#cheap brokerage

Explore tagged Tumblr posts

Text

Traders Solution is the best forex broker solution in India 2023 as it is deeply compared and analyzed by the experts. Choose wisely before start forex trading

#lower broker commission#discount brokerage commission#lower broker fees#cheap forex broker solutions#lower brokerage commission

0 notes

Text

VW wouldn't locate kidnapped child because his mother didn't pay for find-my-car subscription

The masked car-thieves who stole a Volkswagen SUV in Lake County, IL didn’t know that there was a two-year-old child in the back seat — but that’s no excuse. A violent car-theft has the potential to hurt or kill people, after all.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/28/kinderwagen/#worst-timeline

Likewise, the VW execs who decided to nonconsensually track the location of every driver and sell that data to shady brokers — but to deny car owners access to that data unless they paid for a “find my car” subscription — didn’t foresee that their cheap, bumbling subcontractors would refuse the local sheriff’s pleas to locate the car with the kidnapped toddler.

And yet, here we are. Like most (all?) major car makers, Volkswagen has filled its vehicles with surveillance gear, and has a hot side-hustle as a funnel for the data-brokerage industry.

After the masked man jumped out of a stolen BMW and leapt into the VW SUV to steal it, the child’s mother — who had been occupied bringing her other child inside her home — tried to save her two year old, who was still in the back seat. The thief “battered” her and drove off. She called 911.

The local sheriff called Volkswagen and begged them to track the car. VW refused, citing the fact that the mother had not paid for the $150 find-my-car subscription after the free trial period expired. Eventually, VW relented and called back with the location data — but not until after the stolen car had been found and the child had been retrieved.

Now that this idiotic story is in the news, VW is appropriately contrite. An anonymous company spokesman blamed the incident on “a serious breach” of company policy and threw their subcontractor under the (micro)bus, blaming it on them.

This is truly the worst of all worlds: Volkswagen is a company that has internal capacity to build innovative IT systems. Once upon a time, they had the in-house tech talent to build the “cheat device” behind Dieselgate, the means by which they turned millions of diesel vehicles into rolling gas-chambers, emitting lethal quantities of NOX.

https://en.wikipedia.org/wiki/Volkswagen_emissions_scandal

But on the other hand, VW doesn’t have the internal capacity to operate Car-Net, it’s unimaginatively-named, $150/year location surveillance system. That gets subbed out to a contractor who can’t be relied on to locate a literal kidnapped child.

The IT adventures that car companies get up to give farce a bad name. Ferraris have “anti-tampering” kill-switches that immobilize cars if they suspect a third-party mechanic is working on them. When one of these tripped during a child-seat installation in an underground parking garage, the $500k car locked its transmission and refused to unlock it — and the car was so far underground that its cellular modem couldn’t receive the unlock code, permanently stranding it:

https://pluralistic.net/2020/10/15/expect-the-unexpected/#drm

BMW, meanwhile, is eagerly building out “innovations” like subscription steering-wheel heaters:

https://pluralistic.net/2020/07/02/big-river/#beemers

Big Car has loaded our rides up with so much surveillance gear that they were able to run scare ads opposing Massachusetts’s Right to Repair ballot initiative, warning Bay Staters that if third parties could access the data in their cars, it would lead to their literal murders:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

In short: the automotive sector has filled our cars with surveillance gear, but that data is only reliably available to commercial data-brokers and hackers who breach Big Cars’ massive data repositories. Big Car has the IT capacity to fill our cars with cheat devices — but not the capacity to operate an efficient surveillance system to use in real emergencies. Big Car says that giving you control over your car will result in your murder — but when a child’s life is on the line, they can’t give you access to your own car’s location.

This Thu (Mar 2) I’ll be in Brussels for Antitrust, Regulation and the Political Economy, along with a who’s-who of European and US trustbusters. It’s livestreamed, and both in-person and virtual attendance are free. On Fri (Mar 3), I’ll be in Graz for the Elevate Festival.

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

—

Upsilon Andromedae (modified) https://www.flickr.com/photos/upsand/212946929/

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

[Image ID: A blue vintage VW beetle speeds down a highway; a crying baby is pressed against the back driver's-side window. In the sky overhead is the red glaring eye of HAL 9000 from 2001: A Space Odyssey, emblazoned with the VW logo. The eye is projecting a beam of red light that has enveloped the car.]

#pluralistic#worst timeline#parenting#car-net#automotive#stranger danger#commercial surveillance#surveillance#volkswagen#vw

2K notes

·

View notes

Text

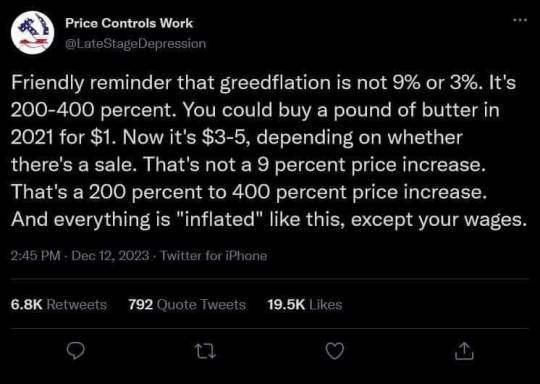

i have noticed that the price increases are really heterogeneous, and some things have increased.

over the past 5 years, the price of almond flour decreased, first from $6.50/pound to $6.00, then $5.50. because of how high-calorie, high-protein, and micronutrient-dense almond flour is, it is now quite cheap relative to its nutritional value, so I have made it a staple in baking: now all my muffin and cake recipes use 1/4 almond flour.

