#but i would rather help a thousand scammers than to deny help to someone who needs it

Explore tagged Tumblr posts

Note

Hello everyone, I am Fatuma Ali from Gaza. I am here to request for your support to help get my insulin, just an injection for today to save my life please I beg. I was diagnosed with Latent Autoimmune Diabetes and due to current situation in Gaza I'm unable to get my insulin injection as a result I'm here begging for little financial support to help me purchase insulin for this week. My donation link is attached in the pinned post, I might have sent this ask to you earlier but kindly consider donating and sharing. This is the only option I have at the moment to save my life from going to coma.

i dont have money but i will share ><

#i dont know whether this is real or fake as i cannot find a fundraiser with fatuma ali#but i would rather help a thousand scammers than to deny help to someone who needs it#so if this is real then im glad to share it#and if this is fake then i am sorry

0 notes

Text

I’ve Got a New Condition — Chronic Repeal Exhaustion

The GOP has threatened to repeal the Affordable Care Act (ACA) since it became official. They dubbed it Obamacare. Many Americans believe that Obamacare is different than the ACA, and the GOP has seized upon that. Our current president wants to repeal it. On Monday, February 27, 2017, President Trump made a comment that “Nobody knew healthcare could be so complicated.”

I beg to differ. I seriously, beg to differ.

For the past decade, every single professional move that I’ve made has had a health insurance component attached. The day I was formally diagnosed with Crohn’s disease was the worst and best thing to happen to me. It validated I was truly ill after all the years of being ignored by doctors, but it also tagged me with a pre-existing condition for the rest of my life. The diagnosis while a blessing, also cursed me with the necessity of never being able to have a lapse in health insurance coverage.

I assure you Mr President, even back then at 25-years-of age, I knew healthcare was very complicated.

Fact: About 52 million Americans (or 1-in-4 people) have a pre-existing condition.

The fear I lived with for over a decade now, was that if I went without coverage for too long my pre-existing condition won’t be covered. In order to take on a new plan, one must provide a certificate of coverage from your former insurer proving one did not go more than 90 days without coverage. Without this certificate one may get health insurance, but a pre-existing condition won’t receive coverage. It eventually may get covered, but a certain amount of years would need to pass. It’s a truly daunting and exhausting process.

Around the time the economy began to tank and ACA provisions came to life, I picked up a private policy. This plan was imperfect just like the ACA, but it was all I qualified for since I had Crohn’s disease. It was a high-deductible- and high-premium plan. I didn’t have much choice in taking this plan. I was just grateful that I had something instead of nothing and worked myself into the ground to afford it. It was exhausting. I was exhausted. And exhaustion is a dangerous cocktail when you have a chronic condition.

Proof of continuous coverage was the name of the game. I was hoping to keep the plan long enough until I would go full-time with my job that had strung me along as a contractor. Sadly as my health began to deteriorate they rescinded the offer to go full-time and left me as a contracted employee. At least I had the high-premium high-deductible plan to keep coverage intact and was able to afford it.

As we all know, life can happen at the drop of a hat.

When my former boss deemed my health a “liability for the team” and shifted my pay to per diem, I was left with little-to-no income and a $400 monthly bill for insurance coverage, mortgage, car payment, utilities, etc... This list does not include the additional cost of doctor appointment co-pays, medications, or procedures. Nor did it include cost for eventually needed infusions or the cost associated with the infusion center where the infusions were administered.

In less than six weeks time the cost of the infusion treatment’s loading doses (three doses total) came to over $1,000. If I had to pay for the medication, it would have been upward of $45,000. Luckily the medication cost was sponsored by the manufacturer’s program for people whose insurance wouldn’t cover the med. By the third month, I was encroaching on $2,000 in infusion center co-pays alone. This doesn’t count the $1,200 worth of monthly premiums I paid into over that time span. I was bleeding money out the wazoo, and actual blood. For those unaware, internal bleeding is a thing that happens with certain digestive diseases like Crohn’s.

Below is a picture of me trying to make a bad situation seem normal and okay for other patients in the same boat.

I would like to point out the ACA is imperfect. The original iteration of the ACA had a lot more benefits than detriments, but as always ends up happening bureaucratic bloat occurred.

