#coronavirus stimulus

Explore tagged Tumblr posts

Text

Sure, you show up when people are organizing picket lines and protests that'll be covered in the news, but do you ever go to the fucking organizing meetings? Do you have any idea what's going on between the high-profile actions? Do you know what other tasks need volunteers? Or are you just there for the things that are "fun" and get attention from outside observers?

#original post#every day in every way I am tempted to throw up my hands and quit organizing because I'm tired of being overworked and underappreciated#while once-every-4-years 'activists' lecture me about how important it is not to 'badmouth' biden and harris#people keep telling me all about harris' wonderful campaign promises as if I don't remember Biden BLATANTLY FUCKING LYING about his#and then not actually giving us the full amount of coronavirus stimulus he FUCKING CAMPAIGNED ON#god I fucking hate everyone today#join a fucking union and go to the fucking meetings or don't fucking talk to me today

65 notes

·

View notes

Text

Just so nobody can say this is out of context, here's a vid of the entire interview.

The Obama administration successfully contained the Ebola outbreak in the United States. The death toll for Ebola in the US was under a dozen. So before leaving office, the Obama National Security Council created a 69-page handbook on how to deal with a pandemic. Trump and his flunkies ignored it with disastrous results.

Trump team failed to follow NSC’s pandemic playbook

The US death toll from COVID-19 is in seven digits. Other industrialized countries with advanced technological infrastructure such as Canada, Taiwan, Germany, and New Zealand had lower fatality rates per capita.

Trump largely ignored the virus until well into March when it had a chance to spread across the US.

The missing six weeks: how Trump failed the biggest test of his life The president was aware of the danger from the coronavirus – but a lack of leadership has created an emergency of epic proportions

The Trump administration, at best, was in denial; at worst, it sabotaged the pandemic response.

youtube

Trump White House made 'deliberate efforts' to undermine Covid response, report says

Trump zombies who claim the economy was marvelous under Trump conveniently forget about everything that happened after February of 2020. Trump's early bungling of the pandemic plunged the economy into recession. The COVID supply chain problems and the economic stimulus required to prevent a depression led to the spurt in inflation which is finally receding.

People who are nostalgic about taking hydroxychloroquine and ivermectin, drinking bleach, and sticking UV lights up their butts must be excited about the opportunity to vote for Trump again.

#donald trump#botched pandemic response#covid-19#coronavirus#public health#anniversary of trump's awful covid-19 response#gross incompetence of the trump administration#the trump recession#trump tanked the economy#trump is a loser#vote blue no matter who#election 2020#election 2024

124 notes

·

View notes

Text

Object permanence

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in SAN DIEGO at MYSTERIOUS GALAXY on Mar 24, and in CHICAGO with PETER SAGAL on Apr 2. More tour dates here.

#20yrsago Orrin Hatch is head of new IP subcommitee https://www.technewsworld.com/story/hatch-to-lead-senate-panel-on-intellectual-property-41548.html

#20yrsago Hollywood stars look like crap in high-def https://web.archive.org/web/20050324045011/http://www.onhd.tv/thelist.htm

#20yrsago Self-replicating 3D printers https://web.archive.org/web/20050410074636/https://www.newscientist.com/article.ns/?id=dn7165

#20yrsago Andre Norton, RIP https://web.archive.org/web/20050318045717/https://www.cnn.com/2005/SHOWBIZ/books/03/17/obit.norton.ap/index.html

#15yrsago YouTube: Viacom secretly posted its videos even as they sued us for not taking down Viacom videos https://blog.youtube/news-and-events/broadcast-yourself/

#15yrsago Entertainment industry sours on term “pirate” — too sexy https://arstechnica.com/tech-policy/2010/03/piracy-sounds-too-sexy-say-rightsholders/

#15yrsago Is the UK record industry arrogant or stupid? https://www.theguardian.com/technology/2010/mar/18/digital-economy-bill-calculated-loss

#10yrsago J. Edgar Hoover palled around with a suspected commie spy https://www.muckrock.com/news/archives/2015/feb/26/fbi-files-congressman-dickstein-show-close-relatio/

#10yrsago DRM for woo: “light therapy” mask’s LED only works 30 times https://www.techdirt.com/2015/03/18/drm-how-to-make-30000-hour-led-bulbs/

#10yrsago Canadian court hands a gimme to copyright trolls https://www.michaelgeist.ca/2015/03/defending-privacy-doesnt-pay-federal-court-issues-ruling-in-voltage-teksavvy-costs/

#10yrsago Clinton’s sensitive email was passed through a third-party spam filtering service https://web.archive.org/web/20150317223142/http://www.dvorak.org/blog/2015/03/16/breaking-news-spam-filtering-service-had-access-to-clinton-classified-emails/comment-page-1/

#10yrsago Following the key Trans-Pacific Partnership senator with a 30′ blimp https://www.youtube.com/watch?v=WDKzwB8GhN0

#5yrsago Plague precautions from 1665 https://pluralistic.net/2020/03/18/diy-tp/#hello-1665

#5yrsago How to make your own toilet paper https://pluralistic.net/2020/03/18/diy-tp/#diy-tp

#5yrsago If nothing is for sale, how will covid stimulus work? https://pluralistic.net/2020/03/18/diy-tp/#covid-stimulus

#5yrsago 3D printed ventilator hero got a patent threat https://pluralistic.net/2020/03/18/diy-tp/#patently-absurd

#5yrsago Epidemiology and public health in 14 minutes https://pluralistic.net/2020/03/18/diy-tp/#explainer

#5yrsago Bigoted Republican Congressjerk votes against coronavirus relief because it might cover same-sex partnerships https://pluralistic.net/2020/03/18/diy-tp/#repandybiggs

#5yrsago How to split a single ventilator for four patients https://pluralistic.net/2020/03/18/diy-tp/#ventilator-sharing

#5yrsago John Green's mutual aid manifesto https://pluralistic.net/2020/03/18/diy-tp/#nerdfighters

#5yrsago American Airlines blew billions, now it wants a bailout https://pluralistic.net/2020/03/18/diy-tp/#aa-crashes

#5yrsago MAGA firefighters dismiss coronavirus as Democrat hoax https://pluralistic.net/2020/03/18/diy-tp/#trump-virus

#5yrsago Charter orders all workers to keep showing up https://pluralistic.net/2020/03/18/diy-tp/#sociopathy

5 notes

·

View notes

Text

Arthur Delaney at HuffPost:

WASHINGTON — For the first year of Joe Biden’s presidency, it looked like Democrats were on the verge of creating the social safety net of their dreams. The coronavirus pandemic had already prompted Congress in bipartisan agreement to boost unemployment insurance and dish out stimulus checks to even the poorest Americans — a significant breakthrough.

