#canara bank private or government

Explore tagged Tumblr posts

Text

#best banking exam#Best government jobs#canara bank#canara bank private or government#eligibility for canarabank#Reservation in Tamil Nadu

1 note

·

View note

Text

BFSI SECTOR IN INDIA: A JOURNEY OF GROWTH, DISRUPTION & FINANCIAL INCLUSION THROUGH FINTECH

Chapter 1: Historical Evolution of the BFSI Sector in India:

Indigenous banking systems & practices.

Introduction of modern banking institutions during the colonial era.

Birth of indigenous banks in the early 20th century.

Nationalization of banks in 1969 & its impact on inclusive growth.

Technological advancements & computerization in the 1980s.

Economic liberalization & entry of private sector banks in the 1990s.

Rise of insurance as a vital component of the sector.

Once upon a time, in the vast & diverse land of India, the seeds of the BFSI (Banking, Financial Services & Insurance) sector were sown. The roots of this sector can be traced back to ancient times when indigenous banking systems & financial practices thrived. In those days, the community would come together to support each other’s financial needs, fostering a sense of trust & solidarity.

The first bank in India was The Madras Bank which was founded in 1683 & the Bank of Hindostan was the first Western-style commercial bank to open in India in 1770. It was the first bank in Calcutta to be managed by Europeans. It was dissolved between 1830 & 1832.

Bank of Hindostan - Sixteen Sicca Rupees

As time went by, the banking landscape in India began to evolve. During the colonial era, the British introduced modern banking institutions, marking the advent of formal banking in the country. The establishment of the Bank of Calcutta on the 2nd of June 1806 (later renamed as Bank of Bengal on 2nd Jan 1809), followed by the Bank of Bombay & the Bank of Madras, laid the foundation for a structured banking system.

The early 20th century witnessed the birth of indigenous banks, such as Punjab National Bank & Canara Bank, which aimed to serve the needs of the Indian population. These banks were instrumental in supporting India’s growing economy & providing financial services to various sectors.

Post-independence, the Indian government recognized the significance of a robust banking system in fostering economic development & ensuring financial stability. The year 1969 marked a significant milestone in the history of the banking sector in India, as the government nationalized 14 major banks, aiming to bring banking services closer to the masses & promote inclusive growth. With the nationalization of banks, the reach of banking services expanded rapidly. Branches were established in remote villages & banking facilities became accessible to the common people. The sector played a pivotal role in channeling funds to key sectors like agriculture, industry & infrastructure, contributing to the country’s overall progress.

As the Indian economy continued to grow, the banking sector embraced technological advancements. The introduction of computerization in the 1980s brought about a paradigm shift in banking operations. Manual processes gave way to automated systems, enhancing efficiency & customer service. The 1990s marked a turning point in the sector’s history with economic liberalization. The government initiated reforms to foster competition, attract foreign investments & strengthen the banking system. This led to the entry of private sector banks, which brought innovation, customer-centric services & a new wave of competition to the industry.

In the 21st century, the BFSI sector witnessed the emergence of insurance as a vital component. Insurance companies expanded their presence, offering life, health & general insurance products to meet the growing demand for risk mitigation & financial protection.

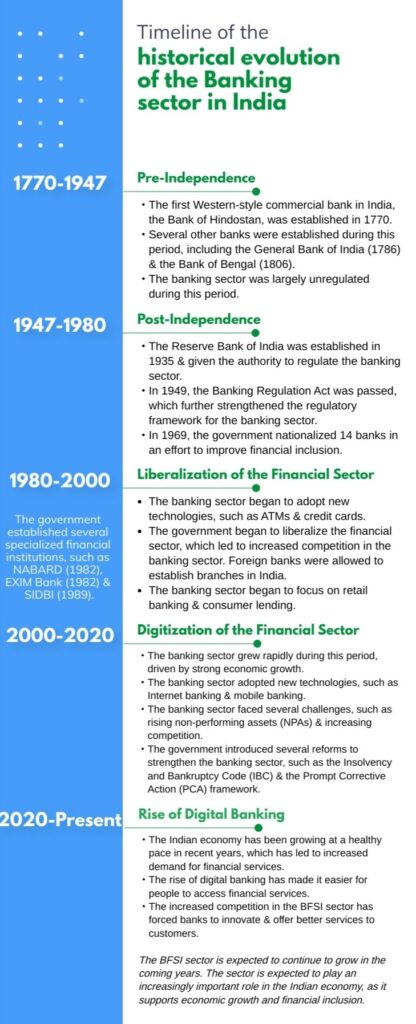

Timeline of the historical evolution of the Banking Sector in India

Chapter 2: The Rise of Fintech & its Transformative Impact:

Definition & significance of fintech.

Fintech revolutionizing traditional financial services.

Introduction of digital payments & the Unified Payments Interface (UPI).

The surge in cashless transactions & financial digitization.

Promoting financial inclusion through mobile banking & digital wallets.

Role of fintech in reshaping lending practices & peer-to-peer lending platforms.

However, the real game-changer in the history of the banking sector in India came with the rise of fintech. Technological advancements, coupled with a burgeoning startup ecosystem, paved the way for fintech companies to disrupt traditional financial services. These innovators leveraged digital platforms, mobile technology & data analytics to provide seamless & personalized financial solutions to customers.

Fintech revolutionized the sector, transforming the way people transact, borrow, invest & manage their finances. Digital payments gained momentum, with the introduction of the Unified Payments Interface (UPI) as a game-changing platform. The ease & convenience of digital transactions led to a massive surge in cashless payments, driving financial digitization across the country.

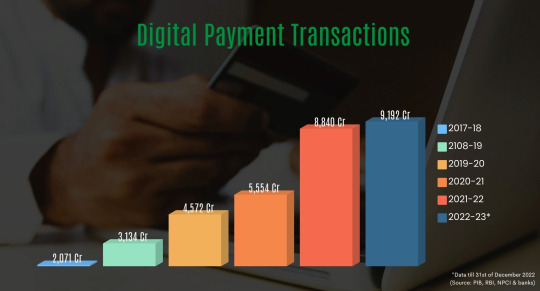

Digital payment transactions have expanded dramatically, from 2,071 crore transactions in FY 2017-18 to 8,840 crore transactions in FY 2021-22.

(Source: RBI, NPCI & banks)

Various simple & convenient modes of digital payments, such as Bharat Interface for Money-Unified Payments Interface (BHIM-UPI), Immediate Payment Service (IMPS) & National Electronic Toll Collection (NETC), have grown significantly in the last five years, transforming the digital payment ecosystem by increasing both person-to-person (P2P) & person-to-merchant (P2M) payments.

BHIM UPI has emerged as citizens’ favorite payment mechanism, with 803.6 crore digital payment transactions worth 12.98 lakh crore conducted in January 2023.

