#buying cheap stocks robinhood

Explore tagged Tumblr posts

Text

Another Overlooked Short Squeeze Meme Stock Candidate!

Another Overlooked Short Squeeze Meme Stock Candidate! https://www.youtube.com/watch?v=PvRvuseuDYs I prefer to focus on stocks that the public is not talking about. Many stocks have incredible runs, gains with very minimal retail presence. Traders have to think outside the box and stop focusing on only one or two big names. ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/FjsbgyX 👉 Instagram: https://ift.tt/cjDF0nT ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How My Subscribers Doubled Their Money Today!!! https://youtu.be/s5M_OGv8AtM 👉 7 Great Value Stocks to Buy BEFORE They Explode! https://youtu.be/0I451lsCjAc 👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥 https://youtu.be/4B3EK7lb38k ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #gme #gmeshortsqueeze #gmestocks #gamestop #gamestopstock #amc #amcstock #amcstocknews #stockanalysis #stockstobuy #stockpicks #stockearnings #bullish #optionstrading #shortsqueeze #shortinterest #shortselling #shorts #robinhood #memestocks #technicalanalysis #fundamentalanalysis #memestock #costtoborrow Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA May 15, 2024 at 06:21AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Text

Mastering Stock Trading Fundamentals: A Beginner's Guide

Beginners may find stock trading scary, but anyone can succeed in the market with the appropriate information and strategy. We'll explain the basic ideas of stock trading in simple language in this extensive book to assist you in starting your path to financial freedom.

To be coming a stock trading join now

Understanding Stocks

Equities, also referred to as shares or stocks, are ownership stakes in a business. Upon purchasing stocks, you gain the status of a shareholder and are eligible to partake in the assets and earnings of the business. On stock exchanges such as the NASDAQ or the New York Stock Exchange (NYSE), stocks are traded.

How the Stock Market Works

Buyers and sellers exchange equities on the stock market. Supply and demand drive prices: a stock's price increases when more people wish to purchase it (demand), and it decreases when more people want to sell it (supply). There are chances for traders to make money because of this ongoing volatility.

Types of Stocks

Stocks can be categorized according to a number of factors, including:

By Market Capitalization: Depending on the market valuation of the company, stocks are sometimes divided into large-cap, mid-cap, and small-cap categories.

By Sector: Stocks can be found in a variety of industries, including consumer products, technology, healthcare, and finance.

By Dividend Yield: A percentage of a company's profits are given to shareholders as dividends, and some stocks pay them. Regular income-seeking investors are fond of dividend stocks.

Setting Investment Goals

Establishing your investing objectives is crucial before you start stock trading. Which kind of return are you after: steady income, rapid growth, or both? You may create a trading strategy that suits your demands and risk tolerance by having a clear understanding of your goals.

Developing a Trading Plan

A trading plan is a road map that includes your trading objectives, tactics, and guidelines for risk control. It ought to contain:

Investment Goals: What do you hope to accomplish with trading?

Tolerance for Risk: What level of risk are you willing to accept?

Trading Strategy: Which type of trading—day, swing, or long-term investing—will you prioritize?

When will you buy and sell stocks? What are your entry and exit criteria?

Risk management: How are you going to reduce losses and safeguard your capital?

To be comming a stock trading join now

Learning the Basics of Technical Analysis

Technical analysis is a technique used to predict future price patterns by examining volume and changes in stock prices. Bollinger Bands, moving averages, and the Relative Strength Index (RSI) are examples of common technical indicators. Making wise trading selections can be aided by understanding how to interpret these indicators.

Understanding Fundamental Analysis

Evaluating a company's competitive stance, industry trends, management team, and financial standing are all part of fundamental research. Profit margins, debt levels, revenue growth, and earnings growth are important variables to take into account. Using fundamental research, investors might find cheap stocks with significant growth potential.

Opening a Brokerage Account

You must register for a brokerage account with a trustworthy broker in order to begin trading stocks. Seek out a broker who provides good customer service, educational materials, low commissions, and an easy-to-use trading platform. E*TRADE, TD Ameritrade, and Robinhood are a few well-known online brokers.

Practicing with Paper Trading

Try practicing with a paper trading account before risking real money. You can mimic real-time stock purchases and sales using paper trading without having to use real money. It's a great method to practice trading without taking any financial risks and test out various trading tactics.

Starting Small and Gradually Scaling Up

When the time comes for you to start trading with real money, start small and increase your investment gradually as you acquire experience and confidence. Refrain from investing all of your money in a single trade, and always follow your trading strategy and risk management guidelines.

Monitoring Your Investments

It takes constant observation of the market and your investments to be a successful trader. Keep up with market developments, company news, and economic data that could affect stock prices. Review your portfolio frequently, and modify your plan as necessary to take advantage of shifting market conditions.

Conclusion

The first step to becoming financially successful in the stock market is learning the fundamentals of stock trading. You can gradually create a lucrative trading portfolio by learning the fundamentals of stocks, creating a trading plan, doing technical and fundamental analysis, and exercising responsible risk management.

Regardless of your level of experience, patience, self-control, and ongoing education are essential for long-term success in the fast-paced world of stock trading.

To be comming a stock trading join now

0 notes

Text

Basics for Finding Simple Stocks on Robinhood to Buy Today

Today, we live in the age of information technology and digitization, and this can only encourage investment. For this reason, today more than ever, that understanding is all that is necessary to trade simply and safely.

For all those who are Looking for a quick and detailed approach to trade now, we shouldn't ignore it. Today, as a result of the evolution of new technologies, it's possible to trade straight from home, with online trading or directly on the stock exchange. Thanks to the web, new forms of investment have been born, increasingly accessible and fast. Today, it is also possible to trade thanks to societal trading.

Word of Caution

Trading from home Quickly and easily today does not presuppose the fact it is easy. An individual should not fall into the temptation to believe that acquiring achievement in the tradition of trading is simple and above all is exempt from risks.

Despite the Evolution, the possibility of more information and more training on how and where to trade today doesn't presuppose the guaranteed success, but the possibility of success or failure has always remained more or less the same. Everything depends on you, your training, and your dedication to trading.

How to Trade Cheapest Stocks Today?

Between yesterday and today, what's changed is the way to exchange money, that's the possibility for a newcomer to access the necessary resources more easily and better understand what to trade in now.

Here's the reason for this publication, supported by practical examples and controlled and authorized brokers. You will see a series of helpful information to better understand how and where to trade today, a step-by-step guide that will explain how and why trade in one industry today rather than another.

Starting to trade Today is simple, simple, and quick! Doing it in the right way instead is somewhat more difficult, especially if you do not have the right knowledge.

Where to Trade Cheap Stocks on Robinhood?

How many of you have asked yourselves this question and how a lot of you now are asking? Understanding where to trade now is the technique for success! In fact, knowing where and how to exchange implies a saving of time and a larger income for you traders, who'll leave already ahead of time of the other traders, and this can lead you to become an advanced and successful trader.

In this guide, we will show you which market is the most accessible to all, the Forex, which will allow you to trade with little savings. We will also show you what is Social Trading, which is a new form of investment based on Forex, and the sharing of information and trading strategies that will allow you to trade and become an expert in this market.

How Much to Trade Today?

