#cryptoinvestments

Explore tagged Tumblr posts

Text

Why a 50 Basis Point Cut Won't Scare Investors: Fed Insights 📉💡

youtube

A 50 basis point cut might sound alarming, but is it really a cause for concern? Fed Chairman Powell’s comments after the announcement suggest they’re playing catch-up with interest rates. Despite the cut, expectations are leaning toward further rate reductions, which could keep the market steady. Let’s dive into the real reasons behind these decisions and what it means for your investments. 📊💭

#Bitcoin#CryptoExposure#AIInvesting#Smartfolio#iFlip#CryptoRevolution#BitcoinETFs#InvestmentStrategy#AIAlgorithms#TechDrivenInvesting#CryptoInvestments#FutureOfInvesting#Youtube

0 notes

Text

Bitwise Files for Aptos ETF Registration in Delaware: What This Means for Crypto

Exploring the Implications of Bitwise’s Aptos ETF Registration in Delaware. Bitwise, a leading exchange-traded fund (ETF) issuer, has recently filed for an Aptos ETF registration in Delaware, a major step in the growing crypto investment market. This filing paves the way for the potential launch of an exchange-traded fund that directly holds Aptos' native token, APT. This move is significant because it marks the possibility of the first U.S. ETF to hold APT tokens, providing a unique way for investors to gain exposure to the Aptos blockchain without purchasing tokens directly.

Aptos, created by Aptos Labs, is a widely anticipated proof-of-stake blockchain. It is gaining traction in the crypto community due to its novel approach to scalability, security, and decentralised finance (DeFi) applications. Bitwise's filing for this ETF hopes to capitalise on the increased interest in cryptocurrencies such as Aptos while also establishing itself as a leader in crypto-related financial products. Also Read: us-lawmakers-move-to-overturn-controversial-irs-defi-broker-rule/ This move follows the launch of similar products in Europe, such as the Bitwise Aptos Staking ETP and the 21Shares Aptos Staking ETP. However, a US version would open up a larger market, indicating that blockchain assets are becoming more accepted in regular investing portfolios. If approved, this registration will provide investors with a safer way to participate in the Aptos blockchain's growth while also marking a milestone in crypto mainstream adoption. With the Aptos token (APT) up 10% following news of the filing, it's evident that the market expects a positive reaction. Aptos has emerged as a significant participant in the blockchain arena, and Bitwise's decision to register for this ETF indicates their forward-thinking approach to growing cryptocurrency products. Investors and enthusiasts alike are eagerly awaiting the clearance, which may usher in a new era for crypto ETFs by integrating blockchain innovation with traditional investment vehicles. Read the full article

#Aptos#AptosBlockchain#AptosETFregistration#Aptostokens#Bitwise#cryptofinance#CryptoInvestments#CryptocurrencyETFs#DelawareETFregistration

0 notes

Text

ACB detects multi-crore scam in Saubhagya Scheme implementation

Raids conducted across 5 distts

JAMMU, Mar 7: The Anti-Corruption Bureau (ACB) today conducted simultaneous raids in five districts of Jammu and Kashmir in multi-crore scam in implementation of Centrally Sponsored Scheme ‘Saubhagya’, which was meant for electrification of all uncovered rural areas. Though there was no official word on the raids carried out by the ACB sleuths, reliable sources told the Excelsior that searches were conducted in Srinagar and Ganderbal districts of Kashmir and Jammu, Doda and Kishtwar districts in Jammu region at houses of the erstwhile Power Development Department (PDD) officers involved in implementation of Saubhagya Scheme of the Central Government. They said raids were carried out after two separate First Information Reports (FIRs) were registered at Srinagar and Jammu police stations of the Anti-Corruption Bureau in misappropriation of funds running into several crores in the implementation of Centrally Sponsored Scheme Saubhagya. In Jammu region, houses of four officers were searched. They included Project Officer Manhar Gupta of Sainik Colony, Jammu, Superintending Engineer Umesh Parihar of Channi Himmat, Superintending Engineer Circle Doda Asgar Hussain of Kishtwar and Superintending Engineer Krishan Kumar of Jammu. Houses of the then Power Development Department officers involved in the scam were also searches in Srinagar City, another locality of Srinagar district and Ganderbal, sources said. Some documents pertaining to scam and investments of the officers have been recovered during the searches. According to sources, the Central Government had released around Rs 900 crore for Jammu and Kashmir for electrification of all un-electrified villages in the erstwhile State under the Centrally Sponsored Scheme Saubhagya. Preliminary inquiries conducted by the ACB revealed misappropriation of several crores in implementation of the scam. After preliminary enquiries, the Bureau registered FIRs in the case and conducted searches at residences of the officers. However, no arrests have been made so far. Further investigations in the case were on, sources said, adding the officers involved in misappropriation of funds will be called for questioning.x

