#cpa exam changes

Explore tagged Tumblr posts

Text

Understanding the CPA Exam

1.Structure 2.Eligibility 3.Exam Format 4.Passing Scores 5.Fees and Scoring 6.Licensing and CPE

To know more visit : https://bit.ly/3t46xBg

#us cpa exam#cpa exam#us cpa course#cpa exam fees in india#cpa exam changes#cpa course#cpa#cpa training#cpa training institute

0 notes

Text

9/24/2023

I’m back!

Work and life really got in the way the past week and a half, but I’m back! I certainly don’t think I have enough time to get through everything in time for my next exam, but I only have 3 testing windows left this year, so I figure I might as well give it a try!

Got in 2 hours tonight, planning for 2-3 hours every weeknight until my exam, and 5-6 hours on most weekend days (barring a few preplanned events).

I’ll get it done! Might take a few tries but I’m determined!

#why does the lighting in my living room change so drastically by just slightly tilting my phone smfh#cpa exam#studyblr#cpa#study blog#studyspo#studying#business student#taycpa#study#gradblr

27 notes

·

View notes

Text

maybe i should get a second job

#tbh guys im bored#i should be studying for the cpa exam except well im not sure i want that anymore. so scary when plans change

3 notes

·

View notes

Text

also im taking next section of the cpa exam on friday (two days!!!!). abt to do my corrections on my first two practice exams and then take the third (final!!!) practice exam…. I don’t feel ready lol

#my practice exam scores feel deceptively high bc I literally feel like I know nothing#like my practice exam scores were 71 and 75 and they kinda say anything over a 67 is good for this section#and two of my friends failed this section once before and neither of them had scores in the 70s#so like ???? maybe ?????#idk y’all I’m sooooo nervous#failing this section would throw off my study plan a lot tbh#bc they’re changing the format of the exam next year (January) and I start full time work this august#idk hopefully I just pass this one and can get the other shorter one out of the way in august#cause I think 3ish months should be good for the big one#but if I don’t pass this one idk what I’ll do#cpa exam#the section im taking Friday is audit btw if anyone here is familiar w the cpa exam

2 notes

·

View notes

Text

youtube

Unlock Your Accounting Career: CPA Changes 2023 & Registration

In this video, we'll discuss the CPA changes that will take effect in 2023 and how you can prepare for them. We'll also discuss the importance of registering with FINTRAM Global to stay current with the latest changes in the accounting industry. If you're interested in a career in accounting, it's important to stay up to date on the latest changes. In this video, we'll discuss the CPA changes that will take effect in 2023 and how you can prepare for them For more information and to avail Best Offers and Exemptions Contact us at +91 8882677955 or +91 7303457955 visit our Website: https://fintram.com/

#cpa course details#cpa changes#us cpa changes#uscpa#cpaexam#cpa india#cpacourse#cpadelhi#cpa changes2023#us cpa changes 2023#certified public accountant#cpa explanation#cpa exam#us cpa course details#Youtube

0 notes

Text

Which Education🎓📚 is right for you?

Mercury rules your interest and consequently which type of course you would select.

Now you have to see how Mercury is placed. For example if Mercury is conjunct Moon it would have same effect as Mercury in Cancer or Moon opposite Mercury.

Mercury -Sun: It is called Budh Aditya yoga. These people can shine in political science, geology, sociology, medicine and they can be good leaders too. They may prepare for competitive exams.

Mercury-Moon: Some changes or confusion in choice of course. Can study more than one subject but both vastly different from each other. Chemical, hotel management, nutrition, chef, psychology, tarot and intuitive studies.

Mercury-Mars: Some obstacles in education, breaks and interruptions (dropping classes), engineering (especially related to machines, drawings, plans, civil, electronics), medicine (especially related to surgery), fire and safety engineering,

Mercury-Venus: Sales, marketing, HR, interior designing, makeup courses, all type of fine arts, vocational courses, acting courses.

Mercury-Saturn: Engineering (like construction , petroleum, mining core subjects), structural engineering, drafting, administrative studies.

