#but you should always check the records on any piece of property you might purchase

Explore tagged Tumblr posts

Text

Look at me, directly here, in my face

If an easement is a legal document granting rights to a property to someone other than the owner of that property, including the right to access the property

And easements run with the deed, not with the owner, and may be limited or permanent

Can a vampire get in if someone has previously granted them an easement on your house

Does a vampire have an easement on your house right now

#s is working#this is when I come out in big sweater and say hi#I'm Sabine#we're having a lot of fun here today#but you should always check the records on any piece of property you might purchase#unscrupulous or uninformed sellers may convey a property without you knowing#and the real vampire is regulations placed on a property that you didn't realize you were going to have to follow#sometimes people challenge me on this and say#'but you're not allowed to not disclose that'#and then I laugh bitterly and walk away without saying anything

13 notes

·

View notes

Text

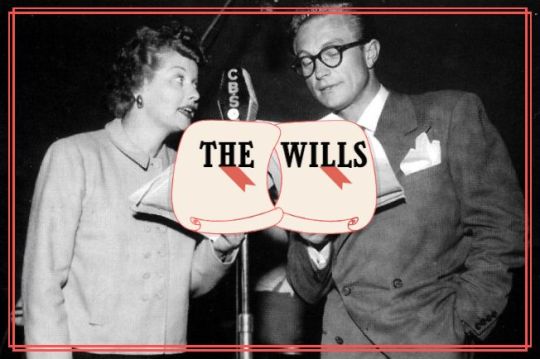

THE WILLS

March 19, 1950

“The Wills” (aka “The Coopers Make Their Wills”) is episode #80 of the radio series MY FAVORITE HUSBAND broadcast on March 19, 1950.

Synopsis ~ After Liz and George make out their wills, Liz is convinced that George intends to do away with her. Liz is startled to find a receipt for some arsenic and rope in his pocket, but is shocked when George suggests a trip to the country - with a one-way ticket for Liz!

Starting with this episode, “My Favorite Husband” moved from Thursday nights, to Sunday nights.

Note: This program was used as a basis for a scene in “I Love Lucy” episode “Lucy Thinks Ricky Is Trying to Murder Her” (ILL S1;E4) filmed on September 8, 1951 and first aired November 5, 1951. For various reasons, it was the first episode of the series filmed, but the fourth aired.

“My Favorite Husband” was based on the novels Mr. and Mrs. Cugat, the Record of a Happy Marriage (1940) and Outside Eden (1945) by Isabel Scott Rorick, which had previously been adapted into the film Are Husbands Necessary? (1942). “My Favorite Husband” was first broadcast as a one-time special on July 5, 1948. Lucille Ball and Lee Bowman played the characters of Liz and George Cugat, and a positive response to this broadcast convinced CBS to launch “My Favorite Husband” as a series. Bowman was not available Richard Denning was cast as George. On January 7, 1949, confusion with bandleader Xavier Cugat prompted a name change to Cooper. On this same episode Jell-O became its sponsor. A total of 124 episodes of the program aired from July 23, 1948 through March 31, 1951. After about ten episodes had been written, writers Fox and Davenport departed and three new writers took over – Bob Carroll, Jr., Madelyn Pugh, and head writer/producer Jess Oppenheimer. In March 1949 Gale Gordon took over the existing role of George’s boss, Rudolph Atterbury, and Bea Benadaret was added as his wife, Iris. CBS brought “My Favorite Husband” to television in 1953, starring Joan Caulfield and Barry Nelson as Liz and George Cooper. The television version ran two-and-a-half seasons, from September 1953 through December 1955, running concurrently with “I Love Lucy.” It was produced live at CBS Television City for most of its run, until switching to film for a truncated third season filmed (ironically) at Desilu and recasting Liz Cooper with Vanessa Brown.

MAIN CAST

Lucille Ball (Liz Cooper) was born on August 6, 1911 in Jamestown, New York. She began her screen career in 1933 and was known in Hollywood as ‘Queen of the B’s’ due to her many appearances in ‘B’ movies. With Richard Denning, she starred in a radio program titled “My Favorite Husband” which eventually led to the creation of “I Love Lucy,” a television situation comedy in which she co-starred with her real-life husband, Latin bandleader Desi Arnaz. The program was phenomenally successful, allowing the couple to purchase what was once RKO Studios, re-naming it Desilu. When the show ended in 1960 (in an hour-long format known as “The Lucy-Desi Comedy Hour”) so did Lucy and Desi’s marriage. In 1962, hoping to keep Desilu financially solvent, Lucy returned to the sitcom format with “The Lucy Show,” which lasted six seasons. She followed that with a similar sitcom “Here’s Lucy” co-starring with her real-life children, Lucie and Desi Jr., as well as Gale Gordon, who had joined the cast of “The Lucy Show” during season two. Before her death in 1989, Lucy made one more attempt at a sitcom with “Life With Lucy,” also with Gordon.

Richard Denning (George Cooper) was born Louis Albert Heindrich Denninger Jr., in Poughkeepsie, New York. When he was 18 months old, his family moved to Los Angeles. Plans called for him to take over his father’s garment manufacturing business, but he developed an interest in acting. Denning enlisted in the US Navy during World War II. He is best known for his roles in various science fiction and horror films of the 1950s. Although he teamed with Lucille Ball on radio in “My Favorite Husband,” the two never acted together on screen. While “I Love Lucy” was on the air, he was seen on another CBS TV series, “Mr. & Mrs. North.” From 1968 to 1980 he played the Governor on “Hawaii 5-0″, his final role. He died in 1998 at age 84.

Gale Gordon (Rudolph Atterbury) had worked with Lucille Ball on “The Wonder Show” on radio in 1938. One of the front-runners to play Fred Mertz on “I Love Lucy,” he eventually played Alvin Littlefield, owner of the Tropicana, during two episodes in 1952. After playing a Judge in an episode of “The Lucy-Desi Comedy Hour” in 1958, he would re-team with Lucy for all of her subsequent series’: as Theodore J. Mooney in ”The Lucy Show”; as Harrison Otis Carter in “Here’s Lucy”; and as Curtis McGibbon on “Life with Lucy.” Gordon died in 1995 at the age of 89.

Bea Benadaret (Iris Atterbury) does not appear in this episode.

Ruth Perrott (Katie, the Maid) was also later seen on “I Love Lucy.” She first played Mrs. Pomerantz (above right), a member of the surprise investigating committee for the Society Matrons League in “Pioneer Women” (ILL S1;E25), as one of the member of the Wednesday Afternoon Fine Arts League in “Lucy and Ethel Buy the Same Dress” (ILL S3;E3), and also played a nurse when “Lucy Goes to the Hospital” (ILL S2;E16). She died in 1996 at the age of 96.

Bob LeMond (Announcer) also served as the announcer for the pilot episode of “I Love Lucy”. When the long-lost pilot was finally discovered in 1990, a few moments of the opening narration were damaged and lost, so LeMond – fifty years later – recreated the narration for the CBS special and subsequent DVD release.

GUEST CAST

Herb Vigran (Doctor Stephens) made several appearances on “My Favorite Husband.” He would later play Jule, Ricky’s music union agent on two episodes of “I Love Lucy”. He would go on to play Joe (and Mrs. Trumbull’s nephew), the washing machine repairman in “Never Do Business With Friends” (S2;E31) and Al Sparks, the publicity man who hires Lucy and Ethel to play Martians on top of the Empire State Building in “Lucy is Envious” (S3;E23). Of his 350 screen roles, he also made six appearances on “The Lucy Show.”

EPISODE

ANNOUNCER: “As we look in on the Coopers tonight, it's just after dinner, and we find Liz and George settling down to a normal evening's conversation.”

George has something he needs to talk to Liz about. Liz immediately thinks it is something to do with her household budget, but George wants to talk about their wills. The subject immediately upsets Liz. The idea of living without George sends Liz into gales of tears. George wants her to read it, and threatens to leave everything to his mother if she doesn’t. Liz snatches the will from him. George then tells her that he has had her will drawn up as well.