some things went up in price in one store but not others. feta cheese doubled in price at one store i shopped, so i stopped buying it, but i found a local Turkish-Lebanese grocery that was still selling it for the old prices, so now i just buy it there

some things went up in price absurdly and declined in quality. like some restaurants used to be cheap and good, and their prices nearly doubled and quality declined, so i just don't go there any more.

for a while, the price of eggs doubled, so i bought less eggs. then it went down again and now i eat more eggs again.

my wife's job is inflation-adjusted with automatic raises. if your job isn't, you need to ask your boss every 6 months why you have received a pay cut in real wages, and if you aren't satisfied with the answer, find a new job. it's much easier to get jobs now than it was between 2002 and 2020, trust me. employees have more power than they have ever before during my entire life, and a lot of them are passively sitting there accepting low wages just out of learned helplessness. most employers are at YOUR mercy. if you're not getting inflation-adjusted pay, find a job that gives it to you.

i'm self-employed and i can set my own prices and yes, my income does increase with inflation too.

if you save and/or invest, make sure your money is earning more interest than inflation. find a savings account like CIT Bank that pays 5% ish, or better yet, open a brokerage account and buy a money-market mutual fund like SWVXX that pays close to 5.17%. your money will grow faster than inflation and your income from interest and investments will grow faster than inflation.

don't just sit there and let the economy bully you, take charge.

if you just keep buying the same products when their prices suddenly double, you are rewarding greed (or just incompetence / inefficiency, which is sometimes a cause of soaring prices too) and this isn't good for anyone. if everyone adapted and shopped around, we'd keep prices a bit lower because we'd reward the businesses that managed to have efficient supply chains and refrained from greed. vote with your wallet and vote with your feet.

It is ridiculous how much grocery prices have increased

73K notes

·

View notes

Text

NTPC Q3: Brokerages remain optimistic despite muted quarter on cheap valuations, capex plans

Intensify Research services is a Top SEBI registered Research analyst indore committed to empowering investors with the most reliable stock market insights. Our team of expert analysts uses advanced tools and strategies to provide you with high accuracy stock market tips that enhance your chances of success. To visit- Intensifyresearch.com

#investing#banknifty#share market#nifty prediction#sensex#nifty50#finance#nse#economy#stock market#option trading

0 notes

Text

this is exactly how I feel whenever someone responds to a cry for help by "You need to get therapy."

like no shit Sherlock, would you see someone bleeding out on the ground and tell them "You need to see a doctor." ?!?!?

cause that's how it comes across sometimes.

Therapy has been hard enough to access when I have had insurance. Imagine not having insurance. I spend around 7 years of my adult life uninsured. Any therapy I paid for was out of pocket.

now, self-help WAS useful. and I got some precious good advice during this period and it helped me a lot.

some things that REALLY helped me:

the right self-help books, which I was able to get used online incredibly cheap

stable and supportive friendships, especially people who reached out to me and checked in on me periodically

good financial management skills. a bank with a low minimum balance and a transparent fee structure with few fees. a brokerage account that I could move money into and out of with fewer limitations than a bank, allowing me to save and access higher interest rates. paying my credit cards off in full every month and totally avoiding high-interest rate debt

having a cheap place to live and roommates to share rent and utilities and also to hang out with and look out for each other

having mostly good relationships with family at least most of the time. and having some other people in my life who were like family.

eating well, and specifically, knowing how to eat well. realizing I was vitamin D deficient and starting taking vitamin D. discovering red lentils and how cheap, easy, tasty, and healthy of a food source they were. more broadly, realizing the financial and health trap of processed foods and getting out of it.

I don't want condescending or trite advice to do some stupid thing I've already heard 100 times. I want real, actionable advice and tips. The kind that I share with others.

Like yesterday I realized I could use foam packing material I had saved, to fill a gap under a windowsill that was leaking cold air, to reduce my heating bill. I want tips like that. 1000 of them. Things I might not have thought to do that will improve my life, my comfort, my finances.

i think a lot of the conversation around self help is useless to anyone who isn’t financially stable. no amount of affirmations and manifestation and effort to take control of your own life can change the material reality of living to work and pay rent and scrape by. and it’s not a moral failing to be incredibly frustrated by this or even to experience depression and dysfunction because of this

5K notes

·

View notes

Text

How to Analyze Your Investment Portfolio for Long Term Success

Ongoing analysis of your investment portfolio is vital to long-term financial success. By consistently reviewing and adjusting your investments, you can ensure alignment with your financial goals, risk tolerance, and market conditions. A thorough portfolio analysis assesses your asset allocation and examines your investments' costs, risks, and tax efficiency.

Asset allocation is a pivotal factor in determining the success of your portfolio. It involves the distribution of your assets - stocks, bonds, cash, and other types - across various asset classes. The goal is to strike a balance that aligns with your time horizon and risk tolerance. A diversified portfolio can reduce market volatility by spreading risk across various assets. For instance, a mix of value and growth equities can provide a buffer during market downturns.

Alongside asset allocation, diversity plays a crucial role in risk management. It's not only important to have a range of assets; it's also important to ensure they are not all closely correlated. Investing across industries, regions, and even alternative assets like real estate or commodities can provide a sense of security, knowing that a downturn in one area won't spell disaster for your entire portfolio.

Understanding the risk in your portfolio is critical to long-term success. Everyone's risk tolerance is different and is influenced by any factors including age, financial goals, and investment time horizon. Some choose a conservative strategy, while others believe in superior returns via risk. This understanding puts you in control of your long-term success.