Mercury-Jupiter: Finance, CPA, CMA, accounting, teaching, law field, journalism, VJ, pilots, aeronautical.

Mercury- Rahu: Chemical, nuclear subjects, cinematography, software courses, digital marketing, share markets, computer hardware, import export, AI, Machine Learning courses.

Mercury-Ketu: Computer coding, electrical engineering, bio technology, astrology, virology, research oriented fields.

For Readings DM

#astrology#astrology observations#zodiac#zodiac signs#astro community#astro observations#vedic astrology#astro notes#vedic astro notes#astrology community#mercury signs#mercury in aquarius#mercury retrograde#pisces mercury

838 notes

·

View notes

Text

June 16th:

Not a lot happened today. I woke up late, walked my dog, and then tried to get as much work done as I could. I don't know if it was the material that was hard or if it was just that my brain was not in the right headspace to absorb newish material but I had a lot of trouble understand the video lectures and working through the questions that followed. I did the best I could and took breaks when I needed to but this lead to only getting in just under three hours of studying when my goal was four hours. I haven't hit my daily study goal in who knows how long but at least I'm getting some studying done. Tomorrow I not going to get any studying done as I'm driving two hours away to go to a friends party but when I get back on Sunday I hope to knock a good bit of studying out!

Today's accounting topic: The different risks related to an audit. What to do if the risk of material misstatement is high due to high inherent risk and high control risk which you as the auditor can't do anything to change but can combat by lowering detection risk by performing more substantive procedures such as a test of details. (yes this is still confusing to me too haha)

Other activity: I've had a few people reach out to me about also studying for the CPA exam right now and I just want to say good luck to everyone also working on finishing up this last portion of our licensing journey :) 🍀🍀

#CPA exam review#CPA#cpa exam#study hard#audit#CPA audit#studyblr#study inspiration#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#going to get my nails done tomorrow 👀#very excited theyre driving me up a wall haha

86 notes

·

View notes

Text

Are you aware of US CPA Exam changes from 2024?

US CPA is one of the most lucrative career options in the accounting field. The global demand for CPAs has increased exponentially over the last few years. Parallelly, the roles and responsibilities of CPAs have also varied in accordance with the ever-changing business landscape. The advent of digitization and the implementation of new technologies have revolutionized the finance and accounting industry. To ensure that CPAs are updated and competent with the technology-driven business landscape, AICPA has introduced the CPA Evolution Initiative.

The US CPA Exam Evolution Initiative will come into effect from January 1, 2024 and will have significant changes to the CPA curriculum. The passage below explores in detail the CPA 2024 changes.

CPA Evolution Initiative – What is the New Model?

The new model has been proposed to make the CPAs more tech competent. The new model will follow a Core + Discipline model with 3 Core Sections and 3 Discipline Sections.

CPA students have to study all three core sections. The three core sections are:

Financial Auditing and Reporting (FAR)

Auditing and Attestation (AUD)

Taxation and Regulation (REG)

CPA students can choose one discipline section out of the three. The three discipline sections are:

Business analysis and reporting (BAR)

Information systems and controls (ISC)

Tax compliance and planning (TCP)

Irrespective of the discipline section the CPA candidate chooses, he can opt to practice in other areas well. His choice of discipline section will not have any effect on his CPA licensure.

Transition Policy – What it Means to CPA Aspirants?

AICPA along with NASBA, have created a smooth transition policy for implementing the new changes. The transition policy is simple and straightforward. Below is the break of the transition policy and how it affects the CPA candidates.

Candidates who have passed and have credit for AUD, FAR, or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR, or REG on the 2024 CPA Exam.

Candidates who have passed and have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

Candidates without credit for AUD after Dec 31, 2023, will have to take the AUD core section on the 2024 CPA Exam.

Candidates without credit for FAR after Dec 31, 2023, will have to take the FAR core section on the 2024 CPA Exam.

Candidates without credit for REG after Dec 31, 2023, will have to take the REG core section on the 2024 CPA Exam.

Candidates without credit for BEC after Dec 31,2023 will have to take one Discipline section on the 2024 CPA Exam.

The current sections and curriculum of the CPA exam will not be available for testing after Dec 2023.

