#corporate taxes

Explore tagged Tumblr posts

Text

" ... cutting the tax rate led to less investment, not more. So we shouldn’t believe doomsday predictions that investment will somehow disappear if the tax cut is partially reversed.

It’s not just business investment that performed poorly ... "

3 notes

·

View notes

Text

Perhaps influenced by today at the office, but I'm also seeing this as "The Torments of Corporate Taxes", given the breathtaking number of reports and quantities of information our CPA needs to even start the forms. Looking at the reports, I ask myself exactly how we spent that much on office supplies for seven employees. Oh, right, it includes coffee. Never mind. On to the next report.

Leonid Pasternak (Ukrainian, 1862–1945) - The Torments of Creative Work

65K notes

·

View notes

Text

0 notes

Text

"Once prospectors had been attracted to the available land, the state provided specialized services to assist them in the accurate evaluation of their properties. When most mining companies could not afford complex machinery and continued assessing their claims by pick and shovel surface trenches, several mining companies through the Bureau of Mines purchased two diamond drills, the first in 1894 and the second in 1901, for use by government geologists and rental to private developers. Then, in the hope of inducing more thorough exploration by diamond drill, the Bureau relieved prospectors of some of the financial hardship entailed by absorbing 45 per cent of the modest rental. To assist in the speedy and accurate chemical analysis of mineral samples submitted by both private and government explorers, the province established its first assay office at Belleville in 1898. Soon afterward, when the northern camps came into their own, the government opened regional branches of this office to serve the immediate needs of the mining community. There government technicians evaluated the mineral content of drill cores and rock samples, judged the final determination of disputed mineralization values, and passed out a variety of technical and geological information to enquiring prospectors.

All levels of government, in their eagerness to hasten the location of certain strategic or especially desirable industries offered direct cash incentives such as bounties, bonuses and subsidies, as well as a variety of other inducements. A great deal has already been written concerning the tariff and bounty policies of the federal government. At the other pole of government, municipalities competed with each other in extending the most generous terms to interested industrialists. For instance, the promise of a small but important municipal bounty was enough to move Adam Beck's cigar box factory from Preston to London."

- H. V. Nelles, The Politics of Development: Forests, Mines & Hydro-Electric Power in Ontario, 1849-1941. Second Edition. McGill-Queen’s University Press, 2005 (1974), p. 125.

#ontario history#corporate taxes#mining claims#mining industry#resource extraction#resource capitalism#birth of natural resources#h. v. nelles#reading 2023#academic quote#liberal state#bounty of nature

0 notes

Text

Common Mistakes to Avoid When Filing Corporate Taxes

1 note

·

View note

Text

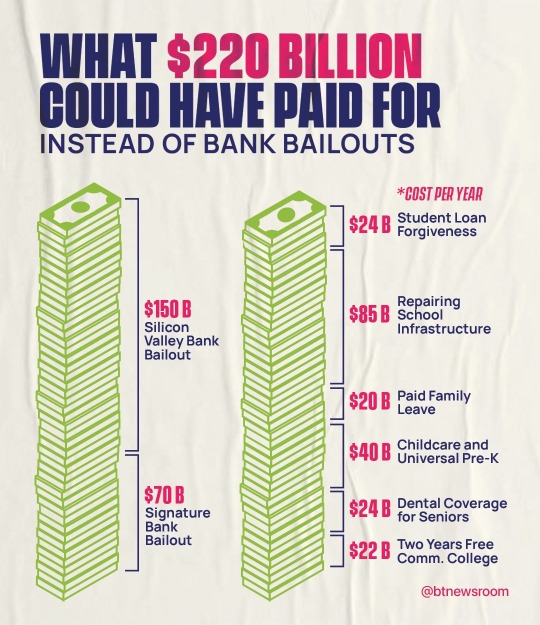

I hate it here

Let this be a lesson against believing politicians lies.

Keeping wealth concentrated in the 1% is the end goal of capitalism.