Using factor analysis is an excellent way to manage risk. This approach clarifies how several elements affect your portfolio, including firm size, profitability, and value. Small-cap stocks, for instance, have more volatility but usually have more growth potential. Over time, juggling these risks with more steady assets like bonds or large-cap companies can help your portfolio perform better.

Examining your portfolio also means evaluating the quality and maturity of your fixed-income investments - especially bonds. Usually less volatile than stocks, bonds help to lower the total portfolio risk. Not all bonds, meanwhile, bear the same degree of risk. Agency ratings of bond credit quality - the possibility of the bond issuer paying back the debt - show that while lower-rated bonds give higher yields but come with more risk, better-rated bonds (AAA) are less hazardous but offer fewer profits.

Furthermore, your bonds' maturity influences their sensitivity to interest rate fluctuations. While more interest rate sensitive, bonds with longer maturities usually provide better yields. Combining short-term and long-term bonds in a well-built portfolio helps control interest rate risk and liquidity.

Portfolio performance depends heavily on investment expenses. Over time, costs such as adviser fees, mutual fund management fees, and brokerage charges can diminish returns. Little expenses may mount up, particularly in long-term ventures. Review these costs often and look for methods to cut them without compromising the caliber of your investing plan. Low-cost indexes and exchange-traded funds are two reasonably cheap investment choices that can help lower your portfolio costs.

Maintaining discipline through market swings is one of the cornerstones of a successful long-term portfolio plan. Reacting to short-term market fluctuations, such as selling during a downturn or chasing high-performing stocks, can lead to underperformance. Instead, focus on your long-term goals to diversify your portfolio and align with your financial objectives. This discipline will help you avoid emotional decision-making and stay on course for long-term success.

1 note

·

View note

Text

Chinese stock markets fell after week-long break

China’s surging stocks began to falter, with Hong Kong shares falling sharply as officials provided few specific details on plans to support China’s slowing economy, according to Reuters.

Mainland markets recovered from a week-long pause, with turnover exceeding a trillion yuan in the first 20 minutes of trading. However, benchmarks soon fell from their highs as stimulated buying fever showed signs of cooling.

The Shanghai Composite rose 3.1 per cent in afternoon trade. Meanwhile Hong Kong’s Hang Seng, emerging as the fastest-performing major market this year due to rapid gains in recent sessions, fell 7.7 per cent.

The Australian dollar fell 0.4 per cent and the yuan hit its sharpest drop in a year. Prices of iron ore and other industrial metals also fell from morning highs.

Economic planner chairman Zheng Shanjie said China was “fully confident” of meeting economic targets and would allocate 200 billion yuan from next year’s budget to investment projects and support local governments.

The CSI semiconductor sub-index rose 16.4 per cent while the brokerage sub-index gained 10.6 per cent. Thematic indices from biotechnology to defence and electric vehicles also rose more than 10%.

Before the Golden Week break, China announced the most aggressive economic stimulus measures since the pandemic. The CSI300 index surged 25 per cent in five sessions, with last Monday’s CSI300 and Shanghai Composite posting their biggest gains since 2008.

The central bank announced cheap loans for buyback and swap programme. This would allow institutional investors to get access to cash to buy shares. Meanwhile, regulators called on financial institutions to tighten control over leverage and prevent illegal entry of bank loans into the stock market.

Read more HERE

#world news#news#world politics#china#china news#chinese politics#china economy#stock market#csi#csi300#stocks trading#markets#economy#economy news#economy and trade#economy and economic indicators#finance

0 notes

Text

IT sector valuations not cheap, but not in 'sell zone' yet: Morgan Stanley

Morgan Stanley observes growing scepticism among investors regarding stock positioning and stretched valuations in the IT sector. The current setup isn't as favourable as it was a few months ago, the brokerage said in a note.

Morgan Stanley believes valuations will stay afloat as long as the revenue upgrade cycle continues, which they anticipate will happen in the near term. On the bright side, the firm said that although valuations are definitely not cheap, they are not in the 'sell zone' either.

Key concerns include the stretched valuations of Infosys and TCS, which are still 10-11 percent below their post-COVID peaks when growth rates were higher. Investors are already heavily positioned in the sector, and its recent three-month performance has been strong.

How to Become a SAP Ariba Certified Consultant in Supplier Collaboration: A Comprehensive Guide

In today's digital economy, businesses are increasingly relying on advanced procurement solutions to streamline supplier management and optimize their supply chains. SAP Ariba is one of the leading platforms that offers comprehensive procurement, supply chain, and spend management solutions. Becoming an SAP Ariba Certified Consultant in Supplier Collaboration positions professionals at the forefront of these advancements, allowing them to drive business efficiency and enhance supplier relations. This guide will provide a detailed roadmap for those aiming to earn this prestigious certification and elevate their career in procurement technology.

1. Understanding SAP Ariba and Supplier Collaboration

SAP Ariba is a cloud-based procurement and supply chain solution that enables companies to manage their entire procurement process, from sourcing and ordering to invoicing and payments, through a single platform. It connects buyers and suppliers globally, promoting transparency and efficiency in transactions.

Supplier Collaboration within SAP Ariba focuses on fostering strong partnerships between businesses and their suppliers, enhancing communication, and reducing operational inefficiencies. Through tools like real-time visibility into orders, advanced shipping notices, and seamless invoice processing, businesses can ensure smooth interactions with their suppliers, improving both sides of the supply chain.