(Source: PIB)

THE TOTAL NUMBER OF DIGITAL PAYMENT TRANSACTIONS UNDERTAKEN DURING THE LAST FIVE FINANCIAL YEARS & THE CURRENT FINANCIAL YEAR ARE AS UNDER:

Note: Digital payment modes considered are BHIM-UPI, IMPS, NACH, AePS, NETC, debit cards, credit cards, NEFT, RTGS, PPI & others

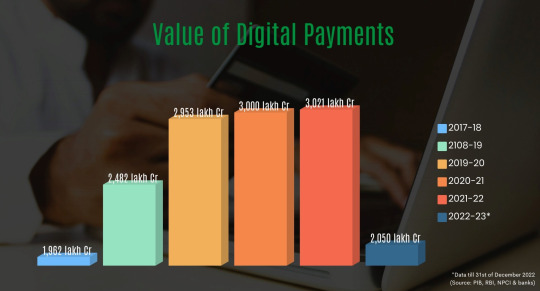

THE TOTAL VALUE OF DIGITAL PAYMENTS DURING THE LAST FIVE FINANCIAL YEARS & IN THE CURRENT FINANCIAL YEAR ARE AS UNDER:

Note: Digital payment modes considered are BHIM-UPI, IMPS, NACH, AePS, NETC, debit cards, credit cards, NEFT, RTGS, PPI & others.

This represents a significant increase, highlighting the growing acceptance of digital payments & the impact of fintech in reshaping the BFSI landscape.

Furthermore, fintech companies played a crucial role in promoting financial inclusion. Through mobile banking, digital wallets & microfinance platforms, they extended financial services to countryside areas & enabled individuals & small businesses to access credit, make payments & improve their financial well-being.

Moreover, fintech has revolutionized lending practices in India. Peer-to-peer lending platforms have emerged as an alternative to traditional lending institutions, providing borrowers with easier access to credit & investors with attractive investment opportunities.

Chapter 3: Embracing Digital Transformation in the BFSI Sector:

Traditional BFSI players investing in digital infrastructure.

Adoption of artificial intelligence, machine learning & data analytics.

Enhancing customer experiences & streamlining processes.

Digital onboarding of customers & virtual assistants for support.

Impact of the recent past years on accelerating digital adoption.

The BFSI sector in India has recognized the need to embrace digital transformation to stay competitive & meet the evolving demands of customers. This has led to several key developments:

Traditional banks & financial institutions investing heavily in upgrading their digital infrastructure. They are modernizing their core banking systems, enhancing online & mobile banking platforms & improving cybersecurity measures. These investments are aimed at providing customers with seamless & secure digital banking experiences.

Artificial intelligence (AI), machine learning (ML) & data analytics are being leveraged by the BFSI sector to gain valuable insights & enhance decision-making processes. Banks are utilizing AI-powered chatbots & virtual assistants to provide instant customer support & personalized services. ML algorithms are used for fraud detection, risk assessment & credit scoring, improving operational efficiency & reducing manual errors.

Digital transformation has paved the way for enhanced customer experiences. Banks are focusing on creating user-friendly interfaces, providing personalized recommendations & offering 24/7 access to banking services. Customers can perform a wide range of transactions online, such as fund transfers, bill payments & account management. This shift to digital channels has significantly reduced the need for physical visits to branches, streamlining processes & saving time for both customers & banks.

Digital onboarding of customers using Video KYC Solutions & virtual assistants for support has simplified the account opening procedures for customers. Through online portals & mobile apps, individuals can complete the entire account opening process remotely, eliminating the need for physical paperwork & branch visits. Additionally, virtual assistants & chatbots are being deployed to handle routine customer queries, providing immediate assistance & improving response times.

In recent past years acted as a catalyst for digital adoption in the BFSI sector. With social measures in place, customers increasingly relied on digital channels for their banking needs. Banks rapidly scaled up their digital capabilities to meet the surge in demand for online services. Digital payment solutions, such as UPI & mobile wallets, witnessed significant growth during this period. This highlighted the importance of robust digital infrastructure & accelerated the pace of digital transformation in the BFSI sector.

Overall, the BFSI sector’s embrace of digital transformation has led to improved customer experiences, streamlined processes & increased access to financial services. The adoption of technologies like AI-driven Credit Underwriting, Bank Statement Analyser, ML & data analytics has enhanced operational efficiency & enabled better risk management. As the sector continues to evolve, the integration of digital technologies will play a crucial role in shaping its future.

Chapter 4: Current Trends & Future Outlook:

Continued focus on digitalization, AI & blockchain.

Open banking frameworks & collaborations between traditional institutions & fintech startups.

Regulatory frameworks to foster innovation & ensure consumer protection.

Expected growth & disruption in the BFSI sector.

Opportunities for further financial inclusion & technological advancements.

THE BFSI SECTOR IN INDIA IS WITNESSING SEVERAL NOTABLE TRENDS & HOLDS PROMISING PROSPECTS FOR THE FUTURE:

In addition to cooperative credit institutions, the Indian banking system includes 12 public sectors, 22 private sectors, 46 foreign, 56 regional rural, 1485 urban cooperatives & 96,000 rural cooperative banks.

The total number of ATMs in India as of Sep 2021 was 2,13,145, with 47.5% located in rural & semi-urban regions.

Bank assets rose in all industries in 2020–2022. In 2022, the total assets of the banking industry (including both public & private sector banks) rose to US$ 2.67 trillion.

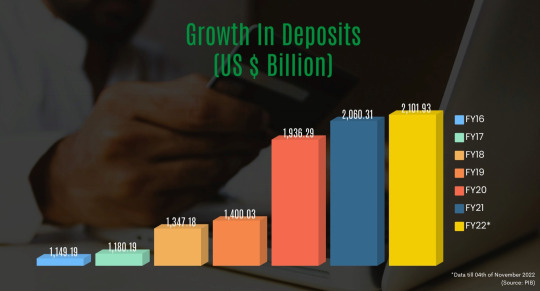

Bank credit grew at a CAGR of 0.62% from FY16 to FY22. Total credit extensions reached US$ 1,532.31 billion as of FY22. Deposits increased at a CAGR of 10.92% from FY16 to FY22, reaching US$ 2.12 trillion by FY22. As of November 4, 2022, bank deposits totaled Rs. 173.70 trillion (2.12 trillion USD).

In March 2020, the SCBs’ Gross Non-Performing Assets ratio (GNPA) was 8.2%; in September 2022, it reached a seven-year low of 5.0%.

(Source: PIB)

GROWTH IN DEPOSITS

Growth In Deposits

These data show that the BFSI sector in India has been growing steadily in recent years. Digitalization will remain a key priority for the BFSI sector. Banks & financial institutions will continue to invest in upgrading their digital infrastructure, enhancing online banking services & providing seamless customer experiences. The adoption of AI & machine learning will further drive automation, data analytics, & personalized services. Additionally, blockchain technology is gaining traction for secure & transparent transactions, enabling faster & more efficient processes.

