#chargeback prevention

Explore tagged Tumblr posts

Text

How Payment Gateways Support Chargeback Management

Navigating the world of online payments can be tricky, especially when it comes to chargebacks. A chargeback occurs when a customer disputes a transaction, asking their bank to reverse the payment. While this process is important for protecting consumers, it can be a source of frustration for businesses. The good news is that payment gateways are here to help! They play a vital role in simplifying chargeback management, making it easier for merchants to handle disputes effectively and maintain strong customer relationships

Chargebacks happen when customers dispute a transaction, asking their bank to reverse the payment. While this protects consumers, it can be frustrating for businesses. Fortunately, payment gateways simplify chargeback management by helping merchants handle disputes efficiently and maintain strong customer relationships.

Read more..

#payment gateway#chargeback sharjah#Online payment chargeback#Best payment gateways for chargeback prevention#Secure payment gateway solutions uae#Chargeback protection for merchants#Payment gateway chargeback support dubai

0 notes

Text

High-Risk E-Commerce: Maximizing Sales with Credit Card Payments

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In today's digital age, e-commerce reigns supreme in the business world. Yet, for enterprises operating within high-risk industries, the e-commerce payment landscape can be challenging to navigate. This is where High-Risk Credit Card Payments come into play as a crucial asset. This article explores how accepting credit card payments can revolutionize high-risk e-commerce. We will delve into strategies that span payment processing solutions to merchant accounts, with a focus on maximizing sales and achieving success within the high-risk e-commerce domain.

DOWNLOAD THE HIGH-RISK E-COMMERCE INFOGRAPHIC HERE

Broaden Customer Reach in High-Risk Sectors Industries characterized as high-risk, such as credit repair and CBD, necessitate the adoption of credit card payments. Offering this payment option not only extends your customer base but also fosters trust. It streamlines payment processing, making it accessible and efficient, which, in turn, instills confidence in customers, encouraging them to make purchases.

The Vital Role of High-Risk Merchant Accounts High-risk e-commerce demands a specialized approach. High-Risk Merchant Accounts are tailored to the unique needs of industries prone to elevated risks. These accounts incorporate features like chargeback protection and fraud prevention, serving as essential tools for high-risk business operations.

Efficient High-Risk Payment Processing Solutions High-Risk Payment Processing solutions cater to the distinctive requirements of high-risk businesses. They simplify payment acceptance, thus reducing the likelihood of transaction issues. The incorporation of a High-Risk payment gateway ensures that sensitive customer information is handled securely, instilling further confidence in your business.

The Significance of E-Commerce Payment Processing Efficient payment processing lies at the core of e-commerce businesses, whether they operate within the high-risk domain or not. Credit card payments play a pivotal role in this payment processing. By providing a seamless e-commerce payment experience, you enhance the overall shopping process, which, in turn, leads to increased sales and heightened customer satisfaction.

Leveraging SEO for Success in High-Risk E-Commerce In the highly competitive e-commerce arena, search engine optimization (SEO) should not be underestimated. The inclusion of pertinent keywords, such as High-risk credit card processing and accept credit cards for e-commerce, boosts your website's visibility. SEO optimization attracts potential customers actively seeking your products or services.

youtube

High-Risk Credit Card Payment Services for Businesses Payment processing is a constantly evolving field, with high-risk industries requiring adaptable solutions. High-Risk Credit Card Payment Services continuously adapt to cater to these distinctive demands. Keeping yourself informed and partnering with the right service providers, whether for CBD merchant processing or credit repair payment processing, is pivotal for sustained success.

In conclusion, high-risk e-commerce enterprises can thrive by embracing High-Risk Credit Card Payments. By offering credit card payments, you broaden your customer base and establish trust, streamline payment processing, and position your business for lasting success in the high-risk e-commerce realm.

#high risk merchant account#payment processing#merchant processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

Homeaglow customer support told me I couldn't cancel because of an issue with my bank, which is kind of ridiculous, but I called the bank anyway and tried my level best to cancel again. The bank told me they weren't even getting any communication with regards to that charge. Which pretty much confirmed what I already knew. Absurd to try and claim that all the other charges went through just fine, but this one (which incidentally means I won't be giving them any more money) somehow can't. I sent them an email explaining this and informed them that if they try to charge me a monthly membership fee again they will receive a chargeback. They may charge me the cancellation fee, but they had better hurry it up and do it quick because as soon as all the other charges post I'm putting a block on my account to prevent them from charging me for anything again.

And of course I gotta document document document everything because probably five years down the road I'll hear from a collection agency and they'll be claiming I owe them five years of membership fees. Then again, I'm moving in eight months and if I simply never tell the collection agency my name there's not really much they can do about it

5 notes

·

View notes

Note

Why is it unwise for individuals to initiate chargebacks? The website is oversaturated with AI-generated assets, yet the operators emphasize the sale of cash shop items and strategies to attract referrals, as new users generate revenue. I don't care if different artists produce various assets; removing AI content should be the primary concern, but instead, making a profit takes precedence. If they were prevented from making money, they would swiftly rectify this issue.

its not that I disagree with your other points at all, but filing chargebacks will get you banned (if you care) and possibly in legal trouble. i would love to hit cj in the wallet but this isnt the way chief

not gonna be posting about chargeback stuff any more, if you want to reply do so in the comments or tags

