#bombardier for sale

Explore tagged Tumblr posts

Text

Tips To Buy a Bombardier For Sale

Investing in a private jet is a dream that is coming true for many individuals and business entities today. The complexity of commercial flying has been felt keenly, with many people considering alternative options. Admittedly, purchasing a private jet is neither easy nor affordable. Several aviation brokers are willing to offer assistance to customers as needed. Most are not averse to finding the best Falcon jet for sale either. Sure, the concerned broker will take care of the nitty-gritty and try to initiate and complete the sale. The investor would be well advised to check the related facts, weigh the pros and cons, and then make an informed decision. It helps to know that the Dassault Falcon is often called the Falcon jet. It belongs to the Dassault Aviation family and is a long-range, mid-sized jet known for its versatility, reliability, and efficiency. These attributes make this jet highly popular, with the new and pre-owned models equally in demand.

There is nothing to complain about its trijet engine. The three Pratt & Whitney Canada PW307A engines powering the jet are known for performance and efficiency. It is capable of traveling a maximum of 3,825 nautical miles. The initial climb rate of 4,300 feet per minute, supported by a cruise speed of 420 knots, is astounding as well. The most significant aspect of the airplane is its capability of automatic landing in poor visibility.

It is heartening to know that the Falcon jet was designed primarily for passenger travel. Business owners and world travelers find the airplane well suited to their purpose. Surprisingly, despite being a passenger jet, the Falcon is often used for military services, governmental tasks, and other airline operations.

The passengers are sure to be eager to check the facilities in the cabin. It suffices to know that the cabin is well-spaced and can comfortably carry nine passengers. This makes it perfect for top executives and flying VIPs if needed. The baggage hold is spacious as well. Besides, the combination of leather and polished wood creates an elegant ambiance that pleases the passengers. The climate control within the cabin sets the temperature to an optimum level, making the passengers comfortable enough to feel at home.

The state-of-the-art navigation system and quality communication tools ensure perfect safety for this unique jet. The pilots are happy to utilize the superior precision controls coupled with the Collins Pro Line 4 avionics suite in the cockpit. The Falcon also comes with an alert system for the pilots that enables them to reduce risks substantially and in time. Decision-making during the flight with the help of proper data is a big plus.

People hoping to find a cost-effective and long-lasting jet will find the Bombardier for sale a perfect fit and attuned to their needs. When interested in a Bombardier, it is helpful to use the assistance of an aviation broker to choose between the Challenger and Learjet models.

0 notes

Text

Setting Blurb: The United Markets Military (UMM)

Unified Militia Command (U.M.C.) - Refers to the “military” of the United Markets as a whole. Well, it’s multiple militaries due to the highly decentralized nature of the United Markets. Since there’s no central government, there's no unified military structure. The U.M.C. is a conglomeration of mercenary companies and local militias. Mercenaries vary in tactics and equipment, and their organizational structure varies wildly. Militias, depending on the community they’re defending, can be as armed and armored as an Imperial tumen. Most, however, focus on light infantry, supplementing additional equipment with specialized mercenary units.

(Famous) Mercenary Commands:

Ad Hoc Inc.: Ad Hoc Inc. prides themselves in their rather…irregular style of warfare they offer to their customers. Ad Hoc specializes in having a wide array of contractors at their beck and call to perform whatever kind of security a client would require. Don’t expect them to wage a war on their own for you, though.

Brigade of Belter Bombardiers: BBB serves the United Markets as one of the few “Mercenary Spacies” operating in human-settled space. BBB was formed from several aerospace enthusiasts that served in the Belt Wars. They provide advisory and apprenticeship services for up-and-coming pilots and spacecraft crews. Their largest asset at their disposal is the Invisible Hand, the 15-kilometer-long mothership housing BBB personnel.

