#crypto exchange vulnerabilities

Explore tagged Tumblr posts

Text

The Extravagant Life of a Singaporean Bitcoin Thief: A Tale of Lavish Spending and High-Stakes Crime

” The shocking story of a Singaporean charged with a US$230M Bitcoin theft, who spent US$500K a night at clubs and bought over 30 luxury cars. Explore the implications for cryptocurrency security, regulation, and the future of digital assets in this detailed analysis of one of the largest crypto heists. “ In a story that reads like a Hollywood script, a young Singaporean named Malone Lam has…

#230M Bitcoin heist#500K a night at clubs#Bitcoin money laundering#Bitcoin security measures#crypto currency theft#crypto exchange vulnerabilities#cryptocurrency regulation#cryptocurrency theft#high-profile crypto crimes#luxury car purchases with Bitcoin#Singaporean Bitcoin theft#US230M Bitcoin heist

0 notes

Text

ERC20 Token Generator Introduction

Have you ever thought about creating your own cryptocurrency? With an ERC20 Token Generator , you can make it happen effortlessly. Let’s explore how to dive into the blockchain universe.

Understanding ERC20 Tokens

ERC20 tokens are a type of digital asset on the Ethereum blockchain, following a set standard for compatibility and functionality.

Advantages of ERC20 Tokens:

Consistency: Adheres to a universal protocol.

Broad Adoption: Recognized across various Ethereum-based platforms.

Robust Support: Strong community and resources available.

How to Use an ERC20 Token Generator

Creating tokens is simplified with these tools. Here’s how it works:

Specify Token Details:

Decide on a name and symbol.

Determine the total number of tokens.

Utilize the Generator:

Access an online generator.

Enter your token information.

Deploy Your Token:

Review your settings.

Launch on the Ethereum network.

Features of ERC20 Tokens

ERC20 tokens provide essential features that enhance their usability:

Standard Operations: Includes transferring and checking balances.

Smart Contract Compatibility: Integrates easily with smart contracts.

Security Assurance: Utilizes Ethereum's strong blockchain security.

Reasons to Create an ERC20 Token

Why create your own token? Here are some compelling reasons:

Raise Capital: Launch an ICO for funding.

Build Engagement: Offer rewards to your community.

Drive Innovation: Explore new blockchain applications.

Challenges to Consider

Despite the simplicity, some challenges exist:

Knowledge Requirement: Some blockchain understanding is needed.

Security Concerns: Vulnerabilities can be exploited if not addressed.

Regulatory Compliance: Ensuring adherence to legal standards is vital.

Best Practices for Token Creation

Follow these tips to ensure a successful token launch:

Code Audits: Regularly check for security issues.

Community Involvement: Seek feedback and make necessary adjustments.

Stay Updated: Keep abreast of blockchain trends and legal requirements.

Conclusion

The ERC20 Token Generator empowers you to create and innovate within the crypto space. Whether you're a developer or entrepreneur, it's a powerful tool for blockchain engagement.

Final Thoughts

Embarking on token creation offers a unique opportunity to explore the digital economy and its possibilities.

FAQs

1. What is the purpose of an ERC20 Token Generator?

It’s a tool to create custom tokens on the Ethereum blockchain easily.

2. Do I need technical skills to create a token?

A basic understanding of blockchain helps, but many tools are user-friendly.

3. Can I trade my ERC20 tokens?

Yes, you can trade them on crypto exchanges or directly with users.

4. What costs are involved in token creation?

Creating tokens incurs gas fees on the Ethereum network.

5. How can I ensure my token’s security?

Perform regular audits and follow best practices for security.

Source : https://www.altcoinator.com/

#erc20#erc20 token development company#erc#erc20tokengenerator#token#token generator#token creation#ethereum#bitcoin

57 notes

·

View notes

Text

Why I remain hopeful about America

Even as darkness falls

ROBERT REICH

JAN 20

Friends,

So many people I know — including, I suspect, many of you — are despairing over Trump’s second regime, which starts today.

I share your fears about what’s to come.

Yet I remain hopeful about the future of America. Here’s why.

Trump hoodwinked average working Americans into believing he’s on their side and convinced enough voters that Kamala Harris and Democrats were on the side of cultural elites (the “deep state,” “woke”ism, “coastal elites,” and so on).

But Trump’s hoax will not work for long, given the oligarchy’s conspicuous takeover of America under Trump II.

Even before Trump’s regime begins, it’s already exposing a reality that has been hidden from most Americans for decades: the oligarchy’s obscene wealth and its use of that wealth to gain power over America.

Seated prominently where Trump is giving his inaugural address today will be the three richest people in America — Elon Musk, Jeff Bezos, and Mark Zuckerberg — each of whom owns powerful media that have either boosted Trump’s lies or refrained from telling the truth about him.

Musk sank a quarter of a billion dollars into getting Trump elected, in return for which Trump has authorized him, along with billionaire Vivek Ramaswamy, to target for elimination programs Americans depend on — thereby making way for another giant tax cut for the wealthy.

The oligarchy’s conflicts of interest will be just as conspicuous.

Musk’s SpaceX is a major federal contractor through its rocket launches and its internet service, Starlink. Bezos’s Amazon is a major federal contractor through its cloud computing business. Zuckerberg is pouring billions into artificial intelligence, as is Musk, in hopes of huge federal contracts.

Ramaswamy, whose biotech company is valued at nearly $600 million, wants the Food and Drug Administration to speed up drug approvals. His investment firm has an oil and gas fund. His new Bitcoin business would benefit if the federal government kept its hands off crypto.

Trump himself has already begun to cash in on his second presidency even more blatantly than he did the first time. He just began selling a cryptocurrency token featuring an image of himself — even though cryptocurrency is regulated by the Securities and Exchange Commission, to which Trump has already said he’ll name a crypto advocate as chair.

Not to mention the billionaires Trump is putting in charge of key departments to decide on taxes and expenditures, tariffs and trade, even what young Americans learn — all of whom have brazen conflicts of interest.

They’ll all be on display today with Trump. Then, many will take their private jets to Davos, Switzerland, for the annual confab of the world’s most powerful CEOs and billionaires.

Not since the Gilded Age of the late 19th century has such vast wealth turned itself into such conspicuous displays of political power. Unapologetically, unashamedly, defiantly.

This flagrancy makes me hopeful. Why? Because Americans don’t abide aristocracy. We were founded in revolt against unaccountable power and wealth. We will not tolerate this barefaced takeover.

The backlash will be stunning.

I cannot tell you precisely how or when it will occur, but it will start in our communities when we protect the most vulnerable from the cruelties of the Trump regime, ensure that hardworking families aren’t torn apart, protect transgender and LGBTQ+ people, and help guard the safety of Trump’s political enemies.

We will see the backlash in the 2026 midterms and the 2028 presidential election, when Americans elect true leaders who care about working people and the common good.

And just as we did at the end of the first Gilded Age of the late 19th century when the oligarchy revealed its hubris and grandiosity, Americans will demand fundamental reforms: getting big money out of politics, taxing huge wealth, busting up or regulating giant corporations, making huge social media platforms accountable to the public rather than to a handful of multibillionaires.

