National Commission. The appealing must be filed within 30 days after the date of the State Commission's decision. The charge for contacting the National Consumer Disputes Redressal Commission is Rs. 5000, payable in the name of the Registrar, National Consumer Disputes Redressal Commission, as a demand draught. An appeal against a National Commission order can be filed in the Supreme Court within one month of the date of the National Commission's order.

0 notes

Text

Bitcoin Could Reach $180,000 In 2024: Fundstrat

Bitcoin (BTC)’s supply and demand dynamics suggest that the asset could surge as high as $180,000 by April 2024, according to a research note from Fundstrat on Monday. The forecast – which precedes the U.S. central bank’s next meeting – largely rests on a Bitcoin spot ETF being approved in the United States, which the markets research firm suspects will blow apart BTC’s current price equilibrium. The Impact Of A Bitcoin ETF At present, Fundstrat finds that Bitcoin experiences roughly $25 million in daily demand – about the same value of new coins brought into circulation by miners each day. “This would bring daily demand to $125 million, while daily supply is only $25 million,” wrote Tom Lee, Fundstrat’s Head of Research. “The implied equilibrium price would need to rise so daily supply matches daily demand.” “Equilibrium analysis suggests that a clearing price is $140,000 to $180,000, before the April 2024 halving,” Fundstrat continued. The “halvening” (another way to refer to the Bitcoin halving) is when the Bitcoin network slashes its BTC emissions per block in half. The event occurs once every four years, and has consistently been followed by major crypto market bull runs in the following year. The next halving will take Bitcoin’s emissions from 6.25 BTC to 3.125 BTC every ten minutes. Though researchers at Coinbase have suggested it may not cause another bull run, Fundstrat’s analysis suggests the halving won’t even be necessary for reaching a new all-time high. This bullish outlook is largely shared by Standard Chartered Bank, whose analysts predicted that Bitcoin will touch $120,000 before 2025, thanks to miners hoarding their newly minted coins in the medium term. Meanwhile, Bloomberg ETF analysts Athanasios Psarofagis and James Seyffart estimated this month that a Bitcoin spot ETF could accrue $54 billion in capital over time, based on the success of Canada’s much smaller market. The Fed’s Upcoming Meeting Fundstrat’s prediction comes days before the next Federal Open Markets Committee Meeting (FOMC) when the Federal Reserve is largely expected to raise its target interest rate by another 25 basis points. Despite the Fed’s persistent rate hikes, both stocks and Bitcoin are up year to date, and expectations of an incoming recession are on the decline. It is surprising to me that every time the market wobbled this year, our institutional clients are ready to short👇 – there is no “buy the dip” – likely happens when drop in inflationary pressures more evident– because #Fed can eventually relent @fs_insight https://t.co/6wxrS6zalW — Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) July 25, 2023 Fundstrat’s Lee predicts that tomorrow’s announcement will move stock prices by 1%, and believes institutions shouldn’t expect a major market correction anytime soon. “We’re still in a position where people are bearish and ready to sell,” said Lee to CNBC’s Squawk Box. “No one is really embracing this as an upward new bull market.” SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms). PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits. Source link Read the full article

0 notes

Text

Axie Infinity, Yield Guild Games & the play-to-earn economy

Around the Block from Coinbase Ventures sheds light on key trends in crypto. In this edition, Justin Mart, Connor Dempsey, and Hassan Ahmed explore the growth of NFT games and the play-to-earn economy. Plus, a look at NFT marketplace activity and the Poly Network exploit.

We’re at an exciting time in crypto: one in which cryptonetworks are blossoming into full-fledged virtual economies. Nowhere is this more on display than with NFT gaming.

At the forefront of NFT gaming sits Axie Infinity and its play-to-earn model: a model that pays people in crypto to play a fun video game. With over one million daily active users, Axie Infinity has exploded in popularity in emerging markets and is showing the potential to be a trojan horse for on-boarding the next generation of crypto users.

On top of that, Axie Infinity and play-to-earn gaming has spawned its own thriving financial services sector.

The rise of Axie Infinity

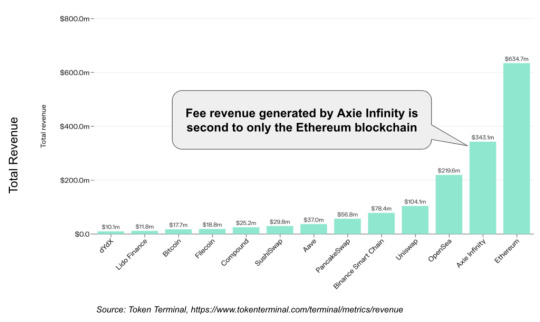

Over the last 30 days, Axie Infinity generated a head turning $343M in fee revenue. This is more than any app or protocol in crypto aside from the Ethereum blockchain, according to Token Terminal.

So where’s that revenue coming from?

How Axie Infinity generates revenue

The Axie Infinity economy consists of a governance token (AXS) and a second token called Smooth Love Potion (SLP) that serves as an in-game currency, along with NFTs that represent both game characters and virtual real estate.

