#construction insurance

Explore tagged Tumblr posts

Text

HOW TO CHOOSE AN HVAC CONTRACTOR

Not all contractors are equal. Before hiring an HVAC contractor, research to ensure you get a professional, competent worker. You want the best for your clients, so choose the right person for the job. Here are some useful tips

0 notes

Text

Key Benefits of Construction Insurance for Contractors

The construction industry is synonymous with dynamism, innovation, and progress. Yet, it also carries inherent risks and uncertainties that contractors must navigate daily. Amidst the hustle and bustle of project sites, contractors encounter challenges ranging from workplace accidents to property damage, highlighting the need for robust risk management strategies.

Construction insurance emerges as a vital safety net, offering contractors financial protection and peace of mind. This enables contractors to protect their businesses, projects, and employees against unforeseen risks and liabilities, ensuring that they can operate safely, efficiently, and successfully in today's dynamic construction industry.

Protection Against Property Damage

Construction projects often involve working with valuable property, equipment, and materials. Damage to property or equipment can occur due to accidents, vandalism, theft, or natural disasters, leading to significant financial losses and project delays.

Construction insurance provides coverage for property damage, including repairs or replacements for damaged property, equipment, and materials. This protection helps contractors mitigate the financial impact of property damage incidents. It ensures that projects can proceed smoothly and on schedule.

Coverage for Completed Operations

Even after a construction project is completed, contractors may still face liabilities and risks related to their work. If defects or errors in construction lead to property damage or personal injury after the project is finished, contractors may be held liable for damages. Construction insurance provides coverage for completed operations, protecting contractors against claims and lawsuits arising from faulty craft, design defects, or other errors or omissions in construction.

Compliance with Contractual Requirements

Many construction contracts and agreements require contractors to carry specific types and levels of insurance coverage as a condition of participation. By carrying construction insurance, contractors ensure compliance with contractual requirements and avoid potential disputes or penalties for non-compliance.

Peace of Mind and Risk Management

Perhaps the most significant benefit of construction insurance for contractors is the peace of mind it provides. Knowing that they have comprehensive coverage in place to protect their businesses, projects, and employees allows contractors to focus on their work with confidence and peace of mind. Construction insurance helps contractors manage risks effectively, minimise financial exposure, and navigate the complexities of the construction industry with greater resilience and security.

If you are looking for trusted advisers and brokers to help you manage construction or merger and acquisition insurance, then 4Sight Risk Partners is for you. With over 75 years of experience in risk and insurance products in Australia, we have helped provide practical and realistic solutions to countless businesses in the country. Visit www.4sightrisk.com.au/ if you have inquiries about our services.

0 notes

Text

Professional Liability Insurance For Small Businesses

Pamphile Insurance Brokerage LLC specializes in providing professional liability insurance for small businesses. Professional liability insurance, also known as errors and omissions insurance, is crucial for protecting small businesses from negligence or inadequate work claims. As a small business owner, it is essential to understand the risks associated with your industry and to have proper insurance coverage in place. This blog will discuss the importance of professional liability insurance for small businesses and how Pamphile Insurance Brokerage LLC can help you find the right coverage to protect your business.

1. Understanding Professional Liability Insurance

Professional liability insurance safeguards businesses and individuals from potential legal and financial repercussions. Also known as Errors and Omissions (E&O), insurance protects against claims arising from alleged mistakes, negligence, or inadequate work. This coverage is particularly relevant for professionals offering services or advice, such as doctors, consultants, and architects. It covers legal costs, settlements, or judgments arising from claims, preserving reputation and financial stability. Comprehending this insurance ensures informed decisions, mitigating potential liabilities and offering peace of mind while conducting professional activities.

