#california santa clara valley

Explore tagged Tumblr posts

Text

The Birth of an Industry: Fairchild’s Pivotal Role in Shaping Silicon Valley

In the late 1950s, the Santa Clara Valley of California witnessed a transformative convergence of visionary minds, daring entrepreneurship, and groundbreaking technological advancements. At the heart of this revolution was Fairchild Semiconductor, a pioneering company whose innovative spirit, entrepreneurial ethos, and technological breakthroughs not only defined the burgeoning semiconductor industry but also indelibly shaped the region’s evolution into the world-renowned Silicon Valley.

A seminal 1967 promotional film, featuring Dr. Harry Sello and Dr. Jim Angell, offers a fascinating glimpse into Fairchild’s revolutionary work on integrated circuits (ICs), a technology that would soon become the backbone of the burgeoning tech industry. By demystifying IC design, development, and applications, Fairchild exemplified its commitment to innovation and knowledge sharing, setting a precedent for the collaborative and open approach that would characterize Silicon Valley’s tech community. Specifically, Fairchild’s introduction of the planar process and the first monolithic IC in 1959 marked a significant technological leap, with the former enhancing semiconductor manufacturing efficiency by up to 90% and the latter paving the way for the miniaturization of electronic devices.

Beyond its technological feats, Fairchild’s entrepreneurial ethos, nurtured by visionary founders Robert Noyce and Gordon Moore, served as a blueprint for subsequent tech ventures. The company’s talent attraction and nurturing strategies, including competitive compensation packages and intrapreneurship encouragement, helped establish the region as a magnet for innovators and risk-takers. This, in turn, laid the foundation for the dense network of startups, investors, and expertise that defines Silicon Valley’s ecosystem today. Notably, Fairchild’s presence spurred the development of supporting infrastructure, including the expansion of Stanford University’s research facilities and the establishment of specialized supply chains, further solidifying the region’s position as a global tech hub. By 1965, the area witnessed a surge in tech-related employment, with jobs increasing by over 300% compared to the previous decade, a direct testament to Fairchild’s catalyzing effect.

The trajectory of Fairchild Semiconductor, including its challenges and eventual transformation, intriguingly parallels the broader narrative of Silicon Valley’s growth. The company’s decline under later ownership and its subsequent re-emergence underscore the region’s inherent capacity for reinvention and adaptation. This resilience, initially embodied by Fairchild’s pioneering spirit, has become a hallmark of Silicon Valley, enabling the region to navigate the rapid evolution of the tech industry with unparalleled agility.

What future innovations will emerge from the valley, leveraging the foundations laid by pioneers like Fairchild, to shape the global technological horizon in the decades to come?

Dr. Harry Sello and Dr. Jim Angell: The Design and Development Process of the Integrated Circuit (Fairchild Semiconductor Corporation, October 1967)

youtube

Robert Noyce: The Development of the Integrated Circuit and Its Impact on Technology and Society (The Computer Museum, Boston, May 1984)

youtube

Tuesday, December 3, 2024

#silicon valley history#tech industry origins#entrepreneurial ethos#innovation and technology#california santa clara valley#integrated circuits#semiconductor industry development#promotional film#ai assisted writing#machine art#Youtube#lecture

8 notes

·

View notes

Text

Here's a better shot of the Santa Clara wash, lower middle. Bottom (leftish) is a senior's development. Sierra Pelona Mountains in the background. The bridge is White's Canyon over the Santa Clara.

#santa clarita valley#canyon country#california#original photographers#photographers on tumblr#santa clara river#river wash

3 notes

·

View notes

Text

The heat did not stop the community from coming out to enjoy another successful Parade of Champions. As in years past, the event featured marching bands from all over California as well as a strong showing from local community groups. All of the participants worked their way down Monroe Street on Oct. 5, entertaining the crowds.Three of the Santa Clara Unified School District high schools took part in the festivities. Read complete news at svvoice.com.

#news#latest news#santa clara news#silicon valley voice#community#Parade of Champions#California#Monroe Street

0 notes

Video

Los Altos Golf and Country Club and Loyla, California Aerial View by David Oppenheimer Via Flickr: Los Altos Golf and Country Club golf course and clubhouse Loyola neighborhood and Los Altos, California aerial - © 2024 David Oppenheimer - Performance Impressions aerial photography archives - performanceimpressions.com

#Los Altos Golf and Country Club#Loyola#Loyola California#Los Altos#Los Altos Hills#golf course#clubhouse#golf#golfing#California#Silicon Valley#country club#aerial#aerial photo#aerial photographer#Santa Clara County#golfers#luxury#private#real estate#golf club#luxury real estate#property#land#club#private club#LAGCC#Bay Area#Tom Nicoll course#1560 Country Club Drive

0 notes

Text

So what are some ways y'all use to determine if someone is actually from your state or not?