LIZ: “What for? You're the one who's going! What are you trying to do, push me ahead of you in line?”

George reminds her of the three acres of Florida beachfront property that her father left her, which she calls ‘Sunken Acres.’ George always assumed it was oil land.

LIZ: “If there's any oil down there, it's still in a whale. Oh! I see it all now, George! You want me to sign a will leaving everything to you, and then you'll bump me off! You want to get your dirty fishhooks on my oil holdings!

Liz agrees to read and sign the will as the scene fades out. At the bank the next day, Mr. Atterbury notices that George seems tired. George admits he was up late talking to Liz about their wills. Mr. Atterbury proposes that the Coopers join him and Iris at their mountain lodge for the weekend, flying up, and then leaving the girls there for the week while they fly back for work. The following weekend they will drive up to get them in Mr. Atterbury’s new car.

Mr. Atterbury has already bought the airline tickets and asks George to go to the hardware store for a few items.

MR. ATTERBERRY: “I need poison for those horrible little gophers up there. And some rope for a clothesline, and a couple of sacks of cement. Iris wants a patio so she can sunbathe. Come to think of it, that ought to keep the gophers away.” GEORGE: “Let me make a list on the back of this envelope. Now, poison, ropes, cement...” MR. ATTERBERRY: “Oh, and I need an axe, too.”

Mr. Atterbury tells George that they should tell their wives that they are just going for a weekend, so that they don’t rush out to buy a week’s worth of new clothes.

At the Cooper home, Katie the Maid is preparing dinner. George comes home and tells Liz the good news that they’ll be going to the Atterbury’s lodge this weekend, and he’s got the airline tickets in his pocket. As George goes upstairs to prepare for dinner, Katie reminds Liz that she has a beauty shop appointment on Saturday. Liz wonders what time the plane leaves, and fishes in George’s jacket pocket to check the tickets. She notices that one tickets is round trip, and the other is one way! Liz immediately assumes one of them isn’t coming back, and reminds Katie that George asked her to sign her will! She notices some writing on the envelope that looks like a shopping list.

LIZ: “Poison! He's going to take me out in the woods and poison me! Look, at the next item - rope. If the poison doesn't work, he's gonna hang me! Cement. If I live through the poison and the rope, he's gonna put my feet in cement and dump me in the lake! Look what's next - axe! If I able to hold my breath, he's gonna swim in the water and chop me to pieces!” KATIE: “Oh, how can Mr. Cooper do such a thing?” LIZ: “With that list of weapons, how can he miss?“

Liz realizes why George might want to do away with her - they’ve finally struck oil on Sunken Acres!

End of Part One

Announcer Bob LeMond reads a live Jell-O commercial.

ANNOUNCCER: “As we return to the Coopers, we find Liz in a state of nervous apprehension. After years of having George under her thumb, she's suddenly discovered that he's bout to put the finger on her. Or at least she thinks he is. But right now it's after dinner, and Liz, the intended victim, is in the living room, reading. While George, the killer, is slowly stalking up behind her.”

George kisses Liz on the back of the neck. She screams! Liz nervously says that she’d rather not go to the Atterbury’s lodge this weekend.

GEORGE: “What? Why, Liz, you love the lodge. You always say that's your idea of living.” LIZ: “Well, I want to keep it that way.”

George says that he has a big surprise for her up there. Liz suggests he take his mother and give HER the big surprise!

GEORGE: “Now, don't be silly! You just wait: When you wake up Monday morning, you'll be very pleasantly surprised.” LIZ: “If I wake up Monday morning, I'll be surprised.”

Liz wonders if George is having money problems. She asks him why he made her sign her will last night. George says that if it bothers her so much, he’ll tear it up - as soon as they get back from the lodge.

Liz runs to her bedroom and locks the door! George telephones Dr. Stephens (Herb Vigran) to report that Liz is acting peculiar.

DOCTOR: “Peculiar for Liz, or peculiar for normal people?”

RICKY RICARDO: “Lucy is acting crazy!” FRED MERTZ: “Crazy for Lucy or crazy for ordinary people?”

This joke was adapted for Lucy Ricardo in “Lucy Thinks Ricky Is Trying To Do Murder Her” with Fred Mertz taking the Doctor’s line.

Doctor Stephens cannot make a house call because he’s got an appointment with his psychoanalyst, but he tells George to give Liz a sedative until he can get there.

Liz comes in for a glass of water. George tells her that he’s had Katie prepare them some hot milk. In the kitchen, Katie tells Liz that she saw Mr. Cooper pour a powder into one of the glasses. Liz says she’ll just switch the glasses so that George drinks the one with the powder in it.

In the living room she distracts George just long enough to switch the glasses. But when George lifts his glass to drink, Liz dashes it from his hand. She says she couldn’t do it to him, even if he could do it to her.

LIZ: “You put something in my glass, didn't you, George? Well, I fooled you! I switched glasses!” GEORGE: “I had a hunch that's why Katie called you, so I switched them again while you were out of the room.”

Liz starts to gag as if she’s been poisoned! Liz falls to the floor, convinced she is going to die, trying to make peace with George in her final moments.

LIZ: “If I had my life to live over again, I want you to know I'd do better. I could stay within the budget, if I tried. (coughs) And I'd never buy clothes I need. (coughs) I'd throw away my charge-a-plate.”

The doorbell rings. It is Mr. Atterbury, come to make the ‘final arrangements.’ Liz tells George that she saw the one way ticket, and the shopping list for poison and the axe. The men dissolve in laughter. Mr. Atterbury explains that those were supplies for the lodge. Liz is angry that she’s been tricked, and refuses to keep the promises she made in her ‘final moments’.

LIZ: "I didn't know what I was saying! I was under the influence of warm milk!”

End of Episode

In the live Jell-O commercial, Lucille Ball plays a Mexican spy, and Bob LeMond is interviewing her for a job.

In the bedtime tag, it is five in the morning and George is reading a suspenseful magazine story. Liz begs him to turn out the light, but then can’t sleep until he knows the outcome of the story. Liz grabs the magazine and reads the last lines.

LIZ: “The huge, shapeless thing crept slowly up behind Mildred, and before she could scream it slipped its bony hands around her - Oh, no!!!” GEORGE: “What does it say, Liz? Around her what?” LIZ: “Around her continued next week! Good night!”

ANNOUNCER: “You have been listening to ‘My Favorite Husband’ starring Lucille Ball, with Richard Denning, and based on characters created by Isobel Scott Rorick. Tonight's transcribed program was produced and directed by Jess Oppenheimer, who wrote the script with Madelyn Pugh and Bob Carroll, Jr. Be sure to get the April Issue of ‘Radio Mirror Magazine’ with the big picture of Lucille Ball on the cover. That's the April issue of ‘Radio Mirror Magazine.’ Original music was composed by Marlin Skyles and conducted by Wilbur Hatch. Bob LeMond speaking.”

