#dca trading bots

Text

If you are new to the crypto market and looking for higher profits, start with MevEngine’s HFT DCA trading bot. They deliver world-leading trading bots equipped with reliable performance, efficiency, and adequate harnessing of the speed-power of high-frequency trading technology [HFT].

0 notes

Text

The advantages of using bots in crypto trading include the ability to automate trades, remove emotions from the decision-making process, and maximize profits while minimizing losses. As the cryptocurrency market continues to grow and become more competitive, the use of bots is likely to become even more popular among traders. However, it's important to note that bots are not a guarantee of success and traders should always do their own research and make informed decisions when it comes to their investments.

#best crypto trading bot#best social trading platform#cornix trading bot#crypto trading platform#cryptocurrency trading#dca crypto bot#dca trading bots

0 notes

Text

DCA Trading Bot: Automate Your DCA Strategy and Profit

In the world of cryptocurrency trading, maintaining a consistent and disciplined investment strategy can be challenging, especially given the market's notorious volatility. One of the most effective strategies to mitigate this volatility is Dollar-Cost Averaging (DCA). This strategy involves investing a fixed dollar amount in a particular cryptocurrency at regular intervals, regardless of its price. A DCA trading bot can automate this process, ensuring consistent and emotion-free investing.

In this blog, we will explore the advantages of using a DCA trading bot and highlight the importance of partnering with a reliable DCA trading bot development company to create a robust and efficient trading tool.

Benefits of Using a DCA Trading Bot

A DCA trading bot automates the systematic investment process, offering several benefits to traders:

1. Emotional Detachment:

Automated trading eliminates emotional decision-making, which can often lead to impulsive and poor investment choices.

2. Time Efficiency:

By automating the DCA strategy, traders save time that would otherwise be spent manually executing trades.

3. Risk Mitigation:

Regular investments reduce the risk of investing a large sum at an inopportune moment, spreading out the investment to smooth out market volatility.

4. Consistency:

The bot ensures that investments are made consistently, adhering to the predefined strategy without deviation.

5. 24/7 Operation:

Unlike human traders, bots can operate round the clock, making timely investments even when the trader is unavailable.

Key Features of a High-Quality DCA Trading Bot

When developing a DCA trading bot, it's crucial to include features that enhance its usability and effectiveness. Some key features include:

1. Customizable Settings:

Users should be able to set their preferred investment amount, frequency, and choice of cryptocurrencies.

2. Real-Time Data Integration:

The bot should have access to real-time market data to make informed trading decisions.

3. Automated Execution:

The bot must be capable of executing trades automatically based on the set parameters.

4. Performance Analytics:

Features for tracking and analyzing portfolio performance help users adjust their strategies as needed.

5. Security Protocols:

Implementing strong security measures, such as encryption and two-factor authentication, ensures the safety of user funds and data.

6. User-Friendly Interface:

A simple and intuitive interface allows users to easily set up and manage their DCA strategies.

Choosing the Right DCA Trading Bot Development Company

Selecting the right development partner is crucial for creating a successful DCA trading bot. Here are some factors to consider:

1. Experience and Expertise:

Look for a company with a proven track record in developing cryptocurrency trading bots and deep expertise in blockchain technology.

2. Customization Capabilities:

The company should offer tailored solutions that meet your specific needs and preferences.

3. Security Focus:

Ensure the company prioritizes security to protect your investments and personal information.

4. Support and Maintenance:

Opt for a company that provides ongoing support and maintenance services to keep your bot updated and functioning optimally.

5. Client Reviews and Testimonials:

Check for positive feedback from previous clients to gauge the company’s reliability and quality of service.

The Development Process

Partnering with a DCA trading bot development company typically involves the following steps:

1. Requirement Gathering:

The company will work with you to understand your needs and the features you want in your bot.

2. Design and Planning:

They will design the bot’s architecture, user interface, and integration with cryptocurrency exchanges.

3. Development:

The coding phase is where the bot’s functionalities are developed and tested.

4. Testing:

Comprehensive testing to ensure the bot performs as expected under various market conditions.

5. Deployment:

Launching the bot and making it available for use.

6. Maintenance:

Ongoing support to address any issues and update the bot as needed.

Conclusion

Automating your DCA strategy with a trading bot can significantly enhance your investment efficiency and profitability. However, the success of this automation heavily relies on the quality of the trading bot. Partnering with a reputable DCA trading bot development company ensures you get a robust, secure, and efficient tool tailored to your needs.

By leveraging the expertise of a professional development team, you can navigate the complexities of bot development and focus on what matters most: growing your investments. Investing in a high-quality DCA trading bot can be a game-changer in your cryptocurrency trading journey, providing consistent, emotion-free investing and helping you achieve your financial goals.

For those looking to streamline their DCA strategy, collaborating with a trusted DCA trading bot development company is the first step toward automated trading success.

#DCA trading bot development#DCA trading bot development service#DCA trading bot development company

0 notes

Text

MevEngine is a Private Tech Agency of Blockchain Engineers, Quant Developers and Strategists Working on the Decentralized Finance market [ DEFI ] and CEFI markets like the Popular Coinbase.io, Binance and Kucoin.