ED raids Safa Valley owners The Enforcement Directorate Jammu today conducted raids at six residential and business office premises in Jammu city belonging to Rajesh Kumar Rathore, Mohd Ashraf and their subsidiary companies in connection with Safa Valley project. Investigation was initiated by the Directorate of Enforcement Jammu under violations of provisions of Foreign Exchange Management Act, 1999 against Bal Krishan Rathore, Rajesh Kumar Rathore and others. During search, it was found that investments in crypto currencies and foreign investments of more than Rs 2 crores were made by Mohd Ashraf, in Dubai. Documents revealed that Mohd Ashraf has also made investments in the immovable properties. Investigation revealed that Bal Krishan Rathore, an NRI had purchased agricultural land and constructed a multi-storey residential project in the name of Safa Valley, situated at upper Bhatindi, Jammu through a company named as Boundaries Builders Pvt. Limited and investments of huge amounts were effected from Dubai for Safa Valley project in the form of unsecured loans. From reliable sources, huge amounts of seizure are in the form of Fixed Deposit Receipts (FDRs) of more than Rs 25 crores which were in the name of company and individuals. During search, soverign gold bonds were also seized. The sale deeds registration papers of immovable properties were also seized during raids which pointed out that huge amounts of investments were made by them in the purchases. From reliable sources, these seized FDRs/immovable proeprties and others will be investigated during the course of questioning of the persons whose houses were raided by ED. During the search, officers from different Enforcement Directorate offices from Jalandhar, Chandigarh and Srinagar participated and services of banks officers was also taken besides assistance from local police for security purpose.

#AntiCorruption#SaubhagyaScheme#PowerDevelopmentDepartment#MisappropriationOfFunds#ACBRaids#JammuAndKashmir#SafaValleyProject#EnforcementDirectorate#ForeignInvestments#CryptoInvestments#RealEstateScam#EDRaids#CorruptionInvestigation#PublicFunds#JammuNews

1 note

·

View note

Text

🔐 Cold Wallet vs. Hot Wallet: Which is Right for Your Crypto? 💼

Are your cryptocurrency investments secure? 🤔 Learn the key differences between cold wallets and hot wallets, their pros and cons, and how to protect your digital assets from hacking and other threats.

💡 Whether you're a long-term holder or a daily trader, understanding your wallet options is essential.

👉 Discover the ultimate guide to crypto wallet security here:

#CryptoSecurity#ColdWallet#HotWallet#CryptoInvestments#Blockchain#cryptocurreny trading#cryptoforbeginners#ethereum#cryptocurrency#btc100k#bitcoin news#cryptocurency news#bitcoin#crypto

0 notes

Text

#Heyden#Heydencoin#CryptoGaming#PlayToEarn#GameFi#NFTGaming#BlockchainGames#MetaverseGaming#CryptoGames#GamingNFTs#GameFiProjects#Web3Gaming#AIGaming#AICommunity#PlayToEarnGames#CryptoGamingCommunity#DecentralizedGaming#cryptoworld#blockchaintechnology#cryptoinvestments#stablecoins#cryptofinance#cryptostaking#virtualcurrency#realestatevirtual#metamask#nft#gaming

0 notes

Text

Secure your future with smart investments in Meta Dynamis! 🚀✨ Take control of your financial journey and enjoy peace of mind with secure, innovative investment solutions. Start building a brighter tomorrow today! 💼💰

🔗 Join Now: https://metadynamis.io

#metadynamis#smartinvesting#financialfreedom#secureinvestments#futureready#investsmart#cryptoinvestments#blockchaininnovation#wealthmanagement#jointhefuture#financialgrowth

0 notes

Text

🔗 The Blockchain Revolution: Is It the Key to Unlocking Your Investment Potential? 💡🔍

Blockchain technology is more than just a buzzword—it’s transforming industries and reshaping how we think about value, trust, and transactions. As we head into 2025, savvy investors are eyeing blockchain as a game-changing opportunity that goes far beyond cryptocurrencies.

