#bonk crypto price prediction

Explore tagged Tumblr posts

Text

Where Can I Buy Bonk Crypto: A Comprehensive Guide

If you are also a fan of cryptocurrencies? and have been following Crypto for some time now, then you must be well aware of dog themed meme coins.Crypto currency tokens like Shiba Inu and Dog Coin have made people millionaires overnight, people like world’s richest man Elon Musk have also said a lot about them. Most of these Mame coins are present on the Ethereum BEST network. One such new…

View On WordPress

#$bonk crypto#bonk crypto#bonk crypto chart#bonk crypto news#bonk crypto price#bonk crypto price prediction#bonk crypto solana#bonk crypto token#bonk crypto website#bonk crypto where to buy#buy bonk crypto#how to buy bonk crypto#what is $bonk crypto#what is bonk crypto#Where Can I Buy Bonk Crypto#where can i buy bonk crypto?#where can you buy bonk crypto#where to buy bonk crypto

0 notes

Text

2 notes

·

View notes

Text

Top 4 Coins to Watch for Explosive Gains: Dogecoin, Chainlink, Bonk, and FoxLetFun Aim for the Moon

Chainlink’s Breakout: Three Bullish Signals Driving Optimism The cryptocurrency market is setting the stage for a potentially explosive period, with four standout coins gearing up for major moves. Dogecoin (DOGE), the meme coin that started it all, is poised for a new rally. Chainlink (LINK) is drawing attention with bullish indicators suggesting a surge could be imminent. Meanwhile, Bonk is gaining traction with optimistic price predictions, and a fresh contender, the FoxLetFun token (FLF), is making waves with its promise of substantial gains and a unique twist on the meme coin narrative. Here’s why these four coins are ready to shoot for the stars. https://buy.foxletfuntoken.com/?ref_url=co-dogelinkbonkflf-180924 Dogecoin Poised for a Rally: Is the Meme Coin King Back in Business? Dogecoin is showing strong signs of a comeback, with market analysts predicting a rally on the horizon. The ever-loyal DOGE community, coupled with the potential for another viral moment courtesy of Elon Musk, has traders buzzing about a possible surge. As the original meme coin, Dogecoin has a proven track record of capturing attention and driving explosive growth, making it a staple for investors looking for quick gains.

To Know More- crypto coins ready to explode

#crypto coins ready to explode#Dogecoin rally 2024#Chainlink bullish signals#Bonk price predictions#FoxLetFun presale#best meme coins 2024#cryptocurrency growth opportunities#crypto coins with social impact#meme coins to watch 2024

0 notes

Link

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. A crypto trader known for predicting XRP’s surge past $1 now eyes Bonk and Yeti Ouro as the next big DeFi opportunities, with substantial growth potential on the horizon. A crypto trader who accurately predicted XRP’s recent rally past the $1 mark is now focusing on two promising DeFi assets, Bonk (BONK) and Yeti Ouro (YETIO). With XRP’s price action showing signs of continued bullish momentum, this trader’s focus has shifted to these emerging projects that could see substantial growth soon. XRP bullish momentum continues, rally to ATH? After predicting the XRP to break past $1, the trader has remained quite optimistic about the future of the digital asset. XRP rallied by 30% to break through its 2021 high of $1.96, which was successfully tested. This price action, along with the formation of a major ‘W’ pattern on the monthly chart, has opened up the possibility of XRP rising to $30 to $35 by 2025. Source X At press time, XRP was trading at $2.42, with many analysts predicting further upward movement. The trader urges holders to exercise vigilance and not fall prey to the price rise of XRP, suggesting that holders capitalize on the rally. ”As they say, there are no certainties in crypto, but the possibility of XRP hitting $35 by 2025 appears to be quite probable,” the trader said. Bonk rally: Is a breakout looming? Alongside XRP, the trader is also interested in Bonk, a Solana-based meme coin that has seen a surge in popularity in the last few months. Bonk has seen its price rise by over 100% since its listing on Coinbase due to high community engagement and a bold token distribution strategy. According to the experts, the price might rise even higher, with a short-term forecast at $0.0000545 and a long-term forecast at $0.000137. Source X The ongoing growth of Bonk’s Decentralized Exchange (DEX), known as BonkSwap, and its strategic position in the Solana ecosystem remain positive. Data from on-chain shows that whales have started paying attention to Bonk, as there has been massive outflow from exchanges, which is considered as a bullish signal. Yeti Ouro gains investor confidence during presale Concurrently, amid these rallies, another coin that has attracted the attention of holders in the crypto community is Yeti Ouro, a DeFi token with a gaming element integrated. The presale of the project has collected more than $1.15 million, with stage one sold out ahead of time, early investors are enjoying over 40% ROI. The tokens now sell for $0.017, with incentives for investors through staking rewards, token burn, and limited supply. The P2E game YetiGo, developed by Yeti Ouro, enhances its already strong appeal by being developed on Unreal Engine 5. It is a racing game that allows players to race and win and get incentives in the process. The development team behind the project consists of individuals who have previously worked on games such as Call of Duty and Spider-Man; they have focused on such aspects as fluid controls, destructible environments, and interactivity to make the game enjoyable to play. As there are only a few days left before the presale price increases, there is increased demand for YETIO tokens among holders. Analysts have projected that YETIO could reach $2.50 to $3.00 in 2025 as the ecosystem continues to expand. To learn more about Yeti Ouro community, visit the website, X, Telegram, and Discord. Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company. 2024-12-16 12:30:00 https://crypto.news/app/uploads/2024/12/crypto-news-XRP-option01-1.webp

0 notes

Text

Analyse Memecoins (+Make Thousands) How To Use Dexscreener to

Memecoins can be a wild ride in the crypto world. Some, like Dogecoin (DOGE) and Shiba Inu (SHIB), have experienced explosive growth in the previous crypto bull run back in 2021–2022.

Website Link https://coinvirally.com/

It is predicted that in 2024 there will be another bull run in crypto markets after the bitcoin halving happening on April 21, 2024. But before even the bull run began some meme coins like PEPE, DOGWIF, BONK, and FLOKI has shown significant growth benefiting most investors who bought the coins when they launched.

Investing in meme coins is a high risk since most can become shitcoins or rug pulls in a short time. If you’re interested in meme coins as well as altcoins, as much as we are then from here on out we will talk about how to mitigate risk by applying a couple of simple steps using Dexscreener which can be beneficial for you.

Website Link https://coinvirally.com/

What is Dexscreener?

Dexscreener is a web platform that gets data from various decentralized exchanges (DEXs) across different blockchains such as Ethereum, Solana, and Base. It allows you to track new token launches, view charts, analyze liquidity, analyze market cap, perform technical analysis, and see trading activity for memecoins and other tokens.

Steps to Analysing Memecoins

I know that it is almost useless to use technical analysis for meme coins since the rarely follow the technical analysis strategies. But there are some patterns and things such as fundamental analysis that you can perform using Dexscreener. These steps we’ve listed below will help you identify new memecoins with potential and mitigate the risk of getting into shitcoins that can be rug pulled anytime.

