#Navigating the UAE Tax Landscape

Explore tagged Tumblr posts

Text

Taxes In UAE For Foreigners: Everything You Need To Know

The United Arab Emirates (UAE) is known for its dynamic business environment, luxurious lifestyle, and tax advantages. For foreigners looking to work, invest, or set up businesses in the UAE, understanding the country’s tax system is crucial. In this guide, we will explore the ins and outs of taxes in the UAE for foreigners.

Basic Overview of the UAE Tax System

The UAE operates on a territorial tax system, which means that taxes are imposed only on activities that occur within the country’s borders. This tax system has several key components:

No Personal Income Tax: Individuals in the UAE, including foreigners, are not subject to personal income tax. This is a significant advantage for expatriates.

No Capital Gains Tax: There is no tax on capital gains in the UAE, making it an attractive destination for investors.

No Inheritance Tax: The UAE does not impose inheritance tax on the transfer of assets upon a person’s demise.

Income Tax in UAE for Foreigners

As mentioned, there is no personal income tax for individuals in the UAE. This means that foreign workers can enjoy their earnings without the burden of income tax deductions, allowing them to save more of their income.

VAT in UAE

The UAE introduced Value Added Tax (VAT) in 2018. Currently set at 5%, VAT applies to most goods and services, but there are several exceptions, including essential food items, healthcare services, and education. Businesses with an annual turnover exceeding the mandatory threshold must register for VAT.

Other Indirect Taxes Foreigners Should Be Aware Of

In addition to VAT, the UAE imposes excise taxes on specific goods, such as tobacco products and sugary drinks. Understanding these taxes is essential, as they can significantly affect the cost of certain items.

Tax Obligations for Foreign Companies

Foreign companies operating in the UAE should be aware of the following tax obligations:

Corporate Income Tax: As of now, the UAE does not impose corporate income tax on businesses, which is advantageous for foreign companies operating in the country.

Withholding Tax: The UAE generally does not impose withholding tax on dividends, interest, or royalties, but it’s essential to review the specifics of tax treaties between the UAE and your home country.

Tax-Free Zones for Foreign Businesses

The UAE offers various free zones designed to attract foreign investment. Companies registered in these zones can benefit from 100% foreign ownership, no import or export duties, and no personal income tax for employees. Some of the popular free zones include Dubai Multi Commodities Centre (DMCC), Jebel Ali Free Zone (JAFZA), and Abu Dhabi Global Market (ADGM).

Navigating the UAE Tax Landscape

Navigating the UAE tax landscape can be complex, especially for foreign businesses and investors. It’s advisable to seek professional guidance from tax advisors and consultants who are well-versed in UAE tax regulations. This will help ensure that you comply with all obligations and take full advantage of the tax benefits the UAE has to offer.

In summary, the UAE’s tax system is highly favorable for foreigners. With no personal income tax, a reasonable VAT rate, and numerous tax-free zones, it’s a prime destination for expatriates, entrepreneurs, and investors looking to make the most of their earnings and business opportunities. However, staying informed about tax regulations and consulting experts is essential to make the most of the UAE’s tax advantages.

M.Hussnain

Private Wolf facebook Instagram Twitter Linkedin

#Basic Overview of the UAE Tax System#Decrease in purchasing power due to VAT#Evolution of Tax Laws in the UAE#Gathering Necessary Documents#How VAT is Imposed in the UAE#Income Tax in UAE for Foreigners#Navigating the UAE Tax Landscape#Tax Filing Deadlines#The Concept of Tax Residence in UAE#The Corporate Tax in UAE#Understanding Taxation in the UAE#VAT in UAE#VAT Refunds for Tourists#VAT Reverse Charge Mechanism

0 notes

Text

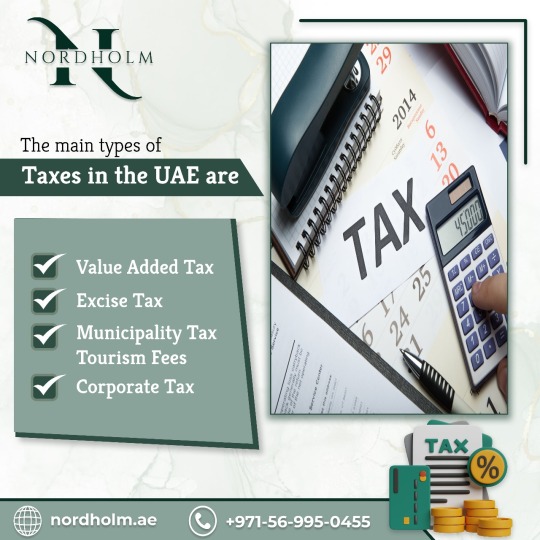

Navigating Dubai's VAT Landscape: Nordholm Accounting's Tailored Approach

Are you an investor or entrepreneur eyeing business prospects in the vibrant landscape of Dubai, UAE? Amidst the promising opportunities, the stringent regulations surrounding Value Added Tax (VAT) registration can be a challenging hurdle. At Nordholm Accounting and Bookkeeping Services, a division of Nordholm Investments, we specialize in offering bespoke accounting and VAT solutions, easing the complexities of VAT compliance for your business expansion in Dubai.

Unlocking Dubai's potential demands a comprehensive understanding of VAT regulations. Nordholm provides a suite of services finely tuned to meet your business needs:

Effortless VAT Tax Registration: Our seasoned team guides you seamlessly through the VAT registration process, ensuring compliance and enabling your business to thrive within legal boundaries.