1 note

·

View note

Note

If the bots thought their human was lonely, do you think they’d try to get another human for them to play with?

ohhh nnope, bots can't really get humans other than through illegal means

the dcas get custody over their human after saving them from a trafficker, and were deemed suitable enough guardians when they reported that they'd found them (and the trafficker). Humans are legally recognized as people, even if they're kind of looked down on as cute helpless things by most all bots, so trading them is explicitly illegal. HOWEVER, there's nothing wrong with simply trying to find another human living in the area, whether in custody or living independently. Any humans in the area would likely be other escapees from their humans' recently busted bunker.

23 notes

·

View notes

Text

Old Habits Die Hard. A Reader x DCA Fallout AU Fic

The Fic

In the apocalyptic wastes of Oregon you find yourself ,a vault robotics mechanic, captured by raiders. After Sun has saved you you agree to become him and Moon’s mechanic in return for them keeping you alive and safe in the wastes.

World Info

~ The PizzaPlex was around and had the virus for a short amount of time when the bombs dropped

~ FazCo was one of the top robotics manufacturers right alongside RobCo and General Atomics. However FazCo focused on the entertainment and child care sectors. As such FazCo robots aren't that uncommon, a large part are sapient AIs.

~ FazCo bots are often stigmatized against since they are known to have started rebelling right before the nuclear fall out. They are still well known to be dangerous. However, settlements will trade with them. All FazCo bots are pre war.

~ Save for the addition of FazCo, the world of Fallout isn't changed much. This fic takes place in Oregon after the events of Fallout 4.

The Y/N, Scavy/nger

~ A mechanic recently expelled from their vault(68) for breaking the rules of the vault.

~ Before this they were in a close relationship with MoonGlow, a MoonDrop Security Bot gen4, that was head of Vault security.

~ A very good mechanic with an interest in FazCo bots and has several blueprints for different kinds in their pipboy.

~ Easily swayed by things that were luxuries in the vault such as: good food, Sugary snacks, Booze.

~ just dog shit aim. Totally reliant on V.A.T.S. when it comes to guns. Give them something Close range.

~ Does not care about pain. High pain tolerance

Top 3 Special Stats: Intelligence, Luck, Enderince

Perks: Weird Wasteland, Robotics Expert, Toughness

Weapon of choice: Mr.Handy BuzzBlade

Sun & Moon

~ Have been traveling the wastes since a few years after the nuclear apocalypse. Mostly they get by doing odd jobs and scavenging what they can.

~ Used the virus to rewrite their own code so they could both defend themselves.

~ Have taken in orphaned children from the wastes on many occasions, currently though they aren't razing one.

~ Generally they think kids are sweet but all too often in the wasteland something goes wrong and they grow up into something terrible. As such they dont trust most humans, Sun usually does all the bartering in settlements.

~ Both have figured out how to make Sundrops and Moondrops and modify the recipes.

~ Moon is great at stealth, while Sun goes in guns blazing

Top three stats - Sun: Agility, Perception, Charisma | Moon: Perception, Agility, Intelligence

Perks - Sun: Demolitions Expert | Moon: Mr.Sandman | Shared: Child at heart

Weapon of choice: Sun: Pistol, SunDrops (actually small cherry bombs) | Moon: sniper rifle, Claws.

There is a lot more, but it's either spoilery or wouldn't make sense yet. Or I'm not sure how to fit it into this post.

I love talking about AUs, so I will happily dish any details asked about.

#fnaf au#fnaf dca#dca au#dca x y/n#dca x reader#fnaf daycare attendant#fallout au#Fallout#fnaf sun#fnaf moon#dca fic#fanfic#au info#drugs and alcohol refrence#ohdh

20 notes

·

View notes

Text

Top 10 Crypto Trading Bots

Top 10 AI Crypto Trading Bots

Navigating the fast-paced cryptocurrency market can be daunting, with constantly shifting trends and increasingly complex trading decisions. AI crypto trading bots offer a smart solution by automating trades and reducing risks. As the market evolves, these bots have become invaluable tools for enhancing trading efficiency. But before diving in...

What Are AI Crypto Trading Bots?

AI crypto trading bots are automated systems driven by machine learning and artificial intelligence. They continuously analyze market data and execute trades on behalf of users, operating 24/7. By making split-second decisions based on real-time data, these bots provide traders with a significant edge in the volatile crypto environment.

Looking to the Future? Partner with Us for Cutting-Edge Blockchain Development Services!

Top 10 Crypto Trading Bots of 2024

As cryptocurrency trading grows more complex, crypto trading bots have become essential for maximizing returns and managing risks. Here’s a rundown of the top 5 crypto trading bots for 2024, showcasing their key features.

1. 3Commas3Commas stands out with its user-friendly interface and advanced trading tools, making it a great choice for both beginners and seasoned traders. Its smart trading terminals and diverse automated bots offer both flexibility and efficiency.

Key Features of 3Commas

Smart Trading Terminals: Advanced tools that implement automated strategies for optimized trading.

Automated Bots: Supports various strategies including DCA, Grid, and Options bots.

Paper Trading: Test your strategies without risk using virtual funds.

Integrations: Seamlessly connects with top exchanges like Binance, Coinbase Pro, and Kraken.

