#carbon removal tax credits

Explore tagged Tumblr posts

Text

Senators introduce bipartisan bill for carbon removal tax credits. (Heatmap AM)

Sens. Michael Bennet (D-Colo.) and Lisa Murkowski (R-Alaska) introduced a bipartisan bill yesterday that would establish tax credits for carbon removal projects. Under the Carbon Dioxide Removal Investment Act, direct air capture projects would get a $250 tax credit per metric ton of carbon removed, and indirect capture projects (through biomass, for example) would get $110. So the tax credit is technology-neutral, meaning both natural and engineered projects would be eligible. But to qualify, projects must store the carbon for 1,000 years or more. “Through technology-neutral support that doesn’t pick winners, this bill creates a level playing field that will advance innovations with the biggest climate impact while supporting new jobs and maintaining U.S. leadership in the carbon removal sector,” said Christina DeConcini, Director of Government Affairs at the World Resources Institute.

5 notes

·

View notes

Text

The global Carbon Offset/Carbon Credit Market is expected to grow from an estimated USD 414.8 billion in 2023 to USD 1,602.7 billion by 2028, at a CAGR of 31.0% during the forecast period.

The carbon offset/carbon credit market growth has been attributed to rising global warming and the need to remove carbon from the atmosphere. Increasing investments in carbon capture technologies and solutions along with the rise in projects that are helping communities and creating social impact, is expected to drive the carbon offset/carbon credit market.

#carbon credit#carbon capture#carbon credits#carbon footprint#carbon emissions#carbon dioxide#carbon#energy#energia#power generation#utilities#renewable power#renewableenergy#carbon offset#carbon removal#carbon reduction#carbon tax#hydrogen future#hydrogen technologies#hydrogene#hydrogen fuel cells#hydrogen#reduce carbon emission#sustainable development#sustainable energy#sustainable#sustainability#enviromental#Carbon free#Carbon capture

0 notes

Text

Things the Biden-Harris Administration Did This Week #36

September 27-October 4 2024

President Biden and Vice-President Harris have lead the federal response to Hurricane Helene. President Biden's leadership earned praise from the Republican Governors of South Carolina, Virginia, Tennessee, and Georgia, as well as the Democratic Governor of North Carolina and local leaders. Thousands of federal workers are on the ground in effected communities having given out to date over 8 million meals, over 7 million letters of water. Both President Biden and Vice-President Harris have been on the ground in resent days meeting with effected families. During her trip to Georgia Vice-President Harris announced that the federal government will reimburse state and local government 100% of the costs from Hurricane Helene.

A strike by the International Longshoremen’s Association that briefly shut down ports on the East Cost and Gulf ended in a tentative deal. Both sides thanked Acting Secretary of Labor Julie Su and Secretary of Transportation Pete Buttigieg for helping push the deal through. President Biden and Vice-President Harris had expressed solidarity with the works when the strike was announced and President Biden directed Secretary Buttigieg to take the lead in pressuring management to make a deal with the Longshoremen. The ILA got a 62% raise as part of the agreement.

Vice President Harris announced new actions to help those struggling with medical debt. This actions include new standards from the Consumer Financial Protection Bureau on debt collection. the CFPB plans on requiring debt collectors to confirm debts are valid and accurate before engaging in collection actions. As well as cracking down on debt collectors that collect on debt that is not owed by patients. Other actions included an announcement by the DoD that it was reducing pricing for civilians who get medical treatment at DoD hospitals and a track down on tax-exempt hospitals who are required by law to offer financial assistance but often do not. These steps come after Vice President Harris in June announced plans to remove medical debt from credit scores. Following the Vice President's call to action North Carolina moved forward a plan to eliminate medical debt for 2 million people in the state. President Biden's American Rescue Plan funds have been used by state and local Democrats to eliminate $7 billion dollars in medical debt.

The Department of Transportation announced $62 Billion in infrastructure funding for 2025. Thanks to the Bipartisan Infrastructure Law passed by President Biden this will be $18 billion dollars more than was spent in 2021. The Biden-Harris Admin has helped support over 60,000 infrastructure projects across all 50 states, rebuilding roads and bridges, breaking ground on America's first high speed rail, updating ports and airports, and breaking high speed internet to rural communities.

The Department of Transportation announced $1 Billion dollars of investment in America's passenger rail future. This comes on top of $8.2 billion in investments announced in December 2023. The funds will help expand and modernize intercity passenger rail nationwide.

The Departments of Energy and Agriculture announced a $2.8 billion joint project to bring 100% carbon pollution-free energy to the rural midwest. The DoE is investing $1.5 billion into helping bring the Palisades Nuclear Plant in Michigan back on-line. Shut down in 2022 plans to refit and reopen it to allow the plant to keep generating clean energy till 2051. Once back online the Palisades Nuclear Plant will help stop an anticipated 4.47 million metric tons of greenhouse gas emissions a year, or 111 million metric tons of greenhouse gas emissions over its lifetime. The USDA is investing $1.3 billion in two rural electric cooperatives, Wolverine Power Cooperative and Hoosier Energy, which cover rural communities in Michigan, Illinois, and Indiana. This investment will help Wolverine and Hoosier connect to the Palisades Plant, reduce prices for customers, and reduce climate pollution, putting Wolverine Power on the path to be 100 percent carbon-free energy before 2030.

The Treasury and the IRS announced that 30 million Americans, across 24 states will qualify for free direct filing of their taxes in 2025. The IRS says that the average American spends $270 dollars and 13 hours filing their taxes. Thanks to the Inflation Reduction Act, passed by President Biden with Vice President Harris' tie breaking vote, Americans will be able to file their taxes quickly and for free directly with the IRS. Tax payers in Alaska, Arizona, California, Connecticut, Florida, Idaho, Kansas, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Washington, Wisconsin, and Wyoming will in 2025 be able to use direct file.

The USDA announced $7.7 billion in funding for Climate-Smart Practices on Agricultural Lands. This represents the single biggest investment in these programs in USDA history. Since implementation began in 2023 this conservation assistance has helped over 28,500 farmers and ranchers apply conservation to 361 million acres of land.

The Department of Energy announced $1.5 billion in investments in transmission infrastructure to help ensure our grid is reliable and resilient. This will help support nearly 1,000 miles of new transmission lines across Louisiana, Maine, Mississippi, New Mexico, Oklahoma, and Texas. These lines will bring 7,100 MW of new capacity and create 9,000 good paying union jobs. Studies find to keep up with growth and meet our climate goals of carbon free energy the US will need to triple the 2020 transmission capacity by 2050. This is an important step to meeting that goal.

#Thanks Biden#Joe Biden#kamala harris#Politics#US politics#American Politics#climate change#climate action#carolina hurricanes#unions#longshoremen#rail#taxes

1K notes

·

View notes

Text

Morgan Stephens at Daily Kos:

California is gearing up for a high-stakes clash with President-elect Donald Trump over environmental policy and immigration—and it’s happening before Trump is even sworn into office. On Monday, Gov. Gavin Newsom issued a bold warning announcing he would intervene if the Trump administration rolls back the federal tax credit for electric vehicle rebates. If the credit is removed, Newsom pledged to provide a state-funded $7,500 rebate for electric vehicle buyers in California. “[Z]ero-emission vehicles are here to stay,” Newsom said in a press release. “We will intervene if the Trump administration eliminates the federal tax credit, doubling down on our commitment to clean air and green jobs in California. We’re not turning back on a clean transportation future—we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

California’s environmental transformation has been nothing short of remarkable. Los Angeles was once shrouded in a thick haze of smog, and the state struggled with dangerous air quality into the late 20th century. Following the creation of the California Air Resources Board and the Federal Air Quality Act, both in 1967, the state began to dramatically improve its air quality. And now California is a national leader in the fight against climate change. It recently reached its goal of 100 days with 100% carbon-free, renewable electricity for at least a part of each day. The state hit another milestone this year, with more than 2 million zero-emission vehicles sold in the state. "This milestone comes a little over two years after California eclipsed the 1 million ZEV sales mark," Newsom’s office stated in a press release. But the fight isn’t just about clean cars. California Attorney General Rob Bonta is preparing for a legal showdown with Trump over immigration policies, including Trump’s planned mass deportations.

