#c-132 caps

Explore tagged Tumblr posts

Text

Chamomile Comic Trivia #25

#129 - List

A bit of a convoluted setup, but I wanted to do something a little less directly halloweeny for October’s comics in 2019 and came up with this idea - I always have been a big fan of the ghostly-voices-heard-in-a-recording trope.

It’s only barely visible in the earlier panels with a speech bubble covering it in the one shown above here, but Cammie’s hair clamp from #117 is resting next to her bedside table.

#130 - Ghosts

For story arcs, I’ve always tried to make every single Chamomile Comic’s context possible to piece together even if someone hasn’t read the ones that came before it as best I can, but in this case the previous comic was so particular and unusual that Cammie would literally need to describe the entire scene that late readers will have just read, so I made a joke out of it instead, almost serving as a marker where I made the decision to not get hung up on it anymore when it’s too hard, lol.

#131 - Whispers

I didn’t choose Layla at random, it’s an important note that she’s the one who bought into Cammie’s nonsense here. It’s never really been the subject of any focus or story arc but I do think Cammie and Layla’s friendship has an unspoken flavour to it that feels a bit different from Cammie and Brianna’s, even though Cam and Bri are besties.

Having said that it presented me with the decision of whether to depict her without her hijab, and at this point in time I leaned away from the idea. Being brutally honest, I kind of expected people to make a big deal out of seeing her without it - it’s sort of an unfortunate but understandable downside of also being a femme-focused pin-up artist, having a cast of women, and drawing it all in a cute art style. A lot of people are here who admire cute feminine character art and I’d be a hypocrite to say there’s anything inherently wrong with that when that’s literally what half my art is! I think I was right with this judgement too, because I definitely did get a comment or two from folks who were all “aww I thought we were gonna get to see her hair”. I know there’s tons of people who like me would shift their mindset to think nothing of it, but I know the folks who don’t would kind of bug me, so I think it’s easier to just not.

Having said all of this, I can’t deny it was a really fun artistic challenge to come up with a way to hide her lack of hijab in the nighttime scene without it feeling intentionally like an Austin Powers prop censorship gag - at least that was my hope!

Realistically I don’t think she would be wearing a cap around Cammie in the morning scene - in more recent comics of course we had another scene where Cammie and Layla shared a room, and I decided to go for a middleground where the point of her hijab is still kept for the audience but I was a little more relaxed about it, since I’ve read threads from folks who wear hijabs who feel it’s misrepresentational to depict them being worn 24/7.

#132 - Accent

Not much to say here. I swear there was a story or inspiration behind the gag of Cammie’s sleeptalking, but it’s gone forever now! I did enjoy deciding that the pure and innocent Cammie has horrifically unsettling dreams that she thinks nothing of.

#133 - Cereal

This was just a one-off gag I had in the idea bank for a while that I never quite knew how to do. The punchline of “all these cereals have expired” was always there and this could have just been a Cammie at home talking to herself strip, but somehow said punchline didn’t feel as funny talking to herself as it did to another character, no idea why. This arc was a perfect opportunity to finally use it even though it doesn’t tie into the actual story of the arc whatsoever (which is fine of course, it’s November by now).

Cammie’s cereals are:

Sugar Crunch (with added Vitamin), a broad parody of sweet cereal Moist Nuts, which is just some funny words Frog Flakes, with regular JezMM mascot Frogy of course Mostly Bran, a parody of All-Bran Wheated Bix, a parody of Weetabix Corny Puns, both a parody of Corn Flakes and one of many silly cereal names that showed up in my old comic Phantasm Dyad, in the episode where they were tracking down the cause of a gaggle of inanimate object ghosts found on the beach - a Cereal Killer.

Funnily enough, another cereal in that comic was “Corned Flakes”, which is basically the same joke as Wheated Bix. Mr. Burns saying “I am enjoying this Iced Cream” in The Simpsons was one of those humour-defining moments for me as a kid I think.

#134 - Dark

Just complaining through my characters here. I hate when the clocks go back and would always rather have more light in the afternoon than the morning. Having the daylight end at 4pm is so depressing, but waking up in the dark and having it get light as your day begins is sort of romantic to me.

I do like how this one has sort of unique lighting - very few comics that take place exactly at dusk like this and I tried to capture that vibe even though it’s just a standard blurry background.

[More Chamomile Comic Trivia] (Above link may not work correctly on tumblr app)

8 notes

·

View notes

Text

1: 0 1 2 3 4 6 a b c d e f g h i j k l m n o p r s t u v w x y 30/36 (24/26) (6/10)

2: 00 0h 10 13 2m 42 ab ac ae af ag al am an ap ar as at bc be bi br bs bu ca cc ce ch ci cn co da dd de dy eb ed ei el er es et ev ew ex fa fo fr ft ge gg go he hi ho hy ib ic id ie il in io is it jo ju kn la ld le li ll lo lu ly ma mi mm mp na nd ne ng nk nl no ns nt nu oc of oi ol om on or ot ou ow pi pl pu ra rc rd re ri rl rn ro rs rt ru ry sa se sh si sm so ss st su ta te th ti to tt tu ty ud ue um un ur us ut ve we wh wi wn wo ws xa yo 148/1296 (142/676) (6/100)

3: 100 10h abs ace aes aft agg amp and ant arc ari art ass ati ato ber bit bra bru bso bud but cae cap cch cel cie cne coi com dag dan ddy der des ebr ele ell ely ere ers ert esa est ety eve ews exa fac for fro fte ger gge gol hel hid hil hin his how ibe icn ide iet ila ina ing ink ins ion iou ism iss ith itt jou jus kno lar leb les lib low lut mar mat mis mit mmi mpl nal nat nde net new nly not now nte num oci oin old olu omm one onl ont ord orl ory ota our ous owe owi own pit ple put rat rcc rde red rev rio rld rna ron rse rst rti rty rut sar sas sho sin sma soc sol ssa ssi ssu sta sue tan tat ted tel ter the thi tic tio tor tte tus udd ued umi und urn ust ute utu ver wes why win wit wor xam you 176/46656 (174/17576) (2/1000)

4: abso aesa afte agge ampl ante arcc ario arti assa assi atic atio ator bert brat brut bsol budd caes cele ciet cnew coin comm dagg dant dere ders ebra eleb ered erse erst erty esar ever exam face fron fter gers gger gold hell hila hink howi iber icne ides iety ilar inat ious isma issu itte jour just know lari lebr libe lowe lute marc mati mism mitt mmit mple nati nder news nota nown numi ocie oins olut ommi only orde orld otat ourn owes owin ples rato rcch rder reve riou rnal ront rsta rutu sass show sina smat soci sold solu ssas ssin ssue stan sued tand tati tely thin this ticn tion tory tted uddy umis unde urna utel utus vers west wing with worl xamp 132/1679616 (132/456976)

5: absol aesar after agger ample arcch ariou assas assin aticn ation atory berty brato brutu bsolu buddy caesa celeb ciety cnews coins commi dagge dante dered derst ebrat elebr ersta evers examp front ggers hilar howin ibert icnew ilari inati ismat issue itted journ known lario lebra liber lowes lutel marcc matic misma mitte mmitt mples natio nders notat numis ociet olute ommit order otati ourna owest owing rator rdere rever rious rstan rutus sassi showi sinat smati socie solut ssass ssina ssued stand tatio think ticne umism under urnal utely verse world xampl 94/60466176 (94/11881376)

6: absolu aggers amples arious assass assina aticne brator brutus bsolut caesar celebr commit dagger dersta ebrato elebra erstan everse exampl hilari howing iberty icnews ilario inatio ismati issued journa lariou lebrat libert lowest lutely marcch maticn mismat mitted mmitte nation nderst notati numism ociety olutel ommitt ordere otatio ournal ratory rdered revers rstand sassin showin sinati smatic societ solute ssassi ssinat tation ticnew umisma unders xample 66/2176782336 (66/308915776)