Cryptohopper Cryptohopper stands out for its user-friendly strategy designer, allowing traders to create custom strategies without coding knowledge. Its market-making and arbitrage bots are especially beneficial for advanced traders.

Key Features of Cryptohopper

Market-Making Bot: Enhances liquidity and profitability with market-making strategies.

Arbitrage Bot: Capitalizes on price differences across multiple exchanges.

Strategy Designer: Enables the creation of custom strategies without the need for coding.

Social Trading: Follow and replicate strategies of top-performing traders.

Elevate your portfolio with our state-of-the-art crypto wallet development services. Let’s collaborate today!

Bitsgap Known for its excellent arbitrage and intuitive grid trading strategies, Bitsgap offers robust portfolio management tools for effortless investment tracking.

Key Features of Bitsgap

Arbitrage Opportunities: Spot and exploit arbitrage across numerous exchanges.

Grid Trading: Automate grid strategies for consistent profits.

Portfolio Management: Easily track and manage all your investments.

Demo Mode: Test your strategies in a risk-free environment.

Pionex Pionex excels with its range of free built-in trading bots and low fees, making it an ideal choice for navigating volatile markets.

Key Features of Pionex

Free Built-in Trading Bots: Offers 16 different bots at no additional cost.

Grid Trading Bot: Automates buying low and selling high in volatile markets.

Smart Trade Terminal: Tools to set stop-loss, take-profit, and trailing strategies.

Low Trading Fees: Exceptionally low fees, just 0.05% per trade.

Quadency Quadency provides a unified trading experience, combining multiple exchange accounts with advanced analytics for informed decision-making.

Key Features of Quadency

Unified Dashboard: Manage multiple exchange accounts from one platform.

Strategy Marketplace: Access pre-built strategies and implement them easily.

Automation: Customizable bots for seamless trading.

Analytics: Advanced tools to support smarter trading decisions.

Transform your business with our leading DeFi development services. Be part of the decentralized finance revolution!

TradeSanta TradeSanta’s DCA and grid bots are designed for traders who prefer automated strategies, with smart order routing to ensure the best prices.

Key Features of TradeSanta

DCA Bots: Automates dollar-cost averaging for strategic investments.

Grid Bots: Automates consistent profit-making strategies.

Smart Order Routing: Ensures optimal prices across multiple exchanges.

User-Friendly Interface: Simple setup and bot deployment.

Shrimpy Shrimpy is renowned for its social trading and portfolio rebalancing features, allowing users to follow top traders and automate portfolio adjustments.

Key Features of Shrimpy

Social Trading: Copy the trades of successful traders.

Portfolio Rebalancing: Automatically rebalance your portfolio for optimized performance.

Backtesting: Test strategies using historical market data.

API Integrations: Easily connect with major exchanges.

Zignaly Zignaly focuses on copy trading and signal providers, giving users a hands-off trading experience by following expert traders’ moves.

Key Features of Zignaly

Copy Trading: Replicate trades of expert traders.

Signal Providers: Subscribe to trading signals from professionals.

Unlimited Exchanges: Connect to multiple exchanges without restrictions.

Profit-Sharing: Share profits with professional traders.

Gunbot Gunbot is known for its extensive customization options and pre-built strategies, along with a supportive community for traders.

Key Features of Gunbot

Highly Customizable: Offers extensive options for customizing strategies.

Pre-Built Strategies: Includes popular strategies like Bollinger Bands and StepGain.

Backtesting and Simulation: Test strategies with historical data.

Robust Community Support: Active community offering strategy tips and advice.

HaasOnline HaasOnline is well-regarded for its sophisticated tools and high customization, making it a strong choice for advanced traders.

Key Features of HaasOnline

Highly Customizable: Tailor strategies to your specific needs.

Pre-Built Strategies: Includes Scalping, Arbitrage, and Market Making strategies.

Advanced Backtesting: Refine strategies using historical data before going live.

Strong Community Support: Backed by a vibrant community for sharing insights and strategies.

ConclusionAI crypto trading bots are transforming the way traders engage with the cryptocurrency market. By automating strategies, enhancing efficiency, and managing risks, these bots are invaluable tools for both beginners and experienced traders. As AI technology continues to evolve, the influence of these bots on the financial sector will only grow.

0 notes

Text

10 Reasons To Invest in Bybit’s DCA Trading Bots

Dollar-Cost Averaging (DCA) bots are automated tools that help you purchase cryptocurrencies at regular intervals with a fixed investment amount. This approach helps mitigate the impact of market volatility on your investments.

What Is a DCA Trading Bot?

A DCA trading bot is a comprehensive platform designed for automated cryptocurrency trading. It provides a range of pre-set parameters and effective trading strategies, saving you time and potentially enhancing your investment returns without incurring additional costs.

How Do Bybit’s DCA Trading Bots Operate?

Bybit’s DCA trading bots, as the name implies, automate the process of buying cryptocurrencies. These bots use a fixed investment amount and predefined time intervals to make purchases over a specific period. This strategy reduces the impact of market fluctuations, helping you maintain an average purchase price that aligns with market trends. Bybit offers the option to create a DCA bot for a single coin or a portfolio of up to five coins.

