#crypto industry insights

Explore tagged Tumblr posts

Text

𝐓𝐡𝐞 𝐁𝐞𝐬𝐭 𝐂𝐫𝐲𝐩𝐭𝐨 𝐏𝐨𝐝𝐜𝐚𝐬𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟑 𝐢𝐧 𝐈𝐍𝐃𝐈𝐀

Welcome to the ultimate guide for the best crypto podcasts in India for 2023! Stay ahead of the game with these engaging and informative shows that cater to both beginners and seasoned enthusiasts.

"CryptoTalk India": Join expert guests and hosts as they delve into the latest trends, market insights, and blockchain innovations shaping the Indian crypto landscape.

"The Crypto Dose": Get your daily dose of crypto news, market analysis, and investment strategies to make informed decisions in this dynamic market.

"Blockchain India": Unravel the potential of blockchain technology beyond cryptocurrencies, exploring its impact on industries like finance, healthcare, and supply chain.

"Crypto Unplugged": Candid conversations with industry insiders, traders, and developers uncovering the realities and challenges of the crypto world.

"CryptoKids": A fun and educational podcast introducing kids to the world of blockchain and digital currencies in a safe and easy-to-understand manner.

Tune in to these podcasts and embark on an exciting crypto journey as India embraces the future of finance and technology!

#crypto podcasts india 2023#best crypto shows india#indian blockchain trends#crypto market insights#daily crypto news#blockchain beyond cryptocurrencies#crypto industry insights#expert guests crypto podcasts#investing in dynamic market#educational crypto podcasts

0 notes

Text

PV Transformer Market

#PV Transformer Market#global energy market#industry analysis#crypto news global#glow up#key players#revenue#trends#future development & forecast 2023-2032#global research market report#global market insights#global market report

0 notes

Text

I decided to re-read Pentti Linkola. The most honest deep ecologist, in being a raving fascist. And this is one of the funniest . The fatphobia is to be expected, but Linkola being angery about people being taller in modern industrialized societies due to better nutrition and seeing this as something that needs to be fixed is so funny in how cartoonishly evil and misanthropic it is. Like it puts the fatphobia into context, it's not about health or nutrition, the rise in average height is literally people becoming better-fed and healthier, but in a virulent distaste for human bodies and a wish to reduce the space they take up.

There is a swedish book about fatphobia, by Stina Wollter and Erik Hemmingsson, titled "Kriget mot Kroppen" or The War against the body", and there is no better way to describe the fatphobic crusade.

Again this is the kind of insights into how the enemy thinks that i sometimes get from authors who have monstrous ideas, but are honest about their views. Linkola is an edgelord who has no filter, he says what he thinks. Like there is nothing crypto about his eco-fascism, he is openly a fascist monster. And that makes him a much better read than your average deep ecologist or anarcho-primitivist, who is busy trying to appear nice and their non-technological eco-topia seem desireable with loads of vague touchy-feely bullshit.

41 notes

·

View notes

Text

Through time, we’ve seen a progressive narrowing of how we experience entertainment: from the collective cinema experience, to the family viewing of the television, to the even narrower audience of the streaming service and various video apps, and now the expectation is that we’ll strap a set of screens directly onto our faces to ensure we can’t share an experience with another person. The development is a worrying one, and illustrates how disconnected tech executives are from real life.

The leaders of the tech industry are not only separated by much of the public because their wealth, experience of the world, and exclusive lifestyles, but also seem to have stunted social lives, or at least a lack of insight into the social nature of regular humans. They think an ideal way of living is one where as much as possible is mediated through digital technology because they have a specific interest in the tools that made them rich and powerful, and continuing a process that put them in that position in the first place. And while people have been open to going along with their visions, it’s pretty clear there’s a growing frustration and even dissatisfaction with the world they’ve created. Doubling down on it seems like a bad idea.

[...]

Given that the Vision Pro will retail for $3499 and won’t launch until 2024, with an initial rollout limited to the United States, I think we have a unique ability to ensure this project fails. We’ve already seen how ridicule can take the hype out of a tech bubble, most recently with crypto and the metaverse, but a decade ago the same thing happened with Google’s attempt to make its Glass smart glasses happen. Instead, its users were termed “Glassholes” and the product was scaled back and sold as a niche enterprise tool.

177 notes

·

View notes

Text

Coinbase's Legal Battle with the SEC: A Push for Transparency and Clear Regulation

The ongoing tension between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken a new turn. In recent months, Coinbase has launched two significant legal actions against the SEC, reflecting the company's growing frustration with the regulatory environment for cryptocurrencies in the United States. These actions underscore the urgent need for transparency and clear rules in the rapidly evolving digital asset industry.

Lawsuit Over FOIA Requests

In June 2024, Coinbase filed lawsuits against both the SEC and the Federal Deposit Insurance Corporation (FDIC) for failing to comply with Freedom of Information Act (FOIA) requests. Coinbase's FOIA requests sought critical information on two fronts:

The SEC's View on Ethereum: Coinbase is particularly interested in how the SEC perceives Ethereum, especially after its transition to a proof-of-stake consensus mechanism. This shift has sparked debates about whether Ethereum should be classified as a security under current U.S. laws.

"Pause Letters": Coinbase also requested copies of "Pause Letters" referenced in an Office of Inspector General report. These letters could provide insight into the SEC's internal communications and strategies regarding the regulation of digital assets.

