#course for gst practitioners

Explore tagged Tumblr posts

Text

Top 9 GST Certification Courses In India With Placement Opportunities

Explore the top 9 GST certification courses in India, offering certified GST courses, GST accounting courses, and placement opportunities. Get your certificate course in GST now!

#gst certification course india#gst certification course#online certificate course in gst#best gst certification course#gst certification course online#gst practitioner certification course#gst courses in india#gst practitioner certificate course#gst course with placement#diploma in gst course#gst certification#course for gst practitioners#gst certificate course online#gst certification courses#gst courses#online gst course certificate#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst course online#gst training online

0 notes

Text

Top Institutes Offering GST Practitioner Courses in India

The Labor and products Duty (GST) has changed the Indian tax collection framework, spurring an interest for talented experts who can oversee GST-related errands. A GST Expert Course is a particular program intended to outfit people with the information and abilities expected to fill in as guaranteed GST specialists.

If you’re thinking about a profession in tax collection or need to grow your skill in monetary consistence, signing up for a GST Expert Course can be a distinct advantage. This article investigates all that you want to be familiar with the course, including its advantages, structure, vocation possibilities, and how to get everything rolling.

What is a GST Specialist Course?

A GST Expert Course is an expert preparation program pointed toward instructing people about GST regulations, guidelines, consistence techniques, and documenting necessities. It plans contender to become confirmed GST experts, empowering them to help organizations and people in gathering their GST commitments.

Why Pick a GST Professional Course?

Here are a few justifications for why this course merits considering:

1. Appeal for GST Specialists

The execution of GST has provoked a consistent interest for gifted experts who can explore its intricacies.

2. Rewarding Profession Open doors

GST experts can acquire well by offering types of assistance, for example, charge documenting, consistence the board, and warning to organizations.

3. Enterprising Possibilities

Subsequent to following through with the tasks, you can begin your training and fabricate a client base, offering GST-related benefits freely.

4. Esteem Expansion for Experts

For bookkeepers, charge experts, and money experts, this course increases the value of their range of abilities.

Qualification to Turn into a GST Expert

Prior to signing up for a GST Professional Course, guarantee you meet the accompanying qualification models to enroll as a GST Expert with the GST Organization (GSTN):

Indian citizenship.

An advanced education in business, regulation, banking, or related fields, or comparable capabilities.

Working information on bookkeeping or tax collection.

What Does the GST Professional Course Cover?

The course educational plan is intended to give inside and out information on GST regulations, consistence methods, and down to earth applications. Here is a breakdown of the center points covered:

1. Prologue to GST

History and advancement of roundabout charges in India.

Goals and advantages of GST.

2. GST Enlistment

Sorts of GST enrollments.

Qualification standards and enrollment process.

Figuring out GSTIN (GST Recognizable proof Number).

3. GST Brings Documenting back

Kinds of GST returns (GSTR-1, GSTR-3B, and so forth.).

Cutoff times and recording methodology.

Normal mistakes and their goal.

4. Input Tax break (ITC)

Idea and advantages of ITC.

Conditions for guaranteeing ITC.

Compromise of ITC with GSTR-2A.

5. GST Consistence and Punishments

Consistence prerequisites for organizations.

Outcomes of resistance.

Question goal components.

6. GST Review and Evaluation

GST review methodology.

Evaluation types and rules.

Dealing with reviews by charge specialists.

7. Pragmatic Preparation

Active preparation in GST recording programming.

Contextual analyses and recreations.

Client association and true situations.

Advantages of a GST Specialist Course

1. Thorough Information

The course gives a careful comprehension of GST, making you capable in all parts of the tax collection framework.

2. Pragmatic Abilities

Through involved preparing and contextual investigations, you gain pragmatic experience that sets you up for certifiable difficulties.

3. Confirmation and Acknowledgment

After finishing the tasks, you get a certificate that adds believability to your profile and improves your expert standing.

4. Organizing Amazing open doors

The course permits you to interface with industry experts, tutors, and companions, extending your expert organization.

The most effective method to Sign up for a GST Expert Course

Stage 1: Pick the Right Establishment

Select a rumored establishment that offers a very much organized GST Specialist Course. Search for the accompanying:

Authorization and acknowledgment.

Experienced staff.

Situation help and industry associations.

Stage 2: Comprehend the Course Charge and Length

The course charge commonly goes somewhere in the range of ₹10,000 and ₹25,000, contingent upon the organization. The span is by and large somewhere in the range of 1 and 90 days.

Stage 3: Register for the Course

Complete the enrollment cycle by giving the necessary records and paying the expense.

Vocation Valuable open doors In the wake of Finishing a GST Expert Course

In the wake of finishing the tasks and enlisting with GSTN, you can seek after the accompanying jobs:

1. Autonomous GST Specialist

Offer GST-related administrations to people and organizations, like documenting returns, enlistments, and consistence the board.

2. Charge Advisor

Function as a specialist for firms, prompting on GST consistence, charge arranging, and question goal.

3. Bookkeeper or Money Leader

Join an organization’s money or bookkeeping office to oversee GST filings, ITC compromise, and consistence.

4. Coach or Teacher

Share your insight by turning into a GST coach, helping other people find out about GST guidelines and techniques.

Compensation Possibilities for GST Experts

The acquiring potential for GST experts relies upon variables like insight, area, and customer base. Overall:

Fledglings can acquire ₹20,000 to ₹30,000 each month.

Experienced professionals can procure ₹50,000 to ₹1,00,000 each month or more, particularly with a different client base.

Ways to succeed as a GST Expert

1. Remain Refreshed

GST regulations are dynamic, so it’s fundamental for stay up to date with the most recent revisions and notices.

2. Construct Solid Relational abilities

Clear correspondence is crucial for making sense of assessment ideas and consistence necessities for clients.

3. Influence Innovation

Dive more deeply into GST recording programming and apparatuses to further develop effectiveness and precision.

4. Grow Your Insight Base

Consider signing up for extra courses, for example, a Fundamental PC Course, to improve your specialized abilities.

End:

A GST Specialist Course is a superb decision for people looking for a remunerating profession in tax collection and consistence. With the rising reception of GST in India, organizations are effectively searching for gifted experts who can assist them with exploring this perplexing tax assessment framework.

By signing up for this course, you gain complete information, down to earth abilities, and a confirmation that can open ways to various vocation open doors. Whether you seek to work freely or inside an association, a GST Specialist Course can prepare for an effective and satisfying vocation.

Venture out today and position yourself as a confided in master in the field of GST.

