#chapter 13 bankruptcy washington state

Explore tagged Tumblr posts

Text

An Introduction to Bankruptcy Filings for US Businesses

In the United States as elsewhere, both businesses and individuals can find themselves in situations that make it impossible to repay outstanding debts. A business in such a scenario may have the option of filing for commercial bankruptcy. Commercial bankruptcy is a legal process managed at the federal level which has been designed to absolve all or a portion of a company’s debts. The bankruptcy process may also involve restructuring the length and other terms of a repayment plan.

Each of the nation’s 94 federal judicial districts is capable of handling bankruptcy matters, and the vast majority of bankruptcy cases are filed in the local district bankruptcy court. Chapter 7 and Chapter 11 represent the most common bankruptcy filings for US businesses, though some companies may declare Chapter 13 bankruptcy.

Chapter 7 bankruptcy is sometimes referred to as liquidation bankruptcy. It is a popular filing for consumers, but businesses can also declare Chapter 7 bankruptcy and begin liquidating assets to pay off outstanding debts. A judge will order a stay of collection against the business if a Chapter 7 petition is accepted by the bankruptcy court. At this point, a court-appointed trustee will begin facilitating bankruptcy processes, with a focus on satisfying debts to the fullest extent possible via the sale of business assets.

After an individual finishes Chapter 7 processes, they are discharged of any remaining debt. Businesses, on the other hand, typically cease to function, particularly if they have not satisfied all debts, because Chapter 7 results in the loss of all valuable assets and profitability is no longer possible.

Chapter 11 bankruptcy, meanwhile, is rarely declared by individuals and is almost exclusively implemented by businesses. Chapter 11 has been designed so that companies can continue to carry out normal business operations for the duration of the bankruptcy proceedings. There are, however, limitations on what businesses can and cannot do during Chapter 11 processes, and certain operations may require court approval.

After a business has petitioned the bankruptcy court, leadership may or may not be assigned a trustee by the court. In either case, the business provides the court with a proposal for reorganization. This strategy may include some degree of liquidation, but the main purpose of reorganization is to make meaningful strategic and operational changes that help the business repay debts in the future. Creditors and the bankruptcy courts have input on reorganization strategies, and during some Chapter 11 filings, creditors can submit their own plans for reorganization.

While business leaders will strategically attempt to choose the best option between Chapter 7 and Chapter 11, the choice is not always permanent. For instance, if a court rejects a reorganization plan under Chapter 11, or if a business fails to make a proposal, the bankruptcy may transition to Chapter 7.

Alternatively referred to as a wage earner’s plan, Chapter 13 bankruptcy allows a person who makes a regular salary to propose a repayment plan for their debts. This type of bankruptcy is geared toward individual debtors, but certain aspects extend to small business owners. Most repayment plans must account for outstanding debts within three to five years.

Several notable American businesses have filed for bankruptcy. In 2008, Lehman Brothers made the largest bankruptcy filing in US history at just over $691 billion, more than double Washington Mutual’s roughly $328 billion filing, also in 2008.

0 notes

Photo

Bankruptcy Law Firm In Seattle

If you wish to file a bankruptcy petition in Washington but don’t know Which option is best for you then read this infographic to know which bankruptcy chapter best suits your needs. To know more about bankruptcy contact our Seattle bankruptcy lawyer at Northwest Debt Relief Law Firm. Call as today at 206-258-6225.

#chapter 13 bankruptcy process in seattle#seattle chapter 13 trustee#bankruptcy chapter 7 filing fee in seattle#chapter 13 seattle#bankruptcy law firm in seattle#bankruptcy lawyer seattle#seattle bankruptcy attorney#bankruptcy lawyers seattle#seattle bankruptcy lawyer#bankruptcy seattle#bankruptcy lawyer in seattle#chapter 13 bankruptcy washington state

0 notes

Link

Get legal assistance in filing for bankruptcy or with any issue concerning bankruptcy law in Seattle WA. Call us at 206-258-6225 & speak with one of our bankruptcy attorneys in Washington. Visit https://nwdrlf.com/chapter-thirteen-bankruptcy-confirmation/ now.

#chapter 13 bankruptcy process in seattle#chapter 13 bankruptcy washington state#seattle chapter 13 trustee#chapter 13 seattle#chapter 13 bankruptcy filing fee in seattle#chapter 13 filing fee in seattle#cost of chapter 13 bankruptcy in seattle

0 notes

Link

#debt relief attorney in seattle#chapter 13 bankruptcy process in seattle#bankruptcy law firm in seattle#bankruptcy lawyers in seattle#bankruptcy attorneys seattle#seattle bankruptcy lawyers#bankruptcy attorneys in seattle#seattle bankruptcy attorneys#bankruptcy lawyer in seattle#chapter 7 bankruptcy washington state#bankruptcy washington state

0 notes

Text

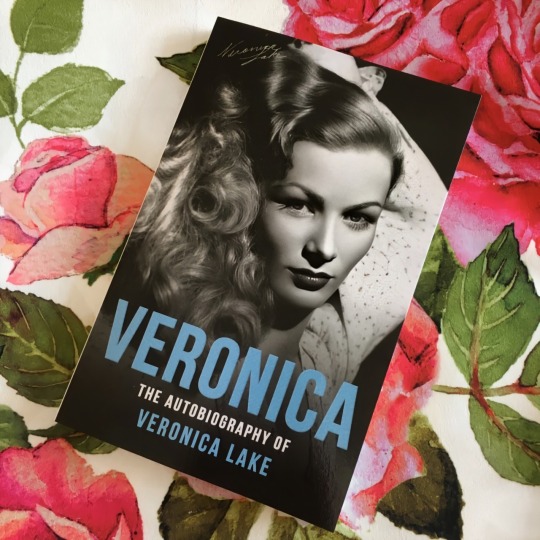

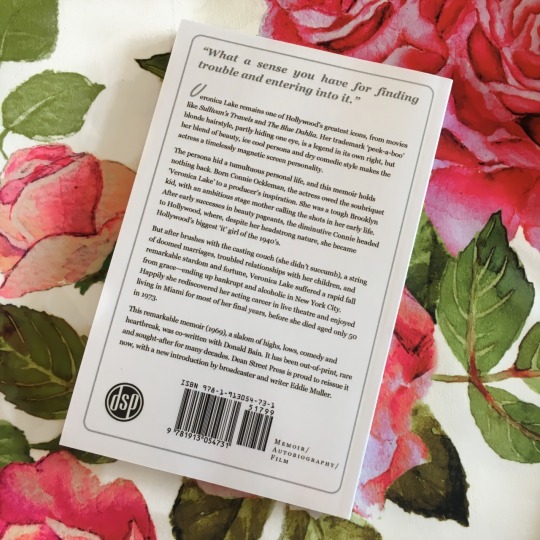

When most people hear the name, “Veronica Lake” usually one of three things comes to mind – that incredible peek-a-boo hair, the Film Noir’s with Alan Ladd or possibly Kim Basigner playing a Miss Lake lookalike in L.A. Confidential (1997) – fun fact, she won the Best Supporting Actress Oscar for that role. Although, with Veronica’s heyday being well over half a century old, that’s sadly usually as far as it goes.

However, with the Classic Hollywood Era being hugely timeless and forever coming back into fashion, the genre is becoming less of a niché subject and more Stars are on the public radar. If you’re a long time Vintage Lover like myself, you’ll be aware that unfortunately, a lot of our favourites don’t have many books written about them, or if they do, they’ve been out of print for a number of years and can be hard to find, or very expensive. Therefore, when I came across the news that Dean Street Press were publishing a reprint of Veronica’s Autobiography, which was first released in 1969, I was absolutely ecstatic! As most who know me are probably aware of my love for Blonde Bombshells, it may not be as well known that Veronica is my other favourite, after Marilyn.

There have only been two books published on Veronica, which I must add, astounds me – and one of them is this one which was co-written by ghost writer Donald Bain, who sadly passed away in October of 2017. The other is by Jeff Lenburg and I am fortunate enough to have both. However, Lenburg’s book is fairly controversial as he takes a lot of his information from Veronica’s mother, who claims a lot of detrimental things about her daughter – yet was estranged from her for many, many years. I think it’s actually being reprinted this summer and I will read it again, but would definitely advise new fans to stick to Veronica’s own words.

