#cost of traditional financial advisors

Explore tagged Tumblr posts

Text

Investing for Beginners: Where to Start Now and Build Wealth — Earning Ventures Investing For Beginners: Where To Start Now And Build Wealth

Investing for beginners: start by understanding your financial goals and risk tolerance, then explore low-cost index funds and consider utilizing a robo-advisor for guidance. Investing can be overwhelming, especially for beginners.

With so many options and strategies available, it’s important to start with a solid foundation. Before jumping into the world of investments, take the time to understand your financial goals and risk tolerance. This will help you determine the appropriate investment approach for you.

One popular starting point for beginners is investing in low-cost index funds. These funds allow you to invest in a diversified portfolio of stocks or bonds, without the need to pick individual securities. This helps reduce risk and provides broad market exposure. For those who want a more guided approach, robo-advisors can be a valuable tool. These online platforms use algorithms to build and manage a personalized investment portfolio based on your goals and risk tolerance. They offer convenience and professional guidance at a fraction of the cost of traditional financial advisors. Whether you choose index funds or a robo-advisor, the key is to start investing early and regularly. Over time, this can help you build wealth and achieve your financial goals. So, take the first step today and start investing for your future.

#achieve your financial goals#investing for your future#investing in low-cost index funds#understanding your financial goals and risk tolerance#cost of traditional financial advisors#manage a personalized investment portfolio#world of investments

0 notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

Random actual vent that is probably more venty than my usual random little things, but occasionally I have to step back and think how asinine the salary system for PhD students can sound to people outside of academia. I really just want to like... lay it on the table, because it really is fucking dumb and I occasionally want validation that its fucking dumb.

Note that this is all coming from a traditional lab sciences, in the US perspective. Also, I'm really fucking ADHD and have a really, really shitty brain for bureacracy, so this is a rant and isn't really intended to be informative and might be wrong in places, its just me word vomiting.

Let's start with something straight off the bat- grad school isn't really school. It's work that creates value for the university, and you happen to take one or two courses on the side that the university has determined will make you better at that work (your mileage may vary). It's an entry level job, essentially. You create value for the university in one of two ways- you either contribute to research that gets them grant money, or you teach undergrads that pay tuition. We'll get back to how that affects you later, but first lets talk about something else: what the university claims they pay you vs what you actually get paid.

On paper, my income is approximately 3 times as much as my actual, take home income. There's two reasons for this. The first is that I am technically charged tuition by the central university, which is then immediately paid off by the source of my income. In official job titles, that's technically included in what you're getting paid, although most universities don't even bother advertising that. The other confounding factor is that you're literally always considered part time. The exact % time varies depending on your exact schedule, and of course your university, but its actually weirdly consistent even between universities. Technically, the work you do on your thesis isn't "work", and the university doesn't technically pay you to do it. Even though the work you do on your thesis literally generates revenue for the university in the form of grant overhead. But we'll get to that. If you're a researcher for a given appointment term, you're expected to also do research activities that are unconnected to your thesis- which is ridiculous, because there's no lab in existence where the work isn't all interconnected in some way.

Half time appointments are common, but lots of different percentages exist.

So, if you ever see a figure that says that a grad student position is paid at about $80k a year, that's whats going on. The highest take-home income I have EVER heard of in the US for PhD students is $54k, at Stanford neuroscience. I think its a bit higher now, but that at least gets you a ballpark. Most STEM PhD students on the high cost of living coasts are paid 30-40k ish, and in cheaper areas you can expect to take 5k off of that. These are for degrees that usually make six figures on the job market.

And then there's the other convoluted problem- the source of the funding. This is where the academia salary model really has a unique brand.

Basically, when you're a PhD student, you're not working one job for the full 5-7 years. You're constantly flipping between job titles within the university, and who exactly is paying you changes as a result.

The most basic distinction is researcher vs teaching assistant. TA is easy- you work "part time" (but oh my god those workloads are not part time sometimes [although the class I'm TAing now is very chill so its w/e][fuck you molecular genetics at my master's uni tho]), and the department you're teaching for pays for your tuition and your salary as a result.

Researcher is a bit weirder. Basically, each lab is conducted as its own independent financial unit, managed by a Principle Investigator (PI, or to any grad student, the professor/boss/research advisor/liege/monarch/authority of the lab). The PI is constantly writing lab wide grants to supply the core funding of the lab, including the salary of the grad students. Grants can be pretty general, but there are also very specific ones that check in how the money is being spent. These include training grants/fellowships/tbh the name is arbitrary for a lot of these. Those are grants that are written to supply the salary of a specific grad student.

Couple things to note- the university charges the PI in a lot of ways on this. Notably:

They charge tuition on every grad student, as mentioned previously, which under a researcher appointment is paid from the PI to the university.

They charge overhead on grants- basically, they take money out of every grant the PI gets.

If the previous two sources aren't enough, oftentimes universities will pay rent on the amount of building space a lab takes up (although this is very inconsistent between universities)

Researcher appointments are considered favorable to teaching appointments, because they mean you can spend more of your time on your thesis. But, its dependent on whether your PI has the funding to pay you all that, which is a big if. So, every quarter or semester or year or however much your university decides to renegotiate it, you essentially switch jobs, in a way. Obviously its a lot more simple and streamlined than actually switching jobs, but your title, responsibility, source of income, and sometimes your actual pay changes constantly.

And to anyone who has been through a PhD, you're nodding along like this is all the basic stuff, because all this is so NORMAL. Like this is all the normal system, and this is the bare basics of it as well. And it's weird that it's normal, right? Like, most of my career has been tied to academia, so I don't have a fantastic benchmark for this, but this isn't how it works outside of academia like... at all.

Over the course of late last year and bleeding into this year, multiple graduate student unions have had strikes or negotiations regarding pay scale, but its been a very difficult situation for the average grad student to untangle because of how weird the source of pay is. Because technically, even though you functionally work a single, salaried job with slightly changing obligations, what's happening behind the scenes is that you're essentially hopping between jobs every couple of months. In an ideal system, those jobs always have the same pay, but that's increasingly becoming not the case. Sometimes that means getting paid more overall, sometimes slightly less. Union negotiations have made this pay slightly higher overall, but its still a mess of a system.

And obviously, there's paperwork associated with so many of these steps.

So in my last post, when I said "getting a grant", that was what I was referring to- applying for training grants that will guarantee that I don't have to teach extra or get extra money from my PI for the time I'm here. I'd love to get more teaching experience, but ofc I want to do it when I want to, not when I have to. I'm applying for multiple training grants over the next couple of months that will hopefully fund my salary specifically, and hopefully I'll get at least one of them. And tbh, I don't even care that much about teaching, I more want them because it'll dramatically simplify all this for me.