7: absolut assassi assinat aticnew bratory bsolute celebra committ daggers derstan ebrator elebrat erstand example hilario ilariou ination ismatic journal larious lebrato liberty maticne mismati mmitted ndersta notatio numisma olutely ommitte ordered otation reverse sassina showing sinatio smaticn society solutel ssassin ssinati ticnews umismat underst xamples 45/78364164096 (45/8031810176)

8: absolute assassin assinati aticnews bsolutel celebrat committe derstand ebratory elebrato examples hilariou ilarious ismaticn lebrator maticnew mismatic nderstan notation numismat ommitted sassinat sination smaticne solutely ssassina ssinatio umismati understa 29/2821109907456 (29/208827064576)

9: absolutel assassina assinatio bsolutely celebrato committed elebrator hilarious ismaticne lebratory maticnews mismaticn nderstand numismati sassinati smaticnew ssassinat ssination umismatic understan 20/101559956668416 (20/5429503678976)

10: absolutely assassinat assination celebrator elebratory ismaticnew mismaticne numismatic sassinatio smaticnews ssassinati umismaticn understand 13/3656158440062976 (13/141167095653376)

11: assassinati celebratory ismaticnews mismaticnew numismaticn sassination ssassinatio umismaticne 8/131621703842267136 (8/3670344486987776)

12: assassinatio mismaticnews numismaticne ssassination umismaticnew 5/4738381338321616896 (5/95428956661682176)

13: assassination numismaticnew umismaticnews 3/170581728179578208256 (3/2481152873203736576)

14: numismaticnews 1/6140942214464815497216 (1/64509974703297150976)

74K notes

·

View notes

Text

Faygo: Cotton Candy (Review)

(our ratings & experiences)

Flavour Accuracy

Myles: 16/20

Roni: 18/20

Average Rating: 17/20

If the people at Faygo were trying to replicate the amount of sugar that goes into cotton candy, they were spot on. However, only the smell and the aftertaste of the drink felt accurate to cotton candy. Try not to gulp down too much of it at once. It tastes less like cotton candy the more you have it in a short amount of time

This smelled and tasted just like cotton candy almost all the way through to me, only it lacks an immediate flavour profile until about a second after you take a sip. Agreeing with Myles on the fact that it tastes less and less like cotton candy the more you drink, which is only slightly concerning. I think my taste buds stopped processing the sweetness about half way through my bottle.

Health Concern

Myles: 9/20

Roni: 11/20

Average Rating: 10/20

Didn't have much concern at first. Quickly drinking the stuff however left a sickly sweet taste in my mouth and it made me wonder if this is a soft drink I should be spending $6 AUD on.

Generally speaking, I could feel that this was bad for my stomach as I drank it. However, because of how cotton candy-esque it tasted, it also felt like it was lighter on sugar than it actually was (132% of the daily intake of sugar in a single bottle...) It honestly could've been worse. Was going to give a 16 before my stomach started cramping abnormally, like my body was rejecting this sudden increase of sugar. -5 for that.

Color Appeal

Myles: 19/20

Roni: 15/20

Average Rating: 17/20

10/10 liquid color. Reminds me of pool water without all the chemicals and the smell. Not sure if this is just a me thing but any drink that's brightly colored greatly appeals to me.

I like the colour blue as much as the next person and I think that if I were to drink any blue liquid, this would be the most appealing shade of blue there is. Capping it at a solid 15 though, just because the colour blue doesn't scream 'ingestible' to me. Reminds me of cleaning solution or liquid car coolant.

Overall Enjoyment

Myles: 10/20

Roni: 8/20

Average Rating: 9/20

Try not to drink a lot of this in a short period of time like I did. Better to savour the flavour over time instead of ruining the experience by getting sick of the taste too quickly.

The more time spent I drinking this, the worse I felt about what I was drinking. The first few sips were actually pretty enjoyable, but drinking the last third of it was legitimately the most challenging thing I did today.

Re-drinkability

Myles: 12/20

Roni: 7/20

Average Rating: 9.5/20

Because of the way this particular flavor seems to get worse the more I have it, I would NOT get this drink again. The only time I'd ever drink this again is when there aren't any other good Faygo flavors available.

I experienced Cotton Candy Faygo once, and I have no desire to purchase another bottle for myself soon. However, if somebody offered me a smaller amount of it, I wouldn't refuse to take it.

Summary

Myles' Rating: 66/100

Roni's Rating: 59/100

Average Rating: 62.5/100

Grade: C

1 note

·

View note

Text

Looks like I’m losing 1 lbs a day. Not bad, I miss losing 2 lbs a day as a teenager lol. I didn’t have as strong will power back then as I do now tho. I’m proud, confident. I only bought my scale 2 days ago. I wanted to lose at least 10 lbs and see if I can fit into the dress. At this point, imma aim for 20. I can lose 20 lbs in 20 days. That will be I c o n I c. No one is stopping me. No one can stop me. I don’t even have to hide this. I’m so fucking excited. I’m watching eurphoria too which is a huge distraction. I would go on ED tumblr and then just forget I’m even hungry. After euphoria I can watch those ED movies again bc those are always inspiring. Heck by my birthday I can be so small and skinny.

I start to look good at 114 lbs. we will get back to 100 lbs. for now let’s focus on 10. I started earlier but I didn’t know my weight. So let’s say we started at 135.

SW: 135

CW: 133

GW1: 125

GW2:115

GW3: 105

GW4: 95

GW5: 85.

We will cap it at 85lbs for now. It’s a long road ahead but I believe we can get there.

I have noticed that sometimes it will take a day and a bit to lose 1 lbs. I want to start fasting by 7. Deff have tea n all but no food after 7 so I have to eat dinner at work. Maybe I won’t have to tonight bc it’s the weekend tomorrow. It was hard throughout the week bc I couldn’t sleep on an empty stomach. Which then effects the weight loss in the AM which can get frustrating. You’re doing everything right Sav. Eating one small meal a day. Yesterday was sushi. I have pasta in the fridge I can eat when I get home tonight. Will I have a non alone today? Goodness no. I might ngl. We will see. I’ll be strong and won’t. I’ll have a mocha instead. The mocha isn’t very sweet which is nice. Maybe a regular coffee. Idk I’m not big on americanos. I bought the Godiva coffee so that really helps when it comes to fasting. I haven’t started fasting yet but I think I’ll get there soon. I just love an ice latte in the AM.

Fingers crossed we are down to 132 tomorrow. It’s a waiting game. If not at least I have the weekend to workout and clean to burn those calories. Maybe I’ll fast. I can go to the beach and walk or south lands. I dunno but it will be nice either way.

1 note

·

View note

Note

why do u rb from so many ppl that ship ri//ck and mo//rty ce//st ,,

I have all that blacklisted. If I see cool fan art, I reblog it. I don’t really care for all that drama. I’m just here for the cool and funny things this fandom produces. But just to be clear, anything I reblog I assume is just normal everyday stuff. People can add whatever label they want, see what ever they want but I don’t see it that way. I’m not here to judge.

#replies#just to be clear as well I don't ship any of that stuff#I just don't care lol#anything I reblog I assume it's ship free#c-132 caps

24 notes

·

View notes

Text

I posted 132 times in 2021

22 posts created (17%)

110 posts reblogged (83%)

For every post I created, I reblogged 5.0 posts.

