#commercial property mortgage services

Explore tagged Tumblr posts

Text

Trusted Investment Property and Home Buyer Mortgage Broker Services in Surrey

Navigating the complex world of mortgages can be daunting, but with Sandhu & Sran Mortgages, you have access to the best mortgage broker services in Surrey. Our team of reliable and trusted mortgage brokers specializes in a variety of financial solutions tailored to meet your needs. Whether you're an investment property seeker or a first-time home buyer, we offer expert guidance and support.

For those looking into investment property mortgage options, our experienced brokers help you secure the best deals in Surrey, ensuring your investment yields maximum returns. If you’re purchasing your first home, our home buyer mortgage brokers simplify the process, working with first-time home buyer lenders in Surrey to get you approved quickly and efficiently.

We also provide commercial property mortgage services, ideal for businesses seeking to expand or purchase new premises in Surrey. Our Home Equity Line of Credit services offer flexible financing options, allowing you to leverage your home's equity to meet various financial needs.

In addition to residential and commercial property services, Sandhu & Sran Mortgages offers specialized truck loans, including heavy-duty truck financing in Surrey. Whether you need financing for new or used trucks, our solutions are designed to support your business growth.

Farm mortgages are another area of expertise, providing financing options for agricultural properties. With our deep understanding of the local market, we help farmers and agricultural businesses secure the funds needed to thrive.

At Sandhu & Sran Mortgages, we pride ourselves on offering a comprehensive range of services, including private mortgages and mortgage renewal options. Our commitment to personalized service ensures that every client receives tailored advice and solutions that fit their unique circumstances.

Choose Sandhu & Sran Mortgages for all your mortgage needs in Surrey, and experience the difference of working with a team that puts your financial goals first. From investment properties to truck loans, we’re here to guide you every step of the way.

#first-time home buyer lenders in Surrey#commercial property mortgage services#private mortgages#mortgage renewal options

0 notes

Text

Understanding Real Estate Contract Contingencies in Florida: Protecting Your Investment

Florida Real Estate & Business Attorneys_2 Hey everyone, Florida Real Estate Attorney Ryan S. Shipp here! If you’re buying or selling real estate in Florida, understanding contingencies in your real estate purchase and sales contract is crucial. What Are Contract Contingencies? Contingencies are conditions that must be met before closing, allowing buyers or sellers to cancel without penalty if…

#appraisal contingency#buyer protection#Commercial Real Estate#contract negotiation#contract review#financing contingency#Florida home buying#Florida home selling#Florida property law#Florida Real Estate Attorney#Florida real estate contracts#home buying process#home inspection#home selling process#inspection contingency#Legal guidance#mortgage approval#property appraisal#property purchase agreement#purchase and sale agreement#real estate attorney near me#Real Estate Closing#real estate contingencies#real estate contract#real estate dispute resolution#Real estate investment#Real Estate Law#real estate legal services#Residential real estate#seller protection

0 notes

Text

Belle Property Management Services - Auspak Home Loans 🏡🔑

Looking for expert property management services? Auspak Home Loans partners with Belle Property to offer you top-notch property management solutions. Whether you’re a property owner or an investor, our team ensures your property is well taken care of, providing peace of mind and maximizing returns. 💼💰

From tenant screening to rent collection and maintenance, we handle it all with professionalism and attention to detail. Let us take the hassle out of managing your property so you can focus on growing your investment portfolio.

Contact Auspak Home Loans today to learn how Belle Property management services can help you make the most of your real estate! 🏠📈

#BellePropertyManagement #AuspakHomeLoans #PropertyManagementServices #PropertyInvestors #RealEstateSolutions #RentalManagement #MaximizeYourReturns #StressFreeManagement #RealEstateWaverley #PropertyCare

#Belle Property real estate agents#Buy with Belle Property#Belle Property commercial real estate#Property finance solutions#Property Finance Broker#Professional mortgage services#Belle Property listings#Belle Property management services

1 note

·

View note

Text

#loan junction#loan in lucknow#finance agencies near me#loan provider near me#personal loan in lucknow#home loan service provider in lucknow#Loan Against Property service provider in lucknow#Business Loan service provider in lucknow#Personal Loan service provider in lucknow#Auto Loan service provider in lucknow#Commercial Property Loan service provider in lucknow#Gold loan service provider in lucknow#How to Choose the Life Insurance Policy?#best loan eligibility check website in lucknow#Home loan calculator#home loan eligibility#Mortgage loan#Mortgage loan calculator#lower rate loan provider#Online loan provider#Online personal loan provider#hdfc home loan#icici bank home loan#sbi home loan interest rate

1 note

·

View note

Text

Excerpt from this story from the New York Times:

