#Financial Advisory Firms in Dubai

Explore tagged Tumblr posts

Text

tax consultants in Dubai

#bookkeeping services dubai#VAT Services in dubai#Tax consultants in Dubai#Accounting Services In UAE#Accounting Services In Dubai#Financial Advisory Firms in Dubai#Excise compliance in the UAE#tax consultants in Dubai

1 note

·

View note

Text

Best Accounting Firms in Abu Dhabi @0502510288

Accounting and Bookkeeping Company in UAE - We are one of the best Accounting firms in Abu Dhabi, Dubai UAE provides top finance vision etc. Even though there are numerous accounting firms all over Abu Dhabi, this guide for selecting the right partner for your financial management includes top organizations.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

#Bookkeeping services UAE#Accounting solutions UAE#Professional bookkeeping UAE#Financial record keeping UAE#Small business bookkeeping UAE#Accounting Firms Ajman#Bookkeeping Firms Ajman#Professional accounting services in Ajman#Online Bookkeeping Services UAE#Accounting Outsourcing Services in Ajman UAE#Accounting and Bookkeeping Ajman#Audit Firms Ajman#Audit period in the Ajman UAE#Financial statement audit importance in Ajman#IT support for small and medium scale industries in Ajman#IT Support Services in Ajman UAE#VAT consultation services in Ajman UAE#VAT Registration in Ajman UAE#VAT & Tax Registration Services in Ajman#VAT advisory services in Ajman Dubai#Tax Audit Services in Ajman UAE#Tally Software Solutions Ajman#Tally accounting services in Ajman UAE#Value Added Tax (VAT) in Ajman

0 notes

Text

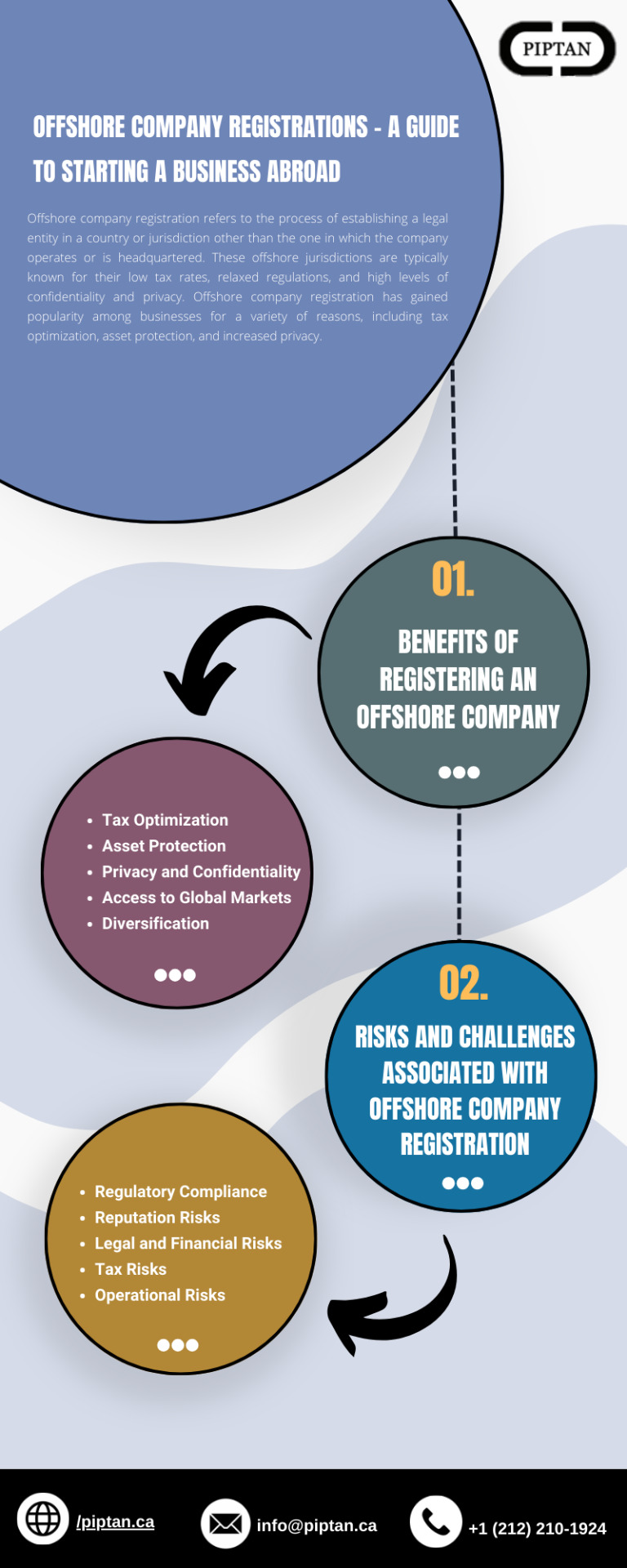

Offshore Company Registrations - A Guide to Starting a Business Abroad

Offshore company registration refers to the process of establishing a legal entity in a country or jurisdiction other than the one in which the company operates or is headquartered. These offshore jurisdictions are typically known for their low tax rates, relaxed regulations, and high levels of confidentiality and privacy. Offshore company registration has gained popularity among businesses for a variety of reasons, including tax optimization, asset protection, and increased privacy. The process of registering an offshore company typically involves hiring a professional service provider, such as a law firm or corporate services provider, to assist with the incorporation process. The service provider will typically guide the client through the process of selecting the most appropriate offshore jurisdiction, based on the client's specific needs and objectives, and then assist with the necessary documentation and filings to establish the company.

1 note

·

View note

Text

What to Expect from Your Tax Consultant in Dubai

Tax regulations in Dubai and the wider UAE can be complex, especially for businesses navigating the financial and legal frameworks of the region. This is where the expertise of tax consulting firms in Dubai becomes invaluable. These firms ensure businesses comply with local laws while optimizing their tax strategies. If you’re considering engaging a tax consultant, here’s a detailed guide on what to expect and why BDJ Consult can be your ideal partner.

