#compliance consulting firms

Explore tagged Tumblr posts

Text

Regulatory Compliance in 2024: A Comprehensive Guide for SMEs

Discover how SMEs can navigate 2024's regulatory changes with effective compliance strategies. Learn about recent updates, governance, and leveraging freelance consultants. Go here https://buymeacoffee.com/regulatoryrisks/regulatory-compliance-2024-a-comprehensive-guide-smes

#hire compliance consultants#compliance consulting firms#hire regulatory compliance experts#hire a freelance compliance consultant#legal services#law

0 notes

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

Advisory Service in uae

Navigate the complexities of business with LGA Auditing, your trusted partner for advisory services in the UAE. Our experienced team offers tailored solutions to help your business grow and succeed.

Our services include:

1. Financial Advisory: Optimize your finances with expert guidance. 2. Business Setup Consulting: Seamless company formation in UAE. 3. Tax Advisory: Stay compliant with UAE tax regulations. 4. Risk Management: Mitigate risks and ensure long-term success.

Whether you're a startup or an established enterprise, we provide strategic insights to make informed decisions.

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

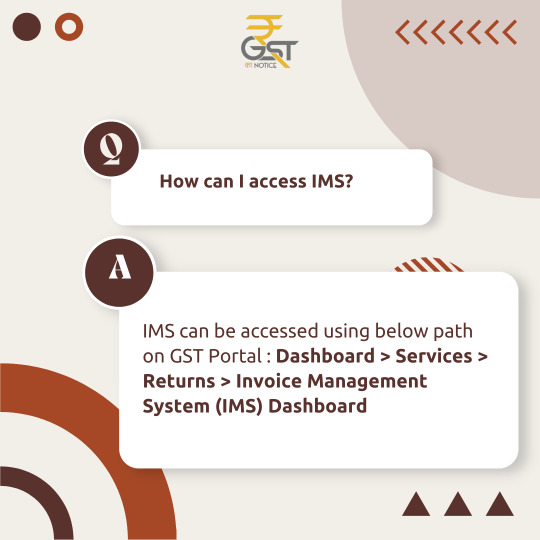

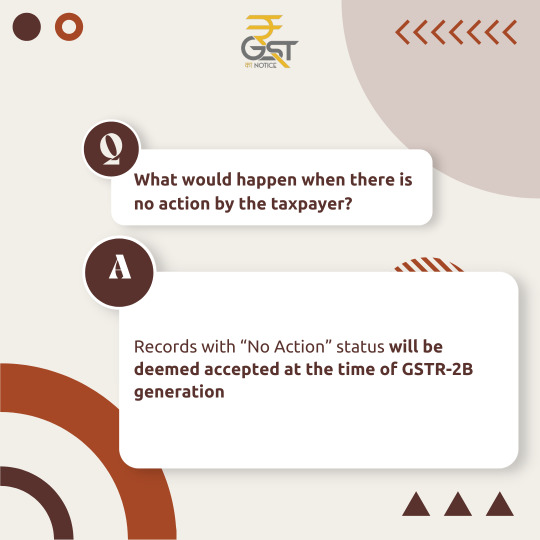

FAQs on Invoice Management System (IMS)... Find your information... For any assistance visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstindia #gstn #gstfact #gstupdates #ims #gstreturn #gstregistration #gstnotice #cbic #dggi #ca #tax #taxlaw #indirecttax #finance #business #budget #gstcouncil #gstcouncilmeeting

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#corporate lawyer in india#gst#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gst services in india#gst services#gstreturns#gst registration#tax#taxation#gstfiling#gst compliance#ims#invoice management system#faq

0 notes

Text

The Role of Accounting Firms in Abu Dhabi in Supporting Startups and SMEs

Abu Dhabi, the capital of the UAE, has become a vibrant hub for startups and small to medium-sized enterprises (SMEs). With its strategic location, supportive government policies, and growing investment landscape, the city offers numerous opportunities for new businesses. However, navigating the complexities of finance, compliance, and taxation can be daunting for entrepreneurs. This is where Accounting firms in Abu Dhabi play a crucial role. Let’s explore how these firms support startups and SMEs in their journey to success.