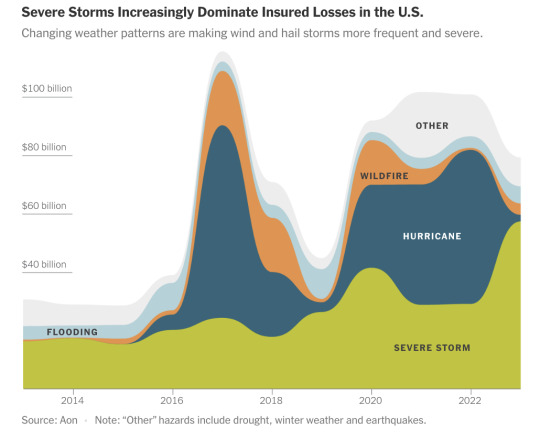

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

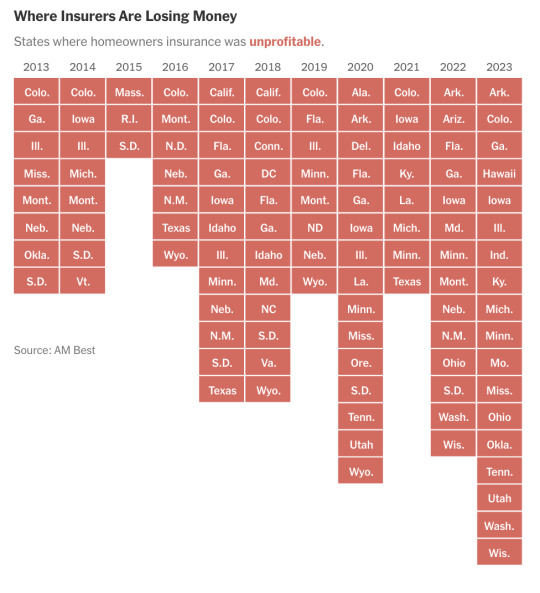

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

136 notes

·

View notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

The Ultimate Guide to Finding the Best Mortgage Consultant in Dubai

Navigating the mortgage market in Dubai can be complex, and finding the right mortgage consultant can make all the difference. A good consultant can guide you through the various options, help you secure the best rates, and ensure a smooth transaction. This comprehensive guide provides everything you need to know about finding the best mortgage consultant in Dubai.

For more information on home loans, visit Home Loan UAE.

Why You Need a Mortgage Consultant

A mortgage consultant offers numerous benefits, including:

Expert Knowledge: Mortgage consultants have in-depth knowledge of the mortgage market and can provide valuable insights.

Time-Saving: They handle the research, paperwork, and negotiations, saving you time and effort.

Better Rates: Consultants can negotiate better rates and terms with lenders due to their industry connections.

Personalized Service: They provide personalized advice tailored to your financial situation and goals.

For property purchase options, explore Buy Commercial Properties in Dubai.

Steps to Finding the Best Mortgage Consultant

Research and Referrals: Start by researching online and asking for referrals from friends, family, and colleagues. Online platforms and forums can provide reviews and ratings of different mortgage consultants in Dubai, giving you a good starting point.

Check Credentials: Ensure the consultant is licensed and has a good track record. Look for certifications and memberships in professional organizations, which indicate a commitment to high standards and ongoing education.

Interview Multiple Consultants: Interview several consultants to compare their services, fees, and expertise. Prepare a list of questions to ask during these interviews to help you gauge their knowledge and experience.

Ask the Right Questions: Inquire about their experience, the types of loans they specialize in, and how they can help you achieve your goals. Also, ask about their success stories and how they have helped clients with similar financial situations to yours.

For mortgage options, consider Mortgage Financing in Dubai.

Evaluating Your Options

When evaluating mortgage consultants, consider the following factors:

Experience and Reputation: Choose a consultant with extensive experience and a strong reputation in the industry. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Communication Skills: Ensure the consultant communicates clearly and promptly. Good communication is crucial for a smooth mortgage process.

Transparency: Look for transparency in fees and terms. The consultant should provide a clear breakdown of their fees and any potential additional costs.

Customer Reviews: Check online reviews and testimonials to gauge client satisfaction. Look for patterns in the reviews to identify strengths and weaknesses in the consultant's services.

For rental options, visit Apartments For Rent in Dubai.

The Role of a Mortgage Consultant

A mortgage consultant's primary role is to act as a bridge between you and potential lenders. They help you understand your financial situation, identify suitable mortgage products, and guide you through the application process. Here are some specific tasks they perform:

Financial Assessment: Evaluating your financial situation, including your income, expenses, credit score, and debt-to-income ratio, to determine your mortgage eligibility.

Exploring Mortgage Options: Identifying and comparing different mortgage products from various lenders to find the best fit for your needs.

Rate Negotiation: Negotiating the best mortgage rates and terms with lenders on your behalf.

Paperwork Management: Handling all necessary documentation and ensuring compliance with regulations.

Closing Assistance: Assisting with the final steps of the mortgage process and closing the deal.

Benefits of Working with a Mortgage Consultant

Working with a mortgage consultant offers several advantages, including:

Access to a Wide Range of Products: Mortgage consultants have access to a broad range of mortgage products from different lenders, increasing your chances of finding the best deal.

Expert Guidance: Consultants provide expert advice on the best mortgage options based on your financial situation.

Time Savings: By handling the research, paperwork, and negotiations, consultants save you time and effort.

Stress Reduction: Managing the complexities of the mortgage process can be stressful. A consultant can alleviate this stress by guiding you through each step.

Customized Solutions: Consultants offer personalized mortgage solutions tailored to your specific needs and goals.

For property sales, visit Sell Your Property.

Real-Life Success Story

Consider the case of Ahmed, a first-time homebuyer in Dubai. With the help of a top-rated mortgage consultant, Ahmed secured a favorable mortgage rate and purchased his dream home. The consultant's expertise and personalized service made the process smooth and stress-free.