In a recent interview with The Nation, Bonta made it clear the state will take every available step to protect its immigrant communities—no matter what the Trump administration throws at them. “I’ve been preparing and readying for this possible moment for months, and in some cases years, depending on the topic,” said Bonta, adding, “They want to do what they want, when they want, how they want it, even if it violates the Constitution or a federal statute.” Bonta’s team is also worried about “the harm that will be visited on Americans, including Californians, that will be the result of unlawful activity and, in the immigration space, xenophobia, racism, discrimination, fearmongering, scapegoating,” he said.

California is a key state in the battle against Donald Trump in his 2nd term, just like his first term.

22 notes

·

View notes

Text

GREEN PARTY MANIFESTO 2024 SUMMARY

tldr: there's a feeling of tension in this manifesto, between youthful zennial climatic ecosocialism and old-guard hippy-liberal environmentalism. this year the greens may well go from 1 MP to the dizzying heights of 2 (there's whispers on the wind that they may even get 3...), and the green council delegation is at 800-odd now, so this could easily be a changing-of-the-guard moment

with the great Berry and the ok Denyer in parliament the party could have more momentum in battling the starmerite government, and with that, it has the ability, the possibility to pick up more momentum. this is a big opportunity in the party's history - over the next five years it can and could be pushed into a holistic ecosocialist movement by the centrally influential mass party membership, and remove the last dregs of its tunnel vision to provide a lefty movement for everyone, green and pink, a Newfoundland coalition. with votes at 16 on the cards and this potential evolution of the party, 2029 could be a big moment for this country's left. whether or not the greens play the role of keystone is up to them

it is also the only manifesto to use the term 'neurodivergent'

💷ECONOMY

wealth tax of 1% on individuals with assets over §10m and 2% for assets over §1b (an extremely humble proposal), reform capital gains and investment dividend taxation to be at the same rates as income taxation, remove the income-based bands on national insurance contributions, ie raising total income taxation by 8% at §50k/a, – altogether raising government revenues by upwards of §70b/a

stratify VAT to reduce it for consumer stuff and hike it for stuff like financial services

permanent windfall tax on banks for whenever they get windfalls

perform a holistic land survey to get the data needed for a new, effective Land Tax

abolish the tax relief on existing freeports and SEZs

heavy carbon tax to raise a boatload of billions, rising progressively over a decade to allow industrial adaptation, for a ~§80b state windfall for five years that'll be for green investment as this windfall starts to recede

renationalise water and energy

§15 minimum wage, 10:1 pay ratio for all organisations public and private (ie §150 sort-of maximum wage, ~§300k/a), mandatory equal pay audits, 'support' lower hours and four-day weeks [clarification needed]

unambiguously define gig workers as workers with contract rights from day one, repeat offenders of gig-slavery will be banned from operating in the country

every City bank required to produce a strategy with a clear pathway to divestment of all fossil fuels "as soon as possible and at least by 2030", every City non-banking organisation simply to be banned from having fossil fuel in their portfolios, credit to be banned for repeat City climate offenders, mandate the BoE to fulfil the funding of the climate transition and climate leadership of the City, FCA to develop measures to ban fossil fuel share trading in the City and immediately prohibit all new shares in fossil fuels

"we will explore legal ways for companies to be transformed into mutual organisations"😈

develop regional cooperative banks to invest in regional SMEs, coops and community enterprises

diversify crop growth, promote local agricultural cooperatives and peripheral urban horticultural farms, give farmers a sort of collective bargain against grocers

aim towards a circular economy: require ten-year warranties on white goods, rollout of right-to-repair

tighten monopoly laws on media with a hard cap preventing >20% of a media market being owned by one individual or company and implement Leveson 2

🏥PUBLIC SERVICES

abolish tuition fees and cancel standing debt

surge nhs funding by §30B, triple labour's spending plans for everything, the entire budget, the entire state, everything

free personal care, with occupational therapy being part of this

35h/w free child care (eg seven hours over five days, or seven days of five hours)

renationalise many academies under local authorities, abolish the "charity" status of private schools and charge VAT

surge funding for smoking-cessation, addiction support and sexual health service

surge funding for public dentistry with free care for children and low-earners

free school breakfasts in primary school and free school lunches for all schools

one-month guarantee of access to mental health therapies

online access to PrEP

let school playing fields be used in the evenings by local sports clubs

greater funding for civic sports facilities and pools

🏠HOUSING

unambiguously-under-the-law nationalise the crown estate for an absolute fuckton of land and assets for housing and for green energy and rewilding for FREE

rent control for local authorities, ban no-fault evictions and introduce long-term leases, create private tenancy boards of tenants

local authorities to have right of first refusal on the purchase of certain properties at aggressive rates, such as unoccupied or uninsulated buildings

all new homes to be Passivhaus standard with mandatory solar panels and heat pumps

§30B across five years to insulate homes, §12B of which is for social homes, and §9B more for heat pumps, and §7B more for summer cooling

planning law reform: council planning mechanisms to priorities little developments all over the place rather than sprawling blobs, demolitions to require as thorough a planning application as erections, new developments required to not be car dependent

planning laws to require large-scale developments feature access to key community infrastructures such as transport, health and education, often mandating the construction of new key infrastructures, support nightlife and local culture in planning regulations

exempt pubs and local cultural events from VAT

building materials to be reusable, builders' waste rates to be surged to encourage use of reuse

750k new social homes in five years

🚄TRANSPORT

'a bus service to every village', restore local authority control and/or ownership of their busses

renationalise rail via franchise-concession lapsing, slowly assume ownership of the rolling stock (currently leased, and would continue to be so under labour's implementation of renationalisation) by buying a new train when the stock needs to be replaced

electrification agenda across the rail network, strategic approach to rail line and station reopenings

bring forward (sorta, the tories suspended it but labour says they'll reinstate it) the new petrol car ban from 2030 to 2027, existing petrol cars targeted to be off the road by 2034, investigate road-price charges as a replacement for petrol tax, hike road tax proportionally to vehicle weight, drop urban speed limits from 50kph to 30kph (or from 30mph to 20mph if you only speak Wrong), mass funding for freightrail and support logistics firms transitioning away from lorries

§2.5b/a for footpaths and cycleways, target of 50% of urban journeys to be extravehicular by 2030

frequent-flyer levy, ban on domestic flights within three-hour rail distance, remove the exemption of airline fuel from fuel tax, prioritise training of airline workers into other transportational jobs