1. Providing Financial Guidance

One of the primary roles of accounting firms is to provide financial guidance to startups and SMEs. These firms help entrepreneurs understand their financial health by offering insights into cash flow management, budgeting, and financial forecasting. With accurate financial data, businesses can make informed decisions and plan for future growth.

2. Tax Compliance and Planning

Navigating tax regulations in the UAE can be complex, especially for new businesses. Accounting firms in Abu Dhabi assist startups and SMEs with tax compliance, ensuring they meet all local regulations. They also provide strategic tax planning advice, helping businesses minimize their tax liabilities while remaining compliant with the law. This is particularly important with the introduction of VAT and other tax measures in the UAE.

3. Bookkeeping Services

Maintaining accurate financial records is vital for any business, but startups and SMEs often lack the resources to manage this effectively. Accounting firms offer comprehensive bookkeeping services, which allow business owners to focus on their core operations. Regular bookkeeping helps in tracking expenses, managing invoices, and preparing for audits.

4. Assisting with Business Setup

For startups, the process of setting up a business can be overwhelming. Accounting firms provide valuable assistance in this area, guiding entrepreneurs through the legal and financial requirements of establishing a company in Abu Dhabi. This includes obtaining the necessary licenses, understanding local regulations, and setting up accounting systems.

5. Financial Audits and Reviews

Regular financial audits are essential for businesses seeking investment or loans. Accounting firms conduct audits to ensure the financial statements are accurate and comply with regulations. For startups looking to attract investors, a clean audit can significantly enhance credibility and increase the chances of securing funding.

6. Advisory Services for Growth

As startups and SMEs grow, they face new challenges and opportunities. Accounting firms in Abu Dhabi provide advisory services that help businesses strategize for growth. This includes mergers and acquisitions, market entry strategies, and financial restructuring. Their expertise can be invaluable in navigating these complex decisions.

7. Facilitating Access to Funding

Access to capital is often a challenge for startups and SMEs. Accounting firms can assist in preparing financial projections and business plans that are crucial for securing funding from banks, venture capitalists, or angel investors. Their expertise in financial modeling can make a significant difference in how potential investors perceive a business.

8. Supporting Technology Integration

The rise of financial technology (fintech) has transformed the accounting landscape. Accounting firms in Abu Dhabi are increasingly incorporating technology into their services, helping startups and SMEs implement accounting software and automated solutions. This not only improves efficiency but also enhances the accuracy of financial reporting.

9. Networking and Connections

Many accounting firms have extensive networks that can benefit startups and SMEs. They can connect businesses with other professionals, potential clients, and investors, fostering valuable relationships that can drive growth. These connections are particularly beneficial in a city like Abu Dhabi, where networking can lead to new opportunities.

Conclusion

In a rapidly evolving business environment, the support of accounting firms in Abu Dhabi is invaluable for startups and SMEs. From financial guidance and tax compliance to business setup and growth strategies, these firms play a multifaceted role in helping businesses thrive. By leveraging their expertise, entrepreneurs can focus on what they do best — innovating and growing their businesses — while leaving the complexities of finance and compliance to the professionals. As Abu Dhabi continues to grow as a business hub, the partnership between startups, SMEs, and accounting firms will be essential for sustainable success.

#accounting firms#Abu Dhabi accountants#financial services#bookkeeping#tax services#audit services#payroll management#financial consulting#tax planning#business advisory#corporate finance#VAT services#accounting solutions#financial reporting#compliance services#CFO services#accounting software#SME accounting#forensic accounting#accounting outsourcing

0 notes

Text

#Environmental Due Diligence#environmental consulting firms#environmental compliance audit#environmental consultant#environmental consultants

0 notes

Text

Top Consultation and Services Firm in Gurgaon Delhi NCR NOIDA JAIPUR

Consultation Audit Services are essential for businesses aiming to uphold compliance with industry standards and enhance their operational effectiveness. These services involve skilled consultants performing comprehensive audits to assess an organization’s processes, financial health, or adherence to legal requirements. By pinpointing potential risks and providing practical solutions, consultation audit services help ensure that businesses remain compliant and function efficiently.