The Role of Tax Consulting Firms in Dubai

Ensuring Compliance with UAE Tax Regulations

One of the primary roles of a tax consulting firm is to ensure that your business complies with the UAE's tax laws. This includes adherence to Value Added Tax (VAT) regulations, corporate tax compliance, and international tax treaties. Consultants provide detailed guidance to ensure you meet filing deadlines and avoid penalties.

Providing Strategic Tax Planning

Tax consultants help businesses reduce their tax liabilities by offering strategic advice. They evaluate your business structure, income streams, and financial practices to identify opportunities for tax savings, ensuring that you’re not paying more than necessary.

Managing Tax Audits and Disputes

If your business is subject to a tax audit, a professional tax consultant will act as your representative. They prepare all necessary documentation, liaise with tax authorities, and resolve any disputes, minimizing risks and disruptions to your operations.

Key Services Offered by Tax Consulting Firms in Dubai

VAT Registration and Compliance

VAT, introduced in 2018, requires businesses in Dubai to register, file returns, and maintain accurate records. Tax consultants assist with VAT registration, filing periodic returns, and maintaining compliance with all related regulations.

Corporate Tax Advisory

With the UAE implementing corporate tax, consulting firms provide advice on structuring business activities to optimize tax outcomes. They help assess the impact of tax laws on profits, dividends, and inter-company transactions.

International Taxation

For businesses operating across borders, international taxation can be a challenge. Consultants provide insights into double taxation treaties and help optimize your global tax obligations.

Bookkeeping and Tax Reporting

Accurate financial records are critical for tax compliance. Tax consulting firms offer bookkeeping and tax reporting services to ensure your financial data aligns with regulatory requirements.

How Tax Consulting Firms Add Value to Your Business

Expertise and Insights

Tax consulting firms in Dubai, like BDJ Consult, have a deep understanding of local and international tax laws. Their expertise ensures that businesses can focus on their operations without worrying about tax complexities.

Risk Mitigation

By ensuring compliance, tax consultants help businesses avoid penalties, legal disputes, and reputational damage. They proactively identify and address risks before they escalate.

Cost Savings

Optimized tax strategies lead to significant cost savings. Whether it’s reducing VAT liabilities or benefiting from tax incentives, a professional consultant ensures you’re financially efficient.

Why Choose BDJ Consult for Tax Consulting in Dubai

Decades of Experience

With over 20 years of expertise, BDJ Consult has established itself as a leading name among tax consulting firms in Dubai. Our experienced professionals deliver tailored solutions to meet your unique business needs.

Comprehensive Services

From VAT compliance to corporate tax advisory, BDJ Consult offers a wide range of services. We act as your one-stop shop for all tax-related requirements.

Client-Centric Approach

At BDJ Consult, we prioritize transparency, integrity, and confidentiality. Our personalized approach ensures that every client’s concerns are addressed effectively.

Up-to-Date Knowledge

The UAE’s tax landscape is constantly evolving. Our consultants stay updated on regulatory changes, ensuring your business remains compliant and competitive.

Steps to Engage a Tax Consultant in Dubai

Identify Your Needs

Determine the specific tax-related challenges your business faces, such as VAT filing, corporate tax compliance, or international tax planning.

Research Reputable Firms

Look for firms with proven expertise, positive client testimonials, and a wide range of services. BDJ Consult, for instance, is recognized for its reliability and professionalism.

Schedule a Consultation

Engage with the consulting firm to discuss your requirements. A professional firm will offer tailored solutions based on your business structure and financial goals.

Build a Long-Term Partnership

Tax consultancy is not a one-time service. Regular engagement ensures that your business stays compliant and benefits from ongoing tax optimization.

Conclusion

Engaging a professional tax consultant in Dubai is essential for businesses aiming to stay compliant, minimize risks, and optimize tax strategies. Whether you need assistance with VAT, corporate tax, or international taxation, a reliable partner like BDJ Consult can make all the difference. As one of the leading tax consulting firms in Dubai, BDJ Consult is committed to delivering excellence. With our experienced team and client-centric approach, we ensure that your business thrives in Dubai’s dynamic regulatory environment. Contact us today to learn how we can support your tax-related needs.

0 notes

Link

Job title: Wealth Manager - Dubai Company: Independent Resourcing Consultancy Job description: Wealth Manager - DubaiThis firm is a pioneering, independent financial advisory consultancy, unwavering in its dedication to safeguarding the financial futures of its clients. Established by UK-qualified financial advisers, the company distinguishes itself with its vibrant energy and innovative approach, setting it apart in the competitive offshore marketplace.The firm's primary aim is to equip its Wealth Managers with the essential skills and knowledge to excel in their careers. It boasts a robust selection process to ensure its team can deliver superior services compared to its competitors. The dedication to professional development is evident, as all team members are encouraged to acquire the knowledge and expertise necessary for providing top-tier financial planning and wealth management services to expatriates across the globe.Support is provided for team members to achieve all relevant qualifications, including the highly recognized Level 4 UK financial planning requirements, with encouragement for further educational pursuits. Preference is given to candidates who have already attained Level 4 certification before joining the team.Position: Wealth ManagerLocation: DubaiEducation: Master's DegreeOpportunity:This opportunity targets advisors with experience as Independent Advisors or Wealth Managers, or those ready to advance in their career. The selected candidate will offer exclusive international and local solutions to advise and serve their clients independently.Engaging directly with clients, the Wealth Manager will assess and advise on medium to long-term financial objectives. Advice will be tailored to the clients nationality and location, encompassing areas such as Lump Sum Investing, Retirement Planning, Education Fee Funding, Life Insurance, and Estate & Inheritance Tax Planning.Wealth Managers collaborate closely with marketing, coordination, and paraplanning teams to facilitate daily client interactions.Team members are expected to uphold high standards, with continuous training provided to ensure compliance with both client and company expectations.Wealth Managers will also gain access to a bespoke CRM system developed in-house by former Wealth Managers.Values:- A strong interest in pursuing or advancing a career in Financial Services.- A commitment to learning, with all Wealth Managers aspiring to achieve a minimum of Level 4 qualification.- Exceptional communication skills and professionalism.- Driven by success and targets.- Highly motivated with a positive outlook.- Desire to contribute to a firm renowned for its strong reputation and expanding global presence.- Fluency in English, proven sales capabilities, and an entrepreneurial spirit are must-haves.The firm offers competitive remuneration and exceptional earnings for top performers, along with regular incentives, including international conventions.There is also the potential for involvement in the firm's ambitious global expansion plans, including the opportunity to open new offices worldwide.Note: Ideal candidates will already possess an established AUM/book of existing clients.The firm offers competitive remuneration and exceptional earnings for top performers, along with regular incentives, including international conventions.There is also the potential for involvement in the firm's ambitious global expansion plans, including the opportunity to open new offices worldwide.Note: Ideal candidates will already possess an established AUM/book of existing clients. Expected salary: Location: Dubai Job date: Thu, 02 Jan 2025 23:34:45 GMT Apply for the job now!