I added 345 tags in 2021

#whump - 106 posts

#bromance - 79 posts

#fanfiction - 26 posts

#collapse - 23 posts

#penpatronus - 21 posts

#penpatronusaooo - 21 posts

#worry - 18 posts

#tony stark - 18 posts

#steve rogers - 17 posts

#unconscious - 16 posts

Longest Tag: 108 characters

#i want to make it clear that ya boy just met this dude in the first gif and that's how gently he catches him

My Top Posts in 2021

#5

WHUMP STORIES!!! (With plots) Hurt Eddie, Hurt Buck, Hurt Christopher!

GIFTS

https://archiveofourown.org/works/31871869

A reimagine of ”Survivors,” season 4, episode 14. Whump, bromance, hurt/comfort, caregiving, drama, obligatory hospital scene. The sniper shoots the front tires of the ladder truck… right when Eddie and Buck are under it. What else could go wrong? Everything.

The Happiest Place on Earth is Wherever I Am With You

https://archiveofourown.org/works/32187871/chapters/79758115

Buck and Eddie are at Disneyland with Carla and Christopher when a plane crashes into the park. And that's not even the craziest thing that happens to them that day! Watch the injured boys traverse an obstacle course of fire and debris as they try to escape. I write Buck and Eddie as brothers, but I want my slash fan friends to please feel free to read this as pre-Buddie.

Sinking Ships

https://archiveofourown.org/works/32055805/chapters/79408603

Buck and Eddie are in the middle of the worst fight of their friendship when they board a burning cruise ship to help 100 other firefighters rescue the 5000+ passengers. It’s a disaster, but containable, until there’s a massive explosion and the ship starts to sink. Injured and in over their heads in more ways than one, will Buck and Eddie survive the robber-arsonists, save the passengers, repair their relationship, AND get off the sinking, burning ship alive?

Comments, kudos, bookmarks. You know what to do.

6 notes • Posted 2021-11-15 03:54:41 GMT

#4

https://archiveofourown.org/works/21084692/chapters/66585376

The sword was larger than Steve’s arm. He gently wrapped his left hand around it, then looked at Tony’s whitening face. “Hold on to me,” he instructed. Tony wrapped his arms around Steve’s neck and pushed his nose against his blue uniform. Steve counted to three, and pulled.

Tony screamed, nearly deafening his friend. His arms went limp, followed by the rest of his body, and he collapsed against Cap.

“Tony!”

“Is a’righ…” Tony said. He regained a bit of strength and sat up, his left arm against Steve’s right arm. “Is a’righ, C-Cap…” Tony aimed what was left of the suit that covered his right hand, and sprayed what looked like a thick mist of chemicals against his wound. The bleeding instantly stopped. Steve touched the sealant, mesmerized. It was warm. Tony took the device off his hand, then, and handed it to Steve. “Press your middle and forefinger down and to the left,” he instructed. Steve, realizing what Tony wanted him to do, put the device around his hand, gently leaned Tony forward so that he could get to his back, and applied the sealant to the exit wound. Tony grunted and coughed. He put his face in his hands and groaned, then leaned, once again, against Steve’s chest.

CONTINUED::

https://archiveofourown.org/works/21084692/chapters/66585376

7 notes • Posted 2021-05-18 08:55:23 GMT

#3

https://archiveofourown.org/works/21084692/chapters/65996959#workskin

Like a raw slab of meat hanging in a slaughterhouse. That’s what Tony felt like – no, that’s what he was. The chains he was shackled to hung from the ceiling of a vast circular room. He stood on tiptoes on a platform, hanging from his wrists. Around the platform, behind tinted windows, were dozens of what the ringmaster called “the bidders.” Tony didn’t know the ringmaster’s name, so that’s what he nicknamed him. Because the operation was a fucking circus, and Tony was the main attraction.

The ringmaster had long, bleached-blond hair, and fish breath. He wore a tux like they were at the opera. Tony wore only dark jeans. When he was taken he was stripped, which was the most pleasant part of the kidnapping. That was 24 hours ago. He’d traveled by private plane and didn’t eat, didn’t sleep, and didn’t get any water as the kidnappers celebrated their victory with champagne.

The ringmaster strolled over to the dangling Tony Stark and whispered to him, “Let’s put on a good show, eh, Stark?”

Tony spat in his face. “I’m not your dancing monkey.” He received a punch to the mouth for that, and Tony’s bottom lip split open. Blood trailed down his chin.

“No, you’re not,” the ringmaster said, “you’re the punching bag.”….

Continued::

https://archiveofourown.org/works/21084692/chapters/65996959#workskin

8 notes • Posted 2021-05-18 22:39:43 GMT

#2

https://archiveofourown.org/works/21084692/chapters/65381686#workskin

They were supposed to sneak through the forest in the middle of the night and take out the arms dealer’s base quickly and quietly. But, somewhere along the way they tripped an alarm and when they emerged from the tree line, the bad guys were waiting for them. A dozen spotlights landed on the Avengers, and a hundred guns started firing. Strange and Wanda got their shields up. Cap ordered the group to advance with Iron Man, Hulk, Vision, and Parker going high down the middle; Nat, Strange, and Steve going left; and Clint, Wanda, and Thor going right. The Avengers took two steps forward – and then the mission was abruptly called off. Called off, because one of their big guns went down fast.

Tony was in the middle of saying, “Is that a fucking catapult?” when the catapult propelled a shower of liquid silver all over the Iron Man suit. The liquid coated the suit and solidified within seconds, taking the exact shape of a human body. Unfortunately, it wasn’t silver – it was liquid Vibranium. Tony dropped from the sky like a dead bird…..

CONTINUED::

https://archiveofourown.org/works/21084692/chapters/65381686#workskin

8 notes • Posted 2021-05-15 00:28:13 GMT

#1

Sinking Ships

Chapter 3: A Bullet for Buck

READ HERE https://archiveofourown.org/works/32055805/chapters/79516690#workskin

Buck’s heartrate skyrocketed. He raised his arms in surrender, locked eyes with Eddie and begged, without looking away from his friend, “Don’t shoot him. Please.”

The man behind the gun pointed at Eddie’s head was tall, lanky, dressed in black, and wearing Buck’s missing helmet. A shorter man behind him, wearing Eddie’s helmet, pointed his own gun and went to stand beside Buck, weapon pointed up at his temple. Eddie’s eyes widened and his lips clenched like a fist.

“What suite was she in?” the taller guy repeated. “Where’s that jewelry?”

READ MORE HERE https://archiveofourown.org/works/32055805/chapters/79516690#workskin

17 notes • Posted 2021-06-22 12:12:53 GMT

Get your Tumblr 2021 Year in Review →

4 notes

·

View notes

Text

The UK’s average gas and electricity bill

The average gas and electric bill in the UK is a big deal. We all want to know what the average cost is so we can make sure we’re below it. After all, who wants to pay more than they have to when it comes to energy?

According to January 2022 figures from industry watchdog Ofgem, the average dual fuel variable tariff was £1,277 a year, or £106.41 a month.[1] So we can estimate that gas and electricity costs around £3.50 a day.

But average figures are a bit of a red herring. This is because average prices tend to be similar to the energy price cap ��� which makes average costs seem lower than they actually are. And as each bill depends on a number of factors such as location, usage and tariff type, they’ll vary immensely.

With the price cap set to rise from 1 April, average energy bills will also increase. But the latest January 2022 figures from Ofgem found that the cheapest tariff available was £1,205 a year, or £100 a month.[2]

Gas and electric bills in winter

Naturally bills for energy are going to be higher in the winter. Keeping a typical house warm in winter can easily cost around half of the yearly bill. In the summer you can let the sun do most of the work.

If winter in the UK is particularly harsh, costs will go up. Remember the ‘Beast from the East’ in 2018? That cold freeze brought a lowest temperature of -14°C to the Scottish mountain ranges. Unsurprisingly, energy consumption was higher than usual during that period, according to government data.