Open banking is gaining momentum in India, fostering collaboration between traditional BFSI players & fintech startups. Open banking frameworks enable secure data sharing between banks & third-party providers, leading to the development of innovative products & services. Traditional institutions are partnering with fintech startups to leverage their technological expertise, agility & customer-centric solutions. This collaboration is expected to fuel innovation, enhance customer experiences & expand the range of financial services offered.

Regulators in India are actively working towards creating an enabling environment for innovation in the BFSI sector. Regulatory sandboxes & guidelines are being developed to facilitate experimentation with new technologies & business models. Simultaneously, consumer protection measures are being strengthened to ensure transparency, data privacy & security. Regulators are working closely with industry stakeholders to strike a balance between innovation & risk mitigation.

The BFSI sector in India is poised for significant growth & disruption in the coming years. Factors such as increasing internet penetration, smartphone adoption & government initiatives like Digital India & Jan Dhan Yojana are driving financial inclusion & expanding the customer base. Fintech startups are challenging traditional players with their innovative offerings, reshaping the competitive landscape. The sector will witness further digitization, evolving customer expectations & new business models that leverage technology.

India has seen a boom in fintech & microfinancing in recent years. Due to a five-fold growth in digital disbursements, India’s digital lending, which stood at US$ 75 billion in FY18, is predicted to increase to US$ 1 trillion in the coming time.

The Indian fintech sector has so far (January 2017–July 2022) garnered US$ 29 billion in financing across 2,084 agreements, making up 14% of the world’s funding & placing second in terms of deal volume.

India’s fintech business is anticipated to grow to 6.2 trillion rupees (US$ 83.48 billion) by 2025.

The BFSI sector presents ample opportunities for advancing financial inclusion & leveraging technology for societal impact. Fintech solutions can bridge the gap in financial services for underserved populations, enabling access to credit, insurance & savings products. Technology can also play a crucial role in addressing challenges related to identity verification, fraud prevention & cybersecurity. The Adoption of emerging technologies like biometrics, the Internet of Things (IoT) & decentralized finance (DeFi) can unlock new avenues for financial inclusion & innovation.

The journey of the BFSI sector in India has been nothing short of remarkable. From its historical roots in indigenous banking practices to the modernization brought about by colonial influences, the sector has continuously evolved to meet the changing needs of the nation. The nationalization of banks in 1969 & subsequent economic liberalization paved the way for inclusive growth & expansion of financial services to the masses.

The BFSI sector plays a crucial role in India’s progress & development. It acts as a backbone for the economy, providing essential financial services, facilitating investment, promoting savings & channeling funds for productive purposes. The sector’s stability & efficiency are key to ensuring economic stability & supporting various sectors such as agriculture, industry & services.

Looking ahead, the future of the BFSI sector in India appears bright & promising. The sector is poised for continued growth & transformation, driven by technology & innovation. The ongoing focus on digitalization, artificial intelligence & blockchain will further enhance customer experiences, streamline processes & enable the development of innovative financial solutions. Open banking frameworks & collaborations between traditional institutions & fintech startups will lead to the emergence of new business models & a broader range of financial services.

While challenges & risks exist, such as ensuring data security, privacy & regulatory compliance, the overall outlook for the BFSI sector remains optimistic. The sector is well-positioned to leverage technology, adapt to changing customer preferences & drive financial inclusion. By embracing innovation, fostering collaboration & addressing societal needs, the BFSI sector will continue to be a catalyst for economic growth & empowerment in India.

In conclusion, the journey of the BFSI sector in India, from its historical roots to the present-day landscape, showcases the sector’s resilience & adaptability. As a critical driver of the nation’s progress, the sector will continue to evolve, leveraging technology & innovation to meet the evolving needs of the Indian population. With a strong foundation & an optimistic outlook, the BFSI sector is poised to shape a prosperous future for India.

1 note

·

View note

Text

List Of All Public And Private Sector Banks In India 2022

List Of All Public And Private Sector Banks In India 2022 In India, banks are the most traditional type of financial intermediary. They are crucial in directing family funds toward both structured and unorganized industries. Indian Commercial Banks, Industrial Banks, Exchange Banks, Agricultural Banks, Cooperative Banks, and Indigenous Bankers comprise the Indian Banking System. The Reserve Bank of India serves as the system’s central bank.Types of Banks Indian banks are categorized into four major types: Commercial Banks: These are further classified into Public Sector Banks – The government owns most of the stock. Punjab National Bank, State Bank of India, Central Bank of India, and other institutions are examples of public sector banks. Private Sector Banks – Private individuals own the majority of the stake. Private banks include institutions like HDFC Bank, ICICI Bank, AXIS Bank, etc. Regional rural banks, Foreign banks – Foreign banks are those with their corporate headquarters located outside of India. Standard Chartered, American Express, Citibank, and other institutions are examples of foreign sector banks. Small Finance Banks Payments Banks Cooperative Banks List of All Public and Private Sector Banks in India 2023 List of Public Sector Banks - Bank Name-Establishment-Headquarter - Bank of Baroda-1908-Vadodara, Gujrat - Bank of India-1906-Mumbai, Maharashtra - Bank of Maharashtra-1935-Pune, Maharashtra - Canara Bank-1906-Bengaluru, Karnataka - Central Bank of India-1911-Mumbai, Maharashtra - Indian Overseas Bank-1937-Chennai, Tamil Nadu - Punjab and Sind Bank-1908-New Delhi, Delhi - State Bank of India-1955-Mumbai, Maharashtra - UCO Bank-1943-Kolkata, West Bengal - Union Bank of India-1919-Mumbai, Maharashtra - Punjab National Bank-1894-New Delhi, Delhi - Indian Bank-1907-Chennai, Tamil Nadu - List of Private Sector Banks - Bank Name-Establishment-Headquarter - Axis Bank-1993-Mumbai, Maharashtra - Bandhan Bank0-2015-Kolkata, West Bengal - CSB Bank-1920-Thrissur, Kerala - City Union Bank-1904-Thanjavur, Tamil Nadu - DCB Bank-1930-Mumbai, Maharashtra - Dhanlaxmi Bank-1927-Thrissur, Kerala - Federal Bank-1931-Aluva, Kerala - HDFC Bank-1994-Mumbai, Maharashtra - ICICI Bank-1994-Mumbai, Maharashtra - Induslnd Bank-1964-Mumbai, Maharashtra - IDFC First Bank-2015-Mumbai, Maharashtra - Jammu and Kashmir Bank-1938-Srinagar, Jammu and Kashmir - Karnataka Bank-1924-Mangaluru, Karnatka - Karur Vysya Bank-1916-Karur, Tamil Nadu - Kotak Mahindra Bank-2003-Mumbai, Maharashtra - IDBI Bank-1964-Mumbai, Maharashtra - Nainital Bank-1922-Nainital, Uttrakhand - RBL Bank-1943-Mumbai, Maharashtra - South Indian Bank-1929-Thrissur, Kerala - Tamilnad Mercantile Bank-1921-Toothukudi, Tamil Nadu - YES Bank-2004-Mumbai, Maharashtra Apply for LoanHow Can We Help YouApply for Loan cibil issue Want to discuss want to know ROI Personal Loan Business Loan Loan against property Home Loan education loan auto loanAmount Looking in Lac Selected Value: 10 Comment or Message Submit Read the full article