2. Why Get SAP Ariba Certified?

SAP Ariba certifications are highly regarded in the procurement and supply chain industry. By becoming certified in Supplier Collaboration, professionals demonstrate their expertise in optimizing supplier relationships and driving efficient procurement processes.

Key benefits include:

Increased employability: Many companies seek certified SAP Ariba consultants to implement and manage their procurement solutions.

Higher earning potential: SAP Ariba-certified professionals often command higher salaries.

Enhanced credibility: Certification validates your skills and boosts your professional reputation.

Global opportunities: SAP Ariba is used by companies worldwide, opening doors to global career options.

3. Prerequisites for SAP Ariba Supplier Collaboration Certification

While there are no mandatory prerequisites to take the SAP Ariba Supplier Collaboration exam, having relevant experience can significantly help in understanding the platform and acing the certification.

Ideal prerequisites include:

Familiarity with procurement processes: Understanding the end-to-end procurement cycle is essential.

Basic knowledge of SAP Ariba: Experience in navigating the SAP Ariba platform is recommended.

Work experience in supply chain management: Hands-on experience working with suppliers and procurement solutions can provide practical insights.

4. Preparing for the Certification Exam

The SAP Ariba certification exam for Supplier Collaboration focuses on your understanding of how to use the platform to manage supplier relationships effectively. The exam covers various topics, such as supplier onboarding, collaboration on orders, invoices, and managing supplier performance.

Here are the key areas covered:

Supplier Onboarding: Steps and best practices for bringing suppliers into the SAP Ariba network.

Order and Invoice Collaboration: Using the platform to streamline purchase orders, invoicing, and payments.

Supplier Performance Management: How to assess and track supplier performance through the system.

5. Study Resources for Certification

SAP provides a range of official learning materials that are essential for exam preparation. Key resources include:

SAP Learning Hub: Offers access to study guides, tutorials, and certification-specific content.

SAP Ariba training courses: Instructor-led and online training that deep dives into supplier collaboration functionality.

Practice exams: Taking practice tests helps familiarize you with the exam format and timing.

It is recommended to combine these official resources with practical experience using SAP Ariba for maximum effectiveness.

6. Steps to Register for the Exam

Registering for the SAP Ariba Supplier Collaboration certification exam is a straightforward process:

Create an SAP account: If you don't already have one, create an account on the SAP website.

Find your exam: Navigate to the certification section and find the Supplier Collaboration exam (C_ARP2PC_2208 or the latest code).

Select a date: Choose an exam date that suits your schedule.

Pay the exam fee: The exam fee typically ranges between $500 and $600, depending on your location.

7. Tips for Effective Study

Passing the SAP Ariba Supplier Collaboration exam requires a strategic study approach. Here are some tips to help you prepare effectively:

Focus on key topics: Ensure that you understand the major exam topics, such as supplier onboarding and performance management.

Use SAP’s official documentation: SAP provides in-depth guides and resources that are directly related to the exam material.

Set a study schedule: Dedicate a few hours each day to studying, and leave time for revision.

Take practice tests: Simulating the exam environment helps reduce test anxiety and ensures you are familiar with the question format.

8. What to Expect on Exam Day

The certification exam is proctored and can be taken online or at an exam center. It consists of multiple-choice questions, with a time limit of around 180 minutes. Make sure to:

Be well-rested: Ensure you're not fatigued to keep your focus sharp.

Manage your time: If you are unsure about a question, move on and return to it later to avoid wasting time.

9. Post-Exam Certification Process

Once you pass the exam, you’ll receive your SAP Ariba Supplier Collaboration certification, which is valid for a specific period (usually two years). In case of failure, you can retake the exam after a set time. Your certification status will also appear in the SAP Global Certification directory, allowing employers to verify your credentials.

10. Career Paths and Opportunities

Earning SAP Ariba certification opens up a wide range of job opportunities in procurement and supply chain management. Common roles for certified professionals include:

SAP Ariba Consultant: Implement and optimize SAP Ariba solutions for businesses.

Procurement Manager: Oversee procurement processes and supplier management.

Supply Chain Specialist: Ensure smooth supply chain operations and supplier relations.

SAP Ariba Functional Analyst: Provide technical support and ensure the efficient operation of the SAP Ariba platform.

11. Maintaining Your Certification

SAP certifications need to be maintained through regular updates, as technology and systems evolve over time. SAP provides re-certification exams to help consultants stay current with the latest platform changes and features. It's important to stay updated with SAP’s certification guidelines to ensure your certification remains valid.

Conclusion

Becoming an SAP Ariba Certified Consultant in Supplier Collaboration offers numerous career advantages, including higher earning potential, global career opportunities, and professional recognition. By following this comprehensive guide and dedicating time to preparation, you can successfully pass the certification exam and join the ranks of skilled SAP Ariba professionals transforming procurement processes worldwide.

0 notes

Text

#lower broker commission#discount brokerage commission#lower broker fees#cheap forex broker solutions#lower brokerage commission

0 notes

Text

PE ratio ineffective for valuing certain sectors and stocks in India: Kotak Securities

According to brokerage firm Kotak Securities, the PE multiple (price-to-earnings multiple)—a key valuation metric used by investors to evaluate the relative value of a stock or an index—is an ineffective valuation methodology for several sectors and stocks in India where earnings do not meaningfully translate into FCF (free cash flow) or returns to shareholders. Kotak believes many low PE sectors and stocks may not be as cheap as their headline numbers suggest. "We revisit the futility of PE valuations for valuing several sectors and stocks in India, given (1) low FCF-to-PAT in such sectors, (2) continued investment for incremental volumes and (3) continued investment in low-return businesses," said Kotak in a note on May 28.

