#day in the life of the best sahd ;-;

Explore tagged Tumblr posts

Photo

#ts4#sims 4#sims#simblr#pines legacy#odin pines#elizabeth pines#day in the life of the best sahd ;-;

445 notes

·

View notes

Note

Never thought I’d see the day Nick Deorio was fighting in the trenches with us as a drolo. It almost makes me want to reinstall twitter just for that. Almost. Mans was scarred from John Swan and he wants to be on the right side of the argument this time. He’s seen dream come with receipts so he knows. Not an expected soldier, but I’ll take him regardless.

Saw a previous anon post about how Twitter has the mindset of “being a woman means being a perfect person” and how that’s not a good mindset to have; I wholeheartedly agree with that anon.

I’m of the mindset that I will protect all women, but I will not support them. There have been people in my life that are women that have made dumb decisions and have dangerous mindsets and I’ve called them out on it continuously. However, the second they tell me they need my help, I’m there. It doesn’t matter if we haven’t talked in months, or since high school-you ask for my help, you got it. No questions asked. Because like that anon said, we are human first before we’re women and we are going to make mistakes. I want to make mistakes and have the ability to own up to them like anyone else, cause if people protect me from myself, I’ll be a very misguided and disillusioned person.

I also think that mindset stems from many people not knowing what feminism actually is. I’ve seen on TikTok this trend of women going “I’m not a feminist” and then saying some wild ass thing like “I can wear dresses” as if that’s all feminism entails. True feminism is recognizing men and women are equal to each other and deserve to be treated as such. Equal pay, same opportunities corporate-wise, same options to be SAHM or SAHDs, etc. That also means women can be horrible people just as much as men, and they deserve to be held accountable for it.

Twitter thinks women need protecting and we can do no wrong and that’s absolutely dangerous. And I think thats part of why Caiti responded the way she did in her final stream, cause she’s been misguided to believe that she can do no wrong as a woman, hence the angry reaction to people pointing out her inconsistencies. And I feel for her, cause she’s young, and it seems like shes still easily impressionable, which is the perfect combination for Twitter to take over her thinking. I hope she takes a long, indefinite break from the internet and goes to see adults who aren’t chronically online to help her, cause she’s a very unstable person.

Women aren’t perfect, and we shouldn’t be protected from ourselves. But if one of us is in genuine need of help, we rally as a people to be there; that’s the best part of being a woman-the sisterhood and that gets taken away the more people develop the “women are perfect and need to be protected” mindset.

-L :)

oooh very good additions!

One of the worst things to ever happen to the internet is to create a space for words to be watered down to the point that people have completely missed the meaning of the original word and now it's something different.

Which leads people to speak damaging rhetoric in the name of something they /think/ they're representing properly when thats just not the case. (Unfortunately this is how we get radfems and terf rhetoric under "feminism" according to some people on the internet)

25 notes

·

View notes

Note

may i ask you questions 1,15,18 and 19 from the captain swan christmas ask game that was floating around?

🏴☠️🦢❔🎅

Absolutely! Thank you for the ask!

1 - How long have you been a OUAT fan?

I started watching as it was released, eleven years ago. And, I adored it. But, some life events occurred and situations changed and I failed to pick it back up until this year. We have Disney + b/c children and it popped up there. I love fairytale retellings, especially when the villain is given depth. So, I picked it back up and have rewatched it three times? Some episodes four times, since August/September. It and Miranda are my comfort shows, so the rewatch numbers are going to be ridiculous very soon. ha 15 - Favourite Christmas Song

This just changed this year - "Snow Waltz" by Lindsey Stirling

18 - Do you have any Captain Swan Christmas headcanons?

If you haven't seen Kazzy's answers to this, I point you that way b/c those have been living (rent-free) in my head since she shared them. Original HC though... Killian always gets the best gifts. Not necessarily big or extravagant but always something that means so much to Emma. Emma gives gifts that are practical. Killian adores them and uses them endlessly and dramatically so Emma knows he likes them. Regina, the Charmings, and the Swan/Jones get together on Christmas Eve for a late family lunch. Killian makes everyone breakfast while they all cook. Regina makes the centrepiece of the meal and she is an outstanding cook. Snow makes pies - not apple - and desserts and they are wonderful. David makes a spiced cider to warm everyone up - one for the kids and one for adults. Emma brings a side dish that she picked up at Granny's the night before and put in her own dish to reheat when everyone starts cooking together. Everyone knows she doesn't cook it, but no one calls her out. They play Christmas music in the background and trade homemade gifts afterwards. (Snow - knitting, David - woodwork, Emma - painting, Killian - leatherworking, Henry - stories, Prince Neal - fingerprinting that Snow clearly helped with, Hope - drawing with crayons that she didn't let anyone help with)

19 - Favorite Captain Swan headcanons in general?

Killian and Emma have watched every Peter Pan retelling, cartoon, etc, and Killian vehemently discusses his portrayal in the media. Sometimes Emma will mutter "tick-tock" just to rile him up again. Killian doesn't work at the sheriff's office long, he finds it stifling. He ends up being a SAHD with Hope. They go to parks, go sailing, and have an adventure every day. Killian cooks. He is very good at it. Emma has gotten very good at very specific snack items - making popcorn on the stove, grilled cheese, etc.

I should probably actually get some work done this morning, so I will leave us there.