For me, the easiest way to determine if someone is actually from California or not is by finding out whether they think the San Francisco Bay Area, and more specifically the South Bay — what most non-Californians know as "Silicon Valley" 🤢 — is NorCal or SoCal

Oh and whether or not they know that "Silicon Valley" is part of the San Francisco Bay Area but does not include San Francisco (or Oakland) is another reliable way to determine who's from here and who isn't

#helpful hint: for most californians the unofficial 'border' between norcal and socal is the grapevine#others may put it just below fresno and monterey counties#and a few just below santa clara and santa cruz counties#but for the most part almost nobody actually from here thinks san francisco is 'socal'#and also the only people who say they're from 'silicon valley' are techbros#those of us actually from so-called 'silicon' will usually just say we're from san francisco#many of whom aren't even originally from california much less the sf bay area#or santa clara or san jose or even 'the bay area'#yes there's more than one 'bay area'#but 'the bay area' without any identifiers always refers to the sf bay area

1 note

·

View note

Text

California Voters—What to Do If Your Ballot is Rejected

From the San Francisco Chronicle: https://bit.ly/4fexCEC

"Whether you forgot to sign your ballot return envelope or signed it in a way that doesn’t match previous signatures, your ballot can be fixed in the weeks after the election. Every election cycle, a portion of ballots across California are rejected. Most of them were turned in late — which cannot be remedied — or had an issue with the signature on the envelope containing the ballot. Luckily for voters, signature problems can be “cured” by submitting a form sent by their county elections office by Dec. 3. The quickest way to know if your ballot has a problem is to sign up for ballot tracking through the California Secretary of State’s website at https://wheresmyballot.sos.ca.gov. Voters will be able to see if their ballot has been accepted and counted or if there is a problem that can be addressed. Voters whose ballots need fixing will also receive a letter from their county elections office, as well as a phone call and email if that information is on file. John Arntz, director of the San Francisco Department of Elections, said that the notification should come to voters in English and Chinese, unless they have selected a different secondary language for voting. Arntz said that the notification includes a form for voters to complete to verify their signature. They can either return it by mail, email or in person to have their vote counted. Alexander said that signature problems — which affected 394 San Francisco ballots in the March primary election — can affect first-time and younger voters who have not yet developed a regular signature or are unaware that the signature on their ballots will be compared to the signature on file with the Department of Motor Vehicles. Older voters are also impacted more often by signature problems as their dexterity and handwriting changes with age, making it more difficult to match their previous signatures. Alexander said that voters have 28 days — based on a new state law implemented this election — to get ballot curing forms back to their county elections office to have their votes counted. Counties will not be able to certify their votes until that deadline passes, Alexander said. In San Francisco, with ranked-choice voting for mayoral candidates, the cured ballots could end up impacting the final results if the election is neck and neck. Arntz said that the reports put out before he certifies the election are just a snapshot of the votes counted by that moment, but that cured votes submitted by the deadline could change the trajectory of the instant runoff election. In this year’s primary election, nearly 1,200 Alameda County voters had fixable signature problems. San Mateo County had over 400, Contra Costa County had over 1,000 and Santa Clara County had nearly 500. Alexander estimates that only about 50% of those ballots end up being cured and counted, based on a study her organization did of a handful of California counties. Recently, campaigns have realized in races with razor-thin margins that ballot curing can make a difference, Alexander said. For tight House races in the Central Valley and Southern California, volunteers could be working for weeks after Election Day to get signatures fixed."

162 notes

·

View notes

Text

Books From a Non-Human Perspective

I've seen discussions on books going around the alterhuman community, and it caused me to recall some of my own favorite books from a non-human perspective. The most memorable of these were from a non-human perspective, and focused more on nonhuman existence, than supernatural or fantastical elements.

I've noticed that I tend towards books that are more realistic- not to say that I only read realistic books, but many of the stories I like are focused on the animal's point of view, aren't really shapeshifting focused, and are more focused on being "practically nonhuman". Like, you'll see what I mean if you check out the books 😉

(I've added descriptions and images from the books to the post, all credit goes to Google/Amazon.)

Child of the Wolves - Elizabeth Hall

Granite, a Siberian husky puppy, is all alone in the Alaskan forest after escaping from his kennel. Each moment of his life is threatened until Snowdrift, a great white wolf, welcomes him into a wolf pack. But Granite must earn his place among the wolf tribe by facing vicious attacks from the other wolves, the human wolf hunters, and the constant challenges of the frozen forest.

Lexi's Tale - Johanna Hurwitz

Can Lexi, the street-smart squirrel and his friend PeeWee, a well-read guinea pig, make a difference in the life of a man living hungry and friendless in Central Park?