The DCA approach employed by Bybit’s bots enables you to average the price of your assets by buying tokens regularly. This method is ideal for long-term investing, HODLing, and strategies like smile curving.

Parameters for DCA Trading Bots:

Currency: This is the currency used for purchasing your coins. Bybit supports investments in USDT or USDC. Note that USDC is restricted to the USDC market, so you cannot mix it with ADA/USDT or BTC/USDC, and vice versa for USDT.

Fixed Investment Amount: This defines the amount allocated for buying cryptocurrency during each period. The minimum and maximum order quantities can be checked in the Order Zone.

Investment Frequency: This specifies how often you want to invest in the selected cryptocurrency or portfolio. The first investment occurs shortly after setting up the DCA bot. Longer intervals are suited for extended plans. Bybit offers a variety of time settings, ranging from minutes to weeks.

Max. Investment Amount (Optional): This specifies the highest amount you are willing to invest in the portfolio.

Transfer All Assets (Optional): When enabled, this option will transfer all assets from the bot to the users’ spot account. This setting determines how you wish to manage your DCA bot.

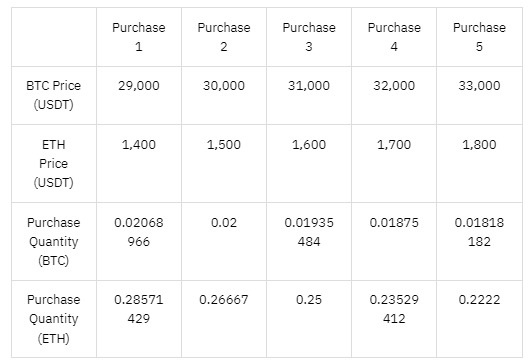

Example of How the DCA Bot Functions:

Coins: BTC and ETH

Investment Currency: USDT

Investment Frequency: Weekly

Total Fixed Investment Amount: 1,000 USDT

BTC Fixed Investment Amount: 600 USDT

ETH Fixed Investment Amount: 400 USDT

Max. Investment Amount (Optional): 5,500 USDT

For instance, if Trader A chooses to invest over a period of five weeks with a weekly investment frequency, the DCA bot will automatically execute a total of five transactions. The details of these transactions are as follows:

Understanding Dollar-Cost-Averaging (DCA) Bot Performance

Over a five-week investment period, the average entry prices for BTC and ETH are calculated as follows:

BTC Average Entry Price (USDT): (29,000 + 30,000 + 31,000 + 32,000 + 33,000) / 5

ETH Average Entry Price (USDT): (1,400 + 1,500 + 1,600 + 1,700 + 1,800) / 5

In this scenario, Trader A purchases 0.09697632 BTC at an average price of 31,000 USDT and 1.2598973 ETH at an average price of 1,600 USDT. Given that Trader A has set a maximum investment limit of 5,500 USDT, and since the remaining 500 USDT is insufficient to cover the cost of a sixth auto-purchase (each investment being 1,000 USDT), the DCA bot will automatically cease operations after the fifth purchase. Consequently, the BTC and ETH held by the bot will be transferred back to Trader A’s Spot Account.

If Trader A opts not to set a maximum investment limit and the Spot Account balance falls short for the next auto-purchase, Trader A will receive an email alert to add more funds. The DCA bot will be paused until the Spot Account is replenished, after which it will resume at the next scheduled interval.

Please be aware that a DCA bot suspension due to insufficient funds does not result in automatic closure. Manual termination of the DCA bot is necessary if you wish to end its operations.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging (DCA) is particularly advantageous for those optimistic about a good asset, as it allows you to purchase at lower prices and reduce costs if prices drop.

The DCA strategy can lower the risks associated with investing during volatile market conditions. By averaging out purchase prices, DCA can help mitigate losses or potentially enhance profits. It avoids buying at peak prices and enduring prolonged losses. However, while it reduces risk, it may also limit potential gains. For those confident in an asset’s long-term value, DCA is a strategy worth considering.

Why Invest in Bybit’s DCA Trading Bots?

Easy Setup: Amid fluctuating market conditions, many investors seek to streamline their investment processes. Bybit’s DCA bot allows for automated daily, weekly, or monthly purchases, eliminating the need for chart analysis or technical evaluation. Take advantage of the DCA bot to simplify your investment routine and reduce repetitive tasks.

User-Friendly Platform: The DCA bot is accessible to users of all experience levels. Beginners can utilize the Auto-Fill function to set up a bot with either preset or custom parameters. More advanced traders can join our community for the latest market analysis and strategy recommendations.

No Additional Costs: Bybit offers the DCA bot at no extra charge. There are no hidden fees, and trading costs are based on your VIP status, calculated upon successful order execution.

Wide Market and Crypto Pair Options: The DCA bot is available on the Bybit spot platform for both USDT and USDC markets. Users have access to a diverse range of coins, including BTC, ETH, and BIT. Visit the Order page to see all supported coins.

Eliminates Emotional Trading: Daily trading can be emotionally taxing, with price fluctuations causing stress. Bybit's DCA bot automates the process, allowing you to set investment parameters and letting the bot handle transactions. If funds run low, you'll receive an email reminder to top up, ensuring continued investment.