2. The Importance of Professional Liability Insurance for Small Businesses

Professional liability insurance is indispensable for small businesses. It shields them from the financial repercussions of errors, omissions, or negligence in their professional services. With the modern litigious landscape, even minor mistakes can result in costly lawsuits that jeopardize a business’s survival. This coverage covers legal fees, settlements, and damages, safeguarding a company’s assets and reputation. Furthermore, it inspires trust among clients, demonstrating a commitment to quality and accountability. Small businesses must recognize that professional liability insurance is an investment in their long-term viability and peace of mind.

3. How to Determine if your Small Business Needs Professional Liability Insurance

Determining if your small business needs professional liability insurance is vital for safeguarding your operations. Evaluate your industry’s risk factors, considering potential errors, negligence, or omissions that could lead to lawsuits. If your business provides clients services, advice, or expertise, the likelihood of liability claims increases. Assess your exposure to client dissatisfaction, financial losses, or legal disputes arising from your work. Additionally, analyze contract requirements; some clients may mandate this coverage. Professional liability insurance protects against costly legal expenses and damages, even if not mandatory. Careful consideration ensures your business is well-protected and resilient.

4. Choosing the Right Coverage and Provider for your Business

Selecting the appropriate coverage and provider for your business insurance is pivotal. Careful consideration ensures tailored protection against potential risks and liabilities—comprehensive coverage guards against unforeseen events, safeguarding assets, employees, and operations. A suitable provider offers competitive rates, reliable customer service, and swift claims processing. A well-matched insurance plan alleviates financial burdens, fostering business continuity in the face of challenges. Thorough research and consultation with insurance professionals enable informed decisions that fortify your business’s resilience, providing the confidence to navigate uncertainties and thrive in your industry.

5. Claims and Coverage Options for Professional Liability Insurance

Professional liability insurance provides a substantial impact through its comprehensive claims and coverage options. It is designed for professionals to shield against claims arising from errors, omissions, or negligence in their services. The coverage ensures legal defense costs, settlements, or judgments, safeguarding financial stability. Tailored coverage options accommodate specific industries and risks, including legal, medical, and consulting fields. This insurance fosters client trust by showcasing a commitment to quality service. It also shields reputation, which is crucial in today’s competitive market. By alleviating financial burdens from lawsuits, professional liability insurance empowers professionals to focus on their expertise and maintain a secure business trajectory.

Conclusion

Pamphile Insurance Brokerage LLC provides reliable and comprehensive professional liability insurance for small businesses. Our team of experienced professionals understands the unique risks that small businesses face and can tailor a policy to meet your specific needs. Don’t leave your business vulnerable to potential lawsuits and financial losses. Contact us today to discuss how we can protect your interaction with our professional liability insurance.

Contact Us:

Address: 70 East Sunrise Highway Suite 500 Valley Stream, New York 11581

Email: [email protected]

Phone: 5163738461

Website: Pamphile Insurance Brokerage LLC

Blog: Professional Liability Insurance For Small Businesses

#health insurance#home insurance#insurance#business liability insurance#life insurance#construction insurance#homeowners insurance

1 note

·

View note

Text

0 notes

Text

0 notes

Text

General Contractors Insurance

At PBIB, our knowledge of the products and the marketplace we serve is unparalleled. As former contractors, we know the construction industry from the ground up

Trust PBIB for comprehensive construction insurance solutions. With a deep understanding of the construction industry, we've got you covered.

Construction projects come with their fair share of risks and uncertainties. As a construction professional, you know that securing the right insurance is crucial for safeguarding your business and projects. Pascal Burke Insurance Brokerage Inc (PBIB) is your go-to source for construction insurance, offering unparalleled expertise and tailored solutions to protect your interests.

Understanding the Construction Industry Inside Out At PBIB, we don't just sell insurance; we live and breathe the construction industry. Our team consists of former contractors who have worked in the field, giving us an insider's perspective on the challenges and unique risks that construction businesses face. This in-depth knowledge allows us to provide construction insurance that is not only comprehensive but also specifically tailored to the industry.

A Comprehensive Range of Construction Insurance

We offer a wide range of construction insurance options to suit your needs:

Builders Risk Insurance: Protect your construction projects from unforeseen events such as fires, theft, and natural disasters.