Democrats under Biden seized the momentum in March 2021, quickly passing another relief bill that sent a third round of stimulus checks and even created a child allowance, worth as much as $300 per kid, for almost all parents in America. “I think this will be one of the things that the vice president and I will be most proud of when our terms are up,” Biden said a few months later as the payments started. “This has the potential to reduce child poverty in the same way that the Social Security [program] reduced poverty for the elderly.” But the payments, contrived as advance refunds of the child tax credit, were only temporary, and the big plan to make them permanent — alongside new child care subsidies, paid leave for workers and universal prekindergarten — was stymied in part by dubious concerns from within the Democratic Party on how parents would spend the money. And so Biden, who may have hoped to be as consequential a president as Franklin D. Roosevelt, the author of the New Deal and its foundational supports for workers and older adults, has to settle for less — but not nothing. Biden will be leaving office having made his mark on the federal safety net in a number of ways. [...] The higher food benefits have lifted more than 2 million people above the poverty line, while 4 million would go uninsured if it weren’t for the enhanced premium support. The latter policy will expire at the end of the year, however, if Republicans don’t proactively keep it going. In short, while Biden may not have revolutionized the U.S. political economy like Roosevelt, whose reforms banished poorhouses to the annals of history, Biden made policy marginally more favorable to workers and families. [...] In his farewell address this week, Biden touted the overall success of the American economy, which was buoyed by the aggressive relief bill he signed into law, rather than any lasting social policy he’d put in place.

“Instead of losing their jobs to an economic crisis that we inherited, millions of Americans now have the dignity of work; millions of entrepreneurs and companies creating new businesses and industries, hiring American workers, using American products,” Biden said. Unfortunately for Biden and Democrats generally, most people hated the economy of the last four years, thanks to price inflation that may have been the single biggest contributor to President-elect Donald Trump’s victory over Vice President Kamala Harris. Higher prices made people feel poorer, and it’s possible that the retrenchment of federal spending after 2021 did so as well, though no such nuance shows through in consumer surveys. [...] The child tax credit will be a live issue this year. Republicans want to reauthorize their own temporary changes to the credit that they made as part of their 2017 tax bill, which expanded the credit to help cover for other tax changes that were disadvantageous for families. And some Republicans, including Vice President-elect JD Vance, have talked about increasing the credit as a means of encouraging people to have more kids. The Democratic child tax credit expansion, costing more than $100 billion annually, led to the sharpest reduction of child poverty in modern U.S. history. For six months, American parents got to experience the kind of monthly support that is typical in every other advanced country on Earth. Democrats were on the verge of continuing the child tax credit beyond that point, but couldn’t get agreement from then-Democratic Sen. Joe Manchin (W.Va.), who told his colleagues that he feared parents spent the money on drugs.

Joe Biden’s Presidency brought a glimpse of a better safety net.

#Joe Biden#Biden Administration#Child Tax Credit#Food Assistance#Obamacare Subsidies#Stimulus Checks#Stimulus#Unemployment Insurance

2 notes

·

View notes

Text

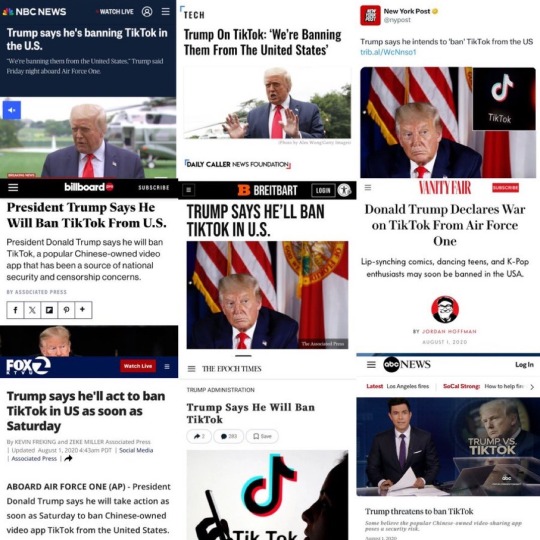

Links for every single article mentioned in this collage :)

Reminder for when he “saves” it. He was the one who wanted this, and now he gets to be the hero and win favour with young constituents. Don’t give him the credit for fixing his own problem.

104K notes

·

View notes

Text

Stock Market Changes Through Historical Events

Historical events have a significant impact on the stock market, often serving as a barometer for shifts in global sentiment and economic conditions. Events such as the emergence of new technologies or global health crises can trigger volatility or even lead to long-term market trends.

Stock Market Changes Through Historical Events, for instance, technological advancements, such as the rise of the internet in the 1990s, fueled the dot-com boom, causing stock prices of tech companies to surge, followed by a sharp decline when the bubble burst in 2000. Similarly, the rapid growth of artificial intelligence in recent years has dramatically impacted the stock values of tech giants like Microsoft and Nvidia. Health crises, such as the COVID-19 pandemic, show how fragile the market can be in the face of global uncertainty. When the pandemic hit, the stock market saw a historic plunge, only to later recover thanks to government stimulus packages and advancements in vaccine development.

Similarly, global conflicts like World War II and the 9/11 attacks also caused major market drops, but the long-term impact varied as economic activities and policies adjusted.

