#corporate income tax uae

Explore tagged Tumblr posts

Text

The introduction of corporate income tax UAE is one of the most radical changes in the taxation policy of the country. The UAE Ministry of Finance announced it on January 31, 2022, with the view to implementing it for the financial year commencing on 1st June 2023. This development demands that businesses of all kinds take cognizance of its implications and apply them.

#corporate tax uae#corporate income tax uae#corporate tax registration uae#uae corporate tax#uae corporate income tax#uae corporate tax registration

0 notes

Text

0 notes

Text

Taxes In UAE For Foreigners: Everything You Need To Know

The United Arab Emirates (UAE) is known for its dynamic business environment, luxurious lifestyle, and tax advantages. For foreigners looking to work, invest, or set up businesses in the UAE, understanding the country’s tax system is crucial. In this guide, we will explore the ins and outs of taxes in the UAE for foreigners.

Basic Overview of the UAE Tax System

The UAE operates on a territorial tax system, which means that taxes are imposed only on activities that occur within the country’s borders. This tax system has several key components:

No Personal Income Tax: Individuals in the UAE, including foreigners, are not subject to personal income tax. This is a significant advantage for expatriates.

No Capital Gains Tax: There is no tax on capital gains in the UAE, making it an attractive destination for investors.

No Inheritance Tax: The UAE does not impose inheritance tax on the transfer of assets upon a person’s demise.

Income Tax in UAE for Foreigners

As mentioned, there is no personal income tax for individuals in the UAE. This means that foreign workers can enjoy their earnings without the burden of income tax deductions, allowing them to save more of their income.

VAT in UAE

The UAE introduced Value Added Tax (VAT) in 2018. Currently set at 5%, VAT applies to most goods and services, but there are several exceptions, including essential food items, healthcare services, and education. Businesses with an annual turnover exceeding the mandatory threshold must register for VAT.

Other Indirect Taxes Foreigners Should Be Aware Of

In addition to VAT, the UAE imposes excise taxes on specific goods, such as tobacco products and sugary drinks. Understanding these taxes is essential, as they can significantly affect the cost of certain items.

Tax Obligations for Foreign Companies

Foreign companies operating in the UAE should be aware of the following tax obligations:

Corporate Income Tax: As of now, the UAE does not impose corporate income tax on businesses, which is advantageous for foreign companies operating in the country.

Withholding Tax: The UAE generally does not impose withholding tax on dividends, interest, or royalties, but it’s essential to review the specifics of tax treaties between the UAE and your home country.

Tax-Free Zones for Foreign Businesses

The UAE offers various free zones designed to attract foreign investment. Companies registered in these zones can benefit from 100% foreign ownership, no import or export duties, and no personal income tax for employees. Some of the popular free zones include Dubai Multi Commodities Centre (DMCC), Jebel Ali Free Zone (JAFZA), and Abu Dhabi Global Market (ADGM).

Navigating the UAE Tax Landscape

Navigating the UAE tax landscape can be complex, especially for foreign businesses and investors. It’s advisable to seek professional guidance from tax advisors and consultants who are well-versed in UAE tax regulations. This will help ensure that you comply with all obligations and take full advantage of the tax benefits the UAE has to offer.

In summary, the UAE’s tax system is highly favorable for foreigners. With no personal income tax, a reasonable VAT rate, and numerous tax-free zones, it’s a prime destination for expatriates, entrepreneurs, and investors looking to make the most of their earnings and business opportunities. However, staying informed about tax regulations and consulting experts is essential to make the most of the UAE’s tax advantages.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#Basic Overview of the UAE Tax System#Decrease in purchasing power due to VAT#Evolution of Tax Laws in the UAE#Gathering Necessary Documents#How VAT is Imposed in the UAE#Income Tax in UAE for Foreigners#Navigating the UAE Tax Landscape#Tax Filing Deadlines#The Concept of Tax Residence in UAE#The Corporate Tax in UAE#Understanding Taxation in the UAE#VAT in UAE#VAT Refunds for Tourists#VAT Reverse Charge Mechanism