The republished version of Veronica’s Autobiography features a new cover with a stunning publicity photo of her in Ramrod (1947) which was directed by her then Husband, André de Toth. The book is a shiny paperback, with a non crease format, so even when you’ve finished reading, it will be in great condition and can take pride of place on your bookshelf! At 215 pages and 27 chapters, it’s not a huge length, but definitely a substantial read and full of personal anecdotes from the Golden Age of Hollywood.

Broadcaster and writer, Eddie Muller adds a new Introduction and his following words really stuck with me, their relevancy still to this day does not go unnoticed,

“I’ll point out instead that while the public has granted Sterling Hayden, a legendary boozer and hash-head, a legacy as a heroic, larger-than-life iconoclast, it has branded Lake’s life after Hollywood a steady downward spiral of abasement, worthy of only pity. Blame a cultural double standard that applauds reckless rebellion in men but shames it in women.”

As the chapters do not have titles, I’ve decided to write down a snippet of information which sums up the pivotal points and various timelines in each section.

______________________________________________________________________________

Chapter 1:

– Starts in 1938 and traces Veronica’s move to Hollywood with her mother, step-father and cousin on the 4th of July. Veronica enrolls in the Bliss Hayden School of Acting and has her first role in a movie as an extra in RKO’s Sorority House (1939).

Chapter 2:

– Veronica’s signature peek-a-boo hairstyle is unintentionally created on the set of Forty Little Mothers (1940) by Director, Busby Berkeley who stated, “I still say let it fall. It distinguishes her from the rest”.

Chapter 3:

– Director, Freddie Wilcox sets up Veronica’s first Screen Test, whilst at home her step-father suffers a collapsed lung.

Chapter 4:

– Veronica joins the iconic William Morris Agency and recounts her knowledge of the infamous Hollywood Casting Couch and how she turned away from the many advances.

Chapter 5:

– Veronica meets her first husband, John Detlie and has her named changed by Producer, Arthur Hornblow Jr., who, after a second Screen Test, decides to cast her as Sally Vaughn in her breakout movie, I Wanted Wings (1941).

Chapter 6:

– Focuses on the location filming of I Wanted Wings (1941) from August 26th 1940 in San Antonio, Texas.

Chapter 7:

– Continues filming in Hollywood for I Wanted Wings (1941) and elopes to marry her first husband, John Detlie.

Chapter 8:

– Veronica discusses the first 8 years of her childhood and her move to Florida in her teen years and the two schools she attended in Montreal and Miami.

Chapter 9:

– Recounts various appearances in Miami Beauty Pageants as a teenager.

Chapter 10:

– Returns to 1941 with the release of I Wanted Wings (1941) and focuses on the worldwide phenomenon of the famous hair. Also finishes with Director Preston Sturges hiring Veronica for the role of The Girl in Sullivan’s Travels (1941).

Chapter 11:

Veronica shares the news of her first pregnancy with her mother and how her third trimester would coincide with the physical demands of filming Sullivan’s Travels (1941).

Chapter 12:

– Covers the filming of Sullivan’s Travels (1941) from May 12th 1941 and the revelation of Veronica’s pregnancy. It’s simply incredible when watching the film all these years later to come to the realization that she was between six to eight months pregnant!

Chapter 13: – The filming of This Gun For Hire (1942) and The Glass Key (1942).

Chapter 14:

– The filming of I Married A Witch (1942), So Proudly We Hail! (1943) and The Hour Before The Dawn (1944). Veronica also discusses the deterioration of her marriage and the tragic loss of her second baby, Anthony, who died a week after being born two months prematurely.

Chapter 15:

– Veronica divorces John and retells various anecdotes of the Hollywood Lifestyle in it’s heyday in the 1940s.

Chapter 16:

– Veronica discusses the filming of Star Spangled Rhythm (1942) and also her dating history during this period. She shares some fascinating stories of various celebrity anecdotes which include such Stars as, Errol Flynn, Katharine Hepburn, Howard Hughes and Gary Cooper.

Chapter 17:

– The filming of Bring On The Girls (1945), Duffy’s Tavern (1946) and Hold That Blonde! (1945). Veronica recalls marrying her second husband, Andre de Toth and shares a moving story from her visit to The White House in January 1945.

Chapter 18:

– The filming of Miss Susie Slagles (1946), Out Of This World (1945), Ramrod (1946), The Blue Dahlia (1946), Saigon (1947) and The Sainted Sisters (1948). Veronica and Andre expand their family as she has her third baby, a boy named Michael. She also talks about her and Andre obtaining their Pilot Licenses and how the death of her step-dad deeply affected her.

Chapter 19:

– Features a highly entertaining story of Veronica flying her plane, whilst carrying her forth child, in her fifth month of pregnancy. With her on board is her secretary Marge, who up until then had never flown before.

Chapter 20:

– Veronica gives birth to her forth baby, a girl named Diana and talks about the turmoil of her relationship with her mother, who decided to sue her for, “lack of filial love and responsibility” and over $17,000.

Chapter 21:

– The filming of Slattery’s Hurricane (1949) and Stronghold (1951). Veronica discusses her frustration with Andre’s prolific spending, which results in them filing for bankruptcy and ultimately, the deterioration of their marriage.

Chapter 22:

– Veronica moves to New York in 1951 and continues her acting career through various television appearances and the stage. She enters her third marriage to husband, Joe McCarthy, which she admits was volatile from the start and they divorce after just four years, in September 1959.

Chapter 23:

– Covers the years 1959 through to 1961. Veronica discusses her time taking a job as a cocktail waitress – which contrary to popular belief, she actually quite enjoyed. She also talks about the traumatic accident which resulted in a severely broken ankle, which caused her inability to act for two years.

Chapter 24:

– Delves into her relationship with Andy Elickson, a Merchant Seaman, who she met during her time working in the Martha Washington Hotel and focuses on the period between 1961 and 1966. She also writes about a high note in her stage career; appearing in Best Foot Forward in 1963.

Chapter 25:

– Veronica discusses her move to Miami from New York in 1966.

Chapter 26:

– The filming of Footsteps In The Snow (1966) and Flesh Feast (1970) which was then known as Time Is Terror and was originally shot in 1967.

Chapter 27:

– Ends in October 1967 with Veronica discussing her reading performance of The World of Carl Sandburg, which she describes as one of the, “finest moments” of her life.

______________________________________________________________________________

Veronica’s words are full of honesty, she does not sugar-coat her flaws and her anecdotes convey a great sense of humbleness towards her career and lots of self criticism to her talent, the latter which saddens me. I’ve noticed many of the great Stars rarely seem to have any belief in themselves. If only they could see how loved and appreciated they truly are. However, her loyalty and generosity towards her close friends and even acquaintances does not go unnoticed. It’s refreshing to see her be able to share her own story, without various opinions and conspiracies that have grown over the years being included.

Overall, there’s only two downsides that springs to mind. Firstly, as the book was originally published in 1969 and finishes at the end of 1967, we’re missing the six final years of her fascinating life and tragically nothing can be done to change this. Of course no one is at fault, it’s just a shame that those last years will remain mostly a mystery to us. It would have been wonderful to read about her time in England. Lastly, in the original edition, a number of pages featured very rare photos of Veronica throughout her years, including her own comments. Sadly, only a small version of the cover photo reappears at the end of the newly republished book. I’m assuming this is down to cost and or copyright, but it would be nice to see these rare treasures reappear in the latest edition for fans that are not fortunate enough to also own an original copy.

Ultimately, Veronica always maintains her true self and comes across as not a Screen Icon, but just like one of us – albeit with some extraordinary Hollywood stories. She’s simply, and I mean this in the most complimentary way – a human being. It’s been almost a decade since I discovered Veronica, eight years in fact and I for one have not only became even more endeared to Miss Lake, but, I have also developed a warm space in my heart for my fellow 5’2″ little lady, Miss Connie/Ronni Keane.

Lastly, a huge thank you to Dean Street Press for believing in the popularity of Veronica and so wonderfully reprinting hers and Donald Bain’s special words for us all to enjoy.