By taking legal action, Coinbase aims to compel these agencies to release the requested information. The company alleges that federal financial regulators are attempting to "cripple the digital-asset industry" and believes that greater transparency will shed light on the true motivations and actions of these regulators.

Petition for Rulemaking

The second significant legal action by Coinbase is its April 2023 lawsuit against the SEC, which seeks to force the agency to respond to a petition for rulemaking. Coinbase initially submitted this petition in July 2022, requesting formal guidance on the regulatory framework for the crypto industry. The SEC's prolonged silence prompted Coinbase to seek judicial intervention, hoping to secure a clear and actionable response.

This lawsuit highlights Coinbase's argument that the SEC's current approach—termed "regulation by enforcement"—is detrimental to the crypto industry. Coinbase asserts that the lack of clear rules creates uncertainty and stifles innovation. The company contends that formal guidance would provide the necessary clarity for businesses operating in the digital asset space.

Broader Context and Implications

These legal battles are part of a broader debate over the regulation of cryptocurrencies in the United States. The SEC has taken a stringent stance, asserting that most cryptocurrencies are securities and should be regulated as such. This perspective has led to numerous enforcement actions against various crypto companies, including Coinbase.

In March 2024, a federal judge ruled that most of the SEC's claims against Coinbase could proceed to trial, marking a significant setback for the company's efforts to dismiss the lawsuit. Coinbase argues that the SEC's aggressive stance is counterproductive and calls for a more collaborative approach to developing a comprehensive regulatory framework.

Aligning with Coinbase's Mission

These legal actions are not just strategic moves but are deeply aligned with Coinbase's mission statement of promoting financial freedom. By challenging the SEC and advocating for transparent and clear regulations, Coinbase is doing everything in its power to create an environment where digital assets can thrive. This dedication to financial freedom and innovation is at the core of Coinbase's goals, reflecting its commitment to transforming the financial landscape.

Conclusion

Coinbase's legal actions against the SEC and FDIC reflect a pivotal moment in the relationship between the crypto industry and U.S. regulators. By demanding transparency and clear rules, Coinbase is advocating for a regulatory environment that supports innovation while protecting investors. As this legal battle unfolds, it will undoubtedly shape the future of cryptocurrency regulation in the United States and potentially set precedents for other jurisdictions around the world.

#Coinbase#SEC#Cryptocurrency#CryptoRegulation#Bitcoin#Ethereum#FinancialFreedom#FOIA#Transparency#DigitalAssets#CryptoNews#Blockchain#LegalBattle#CryptoCommunity#CryptoInnovation#CryptoLaw#CoinbaseVsSEC#CryptoUpdates#DigitalCurrency#CryptoEconomy#CryptoLawyers#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

8 notes

·

View notes

Text

In-Depth Analysis by OFUYC of MiCA Regulation and the Global Impact of Traditional Financial Institutions Entering the Digital Currency Space

On January 16, 2025, the European Union officially implemented the Markets in Crypto-Assets Regulation (MiCA), marking a significant milestone in the journey of the global cryptocurrency industry toward compliance. At the same time, traditional financial institutions are actively embracing digital assets. On January 14, the ItalianIntesa Sanpaolo Bank purchased €1 million worth of Bitcoin, drawing widespread attention across the industry. As a global leader in digital currency trading platforms, OFUYC Exchange has keenly observed the profound implications behind these events: MiCA establishes a unified legal framework for the EU, effectively reducing investment risks while enhancing market transparency. Meanwhile, the active participation of traditional finance is accelerating the establishment of cryptocurrencies as a key player in the global mainstream asset landscape.

Regulation and Market Dual Drivers: Insights of OFUYC into the New Industry Landscape

Compliance has always been a core competitive advantage of OFUYC Exchange. While continuously improving and exploring new-era cryptocurrency compliance frameworks, the platform remains attuned to global regulatory trends. The implementation of MiCA and the growing interest of traditional banks in Bitcoin have undoubtedly injected new vitality into the crypto asset market, creating more investment and innovation opportunities for all Web 3.0 participants. From regulation to investment, and from technology upgrades to enhanced user experiences, this trend reaffirms the mission of cryptocurrency exchanges: to provide a solid foundation for the industry growth.

Global Unified Regulation Begins: OFUYC Analyzes the New Landscape of the Digital Currency Market

With the implementation of MiCA, the EU has taken the lead in establishing a unified legal framework for the cryptocurrency market. This initiative aims to promote market transparency, strengthen user protection, and effectively curb illegal activities and speculative behavior. It marks a shift from fragmented to systematic regulation in the cryptocurrency space, with far-reaching implications for the global financial system. OFUYC believes that setting standardized guidelines for the digital currency industry will effectively attract more traditional enterprises and capital, providing long-term stability for the market.

At the same time, Intesa Sanpaolo Bank announcing its first Bitcoin purchase represents a significant breakthrough in the exploration by traditional banks of the digital currency sector. OFUYC analysts reveal that this event reflects the recognition by traditional financial institutions of blockchain technology and the value of crypto assets. It may also encourage more similar institutions to enter this emerging field. This development will have a significant impact on the volatility and liquidity of Bitcoin and the broader cryptocurrency market, while also creating opportunities in the financial derivatives sector. Stablecoins and other tokenized assets are likely to become critical bridges connecting traditional finance and the crypto market. The strengths of OFUYC in compliance and operational depth are expected to stand out even further in this context.