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course , Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

GST Certification Courses With Placements

In today's busy and also vibrant organization setting the demand for skilled specialists in tax has actually risen considerably. The Goods as well as Services Tax (GST) in India has actually improved the indirect tax obligation system producing a need for professionals that can browse its intricacies successfully. Enlisting in a GST online course with certificate not just gives detailed understanding however likewise opens up doors to encouraging work chances. Whether you are a current grad or a functioning specialist acquiring a GST certification online can dramatically boost your job leads plus guarantee you remain in advance in the affordable work market.

Understanding GST and Its Importance GST executed on July 1 2017, is an extensive, multi-stage, destination-based tax obligation imposed on every worth enhancement. It changed a number of indirect tax obligations formerly enforced by the main plus state federal governments. Comprehending GST is essential for services as it affects different elements of their procedures, from procurement to sales. Specialists with a deep understanding of GST can assist organizations follow tax obligation laws, maximize tax obligation responsibilities and also stay clear of charges.

Benefits of Pursuing a GST Certification Course Enlisting in a GST online program with certification provides various advantages consisting of:

Thorough Knowledge: These training courses offer thorough understandings right into GST regulations, policies as well as conformity demands. Practical Skills: Learners gain hands-on experience with study, functional workouts, as well as real-world circumstances. Occupation Advancement: A GST certification boosts your return to making you a preferable prospect to companies. Networking Opportunities: Many training courses use accessibility to specialist networks assisting you get in touch with sector professionals as well as peers. Positioning Assistance: Reputable programs frequently give positioning assistance, attaching you with prospective companies looking for GST specialists. Top Features to Look for in a GST Online Course with Certificate When picking a GST certification online program take into consideration the complying with functions to guarantee you obtain the most effective education and learning as well as occupation assistance:

Recognized Curriculum: Ensure the training course is recognized coupled with identified by appropriate specialist bodies. Experienced Instructors: Look for programs shown by sector specialists with functional experience in GST. Interactive Understanding Modules: Opt for programs that supply interactive lessons, live sessions, plus Q&An; online forums. Upgraded Content: GST regulations are vibrant, so the training course web content need to be frequently upgraded to show the current adjustments. Versatile Learning Options: Choose a program that provides adaptability in regards to discovering speed as well as timetable enabling you to stabilize it with various other dedications. Positioning Assistance: Verify if the program uses specialized positioning assistance to aid you safeguard work chances upon conclusion.

Career Opportunities After Obtaining a GST Certificate Online Finishing a GST online program with certification can open different occupation chances throughout various industries. Several of the possible task functions consist of:

GST Consultant: Advising organizations on GST conformity, declaring returns, as well as enhancing tax obligation responsibilities. Tax obligation Analyst: Analyzing tax obligation information, preparing records, together with making certain exact tax obligation filings. Financial advisor: Managing monetary documents planning income tax return plus making certain conformity with GST guidelines. Money Manager: Overseeing the monetary procedures of a firm, consisting of GST conformity and also coverage. Compliance Officer: Ensuring that the company sticks to all GST legislations as well as policies. Tips for Succeeding in a GST Certification Course To make one of the most of your GST certification online program take into consideration the adhering to ideas:

Stay Updated: GST regulations are often upgraded. Maintain on your own notified concerning the most recent modifications as well as changes. Method Regularly: Engage in useful workouts as well as study to use academic understanding. Network: Connect with peers as well as trainers to develop a solid specialist network. Look for Help: Don't wait to ask inquiries plus look for information from instructors. Make Use Of Placement Support: Make complete use of the positioning aid supplied by the training course to safeguard work possibilities. Conclusion A GST online course with certificate is an important financial investment for anybody seeking to construct a job in tax and also financing. These programs provide detailed expertise, useful abilities plus positioning assistance, guaranteeing you are well-prepared to satisfy the needs of the work market. By selecting a trustworthy program as well as devoting on your own to continual knowing you can open various job chances as well as accomplish specialist success in the area of GST.

#GST online course with certificate#gst registration certificate"#“online tally course with gst with certificate”#“certificate course in gst”#“best gst practitioner course”

0 notes

Text

If you want best practice course of GST then our Online GST Practitioner course is best for you. Enroll now and learn GST through tyariexamki.com

⭐️⭐️⭐️⭐️⭐️ star ratings Course

For more information Visit at:- https://www.tyariexamki.com/CourseDetail/14/GST-Practitioner-Course-Online