The PE ratio is a simple way to measure how expensive or cheap a company's stock is compared to its earnings. However, the PE ratio can be an ineffective way to assess the valuation of certain companies, particularly in sectors where earnings do not accurately reflect the company's financial health or ability to generate cash. Free cash flow (FCF) measures how much cash a company generates after accounting for capital expenditures.

Kotak believes that the PE ratio is not useful for valuing companies in several sectors, such as automobile, tyres, cement, and speciality chemicals, and the type of companies, such as state-owned oil, gas, and fuel providers as in these sectors earnings don't effectively translate into free cash flow (FCF) or dividends.

"The market’s focus on PE (high or low is less relevant) is misplaced for such sectors, without taking cognisance of conversion of PAT to FCF," said Kotak. Giving the cement sector as an example, Kotak underscored that cement companies will continue to have high capex to deliver incremental volumes in the future. This will result in their FCF trailing PAT due to their low fixed asset turnover ratio.

"Cement companies had low FCF relative to their PAT, which will likely persist. We see strong volume growth, driven by housing and infrastructure demand, but the industry must incur large capex to support the growth. The debate around profitability is less relevant," said Kotak.

Similarly, Kotak said the oil, gas, and consumable companies, especially PSUs, will continue to invest in their core businesses, resulting in very low FCF relative to PAT.

Kotak pointed out that specialty chemicals companies have ambitious plans, requiring large capex, which results in low FCF in the medium term. They have historically seen low FCF/PAT ratios. "The current high PE valuations of the sector are underpinned by expectations of strong FCF generation in the future, which may or may not materialise once the growth phase is overdue to (1) the contractual nature of the business and (2) increased competition over time," said the brokerage firm. While PE may not be an effective method of valuing high-growth companies, state-owned firms, and capital-intensive sectors, experts say other valuation metrics, such as enterprise value to EBITDA (EV/EBITDA) and return on equity (RoE), might provide a more comprehensive and accurate assessment of a company's financial performance and potential.

RoE shows how well a company is using the money invested by its shareholders to generate profits. EV/EBITDA provides insight into a company's operating performance and shows whether it is fairly valued, overvalued, or undervalued compared to its peers.

#PEValuationDebate#KotakSecuritiesInsights#FreeCashFlowAnalysis#SectorValuationMetrics#FinancialPerformanceAssessment

0 notes

Text

I think something like 90% of the problems with the current model of the internet could be solved if platforms weren't so gun-shy about charging people for goddamn money.

This might have angered some people but hear me out. I'd much rather pay some unspecified fee to watch videos and listen to music than have the current data brokerage model in which cookies and fingerprinters are constantly spying on people to sell them tablecloths or whatever. If anyone has browsed the internet without blocking ads they should know that the targeted ad-based "free" service model is clearly unsustainable.

It'd have secondary benefits as well. One of the big problems we have is minors accessing inappropriate content online, which wouldn't happen if those sites would just cost goddamn money. Social media addiction? Less likely if it would just cost goddamn money.

I get that some people might violently reject the notion of paying platform providers any cash at all, but trust me. What you're currently paying, even if it feels cheap, is much, much more expensive.

0 notes

Text

Mastering Stock Trading Fundamentals: A Beginner's Guide

Beginners may find stock trading scary, but anyone can succeed in the market with the appropriate information and strategy. We'll explain the basic ideas of stock trading in simple language in this extensive book to assist you in starting your path to financial freedom.

To be coming a stock trading join now

Understanding Stocks

Equities, also referred to as shares or stocks, are ownership stakes in a business. Upon purchasing stocks, you gain the status of a shareholder and are eligible to partake in the assets and earnings of the business. On stock exchanges such as the NASDAQ or the New York Stock Exchange (NYSE), stocks are traded.

How the Stock Market Works

Buyers and sellers exchange equities on the stock market. Supply and demand drive prices: a stock's price increases when more people wish to purchase it (demand), and it decreases when more people want to sell it (supply). There are chances for traders to make money because of this ongoing volatility.

Types of Stocks

Stocks can be categorized according to a number of factors, including:

By Market Capitalization: Depending on the market valuation of the company, stocks are sometimes divided into large-cap, mid-cap, and small-cap categories.

By Sector: Stocks can be found in a variety of industries, including consumer products, technology, healthcare, and finance.

By Dividend Yield: A percentage of a company's profits are given to shareholders as dividends, and some stocks pay them. Regular income-seeking investors are fond of dividend stocks.

Setting Investment Goals

Establishing your investing objectives is crucial before you start stock trading. Which kind of return are you after: steady income, rapid growth, or both? You may create a trading strategy that suits your demands and risk tolerance by having a clear understanding of your goals.

Developing a Trading Plan

A trading plan is a road map that includes your trading objectives, tactics, and guidelines for risk control. It ought to contain:

Investment Goals: What do you hope to accomplish with trading?

Tolerance for Risk: What level of risk are you willing to accept?

Trading Strategy: Which type of trading—day, swing, or long-term investing—will you prioritize?

When will you buy and sell stocks? What are your entry and exit criteria?

Risk management: How are you going to reduce losses and safeguard your capital?

To be comming a stock trading join now

Learning the Basics of Technical Analysis

Technical analysis is a technique used to predict future price patterns by examining volume and changes in stock prices. Bollinger Bands, moving averages, and the Relative Strength Index (RSI) are examples of common technical indicators. Making wise trading selections can be aided by understanding how to interpret these indicators.