From finance to healthcare, supply chains to gaming, blockchain is powering innovation with its decentralized, secure, and transparent infrastructure. It’s creating new investment avenues, allowing for smart contracts, tokenization of assets, and unprecedented efficiency across sectors.

So, is blockchain the key to unlocking your investment potential? As the technology matures and expands, those who understand its disruptive power stand to benefit immensely. Whether you're investing in blockchain startups or established companies integrating the tech, the revolution is here—and it might just be the future of your portfolio.

The time to explore blockchain is now! 🚀

#BlockchainRevolution#InvestmentPotential#BlockchainInvesting#CryptoInvestments#TechInnovation#FutureOfFinance#DigitalAssets#BlockchainTechnology#InvestmentOpportunities

0 notes

Text

Crypto Serial Entrepreneur ft. Brian Decker | Coffeez for Closers with Joe Shalaby

youtube

Crypto Serial Entrepreneur ft. Brian Decker | Coffeez for Closers with Joe Shalaby Ep. 13 This Week on Coffeez for Closers: Brian Decker Dive into this week's exhilarating episode of "Coffeez for Closers" where we're thrilled to host Brian Decker, an extraordinary figure whose expertise spans public speaking, brand consulting, marketing, and beyond. A serial entrepreneur with a keen eye for cryptocurrency investments, Brian's journey is a testament to innovation, strategic acumen, and entrepreneurial zeal. 🔹 About Brian Decker: Brian's diverse career is a beacon of entrepreneurial success, marked by significant achievements in various sectors: 🚀 Serial Entrepreneur: Brian has launched and nurtured multiple ventures, showcasing his versatility and business acumen. 💼 Marketing Maestro: Renowned for his groundbreaking strategies in marketing and brand consulting. 🏠 Real Estate Visionary: Transforming the real estate marketing landscape with innovative approaches and insights. 💬 Public Speaking Pro: A compelling orator, Brian engages and inspires with his insightful talks. 💡 Crypto Investment Pioneer: Ahead of the curve in cryptocurrency investments, Brian has both foresight and success in the dynamic crypto market. 🎙 What's on the Agenda: Brian's journey as a serial entrepreneur and the lessons learned along the way. Deep dives into his successful forays into cryptocurrency investment. Strategies and insights from his extensive experience in marketing, real estate, and public speaking. Prepare for a session brimming with wisdom, inspiration, and entrepreneurial strategies from none other than Brian Decker. His story is not just about achieving success across different domains but about the relentless pursuit of innovation and excellence. 👉 Hit Subscribe! Make sure to subscribe to "Coffeez for Closers" for this must-listen episode. Engage with us through likes, shares, and comments to join a community eager for growth and learning.

0 notes

Text

💼💰 Investors, rejoice! 🚀 At Little House Big Return, we offer you the best of both worlds. 💎🏡 Not only do you enjoy the stability of real estate rental income from our purpose-built tiny homes, but you also get to participate in the explosive potential of crypto investments.

#RealEstateInvesting #CryptoInvestments #PassiveIncome #LittleHouseBigReturn #InvestmentOpportunities #FinancialFreedom 🏠💎

#RealEstateInvesting#CryptoInvestments#PassiveIncome#LittleHouseBigReturn#InvestmentOpportunities#FinancialFreedom 🏠💎

0 notes

Text

Cryptocurrency and Blockchain Technology

Cryptocurrency and blockchain technology have piqued the interest of investors, technologists, and legislators alike, promising to transform the financial landscape. This article will look at the latest trends, advancements, and prospective effects of cryptocurrency and blockchain technology on banking.

The Evolution of Cryptocurrency

Bitcoin, created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, marked the beginning of the cryptocurrency era. Since then, thousands of alternative cryptocurrencies, or altcoins, have emerged, each with unique features and purposes. Growth of Blockchain Technology Blockchain, the underlying technology behind cryptocurrencies, has also evolved significantly. Originally devised as to record Bitcoin transactions, blockchain technology is now being explored for a wide range of applications beyond digital currencies.

Latest Trends in Cryptocurrency

Decentralized finance, or DeFi, has emerged as a major trend in the bitcoin sector. DeFi platforms seek to duplicate traditional financial services including lending, borrowing, and trading without the use of intermediaries such as banks. Non-Fungible Tokens (NFTs) Non-fungible tokens (NFTs) have received a lot of interest due to their capacity to represent ownership of unique digital goods like artwork, collectibles, and digital real estate. The NFT industry has expanded rapidly, attracting artists, investors, and collectors alike. Central Bank Digital Currencies (CBDCs) Central banks are looking at the prospect of releasing their digital currency, known as central bank digital currencies, or CBDCs. These digital currencies seek to increase efficiency, lower expenses, and promote financial inclusion.