Additionally, recessions and financial crises, such as the 2008 housing collapse, often lead to bear markets, but they can also create opportunities for recovery as economies bounce back. Political decisions, regulatory changes, and trade policies also influence investor behavior and stock performance, making the market a reflection of both current events and investor sentiment. Throughout history, significant events have had a major impact on the stock market. Whether it’s a global crisis, technological advances, or geopolitical turmoil, the market often reacts in ways that we can’t always predict. Here’s a timeline of some of the biggest events from the past century that shook up the stock market, measured by indices like the Dow Jones Industrial Average, the S&P 500, or the NASDAQ for tech stocks. The Wall Street Crash of 1929 (October 1929 – July 1932) The crash in October 1929 caused a dramatic 89% drop in the Dow by 1932. It wasn’t just one factor that caused this; a weak banking system and overvalued stocks played key roles. This event triggered the Great Depression. The Kennedy Slide of 1962 (December 1961 – June 1962) This downturn, which dropped the Dow by 27% over seven months, wasn’t due to one clear factor, but speculation about inflated stock prices and waning investor confidence were suspected. The market did bounce back after about 14 months. Black Monday (October 19, 1987) Black Monday is a day that investors remember well—a 22.6% drop in the Dow led to a global financial crisis. This prompted the creation of circuit breakers to prevent such extreme drops in the future. Black Friday (October 13, 1989) On this day, the market dropped 6.9%, a huge fall after Black Monday. But the Dow rebounded quickly and reached a new record by the following Monday. The Dotcom Bubble (January 1995 – March 2000) With the rise of the internet, tech stocks soared, and the NASDAQ surged by 582% in just five years. But eventually, the bubble burst, leading to significant losses. Dotcom Bubble Burst (March 2000 – October 2002) When internet startups didn’t live up to expectations, the NASDAQ dropped by over 75%, wiping out $5 trillion in market value. While many startups failed, companies like Amazon and eBay survived and continue to thrive. September 11, 2001 Terrorist Attacks The stock market closed immediately after the attacks and didn’t reopen until September 14. When it did, the S&P 500 saw a 4.9% drop. Though the market took a hit, it has since continued to grow. 2008 Recession (October 2007 – March 2009) The housing bubble burst and the subprime mortgage crisis led to a 51.1% drop in the Dow. The market struggled, and the Great Recession hit hard, but recovery began after a period of time. Coronavirus Crash (March 2020) The global pandemic caused a 37% drop in the Dow as panic spread and investors sold off in droves. Circuit breakers were triggered, but the market bounced back with help from government stimulus packages and low-interest rates. As you can see, major world events have shaped the stock market in ways we could never have predicted. If you're concerned about how these events might affect your retirement savings, taking control of your investments with a self-directed IRA could give you the flexibility you need to weather any storm.

The recent Days

When big events happen in the world, it’s fascinating how they can show up in the stock market. Whether it’s a groundbreaking new technology or a global health crisis, what’s happening around us often affects how investors behave. Take the rise of the internet in the 90s, for example—it sent tech company stocks soaring, but when the dot-com bubble burst, the market took a serious hit. Fast forward to today, and the surge in AI technology has been a huge boost for companies like Microsoft and Nvidia. The team at Madison Trust compiled a list of major events and their effects on the stock market. Skillz Middle East makes Digital Transformation happening for your company. We focus on the quick win to ensure Digital Marketing, e-learning, Web Meeting, Web Conferencing, Digital Signature, Digital Asset Management are ready to enhance your organization. Digital Marketing shall save money and bring a more efficient conversion for your brand and products. Read the full article

0 notes

Text

We’re Dying From Coronavirus. Corporations Are Getting Rich Off It.

https://jacobin.com/2020/06/coronavirus-pandemic-2008-bailout-wall-street-rich-stimulus

0 notes

Link

0 notes

Text

During his time in office President Biden

-Used subsidies to create microchip factories in the U.S. , a move that competes with overseas factories WITHOUT RAISING THE PRICES FOR CITIZENS THE WAY TARRIFS WILL

-Dramatically expanded our sustainable energy while moving oil production to the U.S., which increased jobs in both areas. This also decreased our reliance on a war torn area AND WAS THE FIRST NECESSARY STEP TO DISARM ISRAEL

-Actively supported unions, which is probably why the major dockyard strike that some feared would hurt the economy ended in under a week

-Worked on oversight of AI

-Provided college debt relief

-Sent out stimulus checks DIRECTLY TO US CITIZENS when there was massive unemployment caused by Covid. This definitely saved lives and probably kept the looming economic depression at bay

-Increased veteran support to include additional aid for burns and toxin exposure

-and brought the country back from the brink of another depression by creating more jobs than any president before him

In contrast, when Trump was in the White House he:

-Spent billions on a wall he didn’t finish

-Put a part of the wall he did finish directly through a locally famous butterfly sanctuary

-Create special jails for immigrants that didn’t have showers, enough clean water, toilets, and according to some accounts, enough food.

-Sent some first generation U.S. citizens there as well

-Sprayed these prisoners with pesticides to “clean them” during the pandemic

-Did nothing when he first found out about Covid

-Told his followers to drink bleach

One of these Presidents was worst we’ve ever had. It wasn’t Biden.

1K notes

·

View notes

Text

The Curious World of Gold Prices: FintechZoom's Views

Introduction

Always a major commodity in the financial markets, gold serves as a safe refuge during economic crisis, a hedge against inflation, and a basic component of world reserve currencies. Platforms like FintechZoom provide real-time insights and analyses priceless for traders, investors, and economists both as the financial terrain changes. We will investigate the elements driving gold prices in this blog, look at current trends, and learn how FintechZoom could be a very useful tool for people engaged in the precious metal market.

Gold's Historic Significance

From its use in ancient civilizations as money and jewelry to its part in contemporary financial systems, gold's appeal stems from past. Gold has long been a consistent source of value, holding worth over millennia. Unlike fiat money, which might be devalued by inflation and other economic events, gold's inherent value stays rather constant.

Aspects Affecting Gold Prices

Economic Indices: Economic data greatly shapes the value of gold. Important markers are GDP growth, employment numbers, and inflation rates. Investors swarm gold as a safe haven during times of economic uncertainty or downturns, so driving up its price.

Monetary Policy: The gold market depends much on central banks. Gold prices might change depending on policies on reserve requirements, money supply, and interest rates. Low rates, for example, often lower the opportunity cost of owning gold, which increases its appeal.

Geographic Events: Geopolitical Gold prices can vary greatly depending on political unrest, wars, and world conflicts. In geopolitally tense times, investors see gold as a safe investment.