Friends, we could not remain on the path we were on. The sludge had been thickening even under Democratic administrations. Systematic flaws have remained unaddressed. Inequalities have continued to widen. Corruption and bribery have worsened.

It’s tragic that America had to come to this point. A few years of another Trump regime, even worse than the first, will be hard on many people.

But as the oligarchy is conspicuously exposed, Americans will see as clearly as we did at the end of the first Gilded Age that we have no option but to take back power.

Only then can we continue the essential work of America: the pursuit of equality and prosperity for the many, not the few. The preservation and strengthening of a government of, by, and for the people.

23 notes

·

View notes

Text

I can't ask you to boycott Tesla...

...because I know the vast majority of Tumblr can't buy a Tesla. Musk's views have resulted in plummeting Tesla sales in 2024 - !as much as 63% in France!

But there IS another way to defund Elon Musk, and that is to write to advertisers on X (formerly Twitter) and pressure them to withdraw.

I know a lot of us have left, but if you have an old account on there and don't mind quiet, grindy, but highly impactful direct action, here is a step-by-step guide.

Choose 1-3 advertisers that are

Not affiliated with Musk/DOGE/Tesla/SpaceX/Starlink or the US Federal government. US State government entities and initiatives are probably OK to contact. Non-US government bodies are even better choices.

Have a contactable presence outside of Twitter; eg. an email address for complaints, a website feedback form etc.

Pay at least lip service towards diversity, equality and/or accessibility in a mission statement, organisational pledge, or through the use of inclusive imagery and language.

Avoid:

Advertisers ideologically aligned with Musk, or targeting specific individuals. Many far right think tanks and individuals take out advertising on Twitter. Some are likely sock puppets of Musk’s own allies. Look for vague buzzwords about ‘improving efficiency’, ‘anti-woke’, ‘free speech’ etc. Don’t waste your time on them.

Cryptocurrency exchanges, as they're probably scammers to start with.

Now, to create your letter!

1 – Save a screenshot of the ad for attachment to your message. Not every personnel assigned to handling complaints is aware of every ad campaign.

2 – Begin by highlighting the relevance of the org or company to you eg.

“I am a taxpayer in (state/country/region)…”

“As a customer/fan/subject matter expert of …”

“As someone who uses similar products/services…”

3 – State your reaction to the ad, eg.

“…I am disappointed/shocked/upset to see your advertisement on X (formerly twitter).”

4 – Explain why Pick a mixture of ideological and financial reasons

Ideological:

Musk’s bigoted views, citing examples. Eg. nazi salutes, transphobia etc

The impact of DOGE on vulnerable Americans and/or the impact of withdrawing USAID overseas.

Permissiveness towards bigotry and abuse on X eg. Andrew Tate, Nazi accounts, ubiquitous bullying

… and that these run counter to the organisation’s / company’s values and image, quoting their own mission statements if desired; and that they risk tarnishing their brand through association. I haven’t added example URLs for these as there are simply way too many choices!

Financial:

Bot and inauthentic activity on X is greater than that of authentic users (references: https://www.abc.net.au/news/science/2024-02-28/twitter-x-fighting-bot-problem-as-ai-spam-floods-the-internet/103498070 , https://mashable.com/article/x-twitter-elon-musk-bots-fake-traffic , https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0313293

Very high incidence of click fraud (false and manufactured engagement with advertising, increasing advertisers’ expenditure) references: https://www.socialmediatoday.com/news/new-report-finds-x-may-be-inflating-ad-performance-results/707860/ , https://searchengineland.com/x-surge-traffic-fake-437715

Reluctance of users to engage with ads due to numerous advertisements by scammers eg. https://www.bleepingcomputer.com/news/security/x-users-fed-up-with-constant-stream-of-malicious-crypto-ads/ , https://www.cbc.ca/news/canada/cbc-ads-fake-investment-scheme-1.7439812 , https://uk.finance.yahoo.com/news/celebrity-deepfake-scam-ads-were-000100107.html?guccounter=1

5 – State the consequences of continuing to advertise on X

“I believe this is a waste of taxpayers’ money that could be better spent elsewhere…”

“Continuing to advertise on X harms your company’s / organisation’s image…”

“If you continue to advertise on X, I will take my business to your competitor…”

6 – Sign off

Yours Sincerely, (your name/pseudonym)

---------------------

Over time, you can build a toolbox of sentences to put together and create unique letters for each advertiser. If you have time to doomscroll, you have time to do this, and it only takes as few as 2-3 people writing in to get an advertiser to reconsider.

19 notes

·

View notes

Text

A crypto investor has brought a class action lawsuit against Pump.Fun, a platform for launching and investing in meme-inspired cryptocurrencies, after suffering trading losses.

Representing the plaintiffs are Wolf Popper and Burwick Law, the two firms handling a separate class action brought by investors in December over a memecoin launched by web personality Haliey Welch, better known as the Hawk Tuah girl, which collapsed in value soon after trading began. (Welch was not named as a defendant in that suit.)

“These ‘emperor’s new clothes’ crypto schemes can’t keep masquerading as legitimate finance, leaving the vulnerable in the lurch," says Max Burwick, founding partner at Burwick Law.

Pump.Fun was a hit when launched in January 2024, giving people a way to launch memecoins—highly volatile cryptocurrencies that typically have no inherent purpose beyond speculation—instantly and at no cost. The new lawsuit, filed Thursday in the Southern District of New York, alleges that Pump.Fun has operated as an unregistered securities issuer and seller. In making marketing claims that downplay the likelihood of losing money trading memecoins, the complaint alleges, the platform also put investors at heightened financial risk.

Separately, the lawsuit alleges that these memecoin platforms, like Pump.Fun, are designed in such a way as to incentivize pump-and-dump activity. “Early investors or insiders artificially inflate token prices through coordinated buying and promotional campaigns, then sell their holdings at peak prices, causing the token's value to collapse and leaving later investors with substantial losses,” the complaint claims.

The complaint points to the circumstances around the launch of a particular Pump.Fun memecoin—PNUT, which references the celebrity squirrel euthanized last year in New York—to evidence its claims.

Pump.Fun did not respond to a request for comment. But in an interview with WIRED last year, Noah Tweedale, one of the three Pump.Fun cofounders named in the suit, refuted the idea that the platform stands to benefit from regular investors losing money. “The idea with Pump was to build something where everyone was on the same playing field,” Tweedale said. “I want to stress, we don’t want people to lose money on our platform. It doesn’t benefit us by any means.”

More than 6 million unique memecoins have been launched through Pump.Fun, the most successful of which are valued at hundreds of millions of dollars. The memecoin market is now worth in excess of $100 billion in aggregate, market data shows.

In its first 12 months in operation, Pump.Fun is reported by third parties to have generated more than $350 million in revenue, taking a 1 percent cut of trades. The platform is on pace to make more than $1 billion in revenue in 2025.

However, the lawsuit brought by the crypto investor—which follows reports of unethical trading activity, criticism relating to content moderation, and a warning issued against Pump.Fun by the UK financial regulator—could threaten to put a dampener on the runaway growth.