1 note

·

View note

Text

What is the New Fixed Deposit Rule by RBI

Fixed Deposits are among the most popular investment tools, especially among traditional investors. This is due to the safe and guaranteed returns they offer to depositors. Government, private banks, and financial institutions have recently revised fixed deposit interest rates. This has made FDs once again one of the most sought-after investments.

Although FDs have been around for a long time, much like all investment tools, they also evolve on a regular basis. This involves changes in rules and regulations that govern their operations. Such change has occurred recently when the Reserve Bank of India (RBI) made a significant change regarding the interest rate on FDs? This blog will discuss the same in detail.

If you have a habit of not claiming the interest earned on your fixed deposits, then pay attention as you might end up earning a lower interest rate on your deposit. Yes, you read that right. The SBI, Yes Bank, HDFC Bank or ICICI Bank FD interest rates applicable on your deposit can lower if you fail to claim the interest earned on time. As per the new rule, if the FD amount is left unclaimed by the depositor, then the lower of the contracted rate of interest and the interest rate applicable on the savings account will be applicable to the FD.

Overdue Fixed Deposit

A fixed deposit is deemed to be overdue when the depositor fails to claim the amount or renew the fixed deposit upon maturity, and the deposited amount sits idle with the bank. This can be a cause for concern for people who leave their FDs unattended after maturity.

A Good News

While the above-mentioned development may have worried you, there is some good news as well to lift your spirits. All Indian banks and non-bank finance companies that offer term deposit solutions have recently revised their fixed deposit interest rates and are now offering higher rates to depositors.

You can now enjoy 0.50 to 1.50 percent higher Mahindra Finance, Shriram Transport Finance, Canara Bank and Kotak Bank FD interest rates on your deposits. This makes fixed deposits even more lucrative investment options, especially when the dark clouds of recession are looming over the world economy.

Thus, if you want safe and guaranteed returns, then go for FDs. You can check the latest Bandhan Bank, Bank of India, Bank of Baroda, and Indusind Bank FD interest rates on the ZFunds website.

0 notes

Text

Canfin Homes stock may give 20% returns in six months

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/canfin-homes-stock-may-give-20-returns-in-six-months/

Canfin Homes stock may give 20% returns in six months

Housing is a significant engine of growth and development for the economy and the Indian residential real estate market constitutes a major portion of the property market by sales volumes. There was a slowdown in the property market during the last seven years, but post the Covid pandemic, the Indian real estate sector has again witnessed high growth on the back of rise in demand for residential homes. Analysts tracking the industry expect housing finance companies to record a growth of over 10% during FY-2023 with private equity investments in real estate estimated to grow to US$100 billion by 2026 with Tier1 and Tier 2 cities being the prime beneficiaries. Covid-19 had impacted the housing finance companies disbursement and collection efficiency with growth taking a big knock. However, the collection efficiency started bouncing back by the middle of 2021 and improved further in the second and third quarters of the FY22. With healthy demand in the industry and growing economic activity, the housing finance market is expected to result in a steady growth of disbursements and improvement. The overall portfolio book of housing finance companies is estimated to be around Rs 11 lakh crore as of July 2022 with exposures across home loans, loan against property, construction finance and lease rental discounting segments. With rapid urbanisation, improved affordability coupled with supportive government initiatives and discounts from real estate companies, analysts and fund managers tracking the sector expect housing finance companies to grow exponentially going ahead, particularly the affordable housing segment. Since around 66% of the country’s population is below 35 years of age and around 30% of the population resides in cities, housing finance companies stand to benefit immensely from the housing sector’s growth. Plus they are well equipped with competitive product offerings and product pricing, superior customer service and last mile connectivity with potential customers where large banks are unable to service. The last two years have been a blessing in disguise for the real estate sector as there is huge demand potential through shift in preferences by end consumers to own a home across the country. Canfin Homes promoted by Canara Bank is a top notch housing finance company and listed on both the BSE and NSE stock exchanges. The company posted decent second quarterly financial numbers for 2023 with Net Sales at Rs 657.48 crore during September 2022 up 40.55% from Rs 467.77 crore as of September 2021. The Net Profit stood at Rs 141.71 crore during September 2022 up 14.62% from Rs 123.64 crore in September 2021 while the EBITDA stood at Rs 607.24 crore in September 2022 up 37.27% from Rs 442.38 crore for September 2021.Fund managers and large brokerage houses are quite bullish on the Canfin Homes stock currently priced at Rs 516 to appreciate by 20% in the next six months’ time frame. Rajiv Kapoor is a share broker, certified mutual fund expert and MDRT insurance agent.

0 notes

Text

Is your bank safe? List of Best Safe Banks in India

When selecting the right bank for putting your hard-earned money, consider many things. This list of the Top safest banks in India includes HDFC Bank, ICICI Bank, and PNB. However, this list is not in any particular order. We have highlighted the strengths and weaknesses of each bank, along with their overall credibility. One of the most significant indicators of a bank's soundness is its market capitalization, which measures its financial strength. The bank's market capitalization is more critical than Rs 11 lakh crore, making it the fifth-largest bank in the country. Professional management and outstanding business leadership make it an excellent choice for those putting their hard-earned money into these institutions.

While many Top safest banks in India have failed to meet the criteria for the list, China is the only country with multiple banks on the list. Last year, 24 of India's banks did not provide the required data to be included in the list. Despite this, four Chinese banks have made a list this year. Bank of Baroda, Hubei Bank, Canara & IDBI, and ICBC.

The problem with online banking is that you cannot access your funds quickly. Even if you have an ATM network, you may have trouble accessing your hard-earned money. In addition, you may have to transfer large amounts to a brick-and-mortar bank account, which may take several days. Despite this drawback, online banking is an essential part of today's cashless lifestyle. A bank account provides 24x7 security for your hard-earned money. You can also earn interest on your savings and manage your expenses online.

While there are several reasons to choose a bank for your hard-earned money, the primary function of any bank is to receive deposits and loan them to those in need. This makes banks the symbol of trust in the world. The top safest banks in India to put your hard-earned money are nationalized banks. These banks have been around for centuries, and their reputation for excellent customer service has led to many people putting their hard-earned money in them.