1 note

·

View note

Text

I genuinely think there is space for both takes on this genuinely I do. Cause SAI was so so good, but so many people didn’t like it and thought he was selling out or whatever! They thought he was going against what people believed to be his true artistic nature to do pop music and that the whole album was disingenuous, but I believe with my whole heart that those people have it completely backwards, meaning that I believe this was the most genuine thing he could have done during this time in his life. Scaled and Icy was written and produced during the pandemic, and that was an insane time for all of us, objectively. Right before SAI started being a real project was when the first lockdowns happened. At this point in his life, Tyler and Jenna had just had their first baby in February of 2020, and he and Josh were scheduled for what he referred to as a "victory lap" for Trench's "The Bandito Tour". Obviously, all of those shows were canceled, and it was an insane time for everyone. Josh was in LA with Debby and Jenna and Tyler were with Rosie. He basically became a full time SAHD while he was making music on facetime with Josh. When they were writing this music, the clear indication given their musical history and previous discographical contributions was to go head first into like the depths of darkness, cause that's where most of the world was. But that's not where Tyler was. He was getting to watch his daughter grow up and sleep in his own bed with his wife every night and Josh was getting married to Debby Ryan. They had been on tour for over a year straight at that point coming out of a beautifully done hiatus that was not only logistically very impressive but artistically incredible. The music they had spent their hiding time after Blurryface making was raw, and dark and perfect. So many lives were lost during this time. It was scary, and tense, and people just needed a pick me up coming out the other side of 2020 into 2021. Tyler said in an interview that he had to actively resist the urge to go dark with this album, he was literally writing it in his basement. He also said that this album was at its core, about imagination. Cause at the time, imagination was all that this world had, and that is what he chose to lean into. In the apple music interview he said "The idea of adding to the pressure of what's going on in our world, it didn't feel right." I think given his life circumstances at the time, it was the best, most genuine thing he could have put out, and having something bright and bubbly to listen to was very good for everyone. Also while the lore for this story is super cool, if we are constantly entrenched in the lore and don't allow outside perspectives, the music becomes inaccessible to people. So IRL, it wasn't disingenuous at all. He did what felt right and chose to share the fruits of that with us. But this is where the other argument comes in. In the context of the lore, SAI is INHERINTLY disingenuous, but obviously we didn't know this at the time of the release and arguably this didn't become even remotely clear until well after the live stream performance (feature performance event in universe cannon). We know it's disingenuous in terms of the lore because of this specific letter from Clancy that can be found on dmaorg.info that I've included below. For those of you who can't read cursive, here is the TL;DR.

Clancy is in prison after his last escape attempt. Since his imprisonment though, he has accidently made quite the name for himself in the city of Dema as an artist and rebel. The Bishops Hate This, but ever determined to maintain power over the people of Dema, they decide to use Clancy's fame to their advantage and decide to start forcing him to make propaganda that he will be forced to perform on a TV show (FPE aka the live stream available for our viewing). They bring him a room every day with a blue door and he sits and writes music under the supervision of Keons (Clancy's bishop) and 3 other bishops he does not recognize (sometimes up to 8 of the bishops, but never all 9, and Nico was never present because Clancy claims he would be able to "feel it if he was there"). These writing sessions went on for many months. Everything written was monitored and had to be "for the benefit of the city of Dema". After the FPE, Clancy preforms at the annual assembly of the glorified (as entertainment for the yearly Big Party For The VIPs of Dema), which takes place on a submarine. Trash the dragon (being controlled by Keons) then destroys the submarine, allowing Clancy to escape to Voldsøy, (map also attached) where he is able to learn psychokinesis from the Neds (neural expansion devices). So where does this leave us? An album, that outside of the lore was, given the circumstances of the real world tragedies that were happening left and right, the most genuine work they could have created at the time, but in universe was LITERALLY forced creativity and by definition disingenuous because it was monitored and forced album they have created. It is also important to mention the in universe parallels to what was going on IRL with the absence of the "real" torch bearer. Although he was being monitored by the bishops during his creative process, Clancy was technically creating in solitude during these sessions, the same way Josh and Tyler were having to create in (technical due to their ability to face time and the way their computer interfacing worked) solitude! During the duration of the SAI lore segments, and up until the Navigating MV (although they obviously had been able to reconnect IRL long before this) the torchbearer was not with Clancy the WHOLE time. He was alone on Voldsøy, alone when he learned psychokinesis, alone when he signaled the banditos after starting a fire in Dema using Keons's body, and alone when he crossed the Paladin Strait. But moving back to point of this post lol. Of course Clancy "regrets" making SAI. It was not the type of music he wanted to make and it didn't carry the message that held close to his firm beliefs that the people of Dema were trapped and needed to be rescued, or that the Bishops and Vialism as a whole were wrong. But Tyler? Scaled And Icy was written in a terrible time for the world and a kind of magical time for Tyler and his family. The album that resulted from his taking a hard turn into left field was taken at face value as just some mediocre pop album they were making to get more radio play or to try to win another Grammy by so many people in and out of the fan base that the backlash it received as being fake or lazy after they had to work extra hard to make it could NOT have felt good. I don't think the real life regret stems from him not being happy with the album, but rather unhappy that it was received so poorly by so many of us. It didn't stick. The industry was meh about it. This is very clearly (and beautifully) illustrated in the MV for "The Craving" single version. They both work so hard with the delicacy and intricacies of their respective parts of the "offering" to the shot put suits (who are representative of the industry). The bullet is fired, and it does not his the target. "That's a miss. Next." Then they're left with an empty box. So in conclusion I guess SAI was a really good album that did exactly what it was supposed to given the time it was written and released, and I personally think its gotten better with age, but I can understand why Tyler might disagree.