Developments in Blockchain Technology

Blockchain developers prioritize interoperability and scalability. Projects such as Polkadot, Cosmos, and Ethereum 2.0 are developing ways to improve blockchain network interoperability and scalability. Enhanced Security and Privacy Advances in cryptography approaches and privacy-preserving technology improve blockchain network security and privacy. These advancements are critical to establishing trust and confidence in blockchain-based systems.

Potential Impact on the Financial Landscape

Cryptocurrency and blockchain technology can potentially disrupt established banking institutions by providing faster, less expensive, and more inclusive financial services. This disruption could result in a shift of power in the banking industry. Financial Inclusion and Access Blockchain technology has the potential to provide financial services to the unbanked and underbanked populations worldwide, opening up new opportunities for economic empowerment and financial inclusion. Regulatory Challenges and Opportunities The rapid growth of cryptocurrency and blockchain technology has prompted governments and regulatory bodies to develop frameworks and policies to address concerns such as consumer protection, money laundering, and tax evasion. Clear and balanced regulation is essential to foster innovation while ensuring investor protection and financial stability.

Conclusion

Finally, cryptocurrencies and blockchain technology are fundamentally changing the financial world. The future of finance appears to be becoming more decentralized, digital, and inclusive, with the rise of non-fungible tokens, the research of central bank digital currencies, and advancements in blockchain technology. As these technologies advance and develop, their impact on the financial environment will only increase, ushering in a new era of innovation and opportunity. Read the full article

#Blockchain#BlockchainApplications#BlockchainDevelopments#BlockchainSecurity.#CentralBankDigitalCurrency(CBDC)#CryptoInvestments#CryptocurrencyRegulation#CryptocurrencyTrends#DecentralizedFinance(DeFi)#DigitalAssets#DigitalCurrency#FinancialInnovation#FinancialTechnology(FinTech)#Non-FungibleTokens(NFTs)

0 notes

Text

2024 Crypto Forecast: Strategic Investments Unveiled! | Crypto Elite

Dive into the future of crypto with our exclusive 2024 forecast! Discover the hottest investment opportunities and the compelling reasons behind them. From promising projects to emerging trends, we guide you through the landscape of possibilities. Stay ahead of the curve and maximize your gains in the ever-evolving world of cryptocurrency. Subscribe for key insights and make informed decisions in your crypto journey

youtube

0 notes

Text

Bitcoin & AI: Revolutionizing Crypto Exposure with Smartfolios 🚀💡

youtube

Many of our customers have been eager to gain exposure to Bitcoin, and we’ve listened! On the iFlip platform, we’ve developed a unique AI-driven approach to crypto investing. With the green lighting of Bitcoin ETFs in America, we’re able to offer smarter ways to manage Bitcoin investments using advanced algorithms and technology. 📈🔒 Ready to jump in? Let’s explore how AI is reshaping crypto

#Bitcoin#CryptoExposure#AIInvesting#Smartfolio#iFlip#CryptoRevolution#BitcoinETFs#InvestmentStrategy#AIAlgorithms#TechDrivenInvesting#CryptoInvestments#FutureOfInvesting#Youtube