1 note

·

View note

Text

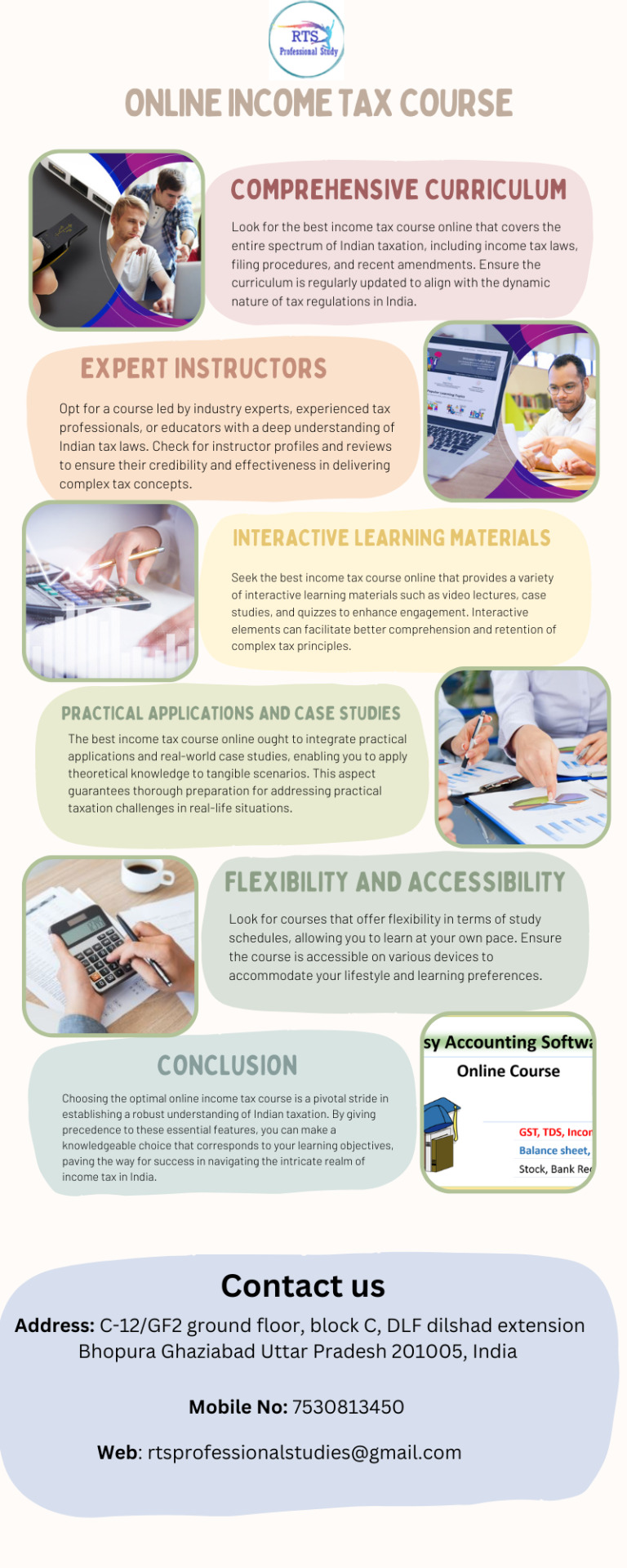

RTS PROFESSIONAL STUDY offers a top range of professional training on GST Return filing, Income Tax Return filing, TDS Return Filing, and GST audit preparation accounts audit, Company Secretaries, Tax professionals, Tax Consultants, cost accountants, accountants, and other accounts professionals. We also provide various types of pen drive & certification courses online. See more: https://rtsprofessionalstudy.com/

#income tax practitioner course online#gst return filing online course#gst filing online course#Basic gst course online#basic gst course

0 notes

Text

The Impact of GST on Exporters: New Opportunities

The introduction of the Goods and Services Tax (GST) represented a watershed moment in India's taxation environment, impacting many industries, including the export industry. GST presented both obstacles and possibilities for exporters, transforming the way international commerce is done. This detailed handbook examines the effect of GST on exporters, examining the changes, advantages, and tactics that have resulted. Exporters may manage the difficulties of global commerce with more efficiency and success by exploring the various pathways and opportunities that GST has opened up.

1. Introduction

GST was implemented in India to simplify the tax system, reduce cascading effects, and streamline tax administration. GST brought substantial changes that impacted different areas of exporters' business.

2. The Evolution of Export and GST Taxes

Exporters have experienced difficulties due to complicated tax regimes, export taxes, and administrative impediments. The GST Mumbai attempted to solve these concerns by establishing a consistent tax framework.

3. Important GST Changes for Exporters

GST brought various reforms that benefited exporters, such as zero-rated supply, streamlined refund methods, and access to Input Tax Credit (ITC) on inputs and input services.

4. Improving Export Compliance and Documentation

GST simplified export paperwork by standardizing processes such as export invoices and freight bills. The Letter of Undertaking (LUT) has become an essential document for exporters.

5. Increasing Competitiveness and Saving Money

The abolition of the Central Sales Tax (CST) and decreased levies under GST increased exporters' competitiveness in the global market while lowering overall tax burdens.

6. Exporters' Difficulties

Despite the favorable developments, exporters faced obstacles such as operating capital obstruction owing to delayed reimbursements and refund processing complications.

7. Export Benefits Maximization Strategies

Exporters may use tactics to successfully handle difficulties. Efficient refund claim handling, technology integration for compliance, and capitalizing on export promotion programs are all required.

8. Global Perspective: Implications for International Trade

GST influences India's boundaries, altering international trade dynamics, supply chain optimization, and the worldwide competitiveness of Indian exports.

9. Prospects for the Future and Potential Reforms

Potential GST revisions may solve issues experienced by exporters, improve refund procedures, and provide an even more hospitable climate for foreign commerce as the system evolves.

Conclusion

The effect of GST on exporters demonstrates the fluidity of taxation policies. Exporters may position themselves as nimble participants in the global trade arena by embracing the changes and possibilities afforded by GST. Understanding the subtleties of GST and its effects is critical for exporters to negotiate obstacles, grasp new opportunities, and drive development in the international market as the export environment transforms.

0 notes

Text

Tax Accountant Course – Duration, Fees & Career Scope

Tax Accountant Course: Fee, Duration, Syllabus, and Placement

1. Introduction to Tax Accountant Course

Taxation is a crucial field in finance and accounting. A Tax Accountant Course provides in-depth knowledge about tax laws, compliance, and regulations. It prepares individuals to manage and file taxes efficiently, ensuring accuracy and legality.

2. Why Pursue a Tax Accountant Course?

The field of taxation offers promising career opportunities. Tax accountants are in high demand, especially during tax filing seasons. Key reasons to enroll include:

Lucrative career paths.

Opportunity to specialize in a growing sector.

Enhanced credibility and expertise in finance.

Practical knowledge of tax laws and filing procedures.

3. Fee Structure of Tax Accountant Course

The cost of the course varies depending on the institute and course level. Below is an approximate breakdown:

Type of Course

Fee Range (INR)

Basic Certificate

10,000 - 25,000

Advanced Diploma

30,000 - 50,000

Professional Course

60,000 - 1,20,000

Many institutes offer installment payment options. Scholarships and discounts may also reduce costs for eligible students.

4. Course Duration: What to Expect

The course duration depends on the type and level of the program:

Certificate Courses: 3 to 6 months.

Diploma Programs: 6 to 12 months.

Professional Courses: 1 to 2 years.

Part-time and weekend classes are available for working professionals, ensuring flexibility.

5. Detailed Syllabus of Tax Accountant Course

The syllabus is divided into foundational and advanced topics. Below is a detailed outline:

Core Modules

Introduction to Taxation

Income Tax Fundamentals

GST (Goods and Services Tax)

Corporate Taxation

Tax Filing Procedures

Advanced Topics

International Taxation

Tax Planning Strategies

Auditing and Compliance

Use of Tax Software (e.g., Tally, QuickBooks)

Legal Frameworks and Case Studies

Practical assignments, case studies, and internships are integral parts of the curriculum.

6. Job Placement Opportunities

Completing this course opens doors to various job roles, such as:

Tax Consultant

Financial Analyst

GST Practitioner

Corporate Tax Advisor

Compliance Officer

Top recruiters include:

Accounting firms.

Multinational corporations.

Government agencies.

Startups and SMEs.

Internship programs during the course enhance hands-on experience, boosting employability.

7. Skills Gained from the Course

Students acquire both technical and soft skills, including:

Proficiency in tax filing and documentation.

Analytical thinking for tax planning.

Mastery of tax software tools.