Finding New Memecoins

It’s true that every day more than over a hundred memecoins and shitcoins get listed or added to the world. However, some of these coins do have the potential to be groundbreaking. Here are the steps you can use to find a newly listed memecoin on Dexscreener.

Website Link https://coinvirally.com/

New Pairs: Click on “New Pairs” to see a list of recently launched tokens across all supported blockchains. You can sort this list by age (newest first) to find the latest meme coin launches. Filtering the List: Be cautious, as not all new coins are legitimate. To narrow down your search and focus on potentially more established

coins, you can use the following filters:

Age: Filter by a specific timeframe (e.g., 6–24 hours) to find memecoins that have been around for a little while and might have some traction.

Liquidity: Look for coins with a higher liquidity amount. This indicates a more established coin with more money available for trading. Platform: If you prefer a specific blockchain like Solana, you can filter by the platform to see only meme coins launched on that chain. Analyzing the Charts

Once you’ve identified a potentially interesting memecoin, take a closer look at its chart on Dexscreener. Here are some key things to consider:

Website Link https://coinvirally.com/

Liquidity Lock: Look for a green lock symbol next to the liquidity on the chart. This indicates that the liquidity is locked, preventing developers from rug-pulling the coin (suddenly selling all their coins and crashing the price).

Volume: Healthy volume is crucial. Look for coins with increasing or consistent volume bars at the bottom of the chart. This suggests a growing interest in the coin.

Price Trend: Avoid coins with a sustained downward price trend. Ideally, you want to see a coin that’s either consolidating or experiencing an upward trend.

Technical Analysis: While not covered in detail in the video, some users leverage technical analysis indicators on the chart to identify potential entry and exit points.

Website Link https://coinvirally.com/

Additional Research

Dexscreener provides a starting point, but further research is vital before investing. Look for the following:

Whitepaper: Does the coin have a well-defined purpose and roadmap? Then most likely it is going to be a good project. For instance, take Shibainu, they had a whitepaper and they are still

around and fighting to go up.

Audit: A crypto audit is a detailed report on the project, which only a few memecoins hold. This can state issues in the project and give an overall score for the project which can build confidence. Having an audit and receiving a good score is a good signal, especially for a memecoin project.

Website Link https://coinvirally.com/

#marketing agency#marketing automation#marketing#marketing strategy#marketing tips#100 days of productivity#business growth#business#branding#marketing digital

0 notes

Text

Analyse Memecoins (+Make Thousands) How To Use Dexscreener to

Memecoins can be a wild ride in the crypto world. Some, like Dogecoin (DOGE) and Shiba Inu (SHIB), have experienced explosive growth in the previous crypto bull run back in 2021–2022.

Website Link https://coinvirally.com/

It is predicted that in 2024 there will be another bull run in crypto markets after the bitcoin halving happening on April 21, 2024. But before even the bull run began some meme coins like PEPE, DOGWIF, BONK, and FLOKI has shown significant growth benefiting most investors who bought the coins when they launched.

Investing in meme coins is a high risk since most can become shitcoins or rug pulls in a short time. If you’re interested in meme coins as well as altcoins, as much as we are then from here on out we will talk about how to mitigate risk by applying a couple of simple steps using Dexscreener which can be beneficial for you.

Website Link https://coinvirally.com/

What is Dexscreener?

Dexscreener is a web platform that gets data from various decentralized exchanges (DEXs) across different blockchains such as Ethereum, Solana, and Base. It allows you to track new token launches, view charts, analyze liquidity, analyze market cap, perform technical analysis, and see trading activity for memecoins and other tokens.

Steps to Analysing Memecoins

I know that it is almost useless to use technical analysis for meme coins since the rarely follow the technical analysis strategies. But there are some patterns and things such as fundamental analysis that you can perform using Dexscreener. These steps we’ve listed below will help you identify new memecoins with potential and mitigate the risk of getting into shitcoins that can be rug pulled anytime.

Finding New Memecoins

It’s true that every day more than over a hundred memecoins and shitcoins get listed or added to the world. However, some of these coins do have the potential to be groundbreaking. Here are the steps you can use to find a newly listed memecoin on Dexscreener.

Website Link https://coinvirally.com/

New Pairs: Click on “New Pairs” to see a list of recently launched tokens across all supported blockchains. You can sort this list by age (newest first) to find the latest meme coin launches. Filtering the List: Be cautious, as not all new coins are legitimate. To narrow down your search and focus on potentially more established

coins, you can use the following filters:

Age: Filter by a specific timeframe (e.g., 6–24 hours) to find memecoins that have been around for a little while and might have some traction.

Liquidity: Look for coins with a higher liquidity amount. This indicates a more established coin with more money available for trading. Platform: If you prefer a specific blockchain like Solana, you can filter by the platform to see only meme coins launched on that chain. Analyzing the Charts

Once you’ve identified a potentially interesting memecoin, take a closer look at its chart on Dexscreener. Here are some key things to consider:

Website Link https://coinvirally.com/

Liquidity Lock: Look for a green lock symbol next to the liquidity on the chart. This indicates that the liquidity is locked, preventing developers from rug-pulling the coin (suddenly selling all their coins and crashing the price).

Volume: Healthy volume is crucial. Look for coins with increasing or consistent volume bars at the bottom of the chart. This suggests a growing interest in the coin.

Price Trend: Avoid coins with a sustained downward price trend. Ideally, you want to see a coin that’s either consolidating or experiencing an upward trend.

Technical Analysis: While not covered in detail in the video, some users leverage technical analysis indicators on the chart to identify potential entry and exit points.

Website Link https://coinvirally.com/

Additional Research

Dexscreener provides a starting point, but further research is vital before investing. Look for the following:

Whitepaper: Does the coin have a well-defined purpose and roadmap? Then most likely it is going to be a good project. For instance, take Shibainu, they had a whitepaper and they are still

around and fighting to go up.

Audit: A crypto audit is a detailed report on the project, which only a few memecoins hold. This can state issues in the project and give an overall score for the project which can build confidence. Having an audit and receiving a good score is a good signal, especially for a memecoin project.

Website Link https://coinvirally.com/

#marketing#marketing agency#marketing automation#business growth#marketing digital#marketing strategy#business#agatha all along#agatha harkness#branding

0 notes

Text

Analyse Memecoins (+Make Thousands) How To Use Dexscreener to

Memecoins can be a wild ride in the crypto world. Some, like Dogecoin (DOGE) and Shiba Inu (SHIB), have experienced explosive growth in the previous crypto bull run back in 2021–2022.

Website Link https://coinvirally.com/

It is predicted that in 2024 there will be another bull run in crypto markets after the bitcoin halving happening on April 21, 2024. But before even the bull run began some meme coins like PEPE, DOGWIF, BONK, and FLOKI has shown significant growth benefiting most investors who bought the coins when they launched.