Value of the US dollar has a notable inverse relationship with gold prices in terms of fluctuations. For foreign buyers, a stronger dollar increases the cost of gold, so lowering demand; a weak dollar has the reverse effect.

Supply and market demand: The price of gold is directly impacted by demand from sectors including jewelry, technology, and investment as well as by mining output and recycling's effects on supply.

Recent developments in gold prices

Gold prices have been rather erratic in recent years, shaped by different worldwide events and economic policies. Let's review some important patterns:

coronavirus 19 Pandemic: The worldwide epidemic set off hitherto unheard-of levels of economic uncertainty that drove gold prices skyward. Fears of inflation drove investors toward gold as central banks carried out bold fiscal stimulus and monetary easing.

Concerns about inflation: Significant pressures on inflation resulting from post-pandemic recovery Though the link is complicated and affected by several factors, including real interest rates, gold, usually considered as an inflation hedge, has benefited from these worries.

Technological Advancements: Blockchain and digital gold trading platforms among other financial technology innovations have made gold more available to a wider audience. These developments have improved the gold market's transparency and liquidity.

Many central banks—especially those in developing nations—have been building more gold reserves. Supporting gold prices, this trend shows a diversification approach away from the US dollar.

Gold Price Insights Using FintechZoom

Leading venue offering real-time financial news, data, and analysis is FintechZoom. For those who invest in gold, it provides several tools that might improve decision-making:

FintechZoom guarantees investors have the most recent information at their hands by offering up-to--minute gold price updates. Those who trade short-term or make quick investment decisions depend on this ability.

With regard to several economic indicators, geopolitical events, and market attitude, the platform provides in-depth study of gold price fluctuations. Detailed studies and expert analysis enable investors to grasp the fundamental causes influencing gold prices.

By means of historical gold price data, investors can spot long-term trends and tendencies. Those who want to make wise decisions depending on past performance and cyclical behavior of gold must have this knowledge.

FintechZoom compiles pertinent news and events possibly influencing gold prices. Anticipating price movements depends on keeping up knowledge of world events, central bank policies, and economic developments.

For traders, FintechZoom provides a selection of technical analysis instruments including trend lines, charts, and indicators. These instruments use technical signals and price trends to help find possible points of entrance and exit.

Techniques for Allocating Gold Funds

Investing in gold calls for a calculated approach based on long-term goals as well as present possibilities. Investors should give these some tactics some thought:

Purchasing physical gold in the form of coins, bars, or jewelry is a conventional approach of investment. Though it offers a physical benefit, storage and insurance expenses should be taken into account.

ETFs for Gold: Mutual Funds Without having to physically handle it, mutual funds and exchange-traded funds (ETFs) expose to gold. These financial instruments offer liquidity and diversification advantages as well as track the value of gold.

Investing in companies engaged in gold mining and production provides a leveraged view of gold prices. Still, it's important to evaluate these companies' geopolitical and operational risks.

Futures and Options: Contracts offering a means of gold price movement speculation allow sophisticated investors. These derivative instruments carry more risk and call for a strong awareness of the market.

Thanks to fintech innovations, investors may purchase and sell fractional ownership of gold on digital gold platforms. These sites provide less entry requirements and convenience.

The direction of gold prices:

Given the several elements influencing gold prices, it is difficult to project their future. Still, several patterns will probably affect the market:

Sustainable and Ethical Gold: Growing knowledge of ethical and environmental problems in mining could stimulate market for gold derived sustainably. Investors are growing more aware of how their choices affect the surroundings and society.

Blockchain technology integration in gold trading might improve traceability and openness, so improving the market efficiency. Digital gold platforms probably will become more popular.

Monetary Policy Shifts: Particularly in reaction to inflation and economic recovery, central bank policies will always be very important. Any notable modification in monetary policy or interest rates could affect gold values.

Global Economic Conditions: Investor attitude toward gold will be influenced by trade conflicts, geopolitical stability, growth possibilities, and state of the global economy. Gold is probably going to be a preferred asset in unsure times.

Final Thought

Still a great value in the financial markets, gold provides inflation and economic uncertainty protection. For investors trying to negotiate the complexity of the gold market, sites like FintechZoom offer insightful tools and analysis. Understanding the elements affecting gold prices and using technology developments will help investors to make wise decisions and maximize their portfolios.

The interaction of economic policies, technological developments, and world events will always help to define the gold market going forward. Maximizing possibilities in this ever-changing terrain will depend mostly on keeping informed and flexible.

0 notes

Text

Object permanence

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in CHICAGO with PETER SAGAL on Apr 2, and in BLOOMINGTON on Apr 4. More tour dates here.

#10yrsago San Francisco Sheriff’s Deputy ring accused of pit-fighting inmates https://www.sfgate.com/crime/article/S-F-jail-inmates-forced-to-fight-Adachi-says-6161221.php

#10yrsago Welfare encourages entrepreneurship https://www.theatlantic.com/politics/archive/2015/03/welfare-makes-america-more-entrepreneurial/388598/

#10yrsago Here’s the TSA’s stupid, secret list of behavioral terrorism tells https://theintercept.com/2015/03/27/revealed-tsas-closely-held-behavior-checklist-spot-terrorists/

#5yrsago Reasonable covid food-safety advice https://pluralistic.net/2020/03/27/just-asking-questions/#germophobes

#5yrsago Boris Johnson has coronavirus https://pluralistic.net/2020/03/27/just-asking-questions/#bojo

#5yrsago States prep for postal voting https://pluralistic.net/2020/03/27/just-asking-questions/#save-usps

#5yrsago Plutes cash in on stimulus https://pluralistic.net/2020/03/27/just-asking-questions/#stimulus-scam

#5yrsago The US is now the epicenter of the pandemic https://pluralistic.net/2020/03/27/just-asking-questions/#suicide-cults

#1yrago End of the line for corporate sovereignty https://pluralistic.net/2024/03/27/korporate-kangaroo-kourts/#corporate-sovereignty

4 notes

·

View notes

Text

Asia-Pacific Metal Packaging Coatings Market - Forecast(2024 - 2030)

Asia-Pacific Metal Packaging Coatings Market Overview

Asia-Pacific Metal Packaging Coatings Market size is forecast to reach US$1,990.4 million by 2027, after growing at a CAGR of 7.3% during 2022-2027. The preference for metal food & beverage containers in the Asia-Pacific region has been increasing rapidly, owing to its range of benefits such as better product protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging. The development of new coating technologies which include Bisphenol A non-intent (BPA-NI) coatings are further fueling the growth of the market in the Asia-Pacific region. Moreover, increasing demand for metal packaging coatings from the pharmaceutical industry are further accelerating the growth of the market in the Asia-Pacific region. Also, strict regulations regarding the use of plastics in various countries across the Asia-Pacific region along with increasing product launches and developments associated with metal packaging is expected to increase the demand for metal packaging coatings for use in various end-use industries over the forecast period.