I love what I do to death, but untangling this shit is what gives me imposter syndrome more than anything. I think my arrogant streak shows when I can genuinely say that I've never felt imposter syndrome based on my scientific knowledge. I have felt it over two things- my motivation/productivity (which is a different rant entirely), and the fact that I am really, really bad at untangling the level of bureaucracy required to just... exist here. Just give me my fucking paycheck and let me do my science, and tell me when you want me to teach.

60 notes

·

View notes

Text

Millennials Money Tips for Personal Finance

It is very difficult for millennials to manage their own finances today as the world of competition requiring one to workout harder has changed in a matter of months. From student loan debt to increasing living costs, this generation has faced financial struggles that are all its own. Nevertheless, there are strategies out there that can work for the millennial in search of sustainable financial security or even just a better bottom line. Below are a few of the basic personal finance tips for millennials.

1. Set Clear Financial Goals

The first step in any financial plan is establishing specific and attainable goals. Whether it's to buy a home, pay off your student loans, or save for retirement — knowing what you're working towards will keep you more engaged and inspired. Divide your goals into short-term (one to two years), medium-term (three to five years) and long-(five or more). This approach helps you to prioritize and use your resources accordingly.

2. Create and Stick to a Budget

The Facet of Financial Management: Budgeting Track your income and expenses: The very first step is to track how much you are earning, after that what things consume your bills? Budgeting tools; you may use an app to categorize what you spend on and where they can be reduced. If possible, adhere to the 50/30/20 rule — apportion half of your funds towards needs and twenty percent for saving or repaying debt.

3. Build an Emergency Fund

It is only a rainy day fund to act as an emergency safety net in case life decides not to follow your plan. The hopefully three to six months of absolute must-have sequestered in a separate, liquid account. It can help you with the cost of surprising expenses–whether they be medical bills or it lets you maintain your financial schedule, rather than having a huge hole in it due to car repairs.

4. Manage Debt Wisely

For many millennials, student loan debt can be a large financial weight. Start your payoff journey with high-interest debt — credit card balances are a solid place to begin. Refinance or consolidate student loans at a lower interest rate. Establish and Maintain a HISTORY of consistent on-time payments to improve your credit score, reducing overall debt.

5. Invest for the Future

If you want to create wealth then investment is the most important thing for it. If your employer offers a matching 401(k) plan, that is what you should start with. Demand more investment options like IRAs, Stocks and Mutual Funds. Simply Diversify A toasted way to diversification! The point is that, your money should earning with compounding.

6. Enhance Financial Literacy

One can be really good at making informed decision which is backed by financial literacy. Use online sources, books and courses to learn more about personal finance. Understanding concepts such as interest rates, inflation and investment options can help you make more informed financial decisions.

7. Plan for Retirement

Architecting retirement: It is never too early to plan for retirement. Save a minimum of 15% of your income toward retirement. Make use of Roth IRAs and traditional IRA tax-advantaged accounts. You may want to talk with a financial advisor who can help you put together your own retirement plan based on what you hope for in retirement and how much risk you are willing to take.

8. Protect Your Assets

But while it may not be the sexiest asset class around, insurance is integral to any complete financial plan. Make sure of health, auto and and home insurance coverage. Good idea: If you have dependents, consider life insurance. Disability insurance provides you income in the event of an illness or injury.

9. Check Your Credit Score

Great credit can unlock lower-interest rates and financial possibilities. Review your credit report on a regular basis for inaccuracies and work towards building up the score. By paying your bills on time, keeping credit card balances low and only opening new accounts when you need them (and therefore improved scores so long as other key factors don't weigh in ).

10. Seek Professional Advice

If you are unsure of where to begin or need help, then speak with a financial advisor. They can give you advice and even consult with you to build a financial plan as well. Also look for a good pedigree — Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

With these personal finance tips, a millennial can move forward in the financial journey feeling more secure for their future. Earning money is only part of the process… its mastering discipline, consistency and continuous learning that leads to long-term financial success.

#millionaire#millionarelifestyle#investing#investment#personal finance#startup#business#entrepreneur#economy#mindset#luxury#luxurious

3 notes

·

View notes

Text

Explore the Benefits of Earning an Online Professional Degree at Hawkins University

In today's fast-paced world, the traditional pathways to higher education are evolving, making way for more flexible and accessible options. Online education has emerged as a game-changer, allowing students to pursue their academic and career goals without compromising their personal and professional commitments. Among the various online learning opportunities available, professional degrees stand out for their potential to significantly enhance your career prospects. Hawkins University, a leader in online education, offers a range of professional degree programs designed to equip you with the skills and knowledge needed to excel in your chosen field. In this blog post, we will explore the numerous benefits of earning an online professional degree from Hawkins University.

1. Flexibility to Learn at Your Own Pace

One of the most compelling advantages of earning an online professional degree at Hawkins University is the flexibility it offers. Unlike traditional on-campus programs, online degrees allow you to study at your own pace and on your own schedule. Whether you're a working professional, a parent, or someone with other commitments, Hawkins University's online programs are designed to fit into your busy lifestyle. You can access course materials, participate in discussions, and complete assignments from anywhere in the world, at any time that suits you.

2. Access to High-Quality Education

Hawkins University is committed to providing a high-quality education that rivals that of traditional institutions. The university's online professional degree programs are designed by industry experts and experienced faculty members who bring real-world knowledge into the virtual classroom. The curriculum is regularly updated to reflect the latest trends and advancements in your field, ensuring that you receive a relevant and up-to-date education. Moreover, Hawkins University offers a robust support system, including academic advisors, career counselors, and technical assistance, to help you succeed in your studies.

3. Cost-Effective Education

Pursuing a professional degree can be a significant financial investment, but Hawkins University strives to make education more affordable. Online programs typically eliminate many of the costs associated with on-campus education, such as commuting, housing, and campus fees. Additionally, Hawkins University offers a variety of financial aid options, including scholarships, grants, and payment plans, to help you manage the cost of your education. This makes earning a professional degree more accessible and less burdensome on your finances.

4. Diverse Range of Programs

Hawkins University offers a diverse range of online professional degree programs, catering to various industries and career paths. Whether you're interested in business, healthcare, technology, or education, you can find a program that aligns with your career goals. Each program is designed to provide you with the specialized knowledge and skills required to excel in your chosen field. Additionally, the university's strong network of alumni and industry connections can open doors to new career opportunities and professional growth.

5. Career Advancement Opportunities

Earning an online professional degree from Hawkins University can significantly enhance your career prospects. Many employers value the dedication and self-discipline required to complete an online degree, and the skills you acquire during your studies can set you apart from other candidates. Whether you're looking to advance in your current job, switch careers, or start your own business, a professional degree from Hawkins University can provide you with the credentials and confidence you need to achieve your goals. Furthermore, the university offers career services to assist you in job placement, resume building, and interview preparation.

6. Networking Opportunities

While online education may seem solitary, Hawkins University fosters a strong sense of community among its students and alumni. Through virtual classrooms, discussion forums, and social media groups, you can connect with fellow students, faculty, and industry professionals from around the world. These connections can lead to valuable networking opportunities, collaborations, and lifelong friendships. Hawkins University also hosts webinars, workshops, and events where you can engage with experts in your field and stay informed about industry trends.