Ahmed was initially overwhelmed by the mortgage process and unsure of where to start. He decided to seek the help of a mortgage consultant. The consultant began by assessing Ahmed's financial situation, including his income, expenses, and credit score. Based on this assessment, the consultant identified several mortgage options that suited Ahmed's needs.

The consultant then guided Ahmed through the mortgage application process, helping him gather the necessary documentation and ensuring everything was in order. Thanks to the consultant's industry connections, Ahmed was able to secure a favorable mortgage rate that he wouldn't have been able to find on his own.

Throughout the process, the consultant kept Ahmed informed, answering his questions and addressing his concerns promptly. This personalized service made a significant difference, making the process smooth and stress-free for Ahmed. In the end, Ahmed successfully purchased his dream home and was extremely satisfied with the consultant's services.

Questions to Ask a Mortgage Consultant

When interviewing potential mortgage consultants, it's important to ask the right questions to ensure they can meet your needs. Here are some questions to consider:

What is your experience in the Dubai mortgage market? Understanding their level of experience can give you confidence in their ability to handle your case.

What types of loans do you specialize in? Some consultants may have more experience with certain types of loans, such as first-time homebuyer programs or refinancing.

How do you help clients secure the best mortgage rates? This question helps you understand their approach to negotiating with lenders.

What are your fees, and how are they structured? Transparency about fees is crucial to avoid any surprises later on.

Can you provide references from previous clients? References can provide insight into the consultant's reliability and effectiveness.

For more resources and expert advice, visit Home Loan UAE.

Conclusion

Finding the best mortgage consultant in Dubai can significantly impact your home-buying experience. By following the steps outlined in this guide and leveraging professional services, you can secure the best mortgage deals and achieve your property goals. Remember to research and interview multiple consultants, ask the right questions, and evaluate your options carefully. With the right consultant by your side, you can navigate the mortgage process with confidence and ease. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

A Comprehensive Guide to Working with a Mortgage Broker in Dubai

Introduction to Home Loans in Dubai

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. This comprehensive guide provides insights into the benefits of using a mortgage broker and how to effectively work with one.

The Role of a Mortgage Broker

A mortgage broker acts as an intermediary between borrowers and lenders, helping you find the best mortgage deals and guiding you through the application process. Here are some benefits of using a mortgage broker:

Expert Knowledge: Brokers have extensive knowledge of the mortgage market.

Access to Multiple Lenders: They work with multiple lenders, giving you more options.

Personalized Service: Brokers offer services tailored to your financial situation and needs.

Time Savings: They handle the paperwork and negotiations, saving you time and effort.

For more information on home loans, visit home loan dubai.

Steps to Working with a Mortgage Broker

Initial Consultation: The process begins with an initial consultation where the broker assesses your financial situation and mortgage needs.

Pre-Approval: The broker helps you get pre-approved for a mortgage, giving you an idea of your borrowing capacity and interest rate.

Property Search: With pre-approval in hand, you can start searching for properties within your budget. For listings, visit Buy Commercial Properties in Dubai.

Application Submission: Once you find a property, the broker submits your mortgage application to multiple lenders.

Offer and Negotiation: The broker reviews offers from lenders and negotiates the best terms on your behalf.

Final Approval and Closing: After selecting the best offer, the broker assists with the final approval and closing process, ensuring all documentation is complete.

For expert mortgage advice, consider Mortgage Financing in Dubai.

Key Considerations When Choosing a Mortgage Broker

Experience and Expertise: Choose a broker with extensive experience in the Dubai mortgage market. An experienced broker will have a deep understanding of market dynamics and lender requirements.

Fee Structure: Understand the broker's fee structure. Some brokers charge a flat fee, while others earn a commission from the lender. Ensure you are comfortable with their fees and services.

Customer Reviews: Read customer reviews and testimonials to gauge the broker's reputation and track record. Positive reviews can indicate a reliable and effective broker.

Personal Connection: Choose a broker who you feel comfortable working with and who understands your needs and goals.

Specialization: Some brokers specialize in specific types of mortgages or property transactions. Find a broker whose expertise aligns with your needs.

For rental options, visit Apartments For Rent in Dubai.

Benefits of Using a Mortgage Broker

Access to Exclusive Deals: Brokers often have access to deals that are not available to the general public.

Expert Negotiation: They can negotiate better terms and rates with lenders.

Stress Reduction: Brokers handle the complex paperwork and administrative tasks, reducing your stress.

Comprehensive Financial Advice: They provide valuable financial advice, helping you make informed decisions.

Customized Solutions: Brokers offer solutions tailored to your specific needs and financial situation.

For villa listings, visit Villas For Sale in Dubai.

Real-Life Success Story

Consider the case of Emma, a first-time homebuyer in Dubai. With the help of a mortgage broker, she secured a favorable mortgage rate and purchased her dream apartment in Dubai Marina. The broker's expertise and negotiation skills saved her time and money, making the home-buying process smooth and stress-free.

Conclusion

Working with a mortgage broker in Dubai can simplify the mortgage process and help you secure the best deals. By leveraging the broker's expertise, relationships with lenders, and negotiation skills, you can achieve your homeownership goals more efficiently. For more resources and expert advice, visit Mortgage Financing in Dubai.