The gameplay itself is often compared to Pokemon, where players battle “Axies” (pictured below) against those of other players. Different Axies have different strengths and weaknesses, and the strategy of the game comes down to playing to your Axies strengths better than your opponent. Players get paid in SLP for defeating opponents. Additionally, players can compete daily quests to earn additional SLP. Axies can also be “bred” together to create new Axies which can in turn be sold to other players for profit.

Every time an Axie is traded, a plot of real estate is sold, or two Axies are bred, the protocol takes a fee priced in a combination of AXS and SLP. Rather than go to the developers, this revenue is placed in the Axie treasury, which has ballooned to nearly $600 million.

https://medium.com/media/a5881a034e856752cd2d7fe775bd476d/href

An emerging markets phenomenon

While the protocol revenue numbers alone depict the emergence of a new breakout crypto application, what’s more exciting is where Axie Infinity is taking off: in developing nations where players can often earn more playing the game and selling SLP for their native currencies than they can with a typical day job.

With an estimated 50% of daily active users (DAUs) coming from the Philippines, the game is also picking up steam in other emerging markets like Indonesia, Brazil, Venezuela, India, and Vietnam.

Created by game developer Sky Mavis in 2018, Axie started picking up organic traction in the Philippines in early 2020 after a few players realized they could make legitimate incomes by playing. When Covid lockdowns hit and many were put out of work, more were encouraged to give it a try. A documentary on the game’s growth called PLAY-TO-EARN went viral in May 2021 and DAUs went vertical soon after.

Business models of the metaverse

Unlike many mobile games, Axie Infinity is not free to play. To get started, players need to obtain 3 Axie Infinity characters. In the earlier days of the game, the average Axie was selling for under $10. With the game’s rapid growth and the broader NFT rally, the average Axie is now selling for nearly $500 according to CryptoSlam.

Given Axie’s base within the Philippines and other emerging markets, a $1,500 entry tag is a non-starter for most would-be players. To mitigate this barrier to entry, an informal market emerged in which NFT owners began lending players the NFTs needed to play the game in exchange for a cut of their winnings. This is done through QR codes that let players use Axie NFTs in game without the lender having to cede ownership on-chain.

This informal market has blossomed into a formal play-to-earn financial services sector. The largest and most prominent player is a project called Yield Guild Games.

Yield Guild Games (YGG)

Founder Gabby Dizon likes to say that Yield Guild Games is one part Berkshire Hathaway and one part Uber.

Just as Berkshire Hathaway is a holding company for a multitude of businesses, YGG is essentially a holding company for play-to-earn gaming assets. Starting in 2020, they’ve been buying up yield producing NFTs, governance tokens, and ownership stakes in promising gaming projects and protocols.

Similar to how Uber pairs people who want to earn money driving with people who need rides, YGG pairs people who want to make money gaming with the NFTs they need to earn in play-to-earn games. In many parts of the world, people are opting to work with YGG over Uber simply because it pays more.

YGG recently released its July Asset & Treasury Report that offers an interesting glimpse into the new kinds of business models NFTs and play-to-earn games are creating.

YGG by the numbers

Within YGG, there are scholars and community managers. Scholars receive NFTs that they in turn put to work earning crypto. Community managers recruit and train new scholars. 70% of winnings go to scholars, 20% to community managers, and 10% to the Yield Guild Games treasury.

According to the report, 2,058 new scholars joined YGG in July bringing the total to 4,004. In the same month, YGG scholars generated 11.7M SLP by playing Axie Infinity, which equated to over $3.25M in direct revenue. From April through July, scholars and community managers have earned a cumulative of $8.93M.

From its cut of all SLP earned by scholars, YGG earned $329,500 in July and a total of $580,000 since April. YGG’s expenses currently outstrip revenue, as they spent $1.62M in July alone “breeding” new Axie’s to meet scholar demand (breeding can cost anywhere from $200 to $1,200 per Axie).

The YGG Treasury

The YGG treasury consists of tokens and stablecoins held in a wallet, NFTs, and venture investments made in various play-to-earn games. The project has been funded by a $1.325M seed round led by Delphi Digital and another $4.6M round from a16z. They also raised $12.49M from the sale of the YGG governance token, while holding 13.3% of its outstanding supply.

As of the end of July, the YGG wallet’s holdings stood at $415M, with the majority stemming from the YGG token ($373M). The YGG token is part of Yield Guild Game’s plan to transition into a community-governed DAO.

https://medium.com/media/62856357da8af3813154056ea8ff43ab/href

The price of YGG has tripled in August, meaning their treasury currently stands at over $1B.

https://medium.com/media/ad2c70e2ac461dd1cfc6d0faaf9bc986/href

Much of YGG’s capital has been put to work buying NFTs that can earn yield from play-to-earn games. By the end of July, the YGG treasury had amassed 19,460 NFTs valued at over $10M across 12 play-to-earn games. Axie Infinity NFTs comprised close to 90% of that value.

https://medium.com/media/df13de155b6354a002f814bf13a0e5d8/href

YGG has also made early stage investments across 8 play-to-earn games via SAFT (Simple Agreement for Future Tokens), and locked in ~$1M for yield farming in blue-chip DeFi projects.

https://medium.com/media/98e46ab915bf0e874d9c866897c36252/href

Play-to-earn in the real world

A key element of the YGG model is that players are lent NFTs with zero downside risk and without having to put down any upfront capital. In return, they surrender 30% of their winnings but retain the majority — a critical hook to onboarding a new class of crypto users that have historically been priced out.