Gas and electric bills by people and property

We can break down the average gas and electric bill in the UK into small, medium and large sized houses. The following are statistics we calculated, based on Ofgem and data for 2021.

Small house or flat, with 1 or 2 bedrooms or occupants

With an annual gas output of 8,000kWh and an electricity output of 1,800kWh

Average monthly utility bill of £66, annual cost £802

Average cost per person of £33 a month, £401 a year

Medium house with 2 or 3 bedrooms for 3 people

With an annual gas output of 12,000kWh and an electricity output of 2,900kWh

Average monthly utility bill of £95, annual cost £1,151

Average cost per person of £31 a month, £383 a year

Large house with 3 or 4 bedrooms and 5 people

With an annual gas output of 17,000kWh and an electricity output of 4,300kWh

Average monthly utility bill of £132, annual cost £1,592

Average cost per person of £26 a month, £318 a year

Cheapest energy prices in UK vs most expensive

Right, now we’ve dazzled you with data, we’re gonna tell you to move. Only joking. But the average price does change dramatically depending on where you live in the UK.

Let’s focus on electricity for this one. In 2021, areas like Northern Ireland, the South East, South West and South Wales paid 19.5p/kWh on average to supply electricity to their homes. But Merseyside and North Wales were the most expensive, paying as much as 20p/kWh.

Yorkshire, the North West, North East and East Midlands were among the cheapest, according to government data.

Reducing your energy costs

Whatever your situation, you can always reduce the cost of gas and electricity in your home.

Check out our tips to cut down energy costs for simple, practical things you can do to save money on your bills. Making a note of the most expensive appliances to run is a great place to start. Do you really need these? If you can live without them, it’ll help.

Alternatively, have a look at the average room temperatures and see how your home compares.

Have you thought about switching energy supplier? We can help you save money by finding you some of the best deals. If you have a few minutes to spare, let’s get to work.

[1]Average standard variable tariff on the market price from Ofgem‘s ‘Retail price comparison by company and tariff type: Domestic (GB)’ chart. Average price cap set by Ofgem from 1 April 2022.

[2]Average cheapest available tariff on the market price from Ofgem‘s ‘Average tariff prices by supplier: Standard variable and fixed default vs cheapest available tariffs (GB)’ chart. Average price cap set by Ofgem from 1 April 2022.

The post The UK’s average gas and electricity bill appeared first on Look After My Bills.

This content was originally published here.

0 notes

Link

The compact car offers more features than practical small dimensions. These vehicles can be very practical and easy to drive, with pleasant comfortable cabins, great for moving in or out of town, and many of their models today are also available with attractive interior space for passengers and luggage, along with features The high tech you are looking for.

Here's a list of the 10 best compact and small cars for shoppers of 2021, ranked from least to most important, according to CarMax's ranking.

1- Subaru Impreza

If you're looking for a small sedan or hatchback with all-wheel drive as standard, the Subaru Impreza delivers great traction in wet weather.

In addition to the all-wheel drive system, the car, starting from the 2017-2019 models, is equipped with a 152-horsepower 2.0-liter four-cylinder engine, which produces 145 pound-feet of torque and is connected to a five-speed manual transmission.

Whether you're cruising on city streets or looking for adventures off the track, this model is also engineered for responsive steering and looks sporty, especially around corners.

Standard features on the Subaru Impreza Limited include 17-inch alloy wheels and fog lights, along with leather upholstery as a feature of the interior. In addition, it is equipped with a 6-way electric driver's seat and an 8-inch screen

2- Ford Fiesta

Available as a sedan or small hatchback, the Ford Fiesta offers a range of powertrain options. The 2017-2019 models start with a 1.6-liter four-cylinder engine that delivers 120 horsepower and 112 pound-feet of torque.

2017 models start with the optional 1.0-liter turbocharged three-cylinder engine. The 2017-2019 Fiesta ST hatchback models can also offer motivating performance from its 197-hp 1.6-liter turbocharged four-cylinder engine with 202 lb-ft of torque.

The Ford Fiesta S comes well-equipped with 15-inch steel wheels with caps, power side mirrors, fabric upholstery, a six-speaker audio system and the SYNC ® infotainment system

3- Nissan Sunny

Whether you're shopping for a petrol car for the weekend or sharing a ride with friends, the Nissan Sunny is surprisingly roomy for its compact size. Especially the Note, with 14.9 cubic feet of luggage space, and the 2017-2019 models offer plenty of room for luggage or sports equipment.

Taller passengers may prefer to ride in the rear seat, which offers 37 inches of legroom under the hood and is powered by a 1.6-liter four-cylinder engine.

Standard features include 15-inch steel wheels with wheel covers, chrome exterior door handles, a six-way manual driver's seat, fold-down rear seats, and two 12-volt auxiliary power outlets.

4- Mazda 3

With its dynamic handling and impressive acceleration, the Mazda3 is a hugely popular small car, available as a sedan or hatchback, and base 2017-2018 models come with a 2.0-liter four-cylinder engine with 155 horsepower and 150 pound-feet of torque.

A choice of Touring or Grand Touring models gives you a four-cylinder engine with 184 horsepower and 2.5 liters for extra power.

It has a stylish interior with soft-touch materials and padded seats that can be comfortable for long drives. The Mazda3 has been redesigned for 2019 and is powered by a single 2.5-liter four-cylinder engine.

Standard features include an eight-way power-adjustable driver's seat, two-position driver's seat memory, heated front seats, a Bose ® 12-speaker audio system and aluminum front door speaker grilles.

5- Ford Focus

Offered in sedan and hatchback models, the Ford Focus is an affordable compact car that's great for commuting or running errands. Its 2017-2018 models come standard with a 2.0-liter four-cylinder engine with automatic transmission, or an optional 1.0-liter four-cylinder engine with a turbocharger.

With a quiet cabin and balanced handling that gives you a fun driving focus, whether you're going to the beach or on a shopping spree, you can enjoy plenty of room for your belongings with the 23.3 cubic feet of cargo volume capacity in the 2017-2018 hatchback.

Standard features include 17-inch alloy wheels, power sunroof, Sync 3 infotainment system, Apple CarPlay, and reverse sensing.

6- Volkswagen Jetta

A family-friendly sedan that's very practical and fun to drive. The 2017-2019 models start with a 1.4-liter turbocharged four-cylinder engine. If you want sporty performance, the 2017-2018 Jetta also offers two optional engines, including a four-cylinder engine. 170 hp 1.8-liter or 210 hp with a turbocharged 2.0-liter four-cylinder on the GLI.

With ample legroom and overhead room for taller passengers, and approximately 15.5 cubic feet of luggage capacity, the Jetta can be perfectly comfortable for long trips.

The redesigned 2019 Volkswagen Jetta SE includes features such as 16-inch black alloy wheels, power tilt/slide panoramic sunroof, dual-zone automatic climate control, heated front seats and forward collision warning system.

7- Chevrolet Cruze

Available as a sedan or small hatchback, the Chevrolet Cruze is stylish and well-suited to a variety of lifestyles. Whether you're sharing the kids or enjoying a night on the town, your passengers can enjoy plenty of personal space with 36.1 inches of rear-seat legroom available starting from 2017 models. -2019, including 14.8 cubic feet of volume in the sedan or 22.7 cubic feet in the hatchback

Available in five trim levels, the 2017-2019 Cruze includes several connectivity features, including Apple CarPlay and Android Auto integration on all models.

It also features 17-inch aluminum wheels, heated exterior mirrors, a heated leather-wrapped steering wheel, heated front seats, and an eight-way power-adjustable driver's seat.

8- Toyota Corolla

A compact sedan with a spacious interior that caters to your specific goals and travels, with 41.4 inches of rear-seat legroom on 2017-2019 models, taller passengers shouldn't feel cramped in this sedan. There is also 13 cubic feet of cargo volume for carrying luggage, groceries or baby gear. The Corolla 2017-2019 is powered by a 132-horsepower 1.8-liter four-cylinder engine.