For anyone who wants to see more of Veronica, I’ve amassed a fairly large archive of photos over the years which can be viewed on my blog devoted entirely to her; missveronicalakes.

Follow me at;

BLOGLOVIN

INSTAGRAM

TUMBLR

TWITTER

YOUTUBE

For inquiries or collaborations contact me at;

Veronica: The Autobiography of Veronica Lake; Book Review. When most people hear the name, "Veronica Lake" usually one of three things comes to mind - …

#1940s#1950s#1960s#autobiography#blonde bombshell#book review#classic hollywood#constance keane#donald bain#femme fatale#icon#legend#old hollywood#peek-a-boo blonde#veronica lake#vintage

29 notes

·

View notes

Link

LETTERS FROM AN AMERICAN

October 12, 2020

Heather Cox Richardson

According to a proclamation from the president, today is officially “Columbus Day,” when we honor the “many immeasurable contributions of Italy to American history.” The president’s proclamation goes on to complain that “in recent years, radical activists have sought to undermine Christopher Columbus’s legacy” by replacing a recognition of his “vast contributions” with talk of failings, atrocities, and transgressions.

Trump’s proclamation goes on: “Rather than learn from our history, this radical ideology and its adherents seek to revise it, deprive it of any splendor, and mark it as inherently sinister. They seek to squash any dissent from their orthodoxy.” He notes the steps he has taken to “promote patriotic education:” he signed an Executive Order to create a National Garden of American Heroes, set up “the 1776 Commission, which will encourage our educators to teach our children about the miracle of American history and honor our founding,” and signed an Executive Order “to root out the teaching of racially divisive concepts from the Federal workplace.”

For all of Trump’s attention to patriotic education, his proclamation is quite bad history. Aside from its whitewashing of the effects of Columbus’s voyage of “discovery,” the proclamation misrepresents the original point of Columbus Day, which had a lot more to do with putting down white supremacy than celebrating the “enduring significance” of Columbus in opening “a new chapter in world history.”

President Franklin Delano Roosevelt officially instituted Columbus Day in 1934, but the idea for the holiday rose in the 1920s, when the Knights of Columbus tried to undercut the resurgence of the Ku Klux Klan by emphasizing the role minorities had played in America. In the early 1920s, the organization published three books in a “Knights of Columbus Racial Contributions” series, including The Gift of Black Folk, by W. E. B. Du Bois. They celebrated the contributions of immigrants, especially Catholic immigrants, to America with parades honoring Christopher Columbus. The Knights of Columbus were determined to reinforce the idea that America must not be a land of white Protestant supremacy.

Trump’s words about patriotic education also ring hollow when the news of the day makes it seem that the administration is more interested in staying in power than in protecting our democratic government.

Today was the first day of early voting in Georgia, and a record 126,876 voters cast ballots. In the state’s Democratic areas some people had to wait in line for as long as ten hours to vote.

Trump’s contribution to early voting today was to tweet “California is going to hell. Vote Trump!” and “New York has gone to hell. Vote Trump!” and “Illinois has no place to go. Sad, isn’t it? Vote Trump!” Once again, he insisted that he has a healthcare plan, although he has been promising such a plan since before his inauguration and none has ever materialized. “We will have Healthcare which is FAR BETTER than ObamaCare, at a FAR LOWER COST - BIG PREMIUM REDUCTION. PEOPLE WITH PRE EXISTING CONDITIONS WILL BE PROTECTED AT AN EVEN HIGHER LEVEL THAN NOW. HIGHLY UNPOPULAR AND UNFAIR INDIVIDUAL MANDATE ALREADY TERMINATED. YOU’RE WELCOME!”

Dr. Anthony Fauci, one of the nation's top infectious disease specialists who is advising the White House, is openly angry that the Trump campaign took his words out of context to make it seem like he was applauding the administration’s handling of the coronavirus pandemic. He said that, by using his words misleadingly and against his will, the Trump campaign is “in effect harassing me.” Fauci’s anger hasn’t stopped the campaign, which today broke precedent to use an image of the Chairman of the Joint Chiefs of Staff General Mark Milley in a campaign ad. The image was used without Milley’s knowledge or consent, and violates the military’s strict policies against participation in political campaigns.

An article in the New York Times today outlines how the administration appears to be trying to buy votes by funneling money to key constituencies before the election. Trump has said he is sending $200 cards to seniors to help them pay for drug prescriptions. He approved $13 billion in aid to Puerto Rico, which could help win him votes in Florida (politicians often campaign in territories or even foreign countries from which immigrants come because it helps them win votes at home). He has required the Agriculture Department to enclose letters in both English and Spanish in its food distributions to families giving Trump credit for both “sending nutritious food” and “safeguarding the health and well-being of our citizens.”

The administration will also distribute $46 billion (not a typo) to farmers in the South and Midwest who have been whacked by Trump’s trade war with China and coronavirus, to try to offset the record farm debt accumulating and the rise in farm bankruptcies, although it appears the money goes primarily to big operations.

Instead of using the presidency to protect the interests of the nation, Trump appears to be using it as a money-making operation for his family. The New York Times on Saturday continued its series on Trump’s taxes, showing how he turned his hotels and resorts into “a system of direct presidential influence-peddling unrivaled in modern American politics.” Under terrible financial stress, the president used his office to line his pockets. Foreign politicians, businessmen, and contractors who wanted federal contracts, would throw pricey events, donate to Trump’s campaign, or buy memberships at Trump’s properties—he raised the membership fee at Mar-a-Lago to $250,000-- where Trump would often be there to help them get what they wanted.

Looking at Trump’s record undercutting our democracy, even just for today alone, makes you wonder just what he means by “patriotic education,” and who, exactly, are the “radical activists” he attacks for not honoring “the miracle of our founding.”

Here's the story: historians are not denigrating the nation when they uncover sordid parts of our past. Historians study how and why societies change. As we dig into the past we see patterns that never entirely foreshadow the present, but that give us ideas about how people have dealt with circumstances in the past that look similar to circumstances today. With luck, seeing those patterns will help us make better decisions about our own lives, our communities, and our nation in the present. As they say, history doesn’t repeat itself, but it often rhymes.

If we are going to get an accurate picture of how a society works, historians must examine it honestly. That means seeing the bad as well as the good, because, after all, any human society is going to have both. Sometimes good human actions change society; sometimes bad ones do. George Washington’s heroic refusal to be a king is no truer than his enslavement of other human beings, and both changed our nation in ways that we need to understand if we are to make good decisions about how to take care of our own society.

History, though, is different than commemoration. History is about what happened in the past while commemoration is about the present. We put up statues and celebrate holidays to honor figures from the past who embody some quality we admire. But as society changes, the qualities we care about shift. In the 1920s, Columbus mattered to Americans who opposed the Ku Klux Klan because he represented a multicultural society. Now, though, he represents the devastation of America’s indigenous people at the hands of European colonists who brought to North America and South America germs and a fever for gold and God. It is not “radical activism” to want to commemorate a different set of values than we held in the 1920s.

What is radical activism, though, is the attempt to skew history to serve a modern-day political narrative. Rejecting an honest account of the past makes it impossible to see accurate patterns. The lessons we learn about how society changes will be false, and the decisions we make based on those false patterns will not be grounded in reality.

And a nation grounded in fiction, rather than reality, cannot function.

——

LETTERS FROM AN AMERiCAN

Heather Cox Richardson

1 note

·

View note

Text

World View delays plans and furloughs staff because of pandemic

https://sciencespies.com/space/world-view-delays-plans-and-furloughs-staff-because-of-pandemic/

World View delays plans and furloughs staff because of pandemic

WASHINGTON — World View, the stratospheric ballooning company, has put on hold new business initiatives and furloughed some staff because of the coronavirus pandemic.

The company, which has developed a high-altitude balloon platform called Stratollite intended to provide remote sensing and other services traditionally provided by spacecraft, announced in March it would start flying a series of its balloons in an “orbit” or “racetrack” over parts of North and Central America. The company envisioned a series of Stratollites flying in that orbit, providing imagery with a resolution as sharp as 5 centimeters, far better than satellites can offer.