CPA Exam 2024 – What are the Content Changes?

There are some significant changes in the curriculum of each section for the CPA exam 2024. The content from the section has been transferred to the other sections.

The only section that remains relatively unchanged is AUD. While no content has been removed from it, some content from BEC has been added to this section. The newly added topics in the AUD section are basic economic concepts and business processes and internal controls. Some existing content from FAR will be moved to the BAR discipline section under the new model. These topics include business combinations, R&D costs, stock compensation, and public company reporting, among many others. Some BEC topics have also been moved to the FAR section. Similarly, some existing REG content has been moved to the TCP discipline section. This content includes gross income concepts.

In the case of discipline sections, the BAR section includes complex technical accounting topics along with lease accounting and revenue recognition. It also includes certain topics from the BEC section such as managerial and cost accounting, variance analysis, non-financial measures of performance, and financial valuation decision models. ISC exam section will evaluate the candidate on knowledge of IT audit and advisory services. It also borrows some BEC topics. Lastly, the TCP discipline section evaluates the candidates on knowledge of federal tax compliance policies and focuses on complex tasks. As specified already, some REG topics have been included in the TCP section.

Below is the summary of how the content has been spread across different sections under the CPA 2024 model:

REG – REG + TCP

FAR – FAR + BAR

AUD – AUD

BEC – FAR + BAR + AUD + ISC

CPA Exam 2024 – Scoring Weight Changes

There is not much change in the scoring weight of the CPA exam. Under the new model, every section has a scoring weight of 50% MCQs and 50% TBSs, except one section. The ISC discipline section gives 60% weightage to MCQs and 40% weightage to TBSs.

CPA Exam 2024 – Section Time and Question Count Changes

There is no change in the section time. The current section time of 4 hours will remain the same for the new model as well. In the case of question count, the new model has 2 changes. The current model has a question count in the range of 62-72 MCQs and 8 Sims, except for BEC. The BEC exam has 4 TBSs and 3 Written Communication questions. Under the new model, the ISC exam section will have 82 MCQs and 6 TBSs. Similarly, FAR and BAR exam sections will have 50 MCQs and 7 TBSs

CPA Exam 2024 – Skill Level Changes

There are no changes in the skill level categories but there are a few minor changes in the skill level allocation for some sections. The changes to the question count also reflect the skill level changes. For instance, ISC with more MCQs has more skill allocation to Remembering and Understanding. AUD section lays more emphasis at Remembering and Understanding and Analysis levels, whereas FAR section lays emphasis at Remembering and Understanding and Application levels. The latter section has fewer questions at the Analysis level.

REG section retains the same skill level with no changes. FAR and BAR have more questions at the application level with MCQs having complex calculations. TCP section contains the highest percentage of questions at the Application level.

It should be noted that these changes are not finalized. There might be a few changes to the new model. But, the core concept of the model will remain the same. AICPA has announced that it is waiting for inputs on the new model till September 30, 2022. Post that, it will review the comments and make any changes if deemed fit. The blueprint will be finalized in December 2022 and will be published in January 2023.

2 notes

·

View notes

Text

What Is The Trend Among Indian CFA Applicants?

The number of Indian candidates applying for the Chartered Financial Analyst cfa level 1 exams has increased, which can only be described as an emerging trend.

Right now, India positions third with the most number of competitors taking the test. In June 2022, the cfa institute reported that 14,776 candidates appeared from India, China, and the United States. The worldwide number was 71,914.

CFA test in India

Specialists in the business accept that the pattern is a consequence of the development found in the Indian economy. The nation has turned into a trustworthy speculation objective guaranteeing an expansion in venture experts.

The CFA Sanction expects contender to breeze through three test levels, have a work insight of something like four years in ventures, and focus on the set of principles in proficient lead. Following this, competitors are supposed to apply to a CFA Foundation Society and become an individual from the famous CFA Establishment.