Ok yeah sure maybe "I wish I never did Saturday" is Tyler regretting the SAI album OR. AND HEAR ME OUT. It's Clancy wishing he had never been held captive and forced to make a propaganda album because it must have ruined a lot of the hard work the Bandito rebellion did in Dema 😌

#twenty one pilots#tøp clique#top lore#clancy#tyler joseph#josh dun#scaled and icy#i had some more to say honestly but i ran out of characters#sorry for the rant#this took me way too long to write#clancy album#twenty øne piløts

401 notes

·

View notes

Video

youtube

Mittens & me #business #affiliatemarketingforpeopleover40 #affiliatemar... 👉I can’t believe how much I used to work to barely get by…since starting my online biz, my world has been turned upside down.IN THE BEST WAY POSSIBLE!For 30 years, I worked 60-80 hours a week and I now work 1-2 hours a day and can do it from anywhere!.If you are tired of working so d*mn much, spending time away from your family, or just want the freedom to enjoy your life in the way you want to…✨👉Follow for more tips!! 👇.💰 @margetingtom👈✝️ @margetingtom👈⭐️ @margetingtom👈.💬Comment if you have any questions!#smallbusiness #businessconsultant #businessadviser #seooptimatzation #businessman #nomore925 #richdadpoordad #sahm #sahd

0 notes

Text

Ideas for continuing shorts/a show based on Encanto

Okay so Encanto came out and it is doing really really well, like a lot of people are calling it the best thing Disney has done in very long time... so naturally Disney wants to turn it into a whole franchise. Once upon a time that would have just meant at least 2 sequel movies and a ton of dolls/cloths. Well they are selling the dolls/cloths, and we may some day get the sequels. But in the age of streaming and Disneyplus there is talk of Disney first doing a series of shorts or possibly even a show. I love both those ideas and here is some what I would like to see.

The creators tweeted that Casita has only 1 bathroom and all 12 Madrigal fight over time in it. Make a short on that.

They also said that Felix and Agustin are good friends and, since they have no powers, are basically SAHD' as well as doing the majority of the house work. Give me a day in their life.

I want flashbacks to when the triplets were growing up and what things were like back when it was just them and Alma inside Casita. On that note it occurs to me that their next birthday will be the first one all three have celebrated toghter in atleast 10 years, and I NEED everybody in the family (cough* the town*cough) to make a big deal out of that.

Show me Bruno trying to get to know his nieces and nephews. I want them to all watch/perform his telanovas together and bond. Also my personal headcannon is that 7foot rat-man Bruno was like Camilo's favorite piece of fanfiction, and Bruno gets worried that maybe Camilo won't like the real him. But once Camilo finds out his Uncle is a performer, and a card, he, much to Pepa's dread, starts to freaking worship him and always wants to be around him.

I would like some flashbacks and a bit more background as to what Alma and Pedro's relationship was like. Maybe have it be their anniversary or Pedro's birthday, and Alma is really reminesant over him. Her family get worried she is falling back into depression, so they ask her to tell them about some of her happiest times with Pedro, and them try to recreate them for her.

Okay so I would prefer if shorts where used to flesh out characters who got less screen time in the movie ( Agustine, Camilo, Dolores, etc) and don't want Mirabel to be the main focus of them all...but we'll I think its cool that she loves and is really good at embroidery and sewing. Since the movie didn't really give focus to these hobbies I would like a short or an episode of her wanting to make something really special and getting a case of artist block. Have her relatives do a bunch of things with her to try and help her get inspired. The girl deserves to get some support as opposed to always being the one to give it.

I want Luisa to adopt pets, either rescue a bag of abandoned kittens ,or maybe one of the donkeys she takes care of gives birth to a runt the rancher doesn't want and is planing to get rid of. But Luisa steps in and says she wants it. Have Luisa try to train them and make them really strong, but for them to get tired and decide to rest. Luisa gives in and just curls up with them for a break.

It's like the 5th rainy day this week, and everybody is stuck inside and acting really board. Camilo tries to start a house wide prank war to keep everybody (including Casita) entertained. Shenanigans ensure.

Flesh out Dolores and Mariono's relationship (no babies yet). They are implied to be each others true loves, but what is them dating like? Does Dolores help him with his poetry? What are her interests? Maybe do something where a big milestone is coming up and it seems like Mariano doesn't have anything planed so Dolores decides she will plan a special date. But it turns out Mariano did plan something for that evening, he just been nonverbal about it so he could surprise her, and they wind up surprising each other.

Antonio discovering uses for his powers. It occurs to me that he would understand pets. Someone suggested that dead goldfish lady might be Felix's bio sister; they look kind of alike and she is one of the few villagers who makes casual visits (not just for a party) to Casita. What if while babysitting him she mentions having a new fish that she is worried isn't acting well, so he sticks his finger in the water to bring the fish to the surface and asks it what it needs. Later the pair are shown infront if a brand new pond in her backyard that is full of goldfish, with Antonio telling her they are all very happy. Off in the distance you see a line of people and their pets wanting to see Antonio and ask if their is anything they could do better.