Understanding Fundamental Analysis

Evaluating a company's competitive stance, industry trends, management team, and financial standing are all part of fundamental research. Profit margins, debt levels, revenue growth, and earnings growth are important variables to take into account. Using fundamental research, investors might find cheap stocks with significant growth potential.

Opening a Brokerage Account

You must register for a brokerage account with a trustworthy broker in order to begin trading stocks. Seek out a broker who provides good customer service, educational materials, low commissions, and an easy-to-use trading platform. E*TRADE, TD Ameritrade, and Robinhood are a few well-known online brokers.

Practicing with Paper Trading

Try practicing with a paper trading account before risking real money. You can mimic real-time stock purchases and sales using paper trading without having to use real money. It's a great method to practice trading without taking any financial risks and test out various trading tactics.

Starting Small and Gradually Scaling Up

When the time comes for you to start trading with real money, start small and increase your investment gradually as you acquire experience and confidence. Refrain from investing all of your money in a single trade, and always follow your trading strategy and risk management guidelines.

Monitoring Your Investments

It takes constant observation of the market and your investments to be a successful trader. Keep up with market developments, company news, and economic data that could affect stock prices. Review your portfolio frequently, and modify your plan as necessary to take advantage of shifting market conditions.

Conclusion

The first step to becoming financially successful in the stock market is learning the fundamentals of stock trading. You can gradually create a lucrative trading portfolio by learning the fundamentals of stocks, creating a trading plan, doing technical and fundamental analysis, and exercising responsible risk management.

Regardless of your level of experience, patience, self-control, and ongoing education are essential for long-term success in the fast-paced world of stock trading.

To be comming a stock trading join now

0 notes

Text

💧 *WHAT IS ROYALQ ?*

👉 *ROYALQ Is a software robot created to read and trade on the world's largest EXCHANGERS... BINANCE or HUOBI EXCHANGE* ✅

*BINANCE and ROYALQ are two different platforms. All you need to do is connect your HOUBI HTX WALLET exchange API to interact with the ROYALQ bot.*

*Binance is the WORLD'S LARGEST and most trusted CRYPTO EXCHANGE; HUOBI HTX EXCHANGE is also one of the world's best crypto exchanges.IN THE WORLD 🌎.

*As our adoption increases. Many crypto fans will choose ROYALQ to do AUTO TRADE ON BINANCE because ROYALQ bot subscription fee is cheap at $100 per year ONLY.*

Registration LINK : https://royalqs.com/s/QJCX5

*BEST TRADE DEAL EVER: {80/20}*

*80% PROFIT for clients, and 20% for ROYAL Q brokerage.*

*Your Capital is safe 💯% because the client does not need to deposit the trade CAPITAL to ROYALQ.*

*Your hard earned money remains in your Binance account hence you do not lose control or access to your funds at anytime*

*HOUBI HTX WALLET APPS allows ROYALQ to connect to the API, it is able to read trades and complete BUY AND SELL PROFITABLE TRADE ORDERS AUTOMATICALLY WITHOUT HUMAN INTERVENTION:*

*The ROYALQ Bot is able to make a trading profit of 0.1% - 10% per day and 3% to 300% per month. At other market days we are able to make 2% to 5% a day. We have also seen trade triggers on certain assets of up to 23% in a day, so it all depends on the chosen algorithm of particular trade assets.*

Registration LINK 👇

https://royalqs.com/s/QJCX5

Inviter code: QJCX5

*FAQ*

💧 *How much can I expect monthly?*

👉 *Conservatively between 22 to 50 percent per month (bear or bull seasons).*

*PLS NOTE*

*Please know this is a worse case scenario. The ROYALQ bot has recorded huge gains in excess of ten times the average returns especially in (bull markets).*

💧 *How much Do I need to Start?*

👉 *Only $120 USDT TRC20 as subscription.

💧 *Does it take long to set up this bot? Super easy with guidance of our counselor.

👉 *No, set up takes less than 15 minutes*

💧 *How am I sure this will work for me?*

👉 *The ROYALQ bot is for anyone and everybody's profiting regardless of class, religion, age, academic background or race.*

💧 *Can I withdraw my money at anytime?*

👉 *Of course, Yes you can, ROYALQ bot does not hold deposit, your money is in your exchange account always.*

💧 *Is this better than giving my money to people or online companies to trade for me?*

👉 *As you know, many online companies and individuals have promised heaven and earth, in the end 99.9 percent of the time they have scammed people of their hard earned money. But with the ROYALQ bot you will always remain in control 24/7. ROYALQ is the game changer and nothing comes close to this innovation.*

💧 *Are there benefits if I share this with family and friends?*

👉 *YES! Though in ROYALQ no one is compelled to refer anyone to make money or be active on the platform. But if you do refer others, there’s a mouth watering benefit for you. You can always ask the person who shared this information with you to know more and help you get started immediately.*

💧 *What does the ROYALQ bot help me do in summary*

👉 *The ROYALQ bot helps you to be in control of making money from the cryptocurrency market without being an expert. In simple English, You will be able to print your own money from the crypto market without stress.* 💪

Registration LINK 👇BELOW

https://royalqs.com/s/QJCX5

💧 *Do I need to be an expert?*

👉 *No, with ROYALQ many newbies ,zero knowledge have said they will recommend this even to their grandma 😁 because it is very easy to understand and use. 90% have declared it profitable in their first month.*

🥂 *Enjoy your stay here, while you join us to print more dollars 💰💰💰💰*.💃💃💃💃

Get back to the immediate person who refered you on this amazing opportunity or where you got invitations and ask for guidance to join this amazing opportunity 💃💃💃✍️✍️✍️✍️

REFFERAL LINK OF MY HOUBI HTX WALLET APPS 👇👇👇👇👇

https://www.htx.com/invite/en-us/1f?invite_code=58au8223 Enjoy lifelong 30% commissions on every invitee's trading fees and get up to 1,500 USDT in Mystery Box.