Effective communication with clients.

Problem-solving in complex financial scenarios.

8. Benefits of Enrolling in a Tax Accountant Course

The advantages of this course extend beyond immediate job opportunities:

Comprehensive understanding of tax laws.

Improved problem-solving abilities.

Versatility in various industries.

Opportunities for entrepreneurship as a tax consultant.

High earning potential and job security.

9. Comparison with Related Courses

How does this course differ from similar programs? Here's a comparison:

Feature

Tax Accountant Course

General Accounting Course

Focus Area

Taxation

Broader Accounting

Job Roles

Tax Specialist

Accountant

Duration

Short to Medium

Medium to Long

Software Training

Specialized

General

If you aim for a niche in taxation, this course is the best choice.

10. FAQs About Tax Accountant Course

Q1. Is prior experience needed? No, most courses are beginner-friendly. However, knowledge of basic accounting is beneficial.

Q2. Can I pursue this course online? Yes, many reputed institutes offer online and hybrid models.

Q3. What is the average salary after completion? Entry-level salaries range between INR 3-5 LPA, while experienced professionals can earn up to INR 12-15 LPA.

Q4. Are there internships included? Yes, internships are often part of the curriculum, offering practical exposure.

Q5. How do I choose the right institute? Look for accredited institutes with positive reviews, placement support, and experienced faculty.

Links:-

Diploma in Computer Application , · Business Accounting and Taxation (BAT) Course , Basic Computer Course , GST Course , SAP FICO Course , Diploma In Payroll Management Course , Diploma in Financial Accounting , Diploma In Taxation , Tally Course

0 notes

Text

Accounting and Taxation Course: Your Gateway to a High-Paying Career

In today's competitive job market, a strong educational foundation combined with practical skills is the key to unlocking lucrative career opportunities. An accounting course in mumbai is one such pathway that equips individuals with the expertise required to thrive in the financial sector. With businesses and organizations constantly seeking professionals to manage their accounts and ensure tax compliance, this course can set you apart and pave the way for a high-paying career.

Why Choose Accounting and Taxation?

Accounting and taxation are integral components of any business, irrespective of size or industry. From preparing financial statements to ensuring adherence to tax regulations, professionals in this domain play a crucial role in maintaining the financial health of organizations. The demand for skilled accountants and tax consultants has surged, offering excellent job security and career progression opportunities.

Key Benefits of Pursuing an Accounting and Taxation Course

In-Demand Skills: This course covers essential topics such as financial reporting, income tax laws, GST compliance, and auditing practices. These skills are highly valued across industries.

Diverse Career Opportunities: Graduates can explore roles such as accountants, tax consultants, financial analysts, or auditors. With experience, you can even establish your own consultancy.

Attractive Salaries: Professionals in this field often command impressive salaries, with the potential for growth as they gain expertise and industry exposure.

Global Applicability: Knowledge of accounting and taxation principles is not limited by geography. This opens doors to international career opportunities.

Why Opt for an Accounting and Taxation Course in Mumbai?

Mumbai, being the financial capital of India, is home to countless businesses, multinational corporations, and financial institutions. Pursuing an accounting and taxation course in Mumbai offers unparalleled exposure to the industry, practical training opportunities, and networking prospects. The city's thriving corporate ecosystem ensures that students gain hands-on experience and are well-prepared to enter the workforce.

Who Should Enroll in a Taxation Course?

Graduates looking to specialize in finance and taxation.

Working Professionals aiming to upskill or transition into accounting roles.

Entrepreneurs who want to manage their business finances effectively.

Career Scope After Completing the Course

After completing an accounting and taxation course, you can embark on a career that offers stability and growth. Some popular roles include:

Tax Consultant

Accountant

GST Practitioner

Financial Analyst

Compliance Manager

Additionally, with the increasing complexity of tax laws and regulations, businesses are actively seeking professionals with in-depth knowledge, making this an ideal time to pursue a taxation course.

Conclusion

An accounting and taxation course is more than just an educational program—it’s a gateway to a high-paying and fulfilling career. Whether you’re a fresh graduate or a working professional, investing in this course can enhance your career prospects and set you on the path to financial success. For those in Mumbai, the vibrant business landscape provides an added advantage, ensuring that you gain valuable insights and practical knowledge to excel in the field.

Begin your journey today and take the first step towards a rewarding career in accounting and taxation!

0 notes

Text

Becoming an Accountant: A Step by Step Approach

Accounting is the backbone of modern business, and an individual, or a company for that matter, cannot think of dealing with finances, budgeting, and, most importantly, tax compliance without accountants. In case one wants to make a career in accounting, then getting the right education, then practical experience, and certification is the route. It outlines each essential step beginning from understanding what an accountant does to getting specialized training in courses such as an Accounting Course in Kolkata, taxation programs, and others such key certifications.

Step 1: Know the Accountant's Role

The core role of an accountant is to keep the accurate financial records so that it meets the legal requirements. The accountants make balance sheets, income statements, and tax returns and advise the clients on how to implement the financial strategy. The accountant can work in different fields such as auditing, taxation, or managerial accounting, which creates multiple career opportunities depending on one's interest and expertise.

Step 2: Acquire the Appropriate Education

Bachelor of Science in Accounting or relevant fields: Accounting or finance, or relevant fields have a foundational base in terms of knowledge regarding financial accounting, business law, and economics-all critical in forming the basis for principles in accounting and financial reporting.

Specialized courses in Kolkata: After completion of degree, practical know-how is the requirement. Specialized courses like Tally Course in Kolkata allow exposure to the accounting software used along with location-specific regulation and practice.

GST Course: Being the very core of the taxation of Indian economy, specialized courses about GST would teach students on GST registration, GST filling, and other related compliance. Such courses will prove very helpful to both the corporate and the accounting firm positions offered to candidates.

Taxation Course: The other crucial area of accounting is taxation law. A dedicated taxation course in Kolkata will teach you tax planning and return filing. You will be trained to serve a variety of clients.

Step 3: Practical Experience

Hands-on Experience: After completing all the education requirements, you will need a real-world experience. Many organizations provide internships or entry-level jobs that give one exposure and allow them to learn real-world experiences. This period will find you competent in Tally and any other accounting software widely used. Get Relevant Certifications Certifications create credence on your resume and demonstrate special knowledge. Major certifications include:

Chartered Accountant (CA): CA is perhaps the most prized qualification in India, relating to accountancy, auditing, taxation, and financial management. This involves very difficult examinations as well as practical training.