They will do whatever is necessary to keep the working class desperate and dependent on the system that impoverishes them.

#at what point to wh break out the guillotine#i’m so serious#capitalism#late stage capitalism#silicon valley bank#bank bailout#corruption#corporate corruption#corporate greed#eat the rich#tax the 1%#tax the rich#government bailout

8K notes

·

View notes

Text

100,000 dollars is not a lot of money.

it is also a lot more money than i will ever have. my student loans make up half of that - they're coming back, i'm told, like we all bounced back recently. the other day while paying for gas to go to work, i overdrew my account without knowing it.

i sat in the car and looked at the charge and tried to do the math. where the fuck is the money even going? i don't live extravagantly. i live in a hole in the ground, in an apartment the size of a sneeze; covered in ants. yes, i wanted to live close to a population center. maybe that's my fault. i've downloaded the apps and i've spoken to the experts and i've cut back on excess. i can't help the pharmacy bills or the medical debt.

i have a good, well-paying job. when i googled it to see if i was getting a fair salary, i found out i'd be making "upper middle class" money. which doesn't make sense - is "upper middle class" now just "able to afford a one-bedroom without a roommate". when i was younger, upper-middle meant a nice big house and a backyard and vacations and not flinching about eating at a resturant.

i was talking to my friend who is a realtor. he said 100,000 dollars is extremely cheap for housing. he's not wrong. 100,000 dollars would change my life. 100,000 dollars also won't really buy you anything. it could get you out of debt, potentially, if you were lucky and had a certain amount of scholarships to tack onto your degree. you could pay off the car and then have enough left over for "spending" money. how fucking amazing. one vacation, maybe two if you're thrifty. and then - like magic - the money would evaporate into nothing. people would sigh and tell you see, you should have put it into savings! like "upper middle class" people can't afford to value "actually living" over squirrelling wealth. you should spend your life only in scarcity. like that is what made the rich people all their real "actually a lot of money".

100,000 dollars would literally set me free. it also would just set me back to "earning normally" instead of paying down debt into infinity. god, do you know how many of us just want that? that our first thought is we could stop scrambling and just be free of debt if we won the lottery? that we don't even necessarily need to stop working - we just wouldn't have to worry about failing or falling?

and. at the same time. 100,000 dollars is next to fucking nothing.

#writeblr#me paying my taxes this year:#haha good to know im literally doing more for my community out of my tiny apartment#than most corporations will do in their entire scope! :) these motherfuckers will NEVER pay taxes!!!#bc they lobby others to be sure we CHOKE :) !!!#i hope this is clear like. this isn't someone being like ''haha if i got 100k it wouldn't be a big deal''#it's more like. the gap between corporations and the ppl WORKING in those corporations#has become HORRIFIC. 100k to the company i work for is like. pocket change to them.#and it is LIFE CHANGING for me.#they could cut me a check for 100k tomorrow and not even budge their margin of error

7K notes

·

View notes

Text

Taxes for the people who haven't been paying them.

0 notes

Photo

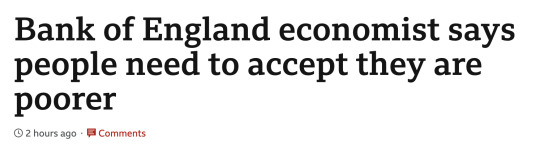

probably a good thing i don’t live in london because i might be inclined to hunt this man down and kill him with my bare hands xox

#i am so sick of this island lmao#PEOPLE CAN'T AFFORD TO EAT OR HEAT THEIR HOMES#CAN'T AFFORD TO PUT SHOES ON THEIR CHILDREN'S FEET#'we all have to do our bit' while our gov passes multmillion £ contracts to their rich pals#ruining our public services while someone lines their pockets#large corporations consistently dodging tax and getting away with it#this IS the bad place honestly#fuck the tories

7K notes

·

View notes

Text

Don't let republicans fool you with their national populism cause they do not give a single care for veterans who died and suffered for America. They would hollow out the VA and fill it corporate and political stooges who would blindly follow the GOP's bidding. Our government doesn't care enough for veterans and here we have Republicans confirming it, remember it was Biden who passed the CARE act. So remember a future where our soldiers suffer more than they already do is what the Republicans want.