7. Personal Growth and Development

Earning a professional degree online is not just about acquiring technical skills; it's also an opportunity for personal growth and development. The process of balancing your studies with other responsibilities teaches you valuable time management, communication, and problem-solving skills. Additionally, the diverse perspectives you encounter in an online learning environment can broaden your understanding of different cultures and viewpoints, making you a more well-rounded individual. Hawkins University is dedicated to helping you grow both professionally and personally, preparing you for the challenges and opportunities that lie ahead.

8. Global Recognition and Accreditation

Hawkins University is recognized globally for its commitment to excellence in education. The university's online professional degree programs are fully accredited, ensuring that your degree is respected by employers and institutions around the world. Accreditation is a mark of quality that guarantees you are receiving an education that meets rigorous academic standards. This recognition can give you a competitive edge in the global job market and increase your earning potential.

9. A Pathway to Lifelong Learning

The journey doesn't end once you earn your degree. Hawkins University encourages lifelong learning and offers a variety of continuing education opportunities to help you stay ahead in your field. Whether you're interested in pursuing advanced certifications, attending workshops, or enrolling in additional degree programs, Hawkins University provides the resources and support you need to continue your education and achieve your career aspirations.

Conclusion

In conclusion, earning an online professional degree from Hawkins University is a smart investment in your future. With flexible learning options, high-quality education, cost-effective programs, and a wide range of career advancement opportunities, Hawkins University is the ideal choice for anyone looking to enhance their skills and achieve their professional goals. If you're ready to take the next step in your career, explore the online professional degree programs at Hawkins University and discover how they can transform your life.

Visit Hawkins University to learn more about the programs and take the first step towards a brighter future.

2 notes

·

View notes

Text

The Process of Buying Villas in Dubai: Step-by-Step Guide

Buying a villa in Dubai is an exciting and significant investment. This step-by-step guide will walk you through the entire process, from initial research to closing the deal, ensuring a smooth and successful purchase.

1. Define Your Requirements

Start by defining your requirements and preferences.

Budget: Determine your budget, including the purchase price, associated costs, and potential mortgage payments.

Location: Choose a location that suits your lifestyle and investment goals. Consider proximity to work, schools, and amenities.

Type of Villa: Decide on the type of villa that meets your needs, whether it’s a luxury villa, family villa, or eco-friendly villa.

For more on available villas, check out Buy Luxury Property in UAE.

2. Research the Market

Conduct thorough research to understand the market dynamics and property values.

Market Trends: Stay updated with the latest market trends and property prices in different areas of Dubai.

Historical Data: Analyze historical data on property prices to gauge future potential.

Future Developments: Consider areas with upcoming developments as they may offer good investment opportunities.

For comprehensive market insights, visit Real Estate Investment in Dubai.

3. Secure Financing

Explore different financing options to determine the best way to finance your villa purchase.

Home Loans: Banks and financial institutions in Dubai offer home loans with competitive interest rates and flexible repayment terms.

Mortgage Services: Specialized mortgage brokers can help you navigate the mortgage process, compare different lenders, and secure the best rates.

Developer Financing: Some developers offer financing options directly to buyers, which can be an attractive alternative to traditional bank loans.

For detailed mortgage advice, check out Dubai Mortgage Advisors.

4. Hire a Real Estate Agent

Working with a reputable real estate agent can simplify the buying process and provide valuable insights.

Experienced Agents: Choose agents with a strong track record and good knowledge of the Dubai villa market.

Negotiation Skills: An experienced agent can negotiate better deals on your behalf and help you understand the intricacies of the market.

For expert advice, visit Rent Your Property in Dubai.

5. Conduct Property Inspections

Always inspect the property before finalizing the purchase to ensure it meets your expectations.

Physical Inspection: Check the overall condition of the villa, including the structure, fixtures, and amenities.

Legal Inspection: Verify the property’s legal status, including ownership and any potential encumbrances.

For more on property inspections, visit Sell Your Property in Dubai.

6. Make an Offer

Once you find the right villa, make a formal offer.

Negotiation: Be prepared to negotiate the price and terms. An experienced real estate agent can help you with this process.

Offer Letter: Submit an offer letter outlining the price, terms, and conditions of the purchase.

For more on making offers, check out Best Mortgage Services.

7. Finalize the Sale

After agreeing on the price and terms, finalize the sale.

Sale and Purchase Agreement (SPA): Sign the SPA, which outlines the terms of the sale. Ensure that all parties are in agreement with the terms.

No Objection Certificate (NOC): Obtain the NOC from the developer, confirming that there are no objections to the sale.

Transfer of Ownership: Complete the transfer of ownership at the Dubai Land Department. This involves paying the required fees and registering the property in your name.

For more on finalizing the sale, visit Under-Construction Properties in Dubai.

8. Post-Purchase Considerations

After buying your villa, there are several things to keep in mind to ensure a smooth transition.

Moving In: Plan your move carefully and consider hiring professional movers.

Property Management: If you’re not planning to live in the villa full-time, consider hiring a property management company.

Community Involvement: Engage with your new community to build relationships and stay informed about local developments.

For rental options and more, check out Property For Sale in Dubai.

Conclusion

Buying a villa in Dubai is a significant investment that offers a luxurious lifestyle and potential for high returns. By following this step-by-step guide, you can navigate the buying process with confidence and make an informed decision. From defining your requirements and researching the market to securing financing and understanding the legal aspects, each step is crucial to ensuring a successful purchase.

For more information and assistance with buying villas in Dubai, visit Home Loan UAE.

4 notes

·

View notes

Text

Funding Plan for Chandan House Painting

As the owner of Chandan House Painting, I have devised a comprehensive funding plan to ensure our business is well-capitalized from the start. Here’s how we plan to secure the necessary funds:

1. Personal Savings

Source:

I will be utilizing my personal savings to provide an initial injection of capital into the business.

Rationale:

Control and Ownership: Using my own savings means I retain full control over the business, making strategic decisions without external interference.

No Interest Payments: By leveraging my savings, we avoid the burden of interest payments and debt, allowing us to reinvest profits directly back into the business.

Commitment: Investing personal savings demonstrates my commitment and belief in the success of Chandan House Painting.

Action Steps:

Assess and allocate a portion of my savings specifically for startup costs, ensuring personal financial stability is maintained.

2. Friends and Family Funding

Source:

I plan to raise additional funds through loans or investments from friends and family who believe in my vision and business plan.

Rationale:

Trust and Support: Friends and family are likely to offer financial support due to their trust in me and my business acumen.

Flexible Terms: These loans or investments often come with more flexible and favorable terms compared to traditional financing options.

Low-Cost Financing: Typically, these sources may offer lower interest rates or even interest-free loans, reducing the financial burden on the business.