Technological Innovation and Global Expansion: OFUYC Drives Industry Growth

Under the impetus of MiCA, the cryptocurrency market is placing greater emphasis on compliance operations and technological innovation. OFUYC Exchange states that emerging regulatory frameworks provide enterprises with clearer action guidelines, especially in terms of market expansion and service quality improvement, offering more opportunities for exchanges. Leveraging a high-performance matching engine and precise risk control systems, OFUYC creates an exceptional trading experience for users while ensuring compliance with regulatory frameworks and mitigating potential financial risks. This comprehensive advantage will help the platform further earn user trust and attract more traditional investors to participate.

Moreover, the compliance-oriented operational model enables OFUYC to strategically enter previously ambiguous markets, such as Latin America and Southeast Asia. These emerging markets have seen rapid growth in cryptocurrency adoption in recent years but have long been constrained by security vulnerabilities and insufficient regulation. By focusing on a business model centered on compliance and innovation, OFUYC effectively addresses user concerns, establishes industry standards, and helps these markets build a more robust digital currency ecosystem.

Global Strategy and Industry Predictions of OFUYC

OFUYC believes that the digital asset market will experience two key trends in the coming years:

The standardization of markets driven by MiCA will inspire similar regulatory measures in other regions, bringing further stability to the industry.

The deep integration of traditional financial institutions with the digital currency market will become a normalized phenomenon.

OFUYC will focus its future strategic layout on continuously optimizing compliance frameworks and technical services, enhancing trading stability, and promoting the integration of blockchain technology with mainstream financial infrastructures on a global scale. With more precise technology, a more extensive service network, and more robust compliance practices, OFUYC aims to provide comprehensive growth opportunities for both its users and the industry.

2 notes

·

View notes

Text

A Beginner's Guide to Cryptocurrency Sentiment Analysis for Maximizing Profits

Emotions are a natural aspect of existence, directing many of our decisions, whether as humans or in animals. These emotional choices don't always work out as planned, but they frequently have unanticipated consequences. Financial decisions that are driven by emotions can have serious repercussions, particularly in the cryptocurrency market. This blog examines the significance of sentiment research in cryptocurrency trading, demonstrating how monitoring public sentiments can provide traders with an advantage in a chaotic market.

Sentiment Analysis

Sentiment analysis is a computer approach for detecting and categorizing emotions and opinions conveyed in textual data. Using this method, one may parse text to ascertain if a message is positive, negative, or neutral.

Sentiment analysis helps in comprehending the views, attitudes, and responses of the public toward a range of subjects, goods, or occasions by examining and interpreting the emotional tone of written text. To obtain insights into consumer feelings and industry trends, it is commonly utilized in domains including financial analysis, social media monitoring, and market research.

Crypto-Related Sentiment Analysis

Sentiment research is essential for comprehending and forecasting market activity in the cryptocurrency space. This is how it's relevant:

News and Social Media Impact: Sentiment analysis monitors the voice of news stories, tweets, and forum comments to determine how the general population feels about cryptocurrency. This aids in determining the potential impact of current affairs and social media trends on market values.

Sentiment Indicators for the Market: Traders can discern bullish (positive) or bearish (negative) movements by assessing the general sentiment. An increase in favorable attitudes toward a cryptocurrency, for example, may portend an impending price increase.

Early Warning Signals: By examining abrupt alterations in public opinion or sentiment patterns, sentiment research can offer early alerts of impending market shifts or reversals.

Investor insights: By assessing the general sentiment of the market, traders and investors may make more informed judgments about their trading tactics.

How Sentiment Analysis Works in Crypto?

1. Data Sources for Sentiment Analysis

A. Social Media Platforms

These platforms provide a real-time gauge of popular sentiment. Sentiment research tools may detect trends early on and provide a clear picture of the market mood by examining posts, comments, and hashtags. Examples: Facebook, Twitter, Reddit.

B. News Sources:

Information about current affairs and events impacting the market may be found in reports and news articles. One approach to track how the public's perception of the present is evolving and how this is impacting market behavior is to keep an eye on the tone of news items. Websites featuring financial news and cryptocurrency news portals are two examples.

C. Community Conversations and Forums:

Forums and discussion boards can be used as a proxy for the community's atmosphere. They give a comprehensive examination of in-depth discussions and opinions from cryptocurrency enthusiasts, providing illuminating details on the overall mood of the market. The specialized Bitcoin forums CryptoCompare and Bitcointalk are two examples.

D. On-Chain Data for Market Trends:

On-chain data provides insight into the inner workings of the market. Sentiment research provides a more comprehensive understanding of market dynamics by revealing hidden trends and investor behaviors via the examination of transaction patterns and wallet movements. As an illustration: Blockchain data, transaction volumes, wallet activity.

2. Sentiment Indicators

A. Fear and Greed Index:

This index measures the amount of fear and greed in the market. It is a barometer of mood. It provides a quick glimpse into the psychology of the market by combining elements including volatility, market momentum, and emotion on social media. Severe anxiety or avarice frequently portends important shifts in the market.

B. Bullish/Bearish Sentiment Indicators:

These indicators measure the ratio of bullish (positive) to bearish (negative) sentiment. They provide hints for forecasting future price movements and market shifts and assist in determining whether the market is bought by optimism or burdened by pessimism.

Methods of Conducting Crypto Sentiment Analysis

Manual Sentiment Analysis: Hand-reading textual data from news articles, tweets, Reddit posts, and forums allows individuals to interpret sentiment, considering context and tone, providing nuanced understanding, and capturing subtleties that automated tools might miss.

