#cause only subbed is on this streaming service you have to pay a year subscription for and seems sketchy

Explore tagged Tumblr posts

Text

$3 a season at the thrift store (´⌣`ʃƪ) ♥

Last year I completely ditched all the streaming and subscription services we were paying for--Hulu, Youtube Premium, Netflix, gone! It started as a necessary step to help cut costs during a recent (unwanted) downgrade in household employment. But even now that things have picked back up I don't want them back.

I don't like how content is created and consumed nowadays. I hate the impermanence and the 'second screen-ness' and the constant tinkering...random episodes from older shows re-edited because they couldn't license the music rights a second time, entire episodes missing in some bizarre, tokenistic appeal towards progressivism, as if a random episode of The Golden Girls showcasing racial issues in a slightly less eggshell-y way than today is the cause of inequity in the world, rather than the all-white board that pushed the delete button.

I hate the bombardment of 18 million sub-par options cluttering up the screen, the endless scroll of mindlessly trying to find something to watch. I despise getting some pretty good enjoyment out of the first few hours of a series only for it to slowly become clear that what I'm watching is a 90-minute film obnoxiously stretched to 7 hours as an entire creative team collectively forgets how to edit themselves.

I hate that nothing released in the last half decade has ever been something I've wanted to watch more than once. What a disposable waste of film digital camerawork.

I hate having to chase shows around as they hop from service to service. Can't stand seeing older shows stretched into the wrong aspect ratio because someone in a board room somewhere decided for me that I have a crippling fear of pillar boxes.

So our household has officially jumped ship. As the streaming services I used to enjoy (when they were a way to find older shows and movies long past their initial runs, before each service was trying to replace what was once a novel entertainment idea with some sort of Voltron-esque amalgamation of television and Hollywood Frankensteined together into one big financially unsustainable nightmare) give way to a landscape so convoluted and expensive that it's on track to just become Cable TV 2.0, I've dived back into my physical media collection.

One thing fortunate about the packrat gene I was born with is that I never got rid of all my stuff. The physical DVDs, Blu-Rays, CD's, etc...they're all still there on the shelves of my honest-to-God entertainment system. The Sanyo TV from 2007 still works perfectly (we've gone through 3 bedroom Smart TVs in the time we've had that hand-me-down old set). It was all still here waiting for me.

On a side note, may I sing the praises of my 20 year-old Sanyo for a minute? Thing can play PAL region video signals fucking flawlessly, no converters necessary! That's so rare for North American TVs. I remember when I first got my PAL-region Playstation, naively unaware of the idea that it likely wouldn't work on a US television, and then plugging it in to just...perfection. All those Reddit threads I'd been sent by my coworkers as they warned me not to hook it up (you don't have the right converters, you're going to break everything!). Nope, turns out I have accidentally and serendipitously found myself with the perfect television set for a retro-gaming and electronics weirdo like me. Sanyo, you rock(ed? Are they still around? I'm not sure...)

I know it's not for everyone. But I love my physical media collection. This perfectly curated little space just for me. I love looking up from my TV and seeing the Japanese version of Gremlins that I found for like 200 yen at a flea market in Gifu, the old DVD of Lilo & Stitch that still lets Lilo crawl right into the dryer, the little dummy, and the pièce de résistance, that random bootleg Diabolik Lovers DVD where someone in the localization room fucked up and all the em dashes in the summary got replaces with eñes.

Ideas like having streaming and physical media just haven't worked out for me. Because I end up just using streaming as a way to sort of preview a few things to see if I want to buy them or not, and really that's not worth the hundred bucks a month it costs to keep up with them all. Plus it was like the subscriptions were sucking the life out of my physical DVDs. Maybe this wasn't the case for anyone else, but just knowing in the back of my mind that I had Netflix or Hulu or whatever was...almost paralyzing. My movies were all gathering dust because I was ignoring them in favor of...cycling endlessly through multiple pages of Apple TV listings, knowing there had to be something somewhere in there and that because it might be gone in a week I needed to find it and watch it now instead of the movies I already owned. Insufferable.

There's a part of me that feels so free knowing I'll never again have to suffer through Hulu playing I swear to God the exact same three ads over and over and over and over and over again.