3 notes

·

View notes

Text

A Guide to the Most Luxurious Properties for Sale in Dubai

Dubai is synonymous with luxury, and its real estate market offers some of the most opulent properties in the world. From stunning penthouses to sprawling villas, the options are endless. This guide will help you navigate the market for the most luxurious properties for sale in Dubai.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

High ROI: Dubai's luxury real estate market offers high returns on investment due to its desirability and robust demand.

Tax Benefits: Dubai offers a tax-free environment, making it an attractive destination for real estate investment.

World-Class Amenities: Luxury properties in Dubai come with world-class amenities, including private pools, gyms, and concierge services.

Prime Locations: Many luxury properties are located in prime areas, offering stunning views and easy access to key attractions.

Security: Dubai is known for its safety and security, providing peace of mind for property owners.

For commercial property investment options, explore Buy Commercial Properties in Dubai.

Types of Luxury Properties in Dubai

Penthouses: Located in high-rise buildings, penthouses offer panoramic views of the city and luxurious living spaces.

Villas: Spacious villas with private gardens, pools, and state-of-the-art facilities are available in exclusive communities.

Townhouses: Luxury townhouses offer a blend of privacy and community living, with high-end finishes and amenities.

Beachfront Properties: Properties along the coastline provide direct beach access and breathtaking ocean views.

Golf Course Properties: These properties offer views of lush golf courses and access to exclusive golf clubs.

For mortgage financing options, consider Mortgage Financing in Dubai.

Popular Areas for Luxury Properties

Palm Jumeirah: Known for its iconic palm-shaped island, this area offers some of the most luxurious villas and apartments in Dubai.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, this area offers upscale living in the heart of the city.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers luxurious villas with golf course views.

Dubai Marina: Known for its vibrant nightlife and stunning waterfront properties, Dubai Marina is a popular choice for luxury living.

Jumeirah Beach Residence (JBR): This beachfront community offers a mix of luxury apartments and penthouses with stunning sea views.

For rental property management services, visit Apartments For Rent in Dubai.

Tips for Buying Luxury Properties in Dubai

Set a Budget: Determine your budget before you start looking at properties. This will help narrow down your options and prevent overspending.

Research the Market: Understand the current market trends and property values in the areas you're interested in.

Work with a Realtor: A reputable realtor with experience in the luxury market can help you find the best properties and negotiate the best deals.

Inspect the Property: Ensure the property is in good condition and meets your standards. Consider hiring a professional inspector.

Consider Future Value: Think about the property's potential for appreciation and its resale value.

For property sales, visit Sell Your Property.

Real-Life Success Story

Consider the case of James, an investor from the UK who decided to invest in a luxury villa in Palm Jumeirah. With the help of a local realtor, James found a stunning property that met all his requirements. The realtor guided him through the buying process, ensuring all legalities were handled smoothly. Today, James enjoys a high return on his investment, with the villa's value appreciating significantly.

Future Trends in Dubai's Luxury Real Estate Market

Sustainable Living: There is a growing demand for eco-friendly and sustainable luxury properties.

Smart Homes: Properties equipped with smart home technology are becoming increasingly popular.

Wellness Amenities: Luxury properties are now offering wellness-focused amenities such as spas, gyms, and yoga studios.

Flexible Spaces: There is a trend towards properties with flexible living spaces that can be adapted to different needs.

Branded Residences: Collaborations with luxury brands to create branded residences are on the rise.

Conclusion

Investing in luxury properties in Dubai offers numerous benefits, from high ROI to world-class amenities. By understanding the market, working with a reputable realtor, and considering future trends, you can make a sound investment in Dubai's luxury real estate market. For more resources and expert advice, visit Home Loan UAE.

5 notes

·

View notes

Text

sell commercial solar

If you have any desire to figure out how to sell sunlight-powered chargers quickly, you should comprehend what’s driving the unbelievable interest the business is encountering. These are the four fundamental variables

Rising energy costs Have you taken a gander at your energy bill of late? Tragically, you’re probably paying essentially more than you were quite a while back. Be that as it may, sadly, so are individuals you sell sun based to every day.

Quite possibly the best thing about sunlight-based chargers is that they permit property holders to bring down their energy costs since they never again depend on service organizations to give them power. Thus, most property holders save $1,500 a year in the wake of putting resources into sunlight-based chargers.

Falling sunlight-based charger costs

Everyone needs to get a good deal on their power bill — however not if the expense of doing so is restrictive. Quite a while back, this could have been the situation. Notwithstanding, nowadays, the cost of introducing sunlight-powered chargers has dove by over 75%, making it significantly more reasonable.

As a little something extra, sun powered has been demonstrated to increment home estimations. For instance, one investigation discovered that homes with sun power sell for 4.1% more, coming about in a $9,274 normal knock-in deal cost.

Regulation and motivating forces Set forth plainly, the American government is holding nothing back on the sun-based industry.

The Expansion Decrease Demonstration of 2022 is a help to everybody selling sun power. It permits mortgage holders to deduct 30% of their recently introduced planetary groups from their government charges. This could bring about immense investment funds.

Cross-country sunlight reception Last but not least, sun oriented has gone standard.

Sun-powered is presently not a specialty energy hotspot for the world-class not many. All things being equal, it’s presently available to most mortgage holders and developing rapidly on account of the expense-saving potential.

Match this with the way that sunlight-based is an environmentally friendly power energy source and by and large, viewed as better for the planet, and you have a popular item that the vast majority are eager to claim.