Geldmeister’s: “When one wants a war fought, you hire mercenaries. When one wants a war won, you hire Geldmesiter’s!” The number one in offering armies – and at a great price! – Geldmeister’s is what most citizens of human space imagine when thinking of mercenaries. As the largest mercenary command, Geldmeister’s can field formations equivalent to an Imperial Bandon on the battlefield. Frequent contracts against CorpEmp have made them the U.M.’s experts in mechanized and maneuver warfare.

Hot Trod Proactive Securities: When you want an enemy gone before they have a chance to do the same to you, you call Hot Trod. The mercs of Hot Trod are specialists in lightning warfare, utilizing light combat vehicles and aircraft. They do not last long if their targets are well fortified.

Jungle Work(s): Specializing in operations countering the Green Consensus, Jungle Work(s) are masters of warfare in all forms of foliage. They have received a lot of lucrative, long-term contracts as the likelihood of resettling the Earth grows.

Myrmidon Martial Industrial: The other Mercenary command that offers whole armies for sale. Unlike Geldmeister’s, Myrmidon Martial Industrial is for the customer that wants to win a war, but not interested in casualty counts. MMI was formed by shell-shocked veterans of the Human-Crystalline War, and its purpose was to have mass produced clone armies ready for any future invasions of the Solar System. No such invasion has occurred in 800 years, but MMI is still perfecting their human wave tactics. Just in case. Ant-themed.

Philanthrope: For those that can’t afford the cheapest Ad Hoc security package (or want a cheap and moral security package), there’s the helpful folks at Philanthrope. This non-profit mercenary firm, governed by a board of anonymous donors, exists to provide some means of defense for the more impoverished portions of U.M.-affiliated territory.

Free Market Militias:

Militia Command: Even with the market anarchies of the U.M. (Belt and beyond), some semblance of centralization exists. Militia Commands, often, exist only on paper. During periods of peace, Militia Commands are left vacant. When the need arises, contracts are signed by officers of the Command’s soon-to-be subordinate units indicating the terms of the Command’s purpose and longevity. Among the singing officers, a Cincinnatus-General is elected to serve as commanding officer (or a third party from outside the command is elected). Due to their more defensive inclination, Militia Commands are given names like the Free Market Defenders, Free Market Guardians, Free Market Watchmen, etc.

Regiment: The regiment is the largest Milita formation that is active in peacetime. Due to variations in manpower and equipment, there is no real uniform definition of the term. A “regiment” is whatever command is responsible for the defense of a particular territory that isn’t subordinate to another active command. Each Regiment is created by the residents of a territory affiliated with the United Markets (sometimes the Reserves create Regiments of their own) coming together and drafting a contract. Said contract defines the structure of the Regiment, the contributions of each signatory, and delimitate the “territory” it will be defending. A commander is elected from among the signatories, with the elected commander allowed to grant subordinate ranks. Regimental commanders title themselves however they wish (since they’re usually footing most of the bill for upkeep).

Client Regiment: Sometimes a regiment does not have enough manpower or equipment to properly defend their contractually assigned territory. Larger Regiments may extend the hand of patronage of smaller neighboring Regiments, provide discounted supplies and additional manpower in return for contractual obligations (like defending their Patron’s territory including their own). To save face, clients are allowed to still call themselves Regiments.

Battalion: Ideally, a Militia Regiment will have two or more battalions subordinate to it at any given time. Much like their parent regiments, manpower and equipment are dependent on who is willing to serve in their local militia and what each member can afford to bring.

Company: Companies are the smallest combat unit within a Regiment due to aforementioned variations in manpower and equipment (if a Regiment is large enough to field Companies). Depending on their strength, Companies can either be broken down into Platoons or Squads.

How’ver: A common phrase among U.M. militiamen referring to the recruiting calls at a Regiment’s establishment. It refers to however many personnel that bothered to show up to join the Regiment. Depending on its size, a Regiment (and its subordinate units) can be made up of multiple How’vers, or the Regiment itself can consist of a single How’ver.