Another fundamental point before starting to trade is understanding how much you are willing to trade now. The quantity of capital that you're willing to trade changes based on the dealer's economic assets but also to the degree of preparation.

For this reason, we consider it useful to advise you to begin trading with a demo account, or a free trading account, which permits you to understand what are the risks of online trading but, most importantly, to feel the trading strategies or perhaps just doing understanding with the trading platform.

Given this, let's Examine how much to trade now.

Trading capital today requires the following:

• The possibility of making use of its funding

• Use financial resources in fruit-bearing operations

How Much is the Capital Needed to Begin Trading Today?

Many traders Associate the significance of a large sum of cash to the term"capital." Obviously, there's not an equal capital for everybody, but every dealer decides to trade his capital, based on what are the possibilities. So, for a basic level trader, trading $100 is equivalent to an experienced trader trading $1000.

Capital, therefore, Is a comparative amount for each of us. Almost always, however, capital, in its most general meaning, takes the form of a value that's extremely difficult to obtain and utilize for a possible investment. Today, we can tell you exactly what the world of online trading has become available to everyone, even to traders who don't have immense amounts of funds.

How Much to Trade for Tangible Outcomes?

There are brokers that offer the possibility of trading in the stock market even with just $100 of initial capital, which is a ridiculous amount, that enables you not only to have the world of online investment but also to get rid of wrong beliefs which online trading or stock exchange investment is just for people who own money. This is known as"test capital."

To understand this concept, we believe it to be of basic significance; if one understands it, the very concept of capital takes on a different meaning; in actuality, it is going to mean every sense of greatness or importance. In other words, the idea of capital will mean just the sum of money that is available and in the case of incorrect investment does not affect the financial situation of the dealer.

Be careful not to confuse this concept with the incorrect notion of trading money in the wrong way. In reverse, you'll have to care for the money you are going to trade with the utmost respect, giving it the utmost significance. Just constantly remind yourself that you earned that money by working hard; you do not need to waste it.

Keep in Mind that trading In online trading is risky and undermines the loss of the whole capital. So, pay close attention to this concept. It does not matter what the amount to trade or what funding is available. The important is to understand the value of the funds you trade.

If you follow this advice, you can find out how simple and fast to do online trading or trade in the stock exchange in a couple of steps and, especially enjoy all of this now, how it's really affordable for everyone, due to the Internet. There is nothing left but to continue this path and make yours the information in this guide on how to trade today. When it comes to investment strategies, the amount invested can't be ignored.

youtube

#cheapest stocks on robinhood#cheap stocks robinhood#buying cheap stocks robinhood#finding cheapest stocks on robinhood

0 notes

Text

Understanding /r/wallstreetbets

There is no shortage of takes about what's going on with Gamestop (and other surging stocks), Robinhood and Reddit's r/wallstreetbets, many of them contradictory - at least on the face of them. But I think it's possible for most of these takes to be right. Here's how.

First you need to understand the underlying mechanics of the story. Stock markets are fundamentally a way of making bets, including bets on the outcome of other peoples' bets, and bets on the outcomes of *those* bets.

All this complexity creates lots of exploitable opportunities. Some of these opportunities are considered legitimate and are given respectable names like "arbitrage." Others are considered illegitimate, and are called disreputable things like "stock manipulation."

A hypothetical Martian observing all this through a telescope could not tell you which kinds of bets were honest and which were dishonest, because the difference isn't about any objective standard, but rather, about power.

The strategies of powerful people are legit, while the strategies of their would-be dethroners are not legit. Sometimes, even outright frauds are OK if they're done by people with enough power.

If your scam pays out quickly enough, you can sometimes parlay the resulting cash into retrospective legitimization, so even the strategies of the out-group can end up being retconned as legit, if they're successful enough.

That's why Amway isn't illegal: Betsy DeVos's father-in-law was simultaneously the boss of Amway and head of the US Chamber of Commerce, and Gerry Ford was his Congressman, who was then elevated to president in time to legalize its business model.

To understand the Gamestop rise, you have to understand a couple of different kinds of bets.

"Shorting": this is a bet that a stock will go down. There's a complicated backstory to how you make this bet, but it doesn't matter.

The thing to know here is that shorting a stock can make you rich...if the stock goes down. But if the stock goes up, you lose money. There's not really any limit to how much you can lose here.

Every time the stock goes up, the shorts have to pony up more money to keep their bet alive (in the hopes that it will go down again later), or they have to take their losses, pay out the winner of the bet and surrender any chance of winning later.

Shorting isn't just a bet on someone else's failure - it's a way to fund bullshit-detection. If you know (or suspect) that a company is lying about its prospects, you can bet against it.

Shorts fund a lot of research into defective products and scammy businesses, because they win when bad companies are exposed and their stocks go down. Some of the scary security research you read about bad IoT software is funded by shorts.

That's why habitual bullshitters like Elon Musk *hate* shorts. Musk leads a cult of credulous worshippers who buy whatever he's selling. Shorts make bets that Musk's cultists will get deprogrammed. Musk uses this to sharpen his cultists' resolve: "they want us to fail!"

"Options": many different bets get lumped in as "options" but for the purposes of this discussion, buying an option means buying the right to buy stocks later. The people who sell you the option usually go out and buy the stock right away so they'll have it to sell.

"Front-running": Cheating. Front-runners insert themselves into transactions by spying. If I know that Alice is buying a bunch of Bob's shares, I can snap them up a millisecond before Alice gets there, mark them up, and sell to Alice at a profit.

"Retail investor": An "average joe" who buys stocks from a brokerage like Robinhood.

"Institutional investor": Hedge funds, private equity funds, pension funds, index funds, investment banks, etc. Whales and sharks.

"High-frequency trader": A bot. Someone (usually an institutional investor) who uses an algorithm to buy and sell shares very quickly. HFTs might buy a stock and sell it less than a second later (when they're front-running, for example).

With that all out of the way, here's what seems to be going on. Reddit's r/wallstreetbets is a "retail investor" forum of average joes, many of them angry at the scammy, evil stuff that the big institutional investors get up to.

Their grievances are mixed: some are angry that big investors have figured out how to destroy good businesses for money. Some are angry because *only* big institutionals get in on the action when that happens and average joes are locked out of those plays.

They are stuck at home, have little to spend their money on, and - critically - have access to "trading platforms" like Robinhood that let them buy and sell stocks without any fees (institutionals often have sweetheart deals like this, but average joes used to pay to play).

They're getting together to make money and to punish their enemies. The easiest enemies to punish are shorts, because if they push up a stock even a little, the shorts get pounded for millions of dollars.

If they can keep the stock up long enough, the shorts will give up and the average joes will collect their winnings. And the average joes are clever. They've figured out that they don't even have to buy the stocks to force the price up - they can buy cheaper options instead.

An option is a bet. The people on the other side of the bet usually buy the stocks they sell options on. If I buy an option to buy a stock from you and then the stock goes up, you have to go out and buy the stock and sell it to me at a loss.

If you're an option seller who thinks a stock will go up, you protect yourself by buying shares now.

Buying options is a cheap way to get someone else to buy a stock, which pushes the price up. If the price is going up, options sellers will snap up more stock.