Action Steps:

Prepare a professional business plan and presentation to clearly communicate the business potential and financial needs to friends and family.

Set clear, formal terms for any loans or investments, including repayment schedules and interest rates, to ensure transparency and maintain good relationships.

3. Small Business Grants and Loans

Source:

We will explore small business grants and loans available through government programs and financial institutions.

Rationale:

Non-Repayable Grants: Grants from government bodies and private organizations do not need to be repaid, providing essential funds without adding to our liabilities.

Favorable Loan Terms: Small business loans often come with favorable terms, including lower interest rates and flexible repayment schedules, making them a viable option for additional financing.

Support Programs: Programs such as the Canada Small Business Financing Program (CSBFP) offer valuable support and resources to startups.

Action Steps:

Research and identify suitable grants and loans specifically tailored for small businesses in Ontario.

Prepare comprehensive business and financial plans to strengthen our grant and loan applications.

Engage with local small business development centers and financial advisors to navigate the application processes effectively.

By combining personal savings, funds from friends and family, and leveraging small business grants and loans, Chandan House Painting will have a robust financial foundation. This diversified funding approach not only ensures that we have the necessary capital to start and run our business but also minimizes financial risks and fosters sustainable growth.

5 notes

·

View notes

Text

Navigating the Canadian Dream: Best Mortgage Refinancing in Halifax and Tailored Mortgages for Newcomers

Canada has long been a land of opportunity and a welcoming destination for newcomers seeking a better life. Whether you're a long-time resident or a recent arrival, the dream of homeownership is a common aspiration. In this guide, we explore the best mortgage refinancing in Halifax and specialized mortgage solutions designed for newcomers to Canada.

Best Mortgage Refinancing in Halifax: A Gateway to Financial Freedom

Halifax, the vibrant capital of Nova Scotia, boasts a rich history and a thriving real estate market. If you already own a home in Halifax, you may be considering mortgage refinancing as a strategic move to enhance your financial situation. The best mortgage refinancing options in Halifax offer competitive rates, flexible terms, and the opportunity to tap into your home's equity for various financial needs.

When seeking the best mortgage refinancing in Halifax, it's crucial to consider factors such as interest rates, closing costs, and the overall impact on your long-term financial goals. Working with reputable lenders and mortgage professionals can help you navigate the process and secure a refinancing solution that aligns with your unique needs.

Tailored Mortgages for Newcomers to Canada: Building Your Canadian Homeownership Journey

Moving to a new country comes with its own set of challenges, and securing a mortgage as a newcomer is often one of them. Fortunately, many financial institutions in Canada understand the unique circumstances faced by newcomers and offer specialized mortgage products to ease the transition into homeownership.

These tailored mortgages for newcomers typically take into account factors such as credit history from the home country, employment status, and other considerations that may differ from traditional mortgage applications. Some lenders also offer down payment assistance programs specifically designed for newcomers, making the dream of owning a home in Canada more accessible.

Navigating the Canadian mortgage landscape as a newcomer can be daunting, but with the right guidance, it becomes a smoother process. Seeking advice from mortgage advisors who specialize in working with newcomers can provide valuable insights and help you find a mortgage solution that fits your financial situation.

Conclusion: Your Path to Homeownership in Halifax

Whether you're a current resident of Halifax looking to refinance your mortgage or a newcomer to Canada dreaming of homeownership, there are tailored solutions available to meet your needs. The key is to research the best mortgage refinancing options in Halifax and explore specialized mortgages for newcomers offered by reputable lenders. With careful consideration and expert guidance, you can embark on a successful homeownership journey in the welcoming and vibrant communities of Halifax, making Canada your home.

#Best Mortgage Refinancing halifax#Mortgages for Newcomers to Canada#mortage#mortgage broker halifax#finance

2 notes

·

View notes

Text

How are startups disrupting traditional industries?

Startups are often at the forefront of disrupting traditional industries by introducing innovative technologies, business models, and approaches. Here are several ways in which startups are causing disruption:

1. Technology Integration

- Startups leverage emerging technologies such as artificial intelligence, blockchain, and the Internet of Things to create more efficient and streamlined processes in industries like finance, healthcare, and manufacturing.

2. E-Commerce and Direct-to-Consumer Models

- E-commerce startups have revolutionized retail by providing direct-to-consumer sales channels, cutting out intermediaries and reducing costs. Companies like Amazon and Alibaba have transformed the way people shop.

3. Sharing Economy

- Startups in the sharing economy, like Uber and Airbnb, have disrupted transportation and hospitality industries by connecting service providers directly with consumers through online platforms.

4. Fintech Innovation

- Fintech startups have transformed the financial services sector by introducing digital payments, robo-advisors, crowdfunding platforms, and blockchain-based solutions, challenging traditional banking models.

5. HealthTech Advancements

- Health technology startups are disrupting healthcare by introducing telemedicine, personalized medicine, wearable devices, and digital health platforms, making healthcare more accessible and efficient.

6. Renewable Energy and CleanTech

- Startups in the clean energy sector are disrupting traditional energy industries by developing innovative solutions for renewable energy, energy storage, and sustainable practices.

7. EdTech Revolution

- Education technology startups are changing the way people learn by offering online courses, interactive platforms, and personalized learning experiences, challenging traditional educational institutions.

8. AgTech and FoodTech

- Agricultural technology startups are improving efficiency and sustainability in farming, while food technology startups are introducing alternative proteins, lab-grown meat, and sustainable food production methods.

9. InsurTech Transformation

- InsurTech startups are leveraging technology to streamline and personalize insurance processes, making insurance more accessible, affordable, and customer-centric.

10. Space Exploration and Aerospace Innovation

- Startups in the space industry are disrupting aerospace by developing cost-effective satellite technologies, commercial space travel, and new approaches to space exploration.

11. Smart Manufacturing

- Startups in the manufacturing sector are implementing Industry 4.0 technologies, such as automation, IoT, and data analytics, to create more agile and efficient production processes.

12. Telecommunications Disruption

- Telecom startups are challenging traditional telecommunications companies by providing innovative solutions for connectivity, communication, and data transfer.

These examples showcase how startups are challenging the status quo across various industries, prompting established companies to adapt, innovate, or risk becoming obsolete. The agility, creativity, and willingness to take risks inherent in many startups enable them to drive significant changes in traditional business landscapes.

3 notes

·

View notes

Text

8 Easy Ways to Study Abroad

Research Your Options: Start by researching universities and programs that align with your academic and personal goals. Consider factors such as the country’s culture, language, tuition costs, available scholarships, and the program’s reputation. The more you know, the better prepared you’ll be to make an informed decision.

Plan Ahead: Study abroad requires meticulous planning. Begin the application process well in advance to ensure you have ample time to gather documents, write essays, and meet deadlines. Universities abroad often have specific admission requirements, so make a checklist to keep track of your progress.

Reach Out to Advisors: Many educational institutions have dedicated advisors or offices that specialize in international student affairs. These experts can guide you through the application process, help you understand visa requirements, and provide insights into cultural adjustments you might need to make.