The program educational plan tests abilities and information expected in the venture business. Considering that the worldwide market is changing at an exceptional speed, the CFA test guarantees premium expert lead, moral norms, and global fiscal summary examination. The Level I test especially tests competitors on their capacity to associate their hypothetical comprehension with training. They must demonstrate their capacity for real-time analysis of the investment industry. Other significant ideas incorporate corporate money, abundance the executives, portfolio examination, protections investigation and valuation, financial aspects and quantitative techniques.

Candidates typically need more than three years to successfully complete the CFA Program. Each of the three levels requires determination and a commitment to at least 300 hours of study.

The CFA tests are held across the world in excess of 70 urban communities in December and north of 170 urban areas in the long stretch of June. Test centers are assigned to candidates based on where they prefer to be.

India’s metropolitan areas of New Delhi, Bengaluru, Mumbai, and Kolkata saw the greatest number of Level 1 test takers in 2022.

IndigoLearn is among the global leaders in international training for CPA, CFA,CMA, ACCA, Data Science & Analytics. It has helped over 500,000 professionals across the globe. With IndigoLearn, 9 out of 10 students pass their exams.

Article Source: cfa preparation

#cfa level 1#cfa institute#cfa institute india#cfa program#cfa qualifications#cfa level 1 cost#cfa preparation#cfa online

2 notes

·

View notes

Text

Importance of Continuous Professional Education Post-CA

Becoming a Chartered Accountant (CA) is a significant achievement, but the journey doesn’t end there. The dynamic nature of the finance and accounting industry demands that professionals continuously update their knowledge and skills to stay relevant. Continuous Professional Education (CPE) is an essential aspect of a CA's career, enabling them to adapt to regulatory changes, technological advancements, and industry trends.

1. What is Continuous Professional Education (CPE)?

CPE refers to structured learning programs designed to enhance the knowledge and skills of professionals. For CAs, this involves attending workshops, webinars, and training sessions, or pursuing advanced certifications. CPE ensures that CAs remain competent and up-to-date with the latest developments in their field.

2. Why is CPE Important?

a) Keeping Up with Regulatory Changes

The regulatory environment in accounting and taxation is ever-evolving. From amendments in tax laws to updates in International Financial Reporting Standards (IFRS), staying informed is crucial. CPE programs help CAs understand these changes and apply them effectively in their practice.

b) Adapting to Technological Advancements

Technology has transformed the way businesses operate, and the accounting profession is no exception. Tools like cloud accounting, AI-driven analytics, and blockchain are becoming mainstream. Participating in CPE programs ensures that CAs are equipped to leverage these technologies for better efficiency and accuracy.

c) Enhancing Professional Skills

Beyond technical knowledge, CPE focuses on developing soft skills such as communication, leadership, and problem-solving. These skills are critical for career advancement, particularly for CAs aspiring to leadership roles.

d) Maintaining Professional Credibility

Clients and employers value professionals who stay informed and competent. By participating in CPE programs, CAs demonstrate their commitment to excellence, enhancing their credibility and reputation.

3. CPE and Exam Preparation Resources

For aspiring CAs, tools like CA Entrance Exam Books, Scanner CA Foundation Books, Scanner CA Intermediate Books, and Scanner CA Final Books are indispensable during their preparation phase. Similarly, for qualified CAs, CPE programs act as the next step in continuous learning, ensuring they remain relevant and effective in their roles.

4. Benefits of CPE

a) Improved Career Opportunities

Continuous learning opens up new career paths. Specialized certifications in areas like forensic accounting, international taxation, or financial planning can help CAs diversify their expertise and stand out in a competitive market.

b) Networking Opportunities

CPE programs often bring professionals together, creating opportunities to network and exchange ideas. These connections can lead to collaborations, mentorship, or new business opportunities.

c) Personal Growth

Learning new concepts and skills fosters personal growth and boosts confidence. CPE helps professionals approach challenges with a fresh perspective, making them more effective problem-solvers.