The Werewolf Club and the Magic Pretzel (series) - Daniel and Jill Pinkwater

Everyone knows people turn into werewolves if they are bitten by a werewolf, but did you know you can turn into a werewolf by:

1.Thinking about werewolves

2.Reading a book like this one

3.For no reason at all

Norman Gnormal didn’t know this until someone signed him up for the Werewolf Club at school. Raised as a puppy (he’s pretty sure his parents wanted a dog but got him instead), he never quite fit in with most kids at school, who don’t growl at people or dig holes in the lawn. But in the Werewolf Club he finds home with other kids who like running on all fours and howling at the moon.

When the club learns that their teacher has been cursed, the only way to cure him is with Alexander the Great’s magic pretzel. But will the club be able to find the pretzel? And can Norman, the only non-werewolf in the club, keep up?

Lionboy (series) - Zizou Corder

When his parents are kidnapped, what's ten-year-old Charlie Ashanti to do? Rescue them, that's what! He doesn't know who has taken his parents, or why. But he does know that one special talent will aid him on his journey--his amazing ability to speak Cat. Charlie calls on his clever feline friends--from stray city cats to magnificent caged lions--for help. With them by his side, Charlie uses wit and courage to try to find his parents before it's too late.

The Call of the Wild - Jack London

The Call of the Wild is a novel by Jack London published in 1903. The story is set in the Yukon during the 1890s Klondike Gold Rush—a period when strong sled dogs were in high demand. The novel's central character is a dog named Buck, a domesticated dog living at a ranch in the Santa Clara valley of California as the story opens.

Stolen from his home and sold into the brutal existence of an Alaskan sled dog, he reverts to atavistic traits. Buck is forced to adjust to, and survive, cruel treatments and fight to dominate other dogs in a harsh climate. Eventually he sheds the veneer of civilization, relying on primordial instincts and lessons he learns, to emerge as a leader in the wild. London lived for most of a year in the Yukon collecting material for the book.

The story was serialized in the Saturday Evening Post in the summer of 1903; a month later it was released in book form. The novel’s great popularity and success made a reputation for London. Much of its appeal derives from the simplicity with which London presents the themes in an almost mythical form. As early as 1908 the story was adapted to film and it has since seen several more cinematic adaptations.

White Fang- Jack London

White Fang is a novel by American author Jack London (1876–1916) — and the name of the book's eponymous character, a wild wolfdog. First serialized in Outing magazine, it was published in 1906. The story takes place in Yukon Territory, Canada, during the 1890s Klondike Gold Rush and details White Fang's journey to domestication. It is a companion novel (and a thematic mirror) to London's best-known work, The Call of the Wild, which is about a kidnapped, domesticated dog embracing his wild ancestry to survive and thrive in the wild. Much of White Fang is written from the viewpoint of the titular canine character, enabling London to explore how animals view their world and how they view humans. White Fang examines the violent world of wild animals and the equally violent world of humans. The book also explores complex themes including morality and redemption.

Return of the Wolf - Dorothy Hinshaw Patent

Clarion author Dorothy Hinshaw Patent is well known and highly respected for her natural history books. "Return of the Wolf," her first work of fiction, draws on her extensive knowledge of wolf behavior, based on first-hand observation. In the course of a year, Sedra, a young female wolf, establishes her own territory, finds a mate, and begins a new wolf pack. Quick-paced, dramatic, and told from the wolf's point of view, this story contains fascinating details of wolves' life in the wild: their communication, the birth and training of pups, and the pack's strategies for hunting and survival.

Frightful's Mountain - Jean Craighead George

Sam Gribley has been told that it is illegal to harbor an endangered bird, so when his beloved falcon, Frightful, comes home, he has to let her go. But Frightful doesn’t know how to live alone in the wild. She can’t feed herself, mate, brood chicks, or migrate. Frightful struggles to survive and learns to enjoy her new freedom. But she feels a bond with Sam that can never be broken, and more than anything else, she wants to return to him.

Runt - Marion Dane Bauer

DEEP IN THE Minnesota forest, where only the strong survive, four regular-sized pups—Leader, Sniffer, Runner, and Thinker—are pushed into the world. Then one last, very small pup is born into the wolf pack. He is called Runt.

From the very start, Runt struggles in the harsh wild world of the wolves. He tries learning along with his brothers and sisters, but makes serious mistakes. It’s hard pleasing his father, King, and the other wolves. If only Runt could prove himself to his powerful father and family. . . .

The Puppy Sister - S. E. Hilton

Nick and his parents get more than they bargained for when their newly adopted puppy, Aleasha, decides she'll have more fun with her new "family" if she becomes human, too. So begins a laugh-out-loud adventure told from Aleasha's point of view, about her transformation from puppy to girl.