IDFC First Bank was once known for its outstanding customer service. However, the service quality has declined over the years. SBI is a government-owned bank with an extensive list of services, and it offers savings, credit cards, and mortgage loans. In addition to these, the bank provides car loans and personal loans for almost every need. These loans are easy to apply for, and the interest rates are competitive.

The PNB bank offers a variety of deposit schemes, including several different types of education loan schemes. These include the PNB Udaan, Pratibha, Kaushal, and Saraswati. The PNB Pride Housing Loan Scheme is for government employees, and the Pradhan Mantri Awas Yojna is for all.

The SBI bank is India's largest public sector bank and has over 1,300 branches. It offers a wide range of banking products and services, including savings accounts and retirement plans. Its savings account calculator is handy and allows you to calculate the amount you'll receive after a specified time. It is also a great choice if you're concerned about the safety of your money.

ICICI Bank is India's third-largest private sector bank, and it has one of the largest ATM networks in the country; customers have consistently rated it as their preferred bank. In addition to retail banking, Axis Bank offers several banking products, including home loans, mortgage loans, and wealth management. If you're concerned about safety, ICICI Bank is your bank.

Another bank on the list is the Bank of Maharashtra, one of the top safest banks in India to put money safely for internships. These internships are offered to students from India, Nepal, Bhutan, and many countries. Students may complete their internships from late May to the beginning of August 2022. These foreign internships for Indian students could be anywhere from one to three months.

Its digital banking products and strong reputation make it an excellent choice; the bank offers various deposit schemes, loans, and digital banking services. Despite its reputation as a safe bank, it's still not ideal for nomads. The government has strict regulations, so putting all of your hard-earned money in one bank is not good.

0 notes

Text

Immune to mitigating solvency problems in downturns, S Ravi, the former BSE chairman

Sethurathnam Ravi (S Ravi) is the former BSE Limited Chairman and Founder and Managing Partner of Chartered Accountants’ firm Ravi Rajan & Co., an advisory and accountancy firm, headquartered in New Delhi, India. In his tenure spanning more than three decades, S Ravi has gained extensive experience in the field of banking and finance, financial and management consulting; including mergers and acquisitions, valuations, rehabilitation & restructuring of companies and turnaround strategies, auditing of companies and banks among others.

According to S Ravi the former BSE chairman, some challenges come across during the bank merger. The impact of these mergers goes deeper than just what is visible. The amalgamation scheme includes the merger of Indian Bank with Allahabad Bank; Oriental Bank of Commerce (OBC) and United Bank of India with Punjab National Bank (PNB); Canara Bank with Syndicate Bank; Andhra Bank and Corporation Bank with Union Bank of India. The merger announcement itself is a bold step considering that Ten PSU banks are involved in the process involving 3,08,732 employees, Rs. 31,79,304 crore deposits, around 37,492 domestic branches and 45,448 ATMs.

These mergers impact deposit holders, shareholders borrowers, employees and the public at large. The rationale for these mergers has been spelt out. It is to create larger banks so that they are more immune to mitigating solvency problems in downturns.

The biggest impact of this merger is of course is the emotional uncertainty that will play on the minds of the bankers themselves. When you have spent an entire career in one place it can be very unsettling to leave. The second thing is uncertainty on the career front because someone will suddenly be dropped into a new ecosystem especially for those coming from the smaller bank. That is a very big challenge. There will be a lot of learning and re-evaluation that will need to take place.

In the case of customers, they will have to look at it in a very different way and that will need to be articulated by the new banks, says the former BSE chairman. The choice for the customer is stark. S Ravi believes that customers will move to safer banks.

S Ravi thinks that customers have seen that the government has pumped in a lot of money into the banks and they will see that the government is supporting these banks. From a customer viewpoint, you feel safer and even as borrowers, the smaller weaker banks were not extending credit and now that situation will change. At the same time, the powers will be realigned. Hypothetically, a General Manager in Allahabad Bank had the authority of over just Rs 50 crore, now as part of Indian Bank, he or she can manage Rs 200 crore. The decision making will become a lot faster and that should help the small to medium segment of businesses.

In a deeper analysis by S Ravi, the former BSE chairman, he says that the branch consists of 8-12 people and those jobs are going nowhere because the brick and mortar will remain the same. Some banks might have branches next to each other and some realignment might happen, but people will not lose jobs. Also, the skillsets of bankers are changing. There will be a lot of demand for the younger people who are more aware of aspects like digital banking. Also, one has to remember that other than HDFC bank, most of the private sector banks in India have had their challenges. One must not think that it is only the PSU banks that are in trouble.

According to S Ravi, the single most important aspect is the emotional aspect. The bank employees have to be taken care of, how do you hold their hands through the entire process is one major area of concern. S Ravi says that he would set up task forces for all these major challenges. There is another huge challenge as well, in the IT space, just to collect and sanitize data. The margin money is different for different types of borrowers in different banks, now collecting that data is important and should have a dedicated task force behind it and then finally make a decision.

#SRaviBse#SethurathnamRavi#SethurathnamRaviBse#SethurathnamBse#SRaviBseChairman#SethurathnamRaviChairman

0 notes

Text

BC Nagesh- The New Indian Express

BC Nagesh- The New Indian Express

By Express News Service BENGALURU: Primary and secondary education minister BC Nagesh on Wednesday said that several partnerships are being signed with private companies to provide vehicles to ferry students of government schools. The minister was speaking in reference to Canara Bank donating two Maruti eco mini vans to the Department of Education as part of their corporate social responsibility…

View On WordPress

0 notes

Text

Is private banking a good career?

May be. Because, the private bank employees salary was low compare to Public Sector Banks. If you have strong background in Banking services, financial services, accounts, good communication and problem solving skills, you will grow your career through Private banks. latest Bank Jobs India

Different Type of Bank Jobs: Clerical Cadre (Clerk), Office Assistant, Attendant, Junior Associates, Peon, Watchman, Various Officers (PO / SO), Consultants, Various Managers, Executives, Counsellors and other Bank related job posts.