6 notes

·

View notes

Text

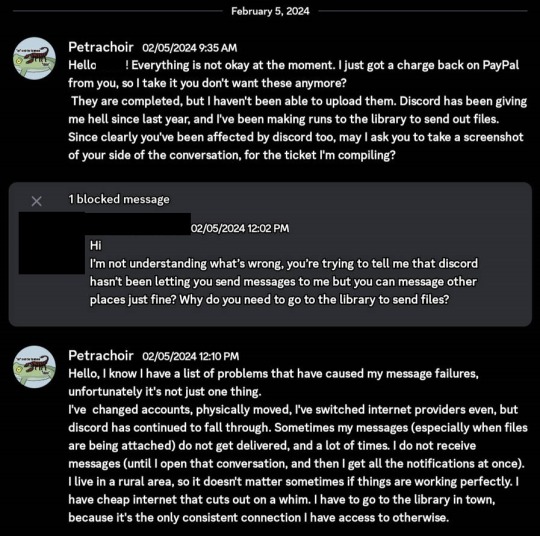

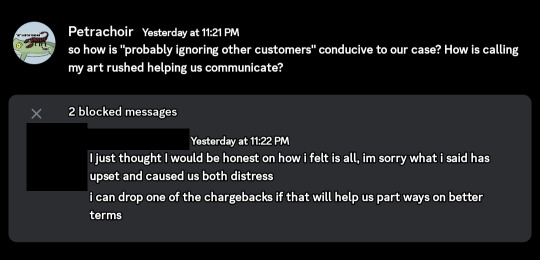

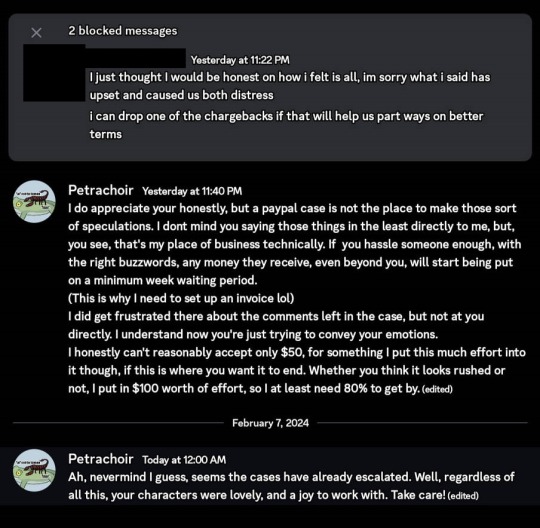

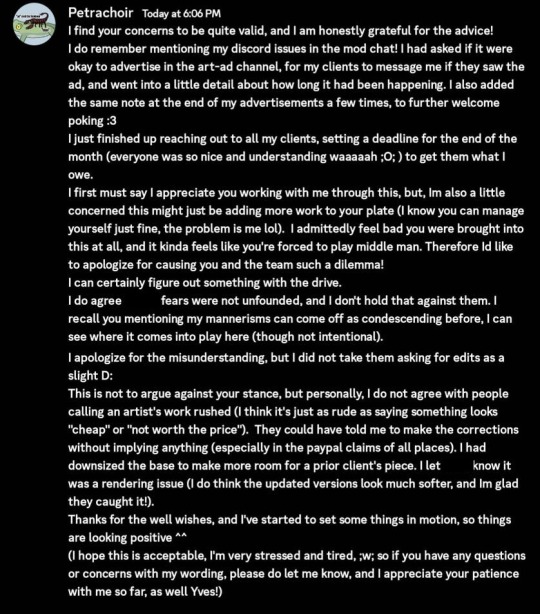

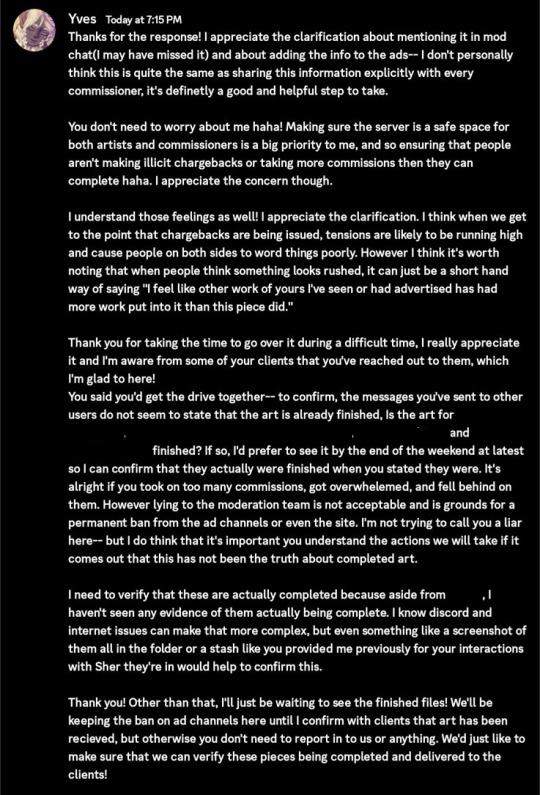

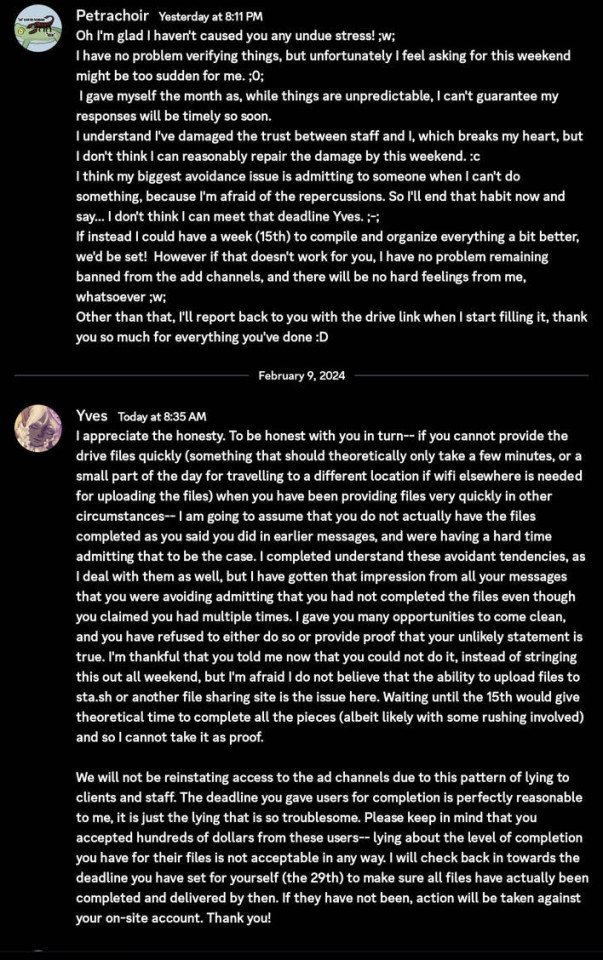

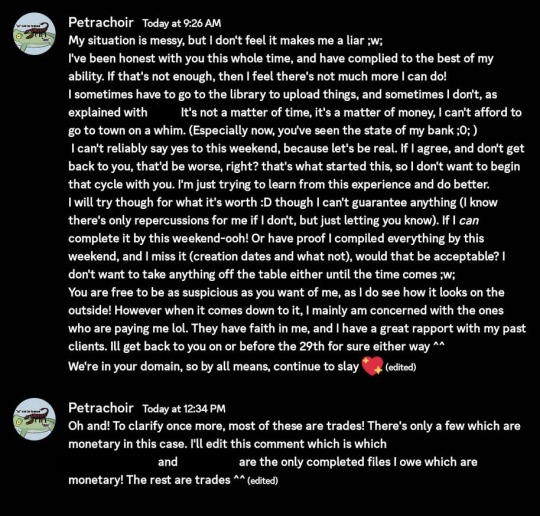

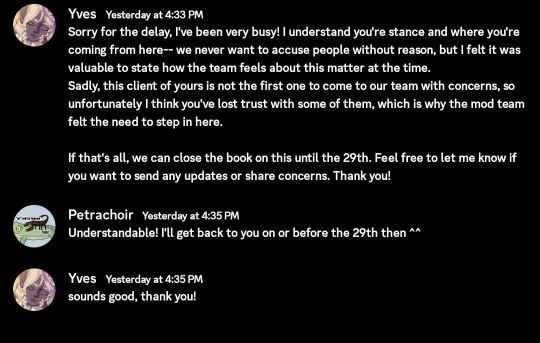

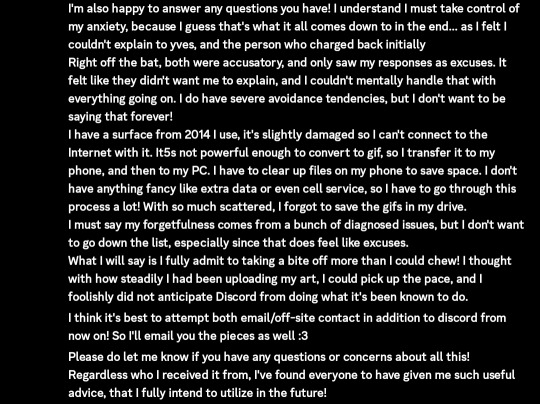

Petrachoir Banning Situation

All names of the people involved apart from Petra and Yves have been censored and all art and file names also censored to prevent anyone from searching for users.