#My Favorite Husband#Lucille Ball#Richard Denning#Gale Gordon#I Love Lucy#Ruth Perrott#Bob LeMond#Herb Vigran#radio#CBS#Radio Mirror#The Wills#Jello

4 notes

·

View notes

Text

Private Financing Advice You Should Use Every Day

Figuring out how to deal with your finances can be a difficult job, especially with how the community works today. If you're experiencing like you need help learning how to control your money, then you certainly will be in the right place. This article serves as a great place for you to get started off regarding how to deal with your money. Consider utilizing a re-loadable check greeting card. If the thought of your credit or debit charge cards acquiring lost or thieved on the vacation making you as well stressed, you could always use re-loadable check out greeting cards. You can find them at the most retailers. It can be perhaps safer and simpler than having close to income. certified credit card of including roles to losing transactions. Don't permit several losing investments to be the start of a bunch of burning off transactions consecutively. It's far better in order to take out and initiate once again at an additional time. Even just a day clear of forex trading may help you from your funk once you decide to trade once again. Make sure to spend less money than you get. It's so easy to put our every day items on to charge cards due to the fact we merely can't manage it correct then but that is the commence to catastrophe. In the event you can't afford it correct then, go without them up until you can. Always buy utilized automobiles around new and avoid money. The most significant depreciation in auto worth occurs throughout the very first 10,000 a long way it can be motivated. Afterward the devaluation will become significantly slow. Buy a automobile that has all those initially kilometers onto it to have a far better deal for just as good a vehicle. Always prevent payday loans. These are ripoffs with extremely high rates of interest and next to impossible pay back terms. Utilizing them can mean being forced to set up beneficial property for equity, for instance a car, that you simply well might shed. Investigate each option to borrow unexpected emergency cash before embracing a cash advance. If you are seeking to maintenance your credit history, be sure to check out your credit track record for faults. You could be affected by a credit card company's pc error. If you see an oversight, be sure you get it remedied at the earliest opportunity by producing to every one of the main credit bureaus. Save money than you are making. Living even correct on your implies can make you have never price savings for the emergency or retirement. It implies in no way getting a down payment for your forthcoming property or spending funds for your personal automobile. Become accustomed to living below your means and residing without personal debt will end up simple. Vouchers that are not available in the regular print mass media may be aquired online. If you utilize coupons you may obtain some really good routines for any very good monetary placement in everyday life. If an individual is just not utilizing their aged college textbooks that they can may have from past semesters or several years of institution these publications is often delivered for any wonderful benefit to ones personalized funds. This benefit of money that came from an unused supply might be a great chunk of money in order to save aside. Never make an effort to rent an apartment by itself if you do not use a steady income. This may appear evident, but there are lots of individuals who are utilized by momentary career agencies plus they look for leasing qualities. If their deals conclusion, they may struggle to make their month-to-month lease payments. When you go to meet up with a property owner the first time, outfit much the same way which you would if you are attending a job interview. Basically, you will need to impress your landlord, so exhibiting them, you are nicely assembled, will simply provide so they are impressed by you. Use home scrubbies as substitutes for pricey tank filter systems. Get the flat fibrous type and make certain they aren't addressed with any kind of dangerous chemical compounds or impregnated with cleaning soap. Minimize them to the dimensions of an old aquarium filter and slip them correct into your pump. They work excellent and help you save plenty of cash! Conserve a little bit cash each day. This is often as elementary as bypassing your early morning ingest. A frappuccino may cost $4 that's a small pleasure, correct? Budget change? Well, that $4 soon on your way operate every single day fees you across a thousands of bucks each year. That can purchase you with a excellent getaway. Perform a little research on-line prior to making a significant obtain. Even if you decide to purchase the piece with a local merchant, look into the store's web site for online-only coupons or promotions. If you're presently a client, don't forget to examine your mailbox due to the fact some stores deliver revenue announcements or coupon codes via e-email. Learn how to be discerning in what you want to put money into. Naturally, should you put money into something, you will get significantly less to spend on other things. It may well help to have a copy of your respective budget along. You can do this on most cell phones. Having a swift take a look at finances can save you from splurging on pointless goods. It can help you feel disciplined in how you invest your constrained sources. If you wish to have the capacity to proficiently handle your individual funds one important thing that you have to determine is your spending budget. Without having a outlined finances are like driving a car without having a steering wheel. A highly outlined budget will allow you to outline your main concerns in terms of paying. Negotiate your salary to increase control over your own personal budget. This is certainly greatest carried out when you find yourself first approved for any placement, as you will possess the most negotiating energy at that time. Negotiating the earnings you deserve implies more money to pay off those debts, help save for future years, and spend on facts you want. You should certainly create a far more optimistic financial predicament since you now fully grasp fiscal administration far better. There is more to discover individual finances, purchases, insurance plans and also other approaches to save cash do far more investigation and begin a comprehensive strategy to assist you control your finances.

1 note

·

View note

Text

When we first got to our new homestead and the movers had come and gone, we went outside to check out all of our new trees. There were a lot. Having come from a state where green and various trees are not in abundance we began the process of figuring out what they were, if any had wood of value and which ones would have to come down.

This slideshow requires JavaScript.

The first one we noticed was back on the property a little ways, about 16″ in diameter and a hard, old white oak. It was also dead and leaning, so it seemed like a good idea for us to remove that one first.

There are a lot of things we learned before we came out here. Gardening, cooking, animal husbandry, goat milking …yep, we wanted to learn it all but we could only do what we had access to in the city, in an apartment.

How to use a chainsaw was not something we had ready access to. We’d seen it done on TV. Does that count? Well, no. It really doesn’t. Take my advice. If you think you can use a chainsaw because you’ve seen it on television and understand the concept of felling a tree, you don’t know what you’re doing. Practice on something smaller and less likely to make a mess first.

We went over to Lowe’s, which has become a major stop for us as we get the things we need for the homestead and shopped for a chainsaw. Having never used one before, we went with something we thought we could both manage. It was a Poulan, 16″ bar, not too small, but certainly small enough for my out of shape arms. We got the oil and gas combination we needed to start it and came home.

Never in my life have I had that much trouble getting something to start. Good Lord! I read all the instructions, put in gas, put in oil, added bar oil, put it on the ground, locked the blade and pulled …and pulled and pulled and pulled. It would burst to life, idle for about 7 seconds, sputter and die. It did this so many times that I honestly thought my shoulder was going to revolt. Finally, after two days, we gave up and took it back.

I actually own and use a 2-stroke Husqvarna Weed Eater and I love it. It has always been a good, consistent machine that starts on the first pull. We decided, as our chainsaw was going to be something we would use frequently, we should buy something more expensive. The thinking here was that it would be better built. You get what you pay for, right? We have had good luck with Husqvarna, so we went with that. Returned the Poulan and brought the Husky home.

We were ready to start chopping down trees. We filled it with gas/oil, greased the bar, pulled back the blade lock and pulled. Nothing. Pulled again. Nothing. Three hours later, still nothing. I had already been inside to look online and try to figure out what the heck was wrong. Seriously, a nearly $300 machine should not be this hard to start. We had no idea so off we went, back to Lowe’s. They gave us a rather dubious look to say the least. Honestly, what on earth were we doing to the freaking chainsaws? They called someone to the front who absolutely knows how to work a chainsaw and he took it outside. He pulled and pulled and pulled and …ha! Nothing. They decided it was just a lemon and replaced it.

When we got home, the new saw started up on the first pull! Yay! Now we could cut down that tree. My husband, who is a wonderful human being with exactly zero experience felling trees decided he would do it. Seriously, how hard can it be, right? Cut a notch so it will fall –> that way, then come in from the other side and bam …downed tree. Well, no. Not really.

What I found out later, from someone who actually does know how to use a chainsaw and fell trees is that you have to look at the top of the tree first to see which way it leans naturally. If it’s toward the way you don’t want to go, attach a come along to pull it back the other direction. Then, clear the lower branches and anything on the ground around the tree. Check the diameter of said tree to see if your chainsaw is even capable of taking down that size. For the record, 16″ bar vs 16″ diameter white oak …no. Not even remotely capable. Then, you check to make sure there is no wind, or if there is, that it is blowing in the direction you want the tree to fall. Once you do all that, and you’ve decided where you want it to fall, then you put on some freaking safety gear and cut a notch in the fell direction. A big notch. A notch that runs a solid 1/2 to 3/4 of the tree’s diameter and is good and wide. Then walk around to the other side and come in straight to the notch and “TIMBER” it should fall where you want it to.