Expert VAT Tax Consultancy: Tap into our experts' knowledge for professional advice and adept handling of VAT intricacies, safeguarding your business from potential pitfalls.

Tailored VAT Tax Implementation: We assist in integrating VAT seamlessly into your business framework, offering specialized training to equip your staff with the necessary skills to navigate VAT obligations effectively.

Precise VAT Tax Return Filing: Leveraging automated tools and meticulous scrutiny, we ensure accurate and timely VAT tax return submissions, mitigating risks associated with errors.

Comprehensive VAT Tax Audit: Our services extend to conducting thorough VAT tax audits, ensuring compliance, rectifying discrepancies, and safeguarding your business from penalties.

Partnering with Nordholm guarantees access to unparalleled advantages:

Speed and Precision: Expect swift and accurate services, aligning with your business requirements while maintaining a high degree of accuracy.

Tailored Solutions: Recognizing the unique challenges faced by businesses, we offer customized solutions tailored to your specific VAT and accounting needs.

Accessible Support: Our dedicated team remains available 24/7, offering uninterrupted support and guidance whenever you need it.

Navigating Dubai's VAT landscape need not be a daunting task when you have Nordholm's expertise at your disposal. Trust us to handle the complexities while you focus on steering your business towards success.

For seamless VAT Services in Dubai, trust Nordholm Accounting and Bookkeeping Services. Contact us today to embark on a journey of growth while ensuring steadfast compliance with VAT regulations in the UAE.

7 notes

·

View notes

Text

The Dubai Dream: Business Setup and Growth Strategies – PRO Desk

Embarking on a Business Setup in Dubai is an endeavour filled with promise and potential. At PRO Desk, we're not merely observers of dreams; our commitment lies in transforming these ambitions into thriving realities. Our seasoned experts specialize in guiding numerous Business Start-ups and SMEs through the bustling landscape of Dubai's business arena. We take pride in serving as the guiding compass for entrepreneurs, navigating them through company establishment intricacies and strategic avenues that elevate their industries.

Dubai beckons expatriates and foreign investors with an enticing proposition: 100% ownership and unparalleled advantages in industry setup and registration. This landscape boasts exceptional infrastructure, a tax-free haven, and a flourishing market that magnetizes global visionaries. Yet, navigating this terrain without a dependable business setup consultant in Dubai could jeopardize your aspirations.

We stand steadfast as your partner, committed to converting your investment into a sustainable and prosperous enterprise in Dubai. Consider us the backbone of your journey, offering unwavering support at every pivotal juncture.

Our forte extends beyond competence and professionalism; we consistently surpass expectations while adhering to budgetary constraints. Gain a competitive edge in Dubai's ever-evolving market through insightful guidance from our team of expert business consultants.

Picture an entrepreneur's delight—a flexible economy, ground breaking infrastructure, and globally recognized services await in Dubai. This modern and advanced city welcomes dreamers aiming to carve their niche along the stunning Arabian Sea. However, the right Business Setup Consultant in Dubai is indispensable for turning aspirations into tangible success stories within this dynamic city. According to federal law, mainland corporations can have 49% ownership for foreign entities, with 51% ownership and liabilities designated to UAE nationals in private, public, and LLC firms.

Our services also include entities serving as shields for global entrepreneurs, ensuring asset protection while establishing their presence in Dubai. Collaborate with our business consultants to invest in this bustling business hub. Experience 100% ownership in a tax-free environment without the need for a sponsor or UAE national involvement.

PRO Desk serves as your gateway to navigating Dubai's diverse and promising business landscape. Allow us to be your partners in transforming entrepreneurial visions into resounding successes in the realm of business setup in Dubai.

#DubaiBusinessSetup#StartupsDubai#BusinessInDubai#DubaiEntrepreneurs#UAEStartupScene#SMEsDubai#DubaiFreeZone#DubaiCompanyFormation

7 notes

·

View notes

Text

Regulatory Compliance Challenges for US Financial Institutions in the UAE and the Middle East

The Middle East is one of the fastest regions when it comes to economy and technology. The US companies and investors are curious to grab every opportunity in the hindsight. There is a huge market of real estate on the hand, the financial sector is booming at an accelerated pace on the other hand. However, alongside the promise of profit come significant regulatory compliance challenges that must be navigated with caution and precision.

Complex Regulatory Environment The UAE and the wider Middle East region boast a unique and intricate regulatory framework that differs substantially from that of the United States. While the UAE offers a business-friendly environment with favorable tax policies and incentives for foreign investors, its regulatory landscape can be complex and multifaceted. One of the primary challenges for US financial institutions operating in the UAE is compliance with local laws and regulations, which often diverge from those in the US. These regulations cover a broad spectrum, including anti-money laundering (AML) and counter-terrorism financing (CTF) laws, data protection regulations, foreign ownership restrictions, and Sharia-compliant banking principles.

Anti-Money Laundering and Counter-Terrorism Financing AML and CTF compliance remain paramount concerns for financial institutions worldwide, and the UAE is no exception. US banks operating in the region must adhere to stringent AML and CTF regulations set forth by the UAE Central Bank and other relevant regulatory bodies. Ensuring compliance with these regulations requires robust internal controls, comprehensive due diligence procedures, and ongoing monitoring of transactions. US financial institutions must also stay abreast of the UAE's evolving regulatory landscape and adapt their compliance measures accordingly to mitigate the risk of financial crime.