Alien in a Bottle - Kathy Mackel

If Dinn Tauro hadn't shot Tagg Orion off the Inter-Dimensional Wheel, Tagg and his sidekick, Squeeto, would never have crashed on that nowhere planet called Earth. And Sean Winger would never have found the two extraterrestrials in a bottle on the beach.

Without the aliens Sean wouldn't have a hope of entering a glass sculpture in the Hollis Art Fair -- and winning a scholarship. That's all Sean really wants in this world. Sean just needs two things -- glass and fire. He knows his parents won't help. So when Tagg offers Sean three wishes in exchange for protecting him from Dinn Tauro, how can Sean refuse?

Could two extraterrestrials really hold the answers to Sean's yearnings? Or are they only taking him on an extraterrestrial ride?

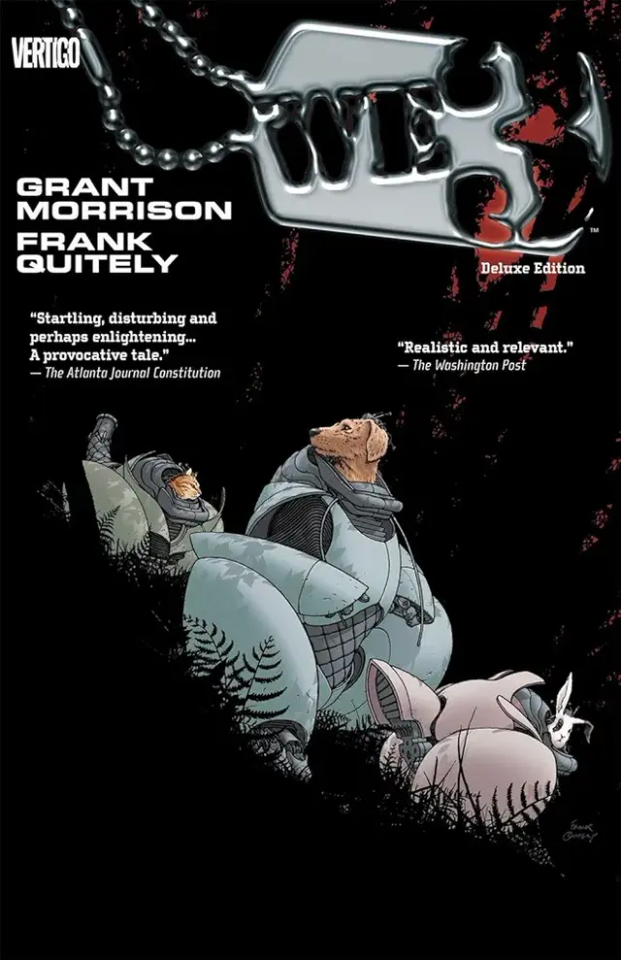

We3 (comic) - Grant Morrison and Frank Quietly

Writer Grant Morrison and artist Frank Quitely deliver the emotional journey of WE3 - three house pets weaponized for lethal combat by the government - as they search for "home" and ward off the shadowy agency that created them.

With nervous systems amplified to match their terrifying mechanical exoskeletons, the members of Animal Weapon 3 (WE3) have the firepower of a battalion between them. But they are just the program's prototypes, and now that their testing is complete, they're slated to be permanently "decommissioned," causing them to seize their one chance to make a desperate run for freedom. Relentlessly pursued by their makers, the WE3 team must navigate a frightening and confusing world where their instincts and heightened abilities make them as much a threat as those hunting them - but a world, nonetheless, in which somewhere there is something called "home."

25 notes

·

View notes

Text

The Best Tips for Shipping Your Car Without Worry

New drivers face many challenges on the road, but safety should always come first. Searching a reliable nationwide car transport, offers you peace of mind throughout the shipping process.

This guide offers useful tips to help new drivers navigate the complexities of car transport safely. By following these simple tips, you can protect yourself and your vehicle while ensuring a smooth journey.

Safety Tips for New Drivers

Safe driving is the life-line of road safety, especially when you have just started driving on San Jose's roads. Research shows seat belts cut serious crash-related injuries and deaths in half. Drivers and front-seat passengers can reduce their risk of fatal injury by 60% in SUVs and 45% in cars by using lap and shoulder belts.

Why Seat Belt Matters:

Reduces Risk of Ejection During Crashes by 75%

Saves Nearly 15,000 Lives Annually

Works Best When Properly Fitted Across Chest and Hips

Required by Law in California for All Drivers

Distracted driving remains one of the most important risks on San Jose roads. Distracted driving took 3,308 lives in 2022. Drivers between ages 25-34 caused the highest percentage of fatal crashes.