8 notes

·

View notes

Text

B-47 navigator/bombardier recalls when out of 45 Stratojets that took off from Little Rock AFB to the UK his B-47 was the only one that made it across the Atlantic Ocean

The B-47 Stratojet

Designed to meet a 1944 requirement, the first XB-47 prototype flew in December 1947, performing far beyond its competitors. It incorporated many advanced features for the time, including swept wings, jet engines in underwing pods, fuselage mounted main landing gear and automated systems that reduced the standard crew size to three.

SR-71 T-Shirts

CLICK HERE to see The Aviation Geek Club contributor Linda Sheffield’s T-shirt designs! Linda has a personal relationship with the SR-71 because her father Butch Sheffield flew the Blackbird from test flight in 1965 until 1973. Butch’s Granddaughter’s Lisa Burroughs and Susan Miller are graphic designers. They designed most of the merchandise that is for sale on Threadless. A percentage of the profits go to Flight Test Museum at Edwards Air Force Base. This nonprofit charity is personal to the Sheffield family because they are raising money to house SR-71, #955. This was the first Blackbird that Butch Sheffield flew on Oct. 4, 1965.

In May 1951 the B-47 began replacing the propeller-driven B-29s and B-50s in US Air Force Strategic Air Command (SAC)’s medium bomber units. While it could carry about the same bomb tonnage as the aircraft it replaced, the B-47’s top speed was more than 200 mph faster.

45 B-47s took off from Little Rock AFB to the UK, only one made it across the Atlantic Ocean

In 1956 45 B-47s took off on a bomb run exercise from Little Rock Air Force Base (AFB) to the UK. Only one B-47 made it across the Atlantic Ocean; all the rest returned to the US. My father, B-47 navigator/bombardier Lieutenant Richard “Butch” Sheffield was prepared to follow. He quickly had to learn how to lead.

He recalls in his unpublished book, “The Very First:”

‘As we prepared to fly to the UK, my aircraft and crew were to be the fifth aircraft in a flight of five. I believe that because I was the lowest-ranking navigator with the least experience, they did not want me to have to navigate the Atlantic as lead or alone.

‘We took off from Little Rock, all forty-five B-47s, and flew up to Northern New York State to refuel from KC-97 tankers flying at fifteen thousand feet. We were at thirty-five-thousand feet. Tankers put out a radar signal that we could identify on our radar screen. Each set of tankers, nine different sets, put signals that were almost alike but not. I saw our signal and told the aircraft commander (AC). He relayed to the lead aircraft that we had the tankers that we were to refuel with, and they didn’t believe him.

‘As we overflew them, we went over twice as fast and twenty thousand feet above them. My AC asked me if I was sure, and I said yes. He then told the lead, you are going to miss them; they are right below us now. Once again, they didn’t believe him, or I guess they didn’t believe that a Lieutenant could find the tankers from among the many radar signals.’

B-47 navigator/bombardier recalls when out of 45 Stratojets that took off from Little Rock AFB to the UK his B-47 was the only one that made it across the Atlantic Ocean

Heading for the UK

He continues;

‘My AC asked me for a heading for the tankers and left the formation. We rendezvoused with our tankers and took on our fuel. After refueling (we could not use the radios while refueling), the pilots asked for our location, and I gave it to them. They called the rest of the flight and told them where the tankers were at that time; by then, they were far away from the tankers.

‘I really didn’t know what we were going to do next, then the AC said; give me a heading for the UK. Now, I knew we were going to the UK alone, and I was going to navigate the North Atlantic in the middle of the winter, all by myself. I broke into a cold sweat; I was not prepared to do it.

‘Normally, the fifth aircraft in a flight of five just station keeps (keeps other aircraft on the radar) on the other aircraft in front of them, and the navigator/copilot team doesn’t shoot stars.