Key Advantages of Consultation Audit Services: Regulatory Compliance: Audits verify that businesses comply with regulations such as tax laws, labor standards, and industry-specific guidelines, thereby minimizing the risk of penalties and legal complications.

Operational Efficiency: Specialists identify workflow inefficiencies and suggest enhancements that can optimize processes, lower costs, and boost overall productivity.

Risk Management: These audits facilitate the evaluation of potential risks, including financial mismanagement or legal non-compliance, and propose strategies for their mitigation.

Customized Solutions: Each audit is tailored to address the unique requirements of the business, ensuring that the advice provided is both targeted and relevant.

Consultation audit firm services are crucial for any organization seeking to maintain compliance, improve efficiency, and manage risks effectively. By utilizing expert insights, businesses can navigate the competitive landscape with confidence.

#labor rights#epf#pf#india#esi#labour lawyers#payroll processing#Consultation Audit#Consultation Audit FIRM#Consultation Audit consultancy#Consultation Audit gurgaon#Consultation Audit noida#Consultation Audit delhi#Consultation Audit jaipur#labour#labour laws#labour law compliance

0 notes

Text

Corporate Compliance Consulting: Navigating Legal Challenges

Corporate compliance refers to the adherence to laws, regulations, standards, and ethical practices relevant to a business. It encompasses a wide range of activities, including ensuring legal and regulatory obligations are met, internal policies are followed, and ethical standards are upheld.

Importance of Compliance Consulting Services

In today’s complex regulatory environment, businesses face numerous compliance challenges. Compliance consulting services play a crucial role in helping organizations navigate these challenges by providing expert advice, developing compliance programs, and ensuring ongoing adherence to applicable laws and regulations.

Overview of the Article

This article explores the importance of corporate compliance, the role of compliance consulting firms, and how businesses can benefit from partnering with a compliance expert like LegalJini. We’ll delve into the challenges companies face, the services offered by compliance firms, and what the future holds for corporate compliance.

Understanding Corporate Compliance

Definition and Scope

Corporate compliance involves a set of internal policies and procedures established to ensure that a company adheres to legal and regulatory requirements. This includes areas such as data protection, financial reporting, environmental regulations, and employment law.

Key Compliance Areas for Businesses

Businesses must navigate a variety of compliance areas, including:

Financial Compliance: Adhering to accounting standards, tax regulations, and financial reporting requirements.

Data Protection Compliance: Ensuring the protection of personal and sensitive data in line with GDPR, CCPA, and other regulations.

Environmental Compliance: Meeting environmental laws and regulations concerning waste management, pollution control, and sustainable practices.

Employment Law Compliance: Adhering to labor laws, employee rights, and workplace safety regulations.

Regulatory Bodies Involved

Numerous regulatory bodies oversee corporate compliance, including:

Securities and Exchange Board of India (SEBI): Oversees securities market regulations.

Reserve Bank of India (RBI): Regulates banking and financial institutions.

Ministry of Corporate Affairs (MCA): Enforces company law and corporate governance standards.

Compliance Challenges

Common Compliance Issues

Businesses often face challenges such as:

Keeping Up with Regulatory Changes: Laws and regulations are constantly evolving, making it difficult for businesses to stay updated.

Complexity of Regulations: Navigating the intricate web of national and international regulations can be daunting.

Resource Constraints: Small and medium-sized businesses may lack the resources to manage compliance effectively.

Impact of Non-Compliance

Failure to comply with regulations can lead to severe consequences, including:

Fines and Penalties: Non-compliance can result in significant financial penalties.

Legal Action: Businesses may face lawsuits and legal challenges.

Reputational Damage: Non-compliance can harm a company’s reputation and customer trust.

Industry-Specific Compliance Challenges

Different industries face unique compliance challenges. For example:

Healthcare: Stringent regulations around patient data and privacy.

Finance: Strict financial reporting and anti-money laundering laws.

Manufacturing: Compliance with environmental and safety standards.