Texting while driving is extremely dangerous. Reading a text takes your eyes off the road for 5 seconds - like driving the length of a football field at 55 mph with closed eyes.

Your vehicle's regular maintenance helps keep you safe on the road. Key Maintenance Requirements:

Check Wiper Blades Periodically and Replace Annually

Monitor Fluid Levels Monthly

Follow Manufacturer's Oil Change Schedule

Test All Lights Regularly

Maintain Proper Tire Pressure

Safe vehicle operation depends on using proper restraints, staying focused, and maintaining your vehicle. Teens who have involved parents are twice as likely to wear seat belts consistently. On top of that, it helps prevent unexpected breakdowns and keeps your vehicle running at its best when you maintain it properly.

Simple Tips for New Drivers in San Jose

San Jose provides detailed resources to help new drivers become skilled at road safety and vehicle operation. The Department of Motor Vehicles (DMV) serves residents through multiple channels.

Their self-service kiosks handle registration services and driver records efficiently.

DMV Service Accessibility

The San Jose Field Office accepts various payment methods including cash, credit cards, debit cards, and digital wallets. Drivers can use self-service kiosks for:

Registration Renewal and Sticker Printing

License Replacement

Vehicle Record Requests

Insurance Verification

California Highway Patrol's Start Smart program helps teenage drivers ages 15-19. They offer free two-hour classes that teach collision avoidance and safe driving practices. The program covers important topics like:

Collision Prevention Techniques

Speed Management

Drunk Driving (DUI) Awareness

Distracted Driving Prevention

Bay Area Driving Academy, a California DMV licensed school (E2019), delivers detailed driver education. San Jose Public Library's partnership with Driving-Tests.org helps students. Their practice tests boost passing rates by 73% compared to studying the DMV manual alone.

Community Support Programs: The Impact Teen Drivers (ITD) program emphasizes:

Teen Driver Education

Distraction Awareness

GDL Requirements Explanation

Family Involvement

Santa Clara Valley supports special needs drivers through qualified professionals who provide adaptive driving services. These programs build driver confidence and develop the core skills needed for safe vehicle operation.

Don’t just drive—drive smart! Safety driving is important for every driver. Remember to stay focused, obey traffic rules, and always wear your seat belt. Avoid distractions and keep a safe distance from other vehicles.

Are you putting your car’s safety at risk during transport? Imagine the peace of mind knowing your car is safe during transport. When searching professional car carrier to transport your car safely, A reliable guide is your first step on finding a trusted car shipping service like San Jose auto transport services.

By following these steps, you trust that your car is in good hands and make your car transport experience smooth and stress-free. Remember, a well-prepared driver is a confident driver. Start planning your journey today for a hassle-free car shipping experience.

Drive smart and stay safe on the road. Take this knowledge with you, and drive confidently. Stay safe out there!

youtube

#safe car shipping#auto transport tips#car carrier service#reliable service#Lucky Star Auto Transport#Youtube

8 notes

·

View notes

Text

Majestic in the Mountains & Santa Clarita Valley Today

Apr. 26, 2024

It rained overnight in the mountains, and intermittently in the day into this evening.

From the mountains down into Santa Clarita, it was very green and the Santa Clara River was running with a significant amount of water. Only this year have I observed water in the river after eight years here, and it has been consistent, as have the creeks in Frazier Park this season.

The climate and landscape have changed so much in ten years of orgonite gifting. Water is abundant and grass lives all year. It looked almost like northern California or southern Oregon in the mountains over Santa Clarita today, and if I didn't look carefully, I would think that giant stump over Castaic was in Ashland, where we gifted in 2016 and observed prominent giant stumps.

We even gifted a new tower today, although the area was gridded in 2015. We have seen two new cell towers along I-5 in this area in the past couple of years, showing the importance of maintenance gifting.

It's raining hard in the mountains tonight. The temperature may drop into the upper 20s, so we may even see a little late April snow.

#orgone#orgone energy#orgonite#orgonite gifting#california#santa clarita#gorman#frazier park#lebec#pyramid lake#castaic#clouds#sky#mountains#nature#santa clara river#river#desert#geo-restoration

10 notes

·

View notes

Photo

Max Gustafson

* * * *

LETTERS FROM AN AMERICAN

March 12, 2023

Heather Cox Richardson

At 6:15 this evening, Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman Martin J. Gruenberg announced that Secretary Yellen has signed off on measures to enable the FDIC to fully protect everyone who had money in Silicon Valley Bank, Santa Clara, California, and Signature Bank, New York. They will have access to all of their money starting Monday, March 13. None of the losses associated with this resolution, the statement said, “will be borne by the taxpayer.”