Investing in meme coins is a high risk since most can become shitcoins or rug pulls in a short time. If you’re interested in meme coins as well as altcoins, as much as we are then from here on out we will talk about how to mitigate risk by applying a couple of simple steps using Dexscreener which can be beneficial for you.

Website Link https://coinvirally.com/

What is Dexscreener?

Dexscreener is a web platform that gets data from various decentralized exchanges (DEXs) across different blockchains such as Ethereum, Solana, and Base. It allows you to track new token launches, view charts, analyze liquidity, analyze market cap, perform technical analysis, and see trading activity for memecoins and other tokens.

Steps to Analysing Memecoins

I know that it is almost useless to use technical analysis for meme coins since the rarely follow the technical analysis strategies. But there are some patterns and things such as fundamental analysis that you can perform using Dexscreener. These steps we’ve listed below will help you identify new memecoins with potential and mitigate the risk of getting into shitcoins that can be rug pulled anytime.

Finding New Memecoins

It’s true that every day more than over a hundred memecoins and shitcoins get listed or added to the world. However, some of these coins do have the potential to be groundbreaking. Here are the steps you can use to find a newly listed memecoin on Dexscreener.

Website Link https://coinvirally.com/

New Pairs: Click on “New Pairs” to see a list of recently launched tokens across all supported blockchains. You can sort this list by age (newest first) to find the latest meme coin launches. Filtering the List: Be cautious, as not all new coins are legitimate. To narrow down your search and focus on potentially more established

coins, you can use the following filters:

Age: Filter by a specific timeframe (e.g., 6–24 hours) to find memecoins that have been around for a little while and might have some traction.

Liquidity: Look for coins with a higher liquidity amount. This indicates a more established coin with more money available for trading. Platform: If you prefer a specific blockchain like Solana, you can filter by the platform to see only meme coins launched on that chain. Analyzing the Charts

Once you’ve identified a potentially interesting memecoin, take a closer look at its chart on Dexscreener. Here are some key things to consider:

Website Link https://coinvirally.com/

Liquidity Lock: Look for a green lock symbol next to the liquidity on the chart. This indicates that the liquidity is locked, preventing developers from rug-pulling the coin (suddenly selling all their coins and crashing the price).

Volume: Healthy volume is crucial. Look for coins with increasing or consistent volume bars at the bottom of the chart. This suggests a growing interest in the coin.

Price Trend: Avoid coins with a sustained downward price trend. Ideally, you want to see a coin that’s either consolidating or experiencing an upward trend.

Technical Analysis: While not covered in detail in the video, some users leverage technical analysis indicators on the chart to identify potential entry and exit points.

Website Link https://coinvirally.com/

Additional Research

Dexscreener provides a starting point, but further research is vital before investing. Look for the following:

Whitepaper: Does the coin have a well-defined purpose and roadmap? Then most likely it is going to be a good project. For instance, take Shibainu, they had a whitepaper and they are still

around and fighting to go up.

Audit: A crypto audit is a detailed report on the project, which only a few memecoins hold. This can state issues in the project and give an overall score for the project which can build confidence. Having an audit and receiving a good score is a good signal, especially for a memecoin project.

Website Link https://coinvirally.com/

#blockchain#business#branding#marketing#marketing agency#marketing automation#bnb#telegram#coin#crypto

0 notes

Text

Bitcoin’s Reign Declines to 60%: Will DOGE and XRP Ignite the Altcoin Surge?

Key Points

Bitcoin’s dominance has fallen to 60%, failing to retest the $93,000 mark.

Altcoins such as Dogecoin, Ripple, and Bonk are gaining traction as Bitcoin’s price stalls.

Bitcoin’s dominance was expected to reach 65% on November 15th, but it fell short of retesting the $93,000 mark, causing a shift in market focus.

The stalling of Bitcoin’s price has led to altcoins, which have long been overshadowed by Bitcoin, to start gaining momentum. The question now is whether Bitcoin’s dominance will continue to decline as altcoins begin to rally.

Altcoins Gaining Traction

Bitcoin’s dominance has dropped to 60% at the time of writing, casting doubt on bullish predictions of a near-term $100,000 breakout. The RSI of 76 suggests that Bitcoin is in an overbought zone, which could signal an upcoming correction.

In contrast, altcoins are on the rise, as indicated by the Altcoin Season Index’s increase from 33 to 39. Top performers such as Ripple [XRP], Dogecoin [DOGE], and Bonk [BONK] are driving market interest.

Altcoin Market Momentum

As Bitcoin’s dominance drops to 60%, there’s a surge in momentum in the altcoin market, hinting at a potential shift towards an altcoin season. Tokens like Dogecoin, XRP, and Bonk have seen significant gains, as shown in the comparative performance chart.

Dogecoin has risen over 114.5%, spurred by increased trading volumes and renewed community enthusiasm. Ripple’s 100.6% rally reflects its sustained momentum post-legal clarity, positioning it as a top performer in the altcoin space. Bonk, a rising memecoin, has outperformed both with a 127.3% surge, demonstrating the power of speculative assets in driving market interest.

This rally across popular memecoins suggests growing confidence in altcoins as Bitcoin faces potential correction risks. If this trend continues, altcoin enthusiasts could witness a full-fledged rally, mirroring past cycles where Bitcoin corrections triggered a capital rotation into high-performing altcoins.

The Crypto Fear & Greed Index, currently at 83 (Extreme Greed), reflects heightened optimism in the market. Historically, such levels of extreme greed often precede corrections, as exuberant sentiment can lead to overbought conditions.

With Bitcoin’s RSI also suggesting potential overextension, the convergence of these signals indicates that the short-term price action might lean towards a pullback. In this environment, altcoins could further benefit as traders rotate capital away from Bitcoin to seek gains in assets showing relative undervaluation.

If Bitcoin struggles to reclaim its dominance, the current market dynamic may fuel an early-stage altcoin season, setting the stage for broader diversification in crypto portfolios. Navigating these market conditions will require a careful balance of optimism and caution, particularly for Bitcoin bulls anticipating a $100,000 breakout.

0 notes

Text

Exploring the Mystick Markets: A Guide to Current Crypto Trends

Introduction

The cryptocurrency market is experiencing a significant recovery in 2023, rebounding from the downturn of 2022, commonly referred to as the “crypto winter.”

Understanding current crypto trends is crucial for both investors and enthusiasts. Awareness of these trends can inform investment strategies and decision-making.

This guide aims to provide insights into the current landscape of cryptocurrencies, covering key developments, emerging technologies, and market performance. By equipping you with this knowledge, you can navigate the evolving world of crypto more effectively.

Current Trends in the Crypto Market

The cryptocurrency market is recovering from the “crypto winter” of 2022. This has attracted both individual and institutional investors. A significant development was when the U.S. SEC approved Bitcoin and Ethereum ETFs, allowing institutions to invest without directly owning cryptocurrencies. As a result, we are seeing a lot of money coming into the market, driving prices up and boosting investor confidence.