“This is really our coming out time” after years of development, said Tom Pirrone, senior vice president of business development at World View, during a briefing about the company’s plans March 3 during the Next-Generation Suborbital Researchers Conference in Broomfield, Colorado. “This is a high-margin, very profitable business.”

At the time, World View expected to start flying Stratollites in that racetrack in the summer, gradually building up to as many as 20 at a time. Those plans, though, are now on hold as the company hunkers down during the pandemic.

“We’re having to delay our go-to-market activities,” Ryan Hartman, chief executive of the company, said in an April 13 interview. “The delay is impacting us by months, not years.”

World View is based in Tucson, Arizona, which is among the states with stay-at-home orders closing nonessential businesses. “We are a manufacturing business,” he said, so such orders are “impactful” to the business.

Hartman said the company has taken steps to conserve funding, including furloughing some employees last week. He declined to say how many employees were furloughed. “Having to furlough any of them has been a difficult decision and a painful process to go through,” he said. “We’re working hard every day to take the steps necessary to recall them as quickly as possible.”

“We’re really focused on the survivability of the company,” he said. “We have sized the team to be able to create a cash runway for ourselves that ensures our survivability and maintains the core competencies of the business.”

World View is among the many companies that have turned to support from the federal government in the form of the Paycheck Protection Program from the Small Business Administration, which provides loans to small businesses to prevent layoffs. The loans will be forgiven if employees are kept on the payroll for eight weeks and the funds used for payroll, rent or utilities.

Like many companies, Hartman said World View ran into difficulties applying for a loan through the program. “The rollout has not been as smooth as any of us would have liked,” he said. The company did apply and is now in a “wait-and-see mode” about its application.

World View has also gotten local relief, he said, in the form of a rent deferment from Pima County, Arizona, which built the facility and leases it to the company as part of an economic incentive package in 2016.

Hartman said the company, like many others in the aerospace industry, is looking for ways to leverage its capabilities to support coronavirus relief efforts. That includes potentially using balloon manufacturing equipment to make medical tents that can be used to triage patients, as well as producing masks and gowns. “We’re just trying to do our part using our core competencies,” he said.

World View is not the only company in the aerospace sector that has had to furlough or lay off employees because of the pandemic. Bigelow Aerospace announced March 23 it laid off all its employees, estimated to be nearly 70 at the time, because of a state order in Nevada closing nonessential businesses. OneWeb Satellites, the joint venture between Airbus and OneWeb, said March 30 it was laying off an unspecified number of employees, a move that came days after OneWeb filed for Chapter 11 bankruptcy.

Other aerospace companies, though, have escaped layoffs because they are deemed essential by the federal government, exempting them from closure orders. Some are continuing to hire employees. Blue Origin tweeted April 16 that it is hiring about 20 people a week, with more than 500 job openings across the company’s facilities.

#Space

1 note

·

View note

Video

youtube

At Randall & Waldner, PLLC, we have the credentials that assures that you are in the best hands possible. If you are serious about having your legal needs serviced by one of the best firms in the United States, you need only look as far as bankruptcy lawyers in Vancouver Washington.

Randall & Waldner, PLLC 2013 H St, Vancouver, WA 98663 (206) 900-7900

My Official Website: https://uptownbankruptcy.com/ Google Plus Listing: https://www.google.com/maps?cid=3626189694949087759

Our Other Link

chapter 7 lawyer Vancouver WA: https://uptownbankruptcy.com/chapter-7-bankruptcy/ chapter 13 lawyer Vancouver WA: https://uptownbankruptcy.com/chapter-13-bankruptcy/

Other Services We Provide

Bankruptcy Service Lawyers Chapter 7 bankruptcy Chapter 13 bankruptcy Debt Relief Agency Bankruptcy

Follow Us On

Pinterest: https://www.pinterest.com/randallwaldner/

0 notes

Photo

Seattle Bankruptcy Attorneys

Read this infographic to learn about bankruptcy law in Seattle. If you are filing bankruptcy, contact our bankruptcy attorneys Seattle at 206-258-6225 to learn more about what is bankruptcy and which chapter is the best option for you.

#debt relief attorney in seattle#chapter 13 bankruptcy process in seattle#bankruptcy law firm in seattle#bankruptcy lawyers in seattle#bankruptcy attorneys seattle#seattle bankruptcy lawyers#bankruptcy attorneys in seattle#seattle bankruptcy attorneys#bankruptcy lawyer in seattle#chapter 7 bankruptcy washington state#bankruptcy washington state

0 notes

Link

#chapter 13 bankruptcy attorney tacoma#chapter 13 bankruptcy lawyer tacoma#chapter 13 bankruptcy lawyers tacoma#chapter 13 bankruptcy attorneys tacoma#bankruptcy law Firm tacoma#tacoma washington bankruptcy lawyer#bankruptcy law firm in tacoma#bankruptcy attorney tacoma#bankruptcy attorney in tacoma#bankruptcy lawyers tacoma#tacoma bankruptcy lawyer#filing bankruptcy in washington state

0 notes

Photo

(Above) Announcement in the Wilmington Messenger on November 9, 1898.

The 1898 Coup d’etat initiating in Wilmington North Carolina, also called the "Wilmington Riots" and in other States named other disturbances, under the fraudulent and illegal Pretext of "The Declaration of White Independence" (November 8, 1898) has never been corrected in any Branch, Department or Agency of the Trustee Receiver of the Administrative Government in the United States Sovereign and General Government.

The Autochthonous Sovereign General Government of The United States of North America

The Unincorporated Free Association of The United States of North America Republican Form of Government a/k/a (A) "The United States of America, In General Congress assembled,” (B) "The United States in Congress assembled,” (C) "The United States Government belonging to the Family of Nations” and (D) the Preamble and Constitutional United States of America with its three Branch Government headed by "The Congress of the United States" pursuant to Art. 1 of said Constitution (1) Pronounced the authentic "A DECLARATION" by the Representatives of the UNITED STATES OF AMERICA, In General Congress assemble IN CONGRESS, July 4, 1776 that officially started the "Revolutionary War", (2) Enacted the Official Flag of the United States June 14, 1777 with its star of David's Six Pointed Stars and (3) established the "Sigilla Magna Republic Confederate America"> The Seal of the Maiores People United in America a.k.a. the Great Seal of the Confederate/Union Republic of America, i.e., The Official "sea1 of the United States" pursuant to 4 U.S.C.S., Section 41. This is the Pre-Entitled Qualified, HaKhdar, Free Inhabitant and natural born Citizenship of the United States of North America, We Reclaim, Proclaim, Declare, Record and Implement, via the Fas and Hakh.

The 13 Black British Colonies Incorporated Government

The former or pre 1929-1945 Federal Corporation United States of America Democratic form of government a.k.a. (A) The United Colonies, (B) These United Colonies, (C) the Senate and House of Representatives of the United States of America in Congress assembled and the "Thirteen United States of America" being the un-Constitutional [> Preamble and Articles 1-7] three departmental governments of the U.S. headed once by said Congress that (1) Attached or piggybacked the “Declaration of Independence” to Our “A Declaration” that officially started the "War of Independence" [when historically joined and understood they are called the" American Revolution”], (2) unofficially enacted and displayed the Historic Star of Washington's Five-Pointed Stars October 1777 and constructed the "illegal [Great] seal of 1841 ". These denizens or Subjects were once known as "natural-born citizens" and were also once Congressionally Naturalized via United States Courts after two years for civilians.