Explore Scholarships and Financial Aid: Studying abroad doesn’t have to break the bank. Research scholarships, grants, and financial aid options that cater to international students. Many universities offer merit-based scholarships that can significantly offset tuition costs.

Consider Exchange Programs: Many universities have exchange programs that allow you to study abroad for a semester or year while paying your home institution’s tuition. This option can provide a cost-effective way to experience life in a different country.

Language Proficiency: If you’re considering a program in a non-English speaking country, you might need to demonstrate your language proficiency. Taking standardized language tests like IELTS or TOEFL is often a requirement. Dedicated language preparation can boost your chances of acceptance.

Cultural Adaptability: Living in a different country can be a transformative experience, but it requires adaptability. Research the local customs, traditions, and social norms of your chosen destination. Developing cultural sensitivity will help you integrate and make the most of your time abroad.

Embrace Networking: Connect with current or former international students from your desired university or country. Their insights can provide a realistic picture of what to expect and offer valuable advice on everything from housing to academics.

Remember, the journey of study abroad is not just about academics — it’s also about personal growth, expanding horizons, and creating lasting memories. By approaching the process strategically and with enthusiasm, you can make your dream of studying abroad a reality. Seize the opportunity to step out of your comfort zone and embark on a life-changing adventure. Your future self will thank you for it.

#study broad#education#career#university#abroad education#study abroad#abroad#vocational courses#canada#new delhi

3 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

Suncity Industrial Park: Driving India Towards Prosperity

The development of India into an economic powerhouse on a worldwide scale is largely attributable to the country's proliferation of industrial parks. Among these, Suncity Industrial Park stands out as a major factor that contributes to India's rising standard of living. This industrial park is in a prime location and features infrastructure on par with the best in the world, making it an ideal setting for the development of successful firms. In this article, we will delve into the essential features and benefits of Suncity Industrial Park, highlighting its crucial role in advancing India's economic development and attracting investments. Choose the strategic location of the Industrial area near Ahmedabad for your industry and take the next step towards success!

Specifically, we will focus on the role that Suncity Industrial Park plays in this process.

Strategic Location:

The Suncity Industrial Park is situated in an ideal location, making it an ideal entry point for companies that are looking to establish a significant presence in India. The park provides seamless connectivity through well-developed road, rail, and air networks. It is located in close proximity to major transportation hubs and vital cities. This strategic advantage allows for the efficient delivery of goods and raw materials, which in turn reduces the obstacles and costs associated with logistical operations. In addition, the proximity of the park to consumer markets gives firms an advantage over their rivals by lowering the amount of time it takes to distribute their products and bring them to market.

State-of-the-Art Infrastructure:

Suncity Industrial Park is home to cutting-edge facilities that have been built specifically to meet the various requirements of contemporary businesses. The park features industrial facilities that are at the bleeding edge of technology, expansive warehouse areas, and research and development centres that are outfitted with the most recent cutting-edge technology. These facilities have been painstakingly built to improve operational efficiency, productivity, and quality. As a result, firms are able to accomplish higher levels of output and are more competitive. In addition, the park offers a dependable source of power, technologically advanced waste management systems, and stringent security measures, all of which contribute to the creation of an atmosphere that is safe and beneficial to the growth of businesses. Unlock the potential of the thriving Industrial area in Gujarat. Establish your business and get pinned at the nearest proximity to DMIC Corridor, Vadodara.

Supportive Business Ecosystem:

Suncity Industrial Park is aware of the value of a hospitable environment in promoting the growth of enterprises and takes steps to maintain such an environment. The park provides a variety of services and amenities for the purpose of assisting businesses in their objectives for growth and expansion. This includes having access to a trained and talented workforce, training programmes, and aid in acquiring relevant permissions and licences. Moreover, this involves having access to a qualified and talented workforce. In addition, the park makes it easier for enterprises to collaborate and network with one another, which in turn encourages innovation, the exchange of knowledge, and the formation of partnerships that are mutually beneficial. In addition to further strengthening the support ecosystem, the presence of financial institutions, legal services, and business advisors within the park provides comprehensive solutions for enterprises that are operating within the industrial park.

Embracing Sustainability:

Suncity Industrial Park is dedicated to ecological preservation and responsible growth. To reduce its impact on the environment and highlight green causes, the park uses sustainable methods and cutting-edge technology. To lessen the need for traditional energy and cut down on emissions of greenhouse gases, renewable energy sources like solar power are being utilised. The park has effective waste management systems and water conservation methods to reduce its negative influence on the environment. Suncity Industrial Park also promotes a culture of responsible and ethical business practices by providing its tenants with awareness campaigns and incentives to implement green policies and procedures. The park's commitment to sustainability helps it achieve its goals and attracts companies that share India's commitment to environmental protection. Don't miss out on the Industrial plots for sale near Halol at Suncity Industrial Park. Seize the opportunity and invest in your business growth today.

Economic Growth and Job Creation:

The importance of Suncity Industrial Park to India's economic development is beyond dispute. The park invites investments and boosts economic activity by providing a welcoming setting for enterprises to flourish. The park's manufacturing facilities and research centres will have a multiplicative effect, resulting in both high- and low-skilled employment opportunities. This boosts the economy in the area and also improves the quality of life in the neighbouring neighbourhoods. The park's emphasis on innovation and technology developments also supports growth across a variety of sectors, encouraging enterprise and developing the country of India's human resource potential.

Final Thoughts:

Suncity Industrial Park is a symbol of India's march towards economic success. Because of its convenient location, cutting-edge infrastructure, thriving business ecosystem, and dedication to sustainability, it is a top choice for companies wishing to take advantage of India's rapid economic development. Suncity Industrial Park is crucial in propelling India's economy forward and establishing the country as a global economic powerhouse because it fosters innovation, investment, and employment opportunities. As companies within the park achieve success, they boost India's economy as a whole and cement India's status as a top investment destination. Capitalize on the opportunities of tapping into the potential of the strategic Industrial area near Vadodara - Suncity Industrial Park.

#Industrial area near Ahmedabad#Industrial area in Gujarat#Industrial plots for sale near Halol#Industrial area near Vadodara#Suncity Industrial Park

2 notes

·

View notes

Text

Understanding the Benefits of Decentralized Finance and How to Make the Most of Your Investments with Emocoin's Defi Technology

I constantly look for ways to maximize your investments and make the most of your money in my capacity as a financial advisor. I've been hearing a lot lately about decentralized finance (DeFi) and how it might transform the way we make investments. I'll be talking about the benefits of DeFi and how Emocoin's DeFi technology can help you get the most out of your investments in this article.

Decentralized Finance (DeFi): An Introduction

DeFi is a term used to describe a new financial system that is built on blockchain technology. Unlike traditional systems, DeFi is decentralized, meaning that it is not controlled by any central authority. Instead, it is run by a network of computers that work together to process transactions and execute smart contracts.