👮FORCE

abolish the home office, transfer its police/security portfolio to the justice ministry and its citizenship/migration portfolio to a new migration ministry separate from the criminal justice system

abolish the kill the bill bill and restore the right to protest

recognise palestine, push for immediate ceasefire and prosecution of war crimes, back the south africa case, "[support] an urgent international effort to end the illegal occupation of palestinian land"

grant asylum-seekers the right to work before their application is granted

end the hostile environment

abolish Prevent

end routine stop-and-search and facial recognition

commission to reform 'counterproductive' drug regime, decriminalise personal possession

amend the Online Safety Act to "[protect] political debate from being manipulated by falsehoods, fakes and half-truths", ie actually protecting 'fReE sPeEcH' and not everything that rightists imply by that phrase

decriminalise sex work

reform laws to give artists IP protections against ai

cancel trident and disarm

push for nato reforms (in its and our interest, they're not russophiles, they're not galloway, it's ok): get it to adopt a no-first-use nuclear policy, get it to prioritise diplomatic action first rather than military reaction, get it to adopt a stronger line on only acting for the defence of its member states

right to roam🚶♂️

🌱CLIMATE

zero-carbon by 2040, rather than the ephemeral ostensible government target of 2050

stop all new oil/gas licenses, end all subsidy for oil/gas industries, regulate biofuels to end greenwashing, end subsidies for biomass

decarbonise energy by 2030, minimum threshold of energy infrastructures to be community owned, "end the de facto ban on onshore wind" with planning reform

massively expand the connections between the insular grid and the UCTE continental grid to increase electricity import and export and prevent the need for energy autarky

more targeted bans on single-use plastics

"give nature a legal personhood" ok grandma let’s get you to bed

§2b/a to local authorities for local small-business decarbonisation

"cease development of new nuclear power stations, as nuclear energy is much more expensive and slower to develop than renewables. we are clear that nuclear is a distraction from developing renewable energy and the risk to nuclear power stations from extreme climate events is rising fast. nuclear power stations carry an unacceptable risk for the communities living close to facilities and create unmanageable quantities of radioactive waste. they are also inextricably linked with the production of nuclear weapons. green MPs will campaign to phase out existing nuclear power stations." because some people just can't let go of the seventies. nuclear is good. nuclear is our friend

invest in r&d to find solutions to decarbonise 'residual' carbon in the economy, such as HGVs or mobile machinery

increase unharvested woodland by 50% (no time frame given), grants to farmers for scrub rewilding, rewet Pete Boggs, make 30% of the EEZ protected waters and ban bottom trawling

§4b/a in skills training to stop gas communities getting Thatchered, prioritising shifting these workers into offshore wind

a.. licensing scheme for all pet animals? you guys sure about that one

regulate animal farming with a goal of banning factory farms, ban mass routine antibiotics, ban cages/close confinement and animal mutilation

ban all hunting including coursing and "game", ban snaring, ban hunt-landscaping such as grouse moors, end the badger cull, mandate licensing of all animal workers with lifetime striking off for cruelty convictions, compulsory hedgehog holes in new fencing, 'push' for 'ending' horse and dog racing [clarification needed], new criminal offences for stealing and harming pets, 'work towards' banning animal testing

🗳️DEMOCRACY

proportional representation for parliament and all councils

abolish voter ID

votes at sixteen

votes for all visa'd migrants

restore the electoral commission's prosecutory powers and remove the cap on fines it can impose on parties

increase Short Money, especially for smaller parties

create a manifest legal category of organisation for think tanks, to allow better enforcement of lobbying and funding restrictions

consider fun new measures for political accessibility such as MP jobsharing and allowing public provision of offices for all parliamentary candidates

🎲OTHER STUFF

Self-ID including nonbinary recognition, including with an X passport marker

"work towards rejoining the eu as soon as the domestic political situation is favourable", join the eea now (with restored free movement)

let local authorities invest shares in sports teams, including professional ones, dividends ringfenced for public sports facilities and coaching

right to die

20 notes

·

View notes

Text

Over the past few years, the United States has become the go-to location for companies seeking to suck carbon dioxide out of the sky. There are a handful of demonstration-scale direct air capture (DAC) plants dotted across the globe, but the facilities planned in Louisiana and Texas are of a different scale: They aim to capture millions of tons of carbon dioxide each year, rather than the dozens of tons or less captured by existing systems.

The US has a few things going for it when it comes to DAC: It has the right kind of geological formations that can store carbon dioxide pumped underground, it has an oil and gas industry that knows a lot about drilling into that ground, and it has federal grants and subsidies for the carbon capture industry. The projects in Louisiana and Texas are supported by up to $1.05 billion in Department of Energy (DOE) funds, and the projects will be eligible for tax credits of up to $180 per ton of carbon dioxide stored.

“It’s quite clear that the United States is the leader in policy to support this nascent sector,” says Jason Hochman, executive director at the Direct Air Capture Coalition, a nonprofit that works to accelerate the deployment of DAC technology. “At the same time, it’s nowhere near where it needs to be to get on track—to the scale we need to get to net zero.”

But support for carbon storage is far from guaranteed. Project 2025, the nearly thousand-page Heritage Foundation policy blueprint for a second Trump presidency, would dramatically roll back policies that support the DAC industry and carbon capture more generally. The Project 2025 Mandate for Leadership document proposes eliminating the DOE’s Office for Clean Energy Demonstrations, which provides funds for DAC facilities and carbon capture projects, and also calls out the 45Q tax credit that supports DAC as well as carbon capture, usage, and storage—filtering and storing carbon dioxide emitted by power plants and heavy industry. (The Heritage Foundation did not respond to WIRED’s request for comment.)

Sucking carbon out of the sky is not uncontroversial—not least because of the oil and gas industry’s involvement in the sector—but the Intergovernmental Panel on Climate Change’s Sixth Assessment Report says that using carbon dioxide removal to balance emissions from sectors like aviation and agriculture is unavoidable if we want to achieve net zero. Carbon dioxide removal can mean planting trees and sequestering carbon in soil, but a technology like DAC is attractive because it’s easy to measure how much carbon you’re sequestering, and stored carbon should stay locked up for a very long time, which isn’t necessarily the case with forests and soil.

As DAC technology is so new, and the facilities constructed so far are small, it’s still extremely expensive to remove carbon from the atmosphere this way. Estimated costs for extracting carbon go from hundreds of dollars per ton to in excess of $1,000—although Google just announced it is paying $100 for DAC removal credits for carbon that will be sequestered in the early 2030s. On top of that, large-scale DAC plants are likely to cost hundreds of millions to billions of dollars to build.

That’s why government support like the DOE Regional DAC Hubs program is so important, says Jack Andreasen at Breakthrough Energy, the Bill Gates–founded initiative to accelerate technology to reach net zero. “This gets projects built,” he says. The Bipartisan Infrastructure Law signed in 2021 set aside $3.5 billion in federal funds to help the construction of four regional DAC hubs. This is the money that is going into the Louisiana and Texas projects.

Climeworks is one of the companies working on the Louisiana DAC hub, which is eligible for up to $550 million in federal funding. Eventually, the facility aims to capture more than 1 million tons of carbon dioxide each year and store it underground. “If you do want to build an industry, you cannot do it with demo projects. You have to put your money where your mouth is and say there are certain projects that should be eligible for a larger share of funding,” says Daniel Nathan, chief project development officer at Climeworks. When the hub starts sequestering carbon, it will be eligible to claim up to $180 for each ton of carbon stored, under tax credit 45Q, which was extended under the Inflation Reduction Act.

These tax credits are important because they provide long-term support for companies actually sequestering carbon from the atmosphere. “What you have is a guaranteed revenue stream of $180 per ton for a minimum of 12 years,” says Andreasen. It’s particularly critical given that the costs of capturing and storing a ton of carbon dioxide are likely to exceed the market rate of carbon credits for a long time. Other forms of carbon removal, notably planting forests, are much cheaper than DAC, and removal offsets also compete with offsets for renewable energy, which avoid emitting new emissions. Without a top-up from the government, it’s unlikely that a market for DAC sequestration would be able to sustain itself.

Most of the DAC industry experts WIRED spoke to thought there was little political appetite to reverse the 45Q tax credit—not least because it also allows firms to claim a tax credit for using carbon dioxide to physically extract more oil from existing reservoirs. They were more worried, however, about the prospect that existing DOE funds set aside for DAC and other projects might not be allocated under a future administration.

“I do think a slowing down of the DOE is a possibility,” says Andreasen. “That just means the money takes longer to get out, and that is not great.” Katie Lebling at the World Resources Institute, a sustainability nonprofit, agrees, saying there is a risk that unallocated funds could be slowed down and stalled if a new administration looked less favorably on carbon removal.

The Heritage Foundation doesn’t just doubt the carbon removal industry—it is openly skeptical about climate change, writing in one report that observed warming could only “theoretically” be due to the burning of fossil fuels, and that “this claim cannot be demonstrated through science.” In its Project 2025 plan, the foundation says the “government should not be picking winners and losers and should not be subsidizing the private sector to bring resources to market.”