0 notes

Text

Bitcoin ETFs Outflows: BlackRock's IBIT Faces Record Withdrawals

Understanding the Recent Bitcoin ETFs Outflows and Their Impact on BlackRock's IBIT Bitcoin ETFs outflows have recently caught the attention of investors, with BlackRock IBIT facing record withdrawals. On February 26, spot Bitcoin ETFs in the United States recorded their seventh consecutive day of net outflows, reflecting a growing trend of investor caution. According to data from SoSoValue, 12 spot Bitcoin ETFs saw a combined net outflow of $754.53 million, following a massive $1.14 billion in net redemptions the previous day. Leading the outflows was BlackRock's IBIT, which witnessed $418.06 million exiting the fund, marking its highest single-day withdrawal since launch. This development has raised questions about investor sentiment towards Bitcoin and the broader cryptocurrency market. Fidelity's FBTC also continued its streak of redemptions, recording $145.69 million in outflows. Several other Bitcoin ETFs experienced outflows on the same day, including ARK and 21Shares' ARKB ($60.46 million), Grayscale's mini Bitcoin Trust ($55.97 million), Grayscale's GBTC ($22.66 million), Invesco Galaxy's BTCO ($16.83 million), Bitwise's BITB ($13.65 million), WisdomTree's BTCW ($11.52 million), and Franklin Templeton's EZBC ($9.69 million). Read More : Utah Leads the Way: Becoming the First State with a Bitcoin Reserve Despite these outflows, spot Bitcoin ETFs have amassed a total net inflow of $37.12 billion since their inception. Daily trading volumes for these ETFs stood at $5.79 billion, showcasing continued investor interest even amidst market volatility. February alone saw around $3.1 billion exiting the 12 ETFs, with only four days recording net inflows. Industry experts have shared their insights on the situation. ETF Store President Nate Geraci expressed frustration over traditional finance's critical stance on Bitcoin, pointing out that skeptics often celebrate market downturns. He emphasized that despite significant price drops, Bitcoin remains resilient and isn't "going away." Meanwhile, Bloomberg senior ETF analyst Eric Balchunas highlighted the pressure on Bitcoin ETFs, noting that they recorded over $1 billion in outflows in a single day. He, however, provided a balanced perspective by pointing out that these outflows represent less than 2% of assets under management, indicating that over 98% of investors are still holding onto their positions. The ongoing Bitcoin ETFs outflows reflect a dynamic market environment influenced by various economic and geopolitical factors. Investors are advised to stay informed and consider long-term strategies, as cryptocurrency markets are known for their volatility and rapid shifts. Read the full article

#BitcoinETFs#BitcoinETFsOutflows#BitcoinMarketTrends#BlackRockiBIT#CryptoInvestments#Cryptocurrencynews#ETFWithdrawals#financialmarkets

0 notes

Text

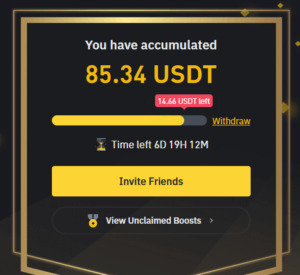

How to Earn 100 USDT on Binance with a Simple KYC Verification

Have you ever dreamt of snagging some crypto treasure effortlessly? Well, buckle up, because I'm about to spill the beans on how you can land yourself a cool 100 USDT on Binance. And guess what? It's as easy as completing your KYC verification!

Unraveling the Crypto Magic 🚀

Binance, the crypto wonderland, has a little surprise up its sleeve. By just ticking off the KYC verification box, you open the door to a treasure trove of 100 USDT. It's like finding money in your old jeans, but way cooler! The KYC Lowdown 🕵️♂️

Read More…

#Binance#BinanceTips#blockchain#CryptoInvestments#CryptoMarket#Cryptocurrency#DigitalAssets#EarnUSDT#EasyMoney#financialfreedom#IncomeGeneration#InvestmentOpportunities#KYCProcess#KYCVerification#OnlineEarnings#Passiveincome#ProfitableTrading#TradingStrategies#TradingTips#USDTIncome

0 notes

Text

Optimize your trading strategies and maximize your potential returns with the Flexibit app 😲📲

Start Today 📈👉

#FlexibitApp#CryptoTrading#SecureInvestments#flexibit#CryptoInvestments#TradeWithConfidence#SmartInvesting#CryptoSuccess#TradeSmart#FinancialFreedom#InvestSmart#FlexiBitInvests#CryptoBeginners#finance#blockchain#crypto#decentralized exchange#bitcoin

0 notes

Text

✨ With Heyden Coin, trading digital assets is easier and safer than ever 🔐📉 🚀 Empowering your digital investments – Heyden Coin opens doors to the world of crypto 🌐💰

Stay connected and be part of the Heyden Coin revolution! 🚀

#Heyden#Heydencoin#CryptoGaming#PlayToEarn#GameFi#NFTGaming#BlockchainGames#MetaverseGaming#CryptoGames#GamingNFTs#GameFiProjects#Web3Gaming#AIGaming#AICommunity#PlayToEarnGames#CryptoGamingCommunity#DecentralizedGaming#cryptoworld#blockchaintechnology#cryptoinvestments#stablecoins#cryptofinance#cryptostaking#virtualcurrency#realestatevirtual#metamask#nft#gaming

0 notes