There's two prominent versions of the Gamestop story. The first is that r/wallstreetbets represents so many angry average joes that they can "move markets" by buying unlikely shares, like Gamestop or AMC, and confound the markets.

https://marketsweekly.ghost.io/what-happened-with-gamestop/

The second story is that r/wallstreetbets has figured out a hack. They inflict asymmetric pain on shorts (a tiny gain for average joes is a huge wound to the sharks). By buying options, they can eke out tiny gains for a fraction of the price.

https://www.cnet.com/news/reddits-gamestop-stock-surge-is-a-terrifying-new-occupy-wall-street/

But there's a *third* story, and I think it's the most important one. That's Alexis Goldstein's account of what's going on with Robinhood and the institutional investors it's in bed with.

https://marketsweekly.ghost.io/what-happened-with-gamestop/

Recall that all of this is only possible because Robinhood lets average joes buy and sell stocks for free. How can Robinhood give away a service that costs it money and still stay in business? (Hint: They're not making it up in volume).

The answer is: surveillance. Robinhood partners with institutional investors and lets them spy on what the average joes are buying and selling. Sometimes, this is just "market intelligence" ("Hey, people like fidget spinners") but the main event is front-running.

If you're paying Robinhood to tell you what assets its customers are about to buy, you can go out and buy them up first and sell them for a profit to Robinhood's customers.

Or you can buy some of that asset up because you know its price will go up once Robinhood's customers orders are filled.

Or both.

Citadel Securities is Robinhood's main institutional investor partner. Founded by billionaire Ken Griffin, they combine tech (high-frequency trading), an "asset manager" (they spend other peoples' money) and a "market maker" (they sell things like options).

Citadel gets to see all those r/wallstreetbets buy orders before they're filled. They can fill some of those orders, making a profit. They can buy some of the same stock for themselves, making a profit. They can sell options, making a profit.

A little bit of this profit comes at the expense of average joes: if there wasn't a front-runner marking up the stocks they buy, the average joes would pay a little less. But the average joes are still profiting from the destruction of the shorts.

Citadel is merely taxing their winnings. The real losers here, though are Citadel's competitors, funds like Melvin Capital, who were seriously short on Gamestop and went bust thanks to all of this. Guess who bought Melvin at fire-sale prices? That's right, Citadel.

So the third story goes like this: there are a lot of average joes. They're numerous, pissed and smart. They move a lot of money against shorts and make it go farther thanks to the force-multiplier effect of options.

*Then* all this activity is multiplied again by Citadel, a fund that is no better (and no worse) than Melvin or the other targets of the average joes' wrath. Citadel's bots are triggered by the average joes' activity, which turns kilotons of damage into gigatons.

It's not clear whether the average joes know they're triggering Citadel's bots, or whether this is just Citadel's bet on frontrunning average joes paying off for Citadel. It's possible Citadel is the joes' patsy, and the joes are *also* Citadel's patsies.

It's also not clear whether Citadel - and its feuding cohort of competing finance-ghouls - can contain the storm. Maybe they profit off the average joes now, but the joes figure it out and turn their weapons on Citadel and the whole system later.

Remember, the "legitimacy" of a financial strategy isn't determined by its objective decency, but rather by the power of the people who deploy it. If the average joes can attain respectability, they may be legitimized.

But the road to legitimacy is rocky. Yesterday, the finance monopolist TD-Ameritrade halted trading on the stocks targeted by the average joes. Today, Robinhood followed suit. Maybe they fear that they can't control the monster they created?

https://www.theverge.com/2021/1/28/22254102/robinhood-gamestop-bloc-stock-purchase-amc-reddit-wsb

210 notes

·

View notes

Text

10 Best Free Investing Apps in 2021

10 Best Free Investing Apps in 2021

Do you presently pay exorbitant investment fees? Do you only invest a little amount of money and can't afford the fees charged by the majority of internet brokers?

Instead, have a look at these investment applications. There are no yearly account fees that detract from your investment results. Some of these applications can manage your whole account for “hands-off” investors who don't want to deal with daily investment choices and portfolio rebalancing.

These applications can help you optimize your profits at the lowest possible cost, regardless of your financial history or approach.

Apps for Investing for Free

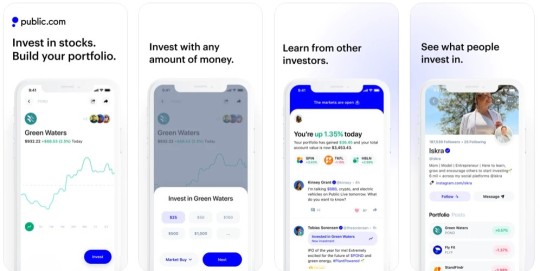

1. Vanguard 2. Webull 3. M1 Finance 4. Robinhood 5. Ally Invest 6. Betterment 7. Personal Capital 8. Fidelity 9. TD Ameritrade 10. Public

Because you invest to increase your income, free investing apps equate to more money in your wallet each month!

You can trade nearly anything for free with these investment applications. Some exclusively trade equities, while others specialize in ETFs (Exchange Traded Funds). Full-service brokerages, on the other hand, provide equities, bonds, ETFs, mutual funds, and FX.

You'll need to pay attention to the research and charting skills in addition to the many investing possibilities. Some are quite basic, while others allow you to run over 100 different charts on your smartphone or tablet.

You may pick between completely automated and self-directed apps, depending on whether you are a rookie investor or have been investing for 30 years.

1. Vanguard

Vanguard is an online broker that offers free stock and ETF trading and is one of the oldest and largest. Most robot advisors invest in multiple stock and bond index ETFs managed by this firm.

You may avoid the yearly advising fees charged by robot advisors by investing directly with Vanguard. However, you must be comfortable managing your own portfolio. Finding investing ideas is simple for Vanguard since it has a dedicated community of investors known as Bogleheads. You could want to create a "three-fund portfolio."

Although stocks and exchange-traded funds (ETFs) have the lowest investment minimums, investors must acquire whole shares.

A $3,000 minimum initial commitment is required for many Vanguard mutual funds. A $1,000 initial commitment is required for their Target Retirement funds.

2. Webull

Webull is an up-and-coming free investment app. Trades in stocks and ETFs are completely free. Other free investing applications do not allow you to trade foreign-listed ADR companies.

You may also trade options and cryptocurrencies with Webull. However, you must purchase whole shares of stocks and ETFs. You may use Webull on any computer or through their Android or iOS app. Webull has some of the greatest stock research features. Short-term traders who depend on technical analysis may benefit from these tools. Paper trading is a fun tool that you might like. This application allows you to simulate stock trading in order to determine your possible profit or loss.

To join Webull, you don't need to have a certain amount of money in your account. You can earn one free stock if you make an initial deposit of $100 or more. Your free stock is worth anything from $8 to $1000. It's a surprise which stock you'll obtain.

3. M1 Finance

M1 Finance is a free investment software that might be useful for individuals looking for a robot-advisor. Premade portfolios with no yearly advising cost are available to investors.

A self-managed portfolio of stocks and ETFs can also be built by DIY investors. All stocks, ETFs, and readymade portfolios are available in fractional shares at M1 Finance. M1 Finance bills itself as a cross between a robo-advisor and a regular broker. This is due to the fact that it not only provides automatic investments but also allows for customization.