Reduces Repetitive Tasks: Automate your investment schedule with the Bybit DCA bot, handling daily, weekly, or monthly purchases with minimal effort. No need for constant chart analysis or manual intervention.

Multiple Bots Capability: Bybit allows users to operate up to 50 trading bots simultaneously, including DCA and Spot Grid bots. Additionally, you can create multiple DCA bots for the same coin, offering flexibility and the ability to diversify investments.

Smaller Investment Portions: Rather than investing large amounts, the DCA bot facilitates smaller, periodic investments. This strategy is ideal for beginners who might be discouraged by market volatility, providing time to conduct more research while the bot invests on their behalf.

Lower Average Entry Point: Bybit’s DCA bot can help you achieve better entry points than manual trading by executing orders at various low price levels. This reduces the overall entry price if the market trends downward, which is particularly beneficial for long-term investments.

Proven Strategy Over Market Timing: DCA helps users manage costs without attempting to time the market’s highs and lows. Consistent investment through a DCA bot can result in a higher net value over time, even in declining markets. Best practices include selecting preferred assets, ensuring adequate funds, running the bot, and being patient.

The Bottom Line

Bybit's DCA trading bot is an effective tool for managing investment risk and avoiding large, lump-sum investments. As a passive strategy with no active management fees, it is ideal for those looking to earn income and contribute regularly to their investments. For a stress-free method to purchase crypto, consider using this bot!

Ready to start your DCA journey? Explore Bybit's DCA trading bots today to enjoy zero fees and highly customizable options.

(all our referrals will have lifetime FREE consultation on bots selection, token selection, trading tips and tricks and much more, Please use LinkedIn messenger only to contact us, be aware of scammers asking for money, we will not DM you first or ask for any fee)

#crypto#bots#dollar#earn money online#how to earn passive income#how to earn money#passive income#online income#online trading#trading platform#artificial intelligence#get rich quick

1 note

·

View note

Text

MevEngine is a Private Tech Agency of Blockchain Engineers, Quant Developers and Strategists Working on the Decentralized Finance market [ DEFI ] and CEFI markets like the Popular Coinbase.io, Binance and Kucoin.

0 notes

Text

DCA vs. Grid Bot Strategy Explained on Clarisco

In the dynamic realm of cryptocurrency trading, automation is crucial for investors seeking to optimize their trading strategies. Dollar-cost averaging (DCA) and Grid Trading are two standout automated strategies. Each provides unique advantages and is designed to meet diverse market conditions and investment goals.

In this blog, we'll explore the key differences between DCA and Grid Bot trading strategies, focusing on their development and implementation, as well as how Clarisco can help you navigate these options effectively.

Understanding Dollar-Cost Averaging (DCA)

Dollar-cost averaging(DCA) is an investment strategy where an investor splits the total investment amount into smaller, regular purchases of a specific asset. This method aims to minimize the effect of market volatility by spreading out investments over time. By doing so, the investor naturally buys more assets when prices are low and fewer when prices are high, resulting in a more balanced and less risky investment approach.

Key Features of DCA

1. Consistency:

DCA involves regular investments, promoting a disciplined approach.

2. Risk Mitigation:

By averaging the purchase price over time, the strategy reduces the risk of making a large investment at a peak price.

3. Simplicity:

Investors don't need to time the market, simplifying decision-making.

Exploring Grid Trading

Grid Trading is a strategy that places multiple buy and sell orders at predetermined price levels. The goal is to profit from market fluctuations by executing trades at these intervals. This strategy creates a "grid" of orders, allowing traders to capture gains from both upward and downward movements.

Key Features of Grid Trading

1. Capitalizing on Volatility:

Grid Trading is designed to thrive in volatile markets by taking advantage of price swings.

2. Automation:

The strategy can be completely automated, eliminating the need for continuous market supervision.

3. Customizability:

Traders can adjust grid parameters to align with market conditions and their risk tolerance.

Comparing DCA and Grid Trading

1. Objective:

- DCA: Focuses on long-term accumulation of assets by averaging the purchase price over time.

- Grid Trading: Aims to generate profits from frequent trades triggered by market volatility.

2. Market Conditions:

- DCA: Suitable for investors looking to build a position in an asset over time, regardless of short-term price movements.

- Grid Trading: Ideal for traders seeking to exploit short-term price fluctuations.

3. Implementation:

- DCA: Involves periodic investments of a fixed amount in a selected asset.

- Grid Trading: Involves setting up a series of buy and sell orders at specified intervals.

4. Risk Management:

- DCA: Decreased risk because of the gradual investment strategy.

- Grid Trading: Higher risk due to frequent trading, but with the potential for higher returns in volatile markets.

DCA Bot and Grid Trading Bots Development Strategy with Clarisco

DCA Bot Development

Creating a DCA bot involves developing a system that automates regular investments. Key components include:

1. Investment Schedule:

The bot should support customizable investment intervals and amounts.

2. Asset Selection:

Users need the ability to choose specific assets for their DCA strategy.

3. Risk Controls:

Incorporating stop-loss and take-profit settings can help manage risks.