0 notes

Text

Corporate Income Tax in the UAE

The United Arab Emirates (UAE) stands as a notable global business hub with its unique tax approach. Renowned for its absence of corporate income tax, the UAE continues to attract multinational corporations seeking tax-efficient operations. The country's tax system promotes economic growth, offering businesses a competitive advantage. While corporate income tax remains non-existent, the UAE has implemented other revenue-generation strategies such as VAT and excise taxes. This tax framework enables companies to reinvest and expand, fostering a thriving business ecosystem. To navigate the nuances and maximize benefits, turn to Ace Patrons. With their expert financial guidance, you can optimize your tax strategies, ensure compliance, and seize growth opportunities.

0 notes

Text

The introduction of Corporate in the UAE follows logically from the UAE's membership in the OECD inclusive framework. The most frequently asked question as the Corporate Tax was implemented was about the UAE Corporate Tax Registration.

The United Arab Emirates (UAE) has been a member of the Organization for Economic Cooperation and Development (OECD) since 2010, and its commitment to international cooperation was reaffirmed in 2016 when it joined the Inclusive Framework on Base Erosion and Profit Shifting (BEPS).click here https://www.reyson.ae

#Corporate Tax Credits in the UAE#corporate tax in Dubai#UAE Corporate Tax Unrealized Losses#UAE Corporate Tax Unrealized Gains#corporate tax consultants in uae#Taxable Income Calculation under UAE Corporate TaxUAE Corporate tax consultants

0 notes

Link

What Services Can You Expect From Our Trusted Tax Agency In UAE

Spectrum is going to be your first and foremost choice, whenever you are looking for a reputed Tax Agency in UAE. We are your legal entity, and we hold the license to operate as a reputed Tax Agency. Our name is also registered with the FTA as a renowned Tax Agency.

Our services are easily appointed by any taxable person. It can be an individual or a company that wants to get their taxes covered for them. Our tax agent will represent your case before the FTA. We will also assist you in fulfilling all your tax obligations and exercising the associated tax rights.

What services do we offer as a Tax Agency in UAE?

This might be the very first time you are trying to get your hands on while procuring help from a tax agency here in the UAE. You have no clue on what to expect from our side. Well, let us guide you through the entire process with ease.

We are ready to assist the taxable person or people with their tax obligations.

Moreover, we are ready to facilitate and offer the significant assistance you need during a tax audit.

We will provide the FTA with all the necessary information, records, documents, and all the major data needed for any taxable person, to get represented by our Tax Agent.

The additional services we cover:

We have listed all the basic points that we, as your reputed Tax Agency in UAE will cover on your behalf. But that’s not all as we have divided our services under multiple heads to make it easier for you. We take care of other practices to help you get a complete package from our end. Those are:

We help you with VAT registration services. We have separate plans for Company, Group, and Individual.

Moreover, we will help you in filing up the VAT returns on behalf of the chosen taxable person.

We will guide to record and maintain all kinds of tax transactions on your behalf.

We will also cover applications for any VAT re-registration in the UAE of any taxable company or person.

Call us today for a free consultation.

Tel: +971 4 269 9329

Mail: [email protected]

#Tax Agency in UAE#Tax Agency Dubai#Corporate tax in UAE#Corporate tax in Dubai#Income tax in UAE#Tax Residency Certificate in UAE#Vat De-Registration UAE.

0 notes

Text

Investment in Brazil could remove countries from tax haven list

Criteria will be established by Brazil’s Federal Revenue Service and are expected to benefit countries like the UAE and Singapore

The Brazilian government included a provision in a new provisional presidential decree addressing the 15% minimum tax on multinational companies’ profits, which allows the executive branch to remove a country from the tax haven list if it makes significant investments in Brazil. This measure, experts say, could be crucial for attracting investments from countries that aim to become financial hubs, such as the United Arab Emirates, which are currently classified as tax havens.