Data Protection and Privacy In an era of heightened concerns surrounding data protection and privacy, US financial institutions operating in the UAE must navigate the intricacies of local data protection laws. The UAE's data protection framework, governed primarily by the Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (PDPL), imposes strict requirements on the collection, processing, and storage of personal data. Compliance with the PDPL necessitates the implementation of robust data protection measures, including encryption, access controls, and data breach response protocols. US financial institutions must also ensure that their data processing activities align with the principles of transparency, accountability, and consent outlined in the PDPL.

Foreign Ownership Restrictions and Sharia Compliance In addition to regulatory compliance challenges, US financial institutions operating in the UAE must navigate foreign ownership restrictions and adhere to Sharia-compliant banking principles. While the UAE permits foreign ownership in certain sectors through the establishment of local branches or joint ventures, ownership limitations may apply in sensitive industries such as banking and finance. Moreover, Sharia-compliant banking practices, which prohibit interest-based transactions and adhere to Islamic principles of finance, present additional considerations for US financial institutions seeking to operate in the UAE. Ensuring compliance with Sharia principles requires specialized expertise and a thorough understanding of Islamic finance principles.

Conclusion As US financial institutions continue to expand their presence in the UAE and the broader Middle East region, regulatory compliance will remain a critical challenge. Navigating the complex regulatory landscape requires a strategic approach, with an emphasis on comprehensive risk assessment, robust compliance frameworks, and ongoing monitoring of regulatory developments.

2 notes

·

View notes

Text

Why Choose Chartered Accountants for Your Financial Needs

In Dubai's quick financial landscape, every small, medium, and large business wants to grow quickly and adapt to their changing business environment and business ethics, consequently our top-rated company, Hussain Al Shemsi Chartered Accountants, offers the best and highest quality accounting and auditing services in the UAE. Our Expert Chartered Professional Accountants provide high-quality accounting services throughout the UAE, including Accounting, Tax Accounting, Consultancy and Advisory and other professional chartered accounting services.

What are Chartered Accountants?

Chartered Accountants are professional Certified Accountants who specialize in business accounting, auditing, financial statement activities, filing corporate tax returns, and also promote business consulting and advisory services. When it comes to Dubai, Ajman, Sharjah, and other UAE locations, our Hussain Al Shemsi Chartered Accountants (HALSCA) team is the most Experienced Chartered Professional Accountants. Our team specializes in auditing, accounting, consulting, tax advisory services, industry driving reviews, and other chartered accounting services in the UAE.

The Role of Chartered Accountants

Taxation Services

HALSCA, the Expert chartered accountants in Dubai, specialize in providing the Best Taxation Services in the UAE that will guide you through difficult tax issues. With intricate knowledge of tax-effectiveness and compliance with the law while managing your financial affairs, whether you are an individual taxpayer, a corporation, or a trust, Hussain Al Shemsi Chartered Accountants provides the top taxation services in the UAE.

Auditing and Assurance

Auditing is an important function in all businesses, hence the Audit and Assurance report is required for a variety of reasons. Audit and assurance is the process of evaluating business accounts and confirming data in financial statements using a variety of documents. The audit process can assist detect corporate risks.

Financial Planning and Advisory

Efficient financial planning and advisory is crucial for long-term prosperity in Dubai's changing economic environment. In order to help individuals and organizations reach their financial objectives, chartered accountants provide strategic advising services. They provide helpful advice and recommendations based on your particular situation, ranging from investment research to budgeting.

The Advantages of Using a Chartered Accountant

Professionalism and Expertise

Dubai's chartered professional accountants are highly knowledgeable and experienced in financial management. Their commitment and professionalism guarantee that your financial affairs are managed with the highest care and attention to detail.

Compliance with Regulations

Navigating the complex regulatory environment of Dubai, UAE, can be challenging without expert guidance. Chartered accountants reduce the possibility of non-compliance and the fines that come with it by making sure your financial procedures follow local laws and regulations.

Strategic Business Guidance

Chartered accountants are trusted advisors who provide strategic insights to propel corporate growth, going beyond simple math calculations. Their experience can assist you in navigating obstacles and seizing chances whether you're growing your business or venturing into new industries.

Accuracy and Efficiency of Finance

You can anticipate increased accuracy and efficiency in your operations when chartered accountants are in charge of your financial processes. They can find chances for optimization and simplify procedures thanks to their sophisticated accounting tools and thorough attention to detail.

Conclusion

Choosing Hussain Al Shemsi Chartered Accountants (HALSCA) Reliable Chartered Professional Accountants in Dubai, UAE, is a strategic move for anyone serious about their financial health. These experts bring a level of professionalism, expertise, and strategic insight that is unmatched in the financial sector. Whether you're a small business looking to optimize your operations, a large corporation seeking efficiency improvements, or an individual in need of personal financial advice, expert chartered accountants in Dubai can provide the guidance and support you need. Their comprehensive services, from tax planning to auditing and financial advisory, ensure that your financial needs are met with precision and care. By partnering with a chartered accountant, you are investing in a secure and prosperous financial future.

#best audit firm in dubai#top accounting firm in ajman#professional chartered accountants in ajman#professional chartered accountants near me#best audit firm in uae#best accounting firm in uae

2 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

Unveiling the Secrets of Corporate Tax Efficiency with Transcend Accounting

At our firm, we specialize in aiding investors to expand their businesses across diverse nations, with a particular focus on the UAE. Our comprehensive services encompass everything from facilitating business establishment in the region—including Company Formation, Visa Procedures, and Bank Account Opening—to Managing HR, Payroll, VAT, Corporate Tax and accounting needs. We provide stress-free and worry-free business services that cater to all the requirements of our investors, ensuring seamless operations and optimal growth.