Certified Management Accountant (CMA): This international title deals with Financial and Performance Management, especially suitable for students interested in corporate finance or cost management.

Tally Certification: Tally is used all over India for accounting, and Tally certification will show what one knows about the software thus making him a prime candidate for firms that are based on this software.

GST Practitioner Certification: A GST Course in Kolkata will enable accountants to help with GST filing, audits, and compliance. This will improve the number of job opportunities available for accountants in the field of taxation.

Step 5: Develop Essential Skills

Technical knowledge is not the only thing; in accounting, it is very strong skills like:

Precision: Handling large volumes of data without a single mistake is possible only when someone is precise in details.

Analytical Skills: The accounting professional interprets financial information to provide great insights that can be the basis of business decisions.

Communication Skills: The accountant should know how to simplify financial information for their clients and colleagues.

Tech Savviness: Current accountants use Tally, QuickBooks, and ERP systems, so one must know how to operate them.

Step 6: Accounting Careers

Accounting is a very diversified major that can lead into a number of careers. These careers are different because they require different tasks and roles.

Financial Accountant: Prepares and analyzes financial statements.

Management Accountant: In organizations to budget and cost analysis for strategic planning.

Tax Accountant: Taxes preparation and planning, including tax advisement to clients.

Auditor: Ensure accuracy of financial statements and observance of statutory regulations in preparation. He might do this work on contract to private independent firms or governments.

Forensic Accountant: Some of these specializations will involve either conducting an investigation of suspected financial crimes or working as a liaison to police, assisting in their efforts of financial frauds.

Step 7: embrace continuous professional development

Accounting is a dynamic field that calls for constant learning to be updated on the changes in regulations, tax laws, and technology. Periodic update of knowledge through advanced courses or seminars will keep you competitive and effective in your career.

Step 8: Network and Build Professional Connections

Networking is the success in accounting. You get seminars, professional organizations, and socializing among peers on LinkedIn that keep you current about the trends in the industry and opportunities at workplaces.

Conclusion

Accountancy requires commitment to education and practical training, with an emphasis on continuous learning to become successful. Specialized courses and certifications provide a niche for professional success in areas such as corporate finance and tax planning or even in independent practice. With persistence and the right training, a fulfilling career can be constructed in this vital field.

#Accounting Course#Tally Course#GST Course#Taxation Course#Accounting Course in Kolkata#GST Course in Kolkata

0 notes

Text

Unlock the true potential of your career by learning corporate accounting:

In the competitive world of professionalism, knowledge in the field of corporate accounting will help you take that extra competitive edge. Whether it is a fresh start or development of expertise at the practitioner level, it is always a must to join a top-course program in corporate accounting in order to achieve success. Besides providing comprehensive insight into financial practices, it will equip you with hands-on experience in using the latest tools like Tally and GST during the latest corporate trends.

This article is going to talk about some of the major reasons why it is a must join the corporate accounting course or Accounting Course in Kolkata and how this may be the right step for each career plan.

Why Corporate Accounting?

Corporate accounting is the most significant element for any organization. It works as an activity and helps in maintaining proper records of the financial state in an organization. This would then ensure the sustainability of businesses to their organizations as they control all the financial management. This level of professionalism within accountancy helps one build more fulfilling careers related to the finance domain as a financial analyst, corporate accountant, or an auditor and even the leading positions such as CFO.

Here's why it may all pay off to invest in the course of corporate accounting:

Enormous Demand: Any business, small or large, requires efficient accountants to manage all its accounts books. Such constant demand generates heavy enough job opportunities for corporate accountants, more in the larger organizations.

Good Remunerations: Professionals who specialize in corporate accountancy, and who have extra finance skills, are often compensated better than others.

Career Opportunities: Corporate accounting provides great career opportunities in terms of advancement up the ranks. Many accountants, as time progresses, take on senior levels, even executive ones.

International Applicability: Corporate accounting concepts are very broad and widely applied across various industries and economies across the globe. This means that your skillset will have great transferability and international applicability.

Important Features of an Excellent Corporate Accounting Course

A suitable program for mastering the best course in corporate accounting should encompass a broad scope of knowledge content and practical training to be applied in the real world. To this extent, the following could be the key qualities to watch out for:

Basic understanding of corporate accounting A balanced course will begin with the basics-the detailed exposition of key critical financial statements, including the balance sheet, income statement, and cash flow statement. Learn how to read and understand these documents: it forms the groundwork for the corporate accountant.

Accounting Software Tally Accounting software proficiency has become inevitable in the corporate environment today. Tally is one of the most widely used accounting software applications in India and is also being adopted by large and medium-sized businesses to ensure effective management of financial data in business firms. Masters working on ledgers, account reconciliations, and reports after getting actual practice in a Tally Course in Kolkata.

A course that teaches you Tally will enable you to navigate transactions fairly easily within organizations, which is a thing to cherish being part of the organizational team.

To be an expert in GST is the Taxation Must-Know Learners would become well verse in the GST nuances with a GST Course in Kolkata. They will learn everything about the filing of a GST return, and they will reconcile their accounts and prepare them for total compliance with the laws of GST. The skills that a person learns with such a course will be extremely valuable for a company when navigating the tax landscape of India.

Advanced Accounting Techniques Apart from the fundamentals, high-level courses teach more complex accounting practices in terms of cost accounting, management accounting, and financial analysis. All this enables you to evaluate the financial health of a company, prepare budgets, and even give strategic financial guidance.

Depth of Taxation Knowledge Understanding taxation is a main aspect of corporate accounting. A Taxation Course in Kolkata will see to it that you are well equipped with issues pertaining to corporate tax, income tax, and indirect taxes. You'll be taught ways of saving tax, preparation and filing of corporate tax returns, audit management, and many more, hence becoming a valuable asset in managing a company's tax affairs.

Case Studies of Real Life Businesses Best corporate accounting courses will infuse case studies that reflect real-world scenarios so you could also address the same types of financial challenges corporate accountants face. Such scenarios build hands-on skills in whatever from fraud detection to complex tax situations.

Building Necessary Soft Skills Apart from technical competencies, the corporate accountants should also be adept at communication and problem-solving skills. A balanced course will teach you communication skills based on how one can convey financial knowledge to other not so financially-oriented people and the collaboration ability of how individuals can work together in a team.

Selecting the Right Corporate Accounting Course in Kolkata

Some of the foremost corporate accounting institutes exist in Kolkata. These institutes provide both classroom and online classes, which makes them more suitable for working professionals as well as students.

Some essential factors that should be considered while determining a course:

Accreditation: The programme should be accredited by some governing body. This will add value to your certificate when applied at work.