#politics#the left#leftism#us politics#culture#progressive#eat the rich#tax the rich#corporate greed#communism#veterans#political#project 2025#republican assholes#republican hypocrisy#republican party#gop#maga#democratic party#democracy#democrats#healthcare#elderly care#elderly wellness#elderly support#elderly assistance#elderly safety#age#issues#seniors

478 notes

·

View notes

Text

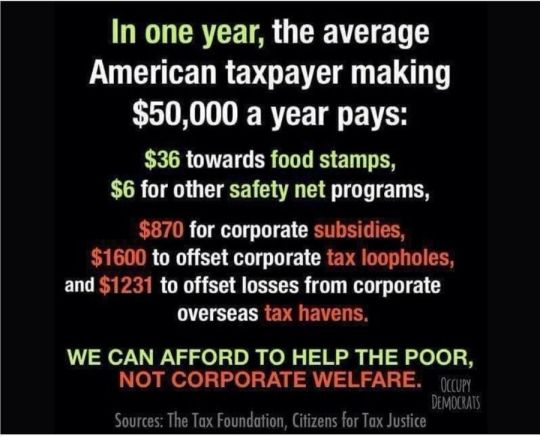

Source

A reminder from 2 yrs ago

Find their tax evading asses

920 notes

·

View notes

Text

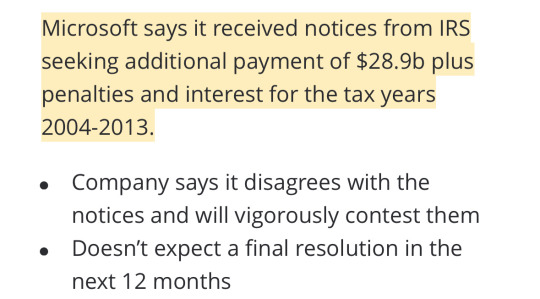

Microsoft put their tax-evasion in writing and now they owe $29 billion

I'm coming to Minneapolis! Oct 15: Presenting The Internet Con at Moon Palace Books. Oct 16: Keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing.

If there's one thing I took away from Propublica's explosive IRS Files, it's that "tax avoidance" (which is legal) isn't a separate phenomenon from "tax evasion" (which is not), but rather a thinly veiled euphemism for it:

https://www.propublica.org/series/the-secret-irs-files

That realization sits behind my series of noir novels about the two-fisted forensic accountant Martin Hench, which started with last April's Red Team Blues and continues with The Bezzle, this coming February:

https://us.macmillan.com/books/9781250865847/red-team-blues

A typical noir hero is an unlicensed cop, who goes places the cops can't go and asks questions the cops can't ask. The noir part comes in at the end, when the hero is forced to admit that he's being going places the cops didn't want to go and asking questions the cops didn't want to ask. Marty Hench is a noir hero, but he's not an unlicensed cop, he's an unlicensed IRS inspector, and like other noir heroes, his capers are forever resulting in his realization that the questions and places the IRS won't investigate are down to their choice not to investigate, not an inability to investigate.

The IRS Files are a testimony to this proposition: that Leona Hemsley wasn't wrong when she said, "Taxes are for the little people." Helmsley's crime wasn't believing that proposition – it was stating it aloud, repeatedly, to the press. The tax-avoidance strategies revealed in the IRS Files are obviously tax evasion, and the IRS simply let it slide, focusing their auditing firepower on working people who couldn't afford to defend themselves, looking for things like minor compliance errors committed by people receiving public benefits.

Or at least, that's how it used to be. But the Biden administration poured billions into the IRS, greenlighting 30,000 new employees whose mission would be to investigate the kinds of 0.1%ers and giant multinational corporations who'd Helmsleyed their way into tax-free fortunes. The fact that these elite monsters paid no tax was hardly a secret, and the impunity with which they functioned was a constant, corrosive force that delegitimized American society as a place where the rules only applied to everyday people and not the rich and powerful who preyed on them.