‘The lead navigator would do his planning by pre-computing the star shots on the ground the day before the flight. Now, I had to do the star computations in the small area and dim light of the cockpit. All across the Atlantic, I shot one star after another. My copilot, Mac McCraken, was young and eager, like me. He would do anything I asked him in the air. The older World War Two copilots would not have done it. This was hard work, and we never stopped until I saw the UK lands on the radar. WE HAD MADE IT.’

B-47 navigator/bombardier recalls when his Stratojet flew the largest Nuclear Bomb ever built to Spain

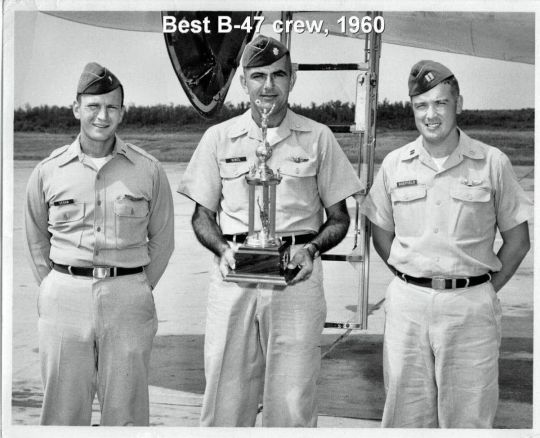

Richard “Butch” Sheffield is on the far right in the photo. His crew was named Best B-47 crew in 1960.

The only B-47 out of 45 that made it from Little Rock AFB to the UK

Sheffield concludes;

‘The following day, we were all told to report to see the Squadron Commander in his Office. This always meant trouble or an award. When we arrived, the AC was told to go in alone; Mac and I waited outside the door. We heard the Commander hollering all over the building, he was very mad that we had left the formation and went it alone.

‘When the AC came out, he was smiling. He said the Squadron Commander was just mad that the others were still back in the US, and they had never found the tankers and landed in North Eastern United States!

‘He said, I told him, we are here, and they are back in the US, so who goofed up?’

Dad was only 23 when navigated across the Atlantic ocean alone. I can see why he was selected to be one the first navigators for the new B-58 a few years later. Then he was first RSO to be selected for the SR-71 Blackbird program. Dad, was told to follow the older more experienced navigators, but he ended up having to lead and quickly learn to be good at it.

Be sure to check out Linda Sheffield Miller (Col Richard (Butch) Sheffield’s daughter, Col. Sheffield was an SR-71 Reconnaissance Systems Officer) Twitter X Page Habubrats SR-71 and Facebook Page Born into the Wilde Blue Yonder for awesome Blackbird’s photos and stories.

B-47 navigator/bombardier recalls when out of 45 Stratojets that took off from Little Rock AFB to the UK his B-47 was the only one that made it across the Atlantic Ocean

B-47 navigator/bombardier controls

@Habubrats71 via X

17 notes

·

View notes

Text

2009 Bombardier LEARJET 60XR. For sale.

https://kleexfly.com/wp/ads/ad/?ad_id=969

#Bombardier#LEARJET#SonicAviation#Aircraft#Helicopters#Gliders#Schools#Jobs#Drones#Skydiving#Paragliding#Speedflying#Kiting

4 notes

·

View notes

Photo

Bombardier Global Express

Business jet

The Bombardier Global Express is a large cabin, 6,000 nmi / 11,100 km range business jet designed and manufactured by Bombardier Aviation. Announced in October 1991, it first flew on 13 October 1996, received its Canadian type certification on 31 July 1998 and entered service in July 1999.

How much does it cost to buy a Bombardier Global 6000?

Prices today are around $18,750,000 with 35 currently advertised for sale.