The best part is that people will just...give you entire sets of TV shows and movies now. They think they don't need them anymore. Every time I'm visiting family or friends, if I comment on how I "really like" a show or a move I see they have, they're likely to just respond with "Oh really? Go ahead and take it, we just watch it on Netflix now. Keep it."

(Thank you Mom, for the "available on Peacock" Twilight Zone collection, thank you college classmate for the "I totally saw it on Fubo" special edition Event Horizon Blu-Ray, and especially thank you to whoever was trusting enough of their Paramount+ subscription to donate ten seasons of Frasier to my local Goodwill.)

No backsies.

1 note

·

View note

Text

I'm partial to the "return to physical media" sentiment, partly because the problems with streaming and digital-only have become glaring, and also out of general cantankerousness. A few recent pieces have pointed out how unsustainable streaming appears to be, and the real problems it has caused for people who work in the entertainment industry (talking here about production crews, writers, and the 90-odd percent of actors who aren't top-billers). One of the arguments in this discussion that goes "now streaming costs as much as cable used to". It's very easy to just subscribe to one or two, watch what you want to watch, then cancel the subscription and try a different one. There may be a small number of people who feel compelled to buy lots of streaming services so they can keep up with everything, but presumably they would also feel the same about all the extra cable channels, so they'd be paying for the highest level cable tier and HBO, Cinemax, and so on.

But I went to my local cable monopoly's website to see what it costs now. Maybe they've cut prices since so many folks have cut the cord. Nope. The lowest-priced tier was $65. Even if you only bought the higher-priced streaming services, you could get four easy and have some change left over, and each one of those would have literally thousands of hours of stuff to watch. Plus, with cable you either have to watch it on their schedule, or pay for a DVR (or I guess it's a digital equivalent now) and hope that it actually catches the shows it's supposed to. And of course it's going to come with a lot of channels I'd never watch, and chances are good all of them include F-- News, which I do not want to support in any way.

So I think I'll stick with streaming for the foreseeable future. Between YouTube, Twitch, and Tubi, there's more than enough "free with ads" streaming. And I'm cool with only subbing to Paramount when there's new Lower Decks or Strange New Worlds, or Disney when there's a new Star Wars show (though I admit i'm mad about Acolyte not getting renewed, so I might be less eager to go back to that one). If AEW goes to HBO Max, even if it streams a week after the cable broadcast, I'll jump on that.

Not to mention that I don't have a real tv these days. After my last one died (only lasted a couple of years), I just stuck with my lap top. I really don't like modern TVs. The sound is awful, they look boring, and you can't do shit without the remote. Also, and I know I'm in the minority here, and my age is a big factor here since i grew up with TV looking a certain way, but the super HD picture looks fake to me. Watching a show where everything is perfectly lit, hardly even any shadows anywhere, everyone's make-up immaculate, sets where everything is perfectly in its place and there's not a mote of dust on anything makes it all feel very artificial. And I'm not the type to demand immersiveness (often when people talk about being immersed, or especially ads that promote a thing as immersive, I'm not sure I even know what they're talking about). I'm very aware that people on the screen are playing make believe and Im' being told a story by other people. That's a good thing, because I appreciate the storytelling skills of all these people, and the whole reason I seek out stories is to be told a good story. But these ultra high def things just look so fake. The fact that I've worn glasses since elementary school might play into it, too. There are few moments when the world I see doesn't have some fuzziness in it, at least at the edges.

0 notes

Note

can i ask what stream ripping software you use? i ask cause im new to this and with everything that is happening in media now, i think it would be good to know how

@demigoat because they asked too.

So the program is called Audials One and yes, it's a pay program. It's not impossibly expensive and, if you can get it during a sale, the price is really good. I got my year's access last December for 20 bucks. You can one-time-purchase the version for that year but, since they come out with new versions every year and a one-year subscription is usually less than the single purchase, I've found the sub works just fine.

I could shill about the product all day it's seriously that useful but I'll just say that, if you pay for it and have access to the almost daily updates (necessary for continued functionality), I've never met a stream this thing can't rip. If you literally have to have it set up to record your monitor while it's playing it can go that basic but usually it can just rip the data internally as you play it.

Or, in some cases like YT, you just load the video and click a button.

The service also has warning labels for various settings. It gives you the options of "safe" ripping settings which don't leave any fingerprints or if you are the risky sort, you can use the "red" settings which, while they usually work faster, have a good chance of getting you TOSsed. They leave that choice up to you but they will give you a warning if you're about to do something risky.