Petra is not here to argue against the ban but to explain the situation.

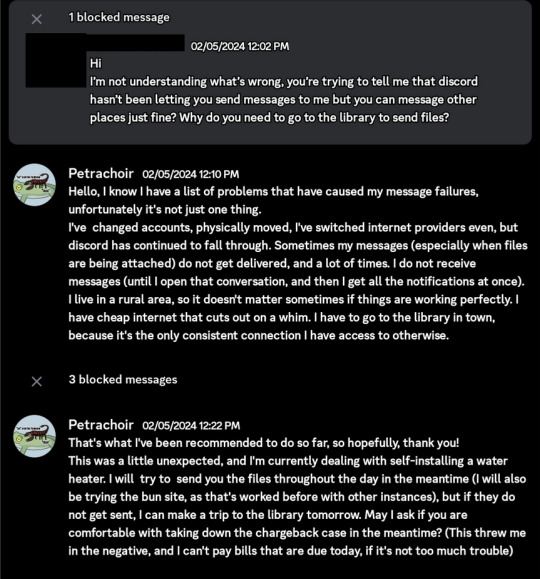

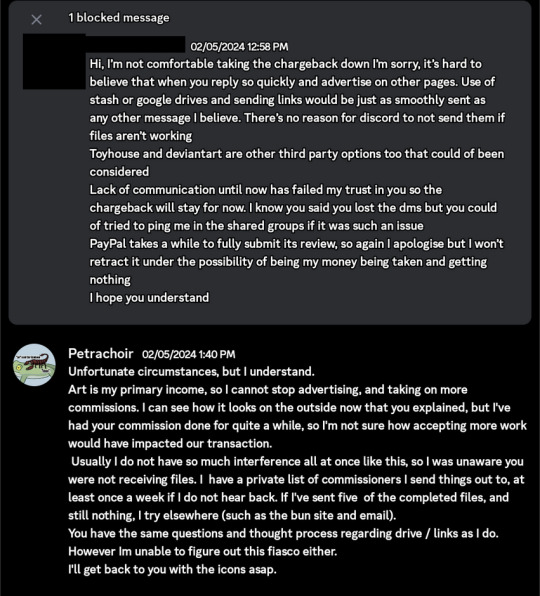

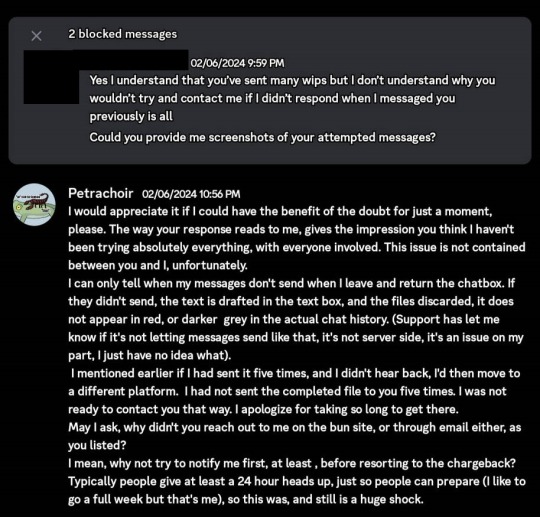

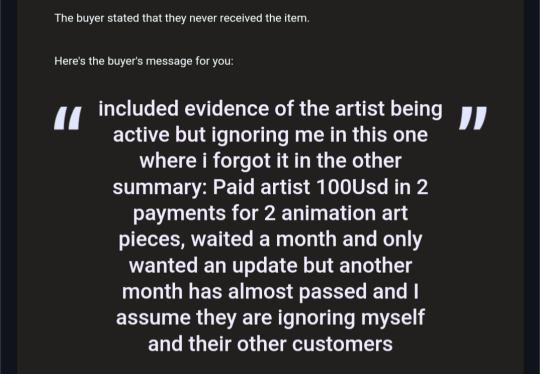

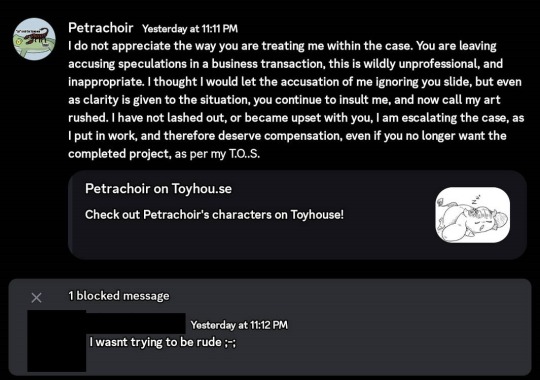

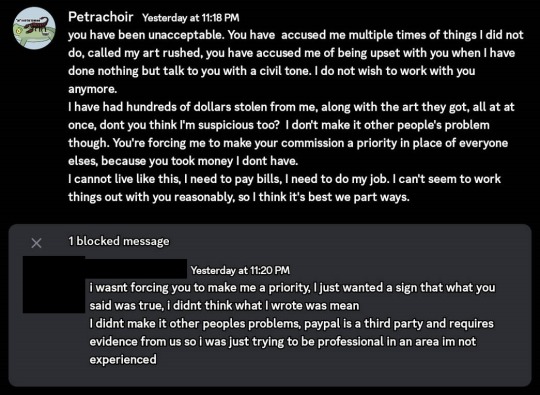

Petra reached out to me about a chargeback situation. Petra's discord seems to have an error with messages being sent/received that they reached out to discord support about but the issue has not been resolved.

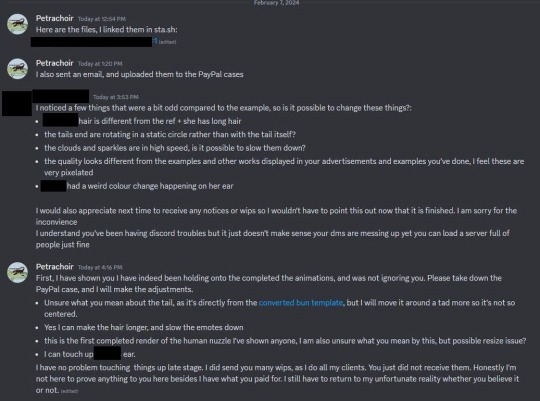

A client from december had filed a chargeback in february on a project they'd completed but did not receive because of the discord error. Here are the screenshots of this conversation and the paypal dispute.

I did receive proof of the upload dates of the files given to the client as well as the email sent to them. I also was sent the updated version that had been sent to the client as well.

The client contacted Yves about the situation which led to the following conversations.