I know some people like to headcannon Isabela as lesbian. I am not going to give people grief for that as long as they acknowledge that is a headcannon, and in cannon she had other, still completely valid, reasons for not wanting to marry Mariano (not being in love with him, not having explored enough of herself and her power yet). I also do think the decision to leave Bubo (her true love) out from the first movie, and having her make decisions based on herself was a good one. But the Bubo in drawings and the deleted scene (well part of the deleted scene, I could do without the more explicitly part) seems like a really funny character, and I would like him to be introduced as long as it was done in a way that didn't impend on Isabela's growth or self discovery. He is clearly supposed to be knowledgeable when it comes to the jungle. Maybe she is having trouble caring for all her new plants, and Dolores hears Bubo wandering around the jungle studying plants, just outside the Encanto. So Lusia and Mirabel go get him and ask him to teach Isabela about the different types of plant needs.

Might be controversial but I would really love a short where the Madrigals are getting ready for/ celebrating traditional Columbia Catholic holidays. Yes they are confirmed to be Catholic.

#Encanto#Encanto franchise#Headcannons#The Madrigal's#Madrigal family#Casita#Alma Madrigal#Julieta Madrigal#Pepa Madrigal#Bruno Madrigal#Madrigal triplets#Agustin Madrigal#Felix Madrigal#Isabela Madrigal#Dolores Madrigal#Luisa Madrigal#Camilo Madrigal#Mirabel Madrigal#Antonio Madrigal#Mariano#Bubo#Pedro Madrigal#Disney#Mirabel deserves to be a Disney princess#The whole family does#Disney make it happen

104 notes

·

View notes

Text

VS1 - Art Project - Self Potrait

For my self portrait I chose to create a collage with all of the things that I am very passioonate about. In the center of the collage is a mother and child which represents my daughter and I. I have a 3 year old daughter who I adore so much who I believe has changed my life. My daughter is the most important thing to me and I strive to be the best influence and provider that I can be for her. I included the earth because I really believe that I can help change the world. There are so many horrific things happening in the world like gun violence, racial injustices, gender inequality and so much more. Not to forget things like global warming and pollution and just so many other things that have a negative impact on the earth. I'm very passionate about doing what I can to make a change and encouraging others to do so as well. The angel represents my faith in God and how I truly believe that God is always n my side and the things I accomplish in this life are because of him. The life Cycle of the Butterfly represents my growth and the stages that I go through in life to one day blossom into the Woman I strive to be. I love art and creatig which is why I included the art pallete and supplies. I am also an educator which is why the teacher, child, and apple are included. I am studying Early Childhood Education and I would like to open my own Childcare center one day where children can learn and grow. The different sahdes of arms locking in represent Unity which I feel very strongly about. As I mentioned there are so many racial injustices happening all around the world and I truly wish that one day we can all come together and treat one another with love no matter the color. I was never raised to see people by color only by the traits of their character. I think we are all equal and no one race is superior to another so I hope that one day everyone else will think so too. The music notes symblize my love for R&B, Soul, Jazz, and Pop music. Music always seems to make me happier whenever I am down. The last picture of the women holding their fist represents women empowerment. Women should be able to make their own decisions and should not be told by others how to think, look, act or so on. Women should be able to do what they want with their minds and bodies and I chose this symbol to represent women in power. All of these things make up who I am and I am very happy with that.

0 notes

Photo

It’s hard to remember that our children are children. And because we are used to them it’s hard to remember to be fully aware of that. Like when your taking your child to the dentist. It’s easy to know how we feel about the appointment time And the drive there, the half day of work you are missing and the crying from the carseat but think for a minute. This is not about how we feel, It’s about how THEY feel. How scared are they? How strange is this to them? Why wouldn’t they be nervous? I use this as a means to encourage parents to see and remember that children are not “little people” they are “NEW people”. They may seem more advanced than they are simply because they can mimic US really well, but understandably they are very new to all of this. The concepts of life are very complex and hard to understand, much less master. If your childhood was good you have to remember that and give that experience to your child. If your childhood was bad then think of all the reasons why and give your child the childhood you would have wanted. No one is perfect and we are all human but remember that children are CHILDREN. They are just fragile little spirits who don’t really know what’s going on or how to handle it. They are literally trying their best to grow up WAY to soon. Just keep trying to treat them like kids. This is their only childhood. . . . . . . . #parenting #toddlers #newmom #newdad #stayathomedads #stayathomedad #stayathomemom #stayathomemomlife #parentingtips #parentingmemes #parentingadvice #children #raisingchildren #childhood #sahd #sahm #gaydad #gaymoms #gaydadsofinstagram #transdad #transparents #inspiration #inspirationalquotes #motivationalquotes #littlekids #parentingtips #parentinggoals #newparent #kidsareawesome #kidsarethefuture https://www.instagram.com/p/B1lErgmBVp0/?igshid=1bb0bv76fhfw5

#parenting#toddlers#newmom#newdad#stayathomedads#stayathomedad#stayathomemom#stayathomemomlife#parentingtips#parentingmemes#parentingadvice#children#raisingchildren#childhood#sahd#sahm#gaydad#gaymoms#gaydadsofinstagram#transdad#transparents#inspiration#inspirationalquotes#motivationalquotes#littlekids#parentinggoals#newparent#kidsareawesome#kidsarethefuture

0 notes

Text

may i?

A/N: hey, this is just a quick drabble i came up with. it was supposed to be a oneshot, but somehow i lacked inspiration, and it was a bit shorter. i needed to write the idea down when i got it, so here it is. i apologize since it’s not my best work. hope you enjoy nevertheless!

summary: maybe being stood up that night wasn’t that bad after all.

genres: fluff

word count: 2.7k

warnings!: nah fam this is just disgustingly yucky fluff.