But without government support, the private sector would never develop technologies like DAC, says Jonas Meckling, an associate professor at UC Berkeley and climate fellow at Harvard Business School. The same was true of the solar industry, Meckling says. “You cannot start an industry with a societal good in mind unless you get governments to take an active role,” says Nathan of Climeworks.

While there are some question marks over the future of DOE grants for DAC, the industry appeals to legislators on both sides of the aisle. The Texas DAC hub is being built by 1PointFive, a subsidiary of Occidental Petroleum, and both DOE projects are located in firmly red states. When it was announced that DOE DAC hubs funding would be spent in Louisiana, Senator Bill Cassidy said: “Carbon capture opens a new era of energy and manufacturing dominance for Louisiana. It is the future of job creation and economic development for our state.”

In the long run, Nathan says, the aim is for DAC to be viable on its own economic terms. In time, he says, that will mean regulation that requires industries to pay for carbon removal—a stricter version of emissions-trading schemes that already exist in places like California and the European Union. Eventually, that should lead to a place where the direct air industry no longer requires government support to remove carbon from the atmosphere at scale. “I’m looking at the fundamentals, and those aren’t driven by who’s in office,” Nathan says.

12 notes

·

View notes

Note

All carbon credits are bs greenwashing. Unless she has a magical way to remove the emissions she's producing, which btw...she doesn't, she can fuck off with her ExxonMobil bullshit.

Christ, I'd have more respect if she just paid to build some parks or plant trees over bullshit carbon credits. At least then someone other than the company she's paying and her own interests (pr and tax write off) would benefit.

^^^

20 notes

·

View notes

Photo

Biden's first year

Government/Health Spending

1.9T American Rescue Plan

$1400 stimulus checks for adults, children, and adult dependants

1 year child tax credit expansion - $3600 0-5, $3000 6-17, removed income reqs and made fully refundable

One year EITC expansion

$350 billion state and local aid

$130 billion for schools for safe reopening

$40 billion for higher ed, half of which must go to student aid

Extended $300 supplemental UI through September 2021

Expanded eligibility for extended UI to cover new categories

Made $10,200 in UI from 2020 tax free

$1B for Head Start

$24B Childcare stabilization fund

$15B in low-income childcare grants

One Year Child and Dependent Care credit expansion

$46.5B in housing assistance, inc:

$21.5B rental assistance

$10B homeowner relief

$5B for Sec 8 vouchers

$5B to fight homelessness

$5B for utilities assistance

Extended Eviction moratorium through Aug 2021 (SC struck down)

2 year ACA tax credit expansion and ending of subsidy cliff – expanded coverage to millions and cut costs for millions more

100% COBRA subsidy through Sept 30th, 2021

6 month special enrollment period from Feb-Aug 2021

Required insurers to cover PrEP, an HIV prevention drug, including all clinical visits relating to it

Extended open enrollment from 45 to 76 days

New year round special enrollment period for low income enrollees

Restored Navigator program to assist with ACA sign up

Removed separate billing requirement for ACA abortion coverage

Eliminated regulation that allows states to privatize their exchanges

Eliminated all Medicaid work requirements

Permanently removed restriction on access to abortion pills by mail

Signed the Accelerating Access to Critical Therapies for ALS Act to fund increased ALS research and expedite access to experimental treatments

Rescinded Mexico City Policy (global gag rule) which barred international non-profits from receiving US funding if they provided abortion counseling or referrals

Allowed states to extend coverage through Medicaid and CHIP to post-partum women for 1 year (up from 60 days)

Judicial

42 Lifetime Federal judges confirmed – most in 40 years

13 Circuit Court judges

29 District Court judges

Named first openly LBGTQ woman to sit on an appeals court, first Muslim American federal judge, and record number of black women and public defenders

Infrastructure

$1.2T infrastructure law, including $550B in new funding

$110B for roads and bridges

$66B for passenger and freight rail

$39B for public transit, plus $30.5B in public transit funds from ARP

$65B for grid expansion to build out grid for clean energy transmission

$50B for climate resiliency

$21 for environmental remediation, incl. superfund cleanup and capping orphan wells

$7.5B for electric buses

$7.5B for electric charging stations

$55B for water and wastewater, including lead pipe removal

$65B for Affordable Broadband

$25B for airports, plus $8B from ARP

$17B for ports and waterways

$1B in reconnecting communities

Environmental

Rejoined the Paris Climate Accords 50% emission reduction goal (2005 levels) by 2030

EO instructing all federal agencies to implement climate change prevention measures

Ordered 100% carbon free electricity federal procurement by 2030

100% zero emission light vehicle procurement by 2027, all vehicles by 2035

Net Zero federal building portfolio by 2045, 50% reduction by 2032

Net Zero federal procurement no later than 2050

Net zero emissions from federal operations by 2050, 65% reduction by 2030

Finalized rule slashing the use of hydrofluorocarbons by 85% by 2036 – will slow temp rise by 0.5°C on it’s own.

Set new fuel efficiency standards for cars and light trucks, raising the requirement for 2026 from 43mpg to 55mpg.

Protected Tongass National Forest, one of the world’s largest carbon sinks, from development, mining, and logging

Revoked Keystone XL permit

Used the CRA to reverse the Trump administration Methane rule, restoring stronger Obama era standards.

EPA proposed new methane rule stricter than Obama rule, would reduce 41 million tons of methane emissions by 2035

Partnered with the EU to create the Global Methane Pledge, which over 100 countries have signed, to reduce methane emissions by 30% by 2030 from 2020 levels

US-EU trade deal to reward clean steel and aluminum and penalize dirty production

Ended US funding for new coal and fossil fuel projects overseas, and prioritized funding towards clean energy projects

G7 partnership for “Build Back Better World” – to fund $100s of billions in climate friendly infrastructure in developing countries

Restoring California’s ability to set stricter climate requirements

Signed EO on Climate Related Financial Risk that instructs rule making agencies to take climate change related risk into consideration when writing rules and regulations.

$100M for environmental justice initiatives

$1.1B for Everglades restoration

$100M for environmental justice initiatives

$1.1B for Everglades restoration

30 GW Offshore Wind Plan, incl:

Largest ever offshore wind lease sale in NY and NJ

Offshore wind lease sale in California

Expedited reviews of Offshore Wind Projects

$3B in DOE loans for offshore wind projects

$230M in port infrastructure for Offshore wind

Solar plan to reduce cost of solar by more than 50% by 2030 including $128M in funding to lower costs and improve performance of solar technology

Multi-agency partnership to expedite clean energy projects on federal land

Instructed Dept of Energy to strengthen appliance efficiency rules

Finalized rule to prevent cheating on efficiency standards

Finalized rule to expedite appliance efficiency standards

Repealed Federal Architecture EO that made sustainable federal buildings harder to build

Reversed size cuts and restored protections to Bears Ears, Grand Staircase-Escalante, and Northeast Canyons and Seamounts Marine National Monuments

Restoring NEPA regulations to take into account climate change and environmental impacts in federal permitting

Extended public health emergency through at least April 15, 2022

Covid & Health

$50B in funding for FEMA for COVID Disaster Relief including vaccine funding

Set 100% FEMA reimbursement to states for COVID costs, retroactively to start of pandemic

$47.8B for testing

$1.75B for COVID genome sequencing

$8.5B to CDC for vaccines

$7.6B to state and local health depts

$7.6B to community health centers

$6B to Indian Health Services

$17B to the VA, including $1B to forgive veteran medical debt

$3B to address mental health and substance abuse

Over 500 million vaccine shots administered in a year

Established 90,000 free vaccination sites

Raised federal reimbursement from $23 to $40 per shot for vaccine sites

6000 troops deployed for initial vaccination

Cash incentives, free rides, and free childcare for initial vaccination drive

400 million vaccines donated internationally, 1.2 billion committed

$2B contribution to COVAX for global vaccinations

Funded expansion of vaccine manufacturing in India and South Africa

Implemented vaccine mandate for federal employees, contractors, and employees at healthcare providers that receive Medicare/Medicaid funding.