It should be noted that stream ripping, as opposed to torrents and actual one-click downloading, is protected by a court judgment from i believe the 1980s regarding recording songs off the radio. The only issue is that every single streaming service has written it into the TOS that you can't so that's where the hangup is. (I believe. My minor in popular culture came from over a decade ago the laws could have changed since then.)

Anyway, I cannot recommend buying the program enough it has served me so well in the past 3 years since I found it. HERE is the link to the product page, although I will warn you the main homepage has this big giant eye in the background that can be kind of creepy. Also flashing lights. (The page linked does not as of the time of posting, 8/24/22) So yeah. Anyone who wants an awesome ripping program, go for it. As stated, it's done me well so far, hopefully, it can help out some of you as well.

Of note: I'm in the US and this is a US-based program, I believe. I can't vouch for international usage because I've never used it internationally. Anyone who has info about that feel free to add it.

20 notes

·

View notes

Note

Hey I've seen you support crunchyroll in the past so what's your thoughts on this whole merger with funimation?

Short answer? Worried.

Many years ago, I tried to actually pay for a subscription to funimation's streaming service. I signed up, gave them a significant amount of real money, and then discovered that their website was so fucking broken I could not get it to play a single full episode of anything. So I cancelled that, and felt perfectly justified in just pirating anything they had exclusive rights to in my region.

But since then, I keep hearing more about the company, and all of it is worse. Rewriting the scripts of shows to insert their own political messages while removing the words of the original writers, often going so far as to completely change the story in blatantly homophobic ways? Buying exclusive licensing deals to new releases, only to decide that the content of the shows is too controversial and refusing to actually let anybody see it? Abusing employees, firing people without cause, and then openly lying about it? No matter what aspect of the company you look at, everything they do is terrible.

[I mean CR has done some really stupid stuff over time, but overall they deliver what they promise and don't fuck things up too badly. I'd go so far as to say they're the best out of our current set of options, and a vast improvement over anything that came before them.]

And then a few years back I remember Crunchy and Funi announcing this big partnership thing, where instead of fighting over licencing deals they would share libraries, with CR streaming the subs that their customers mostly wanted and Funi handling the dubs that their customers wanted and both of them getting a vastly expanded catalog... until a couple months later when Funi pulled out of the deal with no explanation, taking everything they had a license to with and cutting off viewers mid-stream. The only thing I can think of is that they discovered that if there was any other legal source for the shows they "owned" then everybody would jump over to the alternative and never use their vastly inferior service again? And so instead of trying to attract customers back by improving their service, they said 'fuck you' to all the customers and went back to trying to hold a monopoly on japanese media in the west?

And now we hear about this "merger". And maybe there's nothing for the customers to worry about, maybe the part of the service we see will be unchanged and the only people who really get hurt by this will be the Japanese artists and producers who used to get to pick the best of competing bids for international release, but now have to accept whatever scraps Funi deigns to throw them. But we all know that when a huge, powerful, stupid company like Funi "merges" with a small, passionate group like CR, they really become the new owners. And all the press releases giving you a bunch of corpspeak about how dedicated they are to providing the best service, but never actually saying anything meaningful? Definitely not doing anything to allay my concerns.

I mean, piracy will still always work, but that leaves me with no way to actually pay the people making the anime for any of it, and that leaves a bad taste in my mouth.

11 notes

·

View notes

Text

Victoria Barreto’s Blog: Marketing Insights

Printed Book Sales Rising Again in the US

Are printed copies of books really making a comeback?

Yes, in the US good-old fashioned book sales have been steadily rising and are currently in growth in the product life cycle. As the infographic shows, this recovery picked up extra pace during the pandemic, too. According to Publishers Weekly, the 2021 increase was led by fiction titles. "The young adult fiction segment had the largest increase, with unit sales jumping 30.7%, while adult fiction sales rose 25.5%. Sales in the juvenile fiction category increased 9.6%".

However, there was one segment recorded to have a decline in unit sales which was juvenile young-fiction. This fall was believed to occur after the introduction of COVID in 2021which led many parents to purchase educational books for their children in hopes of still educating them despite being on lockdown. On the opposite side of that since the reopening of establishments and public places there has been a big increase in the small travel sub category of books with sales at an increase of 23%.