The lawsuit hinges on the idea that memecoins should in some circumstances be classified as securities, a particular type of investment instrument. The complaint claims that by failing to register token sales with the Securities and Exchange Commission (SEC), the relevant US financial regulator, Pump.Fun allegedly violated securities laws and denied investors the disclosures required of regulated entities.

Whether cryptocurrencies should be classified as securities is a long-running debate that has spawned a mess of litigation between the SEC and cryptocurrency companies. Though the SEC has not pursued many memecoin-related cases to date, in the lawsuit against Pump.Fun, the crypto investor alleges that all memecoins issued through the platform resemble securities by virtue of the way they are marketed.

“This largely turns on the question of an expectation of returns through marketing promises,” says Burwick. “The issue with almost every memecoin is: How was this marketed?” Essentially, if a creator or issuing platform suggests that a coin is headed to the moon, Burwick believes it is a security.

In the interview with WIRED, Tweedale rejected the idea that memecoins might fall under the purview of the SEC. “Memecoins being securities is a joke. That can’t be the case,” he said.

Elsewhere, the lawsuit alleges that Pump.Fun essentially gamified the trading experience and engaged in a "sophisticated marketing campaign" that combined "promises of exponential returns, luxury lifestyle imagery, and coordinated social media promotion,” which had the effect of obfuscating the risk profile of memecoin investing.

The architecture of the Pump.Fun platform, which relies upon a mathematical mechanism known as a bonding curve to eliminate the cost of issuing a memecoin for creators, amplifies the potential financial harm by creating a dynamic whereby early buyers benefit disproportionately, the investor has alleged.

Meanwhile, in failing to verify the age or identity of its users, Pump.Fun exposes minors and inexperienced investors to both financial risk and the explicit material rife on the platform, the complaint alleges. In December, Tweedale told WIRED that Pump.Fun plans to introduce age restrictions but provided no further specifics.

Memecoin trading has frequently been compared to gambling at a casino. But the metaphor is ill-fitting, Burwick claims, because it erases the responsibility to investors that should be borne by the platforms through which memecoins are issued.

“This is not a casino … Retail investors are sold an opportunity to make a return on their investment, but the reality is that they have an entire system they are playing against. They don’t understand how heavily the odds are stacked against them,” says Burwick. “Pump.Fun is not gambling—it’s the illegal issuance of securities.”

5 notes

·

View notes

Text

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

If you’re just starting out with digital currencies, don’t worry—you’re in good company! Cryptocurrencies can feel overwhelming at first, but with the right guidance, anyone can grasp how they work and how to invest safely.This guide will break down the basics, explain how cryptocurrency operates, and walk you through the essential steps to start investing wisely.By the end, you’ll have a solid foundation in cryptocurrency, security tips to protect your investments, and insights into the best strategies to make money safely in 2025. What is Cryptocurrency? ryptocurrency, often called "crypto," is a form of digital currency that exists purely in electronic form. Unlike the cash in your wallet or the balance in your bank account, cryptocurrencies are decentralized, meaning they are not controlled by any government or financial institution.Instead, they operate on blockchain technology—a secure, transparent ledger that records all transactions in a way that is nearly impossible to alter. How Does Cryptocurrency Work? Imagine a digital notebook where every transaction is permanently recorded and visible to everyone. This notebook is known as the blockchain. Each transaction is verified by a network of computers, making it highly secure and resistant to fraud.Unlike traditional banking systems, where a central authority like a bank processes transactions, cryptocurrencies rely on a decentralized system. This means users have more control over their funds, but it also means they are responsible for keeping their investments safe. Why is Cryptocurrency Popular? There are several reasons why cryptocurrency has gained so much attention over the years:- Decentralization: No single entity has control over cryptocurrencies. - Security: Transactions are encrypted, making them highly secure. - Transparency: Blockchain records all transactions, ensuring accountability. - Growth Potential: Many investors view cryptocurrencies as a promising new financial opportunity.Whether you want to use crypto for everyday purchases, transfer money internationally, or invest in the long term, understanding how it works is the first step.

How to Invest in Cryptocurrency for Beginners If you’re ready to take the plunge into cryptocurrency investing, follow these steps to ensure a smooth and secure experience. Step 1: Choose a Cryptocurrency Exchange Before you can buy cryptocurrency, you’ll need to create an account on a cryptocurrency exchange. Think of an exchange as an online marketplace where you can trade digital currencies.Popular platforms like Bybit, Coinbase, and Kraken offer user-friendly interfaces, making them ideal for beginners.🔥 Looking for a secure and easy-to-use exchange? Start your crypto journey with Bybit and enjoy seamless trading with exclusive bonuses! 👉 Sign Up for Bybit Now Step 2: Decide on the Cryptocurrency to Invest In With thousands of cryptocurrencies to choose from, selecting the right one can feel daunting.For beginners, it's often best to start with well-established options like Bitcoin (BTC) or Ethereum (ETH), as they tend to be more stable and widely accepted. These coins have a proven track record and are generally less risky compared to newer, lesser-known cryptocurrencies. Step 3: Set Up a Secure Wallet Once you’ve chosen an exchange and purchased your cryptocurrency, you need a place to store it. Cryptocurrency wallets come in two main types:- Hot Wallets: These are online wallets connected to the internet, making them convenient but also more vulnerable to hacking. - Cold Wallets: These are offline wallets (like hardware devices or paper wallets) that provide better security for long-term storage.For beginners, a combination of both types is recommended—use a hot wallet for small, frequent transactions and a cold wallet for large investments. Step 4: Make Your First Purchase Once your wallet is set up, you can buy your first cryptocurrency.You don’t have to purchase a whole Bitcoin or Ethereum—you can buy fractions of a coin based on your budget. After purchasing, the cryptocurrency will be stored in your wallet. Step 5: Develop an Investment Strategy Investing in cryptocurrency isn’t just about buying and holding—it’s about having a plan. Some common strategies include:- HODLing: Holding onto your crypto for the long term, regardless of market fluctuations. - Trading: Actively buying and selling crypto to take advantage of price swings. - Staking: Earning passive income by locking up your crypto to support blockchain operations.Understanding these strategies will help you make informed investment decisions.Correlated Article:

How to Travel the World and Make Money: The Digital Nomad’s Guide to Earning with Cryptocurrencies

Risks of Investing in Cryptocurrency While cryptocurrency has the potential for high returns, it also comes with risks. Here are some key factors to be aware of: 1. Scams and Fraud Scammers often prey on beginners with fake investment schemes, phishing attacks, and pump-and-dump schemes. Always research projects thoroughly before investing your money. 2. High Volatility Cryptocurrency prices can change dramatically within hours. While this presents an opportunity for profit, it also means you can lose money just as quickly. It’s essential to be prepared for market swings. 3. Lack of Regulation Unlike traditional investments, cryptocurrency is still relatively unregulated in many countries. This means fewer protections for investors and a higher risk of encountering scams or fraudulent projects. 4. Security Threats Although blockchain technology is secure, hackers frequently target exchanges and wallets. Always use strong passwords, enable two-factor authentication (2FA), and consider using a hardware wallet for extra security. Best Crypto for Beginners to Invest In If you’re unsure where to start, here are some of the most beginner-friendly cryptocurrencies:- Bitcoin (BTC): The original and most well-known cryptocurrency, often considered the safest bet for new investors. - Ethereum (ETH): Known for its smart contract capabilities, Ethereum is a great choice for those interested in blockchain applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Binance Coin (BNB): Useful for those trading on Binance and involved in the broader crypto ecosystem. - Cardano (ADA): A research-driven cryptocurrency focusing on sustainability and scalability.Starting with these established coins can help reduce risk while you learn the ropes.