But, it continued, “Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

The statement ended by assuring Americans that “the U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry. Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe.”

It’s been quite a weekend.

On Friday, Silicon Valley Bank (SVB) failed in the largest bank failure since 2008. At the end of December 2022, SVB appears to have had about $209 billion in total assets and about $175 billion in deposits. This made SVB the sixteenth largest bank in the U.S., big in its sector but small compared with the more than $3 trillion JPMorgan Chase. This is the first bank failure of the Biden presidency (while Donald Trump Jr. tweeted that he had not heard of any bank failures during his father’s presidency, there were sixteen, eight of which happened before the pandemic). In fact, generally, a few banks fail every year; it is an oddity that none failed in 2021 or 2022.

The failure of SVB created shock waves for three reasons. First, SVB was the major bank for technology start-ups, so it involved much of a single sector of the economy. Second, only about $8 billion of the $173 billion worth of deposits in SVB were less than the $250,000 that the FDIC insures, meaning that the companies who had made those deposits might not get their money back quickly and thus might not be able to make payrolls, sparking a larger crisis. Third, there was concern that the problems that plagued SVB might cause other banks to fail, as well.

What seems to have happened, though, appears to be specific to SVB. Bloomberg’s Matt Levine explained it most clearly:

As the bank for start-ups, which have a lot of cash from investors and the initial public offering of stock, SVB had lots of deposits. But start-up companies don’t need much in the way of loans because they’ve just gotten so much cash and they don’t yet have fixed assets. So, rather than balancing deposits with loans that fluctuate with interest rates and thus keep a bank on an even keel, SVB’s directors took a gamble that the Federal Reserve would not raise interest rates. They invested in long-term Treasury bonds that paid better interest rates than short-term securities. But when, in fact, interest rates went up, the value of those long-term bonds sank.

For most banks, higher interest rates are good news because they can charge more for loans. But for SVB, they hurt.

Then, because SVB concentrated on start-ups, they had another problem. Start-ups are also hurt by rising interest rates because they tend to promise to deliver returns in the long term, which is fine so long as interest rates stay steadily low, as they have been now for years. But as interest rates go up, investors tend to like faster returns than most start-ups can deliver. They take their money to places that are going to see returns sooner. For SVB, that meant their depositors began to need some of that money they had dumped into the bank and started to withdraw their deposits.

So SVB sold securities at a loss to cover those deposits. Other investors panicked as they saw SVB selling at a loss and losing deposits, and they, too, started yanking their money out of the bank, collapsing it. Banks that have a more diverse client base are less likely to lose everyone all at once.

The FDIC took control of the bank on Friday. On Sunday, regulators also shut down Signature Bank, based in New York, which was a major bank for the cryptocurrency industry. Another crypto-friendly bank, Silvergate, failed last week.

Congress created the FDIC under the Banking Act of 1933 to restore trust in the American banking system after more than a third of U.S. banks failed after the Great Crash of 1929, sparking runs on banks as depositors rushed to take out their money whenever rumors suggested a bank was in trouble, thus causing more failures. The FDIC is an independent agency that insures deposits, examines and supervises banks to make sure they’re healthy, and manages the fallout when they’re not. The FDIC is backed by the full faith and credit of the government, but it is not funded by the government. Member banks pay insurance dues to cover bank failures, and when that isn’t enough money, the FDIC can borrow from the federal government or issue debt.

Over the weekend, the crisis at SVB became a larger argument over the role of government in the protection of the economy. Tech leaders took to social media to insist that the government must cover all the deposits in the failed bank, not just the ones covered under FDIC. They warned that the companies whose deposits were uninsured would fail, taking down the rest of the economy with them.

Others noted that the very men who were arguing the government should protect all the depositors’ money, not just that protected under the FDIC, have been vocal in opposing both government regulation of their industry and government relief for student loan debt, suggesting that they hate government action…except for themselves. They also pointed out that in 2018, under Trump, Congress weakened government regulations for banks like SVB and that SVB’s president had been a leading advocate for weakening those regulations. Had those regulations been in place, they argue, SVB would have remained solvent.

It appears that Yellen, Powell, and Gruenberg, in consultation with the president (as required), concluded that the collapse of SVB and Signature Bank was a systemic threat to the nation’s whole financial system, or perhaps they concluded that the panic over that collapse—which is a different thing than the collapse itself—was a threat to the nation’s financial system. They apparently decided to backstop the banks to prevent more damage. But they are eager to remind people that they are not using taxpayer money to shore up a poorly managed bank.

Right now, this appears to leave us with two takeaways. The Biden administration had been considering tightening the banking regulations that were loosened under Trump, and it seems likely that the need for the federal government to step in to protect the depositors at SVB and Signature Bank will make it much harder for those opposed to regulation to keep that from happening. There will likely be increased pressure on the Biden administration to guard against helping out the wealthy and corporations rather than ordinary Americans.