Covid-19 Impact

The COVID-19 outbreak led to major economic problems and challenges for the food & beverage, pharmaceutical, cosmetic, and other industries in the Asia-Pacific region. According to the International Monetary Fund (IMF), the GDP growth of the Asia declined by 1.3% and Australia by 2.4% as indicated in the graphs, owing to the economic impact of COVID-19. The governments all across the Asia-Pacific region announced strict measures to slow the spread of the coronavirus and only the production of essential commodities were allowed, which impacted the non-essential commodity industries, thereby impacting the production of metal packaging coatings as well. However, economic stimulus packages allotted for multiple sectors in the Asia-Pacific region and the start of industrial production activities since 2021 is improving the metal packaging coatings market growth in the Asia-Pacific region by its increasing utilization in various industries.

Report Coverage

The report: “Asia-Pacific Metal Packaging Coatings Market Report – Forecast (2022-2027)”, by IndustryARC, covers an in-depth analysis of the following segments of the Asia-Pacific metal packaging coatings industry.

By Packaging Types: Food (2 piece and 3 piece), Caps & Closure (External and Internal), and General Line (External and Internal) By Coating Types: Water based, Solvent based, and Powder based. By Resins Type: Acrylic, Fluoropolymer, Urethanes, Epoxy (BPA and Non-BPA), Amines, and Others. By Application: Food (Sea Food, Meat, Infant Nutrition & Dairy, Vegetables, Catering, Biscuits, Cookies & Confectionary, Fats & Oils, Toppings, and Others), Pharmaceutical, Cosmetics, Personal Care, and Others. By Country: China, Japan, Thailand, Vietnam, India, Indonesia, Malaysia, and Rest of Asia-Pacific.

Request Sample

Key Takeaways

China dominated the Asia-Pacific Metal Packaging Coatings Market in the year 2021. One of the key drivers driving the market is increasing use of metal packaging in food products such as fruits, vegetables, infant nutrition & dairy, bakery, and other similar products in order enhance the durability of metal packaging.

Increasing product launches for phenolic resins that are primarily used in a wide range of metal packaging coatings employed in food, pharmaceuticals, and other applications which require a smooth, durable, and spotless finish, has driven the market growth. For instance, In June 2020, companies such as Allnex GMBH, which has its presence in the Asia-Pacific region launched its new eco-friendly phenolic resin for use in BPAni application for metal packaging coatings.

Strict environmental regulations are driving metal packaging coating manufacturers in the Asia-Pacific region to adopt environmentally conscious practices, thus, the demand for water-based coatings are increasing significantly in the region.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Coating Types

The water based coating segment held the largest share in 2021 and is expected to grow at a CAGR of 8.2% by 2027. Water-based coating is an environmentally friendly surface treatment that disperses the resin used in the coatings using water as a solvent. They have a high degree of flexibility and reduce moisture and solar radiation absorption, thereby, resulting in fewer solvent emissions. The VOC (Volatile Organic Compounds) content in the water-based coating is significantly low, and since there are regulations restricting the high VOC content in Asia-Pacific is resulting in its increasing adoption by metal packaging coating manufacturers based in the region. For instance, in 2021, China launched its 14th Five-Year Plan, the chemical sector refocused its environmental protection goals on low-carbon transformation and comprehensive control of VOC emissions, as well as a considerable emphasis on encouraging low VOC products. Furthermore, as compared to solvent-based coatings, water-based coatings for metal packaging require less coating to cover the same surface area, cost less, and do not require any additives, thinners, or hardeners because they provide higher adherence. Thus, water-based barrier coatings are utilized to protect the metal packaging from external and internal effects by sealing the substrate surface.

Inquiry Before Buying

Asia-Pacific Metal Packaging Coatings Market Segment Analysis - By Application

Food sector held the largest share with 66% in the Asia-Pacific Metal Packaging Coatings Market in 2021 and is anticipated to grow at a CAGR of 7.4% during the forecast period 2022-2027. Metal packaging cans, containers, tins, and more are utilized for the packaging of the food because these types of packaging maintain the food filling's flavors and nutritional content ranging from months to several years. However, the direct contact between the metal packaging and food content filled inside the cans and other types of packaging are not safe. The direct contact between metal and food can degrade the food content, owing to this food-friendly coating are applied to safeguard the packaged food from corroding metal. The shifting the focus of Asia-Pacific packaging manufacturers from plastic to metal is expected to drive up the demand for metal packaging coatings for food cans. This is further projected to expand the market growth in the Asia-Pacific region. According to UACJ Corporation, between 2019 and 2022, global demand for aluminium used in cans will rise 11% to 6.61 million tons per year. Southeast Asian countries are likely to account for half of that demand, according to the report. Thus, rising demand for cans will accelerate the production for aluminium cans, which further benefits the metal packaging coatings demand.

Asia-Pacific Metal Packaging Coatings Market Segment Analysis – By Country

China dominated the Asia-Pacific Metal Packaging Coatings Market in terms of revenue with a share of 59% in 2021 and is projected to dominate the market during the forecast period (2022-2026). In China, the metal packaging coatings market is fueled by the growth of the country’s food & beverage sectors. For instance, according to the China Chain Store & Franchise Association, China’s food and beverage sector was valued at around US$ 595 billion in 2019, an increase of 7.8% in comparison to 2018. Metal cans offer a range of benefits such as better food protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging such as paper or plastic packaging. In August 2020, ORG technology, the Chinese manufacturer of food cans, launched its white paper on the strategic development of food cans. The company focused on coated iron metal cans with moisture-proof, environmental protection, safety, corrosion resistance, anti-extrusion, and other characteristics to gain traction in the market. In this way, such increasing food production along with the development of food cans in China, owing to its various benefits as mentioned above, is expected to increase the demand for metal packaging coatings to further enhance the durability of such food cans. This is expected to accelerate the growth of the market in China during the forecast period.