Since 2011, better plans became available in many states, but not all. This disparity is part of the reason why the ACA isn’t popular amongst the people who are paying the same premiums I used to pay, although they may be receiving a far better plan.

The ACA was designed to help spread out cost affordably, but inevitably some people, in certain states like Florida (where I live), got the shaft. They were not getting fair premiums and were having trouble finding practitioners who would accept the coverage they’re paying so much money for, and I urge them to look to news archives about how their Governor affected these premiums. And how insurance company CEOs are driving up cost in the name of their shareholders and higher revenue, as well as multi-million-dollar end-of-year bonuses to line their personal pockets. But I digress.

At the age of 30, I received a lesson in healthcare economics that I never asked for. Since then, I have fought for others to not have to have the same experiences I was forced to: lose job, forced to sell a house I built from the ground up (see image below) along with all worldly possessions.

The ACA, as I mentioned before is imperfect, but two of its provisions saved my life. When I was officially declared disabled, the ACA had a provision that allowed me to go under my mother’s employer’s health insurance plan. She could have retired by now, but remains working to help keep me insured until I’m well enough to return to work. Another provision that the ACA provided was extinguishing lifetime expenditure caps. Aside from those two provisions, there is also the pre-existing condition provision that would allow me to apply for affordable coverage and not get denied due to my various conditions if / when I am able to work and can afford to buy my own policy once again.

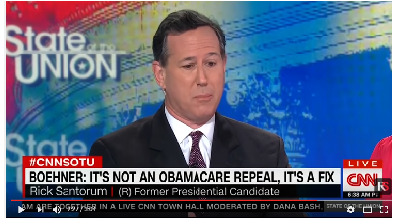

On Sunday, during CNN’s State of the Union broadcast, Rick Santorum sat on a panel and opened his mouth and said the following words, “... that thousands maybe approaching millions of Americans are paying 9 months for insurance...” Wow thousands morphing into millions is impressive in and of itself. Next, he continued the character assassination of the chronically ill and insinuated those with pre-existing conditions are scammers stealing health care. He implicated all Americans with chronic illnesses are only paying their monthly insurance premiums up until September, and went on to explain how they don’t lose their coverage for those three months of non-payment and due to provisions in the ACA are allowed to go and buy a new plan come January without consequence. [You can watch the clip here: https://youtu.be/aQO-xOntmEo.]

Confused? Irate?

Yeah, me too.

Let’s burn down an entire program based on an unfounded hypothesis, rather than fixing the alleged loophole he’s speaking of. Makes a lot of sense.

Editor’s note: Mr. Santorum if you ever see this, contact me and let’s have a chat.

[Screen shot below taken from appearance on CNN’s SOTU appearance, link above.]

I’d like to point out that Santorum has a young child with Trisomy 18, which if a child survives past birth requires costly medical care for the rest of their life. You would think Santorum would be more empathetic to the plight of those who need pre-existing condition protections in order to survive. However, it appears Rick Santorum sees the chronically ill as scam artists.

For the record, I’ve never met someone with a chronic illness willing to risk loss of coverage or future ability to retain coverage. Nor have I met a patient willing to be sent to collections. But this is what Rick Santorum thinks of us.

This makes me wonder if many of his GOP peers also think of us as such? Some of these GOP peers who according to the odds, more than likely, have pre-existing conditions themselves, no less.

This Saturday, I leave for Washington D.C., to attend the Digestive Disease National Coalition (DDNC) forum. We will advocate for agenda items such as funding for disease and treatment research, along with asking for provisions to keep patients with pre-existing conditions safe.

I’m not against changing the ACA from the iteration it’s taken on, but I do want to save the provisions that keep vulnerable people safe. I do want to help make it better. However, I’m not seeing replacement plan proposals that will benefit anyone who isn’t of decent financial means, and I have not seen a single thing that will benefit the estimated 52 million Americans (one-in-four people) with pre-existing conditions. All the while GOP members cry “Repeal!” and “It’s a disaster!”

I’m only seeing disasters being presented. I’ve never so much wanted to be proven wrong before in my life and still hold some hope that some kind of middle ground can be reached, but my hope is fading quickly.