M1 Finance does not offer tax-loss harvesting, unlike full-service advisors. It's worth noting that M1 Finance doesn't provide 529 or 401k plans. It does, however, provide IRAs, such as Roth IRAs, regular IRAs, and SEP IRAs.

https://youtu.be/NbdUvgvKjLQ

Before you can make your first transaction, you must have a minimum account balance of $100 for brokerage accounts and $500 for retirement funds. The minimum for subsequent transactions is $25.

4. Robinhood

Do you want a free app that allows you to trade stocks and options? Robinhood offers an investment app as well as a platform that can be used from a laptop.

Unlike its namesake, this software does not take from the wealthy in order to give to the needy. You will, however, pay $0 each trade, making this the most cost-effective option to purchase and sell stocks and ETFs. With a $5 minimum investment, you may acquire fractional shares of stocks and ETFs. Not all investing applications allow you to invest in fractional shares.

If you still rely on research reports and sophisticated charting before trading, Robinhood's charting features are limited. The fractional investment feature, on the other hand, is a decent tradeoff. Webull and Robinhood have a lot in common. More information about the two may be found here. Both investing applications are solid options, but they cater to different types of investors.

5. Ally Invest

If you use Ally for your online banking, this might be a good investing choice for you. To create a Self-Directed Account, there is no minimum initial deposit. Ally Invest has a lot of tools that are both powerful and simple to use. A trading simulator and probability calculator are among the stock screener tools available for trading stocks and options.

Trades in stocks and exchange-traded funds (ETFs) are completely free. Options transactions are commission-free, however each contract costs $0.50. Access to the Managed Portfolios option is another reason to choose Ally Invest. Investors can split their account between a Managed Portfolio and a Self-Directed Account, where they can buy hand-picked equities and ETFs.

In addition, unlike other robot advisors, Ally Invest Managed Portfolios do not charge an advising fee. However, compared to other automatic investing applications, these portfolios have a greater cash balance.

6. Betterment

Because of their cheap costs, simplicity of use, and automated portfolio rebalancing, Betterment is one of the most popular "robot advisors.". They also provide free tax-loss harvesting. Betterment will strive to make tax-advantaged investments wherever feasible to limit your year-end capital gains to a minimum.

You simply need $1 to begin investing with Betterment. Betterment will invest in an ETF portfolio of stocks and bonds once you complete the first questionnaire, which assesses your investing goals and risk tolerance. As you become older and closer to retirement, Betterment will automatically move your portfolio allocation from stock-centric ETFs to more stable bonds.

Portfolios for socially responsible investment are also available. However, these funds charge greater costs than a traditional index fund approach.

The standard management charge is 0.25 percent of the entire value of your portfolio. Depending on the size of your initial contribution, you may be able to avoid paying management fees for a year.

7. Personal Capital

Personal Capital is a financial platform with two functions. Personal Capital's free budgeting software is used by many users to keep track of their spending and set financial objectives.

They also provide a free investment cost analyzer that analyzes your present investments and gives recommendations for low-fee funds that are similar. Personal Capital is also popular among those who want to keep track of their net worth.

You may invest with Personal Capital and get free access to a financial counselor if you have at least $100,000 to invest. Even if you don't have this much money to invest (yet), regardless of whatever brokerage you choose, you can track your existing investments for free.

Personal Capital might be the simplest method to view all of your money in one spot if you utilize many brokers.

8. Fidelity

Fidelity, which is one of the major online brokers, has a lot to offer.

For starters, taxable and retirement investment accounts have no account minimums. Children's investment accounts are also accessible.

It's free to trade stocks and ETFs, much like the other free investment applications. There's also a line of Fidelity ZERO index mutual funds with no fund or trading fees and a $1 minimum investment. Fractional investing is accessible for over 7,000 US equities and ETFs through the Fidelity mobile app. When using the Fidelity website on a laptop, investors must purchase entire shares.

Fidelity's analyst reports and research tools are another incentive to consider them. Many rudimentary investment applications just provide news headlines and graphing capabilities. Investors may access free third-party studies from well-known research firms while doing investing research with Fidelity.

Fidelity Go is a good option for those looking for a fully automated investing portfolio. This robo-advisor doesn’t charge an advising fee for account balances below $10,000.

9. TD Ameritrade

If you want powerful research tools, go at TD Ameritrade. With its online browser and mobile app, TD Ameritrade provides excellent charting capabilities and third-party analyst reports.

Its sophisticated trading platform, TD Ameritrade is available for free. Other brokers charge a premium for comparable services. Trades in stocks and exchange-traded funds (ETFs) are completely free. For both taxable and retirement accounts, there is no account minimum.

The TD Ameritrade teaching tools are beneficial to both new and seasoned investors. Short online videos and live webinars on popular investment subjects are available.

10. Public

This app may appeal to you since it does not charge for order flow (PFOF) when you purchase or sell positions. Other free applications may charge a tiny fee to market makers, and as a result, you may not obtain the best trading price. This investment software comes with a variety of customizing options:

Limit and stop orders are advanced order types that allow you to only execute a deal at a particular price rather than the current market value. You may arrange your positions into short-term and long-term investment ideas using the portfolio organizer. The program provides a push message if you sell a long-term concept before keeping your shares for at least one year.

Investing themes: The service offers investing themes that can assist you in making informed decisions on environmental, social, and market developments. Community on the internet: Connect with other investors, view their portfolios, and talk with them inside the app to exchange investment ideas and perspectives. Education tools: Basic instructional tools can help new investors gain a basic grasp of how the stock market operates.

It can be an excellent platform for novice and seasoned investors who don't require the extra investment choices offered by traditional brokerages, such as mutual funds or CDs.

Summary Without having to pay trading commissions or account fees, anybody may invest and start earning compound interest. Popular financial applications, such as the ones listed above, may make investing easier and more convenient than ever before. A free investing app can assist you whether you're investing in stocks, ETFs, or real estate.

#investment#trading app#money management#vanguard#webull#m1 finance#robin hood#ally invest#betterment#Personal Capital#Fidelity#TD ameritrade#public

4 notes

·

View notes

Text

New York Magazine: You wrote on Twitter Wednesday, “The Reddit horde through collective action is doing to hedge funds what hedge funds do to normal investors all the time.” What do you mean by that?

Chris Arnand: Hedge funds can operate in a few different ways. But a classic one is to take a position and then “talk your book.” So, you go to Davos, go to dinner at investment conferences, and use all the knowledge you gather from these conversations with government officials and other investors to put on a trade. And you execute that trade in a way that gets you the most bang for your buck by exploiting complex financial products and what we call “technicalities” in the market: the way other people are positioned, the holdings people have. Then you go on CNBC, send out morning newsletters, send out direct messages via Bloomberg to your friends, and sell everyone on your trade.

That’s applauded behavior on Wall Street. You’re outsmarting the room, and you’re telling people that you’re outsmarting the room. In many ways, that’s what happened on Reddit over the course of the last six months. But it wasn’t done by one firm; it was done by 2.3 million self-described degenerates.

And they really did both: They took a position, and they talked their book! Somebody actually laid out a pretty good presentation on why GameStop was undervalued, a presentation that would have gone down pretty well in hedge-fund circles a while back. And then they built on that and they all piled in. They did it in a very clever way to take advantage of the positioning of Wall Street.