5. Popular CPE Programs for CAs

a) Workshops and Seminars

These programs focus on specific topics like GST, transfer pricing, or audit techniques. They are ideal for gaining in-depth knowledge in a short time.

b) Online Courses

Platforms like Coursera, edX, and ICAI’s e-learning portal offer flexible learning options. Topics range from advanced accounting to emerging technologies like blockchain.

c) Certifications

Certifications such as CPA (Certified Public Accountant), ACCA (Association of Chartered Certified Accountants), or CFA (Chartered Financial Analyst) add global recognition to a CA’s credentials.

d) Self-Study Programs

For self-paced learners, resources similar to CA Foundation Scanner, CA Intermediate Scanner, and CA Final Scanner can be used to deepen understanding of complex subjects.

6. Challenges in Pursuing CPE

a) Time Constraints

Balancing work and learning can be challenging, especially for practicing CAs. Prioritizing and scheduling time for CPE is essential.

b) Cost of Programs

Some CPE programs can be expensive. However, many organizations reimburse these costs as part of professional development initiatives.

c) Choosing Relevant Topics

With numerous options available, selecting programs that align with career goals and interests can be overwhelming. Identifying areas of improvement and industry demand can guide this decision.

7. How to Incorporate CPE into Your Career

a) Set Clear Goals

Identify your career aspirations and choose CPE programs that align with those goals.

b) Leverage Technology

Use online platforms and virtual webinars to learn at your own pace.

c) Track Progress

Maintain a log of completed CPE activities to track your learning journey and ensure compliance with mandatory requirements.

d) Stay Consistent

Make CPE a regular part of your professional life. Even short courses can accumulate into significant learning over time.

8. Conclusion

Continuous Professional Education is a cornerstone of success for Chartered Accountants. Just as resources like CA Entrance Exam Books, Scanner CA Foundation Books, CA Intermediate Scanner, and Scanner CA Final Books are vital during the exam phase, CPE is essential for professional growth post-qualification. By staying updated with industry trends, enhancing skills, and embracing lifelong learning, CAs can ensure their relevance and effectiveness in a rapidly changing professional landscape. Invest in CPE to not only advance your career but also contribute to the broader accounting and finance community.

0 notes

Text

The US CPA Exam Subjects (2024 Onwards)

Discover the updated landscape of the US CPA Exam with a focus on the latest subjects introduced in 2024. Uncover the essential topics shaping the examination, providing valuable insights for aspiring CPAs navigating the evolving requirements.

Stay ahead in your preparation for success in the dynamic world of accounting with Miles Education.

To know more, visit: https://bit.ly/3Qpi5XC

#cpa exam#cpa exam changes#cpa syllabus 2024#cpa latest subjects#cpa evolution#what are the changes in CPA exam

0 notes

Text

CPA Prep from Home: Discover the Best CPA Courses Online for 2024

Prepare for the CPA exam from the comfort of your home with the best online CPA courses for 2024. These top-rated programs offer comprehensive tutorials, practice exams, and flexible schedules, making it easier to fit study time into your busy life. With expert instructors and proven study materials, these courses provide the support you need to succeed and pass the CPA exam on your first try.

Why Choose the Best CPA Course Online for Exam Success?

Preparing for the CPA exam requires top-quality resources, especially when studying from home. Selecting the best CPA course online can be the difference between passing on the first try and retaking sections. Online CPA courses offer flexibility, targeted materials, and expert guidance, making them ideal for busy professionals.

Key Features to Look for in the Best CPA Course Online

Not all online CPA courses are created equal. To choose the best CPA course online, prioritize features like adaptive learning technology, real-time updates for exam changes, and comprehensive study guides. Look for options that offer interactive lessons and practice exams for a well-rounded experience.

Benefits of Studying with the Best CPA Course Online

Taking the best CPA course online comes with many advantages. Online courses offer flexible schedules, personalized learning paths, and access to instructors and resources whenever needed. This flexibility allows you to study on your terms, increasing retention and efficiency.

Top-Rated Providers of the Best CPA Course Online

Several reputable providers offer the best CPA course online. Becker, Wiley CPAexcel, and Roger CPA Review are among the top names. Each provides unique strengths such as engaging lectures, comprehensive test banks, and adaptive review tools. Research these options to find the right fit for your learning style and budget.

How to Make the Most of the Best CPA Course Online?

To get the most from the best CPA course online, set a regular study schedule, take full advantage of practice questions, and review difficult sections more than once. Many courses include study planners and progress trackers to help keep you on track toward exam day.