The Toyota Corolla features 15-inch steel wheels, 60/40 fold-down rear seat fabric upholstery, a rear-view camera, and a 6.1-inch touchscreen.

9- Nissan Sentra

Spacious and comfortable, using a 1.8-liter four-cylinder engine producing 124 horsepower and 125 pound-feet of torque, the 2017-2019 Sentra is fuel-efficient and offers 37.4 inches of rear seat legroom and 15.1 cubic feet of cargo volume, making it Flexible to accommodate sports or camping equipment.

By folding the 60/40 split rear seats and reclining the front passenger seat, you can even fit eight-foot items into this sedan.

Standard features on the Nissan Sentra SV include heated front seats, fabric upholstery, a leather steering wheel, a six-speaker audio system, and a rearview monitor.

10- Honda Civic car

Topping the list is the Honda Civic, which offers a plethora of options with three body styles, a long list of equipment, and two high-performance models: the 2017-2019 Civic C and Cape R, which start with 158 horsepower from a 2.0-liter four-cylinder engine, or with a 174-liter four-cylinder engine. 1.5 hp turbocharged (EX-T models and higher in 2017-2018, EX models and higher in 2019 models).

On the road, the Civic is designed to drive with confidence and deliver excellent handling that feels comfortable when cornering or traveling off-road.

Standard features on the 2017-2019 Honda Civic Touring include chrome door handles, rain-sensing windshield wipers, heated front and rear seats, and a 4-way power-adjustable passenger seat, with a 10-speaker audio system.

Source: CarMax

0 notes

Text

Counter Sports are NOT required to give full scholarships. Schools can and do give partials in football.

I’ve had supposedly knowledgeable sports media personalities tell me I was wrong and imply that I am clearly an idiot for thinking that the reason most athletes get full scholarships in revenue sports is because they are worth it, and instead I must not know that all counters are required to get a full GIA if they even get $1 of athletic aid. I have heard it dozens of time that “partial scholarships are not allowed in college football or basketball”

It’s totally false and it misreads the counter rules so completely that it confuses an interesting economic fact (Most P5 schools give out 100% of their allowed scholarship money in football and men’s basketball) with a rule ( supposedly b/c they have to, but they don’t).

Despite being false, I’ve had ADs like Dan Radakovich of Clemson tell me it is against the NCAA rules to give partial scholarships if any counter sport, including FB, MBB, and WBB.

https://youtu.be/72Gr3tzFJTg?t=3006

I’ve had supposedly knowledgeable sports media personalities tell me I was wrong and imply that I am clearly an idiot for thinking that the reason most athletes get full scholarships in revenue sports is because they are worth it, and instead I must not know that all counters are required to get a full GIA (quick terminology note: GIA is slang for “athletic scholarship -- it stands for Grant-in-Aid) if they even get $1 of athletic aid.

https://twitter.com/dandakich/status/907378048911204352

I’ve had random twitter bros tell me partials aren’t allowed in football and basketball as well:

https://twitter.com/FlyforaWeitzguy/status/907392030170640384

https://twitter.com/mloos2121/status/848740369667956741

(to be fair to Mr. Loos, when presented with some data, he admitted he might be wrong: https://twitter.com/mloos2121/status/848741840769646592 )

Despite the implied knowledge of NCAA rules with which some claims are tossed out, the claim that football (or any counter sport) mandates full GIAs is false. It’s False. Stop telling yourself it’s true because it’s false. In what follows I will first present the rule and explain why it allows partial scholarships. Next, I will provide public data, recently unredacted, showing that schools in the Mac and the Sunbelt frequently provide partial scholarships in football, which is empirical evidence that the rule does not forbid them from doing this. And then finally, if you make it that far, I’ll explain why this matters for assessing athlete value.

Part I: The Relevant Rules

First the rules themselves, as per the NCAA’s D1 2017-18 bylaws.

15.5.1 Counters. A student-athlete shall be a counter and included in the maximum awards limitations set forth in this bylaw under the following conditions: ...

(a) Athletics Aid. A student-athlete who receives financial aid based in any degree on athletics ability shall become a counter for the year during which the student-athlete receives the financial aid; or...

What this says is if you receive even a penny of athletic aid, you are a “counter” under NCAA terminology. Remember that term and its definition.

15.5.6.1 Bowl Subdivision Football. [FBS] There shall be an annual limit of 25 on the number of initial counters (per Bylaw 15.02.3.1) and an annual limit of 85 on the total number of counters (including initial counters) in football at each institution.

This rule says that you can’t have more than 85 total counters, and, as above, if you give even a penny of aid to anyone in a counter sport like football, he “counts” and so this means only 85 people can receive aid at one time (with limited exceptions for things like being on medical redshirt, etc.)

Finally, there is the following FBS-specific requirement (per Figure 20-1)

which says FBS members must:

"provide an average of at least 90% of permissible maximum number of football grants-in-aid during a rolling two-year period” and

"Annually offer a minimum of 200 athletics grants-in-aid [across all sports] or spend $4 million on athletics grants-in-aid [across all sports] annually.”

So for those who are not quick at numbers, 90% of 85 is 76.5, which means if you have FBS football, you have to give at least 76.5 GIAs worth of aid and you cannot give more than 85 GIAs worth of aid.

Those are literally the rules on what you can/cannot give a counter [other than, of course, the cap itself which sets the maximum value of a GIA, but that is a subject of a thousand different posts and lawsuits, etc., let’s stay focused on this one point!] and if you want to tell me there is a rule mandating full GIAs for counters in football, feel free, but you will need to point me to a specific rule to prove it. And good luck, because such a rule doesn’t exist.

Part II: Empirical Data

If there were such a rule, (which there is not) then what we would NOT see is schools with a different number of counters (i.e., athletes getting some aid) and number of full-GIA equivalencies . If there are more counters than equivalencies, someone is getting less than full aid. And if we see a large disparity on this dimension, year after year, then it is not some weird one-time glitch or whatever.

Remember that schools have to give 76.5 GIAs and cannot give more than 85. And what does the empirical data show? Well, in public documents from the “in re NCAA Athletic GIA Antitrust Litigation” case (also known as “Alston/Jenkins” or “The Kessler Case”), my colleague Dan Rascher had access to individual athletes’ financial aid data. A lot of it remains under seal, but one piece that is public explains that

“In the Sun Belt and Mac, an average of 7.35 counter per school received less than 90% of a GIA... the least five compensated GIA recipients from each of the 24 teams in those two FBS conference received an average of 30% of a GIA...” (my bold added for emphasis)

Here’s that document, which you can pull off of the PACER system at“Case 4:14-md-02541-CW Document 809-67 Filed 04/06/18 Page 2 of 61″

So to be clear this is not one team violating the rule once or twice. The average across all 24 teams in the Sun Belt and MAC got less than 30% of a GIA. And this is not some weird quirk of aggregate reporting -- Rascher explains he had access to “Squad Lists” which show individual athletes and their individual aid packages.

And we know this was not a typo on Rascher’s part, as he gave this same data in a later report (PACER info: “Case 4:14-md-02541-CW Document 809-63 Filed 04/06/18 Page 14 of 132″)

So if your going to comb the NCAA rules for the requirement that all Counter Sport athletes get full GIAs, you might want to also ask how 24 schools all failed to follow this rule for dozens of athletes in a single year. One answer is the supposed rule is massively violated. But again, the easier answer is that they didn’t violate the rule because no such rule exists. And Occam’s Razor wins again, because there is no such rule, and it is perfectly fine to give partial GIAs to athletes in counter sports.