Role of Compliance Consulting Firms

What is a Compliance Consulting Firm?

A compliance consulting firm is a specialized service provider that helps businesses ensure they meet regulatory and legal obligations. These firms offer expertise in various compliance areas and provide tailored solutions to help companies mitigate risks.

Services Offered by Compliance Consulting Firms

Compliance consulting firms offer a range of services, including:

Risk Assessment: Identifying potential compliance risks and vulnerabilities.

Compliance Program Development: Creating and implementing comprehensive compliance programs.

Training and Education: Providing training sessions to educate employees on compliance requirements.

Audit and Monitoring: Conducting regular audits to ensure ongoing compliance.

The Importance of Tailored Compliance Solutions

Each business has unique compliance needs. A one-size-fits-all approach does not work in compliance. Tailored solutions are essential to address specific challenges and ensure that all regulatory requirements are met.

How to Choose a Compliance Partner

Factors to Consider When Choosing a Firm

When selecting a compliance consulting firm, consider the following factors:

Expertise: The firm should have a deep understanding of the regulatory landscape in your industry.

Experience: Look for a firm with a proven track record in providing compliance services.

Customization: Ensure the firm can offer tailored solutions that meet your specific needs.

Questions to Ask Potential Partners

Before partnering with a compliance firm, ask the following questions:

What is your experience in our industry?

Can you provide references from similar projects?

How do you stay updated on regulatory changes?

Evaluating Expertise and Experience

Evaluate the firm’s expertise by reviewing their case studies, client testimonials, and industry certifications. A firm with extensive experience in your industry is more likely to understand your unique compliance challenges and provide effective solutions.

Benefits of Hiring a Compliance Firm

Proactive Risk Management

Compliance firms help businesses proactively manage risks by identifying potential compliance issues before they escalate. This proactive approach reduces the likelihood of costly legal challenges and fines.

Cost-Effectiveness and Resource Optimization

Outsourcing compliance tasks to a specialized firm can be more cost-effective than managing them in-house. Compliance firms have the expertise and resources to handle complex compliance issues efficiently, allowing your business to focus on core operations.

Enhancing Corporate Governance

A strong compliance program enhances corporate governance by promoting ethical behavior, transparency, and accountability. Compliance firms help businesses establish robust governance frameworks that align with regulatory requirements.

The Future of Compliance Consulting

Trends in Corporate Compliance

The corporate compliance landscape is constantly evolving. Emerging trends include:

Increased Focus on Data Privacy: With data breaches on the rise, data privacy has become a top compliance priority.

Globalization of Compliance: As businesses operate across borders, they must navigate an increasingly complex global regulatory environment.

The Role of Technology in Compliance

Technology is playing a growing role in compliance. Automated compliance tools and software solutions help businesses manage compliance tasks more efficiently. These tools can monitor regulatory changes, conduct audits, and generate compliance reports.

The Growing Demand for Compliance Services

The demand for compliance consulting services is expected to grow as businesses face increasing regulatory scrutiny. Companies are recognizing the value of partnering with experts to ensure they meet their compliance obligations.

LegalJini: Your Compliance Partner

Overview of LegalJini’s Services

LegalJini offers comprehensive compliance consulting services tailored to meet the needs of businesses across various industries. Their team of experts provides solutions in areas such as data protection, financial compliance, and corporate governance.

Why Choose LegalJini?

LegalJini stands out as a trusted compliance partner due to their deep industry expertise, commitment to client success, and ability to deliver customized compliance solutions. Their proactive approach ensures that your business stays ahead of regulatory changes and mitigates compliance risks effectively.

Contact Information and Next Steps

To learn more about how LegalJini can help your business navigate compliance challenges, visit their website or contact their team for a consultation. Take the first step towards enhancing your compliance program today.

Conclusion

Corporate compliance is essential for businesses to operate legally and ethically. Compliance consulting firms play a crucial role in helping businesses navigate complex regulatory environments, manage risks, and enhance corporate governance.