The Declaration of White Independence Incorporated Government

The Administrative "Federal Republic in central N America" (> World Encyclopedia of flags, p. l92)] united States of America Municipal form of government a.k.a. (A) The Democratic and Republican party government, (B) The Indivisible Government (See Documents and Readings in American Government, pages 608-610), (C) The "fourth branch of government (See, e.g., Separation of Powers and the Independent Agencies: Cases and Selected Readings, Library of Congress, 1969, pages 383-et seq.); and (D) The Feds/Fez headed by an unconstitutional president, and subordinately controlled by the Joint-Committees of ["The] Congress" who having actually and Effectually taken over the task of fulfilling the (1) "Declaration of White Independence" on October 8, 1898 in the Coup detat initiating in Wilmington North Carolina, (2) Raised the Administrative Commercial and Bankruptcy Flag of the United States between 1929-1935 with its Presidential arrangement of Stars/Mullets, Fringes and dimensions (see 4 U.S.C.S., Chapter 1, Interpretive Notes and decisions, 1980 Ed. p.895); and the "Crested eagle"> The Phoenix, Draco or Maru in Finial of the flag: (more about the Moorish-Eagle below) and (3) The "Great Seal of the United States" of 1935-1986 with its CRESTED EAGLE. All citizens of this government are "subjects to another's jurisdiction" and are Contractual "White Negroes" or property of the "State where in they reside" regardless of your Color.

Now, the Autochthonous, We The People, “IN” the Posterity Sovereign General Government of The United States of North America, was not a part of, nor participated in, the 1898 Wilmington Coup d’etat of the 13 Black British Colonies aka the Federal United States. More importantly, the Autochthonous Sovereign Government never recognized nor adhered to the “Declaration of White Independence,” and never granted so-called “White Independence” and sovereignty to foreign subjects/serfs.

HOUSTON, WE HAVE A PROBLEM, Washington DC, United States Congress, United States Senate, Roman American Empire, Holy See, Vatican, City of London, British Commonwealth and Britain, does not have a Contract with the Autochthonous Sovereign Government.

Further, during Ronald Wilson Reagan’s tenure, he gave up, transferred, the complete and entire Titleship/Ownership of United States, Incorporated and United States of America, Incorporated, pursuant to United States Treasury Federal Identification Number 8216 and 8217. Thus, 8216-8217 never declared Bankruptcy, nor does any President, Governor, Mayor and County Executives, Pope and Queen have the power and authority to declare US, Inc. and USA, Inc. Bankruptcy.

Accordingly, all companies incorporated within US and USA, are under the controlling interest, and Titleship/Ownership of 8216 and 8217, which is now under the dominion of the Autochthonous Posterity Sovereign General Government of The United States of North America, in the Family of Nations, “Law of Nation”.

On that note, GAME OVER.

Sincerely,

H.E. HRH Ernest Rauthschild Royal Prime Minister 8216-8217 The United States of North America – The Republic of North America

0 notes

Text

Lindon Utah Foreclosure Lawyer

Lindon is a city in Utah County, Utah, United States. It is part of the Provo–Orem, Utah Metropolitan Statistical Area. The population was 10,070 at the 2010 census. In July 2018 it was estimated to be to 10,970 by the US Census Bureau. Lindon has an abundant cultural and historical background. Originally settled in 1861, Lindon began as pioneers moved into what was then the Lindon grazing land. The town was originally named “String Town” because of the way the houses were strung up and down the street between the towns of Orem and Pleasant Grove. An old linden tree (Tilia) growing in town in 1901 inspired the present (misspelled) name. Over the past century Lindon has seen organized development, but it has tried to remain true to its motto: “Lindon: a little bit of country”.

youtube

Short Sales vs. Deeds in Lieu of Foreclosure

If you’re having trouble making your mortgage payments and the loan holder (the bank) has denied your request for a repayment plan, forbearance, or loan modification or if you’re not interested in any of those options two other ways to avoid a foreclosure are completing a short sale or a deed in lieu of foreclosure. One benefit to these options is that that you won’t have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu of foreclosure is almost as bad as a foreclosure when it comes to credit scores. For some people, though, not having the stigma of a foreclosure on their record is worth the effort of working out one of these alternatives.

Short Sales

A short sale occurs when a homeowner sells his or her home to a third party for less than the total debt remaining on the mortgage loan. With a short sale, the bank agrees to accept the proceeds from the sale in exchange for releasing the lien on the property.

youtube

The bank’s loss mitigation department must approve the short sale before the transaction can be completed. (The process of finding a way to avoid foreclosure is called “loss mitigation.”) To get approval for a short sale, the seller (the homeowner) must contact the loan servicer—the company that manages the loan account—to ask for a loss mitigation application. The homeowner then must send the servicer a complete application, which usually includes: • a financial statement, in the form of a questionnaire, that provides detailed information regarding monthly income and expenses • proof of income, if applicable • most recent tax returns • bank statements (usually two recent statements for all accounts), and • a hardship affidavit or statement. • The purchase offer. A short sale application will also most likely require that you include an offer from a potential purchaser. Banks often insist that there be an offer on the table before they will consider a short sale, but not always.

• A second mortgage holder must agree to the short sale. If there is more than one mortgage on the property, both mortgage holders must consent to the short sale. The first mortgage holder will offer a certain amount from the short sale proceeds to second mortgage holder to release their lien, but the second mortgage holder can refuse to accept the amount and kill the deal.

Deficiency Judgments Following Short Sales

Many homeowners who complete a short sale will face a deficiency judgment, though a few states disallow them after this kind of transaction. The difference between the total debt and the sale price is called a “deficiency.” For example, say your bank gives you permission to sell your property for $200,000, but you owe $250,000. The deficiency is $50,000. In many states, the bank can seek a personal judgment against you after the short sale to recover the deficiency amount.

youtube

While many states have enacted legislation that prohibits a deficiency judgment following a foreclosure, most states do not have a corresponding law that would prevent a deficiency judgment following a short sale. How to avoid a deficiency with a short sale To ensure that the bank can’t get a deficiency judgment against you following a short sale, the short sale agreement must expressly state that the transaction is in full satisfaction of the debt and that the bank waives its right to the deficiency.

If the bank forgives some or all of the deficiency and issues you a IRS Form 1099-C, you might have to include the forgiven debt as taxable income. When It Might Be a Good Idea to Let a Foreclosure Happen and Other Issues to Consider

In some states, a bank can get a deficiency judgment against a homeowner as part of a foreclosure or thereafter by filing a separate lawsuit. In other states, state law prevents a bank from getting a deficiency judgment following a foreclosure. If the bank can’t get a deficiency judgment against you after a foreclosure, you might be better off letting a foreclosure happen rather than doing a short sale or deed in lieu of foreclosure that leaves you on the hook for a deficiency. For specific advice about what to do in your particular situation, talk to a local foreclosure attorney. Also, you should take into consideration how long it will take to get a new mortgage after a short sale or deed in lieu versus a foreclosure. Fannie Mae, for instance, will buy loans made two years after a short sale or deed in lieu if there are extenuating circumstances, like divorce, medical bills, or a job layoff that caused you economic difficulty, compared to a three-year wait after a foreclosure. (Without extenuating circumstances, the waiting period for a Fannie Mae loan is seven years after a foreclosure or four years after a short sale or deed in lieu.) On the other hand, the Federal Housing Authority (FHA) treats foreclosures, short sales, and deeds in lieu the same, usually making its home loan insurance available after three years.

Deeds in Lieu of Foreclosure

Another way to avoid a foreclosure is by completing a deed in lieu of foreclosure. A deed in lieu of foreclosure is a transaction in which the homeowner voluntarily transfers title to the property to the bank in exchange for a release from the mortgage obligation. Generally, the bank will only approve a deed in lieu of foreclosure if there aren’t any other liens on the property.

You Might Want to Complete a Deed in Lieu of Foreclosure

Because the difference in how a foreclosure or deed in lieu affects your credit is minimal, it might not be worth completing a deed in lieu unless the bank agrees to: • forgive or reduce the deficiency • give you some cash as part of the deal, or • give you some additional time to live in the home (longer than what you’d get if you let the foreclosure go through). Banks sometimes agree to these terms to avoid the expense and hassle of foreclosing. If you have a lot of equity in the property, however, a deed in lieu is usually not a good way to go. In most cases, you’ll be better off by selling the home and paying of the debt. If a foreclosure is imminent and you don’t have much time to sell, you might consider filing for Chapter 13 bankruptcy with a plan to sell your property.