Tick, tock, tick, tock. The clock was ticking, slower than ever. It felt like eternity when I had looked at the clock, although it had just been twenty minutes. It was twenty minutes too much, though. He was supposed to arrive in time, and he knew it as well. But where was he? Thoughts were being thrown around my mine, I couldn’t help them. Endless, hopeless thoughts. What if something had happened to him? A car crash, a mother’s death or something? What if he was only stuck in traffic? What if, what if, what if?

“Miss? Would you like another glass of water?” The same waitress popped by. I smiled and nodded. She had some pity in her gaze and although I wanted to tell her that it was justified, I was supposed to play the role of someone that was totally capable to hold herself together. Even if her date would never show up. “I’ll bring the glass. But I’m afraid I was have to remind you that we’re closing in an hour”, she ended her monologue that she might’ve wished was a dialogue. I nodded to show her that I understood what she said, and she was off to go somewhere.

I looked at my watch again, and sighed. Funny. He was the one that asked me out, and now he didn’t even dare to show up here? God, guys really are something out of this world. But maybe it was my fault? I could’ve gotten the day wrong, and just showed up here like a fool. Or maybe he was just still in traffic? No, he would’ve sent me a message if it was about the traffic.

People were starting to stare at me more and more. I felt like some animal being displayed in a zoo, for everyone to stare and wonder, how it got there. Some of the people staring at me had pity in their eyes, some had amusement. I didn’t look back at them, although I wanted to. Maybe their staring was justified. A lonely sitting alone in a restaurant for hours, waiting for someone that might never arrive. I could’ve ordered myself some food, but the little part in me wanted to keep the hope that he would show up at some point. He would show up, apologize for being late, and then he’d spend time with me again. My mind kept telling me that the hope was lost, but the voice of my heart was stronger.

I sighed and took a sip of my water. Its plain taste lingering on my tongue as I swallowed it down felt strange. I should be enjoying wine here with him, not just be sitting here and waiting for someone, who might’ve stolen my heart but never gotten it back with a glass of water. Natural water, not even sparkly for a more celebrational feeling.

No, this will not do. I was not going to just here and wait for him - I’ve done enough of it already. It was time for me to go, tail between my legs and accept my disappointment. I took one last sip of my tasteless drink before I stood up. I was done being humiliated. The waitress took a look of me and showed me an apologetic smile. “It’s on the house, Miss. We’re sorry for tonight”, she said, and I showed her a little smile, although I didn’t feel obligated to even show one. But she deserved it, she had been kind to me throughout the whole evening and I appreciated that. She probably had guessed what the situation had been before, so she probably had understood what it had meant. I walked to the front door and opened it, stepping outside to the chilly and misty September air. The leaves were starting to show colours, such colours you always seem to forget when they fall down. Different sahdes of red, orange and yellow, all intermingled to a gorgeous harmony.

I breathed in. Where was I supposed to go after this? He had said that he’ll come with a car, so that I wouldn’t have to buy two trips on a bus. I didn’t have the money to order myself a taxi or go on public transportation. Damn the boy for not showing up and guaranteeing me a ride to whatever I felt like going to.

As of faith, or perhaps something else, I felt someone bump into me. Annoyance was growing on me, so I was ready to turn around and tell the silly someone who had dared to touch me by accident a few chosen words. My mouth went dry, when I was faced with the person of the action. “Oh my God, I’m sorry. I didn’t see you there”, the man said as he took a step behind me. The man wasn’t the tallest I had ever seen, but his body made up for it. He had muscles, and he seemed strong, a little intimidating as well. If it wasn’t for the apologetic look on his face, I could’ve been scared. But something in him showed me that he was a good guy. At least from the outside.

“Oh, no. It’s okay. I was in the way, anyway”, I mumbled out, a bit baffled by my words and his kindness. The man showed a little smile, still looking like he felt the unstoppable need to apologize. The man ruffled his hair, a bit awkward about the situation. Maybe he didn’t feel like he needed to get out of the way of me, or maybe he just didn’t know how.

“My name is Jimin”, he introduced himself, being pushed to say something by the whole atmosphere. I nodded and told my name to him.

“That’s a pretty name”, he said; although I doubted he really meant that. It was just a casual compliment you’d tell anyone. Who knew.

“What are you doing here, by the way? Like, you’re standing in a bit strange place, if I may say so. In front of a restaurant. Not that you’re not allowed to stand there, or anything. Just wondering”, Jimin proceeded to the next question. My mind started to quickly analyze through all the things I could say. I could just lie and tell him that I’m waiting for my ride, or something else that was equally silly. Or I could just tell the truth. He was a stranger; he wouldn’t need to be kept secrets. I didn’t know him, which probably meant that he wouldn’t go ‘round town telling everyone about events that had occured to me.

“Well, I was supposed to have a date. Unfortunately, he didn’t show up tonight, so now I’m kind of trying to think, where am I supposed to go, when I have no ride nor money to go home”, I sighed, trying to sound like it was nothing. Something to brush off easily. Jimin’s expression changed into something even more apologizing.

“Oh, that sucks. I’m sorry.”

“Don’t be. It’s not your fault. I just have bad taste in men. There’s no one to blame but me”, I smiled, although the curving of my lips showed no happy emotions. A dry smile, you could say.