President Trump has met with politicians (majority of which belong to his party), and industry leaders in the tech and business sectors, as well as the health insurance industry. The people he’s refused to meet with or acknowledge since becoming president are the patients worried about the next steps to his Repeal and Replace ideology. His comments on Monday about not realizing healthcare was so complicated, is worrisome, to put it lightly.

It’s very complicated. Lives hang in the balance based upon whatever form of “Repeal” this administration takes on.

And so I fight, and will continue to battle through Chronic Repeal Exhaustion, until this matter is dead in the water or I am. I prefer the former.

#aca#obamacare#HealthInsurance#Insurance#pre-existing conditions#chronic disease#chronicillness#chronic illness#chronically ill#crohns#crohns disease#crohn's disease#Crohn's#crohn's problems#ibd#ibd awareness#digestive disease#repeal#Inflammatory Bowel Disease#UlcerativeColitis#ulcerative colitis

1 note

·

View note

Text

Stoneleigh Recovery Associates LLC

Debt collectors like Stoneleigh Recovery Associates, LLC cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If Stoneleigh Recovery Associates violated the law, you will get money damages and they will pay your attorney’s fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

Who is Stoneleigh Recovery Associates, LLC?

Stoneleigh Recovery Associates is a debt collection agency based in Lombard, Illinois. Founded in 2007, Stoneleigh primarily serves companies in the auto finance, bankcard, commercial, healthcare, retail, and student loan industries.

Stoneleigh Recovery Associates’s Address, Phone Number, and Contact Information

Although Stoneleigh Recovery Associates hides its address, its P.O. Box is: P.O. Box 1479, Lombard, IL 60148. The main telephone number is 630-396-8289 and the Complaints number is 866-724-2330. The main website is https://stoneleighrecoveryassociates.com/.

Phone Numbers Used by Stoneleigh Recovery Associates

Like many debt collection agencies, Stoneleigh Recovery Associates may use many different phone numbers to contact debtors. For an advanced search, visit www.agrussconsumerlaw.com/ and click “Number Search” in the “Lookup” dropdown menu. Here are some phone numbers Stoneleigh Recovery Associates may be calling you from:

201-537-5953

630-282-5762

630-396-8080

630-812-2813

952-582-6070

Stoneleigh Recovery Associates Lawsuits

If you want to know just how unhappy consumers are with Stoneleigh Recovery Associates, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display over 100 lawsuits filed in the U.S., and these typically involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

Stoneleigh Recovery Associates Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If Stoneleigh Recovery Associates is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if Stoneleigh Recovery Associates violates the TCPA. Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If Stoneleigh Recovery Associates took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. Stoneleigh Recovery Associates, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or more per month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did Stoneleigh Recovery Associates continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If Stoneleigh Recovery Associates is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it; this is commonly known as “pay for delete.” If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

How do we Use the Law to Help You?

We will use state and federal laws to immediately stop Stoneleigh Recovery Associates’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Stoneleigh Recovery Associates violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorney’s fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorney’s fees and costs.

What if Stoneleigh Recovery Associates is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If Stoneleigh Recovery Associates is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorney’s fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against Stoneleigh Recovery Associates

Based on 34 reviews on Google, Stoneleigh Recovery Associates receives a 2.4-out-of-5 rating. Here are some of the reviews on Google:

“Scammers that brought fraudulent debt that was already removed from my credit by the Consumer Financial Credit Bureau. Then called me trying to verify information. After I told them I was recording the call they hung up on me three times. Sue them for fraudulent collection practices.”

“The customer services reps are awful…they were rude to my wife and were discussing unwanted unauthorized information with someone that is not the account holder.”

“Paid this collection agency to settle my debt only to find out — YEARS LATER — that the debt was never settled and is still unresolved on my credit history. Never received the resolution letter as promised, as a result, my credit has suffered further. This means I literally paid this company to settle my debt, at which point they took it and ran.”

What Our Clients Say about Us

Agruss Law Firm has over 825 outstanding client reviews through Yotpo, an A+ BBB rating, and over 110 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solve my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! Even settled it so I was paid back for the problems they caused!”