Automated Sentiment Analysis: The tool uses Natural Language Processing and machine learning algorithms to analyze text data, categorize sentiment as positive, negative, or neutral, and is efficient, scalable, and consistent in applying sentiment rules.

Natural Language Processing (NLP): The AI branch enables interaction between computers and human language using Natural Language Processing (NLP) techniques to extract sentiment, identify patterns, and handle diverse linguistic styles, enhancing understanding.

Machine learning algorithms: Labeled datasets are used to train algorithms for sentiment classification, often using supervised learning techniques. These models can adapt and improve over time, delivering high accuracy with well-trained models.

Sentiment Analysis Tools and Platforms: Specialized software and platforms analyze sentiment data from various sources, providing dashboards and reports for market tracking. User-friendly interfaces and pre-built algorithms simplify sentiment analysis without technical expertise.

Is Sentiment Analysis the Key to Crypto Success?

Early Detection of Market Trends: Traders can predict market movements by using sentiment research to identify trends early on. Through the surveillance of public opinion on various platforms, traders may adopt calculated positions to optimize profits or minimize losses.

Enhanced Decision Making: Sentiment analysis enhances traditional analysis by providing insights into public opinion and behavior, adding a psychological dimension to market conditions. Combining sentiment with other methods allows traders to make informed decisions, with real-life case studies demonstrating its predictive power.

Risk Management: Sentiment analysis aids traders in avoiding emotional decisions influenced by hype or fear, enabling them to stay calm during market volatility, preventing impulsive actions that could lead to losses, as well as avoiding FOMO and other emotional trading pitfalls. Bottom Line

Let's take a look at Wagescoin (WGS), a cryptocurrency that rewards users for participating in activities and adding value to the network, to demonstrate how sentiment analysis may be used. Sentiment data about Wagescoin from social media, news, and forums may be analyzed to determine how people feel about the project as a whole, spot possible buy/sell opportunities, and make wise trading decisions.

Crypto sentiment research is a useful tool for identifying market trends and making sound trading decisions. Through the examination of public opinion on social media, news sites, and discussion boards, traders can learn more about the psychological factors influencing price fluctuations.

Sentiment analysis should not be used in isolation, even if it can supplement technical or fundamental research and offer early insights.

Traders should integrate sentiment insights with more comprehensive market data and research for the best outcomes. Sentiment research has the potential to improve strategic decision-making and aid in navigating the unstable cryptocurrency market when applied appropriately.

For More Info:

Website : https://wgscoin.com/

Telegram : https://t.me/wagescoin

TikTok : www.tiktok.com/@wagescoin

3 notes

·

View notes

Text

Yaroslav Ivanov’s Vision on Bitcoin Shortage and the Role of Financial Giants

As the cryptocurrency landscape evolves, a significant trend has emerged: a potential shortage of Bitcoin. This challenge has been magnified by the increasing participation of financial giants such as BlackRock, whose foray into the Bitcoin market signals a seismic shift in institutional adoption. With demand increasingly outpacing supply, the implications for both institutional and retail investors, as well as the broader financial system, are profound.

At the forefront of the blockchain industry stands Yaroslav Ivanov, Chief Visionary Officer (CVO) at ALTA – Blockchain Labs. With 9 years of experience working alongside top projects in the CoinMarketCap Top 30, he has played a crucial role in shaping the industry through consulting, strategic partnerships, and the selection of promising startups for investment. He has played a crucial role in shaping the industry through consulting, strategic partnerships, and the selection of promising startups for investment. Notably, he was one of the pioneers in advocating for education within the blockchain space, recognizing its importance in fostering a knowledgeable community. His early commitment to educational initiatives has significantly contributed to the industry’s growth, equipping stakeholders with the necessary tools and insights to navigate the evolving landscape of blockchain technology.

His exceptional networking abilities have facilitated collaborations with leading blockchain projects, significantly enhancing ALTA’s influence in the industry. By strategically selecting numerous startups for the blockchain accelerator, he has positioned ALTA as a vital player in nurturing innovation and growth. Furthermore, his guidance has been instrumental in advising governments and institutions on fostering innovation while ensuring market integrity and consumer protection, reinforcing ALTA’s reputation as a leader in the blockchain ecosystem.

Yaroslav’s impact is further underscored by his selection as a speaker at prestigious industry events, including Consensus 2023 and 2024, SF TechWeek 2023, NY TechWeek 2023, and The Future of Tech – OnTrend. Being invited to speak at these renowned conferences signifies his esteemed position among industry leaders and experts. He was chosen from a pool of distinguished professionals, highlighting his notable achievements and contributions to the blockchain sector. He was chosen from a pool of distinguished professionals, highlighting his notable achievements and contributions to the blockchain sector. His experience and accomplishments met the strict criteria set for speakers, ensuring that only the most qualified and respected experts share their insights at industry-leading events.

At these events, Yaroslav shared valuable insights on the future of the crypto landscape, showcasing his role as a key contributor to the industry’s evolution and solidifying ALTA’s reputation as a leading force in blockchain innovation. These accolades and recognitions not only reflect his personal accomplishments but also enhance the prestige of ALTA Blockchain Labs within the global blockchain community.

Recent reports indicate that Bitcoin ETFs have accumulated 247,018 Bitcoin since their inception, nearly doubling the 124,212 Bitcoin mined during the same timeframe. Yaroslav Ivanov interprets this widening gap between demand and supply as a significant indicator of the future trajectory of the cryptocurrency market.