“Well, I still feel bad that you had bad luck. I think it’s not very kind for someone to just leave another one waiting for a date, and then not show up themselves. It’s like putting up fake hopes, and no one really deserves that”, Jimin sighed and smiled. It was warm, and although he probably didn’t mean to, his smile showed a little pity. I didn’t like people feeling pity for me for something they can’t help themselves, but since Jimin was a stranger, I could forgive him.

“Well, I guess I’m one more experience richer and that I now know how to choose guys better”, I answered, wiping loose strands of hair from my face. The atmosphere was growing deeper again, and not in a positive way. Jimin, again, was the first one to break through the almost uncomfortable feeling that had clouded us.

“Well, uh… Do you need a ride home? I mean, I could drive you. Unless you don’t want to, that’s fine. I get it, a man offering you a ride pretty late seems pretty sketchy, so I totally understand if you don’t want to come with me, you know?” Jimin murmured, clearly shy of his words. A smile curved on my lips. The guy was sweet. I pondered on my answer. Should I be taking his ride? After all, he was just a stranger, and he could be playing the nice guy card, until it was safe not to. Why should I trust him? Yet there was something so endearing and magical about him, that I couldn’t find the declining words in my mouth. Life was an adventure, right? Maybe letting Jimin drive me to my destination wouldn’t be too dangerous. He deemed the good guy attitude.

“That sounds great, if it isn’t a burden”, I stopped him before he’d get too much into whatever he was saying. Ruining his chance of blurting out too much unnecessary words, Jimin showed me a kind grin, keeping his mouth shut.

“Okay, that’s good. My car’s near here, so we can just walk there”, Jimin suggested, and I answered with a nod. Without a need to see more of agreement, he proceeded to start walking towards the vehicle. I walked behind him, admiring his built body. Was it faith or coincidence that on this particular night, I faced this stranger who was so happily willing to drive me. Well, might as well make the best of it. The evening had been pure garbage, if we were being honest, so we could make the best of it.

“Jimin?” I called out his name, and he turned around.

“Yes?”

“How about we get coffee on the way to my place? I mean, I could use something to drink right now, but I don’t want to make you drink alcohol since you’re driving”, I suggested. Jimin seemed to pay a few seconds to the thought, but he ended up nodding.

“Sure, that sounds great”, he answered, and fished out the car keys from his right pocket. His movements were swift and smooth, and it took him no longer than a few seconds to open the car with the keys. He rushed to the door, and opened it for me. A gentleman, even.

“Thank you”, I expressed, and he just answered with a kind, friendly smile. He seemed a bit stiff, but perhaps it was shyness.

“Are you fine with Joe’s café? I know the name is pretty lame, but the coffee’s great there, and I think you’d like it. At least I do”, Jimin stuttered with his words a bit, but I couldn’t deny that he was absolutely adorable. Honestly, I didn’t care where would I get my coffee, as long as I got the caffeine.

“Sure.”

“Okay, let’s go then, shall we?”

The coffee shop was neat and simple, but the taste of the drinks was anything but. The rich taste lingering on my tongue, filling and warming my slightly cold fingertips, creating a safe, secure feeling as I swallowed it down. Jimin clearly had a good taste in coffee, and bringing me there was definitely a plus.

The evening passed rather quickly. After ordering a cup of coffee, and having a discussion about everything between the land and the sky, we ordered another. As we sipped up the drinks, all sense of time seemed to be loss when the conversations got deeper. Jimin was a funny guy. He might’ve seemed a bit shy in the beginning, but when he dared to step out of his shell, a whole new person came with him. Someone, who laughed at everything and anything, but still knew how to keep the conversation meaningful and interesting. He had sparked my interest the first time he had bumped into me, and now the little spark created was slowly burning to be bigger.

Somehow he could always say something new and unique with his words. He possessed something, that I had never seen before in anyone. Perhaps it was his smile, or the fact that whenever he laughed, symphonies started to play in everyone’s head. Or maybe it was just the fact that he was kind and warm, wanting to make new acquaintances that could perhaps develop into something deeper. As I got to talk to him more, the mere memory of being stood up before was hazy. I could barely even remember the guy’s name, and all the negative emotions that I had previously felt, were long gone.

But, as most restaurants have a closing time, Joe’s café had one, too. Jimin walked me outside to his car, and again, as of habit, he opened the door for the lady, patiently waiting for me to get in and be seated. Then he returned to his original spot behind the wheel and started the car after climbing in. This was it. My last moments with this mysterious Jimin. With a sting in my heart, I told him my address and asked him to drive me there.

I have no idea how, but Jimin managed to make the car ride fun. The conversations that were interrupted by the café closing were continued, with even more laughs inbetween. The chilly September air didn’t feel like nothing anymore, not with the warmth Jimin kept on spreading around him. For my misfortune, the ride ended way too soon, and as he parked in front of my flat, I noticed myself feel a little bit sad.

“Well… This is my place”, I stated the obvious. Jimin nodded, slowly going back to his shy shell again. Bloody hell, this was really going to happen. I was supposed to go home after this, and forget about everything that had happened on this night. How was I supposed to do that? Jimin had made me feel so much better, more happier about the bad faith I was destined to face. And now I was supposed to let him walk away?

No.

“Uh, Jimin?” I asked, my voice shy and tender. I wasn’t a shy person, or a scaredy cat, but talking to Jimin made butterflies fly in my stomach, without a will or a need to stop.