Cost and Value of the Best CPA Course Online

Investing in the best CPA course online is a commitment, but it often pays off through improved test performance and time savings. While these courses can be an investment, the pass rates and career benefits make them worthwhile. Some providers also offer financing options or discounts to help with budgeting.

Is the Best CPA Course Online Right for You?

Online CPA courses aren’t for everyone, so it’s essential to consider your study habits and learning preferences. If you’re self-motivated and prefer studying on a flexible schedule, the best CPA course online can be a game-changer. Otherwise, you may benefit more from in-person study options or live online courses.

Conclusion

Preparing for the CPA exam from home has never been easier, thanks to the variety of high-quality online courses available. By selecting the best CPA course online, you’ll gain access to tailored resources, flexible study schedules, and expert guidance to help you succeed. With 2024 offering new options and updates, now is the perfect time to start your journey toward CPA success.

0 notes

Text

CPA Exam Changes: What to Know About the Latest Updates

The CPA Exam is a crucial step for anyone aspiring to become a Certified Public Accountant. As the accounting profession evolves, the exam itself undergoes periodic changes to stay relevant and effective. In this blog, we'll discuss the latest updates to the CPA Exam, what they mean for candidates, and how to prepare for them.

Key Updates to the CPA Exam

The American Institute of CPAs (AICPA) recently announced several important changes to the CPA Exam, effective in 2024. Here’s a breakdown of what to expect:

1. Increased Focus on Technology

The new exam will place a greater emphasis on technology-related skills.

Topics like data analytics, cybersecurity, and accounting software will be included.

Candidates will need to demonstrate proficiency in using technology to analyze financial data and solve accounting problems.

2. Changes in Exam Structure

The exam will consist of three main sections instead of four.

The sections will be redesigned to reflect a more integrated approach to accounting topics.

This change aims to streamline the testing process and better assess a candidate’s ability to apply accounting concepts in real-world scenarios.

3. Incorporation of New Content Areas

New content areas such as sustainability and business strategy will be added.

These areas reflect the growing importance of environmental, social, and governance (ESG) factors in accounting.

Candidates will need to understand how these factors affect financial reporting and decision-making.

4. Enhanced Testing Format

The format of the exam will include more simulation-based questions.

These simulations will test practical application and critical thinking skills.

Candidates will face real-world scenarios that require them to analyze information and make informed decisions.

5. Revised Scoring System

The scoring methodology will be updated to provide a more accurate assessment of a candidate's capabilities.

The minimum passing score will remain at 75, but the scoring process will be refined to ensure fairness and consistency.

Candidates can expect more detailed feedback on their performance in specific areas.

Preparing for the CPA Exam Changes

With these updates on the horizon, candidates must adjust their study strategies. Here are some tips to help you prepare effectively:

Familiarize Yourself with New Content:

Review the updated exam blueprint on the AICPA website to understand the new content areas.

Incorporate study materials that cover technology, sustainability, and business strategy.

Practice with Simulation Questions:

Use practice exams that include simulation-based questions to get accustomed to the new format.

This will help you develop critical thinking skills and improve your ability to apply concepts in real scenarios.

Leverage Online Resources:

Consider using tutoring services, like those offered at Andrew Katz Tutoring, to get personalized guidance.

Online resources can provide valuable insights into the latest exam trends and effective study techniques.

Join Study Groups:

Collaborate with peers who are also preparing for the CPA Exam.

Study groups can offer support, motivation, and different perspectives on complex topics.

Create a Study Schedule:

Develop a comprehensive study plan that allows ample time for each content area.

Break down your study sessions into manageable chunks to avoid burnout.

Conclusion

The CPA Exam changes coming in 2024 reflect the evolving landscape of the accounting profession. By understanding these updates and adapting your study approach, you can position yourself for success. Remember, preparation is key, and utilizing resources like Andrew Katz Tutoring can help you navigate these changes confidently. Good luck with your CPA Exam journey!