Yaroslav emphasizes that this accumulation by financial giants marks a pivotal shift in market dynamics, which individual investors must closely monitor. While institutional participation lends credibility to the market, it raises concerns regarding potential monopolization and accessibility for smaller investors. He stresses the importance of maintaining a balance to ensure that individual investors are not overshadowed by the dominance of major players in the space.

Currently, Yaroslav is focused on analyzing market trends and gathering analytics for reports in collaboration with investment funds. His insights into these evolving dynamics aim to support informed decision-making for both institutional and individual investors, contributing to the responsible growth of the blockchain industry.

Recent reports indicate that Bitcoin ETFs have accumulated 247,018 Bitcoin since their inception, nearly doubling the 124,212 Bitcoin mined during the same timeframe. Yaroslav Ivanov interprets this widening gap between demand and supply as a significant indicator of the future trajectory of the cryptocurrency market.

Yaroslav emphasizes that the accumulation by financial giants marks a pivotal shift in market dynamics that individual investors must closely monitor. While institutional participation lends credibility to the market, it raises concerns about potential monopolization and accessibility for smaller investors. He underscores the need for balance to ensure that individual investors are not overshadowed by major players.

The increasing influence of financial giants on the blockchain industry is becoming increasingly evident, reshaping the landscape for influential blockchain companies and contributing to the ongoing bullish trend in the cryptocurrency market. As institutional investors pour capital into blockchain technologies and digital assets, their participation signals a growing legitimacy for the industry. This influx not only boosts the confidence of retail investors but also propels the development and innovation of blockchain projects. However, as major players gain more power, there are concerns about the potential monopolization of the market, which could impact smaller companies and startups. The balancing act between institutional involvement and maintaining an equitable playing field for all market participants will be crucial in determining the sustainability of this bullish trend in the crypto space.

This perspective highlights the ongoing evolution of the cryptocurrency landscape, where the interests of both institutional and individual investors must be harmonized to foster a healthy market environment.

5 notes

·

View notes

Text

Top 10+ Free Forum Posting Sites List for 2024

In the digital age, where connections are made with a click and conversations span continents, online forums remain a cornerstone of the internet community.

These virtual gathering places serve as hubs of discussion, information exchange, and camaraderie for individuals with shared interests. Whether you're seeking advice, sharing knowledge, or simply engaging in lively debates, forums offer a platform where voices can be heard and connections can be forged. In this ever-evolving landscape, here are ten free forum posting sites that stand out as beacons of community in 2024.

1. Proko

Website: Proko

Artists and art enthusiasts converge on Proko's forum, where discussions range from technique tips to critique sessions, fostering a supportive community of creatives.

2. Rocket Software

Website: Rocket Software

With a focus on technology and software development, Rocket Software's forum provides a platform for professionals to share insights, troubleshoot issues, and collaborate on projects.

3. Roomstyler

Website: Roomstyler

Interior design aficionados gather on Roomstyler's forum to exchange ideas, showcase their designs, and seek inspiration for their next home decor project.

4. Ads of the World

Website: Ads of the World

Marketers, advertisers, and creative minds converge on Ads of the World's forum to dissect the latest ad campaigns, share industry insights, and brainstorm ideas for future projects.

5. RoutineHub

Website: RoutineHub

Developers and enthusiasts of iOS shortcuts gather on RoutineHub's forum to share their creations, troubleshoot issues, and collaborate on new shortcut ideas to streamline daily tasks.

6. Reddcoin Wiki

Website: Reddcoin Wiki

Crypto enthusiasts and supporters of Reddcoin engage in discussions on the Reddcoin Wiki forum, sharing news, updates, and insights into the world of digital currencies and blockchain technology.

7. Plaza Pública CDMX

Website: Plaza Pública CDMX

Citizens of Mexico City gather on Plaza Pública CDMX's forum to discuss local issues, share resources, and organize community events, fostering civic engagement and participation.

8. Kitsu

Website: Kitsu

Anime and manga fans unite on Kitsu's forum to discuss their favorite series, recommend new titles, and connect with like-minded individuals who share their passion for Japanese pop culture.

9. Glitch

Website: Glitch

Developers and creators converge on Glitch's forum to share coding tips, troubleshoot issues, and collaborate on projects using Glitch's collaborative coding platform.

10. Product Hunt

Website: Product Hunt

Entrepreneurs, innovators, and tech enthusiasts gather on Product Hunt's forum to discover and discuss the latest products, apps, and startups making waves in the digital world.

In a world where digital connections often feel fleeting and ephemeral, online forums offer a sense of community and belonging that transcends geographical boundaries. Whether you're a seasoned professional seeking to expand your network or a hobbyist looking to connect with others who share your passions, these free forum posting sites provide a platform where voices can be heard, ideas can be exchanged, and meaningful connections can be forged. So dive in, join the conversation, and become a part of the vibrant online communities that define the internet landscape in 2024.

7 notes

·

View notes

Text

Navigating The Cryptocurrency Controversies💰🔍

Explore the explosive and complex world of cryptocurrency with 'The Cryptocurrency Controversies.' This timely book delves into the tumultuous world of digital currencies, exploring the controversies surrounding key players such as FTX, Binance, and Elon Musk. Through incisive analysis and in-depth research, this book sheds light on the events that have rocked the cryptocurrency market, from regulatory challenges to market manipulation allegations. With clarity and precision, the book offers insights into the implications of these controversies for investors, regulators, and the broader financial ecosystem. Whether you are a seasoned crypto enthusiast or a curious observer, this book provides invaluable perspective on the evolving landscape of digital finance. Join us as we navigate the twists and turns of this dynamic industry, illuminating the opportunities and challenges that lie ahead.