Cryptocurrency Security Tips Keeping your crypto safe is crucial. Follow these best practices to protect your investments: 1. Use Strong Passwords & Enable 2FA Create long, unique passwords for your exchange and wallet accounts. Use two-factor authentication (2FA) for an extra layer of security. 2. Store Large Amounts in a Cold Wallet For secure, long-term storage, use a hardware wallet such as Ledger or Trezor. Keeping your funds offline adds an extra layer of protection, making it much harder for hackers to gain access. 3. Avoid Suspicious Links & Scams Never click on unsolicited emails, fake airdrops, or suspicious investment offers. Scammers often impersonate crypto platforms to steal your credentials. 4. Use Reputable Exchanges & Wallets Stick to well-known platforms with strong security measures. Always verify websites before entering sensitive information. Conclusion: Your Next Steps in The Crypto Market Cryptocurrency can be an exciting and profitable investment if approached wisely. This guide has provided you with the essential knowledge to get started safely.Whether you choose to buy and hold Bitcoin, trade Ethereum, or explore new investment opportunities, the key is to start slowly, stay informed, and always prioritize security. Ready to take your first step into cryptocurrency trading? Bybit offers a secure, beginner-friendly platform to buy, sell, and trade crypto.Sign up today and take advantage of exclusive bonuses! 👉 Join Bybit Now and Claim Your Welcome Bonus

Frequently Asked Questions (FAQs) about Cryptocurrency Trading for Beginners

Is cryptocurrency legal? Yes, cryptocurrency is legal in many countries, but regulations vary. Some countries fully support it, while others impose restrictions or bans.Always check your local laws before investing. How much money do I need to start investing in cryptocurrency? You can start with as little as $10, depending on the exchange. Many platforms allow fractional purchases, meaning you don’t need to buy a whole Bitcoin or Ethereum. What is the safest way to store cryptocurrency? A hardware (cold) wallet is the safest option for long-term storage. It keeps your crypto offline, making it less vulnerable to hacking. Use a combination of hot and cold wallets for security and convenience. Can I lose money in cryptocurrency? Yes, due to market volatility, cryptocurrency prices can rise and fall dramatically. You can lose money if the market drops or if you invest in a scam. Only invest what you can afford to lose. How do I avoid cryptocurrency scams? - Use reputable exchanges and wallets. - Enable two-factor authentication (2FA). - Avoid unsolicited investment offers and emails. - Verify the legitimacy of projects before investing. Should I invest in new cryptocurrencies? New cryptocurrencies can offer high rewards but also carry high risks. Some are legitimate, while others are scams. Conduct thorough research before investing in any new digital asset. What are gas fees? Gas fees are transaction fees paid to process transactions on a blockchain. Networks like Ethereum require gas fees for smart contract operations, and these fees can fluctuate depending on network demand. Can I earn passive income with cryptocurrency? Yes! Some ways to earn passive income include:- Staking: Locking up your crypto to support blockchain operations and earn rewards. - Yield farming: Providing liquidity to decentralized finance (DeFi) protocols for returns. - Lending: Lending your crypto to earn interest on platforms like Aave or Compound. Is cryptocurrency taxed? In many countries, cryptocurrency is subject to capital gains tax. Selling crypto for a profit, trading, or earning through staking may require tax reporting. Check your local tax laws to ensure compliance. What happens if I lose access to my wallet? If you lose access and do not have your backup seed phrase, you may lose your funds permanently. Always store your seed phrase securely in a physical location, never online. What is the difference between a coin and a token? - Coin: A cryptocurrency that operates on its own blockchain (e.g., Bitcoin, Ethereum). - Token: A digital asset that operates on an existing blockchain (e.g., ERC-20 tokens on Ethereum). How do I send cryptocurrency to someone else? - Copy the recipient’s wallet address. - Paste the address into your wallet’s “Send” section. - Choose the amount to send and confirm the transaction. - Double-check the address before finalizing the transaction to avoid errors. How long does a cryptocurrency transaction take? Transaction times vary depending on the blockchain network and congestion. Bitcoin transactions can take 10 minutes to an hour, while Ethereum transactions typically take a few minutes. Some blockchains, like Solana, offer near-instant transactions. What is a blockchain fork? A fork occurs when a blockchain network splits into two separate versions due to changes in protocol or disagreements in the community. Hard forks (e.g., Bitcoin Cash from Bitcoin) create a new chain, while soft forks update an existing chain without splitting. What are the best cryptocurrencies for beginners to invest in? Some beginner-friendly cryptocurrencies include:- Bitcoin (BTC): The most established and widely accepted cryptocurrency. - Ethereum (ETH): Known for smart contracts and decentralized applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Cardano (ADA): A research-driven cryptocurrency focused on sustainability. Can I use cryptocurrency for everyday purchases? Yes! Many businesses accept cryptocurrency for payments, and crypto debit cards allow users to spend their digital assets like cash. However, adoption varies by location. What is a stablecoin? A stablecoin is a cryptocurrency designed to maintain a stable value by being pegged to a fiat currency (e.g., USDT, USDC). These are useful for reducing volatility and making transactions easier. What is DeFi (Decentralized Finance)? DeFi is a blockchain-based financial system that eliminates traditional intermediaries like banks. It offers services such as lending, borrowing, and trading through smart contracts on platforms like Uniswap and Aave. Can I mine cryptocurrency? Yes, but mining is not as profitable for individuals as it used to be. Bitcoin mining requires specialized hardware (ASICs), while other cryptocurrencies like Ethereum (until its transition to proof-of-stake) could be mined with GPUs. What is an NFT (Non-Fungible Token)? NFTs are unique digital assets that represent ownership of art, music, virtual goods, and more. Unlike cryptocurrencies, each NFT is one of a kind and cannot be exchanged on a one-to-one basis. How do I track my crypto investments? You can track your portfolio using crypto tracking apps like:- CoinMarketCap - CoinGecko - Blockfolio - Delta What happens to my cryptocurrency if I die? Without proper estate planning, your cryptocurrency could be lost forever. To ensure your assets are passed on, store your private keys and seed phrases securely and designate a trusted person to access them. What is a rug pull? A rug pull is a type of scam in which developers abandon a project after raising funds, leaving investors with worthless tokens. Read the full article

#beginner’sguidetocrypto#bestcryptocurrenciesforbeginners#Bitcoin#blockchaintechnology#cryptoexchange#cryptotrading#Cryptocurrency#cryptocurrencyforbeginners#cryptocurrencyinvestmentstrategies#cryptocurrencyrisks#cryptocurrencysecuritytips#digitalcurrencies2025#Ethereum#howtobuycryptocurrency#howtoinvestincryptocurrency#howtomakemoneywithBitcoin#howtoprotectyourcryptocurrency#makemoneywithcryptocurrency#safecryptoinvestment#securecryptocurrencyinvesting

2 notes

·

View notes

Text

Revolutionizing DeFi Development: How STON.fi API & SDK Simplify Token Swaps

The decentralized finance (DeFi) landscape is evolving rapidly, and developers are constantly seeking efficient ways to integrate token swap functionalities into their platforms. However, building seamless and optimized swap mechanisms from scratch can be complex, time-consuming, and risky.