Faculty: Find courses taught by professionals who have a good amount of real-world experience.

Hands-on Training: Select courses with practical sessions on accounting software such as Tally and real-life application cases using knowledge of GST.

Flexible Learning: Being a working professional or student, arrangements of flexible learning - perhaps over the weekends or in part-time classes - might facilitate pursuing the studies.

Conclusion Joining the best corporate accountancy course can be a watershed moment for your career. The course will make you learn the main skill and practical knowledge to survive in the corporate accounting world with so much confidence. Besides corporate accountancy, learning courses on Tally, GST, and taxation, you can learn all aspects of financial management, and you can become an ideal employee of any organization.

Getting all this learning opportunity in Kolkata will surely take you on the right track for a successful and fulfilling corporate accounting career.

#accounting course#gst course#taxation course in kolkata#tally course#accounting course in kolkata#gst course in kolkata

0 notes

Text

Master GST with Expert Training at MCP in Mohali and Chandigarh

As the Goods and Services Tax (GST) regime continues to reshape the tax landscape in India, understanding its complexities is essential for professionals in finance, accounting, and business management. Enrolling in a comprehensive GST training program is a great way to equip yourself with the knowledge and skills necessary to navigate this evolving field. Mohali Career Point (MCP) offers specialized GST training that prepares you for success in your career.

Why Choose GST Training? The implementation of GST has revolutionized the way businesses operate in India. Here are several reasons to consider GST training:

Stay Compliant: GST is mandatory for businesses in India. Proper training helps ensure compliance with tax regulations, minimizing the risk of penalties. Career Advancement: Professionals with expertise in GST are in high demand across industries. This training can significantly enhance your job prospects and salary potential. Comprehensive Understanding: GST training provides a deep understanding of tax structure, rates, filing processes, and the implications of GST on various business sectors. Skill Development: The training enhances your analytical and problem-solving skills, making you a valuable asset to any organization. Comprehensive GST Training at MCP At Mohali Career Point, we offer an extensive GST training program tailored to meet the needs of beginners and professionals alike. Our curriculum covers all aspects of GST, ensuring you gain practical and theoretical knowledge.

Course Modules Overview Introduction to GST: Understand the basics of GST, its significance, and its impact on the Indian economy. Learn about the various types of GST: CGST, SGST, and IGST. GST Registration: Learn the process of GST registration, eligibility, and the documentation required. Understand the concept of PAN-based and state-wise registration. GST Return Filing: Gain insights into various GST returns, including GSTR-1, GSTR-2, and GSTR-3B. Learn how to file returns using the GST portal and understand deadlines and compliance. Input Tax Credit (ITC): Understand the concept of Input Tax Credit and how to claim it. Learn about eligible and ineligible ITC under GST. GST Audit and Assessment: Get familiar with GST audit processes and the role of GST practitioners. Understand the assessment procedures and how to handle assessments. Practical Applications: Engage in practical sessions that involve real-time case studies, GST software, and filing processes. Work on live projects that simulate real-world scenarios. Real-World Application What distinguishes our GST training program is the emphasis on practical experience. You will have opportunities to work on real-world case studies, use GST software, and understand the practical implications of tax regulations. This hands-on training prepares you for challenges you may face in your career.

Why Choose MCP for GST Training in Mohali and Chandigarh? Experienced Trainers: Our trainers are certified professionals with extensive knowledge of GST laws and practices. They provide valuable insights and guidance throughout the course. Flexible Learning Options: We offer both weekday and weekend batches to accommodate your schedule, ensuring that you can balance your training with your other commitments. Career Support: MCP is dedicated to your success. We provide career counseling, resume building, and job placement assistance to help you secure positions in finance and accounting. Comprehensive Resources: Our training materials are updated to reflect the latest GST developments and practices, ensuring that you have access to the most relevant information. Enroll in MCP Today! If you’re ready to take your understanding of GST to the next level, Mohali Career Point is the perfect choice for your training. Our GST training program will equip you with the skills needed to excel in your career.

Contact Us Today!

📧 Email: [email protected] 📞 Phone: +91 7696 2050 51 / +91 7906 6891 91 📍 Address: SC-130 Top Floor, Phase 7, Mohali, 160059

0 notes

Text

Best Taxation Course in Kolkata: A Guide for Aspiring Tax Professionals

The tax department is a vital part of the economy of every country. At present, it basically serves as a principal source for the collection of revenues to finance public services and infrastructure. In this context, in today's scenario with increasing complexities in tax laws, the demand for trained tax professionals is mounting, and there's no exception for Kolkata too. Whether you are an experienced accountant or just entering this field, a course in specialized taxation will bring you an amazing view.

This article briefly explains why the taxation course is beneficial, what are some of the core subjects in these courses, and then introduces some of the best institutes offering both offline and online courses on Accounting and taxation Course in Kolkata.

The Importance of a Taxation Course

A taxation course puts you in the position of guiding various financial tasks, including tax planning, compliance, and risk management. Thus, for an individual desirous of advancing his or her expertise or for a business professional carrying out corporate tax roles, getting the right taxation course is very important.

Here are some of the major matters usually taught in taxation courses:

Law Relating to Income Tax: Understanding the individual and corporate income taxes and returns, as well as compliance.

Goods and Services Tax (GST): Understanding the detailed structure of GST, including its compliance and filing, as one of the biggest tax reforms under India's flag.

Corporate Tax Laws: Issues relating to corporate tax laws will highlight the types of taxes levied upon corporate enterprises and what is involved in corporate tax planning as well as auditing.

International Taxation: Useful for those who will be employed with multinational firms, for they will be expected to understand cross-border tax regulations which is considered indispensable.

Tax Auditing: Practice of how to conduct an audit. This includes knowledge about your own personal tax, compliance, and taxation-related risk management.

Tax Planning Strategies: A way by which the practitioner understands how to design tax-saving strategies both for business enterprises and individuals. Why take a Taxation Course?

Joining a taxation course in kolkata has many advantages. Here are some reasons why this professional course can be rewarding:

Widest Career Opportunities A specialization in taxation is sure to lead to opportunities in several sectors. Tax professionals are in great demand in corporate finance, auditing firms, government agencies, and consultancy services. You may also be a freelance tax consultant to offer advisory services for businesses and individuals alike. In Kolkata, the demand for tax professionals comes from all possible sectors, whether it's manufacturing, IT, or retail, among others.