Strategic Planning: The Backbone of Tax Efficiency

At the core of enhancing corporate tax efficiency lies strategic planning. Our accounting team specializes in crafting bespoke tax strategies that precisely align with the unique needs and objectives of businesses. Through meticulous analysis of financial data and forecasting future trends, we assist businesses in optimizing their corporate tax structure to minimize liabilities and maximize savings.

Leveraging Local Tax Incentives

One of the key advantages of utilizing our accounting's corporate tax services in Dubai is tapping into the array of local tax incentives and exemptions. From free zone benefits to specific industry incentives, we have a deep understanding of the local tax landscape and can guide businesses in leveraging these opportunities to their advantage. By strategically positioning businesses within the appropriate tax jurisdictions, we can unlock significant cost savings.

Technology-Assisted Simplified Tax Procedures In the age of digitization, increasing tax efficiency requires the use of technology. we use state-of-the-art instruments and software to automate tedious work, reduce errors, and expedite corporate tax procedures. By using technology, businesses can save time and money on tax compliance, allowing them to focus on their core operations and key strategic initiatives.

Global Expansion:

Expanding your business globally opens up a world of opportunities, but it also introduces complexities in terms of taxation and compliance. corporation tax services are vital in helping companies who are expanding into foreign markets by offering them the necessary support. These services ensure compliance with tax rules and regulations in numerous jurisdictions and have the experience to navigate the complexities of cross-border taxation.

Peace of Mind:

Businesses can have priceless peace of mind knowing that their tax matters are being managed by appropriately qualified professionals when they use corporate tax services.

Taxation is a complex and ever-changing field, and attempting to manage it internally can be daunting and time-consuming for businesses.

We offer a pathway to financial optimization for businesses operating in the dynamic landscape of Dubai. By employing strategic planning, leveraging local tax incentives, and embracing technology, we empower businesses to maximize tax efficiency and save money. Achieving long-term financial success can be significantly increased by partnering with Transcend Accounting.

So, why not take the leap and explore the advantages of Transcend Accounting's corporate tax services in Dubai today?

#TaxEfficiency#DubaiBusiness#CorporateTax#FinancialOptimization#TranscendAccounting#TaxSavings#StrategicPlanning#TechnologyInTax#TaxIncentives#BusinessGrowth#taxation#uaebusiness#business strategy

3 notes

·

View notes

Text

Unlocking Success: Your Ultimate Guide to VAT Registration in the UAE with Goviin Bookkeeping

As the UAE continues to emerge as a global powerhouse for business, entrepreneurs worldwide are drawn to its promising opportunities. However, amidst the excitement of expansion, one crucial aspect often overlooked is Value Added Tax (VAT) registration. At Goviin Bookkeeping, we recognize the importance of seamless VAT registration for businesses to thrive in the UAE's dynamic market. Join us as we explore the intricacies of VAT registration and how we can be your guiding light to compliance and success.

Timing plays a crucial role in the dynamic landscape of the business world. Timely VAT registration isn't just a legal obligation; it's a strategic move to safeguard your business from penalties and fines. we understand the urgency and offers tailored solutions to ensure businesses stay compliant while focusing on growth and innovation.

We pride ourselves on our team of seasoned VAT consultants, each equipped with the expertise to navigate the complexities of VAT registration in the UAE. Whether you're a start-up or an established enterprise, our consultants are committed to understanding your unique requirements and providing personalized guidance every step of the way.

Navigating VAT registration can be overwhelming, especially for businesses unfamiliar with local regulations. we simplify the process by breaking it down into manageable steps, ensuring a smooth and hassle-free experience. From document preparation to submission, our experts handle the intricacies, allowing you to focus on what matters most – growing your business.

VAT registration in the UAE is categorized into Compulsory, Voluntary, and Exemption registrations, each with its own set of criteria. we help businesses decipher these categories, ensuring they select the most suitable option aligned with their annual turnover and business objectives. With our guidance, businesses can make informed decisions and avoid potential pitfalls down the road.

Embarking on the VAT registration journey shouldn't be daunting. we simplify the process by providing businesses with user-friendly tools and resources to kickstart their registration. Whether it's accessing the FTA's online portal or seeking assistance from our dedicated tax agents, we empower businesses to take the first step towards compliance with confidence.

In the bustling landscape of the UAE's business world, VAT registration is a non-negotiable step towards success. we're more than just consultants – we're partners committed to your growth and prosperity. Let us be your trusted ally in navigating the intricacies of VAT registration, ensuring compliance, and unlocking the full potential of your business in the UAE. With Goviin Bookkeeping by your side, success is within reach.

#VATRegistration#UAEbusiness#GoviinBookkeeping#ComplianceMadeEasy#BusinessGrowth#VATConsultants#TaxAdvisory#Entrepreneurship#StartupSuccess#UAEeconomy#BusinessExpansion#FinancialCompliance#Taxation#SmallBusiness#GrowWithGoviin#BusinessStrategy#VATCompliance#LegalRequirements#BusinessInUAE#ExpertConsultation#GlobalMarketplace#BusinessOpportunities#FinancialStability#StrategicGrowth#Innovation#BusinessSuccess

3 notes

·

View notes

Text

Mohammed Al Qahtani: Your Premier Legal Partner in the UAE

In the dynamic legal landscape of the UAE, having a seasoned legal expert by your side is essential for navigating complex legal challenges. Mohammed Al Qahtani stands out as one of the top legal professionals, distinguished by his extensive experience and unwavering commitment to client success. With over 12 years of experience, he delivers exceptional legal services tailored to diverse needs.