New York Magazine: Is it possible to briefly summarize what made their trade clever (in a way that a lay reader would understand)?

Chris Arnand: They did it through “call options.” Which is when you buy the right to purchase a stock at a set price within a specific time period. So let’s say GameStop was trading at $20 a share. The Redditors would buy a call option that gives them the right to buy a GameStop share for $50 at some point in the near future. And you can buy that very cheap because no one thinks the price of a GameStop share is ever going above $50. The broker dealers will sell the call options at a low price because they think it’s a low-probability event. But the Redditors know it is not a low probability event because they are going to push up the stock.

Now, broker dealers don’t want to take risks, contrary to what a lot of people seem to think. They don’t want to be betting that GameStop shares won’t rise above $50. So when they sell the call options, they hedge their risk. And they do that by buying their own GameStop shares, so they get some benefit if the stock somehow rises past $50. But it seems like a small risk. So if they sold a call option for 100 shares, they’ll only buy five or ten.

Then Redditors start running up the price. Suddenly, the broker dealers have to buy more GameStop stock to cover their risk. But when they do that, the stock price goes up even further. It becomes what is called a “gamma squeeze.” And the Redditors also know — as you wrote in your piece — that a lot of major players were shorting GameStop. So they knew they could get a short squeeze going, which sets off additional buying across the spectrum by hedge funds who were short and then by bankers who got stuck in a gamma squeeze and had to protect their hedges. So it just sets off to the moon.

That’s all considered fair game on Wall Street. That cleverness is rewarded. It’s why the hedge-fund people get paid the big bucks.

New York Magazine: Do you think the Reddit investors knew what they were doing?

Chris Arnand: That’s not clear to me. I think they just realized that they could get a lot of bang for their buck by buying call options. And then I think a few noticed, “Hey, as we drive the price up, this is going to make them have to buy more and then it’s going to become a self-fulfilling prophecy.” However it happened, what the Reddit crowd did collectively was a smart trade. It’s the kind of thing that would win you admiration on Wall Street.

New York Magazine: To play devil’s (i.e., hedge fund’s) advocate: When hedge funds execute clever feats of market manipulation, the losers are generally other rich people. By contrast, when charismatic Reddit posters (who got in on the GameStop trade early) try the same maneuver, they do so by encouraging a bunch of non-wealthy amateur investors to pile into a trade that many likely do not understand. So the losers are potentially less insulated against financial strife. That at least seems to be the sort of distinction that those tut-tutting WallStreetBets on CNBC want to draw. Is there something to that paternalistic argument?

I think that actually gets to the heart of it: Either you believe in the free market or you don’t. To be clear, I don’t. I’m not suggesting that what the hedge funds do is legitimate and therefore what Reddit’s doing is legitimate. I’m saying you have to apply your standards equally. I’m not particularly happy, personally, that Reddit is copying the hedge funds. I wish the hedge funds would stop doing what they’re doing. But if it’s legal for the hedge funds, you can understand why people on Reddit would be outraged when people act like it’s not legal for them to do the same.

The ideology of Wall Street is libertarianism. It’s that people have agency and should be allowed to exercise it. It’s a non-paternalistic worldview. It’s “Everyone is out for themselves, and the reason we make money isn’t because we’re more selfish, it’s because we’re smarter.” If that’s your attitude, fine. That’s not my attitude. I think Wall Street’s ethos — “Profits at all costs, everything is a market, the world is casino, I just want to make my money so I can buy my nuggets” — is really negative. I don’t like that the corrupt attitude of the rich has trickled down. But if the rich are going to be able to play this game, then why are you surprised when the less rich start playing?

– “Robinhood Banning GameStop Proves the Free Market Is a Lie,” by Eric Levitz, New York Magazine

17 notes

·

View notes

Text

New Dumbo Movie Explains Shorting Stocks of GameStop, Blackberry, Bed Bath and Beyond and Beyond...

Friday January 29th 1.29.2021 5:20 AM Shorting is betting that a worthless stock is even more worthless in the future. Put. A Bet you are going to lose $ so, loan me your stock, and I’ll buy it from you later at the set price even though now it’s worth less and I get richer, right?!!... I thought I got it. But I clearly don’t. I don’t get betting against the house or pawn shops. This Dumbo Disney movie cleared it up tho.

I was watching the 3.29.2019 Dumbo movie which is so different than the 1941 blatantly racist version. They both separate kids from parents and put them in cages. But I digress.

This time, after the Spanish Influenza pandemic killing half of his acts, the Circus owner, Medici, buys an Indian/Asian Elephant as a cheap investment. She has a baby with freakishly large ears, so Medici sells her back to the original owner for half of the price. Like a pawn shop.

Yet the baby, Jumbo Junior, can fly....And sky rockets ticket sales of the Medici Bros. Circus. IT’s because of the “Feather” that Junior can fly. Guess what, Robinhood stock app’s brand is a what????A FEATHER!!!

Yes Robinhood app was used to raise the price of the lost and forgotten stocks and made regular people soar to riches, like Dumbo. They went to Dreamland yet it burned by the hands of the financiers and money men. The good people stole Mrs. Jumbo and helped her and her son go to the docks near the World Trade Center/ Wall Street via the Brooklyn Bridge from Brooklyn.

Perhaps the money is now going to be invested in off-shore accounts or into Safari’s in East Africa, since that’s where the Jumbo family immigrated. Jumbo is a Swahili greeting. So Hello.

What's more, Medici is given 100 shares of Vandever stock along with 100k. Funny that the check is not in dollars. It appears to say Guly.

4 notes

·

View notes

Text

The Most Expensive Stock to Short Could Be The Next GME | AMC

The Most Expensive Stock to Short 🩳 Could Be The Next GME | AMC https://www.youtube.com/watch?v=Jo0hUsF0th0 The Most Expensive Stock To Short! Could This Be The Next $GME, $AMC Short Squeeze??? ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ LINKS Trump Media is the most expensive U.S. stock to short — by far https://ift.tt/J7zUSZB Short Borrow Fee Rates $DJT https://ift.tt/9Ir8KQE Trump Media CEO urges House GOP leaders to address 'potential manipulation' of DJT stock https://ift.tt/KV3sEki Short Float https://ift.tt/lfmc4xY ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/FjsbgyX 👉 Instagram: https://ift.tt/cjDF0nT ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How My Subscribers Doubled Their Money Today!!! https://youtu.be/s5M_OGv8AtM 👉 7 Great Value Stocks to Buy BEFORE They Explode! https://youtu.be/0I451lsCjAc 👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥 https://youtu.be/4B3EK7lb38k ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #gme #gmeshortsqueeze #gmestocks #gamestop #gamestopstock #amc #amcstock #amcstocknews #stockanalysis #stockstobuy #stockpicks #stockearnings #bullish #optionstrading #shortsqueeze #shortinterest #shortselling #shorts #robinhood #memestocks #technicalanalysis #fundamentalanalysis #djtstock #trumpmedia Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA May 14, 2024 at 08:49AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

0 notes

Link

All of the excitement in penny stocks this year has traders looking for places to call home. The issues faced by Robinhood users recently, thanks to a massive spike in certain stocks, have some traders searching for a new broker.