This is where STON.fi API & SDK come into play. They provide developers with a ready-to-use, optimized solution that simplifies the process of enabling fast, secure, and cost-effective swaps.

In this article, we’ll take an in-depth look at why developers need efficient swap solutions, how the STON.fi API & SDK work, and how they can be integrated into various DeFi applications.

Why Developers Need a Robust Swap Integration

One of the core functions of any DeFi application is token swapping—the ability to exchange one cryptocurrency for another instantly and at the best possible rate.

But integrating swaps manually is not a straightforward task. Developers face several challenges:

Complex Smart Contract Logic – Handling liquidity pools, slippage, and price calculations requires expertise and rigorous testing.

Security Vulnerabilities – Improperly coded swaps can expose user funds to attacks.

Performance Issues – Slow execution or high gas fees can frustrate users and hurt adoption.

A poorly integrated swap feature can turn users away from a DeFi application, affecting engagement and liquidity. That’s why an efficient, battle-tested API and SDK can make a significant difference.

STON.fi API & SDK: What Makes Them a Game-Changer?

STON.fi has built an optimized API and SDK designed to handle the complexities of token swaps while giving developers an easy-to-use toolkit. Here’s why they stand out:

1. Seamless Swap Execution

Instead of manually routing transactions through liquidity pools, the STON.fi API automates the process, ensuring users always get the best swap rates.

2. Developer-Friendly SDK

For those who prefer working with structured development tools, the STON.fi SDK comes with pre-built functions that remove the need for extensive custom coding. Whether you’re integrating swaps into a mobile wallet, trading platform, or decentralized app, the SDK simplifies the process.

3. High-Speed Performance & Low Costs

STON.fi’s infrastructure is optimized for fast transaction execution, reducing delays and minimizing slippage. Users benefit from lower costs, while developers get a plug-and-play solution that ensures a smooth experience.

4. Secure & Scalable

Security is a major concern in DeFi, and STON.fi’s API is built with strong security measures, protecting transactions from vulnerabilities and ensuring reliability even under heavy traffic.

Practical Use Cases for Developers

1. Building Decentralized Exchanges (DEXs)

STON.fi API enables developers to integrate swap functionalities directly into their DEX platforms without having to build custom liquidity management solutions.

2. Enhancing Web3 Wallets

Crypto wallets can integrate STON.fi’s swap functionality, allowing users to exchange tokens without leaving the wallet interface.

3. Automating Trading Strategies

The API can be used to build automated trading bots that execute swaps based on real-time market conditions, improving efficiency for traders.

4. Scaling DeFi Platforms

For DeFi applications handling high transaction volumes, STON.fi API ensures fast and cost-effective execution, improving user retention.

Why Developers Should Consider STON.fi API & SDK

For developers aiming to create efficient, user-friendly, and scalable DeFi applications, STON.fi offers a robust solution that eliminates the complexities of manual integrations.

Saves Development Time – Reduces the need for custom swap coding.

Improves Security – Pre-tested smart contracts minimize vulnerabilities.

Enhances User Experience – Faster swaps create a smoother, more reliable platform.

Optimizes Performance – Low latency and cost-efficient execution ensure better outcomes.

Whether you’re working on a new DeFi project or improving an existing platform, STON.fi’s API & SDK provide a solid foundation to enhance functionality and scalability.

By leveraging STON.fi’s tools, developers can focus on building innovative features, rather than getting caught up in the technical challenges of token swaps.

3 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

Visit the Stonfi Dex now

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

> "A highly anticipated decision by the US Securities and Exchange Commission on whether to approve a spot-Bitcoin exchange-traded fund quickly morphed into a major cybersecurity incident on Tuesday.

> "The SEC’s X account was compromised and a fake post claiming that the agency had green lit plans for the products fueled a brief surge in the price of the world’s biggest cryptocurrency. It also has sparked an investigation by US authorities into how a social media account at Wall Street’s main regulator was compromised. …"

Look, I have no inside information, but most of the reporting I have read about spot Bitcoin ETFs has said that 1. the SEC is going to approve them, 2. by the end of today, and 3. this is public knowledge that everyone believes.

So you would think it would be pretty priced in? It just does not seem to me like there would be a ton of alpha in (1) constantly refreshing the SEC’s Twitter account, (2) looking for a tweet saying “okay spot Bitcoin ETFs are cool now,” and (3) buying Bitcoin on the news. Which implies there would not be a ton of alpha in (1) buying a bunch of Bitcoin, (2) hacking the SEC’s Twitter account, (3) tweeting “okay spot Bitcoin ETFs are cool now” and (4) selling your Bitcoin into the resulting enthusiasm.

[...]

Doesn’t it seem at least possible that this hack was just trolling? It didn’t move Bitcoin prices that much, and it shouldn’t have: The fake announcement was something that everyone expects to actually be true today. But it is very funny? The key element of online trolling is irony, and there is plenty of irony here. Like:

1. The crypto community and the SEC do not particularly like each other: Gensler’s SEC has launched a broad and aggressive crackdown on crypto, and it is only going to (probably!) approve spot Bitcoin ETFs today because a court forced it to. If you’re a Bitcoin enthusiast with the skills to hack the SEC’s Twitter, you might want to manipulate the price of Bitcoin, but you might also just want to make the SEC look bad.

2. Having the SEC (1) announce that Bitcoin ETFS are approved, (2) walk back that announcement, and then (3) announce it again, for real this time, the next day, really is quite embarrassing. Like if the hacker made the SEC say something outlandish and false, that would be a little funny. But making the SEC say something true a day early is extremely funny.

3. In addition to cracking down on crypto, one of the SEC’s big regulatory priorities under Gensler has been punishing companies for cybersecurity incidents.[2] The SEC once sued a company for using weak passwords, and its enforcement director said that the case “underscores our message to issuers: implement strong controls calibrated to your risk environments.” But apparently the SEC’s Twitter was compromised because it didn’t turn on two-factor authentication. Nyah nyah nyah nyah nyah!

[...]

Anyway, the great counter-troll here would be for the SEC to announce today “you know what, all the Bitcoin ETF applications are rejected, we’ll see you in court again. We were going to approve them, but it turns out that the Bitcoin market is still too vulnerable to manipulation, as you can tell by the fact that someone hacked our Twitter to manipulate Bitcoin.”

18 notes

·

View notes

Text

Launch Your Own Crypto Platform with Notcoin Clone Script | Fast & Secure Solution

To launch your own cryptocurrency platform using a Notcoin clone script, you can follow a structured approach that leverages existing clone scripts tailored for various cryptocurrency exchanges.