Implemented vaccine/test mandate for large businesses (SC struck down)

Invoked DPA for testing, vaccine, PPE manufacturing

Federal mask mandate for federal buildings, federal employees, and public transportation

Implemented test requirement for international travel

Implemented joint FDA-NIH expedited process to approve at home tests more quickly

Over 20,000 free federal testing sites

8 at home tests per month required to be reimbursed by insurance

1B at home tests available for free by mail

50M at home tests available free at community health centers

25M high quality reusable masks for low-income residents in early 2021

400M free N95 masks at pharmacies and health centers

Military medical teams deployed to help overburdened hospitals

Rejoined the WHO

Civil Rights

Ended the ban on trans soldiers in the military

Reversed Trump admin limits on Bostock ruling and fully enforced it

Prohibited discrimination against LGBTQ patients in healthcare

Prohibited discrimination against LGBTQ families in housing under the Fair Housing Act

Prohibited discrimination against LGBTQ people in the financial system to access loans or credit

Justice Department declared that Title IX prohibits discrimination based on sexual orientation and gender identity in education.

Revoked ban on Federal Diversity Training

Instructed the VA to review its policies to remove barriers to care for trans veterans

First Senate confirmed LGBTQ Cabinet Secretary

First trans person confirmed by the Senate

Extended birthright citizenship to children of same sex couples born abroad

State Department allows X gender marker on passport for non-binary Americans

Banned new contracts with private prisons for criminal prisons

Justice Department reestablished the use of consent degrees with police departments

Pattern and Practice investigation into Phoenix, Louisville, and Minneapolis

Banned chokeholds and limited no-knock raids among federal law enforcement

Initiative to ban modern day redlining

Doubled DOJ Civil Rights Division staff

Increase percentage of federal contract for small disadvantaged businesses from 5% to 15% ($100B in additional contracts over 5 years)

Sued TX and GA over voting laws. Sued TX over abortion law. Sued GA over prison abuse.

Signed law making Juneteenth a federal holiday

Signed EO to use the federal government to improve voting access through federal programs and departments.

Signed COVID-19 Hate Crime Act, which made more resources available to support the reporting of hate crimes

Signed EO for diversity in the federal workplace

Increased federal employment opportunities for previously incarcerated persons

Public Security

Banned ghost guns

New regulations on pistol-stabilizing braces

First annual gun trafficking report in 20 years

New zero tolerance policy for gun dealers who wilfully violate the law

Signed COPS act, ensuring confidentiality for peer counselling for police officers

Signed Protecting America’s First Responders Act, expediting benefits for officers disabled in the line of duty

Signed bill making it a crime to harm US law enforcement overseas

Student Loans

Student loan freeze through April 30th, 2022

Changed criteria so an additional 1.14M borrowers qualified for the loan pause (retroactively forgave interest and penalties)

Forgiven $11.5B in student loans for disabled students, students who were defrauded, and PSLF

Fixed PSLF so that it is much easier for previous payments to apply. Determined that the paused months will apply to PSLF

Student loan debt forgiveness is tax free through 2025

Immigration

Ended Border Wall emergency and cancelled all new border wall construction and contracts

Repealed Trump’s Muslim Ban

Set FY 2022 refugee cap to 125,000, the highest in almost 30 years

Prohibiting ICE from conducting workplace raids

Family reunification taskforce to reunite separated families. Reunited over 100+ families and gave them status to stay in US

Granted or extended TPS for Haitians, Venezuelans, Syrians, and Liberians

Lifted moratorium on green cards and immigrant visas

Ended use of public charge rule to deny green cards

Loosened the criteria to qualify for asylum

Changed ICE enforcement priorities

Re-initiated the CAM Refugee program for Northern Triangle minors to apply for asylum from their home countries

$1B+ in public aid and private investment for addressing the root causes of migration

Ended family detention of immigrants and moved towards other monitoring

HHS prohibited working with ICE on enforcement for sponsors of unaccompanied minors

Got rid of harder citizenship test

Allowed certain visas to be obtained without an in person consulate interview

Rescinded “metering” policy that limited migrants at ports of entry

Foreign Relations

Ended the War in Afghanistan

First time in 20 years US not involved in a war

Ended support for Saudi offensive operations in Yemen

Airstrikes down 54% in 2021 from 2020.

Issued policy restricting drone strikes outside of warzones

Restored $235M in aid to Palestinians

AUKUS defense pact with Australia and UK

New rules to counter extremism within the military

Signed law funding capitol police and Afghan Refugees

EO on competitiveness to write consumer friendly rules, such as right to repair

EO on improving government experience, incl

Social Security benefits will be able to be claimed online

Passports can be renewed online

General

Makes it easier for low-income families to apply for benefits

Increase telehealth options

WIC recipients can use benefits online

$7.25B in additional PPP funds

Signed PPP extension law to extend the program for 2 months

Changed criteria to make it easier for small and minority businesses to qualify for PPP loans

$29B Restaurant Recovery Fund to recover lost revenue

$1.25B Shuttered Venue fund

$10.4B for agriculture

30 year bailout of multi-employer pension funds that protects millions of pensions through 2051.

Pro-labor majority appointed to NLRB

Established task force to promote unionization

Restored collective bargaining right for federal employees

Negotiated deal for West Coast Ports to run 24/7 to ease supply chain

Signed EO to secure and strengthen supply chains

Investing $1B in small food processors to combat meat prices

Extended 15% SNAP benefit increase through Sept 30, 2021

Made 12 million previously ineligible beneficiaries eligible for the increase

Public health emergency helps keep benefits in place

Largest permanent increase in SNAP benefit history, raising permanent benefits by 27% ($20B per year)

Made school lunches free through for all through the 2021-2022 school year

Extended the Pandemic EBT program

Largest ever summer food program in 2021 provided 34 million students with $375 for meals over the summer.

2 notes

·

View notes

Text

here's a list!! :>

LABOR

- expanded protections for pregnant and nursing workers - already in place for larger employers - to almost everyone in the state.

- created new worker protections for Amazon warehouse workers and refinery workers.

- banned "captive audience meetings" where employers force employees to watch anti-union presentations.

- passed new wage protections for the construction industry, against industry resistance.

- banned noncompete agreements and created statewide paid sick leave.

- created a huge new statewide paid family and medical leave program, raising the number of workers receiving paid leave from 25% to 100%.

SCHOOLING

- passed a bunch of labor protections for teachers, including requiring school districts to negotiate class sizes as part of union contracts.

- raised education spending by 10%, or about 2.3 billion.

- made hourly school workers (e.g. bus drivers and paraprofessionals) eligible for unemployment during summer break, when they're not working or getting paid.

- made public college education free for Minnesota families that make under $80k per year.

- made school breakfast and lunches free for all students.

ENVIRONMENT

- spent nearly a billion dollars on a variety of environmental programs, from heat pumps to reforestation.

- created an energy standard for 100% carbon-free electricity by 2040.

HEALTH

- created a state board to govern labor standards at nursing homes.

- banned conversion therapy for minors.

- laid the groundwork for a public health insurance option.

- made the largest increase to nursing home funding in state history.

- expanded the publicly subsidized health insurance program to undocumented immigrants.

- bumped up salaries for home health workers to address the shortage of in-home nurses.

- legalized drug paraphernalia: allows social service providers to conduct needle exchanges and address substance abuse with reduced fear of incurring legal action.

- created a Prescription Drug Affordability Board: sets price caps for high-cost pharmaceuticals.

- passed strict new regulations on PFAS ("forever chemicals"). the law, "Amara's Law," is named after a 20 year old cancer victim.

- signed a $240 million lead pipe removal bill. (this passed with unanimous support!)