Educational Background and Professional Affiliations

Mohammed Al Qahtani holds a degree in Sharia and Law from the University of Legal Sciences, earned in 2012. He is an esteemed member of prominent organizations such as the International Arbitration Association and the UAE Lawyers and Legal Consultants Association. Additionally, he holds a master’s degree in international arbitration, underscoring his dedication to excellence in the legal field.

Areas of Expertise

International Crime and INTERPOL Cases: Mohammed Al Qahtani has extensive expertise in handling international crime cases, working closely with global law enforcement agencies to ensure top-tier representation for clients facing legal issues abroad.

Criminal Defense: Renowned for his strategic criminal defense skills, Al Qahtani aids clients in mitigating or nullifying penalties through a thorough understanding of criminal law and a meticulous approach to each case.

Legal Document Management: He excels in drafting legal documents, trademark registration, and contract negotiations, ensuring efficient and seamless operations within legal offices.

Real Estate Litigation: Al Qahtani provides robust legal support in real estate disputes, safeguarding clients' interests through expert knowledge of property law and comprehensive litigation strategies.

Corporate and Commercial Law: Specializing in mergers, acquisitions, and corporate structuring, he offers strategic legal advice that empowers clients to make well-informed business decisions.

Labor Law and Employment Disputes: Al Qahtani provides guidance on employee rights and obligations, ensuring compliance with UAE labor laws and effectively resolving workplace challenges.

Arbitration and Dispute Resolution: With significant expertise in arbitration, he facilitates out-of-court dispute resolutions, delivering satisfactory outcomes for clients through adept negotiation and arbitration practices.

Cybercrime and Digital Law: Adept at handling cybercrime cases, Al Qahtani collaborates with law enforcement agencies to protect clients' digital interests and resolve complex issues in the realm of technology law.

Commitment to Professional Development

Mohammed Al Qahtani is dedicated to continuous learning. He has completed specialized training in fields such as international arbitration, tax transparency, Islamic finance, competition law, and intellectual property rights. This steadfast commitment ensures he remains at the forefront of legal advancements, providing cutting-edge legal solutions to clients.

Conclusion

In summary, Mohammed Al Qahtani is a trusted legal partner in the UAE, combining vast experience with a commitment to ongoing professional growth to deliver superior legal services. His diverse expertise and strategic approach make him an invaluable ally for clients seeking reliable and effective legal representation.

0 notes

Text

Dubai Freelance Visa is a specialized service offered by Dubai Freelance Visa Agency, dedicated to assisting individuals in obtaining their freelance visas in the UAE. With the rise of the gig economy, more professionals are seeking the flexibility and independence that freelancing provides. Our agency simplifies the process of securing a Freelance Visa Dubai, ensuring that clients can focus on their work without the hassle of complicated paperwork.

Why Choose Dubai Freelance Visa?

As a leading provider of Freelance Visa UAE services, we understand the unique needs of freelancers and digital nomads. Our team is committed to delivering personalized support throughout the application process, from initial consultation to visa approval. We offer comprehensive guidance on the necessary documentation and requirements, making it easier for you to start your freelance journey in Dubai.

Benefits of a Freelance Visa

Flexibility: Work on your own terms and choose projects that align with your skills and interests.

Tax Advantages: Enjoy 0% corporate and personal tax rates, allowing you to maximize your earnings.

Legal Residency: Obtain a legal residence permit that enables you to live and work in Dubai.

Sponsorship Opportunities: The freelance visa allows you to sponsor family members, making it easier to settle in the UAE.

How to Get Started

To begin your application for a Dubai Freelance Visa, simply reach out to us through our contact page. Our experienced consultants will guide you through every step of the process, ensuring that all requirements are met efficiently.

For more information about our services and how we can assist you with your freelance visa needs, visit our website. With our expertise, you can confidently navigate the freelance landscape in Dubai and take advantage of all the opportunities it offers.

Whether you're an established freelancer or just starting out, Dubai Freelance Visa Agency is here to support your journey toward a successful freelance career in the UAE. Let us help you unlock your potential in one of the world's most dynamic cities!

#freelance visa dubai#dubai#dubai visa#sharjah#freelance visa#visiting visa#uae freelance visa#germany#france#canada#srilanka#transportation#singapore#vietnam#travel#business setup

0 notes

Text

The United Arab Emirates (UAE) has emerged as a global business hub, attracting investors and entrepreneurs from around the world. However, navigating the UAE's evolving tax landscape can be complex. This is where professional tax advisory services become crucial.

0 notes

Text

Affordable Corporate Tax Services for SMEs in Dubai – What You Need to Know

The introduction of corporate tax in Dubai has added a new layer of complexity for businesses, especially for SMEs (Small and Medium Enterprises). Ensuring compliance with these regulations can be a challenge, but it doesn't have to break the bank. This blog explores the importance of corporate tax services for SMEs in Dubai and outlines how to find affordable solutions.

Why SMEs Need Corporate Tax Services in Dubai

While the UAE introduced a corporate tax regime with a 0% tax rate for taxable income below AED 375,000, many SMEs will fall above this threshold. Navigating the intricacies of corporate tax can be overwhelming for small businesses, leading to:

Compliance Risks: Misinterpreting regulations can lead to penalties and fines from the Federal Tax Authority (FTA). A corporate tax consultant in Dubai can ensure your business adheres to all tax requirements.

Missed Opportunities: There may be legitimate tax optimization strategies available, such as maximizing deductions and utilizing free zones effectively. Corporate tax services can help identify these opportunities and minimize your tax burden.