General Liability Insurance: Safeguard your business from liability claims, accidents, and injuries on your construction sites.

Contractor's Equipment Insurance: Ensure your valuable equipment is protected, reducing downtime in case of damage or theft.

Surety Bonds: Get the necessary bonding to secure contracts and establish trust with your clients.

Professional Liability Insurance: Protect your business from claims related to errors or omissions in your professional services.

Tailored Solutions for Your Unique Needs

No two construction businesses are the same, which is why we work closely with our clients to design insurance solutions that meet their specific requirements. Whether you're a general contractor, subcontractor, or specialty contractor, we have the expertise to guide you in choosing the right coverage.

Why Choose PBIB for Construction Insurance?

Industry Expertise: As former contractors, we know the construction industry from the ground up.

Customized Solutions: We tailor our insurance options to meet the unique needs of your construction business.

Exceptional Service: Our team is committed to providing top-notch service and support throughout your policy term.

Marketplace Knowledge: Our knowledge of the insurance marketplace ensures you get the best coverage at competitive rates.

Claims Assistance: We're there for you in the event of a claim, guiding you through the process and ensuring a fair outcome.

When it comes to securing the right insurance for your construction business, Pascal Burke Insurance Brokerage Inc stands out as a trusted partner with unparalleled industry knowledge. To explore our construction insurance options further, visit our website at https://pbibins.com/.

Address: 2102 Business Center Drive, Ste. 280 Irvine, CA 92612

Call: (877) 893-7629

#Pascal burke insurance brokerage inc#Construction insurance#Commercial insurance#Contractor insurance#Glazing contractors#Landscape contractors#Refrigeration contractors#Painting contractors

0 notes

Text

#brandon scott#francis scott key bridge collapse#baltimore mayor#racist attacks#diversity equity inclusion#wes moore#baltimore politics#political criticism#city leadership#baltimore community#urban challenges#racial discrimination#political backlash#community activism#baltimore bridge collapse#infrastructure disaster#francis scott key bridge#construction accident#rescue operations#salvage effort#port of baltimore#supply chains#federal government#reconstruction cost#insurance claims#liability

53 notes

·

View notes

Text

Top Benefits of Combining Builder Risk and Commercial Property Liability Insurance

Combining Builder Risk and Commercial Property Liability Insurance can provide a comprehensive coverage solution for construction projects. Builder Risk Insurance covers property damage and theft during construction activities, while Commercial Property Liability Insurance protects against lawsuits from third parties for injuries or property damage.

One of the top benefits of combining these two insurance types is cost savings. By bundling both policies together, construction companies can often secure a discounted premium compared to purchasing them separately. This can result in significant savings for businesses, especially for larger projects that require extensive coverage.

Another key benefit is streamlined claims handling. When both Builder Risk and Commercial Property Liability Insurance are combined, any claims that arise during the construction process can be handled more efficiently. This reduces the risk of gaps in coverage and ensures a seamless claims process for the insured.

Additionally, combining these two insurance types provides broader coverage for construction companies. Builder Risk Insurance typically covers physical damage to the project site, materials, and equipment, while Commercial Property Liability Insurance protects against bodily injury and property damage claims from third parties. By having both types of coverage in place, construction companies can be better protected against a wide range of risks.

Furthermore, combining Builder Risk and Commercial Property Liability Insurance can help construction companies meet contractual requirements. Many construction projects require contractors to carry both types of insurance, so having a combined policy can make it easier to comply with contract specifications and secure new business opportunities.

In Ontario, Commercial Liability Insurance is a vital component of any construction project. This type of insurance provides coverage for bodily injury, property damage, and personal injury claims that may arise during the construction process. By combining Commercial Liability Insurance with Builder Risk Insurance, construction companies in Ontario can ensure they have a comprehensive risk management strategy in place.