If you search through some of the discussions on places like Reddit, penny stock traders are finding that brokers like Webull and Fidelity have come into focus. I’m not endorsing any single broker over another. But seeing different trends is important. One of the big reasons is that now we’ve got traders who’re used to only trading penny stocks on Robinhood that’ve never been able to access OTC stocks before. Other brokers, including Webull, have also followed this path...Continue Reading On PennyStocks.com

#penny stocks#stocks to buy#stocks to watch#best penny stocks#cheap stocks#robinhood#fidelity#webull#stocks under $1

1 note

·

View note

Text

Saga of Wall Street's pandemic darlings ends with tears

New Post has been published on https://medianwire.com/saga-of-wall-streets-pandemic-darlings-ends-with-tears/

Saga of Wall Street's pandemic darlings ends with tears

Oct 12 (Reuters) – Think about something novel you started doing two-and-a-half years ago to make life easier during the COVID lockdown and chances today are that there is a related story about a stock market casualty.

Add investor worries about soaring inflation and an economic slowdown that tipped Wall Street into a bear market this year, and you will find a bleak picture for the companies that became hugely popular during the pandemic.

Connected stationary bike maker Peloton Interactive (PTON.O) told employees last week that its fourth round of job cuts this year is a bid to save the company. Its problems put a spotlight on other pandemic hot-shots like Zoom Video Communications (ZM.O), Nautilus Inc (NLS.N), DocuSign Inc (DOCU.O) and DoorDash Inc (DASH.N).

Growth investors pushed Peloton stock to a $171.09 record in early 2021. Demand was so strong for its bikes that restless consumers had to wait out long delivery delays. But Peloton shares are now down 95% from their peak, closing at $8.53 on Wednesday. The S&P 500 (.SPX) by comparison is down about 25% from its record high in January this year.

Others bought exercize gear from Nautilus during the pandemic, sending its stock up to $31.30 in early 2021. It last traded at $1.65.

Zoom became synonymous with online meetings as many people worked remotely and even turned to video conferences for social gatherings. But Zoom’s shares were last at $75.22 versus its $588.84 peak, reached in October 2020.

Other stay-at-home favorites were online retailer Amazon.com (AMZN.O) and food delivery service DoorDash . People also flocked to consumer-friendly brokers like Robinhood Markets (HOOD.O) while stuck at home with no sports to bet on. But after scaling $85 in August 2021, Robinhood last traded at $10.66.

“These are companies with good enough ideas that they get enough funding. They catch a wave like COVID, their use explodes,” said Kim Forrest, chief investment officer at Bokeh Capital Partners in Pittsburgh. But once that growth slows, investors lose interest.

“They kind of used up all the air in their universe, and they have nowhere to grow. So, while people might still be using the Peloton, not enough people are buying the Peloton,” said Forrest.

Daniel Morgan, portfolio manager at Synovus Trust in Atlanta, Georgia, says Peloton may appear cheap, but he is wary because it is not profitable. Its price-to-sales multiple has fallen to 0.8, on a trailing 4-quarter basis, from an average multiple of 6.6 since it went public in Sept. 2019, Morgan said.

Wall Street expects Peloton to report an adjusted loss per share of $2.07 for its fiscal year ending in June compared with a loss of $7.69 in its fiscal year 2022, according to Refinitiv.

Zoom has been making money and its valuation also appears cheap at 35 times earnings per share versus an average multiple of 135 since its April 2019 debut, Morgan said.

Still, he is concerned about its profit decline. Zoom’s adjusted earnings per share is expected to fall 27% for its fiscal year ending in January versus 2022 growth of 55.5%, according to Refinitiv.

Morgan also pointed to a growth slowdown for DoorDash and retail giant Amazon.com as they are also being hurt by soaring inflation and economic uncertainty.

“Each company is going to have to see how their particular business model can execute in a normalized environment,” he said.

Carol Schleif, deputy chief investment officer at BMO’s family office in Minneapolis, cautioned against investing in companies that look cheap and have loyal customers. It’s all about management, balance sheets and projected income, she said.

While one possible outcome for pandemic favorites with slowing growth could be a buyout by a larger company, Schleif is wary of making this bet.

“Buying a stock because you think it’s going to get taken out, that’s a risk. I wouldn’t be willing to do it with any money I wasn’t willing to lose,” she said. “It’s not really investing. It’s more opportunistic.

Reporting By Sinéad Carew, Lance Tupper and Chuck Mikolajczak; Editing by Alden Bentley and Richard Pullin

Our Standards: The Thomson Reuters Trust Principles.

Read the full article here

0 notes

Text

Is it better to own more shares of a cheap stock or fewer shares of a pricey stock?

There is no mathematical difference between buying more shares of a less expensive stock versus buying fewer shares of a more expensive stock. Let’s say you buy either 100 shares of a $1 stock or 1 share of a $100 stock. If both gain (or lose) 10%, your theoretical gains (or losses) would be the same.

Even better, with an increasing number of online stock brokers like M1 Finance, Robinhood, and Matador offering commission-free trades, you don’t even have to factor in commission fees when debating whether to buy 100 shares or 1 share in a single transaction.

That said, cheaper stocks, especially those known as penny stocks, can be riskier stocks to hold. Remember to do your research before investing in any company or fund.

Sources: Motley Fool: “Is it better to buy more shares of less expensive stocks?”; MarketWatch: “Buying ‘cheap’ stocks is an expensive mistake”

Disclaimer: LetStockAbout’s linking to a brokerage does not imply an endorsement. Always do your research before opening a brokerage account.

1 note

·

View note

Text

trading options in an ira Louisiana If an options trading system was like a tic-tac-toe system, then we would all be wealthy.

Key Principles

trading options in an ira Louisiana When you add new trading criteria to your system, you should be able to see an improvement to your statistics.

options trading advice service Louisiana You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis.

earnings options trading course Louisiana Keep it simple, buy calls for and upside trade or buy puts for a downside trade.

books on options trading for beginners Louisiana This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc.

options trading delta Louisiana If you do not, it is time to reassess your defined criteria.

options trading reddit Louisiana Options Trading System - 5 Steps To Better Options TradingWhat is an Options Trading System?

options trading robinhood Louisiana It takes the subjectivity and second guessing out of your trading so you can focus on preset factors that make for an explosive trade.

trading options training course Louisiana Trade - Once you have defined the basics of your strategy, it is time to trade.

trading options in an ira Louisiana The frequency of your analysis will depend on how much you are trading.

The second skill of trading options profitably is factoring time into your trading system in relation to trading a particular stock option and knowing the statistics of your option trading methodology or option trading setup by knowing the average holding period of a trade signal. If your average holding time for an option trade is seven days then you don't want to buy an option with three months of time premium left on it because you would be paying more for the extra time with the option's purchase price. Nor would you buy an option with less that 30 days till expiration as time decay would erode the value of option so quickly that even if the option's underlying stock movement moved favorably to you the time decay would prevent you from realizing a gain in the option itself. The third thing to profitable option trading is understanding the relation of volatility between the market, the underlying stock that underlies the stock option, and the effect is has on the value of the option itself. When the general stock market as an index goes through periods of volatility or low trading ranges the stocks that make up the market tend to follow overall trend and also begin to experience periods of low overall volatility which in turn can cause derivative like stock options to become cheap or low premiums. But if the market's volatility rises it is likely that individual stocks will follow the trend causing stock option premiums to increase in value given that the market moves in the trader's favor.