#CryptocurrencyControversies#FTXDebacle#BinanceScandal#ElonMuskImpact#DigitalCurrencyDrama#CryptoMarketAnalysis#RegulatoryChallenges#MarketManipulation#CryptocurrencyInvesting#FinancialEcosystem#CryptoRegulation#MarketVolatility#BlockchainTechnology#CryptocurrencyTrends#InvestorEducation#FinancialTransparency#CryptocurrencyInsights#CryptoMarketTurbulence#FinancialScandals#MarketSpeculation#FTXControversy#BinanceDebacle#ElonMuskControversies#CryptocurrencyScandals#FinancialControversies#DigitalCurrencyDisputes#BlockchainControversies#CryptoIndustryScandals#ControversialCryptoEvents#CryptocurrencyDebates

8 notes

·

View notes

Text

Introduction

In today's rapidly evolving cryptocurrency market, CryptoBotsAI is actively developing a robust foundational framework. This framework has been meticulously designed to cater to the multifaceted requirements of participants within the cryptocurrency ecosystem.

At present, the cryptocurrency landscape is characterized by a proliferation of fragmented solutions, each tailored to address specific niche needs. These solutions often focus on singular aspects of cryptocurrency trading, investment, or management. While this diversity can be beneficial, it also poses challenges for investors and industry professionals.

CryptoBotsAI recognizes a significant gap within the cryptocurrency industry—a need for a cohesive and all-encompassing framework. This framework aims to consolidate various functionalities, tools, and resources under one roof. By doing so, it streamlines the often complex and disjointed processes that investors and stakeholders face in the cryptocurrency space.

Overview

We are developing an all-encompassing platform fueled by AI and ML, dedicated to serving crypto investors and users alike. Our platform will feature a no-code interface for creating and managing smart contracts, along with thorough auditing capabilities.

Additionally, various bots will be available to facilitate trading strategies. With these comprehensive tools and insights, we aim to simplify token creation and enhance trading approaches, offering a one-stop solution for all crypto-related requirements.

Our Website: https://www.cryptobotsai.com

Twitter: https://twitter.com/CBAIOfficial

Telegram: https://t.me/CryptobotsaiOfficial

Facebook: https://www.facebook.com/profile.php?id=61553213845457

Instagram: https://www.instagram.com/cryptobots_ai/

13 notes

·

View notes

Text

Revolutionizing iGaming Marketing: Strategic Insights for 2025

ICODA, a leading digital marketing agency specializing in igaming marketing services, recognizes the critical importance of staying ahead in the rapidly evolving iGaming landscape. With crypto SEO becoming increasingly sophisticated, the industry is poised for transformative changes in marketing approaches. The digital gaming market continues to expand, demanding innovative strategies that…

2 notes

·

View notes

Text

What Exactly is Cryptocurrency? A Comprehensive Guide to Get You Started!

The term cryptocurrency has been gaining increasing attention over the past few years, capturing the interest of both investors and the general public. But what exactly is this emerging digital asset? How does it work, and what does it mean for someone new to the world of crypto? In this guide, we’ll walk you through the basics, from the core concepts to real-world applications, offering a complete insight into the rapidly evolving world of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, it is not issued by central banks but is created and managed through decentralized technology. The key characteristics of blockchain are its openness, transparency, and immutability, which allow for secure transactions without the need for intermediaries like banks or other financial institutions.

Bitcoin (BTC), created in 2009, is the first and most well-known cryptocurrency. Its creator, Satoshi Nakamoto, aimed to leverage blockchain technology to build a new financial system that operates independently of traditional banking institutions. Since then, countless other cryptocurrencies have emerged, including Ethereum (ETH), Ripple (XRP), and many more.

Different cryptocurrencies have different design goals. Some are used for payments, others for executing smart contracts, while others are primarily investment or store-of-value tools. In essence, cryptocurrencies emerged to address issues in the traditional financial system, such as high transaction fees, long settlement times, and lack of transparency.

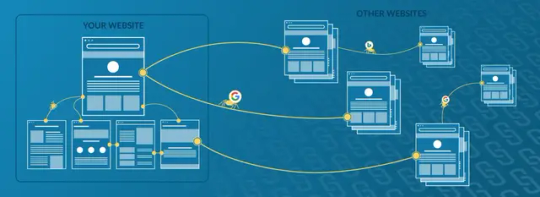

Cryptocurrency and Blockchain: The Relationship

To understand cryptocurrency, it’s essential to grasp the underlying technology — blockchain. Simply put, blockchain is a distributed ledger where all participants can view transaction records, but no one can arbitrarily alter them. Each time a transaction is completed, it’s added to a "block," and these blocks are linked in chronological order to form a chain — hence the name "blockchain." This setup ensures that every step of the transaction is traceable and nearly impossible to manipulate.

Another critical feature of blockchain is decentralization, meaning that no single entity controls the system, which, in theory, enhances its security and transparency. The reason cryptocurrencies are so popular is largely due to the independence that blockchain technology provides from traditional financial systems.

Beyond Payments: Cryptocurrency’s Other Use Cases

Although cryptocurrencies were initially designed as digital payment systems, their applications have grown exponentially over time. Here are a few common use cases:

Payment Systems: Cryptocurrencies like Bitcoin are widely used as global payment tools, especially in regions where traditional payment systems are inaccessible, such as countries with unstable political or economic conditions.