According to the provision included in the decree, a jurisdiction classified as a tax haven or offering preferential tax regimes “may be exceptionally excluded for countries that significantly promote national development through substantial investments in Brazil.”

The Federal Revenue Service will be responsible for regulating what types of investments, including their amounts and frequency, could qualify a country for exclusion from the list. These investments will need to support national development, and the criteria will also be outlined in the regulations.

Currently, the tax authorities consider countries that tax income at a rate below 17% as tax havens. Jurisdictions that protect the confidentiality of corporate ownership structures are also categorized this way.

Continue reading.

3 notes

·

View notes

Text

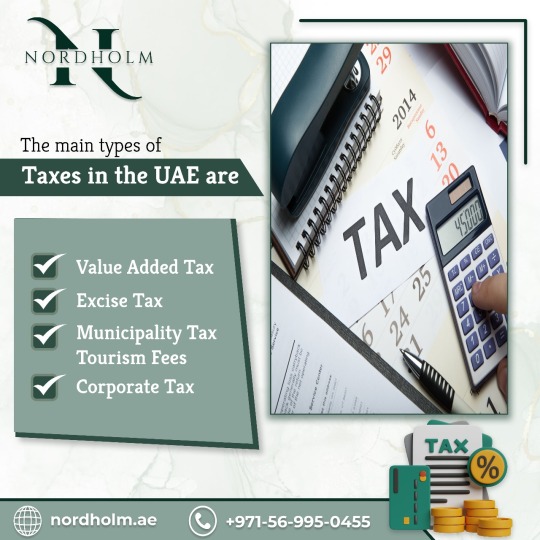

Best Expert Tax Services in Dubai for Investor Success - Nordholm

Welcome to Nordholm Accounting and Bookkeeping Services, a subsidiary managed by Swiss entity Nordholm Investments, dedicated to guiding investors through the intricate landscape of business growth in the UAE, particularly concerning Tax Services in Dubai. Our suite of services encompasses the entire gamut of business establishment, visa processing, bank account setup, HR solutions, payroll management, VAT compliance, and comprehensive accounting services.

Navigating Dubai's intricate business environment necessitates meticulous attention to tax compliance and accurate financial records. Entrusting these critical tasks to seasoned professionals is essential for seamless operations while ensuring strict adherence to diverse tax regulations.

Our range of Tax Services in Dubai includes comprehensive assistance in various areas:

Corporate Tax Advisory: Although Dubai imposes no corporate or income taxes on individuals and corporations, specific considerations apply to branches of foreign entities. Our experts offer strategic guidance, ensuring compliance with applicable regulations and optimizing financial strategies within this unique tax framework.

VAT Compliance Expertise: Operating under a Value Added Tax (VAT) system, Dubai mandates compliance with VAT regulations. Our specialized services assist businesses in Navigating VAT intricacies, timely filing of returns, and implementing strategies to effectively manage VAT liabilities.

Navigating Customs Duties: For businesses involved in importing or exporting goods, understanding and adhering to customs duties are critical. Our services encompass navigating customs regulations, duty exemptions, and ensuring meticulous documentation to mitigate duty-related risks.

Expertise in Excise Taxes: Dubai imposes excise taxes on specific goods like tobacco, sugary drinks, and energy drinks. Our services aid businesses in understanding, reporting, and complying with these taxes, ensuring adherence to statutory requirements.

Tailored Industry-Specific Tax Guidance: Certain industries in Dubai might face specific taxes or levies. We provide tailored guidance to ensure compliance with industry-specific tax obligations, such as tourism-related taxes or real estate-related fees.

At Nordholm Accounting and Bookkeeping Services, we're committed to providing comprehensive support for investors navigating Dubai's multifaceted business landscape, especially regarding Tax Services. Partner with us for expert guidance, ensuring compliance and strategic positioning for sustainable growth in this dynamic market.