“Yes?” He asked. He sounded curious at whatever I was going to say. Here we go.

“Could I possibly get your number? Tonight was really nice and I really liked being with you and it doesn’t even have to be something serious, if you don’t want to, I just want to be able to talk to you more than just today”, my speech was fast, and as I vomited the words out, I noticed myself how they didn’t make much sense of any kind. Jimin’s expression was a bit baffled. I was already fearing for the worse, but then the warm and familiar smile was spread on his lips.

“I was just going to ask you the same thing. Glad you did it first, though. This way I don’t have to embarrass myself”, Jimin giggled, and a smile was spread on my face as well. So he did feel the same as what I did! I didn’t make a complete fool out of myself.

Jimin gave me his phone and asked me to write my number down. My fingers were fast, and in no time, my number was saved in his phone. Jimin smiled when he sent a text to the number for me to be able to see, who was the number. “There, now you know that I’m me, and not just some random guy from the streets who somehow managed to get your phone number.”

I smiled at his silly statement. When will he not be adorable?

“Well, Jimin. I’m afraid I might have to go inside now. I’ll send you a message about the next time we could see, okay?” I suggested, and Jimin seemed to be content with the resolution. I showed a friendly smile as I opened the door and stepped out. The air didn’t even feel like it was cold, not when Jimin was standing close to me.

“Good night, Y/N.”

“Good night, Jimin”, I said before I closed the door and watched Jimin drive off to somewhere. How peculiar, but so, so enjoyable.

19 notes

·

View notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it's OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let's first discuss my outlook for 2019 and then I'll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There's an old saying on Wall Street: don't fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it's baffling why the Fed thinks inflation will accelerate in 2019.

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. And unless JP is a complete idiot for going to Princeton and Georgetown, he will probably adjust his interest rate stance if we enter full bear market territory. And let's put things in perspective, a -6.4% year for the S&P 500 is not that bad.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 2.45% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a potentially greater return?

My answer is no. Give me a 2.45% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there's probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son's 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I'm in the “low interest rates for life” camp. Once again, I don't see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don't see a real estate crash like the stock market crash of 4Q2018. Instead, we'll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I've learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I've given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don't stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it's time to get some help with writing. I'll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I'll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I've discovered how great it is to hire help around the house, it's only logical to hire help for our business.

4) Focus on profits. Since I'm going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I'll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It's going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don't pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better. I'm aiming for thought diversity not groupthink.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I've discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

Sit comfortably in circle time for more than 10 minutes

Enjoy playing with the piano, guitar, and drums

Play with toys without mouthing them

Screw and unscrew jar lids and turn door handles

Build towers of more than 6 blocks

Copy a circle with pencil or crayon

Show affection for friends without prompting

Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

Walk down stairs unassisted

Maintain balance while catching a ball or when gently bumped by peers

Throw and attempt to catch ball without losing balance

Walk and maintain balance over uneven surfaces

Use both hands equally to play and explore toys

Learn to pedal a tricycle

Daily Activities

Able to self-calm in car rides when not tired or hungry

Tolerate diaper changes without crying or whining

Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

Able to self-calm to fall asleep

Able to tolerate and stay calm during dental visits

Able to brush his teeth without whining or crying 3X a day

Is potty trained before preschool starts in September

Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

Uses “in” and “on”

At least 75% of speech is understood by any caregiver

Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

Understands “mine” and “yours”

Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we're all getting sick more often now as he's exposed to other kids. Luckily, my wife and I haven't been sick at the same time yet. We'll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I've been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don't care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I've never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it's also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a canon in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I'd be feeling nervous today since the stock market corrected by 20% soon after. It's not unreasonable to assume to house is now worth $200,000 (4.5%) less today.

Meanwhile, the seller of the house in Honolulu I've been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there's a good chance they will accept $3.5M – $3.7M because they finally dropped the ask down to $3.98M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won't need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Same for many big city residents around the world e.g. London, Hong Kong, Singapore, Sydney, Mumbai, etc. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It's going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai's finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I'm having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I'm going to give myself four weeks where I'll just publish one post plus I'll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I don't want to take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who also launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It's clear I haven't done a good enough job appreciating her efforts over the years, which is why I'm committed to do more for her in 2019 and beyond.

Steady As She Goes

If we can grow our net worth by just 5%, I'll be happy. I'm willing to forego upside investment potential to help ensure our net worth goes up in 2019. Despite our public investments accounting for only about 30% of our net worth, it gave me the most stress in 2018. This will change.

I still have hope the Fed will slow down its rate hikes. If they do, I'm confident the economy will chug along at 2% – 2.5% GDP growth and not enter into a recession. However, there are no exciting positive catalysts on the horizon except for a trade agreement with China by end of 1Q. 2019 will likely be another volatile year.

The last two years working on FS and being a SAHD has worn me out. Given we save most of our after-tax business income by living off our passive income, I'm excited to live it up more in 2019 and use my “vacation credits” to take it easier.

If you have any tips on how to smartly inflate your lifestyle without feeling guilty, I'd love to hear them. I also want to learn how to inhale the roses more often without feeling the need to always be productive.

What are some of your goals for 2019? How do you see the stock market and economy unfolding?

The post Financial Samurai 2019 Economic Outlook And Personal Goals appeared first on Financial Samurai.