0 notes

Text

Partner with experienced chartered accountant to streamline your finances and drive success. From tax planning to financial management, our expert chartered accounting services ensure your business stays on track. Get professional support and advice that aligns with your goals. Reach out today for a consultation!

0 notes

Text

Outsource Accounting Services in Dubai: Your Gateway to Financial Excellence

In today’s fast-paced business world, managing finances efficiently is critical for success. Whether you are a budding entrepreneur or a seasoned business owner, outsourcing accounting services in Dubai has emerged as a strategic move for streamlining financial operations and ensuring compliance with local regulations. The vibrant and competitive economic landscape of Dubai necessitates precision, accuracy, and expertise in financial management—qualities that outsourced accounting professionals bring to the table.

Why Outsource Accounting Services in Dubai?

Dubai, a global business hub, is known for its dynamic market, favorable tax policies, and diverse industries. However, navigating its financial and regulatory framework can be complex. Outsourcing accounting services provides businesses with access to skilled accountants in Dubai who specialize in handling financial records, bookkeeping, and compliance requirements efficiently.

Expertise and Accuracy Partnering with qualified professionals, including chartered accountant firms in Dubai, ensures that your financial records are managed with the highest level of precision. These experts possess in-depth knowledge of local and international accounting standards, minimizing errors and improving overall financial accuracy.

Cost Efficiency Hiring and maintaining an in-house accounting team can be costly. Outsourcing allows you to cut overhead costs related to salaries, training, and office space while still benefiting from top-notch accounting and bookkeeping services in Dubai.

Focus on Core Business Activities Delegating financial tasks to experienced accountants enables you to concentrate on growing your business. By outsourcing, you free up time and resources, allowing your team to focus on strategic goals and customer satisfaction.

Regulatory Compliance Dubai’s regulatory landscape requires businesses to adhere to strict financial reporting standards. Outsourced accounting professionals stay updated on these regulations, ensuring your business remains compliant and avoids penalties.

Services Offered by Outsourced Accounting Firms in Dubai

Outsourced accounting providers offer a comprehensive range of services tailored to meet the needs of businesses across various industries. Some of the key accounting services in Dubai include:

Bookkeeping Services: Accurate recording and categorization of financial transactions.

Financial Reporting: Preparation of balance sheets, income statements, and cash flow statements.

Tax Planning and Compliance: Assistance with VAT filing, registration, and advisory.

Audit Support: Preparing financial records and coordinating with external auditors.

Payroll Management: Ensuring timely and accurate payroll processing.

Budgeting and Forecasting: Providing insights to help businesses plan and allocate resources effectively.

Choosing the Right Accounting Partner

When selecting an outsourcing partner, it’s essential to consider their expertise, reputation, and alignment with your business needs. Look for chartered accountant firms in Dubai with a proven track record of delivering reliable accounting and bookkeeping services.

Key Factors to Consider:

Experience: Ensure the firm has extensive experience handling businesses in your industry.

Certifications: Opt for firms with certified accountants, such as chartered accountants, who adhere to global standards.

Technology: Check if the firm uses advanced accounting software to enhance accuracy and efficiency.

Flexibility: Choose a partner capable of scaling services to match your business growth.

Confidentiality: Ensure that the firm follows strict data security measures to protect sensitive financial information.

Benefits of Outsourcing Accounting in Dubai

Outsourcing accounting and bookkeeping services in Dubai offers several advantages, making it a preferred choice for businesses of all sizes. Here are some key benefits:

Scalability: Outsourced services can easily adapt to the changing needs of your business, whether it’s a start-up or a large enterprise.

Access to Advanced Tools: Leading firms leverage cutting-edge accounting tools, ensuring accuracy and efficiency in financial management.

Compliance Assurance: Stay ahead of regulatory requirements and avoid non-compliance penalties.

Improved Decision-Making: Timely and accurate financial insights empower business owners to make informed decisions.

Global Standards: Reputable firms adhere to international accounting standards, ensuring your business stands out in the global market.

The Future of Accounting in Dubai

As Dubai continues to attract investors and entrepreneurs from around the world, the demand for professional accounting services is on the rise. Businesses are increasingly turning to outsourcing as a cost-effective and efficient solution for managing their financial operations. The emphasis on technology-driven solutions, such as cloud-based accounting platforms, further underscores the importance of staying ahead in the financial domain.

By outsourcing accounting services in Dubai, businesses can leverage the expertise of seasoned accountants, ensure compliance with local regulations, and focus on achieving their strategic objectives. Whether you are looking to optimize financial processes, reduce costs, or ensure accurate reporting, partnering with professional accounting firms is a step toward financial excellence.