Schedule a Call

Asia-Pacific Metal Packaging Coatings Market Driver

Increasing Preference for Metal Containers in Food & Beverage Sector

Metal packaging coatings are primarily used to coat different metals such as steel, aluminum, tin-plate, and more that are used for food & beverage packaging in order to enhance its ability to resist corrosion. Metal containers offer a range of benefits such as better product protection, durability, sustainability, affordability, light-weight, and more in comparison to other types of packaging such as paper or plastic packaging. For instance, vegetables, fruits, pet food, soups, and meats are often packaged in metal cans. Canning foods help prolong their shelf life and can help people afford to make healthy dietary choices. Similarly, soda, beer, and even wine are usually packaged in aluminum cans since aluminum beverage cans are the most recycled category for aluminum products, with nearly 50 percent of all cans recycled annually. Thus, all of these benefits of metal containers are driving its demand over other types of packaging. As a result, many companies in the Asia-Pacific region have begun packaging their food & beverages in metal containers. For instance, in February 2021, Responsible Whatr, a brand based in India, launched spring water in aluminum beverage cans made by Ball Corporation, a leading manufacturer of aluminum packaging. The company intends to create a brand that signifies sustainability and become a significant contributor to the circular economy. In July 2020, Showa Aluminum Can Corporation (SAC), metal packaging manufacturer, launched its third aluminum can manufacturing facility in Vietnam with an overall plant capacity of 1.3 billion cans per year in order to meet the growing demand for metal packaging from the food & beverage sectors of the country. Thus, such increasing preference and use of metal containers in the Asia-Pacific region are expected to increase the demand for metal packaging coatings to further enhance the durability of the metal containers, thus, accelerating the growth of the market in the Asia-Pacific region.

Growing Demand from the Pharmaceutical Industry

Metal packaging coatings are primarily used in the pharmaceutical industry in order to provide protection to the metal from atmospheric corrosion and support decoration, labeling, and consumer information. Its range of benefits such as impermeability to light, moisture, gases, and water, durability, light-weight, and ease of printing labels directly onto the metal surface make them ideal for use in the pharmaceutical industry. Thus, an increase in pharmaceutical production in the Asia-Pacific region is expected to drive the market growth during the forecast period. According to Vietnam’s Ministry of Health, the pharmaceuticals industry is expected to grow at the rate of 10% per year from 2017 to 2028, owing to an increase in pharmaceutical production and sales in the country. Also, according to International Trade Administration, the local pharmaceutical production in Japan reached up to US$59,958 in 2017, US$62,570 in 2018, US$87,027 in 2019, and US$84,600 in 2020 respectively. thus, indicating an increase in pharmaceutical production in Japan per year. An increase in pharmaceutical production is expected to drive the demand for metal packaging coatings in the pharmaceutical industry, thus accelerating the growth of the market in the upcoming years.

Buy Now

Asia-Pacific Metal Packaging Coatings Market Challenges

Volatility of Raw Material Prices

Primary raw materials including resins, solvent, and more used in the production of metal packaging coatings are derived from crude oil. As a result, fluctuations in the prices of crude oil in the Asia-Pacific region may hinder the growth of the market. For instance, India’s Crude Oil Basket (COB) reached US$19.90 per barrel, which was the lowest record since February 2002. During the first 11 months of the year 2020-21, the average annual price of India’s COB was around US$42.72 per barrel, which decreased by 30% than the average COB price in 2019-20. Likewise, as per revised estimates for 2020-21, the COB has increased by around 35% from its initial budget estimate. Since October 2021, Vietnam has also witnessed a spike in demand for crude oil. According to the oil price, the price of light crude oil exceeded US$94.38 per barrel in February 2022, an increase of 3.63% that is equivalent to US$3.3, the highest record since November 2014. Similarly, the price of Brent crude oil also increased and reached up to US$95.39 per barrel, an increase of 1.98% which is equivalent to US$1.85.

Asia-Pacific Metal Packaging Coatings Industry Outlook

Technology launches, acquisitions, and R&D activities are key strategies adopted by players in the Asia-Pacific Metal Packaging Coatings Market. Asia-Pacific metal packaging coatings top 10 players include:

The Sherwin Williams Company

PPG Industries Inc.

AkzoNobel N.V.

Kansai Paint Co., Ltd.

Altana AG (Actega)

Henkel AG & Co. KGaA

Axalta Coating Systems Ltd.

Eason & Co.

Toyochem Co., Ltd.

Kangnam Jevisco Co., Ltd. and Others.

Recent Developments

In June 2021, AkzoNobel has invested in research and development activities associated with packaging coatings. The research is primarily focused on development of a new, and recyclable coating through use of bio-derived polyelectrolytes. These polyelectrolytes are 100% natural and are extracted from shrimp shells or waste from the wood processing industry. The versatility of natural polyelectrolytes will allow the company to become less dependent on synthesized polymers for packaging coatings.

In May 2021, ALTANA completed its acquisition of the closure materials business of Henkel group, a chemical and consumer goods manufacturing company with a strong regional presence in the Asia-Pacific region. Within the ALTANA Group, the business will be integrated into the ACTEGA division and globally assigned to the metal packaging solutions business line including the Asia-Pacific region. The main objective of this acquisition is to strengthen the company’s focus on innovative specialty chemicals.

In March 2021, Toyochem launched a new line of Bisphenol A non-intent (BPA-NI) internal coatings for metal beverage bottles and cans. These coatings are based on acrylic emulsion and polyester resins. The new BPA-NI internal sprays and coil coatings for stay-on tab (SOT) ends are specially formulated to achieve the required performance results, while addressing BPA-related health and food safety concerns from regulators and consumers in the Asia-Pacific region and worldwide.