The introduction of printed books becoming more poplar at this time is beneficial not only to the book selling markets but also to its consumers. Considering that many jobs require you to stare at a computer screen all day, it’s wise to give your eyes a break whenever you can. One survey of 429 university students revealed that nearly half had complained of strained eyes after reading digitally. Electronic books can cause screen fatigue, which may lead to blurred vision, redness, dryness, and irritation. With print books, you don’t have to worry about any of that. We can see in the graph above that before the craze of technology printed books were at a high demand then as the new technology started to emerge and become such an integrated part of peoples every day lives it began to drop, but now with people becoming more self aware and realizing the damage of always being on a screen and missing those personal interactions the sale and demand for paper books has began to rise again.

https://www.statista.com/chart/27285/printed-book-unit-sales-timeline-united-states/?utm_campaign=ad0c2c3f11-All_InfographTicker_daily_COM_AM_KW16_2022_Fr&utm_medium=email&utm_source=Statista%20Newsletters&utm_term=0_662f7ed75e-ad0c2c3f11-314931969

Netflix is finally open to ads. What’s next?

https://www.youtube.com/watch?v=GaW56VElNXM

Why is Netflix open to introducing ads to their known to be “ad free” service?

Netflix started out as one of the most popular streaming services that was subscription based and contained content free of ad interruptions, however, now with Netflix losing subscribers and facing stiff revenue and the dropping of its stock by nearly 30%, Netflix is looking at how to introduce advertisements to its platform.

While it is the dominant streaming platform, with 158 million global subscribers, Netflix also has a $12 billion pile of debt. And it is facing competition from deep-pocketed streaming newcomers like the Walt Disney Company and Apple. If Netflix is to remain a top player in this industry it may have to change with the times.

After years of growth and domination in the streaming industry Netflix is currently facing a lot of problems that they think advertising may help it solve. Netflix is facing a lot of competition as well as a problems with the sharing of accounts through house holds which Netflix estimates to be around 100 million. In order for Netflix to stay a strong competitor and maintain its advantage in this industry it is going to have to introduce advertisements in its available content to users. According to a survey conducted most viewers in the U.S. prefer to see ads if they can pay less for the service. In addition to that I do not think Netflix’s main and only problem is their ad-free service or the sharing of accounts but also their lack of good new original content. I think if Netflix can create and add more demanded and wanted content to their platform they would see significant growth again, consumers have been unimpressed by their recent releases and the content available to view on Netflix so I think in order to gain viewers back and drive up their subscribers as well as market share Netflix needs to work on its marketing reach of new content and the demand of content that their consumers want from them.

Not only could the introduction of ads and new content to Netflix's’ platform help them substantially as far as their stocks and revenue are concerned but this could also open the door to new opportunities for them such as help their marketers tap into a new supply of inventory for the company which would offer a greater diversity and scale. With the help of advertisements and the help of these possible new opportunities Netflix would have a chance at increasing its market margins, and current average revenue per user above $14.78, making shareholders happy, and advertisers thrilled with the opportunity to engage with consumers watching great content.

https://www.marketingdive.com/news/netflix-open-to-ads-whats-next/622375/

youtube

Streaming Drives Global Music Industry Resurgence

Why has the music industry grown so much over the past years?

Music has been an integrated part of peoples lives for generations and with the introduction of new technology it has continued to become an even bigger part of peoples everyday lives. CD’s started the popularity of music but with the advancement of technology we are now able to stream and share music and the touch of a button. The advancements in the iPhone, tablets and home devices make it easier to access music than ever before, which is why we have seen a substantial growth in the music streaming industry in these recent years.

The year 2021 was another good year for the music industry the worldwide recorded music revenues totaled $25.9 billion last year, up 18.5 percent from the previous year’s total of $21.9 billion. Marking the seventh consecutive year of growth for the global music industry after nearly two decades of gradual decline.