#DubaiTaxExperts#TaxComplianceDubai#NordholmTaxServices#TaxAdvisoryDubai#VATConsultants#TaxPlanningUAE#DubaiBusinessTaxes#CorporateTaxDubai#TaxSolutions

5 notes

·

View notes

Text

Navigating Corporate Income Tax UAE: What Businesses Need to Know

The introduction of corporate income tax UAE is one of the most radical changes in the taxation policy of the country. The UAE Ministry of Finance announced it on January 31, 2022, with the view to implementing it for the financial year commencing on 1st June 2023. This development demands that businesses of all kinds take cognizance of its implications and apply them.

What is Corporate income Tax?

Corporate income tax is a direct tax levied on the annual net profit of companies and other entities. Corporate income tax UAE will be computed based on the net income of an enterprise after making adjustments as per the UAE Corporate Tax regulations. The stated policy of taxation has an objective to diversify the UAE's revenue base without losing its global business hub status.

Who is Liable for Corporate Tax?

In this regard, every business will fall under then corporate tax registration UAE, including activities licensed in free zones, but with an exception of activities having to do with the extraction of natural resources. This will ensure corporate taxation will mainly affect business entities as a unique case and thus preserve the UAE's tax haven status for persons. Of importance to note here is the fact that individual income from employment, real estate, other kinds of investments, and income acquired without business registration will not be subject to such corporate taxation.

Key Sectors Affected

Traditionally, the UAE has been a tax-free country, but this new corporate income tax UAE has targeted certain sectors. This may include the oil and gas sector, banking, and telecommunication. Through this step, the government is trying to police the highly profitable industries with an element of revenue generation. Enterprises in these sectors need to understand precisely their taxation obligations and ensure compliance with the new regulations.

Compliance and Expert Support

The recent induction of corporate income tax UAE means that businesses have to ready themselves for an entirely new regime. Compliance in this regard will be very important if one is to avoid penalties and ensure smooth operations. Professional advice under such circumstances can help enormously.

ACE Tax Consultants UAE

ACE Tax UAE is fully equipped to deliver expert tax consultancy especially designed for the needs of businesses and corporate tax registration UAE. We can guide you on remaining compliant with new corporate tax requirements while achieving your financial goals.

It's the start of an era with corporate income tax UAE. This simply means that businesses in the UAE should update themselves and become proactive to the new obligations. Be it a small business or part of a large enterprise; there is every reason to understand and adjust to these changes for further success.

0 notes

Text

The introduction of corporate income tax UAE marks a huge change in the business scene. As organizations get ready for these changes, understanding the complexities of corporate tax registration UAE nuances becomes significant.

0 notes

Text

#Corporate tax rate in India#income tax#union budget 2024#corporate tax services in uae#tax plannning#corporate tax planing#corporate tax rate in india ay 2024-25#income tax slab for ay 2024-25#corporate tax rate#corporate tax rate in India 2024#income tax department#Corporate tax rate in india ay 2024 25 pdf#income tax rate for pvt ltd company for ay 2024-25#Corporate tax rate in India for last 10 years#Current corporate tax slab rates for companies in India 2024#Understanding income tax obligations for Indian companies#How GST impacts corporate tax liabilities in India#List of corporate tax exemptions available for Indian businesses#Tax rates for foreign companies operating in India#tax advisor#online ca consultation service#professional tax consultant service

0 notes

Text

UAE Corporate Tax and Property Investments: Are Owners Accountable to File Taxes?

As the UAE ushers in its first form of taxation - the Corporate Tax 2023 - there’s been a surge in queries online. Among the many questions, the one that was asked most frequently was: Who must adhere to mandatory tax filing, and who is exempt from this financial threshold?

To put an end to these uncertainties, a beacon of clarity came from the Ministry of Finance through a decisive cabinet decision. This landmark decision delineates the regulations governing foreign corporations and non-resident property owners, be it in Dubai or anywhere else in the country.