Instructions to SELL MORE Sun-powered chargers Anybody can figure out how to sell sunlight-based chargers — simply follow the tips underneath. When your group carries out these prescribed procedures, they’ll begin selling sun power much speedier than previously.

Comprehend sunlight-based tax reductions and motivations Sun-powered chargers are less expensive than they used to be. However, they aren’t modest......sell commercial solar

2 notes

·

View notes

Text

What's better than rent control?

Landlords competing for tenants—not the other way around! How do you get competition between landlords? Not by making it less attractive to supply accommodation, but by making it less attractive not to—by taxing vacant lots and unoccupied dwellings. A “vacancy tax” applies not only to what real-estate agents call vacancies (properties advertised for rent), but also to unoccupied properties that are not on the rental market. To avoid the tax, the owners need to find occupants. In the case of undeveloped subdivisions, finding occupants requires prompt development—not “drip-feeding” the market. In the case of vacant lots, finding occupants requires building (and the zoning system, if there is one, can determine the minimum density needed to avoid the tax).

What would property owners think of this? Consider:

If you're a property investor, you're betting on growth in the economy's capacity to pay rent and service mortgages. So you need your fellow investors to be generating economic activity on their land—not just hoarding it. And you can't have one rule for your fellow investors and another one for you!

A vacancy tax on residential property is good for commercial property owners because it keeps nearby residential properties populated with prospective customers and workers. And it's good for homeowners with variable-rate mortgages because it's anti-inflationary, making the central bank less likely to raise interest rates and more likely to lower them. (And of course the tax doesn't apply to your home, which by definition is not vacant.)

A vacancy tax on commercial property is good for residential property owners because it keeps nearby commercial properties populated with employers and service-providers. It's good even if you're a commercial property owner because it keeps nearby commercial properties populated with complementary businesses that will attract foot traffic to your property!

A vacancy tax is not meant to be paid. It's meant to be avoided!

A vacancy tax is good for general taxpayers because the avoidance of it requires economic activity, which expands the bases of other taxes, allowing their rates to be lower. (And of course a vacancy tax is good for real-estate agents because it generates more rental-management fees or—if owners decide to sell rather than let—sales commissions.)

For all these reasons, the benefit of a vacancy tax for tenants need not come at the expense of owners. It can come out of economic growth, which is also good for owners.

RETWEET IF USEFUL.

3 notes

·

View notes

Text

What are commercial real estate services?

Commercial real estate services refer to a range of professional services and activities related to the buying, selling, leasing, managing, and investing in commercial properties. Commercial properties include office buildings, retail spaces, industrial facilities, hotels, warehouses, and other income-producing real estate assets. These services are typically offered by real estate professionals, companies, and organizations specializing in the commercial real estate sector. Here are some of the key components of commercial real estate services:

Brokerage Services: Commercial real estate brokers help clients buy, sell, or lease commercial properties. They facilitate transactions, negotiate terms and conditions, and provide market insights to help clients make informed decisions.

Property Management: Property management companies oversee the day-to-day operations of commercial properties on behalf of owners. This includes tasks such as rent collection, maintenance, tenant relations, and financial reporting.

Leasing and Tenant Representation: Commercial real estate agents and brokers specializing in leasing help property owners find suitable tenants for their spaces. Tenant representation services assist businesses in finding suitable properties to lease.

Investment Services: Investment firms and professionals provide guidance on real estate investment strategies. They may help investors acquire, manage, or divest commercial properties to optimize returns.

Appraisal and Valuation: Appraisers determine the market value of commercial properties, which is crucial for financing, taxation, and decision-making purposes. Valuation services help property owners understand the worth of their assets.

Development and Construction: Developers and construction companies focus on creating new commercial properties or renovating existing ones. They handle the design, permitting, and construction phases of commercial real estate projects.

Financing and Mortgage Services: Lenders and financial institutions offer loans and mortgage products tailored to commercial real estate projects. These services help property buyers secure the necessary capital for their investments.

Market Research and Analysis: Real estate research firms provide market data, trends, and analysis to assist clients in making informed decisions. This includes information on vacancy rates, rental rates, and demand trends.

Consulting and Advisory Services: Real estate consultants offer strategic advice and planning services to property owners, investors, and developers. They may help clients optimize property portfolios, assess market risks, or formulate investment strategies.

Legal and Regulatory Services: Real estate attorneys specialize in handling legal aspects of commercial real estate transactions. They ensure that contracts, leases, and other legal documents comply with local laws and regulations.

Environmental Assessment: Environmental consultants assess commercial properties for environmental risks and compliance with environmental regulations. This is particularly important for properties with potential contamination issues.

Property Tax Services: Property tax consultants assist property owners in managing and minimizing property tax obligations by evaluating assessments and pursuing tax appeals when necessary.

Overall, commercial real estate services encompass a wide range of activities aimed at facilitating the acquisition, management, and optimization of commercial properties, with the goal of maximizing returns and minimizing risks for property owners, investors, and businesses.

2 notes

·

View notes

Text

How to Choose the Right Property for Real Estate Investment

Introduction

Investing in real estate can be a lucrative venture, but choosing the right property is crucial for long-term success. Whether you're a seasoned investor or a first-time buyer, thorough research and careful consideration are essential. In this article, we will guide you through the process of selecting the right property for real estate investment. By understanding key factors such as location, market trends, property condition, and financial feasibility, you can make informed decisions and maximize your investment potential.