Overall, the benefits of combining Builder Risk and Commercial Property Liability Insurance for construction projects are numerous. From cost savings to broader coverage and streamlined claims handling, this insurance solution offers a holistic approach to risk management for construction companies. By partnering with a knowledgeable insurance provider, construction companies can tailor a policy that meets their specific needs and provides peace of mind throughout the duration of their projects.

#Construction Insurance#Commercial Property Liability Insurance#Commercial Liability Insurance Ontario#Builder Risk Insurance Coverage

0 notes

Text

going to the doctor today I hope he doesn't ritualisticly kill me

#also i have to drive to the farther office cause the one i usually go to you cant get to cause of the construction#which does suck but thats ok#i dont get to drive that way often and its kinda a weird area#not very built out so theres pretty flowers#im gonna bring my jean plush cause im nervous#we're probably gonna plan the date for my spinal cord stimulator trial#although idk#insurance hasnt gotten back to me yet 😬

7 notes

·

View notes

Text

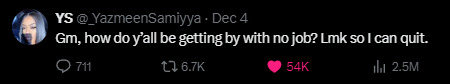

if anyone got tips pls share with the group 🫶🫶🫶🫶

#i've had enough 🫶🫶🫶🫶🫶🫶🫶🫶#i'm not getting paid enough to deal w these people's bullshit#just applied to 2 jobs that look solid#& those are the first 2 in WEEKS btw that didn't seem like fucking disasters#1 is mostly for the hybrid opportunity & bc they got ALL the insurances#the other is bc it's downtown montreal (<3) and a cause i'm passionate about - be great to do some MEANINGFUL work#seems like there's a shortage of *decent* job opportunities in my field lately#and idk how i'm getting less callbacks now that i HAVE experience as opposed to when i didn't ???#weird.#anyway.#i'm pissed off this week cause they're crossing my boundaries more and more here & also this garbage weather#FUCKING SNOW#FUCKING HAVING TO SHOVEL AND CLEAN MY CAR BEFORE I CAN DRIVE HOME#FIRST THE CONSTRUCTIONS AND TRAFFIC THEN IT WAS DONE I HAD 3 DAYS OF PEACE AND NOW THIS#LESS AND LESS TIME TO ACTUALLY REST AT HOME BEFORE I GOTTA COME BACK HERE AND DO IT ALL OVER AGAIN#MAN I REALLY FUCKING HATE IT HERE#so yea anyway 🤠😁#anybody got tips to make quick easy money? pls help. lol#i need to start my freelancing business fr fr i just don't feel like i'm creative enough to come up w something lucrative#like i'm making a little money on the side rn but it's def not enough to be a side hustle#i'm just so sick of having to apply to jobs and do interviews and sell myself and working for nasty ass people#yesterday they invited me again to their dumbass christmas party. brother i am not going to your fuckass 60+ y.o. foreign ppl dinner#there is NO one my age and EVERYONE speaks ur language that i dont understand. i'm not spending a second more than required with y'all#AND LIKE 90% OF THEM ARE MEN LIKE. EW. FUCKING EW. NO#i swear if they pressure me one more time or ask me again why i'm not going i'm gonna snap#you are NOT entitled to ANY information about me or my personal life or my reasons why i don't wanna do certain things#i'm here to GET MY MONEY and GO#i can't wait to quit.#**

2 notes

·

View notes

Text

Yes, it is possible for a small business to pay for your health insurance. Many small businesses choose to offer health insurance as part of their employee benefits package to attract and retain talent. However, the rules and regulations around offering health insurance as a small business can be complex and may vary depending on your location and the size of your business.