The UAE Ministry of Finance has taken a carefully thought-out step by introducing Cabinet Decision No. 56 of 2023. This decision sets new rules for foreign companies and non-residents, making them answerable to the new Corporate Tax in the UAE. What it means is that these entities now have to pay taxes on the money they make from real estate and other property investments in the UAE.

To navigate this situation, these companies need to start working with the UAE's regulatory authorities. Given that this rule applies to properties used for business and investment within the UAE. Recent information from the Ministry of Finance says that foreign companies (or property developers in UAE) owning property in the country must pay Corporate Tax based on their income after deducting expenses.

However, there's a positive side to these tax rules. Businesses affected by this tax can subtract relevant expenses that match the rules outlined in the Corporate Tax law. This smart calculation of deductions lowers the amount of income that gets taxed, which helps ease the financial load.

For people in situations where they are foreigners living in another country or who live in the UAE. If they own a real estate property, like a building, regardless if they’ve bought it themselves or through special arrangements, they usually wouldn’t have to pay a special tax on the money they make from it. But this special tax exemption doesn't apply anymore if they do certain kinds of business activities specified in the Cabinet Decision.

In a similar way, there's another situation where real estate investment trusts and certain investment funds can make their mark. They can avoid paying Corporate Tax on income from UAE's properties if they follow specific rules and conditions.

Younis Haji Al Khoori, the undersecretary of the Ministry of Finance, whose declarations echo global wisdom, elucidates, "The Corporate Tax treatment of income derived from UAE real estate and other immovable property by foreign juridical persons is in line with international best practice," further reinforcing the tenet that income tied up with immovable property should be up for taxation within the sovereign grounds which hosts the said property.

His strong message echoes deeply. The UAE's Corporate Tax Law cleverly combines elements that follow international tax rules, carefully designed to create fairness, ensuring a balanced situation for local and foreign companies dealing with property income in the UAE.

Summary

In summary, the symphony of this paradigm shift composes a melody of equity woven through the tapestry of Corporate Tax. As the sands of Dubai bear witness, this arrangement aligns itself with global conventions, creating an environment where enterprises, irrespective of their origin, will stand on equal footing.

#residential projects in dubai#top developers in dubai#residential property for sale in dubai#shapoorji properties

2 notes

·

View notes

Text

How Nigerians Can Easily Migrate To Dubai Via Property Ownership & Investment

According to the latest inbound tourism data for Dubai, over 144,000 Nigerians visit the emirate yearly, marking a year-on-year rise of 33%. The result makes Nigeria Dubai’s fastest-growing visitor source market to date.

In this article, we will look at:

Why Nigerians love Dubai

Why Dubai is a prime investment opportunity for Nigerians

Visa Restrictions

How Nigerians can now easily migrate to Dubai via Property Investment & Ownership

Alright, let’s dive in.

There are several reasons why Nigerians love Dubai:

Shopping: Dubai is known as a shopper’s paradise, with some of the world’s largest and most luxurious shopping malls. Nigerians love to shop, and Dubai offers a wide range of high-end fashion, electronics, jewelry, and luxury items that are not always available in Nigeria.

Tourism: Dubai is a popular tourist destination, with a variety of attractions such as the Burj Khalifa, the world’s tallest building, and the Palm Jumeirah, an artificial island. Nigerians enjoy visiting these attractions and taking part in the city’s vibrant nightlife.

Business opportunities: Dubai is a hub for international business, and many Nigerians travel there to explore new business opportunities. The city’s favorable tax policies and regulations make it an attractive location for entrepreneurs and investors.

Safety: Dubai is one of the safest cities in the world, with a low crime rate. Nigerians appreciate the safety and security that Dubai offers.

Luxury: Dubai is known for its luxury lifestyle, and Nigerians who can afford it often enjoy staying in the city’s opulent hotels and resorts, dining at high-end restaurants, and taking part in exclusive experiences such as desert safaris and helicopter tours.