And, perhaps even more important, the weekend of panic and fear over the collapse of just one major bank should make it clear that the Republicans’ threat to default on the U.S. debt, thus pulling the rug out from under the entire U.S. economy unless they get their way, is simply unthinkable.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Finance#the economy#Heather Cox Richardson#Letters From An American#Banking regulation#bank collapse#bank failure#Max Gustafson#debt#student loan debt#venture capitalists

81 notes

·

View notes

Text

A historically hot summer continues its deadly rampage with no signs of letting up.

A historically hot summer in the United States is causing a deadly surge in July, with the toll expected to rise as the hottest days are yet to come.

This has been the hottest summer on record for around 100 US cities, spanning from Maine to California. Heat is suspected in the deaths of at least 37 people in the US in July, though this number is likely underestimated due to the time it takes to attribute deaths to extreme heat, nature’s most prolific weather killer.

See more:

youtube

Many of the deaths have occurred in the West, where cities have shattered all-time high-temperature records during an unprecedented and prolonged heatwave—conditions scientists link to the effects of climate change driven by fossil fuel pollution.

In Santa Clara County, California alone, heat is being investigated as the cause of at least 19 deaths, according to the county’s medical examiner office.

While everyone is vulnerable to heat, certain groups are at higher risk. These include children, the elderly, pregnant individuals, people with heart or blood pressure issues, outdoor workers, and anyone without access to reliable cooling.

In Santa Clara County, at least three of the potential heat-related deaths involved unhoused individuals without adequate access to cooling, and nine were over the age of 65, the county medical examiner reported to CNN.

In Southeast Texas, at least one person has died from heat-related causes, as over 1 million people remain without power four days after Hurricane Beryl. Others have died or fallen ill from improper attempts to stay cool using generators.

Tragically, four children have lost their lives this month due to heat-related incidents: a 2-year-old in Arizona and Georgia, a 4-year-old in Texas, and a 5-year-old in Nebraska who were left in cars. Additionally, a 10-year-old child died from a heat-related medical event while hiking in a Phoenix park amid scorching temperatures last week, as Phoenix has broken or tied multiple daily heat records since July began.

See more: https://www.flickr.com/photos/weatherusa_app/53775099164/in/dateposted-public/

In Phoenix, temperatures have soared above 110 degrees, with nightly lows remaining above 90 degrees since last Tuesday. Maricopa County is investigating dozens of deaths potentially linked to extreme heat.

Oregon has reported at least 10 suspected heat-related deaths, with six occurring in Portland's Multnomah County. Portland saw record-breaking highs for five consecutive days last week, with temperatures reaching triple digits on three occasions.

The heat wave has also impacted outdoor enthusiasts. A motorcyclist succumbed to heat exposure in Death Valley, where temperatures soared to 128 degrees, setting a new daily record and coming within six degrees of the hottest temperature ever recorded on Earth.

A 50-year-old man also tragically passed away while hiking in Grand Canyon National Park on Sunday amid extreme heat, confirmed by the National Park Service.

Climate and Average Weather Year Round in 44102-Cleveland-OH:

https://www.behance.net/gallery/200457469/Weather-Forecast-For-44102-Cleveland-OH

Confirming heat as the cause of these deaths remains a complex process, as noted by David S. Jones, a physician and historian at Harvard University, in previous comments to CNN. Medical examiners or coroners must determine a single cause of death, and in some areas, these officials may lack medical backgrounds, being political appointees or elected officials.

"The assessment of (cause of death) itself is intricate," Jones explained. "For instance, if someone is found deceased in an apartment, determining the primary cause of death—such as attributing it to heart disease because the heart stopped—is often the approach taken by many medical examiners."

As more deaths are confirmed and temperatures remain high, heat-related fatalities are expected to increase in the coming weeks.

While the intense heat in the Western United States is set to gradually ease starting late this weekend, temperatures will return to near-normal or slightly above-average summer levels. July typically remains hot across the region, even without daily record-breaking heat.

Across much of the US, above-average temperatures are forecasted to persist through the end of July and potentially into early August, according to the Climate Prediction Center.

See more:

https://weatherusa.app/zip-code/weather-80023

https://weatherusa.app/zip-code/weather-80024

https://weatherusa.app/zip-code/weather-80025

https://weatherusa.app/zip-code/weather-80026

https://weatherusa.app/zip-code/weather-80027

5 notes

·

View notes

Text

Crinkles from Silicon Valley Animal Control Authority in Santa Clara, California

Click here for more information about adoption and other ways to help!

Click here for a link to Silicon Valley Animal Control Authority's main website.