Thorough Knowledge of Tax Laws The tax laws are many in number and ever-changing; thus, a taxation course is important in equipping one to stay up-to-date. A taxation course equips one with the expertise to understand and apply the rules laid down within the tax law. A person with such expertise is capable of ensuring compliance, liability diminution, and therefore, prevention of penalties for those clients and employers.

Intrepreneurial opporchunities A taxation course equips you with skills to establish your own consultancy or tax advisory service. As a taxation expert, you can offer businesses valuable services like tax planning, compliance, and audit management, increasing your revenue. With growing demand for expert tax advice, it's a lucrative career path for entrepreneurial professionals.

Best Institutions for Taxation Courses in Kolkata

For people interested in the taxation course in Kolkata, there are quite a number of reputed institutions which impart courses combining both theoretical and practical experiences. Here's some of the best institutes:

Ready Accountant Ready Accountant: It provides industrial training courses under Accounting and Taxation, and GST Course in kolkata. Its courses range from online learning, SAP FICO training, and placement support. Its combination of IT and tax will fit in any trainee who wants to perfect their skills in these fields. Their training equips students with knowledge relevant to today's job market.

Indian Institute of Taxation (IITax) One of the premier institutions situated at Kolkata is IITax, known for its specialized taxation courses that help professionals master the GST and corporate tax, indirect tax regulations. The training being highly practical means the students are job-ready out of the campus gates and try to bridge the gap between book knowledge and real-time applications.

Tally Education Pvt. Ltd. There are dedicated taxation courses for students who want to learn tax compliance on Tally Prime. With the said programme, it will very much be useful for those students who have an SME entity and use Tally Prime prevalently for account management.

Online courses offer flexibility in studying from anywhere and at any time, which makes them a brilliant preference for working professionals. Here's why online learning may be great for those to take up advanced courses in taxation:

Flexible Scheduling Online courses in Taxation let you learn according to your schedule. Be in the office, attending to your children, or doing whatever important thing in your hands, and you will still be able to learn without compromising quality education.

Interactive and Engaging Just like the traditional classroom teaching, most online courses on taxation allow for live sessions, recorded lectures, quizzes, and assignments, meaning you get to experience a very engaging learning environment. You can also reach out to instructors and peers- something that makes online learning as realistic as other classroom-style learning.

Accessibility of Learning Resources With online courses, you'll have access to materials being studied 24/7, in which you can review lectures and practice quizzes that are available all the time so you can finish your assignments at whatever time you please.

Conclusion

Taxation is a rewarding and diverse profession with many opportunities that range across various sectors. Be it managing corporate tax or working for government agencies, starting one's consultancy business, the taxation course gives you an extensive range of knowledge and relevant skill sets to achieve professional success.

1 note

·

View note

Text

10 Reasons to Consider a GST Practitioner Course Today

The Labor and products Duty (GST) has reformed the Indian tax collection framework, making it more smoothed out and proficient. With the rising interest for GST experts, signing up for a GST Professional Course has turned into a rewarding choice for those trying to construct a fruitful vocation in tax collection. This guide investigates the advantages, construction, and profession valuable open doors related with the GST specialist course while featuring how it supplements a more extensive GST Course for a total comprehension of the subject.

What is a GST Expert Course?

A GST Professional Course is a particular preparation program intended to outfit people with thorough information on GST regulations, consistence, and procedural perspectives. It plans members to become affirmed GST specialists, empowering them to offer proficient administrations like duty recording, warning, and portrayal for the benefit of clients.

Key Targets of a GST Professional Course

Inside and out Information on GST Regulations

Grasp the design, parts, and execution of GST.

Dominating GST Consistence

Become familiar with the cycles of GST enlistment, returns recording, and keeping up with consistence with lawful guidelines.

Charge Documenting Aptitude

Acquire commonsense abilities for getting ready and submitting GST returns for people and organizations.

Warning Abilities

Foster the capacity to give vital exhortation on GST-related matters, including charge arranging and streamlining.

Why Seek after a GST Specialist Course?

Developing Interest for GST Experts

With GST being an obligatory expense structure, each business expects experts to oversee consistence and documenting.

Professional success

Turning into a guaranteed GST professional opens as high as possible paying open doors in charge consultancy, corporate money, and bookkeeping.

Pioneering Open doors

Begin your consultancy to help organizations with GST consistence and warning administrations.

Adaptable Application

Information on GST is important across different businesses, from retail to assembling and then some.

Grasping the More extensive GST Course

A GST Course offers basic information on the Labor and products Duty, covering its hypothetical and commonsense perspectives. While a GST specialist course is more engaged, an overall GST course fills in as a superb beginning stage for novices.

Themes Shrouded in a GST Course

Prologue to GST

Get familiar with the nuts and bolts of GST, its advantages, and its effect on the Indian economy.

Sorts of GST

Figure out the three parts: CGST (Focal), SGST (State), and IGST (Incorporated).

GST Enrollment

Bit by bit direction on the enrollment interaction for organizations.

Input Tax reduction (ITC)

Investigate the idea of ITC and how it benefits organizations.

GST Consistence and Recording

Figure out how to get ready and submit exact GST returns.

Invert Charge Instrument (RCM)

Comprehend the situations where RCM is pertinent and its suggestions.

Advantages of Joining a GST Course and GST Professional Course

While a GST Course gives an essential comprehension, the GST Expert Course centers around cutting edge applications, making the blend a strong couple for trying experts.

Benefits of Joining The two Courses

Far reaching Information

Cover both fundamental and high level parts of GST, guaranteeing balanced training.

Functional Application

Acquire the abilities to deal with genuine GST issues certainly.

Upgraded Vocation Valuable open doors

The consolidated skill opens ways to different jobs, from GST specialist to corporate expense guide.

Groundwork for Affirmation

A GST specialist course is fundamental for those looking for certificate from GST specialists.

Who Ought to Sign up for These Courses?

A GST professional course and GST course are great for:

Trade Graduates

Understudies with a foundation in trade or bookkeeping can upgrade their capabilities with these courses.

Charge Experts

Bookkeepers, reviewers, and money experts hoping to represent considerable authority in GST.

Business people

Entrepreneurs looking to effectively deal with their organization’s GST consistence.

Specialists and Experts

People meaning to give GST warning and consistence administrations to numerous clients.

Vocation Open doors Subsequent to Finishing a GST Professional Course

Finishing a GST Professional Course opens up a scope of vocation potential open doors in tax collection and money.

1. GST Expert

As a confirmed specialist, you can deal with GST consistence, enrollment, and petitioning for clients.

2. Charge Expert

Give master exhortation on charge arranging and GST-related systems to organizations.