Just like with a short sale, the first step in obtaining a deed in lieu of foreclosure is for the borrower to contact the servicer and request a loss mitigation application. As with a short sale request, the application will need to be filled out and submitted along with documentation about income and expenses. The bank might require that you try to sell your home before it will consider accepting a deed in lieu, and require a copy of the listing agreement as proof that this has been done.

youtube

Deed in Lieu of Foreclosure Documents

If approved for a deed in lieu of foreclosure, the bank will send you documents to sign. You will receive: • a deed that transfers ownership of the property to the bank, and • an estoppel affidavit. (Sometimes there might be a separate deed in lieu agreement.) The estoppel affidavit sets out the terms of the agreement and will include a provision that you are acting freely and voluntarily. It might also include provisions addressing whether the transaction is in full satisfaction of the debt or whether the bank has the right to seek a deficiency judgment. Deficiency Judgments Following a Deed in Lieu of Foreclosure With a deed in lieu of foreclosure, the deficiency amount is the difference between the fair market value of the property and the total debt. In most cases, completing a deed in lieu will release the borrowers from all obligations and liability under the mortgage, but not always.

Anti-deficiency laws

Most states don’t have a law that prevents a bank from obtaining a deficiency judgment following a deed in lieu of foreclosure. Washington, however, is one state that does prohibit a bank from getting a deficiency judgment after a deed in lieu. So, the bank might try to hold you liable for a deficiency following the transaction. If the bank wants to preserve its right to seek a deficiency judgment, it generally must clearly state in the transaction documents that a balance remains after the deed in lieu, and it must include the amount of the deficiency. How to avoid a deficiency with a deed in lieu of foreclosure To avoid a deficiency judgment with a deed in lieu of foreclosure, the agreement must expressly state that the transaction is in full satisfaction of the debt. If the deed in lieu of foreclosure agreement does not contain this provision, the bank might file a lawsuit to obtain a deficiency judgment. Again, you might have tax liability for any forgiven debt.

The process for completing a deed in lieu will vary somewhat depending on who your loan servicer is and who the lender (or current owner of your loan, called an “investor”) is. Generally, you’ll have to try to sell the property for at least 90 days at fair market value before the lender will consent to accepting a deed in lieu. Also, you usually must have clear title, which means there can’t be other liens on the property. You might have to provide details about your finances and show that the home won’t sell for what’s owed. As part of the deal, the homeowner usually agrees to vacate the home, leaving it in good (“broom swept”) condition, and sign over ownership to the lender. In some cases, the borrower will have to submit an affidavit indicating that the process was voluntary. In some cases, the lender will allow the homeowner to rent the home even after turning over the deed. Fannie Mae, for example, offers this option to borrowers who have Fannie Mae loans. Also, in some cases, the departing homeowner will receive relocation money after completing a deed in lieu.

Call A Foreclosure Lawyer

Some people think that completing a deed in lieu will cause less damage to their credit score than a foreclosure. But the difference in how a foreclosure or deed in lieu affects your credit is minimal. For this reason, it might not be worth doing a deed in lieu unless the lender agrees to forgive or reduce the deficiency, you get some cash as part of the deal, or you get some extra time to live in the home (longer than what you’d get if you let the foreclosure go through). In some cases, the lender will agree to one or more of these conditions to avoid the expense and hassle of foreclosing. Also, you should take into consideration how long it will take to get a new mortgage after a deed in lieu versus a foreclosure. Fannie Mae, for instance, will buy loans made two years after a deed in lieu if there are extenuating circumstances, like divorce, medical bills, or a job layoff that caused you economic difficulty, compared to a three-year wait after a foreclosure. (Without extenuating circumstances, the waiting period for a Fannie Mae loan is seven years after a foreclosure or four years after a deed in lieu.) On the other hand, the Federal Housing Authority (FHA) treats foreclosures, short sales, and deeds in lieu the same, usually making its home loan insurance available after three years. If you have a lot of equity in the property, however, a deed in lieu is usually a poor choice. You’d be better off by selling the property and paying of the debt. If you don’t have a lot of time and a foreclosure is imminent, you might consider filing for Chapter 13 bankruptcy with a plan to sell your home.

youtube

With a deed in lieu, the homeowner may negotiate what will happen to the deficiency, if one exists. Because a deed in lieu is a voluntary agreement between you and the lender, it’s possible to negotiate a deal in which: • the lender agrees not to pursue a deficiency judgment • you agree pay part of the deficiency, or • you agree to repay the deficit over time. Be aware that, if the lender forgives all or part of the deficiency, you might face tax consequences. Should You Let the Foreclosure Go Through? In some states, a bank can get a deficiency judgment against a homeowner as part of a foreclosure or thereafter by filing a separate lawsuit. In other states, an anti-deficiency law prevents a bank from getting a deficiency judgment following a foreclosure. If the bank can’t get a deficiency judgment against you after a foreclosure, you might be better off letting a foreclosure happen rather than agreeing to a deed in lieu of foreclosure that leaves you responsible for all or a portion of a deficiency. (For specific advice about what to do in your particular situation, talk to a local foreclosure attorney.)

If you’re considering completing a deed in lieu, consider talking to a lawyer. Many different foreclosure avoidance options exist, including loan modifications and short sales, and some options might be better than others, especially for specific situations. To find out if a deed in lieu might be right for you or to explore other possible options, contact a lawyer.

Avoiding a Deficiency Judgment

In some states, lenders have the right to sue borrowers for deficiencies after a foreclosure or a deed in lieu of foreclosure. A deficiency is the difference between the amount you owe on your mortgage loan and the price your lender gets for your home when it sells at a foreclosure sale. In other words, if you owe your mortgage lender $300,000 on your house and you default, and the foreclosure sale brings in just $250,000, the deficiency is $50,000. If permitted by state law, the lender can sue you for the $50,000 and get a deficiency judgment—even though it already took the house. With a deed in lieu of foreclosure, the deficiency is the difference between the total debt and the fair market value of the house. As part of the deed in lieu of foreclosure negotiations, you should get your lender to agree to release you from having to repay any deficiency, perhaps in exchange for your agreeing to deliver the house to your lender in good condition. Make sure to get the deficiency waiver in writing. Though, if the lender forgives all or part of the deficiency, you could face tax consequences.

Know Your Options

If you are a distressed homeowner who’s facing a foreclosure, knowing your options is very important. As soon as you realize that you’re in financial distress, call your servicer’s loss mitigation department to find out what alternatives to foreclosure—such as a refinance, loan modification, short sale, or deed in lieu of foreclosure—are available to you. (The servicer is the company that manages your loan account on behalf of the lender. Servicers process borrower payments, manage escrow accounts, and pursue foreclosure for defaulted loans.) You have nothing to lose by calling the servicer and the call might make a huge difference. You will typically be provided a packet of information and documents to complete. If you don’t understand the contents of any of these documents, ask for help, either from an attorney or a free HUD-certified housing counselor. While the foreclosure process can be scary, you have some choice in the matter.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Utah Divorce Code 30-3-34

HIPPA Law Lawyers

Payments On Taxes

Staying Safe In Wildfire Season

Wage Garnishment Law

Utah Divorce Code 30-3-34.5

{ "@context": "http://schema.org/", "@type": "Product", "name": "ascentlawfirm", "description": "Ascent <a href="https://www.ascentlawfirm.com/divorce-law/" >Law helps you in divorce, bankruptcy, probate, business or criminal cases in Utah, call 801-676-5506 for a free consultation today. We want to help you. ", "brand": { "@type": "Thing", "name": "ascentlawfirm" }, "aggregateRating": { "@type": "AggregateRating", "ratingValue": "4.9", "ratingCount": "118" }, "offers": { "@type": "Offer", "priceCurrency": "USD" } }

The post Lindon Utah Foreclosure Lawyer first appeared on Michael Anderson.

from Michael Anderson https://www.ascentlawfirm.com/lindon-utah-foreclosure-lawyer/ from Divorce Lawyer Nelson Farms Utah https://divorcelawyernelsonfarmsutah.tumblr.com/post/631045843924975616

0 notes

Video

youtube

At Randall & Waldner, PLLC, we have the credentials that assures that you are in the best hands possible. If you are serious about having your legal needs serviced by one of the best firms in the United States, you need only look as far as bankruptcy attorneys in Vancouver Washington Randall & Waldner, PLLC.