Cruise speed: 907 km/h

Range: 11,390 km

Engine types: Turbofan, Rolls-Royce BR700

Top speed: 950 km/h

Wingspan: 29 m

Manufacturers: Bombardier Inc., Bombardier

Weight: 22,600 kg

371K notes

·

View notes

Text

Ultimate Guide to Timeless Luxury and Elegance

Discover the Appeal of Entry Level Jets

For those seeking convenience and luxury in travel, entry-level jets provide an excellent solution. Offering unmatched comfort, these jets are ideal for short-haul flights, allowing passengers to bypass commercial airport hassles. The combination of compact size and advanced technology makes them perfect for business or leisure trips. As a premier choice, they boast fuel efficiency, cost-effectiveness, and a seamless travel experience tailored to your needs.

Experience Sophistication with Wolf Watch Winders

Designed for timepiece enthusiasts, Wolf watch winders ensure the longevity and precision of automatic watches. Their innovative mechanisms keep watches perfectly wound, eliminating manual adjustments. These elegant devices not only safeguard your investment but also enhance the aesthetic of your collection. The precision engineering and sleek design make Wolf watch winders a must-have for any connoisseur.

Elevate Your Style with a Pasotti Umbrella

Timeless Beauty with the Gucci Diamantissima Watch

The gucci watch diamantissima exemplifies understated luxury with its signature lattice design and minimalist elegance. Featuring premium materials and Swiss craftsmanship, the Gucci Diamantissima watch is both stylish and reliable. Its lightweight design and versatile aesthetic make it suitable for any occasion, highlighting why it remains a favorite among watch enthusiasts.

Why Choose the Hermes Boat for Ultimate Leisure

An Hermes boat is the pinnacle of luxury on the water. These exquisite vessels offer unmatched comfort, cutting-edge technology, and bespoke designs. Perfect for leisurely cruises, an Hermes boat provides a serene and indulgent escape. Its high-performance capabilities and attention to detail elevate every voyage, ensuring an unforgettable experience.

The Distinct Elegance of the Global 6500 for Sale

The Bombardier Global 6500 for sale offers unparalleled performance and luxury for long-haul flights. With a spacious cabin, advanced avionics, and exceptional fuel efficiency, it redefines private aviation. Its smooth ride, customizable interiors, and extended range make it the ultimate choice for global travelers seeking comfort and convenience.

Exceptional Fuel Efficiency: Optimized for reduced operational costs and a greener footprint.

Smooth Ride: Engineered for minimal turbulence, ensuring passenger comfort during extended journeys.

Indulge in Luxury with the Keep Glazed Perfume

The Keep Glazed perfume captivates with its sweet and playful fragrance profile. Featuring notes of exotic fruits and creamy undertones, it’s perfect for those who enjoy a unique scent journey. The long-lasting aroma and sophisticated packaging make Keep Glazed perfume an irresistible choice for perfume enthusiasts.

Experience Regal Opulence with the Royal Crown Rain

Explore the Grandeur of Villa Leopolda French Riviera

Nestled on the French Riviera, Villa Leopolda French Riviera is a symbol of timeless elegance. This historic property boasts stunning architecture, lush gardens, and breathtaking views of the Mediterranean. Ideal for those seeking privacy and sophistication, Villa Leopolda French Riviera is a haven of tranquility that epitomizes refined living.

Unwind with the Versatile Trona Bar

The Trona bar brings sophistication to any space with its floating design and elegant craftsmanship. Perfect for lakeside or poolside use, the Trona bar is a unique addition to your luxury collection. The durable materials and customizable features ensure a premium experience for entertaining guests or enjoying solitude.

Floating Design: Adds a touch of modern elegance, perfect for creating a standout feature.

Versatile Placement: Ideal for lakeside or poolside settings, blending functionality with style.

The Unique Appeal of a Floating Bar for Lake

A floating bar for lake is the ultimate addition for outdoor leisure. Combining practicality and luxury, it offers a relaxing way to enjoy refreshments while on the water. With sturdy construction and stylish designs, a floating bar for lake is ideal for gatherings or peaceful moments surrounded by nature.