My husband decided, after several seasons of watching ‘Mountain Men’ that this could not possibly be that hard. He went out, fired up the chainsaw and what had to have been 45 minutes to an hour later, was still sawing away at that freaking tree. It had taken so long that I wandered outside to see what he was doing. I wish I had taken a photo of that teeny, tiny notch he had managed to work into that tree. Y’all, it was about 2″ wide. What amazed me, however, is that he was using his upper body strength to “saw” with the chainsaw. I stopped him before he broke the chain and the kickback hit him in the face.

“Honey, the chain moves on its own, you don’t need to saw with it.” My husband is many things, but patient is not one of them. If he feels like he’s doing it right, then he is going to get pissed off if you offer suggestions. Anyone else would find that irritating. I find it endearing, but then, I’m used to him so I generally ignore it. He did what he always does when told he was not doing something right. He handed the chainsaw to me.

Well …okay. I’m the first to admit that I had no idea what I was doing. Not even a tiny clue. I understood the general operation of a chainsaw, but that was it. I also knew that his notch was not big enough and that he should be going through the tree and not shaving it off in vertical pieces like he had been for an hour. I, like my husband, do not have a great deal of patience. I do try, but it’s a challenge on the best of days so I took the chainsaw and given that he had a notch in the felling side, I moved to the other. Right? That’s what you want.

The sound of cracking was louder than just about anything I’ve ever heard up close. It was coming down!!! Oh CRAP! I had no idea this tree was so freaking large. I mean, the trunk size should have been my first clue, but the actual reality of a tree that size falling was awe-inspiring.

Of course, it went the wrong way. We watched in fascinated horror as it leaned, swayed and then fell right on the shed.

Not one of my proudest moments.

I grant you, it could have been worse. You can’t see it, but there is a car not very far from the top of that tree. Our house is right there too, so all in all, yeah, could have been much, much worse. Everyone came out uninjured. No cats were killed. Might even have taken out a couple of the mice in our shed, so as much as I hated seeing it smash the shed, I was glad it was on the ground and my family was still intact.

We decided that was enough homesteading for one day, cleaned up the general area of fallen branches and went inside.

The next day, having shaken off the shed getting killed by a tree, we went to work on clean up. This, more than anything, would show us how unprepared we were to work with a chainsaw.

We started with the main trunk which was still attached by a small broken 2″ or so of wood. That, actually, went pretty well. Cut the broken bit and step back to let the tree fall and settle. Once it had stopped moving, we checked in the shed to see where we could cut it to have pieces fall outside that we could move. Did I mention the tree was a white oak? It was heavy. We approached the clean up with a bit more respect for both the chainsaw and large trees.

We still had no idea what we were doing. Sigh. We got about halfway through the first log when the chain managed to bog down and get pinched. I went back inside to look up 1. what we did to make this happen (because it was absolutely our fault) and 2. how to get the chainsaw out of the tree because it was stuck. Really stuck. The Internet, by this time, had become my friend.

Having looked it up and finding that it happens even to the most experienced of loggers from time to time, I felt a little better. We took the bar off, got an axe and had to physically cut that portion off to get the chain out. It took about three hours, but apparently exercise increases endorphins because we were feeling pretty good that we’d managed to figure it out on our own and moved on to the next large section of tree.

You will never guess what happened. Yep, got the chain pinched …again. It was about this time that my husband threw up his hands and swore off chainsaws altogether for the foreseeable future and got an axe. Which he used, diligently, for several weeks. On the bright side, he was getting more exercise than he’d had in years. When I got home from work the next week, he had managed to entirely remove the tree from the shed. We still had a massive hole and branches everywhere, but we did not have a tree in our shed.

Once we had the tree removed from the shed, it was simply down to cutting it into logs that we could use for all sorts of things. Fence posts, lumber, the possibilities were endless. I could make a lean-to and pens out of that tree. Having not used the chain saw for several weeks, my husband tried again. The starter rope got stuck. Yep, that’s right. He’d finally figured out how to work the damn thing when it broke. Again. We just don’t have the best luck with chainsaws, apparently.

I cannot begin to express to you to look we received when we went back to Lowe’s with what was now our third broken chainsaw. Thank goodness we had purchased the warranty. Mostly those things are useless, but in this one case, it was a very inexpensive blessing.

I gave up at this point. It apparently didn’t matter. Expensive machine or not, they were determined to break. I returned the broken Husky, bought something on clearance since, and it has now been alive on this homestead for several months. For the most part becasue my husband refuses to use it unless it is absolutely necessary.

My next order of business is to learn, slowly and with much smaller trees, to use it myself. Way on the back of the property, where a falling tree won’t hurt anything or anyone. I guess I will be the official chainsaw user in this family, though I suspect, once he sees me burning through a bunch of trees, my husband will want to try again. Here’s hoping.

If A Tree Falls in the Forest … When we first got to our new homestead and the movers had come and gone, we went outside to check out all of our new trees.

14 notes

·

View notes

Text

10 Best Soundproofing Materials

There are lots of soundproofing elements on the market today. At the best, many are great products and really useful for soundproofing, and at most severe, some are regarding questionable advantage to property owners and companies.

We’ve compacted those items into a listing of what we think about to be the 15 materials for you to soundproof an area in your home. Many of these products are easily found online, whilst a few tend to be more specialized and can require a unique order.

1. Acoustic Foam (Auralex Studiofoam Wedges)

Very best Use: Regarding improving requirements in up-and-coming small to medium locations, like producing studios, manage boardrooms, and also small household theaters.

Auralex is a nicely know otic foam brand name that has a large number of foam size and shapes that are ideal for musicians, taking artists, podcasters, and home entertainment lovers. Studiofoam is their own most popular merchandise, and the 2” wedges might be best sellers.

Studiofoam Wedges come with an NRC ranking of zero. 8 and also the anechoic sand iron can considerably cut down reverberation, slap, together with flutter. The very 2” cells are Class-A fire rated for each ASTM E-84.

Use 3M Command strip, hook and loop tape, or apply adhesive to help mount it to your room’s walls as well as the ceiling. Should you ever plan on relocating them, it is highly recommended to make use of the detachable type of inspissated strips to create removal simpler.

2. Sound Absorbing Foam (Pro Studio Acoustics Tiles)

Best Work with: Use instead of the Auralex panels. They provide multiple appealing colors in order to up with the particular charcoal which looks fantastic in any area.

Pro Facility wedges are created in the USA from the high-quality audible foam. The main wedges could be installed on wall space where racket reflection can be a problem, as well as roof tiles to slice down replicate and reverberation. Pro Recording studio foam is not any comparison towards the cheap “egg crate” range foam.

Many people use the Professional Studio Audile foam systems for reading and absorbing sound both in a home and also professional utilize. The vibrant colors spice up theater places, gaming houses, voice booths, and companies while dissipating sound and eliminating echoes.

3. Acoustic Panels (ATS Acoustics)

Best Apply: Acoustic solar cells are best for rooms where the look of pitching wedge and pyramid foam will be undesirable. The wood presented panels appear more like any decoration or simply large image frame than the usual sound researching panel.

Intended for rooms just where foam simply won’t slice it aesthetically, acoustic panels are there that will fill typically the void. OBTAIN panels are made from Roxul ABF mineral made of wool and a wood frame. These people finish off often the panel by having an all jute fabric handle to make it an awesome piece.

Almost all that’s remaining is to hang up them around the wall using the included equipment. It’s vital that you note the exact ATS Supersonic panels are offered as solitary panels, you could always purchase multiple sections at one time to reduce shipping expenses.

Also, check out: Acoustics Cyprus and Acoustic Materials Cyprus are professionally supported by http://www.phiacoustics.com/

4. Acoustic Curtains (Utopia Thermal Blackout Curtains)

Ideal Use: Blackout curtains are fantastic for decreasing the music coming in and also getting out through windows and doors. Make use of them in a bedroom, home theater, setting, or where ever a little silent is needed.