Randall & Waldner, PLLC 2013 H St, Vancouver, WA 98663 (206) 900-7900

My Official Website: https://uptownbankruptcy.com/ Google Plus Listing: https://www.google.com/maps?cid=3626189694949087759

Our Other Link

chapter 7 lawyer Vancouver WA: https://uptownbankruptcy.com/chapter-7-bankruptcy/ chapter 13 lawyer Vancouver WA: https://uptownbankruptcy.com/chapter-13-bankruptcy/

Other Services We Provide

Bankruptcy Service Lawyers Chapter 7 bankruptcy Chapter 13 bankruptcy Debt Relief Agency Bankruptcy

Follow Us On

Pinterest: https://www.pinterest.com/randallwaldner/

#bankruptcy attorneys in Vancouver Washington#Vancouver Washington bankruptcy attorney#bankruptcy attorney Vancouver WA#bankruptcy lawyer near me

0 notes

Photo

Debt Relief Attorney In Seattle

Read this infographic to learn about how bankruptcy filing can resolve your debt problems. To find out more about resolving your debt problems contact our Seattle bankruptcy attorneys at 206-258-6225.

#debt relief attorney in seattle#chapter 13 bankruptcy process in seattle#bankruptcy law firm in seattle#bankruptcy lawyers in seattle#bankruptcy attorneys seattle#seattle bankruptcy lawyers#bankruptcy attorneys in seattle#seattle bankruptcy attorneys#bankruptcy lawyer in seattle#chapter 7 bankruptcy washington state

0 notes

Link

If you’re facing serious financial problems, you may be considering filing for bankruptcy. Follow this link post and know more about it.

#affordable bankruptcy lawyer in vancouver wa#debt relief lawyer in vancouver wa#cheap bankruptcy attorneys in vancouver wa#cheap bankruptcy lawyer in vancouver wa#bankruptcy law firm vancouver wa#low cost bankruptcy lawyers in vancouver wa#bankruptcy lawyers in vancouver wa#vancouver wa chapter 7 bankruptcy lawyer#vancouver wa credit card debt laws#credit counseling vancouver wa#chapter 13 bankruptcy washington state rules#collections agency vancouver wa#chapter 13 bankruptcy filing fee#chapter 13 bankruptcy process

0 notes

Text

Lindon Utah Foreclosure Lawyer

Lindon is a city in Utah County, Utah, United States. It is part of the Provo–Orem, Utah Metropolitan Statistical Area. The population was 10,070 at the 2010 census. In July 2018 it was estimated to be to 10,970 by the US Census Bureau. Lindon has an abundant cultural and historical background. Originally settled in 1861, Lindon began as pioneers moved into what was then the Lindon grazing land. The town was originally named “String Town” because of the way the houses were strung up and down the street between the towns of Orem and Pleasant Grove. An old linden tree (Tilia) growing in town in 1901 inspired the present (misspelled) name. Over the past century Lindon has seen organized development, but it has tried to remain true to its motto: “Lindon: a little bit of country”.

youtube

Short Sales vs. Deeds in Lieu of Foreclosure

If you’re having trouble making your mortgage payments and the loan holder (the bank) has denied your request for a repayment plan, forbearance, or loan modification or if you’re not interested in any of those options two other ways to avoid a foreclosure are completing a short sale or a deed in lieu of foreclosure. One benefit to these options is that that you won’t have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu of foreclosure is almost as bad as a foreclosure when it comes to credit scores. For some people, though, not having the stigma of a foreclosure on their record is worth the effort of working out one of these alternatives.

Short Sales

A short sale occurs when a homeowner sells his or her home to a third party for less than the total debt remaining on the mortgage loan. With a short sale, the bank agrees to accept the proceeds from the sale in exchange for releasing the lien on the property.

youtube

The bank’s loss mitigation department must approve the short sale before the transaction can be completed. (The process of finding a way to avoid foreclosure is called “loss mitigation.”) To get approval for a short sale, the seller (the homeowner) must contact the loan servicer—the company that manages the loan account—to ask for a loss mitigation application. The homeowner then must send the servicer a complete application, which usually includes: • a financial statement, in the form of a questionnaire, that provides detailed information regarding monthly income and expenses • proof of income, if applicable • most recent tax returns • bank statements (usually two recent statements for all accounts), and • a hardship affidavit or statement. • The purchase offer. A short sale application will also most likely require that you include an offer from a potential purchaser. Banks often insist that there be an offer on the table before they will consider a short sale, but not always.

• A second mortgage holder must agree to the short sale. If there is more than one mortgage on the property, both mortgage holders must consent to the short sale. The first mortgage holder will offer a certain amount from the short sale proceeds to second mortgage holder to release their lien, but the second mortgage holder can refuse to accept the amount and kill the deal.

Deficiency Judgments Following Short Sales

Many homeowners who complete a short sale will face a deficiency judgment, though a few states disallow them after this kind of transaction. The difference between the total debt and the sale price is called a “deficiency.” For example, say your bank gives you permission to sell your property for $200,000, but you owe $250,000. The deficiency is $50,000. In many states, the bank can seek a personal judgment against you after the short sale to recover the deficiency amount.

youtube

While many states have enacted legislation that prohibits a deficiency judgment following a foreclosure, most states do not have a corresponding law that would prevent a deficiency judgment following a short sale. How to avoid a deficiency with a short sale To ensure that the bank can’t get a deficiency judgment against you following a short sale, the short sale agreement must expressly state that the transaction is in full satisfaction of the debt and that the bank waives its right to the deficiency.

If the bank forgives some or all of the deficiency and issues you a IRS Form 1099-C, you might have to include the forgiven debt as taxable income. When It Might Be a Good Idea to Let a Foreclosure Happen and Other Issues to Consider

In some states, a bank can get a deficiency judgment against a homeowner as part of a foreclosure or thereafter by filing a separate lawsuit. In other states, state law prevents a bank from getting a deficiency judgment following a foreclosure. If the bank can’t get a deficiency judgment against you after a foreclosure, you might be better off letting a foreclosure happen rather than doing a short sale or deed in lieu of foreclosure that leaves you on the hook for a deficiency. For specific advice about what to do in your particular situation, talk to a local foreclosure attorney. Also, you should take into consideration how long it will take to get a new mortgage after a short sale or deed in lieu versus a foreclosure. Fannie Mae, for instance, will buy loans made two years after a short sale or deed in lieu if there are extenuating circumstances, like divorce, medical bills, or a job layoff that caused you economic difficulty, compared to a three-year wait after a foreclosure. (Without extenuating circumstances, the waiting period for a Fannie Mae loan is seven years after a foreclosure or four years after a short sale or deed in lieu.) On the other hand, the Federal Housing Authority (FHA) treats foreclosures, short sales, and deeds in lieu the same, usually making its home loan insurance available after three years.

Deeds in Lieu of Foreclosure

Another way to avoid a foreclosure is by completing a deed in lieu of foreclosure. A deed in lieu of foreclosure is a transaction in which the homeowner voluntarily transfers title to the property to the bank in exchange for a release from the mortgage obligation. Generally, the bank will only approve a deed in lieu of foreclosure if there aren’t any other liens on the property.

You Might Want to Complete a Deed in Lieu of Foreclosure

Because the difference in how a foreclosure or deed in lieu affects your credit is minimal, it might not be worth completing a deed in lieu unless the bank agrees to: • forgive or reduce the deficiency • give you some cash as part of the deal, or • give you some additional time to live in the home (longer than what you’d get if you let the foreclosure go through). Banks sometimes agree to these terms to avoid the expense and hassle of foreclosing. If you have a lot of equity in the property, however, a deed in lieu is usually not a good way to go. In most cases, you’ll be better off by selling the home and paying of the debt. If a foreclosure is imminent and you don’t have much time to sell, you might consider filing for Chapter 13 bankruptcy with a plan to sell your property.