Can Stoneleigh Recovery Associates Sue Me?

Although anyone can sue anyone for any reason, we have not seen Stoneleigh Recovery Associates sue consumers, and it’s likely that the agency does not sue because they don’t always own the debt they are attempting to collect, and would also need to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely that the agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If Stoneleigh Recovery Associates has threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can Stoneleigh Recovery Associates Garnish my Wages?

No, unless they have a judgment. If Stoneleigh Recovery Associates has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If Stoneleigh Recovery Associates has threatened to garnish your wages, contact our office right away.

Stoneleigh Recovery Associates Settlement

If you want to settle a debt with Stoneleigh Recovery Associates, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Stoneleigh Recovery Associates remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from Stoneleigh Recovery Associates for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with Stoneleigh Recovery Associates, we at Agruss Law Firm are here to help you.

Top Debt Collection Violations

Debt collection laws provide a laundry list of what collectors can and cannot do while collecting a debt. Based on our years of experience handling thousands of debt collection harassment cases, here’s what collection agencies most often do to violate the law:

Called you about a debt you do not owe.

Called you at work after you told them you cannot receive calls at work.

Left you a message without identifying the company’s name.

Left you a message without disclosing that the call is from a debt collector.

Called third-parties (family, friends, coworkers, or neighbors) even though the collection agency knows your contact information.

Disclosed to a third-party (family, friends, coworkers, or neighbors) that you owe a debt.

Contacted you after you said to stop calling.

Threatened you with legal action (such as a lawsuit or wage garnishment).

Called you before 8:00 AM or after 9:00 PM.

Continued to call you after you have told the collector you cannot pay the debt.

Communicated (phone or letter) with you after you filed for bankruptcy.

Failed to mark the debt on your credit report as disputed after you disputed the debt.

Frequently Asked Questions

Do I have to pay your fees and costs for helping me with my consumer rights case? No. We handle consumer rights cases based on a fee-shift provision and/or a contingency fee. That means either the other side pays your fees and costs, or we take a percentage of your recovery. Whether it’s a fee-shift case or a contingency-fee case, we don’t get paid unless you get paid, and you’ll never owe us a penny for our time.

What are the damages I can get under the Fair Debt Collection Practices Act? If a collection agency violates any section of the FDCPA, you are entitled to damages up to $1,000.00. You may also be entitled to actual damages if the violation caused you out-of-pocket expenses. For example, if a collection agency threatens you with legal action to induce you to pay the debt, you may be able to get your payment back as actual damages.

What are the damages under the Telephone Consumer Protection Act? You can get $500 per robocall, or $1,500 per robocall if the robocalls were willful. In any type of settlement, Defendants often pay much less than $500 per call. However, if there are 50 calls at issue, even at $250 per call, your case could settle for $12,500.00.

What type of debt is covered under the Fair Debt Collection Practices Act? Only consumer debt, such as personal, family, and household debts. For example, money you owe on a personal credit card, an auto loan, a medical bill, or a utility bill. The FDCPA does not cover debts you incurred to run a business, or debts regarding unpaid taxes, or traffic tickets.

Does the Fair Debt Collection Practices Act apply to banks or credit card companies? No. Only third-party debt collectors are bound by the FDCPA. Original creditors, such as banks and credit card companies, are not bound by the FDCPA.

Are there state laws that protect me from original creditors? Yes! Several states also have laws that provide its citizens an additional layer of protection. If you live in California, Connecticut, Florida, Kansas, Massachusetts, Michigan, Missouri, Montana, North Carolina, Nevada, Oklahoma, Pennsylvania, Texas, or Wisconsin, you have additional state-law rights.

Are mistakes on credit reports common? Yes! Are you one of the 40 million Americans who have a mistake on their credit report? Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft.

What do I do if I have a mistake on my credit report? If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information. If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. To speed up the process, please get a free copy of your credit report at www.annualcreditreport.com. You can also learn more about the FCRA and your rights at http://www.agrussconsumerlaw.com/practices/common-credit-report-errors/

Share your Complaints against Stoneleigh Recovery Associates Below

We encourage you to post your complaints about Stoneleigh Recovery Associates. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by Stoneleigh Recovery Associates over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorney’s fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post Stoneleigh Recovery Associates LLC appeared first on Agruss Law Firm, LLC.