Conclusion

In conclusion, outsourcing accounting services in Dubai is a strategic decision that offers a multitude of benefits, including cost savings, regulatory compliance, and improved financial accuracy. With the support of skilled accountants and chartered accountant firms in Dubai, businesses can navigate the complexities of financial management with ease and confidence. Whether you need bookkeeping, tax planning, or comprehensive financial reporting, outsourcing ensures that your business remains competitive in Dubai’s dynamic market.

By prioritizing expertise, technology, and flexibility, you can find the perfect partner to handle your accounting needs and set your business on a path to sustained growth and success.

0 notes

Text

Dubai International Finance: A Gateway to Global Business

Overview of Dubai International Finance

Dubai’s financial sector includes various institutions, services, and regulatory frameworks that fuel the city’s economic development. The Dubai International Financial Centre (DIFC), a prominent financial free zone, serves as the foundation of this ecosystem. Established in 2004, DIFC is now home to more than 4,000 companies, spanning banks, insurance firms, fintech startups, and professional service providers.

Several key factors drive the success of this financial ecosystem.

Strategic Location: Dubai’s position at the crossroads of Europe, Asia, and Africa provides businesses with seamless access to a market of over 3 billion people.

World-Class Infrastructure: Modern office spaces, cutting-edge technology, and excellent connectivity make Dubai a preferred destination for international financial institutions.

Business-Friendly Environment: Pro-business policies, zero income tax, and 100% foreign ownership in free zones create an attractive environment for investors.

Strong Regulatory Framework: The Dubai Financial Services Authority (DFSA) ensures that all financial activities adhere to international standards, fostering trust and transparency.

Why Choose Dubai’s Financial Hub?1. Diverse Financial Services

Dubai's financial sector offers a wide array of services, including banking, asset management, private equity, insurance, and Islamic finance. DIFC has emerged as a leading center for Islamic finance, reflecting the city’s commitment to innovation and inclusivity.

2. Support for Innovation and Fintech

Dubai is at the forefront of financial technology. DIFC houses the DIFC Innovation Hub, a platform that supports fintech startups through funding, mentorship, and networking opportunities. This initiative aligns with Dubai’s vision of becoming a smart city and a global leader in digital transformation.

3. Tax Advantages

One of the most significant benefits of operating within Dubai's financial ecosystem is the favorable tax regime. Businesses in DIFC enjoy zero corporate tax, zero personal income tax, and no restrictions on capital repatriation, making it a tax-efficient destination.

4. Access to Talent

Dubai’s cosmopolitan environment attracts top talent from around the world. The financial sector benefits from a highly skilled workforce, including seasoned professionals and innovative entrepreneurs.

5. Ease of Doing Business

Dubai ranks highly in global ease-of-doing-business indices. Its efficient government services, streamlined company registration processes, and robust legal framework contribute to its reputation as a business-friendly city.

Key Features of Dubai International Financial Centre (DIFC)

1. Independent Legal System

DIFC operates under an independent common law judicial system, which is separate from the UAE’s civil law framework. This ensures clarity, consistency, and enforceability of contracts, which is crucial for international businesses.

2. Financial Ecosystem

DIFC offers a comprehensive financial ecosystem that includes banking, insurance, capital markets, and advisory services. It also facilitates access to global financial markets, enabling businesses to expand their reach.

3. Innovation Hub

As mentioned earlier, the DIFC Innovation Hub supports startups and established firms in adopting new technologies. The hub focuses on areas such as blockchain, artificial intelligence, and digital payments, driving the future of finance.

4. Sustainability InitiativesDubai is committed to sustainable development. DIFC actively promotes green finance and sustainable investments, aligning with global efforts to combat climate change.

0 notes

Text

Why Your Business Needs a VAT Consultant in Dubai

The subject of fixed taxes is very sensitive in the present world, especially when the companies are on the move. It has become a prerequisite to manage the organizations and to follow all the regulations since the implementation of Value Added Taxation (VAT) in United Arab Emirates in the year 2018. Currently, marketing in Dubai is one of the most developed in the region and businesses cannot afford large errors.

That is why accounting firms in Abu Dhabi become extremely important at this step. It is in this blog that we speak of the importance of VAT consultation in Dubai, why it is important to deal with a qualified agency in this field, and why this path is useful for your business.

1. Understanding VAT Regulations

Value Added Tax, or VAT is a consumption tax is levied upon the concept of value additions that transpire in the course of production or circulation. The normal VAT rate applied in the United Arab Emirates is 5 percent. However, that might sound easy; value-added tax laws are challenging to impose because they are couched in relative pecuniary flexibility, which changes with respect to the business, sector, and type of transaction.

Businesses that don't have a thorough understanding of local tax rules find handling VAT compliance to be a nightmare. The VAT consulting organizations situated in the United Arab Emirates are skilled at understanding the specifics of these laws. An accounting company in Abu Dhabi will assist your company in managing these complexities and staying up to date on any modifications or new decisions issued by the Federal Tax Authority.

2. Decreasing the Threat of Non-Compliance

Value Added Tax laws impose hefty fines, penalties, and occasionally even legal consequences for noncompliance. Missed deadlines and inaccurate VAT filing are just two examples of mistakes that will cost your business severely. Even small mistakes might result in significant financial loss and harm to your company's image.

By working with an accounting company in Abu Dhabi, you may reduce the risks of non-compliance in this regard. You will receive registration guidance, exact return preparation, and records that properly adhere to legal requirements from a group of tax professionals. In order for you to properly handle compliance issues and avoid missing any deadlines, they will also offer extra assistance. Your company will avoid costly errors and maintain a positive relationship with the FTA in this way.

3. Cash Flow Optimization

Maintaining appropriate cash flow is one of the key concerns and, in fact, the goal of any organization, and VAT has a significant impact on this. Consulting firms for VAT in Dubai assist you in optimizing your cash flow by suggesting effective VAT recovery strategies. This is crucial for a company that imports, exports or conducts substantial transactions.