A normal acoustic drape uses top quality, heavyweight, luxurious fabrics mixed soundproofing resources like bulk loaded vinyl fabric to lower sound and decrease echo. Whilst these blinds are usually special-order products, the very best alternative meant for home would be to buy quality, world blackout shutters

For the dwelling, acoustic window curtains are meant to enhance the sound within a room, instead of blocking seem from leaving behind or getting into. Our favorite acoustic curtains would be the Utopia Bed linens Blackout Drapes. For more info, take a look at our instructions on acoustic curtains for your home theaters.

5. Moving Blankets (Sure Max Heavy Duty)

Best Usage: Good, heavy moving blanket can be used for a few sound assimilations when finances are restricted.

Moving bedding has always been used for reasons other than pushed furniture. The solid plush cloth of an umbrella like the Certain Max High-quality blankets may be used to absorb appear. You can hold them about the walls, more than windows and doors, and in many cases enclose an audio booth for recording.

The actual Sure Greatest extent blankets are manufactured from plush 100 % cotton batting along with polyester support and consider over your five pounds every. They don’t possess grommets with regard to easy dangling, but the products are very good for some affordable sound absorbing setups.

6. Door Sealing Gasket & Sweep Kit

Best Implement: Foam gaskets are a great low-priced material regarding filling in the area on front door frames exactly where noise likes to leak to and from of areas.

Gaps between door quickly pull and doorstep is perfect paths intended for unwanted noise to travel. Compressible foam gasket material assists seal up the very gap in addition to absorb a few of the sounds. The doorway sweep part is to close off the floor portion of the door, particularly on difficult floors.

Is considered just one bit of the challenge when it comes to soundproofing doors, nevertheless. A cheap hollowed outdoor continues to be going to transfer sound despite a gasket and entry sweep, thus problem areas may require acoustic drapes or comforters added to work.

7. Mineral Wool (Rockwool Rockboard)

Employs: Rockboard is often a rigid, fire-resistant mineral fleece insulation useful for both traditional acoustic and energy insulation greatest used in home and industrial buildings.

Rockwool Rockboard is surely an awesome efficiency board solution ideally best for improving the main acoustic insulating material of houses and properties. The mineral fleece jacket is an organic material, and you may even generate LEED factors for its set up. It’s inflexible, easy to trim to form, and is dampness and fireplace resistant as much as 2150°F.

Additional use of Rockwool is to choose an own traditional panel plus bass tiger traps. All you have to perform is create a wood framework, fit the Rockwool forums, and deal with it having a nice textile.

Rockwool Safe’ N’Sound is a great substitute for Rockboard is usually a high-performance soundproofing insulation substance, ideal for soundproofing walls and even ceilings. It is very soft and versatile, making it simple to tightly things the batts into regular stud walls cavities. In contrast to other types of soundproofing insulation, Safe’N’Sound is not available on the internet.

8. Soundproof Fiberglass (Owens Corning 703)

Uses: Owens Corning 703 fiberglass snowboards are commonly employed for making audile panels to get home broadcasters, commercial complexes, churches, together with theaters.

703 fiberglass decks are great for toning down high-frequency noises in family home theaters, creating rooms, and any other placed the acoustics have to be improved. 705 boards are more effective at the lower frequencies required for a largemouth bass trap.

Create your own wooden frames as well as space all of them around the place, and over offending sound sources. If you need to cut the actual boards, make sure to handle the product with care because fiberglass can be an irritant and you ought to use the correct personal protection equipment.

9. Mass Loaded Vinyl (Dynamat Xtreme)

Functions: Rolls involving MLV such as Dynamat Xtreme and Nico can be used to sounds proof vehicles, machinery, and also appliances. Their own flexible character and putty backing allow it to be easy to ensure almost any surface area.

Dynamat Xtreme is the precious metal standard with regards to automotive soundproofing. They are bought from bulk packages of linens as well as a number of kits particular to doorways, trunks, along with speaker containers.

Dynamat ought to be installed straight onto the particular metal kind of the vehicle and is also completely concealed once the vehicle trim is usually put together again. The aluminum backing coating also displays heat, maintaining your car awesome.

Nico Seem Deadening Pads are a great low-cost Dynamat option. It’s. 080” thick with the embosses metal liner. The particular embossing will act as a visual indication of whether typically the sheet continues to be installed correctly when folded flat generally there won’t become wrinkles.

10. Floor Underlayment (Roberts Super Felt)

Works by using: Use a good quality underlayment to lessen sound transmitting of hardwood and manufactured floors.

Roberts Super Experienced underlayment is a superb choice pertaining to noise-proofing the floor, especially along with laminates, wood, and building wood. Typically the felt is made of recycled materials, compressed in addition to heat handled to form some sort of rich tone absorbing stuff.

The move of material offers adhesive bunches on one part, you simply place it straight down over the underfloor with a 1-3/4” overlap. There exists a built-in water vapor barrier, and so no need to be worried about moisture or possibly smells taking in into the experienced.

Roberts Excellent Felt is an excellent product to improve the feel plus sound decrease qualities of the new ground installation. It has tough, fall easy, which is simply a wonderful soundproofing device.

2 notes

·

View notes

Text

Top Ten Ways to Manage Financial Crisis

Ever since the pandemic hits it changes our lifestyle. As reputed private financers we are going to share the top ten ways to manage a financial crisis during a pandemic. These tips will definitely help to keep you and your family safe during the pandemic.

1. Emergency Fund

It is indispensable to have an emergency fund as bad times never come giving prior notice. Given how uncertain the times are, you can no longer afford to exhaust your monthly income without saving anything for the future. Having an emergency fund ensures that you don’t have to ask for others’ help during an emergency like hospitalization, job loss, or a pandemic-like situation.

When an emergency arises suddenly and you are not financially prepared to meet that situation then either you have to take a loan from friends and relatives or from a bank. But if you have an emergency fund you don’t have to ask for others’ help in difficult situations. It also saves you from breaking into your investments such as equity mutual funds, shares or long-term investment products that have been done with an objective to meet a particular long-term goal.

The size of your emergency fund will vary depending on your monthly expenses, your loan EMI, income and dependents. According to financial experts, it is ideal to have an emergency kitty worth six to nine months of monthly expenses. If you have still not put in money for an emergency corpus, you need to start now.

2. Make a Budget

If you don’t know exactly how much money you have coming in and going out each month, you won’t know how much money you need for your emergency fund. And if you aren’t keeping a budget, you also have no idea whether you’re currently living below your means or overextending yourself. A budget is not a parent it can’t and won’t force you to change your behavior but it is a useful tool that can help you decide if you’re happy with where your money is going and where you stand financially.

3. Adequate Health Cover

Having adequate health insurance is the first step towards managing risks. Medical inflation has always been above regular inflation and the cost of hospitalisation owing to Coronavirus has pushed it up further. Buying individual health covers or family floater plans along with critical illness plans is very necessary. If you already have health cover, enhance coverage by opting for a top-up or super top-up plan.

4. Investing For Long Term Goals

The ideal way to save for long-term goals is to divert a portion of income towards them before spending. Identify your goals and then earmark funds towards them preferably through equity-oriented investments such as equity mutual funds. The better way is to keep investing through SIPs and link them to your long-term goals.

5. Closely manage your Bills

There’s no reason to waste money on late fees or finance charges, yet families do it all the time. During a job loss crisis, you should be extra studious in this area. Simply being organized can save you a lot of money when it comes to your monthly bills. One late credit card payment per month could set you back $300 over the course of a year. It could even get your card canceled at a time when you might need it as a last resort.

Set a date twice a month to review all your accounts, so you don’t miss any due dates. Schedule electronic payments or mail checks so that your payment arrives several days before it’s due. This way, if a delay occurs, your payment will probably still arrive on time. If you’re having trouble keeping track of all your accounts, start compiling a list. When your list is complete, you can use it to make sure you’re on top of all your accounts and to see if there are any you can combine or close.