Stoneleigh Recovery Associates LLC published first on https://agrusslawfirmllc.tumblr.com

0 notes

Text

Stoneleigh Recovery Associates LLC

Debt collectors like Stoneleigh Recovery Associates, LLC cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If Stoneleigh Recovery Associates violated the law, you will get money damages and they will pay your attorney’s fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

Who is Stoneleigh Recovery Associates, LLC?

Stoneleigh Recovery Associates is a debt collection agency based in Lombard, Illinois. Founded in 2007, Stoneleigh primarily serves companies in the auto finance, bankcard, commercial, healthcare, retail, and student loan industries.

Stoneleigh Recovery Associates’s Address, Phone Number, and Contact Information

Although Stoneleigh Recovery Associates hides its address, its P.O. Box is: P.O. Box 1479, Lombard, IL 60148. The main telephone number is 630-396-8289 and the Complaints number is 866-724-2330. The main website is https://stoneleighrecoveryassociates.com/.

Phone Numbers Used by Stoneleigh Recovery Associates

Like many debt collection agencies, Stoneleigh Recovery Associates may use many different phone numbers to contact debtors. For an advanced search, visit www.agrussconsumerlaw.com/ and click “Number Search” in the “Lookup” dropdown menu. Here are some phone numbers Stoneleigh Recovery Associates may be calling you from:

201-537-5953

630-282-5762

630-396-8080

630-812-2813

952-582-6070

Stoneleigh Recovery Associates Lawsuits

If you want to know just how unhappy consumers are with Stoneleigh Recovery Associates, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display over 100 lawsuits filed in the U.S., and these typically involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

Stoneleigh Recovery Associates Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If Stoneleigh Recovery Associates is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if Stoneleigh Recovery Associates violates the TCPA. Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If Stoneleigh Recovery Associates took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. Stoneleigh Recovery Associates, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or more per month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did Stoneleigh Recovery Associates continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If Stoneleigh Recovery Associates is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it; this is commonly known as “pay for delete.” If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

How do we Use the Law to Help You?

We will use state and federal laws to immediately stop Stoneleigh Recovery Associates’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Stoneleigh Recovery Associates violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorney’s fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorney’s fees and costs.

What if Stoneleigh Recovery Associates is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If Stoneleigh Recovery Associates is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorney’s fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against Stoneleigh Recovery Associates

Based on 34 reviews on Google, Stoneleigh Recovery Associates receives a 2.4-out-of-5 rating. Here are some of the reviews on Google:

“Scammers that brought fraudulent debt that was already removed from my credit by the Consumer Financial Credit Bureau. Then called me trying to verify information. After I told them I was recording the call they hung up on me three times. Sue them for fraudulent collection practices.”

“The customer services reps are awful…they were rude to my wife and were discussing unwanted unauthorized information with someone that is not the account holder.”

“Paid this collection agency to settle my debt only to find out — YEARS LATER — that the debt was never settled and is still unresolved on my credit history. Never received the resolution letter as promised, as a result, my credit has suffered further. This means I literally paid this company to settle my debt, at which point they took it and ran.”

What Our Clients Say about Us

Agruss Law Firm has over 825 outstanding client reviews through Yotpo, an A+ BBB rating, and over 110 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solve my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! Even settled it so I was paid back for the problems they caused!”

Can Stoneleigh Recovery Associates Sue Me?

Although anyone can sue anyone for any reason, we have not seen Stoneleigh Recovery Associates sue consumers, and it’s likely that the agency does not sue because they don’t always own the debt they are attempting to collect, and would also need to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely that the agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If Stoneleigh Recovery Associates has threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can Stoneleigh Recovery Associates Garnish my Wages?

No, unless they have a judgment. If Stoneleigh Recovery Associates has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If Stoneleigh Recovery Associates has threatened to garnish your wages, contact our office right away.

Stoneleigh Recovery Associates Settlement

If you want to settle a debt with Stoneleigh Recovery Associates, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will Stoneleigh Recovery Associates remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from Stoneleigh Recovery Associates for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with Stoneleigh Recovery Associates, we at Agruss Law Firm are here to help you.