In fact, some players in the Philippines are earning 5–10x what they were making from their previous jobs. New homes have been purchased, charitable acts have been made, and even shops are accepting SLP as payment.

Beyond the wealth Axie Infinity has created, the game’s popularity has served as a means for getting a large new class of users comfortable using crypto applications. As these 1 million users interface with cryptocurrencies, NFTs, digital wallets, and DEXs, it’s not hard to see this new cohort as natural users of other DeFi and Web3 applications.

Play-to-earn sustainability

If Axie Infinity is its own digital nation, game developer Sky Mavis serves as its Federal Reserve. Where the Fed has various tools it uses to influence the economy, Sky Mavis can adjust the SLP issuance rate and breeding fees with the aim of keeping the Axie economy healthy. Just like a real economy, digital economies have to consider the effects of inflation.

ETH has been flowing into the Axie economy due to high demand for Axie NFTs. Increased demand for Axie NFTs has led to rising Axie NFT prices. Higher NFT prices have made breeding more profitable. Breeding requires fees paid in SLP & AXS, leading to a rise in token prices. With rising SLP prices, playing becomes more profitable, encouraging others to join. A powerful positive feedback loop no doubt — but what if market conditions change?

Winning Axie Infinity battles and quests yields SLP, inflating the SLP supply. And since breeding is priced in SLP, additional supply of SLP equates to cheaper breeding fees to create new Axie NFTs, inflating Axie NFT supply. These dynamics could have an impact on NFT market prices, which in turn may have a direct effect on the economics for players — a possible negative feedback loop.

Ultimately, Sky Mavis has to keep the SLP supply in-check while improving overall gameplay to keep its player economy and ETH deposits growing. They must also offset the number of players seeking to extract a profit with players who are pure consumers — i.e. playing for the fun of it.

Playing the Long Game

While Sky Mavis works to keep the Axie economy strong, Yield Guild Games is banking on the continued growth of play-to-earn gaming as a whole. By replicating its model for Axie Infinity across new games, it seeks to build a play-to-earn empire. Over the long run, founder Gabby Dizon sees YGG as the “recruitment agency of the metaverse” that ultimately competes with the Ubers of the world for labor. A future straight out of Ready Player One in which millions of people earn a living in the digital world in order to cover expenses in the physical one.

Final word

With the exploding revenue of Axie Infinity, the emergence of DAOs like Yield Guild Games, and the multitude of play-to-earn games on the horizon, it’s clear that this trend has legs. With DeFi, NFTs, and now crypto gaming, we’re rapidly evolving past the original crypto killer app of speculative trading and into a universe of expressive new apps and models. We’re in fascinating times as crypto’s utility phase marches forward with a full head of steam.

Quick Hits

OpenSea Hits $3B monthly volume

In the month of August, NFT exchange OpenSea hit $3B in monthly volume as over 1.5 million NFTs changed hands. Its August volume alone exceeds that of every other month in its history, combined.

https://medium.com/media/094a28282f83142b39aee985b760ecd3/href

OpenSea’s August volume is on par with $3B in gross sales Etsy put up in all of Q2: another sign of just how big the NFT market has grown relative to other online marketplaces in a very short timespan.

Data from The Block shows how dominant OpenSea’s dominance over the NFT landscape really is.

https://medium.com/media/65a33b506b8871ddaa65ed0389cf023c/href

Notably absent from this exchange landscape are any kind of decentralized venues for trading NFTs. This follows past market cycles in which centralized exchanges found product market fit first, before ultimately paving the way for decentralized alternatives (think Uniswap during the DeFi summer).

The DEX market for NFTs is still nascent but one we’re watching is the recently launched Punks.house which is a permissionless venue for trading CryptoPunks made by Zora. We’re also seeing NFT markets begin to decentralize themselves, with NFT art marketplace Super Rare making the first move with the introduction of its RARE governance token. Many suspect OpenSea will eventually take this route as well.

Lastly, while OpenSea is a centralized for profit entity, its code is open source. It wouldn’t surprise us to see a low-fee competitor forked from OpenSea emerge in the coming months.

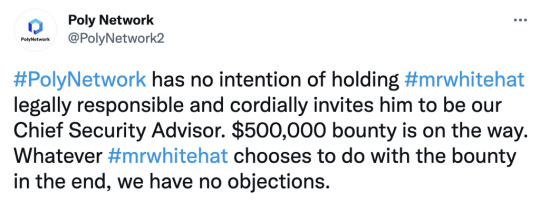

$611M whitehat hack?

In the largest DeFi hack to date, an attacker drained over $611M from the Ethereum, Binance Smart Chain, and Polygon blockchains. Then in a surprise move, he returned almost all of it.