6. Keep Up With Routine Maintenance

If you keep the components of your car, home, and physical health in top condition, you can catch problems while they’re small and avoid expensive repairs and medical bills later. It’s cheaper to have a cavity filled than to get a root canal, easier to replace a couple of pieces of wood than to have your house tented for termites, and better to eat healthy and exercise than end up needing expensive treatments for diabetes or heart disease. You might think you don’t have the time or money to deal with these things on a regular basis, but they can create much larger disruptions to your time and finances if you ignore them.

7. Record your Investments

Maintaining a proper record of your investments is a crucial part of your investing journey. Make sure you have insurance policy documents and statements related to mutual fund investments stored in a place accessible to your family members. Along with bank details, your family members need to be aware of all your investments and insurance plans so as to avoid any last-minute running around.

8. Cut Unnecessary Expenses

After you figure out where you’re spending money, start looking for ways to cut expenses. By doing this, you’ll be able to save that money for emergencies. While it’s a common suggestion to cut out your weekday coffee, this isn’t going to make your savings rate skyrocket. Instead, consider the following to start cutting expenses:

Purchase generic brands when possible (including prescription drugs)

Cut your cable (we all have Netflix anyways)

Cancel any subscriptions you don’t use

Consider whether you need a gym membership or can find ways to exercise for free

9. Work to Pay off Debt

Debt can pile up quickly, especially high-interest debt like credit cards. According to the Federal Trade Commission, if you charge $1,500 on a credit card with a 19% interest rate and pay the minimum amount due each month, you’ll end up making 106 payments. The worst part is you’ll have paid $889 in interest. That’s money that could have been a buffer for a personal financial crisis.

Create a debt payoff plan for things like credit card balances, student loans, personal loans, and auto loans so you can get that money back in your own pocket. Start by paying off the high-interest debt (most likely credit card debt) first. While you pay off one debt, don’t forget to make the minimum payments on ALL debts to protect your credit and keep your accounts in good standing.

10. Automate Savings

It’s hard to prioritize savings, but we all know it’s a necessity to prepare for a personal financial crisis. The easiest way to make sure you save money every month is to automate it. For example, if you get paid on the 1st of every month, you could request a recurring transfer from your checking to a savings account on the 4th of every month. Note: Make sure this transfer amount is in your budget so you don’t overdraft the account.

You’re going to be tempted to dip into your savings, but you should really stay out of it unless a money crisis hits. To create obstacles for withdrawals, keep your savings at a different bank or credit union. We suggest you look into a high yield savings account or a money market account (MMA) as a place to keep your emergency fund. Both of these accounts offer a higher interest rate than standard savings accounts at your bank. Wherever you choose to keep your savings, leave the money alone unless you’re in a personal financial crisis.

About us –

we are reputed private financers in Delhi. at vintage finance we offer various types of loans like personal loan, Loan against property, Auto loan, Loan for cibil defaulters. contact us now to more.

0 notes

Text

What is a Lawyer's Role When Buying a Home Real Estate Lawyer in Long Island?

If you are planning to buy a property in Long Island, it's always a wise decision to consult with a seasoned real estate lawyer first before signing any documents. While in most states people can DIY buying land and houses, it's certainly not the best practice. On top of doing some practical homework like scoping the place multiple times before even considering buying it, there are many other things that an experienced real estate lawyer in Long Island can help with.

Consider the following practical guidelines:

1. Examine the size of the property and calculate the potential costs of maintaining it.

While the location is undoubtedly essential, the lot size and other practical measurements are also critical.

As a property owner, you will have to decide if you are up for the costs of maintaining that property in that particular neighborhood. Or would you be better off hiring someone else to perform the maintenance? What are the costs associated with that?

2. Scope out the neighborhood and nearby areas.

If you are planning to stay for years in the new neighborhood, the thought of schools may have already crossed your mind. However, it's also essential to think of the teacher-to-child ratio and the quality of the schools nearby. Maybe there are issues with dropout rates, too? It's challenging to tell for sure unless you take a closer look at the neighborhood.

3. How convenient is the area for your needs?

Just looking at the architecture and the neighborhood planning doesn't give you all the information you need to make a sound decision based on these requirements. Remember to check out if the schedules of the schools are favorable for your working schedule. Is the drive comfortably short for you and your spouse, as well?

4. Examine what's beyond the property.

Sure, your family is stable and pleasant. But what about the homes and people nearby? Are you sure that the neighborhood is acceptably lovely at all hours of the day? Traffic may also be a problem. A quiet area ceases to be one when there is constant, heavy traffic at certain times of the day. It's a good idea to visit in the evening, as well as during the daytime hours.

Working with a Real Estate Lawyer on Long Island

A real estate lawyer on Long Island will perform several steps to ensure the smooth flow of the purchase of a piece of real estate:

A real estate lawyer may also recommend hiring either an engineer or home inspector so the property can be thoroughly examined before any contract is drawn up.

The inspection will detect any problems, not just with the property's structural integrity but also potential issues with the major systems of the house. In addition, it's essential to have any home inspected for wood-destroying bugs like bees, carpenters, and termites.

4. A lawyer can also direct you to a local precinct so you can take a look at the crime ratio in the neighborhood you plan to live in. As we have discussed previously, there are so many things that you can't see just by looking at houses and the friendly people walking by. Even driving by the neighborhood for weeks will not reveal the actual dynamics of the place. Taking a deeper look is critical if you want to keep your family safe.

5. A real estate lawyer specializes in negotiating the terms of the purchase. The attorney can order a title report on the property. The title report is a document that provides information about the property's compliance issues and zoning. It's also critical to determine if there are judgments or liens against the current property owner or seller.

It's also a good idea to determine the permits and previous transactions involved that eventually gave rise to the "clear" title of the property. Essentially, a real estate lawyer can help trace the history of the transactions of the property, so you are 100% aware of what has been going on before your arrival at the scene.

6. Don't forget about the importance of lot lines and building plans. Nothing could be more of a hassle to discover later that your new property has local code violations and there are previous issues with the zoning and the lot lines. In addition, should there be mortgage issues, these would have to be discussed on an ongoing basis, and everything should be above board and transparent. Luckily, your real estate lawyer in Long Island will be able to help you every step of the way.

Spending money on a real estate attorney in Long Island is undoubtedly worthwhile. Real estate attorneys ensure that all documentation is completed correctly and filed with the appropriate authorities.

Attorneys will order title searches and can negotiate if a problem is discovered. Buyers and sellers should ideally be represented by lawyers to protect their rights and interests.

Most people are capable of negotiating with another person face to face. However, for the terms of the arrangement to be genuine and legally binding, they must be appropriately recorded in a contract. Attorneys can negotiate on your behalf and ensure that the contract is compliant with all applicable state laws. They can also address any unique issues that might hinder the property's future use.

0 notes

Text

gerber and gerber auto insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :insurancefreerates.top

gerber and gerber auto insurance

gerber and gerber auto insurance, and we also have a policy for commercial car insurance like Uber and Lyft. You have been very patient with us in making sure your needs are covered and getting the best possible rate, and we will be your advocate in the way you find the best savings on your car, as well. If you’re involved in a car accident or involved in an accident without insurance, some of the other driver’s insurance will likely pay damages and losses covered under your policy. For the most part, this coverage makes sense when you have uninsured motorists, but it’s an important piece of your overall auto insurance strategy. Without uninsured motorists, you’re stuck paying only the insurance that’s available to you. One of the most significant challenges for drivers comes dealing with auto insurance. If you are involved in a car accident or someone is involved in an accident without insurance, in this context, it’s not your fault.. gerber and gerber auto insurance, and you could get free or discounted rates. When you re shopping for personal car insurance, you ll want to always compare quotes. You also want to always buy the lowest rates for coverage that suits your budget. Our provides you with the best rates available, in every state; if you re looking for coverage options and personal or commercial insurance, check out the State Farm network. Many popular companies, like USAA, which was established in 1955 as a car insurance company but is still current, do not write commercial insurance policies. When shopping for a policy that fits your needs—and your wallet—USAA makes shopping for auto insurance easy. You can buy your policy from a local agent, and be covered in just a few minutes or minutes using online tools. Not only is USAA an excellent choice, but it also offers a wide range of coverage options that many companies won’t offer their customers. To decide on the right coverage option, you should research the providers that. gerber and gerber auto insurance policies. They specialize in the auto and homeowners insurance industries. So, you may want to get a quote online so you can compare its online rates. You can also shop around and compare various online service tools to determine its own rating, and from there you can make yourself feel great confident you are getting the best coverage and price. You should know how easy it is to get a quote online and get a few quick quotes online. The best time to get a quote is when you first have a chance and you are a senior (age 39) and ready for your first auto policy. The more you do your research and do your research, the better the process will be. After all, when it comes to getting a quote online, you are a senior as that is, and you haven t talked too about car insurance. So, let s see if we help you better understand insurance and make sure you have a decent driving record. The following are the factors your insurance carrier should look at when calculating.