Inefficient Processes: Managing corporate tax filings and record-keeping internally can be time-consuming. Outsourcing these tasks to a qualified professional allows you to focus on core business activities.

Benefits of Affordable Corporate Tax Services for SMEs

Investing in affordable corporate tax services for SMEs in Dubai offers a multitude of advantages:

Peace of Mind: Knowing your corporate tax obligations are being handled by a qualified professional provides valuable peace of mind.

Reduced Costs: While there is a cost associated with outsourcing tax services, it can be significantly cheaper than hiring a dedicated internal tax professional.

Improved Accuracy: Experienced tax consultants minimize the risk of errors in tax calculations and filings, potentially saving you money in the long run.

Strategic Tax Planning: Corporate tax consultants can analyze your business and recommend strategies to optimize your tax liability within the legal framework.

Access to Expertise: You gain access to a team of professionals who stay up-to-date on the latest corporate tax regulations in Dubai.

Finding Affordable Corporate Tax Services in Dubai

Several factors come into play when searching for affordable corporate tax services for SMEs in Dubai, particularly in areas like Deira:

Experience with SMEs: Look for a firm that specializes in working with small businesses and understands their unique challenges.

Service Offerings: Ensure the firm offers the services you need, such as corporate tax registration, tax return preparation, and tax advisory services.

Pricing Structure: Many firms offer flexible pricing models, including hourly rates, fixed monthly packages, or retainer agreements. Choose one that aligns with your budget and business needs.

Client Reviews and Testimonials: Reading online reviews and testimonials can provide valuable insights into the firm's reputation and service quality.

Al Zora: Your Partner for Affordable Corporate Tax Solutions

At Al Zora Accounting & Advisory Services, we understand the financial constraints faced by SMEs in Dubai. We offer a range of affordable corporate tax services for SMEs designed to meet your specific requirements.

Our team of experienced tax consultants provides clear communication, personalized attention, and cost-effective solutions. We are committed to helping your SME navigate the corporate tax landscape in Dubai with confidence.

Don't Let Corporate Tax Be a Burden

By partnering with Al Zora for affordable corporate tax services, SMEs in Dubai can ensure compliance, identify tax-saving opportunities, and free up valuable resources to focus on business growth.

Contact Al Zora Accounting & Advisory Services today for a free consultation and discover how our expertise can empower your SME to thrive in the dynamic Dubai market.

#corporate tax#corporate tax services#corporate tax services for SMEs#corporate tax services for SMEs in Dubai#alzora dubai

0 notes

Text

Best Expert Tax Services in Dubai for Investor Success - Nordholm

Welcome to Nordholm Accounting and Bookkeeping Services, a subsidiary managed by Swiss entity Nordholm Investments, dedicated to guiding investors through the intricate landscape of business growth in the UAE, particularly concerning Tax Services in Dubai. Our suite of services encompasses the entire gamut of business establishment, visa processing, bank account setup, HR solutions, payroll management, VAT compliance, and comprehensive accounting services.

Navigating Dubai's intricate business environment necessitates meticulous attention to tax compliance and accurate financial records. Entrusting these critical tasks to seasoned professionals is essential for seamless operations while ensuring strict adherence to diverse tax regulations.

Our range of Tax Services in Dubai includes comprehensive assistance in various areas:

Corporate Tax Advisory: Although Dubai imposes no corporate or income taxes on individuals and corporations, specific considerations apply to branches of foreign entities. Our experts offer strategic guidance, ensuring compliance with applicable regulations and optimizing financial strategies within this unique tax framework.

VAT Compliance Expertise: Operating under a Value Added Tax (VAT) system, Dubai mandates compliance with VAT regulations. Our specialized services assist businesses in Navigating VAT intricacies, timely filing of returns, and implementing strategies to effectively manage VAT liabilities.

Navigating Customs Duties: For businesses involved in importing or exporting goods, understanding and adhering to customs duties are critical. Our services encompass navigating customs regulations, duty exemptions, and ensuring meticulous documentation to mitigate duty-related risks.

Expertise in Excise Taxes: Dubai imposes excise taxes on specific goods like tobacco, sugary drinks, and energy drinks. Our services aid businesses in understanding, reporting, and complying with these taxes, ensuring adherence to statutory requirements.

Tailored Industry-Specific Tax Guidance: Certain industries in Dubai might face specific taxes or levies. We provide tailored guidance to ensure compliance with industry-specific tax obligations, such as tourism-related taxes or real estate-related fees.

At Nordholm Accounting and Bookkeeping Services, we're committed to providing comprehensive support for investors navigating Dubai's multifaceted business landscape, especially regarding Tax Services. Partner with us for expert guidance, ensuring compliance and strategic positioning for sustainable growth in this dynamic market.

#DubaiTaxExperts#TaxComplianceDubai#NordholmTaxServices#TaxAdvisoryDubai#VATConsultants#TaxPlanningUAE#DubaiBusinessTaxes#CorporateTaxDubai#TaxSolutions

5 notes

·

View notes

Text

Unlocking Business Success in the UAE: Your Guide with PRO Desk Consultants

Welcome to PRO Desk, your trusted partner for turning entrepreneurial dreams into thriving ventures in the UAE. Our team of experts specializes in guiding you through the establishment of new ventures and SMEs, offering invaluable insights and support to ensure your success in the dynamic business landscape of the Emirates.

For expatriates and foreign investors seeking a lucrative opportunity, the UAE provides an enticing proposition with 100% ownership and extensive advantages in industry setup and registration. However, navigating this landscape without a Reliable Business Consultant in Dubai could pose challenges to realizing your aspirations.