Key factors influencing current crypto market trends in 2023 include:

Regulatory Developments: The approval of Bitcoin and Ethereum ETFs has opened new opportunities for institutional investment. This shift allows institutions to gain exposure to cryptocurrencies through regulated financial products, which is crucial for fostering trust in the market.

Renewed Investor Confidence: After several major bankruptcies in 2022, investor sentiment has gradually improved. Many are now more willing to re-enter the market, supported by clearer regulations and a growing belief in the long-term viability of cryptocurrencies.

Market Performance Insights

The performance of key cryptocurrencies like Bitcoin and Ethereum illustrates these trends vividly.

Bitcoin Price Surge: Bitcoin has seen a remarkable price surge recently. Current predictions suggest that Bitcoin could reach approximately $77,000 by the end of 2024 according to USA Today, and may even climb to $123,000 by the end of 2025. This optimistic outlook stems from strong demand driven by institutional adoption and increased retail interest.

Ethereum Price Fluctuations: Ethereum’s performance following the launch of its ETFs reflects a more complex landscape. Initially, Ethereum experienced volatility with significant price drops post-launch. However, this fluctuation presents both challenges and opportunities for investors looking to capitalize on potential rebounds.

Investors should stay alert regarding price movement patterns and market signals. Understanding what is currently trending in the crypto market can lead to informed decisions about potential investments.

As the crypto landscape evolves, these current trends highlight significant shifts within the market. The interaction between regulatory changes, institutional investment, and renewed confidence paints an encouraging picture for future growth in this dynamic sector. According to Vaneck, several predictions for 2023 could further shape these trends.

The Rise of Memecoins in Crypto: A Closer Look at Solana Memecoins

Memecoins have become a distinct part of the cryptocurrency world, known for their community-driven approach and often funny branding. Solana memecoins, in particular, have gained popularity because of the platform’s ability to handle large transactions quickly and its low fees.

Popular Solana Memecoins

Bonk Inu (BONK): This token quickly rose to fame in late 2022, fueled by its vibrant community and engaging online presence. It serves as a fun entry point for many users into the crypto world.

Doge Killer (SHIB): Although primarily associated with Ethereum, SHIB has also made waves within Solana discussions due to its strong community and speculative trading potential.

Community Impact

These tokens are significant for more than just speculation; they create communities that promote participation and investment. Social media platforms are essential in gathering support for these projects.

Meme Culture’s Influence

Meme culture has shown to be a strong force behind interest in crypto memecoins. The funny and relatable content surrounding these tokens not only attracts new investors but also helps keep existing holders engaged. This cultural trend highlights the changing nature of investment dynamics in the cryptocurrency industry, making memecoins an important trend within the larger market landscape. Such trends are indicative of a broader phenomenon often referred to as meme coin mania, which is reshaping the investment landscape in ways previously unimaginable.

Token Creation and Trends: Exploring the Solana Token Generator

The token creation process on platforms like Solana is designed to be user-friendly, making it accessible for developers and businesses alike. This ease of use has contributed to the rising popularity of Solana as a platform for launching new tokens.

Tokenization of Real-World Assets

The trend of tokenizing real-world assets on blockchains is gaining momentum. By representing tangible assets such as:

Real estate

Art

Collectibles

these assets can be fractionalized and traded more easily. This method enhances liquidity and accessibility, allowing a broader range of investors to participate in markets that were previously out of reach.

The market for tokenized assets was valued at approximately $2.81 billion in 2023 and is projected to grow significantly by 2030. The integration of blockchain technology provides transparency, security, and efficiency in transactions, further supporting this trend.

Utilizing Solana Token Generator for New Projects

When creating tokens on Solana, the Solana Token Generator simplifies the process with a straightforward approach. Here’s a step-by-step guide to using this tool:

Access the Solana Token Generator: Start by navigating to the official platform.

Connect Your Wallet: Ensure you have a compatible wallet connected to facilitate transactions.

Define Token Parameters: Set the key attributes, including token name, symbol, total supply, and decimal places.

Confirm Token Creation: Review your settings and confirm the creation process.

Distribute Tokens: Once created, distribute your tokens as needed through your wallet.

Key considerations during development include tokenomics, which involves planning how your token will function within its ecosystem, including distribution strategies and potential use cases.

Benefits of Using Solana for Token Creators

Developers benefit from several features offered by the Solana platform:

Low Transaction Fees: Unlike other networks, Solana boasts minimal fees, making it cost-effective for small-scale projects.

Fast Confirmation Times: Transactions are confirmed quickly due to Solana’s high throughput capabilities.

Scalability: The architecture supports large numbers of transactions per second without compromising performance.

By leveraging these advantages, creators can focus more on innovation rather than worrying about transaction costs or network limitations. The potential for growth in the tokenization market combined with efficient tools like the Solana Token Generator positions developers well for future success in this evolving landscape.

Emerging Technologies Shaping Crypto Markets: The Role of AI Integration and Cybersecurity Improvements

The world of cryptocurrency is going through a major change, thanks to the use of artificial intelligence (AI) technologies in crypto projects. This change not only makes things work better but also provides new solutions to the various problems faced by the market.

AI Integration in Crypto Projects

AI technologies are being used to make decision-making processes and operations more efficient. Here are some key areas where AI is being applied:

1. Predictive Analytics

By using AI algorithms, projects can analyze large amounts of data to predict market trends and price movements. This information can help investors navigate through unpredictable situations.

2. Smart Contracts

AI has the potential to improve how smart contracts are executed by automating actions based on real-time data. This ensures accuracy and reduces the chances of human error.

3. Fraud Detection

Advanced machine learning techniques are being employed to identify unusual transaction patterns, which can enhance security measures against fraudulent activities.

One example of an up-and-coming token that incorporates AI is Numeraire (NMR). This token is part of Numerai, a hedge fund that relies on machine learning models contributed by data scientists from around the world. Investors are increasingly recognizing NMR’s potential due to its innovative approach in combining AI with stock market predictions.

Addressing Illicit Activity in Crypto Markets

Even with technological advancements, crime remains a concern in cryptocurrency markets. Recent trends have highlighted several illegal activities:

Scams: Phishing attacks and Ponzi schemes continue to target unsuspecting investors, taking advantage of the lack of regulatory oversight in many areas.

Ransomware Attacks: Cybercriminals demand payment in cryptocurrencies, often targeting both businesses and individuals. Despite improvements in cybersecurity measures, these attacks have seen a resurgence.

The importance of better cybersecurity cannot be stressed enough. As more people start using cryptocurrencies, it becomes crucial to have strong security protocols in place. Here are some key strategies:

Multi-Factor Authentication (MFA): Adding extra layers of security helps protect wallets and accounts from unauthorized access.

Regular Security Audits: Conducting thorough audits on platforms can help identify weaknesses before they can be exploited.

Investors need to stay alert about security threats while navigating this ever-changing landscape. Improved cybersecurity measures are vital for maintaining market integrity and safeguarding investor interests.

0 notes

Text

Ethereum ETF Approval Sparks BUSAI and Market Frenzy

The crypto market gears up for a critical decision on the Spot Ethereum Exchange-Traded Fund (ETF), with particular focus on AI, meme, and prediction market assets. In this context, BUSAI, with its unique position in the market, stands to benefit from the surging optimism.

Ethereum ETF Decision: A New Era for Crypto Investment

The SEC’s recent approval of spot Ethereum ETFs marks a significant milestone for the cryptocurrency market. Beginning July 23, 2024, major U.S. exchanges will list these ETFs, providing mainstream investors with easier access to Ethereum.

Analysts forecast that these ETFs could drive Ethereum prices higher and attract up to $15 billion in new assets. This move follows the earlier approval of Bitcoin ETFs, which significantly impacted Bitcoin’s price and market participation. Ethereum ETFs are predicted to capture a portion of the inflows seen by Bitcoin ETFs, potentially driving Ethereum’s price to new highs.

Crypto Market Surge Ahead of Ethereum ETF Decision

The excitement surrounding the Ethereum ETF decision has triggered a notable rally in several crypto sectors. Tokens related to Artificial Intelligence (AI), meme coins—including cat-themed and Solana-based variants—and prediction market assets have all experienced impressive gains.

Within the AI token category, assets like CorgiAI (CORGIAI), Turbo (TURBO), Grok (GROK), and Kitten Haimer (KHAI) have demonstrated exceptional performance. CORGIAI has led the pack with a 43.8% increase, followed by TURBO and GROK with 25.6% and 5.9% gains, respectively. These tokens have sustained their positive momentum over the past week, reflecting the growing interest and investment in AI-driven crypto assets.

Similarly, cat-themed meme coins such as Popcat (POPCAT), Mog Coin (MOG), Cat in a Dog's World (MEW), and Wen (WEN) have enjoyed significant boosts. MOG and WEN, in particular, have seen notable gains of 40% and 10% over the past seven days, underscoring their growing appeal among investors.

Solana-based meme coins, including Dogwifhat (WIF), Bonk (BONK), BOOK OF MEME (BOME), and Myro (MYRO), have also contributed to the market rally. These tokens have registered impressive gains in the past 24 hours, with BONK and BOME sustaining their value over the past week.

The Fear and Greed Index, a sentiment analysis tool, reflects a state of "extreme greed" in the market. This heightened optimism is driving the rally but also suggests that investors should be cautious of potential market corrections or bubbles.

BUSAI's Strategic Position in a Growing Market

Currently, BUSAI is uniquely positioned to harness the surge in market enthusiasm. Combining the cultural appeal of meme tokens with cutting-edge AI investments, BUSAI effectively taps into two of the hottest trends in the crypto world.

By integrating AI technology with the attraction of meme culture, BUSAI not only attracts a diverse investor base but also stands out in a crowded market. As the popularity of AI tokens and meme coins continues to rise, BUSAI’s strategic focus aligns perfectly with these trends.

This innovative combination is expected to significantly enhance BUSAI’s value, capturing the interest of visionary investors who foresee a bright future for this dynamic coin. The presale has already garnered substantial attention, and many forward-thinking investors have eagerly joined.

The Phase 1 presale of BUSAI has concluded, but don’t worry — Phase 2 is coming soon. Be sure to seize this upcoming opportunity, as this phase promises to offer even more chances to engage with and benefit from BUSAI’s growth trajectory.

The Official Channel: Website | Twitter | Telegram

1 note

·

View note

Text

Ondo (ONDO) has seen a decline, trading at around $1.1768. It faces resistance at $1.2440, the 50% Fibonacci retracement level, and support at $1.1165, the 0.236 Fibonacci level. The MACD shows a bullish crossover, hinting at a potential positive shift, while the RSI at 53.46 indicates a balanced market. Traders should watch these Fibonacci levels for insights into support and resistance zones. A break above $1.2440 could test the $1.3822 level, suggesting a bullish reversal.

Despite a 1.26% decrease in ONDO’s value to $1.18, trading volume surged by 11.63%, with a market cap of approximately $1.64 billion, ranking it 56th. Analyst Crypto Jack sees a bullish breakout for Bonk (BONK), currently at $0.00002669, predicting a surge if it maintains momentum above a critical support level. Bonk’s price increased by 12.99%, with trading volume rising 87.25% to about $371.22 million.

0 notes

Text

What’s New in Cryptocurrency Today?

The cryptocurrency market is constantly evolving, with new developments, innovations and challenges emerging every day. In this blog post, we will highlight some of the most important and interesting news stories that happened in the crypto space today.

Central Bank of Nigeria Lifts Crypto Ban Following New SEC Regulation The Central Bank of Nigeria (CBN) has reversed its ban on dealing with companies involved in digital tokens, following the introduction of a new regulatory framework by the Securities and Exchange Commission (SEC). The SEC has classified cryptocurrencies as securities and has mandated registration and compliance for crypto service providers. This move is expected to boost the adoption and innovation of crypto in Nigeria, which is one of the largest markets for digital assets in Africa.

Bitcoin Price Prediction: BTC Dips Amid Market Moves and Satoshi Identity Revelations Bitcoin, the leading cryptocurrency by market capitalization, has experienced a minor dip, trading at $43,623 with a 0.83% decrease on Saturday. This shift in Bitcoin's price coincides with a rise in stocks and a decline in the dollar value as the long holiday weekend approaches. Moreover, some speculation has emerged about the identity of Satoshi Nakamoto, the anonymous creator of Bitcoin, after a website claimed to reveal his name and location. However, many experts and enthusiasts have dismissed this claim as another hoax.

People’s Bank of China Stresses on Global Regulation for Crypto and DeFi Markets China’s central bank has called on global financial authorities to regulate the digital asset and decentralized finance (DeFi) markets in its recent financial stability report. The People’s Bank of China (PBoC) has warned that crypto and DeFi pose risks to financial stability, consumer protection, anti-money laundering and cross-border capital flows. The PBoC has also reiterated its stance on cracking down on crypto mining and trading activities within its jurisdiction.

Multiple Crypto Influencers Struck By SIM Swap Attacks – Here Are The Details SIM swappers are beginning to target crypto influencers ahead of the holidays, with some taking control of their high-profile accounts on Twitter. Some include the accounts of crypto investment firm Manifold Trading and its founding partner, Jae Chung. SIM swapping is a type of cyberattack that involves transferring a victim's phone number to a new SIM card, allowing the attacker to access their online accounts. Crypto influencers are often targeted by SIM swappers who seek to steal their funds or scam their followers.

New Cryptocurrencies Listed Today And This Week | CoinMarketCap CoinMarketCap, one of the most popular platforms for tracking crypto prices and data, has added new cryptocurrencies to its list in the last 30 days. These new listings can offer a variety of opportunities for those interested in the space. Some of the new cryptocurrencies include Fluid (FLUID), Fuzion (FUZN), Aki Network (AKI), Blue Kirby (KIRBY), Felix 2.0 ETH (FELIX), SANTA CHRISTMAS INU (SANTA), Lemon Terminal (LEMON), Bonkinu (BONKINU), Grok Father (GROK FATHER), Cash Flash (CFT), Solabrador (SOBER), Solana Shib (SSHIB), analoS (ANALOS), Analysoor (ZERO), The Gm Machine (GM), Baby Bonk (BABYBONK), Eggdog (EGG), Syncus (SYNC), Baby Bob (BABYBOB), MainnetZ (NETZ), BABY CAT INU (BABYCAT), PAW (PAW), Wecan Group (WECAN), Papa Grok (PGROK), bemo staked TON (STTON), GrapeCoin (GRAPE), Bitcoin Cats (1CAT) and Eclipse Fi (ECLIP).

These are some of the most relevant and exciting news stories that happened in the crypto world today. Stay tuned for more updates and analysis on this fast-paced and dynamic industry.

0 notes

Text

Dividends And Payouts

INVESTING STOCK ECONOMY EDITOR’S PICK STOCK Biggest Crypto Gainers Today on Uniswap – HORD, KNS, ASTRADAO STOCK Best Crypto to Buy Now December 14 – BONK, Injective, Helium STOCK DOJ Charges Four Individuals for Laundering Millions in Pig Butchering Scheme STOCK Bitcoin Price Prediction as BTC Surpasses $42,000 Amidst Dovish Fed Signals – Is the Bull Run Back? STOCK Crypto Whales are Making…

View On WordPress

0 notes

Photo

New Post has been published on https://primorcoin.com/heres-why-solana-price-may-pump-to-50/

Here's Why Solana Price May Pump to $50

Source: TradingView

The solana price is down by 1% today, having dropped to $21.03 in the past 24 hours. Its current level represents a 26% increase in a week and a 71% surge in the last 30 days, with the layer-one cryptocurrency compensating for some of the steep losses it incurred last year.

And with SOL benefitting from the launch of Solana-based meme token BONK, it’s likely that the altcoin will continue recovering as Solana attracts more traffic. However, because this process of recovery may take some time, traders are arguably better off turning to presale tokens for short-term gains, with move-to-earn crypto Fight Out one of the most promising among them.

Here’s Why Solana Price May Pump to $50

SOL’s indicators continue to show strong momentum, with its relative strength index (purple) remaining close to 70, despite having a dip a few days ago. At the same time, its 30-day moving average (red) is rising up towards its 200-day average (blue), suggesting that SOL may be in the middle of a breakout to a new longer term level.

Source: TradingView

SOL is arguably due a major rally, given that it had been so heavily oversold over the past few months. This overselling was partly the product of system outages that dampened confidence in Solana, and also partly the result of the FTX collapse, with the now-bankrupt exchange having been a major supporter of the layer-one blockchain.

However, with Solana rolling out a number of updates in the second half of 2022, it now seems that it’s on the path to recovery. This is highlighted by the fact that SOL’s price has risen by 70% in the past month, making it one of the best-performing major coins during this period.

As the tweet above shows, Solana boasts one of the busiest development communities in the cryptocurrency ecosystem. As such, it’s likely to continue growing, attracting more protocols and dapps, and boosting its total value locked in to the levels witnessed a year ago.

It’s because of this that it’s credible to predict big rallies for SOL later in the year. It remains 92% below its all-time high of $259.96, a figure which suggests that a medium-term target of $50 is more than feasible.

SOL last stood at $50 back in May of last year. Assuming that the global economy continues to enjoy encouraging macroeconomic news (e.g. declining inflation), and assuming that the cryptocurrency market doesn’t suffer any other major collapses, SOL could return to this level by the middle of the year.

Buy Solana Now

Why Fight Out Move to Earn Crypto May Be More Profitable

Of course, the downside of this is that SOL holders will have to wait for the macroeconomic picture to improve substantially before they’ll witness significant gains. As such, traders looking for shorter term gains may prefer to look to alternatives, with presale tokens being possibly the best bet in what (arguably) remains a bear market.

For instance, Lucky Block (LBLOCK) saw an increase as high as 6,000% in February, compared to a sale price of $0.00015. To take another example, Tamadoge (TAMA) rose by as much as 1,800% compared to its presale price in October, when it was listed on OKX.

While these two coins have obviously finished their presales, there remain a variety of sales happening right now. One of the most promising, at least in terms of the fundamentals of the coin being sold, is Fight Out’s (FGHT), an ambitious move-to-earn platform that combines real-life workouts with Web3.

Based on Ethereum, Fight Out aims to improve on earlier M2E platforms such as STEPN. That is, it will track and reward a much wider variety of workouts, including boxing, weightlifting and yoga, while also offering a range of in-app and IRL courses at its own branded gyms.

The sale for its FGHT token — which will be used for subscriptions and to pay for workouts with trainers — has already raised over $3 million. At the moment, 1 FGHT is on sale for $0.0166, although this price is set to increase in the next stage of the sale.

The sale will end on March 31, with FGHT receiving its first exchange listings from April 5. Investors can participate in the sale by going to its official website and connecting their Connect Wallet or MetaMask wallets.

Visit Fight Out Now

Source link

#Blockchain #Crypto #CryptoNews #TraedndingCrypto

0 notes

Text

Bitcoin Price Prediction 2020 (Halving) | Goldman Sachs Analyst Bitcoin Price | Bitcoin Cash Price Prediction BCH/USD

Current Tether offer Suggests Bitcoin Price is Correcting to $20,000

Bitcoin price charting on a longer time frame, market structure and the issuance of 1 billion Tether so far this year are making crypto and equities analyst FilbFilb incredibly bullish on BTC/USD within the run up to the 2020 halving. Bitcoin traders split into 3 groups Since correcting from 2019’s uncomparable high of $13,800 and thrice failing to break above $12,500, crypto investors broke into three camps. The first took the bearish perspective and predicted a pullback to $8,500-$7,500, often citing the CME gap. The second visualised a protracted amount of consolidation wherever Bitcoin value would stay stapled between $9,000 and $12,000, providing the opportunity for savvy traders and institutional investors to accumulate prior to the 2020 halving. The third cluster taken the parabolic breakdown as nothing quite a blip and stay steadfast in their belief that the digital plus can eventually rally back to $13,500 and higher. 4 ways Bitcoin price structurally shifted in 2019 According to popular crypto and equities analyst Filb Filb, Bitcoin price has undergone a structural shift for several reasons, he explained in his weekly newsletter. The digital plus is consolidating close to $11,800 (a resistance formed in Q1 2018) after bouncing off the double bottom at $9,500. This level now serves a strong weekly support and FilbFilb believes consolidation below resistance is a bullish indicator. Bitcoin Price has broken above $12,000 four times in separate weeks over the last seven weeks and the price action within this zone is different from Q1 2018 as all attempts to surmount $11,800 were met with swift rejection. Bitcoin’s market structure represents a optimistic pennant with a “minimum target” positioning with following necessary weekly resistance at $16,000. According to FilbFilb, this is a “multi month pennant, which is supported by the back breaking rejection of the lows found in 2018.” In 2018, retests of $12,000 consistently broke out the downside, where as in 2019 Bitcoin price action appears likely to make a strong upside move over the coming weeks. The VPVR shows a void in Bitcoin price history above $12,000 and a sharp upside move to $14,000 would open the doors to price discovery. It’s unlikely that a move to or on top of $14,000 would induce selling as those holding a position at this level are probably not looking to sell. A break on top of $14,000 also represents a new 2019 all-time high and the news event surrounding this event could lead to an influx of capital from investors of various ilk. In combination, these factors make a strong bullish case for Bitcoin price in the run up to the May 2020 halving. Tether issuance does not immediately impact market However, FilbFilb also cautions that: “On lower time frames, the Adam and Eve target remains to play out, with $12.9k being the target.”

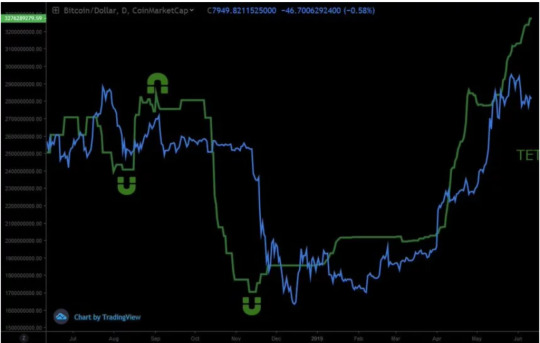

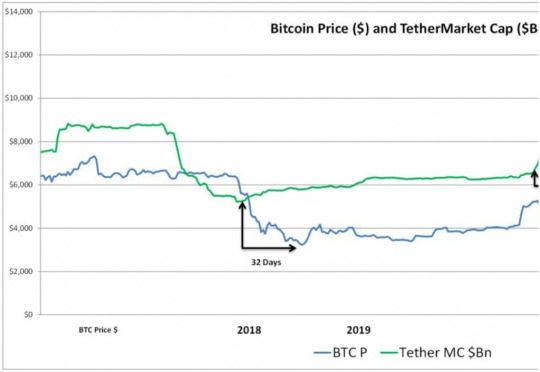

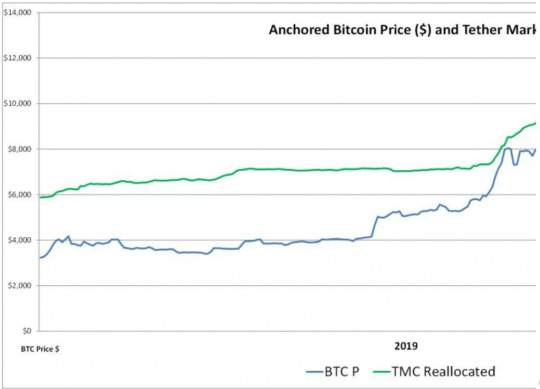

Coin Market Cap As mentioned antecedently, there's a comprehensible lag between Tether issuing and Bitcoin’s corresponding worth action. By beginning at Tether’s market cap bottom and scrutiny this against the time it took Bitcoin to achieve its 2018 bottom, FilbFilb’s notes that there's Associate in Nursing or so 32-day delay between Tether and Bitcoin’s price action. Mind the gap By anchoring Tether’s market cap bottom to Bitcoin’s market cap bottom, the 30-day lag between the two assets is smoothed out to the extent that it is easier to determine the correlation between each asset.

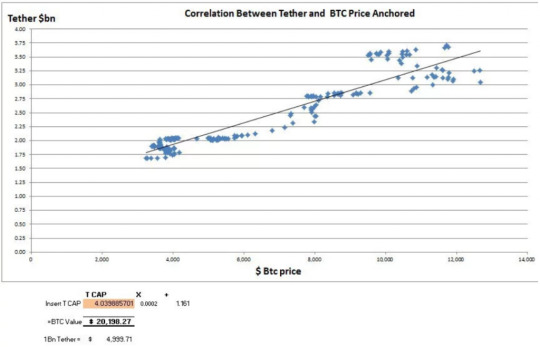

Bitcoin Price Using Y=0.0002x+1.161, FilbFilb concluded that the correlation between Tether and Bitcoin is 0.89. Therefore, when applied to Tether’s current market cap of $4.34 billion, the model suggests that the price of Bitcoin should be somewhere around $20,000. When the same calculation is used without the 32-day re-anchoring, the result was still a 0.8 R-squared. Y=0.0003x + 0.9695 gies a BTC valuation of $13.500, which according to this year’s all time high, isn’t too far off the mark.

Bitcoin Price USD Correlation between Bitcoin and Tether statistically significant Admittedly, there area unit some caveats that the analyst sufficiently addresses: The Tether / Bitcoin Price analysis is only dependent up information from 236 days and correlation doesn't a pure determination of deed. Similar to other stablecoins, issued Tethers could be burned at any moment. More Tethers might be written at any moment, and USDT doesn't represent the complete crypto market provide of stablecoins. Furthermore, Tethers are used for more than simply purchasing Bitcoins. If Bitcoin’s market cap continues to grow, the formula and analysis will require adjustment as the current 1 billion Tether issuance’s impact on a $70 billion Bitcoin market cap will have a special impact on a bigger or smaller Bitcoin market cap. Ultimately, what is worth noting is that there is a statistically significant correlation between Bitcoin price and Tether’s market cap.

Thus, one can infer that Bitcon’s price could be correcting upwards from its current value of $11,500 given the market cap of Tether and the 1 billion in USDT issuances this year. “An extra $1 billion market cap might probably move value by around $5K USD,” adds FilbFilb. But while FilbFilb cautions that he is not comfortable making prediction of a $20,000 Bitcoin price today, he is confident that: “There’s applied math proof to recommend that there area unit enough Tethers in supplying to create a directional move towards it, should they get deployed in that way.” Macro-economic factors support the case for a optimistic Bitcoin Price As previously reported by Cointelegraph, a series of worsening macro-economic factors are presenting challenges for traditional markets. But these issues also appear to be supporting Bitcoin’s allure as a store-of-value investment and hedge against market volatility within traditional markets. Bitcoin’s growing correlation to Gold, China’s yuan devaluation, Brexit, global monetary easing on part of numerous central banks, and negative bond yields are all driving investors to view Bitcoin Price as a hedge against volatility. As Cointelegraph rumored many weeks past, Digital asset research firm Delphi Digital found that the current macroeconomic landscape is creating the “perfect storm” to ignite Bitcoin price appreciation. “The relative size of Bitcoin’s market price compared to the investible gold market, for example, makes it a tempting opportunity for investors starving for assets with above-average growth potential as well,” the researchers note. Therefore, it’s no surprise that investors could also be progressively turning to Bitcoin — and Tether as a simple thanks to access this digital gold — within the returning months as storm clouds still gather over the worldwide economy. The views and opinions expressed here area unit alone those of the author and don't essentially mirror the views of Cointelegraph. Every investment and commerce move involves risk, you must conduct your own analysis once creating a choice.

Goldman Sachs Analysts’ Slide Suggests Now’s a Good Time to Buy Bitcoin

Market intel from Goldman Sachs suggests investors should capitalize on the current price dip and buy bitcoin. In a series of slides ready by a technical analysis team and sent bent on some institutional purchasers, Emma Goldman enclosed one that aforesaid the short target for bitcoin Price (BTC) is $13,971 which investors ought to contemplate shopping for on any dips within the current situation. The investment bank aforesaid that, based on its Elliott Wave analysis, BTC would find support around $11,094, and that there’s scope for a move higher to $12,916, then $13,971. “Any such retracement from $12,916-$13,971 ought to be viewed as a chance to shop for on weakness as long because it doesn’t retrace additional than the $9,084 low,” the slide aforesaid.

Sort term Bitcoin Price It ought to be noted that costs the costs used for the analysis don’t embrace weekend prices and ar seemingly from commodities market information. While this technical analysis appears optimistic on bitcoin, Goldman Sachs’ former business executive and chairman has antecedently same bitcoin simply isn’t his factor. Lloyd Blankfein same in associate interview last Gregorian calendar month that bitcoin is “not on behalf of me … I don’t bonk. I don’t own bitcoin.” (He retired at the tip of last year.) Rumors that Goldman would launch a crypto commercialism table and custody service are reportedly placed on hold over the unsure regulative scene within the U.S. Goldman Sachs slide deck by CoinDesk on Scribd Edit (21:30 UTC, Aug. 12, 2019): altered text to clarify that the intel came via a slide deck from a technical analysis team at Goldman, not an exploration note, which Harold Clayton Lloyd Blankfein is no longer CEO. Goldman Sachs image via Shutterstock; slide deck image via Goldman

Bitcoin Cash price prediction: Can the bulls takeover following a bearish Monday?

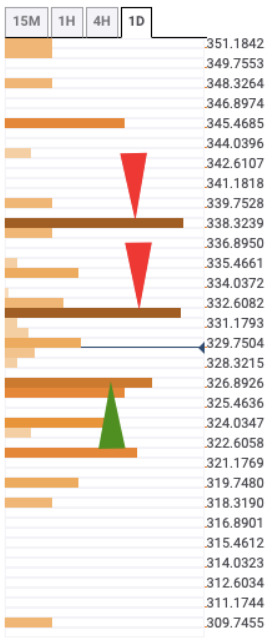

BCH/USD fell from $338.50 to $329 this Monday. Currently, it is priced at $328.55. The daily confluence detector shows two strong resistance levels on the upside. Bitcoin Cash has had a bearish start to Tuesday, following a bearish Monday. This Monday, the price fell from $338.50 to $329. Currently, it is priced at $328.55. The hourly price chart shows that the price initially plunged to $329.65 before the bulls took it back up to $333.45. Following that, the bears took the price down to $329.

The daily confluence detector shows us two healthy resistance levels on the upside. $332-level has the 50-day simple moving average (SMA 50), SMA 5, 1-day Fibonacci 38,2% retracement level, 1-hour Bollinger band middle curve, 1-hour previous high and 15-min Bollinger band upper curve. $339-level has the 1-week Fibonacci 61.8% retracement level. The strongest support level is at $326.75, which has the 1-week Fibonacci 38.2% retracement level. Read the full article

0 notes

Text

Bitcoin ETF Approval Expected in January: K33 Research Report

Summary of Article .container { width: 100%; overflow: hidden; } .image { float: left; margin: 0 10px 10px 0; } .text { text-align: justify; }

Nidhi is a Certified Digital Marketing Executive and Passionate crypto Journalist covering the world of alternative currencies. She shares the latest and trending news on Cryptocurrency and Blockchain.

Growing anticipation surrounding the approval of a spot Bitcoin exchange-traded fund (ETF) in the United States has fueled the rise in Bitcoin (BTC) and the broader cryptocurrency market. As of today, Bitcoin surged past $42,000 and briefly hit $43,000 before facing a robust barrier at $43,500, failing to break through this key resistance level.

Research & Analyst Reveals ETF is Almost “Approved” : Here’s How?

With these changing dynamics, researchers at K33 Research expressed in their report substantial certainty that the green light for a spot Bitcoin ETF is now “almost certain” to come through in January.

In recent updates to its application, BlackRock, the world’s largest asset manager, has shown readiness to implement cash creation before the January 10 deadline. This move aligns with the Securities and Exchange Commission’s (SEC) preference for a “cash redemption model” for bitcoin ETFs. This model facilitates investors to exchange their shares for fiat currency instead of the underlying asset, enabling smoother liquidation without direct bitcoin sales. Analyst Eric Balchunas from Bloomberg interprets BlackRock’s choice of the cash-based model as a strategic pre-holiday maneuver.

K33’s senior analyst Vetle Lunde and vice president Anders Helseth see this development as a positive indicator favoring the potential approval of the ETF within the coming weeks, despite acknowledging the cash creation model’s inefficiencies.

Notably, these adjustments in filings often follow discussions with the SEC, signaling the regulator’s inclination towards approving a Bitcoin ETF. James Seyffart, an ETF expert at Bloomberg, anticipates the SEC greenlighting the first spot in Bitcoin ETF between January 5 and 10, aligned with the initial final deadline for a Bitcoin ETF application.

Meanwhile, altcoins are gaining traction, witnessing a surge in open interest (OI). Despite Bitcoin’s trading volume surging and remaining high, the price has been confined within the $40,000 to $44,000 range. This stagnant range drives attention towards altcoins, especially those experiencing rapid price surges, such as ORDI, BONK, TIA, and INJ.

After 24 meetings and numerous filing edits, can the SEC deny?

Although a definitive timeline for SEC approval remains unconfirmed, experts and crypto enthusiasts expect a favorable decision by January 10. John Deaton and investor Mike Alfred forecast an astonishing 98.7% chance of a spot Bitcoin ETF approval in January. At the same time, Trader Bob Loukas is betting on a 99.9% chance of ETF getting a green light.

There is a lot of talk about how a spot Bitcoin ETF might affect BTC’s price and the cryptocurrency market as a whole. Predictions range from significant investments going into BTC to doubts about how it will affect current BTC operations, as experts at JPMorgan Chase said it would negatively impact the market.

Read the original article here

0 notes