#Asia-Pacific Metal Packaging Coatings Market#Asia-Pacific Metal Packaging Coatings Market Share#Asia-Pacific Metal Packaging Coatings Market Size#Asia-Pacific Metal Packaging Coatings Market Forecast

0 notes

Text

Cutting Payroll Taxes

President Trump has announced that he is going to pursue a stimulus to our economy to cope with its present decline resulting from the coronavirus and the oil war between Russia and Saudi Arabia. As part of his stimulus, he proposes a cut in payroll taxes—an extremely shortsighted and unwise decision, to say the least. Just listening to this recalls to my mind the words of the great French economist, Frederic Bastiat (1801-1850) in his discussion of “That Which is Seen, and That Which is Not Seen”:

“In the department of economy, an act, a habit, an institution, a law, gives birth not only to an effect but to a series of effects. Of these effects, the first only is immediate: it manifests itself simultaneously with its cause — it is seen. The others unfold in succession — they are not seen: it is well for us if they are foreseen. Between a good and a bad economist, this constitutes the whole difference — the one takes account of the visible effect; the other takes account both of the effects which are seen and also of those which it is necessary to foresee. Now this difference is enormous, for it almost always happens that when the immediate consequence is favorable, the ultimate consequences are fatal, and the converse. Hence it follows that the bad economist pursues a small present good, which will be followed by a great evil to come, while the true economist pursues a great good to come, — at the risk of a small present evil.”

Reducing payroll taxes to stimulate the economy is easy. It is popular and readily acceptable to those on the receiving end; but, from whence does the money come to pay our Social Security and Medicare? Does it come out of the air? I don’t think so, and I suspect neither do you. How about when the time comes to reinstate these tax cuts? How popular and readily acceptable will that be then? How much harder will it be for our Representatives and Senators in Congress to sell to the people?

Let us pursue this a little further. It is common knowledge that present payments into the fund are insufficient, and tax collections must be increased for the fund to remain solvent. How acceptable will that be? Now, when you add this increase to the reinstatement above, how much more difficult will that be to achieve? Are we just going to let our Social Security fund go broke?

But we are not only talking about Social Security. Also included in those payroll deductions are payments for Medicare. Although not frequently discussed, it too is common knowledge, i.e. everybody knows it or should, that Medicare is insufficiently funded. It is a major contributor to our annual government deficit and, therefore, national debt.

If our long-range intent is to keep and improve these benefits for the good of our people, it would seem to me that cutting these payroll deductions to stimulate an already over-stimulated economy (One should note that the preponderance of spending by our country and our people is supported by borrowing, i.e. national debt, credit cards, mortgages, student loans, auto financing, payday loans at 100% interest plus, etc.) is, to say the least, very unwise and short-sighted.

On the other hand, if we plan to eliminate Social Security and Medicare, this is the way to go. It’s a sure winner.

Hmm… This brings to mind the sayings of Forrest Gump. “You never know what you’re going to get when you open a box of chocolates,” I think he also said, “Stupid is as stupid does”.

Also, I am compelled to quote the famous words of William Shakespeare in his play Julius Caesar, when Caesar is warned by the soothsayer to “beware the Ides of March”.

Respectfully, From: Steven P. Miller @ParkermillerQ, gatekeeperwatchman.org Tuesday, June 11, 2024, Jacksonville, Florida., USA. Founder and Administrator of Gatekeeper-Watchman International Groups X ... @ParkermillerQ #GWIG, #GWIN, #GWINGO, #Ephraim1, #IAM, #Sparkermiller, #Eldermiller1981 Https://gatekeeperwatchman.org/post/751889961062744064/daily-devotionals-for-may-30-2024-proverbs-gods? MY GROUP ON FACEBOOK/META: https://www.facebook.com/groups/Sparkermiller.JAX.FL.USA

0 notes

Text

RECORD LOW GDP, RECORD HIGH STOCK MARKET - WHY SUCH DICHOTOMY

Empirically, stock market performance and broad macroeconomic trends have had a strong positive correlation. A couple of notable examples include the market crash of the 1930s following the period of the great depression and the crash of 2008 following the contagion impact of the global financial crisis. In 2020, the onset of the COVID-19 pandemic unleashed a similar sell-off in the global stock markets as countries worldwide initiated complete lockdown programs that further tormented the economy and devasted many livelihoods. The prolonged global lockdown dragged the world economy into recession with many countries experiencing massive GDP contraction.

Coronavirus Slump — 2020 Q3 GDP growth in select countries (in %)

With such an economic outlook unfolding, the bear traders would have jumped the gun and extensively shorted the stock market. Much to their surprise, they witnessed a one of its kind bull rally that took the global stock markets to record high levels.

Increase in Global Stock Markets (in %) from Mar’20 to YTD

The global stock markets witnessed an influx of unprecedented buying with most of the global indices achieving record-high levels. Stock markets within the Asian cluster delivered superior performance compared to their European counterparts. Certain indices witnessed 100%+ growth within 9 months. Massive upswings are common in individual scripts, but to see trillion-dollar market capitalization indices deliver such high growth is an addition to the anomalies list of the stock market. It’s evident that Macroeconomics doesn’t guide the markets rather its liquidity that sits on the driving seat.

What led to such unprecedented buying?

To shield the economy from the trickle-down effect of the pandemic-forced lockdown, global economies announced large-scale stimulus packages and ran budget deficits that…

Read More Here: https://www.acquisory.com/ArticleDetails/83/Record-low-GDP_-Record-High-Stock-Market--Why-such-dichotomy

0 notes

Text

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic is foremost a public health crisis. Originating from Wuhan, China, the novel coronavirus (SARS-CoV-2) quickly spread globally, leading to millions of infections and deaths. The scale of the outbreak overwhelmed healthcare systems worldwide, exposing significant gaps in public health infrastructure and preparedness.

One of the most critical impacts has been the strain on healthcare systems. Hospitals and clinics were inundated with COVID-19 patients, leading to shortages of beds, ventilators, personal protective equipment (PPE), and medical staff. Non-COVID-19 medical care was often postponed, resulting in delayed treatments for other diseases and conditions. Moreover, the pandemic underscored the importance of robust health surveillance systems, timely data sharing, and international cooperation in managing global health threats.