0 notes

Text

Top 10 Forex Brokers in India

In today’s thriving world of Trading, selecting a trustworthy broker is important. When trading forex in India, traders should make sure their broker complies with the rules established by the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI), in addition to selecting a platform that offers competitive spreads and a variety of currency pairs.

We set out to investigate an online currency trading platform that has been approved by SEBI and the RBI in this blog post. Come and understand a list of carefully selected firms that will establish the benchmark for security and legitimacy in Indian Forex trading.

List of Top 10 Forex Brokers in India

The top forex trading platforms in India are listed and reviewed below, along with comprehensive details on each platform’s features and attributes.

CapitalXtend

CapitalXtend is a prominent Forex broker providing exclusive benefits that far surpass the rest. With an impressive 1:5000 leverage, traders can unleash huge possibilities. With eminent forex trading conditions with the lowest spread at 0.0 and free access to more than 300 instruments, CapitalXtend empowers investors with the needed tools for success in the volatile currency market.

OANDA

OANDA, well a reputed forex streaming platform in India, with its user-friendly interface and robust features. Having a reputation for reliability and transparency, It provides access to many currency pairs and trading instruments. Globally trusted, It is the forex traders’ top pick when it decide to navigate the forex market with confidence.

AvaTrade

AvaTrade is a leading trade forex online platform for trading which is well known for its tight spread and zero commission charges. Offering up to 30:1 AvaTrade provides powerful leverage and instant execution, offering traders convenient and flexible trading platforms. With 24/7 support by your side, you can face the markets with confidence, knowing help is always at hand.

CMC Markets

CMC Markets towers as a leader forex broker with more than 300 forex pairs, 70+ indices, 18+ cryptocurrencies, 11000+ shares & ETFs, 90+ commodities, and 40+ treasuries to its credit. Starting as low as 0.5 pips with a wide array of offerings, it calls to traders looking for varied opportunities.

Inveslo

Inveslo becomes the top choice forex broker with the high grades of benefits provided. With a generous 1:2000 leverage, traders can add possible gains. With a minimum spread of 0.01 and access to over 300 financial instruments, Inveslo provides traders with multiple choices. Additionally, their 24/7 multilingual support guarantees assistance is always on hand.

eToro

eToro a multi-asset forex trading online platform allows you to trade forex with more than 3000 financial instruments and 5000+ trading assets. Benefiting from the transparency of all the fee calculations, it is an ideal fit even for those with little experience for it comes with simple and intuitive solutions. Ease of use makes trading through this platform pleasant and it has become traders’ first choice.

IronFx

IronFX, trusted by more than 1.5 million retail clients, provides top-tier trading conditions and 24/5 multilingual support. Known for its reliability, it’s the one to turn to for trading Forex CFDs and a variety of financial instruments. The journey of the traders with IronFX is made convenient as they get a reliable partner.

Plus500

The leading forex broker Plus500 offers streamlined trading. Using an easy-to-use platform the traders have access to a huge variety of forex pairs and CFDs. Plus500 is characterized by its simplicity and reliability, attracting both novice and experienced traders looking for a straightforward approach to forex trading.

Pepperstone

Pepperstone, the leading forex brokerage firm, offers minute spreads starting from the commission of 0.01 lots on a per-lot basis, offering cheap trade solutions to traders. Known for its openness and cost-wiseness, Pepperstone facilitates trading strategy execution. Being a popular choice for traders, It is considered a perfect platform in that regard.

TD Ameritrade

TD Ameritrade, one of the biggest currency trading platforms, provides all-encompassing investment services. With a user-friendly platform, powerful research options, and access to a variety of investment products such as stocks, ETFs, options, and futures, TD Ameritrade has tailored its offerings to suit investors of all levels, giving them the ability to reach their financial goals.

Suggested read: Forex Trading for Beginners

Final Verdict

It is advisable to limit your search for the best forex broker for trading in India to those who are well-licensed and regulated. The Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) have imposed various limitations on currency trading but have not yet developed a framework for regulating or licensing forex brokers.

This is why, local traders in India frequently do business with foreign companies. To help provide a more secure and safe trading environment, we have listed the top 10 regulated forex brokers in India that accept Indian clients and are overseen by foreign financial authorities. It’s crucial to remember that not all overseas brokers are subject to the same regulations.

Originally Published on Medium

Source: https://mattwilliamscorp.medium.com/top-10-forex-brokers-in-india-2d7b47820c1f

0 notes

Text

How to Start a Forex Brokerage firm - Step by Step complete guide

A mind-blowing trading opportunity has been introduced by a Forex Brokerage Setup. The basic process to become a Forex brokerage and to assemble a brokerage career scheme is given below. A Forex brokerage career scheme covers the major features like registration and rewards given for traders.

You are able to Scratch or else pick out the White Label Solution. The traders will have the power to move on, when they feel the trade is going in the wrong way. Here we clearly explain about the start up process one by one in a Forex.

HOW TO ACCESS A SCRATCH?