This is the explanation that was sent to a client on why they were having difficulties as well.

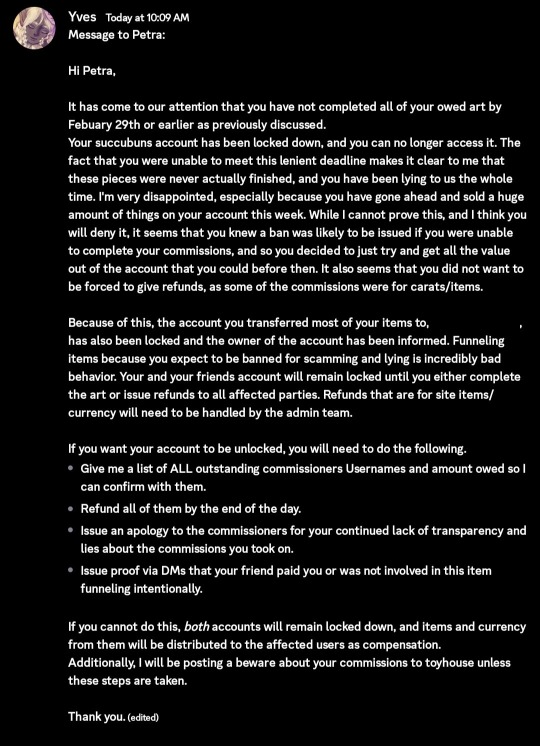

Paypal settled in Petra's favor and cited that proper evidence was given to them but Petra was unable to meet the deadline with Yves so they were banned as a result.

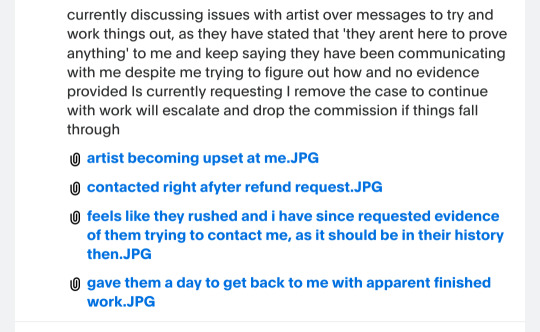

Petra states they felt uncomfortable with the confrontation with Yves from the beginning and feels it was inappropriate to ban someone who wasn't involved. Because of the financial situation they were selling everything as a result.

Petra also informed all clients of the situation to have transparency and all responded that they still wanted the art that was owed to them.

They did not respond to Yves and this was the result.

Petra isn't sure where the 6+ month old commissions part is coming from since the situation was about the december commission. I have also not heard anything about it from the people I was contacted by.

They also felt like they couldn't explain further to Yves due to how they felt uncomfortable and like there was hostility from Yves.

Petra additionally does not agree with how they handled the situation and has been offered advice from many people on how to proceed with commissions and business from now on. They feel like they've been irresponsible and have since made changes to the way they do things but that they have always completed work for their clients in the past.

I have also had two other clients anonymously contact me about this. I will not be disclosing if they are current or previous clients to protect their identities.

Both clients have vouched for Petra's discord issues and working around them. They both have said that discord did delete and not deliver dms multiple times. They were both able to work around this by the means that Petra had been putting out (saying to bump dms in ads they put out, status updates, etc.)

9 notes

·

View notes

Text

Explore the Reason Why your Cash App Account may be closed

Cash App has become a popular tool for sending and receiving money instantly. However, despite its widespread use, some users have found themselves facing a frustrating situation: Cash App has closed their account due to violations of the platform's Terms of Service. Understanding why this happens and what steps to take afterward is crucial to resolving the issue and potentially regaining access.

In this article, we will explore why your Cash App account might be closed, what to do if Cash App has sent money to a closed account, and whether or not you can reopen a closed account. We will also provide solutions to help you navigate through the frustrating situation if Cash App shut down your account. Let's dive in.

Why Did Cash App Close My Account?

There are several reasons why Cash App may close an account. The platform follows strict guidelines to ensure a safe and secure environment for its users. Violations of the Terms of Service can result in immediate suspension or permanent closure of accounts. Below are some common reasons that could explain why Cash App shut down your account:

Suspicious Activity or Fraud: If Cash App detects any suspicious or fraudulent transactions on your account, such as multiple failed attempts to send or receive money or illegal activities, it may close your account to protect both the user and the platform.

Violation of the Terms of Service: Cash App has a detailed Terms of Service that users must follow. Violating these terms, such as sending or receiving money for illegal goods or services, engaging in scam activities, or utilizing the app for other unpermitted uses, may lead to account closure.

Incorrect or False Information: If your Cash App account is linked to incorrect or fraudulent personal information, such as fake names or addresses, Cash App may shut down your account to prevent identity theft or fraud.

Unverified Account: Failure to verify your account by providing the necessary identification documents when requested by Cash App can also result in account closure. Verifying your identity is an important step to ensure compliance with anti-money laundering and financial security regulations.

Excessive Chargebacks or Disputes: If your account has a history of excessive chargebacks or disputes with payments, Cash App may consider this a violation of its policies, leading to account closure.

What to Do If Cash App Sent Money to a Closed Account

One of the most common concerns users face is what happens if Cash App sent money to a closed account. If your account has been closed but you had pending transactions, you may be worried about what will happen to the money.

Funds Returned to the Sender: If someone attempts to send money to your closed Cash App account, the money will typically be returned to the sender. Cash App does not hold onto funds if an account is no longer active.

Contact Cash App Support: If you are unsure about the status of the funds or need assistance with transactions involving a closed account, it's important to contact Cash App support directly. They can provide clarity on the situation and may be able to assist with recovering the funds.

Check Linked Bank Accounts: In some cases, funds may be automatically transferred to a linked bank account even if your Cash App account is closed. Ensure that the bank details linked to your Cash App account are accurate and up-to-date.

Can I Reopen a Closed Cash App Account?

If you find yourself asking, "Can I reopen a closed Cash App account?", the answer depends on why your account was closed in the first place. In some cases, it may be possible to recover your account, while in other situations, the closure may be permanent.

Account Review: If your account was closed due to a temporary issue, such as a security concern or suspicious activity, Cash App may allow you to submit a request for a review. During the review process, you may need to provide additional documentation or identification to verify your account.

Permanent Closure: Unfortunately, not all closed accounts are eligible for reopening. If your account was closed due to severe violations of the Terms of Service, such as fraudulent activity, the closure may be permanent, and you may not be able to regain access to the account.

Create a New Account: If your account was permanently closed, your only option may be to create a new account. However, this may require using a different email address and phone number than what was associated with your original account.

Steps to Take If Your Cash App Account Is Closed

If Cash App shut down your account, follow these steps to resolve the issue or seek alternative options:

Contact Cash App Support: The first and most important step is to contact Cash App's customer support. You can do this through the app or via email. Provide as much information as possible about your account and the situation that led to its closure.

Review the Terms of Service: Take time to carefully review Cash App's Terms of Service to identify any possible reasons for the closure. Understanding what may have gone wrong can help you avoid similar issues in the future.