#home insurance#health insurance#insurance#homeowners insurance#construction insurance#life insurance

0 notes

Text

lol i got my annual visa summary for 2023 and ive decided to overthrow the government

#my health insurance is 15600 per year. just for me. nobody else.#i spent an additional 18000 on medical expenses anyway. lol. fucking lmao#doctor copays. testing. 19 different medications.#the one 'vanity' expense were my contacts which were like $800 but god. fucking GOD.#guillotine construction must begin immediately

9 notes

·

View notes

Note

What do you do for work

i just got hired as a SCENIC CARPENTER!! building backdrops and set pieces and such for a professional theater company in my city 💕 every day i come home i am so sore and so bruised and so dirty sweaty yucky and i love it so much

#apparently its not community theater because the actors are paid i learned this recently#its a BIG DEAL PROFESSIONAL THEATER where they have things like PAYROLL and HEALTH INSURANCE#and i am so crazy unqualified bc i did not do any theater stuff in college i have never worked in theater or this kind of construction#the closest ive got is i went to trade school for fine woodworking so i know my way around power tools and can build a table#but i did some part time work there and they liked my work ethic so so much that they're willing to train me to catch me up to pace#even though they WANTED to hire someone that already had a background in theater. slays to slay 💕#i was just irresistible i guess who knows.#ask#anon

20 notes

·

View notes

Text

.

#called my mom at 7am out of a desperate need for validation#had a 37 minute long convo that amounted to ‘you should look into therapy’#(in a much nicer and more constructive way it was actually a very good conversation’#and she told me that she’s been in therapy for the last year#and that it did wonders for her mental health#and that she went from being on the verge of divorce#to looking forward to spending her retirement with my dad and expanding her home business to cover health insurance#since my dad is currently unemployed and most likely isn’t getting another job (industry and & age related reasons)#and ofc I’m glad to hear that they’re doing better#but I’m wondering if she got thru everything she needed to in therapy#and if she’s sorry about last winter#when for two days in a row she screamed at me for hours on end#about what a failure I am and how much I’m a drag on the family#how I was responsible for their impending divorce#and she was going to gift my dad divorce papers for Christmas and it would be my fault#how I looked like a clown at my recent graduation#and a bunch of other things#if she’s sorry for how every year since I was 14 she’s screamed at me about how I’m responsible for their being on the rocks#how it’s my fault my siblings will grow up in a broken family and we’ll have to sell the family house of 25 years to pay for the divorce#for when in April 2020 she tried to [redacted] herself in front of me while telling me it was my fault and I’d pushed her that far#all while I whisper-screamed for her to stop bc it was midnight and my siblings weee sleeping in the next room#she has never apologized for any of those and I don’t want to bring it up now#bc I don’t want to relive the past#but I wonder#mother mention cw#negativity cw#divorce cw

13 notes

·

View notes

Text

feel like some people need to understand that just bc a word is used as part of a diagnostic label / criteria in the dsm doesn’t mean it doesn’t have like. meaning outside of that

#too tired to explain fully but like.#the word ‘narcissist/narcissistic’ does not just have to solely refer to people with NPD. the word existed way before it was a diagnosis#same with anxious/depressed/obsessive/etc.#like I get the frustration with not wanting people to use words that don’t apply to them#but let’s not act like diagnoses themselves aren’t like. completely socially constructed and subjectively decided categories#designed to make it easier for drug and insurance companies to bill people#like that’s literally it#like yes reduce the stigma#but also maybe let’s do away with this diagnostic purity shit altogether. idk

11 notes

·

View notes

Text

📚

#they’re hiring for a librarian assistant at my local library#I fit all of the qualifications#they don’t need past experience#it’s in MY town and not the next town over where the main route will be under construction for at least a year#it’s a small pay cut but also like a quarter of the distance (only half the time because city vs highway)#and benefits#which I do not get at my current job#(they’re talking offering insurance at my job but I sincerely believe it’s gonna screw over so many employees)#anyway#I’m not like…invested?#it’s just a thing?#so I’m thinking I might apply just to say I did and see what happens?#the problem is I don’t love my job but I love the people and I love having value#like that’s what I need in a job#I need to know I’m needed and liked and on occasion I need someone to laugh at my stupid jokes#and that’s hard to find#guess what I’ll be doing tomorrow instead of browsing Zillow listings for South Dakota

25 notes

·

View notes