Top Debt Collection Violations

Debt collection laws provide a laundry list of what collectors can and cannot do while collecting a debt. Based on our years of experience handling thousands of debt collection harassment cases, here’s what collection agencies most often do to violate the law:

Called you about a debt you do not owe.

Called you at work after you told them you cannot receive calls at work.

Left you a message without identifying the company’s name.

Left you a message without disclosing that the call is from a debt collector.

Called third-parties (family, friends, coworkers, or neighbors) even though the collection agency knows your contact information.

Disclosed to a third-party (family, friends, coworkers, or neighbors) that you owe a debt.

Contacted you after you said to stop calling.

Threatened you with legal action (such as a lawsuit or wage garnishment).

Called you before 8:00 AM or after 9:00 PM.

Continued to call you after you have told the collector you cannot pay the debt.

Communicated (phone or letter) with you after you filed for bankruptcy.

Failed to mark the debt on your credit report as disputed after you disputed the debt.

Frequently Asked Questions

Do I have to pay your fees and costs for helping me with my consumer rights case? No. We handle consumer rights cases based on a fee-shift provision and/or a contingency fee. That means either the other side pays your fees and costs, or we take a percentage of your recovery. Whether it’s a fee-shift case or a contingency-fee case, we don’t get paid unless you get paid, and you’ll never owe us a penny for our time.

What are the damages I can get under the Fair Debt Collection Practices Act? If a collection agency violates any section of the FDCPA, you are entitled to damages up to $1,000.00. You may also be entitled to actual damages if the violation caused you out-of-pocket expenses. For example, if a collection agency threatens you with legal action to induce you to pay the debt, you may be able to get your payment back as actual damages.

What are the damages under the Telephone Consumer Protection Act? You can get $500 per robocall, or $1,500 per robocall if the robocalls were willful. In any type of settlement, Defendants often pay much less than $500 per call. However, if there are 50 calls at issue, even at $250 per call, your case could settle for $12,500.00.

What type of debt is covered under the Fair Debt Collection Practices Act? Only consumer debt, such as personal, family, and household debts. For example, money you owe on a personal credit card, an auto loan, a medical bill, or a utility bill. The FDCPA does not cover debts you incurred to run a business, or debts regarding unpaid taxes, or traffic tickets.

Does the Fair Debt Collection Practices Act apply to banks or credit card companies? No. Only third-party debt collectors are bound by the FDCPA. Original creditors, such as banks and credit card companies, are not bound by the FDCPA.

Are there state laws that protect me from original creditors? Yes! Several states also have laws that provide its citizens an additional layer of protection. If you live in California, Connecticut, Florida, Kansas, Massachusetts, Michigan, Missouri, Montana, North Carolina, Nevada, Oklahoma, Pennsylvania, Texas, or Wisconsin, you have additional state-law rights.

Are mistakes on credit reports common? Yes! Are you one of the 40 million Americans who have a mistake on their credit report? Mistakes on your credit report can be very costly. Along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or maybe you were a victim of identity theft.

What do I do if I have a mistake on my credit report? If you have a mistake on your credit report, there is a process to dispute them. My office will help you pull your credit report and dispute any inaccurate information. If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000.00, plus the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency pays your attorney’s fees and costs. Therefore, you will not pay me a penny for my time. To speed up the process, please get a free copy of your credit report at www.annualcreditreport.com. You can also learn more about the FCRA and your rights at http://www.agrussconsumerlaw.com/practices/common-credit-report-errors/

Share your Complaints against Stoneleigh Recovery Associates Below

We encourage you to post your complaints about Stoneleigh Recovery Associates. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by Stoneleigh Recovery Associates over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorney’s fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post Stoneleigh Recovery Associates LLC appeared first on Agruss Law Firm, LLC.

0 notes

Text

TrueAccord

Debt collectors like TrueAccord cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If TrueAccord violated the law, you will get money damages and TrueAccord will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose!Call us today at 888-572-0176 for a free consultation.

Who is TrueAccord?