What differs between counter sport and equivalency sports is what you can do with the money you save by not giving a full GIA. In an equivalency sport, you can spend that saved money on another athlete -- the more you split scholarships, the more (partial) scholarship athletes you can add to the team. Whereas in counter sports, you can’t do that. If you have 85 GIA athletess in football and you cut the last guy to 50%, you can get an 86th guy to take the other half. Instead, you just have to pocket the savings for some other use -- like paying a English Professor or cleaning up the quad, putting more money into strength and conditioning, etc.

Part III: Why this matters

Well, in addition to proving that Dakich, Radakovich, and countless internet dudes have been wrong when they argued this point to me, what this says is that when we a school giving out more than 76.5 GIAs to football players, that we know they did so because they felt that the 77th, 78th, etc., was worth at least as much (and likely more) than the cost of his scholarship. How do we know this?

a) beyond 76.5 GIAs, there is no requirement that they give any more scholarships. So if we see 78 guys getting GIAs of some level, we know the school felt every single one of them was worth whatever they gave him becaise no one forced them to make the offer, no rule required it, and if they had pocketed the money, they could have spent it elsewhere. Ergo, we know that giving that 78th athlete a scholarship was the most preferred use of that money. And since whichever one of the 78 athletes getting a scholarship is the lowest was worth it, then the other 77 were worth it too.

b) If guy 78 got a full scholarship, then we know he was worth at least that much. Even if the school wanted a backup, a bench player, etc., they could have made him a walk-on, but they didn’t. They could have offered him a partial GIA, but they didn’t. If he got a full, he got it because the school felt that giving a 75% GIA (and the resulting risk of losing him to another program) was a bad choice compared to spending MORE and getting him. That’s what “worth it” means in economic terms -- willing to spend that much to get the desired good.

c) when we see a ashcool use all of its 85 counters and give all 85 counters full scholarships, this tells us that EVERY SCHOLARSHIP ATHLETE WAS WORTH HIS FULL GIA and likely more. There is zero rational reason to pay the 85th guy a full GIA if you can pay the 85th guy less AND STILL LAND HIS SERVICES. Schools pay the last guy on the bench the full amount to ensure they don’t get outbid.

d) the reason people like Dakich and Loos and Radavoch think there is a rule requiring it is because at Power 5 schools and even some of the Group of 5 like in the American, every athlete is worth at least a full GIA, and so if a given school offered less than a full, another school would swoop in and make a higher bid. The cap prevents us from seeing the true value because once someone hits the cap, no one can outbid, and we see a number of “tied” bids and then all of the non-$ effects matter more to the football players, like coaching and fancy locker rooms and the quality of the Classics Dept (ok, maybe not that last one).

And thus -- the prevalence of Full GIAs across 85 athletes across 65+ schools is a sign that every single Full GIA P5 athlete is worth at least as much as his GIA. Every single one. So I would encourage all of you to stop arguing that while the stars are worth more, the benchwarmers are not. The market says otherwise.

And by the way, in basketball the argument is even easier b/c there is no requirement to give ANY GIA to any athlete, an no aggregate requirement (like football’s 76.5) either. So every single athlete you see get a full GIA was worth at least that much. And every school that doesn’t field a team of mostly walk-ons thinks GIA athletes are worth at least as much as it cost to land them.

1 note

·

View note

Photo

There’s so many amazing artists on Tumblr posting awesome Rick and Morty fan art and then there’s me....

259 notes

·

View notes

Text

REPUTATION STADIUM TOUR: AUGUST 7 2018 PITTSBURGH, PA

@taylorswift @taylornation here’s a list of fans attending the Pittsburgh show! Please message us if you’d liked to be added! We are so excited for this tour and hope you all have the BEST night! Don’t forget to tag us in your costumes and signs post.

Ally @taylorswift13love - Section F2 Row 14 Seats 1-2

Lauren @laurenswifty - Section F7 Row 8 Seats 27-28

Alanah @swiftlyalanahfaith13 - Section F7 Row 9 Seats 5-6

Rowan @neversayingsorry - Section F1 Row 11 Seat 13

Haley @soswift-theycallme-taylor - Section 132 Row C Seats 1-2

RJ @inthesilencesilence - Section F2 Row 20 Seats 3-4

Erin @bigreputayytion - Section 225 Row B Seats 18-19

Kristin @beckettswift - Section F11 Row 11 Seats 11-12

Dorothy @moonxcake - Section F13 Row 34 Seat 17-18

Tara @staringatthesunset815 - Section F6 Row 19 Seats 11-12

Nicole @staytreacherous - Section 136 Row F Seats 14-15

See an error? Exchanged/Upgraded your seats? Message us the new/correct info ASAP!

Want to be on your shows list? Sign up here ! This list will stop being updated come 7PM EST/4PM PT. Please just directly message us/send an ask for the Chicago Night 1 show and do not sign up on the google doc. Thanks!

Because of an apparent 50 cap tag limit, if there is that many accounts tagged on a post or it begins to reach 50 users through updating the lists, some accounts will be manually linked with hyperlinks in order to make sure everyone is able to be on these lists. Hyperlinks will still directly send Taylor (or anyone who clicks the link) straight to your tumblr and/or twitter! This just means you won’t get notified on being tagged!

Need costume/sign ideas? Check out the reputation ideas lists here and here.

#reputation stadium tour#reputation#taylor swift#reputation Pittsburgh#reppittsburgh#reputation costumes#reputation tour lists#reputation tour Pittsburgh

26 notes

·

View notes

Text

Speak, even if your voice shakes – Trolling & Social Media

Trolling is defined by Moreau as: when an individual form the online social community “deliberately tries to disrupt, attack, offend or generally cause trouble within the community by posting certain comments, photos, videos, GIFs or some other form of online content” (2017). Moreau (2017) continues by outlining ten types of online trolls, they include:

The insult troll

The persistent debate troll

The grammar and spellcheck troll

The forever offended troll

The show-off, know-it-all or blabbermouth troll

The profanity and all-caps troll

The one word only troll

The exaggeration troll

The off topic troll

The greedy spammer troll

Online trolling or cyber-bullying can sometimes be the cause of teen suicide. The Australian Bureau of Statistics states that in 2016, the number of children who are committing suicide had increased by a third in the last decade – with suicide remaining as the leading cause of death for kids aged 5 – 17 (Marcus, 2017). Boyd suggests that technology offers a new avenue for bullying, in the same way that the phone did before the internet (2014, p. 132). Boyd also continues by suggesting that social media increased the volume of the audience size, of those who are witness to online trolling or bullying (2014, p. 133).

However, in some cases you do have to wonder if the audience size is increased or if everything remains behind closed doors – until it’s too late. For instance, the recent passing of Dolly Everett – the 14 year old girl from the Northern Territory took her own life earlier in January, has again erupted the conversation about online bullying and trolling. After the passing of Dolly, a family friend came forward announcing that his 15 year old daughter is also a victim of cyber-bullying, although he only found out about the bullying through a family friend. His daughter did not advise him. As seen in the image below, a very extreme case of what would be classified as an ‘insult troll’, these types of trolls call other names, they accuse, and they do anything to get a negative emotional response from the recipient (Moreau, 2017). Further to this Boyd (2014, p. 131) suggests that bullying has three components; aggression, repetition and imbalance in power. The image again, clearly possesses aggression.

However, even with the negativity of this tragic story of Dolly, and other victims who have come forward – there is a positive light in this dark space. Individuals are also using social media platforms to come forward and assist in raising awareness about mental health - creating a movement and a sanctuary for people who may be suffering online trolling or bullying. An example of this is Craig Estall’s video that went viral on Facebook after Dolly’s passing. Even news program, The Project interviewed Estall in hope to raise awareness and prevention to teen suicide from cyber bullying. Furthermore, there has been a hashtag created, #DoItForDolly and #SpeakEvenIfYourVoiceShakes, which is emphasising the solidarity of online communities to stop online trolling and bullying and continue raising awareness.