- codified Roe v. Wade, protecting abortion rights.

- fully legalized marijuana.

CLASS

- created a new child tax credit that will cut child poverty by about a quarter.

- banned price gouging in public emergencies.

- put $50 million into homelessness prevention programs.

- put $1 billion into affordable housing programs, including by creating a new state housing voucher program.

TRANSIT

- forced signal priority changes to Twin Cities transit. right now the trains have to wait at intersections for cars, "which, i can say from experience, is terrible."

- passed a law to prevent catalytic converter thefts. (this is a car part that people steal and sell for scrap platinum)

- going to build a passenger train from the Twin Cities to Duluth.

- created a new sales tax to fund bus and train lines, an enormous victory for the sustainability and quality of public transit. transit will be more pleasant to ride, more frequent, and have better shelters along more lines.

- created new protections for Uber and Lyft drivers, "leading to State Senator Omar Fateh to be adorably mobbed by Uber and Lyft drivers."

POLICING

- banned white supremacists and extremists from police forces.

- capped probation at 5 years for most crimes.

- mostly banned no-knock warrants.

- made prison phone calls free.

- restored voting rights to convicted felons as soon as they leave prison.

- expanded background checks and enacted red-flag lavws, passing gun safety measures that the GOP has thwarted for years.

- massively increased funding for the state's perpetually-underfunded public defenders, which lets more public defenders be hired and existing public defenders get a salary increase.

ETC.

- passed the largest bonding bill in state history! total of $2.6 billion in funding improvements to parks, colleges, water infrastructure, bridges, etc. etc. etc.

- made a digital fair repair law that requires electronics manufacturers to make tools and parts available so that consumers can repair their electronics rather than purchase new items.

- made Juneteenth a state holiday.

- ensured that everyone, including undocumented immigrants, can get drivers' licenses.

- "you belong here:" made a raft of laws to make the state a trans refuge, and ensure people receiving trans care here can't be reached by far-right governments in places like Florida and Texas.

- already has some of the strongest election infrastructure (and highest voter participation) in the country, but the legislature just made it stronger, with automatic registration, preregistration for minors, and easier access to absentee ballots.

Massive Minnesota W read em for yourself

46K notes

·

View notes

Text

In his Substack blog, Bill McKibben summarizes this article authored by Brian Deese (one my long-term friends) published in The Atlantic. Brian was President Biden's Director of theNational Economic Council and was a key drafter of the Inflation Reduction Act:

Total investment in clean energy was more than 70 percent higher in 2023 than in 2021, and now represents a larger share of U.S. domestic investment than oil and gas. Clean-energy manufacturing is off the charts. Money is disproportionately flowing into promising technologies that have yet to reach mass adoption, such as hydrogen, advanced geothermal, and carbon removal. And, thanks to a provision that allows companies to buy and sell the tax credits they generate, the law is creating an entirely new market for small developers.

But for all of this progress to deliver, it needs to translate into clean energy that Americans can actually use. In 2023, we added 32 gigawatts of clean electricity to the U.S. grid in the form of new solar, battery storage, wind, and nuclear. It was a record—but it was still only about two-thirds of what’s necessary to stay on track with the IRA’s goal of reducing emissions by 40 percent by 2030.

Brian adds:

The topic of utility reform operates in what the climate writer David Roberts has described as a “force field of tedium.” I can say from experience that starting a cocktail-party conversation about public-utility-commission elections is a good way to find yourself standing alone. But if you care about averting the most apocalyptic consequences of climate change, you need to care about utilities.

A century ago, utilities were granted regional monopolies to sell electricity subject to a basic bargain. They could earn a profit by charging consumers for investments in building new power plants and transmission lines; in exchange, they’d commit to providing reliable electricity to all, and submit to regulation to make sure they followed through.

This model made sense for much of the 20th century, when generating electricity required building big, expensive fossil-fuel-powered steam turbines, and utilities needed to be assured of a healthy return on such heavy up-front investments. But it is at least a generation out of date. Over the past several decades, technology has opened up new ways of meeting consumers’ electricity demand. The 20th-century utility model doesn’t encourage this innovation. Instead, it defaults toward simply building more fossil-fuel-burning plants. As a result, consumers get a less reliable product at higher prices, and decarbonization takes a back seat.

4 notes

·

View notes

Text

A Complete Guide to Solar Panel Installation for Your Home

In recent years, solar panels have become a popular solution for homeowners looking to reduce energy costs and lower their carbon footprint. Installing solar panels is an investment that pays off in the long run, but it can feel daunting if you’re unfamiliar with the process. This guide covers everything you need to know about solar panel installation, from preparation to maintenance.

Why Go Solar?

Before diving into the installation process, it’s important to understand the benefits of solar panels:

Cost Savings: Solar energy reduces your dependence on grid electricity, leading to lower energy bills. Some homeowners even generate surplus energy and sell it back to the grid.

Environmental Benefits: Solar power is a clean, renewable energy source that reduces greenhouse gas emissions.

Increased Property Value: Homes with solar panels are attractive to eco-conscious buyers and often sell at a premium.

Tax Incentives: Many governments offer tax credits, rebates, or other incentives for solar panel installation.

Step-by-Step Solar Panel Installation

1. Evaluate Your Home's Solar Potential

The first step is to determine if your home is suitable for solar panels. Key factors include:

Roof Orientation and Angle: South-facing roofs are ideal in the northern hemisphere.

Shading: Ensure there are no obstructions like trees or buildings blocking sunlight.

Structural Integrity: Your roof must be strong enough to support the weight of solar panels.

Consider hiring a professional solar company to conduct a site assessment.

2. Choose the Right Solar System

There are three main types of solar systems:

Grid-Tied: Connected to the grid, allowing you to sell excess electricity back.

Off-Grid: Independent systems with battery storage for energy.

Hybrid: Combines grid-tied and off-grid systems with backup storage.

Discuss your energy needs, budget, and goals with your installer to choose the best option.

3. Obtain Permits and Approvals

Solar installation typically requires local permits. Your installer will help with:

Building permits.

Electrical permits.

Interconnection agreements with your utility provider.

This step ensures your system meets safety standards and regulations.

4. Select a Reputable Installer

A professional installer ensures your system is safe, efficient, and compliant with local codes. When choosing a contractor:

Check certifications (e.g., NABCEP in the U.S.).

Read reviews and ask for references.

Compare quotes and warranties.

5. Installation Process

The actual installation usually takes one to three days, depending on the system size. Here’s what happens:

Roof Preparation: Installers inspect the roof and add mounting systems.

Panel Installation: Solar panels are secured to the mounting structures.

Electrical Connections: Panels are connected to an inverter, which converts DC electricity to AC.

System Testing: Your installer tests the system to ensure it’s working properly.

6. Inspection and Activation

After installation, a final inspection is conducted by your local authorities and utility company. Once approved, your system can be activated and connected to the grid.

Costs and Financing Options

The cost of solar panel installation depends on the size and type of system. On average, a residential system ranges from $15,000 to $25,000 before incentives. To make solar affordable, consider these options:

Leasing: Pay monthly for the system without owning it.

Loans: Use a solar loan to spread out costs.

Incentives: Take advantage of tax credits and rebates.

Maintenance Tips

Solar panels are low maintenance, but regular upkeep can maximize efficiency:

Clean Panels: Remove dust, dirt, and debris periodically.

Monitor Performance: Use a monitoring system to track energy production.

Inspect Panels: Check for damage or loose wiring annually.

Professional Servicing: Schedule a professional inspection every few years.

Conclusion

Installing solar panels is a smart investment that benefits your wallet and the planet. While the process requires careful planning, working with a trusted installer makes it seamless and hassle-free. With the right system in place, you’ll enjoy clean, renewable energy for decades to come.

Ready to make the switch? Start your solar journey today and harness the power of the sun!