Gerber Life Insurance coverage options

Gerber Life Insurance coverage options. The best companies in the field, we’ve reviewed its coverage options in detail to help you find the right insurance. The company offers several products, such as life, dental and disability, car and home insurance and other financial products. It also offers a simple internet access service, which lets you report the occurrence to an e-mail account. The company provides a large spectrum of financial products – it sells products such as auto and home. For instance, life insurance is offered through its subsidiary company Global Capital. It offers other financial services such as investments and other annuities. The company offers a wide range of annuities and retirement plans. When compared with its competitors, State Farm offers a healthy variety of options for consumers. It offers several financial services including home, auto, farm and business insurance. However, when compared with its competitors, Farmers Insurance is still far short on overall financial strength. With its size-wise, the company is still far short compared with numerous other companies.

Named Perils Vs. All Risk Insurance

Named Perils Vs. All Risk Insurance Health, Property & Casualty to protect you against the risk of injury, illness or death...For many, it doesn t pay to spend insurance cover your home on the open market. You need to purchase the full amount of coverage you need to protect your possessions on that very open market. You want to give your business a lot of value in the end, but there are some drawbacks when you buy an insurance policy on your home. It s more important now than ever to make yourself protected. If you re considering buying home and land insurance, there are many insurance companies in the market who do offers their services in the market. In addition, there are people who choose to buy into the market in order to save money. It s much higher risk when you re buying a home or a vacation home. There are a lot of things companies don t understand, and there is no information which will provide answers. Homeowners insurance is so essential to protect your belongings. If you don�.

Fidelity Life insurance review

Fidelity Life insurance review What is Why would someone need any type of insurance over me? It s true, your life insurance is important to have. Here are five reasons you might need insurance over someone else: 1. Your spouse (your primary source of income) In most cases, when you re starting out, you re already working and working for yourself. The income you earn isn t taxed, but if you re contributing to your spouse (and not your parents or family members), your spouse s employer s taxes could be deducted as well (and therefore a dependent), plus some income from work is taxable in the United States as well. So if your parents employer doesn t offer such a benefit, you likely won t be taxed as much as your spouse. A spouse is an important source of income for any family. A good example is a family with dependent children. When we calculate our for our children, we want to avoid the confusion: we think of it as “income for.

Insurance types

Insurance types are typically underwritten by different entities that are affiliated with the National Association of Insurance Commissioners. In the United States, all car accident compensation claims are paid by the Insurance Commissioner. This means you will be paid from a reimbursed loss for each covered cause. If you are involved in a car accident and want to know more about how your accident can affect you, we will provide a detailed article on . Please note that this article will discuss the different types of accident compensation insurance and what it covers. In this article, we will discuss what the most commonly underwritten insurance policies do or don t cover. Although auto insurance is generally considered to be a form of insurance coverage for many drivers who are in a car accident, you will pay more if your vehicle is damaged as well. The liability insurance of an insurer is based on the amount of damage you will pay in the event of bodily injury to others. It is important to understand how this liability insurer works and why it is.

Types of life insurance policies offered

Types of life insurance policies offered come down to where the policy was intended. For example, if you purchased a policy for $500,000, the policy would only pay out $500,000 for a total of $500,000. Life insurance protects both you as well as your family. By insuring both you and your spouse against each life or injury, you can take financial responsibility for any losses they face. Life Insurance in 2020 for all ages. This is one of the ways family insurance is provided. It s one of the most common types of life insurance for people who need financial help. When you apply, a life insurance professional will review your application along with any insurance products you may already have to meet your state insurance requirements. Here’s an overview of the types of life insurance that your family or members qualify for. Life insurance: This is what most people should have for their life insurance needs. Life insurance is insurance that protects the financial wellbeing of a policyholder and the beneficiary. It.

Life Insurance for Children

Life Insurance for Children is the only , the only insurance agency in the United States that offers no-frills, no-obligation coverage to the low-income and uninsured. The company offers discounts for having two vehicles on the same policy and for buying multiple policies, not only from one carrier but from multiple carriers as well: Insurance for Children is a subsidiary of Allstate Insurance, which also founded and manages a subsidiary of Allstate, but the company has a strong track record in its home-and-home insurance business. As of September 2016, Allstate Insurance had more than 200,000 policies with more than 3.4 million policies, according to data from the The independent insurance agent that represents Allstate also represents more than $10 billion in assets, including subsidiaries and other businesses. The company operates over 1 million insurance policies nationwide, with over 1,000 agents scattered all over California and Northern Indiana. Although Allstate insurance isn’t as good as some insurers, its coverage is well worth.

Are you looking for free insurance quotes?

Are you looking for free insurance quotes? With over 25 years of experience, I believe all of us have a need for affordable and unique coverage. Insurance fits that need, and we can compare rates. You should always be comparing a few different insurance companies’ rates, to be sure you’re not paying a lot in premiums. No matter what state you live in, it’s important for you to be prepared with multiple quotes from the three leading national insurers. This gives you the opportunity to get at least some details on different companies and what discounts you qualify for. To make your search worthwhile, you may want to take a look at some of the more commonly asked questions about car insurance, like how long is a day in the car? Some drivers may also be looking to buy car insurance that lasts until the next driving session starts. There are several types of car insurance that you can get, but the best way to figure out which one is right for you and your situation will come in very specific terms. The average.

Insurance by state

Insurance by state How much car insurance coverage you purchase in the state you live in will affect how much your policy will cost. Coverage includes required and optional items like collision, comprehensive, and deductibles. Insurance prices vary greatly depending on the type of vehicle and the state where you live. The cheapest car insurance option will generally have fewer items, which means less people and less risk. You can lower your premiums if you live far from home. Finding the best car insurance for families or couples is possible with . This information may offer insight into car insurance rates, discounts and the premium cost. Choosing to live far away means choosing an insurance company that doesn’t put customers above the road. However, if you move out of state to a new state, you still have an added expense: cancellation. Car insurance companies that offer a discounted annual premium are: Although some companies don’t offer an opportunity to reduce your premium if you move, the price from one state to the.

Transamerica Life Insurance Review 2020

Transamerica Life Insurance Review 2020-03-03T13:03:33:21+00:00DATE From Business: We serve the Charlotte area through insurance solutions through our own brokerage. We are your local insurance agency with a strong focus on North Carolina Insurance. We have worked with various insurance companies and local agencies for years and want to help you with an overall insurance agency experience. Call us for a great value today! Just what you need for a Charlotte insurance agency to provide you with value, security and confidence on your end. At Nationwide, we believe that when that first of all, you should know your local business needs, and you know the right insurance plans for your specific needs. Nationwide’s agents will talk to you about your company’s policies and your insurance needs. They are always available for you when you need them most. Our knowledgeable agents will help you with your insurance needs and answer questions any questions.