One of the key advantages of DeFi is that it is open to anyone, anywhere in the world. This means that you don't have to go through a bank or financial institution to access financial services. Instead, you can use a DeFi platform to borrow, lend, or invest your money.

Understanding the Advantages of DeFi

There are many advantages to using DeFi. One of the biggest advantages is that it is more transparent than traditional finance. Because DeFi is built on blockchain technology, all transactions are recorded on a public ledger that everyone can see. This means that it is much harder for fraud or corruption to occur.

Another advantage of DeFi is that it is more accessible than traditional finance. With DeFi, anyone with an internet connection can access financial services. This is particularly important for people who live in countries where traditional banking services are not available.

Finally, DeFi is more efficient than traditional finance. Because it is built on blockchain technology, transactions can be executed instantly and at a lower cost than traditional finance. This means that you can save money on transaction fees and get your money faster.

How does DeFi work?

DeFi works by using smart contracts. Smart contracts are self-executing contracts that are stored on a blockchain. They are programmed to execute when certain conditions are met. For example, a smart contract might be programmed to execute when a borrower pays back their loan.

When you use DeFi, you interact with smart contracts instead of people. This means that you don't have to trust anyone to execute the terms of the contract. Instead, you can trust the code that the contract is written in.

Comparison between Traditional Finance and DeFi

There are many differences between traditional finance and DeFi. One of the biggest differences is that traditional finance is centralized, while DeFi is decentralized. This means that traditional finance is controlled by a central authority, while DeFi is controlled by a network of computers.

Another difference is that traditional finance is more regulated than DeFi. This means that there are more rules and regulations that you have to follow when you use traditional finance. With DeFi, there are fewer rules and regulations, which can be both an advantage and a disadvantage.

Finally, traditional finance is more established than DeFi. This means that there are more financial institutions and services available in traditional finance than there are in DeFi. However, this is changing as more and more people start to use DeFi.

What is Emocoin's DeFi technology?

Emocoin is a blockchain project that is focused on creating a decentralized financial system. It is built on the Ethereum blockchain and uses smart contracts to execute financial transactions.

One of the key features of Emocoin's DeFi technology is its liquidity pools. Liquidity pools are pools of tokens that are used to facilitate trades on the platform. They provide liquidity to the platform, which makes it easier and faster to execute trades.

Another feature of Emocoin's DeFi technology is its yield farming capabilities. Yield farming is a way to earn interest on your cryptocurrency holdings. It involves lending your cryptocurrency to a liquidity pool, which then uses it to facilitate trades. In return, you earn interest on your holdings.

Advantages of Using Emocoin's DeFi Technology

There are many advantages to using Emocoin's DeFi technology. One of the biggest advantages is that it is more efficient than traditional finance. Because it is built on blockchain technology, transactions can be executed instantly and at a lower cost than traditional finance.

Another advantage is that it is more transparent than traditional finance. Because all transactions are recorded on a public ledger, it is much harder for fraud or corruption to occur.

Finally, Emocoin's DeFi technology is more accessible than traditional finance. Anyone with an internet connection can access financial services on the platform, which is particularly important for people who live in countries where traditional banking services are not available.

Defi Crypto Investment Opportunities

There are many investment opportunities in the DEFI space. One of the most popular investment opportunities is yield farming. Yield farming involves lending your cryptocurrency to a liquidity pool and earning interest on your holdings.

Another investment opportunity is investing in DeFi projects. There are many DeFi projects that are being developed, and investing in them can be a way to get in on the ground floor of a new financial system.

Finally, you can invest in DeFi tokens. DeFi tokens are tokens that are used on DeFi platforms. They can be used to pay for transaction fees, earn interest, or provide liquidity to a pool.

Risks Associated with DeFi Investments

There are also risks associated with DeFi investments. One of the biggest risks is smart contract risk. Smart contracts are written in code, which means that they can have bugs or vulnerabilities that can be exploited by hackers.

Another risk is liquidity risk. Because DeFi is a new financial system, there is a risk that there will not be enough liquidity in the system to facilitate trades.

Finally, there is also the risk of regulatory compliance. Because DeFi is a new financial system, there is a risk that regulators will step in and impose regulations that could limit its growth.

How to Get Started with DeFi Investment

Getting started with DeFi investments is relatively easy. The first step is to choose the DeFi platform that you want to use. There are many platforms to choose from, so it is important to do your research and choose one that is reputable and secure.

Once you have chosen a platform, you will need to fund your account with cryptocurrency. This can be done by transferring cryptocurrency from your wallet to the platform.

Finally, you can start investing in DeFi projects or using the platform's features to earn interest on your holdings.

Conclusion

Decentralized Finance (DeFi) is a new financial system that is built on blockchain technology. It is more transparent, accessible, and efficient than traditional finance. Emocoin's DeFi technology is a great way to maximize your investments and take advantage of the benefits of DeFi. However, it is important to be aware of the risks associated with DeFi investments and to do your research before investing. With the right knowledge and strategy, DeFi can be a great way to grow your wealth and take control of your finances.

Check out this article on EmoNews

2 notes

·

View notes

Text

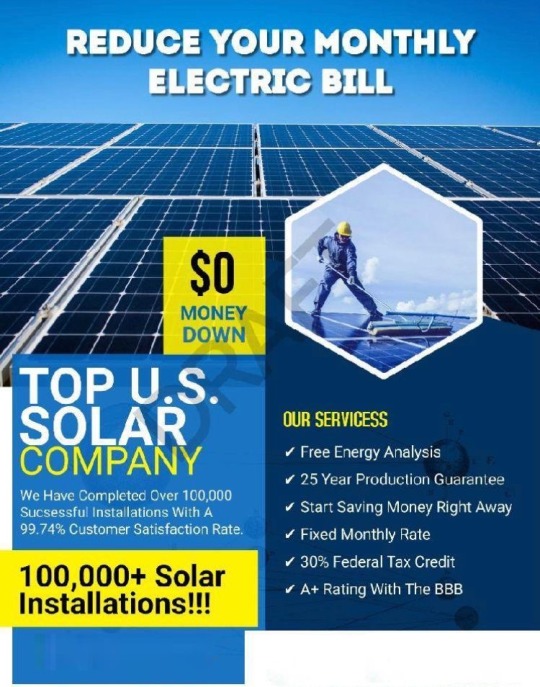

[Hiring] !!$3500 PER SALE DURING TRAINING BEST REMOTE SALES JOB EVER!!

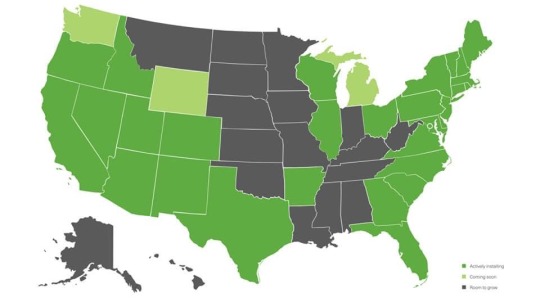

HIGHEST PAYING REMOTE SOLAR SALES COMPANY IN THE USA!!! YOU CAN SELL IN ALL 30 STATES WE CURRENTLY INSTALL IN.