1 note

·

View note

Text

The Biden administration on Wednesday issued one of the most significant climate regulations in the nation’s history, a rule designed to ensure that the majority of new passenger cars and light trucks sold in the United States are all-electric or hybrids by 2032.

Cars and other forms of transportation are, together, the largest single source of carbon emissions generated by the United States, pollution that is driving climate change and that helped to make 2023 the hottest year in recorded history. Electric vehicles are central to President Biden’s strategy to confront global warming, which calls for cutting the nation’s emissions in half by the end of this decade. But E.V.s have also become politicized and are becoming an issue in the 2024 presidential campaign.

“Three years ago, I set an ambitious target: that half of all new cars and trucks sold in 2030 would be zero-emission,” said Mr. Biden in a statement. “Together, we’ve made historic progress. Hundreds of new expanded factories across the country. Hundreds of billions in private investment and thousands of good-paying union jobs. And we’ll meet my goal for 2030 and race forward in the years ahead.”

The rule increasingly limits the amount of pollution allowed from tailpipes over time so that, by 2032, more than half the new cars sold in the United States would most likely be zero-emissions vehicles in order for carmakers to meet the standards.

That would avoid more than seven billion tons of carbon dioxide emissions over the next 30 years, according to the E.P.A. That’s the equivalent of removing a year’s worth of all the greenhouse gases generated by the United States, the country that has historically pumped the most carbon dioxide into the atmosphere. The regulation would provide nearly $100 billion in annual net benefits to society, according to the agency, including $13 billion of annual public health benefits thanks to improved air quality.

The standards would also save the average American driver about $6,000 in reduced fuel and maintenance over the life of a vehicle, the E.P.A. estimated.

The auto emissions rule is the most impactful of four major climate regulations from the Biden administration, including restrictions on emissions from power plants, trucks and methane leaks from oil and gas wells. The rules come on top of the 2022 Inflation Reduction Act, the biggest climate law in the nation’s history, which is providing at least $370 billion in federal incentives to support clean energy, including tax credits to buyers of electric vehicles.

The policies are intended to help the country meet Mr. Biden’s target of cutting U.S. greenhouse emissions in half by 2030 and eliminating them by 2050. Climate scientists say all major economies must do the same if the world is to avert the most deadly and costly effects of climate change.

“These standards form what we see as a historic climate grand slam for the Biden administration,” said Manish Bapna, president of the Natural Resources Defense Council Action Fund, a political action committee that aims to advance environmental causes.

Mr. Bapna’s group has calculated that the four regulations, combined with the Inflation Reduction Act, would reduce the nation’s greenhouse emissions 42 percent by 2030, getting the country most of the way to Mr. Biden’s 2030 target.

Get in Losers we're going to save the planet.

#Joe Biden#Thanks Biden#climate change#climate crisis#electric vehicles#carbon emissions#politics#US politics

44 notes

·

View notes

Text

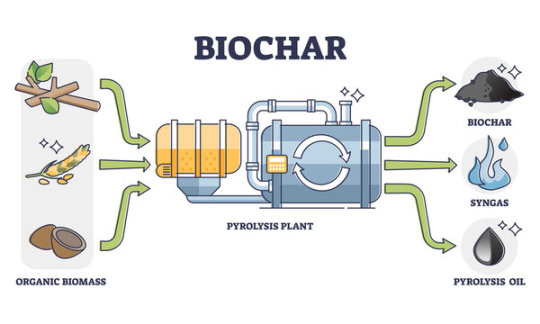

Biochar Market Trends and Innovation Size, Future Report 2034

Biochar is a carbon-rich material produced by heating organic biomass in a low-oxygen environment, a process known as pyrolysis. It is primarily used in agriculture, soil amendment, and carbon sequestration due to its ability to enhance soil fertility and capture carbon dioxide, contributing to climate change mitigation.

The average growth pattern predicts that the worldwide Biochar Market will reach USD 3,429.58 million in 2034. The analysis also anticipates that the market will develop at a compound annual growth rate (CAGR) of 16.2% between 2024 and 2034. According to projections, the global biochar market would generate USD 758.36 million by 2024.

Get a sample copy of this report: https://wemarketresearch.com/reports/request-free-sample-pdf/biochar-market/1613

Biochar Market Drivers

Soil Health Awareness:

Depletion of arable land due to industrialization and urbanization is encouraging farmers to use biochar for its soil-enhancing properties.

Climate Change Mitigation:

Biochar’s role in carbon sequestration aligns with global efforts to combat climate change, such as the Paris Agreement.

Waste-to-Resource Movement:

Increased interest in utilizing organic and agricultural waste efficiently is boosting biochar adoption.

Supportive Policies:

Governments worldwide are incentivizing biochar projects through subsidies, tax benefits, and inclusion in carbon credit programs.

Biochar Market Restraints

Production Challenges:

Pyrolysis technology is capital-intensive, making the initial investment a barrier for small producers.

Regulatory Uncertainty:

Absence of standardized guidelines for biochar production and application in some regions.

Limited Consumer Awareness:

Lack of understanding about biochar's benefits in underdeveloped markets hampers growth.

Biochar Market Opportunities

Integration with Circular Economy:

Using biochar to recycle agricultural waste into a sustainable product supports the circular economy.

Innovation in Feedstock:

Development of cost-effective and diverse feedstock, such as algae or forestry residues, could lower production costs.

Emerging Economies:

Countries in Africa, Southeast Asia, and South America are recognizing biochar as a solution for improving agricultural yields in nutrient-poor soils.

Advanced Applications of Biochar

Environmental Remediation:

Biochar is being used for pollutant removal, such as heavy metals and organic contaminants from soil and water.

Livestock Farming:

Incorporated into animal feed to improve digestion, reduce methane emissions, and enhance overall health.

Construction:

Biochar can be added to building materials like concrete to improve insulation and reduce carbon footprint.

Energy Generation:

Gasification of biochar produces syngas, a renewable energy source.

Global Biochar Market Segmentation

By Feedstock

Woody Biomass

Agricultural Waste

Forestry Waste

Urban and Industrial Waste

By Technology

Pyrolysis

Gasification

Hydrothermal Carbonization

Others

By Form

Solid Biochar

Liquid Biochar

By Application

Soil Amendment

Animal Feed

Waste Management

Energy Production

Construction

Water and Air Filtration

Others

Companies Covered: Biochar Market

The Global Biochar Market is dominated by a few large companies, such as

Biochar Products, Inc.

Biochar Supreme, LLC

ArSta Eco

Carbon Gold Ltd

Airex Energy Inc.

Pacific Biochar Benefit Corporation

Cool Planet

Biochar Now

Agri-Tech Producers, LLC

Pacific Biochar Benefit Corporation

CharGrow USA LLC

Others

These companies have the potential to drive market growth through various strategies. They can focus on offering innovative and high-performance products, taking advantage of advancements in technology. Additionally, expanding their distribution channels to target new customers would be beneficial. Strategic partnerships and collaborations can also be pursued to strengthen market presence and enhance competitiveness.

Biochar Market Regional Insights

Forecast for the North American market

North America accounts for more than 40% of the biochar market, making it the largest market. A significant amount of the global biochar market is accounted for by the United States and Canada in particular. This is largely due to the strong demand for biochar in carbon offset programs, sustainable agriculture, and soil remediation. The region benefits from well-established biochar technology research and development, as well as favorable government policies that promote carbon sequestration and sustainable farming practices.

Forecast for the European Market

Europe's strong agricultural sectors, green innovation, and environmental sustainability goals have made it a prominent player in the biochar business. The European Union's pledge to reduce carbon emissions and advance sustainable agriculture through initiatives like the European Green Deal has increased demand for biochar. Countries like France, Germany, and the United Kingdom are leading the way in the production and use of biochar. EU laws that promote carbon sequestration, renewable energy, and sustainable agriculture, together with increased awareness of soil health.