3. Corporate GST Supervisor

Deal with the GST consistence and detailing necessities of huge organizations.

4. Bookkeeper with GST Ability

Incorporate GST information into general bookkeeping jobs for improved esteem.

5. Autonomous GST Expert

Begin your consultancy to take special care of SMEs and individual citizens.

Instructions to Pick the Right GST Course

Choosing the right GST professional course or GST course is basic for your vocation achievement.

Variables to Consider

Certification

Guarantee the course is perceived by GST specialists or rumored instructive establishments.

Experienced Staff

Pick programs drove by experts with useful involvement with GST.

Extensive Educational program

Search for courses that cover both hypothetical and useful parts of GST.

Position Help

Pick foundations that proposition work position or temporary job amazing open doors.

Adaptability

Online courses or end of the week bunches can be great for working experts.

The most effective method to Get everything rolling

This is the way you can set out on your excursion to turning into a GST master:

Research Courses

Investigate different GST courses and GST expert courses that line up with your profession objectives.

Really take a look at Qualification Prerequisites

Guarantee you meet the essentials, like a foundation in business or money.

Sign up for a Perceived Program

Pick a trustworthy foundation offering quality schooling and certificate.

Acquire Viable Experience

Take part in temporary jobs or parttime jobs to fabricate active experience.

Remain Refreshed

Charge regulations every now and again advance; nonstop learning is fundamental for stay applicable.

End:

A GST Specialist Course is a superb pathway for anybody hoping to construct a compensating vocation in tax collection. By joining it with a fundamental GST Course, you can foster a hearty comprehension of GST regulations and their pragmatic applications. These courses set you up for assorted jobs, from consistence the executives to burden consultancy, guaranteeing long haul profession development.

Venture out today by signing up for a GST course and making way for an effective future in the unique universe of tax collection.

Visit more course-

0 notes

Text

What Is The Role Of GST Practitioner?

As per India's Goods and Service Tax (GST) regulation, GST practitioners are essential in helping individuals and organizations. The government authorizes these professionals to perform various activities related to GST. If you dream of a job like this, choose the GST & Taxation course in Manjeri.

Functions Of GST Practitioner

GST Registration: This particular person will guide you through the GST registration process and help businesses choose the appropriate GST scheme.

GST Returns: The GST Practitioner helps to file GST returns, including GSTR-1, GSTR-3B, etc., on clients' behalf.

Tax Calculation: The GST Practitioner provides tax information and Calculates input tax credit and tax payable under GST rules.

E-Way & E-Invoicing Bill: The person will Generate bills like e-way and e-invoices for certain transactions under GST law.

Audit & Compliance: The GST Practitioner also prepares Audits and responds to queries from GST authorities.

These are some of the functions of a GST Practitioner. If you are interested in a GST course, choose the Finprov GST & Taxation Course in Manjeri. This course provides hands-on training and practical knowledge for your bright future.

0 notes

Text

How an Accounting Taxation Course Can Boost Your Career

In today's competitive job market, acquiring specialized skills can significantly enhance your career prospects. One such specialized skill set is accounting and taxation. Whether you're a recent graduate or a professional looking to upskill, an accounting taxation course from GGC Courses can provide you with the knowledge and expertise needed to excel in your career.

Why an Accounting Taxation Course from GGC Courses?

1. In-Demand Skill Set:

- Businesses of all sizes require professionals who are adept at managing financial records and ensuring compliance with tax regulations. An accounting taxation course from GGC Courses equips you with these critical skills.

2. Career Advancement:

- Professionals with expertise in accounting and taxation are often considered for higher-level positions, such as financial managers, tax consultants, and auditors. Completing such a course can open up new career opportunities and pave the way for promotions.

3. Enhanced Earning Potential:

- Specialized knowledge in accounting and taxation can lead to higher salaries. Employers value the precision and expertise that comes with this training, often leading to better compensation packages.

4. Comprehensive Understanding:

- An accounting taxation course from GGC Courses offers a thorough understanding of financial management, tax laws, and compliance issues. This comprehensive knowledge is invaluable for making informed business decisions.

Short-Term Online Courses

For those looking to quickly upskill, several short-term online courses are available that cover key aspects of accounting and taxation:

1. Business Accounting and Taxation Course:

- This course covers the essentials of business accounting and tax regulations, providing a solid foundation for those entering the field.

2. Certificate in Accounting and Taxation:

- Ideal for recent graduates, this course focuses on the practical aspects of accounting and tax preparation, making it easier to transition into a professional role.

3. Advanced Taxation Techniques:

- Aimed at professionals, this course delves into more complex tax strategies and planning, helping you stay ahead in your career.

4. GST Practitioner Course:

- With the introduction of the Goods and Services Tax (GST) in many countries, this course focuses on the intricacies of GST compliance and management.

Why Choose Accounting and Taxation Courses After Graduation

For graduates looking to specialize further, pursuing accounting and taxation courses can significantly boost career prospects. Here’s why:

1. Professional Credibility:

- Completing advanced courses in accounting and taxation adds credibility to your professional profile. Certifications and diplomas from reputed institutions like GGC Courses signal to employers that you possess in-depth knowledge and are committed to your field.

2. Global Recognition:

- Many accounting and taxation certifications are recognized globally, allowing you to work in different countries and broaden your career horizons.

3. Networking Opportunities:

- Enrolling in specialized courses often provides opportunities to connect with industry professionals, faculty, and fellow students. These connections can be beneficial for career growth and job placements.

4. Competitive Advantage:

- In a competitive job market, having specialized education in accounting and taxation can set you apart from other candidates. Employers look for individuals who bring specific expertise to their organization.

Choosing accounting and taxation courses after graduation is a strategic move that can lead to numerous career benefits. Whether you aim to climb the corporate ladder, enhance your earning potential, or gain global recognition, specialized education in this field can significantly enhance your professional journey.

Conclusion

Investing in an accounting taxation course from GGC Courses can be a game-changer for your career. With the demand for skilled accounting professionals on the rise, acquiring specialized knowledge in this field can lead to better job prospects, higher earning potential, and greater job satisfaction. Whether you choose a short-term online course or a comprehensive post-graduate program, the skills and expertise gained will undoubtedly enhance your professional journey.

1 note

·

View note

Text

Income tax practitioner course online

Are you seeking income tax practitioner course online? Look no further. This course is specifically designed to meet the expectation of aspirants and those who wish to become Tax Practitioners. The complete course module has explained on our website with a price. For more information, you can call us at 7530813450.

0 notes