Provide Identification Documents: If Cash App requests verification documents to reopen your account, be prompt in providing the necessary information. This can include a government-issued ID, proof of address, or other forms of identification.

Stay Patient: The review process can take time, especially if Cash App is investigating suspicious activity. Stay patient and wait for a response from the support team.

Consider Alternatives: If you are unable to reopen your Cash App account, consider using alternative payment platforms such as PayPal, Venmo, or Zelle. These services offer similar features and may be a good substitute for Cash App.

Conclusion

Having your Cash App account closed can be a frustrating experience, especially if you rely on the platform for your daily transactions. Understanding why Cash App may have closed your account and following the proper steps to resolve the issue can help you navigate this challenging situation. While some account closures are permanent, others may be resolved through proper communication with Cash App's support team.

If your Cash App shut down your account, it’s important to stay calm and follow the necessary steps to resolve the situation. Whether it's recovering lost funds, understanding the reason for closure, or considering alternative payment options, you can find a solution that works for you.

4 notes

·

View notes

Text

Top E-Commerce Fraud Prevention Software Solutions

In today’s rapidly evolving digital landscape, e-commerce has become a cornerstone of the global economy. However, this growth has also given rise to sophisticated fraud schemes that pose significant risks to online businesses and their customers. To combat these threats, businesses must invest in robust fraud prevention software solutions. Here’s a look at some of the top e-commerce fraud prevention tools for 2024 that can help safeguard your online store and maintain customer trust.

1. Fraud.Net

Fraud.Net stands out as a comprehensive fraud prevention platform that uses machine learning and artificial intelligence to detect and prevent fraudulent transactions. Its real-time risk scoring system evaluates each transaction based on a multitude of factors, such as user behavior and historical data, to flag suspicious activities. Fraud.Net's integration with various payment gateways and its customizable rule set make it a versatile choice for businesses of all sizes.

2. Signifyd

Signifyd is renowned for its 100% financial guarantee on fraud protection, offering a unique proposition in the e-commerce space. The platform uses a combination of machine learning and human expertise to analyze transactions and identify potential threats. Its approach includes real-time decision-making and an extensive global data network, ensuring that businesses can reduce false positives while minimizing fraud losses. Signifyd also provides tools for chargeback management and fraud analytics.

3. Kount

Kount offers a powerful fraud prevention solution that leverages AI and machine learning to provide real-time fraud detection and prevention. Its platform includes features such as biometric identification, device fingerprinting, and risk scoring to help identify and mitigate fraudulent activities. Kount’s customizable rules engine allows businesses to tailor their fraud prevention strategies to specific needs, while its comprehensive dashboard provides actionable insights into transaction trends and fraud patterns.

4. Sift

Sift is a leading fraud prevention solution that combines machine learning with a vast database of global fraud signals to deliver real-time protection. The platform is known for its adaptability, offering tools to prevent fraud across multiple channels, including payments, account creation, and content abuse. Sift's advanced analytics and customizable workflows help businesses quickly respond to emerging fraud threats and reduce manual review processes.

5. Riskified

Riskified specializes in enhancing the online shopping experience by providing a fraud prevention solution that guarantees approval of legitimate transactions. The platform uses advanced machine learning algorithms and a vast dataset to analyze transactions and identify fraudulent activities. Riskified’s unique chargeback guarantee ensures that businesses are protected against fraud losses, making it a popular choice for high-volume e-commerce operations.

6. ClearSale

ClearSale is a global fraud prevention solution that combines technology with expert analysts to deliver comprehensive fraud protection. Its system uses machine learning to assess transaction risk and manual reviews to ensure accuracy. ClearSale’s multi-layered approach includes fraud detection, chargeback management, and customer service support, making it a robust option for businesses looking to minimize fraud while maintaining a positive customer experience.

7. Shift4

Shift4 provides a versatile fraud prevention solution that integrates with its payment processing services. The platform uses machine learning to monitor transactions and detect fraudulent patterns in real-time. Shift4’s fraud prevention tools are designed to work seamlessly with its payment gateway, offering a streamlined approach to both transaction processing and fraud detection.

8. CyberSource

CyberSource, a Visa solution, offers a suite of fraud prevention tools that leverage AI and machine learning to protect online transactions. Its platform includes features such as device fingerprinting, transaction scoring, and integration with Visa's global network. CyberSource’s customizable fraud management system allows businesses to tailor their fraud prevention strategies to their specific needs and risk profiles.

Conclusion

Investing in a robust e-commerce fraud prevention solution is essential for protecting your business and customers from the ever-evolving landscape of online fraud. Each of the solutions highlighted above offers unique features and benefits, making it crucial to evaluate them based on your specific needs, transaction volume, and risk tolerance. By choosing the right fraud prevention software, you can enhance security, reduce losses, and provide a safer shopping experience for your customers.

#digital marketing#marketing#business#branding#digital services#social media marketing#ecommerce business#e commerce#ecommerce#google ads

2 notes

·

View notes

Text

The Rise of Blockchain Payment Gateways: How They Are Changing Transactions

In recent years, cryptocurrency has gone from being a tech experiment to a practical tool for everyday use. One of the most exciting developments in this space is the rise of blockchain payment gateways. These platforms are giving businesses a way to accept payments in digital currencies like Bitcoin, Ethereum, and stablecoins. But what exactly makes blockchain payment gateways so special, and how can they benefit businesses? Let’s break it down.

What Is a Blockchain Payment Gateway?

Think of a blockchain payment gateway as the bridge between your business and customers who want to pay with cryptocurrency. Instead of relying on traditional banks or payment processors, these gateways use blockchain technology to send and receive payments. Transactions are quick, secure, and work without needing a middleman.

What Makes Them Different?

Direct Transactions: With blockchain, payments go directly from the customer to the business. No middle layers. No unnecessary waiting.

Global Payments Without Borders: Cryptocurrencies don’t care about borders or bank restrictions. A customer from New York can pay a shop in Tokyo just as easily as a local.

Security You Can Trust: Blockchain’s design makes it tamper-proof. Each transaction is recorded on a public ledger, ensuring transparency and preventing fraud.

Lower Fees: Businesses save money because blockchain payments skip the usual banking fees and currency conversion costs.

Privacy for Everyone: Customers don’t need to share personal banking details, which makes transactions safer for them and simpler for businesses.

Why Should Businesses Care?

Cryptocurrency adoption is growing fast. By accepting crypto payments, businesses can:

Reach New Customers: Crypto users are a growing audience. Adding this option could bring in customers who wouldn’t otherwise buy.

Prevent Payment Issues: Traditional systems often have chargebacks, where a customer disputes a payment and the money is reversed. Blockchain payments are final—once made, they can’t be undone.

Stay Ahead of the Curve: Digital currencies are becoming mainstream. Adopting blockchain payments now can put businesses ahead of competitors.

Where Can This Be Used?

E-commerce: Online stores can give customers an easy way to pay with crypto.

Subscriptions: Services like streaming platforms or SaaS companies can use blockchain to handle recurring payments.

Freelancers: Blockchain allows individuals to get paid faster and without high transfer fees, no matter where the client is.