Why Choose PRO Desk?

Our strength lies in competence and professionalism, consistently exceeding expectations while delivering desired outcomes within budgetary constraints. Leverage our expert team of business consultants in Dubai to tap into the growing and dynamic UAE market through insightful sessions tailored to your needs.

The UAE offers an unparalleled environment for business growth, featuring a flexible economy, top-notch infrastructure, and globally recognized services. As one of the most advanced states worldwide, this city provides endless opportunities for entrepreneurs looking to establish their presence along the Arabian Sea, guided by our adept business consultants in Dubai.

Key Benefits:

Advanced public transportation and modern road networks

Cutting-edge telecommunications infrastructure

Tax-free environment

Sophisticated financial services sector

Premium residential properties and elite office spaces

Affordable utilities - water, gas, and electricity

International standard healthcare facilities

Types of UAE Business Companies:

Explore the diverse options for establishing your company in the UAE with our business consultants:

Onshore Companies: Benefit from mainland corporations with 49% ownership while allocating 51% ownership and liabilities to UAE nationals for private, public, and LLC firms as per federal law.

Offshore Companies: Ideal for global entrepreneurs seeking asset-saving solutions while establishing their presence in the Emirates.

Free Zone Companies: Thrive in the world's most vibrant business hub, enjoying 100% ownership in a tax-free environment without the need for a sponsor or UAE national.

#UAEBusiness#StartupOpportunities#BusinessConsultants#DubaiBusinessSetup#FreeZoneAdvantages#PRODeskConsultants#GlobalBusinessHub

6 notes

·

View notes

Text

How to Navigate the Corporate Tax Registration Process in the UAE

The UAE has long been known for its tax-free environment, which has made it a popular destination for entrepreneurs and businesses. However, recent changes in tax laws, particularly the introduction of corporate tax in 2023, have altered the business landscape. With the implementation of a 9% corporate tax rate on profits exceeding AED 375,000, businesses must now navigate a new tax framework. Understanding the corporate tax registration process in the UAE is essential to ensure compliance with the country’s tax regulations.

Audit services and tax consultancy in the UAE will play a critical role for businesses looking to successfully navigate this new tax regime. In this blog, we will walk through the steps of corporate tax registration and how audit firms, chartered accountant services, and tax consultants can assist businesses in ensuring smooth and accurate compliance.

1. Understanding Corporate Tax in the UAE

Corporate tax in the UAE applies to all businesses operating in the country, excluding those in specific free zones and businesses that meet certain exemptions. The introduction of corporate tax represents a major shift in the UAE’s tax policy, as the country moves from a tax-free regime to one where businesses must pay taxes on profits over AED 375,000.

Corporate tax is levied at a rate of 9% on taxable profits, which means that businesses will need to calculate their profits accurately, ensuring that they only pay tax on income that exceeds the threshold. However, there are various complexities involved in calculating taxable profits, and businesses need expert guidance to ensure they are complying with the new tax regime.

Audit firms in UAE are well-equipped to assist businesses in understanding these complexities, ensuring that they comply with the law while minimizing their tax liability.

2. Corporate Tax Registration Process in the UAE

The process of corporate tax registration UAE involves several steps. Below is an overview of the general procedure that businesses must follow to ensure they are properly registered for corporate tax:

Step 1: Determine Taxable Status

Before beginning the corporate tax registration process, businesses must first determine if they are subject to corporate tax. While most businesses in the UAE will be taxed under the new regime, some companies may qualify for exemptions, particularly those in free zones or engaged in specific types of activities. A tax consultancy UAE can help businesses determine their taxable status and assess whether they qualify for any exemptions.

Step 2: Register with the Federal Tax Authority (FTA)

Once a business has determined that it is subject to corporate tax, it must register with the Federal Tax Authority (FTA), the government body responsible for administering tax in the UAE. This registration is mandatory for all businesses that exceed the profit threshold.

The registration process involves submitting certain documents, including business details, proof of operations in the UAE, and financial records. Businesses may also need to provide additional documentation to support their tax status. Chartered accountant services can assist businesses in gathering and preparing the necessary documents for registration.

Step 3: File Corporate Tax Returns

Once a business is registered with the FTA, it must file corporate tax returns annually. The returns should detail the company’s revenue, expenses, profits, and other financial information. Proper record-keeping and accurate financial reporting are crucial to ensure compliance with tax laws.

Audit firms in the UAE can assist businesses by reviewing their financial statements, verifying income and expenses, and ensuring that all relevant tax deductions and exemptions are applied. These services are invaluable in ensuring that the tax return is both accurate and complete, avoiding the risk of penalties.

Step 4: Maintain Accurate Financial Records

Maintaining accurate financial records is essential for compliance with corporate tax regulations. The UAE’s tax system requires businesses to retain records for at least five years. These records must be readily available for inspection by the FTA if requested. Audit services in UAE can assist businesses in setting up efficient accounting systems, ensuring that they have proper documentation for tax purposes.

Regular financial audits will help businesses detect any discrepancies in their financial records before filing tax returns, reducing the risk of errors and subsequent audits by the tax authorities.

3. How Audit Firms and Tax Consultants Can Help

Navigating the corporate tax registration process in the UAE can be challenging, especially for businesses that are not familiar with the country’s tax system. Fortunately, audit firms and tax consultancy services in the UAE can provide businesses with expert guidance and support throughout the entire process.