Grid Trading Bot Development

Grid Trading bots require a more sophisticated setup to handle multiple orders. Essential features include:

1. Grid Configuration:

The bot should allow users to define grid size, order intervals, and price range.

2. Order Execution:

Effective handling of numerous buy and sell orders is essential.

3. Risk Management:

Features like dynamic grid adjustment, stop-loss, and take-profit settings enhance the bot's performance.

How Clarisco Can Help

At Clarisco, we specialize in Grid Trading Bot Development and DCA Bot Development, offering customized solutions to meet your trading needs. Our expert team can help you design, develop, and deploy automated trading bots tailored to your specific strategies. With our advanced technology and deep understanding of market dynamics, we provide robust, reliable, and efficient trading bots that can enhance your trading performance.

Conclusion

Understanding the differences between DCA and Grid Trading strategies is vital for making informed investment decisions. While DCA offers a disciplined approach to long-term investing, Grid Trading provides an opportunity to capitalize on market volatility through frequent trades. Both strategies have their unique advantages and can be effectively automated with the right tools.

At Clarisco, we are committed to helping you navigate the complexities of automated trading. Whether you're interested in Grid Trading Bot Development or DCA Bot Development, our solutions are designed to help you achieve your trading goals with ease and efficiency. Explore our services today and take your trading to the next level.

0 notes

Text

Trending Types Of Crypto Trading Bots in the United States (12th August 2024)

Sniper Bots: https://www.kryptobees.com/blog/sniper-bot-a-quick-profit-generator-in-crypto

Flash Loan Bots: https://www.kryptobees.com/blog/flash-loan-arbitrage-bot-development

Triangular Arbitrage Bots: https://www.kryptobees.com/blog/triangular-arbitrage-bot

DCA Trading Bot: https://www.kryptobees.com/blog/dca-trading-bot-development

MEV Bot: https://www.kryptobees.com/blog/mev-bot-development

Grid Bot: https://www.kryptobees.com/blog/grid-trading-bot-development

DeFi Bot: https://www.kryptobees.com/blog/defi-trading-bot-development

Hedge Bot: https://www.kryptobees.com/blog/hedge-trading-bot-development

#blockchain#cryptocurrency#brazil#france#germany#italy#california#new york#texas#colombia#argentina#uruguay

0 notes

Text

Mastering Meme Coin Trading Unveiling the Best Bots for Your Bull Run

In the exhilarating realm of cryptocurrency, meme coins have carved out a niche that blends speculative fervor with potential profitability. As the market surges with excitement, navigating this landscape demands not just insight, but the right tools to capitalize on every opportunity. At Mobiloitte, we present an exclusive look into the top trading bots Development designed to enhance your meme coin trading journey during this bull run.

Trojan on Solana: Power and Precision

Discover Trojan on Solana, a cutting-edge Telegram-based bot tailored for the Solana blockchain. Engineered by a former Unibot team member, Trojan combines simplicity with advanced trading features such as DCA orders and automated limit orders. Its exceptional efficiency, powered by BOLT PRO technology, ensures lightning-fast transactions, while cross-chain capabilities facilitate seamless asset transfers between Ethereum and Solana. For traders seeking versatility and robust performance, Trojan on Solana stands as an indispensable tool.

BullX: Versatility Across Chains

Experience BullX, the multichain trading bot supporting Ethereum Mainnet, BNB, Base, Arbitrum, Blast, and Solana. Instant trading capabilities allow you to act within seconds of token creation, backed by detailed listings and audit reports that ensure informed decision-making. Whether you're a seasoned trader or new to the game, BullX's comprehensive insights into liquidity, market cap, and token age empower you to navigate diverse blockchain ecosystems with confidence.

BONKbot: Speed and Simplicity on Solana

Designed specifically for the Solana blockchain, BONKbot excels in user-friendliness and transaction speed. Powered by Jupiter, a Solana-based DEX aggregator, BONKbot swiftly navigates decentralized exchanges to secure optimal prices. Its intuitive interface, coupled with customizable MEV protection modes and timely token alerts, ensures seamless trading experiences. For traders prioritizing efficiency and ease of use within the Solana network, BONKbot emerges as a preferred choice.

Why Choose Mobiloitte for Your Trading Needs?

At Mobiloitte we understand that success in meme coin trading hinges on leveraging the right tools. Our curated selection of top-tier trading bots Trojan on Solana, BullX, and BONKbot reflects our commitment to empowering traders with cutting-edge technology and strategic insights. Whether you're aiming to capitalize on market trends diversify your portfolio across multiple blockchains, or streamline your trading operations our solutions are designed to meet your evolving needs.

Seize Your Opportunity

As the cryptocurrency market continues to evolve, staying ahead requires more than just knowledge; it demands actionable tools and strategic partnerships. With Mobiloitte.com, you gain access to not just a platform, but a comprehensive suite of resources designed to elevate your trading game. Our commitment to innovation and customer satisfaction ensures that you're always equipped to make informed decisions and capitalize on the dynamic opportunities presented by this bull run.