Define Your Investment Goals

Before starting your property search, clearly define your investment goals. Are you looking for rental income, long-term appreciation, or a property to flip? Determine your budget, desired return on investment (ROI), and risk tolerance. This will help narrow down your options and focus on properties that align with your objectives.

Research Local Real Estate Market

Thoroughly research the local real estate market to understand trends, supply and demand, and projected growth. Study market reports, consult with local real estate agents, and explore online resources. Identify areas with potential for growth and properties that fit within your investment strategy. Keep an eye on factors like job opportunities, infrastructure development, and population growth, as they can impact property values.

Location

Location is a fundamental factor in real estate investment. Look for properties in desirable neighborhoods with good amenities, proximity to schools, transportation, and commercial hubs. Consider the overall safety and attractiveness of the area. Properties in prime locationstend to appreciate faster and attract reliable tenants, ensuring a steady rental income stream.

Property Condition and Potential

Assess the condition of the property and its potential for improvement or renovation. A well-maintained property may require less upfront investment but may also offer lower returns. Consider your willingness to undertake repairs or renovations and evaluate the associated costs. Look for properties with potential for value-added improvements that can increase rental income or resale value.

Rental Income and Cash Flow Analysis

For rental properties, conduct a thorough rental income analysis. Research local rental rates and vacancy rates in the area. Calculate potential rental income and compare it to the property's expenses, including mortgage payments, property taxes, insurance, maintenance costs, and property management fees. Ensure that the property generates positive cash flow, allowing for a return on investment and covering any ongoing expenses.

Financing Options and Return on Investment

Evaluate different financing options and analyze the return on investment (ROI) for each property. Consider factors such as mortgage interest rates, loan terms, and potential tax benefits. Calculate the potential ROI by factoring in rental income, property appreciation, and expenses. Compare different properties and financing scenarios to choose the option that maximizes your ROI and aligns with your investment goals.

Property Management Considerations

If you prefer a hands-off approach, consider hiring a professional property management company. Research local property management firms and evaluate their reputation, fees, and services. Property managers can handle tenant screening, rent collection, maintenance, and other day-to-day responsibilities, saving you time and effort.

Exit Strategy and Long-Term Planning

Develop an exit strategy and consider the long-term prospects of the property. Evaluate potential appreciation and market conditions to determine the optimal time to sell or refinance. Incorporate your investment goals and time horizon into your decision-making process.

Conclusion

Choosing the right property for real estate investment requires thorough research, analysis, and careful consideration of various factors. By defining your goals, researching the market, evaluating property condition and potential, analyzing cash flow, and considering financing options, you can make informed decisions and set the stage for a successful real estate investment journey.

#Total Environment Project#Total Environment project in Bangalore#Premium properties in Bangalore#real estate#Luxury Apartment in Bangalore#tumblr blog#tumblr update#tumblr settings#tumblr image#viral blog#viral stories#viral trends

2 notes

·

View notes

Text

Taking the Pain out of High Net Worth mortgages for U.S. Real Estate, without AUM requirements

With inexpensive funding and various tax advantages, everyone should take advantage of the benefits of a mortgage when investing in U.S. real estate regardless of the loan size. However, why do the wealthy often find it increasingly difficult to obtain mortgage financing without AUM?

With a portfolio of assets worth millions of dollars, one may assume that securing credit would be a straightforward task for a high net worth (HNW) individual. Unfortunately, the reality can be quite different especially if you’re a foreign national or U.S. Expat.

The unique nature of a HNW’s wealth – their income, investments, and liquidity – puts this group of people at a surprisingly high risk of being turned away by conventional banks unless they are willing to deposit a significant amount of funds for the bank to manage. This is certainly true in the mortgage market, and what’s more, it is an issue that has become more prevalent post-Covid.

American Mortgages has a dedicated HNW Team that focuses on mortgage solutions for foreign nationals and U.S. expatriate clients.

“As a company, our focus is finding solutions that go beyond what Private Banks can offer was the cornerstone of why this has been so successful. Our goal is to be a viable solutions provider and a trusted partner for the private banks and their clients. None of our loans require AUM, hence there are no funds taken away from their current investments or portfolio.” – Robert Chadwick, co-founder of Global Mortgage Group and America Mortgages.

America Mortgages HNW mortgage loans have a multitude of options when it comes to qualifying for a large mortgage loans regardless of the passport you hold.

Asset Depletion – a surprisingly simple way to establish your income. AM Liquid Portfolio uses a unique view on “asset depletion” to qualify HNW clients using their investment portfolio without an encumbrance or pledge of assets. Essentially, all of your assets are entered into a calculation, and a final number is churned out. The final number is then used as the income to qualify. In most cases, as long as the income is sufficient, no other person’s income documentation is required. This makes an often complicated and tedious process simple, transparent, and painless.

Debt Service Coverage – When it comes to HNW borrowers, one of the most overlooked and misunderstood loan programs is debt service coverage. HNW borrowers tend to own multiple properties in various asset classes. If the property is used as a rental, then there may not be any requirement to go through the tedious process of providing and verifying personal income. Again, as HNW borrowers tend to have very complicated tax returns, this is a straightforward way to show the borrower’s debt serviceability.