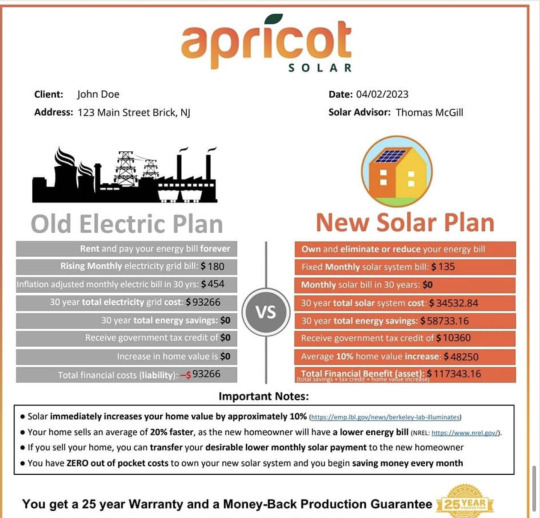

We pay our sales reps an average of $7,000 - $10,000 dollars per sale via Unlimited commissions, (highest in our industry) and that is WITHOUT door knocking or cold calling. During training earn $3500-$5000 split sales, EARN as you LEARN! Straight commissions, 1099 position so you have no caps to how much you can earn!

Our solar installation and production company is ranked top 3 in the USA, currently recognized on the INC. 5000 as one of the fastest-growing companies in the US, rated A+ by the Better Business Bureau, has tens of thousands of happy 5-star clients and generated over $2 BILLION in sales revenue last year.

According to the US government, the solar industry is growing 12 times faster than the rest of the economy because by switching to solar energy, homeowners often lower their energy bill, save tens of thousands of dollars over the life of their home, increase their home value by 10-17%, and can do it with zero out of pocket costs with decent credit!

We take a very unique educational and 'soft sell' approach in helping homeowners, which results in an average total financial benefit of over $100,000+ for many of our clients. We have no traditional redline, so you are able to meet or beat any competitive quote with our price match guarantee.We are a 100% virtual company, so you can work right from your own home, anywhere in the world that has an internet connection.

As a trained solar advisor, you can earn an average $7,000 - $10,000 a sale and as a sales manager you can earn a very high 6 figure yearly income with management overrides and bonuses.

No experience is necessary, because we take an educational approach in helping our clients, however we are very selective and only seek candidates that are very honest, ambitious, teachable and have good people skills. We are hiring both English and Spanish speaking solar advisors.

Because of the overwhelming response to our ads, interviews are on a first come, first serve basis.For more information please reply to this ad right away.

Apply here: https://onboarding.apricotsolar.com/recruit-affiliate/1679698549293x274687705253493280

Contact:[email protected]

#remote jobs#remote#commission work#workfromhome#workfromanywhere#work from office#entreprenuership#enterpreneur#smallbusiness#smallbussinessowner#digitalnomad#hustle#starup#freelancer#sidehustle#onlinebusiness#virtual assistant#remote work#remote workers#worklifebalance#bossmindset#bosslife#success tips#motovation#inspiration#personal development#self improvement#career opportunities#job search#full time jobs

3 notes

·

View notes

Photo

John Deering, Arkansas Democrat Gazette

* * * *

LETTERS FROM AN AMERICAN

January 25, 2023

Heather Cox Richardson

Democrats are generally staying out of the way and letting Speaker Kevin McCarthy and the House Republicans make a spectacle of themselves. In order to get the votes to become speaker, McCarthy had to give power to extremists like Marjorie Taylor Greene (R-GA), and now has openly brought her on board as a close advisor, making the extremists the face of the new MAGA Republican Party. If McCarthy appears to have abandoned principle for power by catering to the far right, Representative George Santos (R-NY) hasn’t helped: stories of his lies have mounted, and financial filings yesterday suggest quite serious financial improprieties.

Even the Senate Republicans seem to be keeping their heads down while the House Republicans perform for their base. Demanding big cuts in spending before they agree to raise the debt ceiling has put the House Republicans in a difficult spot. They have been clear that they intend to slash Social Security and Medicare, only to have Trump, who was the one who originally insisted on using the debt ceiling to get concessions out of Democrats, recognize that such cuts are enormously unpopular and say they should not touch Medicare and Social Security. Senate Republicans have said they will stay out of debt ceiling negotiations until the House Republicans come up with a viable plan.

While the House Republicans take up oxygen, the Democrats are highlighting for the American people how, over the past two years, they have carefully and methodically changed U.S. policy to stop the concentration of wealth and power in the hands of the few.

In July 2021, President Joe Biden signed an executive order to promote competition in the economy. Since the 1980s, he said, when right-wing legal theorist Robert Bork masterminded a pro-corporate legal revolution against antitrust laws, the government had stopped enforcing laws to prevent giant corporations from concentrating their power. The result had been less growth, weakened investment, fewer small businesses, less bargaining power for workers, and higher prices for consumers.

“[T]he experiment failed,” he said.

Biden vowed to change the direction of the government’s role in the economy, bringing back competition for small businesses, workers, and consumers. Very deliberately, he reclaimed the country’s long tradition of opposing economic consolidation. Calling out both presidents Roosevelt—Republican Theodore, who oversaw part of the Progressive Era, and Democrat Franklin, who oversaw the New Deal—Biden celebrated their attempt to rein in the power of big business, first by focusing on the abuses of those businesses and then by championing competition.

The administration put together a whole-of-government approach to restore competition based on the 72 separate actions outlined in Biden’s executive order. A terrific piece today by David Dayen in The American Prospect suggests that the effort has worked. Overall, Dayen concludes, the executive order of July 9, 2021, was “one of the most sweeping changes to domestic policy since FDR.”

While administrations since Reagan have judged whether consolidation is harmful solely by its effect on consumer prices, the Biden approach also factors in the welfare of workers, including their ability to negotiate higher wages. It has also taken on the sharing of medical patents that have raised costs of drugs and equipment like hearing aids by preventing others from entering the market. It has taken on large businesses’ strangling of start-up competitors simply by buying them out before they take off. And, crucially, it has claimed the ability to review previous mergers that it now deems in violation of antitrust laws, citing the 1911 breakup of Standard Oil.

Dayen notes that one of the causes for a sharp drop in mergers and acquisitions in the second half of 2022 is that government agencies are willing to enforce antitrust laws. “Just about everything on competition has been hard-fought,” he writes, “[b]ut there’s plenty of evidence of real movement.”

Not only government agencies, but also the Democratic Congress—along with some Republicans—passed a number of laws that have shifted the economic policy of the nation. Biden is fond of saying that he doesn’t believe in trickle-down economics and that he intends to build the economy from the bottom up and the middle out. New numbers suggest the policies of the past two years are doing just that.