They make sure your company is reporting VAT where it is due and that you are not overpaying. Additionally, the audit & assurance consultant UAE may help you organize your transactions to minimize your VAT duty and optimize recovery, which will improve the cash flow of your company.

4. VAT Strategies Tailored to Suit Your Business

A one-size-fits-all strategy for VAT compliance can be incredibly ineffective because every organization is different. Professional VAT consultancy in Dubai takes the time to understand your company's operations, sector, and unique requirements. Based on that information, it then offers customized solutions that are suited to the VAT needs of your business.

A reputable audit & assurance consultant in UAE will assist you in aligning your tax tactics with your business goals, regardless of how big or small your company is. This will include efficient supply chain management for VAT, efficient tax planning, and tailored solutions for international transactions.

5. Focus on Core Business Functions

It takes a lot of effort to manage VAT compliance internally, which takes resources from the main operation. It takes a lot of effort and experience to file VAT, understand the new rules, and guarantee that tax returns are accurate. In this situation, it is preferable to hire experts to handle the VAT compliance job rather than using your own internal resources so that you may concentrate on the expansion of your company.

All compliance issues, from filing returns to providing advice on complex tax issues, can be handled by these VAT consultants. You will no longer have to worry about VAT compliance, freeing you up to concentrate on market share growth, client acquisition, and innovation.

Conclusion

VAT compliance is a different story when it comes to companies in Dubai because it’s integral to be able to compete in the global market. Accounting firms in Abu Dhabi may help you remain compliant with all the tax regulations, avoid such expensive pitfalls and ensure business processes’ smooth running. Thus, the correct management of VAT, risk minimization, and increased cash flow is critical to sustain and develop your company in the context of the relatively high rate of competition in Dubai.

#accountants in abu dhabi#accounting & finance expert in uae#accounting and bookkeeping companies in uae#accounting companies in abu dhabi#accounting companies in uae#accounting company in abu dhabi#accounting firms in abu dhabi#accounting firms in business bay dubai#audit firms in abu dhabi#best business consultancies in uae#best business consultants in uae#best business setup consultants in uae#bookkeeping and accounting firms in abu dhabi#business consultancy firms in uae#business consulting companies in uae#business consulting firms in dubai#business set up consultants in uae#business setup services and consultants in uae#compliance & regulatory reporting services in the uae#compliance services in uae#compliance services uae#internal audit consultants in uae#audit & assurance consultant uae#corporate banking & finance advisory in the uae#corporate finance services uae#erp advisory services in uae#financial regulatory compliance services uae#mainland business setup consultants in dubai#corporate tax planning dubai#management consulting firms in uae

0 notes

Text

#Bookkeeping services UAE#Accounting solutions UAE#Professional bookkeeping UAE#Financial record keeping UAE#Small business bookkeeping UAE#Accounting Firms Ajman#Bookkeeping Firms Ajman#Professional accounting services in Ajman#Online Bookkeeping Services UAE#Accounting Outsourcing Services in Ajman UAE#Accounting and Bookkeeping Ajman#Audit Firms Ajman#Audit period in the Ajman UAE#Financial statement audit importance in Ajman#IT support for small and medium scale industries in Ajman#IT Support Services in Ajman UAE#VAT consultation services in Ajman UAE#VAT Registration in Ajman UAE#VAT & Tax Registration Services in Ajman#VAT advisory services in Ajman Dubai#Tax Audit Services in Ajman UAE#Tally Software Solutions Ajman#Tally accounting services in Ajman UAE#Value Added Tax (VAT) in Ajman

0 notes

Text

Vass International | Top Auditing Services in UAE | Expert Financial Auditors

Looking for reliable auditing services in the UAE? Our expert audit solutions at Vass International have you covered. Learn how to choose the right auditing services here.

Vass International -Reliable Auditing Services in UAE - Your Guide to Expert Audit Solutions

In today’s rapidly evolving business landscape, maintaining financial integrity and transparency is more crucial than ever. For companies operating in the United Arab Emirates, particularly in its bustling commercial hub of Dubai, selecting the right auditing service is key to ensuring compliance and fostering trust with stakeholders. Among the prominent players in this field, Vass International stands out as a leading choice for reliable auditing services. As one of the most reputable accounting and auditing firms in Dubai, Vass International not only brings expertise and professionalism to the table but also a commitment to delivering tailored audit solutions to meet the unique needs of each business. In this article, we will delve into the importance of expert audit services and explore why Vass International is the go-to partner for companies looking to navigate the complexities of financial oversight with confidence.

The Future of Auditing Services in the UAE - Trends and Innovations The future of auditing services in the United Arab Emirates (UAE) is poised for significant transformation, driven by technological advancements, regulatory changes, and evolving client expectations. As the business landscape becomes increasingly complex, auditors in the UAE are finding new ways to enhance efficiency and deliver added value to their clients. The adoption of cutting-edge technologies such as artificial intelligence, blockchain, and data analytics is reshaping the audit landscape. These innovations not only streamline the auditing process but also provide deeper insights into financial statements and operational efficiencies, positioning audit firms in the UAE as strategic partners in fostering business growth.

Moreover, the UAE’s dynamic economic environment demands that audit firms in Dubai and across the region remain agile and adaptable. The implementation of the UAE's Economic Substance Regulations and the introduction of the new corporate tax regime in 2023 have heightened the need for rigorous auditing practices. This evolving regulatory landscape offers both challenges and opportunities for auditors, necessitating a proactive approach to compliance and risk management. Firms that invest in continuous professional development and stay ahead of regulatory changes will likely find themselves well-positioned to serve their clients effectively.