Critical Theories:

risks of options trading Louisiana

learning options trading course outline Louisiana

options trading bots alerts Louisiana

options trading spreadsheet download Louisiana

options trading online course Louisiana The criteria are different for each type of option trading strategy.

There are five essential keys that any option trader must understand when developing a winning stock option system. First, you must understand the degree which time affects the premium of the option you are considering trading. There are two parts you must consider when factoring time into the stock option trading decisions. The first thing that you must take into account is the intrinsic time left on an option. Since options have a limited time period of anywhere from 30 days to several year depending on the particular option that you bought you must be sure that you purchase the correct option containing enough time on it to insure that time decay doesn't erode your investment away before your position has enough time to be profitable. The second skill of trading options profitably is factoring time into your trading system in relation to trading a particular stock option and knowing the statistics of your option trading methodology or option trading setup by knowing the average holding period of a trade signal. If your average holding time for an option trade is seven days then you don't want to buy an option with three months of time premium left on it because you would be paying more for the extra time with the option's purchase price. Nor would you buy an option with less that 30 days till expiration as time decay would erode the value of option so quickly that even if the option's underlying stock movement moved favorably to you the time decay would prevent you from realizing a gain in the option itself. The third thing to profitable option trading is understanding the relation of volatility between the market, the underlying stock that underlies the stock option, and the effect is has on the value of the option itself. When the general stock market as an index goes through periods of volatility or low trading ranges the stocks that make up the market tend to follow overall trend and also begin to experience periods of low overall volatility which in turn can cause derivative like stock options to become cheap or low premiums. But if the market's volatility rises it is likely that individual stocks will follow the trend causing stock option premiums to increase in value given that the market moves in the trader's favor.

trading spy options Louisiana This means your trading system must be based around actual stock price movement.

Volatility, time and stock movement can all affect your profitability. You need to be cognizant of each of these variables. It is easy to be swayed by emotion when the market is moving. Having a system helps to control your reaction to those very natural and normal emotions. How often have you sat and watched a trade lose money the instant your buy order filled? Or, have you ever watched a stock skyrocket in price while you are pondering over whether or not to buy it? Having a structured plan in place is crucial to make sound and objective trading decisions. By creating and following a good system, you can hone your trading executions to be as emotionless and automatic as a computer. Advantages of an Options Trading SystemLeverage - Trading options gives your account leverage on the stock market. With options, you can control hundreds or thousands of shares of stock at a fraction of the price of the stock itself. A five to ten percent change in the price of a stock can equate to a gain of one hundred percent or more in an option. Try to focus on percentage gains versus dollar amount gains in your trading. It requires a fundamental shift in conventional thinking, but it is crucial to managing a successful trading system. Objectivity - A good options trading system is based on measurable criteria that trigger buy and sell signals. It takes the subjectivity and second guessing out of your trading so you can focus on preset factors that make for an explosive trade. Flexibility - Nearly all options traders will tell you that options allow for flexibility in your trading. Opportunities in the options market make it incredibly easy to profit from short-term positions. With earnings events and weekly options, you can build strategies for overnight gains with clearly defined risk. There are a several ways to profit in any kind of market condition from trending to range bound. Protection - An options trading system based on the appropriate strategy for prevailing market conditions can act as a hedge against other investments. Protective puts are commonly used this way. Risk - A good options trading system limits risk in two important ways. The first way is cost.

ira options trading Louisiana That said, your trading system doesn't need to work for all stocks it just has to work for certain types of stocks, certain volatility of stocks and certain price levels of stocks etc.

Try to focus on percentage gains versus dollar amount gains in your trading.

profiting from weekly options how to earn consistent income trading weekly option serials Louisiana This statement is not meant to be grandiose, idealistic comment made by some 'trading theorist', rather, it is a statement born out of the hard knocks and success experiences of the author and many other long-term, successful trader contemporaries.

Invariably, the one that has the ability to remain as detached from his losing trades as well as his winning trades while maintaining the discipline to follow the system's rules no matter the trading result will emerge the greatest winner in the end. Using these five keys as a basis to develop your stock option trading methodology can help you avoid the mistakes and pitfalls of many beginning option traders. By understanding time decay, factoring an option's time into your trading method, how volatility impacts a stock option's value, what defines a reliable stock option trading methodology, and your own trading psychology you now have a foundation to develop into a winning stock option trader. Finding Or Creating Your Own Options Trading System That WorksStock Options are wonderful! This clever derivative of the equities market has to be one of the most ingenious inventions of modern times. For the trader who can learn how to win at trading options there are many luxuries in life that can be experienced. Success in options trading requires a consistent approach for long-term success. This statement is not meant to be grandiose, idealistic comment made by some 'trading theorist', rather, it is a statement born out of the hard knocks and success experiences of the author and many other long-term, successful trader contemporaries. This "consistent approach" to options trading can also be called a "trading system", or an "options trading system" in this case. The term "trading system" is not necessarily confined to a series of computerized "black box" trading signals. A trading system could be something as simple as "buy an option on a stock in an uptrend that breaks the high of the previous bar after at least two days of pull back down movement that make lower lows. " A trading system is simply an organized approach that takes advantage of a repeated pattern or event that brings net profits. Since an Option is a "Derivative" of the stock you must derive your options trading system from a stock trading system. This means your trading system must be based around actual stock price movement. That said, your trading system doesn't need to work for all stocks it just has to work for certain types of stocks, certain volatility of stocks and certain price levels of stocks etc. So focus your trading system on certain stocks that have price behavior that is predictable to the net results you wish to abstract from a stock. You can develop a trading system, a trading approach, and a trading methodology by identifying a price movement pattern (or lack of price movement pattern) or some event that occurs on some sort of regular basis. This means you can trade price behavior patterns on price charts such as: traditional chart patterns, trends, swings, pivot points, boxes etc. or you can trade events that motivate stock price such as earnings runs, post earnings runs, stock splits, seasonal factors etc. Bottom line to make the maximum profit in options trading you want your stock to move in your favor fast and you want it to move far. Just a relatively small movement in the price of a stock can double your money in options!There are so many different strategies and combinations that you can trade with options.

When you are satisfied with the parameters of your system, you can look into having your own software made for automated trading. Five Steps to Get Started With an Options Trading SystemPick a strategy - You can pick any strategy to start building a system. Buying calls and puts is the easiest way to get started. As you learn and experience more about how prices move, you can add new strategies to your trading to enhance your system. Adding covered calls and protective puts to long equity positions is a logical next step and can supercharge your account by generating monthly or weekly cash flow. Trade - Once you have defined the basics of your strategy, it is time to trade. Start small, one or two contracts, and keep detailed records of your transactions. Be sure to include what the underlying stock price was at the time of your option purchase or sale. Your records will help you analyze how you are doing and where you can improve. When you add new trading criteria to your system, you should be able to see an improvement to your statistics. If you do not, it is time to reassess your defined criteria.

options trading tutorial pdf Louisiana Since an Option is a "Derivative" of the stock you must derive your options trading system from a stock trading system.

You can also get into ratio back spreads, condors, and butterflies.

advice for options trading Louisiana Five Steps to Get Started With an Options Trading SystemPick a strategy - You can pick any strategy to start building a system.