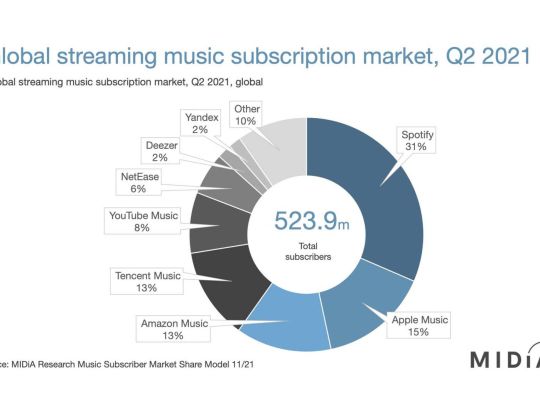

Streaming music is very popular among consumers at the moment and is forecasted to only continue to grow in recent years to come. However one of the biggest things These top music streaming platforms such as Spotify and Apple Music need to watch out for is competition there is a lot of competition in this industry among existing and emerging brands. One of the way these top competitors can stay on top of the competition is by continuously providing their consumers with that they need and well as listening to their new and growing needs as well as to constantly stay on top of the competition by watching out for new products services they might try to offer in hopes of stealing the consumers away.

1 note

·

View note

Text

Now is the time for Walmart to strike at Amazon Prime

Amazon Prime has been an enormous influence on e-commerce, but this online juggernaut is beginning to show cracks. Now is the time for arch-rival Walmart to swoop in with a Prime-like offering that strikes at the weaknesses Amazon has introduced into its formidable loyalty program: price, a lack of focus, and competing subscription services.

Here’s the problem. Amazon has invested in its Prime program continuously, adding feature after feature in an obvious bid to make the service appear as valuable as possible. But while these additions are superfluous to many a user’s needs, everyone pays for them whether they’re used or not.

That’s part of the strategy, of course — if you know your customer won’t stop paying for a subscription, you can use that to squeeze the life out of other subscriptions they might pay for, and redirect that money to yourself. Prime Video and Music, for example, are clearly meant to take the place of Netflix or HBO and Spotify or Apple Music. Why pay for two? And if you have to choose, well, it’s easier to quit HBO than Prime.

This only goes so far, though. For years users have been subject to these pressures, watching the price of Prime rise all the while, and meanwhile other services are getting better and better. Streaming services and exclusive content have multiplied, and Prime users are frequently left out in the cold.

Photo storage? Isn’t that free everywhere? Twitch Prime? Is that really useful for millions of working families? Prime Originals? Not exactly raking in the Emmys. But still… it’s Prime. It’s necessary.

The only one who can realistically break this deadlock is Walmart. Not by providing the same thing as Amazon, but by providing something simpler and more focused, taking over the workhorse duties of Prime (shipping, sales, some basic media of opportunity) at a much lower price, granting the customer freedom to pursue their own choice in subscriptions while not meaningfully affecting their online retail experience.

What would this Walmart offering consist of? They already offer free shipping on a lot of items, free store pickup, and so on. You don’t need to use your imagination here. What would make this better? Free 2-day shipping on all items with no minimum amount; grocery and secure package delivery; a set of basic TV and music streams or even just a partnership with a couple existing products; and lastly some in-store benefits like members-only promotions and perhaps even early access on Black Friday. (Plus extra perks at sub-chains like Sam’s Club.)

Leveraging Walmart’s brick and mortar presence is important, but it’s hard to say what they have the leeway to try there, as it’s likely a delicate balance. But it’s a major advantage to have regular visitors to major retail locations, whereas Amazon has to either home-deliver or install lockers.

There are already indications this is happening — a pilot with a smart-lock company for home delivery, a rumored streaming service, cashierless(ish) checkout (even easier with an account), revamping of existing grocery delivery partnerships, emphasis on cloning or promoting existing services that match or exceed Amazon’s… it looks a lot like a shift to an end-to-end loyalty service.

Whoops: SoftBank CEO reveals Walmart has acquired Flipkart

There are rumors of a Microsoft-powered standalone smart device, but that might conflict with existing voice-ordering partnership with Google. Still, voice assistants are hot and Walmart needs an answer to Alexa if it wants to compete directly with Amazon in the living room. A possible acquisition of Shopify could conceivably broaden the company’s reach considerably as well.

How much would it cost? I’d say if they go about $50 per year they’re asking for trouble. It’s one of those magic numbers not just on its own, but in relation to Amazon’s $120 per year. $60 would be merely half price — $50, why that’s positively generous!