0 notes

Text

Financial Samurai 2019 Economic Outlook And Personal Goals

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I've thought long and hard about how I can make 2019 better. I've found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it's OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let's first discuss my outlook for 2019 and then I'll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There's an old saying on Wall Street: don't fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it's baffling why the Fed thinks inflation will accelerate in 2019.

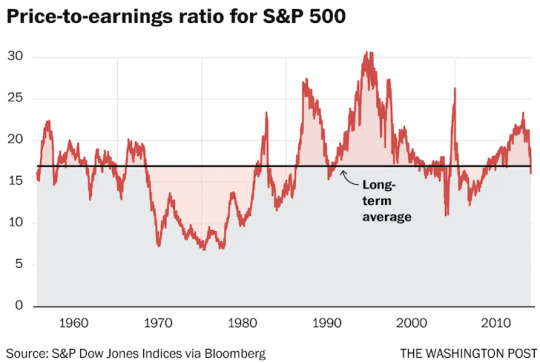

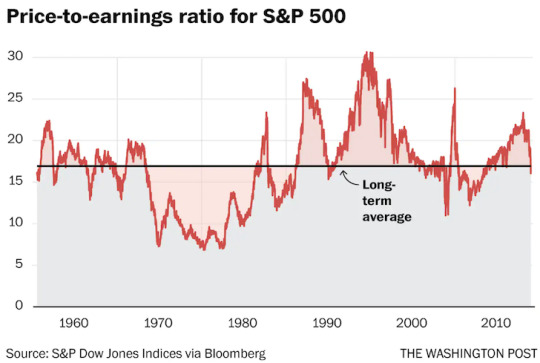

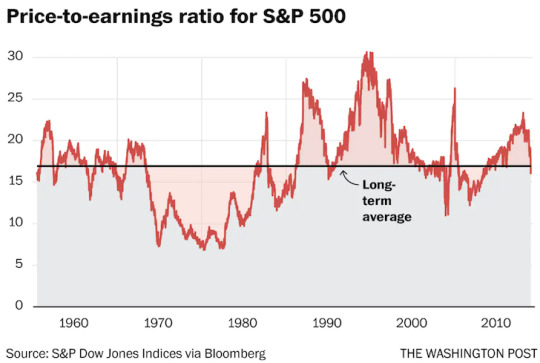

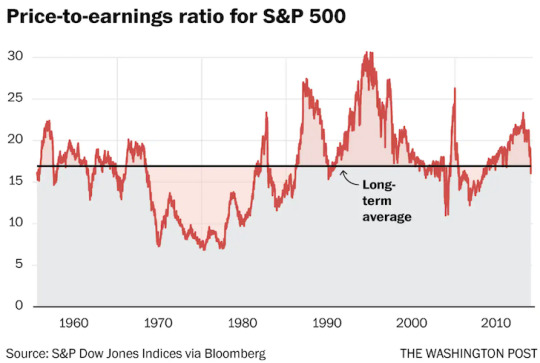

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. And unless JP is a complete idiot for going to Princeton and Georgetown, he will probably adjust his interest rate stance if we enter full bear market territory. And let's put things in perspective, a -6.4% year for the S&P 500 is not that bad.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 2.45% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a potentially greater return?

My answer is no. Give me a 2.45% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there's probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son's 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I'm in the “low interest rates for life” camp. Once again, I don't see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don't see a real estate crash like the stock market crash of 4Q2018. Instead, we'll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I've learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I've given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don't stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it's time to get some help with writing. I'll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I'll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I've discovered how great it is to hire help around the house, it's only logical to hire help for our business.

4) Focus on profits. Since I'm going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I'll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It's going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don't pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better. I'm aiming for thought diversity not groupthink.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I've discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

Sit comfortably in circle time for more than 10 minutes

Enjoy playing with the piano, guitar, and drums

Play with toys without mouthing them

Screw and unscrew jar lids and turn door handles

Build towers of more than 6 blocks

Copy a circle with pencil or crayon

Show affection for friends without prompting

Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

Walk down stairs unassisted

Maintain balance while catching a ball or when gently bumped by peers

Throw and attempt to catch ball without losing balance

Walk and maintain balance over uneven surfaces

Use both hands equally to play and explore toys

Learn to pedal a tricycle

Daily Activities

Able to self-calm in car rides when not tired or hungry

Tolerate diaper changes without crying or whining

Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

Able to self-calm to fall asleep

Able to tolerate and stay calm during dental visits

Able to brush his teeth without whining or crying 3X a day

Is potty trained before preschool starts in September

Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

Uses “in” and “on”

At least 75% of speech is understood by any caregiver

Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

Understands “mine” and “yours”

Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we're all getting sick more often now as he's exposed to other kids. Luckily, my wife and I haven't been sick at the same time yet. We'll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I've been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don't care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I've never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it's also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a canon in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I'd be feeling nervous today since the stock market corrected by 20% soon after. It's not unreasonable to assume to house is now worth $200,000 (4.5%) less today.

Meanwhile, the seller of the house in Honolulu I've been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there's a good chance they will accept $3.5M – $3.7M because they finally dropped the ask down to $3.98M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won't need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Same for many big city residents around the world e.g. London, Hong Kong, Singapore, Sydney, Mumbai, etc. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It's going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai's finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I'm having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I'm going to give myself four weeks where I'll just publish one post plus I'll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I don't want to take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who also launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It's clear I haven't done a good enough job appreciating her efforts over the years, which is why I'm committed to do more for her in 2019 and beyond.

Steady As She Goes