The price of options is very low compared to buying the same amount of stock. The second way is related to stops. A good system will cut losses quickly and keep them small. Any Option Trader Can Develop an Options Trading SystemAs a trader, it is important build a system that utilizes different types of option strategies-iron condors, broken wing butterflies, calendar spreads, back ratios, straddles, strangles, and collars. It might sound like a foreign language right now, but work on the vocabulary one lesson at a time. Break it down piece by piece and make it your own. Each term has a specific application for yielding profits under certain market conditions. Learn them all at your own pace to enhance upon and build your options trading system. The more tools that are in your toolbox, the more prepared you will be for changing market conditions. If the market were to behave in the same way every day, then trading would be child's play. In order to get started in developing your options trading system, you have to create a trading plan or blueprint to guide you in the right direction. Begin with a basic system and tweak it to define your trading criteria and hone your system. It takes time and experience to build a successful option trading system that can return one hundred percent or more in consistently profitable trades. When you are satisfied with the parameters of your system, you can look into having your own software made for automated trading. Five Steps to Get Started With an Options Trading SystemPick a strategy - You can pick any strategy to start building a system. Buying calls and puts is the easiest way to get started. As you learn and experience more about how prices move, you can add new strategies to your trading to enhance your system. Adding covered calls and protective puts to long equity positions is a logical next step and can supercharge your account by generating monthly or weekly cash flow. Trade - Once you have defined the basics of your strategy, it is time to trade. Start small, one or two contracts, and keep detailed records of your transactions. Be sure to include what the underlying stock price was at the time of your option purchase or sale. Your records will help you analyze how you are doing and where you can improve. When you add new trading criteria to your system, you should be able to see an improvement to your statistics. If you do not, it is time to reassess your defined criteria. Evaluate - Evaluate your successes and failures. The frequency of your analysis will depend on how much you are trading. If you are trading actively, then a weekly or monthly review is important. Compare your losses with your winnings. Zero in on the key factors that make up a winning trade and try to fine tune your criteria to enhance your executions. As painful as it may be, analyze your mistakes, too. Fine tune your criteria to eliminate making those same mistakes again.

trading options for a living Louisiana Start small, one or two contracts, and keep detailed records of your transactions.

Directional options trading systems are the best.

Critical Techniques:

options trading research Louisiana

naked options trading service Louisiana

reddit options trading Louisiana

commodity options trading Louisiana

0 notes

Text

In Focus: DraftKings, Think Bigger, Think Long-Term

The easiest way for the average Joe or Jane to beat Wall Street is to invest long-term, that's it. No bells, no whistles, no complex algorithms, just find something good, buy it cheap, and HODL. The strategy is easier said than done because there are so many things happening in the short term that makes it tough to think five or ten years out.

Today with social media, investors, even those thinking long-term get bombarded with short-term wins from theWallStBets crowd or the StockTwits crowd and sometimes the Twitter and YouTube crowd. Seeing a post of someone that bought a few thousand dollars worth of AMC ($AMC) calls on Friday and woke up Monday to $100,000 makes it really hard to stay focused on long-term investing.

Meme stocks aside, the toys of Wall Street, the actual companies being invested in, are thinking long term, at least the good ones are. This is in spite of what Wall Street analysts are doing. Jeff Bezos, while CEO of Amazon ($AMZN)stated in the past, no one on his team should be thinking about next quarter. Bezos always maintained a long-term vision,and that vision has rewarded him and his investors greatly.

Last week, there was a news report that DraftKings ($DKNG) was in a bidding war with FanDuel for The Athletic. TheAthletic is like the Washington Post or NY Times for sports. Subscriptions for the sports publication topped one million last year, and it's been the subject of merger talks before. Earlier in the year, the rumor was that The Athletic would merge with Axios and then go public via a SPAC merger. The deal with Axios fell through leaving The Athletic up for grabs.

DraftKings' move to acquire The Athletic tells me it is building something big that will pay off in the long term. WhileWall Street is thinking about the number of bets DraftKings can get in the next quarter, DraftKings is trying to build out a full fledged digital entertainment ecosystem.

Since I last discussed DraftKings it's down slightly. Since that time in late May 2021, DraftKings moved from around$44.00 per share to over $60 per share, but now it's back in the 40s.

The company's most recent quarterly earnings did not impress Wall Street, and caused a slight sell off on Friday.DraftKings hauled in $213 million of revenue in Q3 2021, a 60% year-over-year increase from revenue in Q3 2020, butthe figure missed analysts estimates by $24.9M. The company saw a rise in operation expenses and sales and marketing costs during the quarter which contributed to a $545 million net loss.

Losses aside, DraftKings was able to increase its average revenue per monthly unique payer to $47 during the quarter, up31% from the same period in 2020. The company adjusted its revenue forecast for 2021 from the range of $1.21 billion -$1.29 billion to $1.24 - $1.28 billion, which still fell short of the $1.29 billion annual revenue that analysts were expecting.

DraftKings also had some regulatory wins during the quarter with successful launches of online sports betting rolling out in Wyoming, Arizona and Connecticut.

A move that speaks to the company wanting to build a bigger enterprise, DraftKings took a $22 billion swing at acquiringBritish gambling house Entain. They missed, but still, the idea that DraftKings entertained this acquisition goes back to what I wrote earlier, this company is thinking long-term and attempting to build something big.

What's Holding Investors Back

There's a lot to fear when thinking about DraftKings. For one, when there were no sports to bet on during the early days of the coronavirus pandemic, bettors moved from DraftKings to Robinhood, and big wins by fellow novice traders have kept people attached to Robinhood. Also, DraftKings and FanDuel were the first through the door, so they took all the bullets, but now betting has become commonplace. ESPN and almost every other sports entertainment network now shows the betting lines regularly. My fear is that instead of partnering with DraftKings, more companies will take the full leap into betting and daily fantasy themselves.

Thinking Long Term, Finding the Bigger Picture

In 2014 Apple acquired headphone maker Beats By Dre. Prior to the acquisition, the Apple rumor of the time was that the company was going to develop a television. Not many analysts were fans of the Beats by Dre acquisition, some wondered why Apple needed a headphone company, others just preferred the TV ideal. What most people missed, is that acquisitions in 2014 was the start of Apple building out its Apple Services arm. The acquisition had very little to do with headphones,it was more about the streaming service that Beats had created. At that time, Apple was still selling songs and albums viaiTunes, and they realized it was a dying business. Also, and this is only my opinion, without the Beats by Dre acquisition,I don't think Apple creates the $12 billion business that is Apple AirPods.

DraftKings is in the early stages of building something big. It started with fantasy sports, and then added casino games and a sportsbook. While it's spending money like mad to acquire customers, it's also spending big to expand the platform.While there is a risk that other companies will enter DraftKings' space, I think sitting idly by waiting for someone to dosomething isn't a smart investment move.

If you want to beat the Street, think and invest long term, find a company with a long term vision and invest in it.

#stocks#investing#investments#investmentEducation#FinancialEducation#WallStreet#StockMarket#Sports#SportsBetting#DraftKings#Betting#MGM#FanDuel#FantasySports#eSports#Money

0 notes

Text

The Biggest Hedge Funds on Wall Street Are Buying The Dip on This Meme Stock!