Here’s a detailed guide on how to proceed:

Understanding Clone Scripts

A clone script is a pre-built software solution that replicates the functionalities of established cryptocurrency exchanges. These scripts can be customized to suit your specific business needs and allow for rapid deployment, saving both time and resources.

Types of Clone Scripts

Centralized Exchange Scripts: These replicate platforms like Binance or Coinbase, offering features such as order books and user management.

Decentralized Exchange Scripts: These are designed for platforms like Uniswap or PancakeSwap, enabling peer-to-peer trading without a central authority.

Peer-to-Peer (P2P) Exchange Scripts: These allow users to trade directly with each other, similar to LocalBitcoins or Paxful.

Steps to Launch Your Crypto Platform

Step 1: Define Your Business Strategy

Market Research: Identify your target audience and analyze competitors.

Unique Value Proposition: Determine what sets your platform apart from others.

Step 2: Choose the Right Clone Script

Evaluate Options: Research various clone scripts available in the market, such as those for Binance, Coinbase, or P2P exchanges. Customization: Ensure the script is customizable to meet your specific requirements, including branding and features.

Step 3: Development and Deployment

Technical Setup: Collaborate with developers to set up the necessary infrastructure, including blockchain integration and wallet services.

Security Features: Implement robust security measures, such as two-factor authentication and encryption, to protect user data and transactions.

Step 4: Compliance and Regulations

KYC/AML Integration: Ensure your platform complies with local regulations by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Step 5: Testing and Launch

Quality Assurance: Conduct thorough testing to identify and fix any bugs or vulnerabilities.

Launch: Once testing is complete, launch your platform and start marketing it to attract users.

Advantages of Using a Notcoin Clone Script

Cost-Effective: Using a pre-built script is generally more affordable than developing a platform from scratch.

Faster Time to Market: Notcoin Clone scripts are ready to deploy, significantly reducing development time.

Customization Options: Most scripts allow for extensive customization, enabling you to tailor the platform to your needs.

Conclusion

Launching your own cryptocurrency platform with a Notcoin clone script is a viable option that can lead to a successful venture in the growing crypto market. By following the outlined steps and leveraging the advantages of Notcoin clone scripts, you can create a robust and secure trading platform that meets user demands and regulatory requirements.

For further assistance, consider reaching out to specialized development companies that offer Notcoin clone script and can guide you through the setup process

#cryptotrading#notcoin#notcoinclonescript#cryptocurrencies#crypto exchange#blockchain#crypto traders#crypto investors#cryptonews#web3 development

3 notes

·

View notes

Text

The Critical Importance of Financial Education in the Age of Bitcoin

Imagine a world where you have complete control over your money, free from banks and government interference. This isn't a far-off dream—it's the reality that Bitcoin is creating. But with great power comes great responsibility, and that's where financial education becomes crucial. In this post, we'll explore why understanding Bitcoin is essential in today's rapidly evolving financial landscape.

The Current State of Financial Education

Financial literacy rates paint a sobering picture. According to a 2020 FINRA study, only 34% of Americans could answer 4 out of 5 basic financial literacy questions correctly. This lack of understanding often leads to poor financial decisions, leaving people vulnerable to economic uncertainties. As digital currencies gain prominence, this knowledge gap becomes even more critical.

Why Bitcoin Requires Financial Education

Bitcoin, the world's first decentralized digital currency, operates on a complex blockchain network. While its potential benefits are significant, understanding its unique characteristics is crucial:

Volatility: Bitcoin's price can fluctuate wildly. In 2021 alone, it saw a 64% increase followed by a 50% drop within months.

Security: Transactions are secured through cryptography, with ownership maintained via private keys.

Decentralization: Unlike traditional currencies, Bitcoin isn't controlled by any central authority.

Benefits of Understanding Bitcoin

Hedge Against Inflation: With a fixed supply of 21 million coins, Bitcoin is designed to be inflation-resistant.

Investment Opportunities: While volatile, Bitcoin has shown significant long-term growth potential.

Financial Freedom: Bitcoin enables peer-to-peer transactions without intermediaries, offering unprecedented financial autonomy.

Real-World Applications

Bitcoin isn't just a speculative asset. In countries like El Salvador, it's legal tender. Remittance services like BitPesa use Bitcoin to reduce transaction costs for international money transfers in Africa.

Common Misconceptions

Let's debunk some myths:

"Bitcoin is only used for illegal activities": While cryptocurrencies have been used illicitly, legitimate uses far outweigh illegal ones.

"Bitcoin has no intrinsic value": Its value comes from its utility as a decentralized, borderless payment system and its scarcity.

Environmental Concerns

It's important to address the energy consumption debate surrounding Bitcoin mining. While Bitcoin does consume significant energy, innovations in renewable energy mining are addressing these concerns.

Comparison with Other Cryptocurrencies

While Bitcoin was the first, thousands of cryptocurrencies now exist. Ethereum, for example, offers smart contract functionality, while Litecoin aims for faster transaction speeds.

Challenges in Bitcoin Education

Complexity: The technology can be daunting for newcomers.

Misinformation: The crypto space is rife with unreliable information.

Regulatory Uncertainties: Regulations vary widely across jurisdictions.

Strategies for Improving Bitcoin Literacy

Educational Resources: Leverage reputable online courses and books. Websites like Bitcoin.org offer comprehensive guides.

Community Engagement: Join forums like r/Bitcoin or attend local meetups.

Practical Experience: Start with small transactions to build familiarity.

Expert Insight

"Bitcoin is not just an asset, it's a new financial system with its own rules. Understanding these rules is crucial for anyone looking to participate in the future of finance," says Andreas Antonopoulos, a leading Bitcoin educator.

Practical First Steps

Set up a small Bitcoin wallet (try Exodus or Green Wallet).

Buy a small amount of Bitcoin on a reputable exchange like Coinbase or Kraken.

Try making a small transaction to experience how it works.

The Role of Influencers and Educators

Platforms like Unplugged Financial play a crucial role in demystifying Bitcoin. By providing clear, accurate information, these educators help bridge the knowledge gap and empower individuals.

Conclusion

As Bitcoin continues to reshape the financial landscape, understanding its principles, benefits, and challenges is vital. By investing time in financial education, you can make informed decisions and potentially harness the power of Bitcoin to achieve greater financial freedom. Remember, in the world of Bitcoin, knowledge truly is power.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialEducation#Crypto#Cryptocurrency#DigitalCurrency#Blockchain#FinancialFreedom#Investment#Decentralization#BitcoinEducation#CryptoCommunity#Money#Finance#FinancialLiteracy#BitcoinInvesting#CryptoKnowledge#BitcoinBenefits#FutureOfFinance#FinancialIndependence#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts

4 notes

·

View notes

Text

Recover Your Crypto with the Best Crypto Recovery Experts

Are you in distress after falling victim to a cryptocurrency scam or losing access to your digital assets? Don't despair – help is at hand! Welcome to Broker Complaint Alert, your trusted partner in the realm of crypto recovery.

Why Choose Broker Complaint Alert?

At Broker Complaint Alert, we understand the complexities and risks associated with the cryptocurrency market. Whether you've been a victim of fraudulent schemes, phishing attacks, or technical mishaps, we have the expertise and dedication to assist you in recovering your lost funds.