In addition to technological advancements and regulatory shifts, the demand for sustainability and corporate social responsibility (CSR) audits is on the rise. As businesses in the UAE increasingly focus on environmental, social, and governance (ESG) criteria, there is a growing need for audit firms in Dubai to incorporate these factors into their auditing processes. This not only enhances transparency but also aligns with global trends that prioritize sustainable business practices. By embracing these shifts, auditors in the UAE can bring meaningful insights to their clients while championing responsible business conduct.

As the landscape continues to evolve, collaboration and knowledge sharing will be paramount. The formation of networks among audit firms in the UAE can foster best practices and drive innovation across the sector. As auditors embrace change and leverage new technologies, their role will extend beyond traditional compliance to encompass advisory services, ultimately becoming indispensable partners in navigating the challenges and opportunities of today's fast-paced business environment. The future of auditing in the UAE is bright, with significant potential for growth and impact.

Enhance Your Business with Vass International's Reliable Auditing Solutions

In today’s rapidly changing business landscape, the importance of reliable auditing cannot be understated. Whether you're a startup looking to establish credibility or an established enterprise seeking to streamline operations, the insights provided by proficient auditors in UAE can be invaluable. Vass International stands out among the numerous audit firms in UAE, offering comprehensive auditing solutions designed to cater to the diverse needs of businesses across various sectors. Their experienced team not only ensures compliance with local regulations but also provides a strategic perspective that helps organizations identify opportunities for growth.

One of the key advantages of collaborating with Vass International is their commitment to transparency and integrity. Their auditors in UAE possess a deep understanding of the regional market dynamics and regulatory requirements, ensuring that your financial statements present a true and fair view of your business. This is particularly crucial for businesses looking to attract investors or secure financing, as potential stakeholders are often keen to assess a company’s financial health before making decisions. With Vass International, you gain peace of mind knowing that your financial reporting is in expert hands.

Moreover, Vass International goes beyond the traditional auditing approach by integrating technology and innovation into their auditing processes. This enables them to offer real-time insights and data analytics that can enhance your business decision-making. By leveraging their expertise, you can uncover inefficiencies, reduce risk exposure, and ultimately improve your bottom line. Choosing Vass International as your auditing partner means you are not just meeting compliance standards; you are actively working towards building a more resilient and agile business.

In conclusion, partnering with a leading firm like Vass International can significantly enhance your business operations. By engaging with their expert auditors in UAE, your organization will benefit from their deep industry knowledge and tailored auditing solutions. As one of the premier audit firms in UAE, Vass International is dedicated to providing unmatched service that empowers your business to thrive in an increasingly competitive environment. Make the smart choice for your auditing needs and watch your business grow.

Join Hands!

0 notes

Text

Navigating Financial Success with Accounting Firms in Dubai

Given that Dubai moves at an equally impressive economic pace and has an effectively competitive and versatile business market, it is a place that is capable of offering success to a company. Regarding financial management in such a competitive environment, accounting firms are significant for the successful accomplishment of the goal.

Regulatory Compliance:

Regarding financial regulations, it is safer to note that Dubai has strict rules that firms must observe. Accounting firms use these regulations with the help of expert advice to avoid legal complications and penalties. These compliances enable businesses to carry out their activities without much hindrance in dealing with the complexities of the legal system.

Financial Accuracy:

Accounting records are necessary for providing a firm's management with facts that can be used to make the right business decisions. Accounting firms provide excellent bookkeeping to ensure the precision of each economic transaction that occurs in an organization. Such accuracy in presenting the results helps businesses understand their financial position and transform it into the needed future projections.

Tax Optimization:

In the context of the UAE, multiple issues related to the taxation system can be noted, and these intricacies can confuse businesses. Certified public accountancy firms provide professional services in the form of tax advice and management and advise clients on the kind of tax treatments available to help reduce tax amounts due on their returns. Tax management is a management that aims to minimize tax burdens while increasing the number of tax benefits.

Strategic Growth:

By supplying detailed information on financial planning and consulting, companies can enhance their capabilities to ensure they allow for the probabilities of educated corporate decisions to maximize profitability. During the last decade, accounting firms have adopted the framework of opinion that they offer to the market by becoming experts in financial advisory and consultancy services, which imply valuable recommendations that are useful in organizations' strategic planning and achieving their goals.

Selecting a suitable accounting firm in Dubai is very important, whether for a small or big company. It is recommended to work with experienced firms that embrace their specialization and value clients and their needs. By working with a qualified accounting firm, companies can confidently overcome all the financial obstacles on their way to success.

0 notes

Text

Dubai Family Office Benefits for Ultra High Net Worth Families

Dubai has established itself as a global hub for wealth management, making it a prime destination for ultra-high-net-worth (UHNW) families to set up Dubai family office. A family office is a private advisory firm dedicated to managing the financial and non-financial needs of affluent families. It acts as a centralized entity for overseeing investments, wealth preservation, succession planning, estate management, and even philanthropic activities.

The concept of a family office goes beyond traditional wealth management. It provides tailored solutions that align with the unique goals and values of each family. In Dubai, the benefits of setting up a family office are amplified by the city’s strategic location, robust economy, and investor-friendly policies. A family office in Dubai enables families to preserve and grow their wealth efficiently while ensuring privacy and confidentiality.

World-class infrastructure, tax advantages, and strong legal framework make it an ideal destination for family office setup in Dubai. Whether catering to a single family or multiple families, a Dubai Family Office offers unparalleled opportunities for effective wealth management and long-term success. With access to global markets and a thriving financial ecosystem, Dubai remains at the forefront of family office UAE services.

What is a Family Office?

A family office is a specialized organization designed to manage the wealth and personal affairs of ultra-high-net-worth families. It acts as a one-stop solution for handling investments, tax planning, estate management, and other financial needs. For families looking for a tailored approach to managing their wealth, a family office offers a perfect solution.

Family offices are gaining popularity due to the city’s tax-friendly environment, strong legal framework, and excellent connectivity to global markets. A Dubai Family Office ensures that the family’s wealth is preserved and grown while maintaining the highest level of privacy and confidentiality.