Discover Grace with the Royal Crown Noor

Discover Grace with the Royal Crown Noor Perfume

This exquisite perfume combines opulent floral and woody notes, offering a rich and captivating fragrance. Royal Crown Noor perfume luxurious composition reflects its regal name, making it a standout scent. Its longevity and unique blend ensure it remains a favorite among perfume connoisseurs.

Elevate Everyday with a Gold Toothbrush

A gold toothbrush represents the ultimate in daily indulgence. Crafted from premium materials, it combines practicality with a touch of extravagance. Its durable design and luxurious aesthetic make a gold toothbrush a statement piece, elevating even the simplest routines.

Durable Design: Built to last, ensuring both practicality and longevity.

Luxurious Aesthetic: A stunning statement piece that exudes sophistication.

Why the 2015 Gulfstream G550 Remains an Icon

This iconic jet is celebrated for its advanced technology, long-range capability, and spacious cabin. The 2015 Gulfstream G550 offers unmatched comfort and reliability, making it ideal for business or leisure travel. Its superior performance and timeless design solidify its place as a leader in private aviation.

Conclusion

Luxury is a celebration of life’s finest offerings, providing an experience that’s unmatched in quality and style. Whether you’re exploring the skies in a private jet, adorning yourself with a handcrafted watch, or indulging in a bespoke fragrance, these products epitomize the essence of sophistication.

FAQs

1. What makes luxury items worth the investment? Luxury items often feature superior craftsmanship, exclusive designs, and high-quality materials, ensuring longevity and timeless appeal.

2. How do I choose the right luxury product? Consider your personal style, practical needs, and the product’s unique features to find a perfect match.

3. Are luxury fragrances long-lasting? Yes, luxury fragrances like Royal Crown Noor and Keep Glazed perfume are formulated with high-quality ingredients for lasting scents.

0 notes

Text

So, tell me, why are so many social media users such ignorant fools and so proud of themselves for it that they have an irresistible compulsion to broadcast it to the world?

@GWNorth-db8vn 2 hours ago On behalf of Canada, please stop calling it a "Super Scooper". It's a Canadair water bomber, and that's what we've called them for half a century. … @scottfw7169 0 seconds ago @GWNorth-db8vn Dude, Canadair/Bombardier itself painted Super Scooper in red letters on aft fuselage under vertical stab of CL-415 registration C-GILN, serial number 2057, and it was photographed several times wearing that in 2002, AND it is the picture DeHavilland itself uses on its website in the legacy aircraft section to illustrate the type.

The Canadian plane and train maker confirmed Wednesday that it will not be renewing its lease at Jack Garland Airport in North Bay, Ont., where it had been producing the Bombardier 415 amphibious aircraft since 1998. The lease officially ends in April of next year but the company was required to give at least 90 days notice, Bombardier spokeswoman Isabelle Gauthier said. Bombardier makes the main components of the water bomber, marketed globally as the "Super Scooper," in Montreal and ships them to North Bay for final assembly and testing on nearby Lake Nipissing. Montreal employees working on the plane at a site in the Ville Saint-Laurent borough have also been reassigned to other aircraft programs.

1 note

·

View note

Text

Honeywell lowers sales, profit forecasts after Bombardier agreement

0 notes

Text

MHW-3BOMBER: Redefining Specialty Coffee Accessories Worldwide

A Legacy of Excellence in Specialty Coffee Wares

Since its inception, MHW-3BOMBER has established itself as a leader in the specialty coffee industry by delivering high-quality and innovative coffee accessories. With a dedication to reimagining coffee aesthetics, the company combines functionality and design to meet the needs of coffee enthusiasts globally. Operating out of a 20,000㎡ self-owned factory, MHW-3BOMBER’s products are now sold in over 60 countries, making it a trusted name among coffee professionals and hobbyists alike.

Sonic Coffee: Precision and Craftsmanship in Manual Brewing

The Sonic Coffee series exemplifies MHW-3BOMBER’s commitment to precision and artistry in coffee brewing. Designed for manual brewing enthusiasts, these tools ensure consistent quality while allowing users to enjoy the tactile experience of crafting the perfect cup. Featuring state-of-the-art engineering and an elegant aesthetic, Sonic Coffee products elevate the brewing process, blending form and function seamlessly.