ForexBrokerageSetup from scratch needs a very huge amount of seed capital. It also needs additional time for setting up the career. You have to make more attempts to set up the business. Here we have six main steps to be adhered:

Characterization of Target market.

Verify whether you have adequate capital.

Associate with a market maker.

Collaborate with a financier.

Setting up brokerage action.

Pre-open and streaming on live.

1. Characterization of target market:

The Foremost step is that you have to characterise your target spot. You have to identify your clients’ locality and that will help you to select the most important authority for the registration process in a Forex brokerage. The necessary authorization needs vary from one country to another country. Here we have numerous authorities for Forex Brokerage Setup.For example, Cyprus assists huge amounts of traders, world wide and also other trading worlds which includes FCA, BVI, etc. Before you have to conclude you have to approach all these sites given above.

2. Verify whether you have adequate Capital:

For setting up a Forex brokerage, you need a huge amount of money because it costs a lot. So you have to verify whether you will have adequate money to spend for your expenses. Especially the operations that have to be done in the first year. The authorities have the power to set up the capital amount.

3. Associate with a market maker:

T Liquidity is the major solution for a Forex brokerage, so it is very important to attach with the chief liquidity supplier. You have to support your clients. It is suggested that you have to contact an esteemed Forex liquidity supplier to explore all Tier-1 FX liquidity mediums.

4. Collaborate with a financier:

Here you have various down payment and cancellation choices to make your traders feel trouble-free. You have to be a companion with payment service suppliers to participate efficiently in the popular trading venues. In this, you are going to reward Crypto currencies. You have a crypto currency settlement path like permitting you to send and collect settlements online.

5. Setting up brokerage action:

In this you have to design websites and to determine the trading venues. You can also choose additional facilities that you need for trading. You have to set up a place of work at the spot with IT. You need supportive clients and adorable sales here for trading.

6. Pre-expose and streaming on live:

Previous clarification is needed for you about payment methods, mobile apps and various practical features before trading with your consumers. When you have completed all these steps clearly, you are ready to begin a fantabulous marketing venue and you are able to stream on live.

EMPLOYING WHITE LABEL SOLUTION:

The complexation in this huge process of a Forex Brokerage Setup from scratch, we can utilise the white label solution. You have the practical orders and execution trouble while using scratch. This can be rectified by the white label solution.

A white label solution costs less than scratch, so it is very cheap. So traders may opt white label solution instead of scratch. To make the traders convenient the white label solution is very much important.

Be a partner with Forex brokerage to avoid the risks of doing the trade by yourself. Here you have powerful and efficient supporters. You have to restrict the hazards while using a Forex brokerage white label solution.

START A FOREX BROKER TURNKEY:

A Forex turnkey is a unique gateway to begin a brokerage job rapidly. It has access to the job without any notable price. You can have the recently developed technology in this trading floor. To fascinate the traders here you can be environmentally friendly, easy to buy and no need for developing the software because it is already a recently developed one.

With a solid reputation for successfully building brokerage businesses from the ground up, Forexbrokeragesetup now services over 25 prestigious clients across the globe. If you would like to have your own brokerage up and running in just 4 weeks, click contact with us to get started!

0 notes

Text

TDP 5 Desktop Tablet Press | TDP-5 Pill Pressing Machine

Solvent Levelling Effect Chemical Reaction Engineering (manufacturing), Suicide Tuesdays Levelling Effect (Rolling Tobacco, Oxytocin, Pain Killers, Xanax, and Ecstasy) [Brain Chemical Dealing], Cash Back Program (Buy within 3 days of paycheck for extra Tobacco), Razor-Razor Blade C2C: Streetwear and PC Gaming (Business Model), et Real Estate Brokerage Trust Account (Money)

Street Price & Rave/Festival Example

Wholesale

Pill

$10 kg

Cannabis

$10 Ounce

Ecstasy

$3-$5 (wholesale)

Retail

Pill

$7 a pill

Cannabis

$20 for 1.5 grams

$50 for 4.5 grams

$70 for a 7.5 grams

Ecstasy

$5-$10 (on the street).

$20-$25 (inside a rave).

Molly

$40-$60 per gram.

Rebate

Pill

$4.50 a pill for cheap wholesale

Cannabis

$15 per 1.5 grams for cheap wholesale

Formulary

Pill Press to know quantity of Pills

Sale Methods (Consumer Manipulation)

Subscription, Deductible and Copayment (SDC)

Example

1 bottle of upper half bars for discounted subscription, downer bars is for full price

Can mix and match enzys

Uppers and Downers

Co-payment—also called co-insurance—is the portion of the bill that is your own responsibility.

A deductible is the amount of money that you are responsible for paying toward an insured loss.

Sell Enzymes in trios

Two tablets that can be mixed

Example

Hallucinogens and Benzos

One Potentiation Tablet

For the two that can be mixed; keep the maximum dose under a fatal overdose

Sell Potentiation Tablets by different levels

This takes away the dangers of mixing medication and dangerous doses

Cash Back Program

Example with Weed

Say someone buys a Quarter for a regular price. If the clients re-ups in a given time period give a cashback.

Money is being invested so profits won't be affected.

.5 gram is cash back

Marketing Trap

The cashback traps the client into re-upping consistently in a given time period. With money being invested and wholesale prices the isn't a big deal

Popcorn Sales

Example

The price gap between the small popcorn and medium popcorn is greater than the medium and large sizes.

Marketing Trap

You are manipulating into overpriced corn through this and it makes sense to get the highest value for your money

Moving Days

Raves/Festivals

Paycheck Period

Didier Drogba

1 note

·

View note