0 notes

Text

Senior Managers and Certification Regime (SM&CR) | FCA Compliance | MEMA Consultants

The Financial Conduct Authority (FCA) introduced the Senior Managers and Certification Regime (SM&CR) in December 2019 to enhance accountability within FCA-regulated firms. This regime replaces the FCA's Approved Persons Regime, mandating firms to appoint Senior Management Functions (SMFs) and, if necessary, Certification Functions (CFs). SM&CR applies differently to Limited Scope, Core, and Enhanced firms, each with specific rules.

SMFs, typically the most senior individuals in a firm, must have Statements of Responsibility and meet fitness and propriety requirements, approved by the FCA. Certification Functions, assessed internally by firms, must be certified annually. All individuals within these roles must adhere to Conduct Rules, ensuring a high standard of individual behavior.

For more information, visit our page on the Senior Managers and Certification Regime.

#Senior Managers and Certification Regime#SM&CR#FCA compliance#Senior Management Functions#Certification Functions#Conduct Rules#FCA regulated firms#MEMA Consultants#accountability#regulatory compliance

0 notes

Text

The Role of Freelance Marketplaces in Assisting Global Cross-Border SME Businesses

Discover how freelance marketplaces help global SMEs with regulatory compliance. Learn about key benefits, popular platforms, and future trends in compliance consulting. Go here https://sharevita.com/read-blog/35238_freelance-marketplaces-in-assisting-global-cross-border-sme-businesses.html

#regulatory compliance consultants#regulatory compliance consultancy#risk management consulting firms#regulatory compliance consultancy marketplaces

0 notes

Text

Why Your Business Needs a VAT Consultant in Dubai

The subject of fixed taxes is very sensitive in the present world, especially when the companies are on the move. It has become a prerequisite to manage the organizations and to follow all the regulations since the implementation of Value Added Taxation (VAT) in United Arab Emirates in the year 2018. Currently, marketing in Dubai is one of the most developed in the region and businesses cannot afford large errors.

That is why accounting firms in Abu Dhabi become extremely important at this step. It is in this blog that we speak of the importance of VAT consultation in Dubai, why it is important to deal with a qualified agency in this field, and why this path is useful for your business.

1. Understanding VAT Regulations

Value Added Tax, or VAT is a consumption tax is levied upon the concept of value additions that transpire in the course of production or circulation. The normal VAT rate applied in the United Arab Emirates is 5 percent. However, that might sound easy; value-added tax laws are challenging to impose because they are couched in relative pecuniary flexibility, which changes with respect to the business, sector, and type of transaction.

Businesses that don't have a thorough understanding of local tax rules find handling VAT compliance to be a nightmare. The VAT consulting organizations situated in the United Arab Emirates are skilled at understanding the specifics of these laws. An accounting company in Abu Dhabi will assist your company in managing these complexities and staying up to date on any modifications or new decisions issued by the Federal Tax Authority.

2. Decreasing the Threat of Non-Compliance

Value Added Tax laws impose hefty fines, penalties, and occasionally even legal consequences for noncompliance. Missed deadlines and inaccurate VAT filing are just two examples of mistakes that will cost your business severely. Even small mistakes might result in significant financial loss and harm to your company's image.

By working with an accounting company in Abu Dhabi, you may reduce the risks of non-compliance in this regard. You will receive registration guidance, exact return preparation, and records that properly adhere to legal requirements from a group of tax professionals. In order for you to properly handle compliance issues and avoid missing any deadlines, they will also offer extra assistance. Your company will avoid costly errors and maintain a positive relationship with the FTA in this way.

3. Cash Flow Optimization

Maintaining appropriate cash flow is one of the key concerns and, in fact, the goal of any organization, and VAT has a significant impact on this. Consulting firms for VAT in Dubai assist you in optimizing your cash flow by suggesting effective VAT recovery strategies. This is crucial for a company that imports, exports or conducts substantial transactions.

They make sure your company is reporting VAT where it is due and that you are not overpaying. Additionally, the audit & assurance consultant UAE may help you organize your transactions to minimize your VAT duty and optimize recovery, which will improve the cash flow of your company.