List of Public Sector Banks List – Nationalized Banks: State Bank and its associates [State Bank of India (SB), State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP), State Bank of Travancore (SBT)], Allahabad Bank, Andhra Bank, Bank of Baroda (BoB), Bank of India (BOI), Bank of Maharashtra (BOM), Canara Bank, Central Bank of India (CBI), Corporation Bank, Dena Bank, Indian Bank, Indian Overseas Bank (IOB), Oriental Bank of Commerce (OBC), Punjab & Sind Bank (PSB), Punjab National Bank (PNB), Syndicate Bank, UCO Bank, Union Bank of India (UBI), United Bank of India, Vijaya Bank, Bharatiya Mahila Bank (BMB), IDBI Bank, Post Bank of India (proposed) and Student Bank of India (proposed).

latest Bank Jobs India

About Indian Banking Sector: The First Banking in India were Bank of Hindustan established in 1770. The Largest Bank in India is the State Bank of India (SBI) – This was one of the three banks funded by Presidencies of British India Government, the other two were the Bank of Bombay and the Bank of Madras. Currently Indian banking sector classified into Scheduled Banks (include Public Sector Banks, Regional Rural Banks (RRBs); Private Sector Banks & Foreign Banks) and Non-Scheduled banks. The Scheduled Banks regulated under the 2nd Schedule of the Reserve Bank of India (RBI) Act, 1934. The Non-Scheduled banks regulated under the Banking Regulation Act, 1949. Currently 27 Public Sector Banks available in India, Its include 19 Nationalized banks, 06 are State Bank of India (SBI) & its associate banks, 02 other public sector Banks (Bharatiya Mahila Bank & IDBI Bank) and 02 banks Newly proposed (India Post Payments Bank). More than 20 Private Sector Banks also available in India.

0 notes

Text

Fixed Deposit : सीनियर सिटीजन को ये बैंक FD पर ऑफर कर रहे सबसे ज्यादा ब्याज

Fixed Deposit : सीनियर सिटीजन को ये बैंक FD पर ऑफर कर रहे सबसे ज्यादा ब्याज | देखा जाए तो आज भी ज्यादातर लोग निवेश करने पर काफी भरोसा करते हैं और खास बात ये है कि वो अपना पैसा रखने के लिए बैंक ( Money Safe in Bank ) को सबसे सुरक्षित मानते हैं! इतना ही नहीं वो शेयर बाजार (Share Market) में पैसे लगाना खतरा समझते हैं! दरअसल वे अपने पैसे पर रिटर्न के मुकाबले सुरक्षा को तरजीह देते हैं! हालांकि बीते कुछ सालों में बैंकों के डूबने के मामले आने के बाद इस सोच में बदलाव आने की उम्मीद है! सीनियर सिटीजन को ये बैंक FD पर ऑफर कर रहे सबसे ज्यादा ब्याज Fixed Deposit इसके अलावा बैंक एफडी (Bank FD) आपको जरू���ी खर्च के लिए पैसे के साथ एकमुश्त राशि का भी इंतजाम कर सकती है! बता दें FD में पैसा ज्यादातर सीनियर सिटीजन (Senior Citizens) लगाते हैं! ज्यादातर बैंक अपने एफडी इंटरेस्ट रेट (FD Interest Rate) में बड़े बदलाव करते रहते हैं! ऐसे में अगर आप भी फिक्स्ड डिपॉजिट में पैसा इन्वेस्ट (Investment in FD) करते हैं तो आपके लिए अच्छी खबर है, जो हम आपको बताने जा रहे हैं! Fixed Deposit : सीनियर सिटीजन के लिए है FD फायदेमंद (FD is beneficial for senior citizens) फिक्स्ड डिपॉजिट (Investment in Fixed Deposit) में निवेश से निवेशकों के पैसे को सुरक्षा तो मिलती ही है! साथ ही बेहतरीन रिटर्न (FD Return) भी मिलता है! निश्चित समय के लिए फिक्स्ड डिपॉजिट में एकमुश्त रकम जमा कर ब्याज के तौर पर मुनाफा मिलता है! FD के तय नियमों (FD Rules) के अनुसार परिपक्वता (Maturity) से पहले जमा किए गए रकम को नहीं निकाला जा सकता! हालांकि कुछ जुर्माना जमा करके पैसे को पहले भी निकाला जा सकता है! निवेशक FD के जरिए सेविंग अकाउंट (Saving Account) के मुकाबले ज्यादा रिटर्न (Good Return) हासिल कर सकते हैं! हाल के समय में कई बैंक ऐसे हैं जो सीनियर सिटीजन को एफडी (FD) के ऊपर 7.3 फीसदी तक ब्याज ऑफर कर रहे हैं! ज्यादा ब्याज की ये सुविधा सीनियर सिटीजन के लिए ही लागू है! निजी बैंक वरिष्ठ नागरिकों को कर रहे हैं ज्यादा ब्याज (Private banks are paying more interest to senior citizens) सूर्योदर स्मॉल फाइनेंस बैंक (Suryodar Small Finance Bank) – 7.3 फीसदी (9 सितंबर 2021 से प्रभावी)उज्जीवन स्मॉल फाइनेंस बैंक (Ujjivan Small Finance Bank) – 7.25 फीसदी (9 दिसंबर 2021 से प्रभावी)नॉर्थ ईस्ट स्मॉल फाइनेंस बैंक (North East Small Finance Bank) – 7.25 फीसदी (19 अप्रैल 2021 से प्रभावी)जना स्मॉल फाइनेंस बैंक (Jana Small Finance Bank) – 7 फीसदी (7 मई 2021 से प्रभावी)फिनकेयर स्मॉल फाइनेंस बैंक (Fincare Small Finance Bank) – 6.75 से 7 फीसदी (25 अक्टूबर 2021 से प्रभावी)ईएसएएफ स्मॉल फाइनेंस बैंक (ESAF Small Finance Bank) – 6.75 फीसदी (1 दिसंबर 2021 से प्रभावी)उत्कर्ष स्मॉल फाइनेंस बैंक (Utkarsh Small Finance Bank) – 6.50 फीसदी (1 जुलाई 2021 से प्रभावी)इक्विटास स्मॉल फाइनेंस बैंक (Equitas Small Finance Bank) – 6.50 फीसदी (1 अक्टूबर 2021 से प्रभावी)एयू स्मॉल फाइनेंस बैंक (AU Small Finance Bank) – 6.50 फीसदी (14 अक्टूबर 2021 से प्रभावी)कैपिटल स्मॉल फाइनेंस बैंक (Capital Small Finance Bank) – 6.50 फीसदी (3 जून 2021 से प्रभावी) Fixed Deposit : 2 से 3 साल की FD पर सरकारी बैंकों की ब्याज दरें (Interest rates of government banks on FDs of 2 to 3 years) यूनियन बैंक ऑफ इंडिया (Union Bank of India) – 5.80 फीसदी (1 सितंबर 2021 से प्रभावी)इंडियन बैंक (Indian Bank) – 5.70 प्रतिशत (5 नवंबर 2021 से प्रभावी)बैंक ऑफ बड़ौदा (Bank Of Baroda) – 5.70 फीसदी (16 नवंबर 2021 से प्रभावी)इंडियन ओवरसीज बैंक (Indian Overseas Bank) – 5.65 से 5.70 फीसदी (9 नवंबर 2021 से प्रभावी)पंजाब एंड सिंध बैंक (Punjab And Sind Bank) – 5.65 फीसदी (16 सितंबर 2021 से प्रभावी)स्टेट बैंक ऑफ इंडिया (State Bank Of India) – 5.60 फीसदी (8 जनवरी 2021 से प्रभावी)पंजाब नेशनल बैंक (Punjab National Bank) – 5.60 फीसदी (1 अगस्त 2021 से प्रभावी)केनरा बैंक (Canara Bank) – 5.60 फीसदी (9 अगस्त 2021 से प्रभावी)बैंक ऑफ इंडिया (Bank of India) – 5.55 फीसदी (1 अगस्त 2021 से प्रभावी)सेंट्रल बैंक ऑफ इंडिया (Central Bank Of India) – 5.50 फीसदी (10 नवंबर को सेंट्रल बैंक में प्रभावी) Read the full article

0 notes

Text

Profitable business in Kerala with low investment.