The poster-child for the IRS's new anti-impunity campaign is Microsoft, who, decades ago, "sold its IP to to an 85-person factory it owned in a small Puerto Rican city," brokered a deal with the corporate friendly Puerto Rican government to pay almost no taxes, and channeled all its profits through the tiny facility:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

That was in 2005. Now, the IRS has come after Microsoft for all the taxes it evaded through the gambit, demanding that the company pay it $29 billion. What's more, the courts are taking the IRS's side in this case, consistently ruling against Microsoft as it seeks to keep its ill-gotten billions:

https://www.propublica.org/article/irs-microsoft-audit-back-taxes-puerto-rico-billions

Now, no one expects that Microsoft is going to write a check to the IRS tomorrow. The company's made it clear that they intend to tie this up in the courts for a decade if they can, claiming, for example, that Trump's amnesty for corporate tax-cheats means the company doesn't have to give up a dime.

This gambit has worked for Microsoft before. After seven years in antitrust hell in the 1990s, the company was eventually convicted of violating the Sherman Act, America's bedrock competition law. But they kept the case in court until 2001, running out the clock until GW Bush was elected and let them go free. Bush had a very selective version of being "tough on crime."

But for all that Microsoft escaped being broken up, the seven years of depositions, investigations, subpoenas and negative publicity took a toll on the company. Bill Gates was personally humiliated when he became the star of the first viral video, as grainy VHS tapes of his disastrous and belligerent deposition spread far and wide:

https://pluralistic.net/2020/09/12/whats-a-murder/#miros-tilde-1

If you really want to know who Bill Gates is beneath that sweater-vested savior persona, check out the antitrust deposition – it's still a banger, 25 years on:

https://arstechnica.com/tech-policy/2020/09/revisiting-the-spectacular-failure-that-was-the-bill-gates-deposition/

In cases like these, the process is the punishment: Microsoft's dirty laundry was aired far and wide, its swaggering founder was brought low, and the company's conduct changed for years afterwards. Gates once told Kara Swisher that Microsoft missed its chance to buy Android because they were "distracted by the antitrust trial." But the Android acquisition came four years after the antitrust case ended. What Gates meant was that four years after he wriggled off the DoJ's hook, he was still so wounded and gunshy that he lacked the nerve to risk the regulatory scrutiny that such an anticompetitive merger would entail.

What's more, other companies got the message too. Large companies watched what happened to Microsoft and traded their reckless disregard for antitrust law for a timid respect. The effect eventually wore off, but the Microsoft antitrust case created a brief window where real competition was possible without the constant threat of being crushed by lawless monopolists. Sometimes you have to execute an admiral to encourage the others.

A decade in IRS hell will be even more painful for Microsoft than the antitrust years were. For one thing, the Puerto Rico scam was mainly a product of ex-CEO Steve Ballmer, a man possessed of so little executive function that it's a supreme irony that he was ever a corporate executive. Ballmer is a refreshingly plain-spoken corporate criminal who is so florid in his blatant admissions of guilt and shouted torrents of self-incriminating abuse that the exhibits in the Microsoft-IRS cases to come are sure to be viral sensations beyond even the Gates deposition's high-water mark.

It's not just Ballmer, either. In theory, corporate crime should be hard to prosecute because it's so hard to prove criminal intent. But tech executives can't help telling on themselves, and are very prone indeed to putting all their nefarious plans in writing (think of the FTC conspirators who hung out in a group-chat called "Wirefraud"):

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Ballmer's colleagues at Microsoft were far from circumspect on the illegitimacy of the Puerto Rico gambit. One Microsoft executive gloated – in writing – that it was a "pure tax play." That is, it was untainted by any legitimate corporate purpose other than to create a nonsensical gambit that effectively relocated Microsoft's corporate headquarters to a tiny CD-pressing plant in the Caribbean.