And the considerable savings opens up a bit of cash for secondary subscriptions like Netflix, which ends up, ironically, causing consumers to lock themselves into Walmart just as they were with Amazon, since once again they can’t switch easily! But they will almost certainly be getting more for their money.

Naturally $50 won’t pay for all that stuff on Walmart’s side — but building brand loyalty on the scale of years, while sucking a customer from a competitor… that’s worth spending a little cash for.

Timing-wise they’d want to announce this well ahead of the holidays — at least three months. First three months free if you sign up now and all that. It’ll be a big cash outlay but you don’t unseat a titan like Amazon on a shoestring budget. You do what it takes to put items in carts and go from there.

Walmart won’t risk its business on this, but it makes sense to do it now and do it with vigor. Walmart doesn’t get by on word of mouth — it needs a full court press ahead of Amazon’s busiest period, in which it can unequivocally say “This is the better option for you. Switch now and you’ll never look back.”

The real question is: what will they call it? MartLand? WalSmart? Or perhaps… Wal Street?

via TechCrunch https://ift.tt/2NyU9yV

0 notes

Text

Now is the time for Walmart to strike at Amazon Prime

Amazon Prime has been an enormous influence on e-commerce, but this online juggernaut is beginning to show cracks. Now is the time for arch-rival Walmart to swoop in with a Prime-like offering that strikes at the weaknesses Amazon has introduced into its formidable loyalty program: price, a lack of focus, and competing subscription services.

Here’s the problem. Amazon has invested in its Prime program continuously, adding feature after feature in an obvious bid to make the service appear as valuable as possible. But while these additions are superfluous to many a user’s needs, everyone pays for them whether they’re used or not.

That’s part of the strategy, of course — if you know your customer won’t stop paying for a subscription, you can use that to squeeze the life out of other subscriptions they might pay for, and redirect that money to yourself. Prime Video and Music, for example, are clearly meant to take the place of Netflix or HBO and Spotify or Apple Music. Why pay for two? And if you have to choose, well, it’s easier to quit HBO than Prime.

This only goes so far, though. For years users have been subject to these pressures, watching the price of Prime rise all the while, and meanwhile other services are getting better and better. Streaming services and exclusive content have multiplied, and Prime users are frequently left out in the cold.

Photo storage? Isn’t that free everywhere? Twitch Prime? Is that really useful for millions of working families? Prime Originals? Not exactly raking in the Emmys. But still… it’s Prime. It’s necessary.

The only one who can realistically break this deadlock is Walmart. Not by providing the same thing as Amazon, but by providing something simpler and more focused, taking over the workhorse duties of Prime (shipping, sales, some basic media of opportunity) at a much lower price, granting the customer freedom to pursue their own choice in subscriptions while not meaningfully affecting their online retail experience.

What would this Walmart offering consist of? They already offer free shipping on a lot of items, free store pickup, and so on. You don’t need to use your imagination here. What would make this better? Free 2-day shipping on all items with no minimum amount; grocery and secure package delivery; a set of basic TV and music streams or even just a partnership with a couple existing products; and lastly some in-store benefits like members-only promotions and perhaps even early access on Black Friday. (Plus extra perks at sub-chains like Sam’s Club.)

Leveraging Walmart’s brick and mortar presence is important, but it’s hard to say what they have the leeway to try there, as it’s likely a delicate balance. But it’s a major advantage to have regular visitors to major retail locations, whereas Amazon has to either home-deliver or install lockers.

There are already indications this is happening — a pilot with a smart-lock company for home delivery, a rumored streaming service, cashierless(ish) checkout (even easier with an account), revamping of existing grocery delivery partnerships, emphasis on cloning or promoting existing services that match or exceed Amazon’s… it looks a lot like a shift to an end-to-end loyalty service.

Whoops: SoftBank CEO reveals Walmart has acquired Flipkart

There are rumors of a Microsoft-powered standalone smart device, but that might conflict with existing voice-ordering partnership with Google. Still, voice assistants are hot and Walmart needs an answer to Alexa if it wants to compete directly with Amazon in the living room. A possible acquisition of Shopify could conceivably broaden the company’s reach considerably as well.

How much would it cost? I’d say if they go about $50 per year they’re asking for trouble. It’s one of those magic numbers not just on its own, but in relation to Amazon’s $120 per year. $60 would be merely half price — $50, why that’s positively generous!