Here's why we stand out as the best crypto recovery experts:

1. Extensive Experience:

Our team comprises seasoned professionals with years of experience in dealing with crypto-related issues. We have successfully handled a myriad of cases, ranging from simple account recovery to complex fraud investigations.

2. Tailored Solutions:

We recognize that every case is unique, and we approach each situation with a fresh perspective. Our experts will work closely with you to understand the specifics of your predicament and devise a personalized recovery strategy.

3. Proven Track Record:

Over the years, we have garnered a reputation for delivering results. Our track record speaks for itself, with numerous satisfied clients who have reclaimed their lost assets with our assistance.

4. Transparent Process:

We believe in transparency and keep our clients informed at every step of the recovery process. You can trust us to provide honest assessments and realistic expectations regarding the outcome of your case.

How We Can Help You:

Our comprehensive range of services includes:

Fraud Investigation: If you suspect fraudulent activity or unauthorized transactions involving your cryptocurrency holdings, our experts will conduct a thorough investigation to uncover the truth.

Account Recovery: Locked out of your crypto wallet or unable to access your funds? We specialize in facilitating the recovery of lost or inaccessible accounts, ensuring that you regain control of your assets.

Legal Assistance: In cases involving legal complexities or disputes with exchanges or trading platforms, our legal team will provide expert guidance and representation to safeguard your interests.

Risk Assessment: Worried about the security of your crypto investments? We offer risk assessment services to identify potential vulnerabilities and recommend proactive measures to mitigate risks.

Get in Touch Today!

Don't let despair overshadow your hopes of crypto recovery. Take the first step towards reclaiming your assets by reaching out to Broker Complaint Alert. Our dedicated team of experts is here to support you every step of the way.

Contact us today to schedule a consultation and let us be your trusted partner in crypto recovery. With Broker Complaint Alert by your side, your journey to financial restitution begins here.

Trust the best – choose Broker Complaint Alert for all your crypto recovery needs.

4 notes

·

View notes

Text

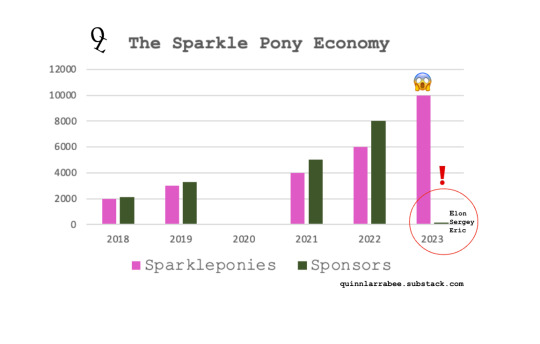

The Sparkle Pony Recession

“I’ve gotten fewer offers this year,” says Carli, a 27-year-old Instagram model, fitness influencer, and TikTok mental health advocate, who is slightly less attractive over Zoom than she is on any of the channels listed on her Linktree, as Zoom’s FaceApp integration is still in R&D. “Like yeah, it’s free, but I may have to fly commercial, and I’m literally sharing a single RV with two girls who I’ve only seen on TikTok–and they don’t even have as many followers as me.” Lingering supply chain issues, tech devaluations, and the end of crypto have dealt the broader Burning Man economy a number of blows the past two years, but they have landed the hardest on its most vulnerable commodity: Sparkle Ponies.

“2022 was how it should be,” continues Carli. “I had two RVs at two different camps and a hepa filter AC yurt at another camp for my mushroom journeys.” Her phone vibrates. She opens it, raises a finger and types furiously. A full two minutes of silence pass. She lifts her head, rolls her eyes, and smiles briefly with only her mouth. “One of my sponsors,” she says, and makes a masturbatory gesture with her hand. “Anyway, people on the outside don’t get it. They think it’s just one big party, but like, it’s a job. I got paid to show up at each of the camps because my aesthetic helps build their brand and better compete with Robot Heart for IG exposure. Appropriate accommodations, cash compensation, an outfit budget, and private travel are what I expect. It’s a fair value exchange,” she says earnestly. “The Burn is more than just a festival, it’s a part of my livelihood, and 2023 is not looking good.” This dispirited sentiment is ubiquitous among younger, architecturally attractive, sort-of-single (mostly) women who therapeutically consume psychedelics and much older men, are never not showing midriff, and always expect to be hosted by the best camps at Burning Man (and everywhere else in the world).

For those of you who haven’t attended Burning Man (hi, grandma! RIP!), you may be unfamiliar with the term sparkle pony.

A Burning Man sparkle pony is a younger-looking, typically (but not always) female person (but not always) whose fungible currency is her outer appearance, who travels to Blackrock City with nothing more than a toothbrush, a spare thong (but not always), and two exceptionally large aluminum wheeler suitcases stuffed with costumes that are almost too large for any means of conveyance but a cargo ship. Sparkle ponies emerged from primordial vibes when Burning Man commercialized, scaled and became an expensive, coveted experience that younger, architecturally attractive (mostly) women wanted to attend but did not want to pay for. Much in the same way that architecturally attractive (mostly) women are able to source complimentary food and beverages from unattractive strangers in restaurants and bars, they began showing up at Burning Man without practical supplies or any kind of skill, clad only in sequined fur bikinis, in the hopes of being taken in by a camp (which is sort of like neighborhood, a cult, and a CPG brand all rolled into one) that wants to raise its vibe by increasing its population of architecturally attractive (mostly) women.

More than any other component of the Burning Man ecosystem, sparkle ponies understand that Burning Man is a gift-based economy and expect everything at Burning Man to be gifted to them.

Sparkle ponies exponentially increased in number and entitlement between 2018 and 2022 when the volume of dry powder in venture capital exploded and tech valuations became hilarious. Newly wealthy, early-middle aged men who wanted to be towered over and findomed by mostly naked, architecturally attractive (mostly) women in sequined fur bikinis and white, platform boots wearing the identical shiny Steampunk captains hat and mirrored heart sunglasses gifted to them by one of the aging 6’5 Robot Heart guys, who are never not just a bit frustrated by the quality of the sound at every DJ set and are perpetually tuning the speakers on their art car (“the Stradivarius”), began sponsoring multiple sparkle ponies in the hopes of winning the ephemeral physical affection of one or more of them.

“It’s a funnel,” explained Tyler Kipperton, who founded a pre-revenue autonomous net-zero generative AI rocket company and achieved partial liquidity through a secondary offering that was completed in early September, 2022 with a family office in Europe and a holding company in China. “I figure if I fly in thirty sparkle ponies and put the best ten of them into an RV with an AC unit that doesn’t have a hepa filter, at least three of them will move in with me, and one of them will be into me when she sees me in black eyeliner and my Caravana Aztec poncho.” Tyler’s phone vibrates. He opens it, raises a finger and types furiously. A full three minutes of silence go by. He lifts his head, rolls his eyes, and smiles briefly with only his mouth. “One of my investors,” he says, and makes a masturbatory gesture with his hand. “I’m going to slay a whole heard of ponies at this Burn,” he says earnestly. “I am optimizing the shit out of my sparkle pony funnel.”