Expert Tax Advice

Tax consultants in the UAE have in-depth knowledge of the country’s tax laws and regulations. They can provide businesses with expert advice on tax planning, helping them minimize their tax liability through legitimate means. Consultants can advise on deductions, exemptions, and strategies to optimize tax payments, ensuring that businesses are not paying more than they are required to.

Accurate Tax Calculations

One of the key responsibilities of tax consultants is to ensure that businesses accurately calculate their taxable profits. Since corporate tax applies only to profits exceeding AED 375,000, it is essential to accurately account for all revenue and expenses. Audit firms and chartered accountants can help businesses prepare accurate financial statements, ensuring that tax calculations are correct and in compliance with the law.

Avoiding Penalties and Audits

Failure to comply with the corporate tax registration process or inaccuracies in tax filings can result in penalties, fines, or audits. To avoid these risks, businesses should work with audit services in the UAE to ensure their records are complete, accurate, and up-to-date. Regular audits conducted by a professional firm can also help businesses identify any areas of non-compliance before the tax authorities do, allowing them to take corrective action in advance.

Ongoing Support and Compliance

The corporate tax landscape in the UAE is likely to continue evolving, and businesses will need ongoing support to stay compliant. Tax consultants and audit firms provide continuous services to ensure that businesses remain in compliance with changing regulations. From handling tax disputes to advising on new tax reforms, these services are essential for businesses seeking to thrive in the UAE’s dynamic economy.

4. The Role of Chartered Accountants in Corporate Tax Compliance

Chartered accountants play a critical role in ensuring that businesses remain compliant with corporate tax regulations. Their services are essential for preparing financial statements, assessing taxable income, and ensuring that tax returns are filed correctly and on time. Chartered accountant services can also offer strategic tax advice, helping businesses optimize their tax structures in line with UAE regulations.

Their expertise in financial reporting and tax compliance allows businesses to focus on growth and operations, knowing that their tax affairs are in capable hands. By leveraging the skills and knowledge of chartered accountants, businesses can successfully navigate the complexities of the corporate tax registration process and remain compliant with all relevant laws.

Corporate tax registration in the UAE marks a significant shift in the country’s tax environment. While this new tax regime may seem daunting to businesses, working with audit services, tax consultants, and chartered accountants can ensure a smooth and successful registration process. By seeking expert advice, maintaining accurate records, and adhering to the tax laws, businesses can avoid penalties and optimize their tax obligations. The right guidance will not only help businesses navigate the registration process but also position them for long-term success in the UAE’s evolving tax landscape.

0 notes

Text

Unlocking Success: Navigating Diverse Business Services in the UAE

At Transcend Accounting, our dedication lies in empowering businesses with a comprehensive suite of services tailored to meet the Diverse Businesses needs of investors seeking success in global markets, including the dynamic landscape of the UAE. Our array of offerings covers every aspect of business establishment and growth, ensuring a seamless journey for our esteemed clients.

We Guide to Company Formation in the UAE: Embark on a journey through the intricacies of setting up a business in the UAE with our expert insights into legal requirements, documentation processes, and key considerations for entrepreneurs.

Visa Procedures Demystified: Navigate the various visa procedures required for business setup in the UAE with ease, as we provide invaluable tips and advice on streamlining the application process for a smooth entry into the UAE market.

Mastering the Art of Opening a Bank Account in the UAE: Dive into the nuances of opening a bank account in the UAE with Transcend Accounting, where we highlight different options available, key documentation requirements, and tips for selecting the right banking partner for your business.

Streamlining HR and Payroll: Our Best Practices for Businesses in the UAE: Our article offers actionable tips and best practices for managing HR and payroll processes in the UAE, ensuring compliance with local regulations and fostering employee satisfaction and productivity.

Navigating the Maze of VAT and Accounting Services in the UAE: Shed light on VAT compliance and accounting services in the UAE with Transcend Accounting's expert guidance, providing practical advice on regulatory changes, tax strategies, and financial transparency.

The Future of Business Services in the UAE: Trends to Watch by Transcend Accounting: Explore emerging trends in business services in the UAE with Transcend Accounting, offering insights into digital transformation and sustainability initiatives that enable businesses to adapt and thrive.

Success Stories: How Businesses Are Thriving with Transcend Accounting's Diverse Services in the UAE: Discover inspiring success stories of businesses leveraging Transcend Accounting's diverse services to achieve growth and success, providing valuable lessons and inspiration for your entrepreneurial journey.

Unlocking Opportunities: Exploring Niche Business Services in the UAE: Delve into niche business services available in the UAE with Transcend Accounting, highlighting opportunities for entrepreneurs to drive innovation and carve out a unique market position.

The Power of Partnership: Collaborating for Success in the UAE Business Ecosystem: Explore the importance of collaboration and partnerships in the UAE business ecosystem with our Accounting, showcasing successful collaborations and offering tips for mutual growth and success.

Beyond Business: Exploring the Cultural and Social Landscape of the UAE with: Join Transcend Accounting on a journey beyond business, exploring the rich cultural heritage and vibrant social scene of the UAE, fostering stronger business relationships and success through understanding local customs and traditions.

#TranscendAccounting#UAEBusiness#BusinessSetup#CompanyFormation#VisaProcedures#BankingUAE#HRManagement#PayrollServices#VATCompliance#AccountingSolutions#BusinessTrends#SuccessStories#NicheServices#PartnershipSuccess#CulturalExploration#EntrepreneurialJourney#BusinessGrowth#MarketInsights#CollaborativeEcosystem#CulturalUnderstanding

3 notes

·

View notes