Just like with a short sale, the first step in obtaining a deed in lieu of foreclosure is for the borrower to contact the servicer and request a loss mitigation application. As with a short sale request, the application will need to be filled out and submitted along with documentation about income and expenses. The bank might require that you try to sell your home before it will consider accepting a deed in lieu, and require a copy of the listing agreement as proof that this has been done.

youtube

Deed in Lieu of Foreclosure Documents

If approved for a deed in lieu of foreclosure, the bank will send you documents to sign. You will receive: • a deed that transfers ownership of the property to the bank, and • an estoppel affidavit. (Sometimes there might be a separate deed in lieu agreement.) The estoppel affidavit sets out the terms of the agreement and will include a provision that you are acting freely and voluntarily. It might also include provisions addressing whether the transaction is in full satisfaction of the debt or whether the bank has the right to seek a deficiency judgment. Deficiency Judgments Following a Deed in Lieu of Foreclosure With a deed in lieu of foreclosure, the deficiency amount is the difference between the fair market value of the property and the total debt. In most cases, completing a deed in lieu will release the borrowers from all obligations and liability under the mortgage, but not always.

Anti-deficiency laws

Most states don’t have a law that prevents a bank from obtaining a deficiency judgment following a deed in lieu of foreclosure. Washington, however, is one state that does prohibit a bank from getting a deficiency judgment after a deed in lieu. So, the bank might try to hold you liable for a deficiency following the transaction. If the bank wants to preserve its right to seek a deficiency judgment, it generally must clearly state in the transaction documents that a balance remains after the deed in lieu, and it must include the amount of the deficiency. How to avoid a deficiency with a deed in lieu of foreclosure To avoid a deficiency judgment with a deed in lieu of foreclosure, the agreement must expressly state that the transaction is in full satisfaction of the debt. If the deed in lieu of foreclosure agreement does not contain this provision, the bank might file a lawsuit to obtain a deficiency judgment. Again, you might have tax liability for any forgiven debt.

The process for completing a deed in lieu will vary somewhat depending on who your loan servicer is and who the lender (or current owner of your loan, called an “investor”) is. Generally, you’ll have to try to sell the property for at least 90 days at fair market value before the lender will consent to accepting a deed in lieu. Also, you usually must have clear title, which means there can’t be other liens on the property. You might have to provide details about your finances and show that the home won’t sell for what’s owed. As part of the deal, the homeowner usually agrees to vacate the home, leaving it in good (“broom swept”) condition, and sign over ownership to the lender. In some cases, the borrower will have to submit an affidavit indicating that the process was voluntary. In some cases, the lender will allow the homeowner to rent the home even after turning over the deed. Fannie Mae, for example, offers this option to borrowers who have Fannie Mae loans. Also, in some cases, the departing homeowner will receive relocation money after completing a deed in lieu.

Call A Foreclosure Lawyer

Some people think that completing a deed in lieu will cause less damage to their credit score than a foreclosure. But the difference in how a foreclosure or deed in lieu affects your credit is minimal. For this reason, it might not be worth doing a deed in lieu unless the lender agrees to forgive or reduce the deficiency, you get some cash as part of the deal, or you get some extra time to live in the home (longer than what you’d get if you let the foreclosure go through). In some cases, the lender will agree to one or more of these conditions to avoid the expense and hassle of foreclosing. Also, you should take into consideration how long it will take to get a new mortgage after a deed in lieu versus a foreclosure. Fannie Mae, for instance, will buy loans made two years after a deed in lieu if there are extenuating circumstances, like divorce, medical bills, or a job layoff that caused you economic difficulty, compared to a three-year wait after a foreclosure. (Without extenuating circumstances, the waiting period for a Fannie Mae loan is seven years after a foreclosure or four years after a deed in lieu.) On the other hand, the Federal Housing Authority (FHA) treats foreclosures, short sales, and deeds in lieu the same, usually making its home loan insurance available after three years. If you have a lot of equity in the property, however, a deed in lieu is usually a poor choice. You’d be better off by selling the property and paying of the debt. If you don’t have a lot of time and a foreclosure is imminent, you might consider filing for Chapter 13 bankruptcy with a plan to sell your home.

youtube

With a deed in lieu, the homeowner may negotiate what will happen to the deficiency, if one exists. Because a deed in lieu is a voluntary agreement between you and the lender, it’s possible to negotiate a deal in which: • the lender agrees not to pursue a deficiency judgment • you agree pay part of the deficiency, or • you agree to repay the deficit over time. Be aware that, if the lender forgives all or part of the deficiency, you might face tax consequences. Should You Let the Foreclosure Go Through? In some states, a bank can get a deficiency judgment against a homeowner as part of a foreclosure or thereafter by filing a separate lawsuit. In other states, an anti-deficiency law prevents a bank from getting a deficiency judgment following a foreclosure. If the bank can’t get a deficiency judgment against you after a foreclosure, you might be better off letting a foreclosure happen rather than agreeing to a deed in lieu of foreclosure that leaves you responsible for all or a portion of a deficiency. (For specific advice about what to do in your particular situation, talk to a local foreclosure attorney.)

If you’re considering completing a deed in lieu, consider talking to a lawyer. Many different foreclosure avoidance options exist, including loan modifications and short sales, and some options might be better than others, especially for specific situations. To find out if a deed in lieu might be right for you or to explore other possible options, contact a lawyer.

Avoiding a Deficiency Judgment

In some states, lenders have the right to sue borrowers for deficiencies after a foreclosure or a deed in lieu of foreclosure. A deficiency is the difference between the amount you owe on your mortgage loan and the price your lender gets for your home when it sells at a foreclosure sale. In other words, if you owe your mortgage lender $300,000 on your house and you default, and the foreclosure sale brings in just $250,000, the deficiency is $50,000. If permitted by state law, the lender can sue you for the $50,000 and get a deficiency judgment—even though it already took the house. With a deed in lieu of foreclosure, the deficiency is the difference between the total debt and the fair market value of the house. As part of the deed in lieu of foreclosure negotiations, you should get your lender to agree to release you from having to repay any deficiency, perhaps in exchange for your agreeing to deliver the house to your lender in good condition. Make sure to get the deficiency waiver in writing. Though, if the lender forgives all or part of the deficiency, you could face tax consequences.

Know Your Options

If you are a distressed homeowner who’s facing a foreclosure, knowing your options is very important. As soon as you realize that you’re in financial distress, call your servicer’s loss mitigation department to find out what alternatives to foreclosure—such as a refinance, loan modification, short sale, or deed in lieu of foreclosure—are available to you. (The servicer is the company that manages your loan account on behalf of the lender. Servicers process borrower payments, manage escrow accounts, and pursue foreclosure for defaulted loans.) You have nothing to lose by calling the servicer and the call might make a huge difference. You will typically be provided a packet of information and documents to complete. If you don’t understand the contents of any of these documents, ask for help, either from an attorney or a free HUD-certified housing counselor. While the foreclosure process can be scary, you have some choice in the matter.

Free Initial Consultation with Lawyer

It’s not a matter of if, it’s a matter of when. Legal problems come to everyone. Whether it’s your son who gets in a car wreck, your uncle who loses his job and needs to file for bankruptcy, your sister’s brother who’s getting divorced, or a grandparent that passes away without a will -all of us have legal issues and questions that arise. So when you have a law question, call Ascent Law for your free consultation (801) 676-5506. We want to help you!

Ascent Law LLC 8833 S. Redwood Road, Suite C West Jordan, Utah 84088 United States Telephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

Utah Divorce Code 30-3-34

HIPPA Law Lawyers

Payments On Taxes

Staying Safe In Wildfire Season

Wage Garnishment Law

Utah Divorce Code 30-3-34.5

{ "@context": "http://schema.org/", "@type": "Product", "name": "ascentlawfirm", "description": "Ascent <a href="https://www.ascentlawfirm.com/divorce-law/" >Law helps you in divorce, bankruptcy, probate, business or criminal cases in Utah, call 801-676-5506 for a free consultation today. We want to help you. ", "brand": { "@type": "Thing", "name": "ascentlawfirm" }, "aggregateRating": { "@type": "AggregateRating", "ratingValue": "4.9", "ratingCount": "118" }, "offers": { "@type": "Offer", "priceCurrency": "USD" } }

The post Lindon Utah Foreclosure Lawyer first appeared on Michael Anderson.

Source: https://www.ascentlawfirm.com/lindon-utah-foreclosure-lawyer/

0 notes