TrueAccord is a startup debt collection agency based in San Francisco, California. Founded in 2013, TrueAccord provides automated, machine learning-based collection services for businesses and has been accredited by the Better Business Bureau since May 2014; the agency has received 20 negative reviews and complaints via the BBB in the past three years for billing/collection problems.

TrueAccord’s Address, Phone Number, and Contact Information

TrueAccord is located at 303 2nd Street, San Francisco, CA 94107. The main telephone number is 866-611-2731 and the main website is www.trueaccord.com/

TrueAccord Lawsuits

If you want to know just how unhappy consumers are with TrueAccord, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display 17 lawsuits filed in ten states,most of which involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

TrueAccord Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If TrueAccord is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if TrueAccord violates the TCPA.Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If TrueAccord took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. TrueAccord, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or moreper month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did TrueAccord continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If TrueAccord is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it;this is commonly known as “pay for delete.”If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

Howdo we Use the Law to Help You?

We will use state and federal laws to immediately stop TrueAccord’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if TrueAccord violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys’ fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys’ fees and costs.

What if TrueAccord is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead ofthe debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If TrueAccord is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against TrueAccord

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by TrueAccord. Here are some of TrueAccord’s reviews on Google:

“This company targets vulnerable consumers to get them to pay debts they never owed.”

“They will rob you. It’s a scam. Avoid at all costs. They will lie to you on the phone, overcharge you and you will receive 0% extra business from them and there is a $700 fee to leave. Change your credit card by your bank and claim it was stolen so they can’t charge you because they’re not legit so they don’t ask for your banking info, just your card like all scammers.”

“I don’t believe this company is real. They’ve sent me a few messages a day about owing a debt but not through mail over the internet. Why are they trying to collect debt over email is very odd. I clicked on one of the messages and they try forcing you to pay a said amount instead of what you can which is also fishy. I’ve ignored the emails from this company…but now I receive over 100 spam messages per day…pretty sure it’s due to them because it didn’t happen before.”

What Our Clients Say about Us

Agruss Law Firm has over 750 outstanding client reviews through Yotpo, an A+ BBB rating, and over 105 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solved my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! He even settled it so I was paid back for the problems they caused!”

Can TrueAccord Sue Me?

Although anyone can sue anyone for any reason, we have not seen TrueAccord sue consumers, and it’s likely that the agencydoes not sue because they don’t always own the debt they are attempting to collect, and would alsoneed to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely thatthe agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If TrueAccordhas threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can TrueAccord Garnish my Wages?

No, unless they have a judgment. If TrueAccord has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If TrueAccordhas threatened to garnish your wages, contact our office right away.

TrueAccord Settlement

If you want to settle a debt withTrueAccord, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will TrueAccord remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from TrueAccord for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with TrueAccord, we at Agruss Law Firm are here to help you.

Share your Complaints againstTrueAccord Below

We encourage you to post your complaints about TrueAccord. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by TrueAccord over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorneys’ fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post TrueAccord appeared first on Agruss Law Firm, LLC.

TrueAccord published first on https://agrusslawfirmllc.tumblr.com

0 notes

Text

TrueAccord

Debt collectors like TrueAccord cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If TrueAccord violated the law, you will get money damages and TrueAccord will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose!Call us today at 888-572-0176 for a free consultation.

Who is TrueAccord?

TrueAccord is a startup debt collection agency based in San Francisco, California. Founded in 2013, TrueAccord provides automated, machine learning-based collection services for businesses and has been accredited by the Better Business Bureau since May 2014; the agency has received 20 negative reviews and complaints via the BBB in the past three years for billing/collection problems.

TrueAccord’s Address, Phone Number, and Contact Information

TrueAccord is located at 303 2nd Street, San Francisco, CA 94107. The main telephone number is 866-611-2731 and the main website is www.trueaccord.com/

TrueAccord Lawsuits

If you want to know just how unhappy consumers are with TrueAccord, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display 17 lawsuits filed in ten states,most of which involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

TrueAccord Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If TrueAccord is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if TrueAccord violates the TCPA.Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If TrueAccord took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. TrueAccord, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or moreper month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did TrueAccord continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If TrueAccord is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it;this is commonly known as “pay for delete.”If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

Howdo we Use the Law to Help You?