Investment opportunities in kerala, has increased rapidly.The investment companies have played a vital role in our day to day life. Best investment options in Kerala, include the following. They are Evenest, Allianz, Federal bank, State bank of India, Canara bank, south indian bank, UAE exchange and financial services, Nissan, Finastra, Bajaj Finance, Landmark entertainment city(LEC) , Halal investing and so on. Halal Investment in Kozhikode is one of the most well-known stock brokers in the area. They have high reliability, efficiency and is well known due to their awesome quality. Short term investment in calicut, necessitates the application of Islamic standards to financial decisions. Investors frequently consider halal investing to be a segment of ethical or socially responsible investing because it is a faith-based approach to investment management. Halal investments entail two things: the money is invested in something that does not cause any societal disruption, and there is no interest involved in any transaction. When these two requirements are met, it is possible to invest money intelligently and efficiently, resulting in significant returns.LEC is the ideal location for you to reawaken that energetic child within you, full of excitement and wonder! With a wide range of fascinating experiences, events, and attractions, LEC has everything you need to pamper yourself silly and want to return again and again! Furthermore, this 35-acre dream property is nestled in the Adivaram Valley, halfway between Wayanad and Kozhikode, where the surrounding peace and pristine natural beauty will soothe your senses.Evernest Investment Advisers Private Limited was founded on July 31, 2020. It is a non-government organisation that is registered with the Registrar of Companies in Bangalore. Allianz Global Investors (abbreviated as AllianzGI or AGI) is a global investment management organisation with offices in more than 20 countries. Federal Bank Limited is a prominent private sector Indian commercial bank with about 1200 branches and 1900 ATMs/Recyclers distributed across the country. The bank was one of the first banks in India to computerise all of its branches, making it a pioneer among traditional banks in India in terms of leveraging technology to leverage its operations.When it comes to purchasing a Life Insurance plan, SBI Life is one of the most well-known and reputable names in the industry.

To know more, please visit, https://landmarkentertainmentcity.com/

#investment opportunities in kerala#halal investment in Kozhikode#halal investing#short term investment in Calicut#best investment options in kerala

0 notes

Text

The Complete List of Banks in India?

The banking system in India is a complex structure with many different types of banks and financial institutions. There are three main banks in India, the Reserve Bank of India, the State Bank of India, and the Indian Overseas Bank.

Entering the banking sector in any one of these countries is not easy unless you know where to start such as by setting up a business account or opening an investment account. These are very important steps to take before entering the business arena especially in countries like India which are notorious for their corrupt government officials. Countries like the United States, Canada, and Australia are more welcoming towards newcomers but that doesn't mean that there aren't any people who would try to scam you out of your money.

This article is about how many banks are in India? The following is a list of different types of banks within the country:

1. State Bank of India (SBI)

2. Punjab National Bank (PNB)

3. ICICI Bank (ICI)

4. Canara Bank (CBN) [Commonly known as Canara bank]

5. Andhra Bank [Commonly known as Andhra bank]

6. United Bank of India [Commonly known as UBI] and

7. HDFC Bank [Commonly known as HDFC]

8. Central Bank of India [Commonly known as CI]

9. Allahabad bank [Commonly known as AUBL]

10. Union Bank of india [Commonly known as UBL]

11. Indian Overseas Bank [Commonly known as IOB]

12. Syndicate Bank [Commonly known as SYNBK] and

13. IDBI bank [Commonly known as IDBI].

SBI is the best bank in India. More than 230 million people in the country are bank account holders. Chartered banks, private sector banks, foreign sector banks and cooperative banks carry out banking business to serve the needs of people in the country. The Indian banking sector is highly regulated and supervised by the Reserve Bank of India (RBI). RBI inspects all banks regularly to ensure that all policies are implemented properly. Apart from this, other government agencies like the should also act effectively if any violation of banking rules is observed.

The government of India has also empowered certain agencies to supervise the banking industry. These are the RBI, the Insurance Regulatory and Development Authority (IRDA), National Housing Bank (NHB), deposit insurance and credit guarantee corporation (DICGC) etc.

0 notes

Text

BC Nagesh- The New Indian Express

BC Nagesh- The New Indian Express

By Express News Service BENGALURU: Primary and secondary education minister BC Nagesh on Wednesday said that several partnerships are being signed with private companies to provide vehicles to ferry students of government schools. The minister was speaking in reference to Canara Bank donating two Maruti eco mini vans to the Department of Education as part of their corporate social responsibility…

View On WordPress

0 notes

Text

How to apply private banking jobs?

www.indiahires.in listed popular private banks direct career page links in this page. Visit Private Bank career page to get current / latest job details. Read all eligibility, qualification and other details, after apply online or offline mode. latest Bank Jobs India

Which bank jobs India is best for job?

Private Sector Banks are under RBI rules, the Reserve Bank of India monitoring all private banks. so, all banks are good for job careers.

Here Top Private banks for Job careers:

✔️HDFC Bank

✔️Federal Bank

✔️ICICI Bank

✔️Indusind Bank

✔️Axis Bank

How can I get a job in bank?

The Private sector banks like HDFC, ICICI, Axis, Yes Bank and Small finance private banks offers various banking jobs opportunity for both fresher and experienced graduates. The selection process will be made through Online Examination and / or Personal Interview.

Is private banking a good career?

May be. Because, the private bank employees salary was low compare to Public Sector Banks. If you have strong background in Banking services, financial services, accounts, good communication and problem solving skills, you will grow your career through Private banks. latest Bank Jobs India

Different Type of Bank Jobs: Clerical Cadre (Clerk), Office Assistant, Attendant, Junior Associates, Peon, Watchman, Various Officers (PO / SO), Consultants, Various Managers, Executives, Counsellors and other Bank related job posts.