Family office setup involves creating a dedicated team of professionals, including financial advisors, lawyers, and estate planners, who work together to meet the family’s goals. This centralized management helps in streamlining operations and making informed financial decisions.

Choosing a family office in Dubai means access to world-class infrastructure and opportunities to diversify investments across the globe. It’s an essential tool for ensuring that wealth is passed on efficiently to future generations. For families seeking the best in wealth management, a family office UAE is the ideal choice for comprehensive and secure financial solutions.

Why Choose a Dubai Family Office?

A Dubai Family Office offers unparalleled advantages for managing wealth and investments. From global connectivity to a tax-friendly environment, setting up a family office in Dubai ensures efficient operations, robust asset protection, and access to world-class infrastructure. Explore why a family office UAE is the ideal choice for your wealth management needs.

Strategic Location

A family office in Dubai benefits from its strategic position connecting Europe, Asia, and Africa. This location enables seamless global investment management and business operations. With exceptional connectivity through air, sea, and road networks, a family office setup here ensures accessibility to international markets and opportunities for growth.

Tax Efficiency

A family office UAE thrives in a tax-friendly environment, free from personal income and capital gains taxes. This makes a family office setup in the region highly cost-efficient for preserving and growing family wealth. By minimizing tax burdens, families can focus on optimizing their investments and long-term financial strategies.

Robust Legal Framework

The family office UAE ecosystem is supported by a strong legal framework ensuring asset protection and confidentiality. The Dubai International Financial Centre (DIFC) provides a secure jurisdiction for family office setup. Its reliable regulations safeguard wealth, making it a trusted platform for high-net-worth individuals and families.

World-Class Infrastructure

A family office in Dubai benefits from cutting-edge infrastructure, including modern financial centers, advanced technology, and high-speed communication networks. These resources support the efficient management of investments and operations. A family office setup here leverages these facilities to deliver world-class services and drive family wealth goals.

Key Benefits of a Dubai Family Office

A Dubai Family Office offers numerous benefits for ultra-high-net-worth (UHNW) families, providing tailored solutions to manage wealth, investments, and legacy planning. From wealth preservation to philanthropic initiatives, family office setup ensures centralized management, privacy, and global investment opportunities. Below are the top advantages of having a family office in UAE.

1. Wealth Preservation

A Dubai Family Office is dedicated to safeguarding family wealth against market volatility and external risks. By employing expert advisors and implementing diversified investment strategies, the family office setup ensures financial stability. Families can secure their assets effectively, making it possible to sustain wealth across future generations with reduced risks.

2. Centralized Management

Family office in Dubai streamlines the management of finances, investments, and administrative affairs. Centralization enhances efficiency by consolidating these functions under one entity. With a centralized approach, families experience better control and organization, leading to improved decision-making and reduced operational complexities.

3. Tailored Investment Strategies

Family office setup provides UHNW families with customized investment plans designed to match their unique goals and risk tolerance. These personalized strategies allow families to achieve financial growth while aligning their portfolios with long-term objectives, ensuring consistent and optimized wealth accumulation.

4. Access to Global Markets

A family office UAE benefits from the region’s strategic location, enabling seamless access to global investment opportunities. The connectivity of the UAE supports efficient management of cross-border investments, helping families diversify their portfolios and capitalize on emerging markets worldwide.

5. Privacy and Confidentiality

The legal and regulatory framework of a Dubai Family Office prioritizes the protection of sensitive financial information. This ensures the highest level of privacy and confidentiality, making family office setup a secure solution for managing wealth and safeguarding personal and financial data.

6. Philanthropic Opportunities

Many families utilize their family office in Dubai to manage philanthropic initiatives. The supportive environment of the UAE fosters global networks for charitable activities. This setup enables families to give back to society, creating meaningful impact while maintaining their philanthropic vision.

7. Succession Planning

Succession planning is a critical aspect of a Dubai Family Office. With specialized services, family office UAE ensures smooth transitions of wealth and business ownership. Effective succession planning secures the family’s legacy and prepares the next generation for successful stewardship of assets.

Steps to Establish a Family Office in Dubai

Setting up a Dubai family office involves a systematic approach to managing wealth and ensuring financial stability for high-net-worth families. This guide provides clear steps for a successful family office setup. From defining goals to adhering to legal regulations, learn how to establish a thriving family office in Dubai or anywhere in the UAE.

1. Define Objectives

The foundation of a successful family office setup is a clear understanding of its goals. Whether focusing on investment management, philanthropy, or comprehensive wealth management, defining the purpose ensures aligned operations. Setting objectives for a family office in Dubai helps streamline efforts toward achieving financial security and legacy planning in the UAE.

2. Choose the Right Structure

Selecting the appropriate structure is crucial for a Dubai family office. Families can choose between Single-Family Offices (SFOs) for tailored solutions or Multi-Family Offices (MFOs) for shared resources. Picking the right legal framework ensures flexibility, operational efficiency, and compliance when establishing a family office in Dubai.

3. Select a Jurisdiction

Choosing the ideal jurisdiction is a vital step for family office setup in the UAE. Options like DIFC and DMCC offer world-class infrastructure and tax benefits. The selected jurisdiction should match the operational needs of your family office in Dubai, ensuring it thrives in a competitive business environment.

4. Hire Professionals

A successful family office UAE requires a team of experts. Recruit skilled financial advisors, legal consultants, and investment managers to ensure smooth operations. The expertise of these professionals is indispensable for wealth preservation and growth, making them integral to a well-structured family office in Dubai.

5. Register and Comply

Complete the registration process and meet local compliance requirements for your Dubai family office. The UAE’s streamlined procedures and regulatory framework simplify this step. Adhering to these regulations ensures the long-term sustainability of your family office setup and builds a strong foundation for financial success.