And the considerable savings opens up a bit of cash for secondary subscriptions like Netflix, which ends up, ironically, causing consumers to lock themselves into Walmart just as they were with Amazon, since once again they can’t switch easily! But they will almost certainly be getting more for their money.

Naturally $50 won’t pay for all that stuff on Walmart’s side — but building brand loyalty on the scale of years, while sucking a customer from a competitor… that’s worth spending a little cash for.

Timing-wise they’d want to announce this well ahead of the holidays — at least three months. First three months free if you sign up now and all that. It’ll be a big cash outlay but you don’t unseat a titan like Amazon on a shoestring budget. You do what it takes to put items in carts and go from there.

Walmart won’t risk its business on this, but it makes sense to do it now and do it with vigor. Walmart doesn’t get by on word of mouth — it needs a full court press ahead of Amazon’s busiest period, in which it can unequivocally say “This is the better option for you. Switch now and you’ll never look back.”

The real question is: what will they call it? MartLand? WalSmart? Or perhaps… Wal Street?

Via Devin Coldewey https://techcrunch.com

0 notes

Text

Is Neil Woodford dividend stock Provident Financial plc a buy after 16% slump?

Shares of FTSE 100 sub-prime lender Provident Financial (LSE: PFG) fell by more than 16% when markets opened on Wednesday. The slump was triggered by a profit warning in which the firm said that profits from its consumer credit division are expected to fall by 48% to £60m this year.

This stock has been a steady performer in recent years and has become one of Neil Woodford’s top holdings. At the end of May, it was the third-largest holding in Woodford’s Income Focus Fund and the fourth-largest in the fund manager’s flagship Equity Income Fund. So what’s gone wrong?

Staff shortages

Provident is in the process of switching its doorstep lending organisation from using self-employed collecting agents to a smaller number of employed “Customer Experience Managers”. This change seems to be causing more disruption than expected.

The company says that the restructuring has caused a £40m shortfall in loan collections and resulted in new lending levels £37m lower than during the same period last year. Vacancy levels among the collection workforce have been running at 12%, twice the expected rate.

The new organisation will take effect in July, when operating performance is expected to improve. But the shortfall in collections and lending will take time to make up. Management now expects the consumer credit division to generate a profit of £60m this year, down from £115m last year.

This is disappointing, especially as on 12 May, the company said that the impact would only be “up to £10m for 2017”. However, the group reported a net profit of £262.9m last year, so a one-off shortfall of £55m should be manageable.

Should you sell?

This workforce reorganisation appears to have been badly planned or perhaps poorly executed. But this should be a fixable problem. As far as we know, it shouldn’t affect the company’s medium-term performance.

Provident’s management has performed well in recent years, delivering average earnings per share and dividend growth of 15% since 2011. With the stock trading on a forecast P/E of 13.3 and with a prospective yield of almost 6%, I would hold on after today’s news.

A top Woodford small-cap

Neil Woodford appears to be keen on the sub-prime credit sector. His fund participated in the IPO of doorstep lender Non-Standard Finance (LSE: NSF) in 2015 and the stock remains a significant holding in both of his income funds.

Although it’s a new arrival on the stock market, this company was founded in 1938. The firm remains a fan of using self-employed collection agents and has said it has no intention of copying its larger rival Provident in switching to employed staff.

For investors, Non-Standard Finance presents an interesting income opportunity. Following a number of acquisitions, normalised revenue rose from £14.7m to £81.1m last year, while normalised operating profit rose to £13.8m. Further growth is expected this year and the company plans to start paying out 50% of normalised earnings per share. This gives the stock a forecast yield of 3.5%, rising to 5% in 2018.

Buying at current levels could lock in an attractive long-term income stream. For investors who are happy to invest in this sector, Non-Standard Finance may be worth a closer look.

Today's top income buy?

Provident Financial and Non-Standard Finance both operate in the same sector. But relying on a single sector for dividend income is highly risky.

Mr Woodford's income funds are diversified across a number of sectors, many of which are represented in our exclusive income investing report, 5 Shares To Retire On. This must-read report contains details of five shares our analysts would buy in today's uncertain market.

The good news is that this report is free and without obligation. To receive your copy today, just click here now.

More reading

2 FTSE 100 stocks for retirement income AND growth

2 growth stocks for the long term

Roland Head has no position in any shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes