#bookkeeping services in usa

Explore tagged Tumblr posts

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

Tax and Bookkeeping Services in USA

Discover how tax and bookkeeping services work together to streamline your financial management. Proper bookkeeping is essential for accurate tax preparation, helping businesses avoid costly errors, stay compliant with regulations, and make informed financial decisions. Learn how these two services work hand in hand to keep your business's finances on track throughout the year. Read more

0 notes

Text

#USA accounting#USA bookkeeping#bookkeeping services in USA#accounting services in USA#bookkeeperlive

0 notes

Text

0 notes

Text

Account Reconciliation Services in Australia: Empowering SMEs with Financial Clarity

In the dynamic economic landscape of Australia small and medium-sized businesses (SMEs) are the foundation of growth and innovation. These companies, often motivated by passion, and determination need a solid financial management in order to survive the market's volatility and competition. We at North Quest Solutions, we understand the specific difficulties facing SMEs and we are committed to providing Account Reconciliation services australia that offer the financial stability and clarity necessary for sustainable growth.

The importance of Account Reconciliation in SMEs

For SMEs keeping precise financial records isn't only a legal requirement, it's an integral part of their business plan. Account reconciliation is the process of checking internal financial records against external statements from suppliers, banks and other companies to ensure that the records are accurate and consistent. This helps to identify any the source of any discrepancies, stop fraud and give a clear overview of the financial health of the business.

But the complexity and lengthy nature of reconciling accounts can be overwhelming for many SMEs. The lack of resources and the necessity to focus on business priorities frequently leave little time for precise financial management. This is the point at which North Quest Solutions steps in and provides special services for reconciling accounts in Australia that are tailored to the requirements of SMEs.

Why SMEs Need Professional Account Reconciliation Services

Improved Accuracy of Financial Information for any company and especially for SMEs accurate financial reporting is crucial. Inaccurate accounts can result in erroneous business decisions, regulatory fines as well as a deterioration in credibility. Our services for reconciliation of accounts assure the accuracy of your records. accurate and reliable, allowing you to make informed choices without hesitation.

Security against Fraud Fraud is harmful to the survival of an SME. Regular reconciliation of accounts helps identify irregularities and transactions that are not authorized and reduces the chance that financial theft could be a cause for concern. When you have North Quest Solutions by your side, you'll have a reliable partner committed to protecting your financial security.

Better Cash Flow Management: Knowing the real situation of your finances helps improve managing cash flow. By reconciling your accounts in a timely manner We assist SMEs maximize their cash flow and ensure they have the funds required to capitalize on opportunities for growth and deal with difficulties.

Compliance with Regulatory Compliance Conforming to the financial regulations is crucial to avoidance of penalties and keeping a excellent standing with regulatory authorities. Our experienced team is on top of the latest requirements for compliance and ensures that your account reconciliation procedures meet the required requirements.

North Quest Solutions: Your Partner in Financial Clarity

In North Quest Solutions, we are much more than an aggregator of services; we are your partner in the pursuit of excellence in your finances. Our services for reconciliation of accounts across Australia are designed to take this burden from your back and allow you to concentrate on what you excel at to propel you business to the next level. This is what makes us different:

Customized Methodology We recognize that each SME is different and comes with unique issues and goals. Our services are designed to meet your specific requirements, and we provide services that's as distinctive as your company.

Modern Technology Utilising the latest technology, we simplify reconciliation processes, which ensures effectiveness and precision. Our modern software solutions enable us to manage complicated reconciliations effortlessly, and deliver results that you can count on.

Expertise and experience Our team of financial experts bring years of experience and know-how in the field. We're skilled at handling the details of reconciling accounts and ensure that your financial documents are maintained in a meticulous manner and any discrepancies are quickly addressed.

continuous support Management of finances is a continual process and we're ready to assist you at throughout the process. From routine reconciliations to dealing with specific issues Our team is there to provide the assistance and assistance you require.

The emotional impact on Financial ClarityFinancial clarity provides a feeling of calm and security which is vital for any business owner. For SMEs being able to rest assured the financial information is in order and current can ease anxiety and let them concentrate on growth and development. We at North Quest Solutions, we are proud to be the main source of this clarity for our clients.Imagine not having to think regarding the authenticity of your accounting with the peace of mind that you have your money flow in order and you can rest assured that your company is compliant with all financial laws. This is the psychological impact on the accounting reconciliation service in Australia which is a service that is not just beneficial to your business but also encourages you to be more entrepreneurial.ConclusionIn the highly competitive and thriving marketplace that is Australia, SMEs need every advantage to compete. Effective financial management, specifically by ensuring accurate reconciliation of accounts, is the key to the success. North Quest Solutions is dedicated to providing SMEs by providing them with financial stability and clarity they require to flourish. Our reconciliation services for accounts across Australia are created to offer peace of mind, allowing you to pursue the things that matter most to you and move the business ahead. You can trust North Quest Solutions to be your partner to achieve the highest level of financial performance and let us assist to turn your business ideas into reality.

#accounting bookkeeping servicesBookkeeping Solutions#Bookkeeping Services in USA#accounting bookkeeping services in australia

0 notes

Text

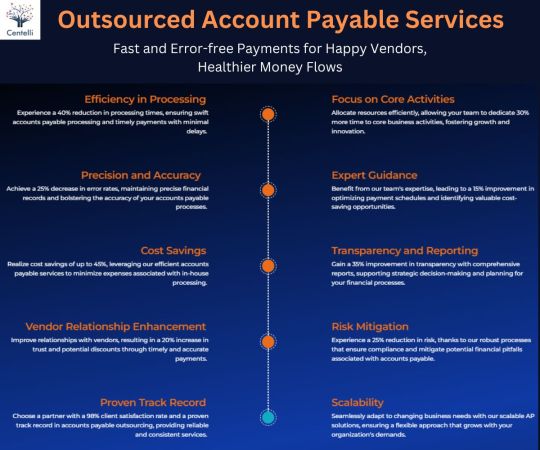

Expert Outsourcing Services in USA: Covering Web & Graphic Design, Data Entry, Bookkeeping

Unleash your business potential with our comprehensive USA outsourcing solutions. Our team of skilled professionals can handle your web design, graphic design, data entry, bookkeeping, and other back-office tasks efficiently and affordably. Focus on your core strengths while we take care of the rest. Get a free quote today and see how outsourcing can help you achieve your business goals!

1 note

·

View note

Text

Outsourcing your bookkeeping is like shedding a hefty burden! It liberates your time, allowing a dedicated and seasoned bookkeeper to handle the nitty-gritty. This partnership ensures you can channel your energy into the core aspects of your business that truly drive success. With the support of expert bookkeeping services, the journey to elevate your business becomes a smoother and more focused endeavor. 🚀💼

0 notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

#real estate#Small businesses#properties#business owners#start ups#online accounting#virtual accounting#online data entry services#small business accountant#bookkeeping in USA

0 notes

Text

https://flowrocket.com/finance

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses

0 notes

Text

0 notes

Text

Trusted Financial Management Outsourcing for Cost-Effective Business Success in the USA

Qualitas Accounting Inc has established itself as a trusted partner for businesses seeking exceptional accounting and financial solutions. With a team of seasoned professionals, the firm delivers a wide array of services tailored to meet the specific needs of clients across industries. From start-ups to established enterprises, Qualitas Accounting supports businesses on their financial journeys with precision, reliability, and innovation.

Their expertise lies in simplifying complex financial processes, ensuring compliance, and providing actionable insights to drive business growth. Whether it's optimizing daily bookkeeping tasks or offering strategic financial advice, their solutions are grounded in a deep understanding of modern business challenges. This commitment to quality and efficiency has made them a standout choice for businesses looking for personalized and dependable accounting services.

Professional Virtual CFO and Outsourced Bookkeeping Services for Scaling Small Businesses

Among their key offerings, Qualitas Accounting is recognized as one of the premier accounting firms Columbia MO, providing reliable services to support local businesses. For companies seeking efficient financial management, they serve as a leading bookkeeping outsourcing company USA, streamlining operations so organizations can focus on growth.

Expanding their reach across the nation, Qualitas Accounting excels in finance and accounting outsourcing USA, helping businesses achieve cost-effectiveness and improved productivity by leveraging their expertise. Additionally, they specialize in virtual CFO services USA, offering high-level strategic guidance and oversight for entrepreneurs who want to scale effectively while maintaining financial discipline.

Choosing Qualitas Accounting Inc means partnering with a firm dedicated to making your financial processes seamless and your goals achievable. With their comprehensive range of services and client-centric approach, Qualitas Accounting remains a trusted ally for businesses striving for financial success. Experience the difference with Qualitas Accounting Inc—reach out today to explore how their tailored solutions can elevate your business to new heights!

#accounting firms Columbia MO#bookkeeping outsourcing company USA#finance and accounting outsourcing USA#virtual CFO services USA

0 notes

Text

Bookkeeping Services in the USA

In the contemporary business landscape, efficient and accurate bookkeeping is crucial for the success and sustainability of any enterprise. Bookkeeping services in the USA play a pivotal role in helping businesses maintain precise financial records, ensuring compliance with regulatory standards, and making informed financial decisions. Whether a small startup or a large corporation, having a reliable bookkeeping service can significantly impact a company’s financial health and operational efficiency.

The Essence of Bookkeeping Services

Bookkeeping involves the systematic recording, organizing, and managing of financial transactions. These services encompass a range of activities such as recording daily transactions, managing accounts payable and receivable, reconciling bank statements, preparing financial statements, and ensuring compliance with tax laws. By maintaining accurate financial records, businesses can track their financial performance, manage cash flow, and plan for future growth.

Key Components of Bookkeeping Services

Transaction Recording: This is the foundation of bookkeeping, where every financial transaction is recorded in the company’s books. This includes sales, purchases, receipts, and payments by an individual or an organization.

Account Reconciliation: Regular reconciliation of bank and credit card statements with the company’s financial records ensures accuracy and helps identify any discrepancies or fraudulent activities.

Accounts Payable and Receivable Management: Effective management of accounts payable and receivable is essential for maintaining healthy cash flow. This involves tracking invoices, managing due dates, and ensuring timely payments and collections.

Financial Reporting: Bookkeeping services provide businesses with periodic financial reports, including balance sheets, income statements, and cash flow statements. These reports offer insights into the company’s financial health and performance.

Payroll Processing: Accurate payroll processing is a critical aspect of bookkeeping. This includes calculating employee wages, withholding taxes, and ensuring timely disbursement of salaries.

Tax Compliance: Bookkeeping services ensure that all financial records are maintained in compliance with federal and state tax laws. This includes preparing and filing tax returns, as well as maintaining records for tax audits.

Benefits of Professional Bookkeeping Services

Accuracy and Efficiency: Professional bookkeepers bring expertise and attention to detail, ensuring that all financial transactions are recorded accurately and efficiently.

Time-Saving: Outsourcing bookkeeping allows business owners to focus on core activities, such as product development, marketing, and customer service, rather than getting bogged down by financial paperwork.

Financial Insight: With accurate and up-to-date financial records, businesses can gain valuable insights into their financial performance, helping them make informed decisions and strategic plans.

Compliance and Risk Management: Professional bookkeepers ensure that financial records comply with relevant laws and regulations, reducing the risk of penalties and legal issues.

Scalability: As businesses grow, their financial management needs become more complex. Bookkeeping services can scale with the business, providing more comprehensive support as needed.

Choosing the Right Bookkeeping Service

When selecting a bookkeeping service, businesses should consider several factors to ensure they choose a provider that meets their specific needs:

Experience and Expertise: Look for a bookkeeping service with a proven track record and expertise in your industry. Experienced bookkeepers can offer valuable insights and tailored solutions.

Technology and Tools: Ensure that the bookkeeping service uses advanced technology and tools to provide accurate and efficient services. Cloud-based bookkeeping solutions offer real-time access to financial data and enhance collaboration.

Customization and Flexibility: Choose a bookkeeping service that offers customized solutions tailored to your business’s specific needs. Flexible services can adapt to your changing requirements as your business grows.

Reputation and Reviews: Check the provider’s reputation and customer reviews. Positive testimonials and references from other businesses can indicate reliable and high-quality service.

Cost and Value: Consider the cost of the bookkeeping service in relation to the value it provides. While cost is important, the cheapest option may not always offer the best quality and service.

Bookkeeping Services and Business Success

Effective bookkeeping is a cornerstone of business success. Accurate financial records provide a clear picture of a company’s financial health, enabling better decision-making and strategic planning. Additionally, well-maintained books ensure compliance with tax laws and reduce the risk of financial errors and fraud.

By outsourcing bookkeeping services, businesses can leverage the expertise of professional bookkeepers, gain access to advanced financial tools, and focus on their core operations. Whether managing day-to-day transactions, preparing for tax season, or planning for the future, professional bookkeeping services provide the support and insights businesses need to thrive.

In conclusion, bookkeeping services in the USA offer essential financial management support that helps businesses maintain accurate records, ensure compliance, and make informed decisions. By choosing a reliable and experienced bookkeeping service, businesses can enhance their financial health and position themselves for long-term success.

for more information:- visit here

#Accounting Services#Top accounting firm#Bookkeeping services in USA#Accounting company in USA#Accounting Services in india#Accounting Services in australia

0 notes