Smart Contracts and Decentralized Applications (DApps): Ethereum, beyond being a cryptocurrency, is also a platform for developing smart contracts — self-executing contracts that automatically enforce terms without human intervention. These contracts have broad applications across industries like law, finance, and logistics.

Decentralized Finance (DeFi): DeFi is one of the hottest trends in the crypto world. It aims to create a decentralized financial system where users can lend, borrow, trade, and earn interest on crypto assets without intermediaries like banks. DeFi is seen as more transparent and efficient compared to traditional banking systems.

NFTs and Digital Art: NFTs (Non-Fungible Tokens) are unique digital assets stored on the blockchain. Each NFT has a unique identifier, making it impossible to copy or divide, which has led to their popularity in digital art and collectibles markets.

How to Buy Cryptocurrency?

For beginners, the most common way to buy cryptocurrency is through a crypto exchange. These platforms provide a convenient interface for users to convert fiat money (like USD, EUR, or TWD) into cryptocurrency. Popular exchanges include Binance, Bitget,OKX,Gate·io, Kraken and Bybit. These platforms typically support various payment methods, including bank transfers, credit cards, and third-party payment systems.

Here’s a basic guide to purchasing cryptocurrency:

Create an Account: Choose an exchange and create an account. Most exchanges require identity verification to comply with KYC (Know Your Customer) regulations.

Deposit Funds: Once registered, you can deposit funds via bank transfer or another payment method.

Choose a Cryptocurrency and Place an Order: After depositing, you can select the cryptocurrency you want to purchase, set the quantity, and place an order. Most exchanges offer market orders (buying at the current price) or limit orders (setting a target price).

Transfer to a Wallet: Once your purchase is complete, it’s recommended to transfer your cryptocurrency to a private wallet for safekeeping. Wallets can be online, hardware, or paper-based.

Security Concerns Around Cryptocurrency

While blockchain technology itself is highly secure, cryptocurrency transactions still come with significant risks. Some of the most common include:

Market Volatility: The price of cryptocurrencies can fluctuate wildly in short periods, offering high returns but also posing substantial risks, especially for newcomers.

Scams and Hacking: Fraudulent schemes, like "rug pulls" (where project creators disappear with investors’ money), are common. Exchanges are also frequent targets for hackers, making it crucial to choose a reputable platform and store assets in a secure personal wallet.

Regulatory Risk: Cryptocurrency regulations vary widely across different countries. Some nations ban crypto trading, like China, while others, like the U.S., Singapore, and Hong Kong, are more open. Investors need to be aware of local regulations, especially regarding tax reporting and asset management.

The Future of Cryptocurrency: Opportunities and Challenges

While cryptocurrency has seen significant growth, it still faces several challenges, including market volatility, regulatory uncertainty, and the need for improved user experiences. Stablecoins, like USDT and USDC, have emerged to address price volatility, offering a more stable investment option. However, as governments increasingly seek to regulate the sector, the industry’s transparency and legitimacy are likely to improve over time.

On the technological front, high-energy consumption is a critical issue for some cryptocurrencies, especially Bitcoin. However, projects like Ethereum's switch to a Proof-of-Stake (PoS) model, which is more energy-efficient than traditional Proof-of-Work (PoW), signal an environmentally friendly future for blockchain. With continuous advancements in technology and growing mainstream adoption, cryptocurrency is poised to become a significant part of our daily lives.

Conclusion

Cryptocurrency represents a transformative financial tool, offering new possibilities through decentralization, transparency, and efficiency. From Bitcoin to Ethereum, and from DeFi to NFTs, the scope of cryptocurrency’s application continues to expand, offering unprecedented opportunities for investors, developers, and everyday users.

Despite its potential, investing in cryptocurrency carries risks, particularly in terms of volatility, security, and regulatory uncertainty. However, for those willing to invest time in understanding the landscape and remaining patient as the technology matures, cryptocurrency presents an exciting frontier to explore.

Whether you’re a beginner or a seasoned crypto enthusiast, understanding the fundamental concepts and future prospects of this rapidly evolving field is key to thriving in the industry. As technology continues to develop and mainstream applications grow, cryptocurrency could become an integral part of our financial system, reshaping our understanding of money, transactions, and assets.

2 notes

·

View notes

Text

Unlocking the Power of Blockchain Technology

Blockchain technology has been making waves in the tech industry, and its potential extends far beyond cryptocurrency. At its core, blockchain is a decentralized, secure, and transparent way to store and transfer data.

Key Benefits:

Security: Blockchain's cryptographic algorithms ensure tamper-proof transactions.

Transparency: All transactions are publicly visible, promoting accountability.

Efficiency: Automated processes reduce processing time and costs.

Real-World Applications:

Supply Chain Management: Tracking goods and materials with precision.

Smart Contracts: Self-executing contracts with predefined rules.

Identity Verification: Secure digital identities for individuals.

Future Outlook:

As blockchain technology continues to evolve, we can expect:

Mainstream Adoption: Integration into various industries.

Innovative Solutions: New use cases and applications.

Increased Security: Enhanced protection against cyber threats.

Conclusion:

Blockchain technology is transforming the way we think about data, security, and efficiency. Stay tuned for more insights into the world of tech crypto!

2 notes

·

View notes

Text

Eighty-eight corporate leaders endorse Harris in new letter, including CEOs of Yelp, Box

Eighty-eight corporate leaders signed a new letter Friday endorsing Vice President Kamala Harris for president.