Why Dubai is a prime investment opportunity for Nigerians

Dubai is a prime investment opportunity for Nigerians for several reasons:

Business-friendly policies: Dubai has a business-friendly regulatory framework, which means that it is easy to set up and run a business in the city. This makes it an ideal destination for Nigerian investors who are looking for an environment that supports entrepreneurship.

Strategic location: Dubai is strategically located at the crossroads of Europe, Asia, and Africa, making it an ideal hub for global trade and commerce. This makes it a convenient location for Nigerian investors who want to tap into the growing markets in these regions.

Tax benefits: Dubai offers a favorable tax regime, with no corporate or personal income tax. This means that Nigerian investors can keep more of their profits, which can be reinvested in their businesses or used for other investment opportunities.

Infrastructure: Dubai has world-class infrastructure, which supports business and trade. The city has modern transportation systems, including a well-connected metro network and extensive road infrastructure. Additionally, it has a well-developed telecommunications infrastructure and state-of-the-art utilities.

Real estate opportunities: Dubai’s real estate market offers excellent investment opportunities, with a range of properties to suit every budget. The city has a booming real estate sector, with high demand for residential, commercial, and industrial properties.

Visa-free entry: Nigerian nationals can enter Dubai without a visa for up to 90 days. This makes it easy for Nigerian investors to travel to the city for business and explore investment opportunities.

Overall, Dubai’s business-friendly policies, strategic location, tax benefits, infrastructure, and real estate opportunities make it an ideal destination for Nigerian investors who are looking for investment opportunities in the Middle East.

Visa Restrictions

Nigerians seeking to migrate to Dubai may face challenges in obtaining a visa due to restrictions that have been imposed on Nigerian passport holders. In 2019, the United Arab Emirates (UAE) suspended the issuance of work visas to Nigerians, citing security concerns. While the ban has been lifted, Nigerians still face restrictions on travel to Dubai.

How Nigerians can easily migrate to Dubai via Property Investment & Ownership

Dubai offers several options for Nigerians to migrate via property ownership and investment. Here are some steps you can take:

Choose the right property: Dubai offers a range of properties, from affordable apartments to luxurious villas. As a Nigerian looking to migrate, you should consider factors like location, budget, and property type.

Understand the visa requirements: To migrate to Dubai, you will need a valid visa. The type of visa you need depends on your purpose of visit, such as work, investment, or tourism. The Dubai government offers several types of visas, including long-term investor visas for property owners.

Invest in a property: Investing in a property in Dubai can offer significant returns on investment. It is important to work with a reputable real estate agent who can guide you through the process of buying a property in Dubai, including the legal requirements and payment procedures.

4. Apply for an investor visa: Once you have invested in a property, you can apply for an investor visa. This type of visa is valid for three years and can be renewed. To be eligible, you must invest a minimum of AED 1 million (approximately USD 272,000) in real estate.

5. Meet other visa requirements: In addition to the investment, you will need to meet other visa requirements, such as a valid passport, proof of income, and a clean criminal record.

6. Seek professional advice: It is essential to seek professional advice from a lawyer or immigration consultant who can guide you through the visa application process and ensure that you meet all the requirements.

Overall, migrating to Dubai via property ownership and investment requires careful planning and a significant financial commitment. However, for Nigerians seeking new opportunities and a higher quality of life, Dubai can be an attractive destination with a thriving economy, world-class infrastructure, and a vibrant cultural scene.

At RealEstateMoses there are several opportunities to invest which gets you a 3 year business license and investor visa for free in Dubai when you purchase 1 bedroom and above.