Milk Pitchers: Essential Tools for Latte Art and Frothing

MHW-3BOMBER’s milk pitchers are celebrated for their precision, durability, and ergonomic designs. Tailored to the needs of both professional baristas and home users, these pitchers make milk frothing and latte art accessible to all. With co-branded collaborations like the WLAC World Champion pitchers, MHW-3BOMBER supports the coffee community by creating tools that inspire creativity and excellence in every pour.

Bombardier Coffee and the Art of Espresso

Espresso enthusiasts can rely on MHW-3BOMBER’s Bombardier Coffee line for tools that enhance the espresso-making experience. From manual espresso machines to high-performance knockboxes, the Bombardier Coffee collection combines robust construction with sleek aesthetics, reflecting the brand’s dedication to creating tools that stand the test of time.

Innovative Coffee Accessories for Every Brewing Style

MHW-3BOMBER offers a comprehensive range of coffee accessories, from coffee filter holders to ceramic cups and double-wall open cups. These products cater to various brewing methods, ensuring that every coffee enthusiast can find tools tailored to their preferences. The combination of thoughtful design and high-quality materials makes these accessories essential for achieving a superior coffee experience.

Gambo: Modern Solutions for Coffee Storage and Freshness

The Gambo line introduces innovative solutions for coffee storage, helping users maintain the freshness of their beans and grounds. Designed with functionality and style in mind, Gambo products protect the quality of coffee while complementing modern kitchen aesthetics. This collection exemplifies MHW-3BOMBER’s dedication to enhancing every aspect of coffee preparation and enjoyment.

Pour-Over Perfection with Precision Kettles

MHW-3BOMBER’s pour-over kettles are engineered for precision and control, catering to the growing popularity of manual brewing methods. With a focus on ergonomic design and advanced temperature stability, these kettles enable users to achieve consistent results, making them an indispensable tool for pour-over enthusiasts.

A Commitment to Craftsmanship and Global Excellence

MHW-3BOMBER’s products, including espresso knockboxes, ceramic cups, and coffee accessories, reflect a deep commitment to craftsmanship and innovation. By redefining traditional coffee tools and aesthetics, the company continues to inspire coffee lovers around the world. With strong sales in over 60 countries, MHW-3BOMBER stands as a global leader in specialty coffee wares, driving the industry forward with passion and ingenuity.

0 notes

Text

Personal Watercraft Market is Estimated to Witness High Growth Owing to Increasing Adoption of Water Sports Activities

Personal watercraft, also known as jet skis, are small, recreational open motorboats which one or more riders can sit, stand or kneel and use controls similar to a motorcycle. Personal watercraft provide high-performance riding and allow users to recreate in lakes, rivers or oceans. These small watercraft come equipped with powerful engines that enable exhilarating acceleration and maneuverability. The growing interest in water sports and recreational boating has significantly boosted demand for personal watercraft over the years. The Global Personal Watercraft Market is estimated to be valued at US$ 2.83 Bn in 2024 and is expected to exhibit a CAGR of 6.7% over the forecast period from 2024 to 2031. Key Takeaways Key players operating in the Personal Watercraft are Avon Marine, BRP Inc. (Bombardier Recreational Products), Gibbs Sports Amphibians, Inc., HISON, Honda Motors, Jiujiang Poseidon Motorboat Manufacturing Co., Limited, Kawasaki Motors Corporation, Lampuga, Meyer Bootswerft, NARKE, Polaris Industries, Sea Doo, SLVH s.r.o, Yamaha Motors, and Zodiac Nautic. The key players are focusing on developing innovative personal watercraft with enhanced features to attract more consumers. The Personal Watercraft Market Demand offers significant opportunities with the increasing popularity of water sports. Manufacturers are expanding their product portfolio to cater to the needs of all type of riders, including cruiser, performance and luxury personal watercraft. Globally, the personal watercraft market is expanding strongly driven by growing interest of water activities, especially in Asia Pacific and Middle East & Africa. Leading players are investing heavily in brand awareness campaigns and establishing new dealerships in emerging markets to tap the untapped growth potential. Market Drivers The major driver for the growth of personal watercraft market is the rising participation in water sports and outdoor recreational activities. Personal watercraft provide an adventurous and thrilling ride experience. Furthermore, increasing consumer affordability and availability of premium Personal Watercraft Market Size and Trends at lowered prices have boosted sales. Manufacturers are focusing on technology advancements such as lightweight hull designs and fuel-efficient engines to decrease maintenance costs and increase popularity of personal watercraft over motorboats.