Debt service coverage ratio– or DSCR – is a metric that measures the borrower’s ability to service or repay the annual debt service compared to the amount of net operating income (NOI) the property generates. DSCR indicates whether a property is generating enough income to pay the mortgage. For real estate investors, lenders use the debt service coverage ratio as a measurement to determine the maximum loan amount.

Bridge/Asset Based Lending – With Covid still in play, it’s not uncommon for investors to experience a temporary liquidity event. Rather than selling their property, they are using their real estate to release equity. Asset-based lending is an option for both residential (non-owner-occupied) and commercial properties.

Simply stated, HNW bridge loans are used for residential and commercial investment property when more traditional institutional financing sources may not be available. Due to temporary liquidity, many borrowers have capital needs that traditional sources often can’t meet. For example, a borrower purchases property out of bankruptcy or foreclosure and needs to close quickly “same as cash” before long term financing can be arrange.

Simplified Income – HNW borrowers often have personal and business tax returns, which are complicated. The complexity of these returns often turns into an administrative nightmare for the borrower when dealing with a mortgage lender. What makes America Mortgages unique is the fact that 100% of our clients are living and working outside of the U.S. We are dealing with HNW clients from Shanghai to Sydney. Simply put, translations and understanding tax codes, deductions, net income, etc., is painful.

America Mortgages HNW Simplified Income documentation is just that. We do not require years or, in some cases, decades of tax returns, P&L, A&L, bank statements, etc. We take an often complicated process and simplify it; 1. If you’re self-employed, we will request a letter from your accountant stating the last two years’ income and current YTD. 2. If you’re employed, then a letter from your employer on company letterhead stating your last two years’ income and current YTD is sufficient. Yes, it’s that simple and painless.

As 100% of our clients are either Foreign Nationals or U.S. Expats, we understand the intricacies and complexities of this type of lending for our borrowers. It’s as simple as that. Our HNW loan programs are structured to meet our client’s requirements. Providing competitive pricing with the assurance that your loan will close is our only focus, and no one does it better.

For more information, Visit: https://usbridgeloans.com/taking-the-pain-out-of-high-net-worth-mortgages-for-u-s-real-estate-without-aum-requirements/

4 notes

·

View notes

Text

Here at Harvey Brooks, we offer estate agency services such as property management, property appraisals, property sales, property lettings, home valuation, tenant management, property marketing, landlord services, commercial property sales, commercial property lettings, mortgage advice, and first time buyer advice to clients throughout Middlesbrough and the surrounding areas of cleveland. If you require additional information about the estate agency services that we offer, be sure to give us a call today. We’re always on hand to take your call, answer any questions and deal with any enquiries that you may have.

Make us your number-one choice when you need estate agency services such as property management, property appraisals, property sales, property lettings, home valuation, tenant management, property marketing, landlord services, commercial property sales, commercial property lettings, mortgage advice, and first-time buyer advice in Middlesbrough and Cleveland. We would love to provide you with the estate agency services you need.

Website: https://harveybrooks.com

Address: 8 Marton Shopping Centre, Middlesbrough, Cleveland, TS7 8DX

Phone Number: 01642 506800

Contact Email: [email protected]

Business Hours: Monday - Saturday : 09:00 AM - 05:00 PM

3 notes

·

View notes

Text

What Are The Factors I Need To Consider When Buying A Property In Dubai

Thanks to the increased foreign direct investments and free trade agreements between UAE and other countries, Dubai has become one of the most happening cities in the world, especially for the wealthy across the globe.

Besides free trade, low tax and zero income tax, Dubai is also dubbed as the business hub of the Middle East and enjoys the status as a favorite travel destination. Such features along with political stability and investment in infrastructure significantly boosted the country’s real estate.

Reportedly, Dubai saw a 76 per cent rise in real estate transactions in 2022 which amounted to a whopping $140 billion, with a majority of buyers from Russia. If you are lured by the lush lifestyle and cheap service from low-wage laborers procured from Asia, Africa and the Middle East, and propelled to buy a property here, here’s how to make a smart purchase and enjoy your slice of the cake.

The Current Trends Of Property Demand In Dubai

While real estate in Dubai is broadly classified on a residential and commercial basis, the former is further classified as villas, apartments, penthouses and working houses or studio apartments that the opulent purchase to house their staff.

The commercial property includes office spaces, trade areas, warehouses, exhibition halls and industrial properties. While the demand for office space is believed to have subsided, the need for warehouses has increased due to enhanced e-commerce developments.

The huge retail companies and international markets in the Emirates have caused this demand for warehouses and sorting places.

Appreciation For Dubai Property

The strategic location and accentuating economy add to the appreciation of property value in Dubai. The flawless infrastructure makes any real estate investment fruitful, especially the off-plan ones.

Through flexible payment plans, off-plan properties have enhanced appreciation since the property price increases as the building nears completion. Likewise, even end users benefit from buying a property at a lower cost with more value for money.

Buyers can also benefit from various plans provided by promoters like post-handover payment plans and rent-to-own plans to name a few. Early investments offer immense profits through the appreciation perspective.

Allegedly the price of properties which are arriving in the markets here are expected to rise by 25 per cent per year. Demand for villas has superseded those for apartments and despite the shortage of luxury villas, the demand only grows.