But if other Microsoft execs were calling this a "pure tax play," one can only imagine what Ballmer called it. Ballmer, after all, is a serial tax-cheat, the star of multiple editions of the IRS Files. For example, there's the wheeze whereby he has turned his NBA team into a bottomless sinkhole for the taxes on his vast fortune:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Or his "tax-loss harvesting" – a ploy whereby rich people do a "wash trade," buying and selling the same asset at the same time, not so much circumventing the IRS rules against this as violating those rules while expecting the IRS to turn a blind eye:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

Ballmer needs all those scams. After all, he was one of the pandemic's most successful profiteers. He was one of eight billionaires who added at least a billion more to his net worth during lockdown:

https://inequality.org/great-divide/billionaire-bonanza-2020/

Like all forms of rot, corruption spreads. Microsoft turned Washington State into a corporate tax-haven and starved the state of funds, paving the way for other tax-cheats like Amazon to establish themselves in the area. But the same anti-corruption movement that revitalized the IRS has also taken root in Washington, where reformers instituted a new capital gains tax aimed at the ultra-wealthy that has funded a renaissance in infrastructure and social spending:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

If the IRS does manage to drag Microsoft through the courts for the next decade, it's going to do more than air the company's dirty laundry. It'll expose more of Ballmer's habitual sleaze, and the ways that Microsoft dragged a whole state into a pit of austerity. And even more importantly, it'll expose the Puertopia conspiracy, a neocolonial project that transformed Puerto Rico into an onshore-offshore tax-haven that saw the island strip-mined and then placed under corporate management:

https://pluralistic.net/2022/07/27/boricua/#que-viva-albizu

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#irs#puerto rico#puertopia#microsoft#micros~1#tax avoidance#tax evasion#pure tax play#big tech can't stop telling on itself#corporate crime#rough ride#the procedure is the punishment#steve ballmer#pour encouragez les autres

903 notes

·

View notes

Text

"Both the Canadian Mining Institute and its Ontario branch vigorously condemned the proposed 3 per cent profits tax which it said would lead directly to a general depression and the virtual ruination of persons with small means. Representatives from the Standard Stock and Mining Exchange protested against what they considered "partial confiscation," and a deputation of Cobalt miners claimed that the industry already paid enough in the form of licenses and fees. According to the main theme of the miners' logic, any tax would discourage both prospecting and investment with tragic results for the farmers and businessmen of southern Ontario, a lamentable train of consequences usually symbolized by the tiresome Bean stalk metaphor.

The gloomy outlook forecast by the miners did not move the government to reconsider its tax. "We think public opinion demands it," Whitney replied to its critics. Frank Cochrane even lectured the deputation of mining men from his own constituency upon their responsibilities in protecting the investment of capital:

Let me tell you straight, as a man, that I believe the present conditions of speculative boom which you deplore are caused by the mining men and brokers themselves. They have gone on filling the papers with reckless statements not calculated to help your district. And not one mining man rose to contradict or counteract this attempt to manufacture a stock boom out of what should be an honest enterprise. Let me tell you men of my own district that this was far more injurious to the getting of capital to develop the mineral resources of this Province than any tax we can put on your profits.

Defending his tax in the Legislature, Cochrane argued that the mining industry depended just as heavily upon the state for protection and redress and relied upon the services of stable government as the other moderately taxed enterprises. Historically, mining development depended more than most other businesses upon government-owned or at least publicly aided railroads. As the industry established itself, which it was most certainly doing after Cobalt, it ought to bear its reasonable share of the burden of civil government. Indeed, the government regarded the 3 per cent profit tax as particularly lenient; local taxes could be deducted, as could legitimate expenses, and marginal mines were completely exempt. This very liberality reflected a concern to encourage future investment and recognized that in many remote areas mining companies had to provide some of the public services usually expected of the state themselves.