The December jobs report from the Bureau of Labor Statistics showed that job growth continues strong. The country added 223,000 jobs in December, and the unemployment rate went down slightly to 3.5 percent. The last two years of job growth are the strongest on record, and the country has recovered all the jobs lost during the pandemic. According to the White House, 10.7 million jobs were created and a record 10.5 million small businesses’ applications were filed in the past two years.

On Monday the Wall Street Journal reported that median weekly earnings rose 7.4% last year, slightly faster than inflation. For Black Americans employed full time, the median rise was 11.3% over 2021. A median Hispanic or Latino worker’s income saw a 4.8% raise, to $837 a week. Young workers, between 16 and 24, saw their weekly income rise more than 10%. Also seeing close to a 10% weekly rise were those in the bottom tenth of wage earners, those making about $570 a week. The day after the Wall Street Journal’s roundup, Walmart, which employs 1.7 million people in the U.S., announced it would raise its minimum wage to $14 an hour, up from $12.

Democrats promised that the CHIPS and Science Act would bring “good paying” jobs to those without college degrees by investing in high-tech manufacturing. A study by the Brookings Institution out yesterday notes that the act has already attracted multibillion-dollar private investments in New York, Indiana, and Ohio and that two thirds of the jobs they will produce are accessible to those without college degrees. Those jobs do, in fact, pay better than most of those available for those without college degrees, although Brookings urged better investment in training programs to make workers ready for those jobs.

The Inflation Reduction Act gave Medicare the power to negotiate drug prices with pharmaceutical companies and capped the cost of insulin for those on Medicare at $35 a month (Republicans blocked an attempt to make that cap available for those not on Medicare). It made hearing aids available over the counter, making them dramatically cheaper, and it also expanded subsidies for the Affordable Care Act. Today the Department of Health and Human Services announced that a record number of Americans enrolled in the ACA in the last open enrollment period: 16.3 million people.

Greg Sargent of the Washington Post notes that much of the investment from these laws is going to Republican-dominated states even though their Republican lawmakers opposed the laws and voted against them. The clean energy investments of the Inflation Reduction Act are going largely to those states, bringing with them additional private investment. A solar panel factory is expanding into Greene’s own district despite her vocal opposition both to alternative energy and to the Inflation Reduction Act.

For 40 years the Republican Party offered a vision of America as a land of hyperindividualism, in which any government intervention in the economy was seen hampering the accumulation of wealth and thus as an attack on individual liberty. The government stopped working for ordinary Americans, and perhaps not surprisingly, many of them have stopped supporting it. Biden refused to engage with the Republicans on the terms of their cultural wars and has instead reclaimed the idea that government can actually work for the good of all by keeping the economic playing field level for everyone.

Biden and members of his administration are taking to the road to tout their successes to the country, especially to those places most skeptical of the government. If they can bring the Republican base around to support their economic policies, they will have realigned the nation as profoundly as did FDR and Theodore Roosevelt before them.

—

Notes:

https://www.nytimes.com/2023/01/23/us/politics/kevin-mccarthy-marjorie-taylor-greene.html

https://www.politico.com/news/2023/01/23/senate-republicans-kevin-mccarthy-debt-00079126

https://www.whitehouse.gov/briefing-room/speeches-remarks/2021/07/09/remarks-by-president-biden-at-signing-of-an-executive-order-promoting-competition-in-the-american-economy/

https://www.washingtonpost.com/archive/lifestyle/1987/07/19/bork-and-the-pro-business-bias/f98206ec-5d73-4e1d-b1fa-066eab789284/

https://www.brookings.edu/research/with-high-tech-manufacturing-plants-promising-good-jobs-in-ohio-workforce-developers-race-to-get-ready/

https://www.wsj.com/articles/bidens-green-subsidies-are-attracting-billions-of-dollars-to-red-states-11674488426

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.whitehouse.gov/briefing-room/press-briefings/2023/01/24/press-briefing-by-press-secretary-karine-jean-pierre-12/

https://www.cnn.com/2023/01/24/business/walmart-raising-wages/index.html

https://www.hhs.gov/about/news/2023/01/25/biden-harris-administration-announces-record-breaking-16-3-million-people-signed-up-health-care-coverage-aca-marketplaces-during-2022-2023-open-enrollment-season.html

https://www.wsj.com/articles/biggest-pay-raises-went-to-black-workers-young-people-and-low-wage-earners-11674425793

https://prospect.org/economy/2023-01-25-pitched-battle-corporate-power/

https://www.washingtonpost.com/opinions/2023/01/25/biden-place-based-industrial-policy-muro/

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

[from comments]

TCinLA

Writes Thats Another Fine Mess

TPM is now reporting that House Republicans want to pass a series of "clean" debt limit suspension bills that brings the debt default crisis to coincide with the new fiscal year, to create a mega crisis of default/government shutdown, and that they will then be putting the most egregious of their spending bills up for votes over the summer before the mega crisis arrives. Interestingly, this will benefit Democrats if they do this, since the Democrats will be able to point to all the egregious cuts the crazies want. Also, enough Republicans have now stated they do not intend to touch Social Security, Medicare, Obamacare or Defense that McCarthy does not have a majority to push those cuts, leaving them very few places they would have to cut heavily to achieve their goals.

In other words, the wheels are coming off the clown car already. Who could have expected that? I ask you!

#political cartoon#John Deering#Arkansas Democrat Gazette#Letters From an American#Heather Cox Richardson#debt limit#MAGA Republicans

2 notes

·

View notes

Text

How Brokers Can Expand Their Client Base with SBA 504 Loans!

SBA 504 loans provide a significant opportunity for brokers to expand their client base and offer a competitive advantage in the market. By helping businesses access affordable, long-term financing for real estate and capital improvements, brokers can reach a wider array of clients and enhance their reputation as a trusted financial advisor.

1. Targeting Small to Mid-Sized Businesses

SBA 504 loans are tailored for small to mid-sized businesses that may not qualify for traditional commercial loans. These businesses often need financing for real estate purchases, construction projects, or heavy machinery. By focusing on this segment, brokers can position themselves as specialists in financing solutions for businesses that may otherwise struggle to find affordable loans.

Promoting the SBA 504 loan program to small business owners, particularly those in industries like manufacturing, retail, healthcare, and hospitality, can lead to an influx of new clients who are looking for accessible capital to expand their operations.

2. Building Relationships with SBA 504 1st mortgage lenders and Certified Development Companies (CDCs)

SBA 504 1st mortgage specialty lenders and Certified Development Companies (CDCs) play a key role in the SBA 504 loan process. By cultivating strong relationships with key players, brokers can improve their ability to connect clients to financing quickly and efficiently. CDCs can also refer clients who are looking for brokers with expertise in SBA 504 loans, further expanding your reach in the market.

3. Offering Competitive Financing Options