Conclusion

Embark on your journey to mastering meme coin trading with Mobiloitte Explore our range of cutting-edge trading bots — Trojan on Solana, BullX, and BONKbot — and discover how each can enhance your trading strategy Whether you're a novice or seasoned trader our solutions provide the competitive edge needed to thrive in today's fast-paced cryptocurrency landscape. Join us at Mobiloitte and elevate your trading experience to new heights.

#crypto trading bot development#crypto trading bot development company#online crypto trading bot#arbitrage crypto trading bot#arbitrage crypto trading#crypto trading bot development services#crypto trading bot service#crypto trading bot software

0 notes

Text

2024’s Best Crypto Trading Bots for Maximizing Profits

Cryptocurrencies and their trading are constantly developing, and one of the biggest advancements in this sphere is the emergence of crypto trading bots. These are automated systems that are used to make trades for you based on your trading plan by using complex algorithms and market information. To increase profitability in 2024, business people need to know and incorporate the most effective crypto trading bots. In this article, I will show you the current best crypto trading bots for 2024, what they offer, and how you can use them to achieve your financial objectives.

Understanding Crypto Trading Bots

What Are Crypto Trading Bots?

Crypto trading bots are preprogrammed applications that help to deal with a trading platform independently performing buy/sell orders on behalf of a trader. Traders apply stored decision-making algorithms depending on the configurable parameters, which might be derived from movements of prices, to make trade decisions. These bots provide market coverage 24/7 hence it is capable of targeting opportunities that you may be unable to attend to due to other activities.

How Do Crypto Trading Bots Work?

Crypto trading bots operate automatically through the use of algorithms to integrate market data analysis and signals to auto-trade based on specific patterns. Parents can be developed to employ certain approaches for example trend following, arbitrage, or market making. Since emotions and bias cannot be an inherent part of trading robots, these trading bots can reduce inconsistency within trading and potentially bring more praise.

The Top Crypto Trading Bots for 2024

1. 3Commas

Key Features:

Smart Trading Terminal: This enables users to work with orders and perform transactions on many exchanges without leaving the main window.

Automated Trading Bots: Freely compatible with grid, DCA (Dollar-Cost Averaging), and options bots.

Backtesting: Allows users to simulate trading strategies against historical price data to help fine-tune their solutions.

Benefits:

User-Friendly Interface: User-friendly for those starting out as well as highly developed for skilled investors.

Customizable Strategies: Users can personally relate the bots to their personality and trading strategies.

Robust Security: For the API key, there is protection, and the use of two-factor authentication is available.

2. Cryptohopper

Key Features:

Marketplace for Trading Strategies: Traders are also able to purchase and sell strategies developed by other traders.

AI-Driven Bots: It shows how machine learning can be used to enhance the firm’s trading options.

Social Trading: Enables users to tag along and replicate the trades of the more experienced traders.

Benefits:

Comprehensive Tutorials: New users have quality and wide information available from the education materials.

Flexibility: Supporting a multitude of exchanges and allowing for flexible options.

Advanced Tools: They have features like trailing stop loss, technical analysis, and others.

3. HaasOnline

Key Features:

Scriptable Bots: HaasScript lets users build their own bots.

Cloud and On-Premises Solutions: Runs for a short period to offer flexibility in deployment.

Market Arbitrage: The bot supports the arbitrage strategy, in which the same cryptocurrency is bought on one exchange and sold on another simultaneously.

Benefits:

Highly Customizable: Ideal for informative expert buyers who wish to have full command of the bots they intend to buy.

Powerful Analytics: Comes equipped with comprehensive market analysis tools.

Reliable Performance: As a car well renowned for fast and efficient movement it is a car every civilian would wish to have.

4. Shrimpy

Key Features:

Portfolio Management: Specializes in rebalancing of portfolios to achieve the most efficient level.

Social Trading: Let users identify the top traders and mimic their actions.

Indexing: Allows users to track their different preferred cryptocurrencies through indexes.

Benefits:

Ease of Use: Very easy to use for all audiences and it is intuitive.

Community Support: Extensive online community and help forums.

Performance Tracking: Measurable indices regarding all the strategies that are to be implemented.

5. Gunbot

Key Features:

Wide Range of Trading Strategies: The indicators of this trading terminal include numerous built-in strategies such as Bollinger Bands, Ping Pong, Step Gain, etc.

Customization: Additionally, users can change strategies into behaviors and develop new ones.

Compatibility: Compliant with several well-established exchanges.

Benefits:

Versatility: This strategy is good for varying market conditions and appropriate for different trading approaches.

Active Community: They are very active in updating their apps and also have centers for active user consultation.

Cost-Effective: Flexible pricing to capture the various prices that one can have on cable.

Choosing the Right Crypto Trading Bot

Consider Your Trading Goals

First of all, while choosing a particular crypto trading bot, one should define what tasks this bot should be able to solve and perform during crypto trading.

Do you want to make long-term investments that can yield good returns in the future or do you want to make quick investments that shall yield good returns immediately? Some bots are best for one tactic while others function for different ones so pick the one that matches your need.

Evaluate Costs and Fees

Crypto trading bots are available in different models that include subscription-based, one-time license, or some earning from the commission shared from the bot.

It is wise to have a look at the money you can afford to spend and what that money will get you when deciding upon a bot.