4. VAT Strategies Tailored to Suit Your Business

A one-size-fits-all strategy for VAT compliance can be incredibly ineffective because every organization is different. Professional VAT consultancy in Dubai takes the time to understand your company's operations, sector, and unique requirements. Based on that information, it then offers customized solutions that are suited to the VAT needs of your business.

A reputable audit & assurance consultant in UAE will assist you in aligning your tax tactics with your business goals, regardless of how big or small your company is. This will include efficient supply chain management for VAT, efficient tax planning, and tailored solutions for international transactions.

5. Focus on Core Business Functions

It takes a lot of effort to manage VAT compliance internally, which takes resources from the main operation. It takes a lot of effort and experience to file VAT, understand the new rules, and guarantee that tax returns are accurate. In this situation, it is preferable to hire experts to handle the VAT compliance job rather than using your own internal resources so that you may concentrate on the expansion of your company.

All compliance issues, from filing returns to providing advice on complex tax issues, can be handled by these VAT consultants. You will no longer have to worry about VAT compliance, freeing you up to concentrate on market share growth, client acquisition, and innovation.

Conclusion

VAT compliance is a different story when it comes to companies in Dubai because it’s integral to be able to compete in the global market. Accounting firms in Abu Dhabi may help you remain compliant with all the tax regulations, avoid such expensive pitfalls and ensure business processes’ smooth running. Thus, the correct management of VAT, risk minimization, and increased cash flow is critical to sustain and develop your company in the context of the relatively high rate of competition in Dubai.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

Hire the Top Corporate Lawyer Services in Dubai

Are you looking for expert legal guidance for your business? Fawzia Mohammad Lawyers & Legal Consultancy offers premier corporate lawyer services in Dubai. From contract negotiations to compliance, our experienced team ensures your business thrives within the legal framework. Contact us today to know how we can help you.

#Dubai Legal Services#Corporate Lawyers#Business Legal Consultancy#Contract Negotiation#Compliance Solutions#Legal Framework#Business Guidance#Expert Legal Advice#Corporate Law Firm#Dubai Business Law#Legal Consultation

0 notes

Text

Company Liquidation Services in uae

LGA Auditing offers expert company liquidation services across the UAE, ensuring a smooth and compliant closure process. From document preparation to debt resolution, we handle every detail with precision. Trust us for hassle-free business liquidation in the UAE!

https://www.scribd.com/document/799230428/Company-Liquidation-Services-in-Dubai

#Auditing Firm Dubai#LGA Auditing UAE#Financial Audit Services#Tax Compliance Dubai#Internal Audits UAE#External Auditing Experts#Accounting and Auditing#VAT Audits Dubai#Corporate Audit Solutions#Risk Management Dubai#Financial Statement Audit#Audit and Assurance Dubai#Business Compliance Audits#Dubai Audit Consultants

0 notes

Text

tax consultants in Dubai

#bookkeeping services dubai#VAT Services in dubai#Tax consultants in Dubai#Accounting Services In UAE#Accounting Services In Dubai#Financial Advisory Firms in Dubai#Excise compliance in the UAE#tax consultants in Dubai

1 note

·

View note

Text

#Industrial Waste Management#stormwater pollution prevention plan#environmental consulting firms#environmental compliance audit#environmental consultant

0 notes

Text

https://aparajitha.com/

Expert Labour Law Compliance Services in India — Aparajitha

Aparajitha is a leading name in labour law compliance services across India. We offer a comprehensive suite of solutions to help businesses navigate the complexities of labour laws, ensuring adherence to regulations in all Indian states.

Here’s what sets Aparajitha apart:

Pan-India Expertise: Our team of experienced professionals possesses in-depth knowledge of labour laws across every Indian state.

Compliance Assurance: We help you stay compliant with all labour regulations, minimizing legal risks and penalties.

Streamlined Processes: We offer efficient and streamlined solutions to manage your labour law requirements.

Cost-Effectiveness: Our services are designed to be cost-effective, providing a high return on your investment.

Enquire today for a free consultation with Aparajitha’s labour law compliance experts. We’ll assess your specific needs and provide a customized solution to ensure your business stays compliant.

Enquire Now!

0 notes