0 notes

Text

something that makes me laugh is the “going concern” reporting requirement in auditing. it means you don’t think the company will stay in business in the year following the audit. literally u have to write and publish a paragraph that boils down to “we have CONCERNS that this company is GOING out of business!!! and management hasn’t said ANYTHING that changes our mind!!!!!!!!!!!!!!”

#companies do NOT like when u do this!#sigh I know no one cares about this stuff but it’s my whole life rn bc im studying for cpa#gotta find humor where I can 🥲#also that ‘management hasn’t said anything that changes our mind’ is literally true#if they have plans that ‘alleviate substantial doubt’ you don’t have to report a going concern#so to me it sounds like ‘this company AINT SHIT and the management is DUMB AS FUCK’#cpa exam#cpa studying

5 notes

·

View notes

Text

youtube

Changes in US CPA in 2024

Major Changes in US CPA in 2024 | US CPA Exam Changes | US CPA Course Detail | US CPA Evolution 2024 US CPA exam is undergoing significant changes in 2024. In this video, we discussed the new format and content of the exam and provided tips and strategies for preparing for the upcoming Exams.

🔹 To know more visit www.fintram.com

📞 Contact us on - +91-8882677955, +91-7303457955 📌 Subscribe to our YouTube Channel / fintramglobal

#changes in cpa course#cpa change in 2024#us cpa evolution 2024#cpa exam changes 2024#cpa exam changes in 2024#2024 cpa exam change#us cpa#change in cpa exam#cpa exam change 2024#becker cpa video#becker cpa course fees#becker cpa course cost#cpa exam change#new 2024 cpa exam#2024 cpa exam changes#how to prepare for the cpa exam#change on the cpa exam#cpa syllabus#change in cpa syllabus#cpa evolution#cpa evolution 2024#cpa 2024 changes#cpa exam#Youtube

0 notes

Text

Life update:

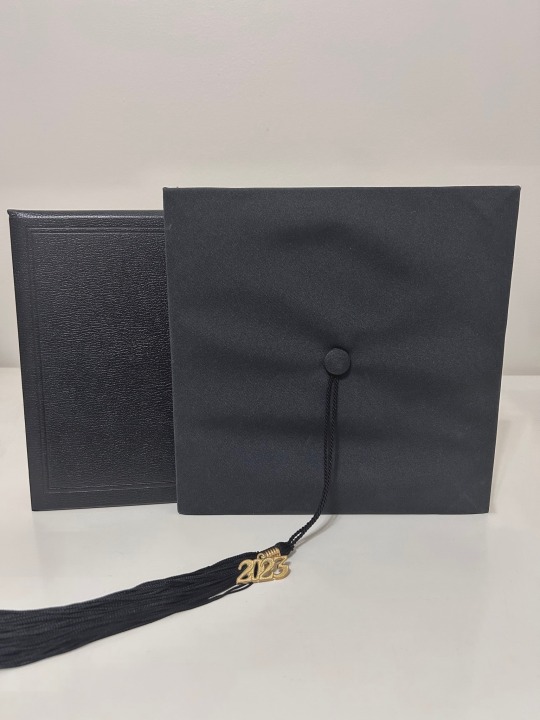

Hello! I took a quick break from Tumblr to focus on some big life changes. Starting off with college graduation to moving back in with my parents for the summer to a trip to the mountains with some friends! All that being said, I officially have graduated with Bachelors of Science in Accounting! But just because my official schooling is over doesn’t mean I’m done studying. Starting on Tuesday I’ll begin studying for the possibly the biggest exam of life, the certified public accountant’s exam or the CPA. It’s four parts and I’m hoping to take the first part at the end of June. I’m not expecting to pass all four parts this summer but my goal is to pass two this summer, one this fall, and one next summer. Which means I’ve got a lot more studying left in me! :)

#study hard#studyblr#study inspiration#study motivation#study blog#study space#studying#student#study#studyspo#college#uni#university#graduation#CPA#cpa exam#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#hoping to be back in full force by tuesday!!#yall this cpa exam studying stuff is going to be so hard :(#its all self study and i have no discipline i'm so not looking forward to it. plus being a college graduate is so weird!!!!

88 notes

·

View notes