The development and distribution of vaccines marked a turning point in the pandemic. Within a year of the virus's emergence, several vaccines received emergency use authorization. However, vaccine distribution revealed stark inequities between high-income and low-income countries, highlighting the need for global strategies to ensure equitable access to life-saving interventions.

Economic Impact

The economic repercussions of the COVID-19 pandemic are vast and enduring. As governments imposed lockdowns and social distancing measures to curb the virus's spread, businesses faced unprecedented disruptions. The International Monetary Fund (IMF) estimated that the global economy contracted by 3.5% in 2020, marking the worst peacetime recession since the Great Depression.

Small businesses and sectors reliant on face-to-face interactions, such as hospitality, travel, and retail, were particularly hard-hit. Millions of jobs were lost, and many businesses were forced to close permanently. Unemployment rates soared, and workers in informal sectors or without social safety nets faced dire economic circumstances.

Governments worldwide implemented various fiscal and monetary measures to mitigate the economic impact. Stimulus packages, unemployment benefits, and small business loans were deployed to support individuals and businesses. Central banks cut interest rates and launched quantitative easing programs to stabilize financial markets. These measures provided temporary relief but also contributed to increased public debt and concerns about long-term economic stability.

The pandemic also accelerated the digital transformation of the economy. Remote work, e-commerce, and digital payments saw significant growth as businesses and consumers adapted to new realities. This shift has long-term implications for the future of work, business models, and economic resilience.

Impact on Education

The COVID-19 pandemic caused unprecedented disruptions in education systems worldwide. At the peak of the pandemic, over 1.6 billion students in more than 190 countries were affected by school closures. The rapid shift to remote learning exposed and exacerbated existing educational inequalities.

Access to technology became a critical factor in determining students' ability to continue their education. Students from low-income families, rural areas, or countries with inadequate digital infrastructure faced significant challenges in accessing online learning. The digital divide widened, with disadvantaged students falling further behind their peers.

Teachers and educational institutions had to adapt quickly to new teaching methods and technologies. The transition to online learning required significant investments in digital tools, training, and support for both educators and students. While some schools successfully implemented remote learning, others struggled, leading to a varied educational experience.

The long-term impact on students' academic progress and social development remains a concern. Prolonged school closures and remote learning disrupted traditional learning environments, affecting students' academic performance, mental health, and social interactions. Addressing these learning gaps and providing support for students' well-being will be crucial in the post-pandemic recovery phase.

Mental Health Impact

The COVID-19 pandemic has had a profound impact on mental health globally. The uncertainty, fear, and stress associated with the virus, coupled with social isolation and economic hardships, have led to a significant increase in mental health issues.

Anxiety, depression, and stress-related disorders became more prevalent during the pandemic. Health care workers, individuals who lost loved ones, and those facing financial difficulties were particularly vulnerable. Social isolation, a necessary measure to contain the virus, exacerbated feelings of loneliness and mental distress.

The pandemic also highlighted the importance of mental health services and the need for accessible mental health care. Telehealth services expanded rapidly to meet the growing demand for mental health support. However, barriers such as lack of internet access, stigma, and limited resources in many regions remain challenges to providing comprehensive mental health care.

Addressing the mental health impact of the pandemic requires a multi-faceted approach, including increasing funding for mental health services, raising awareness, and integrating mental health support into primary care and community services.

Societal and Behavioral Changes

The COVID-19 pandemic has led to significant societal and behavioral changes, some of which may have long-lasting effects. Social distancing measures, mask-wearing, and hand hygiene became integral parts of daily life. These practices have influenced social norms and behaviors, potentially reshaping how individuals interact in the future.

Public spaces, workplaces, and social gatherings were redefined by the need for safety and hygiene. The design and use of public and private spaces adapted to accommodate social distancing and reduce the risk of transmission. Remote work and telecommuting became the norm for many, leading to changes in work culture and expectations.

The pandemic also fostered a sense of community and solidarity in many places. People came together to support frontline workers, help vulnerable populations, and contribute to relief efforts. However, it also exposed and sometimes exacerbated societal divisions, including disparities in health care access, economic inequality, and political polarization.

The pandemic has accelerated the adoption of technology in various aspects of life, from telemedicine and online education to virtual socializing and e-commerce. These technological shifts are likely to persist, influencing how people work, learn, and connect in the future.

Environmental Impact

The COVID-19 pandemic had a temporary positive impact on the environment, as lockdowns and reduced economic activity led to a significant decrease in pollution and greenhouse gas emissions. Cities experienced improved air quality, and wildlife sightings became more common in urban areas.

However, these environmental benefits were short-lived, as emissions and pollution levels rebounded with the resumption of economic activities. The pandemic highlighted the complex relationship between human activity and the environment, emphasizing the need for sustainable practices to address long-term environmental challenges.

The pandemic also influenced global discussions on climate change and sustainability. The unprecedented global response to the pandemic demonstrated the possibility of coordinated action in the face of a global crisis. This has implications for how the world might tackle other pressing issues, such as climate change, through collective effort and innovation.

0 notes

Text

In Djibouti, kiosks are being used as part of a stimulus plan to help the country’s economy stay afloat in the face of the coronavirus pandemic. Kiosks are used to distribute a range of goods such as food, medication, and other essential items to citizens quickly, easily, and safely. At kiosks, customers can conveniently transact and make payments, resulting in a boost in local businesses.

This form of stimulus allows people to be able to access key goods at a minimal cost, creating more spending power for the citizens. Kiosks can also be key in supporting small businesses in the country. Through the use of kiosks, small businesses are able to keep operating, without having to worry about potential losses due to physical distancing.

The money that is being directed to implement the kiosks-as-stimulus plan also helps provide employment during the crisis. It provides jobs to people who are working to design, build, and staff the kiosks. This has direct benefits for the families and the communities of the employed workers.

Additionally, kiosks as a stimulus plan can create more opportunities for businesses, which in turn helps stimulate the economy as the population rises. It helps small businesses grow, by allowing more consumers to access their services.

Kiosks have many advantages in Djibouti’s current situation. They serve as a convenient, cost-effective, and safe way to provide goods to its people and help stimulate the economy.

0 notes