Assess Security Features

Security is always a primary issue when it comes to cryptocurrency investing.

Lastly, make sure the trading bot you are going to engage with has proper measures put in place to enhance the security of its operations like protection of API key, use of two-factor authentication, and last but not least data encryption.

Test and Optimize

To avoid being scammed in this area, frequently use the trials or demo accounts before doing actual business with any specific trading bot.

Great features for backtesting let you fine-tune your strategies based on the evaluation of historical data and provide a better outcome in most case scenarios.

Conclusion

Crypto trading bots are powerful tools that can help business people maximize their profits in the fast-paced world of cryptocurrency trading. By automating trading strategies, these bots offer consistent performance, eliminate emotional biases, and provide round-the-clock market monitoring. The top crypto trading bots for 2024, such as 3Commas, Cryptohopper, and HaasOnline, offer a range of features and benefits to suit different trading styles and goals.

For those looking to leverage the full potential of crypto trading bots, Kryptobees Services stands out as the best crypto trading bot company. With a strong track record, innovative solutions, and a commitment to customer satisfaction, Kryptobees Services can help you navigate the complexities of the cryptocurrency market and achieve your financial objectives.

Invest wisely, automate your trading, and let the best crypto trading bots of 2024 work for you.

0 notes

Text

Developing a Dollar-Cost Averaging (DCA) trading bot involves creating a system that automates the process of investing a fixed amount of money into a particular asset at regular intervals, regardless of its price. This strategy mitigates the impact of market volatility and reduces the risk of making large investments at inopportune times. DCA trading bots offer a strategic approach to investing, promoting consistency and reducing the emotional impact of market swings, ultimately aiding in long-term financial growth.

Explore More - https://www.addustechnologies.com/blog/dca-trading-bot-development

#CryptoTrading#DCAInvesting#TradingBot#CryptoBot#AutomatedTrading#InvestmentStrategy#CryptoInvesting#BotDevelopment#CryptoAutomation#TradingStrategy#Cryptocurrency#AlgoTrading#InvestmentBot#Bitcoins#TechInnovation#BlockchainTechnology#CryptoFinance#MarketStrategy#PassiveIncome

0 notes

Text

Pro AI Trading Platforms

Trading platforms offer people a virtual platform for investing and achieving financial goals. These platforms are often equipped with real-time quotes and news feeds as well premium research tools and charting capabilities that make investing stress-free.

Low fees, investment options, and cutting edge strategy tools are all hallmarks of the best financial planners

.

Getting Started

It is crucial to find a platform that will help you achieve your long-term goals, whether it's boosting your retirement or generating income from investments. The best platforms are those that offer no or low fees and commissions, as well as free premium research and fast trade execution.

Find AI trading software, such as Kryll, that allows you to create your own bots by using a simple no-code editor. Kryll, a leader in the field of automated trading bots for cryptocurrency trading strategies, stands out.

Beware of sites that provide AI trading bots for free. Be wary of sites that offer free AI trading robots.

The Platform

The best AI trading bots are easy-to-use, provide real time market data support, and accommodate personal investing strategies. They can also reduce emotional biases in buy and sell decisions.

Are you looking for a system that offers these capabilities?

The ideal AI crypto trading robot must be transparent and show its track record. It should also provide a reasonable return and have a transparent investment strategy. Be cautious when you hear that a certain product or service is endorsed by celebrities and business leaders. Scammers could use deepfake technologies to fake endorsement videos.

Managing Your Account

This broker has a platform that is easy to use, offers quick access features and provides personalized assistance. It can meet the trading needs of any trader. No account minimum is required for users to access commission-free ETF and option trades. Their funds can be invested in different ways, earning interest, or they can choose not to invest.

The layout of the platform can be customized by traders, adding modules such a charts, news feeds or data panels. Notifications can be set to alert traders of certain market moves, news stories or indicators. This allows them to avoid constantly monitoring the markets.

AI Trade Pro scammers build trust by having intimate, one-on-1 conversations with their victims over messaging apps before leading them to misleading websites that promise huge profits and happiness. It is possible to limit the impact of this scam by taking proactive measures such as reporting suspicious activity, blocking accounts and spreading awareness.

Trading

Diversifying the trading portfolio you use is a key way to achieve trading success. Diverse strategies can help you take advantage of fluctuations in the market while also protecting your profits and avoiding any losses.

Trader AI has a wide range of tools that can help traders achieve success. These include an impressive array of automated trading bots. These bots can save you time by buying the most popular cryptocurrency when prices are low and selling them at predetermined profit levels. This is called smart DCA.

Trader AI uses network firewalls to protect user data and provide customer support by phone or live chat. If there is a breach of security, Trader AI will inform users, update their systems and offer full refunds for any victims.

1 note

·

View note

Text

Kryptobees stands as a premier authority in DCA trading bot development, offering cutting-edge solutions tailored to optimize cryptocurrency investments. With a proven track record of excellence, Kryptobees empowers traders with innovative tools and strategies, ensuring efficient and profitable trading experiences. Trust Kryptobees for expert guidance and unmatched expertise in the dynamic world of cryptocurrency trading.

To Know More: https://www.kryptobees.com/blog/dca-trading-bot-development

0 notes