List of Public Sector Banks List – Nationalized Banks: State Bank and its associates [State Bank of India (SB), State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Mysore (SBM), State Bank of Patiala (SBP), State Bank of Travancore (SBT)], Allahabad Bank, Andhra Bank, Bank of Baroda (BoB), Bank of India (BOI), Bank of Maharashtra (BOM), Canara Bank, Central Bank of India (CBI), Corporation Bank, Dena Bank, Indian Bank, Indian Overseas Bank (IOB), Oriental Bank of Commerce (OBC), Punjab & Sind Bank (PSB), Punjab National Bank (PNB), Syndicate Bank, UCO Bank, Union Bank of India (UBI), United Bank of India, Vijaya Bank, Bharatiya Mahila Bank (BMB), IDBI Bank, Post Bank of India (proposed) and Student Bank of India (proposed).

About Indian Banking Sector: The First Banking in India were Bank of Hindustan established in 1770. The Largest Bank in India is the State Bank of India (SBI) – This was one of the three banks funded by Presidencies of British India Government, the other two were the Bank of Bombay and the Bank of Madras. Currently Indian banking sector classified into Scheduled Banks (include Public Sector Banks, Regional Rural Banks (RRBs); Private Sector Banks & Foreign Banks) and Non-Scheduled banks. The Scheduled Banks regulated under the 2nd Schedule of the Reserve Bank of India (RBI) Act, 1934. The Non-Scheduled banks regulated under the Banking Regulation Act, 1949. Currently 27 Public Sector Banks available in India, Its include 19 Nationalized banks, 06 are State Bank of India (SBI) & its associate banks, 02 other public sector Banks (Bharatiya Mahila Bank & IDBI Bank) and 02 banks Newly proposed (India Post Payments Bank). More than 20 Private Sector Banks also available in India.

Why Government Bank Jobs?

Government Bank Jobs is most secured and high salary jobs in India. Once you enter to Banking career, your life settled. IndGovtJobs.in updates all Govt Bank Jobs, Regional Rural Bank Jobs and Scheduled Bank Jobs in this page. Just bookmark our ‘Bank Jobs – Indian Government Jobs’ for future purpose.

What are the bank jobs india after 12th, Degree?

After 12th Pass: Clerical Cadre posts are suitable for 10th 12th pass candidates. Such as Clerk, Assistant, Bank Assistant, Cashier, Customer Service Representative, Clerical Attendant, Security Guards etc.

After Degree Pass: Probationary Officer (PO), Management Trainees (MT), Officers, IT Officer, Finance Officer, Law Officer, Various Level of Managers, Consultants, Director etc. Bank Jobs India 2022

0 notes

Text

Best investment companies in Kerala

The investment companies have played a vital role in our day to day life. Best investment companies in Kerala, include the following. They are Evenest, Allianz, Federal bank, State bank of India, Canara bank, south indian bank, UAE exchange and financial services, Nissan, Finastra, Bajaj Finance, Landmark entertainment city(LEC) , Halal investments and so on.This first-of-its-kind gigantic entertainment resort in South India promises endless pleasure. LEC is the ideal location for you to reawaken that energetic child within you, full of excitement and wonder! With a wide range of fascinating experiences, events, and attractions, LEC has everything you need to pamper yourself silly and want to return again and again! Furthermore, this 35-acre dream property is nestled in the Adivaram Valley, halfway between Wayanad and Kozhikode, where the surrounding peace and pristine natural beauty will soothe your senses.Evernest Investment Advisers Private Limited was founded on July 31, 2020. It is a non-government organisation that is registered with the Registrar of Companies in Bangalore. Allianz Global Investors (abbreviated as AllianzGI or AGI) is a global investment management organisation with offices in more than 20 countries. Federal Bank Limited is a prominent private sector Indian commercial bank with about 1200 branches and 1900 ATMs/Recyclers distributed across the country. The bank was one of the first banks in India to computerise all of its branches, making it a pioneer among traditional banks in India in terms of leveraging technology to leverage its operations.When it comes to purchasing a Life Insurance plan, SBI Life is one of the most well-known and reputable names in the industry. These plans assist you in building a financial foundation for the future, whether it is for your child's wedding, college, or retirement. Halal investing necessitates making financial decisions based on Islamic standards. Investors must share in profit and loss, get no income (riba), and not invest in a firm that is prohibited by Islamic law, or sharia, according to Islamic principles. The Best investment buissness are the following. They are Dropshipping, courier company, online bakery, online fashion boutique and so on. The Best investment options in Kerala are the following. The Direct equity, Equity mutual funds, Debut mutual funds, National pension system and so on. Halal Investments in Kallai, Kozhikode is one of the most well-known stock brokers in the area. They have high reliability, efficiency and is well known due to their awesome quality. Halal investing in calicut, necessitates the application of Islamic standards to financial decisions. Investors frequently consider halal investing to be a segment of ethical or socially responsible investing because it is a faith-based approach to investment management. Halal investments entail two things: the money is invested in something that does not cause any societal disruption, and there is no interest involved in any transaction. When these two requirements are met, it is possible to invest money intelligently and efficiently, resulting in significant returns.

For more details, please visit, https://landmarkentertainmentcity.com/

#best investment companies#halal investing#investment business#best investment options in kerala#halal investment in kozhikode

0 notes

Text

Stocks to watch: Indiabulls Real Estate, RIL, Concor, Pidilite, Hindalco

Here's a glance at the top stocks that may exchange effectively in the present exchanging session.

MARKET NEWS: Indiabulls Real Estate: The organization said on Monday it would sell its business properties in Mumbai and Gurugram to US-based private value support chief Blackstone for Rs 810 crore.

RIL: The government's interest in pending duty may defer the organization's arrangement to pay off past commitments. The stock, which has risen more than 46 percent in a year and scaled new highs on Friday, fell more than 3 percent in intraday exchange before completion down 1.78 percent on Monday.

Hindalco Industries declared that the Muri treatment facility in Jharkhand has re-began the creation of Alumina. Pidilite Industries: HomeLane, a web-empowered inside plan firm, has brought $30 million up in arrangement D financing from Evolvence India, Pidilite Group and FJ Labs. Syndicate Bank,

Canara Bank: Crisil has set the bank's Perpetual Tier 1 Bonds and Lower Tier II Bonds on Rating Watch with positive ramifications. The rating office has set Canara Bank's long haul obligation instruments on 'Rating Watch with Developing Implications'.

NIIT Tech: The organization's board on Monday fixed the offer buyback cost at Rs 1,725 collecting up to around Rs 3.46 crore which speaks to 20.23 percent of the paid-up value share capital and free saves of the Company.

Fly Airways: The organization reported that the sixth Committee of Creditors passed the goals to give crisp Invitation of Expression of Interest for the Corporate Debtor in the e-casting a ballot finished up on December 22, 2019.

IRCTC: The organization has modified the Tariff of Standard Meals on Static Units over Indian Railways.

READ MORE: Stocks to watch

0 notes