Types of Family Offices in Dubai

Single-Family Office (SFO)

An SFO caters to the needs of one family, offering tailored solutions for wealth management and other services.

Multi-Family Office (MFO)

An MFO serves multiple families, providing cost-effective solutions by pooling resources and expertise.

Conclusion

A Dubai Family Office offers a sophisticated approach to wealth management, focusing on preserving and enhancing assets across generations. Whether you’re looking to establish a family office setup or explore options for a family office in UAE, professional expertise is essential.

Setting up a family office in Dubai ensures seamless integration of personal and business finances, providing tailored services such as investment management, philanthropy, and estate planning. With the dynamic financial landscape in UAE, a well-structured family office can maximize opportunities while safeguarding family wealth. Leveraging local and global markets, a family office in Dubai becomes a hub for personalized financial solutions. Additionally, for those considering a family office setup in Dubai, understanding the nuances of business setup Dubai is crucial to ensuring the efficient management of both personal and business assets.

#family office#family trusts#family foundations#family office uae#business#services#business seup#business setup consltants

0 notes

Text

Accounting & Bookkeeping Services in Dubai: A Guide for New Entrepreneurs

Congratulations! You've taken the exciting leap of launching your business venture in Dubai, a dynamic city brimming with potential. As a new entrepreneur, ensuring your financial well-being is paramount. This is where accounting & bookkeeping services in Dubai become crucial.

Why New Entrepreneurs Need Accounting & Bookkeeping Support

Managing your finances effectively is vital for the success of your new business. However, navigating financial regulations, recording transactions, and generating accurate reports can be overwhelming, especially when juggling other startup tasks. This is where bookkeeping account services in Dubai come in. Here's how they can benefit you:

Maintaining Accurate Records: Experienced bookkeepers meticulously track your income, expenses, and financial transactions. This ensures you have a clear understanding of your financial health at all times.

Compliance with Local Regulations: Dubai has unique accounting and tax regulations, including VAT compliance. A qualified accountant can ensure your business adheres to all these requirements, avoiding future penalties.

Focus on Your Business Growth: Outsourcing your accounting and bookkeeping frees up your valuable time and allows you to focus on core business activities like strategy, marketing, and customer acquisition.

Financial Insights and Decision Making: Regular financial reports generated by your accounting team provide valuable insights into your business performance. This empowers you to make informed financial decisions and optimize your growth strategy.

Finding the Right Accounting & Bookkeeping Services in Dubai

With a plethora of accounting & bookkeeping service providers in Dubai, finding the perfect fit for your startup can feel daunting. Consider these factors to make an informed decision:

Experience with Startups: Look for a firm with experience working with startups in your industry. They will understand your unique financial needs and challenges.

Service Offerings: Ensure the firm offers the services you need, such as bookkeeping, payroll processing, financial statement preparation, and tax support.

Scalability: Choose a firm that can scale its services along with your business growth.

Communication Style and Accessibility: Clear and transparent communication is crucial. Choose a team that is easily accessible and responsive to your needs.

Pricing Structure: Explore various options. Some firms may offer hourly rates, while others might have fixed monthly packages based on your complexity.

Affordable Bookkeeping Solutions for Startups in Deira, Dubai

At Al Zora Accounting & Advisory Services, we understand the financial constraints faced by new entrepreneurs in Dubai, especially in areas like Deira. We offer affordable bookkeeping solutions for startups that are tailored to your specific needs.

Our team of experienced accountants and bookkeepers combines industry expertise with a commitment to clear communication and cost-effective solutions.

Empower Your Startup for Success

Partnering with a reliable accounting and bookkeeping firm in Dubai allows you to focus on your entrepreneurial vision with peace of mind. By ensuring financial compliance, generating insightful reports, and offering strategic financial advice, we become a valuable partner on your journey to business success.

Contact Al Zora Accounting & Advisory Services today for a free consultation and discover how our comprehensive services can help your startup thrive in the vibrant Dubai market.

0 notes

Text

Top Audit Firms in Dubai: Why AMA Audit Tax Advisory Stands Out?

Introduction Dubai, a global business hub, is home to a plethora of audit firms offering diverse services. However, choosing the right firm is critical for businesses aiming for compliance, transparency, and sustainable growth. AMA Audit Tax Advisory stands among the leading audit firms in Dubai, offering unmatched expertise and tailored solutions to clients across various industries.

Why Audit Services Are Essential in Dubai Audit services are vital for maintaining financial transparency and ensuring regulatory compliance. They help businesses:

Detect and mitigate financial discrepancies.

Enhance credibility with stakeholders.

Meet local and international compliance standards, including UAE tax regulations and IFRS.

How AMA Audit Tax Advisory Excels Among Audit Firms in Dubai

Expert Team: AMA Audit Tax Advisory boasts a team of certified auditors with extensive experience in diverse industries. Their in-depth knowledge ensures accurate and efficient audits.

Comprehensive Audit Solutions: We offer internal audits, external audits, financial audits, and VAT compliance audits, catering to the unique needs of businesses in Dubai.

Industry-Specific Expertise: From SMEs to large corporations, our tailored audit solutions ensure every client receives services that align with their business goals and industry requirements.

Compliance and Transparency: With Dubai’s evolving regulatory framework, our firm ensures your business adheres to all compliance standards, avoiding penalties and safeguarding your reputation.

Choosing the Right Audit Firm in Dubai When searching for "audit firms in Dubai," prioritize firms with a proven track record, skilled professionals, and comprehensive service offerings. AMA Audit Tax Advisory ticks all these boxes and more.

Conclusion For businesses in Dubai seeking reliable audit services, AMA Audit Tax Advisory is your trusted partner. Contact us today to experience top-tier audit solutions tailored to your business needs.

#Audit Firms in Dubai#Audit Firms in UAE#Audit Firms in Abu Dhabi#Top 10 Audit firms in Abu Dhabi#Top 10 Audit firms in Dubai

0 notes