Interview with Craig Estall video: https://www.facebook.com/TheProjectTV/videos/10155229439258441/

References:

Boyd, D 2014, 'Bullying: Is the Media Amplifying Meanness and Cruelty?', It’s Complicated: The Social Lives of Networked Teens, Yale University Press, New Haven, USA.

Marcus, C 2018, ‘My heart aches for Dolly and the young girls of today’, The Daily Telegraph, 16 January, viewed 16 January 2018, <https://www.dailytelegraph.com.au/rendezview/my-heart-aches-for-dolly-and-the-young-girls-of-today/news-story/5d59892635af676d3bf07a3c827639e6>.

Moreau, E 2017, ‘10 Types of Internet Trolls You'll Meet Online’, lifewire, 19 May, viewed 16 January 2018, <https://www.lifewire.com/types-of-internet-trolls-3485894>.

5 notes

·

View notes

Text

Rànquing dels diputats catalans a Twitter

Avui 1 de març, coincidint amb dia de ple al Parlament de Catalunya m’he decidit a fer un anàlisi de la presència de tots els diputats i diputades de la cambra a Twitter.

Fa uns dies que busco rànquings interactius a Twitter però com que no n’he trobat cap que actualitzi automàticament les xifres de seguidors de determinats usuaris cada mes actualitzaré la taula mostrant l’increment o decreixement de followers. En les properes setmanes, a més, aprofondiré en cada partit.

Aquesta és la radiografia a data d’avui:

.ritz .waffle a { color: inherit; }.ritz .waffle .s0{background-color:#ffffff;text-align:left;font-weight:bold;color:#000000;font-family:'Arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}.ritz .waffle .s2{background-color:#ffffff;text-align:right;color:#000000;font-family:'Arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}.ritz .waffle .s5{background-color:#ffffff;text-align:left;color:#000000;font-family:'arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}.ritz .waffle .s4{background-color:#ffffff;text-align:left;text-decoration:underline;-webkit-text-decoration-skip:none;text-decoration-skip-ink:none;color:#1155cc;font-family:'Arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}.ritz .waffle .s1{border-right: none;background-color:#ffffff;text-align:left;font-weight:bold;color:#000000;font-family:'Arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}.ritz .waffle .s3{background-color:#ffffff;text-align:left;color:#000000;font-family:'Arial';font-size:10pt;vertical-align:bottom;white-space:nowrap;direction:ltr;padding:2px 3px 2px 3px;}