The separate levy of two cents an acre on all mining lands in the unorganized districts was frankly designed to discourage long-term speculative holdings while providing at the same time an income to support schools and law enforcement. Some of the funds thus raised, Cochrane told J. S. Willison, might also be used to provide the funds for the nickel and silver smelting bonuses which he introduced during the same session. Once passed, the acreage tax and the profits tax became permanent features of the Mines Act. And, despite its protestations to the contrary, the mining industry discovered that it could live quite comfortably with the modest toll.

Growing from strength to strength as it moved from Cobalt silver to Porcupine and Kirkland Lake gold, the mining industry quickly blossomed into a bright and important component of the Ontario economy. From 1902 to the end of 1906, Ontario mines yielded a total output valued at $77,977,533; during the next five years (1907-11) production soared 111.5 per cent to $164,929,057, and between 1912 and 1916 it increased yet another 62.1 per cent to $267,419,383.

...

Profits equalled almost 25 per cent of total production, and in some sectors, silver mining for example, they soared to more than 50 per cent. After Cobalt it was no longer necessary to speak hopefully of Ontario's mineral potential, for in the space of a few short years the province witnessed the rise of a brash, boisterous and rich mining industry.

Of course the Whitney government modestly assumed credit for the "wonderful progress of the mining industry" and crowed mightily about the vastly enlarged "people's share" it had garnered from this new found wealth. Indeed the royalties and the mining taxes, which the government had established in response to the "loud and ignorant clamour" for greater public revenues from this source, delivered handsome returns to the public treasury, particularly when compared with the pre-1907 revenue record. Annual income from all phases of mining activity averaged only $82,511 between 1902 and 1906 but during the following five-year interval it climbed to average almost a million dollars a year!

…

However, figures for the last years of the Whitney administration and the beginning of W. H. Hearst's term demonstrate just as dramatically the tendency towards patronage affecting governments. Between 1911 and 1916, when the value mineral production was increasing by 62.1 per cent, public revenues were falling by 50.5 per cent to an average of only $57,775 a year. With this decline the public share of production popped back to only 0.91 per cent, close to the much-maligned former Liberal level. Over time a strong, confident mining industry accommodated itself to the new regulations, and the regulatory body - in this case a pliant government - interpreted regulations in the interests of its clients. Gradually the companies were negotiated downwards to between 3 and 5 per cent. The International Nickel Company argued successfully its profits should be distributed over the smelting and refinery processes, which did not fall under the profits tax, rather an be attributed entirely to mining, Nor did W. H. Hearst demonstrate the same enthusiasm for royalties from the rich Porcupine and Kirkland Lake discoveries as his predecessors at Cobalt. Accommodation and lack of determination permitted the "people's share," once so proudly championed, fall back to earlier unacceptable levels."

- H. V. Nelles, The Politics of Development: Forests, Mines & Hydro-Electric Power in Ontario, 1849-1941. Second Edition. McGill-Queen’s University Press, 2005 (1974), p. 178-181.

#ontario history#corporate taxes#mining claims#mining industry#resource extraction#resource capitalism#birth of natural resources#h. v. nelles#reading 2023#academic quote#cobalt#porcupine gold rush#gold mining#kirkland lake#liberal state#bounty of nature

0 notes

Text

day 1522

#amphibian#frog#frogsona#tip: dont become self employed you have to do so much taxes related stuff all. the. time#(in my country. who knows about america based on what ive heard about your taxes its probably worse)#i dont neeed help btw im just complaning because i had to look at The Spreadsheets#didnt do my bookkeeping correctly for 2 months but i fixed it👍#its not even THAT bad i just needed to draw like. corporate vent art i guess

443 notes

·

View notes

Text

1K notes

·

View notes

Text

people will be like "so if you were a billionaire, you'd donate all your money?? every last penny?? you wouldn't do anything fun for yourself??" do you understand how much money a billion dollars is

#billionaire#billionaires#minimum wage#eat the rich#tax the rich#corporate greed#capitalism#anti capitalism

196 notes

·

View notes