Forecasts for the Asia Pacific Market

Asia Pacific's biochar market is rising rapidly as a result of growing agricultural activity, urbanization, and waste management problems. Countries including China, India, Japan, and Australia are investing in biochar technologies to address soil degradation, boost agricultural output, and manage organic waste. Furthermore, carbon offset schemes are increasingly using biochar. the government's encouragement of sustainable practices, the necessity for waste management solutions in growing cities, and the expansion of agriculture.

Conclusion

The biochar market is emerging as a pivotal player in the global push toward sustainability, offering transformative benefits across agriculture, waste management, and climate change mitigation. As industries and governments increasingly recognize its potential, biochar is poised to become a cornerstone of sustainable development strategies.

While challenges like production costs and regulatory gaps exist, advancements in technology and supportive policies are paving the way for wider adoption. With its ability to enhance soil health, sequester carbon, and turn waste into value, biochar represents a promising solution for addressing some of the world's most pressing environmental and agricultural challenges.

The future of the biochar market is bright, fueled by innovation, increasing awareness, and global efforts to transition to a circular economy. Embracing biochar at scale could drive a significant positive impact on our planet's ecological and economic balance.

0 notes

Text

9 Significant Benefits Of Installing Solar Panels At Home

Harnessing energy from the sun has become an increasingly popular choice for homeowners seeking sustainable and efficient solutions for their energy needs. With concerns about rising energy costs and environmental sustainability at the forefront, installing carpark electric vehicle charging Sydney at home is a practical decision that offers both immediate and long-term advantages. Beyond being an environmentally responsible choice, these systems offer unique benefits that make them an excellent investment for any household.

This guide explores the major benefits of adopting solar energy and how it can transform your living space into a sustainable and cost-effective environment.

Reduced Energy Costs

One of the most attractive advantages of solar panels is the potential for significant energy savings. By generating energy directly from sunlight, households can greatly reduce their reliance on traditional energy sources. Over time, this translates to noticeably lower energy bills. The savings can be particularly impactful during peak usage times when energy consumption is typically higher. Additionally, the long-term reduction in monthly bills allows homeowners to reallocate these savings toward other expenses or investments.

Energy Independence

By relying on a renewable energy source, homeowners can reduce dependence on external energy suppliers. This is especially beneficial during periods of fluctuating energy prices or potential shortages. Generating your own energy ensures stability and reliability, offering peace of mind that your household’s energy needs will be met regardless of external factors. In some cases, excess energy produced can even be stored or repurposed, further increasing self-sufficiency.

Environmental Benefits

Solar panels are a cornerstone of reducing the environmental impact of energy consumption. By tapping into a clean and renewable energy source, households contribute to lowering emissions associated with traditional energy production. This environmentally conscious choice helps mitigate climate change while promoting a healthier planet for future generations. The reduced carbon footprint from using such systems makes them an essential component of sustainable living.

Low Maintenance Requirements

Once installed, solar panels require minimal maintenance, making them a hassle-free addition to any home. With no moving parts, these systems experience less wear and tear, resulting in fewer repairs and lower upkeep costs over their lifespan. Routine cleaning to remove debris and periodic checks to ensure efficiency are typically all that’s needed to keep the system running smoothly. This reliability makes them a convenient and cost-effective option for busy households.

Long-Term Durability

Solar panels are designed to withstand various weather conditions, including harsh sunlight, rain, and wind. Their robust construction ensures a long operational life, often exceeding 25 years with proper care. This durability provides homeowners with a consistent and dependable energy source, making the initial investment worthwhile over time. Furthermore, advancements in technology continue to improve the resilience and efficiency of these systems.

Potential Financial Incentives

In many regions, governments and organisations offer incentives to encourage the adoption of renewable energy solutions. These may include tax credits, rebates, or performance-based incentives, which can offset the initial installation costs. Taking advantage of such programs reduces the financial burden of transitioning to solar energy and enhances the overall return on investment for homeowners.

Increased Property Value

Homes equipped with solar panels often attract higher market values compared to those without. Potential buyers are increasingly drawn to homes that offer sustainable energy solutions, as these features align with modern preferences for eco-friendly living. Furthermore, properties with lower operating costs, due to reduced energy bills, stand out in competitive real estate markets. This investment not only provides immediate benefits but also adds lasting appeal to your home for future resale.

Adaptability To Various Home Designs

Modern solar panels are versatile and can be integrated seamlessly into different architectural styles. Whether mounted on rooftops, incorporated into shading structures, or installed in open spaces, these systems can be customised to fit your home’s unique layout. This adaptability allows homeowners to enjoy the benefits of renewable energy without compromising aesthetic appeal or structural integrity.

Enhanced Energy Awareness

Installing solar panels often leads to a greater understanding of energy consumption patterns. Many systems include monitoring tools that track energy production and usage, helping homeowners identify areas for improved efficiency. This heightened awareness promotes more responsible energy habits, encouraging households to adopt additional measures to reduce overall consumption.

Choosing to install solar panels at home is more than just an investment in energy efficiency; it’s a commitment to a sustainable and forward-thinking lifestyle. As the world moves toward greener living, embracing this innovative technology is a proactive step that aligns with modern priorities. With countless benefits to both your household and the planet, there’s no better time to make the switch to solar energy and enjoy its lasting impact on your home and lifestyle.

0 notes

Text

Bennet, Murkowski introduce bill to support wide range of carbon dioxide removal approaches

Read the full news release from Senator Bennet. U.S. Senators Michael Bennet (D-Colo.) and Lisa Murkowski (R-Alaska) introduced the Carbon Dioxide Removal Investment Act to establish a new production tax credit designed to jumpstart the United States’ carbon dioxide removal (CDR) industry. The tax credit would support innovative CDR approaches that are ready to be deployed today, while also…

0 notes

Text

Understanding Credit Carbon Price: A Key Tool for Combating Climate Change

As the world intensifies efforts to combat climate change, innovative financial mechanisms are emerging to address carbon emissions. One such mechanism is the credit carbon price, a concept that plays a pivotal role in the global push towards sustainability. This article delves into what credit carbon pricing is, why it matters, and how it can shape the future of our planet.

What is Credit Carbon Price?

At its core, credit carbon price refers to the monetary value assigned to a ton of carbon dioxide (CO₂) emissions reduced or removed through carbon credits. Carbon credits are tradeable permits that represent a reduction of one metric ton of CO₂ or equivalent greenhouse gases. These credits are a cornerstone of voluntary and compliance carbon markets, allowing businesses, governments, and individuals to offset their emissions by funding projects that reduce greenhouse gases elsewhere.

The credit carbon price fluctuates based on demand, supply, and regulatory frameworks. It provides a market-based solution to incentivize investments in clean technologies and carbon sequestration projects.

Why Does Credit Carbon Price Matter?

Encouraging Emission Reductions

Credit carbon pricing creates a financial incentive for organizations to lower their carbon footprint. By assigning a monetary value to emissions reductions, it motivates businesses to adopt greener technologies and practices.

Supporting Climate Projects

Revenue from carbon credits often funds projects like reforestation, renewable energy installations, and methane capture. These projects not only reduce emissions but also contribute to sustainable development in local communities.

Promoting Market Efficiency

A robust carbon credit market with transparent pricing ensures efficient allocation of resources. It allows companies with lower abatement costs to sell credits to those facing higher reduction expenses, achieving emissions reductions at the least economic cost.

Factors Influencing Credit Carbon Price

Several factors determine the price of carbon credits, including

Type of Credit: Credits from nature-based solutions, such as reforestation, often command higher prices due to co-benefits like biodiversity conservation.

Market Demand: Growing corporate sustainability commitments and net-zero targets have significantly increased demand for high-quality carbon credits.

Regulatory Environment: Policies and frameworks, such as those under the Paris Agreement, influence market dynamics and credit valuations.

Verification Standards: Projects certified by reputable standards like Gold Standard or Verra generally have higher credit prices due to their perceived credibility.

The Global Outlook on Credit Carbon Price