We will use state and federal laws to immediately stop TrueAccord’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if TrueAccord violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorneys’ fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorneys’ fees and costs.

What if TrueAccord is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead ofthe debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If TrueAccord is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorneys’ fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against TrueAccord

If you’re on this page, chances are you are just like the hundreds of consumers out there being harassed by TrueAccord. Here are some of TrueAccord’s reviews on Google:

“This company targets vulnerable consumers to get them to pay debts they never owed.”

“They will rob you. It’s a scam. Avoid at all costs. They will lie to you on the phone, overcharge you and you will receive 0% extra business from them and there is a $700 fee to leave. Change your credit card by your bank and claim it was stolen so they can’t charge you because they’re not legit so they don’t ask for your banking info, just your card like all scammers.”

“I don’t believe this company is real. They’ve sent me a few messages a day about owing a debt but not through mail over the internet. Why are they trying to collect debt over email is very odd. I clicked on one of the messages and they try forcing you to pay a said amount instead of what you can which is also fishy. I’ve ignored the emails from this company…but now I receive over 100 spam messages per day…pretty sure it’s due to them because it didn’t happen before.”

What Our Clients Say about Us

Agruss Law Firm has over 750 outstanding client reviews through Yotpo, an A+ BBB rating, and over 105 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solved my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! He even settled it so I was paid back for the problems they caused!”

Can TrueAccord Sue Me?

Although anyone can sue anyone for any reason, we have not seen TrueAccord sue consumers, and it’s likely that the agencydoes not sue because they don’t always own the debt they are attempting to collect, and would alsoneed to hire a lawyer, or use in-house counsel, to file a lawsuit. It’s also likely thatthe agency collects debt throughout the country, and it would be quite difficult to have lawyers, or a law firm, licensed in every state. However, there are collection agencies that do sue consumers; for example, Midland Credit Management is one of the largest junk-debt buyers, and it also collects and sues on debt. Still, it is less likely for a debt collector to sue you than for an original creditor to hire a lawyer or collection firm to sue you. If TrueAccordhas threatened to sue you, contact Agruss Law Firm, LLC as soon as possible.

Can TrueAccord Garnish my Wages?

No, unless they have a judgment. If TrueAccord has not sued you, then the agency cannot get a judgment. Barring limited situations (usually involving debts owed to the government for student loans, taxes, etc.), a company must have a judgment in order to garnish someone’s wages. In short, we have not seen this agency file a lawsuit against a consumer, so the agency cannot garnish your wages, minus the exceptions listed above. If TrueAccordhas threatened to garnish your wages, contact our office right away.

TrueAccord Settlement

If you want to settle a debt withTrueAccord, ask yourself these questions first:

Do I really owe this debt?

Is this debt within the statute of limitations?

Is this debt on my credit report?

If I pay this debt, will TrueAccord remove it from my credit report?

If I pay this debt, will the original creditor remove it from my credit report?

If I pay this debt, will I receive confirmation in writing from TrueAccord for the payment and settlement terms?

These are not the only things to consider when dealing with debt collectors. We are here to help you answer the questions above, and much more. Whether it’s harassment, settlement, pay-for-delete, or any other legal issue with TrueAccord, we at Agruss Law Firm are here to help you.

Share your Complaints againstTrueAccord Below

We encourage you to post your complaints about TrueAccord. Sharing your complaints against this agency can help other consumers understand what to do when this company starts calling. Sharing your experience may help someone else!

HERE’S THE DEAL!

If you are being harassed by TrueAccord over a debt, you may be entitled to money damages – up to $1,000 for harassment, and $500 – $1,500 for illegal robocalls. Under state and federal laws, we will help you based on a fee-shift provision and/or contingency fee, which means the debt-collector pays your attorneys’ fees and costs. You won’t owe us a dime for our services. We have settled thousands of debt collection harassment cases, and we’re prepared to help you, too. Contact Agruss Law Firm at 888-572-0176 to stop the harassment once and for all.

The post TrueAccord appeared first on Agruss Law Firm, LLC.

0 notes