How to Start Using Blockchain Payments

Getting started with a blockchain payment gateway is easier than you might think. Platforms like OxaPay provide tools that help businesses quickly integrate crypto payments. These gateways often include:

Simple setup tools, like plugins for popular platforms like WooCommerce.

Options to accept multiple cryptocurrencies, so customers can pay with their preferred coin.

Features like fixed payment addresses or automated notifications to keep things organized.

Why Blockchain Payments Are the Future

At its core, blockchain is about efficiency and fairness. It simplifies payments, lowers costs, and opens up opportunities for businesses to connect with a global audience. Whether you're running a small shop or a large company, embracing blockchain payment gateways can give you an edge in today’s competitive market.

The shift to digital currency is already happening. The only question is: will your business be part of it?

For more straightforward tips on using blockchain in your business, explore other posts on Blockchain Business Talk. We’re here to help you take the next step with confidence.

1 note

·

View note

Note

Have you ever considered doing like, custom design commissions or similar stuff like that? Or do you feel that would be too taxing creatively? Idk if you do/have done commissions at any point but I feel many people would be interested

I think i absolutely will someday again but i think part of my issue is when a commission comes along that i ""can't"" do justice to

I would probably have to also spend time making sure im secure in terms of like. a TOS. like did artists figure out how to prevent chargebacks yet . Then there's first-time-in-a-while pricing

i would Love to and im super happy that theres interest!!! but i need to figure out what mindset i had when i was still selling squiggles on deviantart for 40 cents in points bc its been that long

#text#:)#my biggest thing is that im just. worrying I think.#like maybe ill start selling but just stumble on some unforeseen issue#idk i haven't had problems before either but my following used to be way smaller so

9 notes

·

View notes

Text

Foloosi - Payment Gateway Service for Educational Institutions

A complete payment processing solution for your Educational Institutions - Schools Colleges can now accept payments via paylink in the UAE with simplified toolkits and also with an easy integration. Foloosi enables best payment gateway for educational institutions like Colleges, Schools, Universities and Edtech Startups to accept payments

The UAE is one of the more mature education markets in the region and remains a draw for investors, providers and students. Its scale and ambition remain undimmed, but what is the reality on the ground? What do the trends over time tell us about the education sector by segment, and what are the key differences between its main markets?

Read more..

#payment gateway#uae#education#Online payment chargeback sharjah#Best payment gateways for chargeback prevention#Secure payment gateway solutions in abu dhabi#Chargeback protection for merchants#Payment gateway chargeback support UAE#payment gateway in dubai#uae business

0 notes

Text

Unlocking the Power of Chargeback Services: A Comprehensive Guide

In the fast-paced world of online commerce, chargebacks can pose significant challenges to businesses, leading to revenue loss, increased fees, and damage to reputation. However, with the right approach and leveraging the proficiency of chargeback service providers, businesses can successfully manage and prevent chargebacks while safeguarding their bottom line. In this comprehensive guide, we'll delve into the intricacies of chargeback services, their importance, key features, how to choose the exact provider, implementation of prevention strategies, and continual optimization for long-term success.

2 notes

·

View notes

Photo

Discover powerful strategies to regain lost revenue and boost your business's bottom line. From customer retention techniques to effective communication strategies, this blog provides actionable advice to help you win back valuable customers and propel your business to new heights. Don't miss out on the opportunity to recover lost sales and maximize your success. Visit the site now - https://www.chargebackexpertz.com/stop-losing-customers-recover-sales-with-these-tips/

0 notes

Text

Emerging Techniques in High-Risk Credit Card Processing

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In today's rapidly evolving digital landscape, e-commerce serves as the lifeblood for countless businesses. Whether you're managing a thriving online store or delivering services through the web, the acceptance of credit card payments is a non-negotiable aspect. However, for certain industries, this seemingly straightforward task transforms into a high-stakes endeavor. Welcome to the world of High-Risk Credit Card Processing, where innovation and security take center stage.

In this article, we will delve deep into the evolving realm of high-risk credit card processing. From CBD merchant processing to credit repair payment gateways, we will explore cutting-edge techniques and technologies that are transforming the landscape of payment processing.

DOWNLOAD THE EMERGING TECHNIQUES INFOGRAPHIC HERE

Understanding High-Risk Credit Card Processing Before we explore emerging techniques, let's grasp the concept of high-risk credit card processing. Industries such as CBD, credit repair, and online gaming often contend with elevated risks of chargebacks, fraud, and regulatory scrutiny. This categorization leads to higher processing fees and a demand for specialized solutions. Traditional payment processing systems encounter limitations in high-risk industries. However, emerging technologies are reshaping the landscape. Modern payment gateway solutions now offer tailored services for high-risk sectors, providing enhanced security and flexibility.

One of the most significant developments in high-risk credit card processing is the introduction of specialized e-commerce merchant accounts. These accounts are crafted to accommodate businesses dealing with high-risk transactions, presenting competitive rates and robust security features. The CBD industry, facing unique legal and financial challenges, has witnessed tremendous growth. Consequently, specialized CBD merchant processing solutions have emerged, ensuring seamless transactions while complying with ever-changing regulations. The credit repair industry is on the rise, demanding reliable payment solutions. Advanced credit repair payment gateways now provide secure and efficient ways to handle credit repair transactions, granting businesses in this niche peace of mind.

The Power of High-Risk Payment Processing High-risk payment processing isn't just about overcoming obstacles; it's about thriving in challenging environments. The ability to accept credit card payments in high-risk industries opens doors to broader customer bases and increased revenue streams. With state-of-the-art credit card payment services, businesses can instill confidence in their customers. Trust is the cornerstone of successful online transactions, and high-risk payment processors understand the importance of reliability. The future of high-risk credit card processing lies in the realm of online transactions. Online payment processing offers convenience and speed, crucial in industries where time is of the essence.

Merchant Accounts Redefined A pivotal element in high-risk credit card processing is the availability of specialized merchant accounts. Tailored to suit the unique needs of businesses in high-risk sectors, these accounts ensure smooth operations without the fear of excessive chargebacks. An integral component of modern high-risk processing is the e-commerce gateway. This technology acts as a bridge between businesses and their customers, ensuring secure and efficient transactions.

youtube

Payment Gateway Solutions Payment gateways have evolved significantly, meeting the needs of businesses in high-risk industries. Contemporary payment gateway solutions offer multi-layered security, fraud prevention, and real-time transaction monitoring. The CBD industry faces unique challenges due to its ever-changing legal status. A dedicated CBD payment gateway ensures that businesses can navigate these challenges seamlessly while providing customers with a safe and convenient payment experience. Credit repair businesses handle sensitive financial data, making security paramount. Credit repair merchant processing solutions prioritize data protection and compliance, enabling businesses to focus on assisting their clients in improving their credit scores.