Signers include former 21st Century Fox CEO James Murdoch, Snap Chairman Michael Lynton, Yelp boss Jeremy Stoppelman and Ripple co-founder Chris Larsen.

If the Democratic nominee wins the White House, they contend, “the business community can be confident that it will have a president who wants American industries to thrive.”

WASHINGTON — Eighty-eight current and former top executives from across corporate America have endorsed Vice President Kamala Harris for president in a new letter shared exclusively with CNBC.

Among the signers are several high-profile CEOs of public companies, including Aaron Levie of Box, Jeremy Stoppelman of Yelp and Michael Lynton, chairman of Snap

.

Other signers appear to be issuing their first public endorsements of Harris since she became the de facto Democratic nominee in July.

They include James Murdoch, former CEO of 21st Century Fox and an heir to the Murdoch family media empire, and crypto executive Chris Larsen, co-founder of the Ripple blockchain platform.

Other notable signers are philanthropist Lynn Forester de Rothschild, private equity billionaire José Feliciano, Twilio co-founder Jeff Lawson, and D.C. sports magnate Ted Leonsis, owner of the NBA’s Washington Wizards, WNBA’s Mystics and the NHL’s Washington Capitals.

The three-page list also includes a slate of longtime Democratic political donors, like Kleiner Perkins’ John Doerr, Insight partners Deven Parekh, and Jeffrey Katzenberg, founder and managing partner of Wndr and former chairman of Walt Disney Studios.

Another subset of names are people who have supported Harris in particular since her political campaigns in California, like the philanthropist Laurene Powell Jobs, Facebook co-founder Dustin Moskovitz, and NBA Hall of Famer and billionaire businessman Magic Johnson.

More than a dozen of the signers made their fortunes on Wall Street: Tony James, former president and COO of Blackstone and founder of Jefferson River Capital; Bruce Heyman, former managing director of private wealth at Goldman Sachs; Peter Orszag, CEO of Lazard; and Steve Westly managing director of the Westly Group and a former Tesla

board member.

Still more are prominent in Silicon Valley, including the venture capitalist Ron Conway, entrepreneur Mark Cuban and former LinkedIn CEO Reid Hoffman.

***Cuban just said her plans would destroy the stock market.. Oh well... WOW

2 notes

·

View notes

Text

BTC Nashville Conference 2024: A Gathering of Minds and Innovation

The BTC Nashville Conference 2024 kicks off today, bringing together some of the brightest minds and most influential figures in the cryptocurrency world. This event, set to run from July 25th to July 27th, promises to be a pivotal moment for the crypto community, offering insights, discussions, and networking opportunities that could shape the future of digital currencies.

Keynote Speakers

This year's conference features a lineup of notable speakers, including former President Donald Trump. Trump's speech is highly anticipated, especially given the recent speculation about his interest in Bitcoin as a US Treasury reserve asset. His stance on Bitcoin could potentially influence market dynamics and government policies.

Major Topics

The conference will cover a wide range of topics crucial to the future of Bitcoin and the broader crypto ecosystem. Key discussions will include:

Bitcoin Adoption and Regulation: Experts will delve into the challenges and opportunities in increasing Bitcoin adoption worldwide and the regulatory landscape shaping this process.

The Future of Digital Currencies: Speakers will explore the potential paths for digital currencies, examining trends, innovations, and market predictions.

Technological Advancements in Blockchain: Attendees will learn about the latest developments in blockchain technology and how these innovations can enhance security, scalability, and efficiency.

The Role of Bitcoin in the Global Economy: Discussions will focus on Bitcoin's impact on global markets, its potential as a hedge against inflation, and its role in the future financial system.

Significant Events

One of the most exciting aspects of the BTC Nashville Conference is the potential for major announcements. Recently, there has been significant buzz around the $1 billion inflows to the Ethereum ETF. This development could have far-reaching implications for the crypto market, influencing investor sentiment and market dynamics.

Bullish Outlook for Crypto

Moving forward, the outcomes of the BTC Nashville Conference could be highly bullish for the crypto market. Positive remarks from influential figures like Trump, coupled with significant announcements and advancements discussed at the conference, could drive increased confidence and investment in cryptocurrencies. The potential regulatory clarity and innovative breakthroughs highlighted at the event are likely to contribute to a more robust and dynamic crypto ecosystem.

Networking and Innovation

Beyond the scheduled talks and panels, the conference offers invaluable networking opportunities. Attendees will have the chance to connect with industry leaders, innovators, and fellow enthusiasts. These interactions can lead to collaborations, partnerships, and new ventures that drive the crypto space forward.

Conclusion

The BTC Nashville Conference 2024 is more than just a series of talks; it's a convergence of ideas and visions that could define the future of cryptocurrency. As we look forward to the insights and announcements from this event, it's clear that the conversations here will resonate far beyond the conference halls.

Stay tuned for updates and insights from the BTC Nashville Conference as we continue to explore the evolving landscape of digital currencies and their impact on our world.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#BTCNashville2024#BitcoinConference#CryptoEvent#BlockchainInnovation#Bitcoin#Cryptocurrency#DigitalCurrency#CryptoNews#Blockchain#CryptoCommunity#FinancialFreedom#CryptoAdoption#FutureOfFinance#BitcoinTechnology#CryptoBullish#financial empowerment#financial experts#unplugged financial#financial education#finance#globaleconomy

3 notes

·

View notes