1

Posició

Seguidors

NomCognomUsuariGrup

Demarcació

2

1673.025CarlesPuigdemont@KRLSJxCATBarcelona

3

2523.592OriolJunqueras@junquerasERCBarcelona

4

3395.819InésArrimadas@InesArrimadasC'sBarcelona

5

4285.881CarmeForcadell@ForcadellCarmeERCBarcelona

6

5285.323RaülRomeva@raulromevaERCBarcelona

7

6173.046MartaRovira@martaroviraERCBarcelona

8

7103.867JordiTurull@jorditurullJxCATBarcelona

9

893.190JosepRull@joseprullJxCATBarcelona

10

982.507MiquelIceta@miquelicetaPSCBarcelona

11

1082.286RogerTorrent@rogertorrentERCGirona

12

1168.768XavierDomènech@XavierDomenechsCECPBarcelona

13

1266.755ToniComín@toni_cominERCBarcelona

14

1365.718XavierGarcía Albiol@Albiol_XGPPBarcelona

15

1458.094JordiSànchez@jordialapresoJxCATBarcelona

16

1557.104ErnestMaragall@ernestmaragallERCBarcelona

17

1655.844AndreaLevy@ALevySolerPPBarcelona

18

1736.825DolorsBassa@dolorsbassacERCGirona

19

1832.072ElsaArtadi@elsa_artadiJxCATBarcelona

20

1931.200CarlesRiera@carlesralCUPBarcelona

21

2029.986Fernando dePáramo@ferdeparamoC'sBarcelona

22

2127.166JosepCosta@josepcostaJxCATBarcelona

23

2223.297LauraBorràs@LauraBorrasJxCATBarcelona

24

2320.260Joan JosepNuet@NUETCECPBarcelona

25

2417.230AntoniCastellà@CastellaToniERCBarcelona

26

2516.131CarlosCarrizosa@carrizosacarlosC'sBarcelona

27

2615.147RubenWagensberg@wagensbergERCBarcelona

28

2714.385EduardPujol@PujolBonellJxCATBarcelona

29

2814.034MatíasAlonso@malonsocsC'sTarragona

30

2912.747JennDíaz@JnnDiazERCBarcelona

31

3012.299AlbaVergés@albavergesERCBarcelona

32

3112.264QuimTorra@QuimTorraiPlaJxCATBarcelona

33

3212.056VidalAragonés@VidalAragonesCUPBarcelona

34

339.714AlbertBatet@albertbatetJxCATTarragona

35

349.355GerardGómez del Moral@gerardgomezfERCBarcelona

36

359.260SergiSabrià@sergisabriaERCGirona

37

369.082FerranCivit@CivitiMartiERCTarragona

38

378.635EvaGranados@Eva_GranadosPSCBarcelona

39

388.551LluísSalvadó@LlSalvadoERCTarragona

40

398.475MariaSirvent@MariaSirvntCUPBarcelona

41

408.319José MaríaEspejo@jmespejosaavC'sBarcelona

42

417.984SoniaSierra@SoniaSierra02C'sBarcelona

43

427.084MartaMadrenas@MartaMadrenasJxCATGirona

44

436.965IgnacioMartín@NmartinblancoC'sBarcelona

45

446.938MartaRibas@martaribasfriasCECPBarcelona

46

456.904ElisabethAlamany@ElisendalamanyCECPBarcelona

47

466.808RamonEspadaler@Ramon_EspadalerPSCBarcelona

48

476.576Carmen deRivera@CarmendeRiveraC'sBarcelona

49

485.995Francesc deDalmases@francescdJxCATBarcelona

50

495.589LluísGuinó@lluisguinoJxCATGirona

51

505.525AuroraMadaula@Aurora_MadaulaJxCATBarcelona

52

515.482JosepRiera@PepRieraFontJxCATBarcelona

53

525.333LorenaRoldán@LroldansuC'sTarragona

54

535.297EusebiCampdepadrós@ECampdepadrosJxCATTarragona

55

544.891DavidCid@CiddavidCECPBarcelona

56

554.782AlíciaRomero@aliciarllPSCBarcelona

57

564.735FerranPedret@FerranPedretPSCBarcelona

58

574.695JéssicaAlbiach@jessicaalbiachCECPBarcelona

59

584.627DavidPérez@davidpscPSCBarcelona

60

594.483SantiRodríguez@santirodriguezPPBarcelona

61

604.285ÒscarPeris@oscarperisERCTarragona

62

614.165NatàliaSànchez@NataliadippCUPGirona

63

624.038EstherNiubó@eniuboPSCBarcelona

64

633.908Noemí de laCalle@Noemi_delaCalleC'sBarcelona

65

643.896JordiTerrades@jterradesPSCBarcelona

66

653.857SusanaBeltran@susanabeltrangaC'sBarcelona

67

663.838RaúlMoreno@raulmorenomPSCBarcelona

68

673.531GemmaGeis@GemmaGeisJxCATGirona

69

683.435JorgeSoler@jsolerCsC'sLleida

70

693.427MontserratFornells@mfornellsERCLleida

71

703.404JeanCastel@GironaJeanC'sGirona

72

713.197NajatDriouech@najat_driouechERCBarcelona

73

723.118MarcSolsona@solsona_marcJxCATLleida

74

733.116CarlesCastillo@CarlesTgnaPSCTarragona

75

743.007AlejandroFernández@alejandroTGNPPTarragona

76

752.954PolGibert@polgibertPSCBarcelona

77

762.946MònicaSales@mncslsJxCATTarragona

78

772.937BernatSolé@bernatsoleERCLleida

79

782.755JoanGarcía@joansabadellC'sBarcelona

80

792.702SergioSanz@sergiobarcelonaC'sBarcelona

81

802.690AssumptaEscarp@aescarpPSCBarcelona

82

812.677FranciscoDomínguez@fjdominguez8C'sTarragona

83

822.654LauraVílchez@LauraVilchezSC'sBarcelona

84

832.613AdrianaDelgado@adrianadelgadohERCBarcelona

85

842.404AnnaGeli@geli_annaJxCATLleida

86

852.281DavidRodríguez@david_drgERCLleida

87

862.257DimasGragera@dimasciudadanoC'sBarcelona

88

872.250DavidMejía@davidmejiayraC'sBarcelona

89

882.189JordiMunell@jordimunellJxCATGirona

90

892.014AntonioEspinosa@aespiceC'sBarcelona

91

902.004ÒscarOrdeig@oscarordeigPSCLleida

92

911.755AlfonsoSánchez@asancfisacC'sGirona

93

921.625MaríaValle@mariavalle7C'sBarcelona

94

931.563NoemíLlauradó@nllauradoERCTarragona

95

941.556ElisabethValencia@evalmimC'sBarcelona

96

951.548CarlosSánchez@CarlosSM_CsC'sTarragona

97

961.535AnnaCaula@anna_caulaERCGirona

98

971.529ImmaGallardo@immagallardoJxCATLleida

99

981.501Josep MariaJové@jmjovelladoERCBarcelona

100

991.484AnnaTarrés@ATarresSincroJxCATBarcelona

101

1001.451JordiAlbert@SantandreuencERCBarcelona

102

1011.450MònicaPalacín@monicapalacin29ERCBarcelona

103

1021.444FrancescTen@ftencJxCATGirona

104

1031.393Rosa MariaIbarra@ROSA_M_IBARRAPSCTarragona

105

1041.373EvaBaró@evabarorERCBarcelona

106

1051.298FerranRoquer@tionroquerJxCATGirona

107

1061.243BeatrizSilva@BeaSilva9PSCBarcelona

108

1071.226MuniaFernández-Jordán@muniafjC'sBarcelona

109

1081.212MartínBarra@_martinbarraC'sBarcelona

110

1091.204ManuelRodríguez@MRodriguez_CsC'sBarcelona

111

1101.132RutRibas@RutRibasERCBarcelona

112

1111.103TeresaPallarès@mtpallaresJxCATTarragona

113

1121.070Josep MariaForné@JosepMForneJxCATLleida

114

113990MartaMoreta@MartaMoretaPSCBarcelona

115

114968AntoniMorral@MorralToniJxCATBarcelona

116

115935XavierQuinquillà@xaviquinquillaJxCATLleida

117

116919José MaríaCano@JoseMaria_CsC'sBarcelona

118

117861RafelBruguera@rafelbrugueraPSCGirona

119

118802GemmaEspigares@GemmaEspigaresERCLleida

120

119723SusannaSegovia@susannasegoviaCECPBarcelona

121

120646FrancescViaplana@xescoviaplanaERCLleida

122

121581HéctorAmelló@Hector_AmelloC'sGirona

123

122543YolandaLópez@YolandaPodemCECPTarragona

124

123428MarinaBravo@MarinaBS_CsC'sBarcelona

125

124345JavierRivas@jrivasescamillaC'sLleida

126

125311DavidBertran@dbertranromanC'sLleida

127

126285IreneFornos@IreneFornosERCTarragona

128

127258IsabelFerrer@MtnezdeBreaJxCATBarcelona

129

128227

María del Camino

Fernández@CaminoFernndezC'sGirona

130

129205Blanca VictoriaNavarro@blanca_vicC'sBarcelona

131

130134NarcísClara@narcis_claraJxCATGirona

132

13170MaialenFernández@MaialenfdezC'sTarragona

133

132-MontserratMacià-JxCATLleida

134

133-María LuzGuilarte-C'sBarcelona

135

134-LluísFont-JxCATBarcelona

136

135-SalouaLaouaji-JxCATBarcelona

function posObj(sheet, id, row, col, x, y) { var rtl = false; var sheetElement = document.getElementById(sheet); if (!sheetElement) { sheetElement = document.getElementById(sheet + '-grid-container'); } if (sheetElement) { rtl = sheetElement.getAttribute('dir') == 'rtl'; } var r = document.getElementById(sheet+'R'+row); var c = document.getElementById(sheet+'C'+col); if (r && c) { var objElement = document.getElementById(id); var s = objElement.style; var t = y; while (r && r != sheetElement) { t += r.offsetTop; r = r.offsetParent; } var offsetX = x; while (c && c != sheetElement) { offsetX += c.offsetLeft; c = c.offsetParent; } if (rtl) { offsetX -= objElement.offsetWidth; } s.left = offsetX + 'px'; s.top = t + 'px'; s.display = 'block'; s.border = '1px solid #000000'; } }; function posObjs() { }; posObjs();

Com podem veure dels 135 diputats del Parlament de Catalunya n’hi ha un total de 4 que no tenen compte a aquesta xarxa social, tres són de Junts per Catalunya i l’altre de Ciutadans. El que més m’ha sorprès, però, és que David Pérez (@davidpsc) del PSC i Josep Maria Jové (@jmjovellado) d’ERC tenen un compte privat i per tant només els poden veure els tweets aquells usuaris que ells autorizin com a seguidors! Realment el contrari del que s’hauria d’esperar d’un diputat amb perfil a aquesta xarxa.

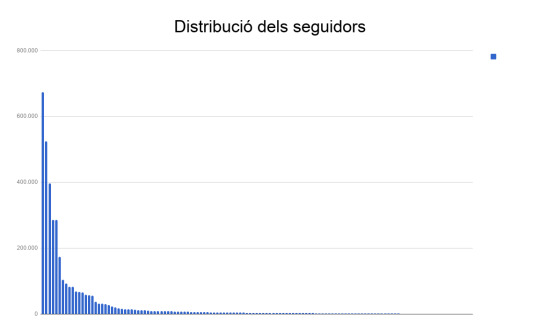

La mitjana de seguidors dels diputats de la cambra és de 28.362 usuaris, tot i que si calculem la mediana aquesta xifra es redueix a 3.838. De fet si ens fixem en la distribució de seguidors veurem que hi ha uns pocs diputats que acumulen grans números de followers i després venen tota la resta.

L’usuari més seguit, com era de preveure, és el president de la Generalitat Carles Puigdemont (@KRLS). En segon lloc i a una distància de 150.000 usuaris trobem el vicepresident Oriol Junqueras (@junqueras). A uns 125.000 seguidors ja trobem a la cap de l’oposició, Inés Arrimadas (@InesArrimadas). Més enrere queden Raül Romeva i Carme Forcadell que entren al TOP 5 a molt poca distància entre ells.

La mitjana de seguidors de la demarcació de Barcelona és de 28.362 seguida per la demarcació de Girona 9.084 amb l’important ajuda del President Roger Torrent (@rogertorrent) i la consellera Dolors Bassa (@dolorsbassac), Lleida és que la puntua més baix amb 1.624 i finalment trobem Tarragona amb 3.663.

Espero que les dades puguin ser d’utilitat, properament aniré tractant-les des de més punts de vista!

1 note

·

View note

Text

Stock daily Filter Report for 2021/05/25 05-40-10