Tyler’s shrewd equation perfectly illustrates the economic problem: the number of viable sponsors has declined, but the number of sparkle ponies in a typical sponsor’s top of funnel has increased, which means that most sparkle ponies will be un-camped this year at Burning Man.

“I get that people are upset about homeless - sorry, unhoused people in New York and California,” says a sparkle pony who–for the sake of anonymity–goes by her Playa name, Glittabug, “but the weather in these places is pretty chill, and there are homeless shelters. What’s going to happen to me at Burning Man if a camp can’t find me? There aren’t homeless shelters in Blackrock City, and it’s super hot and sunny during the day, and I’ve heard that the nights used to be really kind of cold,” she says with grave concern. “I think this is the most urgent housing crisis in the country right now. Why isn’t President Kennedy talking about this? Where’s our bailout?”

“These young (mostly) women don’t have a firm enough grasp on basic economics,” observes Janet Yellin, secretary of the treasury for the United States of America. “Rather than trying to change the reality that there are fewer buyers in the economy, they should be focused on increasing their curb appeal so that the remaining buyers – Sergey Brin, Elon Musk and Eric Schmidt – select them during golden hour at Distrikt’s first set on the last build day, which is when sparkle ponies typically arrive.”

Some of the more savvy sparkle ponies have taken the challenge and are upping their game by raising the height of their white platform boots, increasing the density of sequins on their bikinis, and adding extensions to their hair extensions.

“We’re seeing a veritable sparkle pony arms race,” says Lloyd Austin, secretary of defense for the United States of America. “There is a run on glue guns at Blick Art Supplies in New York City, Miami, and California, and the crafting aisle is entirely empty at Walmart in Austin,” he said. “The nation’s sequin reserves are at their lowest since 1973.”

“I’m going to outshine them all,” says Glittabug emphatically. “No one will sparkle more than me during golden hour on the last build day. “The thing about Sergey is that he’s like, really smart, but he’s basically just a magpie,” she continues. “You know those birds that like, pick up shiny objects and bring them back to their nest? That’s what he does. Only he brings them to his boat.” Glittabug hasn’t looked up from her glue gun, which she is using to add sequins to the rear string of her thong that will be entirely swallowed by her ass cheeks. “I will blind that motherfucker into setting me up in an RV with a hepa filter AC unit.”

“Our satellites have already picked up light reflecting from the bikini tops that are currently being beta-tested by sparkle ponies in Venice Beach, Las Vegas and Williamsburg,” says Secretary Austin. “Given the increase of UFO activity, we are actively concerned that the light reflected off of sparkle ponies could attract non-Earth entities and spark – er, no pun intended – an interstellar conflict.”

Some Silicon Valley entrepreneurs see the sparkle pony arms race as less of a threat and more of an opportunity.

“I think every sparkle pony has the potential to be an energy source,” says Elon Musk. “We can convert them from a resource suck – er, no pun intended, who just lay around complaining about the absence of raw milk and asking people to take photos of them at golden hour, into a value add,” he says, squinting his eyes and looking up at the sky to showcase his enhanced jawline, the way he does when announcing The Next Big Thing and making excuses for the poor performance of one of his companies. “Power generation is an issue on the Playa. Those generators are fucking loud and filthy. We can turn sparkle ponies into a mobile, dynamic power grid, where each one is covered in tiny reflective Solar City solar panels and given a Tesla battery backpack to wear. When they go to bed at sunrise, everyone just plugs into a sparkle pony.” Elon smiles at his use of double entendre. “It’s a win-win-win,” he continues. “sparkle ponies get space in an RV with a hepa filter AC unit, camps get clean energy generated by architecturally attractive (mostly) women, and Burning Man’s reputation among the 1% as a consumptive, filthy, hedonistic, drug-fueled orgy for the .01 percent is slightly mitigated.” At this point Elon looks even higher up into the sky, precariously stretching the skin on his protruding jawline. “Fuck–if we clustered them together as a solar array, we could literally make Burning Man a net zero event.” Elon abruptly ends our Zoom call.

A notification pops up on Twitter–er, X from @elonmusk.

“ATTENTION ALL #SPARKLEPONIES. I will fly you to #burningman from #teterboro, #vannuys or #haywardexecutive and set you up in an RV with a #hepafilter AC unit that is stocked with #rawmilk at a #turnkey camp with bottomless #belugacaviar. We need your sparkle to power the Burn!”

Within seconds, Eric Schmidt re-posts Elon’s tweet (Xeet?), his first social media utterance in nearly a year, with the caption, “same offer + 24 hr hair and make-up staff and invite to my decompression party in LA. DM me.”

Seconds after that, Barbie’s official IG channel posts the following:

“Attention younger-looking architecturally attractive (mostly) women who want to attend Burning Man but do not wish to pay for it! You are the true Barbies of the world, and we have dedicated 1% of the proceeds of the feature-length commercial that Mattel funded to create a homeless camp for sparkle ponies who have no Playa sponsor. Our camp, called Pink Plastica, will provide RVs with hepa filter AC units, all the raw milk you can consume, and unlimited bio-degradable glitter to every single younger-looking architecturally attractive (mostly) woman we select from our funnel of applicants. The only requirement is that, in addition to your white platform boots and heart-shaped Robot Heart sunglasses gifted to you by a very tall bald retired arms dealer, you wear the pink sugarpuss cowgirl outfit featured in Barbie, which we will gift you for your use during your time at Pink Plastica. To redeem this offer, simply scan the barcode on the inside of a new Barbie doll box and upload a selfie with your Instagram handle. If selected, we will DM you within 5 days with a tail number and the coordinates of Pink Plastica. Shine on, sparkle ponies!”

“We have not seen a bailout of this magnitude since 2008,” says Janet Yellin. “It seems we will narrowly avoid a sparkle pony recession thanks to predatory wealth and opportunistic consumer marketing,” she continues.

“I’m going to accept each of the three offers,” says Glittabug. “Burning Man wouldn’t feel right without three camps,” she says as she scans the barcode on the inside of the Barbie box she has torn open. She tousels her hair, turns on her ring light, makes a fish gape expression with her mouth, and takes a selfie. “And Pink Plastica sounds like a dope place for a mushroom journey.” She smiles briefly with only her mouth. “Will you hand me that glue gun?” she asks.

I hand her the glue gun and watch her add sequins on top of the sequins on her sequined Steampunk captains hat. I imagine what her life must be like: free food and illicit substances, constant adoration and coddling laced with only trace amounts of disdain, and absolutely no responsibilities other than her skin and fitness regimen. Relative to people who attend Burning Man and actually contribute their creativity, physical labor or financial resources, sparkle ponies, who contribute nothing but sparkle, have it pretty good for completely replaceable depreciating assets. I wonder for a moment what it would feel like to get a text with a time and a tail number from a doughy, elderly tech bro who would cart me around the Playa on his e-bike like a trinket and feed me and eight other sparkle ponies frozen grapes injected with molly water.

“Will you hand me the Barbie box with the barcode, and could I borrow your ring light?” I ask as I practice my fish gape. Sparkle ponies are mostly women, but not only women.

Is someone you love a sparkle pony or sparkle pony sponsor? Share this with them as a helpful resource.

4 notes

·

View notes

Text