High-risk credit card processing isn't a roadblock; it's an opportunity. Businesses in high-risk sectors can now navigate the complexities of payment processing with confidence, thanks to emerging techniques and technologies. As we've explored, the advent of specialized e-commerce merchant accounts, CBD merchant processing, and credit repair payment gateways has revolutionized the high-risk credit card processing industry. These innovations have not only made it easier for businesses to accept credit card payments but have also enhanced security and customer trust. With the right tools and strategies, businesses in high-risk sectors can thrive and grow. So, if you're in the high-risk arena, it's time to explore the world of high-risk payment processing and embrace the future of secure and efficient e-commerce transactions with Accept-Credit-Cards-Now Merchant processing services.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#Youtube

16 notes

·

View notes

Text

7 Helpful Tricks to Making the Most of Your High Risk Merchant Account merchantaccountproviders.com

High Risk Merchant Account merchantaccountproviders.com are not for the faint of heart. They're often more expensive than standard merchant account providers and have a host of caveats and restrictions that make them difficult to use. However, if you understand how to use this type of provider effectively and take steps to minimize your risks, high risk merchants can enjoy a range of benefits that go beyond just lower rates: they can process transactions at the point-of-sale (POS) or online and increase their sales volumes by reaching new markets. In addition, with careful monitoring and management, these accounts can also help reduce chargebacks, which typically occur when customers dispute charges on their credit card statements after receiving goods or services from a company."

Frequent & Regular Reviews

Frequent & Regular Reviews

A high risk merchant account is an important part of your business, but it's also a bit more complicated than a standard one. As such, it's important that you keep an eye on your account regularly to make sure everything is running smoothly and nothing has gone awry. The first thing you should do when setting up a new high risk merchant account is set up automatic reviews of all transactions so that you can catch any suspicious activity right away. This can help prevent fraud before it happens! If you already have an established account and want to ensure its security even further, consider having someone else check over the statements every now and then--just in case something slips through the cracks while they aren't looking!

Use the Appropriate Codes

Use the appropriate codes.

What are the appropriate codes, you ask? They're called "processing modifiers," and they can be used to change things like:

The amount of money that's debited from your account for each transaction. Some businesses will want this to happen immediately; others prefer it to be spread out over several days or weeks.

The currency in which you receive payment from each customer (e.g., euros vs dollars).

Be Aware of the Expiration Date

The expiration date is the date by which a business must pay its bills. It's important to know when your account expires so that you can avoid losing it and having to get another one. If you don't pay your bills on time, you risk losing your merchant account completely. If this happens and there isn't enough time before the new year begins for companies like ours to process new applications, then we won't be able to help them until after January 1st when we receive updated software from our providers (who also have their own internal deadlines).

So if there's anything we can do for you today about this situation or any other question related specifically toward high risk merchants--whether it's about rates or fees--we'd love nothing more than helping out!

Watch Out for Double-Billing, Cancellations and Refunds

Watch Out for Double-Billing, Cancellations and Refunds

You want to make sure that you're not being double billed or charged for anything you don't need. You also don't want to accidentally cancel your account with the wrong company because it could take months before you get back on track with another one. Make sure that if there's any sort of refund policy or cancellation clause in place, you understand exactly how it works before signing up--and then keep an eye on your account after that point!

Verify All Charges and Billing Statements Carefully

Verify All Charges and Billing Statements Carefully

When you're using a High Risk Merchant Account merchantaccountproviders.com, it's important that you check all charges carefully. This includes looking at every statement that comes in from your processor, as well as any emails or other notifications about pending transactions. This can help prevent fraud or other issues with the processing of your card transactions. If there are any errors or discrepancies on the statements, report them right away so they can be resolved quickly before they become more serious problems down the road!

Pay Attention to Past Due Accounts and Collections Activity

Pay Attention to Past Due Accounts and Collections Activity

It's important for you to stay on top of your accounts, especially if you have high risk merchant accounts. This means that you need to keep an eye on past due accounts, as well as collections activity. If a customer has been late with a payment in the past and then continues to do so with another account, this may be a sign that they are not credit worthy or their financial situation has changed since opening the initial account (which could lead them into financial difficulty).

Monitor Customer Profiles and Account Usage History with Regard to Credit Worthiness, History of Late Payments, etc."

Monitor Customer Profiles and Account Usage History with Regard to Credit Worthiness, History of Late Payments, etc.

While you must be careful not to discriminate against customers based on race or creed, it's important for you to know what kind of history and creditworthiness each customer has before signing them up for a merchant account. This will allow you to better understand how much risk they pose as far as paying their bills on time goes.

Takeaway:

Now that you know what to look out for, here are some helpful tips to avoid high risk merchant accounts:

Pay attention to the expiration date on your card reader. If you don't use it regularly, make sure it's still working before starting up again.

Don't use generic codes when processing transactions; use specific ones from your processor or payment gateway instead. They'll help ensure that the transaction gets processed correctly and quickly so that no one has any problems with their purchase!

Make sure all employees are trained in how these systems work so they can answer questions from customers about their purchases without having any issues themselves (which could lead back down the road toward getting kicked off again).

Conclusion:

We hope that these tips will help you to better manage your High Risk Merchant Account merchantaccountproviders.com. If you have any questions about them or anything else related to your business, please contact us at [email protected] We would love to hear from you!

3 notes

·

View notes

Text

Some Great Benefits Of Online Sms Verification Service

It is easy and quick to validate the authenticity of an individual by using SMS. This is a powerful security device that can help to prevent fraudulent transactions and increase customer satisfaction.

However, it's not an absolute method of authentication on its own. It could be utilized together with other methods to prevent fraud, and also methods of buyer verification.

Authentication

SMS authentication is an effective method of two-factor authentication because it's readily available for all mobile devices, and the majority of consumers are comfortable to the method. It also costs relatively little and doesn't require any extra hardware or software to implement.

The site is also extremely accessible, which allows customers to log in even if they're not on the internet. This helps reduce the possibility of a help desk call and gives users the confidence that their account is secure.

This adds a bit of friction when you the checkout. If they have to enter the code required to finish their purchase, customers may be annoyed and abandon their purchases. This could be an issue for merchants who need to balance the risk of fraud with the desire to create a seamless purchase experience to their customers. It is important to be aware that, by utilizing their fraud prevention methods, businesses can limit the amount and frequently SMS authentication is required.

Fraud Prevention

The constant war between fraudsters and prevention methods, hackers constantly come up with new ways to defeat two-factor authentication. Cybercriminals who attack famous sites for stealing passwords from databases are particularly vulnerable. The stolen passwords are extremely useful on the black market, and often utilized to access the accounts of customers across other websites that are logged in with the same password.

SMS verification is one way to stop these types account takeovers. It requires that users enter a code that is that is sent to their phone prior to logging in or make purchases. The use of this type of verification may also reduce the possibility of chargebacks resulting from stolen credit card details. However, SMS verification does provide another level of difficulty on the process of checkout and could discourage some customers from making purchases at all or even cause them abandon their cart. This is why merchants should carefully balance their need for security with the need to make their customers satisfied.

Efficiency

SMS verification might be the most popular form of two-factor authentication, because it doesn't require downloads of apps as well as QR codes. It's also a breeze to operate, and people from all ages are able to make use of their mobile phones. It's also affordable, and users don't need to purchase additional hardware or software as they do with other methods of verification.