Greetings to you, ladies and gents, I'm Crinkles! I know you see a very handsome fellow with crisp blue eyes but guess what - I also happen to be a big ol' sweetie pie too! That's right, I'm the complete package, looks and personality. If you have a loving fur-ever home for a guy like me, here I am!

38 notes

·

View notes

Text

Excerpt from this LA Times story:

California wildlife policymakers have opted to protect the diminutive Western burrowing owl as they consider listing the rapidly declining species as endangered or threatened.

The state Fish and Game Commission unanimously voted last week to make the unique avian a candidate for permanent safeguards under state law while acknowledging the perspectives of stakeholders from industries that could be affected by the decision.

Conservationists point to development, agriculture and clean energy projects as contributing to the owls’ decline by snatching habitat. Some industry representatives pushed back on the claims and underscored the importance of their role in the state.

“I think economics versus conservation is a false choice,” commission President Samantha Murray said during the Thursday meeting. “In California, we have the fifth-biggest economy in the world. We can have solar and housing and food and burrowing owls.”

The commission rejected a similar bid for protections roughly 20 years ago, and since then the situation has become more dire for the bird — the only owl species to nest and roost in underground burrows. Proponents of exploring the listing of the owls under the California Endangered Species Act said existing regulations and management strategies haven’t worked.

In 2003, when a petition to consider listing the species was denied, there were no more than 10,500 breeding pairs, according to the California Department of Fish and Wildlife. As of last year, there were, at most, 6,500 pairs.

It’s believed the owl with bright yellow eyes has been extirpated from 16% of its range in parts of the coast and Central Valley. It has been nearly wiped out in 13% of its range, also in those regions. In the Bay Area, the owl is barely hanging on.

“At long last there’s a glimmer of hope for California’s rapidly disappearing burrowing owls, who desperately need protection,” said Jeff Miller, a senior conservation advocate at the Center for Biological Diversity, in a statement.

In March, the center, along with the Defenders of Wildlife, the Burrowing Owl Preservation Society, the Santa Clara Valley Audubon Society, the Urban Bird Foundation, the Central Valley Bird Club and the San Bernardino Valley Audubon Society, filed a petition with the commission seeking endangered or threatened status for burrowing owl populations. Miller penned both the 2003 and 2024 petitions.

Miller describes the owls as “eggs on legs” because the animal’s round head and body sit atop long, skinny legs. They stand just 7 to 10 inches tall and, as their name suggests, nest underground. “They can seem kind of goofy,” Miller told The Times earlier this year.

4 notes

·

View notes

Link

Silicon Valley Power (SVP) is talking about a new, mid-year rate increase, about six months after the last increase. In May, SVP is expected to bring the issue to the Santa Clara City Council. The utility wants to increase rates by 5% starting July 1, 2023. According to the City press release, “As you may have read in the headlines, unforeseeably high natural gas prices have had a significant impact on electric and gas utilities throughout California. Read more at svvoice.com

#Santa Clara Local News#Latest news Santa Clara#Santa Clara latest Local News#Santa Clara City Politics News#City Council#California News#Santa Clara City Council#Silicon Valley Power (SVP)

0 notes

Video

Bay View Golf Club Golf Course Aerial by David Oppenheimer Via Flickr: Bay View Golf Club Golf Course golf course at 1500 Country Club Dr, Milpitas, California aerial view - Copyright 2018 David Oppenheimer - Performance Impressions aerial photography archives - www.performanceimpressions.com

#Summitpointe Golf Club#Summitpointe#Milpitas#golf course#1500 Country Club Dr#clubhouse#golf#golfing#California#Silicon Valley#aerial#aerial photo#aerial photographer#1-7090215763#Santa Clara County#golfers#luxury#private#real estate#golf club#campus#property#land#club#private club#Bay Area#95035#United States#USA#VA 2-169-384

0 notes

Text

US government moves to stop potential banking crisis

The U.S. government took extraordinary steps Sunday to stop a potential banking crisis after the historic failure of Silicon Valley Bank, assuring depositors at the failed financial institution that they would be able to access all of their money quickly.

The announcement came amid fears that the factors that caused the Santa Clara, California-based bank to fail could spread, and only hours before trading began in Asia. Regulators had worked all weekend to try and come up with a buyer for the bank, which was the second largest bank failure in history. Those efforts appeared to have failed as of Sunday.

In a sign of quickly the financial bleeding was occurring, regulators announced that New York-based Signature Bank had failed and was being seized on Sunday. At more than $110 billion in assets, Signature Bank is the third-largest bank failure in U.S. history.

They have unlimited money for war and to bail out the banks, but SNAP benefits get cut during an inflation crisis. - redguard

48 notes

·

View notes