Zeroing In On The Right Property

The buyer must clarify self about the property type, purpose of the purchase, preferred locality and its functionality to satisfy the purpose, amount affordable for purchase, mortgage possibilities and the developer’s reputation to hand over the property in the scheduled time while purchasing the property.

It is equally important to check the risks involved and estimated ROI on completion of the project.

Timespan Of Occupation

Purchasing a home anywhere across the world, leave alone in Dubai, must be considered on both a short and long-term basis. An apartment purchased by a newlywed or young couple may seem insufficient when the family expands.

Purchasing villas gives the option to expand and redesign besides providing a better return on investments. These villas which are excellently furnished can be sold to one of the increasing numbers of interested buyers if owners choose to relocate to another country.

Budget

As of February 2023, the starting price of a property in Dubai is reportedly between AED 3 lakhs to 3.5 lakhs. The price of apartments in Dubai depends upon floor area, locality and amenities among various other factors.

The buyer must be prepared to pay a 10 per cent refundable registration fee while purchasing the desired property.

Location

The instance found below shows how price varies among localities for almost the same floor area.

One-bedroom apartments measuring 800 to 900 square feet at Business Bay and Dubai Hills Estate at Mohammed Bin Rasheed are affordable. One-bedroom apartments are also available at Al Wasl (Jumeira), Dubai South City (Jabal Ali) at affordable rates.

Single-bedroom apartments at Emaar Burj Vista measuring between 700 to 1000 square feet cost more than AED 2,00,000 at Downtown Dubai, Dubai Marina. Proximity to Dubai Mall, Dubai Mall Metro Station and easy connectivity to Sheik Zayed Road and Dubai Property justifies the costly price of this single-bedroom apartment.

The Purchase Medium

A buyer could save a lot of money by avoiding brokers or middlemen while purchasing property in Dubai directly from the owner. Notably, brokers charge a 2 per cent agency fee and a 5 per cent VAT charge on the fee.

However, while avoiding brokers, one forgoes professional assessment of properties and expert navigation of transaction details like the contract paperwork, for instance, the art of negotiating.

Dubai Land Department Service Charges

Dubai Land Department service charges, which are mandatory while purchasing property in Dubai, may be shared equally by the buyer and seller or might be entirely paid by the buyer. The DLD charges amount to 4 percent of the property value.

Additionally, the buyer may need to pay a mortgage registration fee if bought through a loan, which amounts to 0.25 per cent of the loan along with AED 290. If the DLD is not paid within 60 days, the purchase is understood to be canceled.

Property Service Charges

The property service charges which are calculated on a square foot basis may range between AED 3 to 30. Besides property service charges one must foot Dubai Electricity and Water Authority fees along with insurance fees, security deposit and property transfer fees.

The property service charge varies along with locations, project type and purchase purpose. The buyer should also pay a ‘sinking fund’ which is a reserve fund that meets expenses for major repairs in future. Interestingly the 10 to 15 per cent price drop in key locations of Dubai facilitates developers selling to new end users.

While places like International City, Discovery Gardens have low service charges at 7 Dirhams per square feet (psf), Business Bay, Dubai Marina, Jumeirah Lakes Towers, Sports City, Jumeirah Village Circle charge moderately at 10 Dirhams psf.

Arabian Ranches 1 and 2 require AED 0.89 psf and 2.44 psf respectively while Burj Vista property owners shell out a massive AED 17.44 psf for property services.

Amenities And Their Scalability, Effectiveness And Quality

Villas are equipped with clubhouses, gyms and modern equipment and are tagged with excellent resale value. Villas in Dubai Hills, Arabian Ranches, Palm Jumeirah, Emirates Hills, Damac Hills and Al Furjan are sought for 18-hole golf course plus proximity to the city, connectivity to Sheik Mohammed Bin Zayed Road, Waterfront view, Privacy with palatial layout, family-friendly atmosphere and proximity to Expo 2020 site in the same order.

Handling Installments

Installment plans are popular in Dubai real estate purchases. 10 percent of the total cost is paid as advance which is followed by installments that cover half the entire cost at the time of handover.

Documents Required

Copies of documents including Emirates ID, passport, Visa page, reservation form, Sales and Purchase Agreement and Mortgage Contract if applicable required while purchasing property in Dubai.

Check Developer Background

It pays to check the developer’s track records before approaching them to buy property. If the developer lacks dedication, his property abounds in unsatisfactory plans and poor finishes while laying tiles, cupboards and walls.

Where To Purchase Off-Plan Properties

Purchasing a property through D Realtors, a professional and authentic real estate player in Dubai, fetches access to the functionally and aesthetically best property in Dubai which is spread across in prestigious locations such as Mohammed Bin Rashid City, The Fields, Burj Khalifa district and Sheik Zayed Road to name a few.

Final Words

The decision to join the game cannot be delayed too much since the prospects have already caught the eyes of many. Waste no time in deciding to take the plunge because the competition is already in the news.

Share this:

#Government approved realtors in dubai#D realtors#Dubai real estate brokers#Realtors in uae#Rent property in dubai#Lease property in dubai#Real estate in dubai#Uae real estate brokers#Buy property in dubai#Buy property in uae#Realtors in dubai#Freehold property in dubai#Buy apartment in dubai#Rera approved brokers in dubai

2 notes

·

View notes