But there are a few disadvantages to the use of phone number verification service. One is that it adds a layer of friction in the process of signing-in that could deter customers from making purchases or creating accounts. If they decide to utilize or not this method, merchants should weigh the advantages of fraud prevention over the benefits of keeping customers.

Certain websites, like provide free services that enable users to skip SMS confirmation. It's not the best idea. This doesn't make sense and could lead to security concerns for customers of other services.

The Security of Your Own Home

Authentication is an essential part of every fraud prevention plan. This is because it helps to make it more difficult for fraudsters to impersonate you, take your accounts if they are compromised, or create fake tickets that are linked to the identity of your. SMS verification is a very popular method for securing your identity, and is easy to incorporate into the checkout process. It's a simple and cheap method.

The phone number verification works by sending an encrypted code to the user's mobile number. A user has to enter the code received in order to be able to log into their account or make a purchase online. This means that only someone that has access to the phone of the user's phone can use it for fraudulent purposes.

The method, however, is not as secured than other methods of authentication like authentication apps and security keys. Additionally, it depends on the network of the phone for its operation, which means it may fail in the event that the internet goes down. Therefore, it's best to use this method in conjunction with other tools to prevent fraud as well as buyer verification methods.

3 notes

·

View notes

Text

Avoiding AVS Mismatch: Causes, Consequences, and Expert Tips for Accuracy

Address Verification System (AVS) mismatch is a common issue for businesses that accept card payments online or over the phone. An AVS mismatch occurs when the billing address provided by a customer does not match the address on file with their credit card issuer. While it may seem like a minor inconvenience, AVS mismatches can lead to serious consequences, including failed transactions, increased fraud risk, and lost revenue. Understanding causes, consequences, and strategies avoid AVS mismatches is crucial for maintaining accuracy and ensuring a seamless payment process.

What is an AVS Mismatch?

An AVS mismatch happens during the payment authorization process when the address details entered by a customer don’t match the information stored by their credit card issuer. The Address Verification System (AVS) is designed to help prevent fraud by verifying key elements of the billing address—typically the street address and ZIP code.

Full Match: Both the street address and ZIP code match the issuer’s records.

Partial Match: Either the street address or ZIP code matches, but not both.

No Match: Neither the street address nor ZIP code matches.

An AVS mismatch usually triggers a warning or a declined transaction, depending on how the merchant’s payment gateway handles the response.

Common Causes of AVS Mismatches

Understanding the causes behind AVS mismatches is the first step in preventing them.

1. Customer Data Entry Errors

The most frequent cause of AVS mismatches is human error. Customers may mistype their billing address or forget to update it after moving.

Missing or incorrect house numbers

Misspelled street names

Wrong ZIP codes

2. Outdated Address Information

If a customer recently moved but hasn’t updated their billing information with the credit card issuer, the address verification process will fail.

Often happens within the first few months after a move

Especially common with subscription services

3. Format Inconsistencies

AVS systems are sensitive to formatting variations. Even minor differences—such as abbreviations or punctuation—can result in mismatches.

"123 Main St." vs. "123 Main Street"

"Apartment 4B" vs. "Apt 4B"

4. International Transactions

AVS is primarily a U.S.-based system, with limited support in other countries. For international transactions, mismatches are more likely due to differences in address formats.

5. Bank-Specific Policies

Some credit card issuers have stricter AVS policies than others. This means a match with one bank might not trigger a mismatch with another.

Consequences of AVS Mismatches

Failing to address AVS mismatches can have serious repercussions for businesses.

1. Declined Transactions

An AVS mismatch often leads to declined transactions, even when the card is valid. This can result in lost sales and frustrated customers.

2. Increased Cart Abandonment

When customers encounter payment errors, they’re more likely to abandon their purchases. A seamless checkout experience is essential for reducing cart abandonment rates.

3. Higher Operational Costs

Resolving AVS-related issues takes time and resources. Customer support teams may spend significant time handling disputes and guiding customers through the payment process.

4. Fraud Risks and Chargebacks

While AVS is a valuable tool for fraud prevention, ignoring mismatches can expose your business to fraud risks. A mismatch could indicate a fraudulent transaction, leading to costly chargebacks.

5. Damage to Customer Relationships

Repeated payment failures can harm your brand’s reputation and lead to customer dissatisfaction. In highly competitive markets, even minor inconveniences can push customers toward competitors.

Expert Tips to Avoid AVS Mismatches

By implementing best practices and leveraging the right tools, businesses can minimize the risk of AVS mismatches.

1. Educate Customers on Accurate Address Entry

Help your customers understand the importance of entering their billing address exactly as it appears on their credit card statement.

Use clear labels and instructions in your checkout form.

Display examples of correct address formats.

Provide an auto-complete feature to reduce entry errors.

2. Implement Address Verification Software

Integrating address verification tools can significantly reduce the chances of AVS mismatches. These tools validate and format addresses in real-time.

Standardize addresses according to postal standards.

Automatically correct minor errors.

Ensure accurate and complete data entry.

3. Allow for Partial Matches with Manual Review

Set your payment gateway to accept partial AVS matches for low-risk transactions, but flag them for manual review. This approach balances security and customer convenience.

Accept partial matches for trusted customers.

Require additional verification for high-risk transactions.

4. Monitor and Analyze AVS Responses

Regularly monitor AVS response codes to identify patterns and potential issues. Use this data to refine your fraud prevention strategies.

Track the frequency of mismatches.

Identify common address errors and adjust your forms accordingly.

Update your fraud detection rules based on historical data.

5. Optimize Checkout Forms

A well-designed checkout form reduces the likelihood of errors and improves the user experience.

Use single address fields with smart parsing instead of multiple fields.

Minimize distractions during the payment process.

Ensure your form is mobile-friendly.

6. Regularly Update Your Database

Ensure your customer database is up-to-date by periodically requesting address confirmations from your customers. This is especially important for subscription-based services.

Send reminders to update billing information.

Validate addresses during account creation and updates.

Remove outdated addresses from your records.

How Businesses Can Benefit from Reducing AVS Mismatches

1. Improved Conversion Rates

A smoother checkout process with fewer errors leads to higher conversion rates and increased revenue.

2. Enhanced Fraud Protection

Reducing AVS mismatches strengthens your fraud prevention measures, protecting your business from fraudulent transactions.

3. Better Customer Experience

By minimizing payment issues, you provide a hassle-free shopping experience that keeps customers coming back.

4. Reduced Operational Costs

Fewer payment errors mean less time spent resolving customer issues, resulting in cost savings.

Conclusion

AVS mismatches can pose a significant challenge for businesses, but understanding their causes, consequences, and how to prevent them is essential for maintaining accuracy and security. By implementing best practices such as educating customers, optimizing checkout processes, and using address verification tools, you can minimize mismatches and create a seamless payment experience.

Reducing AVS mismatches not only protects your business from fraud but also improves customer satisfaction and operational efficiency. Take proactive steps today to ensure your transactions are accurate and error-free, keeping both your business and customers happy.

youtube

SITES WE SUPPORT

AVS Mismatch, Address Guide and How to Send Cards Online by Mail – Blogspot

SOCIAL LINKS

Facebook

Twitter

LinkedIn

Instagram

Pinterest

1 note

·

View note