For more info contact RealEstateMoses- https://linktr.ee/realestate_moses

#realestate_moses#luxuryrealestate#realestatedubai#luxuryhomes#luxurypropertiesindubai#realestateagent#luxurylifestyle#dubailuxury#dubairealtor#investindubaii#luxuryliving#realtorlife#dubaiinvestments#dubailuxuryhomes

2 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

2 notes

·

View notes

Text

Everything You Need to Know About Corporate Tax in UAE

Corporate tax is an essential aspect of running a business in the UAE. With its favorable tax laws and a favorable business environment, the UAE has become a hub for foreign investors. It makes it crucial to have a deep understanding and read the information on the corporate tax system in the UAE, in order to make the most of its benefits. This article will help you understand corporate tax in the UAE by explaining rules, regulations and its benefits in the UAE.

Introduction to Corporate Tax in UAE

There is no personal income tax in the UAE, because of which UAE has a tax-free environment, making it an attractive country to live in for most people. However, corporations are subject to corporate tax on their income earned in the UAE. The introduction of CT in this region was intended to help UAE with the transformation and development that the government has strategically planned to achieve. The country’s tax laws are enforced and implemented by The UAE Federal Tax Authority (FTA). The authority also provides guidelines and regulations for corporations and businesses operating in the UAE. Corporations need to be abiding by these laws and regulations to avoid getting penalized.

The Corporate Tax Law in the UAE

The corporate tax law in the UAE is regulated by the Federal Tax Authority, which oversees the implementation and enforcement of the country’s tax laws. The CT law applies to all businesses operating in the UAE, regardless of their size or structure. The tax is levied on a company’s profits, and the rate at which the tax would be at, depends on the type of business and the industry in which it operates.

Corporate Tax Rates in the UAE

The CT rate depends on the type of business and industry that it operates in, hence there is no standard CT rate in UAE. Oil and gas, insurance, and banking are however, some industries that are exempt from CT. The tax rate for other industries ranges from 0% to 55%.

Benefits of Corporate Tax in UAE

The UAE offers several benefits for corporations, including:

No personal income tax

A favorable tax environment for businesses

A stable and predictable tax system

A streamlined process for tax registration and compliance

Access to a large pool of potential customers and investors

Corporate Tax Filing and Compliance in the UAE

It is necessary for corporations operating in the UAE to file their tax returns on an annual basis. The tax returns must be filed with the Federal Tax Authority(FTA) by the end of the financial year. The tax returns must include detailed information on the corporation’s income and expenses, and must be supported by financial statements and other relevant documents.

Common Mistakes to Avoid in Corporate Tax in UAE

To ensure compliance with the CT laws in the UAE, it is important to avoid common mistakes, including:

Not registering for CT

Filing incorrect or incomplete tax returns

Failing to keep accurate financial records

Not seeking professional advice

FAQ

Q: Is there personal income tax in the UAE?

A: No, there is no personal income tax in the UAE.

Q: Who is responsible for implementing and enforcing corporate tax laws in the UAE?

A: CT laws are enforced and implemented by The Federal Tax Authority (FTA) in the UAE.

Q: What is the standard corporate tax rate in the UAE?

A: The rate depends on the type of business and the industry in which it operates. There is no standard ct in the UAE.

4 notes

·

View notes

Link

What is the purpose of having an Agreement for Avoidance of Double Taxation and Prevention of Fiscal Evasion with UAE by India (DTAA) between UAE and India?

Tax Agency Dubai ,In the Present Era of cross border transactions across the globe, the effect of Taxation is one of the important considerations for any Trade and Investment decisions in another countries.

Where a taxpayer is resident in one country and but has source of income situated in another country, it gives rise to possible double taxation.

DTAA lays down rules for taxation of the income by the Source country and the residence country.

The Provisions of DTAA are compared with domestic law, assessee can opt for anyone which is beneficial to him.

This treaty was entered into by UAE and India with an aim to promote their economic relations and prevent tax evasion.

#Income tax in UAE#Corporate tax in Dubai#Corporate tax in UAE#Tax Residency Certificate in UAE#Registration For Tax Registration Number Dubai#Tax Agency Dubai#Tax Agency in UAE

0 notes