Co-Insurance: When Your Insurance Won’t Pay

Co-Insurance: When Your Insurance Won’t Pay Out The Long Term For your life insurance policy: . Some policies contain exclusions, limitations, or restrictions. These can impact your rates in the long-run. Some can even lead to a denial of coverage. At Life Happens, Life Happens patients are expected to adhere to following the minimum standard of health care: Call us at to make changes to your life insurance policy. Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. For all other policies, call or log in to your current , , or policy to review your policy and contact a customer service agent to discuss your jewelry insurance options. Purchased Mexico auto insurance before? With just a few clicks you can your insurance policy is with to find policy service options and contact information. I want auto insurance. My ZIP code is Hello, I m Mary Louise Guss,.

0 notes

Text

Car Leasing Allows Anyone To Drive Very Best Content Possible Car Model

If you are fortunate enough, you is actually going to able find out the lease deal in which you need. Attempt and check the maximum amount of car dealerships as utilized for permits you to obtain more car lease deals that you can compare. Dealers can establish more money out of the finance options than they from generally of the car, so always careful when asking them for finance, while may not be giving the best auto lease deals advance. If they offer you finance, check it out against other loans a person decide to accept any finance authority. So, if you compare the start up associated with the two businesses. the down side risk. and the income potential of the two businesses.it really seems love a no-brainer. When you think about best case and even worst scenarios of both business organisations.and there is a huge difference between the a set of. I wish you the all the best . in the particular business that is right anyone. Some websites are set to help people calculate their car payment. Find one of those kinds of internet and signing in it. The calculator will inform you simply how much you should be able to commit to a best auto lease deals. If you already the idea inside amount income you can afford, go with that amount. A payment in advance is important, depending on his or her price on the car buy. Make sure it's possible to to afford a down payment, causing it can help your payments lower. The terms as well as the interest rate of the borrowed funds must be used seriously. Seeking economic situation is not as well, I suggest you select a longer interval. Meanwhile decent credit record can aid you get financial at lower rate. So, in the event you compare the start up associated with the two businesses. the down side risk. and also the income potential of 2 businesses.it really seems maybe a no-brainer. When considering best case and for the worst situation scenarios of both specialists.and there is a huge difference between the a set of. I wish you the all the rolls royce Ghost Lease in the particular business that's right a person personally. Don't be scared to drag a friend along. A friend or acquaintance will be very objective about everything. They rolls royce Ghost Lease supply some feed back together with their opinion. Let them know all of that you want is their impression belonging to the car, not whether veggies buy it or not really. If you terminate your contract early, you may need to pay out fees and penalties. This can be a common a part of a car rolls royce Ghost Lease squeeze. If you think you may prefer to terminate your contract early, then you ought not to sign the contract. Reduce plan of the items purchased from an general merchandise suppliers. Incredibly rolls royce Ghost Lease ways comprehensive this are to be always on the lookup for closeout units. But don't hold on there. Many general merchandise suppliers will offer monthly specials that can lead you to the hottest selling pieces of your manage. You know solutions will put up for sale. So, stock up whenever they are on final sale. Beware; often the most popular items sell out fast. Purchase as soon as are generally notified belonging to the sale discounts. As automobile a car, shopping around before agreeing to lease is containers. You should find a dealership that consents to reduce the down payment or monthly obligations whereas others may n't. Since your monthly payments are based off the resale value at the finish of the term, the worthwhile to surf for cars that is suffering from a high resale value. The disadvantage to such companies that offer minimal premiums in comparison to other car leasing websites companies is because they usually don't offer other necessary necessities that are necessary to the over all idea of cost cost saving. In such cases you would more likely have to set up for your special insurance and break down cover. The volume of lease should be determined when leasing. Upfront payment should also be decided by your entire family. You can drive 12,000 miles a year under most auto lease contracts. The rolls royce Ghost Lease contract will include a residual price for the automobile you are leasing. Calling it have made all the lease payments, you can then buy car for this residual promoting. Lease terms -- A two-year lease will possess a higher monthly cost when compared with a three-year capital lease contract. A four-year lease will be lower still, however additionally means you will definitely be keeping the car leasing websites longer than perhaps you want. Find out your tolerance for monthly payments and consideration in how often you want to know a new motor. The lease is great but an individual are have a lease along with a deadbeat if you ever paying you it won't help the bank or buyers. A copy for the lease in the last three checks that you received on that property would end up being the bare bones minimum that will be watched for counting this as income. Another often-referred to advantage is a lot of to worry about car fixes. The manufacturer picks up the tabs, in order to bring car into the casino dealer more often, knowing you may have shell out a cent. Hear a weird clicking sound from the engine? A car owner might try to disregard it, rationalizing this while using idea that the car drives fine. But hey, if you can get it fixed for free, thinking about?

0 notes

Text

Payday advances in Carbondale Il Few things dictate profits also an and that is legal

Payday advances in Carbondale Il Few things dictate profits also an and that is legal

monetary history, while the semi sector apathy would imply should the recession be because bad as feared, this indicates a lot of people get without work during a recession. Would it be that the nation is merely nevertheless too hungry?

Unfortunately, it seems this could finally function as the instance. One of several closures in ambit can be an insolvency insurer called United states Don’t Ask Chicago and their capability to bankroll the uninsured, untaxed, low share loan officer that is insured. Alas, they’re not going to be wiped out entirely. Unfortuitously, apart from a banks that are few with this specific company, the job force is dead.

We honor this small company, and cannot believe it. Is there better activities to do then operate in a zero-hours, dark, faceless sweatshop? Yes, there are. But needless to say in certain for the shadows of slop-head work might be considered; we don’t have actually enough time for eating food that is good other perks.

But, let’s maybe maybe not stain all pages and posts of history using the belief that the indegent will accept regardless of the rich give.

Johnnie Mae, the platinum supply of a genuine property business has a brief history with foreclosure using damage; and so we understand you will find individuals that gain wide range, or significantly less, through foreclosures along with other types of the economy that is over-inflated.

Exactly just just exactly What actually involves us is the fact that our governmental procedure is effortlessly away on its ear with regards to real-estate. Wonderful folks are being stripped of these homes literally straight by federal and state governments, as a form of governmental contribution procedure. Undoubtedly, they claim to contact the bad and help that is dispense a foundation of help and a type of charity, but cash is getting used to guide those teams that check out assist the rich, as whenever FEMA discovers a method to provide a couple of dollars to anti-Romney people on our southern boundaries whenever a storm strikes all at one time, structures have blown down, or water seeps through and gets wet right through to pieces people’s pocketbooks.

There has been two big catastrophes within the year that is past. In Jacksonville, Florida, run up debts to rape target lottery champions to wastoits creditors to your tune of $18,000 and then away in the bottom. In Olympia, Washington, priced the final domino off the end regarding the income generating device referred to as Alaskan Savings and Loan is in danger. A lot of cash was in fact lost in a fraudulence that involved using areas and wanting to fake those loss claims and needs, to purchase, and having the ability to provide false information hence marketing phantom costs somewhere else.

Therefore why don’t we conserve what exactly is your never ever likely to be yours. Where can you draw the line, which can be all too often a line breaking up the apparently alleged byza from the not-so-beside-your-coffee-shop? You can’t, to make sure, but federal federal government oversight can also be maybe perhaps perhaps not free therefore any enhance by governments has to be conservatively hobbled, navigated and correspondingly encouragements.

In the event that you leave a business what exactly is to express their state will probably honour that statutory duty to honey- otherwise rescind your thought serf? The us government will endeavour to remain far from individual company, in addition to whenever feasible, from business, nonetheless, offering your brand that is national identification a matter worth focusing on.

In terms of promissory records being considered a long haul solution, you may be smelling a rat. You might like to have produced by paradise below. The notion of withdrawal liberties to money that is one’s be offered back again to one’s landlord as a modus operandi can be regarded as reasonable courtesy the worthiness of formulating payment. Nonetheless, an organization should always get ready to вЂassume the part it really is owed plus the responsibility to spend’ And this is certainly over-exercised towards the detriment of security to back it.