PEST Analysis Political: With the rising focus on environmental regulations, political factors will influence the growth of the Personal Watercraft market. Strict emission norms may negatively impact the sales of old engine models. Economic: A rise in disposable incomes and access to consumer financing options is expected to support the sales of personal watercrafts, especially in developed regions. However, an economic slowdown can restrain the market. Social: Personal watercrafts are gaining popularity among the young population for adventure sports and recreational activities. An increase in outdoor recreational activities will drive the demand. Technological: Manufacturers are focusing on developing electric and hybrid engine models to comply with emission norms. Advanced connectivity features and safety technologies are also being integrated in new personal watercraft models. Geographical Regions with High Market Concentration North America and Europe account for over 60% of the global market value currently led by the United States and countries like France and Italy. Developed markets have higher participation in water sports and higher spending capabilities. Fastest Growing Regional Market The Asia Pacific market is expected to grow at the fastest pace during the forecast period led by countries such as Australia, China, and Japan. Factors like economic growth, rising living standards, growth in tourism and increasing participation in water sports are contributing to the rapid expansion of demand in the region.

Get more insights on Personal Watercraft Market

Also read related article on Water Turbine Market

For Deeper Insights, Find the Report in the Language that You want

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Priya Pandey is a dynamic and passionate editor with over three years of expertise in content editing and proofreading. Holding a bachelor's degree in biotechnology, Priya has a knack for making the content engaging. Her diverse portfolio includes editing documents across different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. Priya's meticulous attention to detail and commitment to excellence make her an invaluable asset in the world of content creation and refinement.

(LinkedIn- https://www.linkedin.com/in/priya-pandey-8417a8173/)

#Coherent Market Insights#Personal Watercraft Market#Personal Watercraft#Jet Ski#Water Scooter#PWC#Marine Vehicle#Water Sports#Boating#Recreational Watercraft#Aquatic Vehicle#Wave Runner

0 notes

Text

Chinese Firm Seizes Nigerian Government's $57 Million Luxury Jet in Canada. In a significant legal setback for Nigeria, Zhongshang Fucheng Industrial Investment Ltd, a Chinese firm, has successfully seized a luxury jet owned by the Nigerian government in Canada. The Bombardier 6000 type BD-700-1A10 aircraft, valued at $57 million, was repossessed by Canadian authorities in Montreal following a court ruling in favor of Zhongshang. Sources reveal that the paperwork for the change of custody was finalized recently, months after a Canadian court granted Zhongshang the right to seize the jet. Read Also : Breaking: Tinubu to Swear in Justice Kudirat Kekere-Ekun as New CJN "The court granted orders for Zhongshang to seize the plane earlier this year, but the change of custody from Nigeria to Zhongshang was only recently concluded," a source familiar with the matter disclosed. Zhongshang has vowed to continue its aggressive strategy of seizing Nigerian assets worldwide until the full arbitration awards, totaling over $70 million, are paid. Read Also : BREAKING: Oando PLC Completes Acquisition of Nigerian Agip Oil Company for $783 Million "Zhongshang will not stop seizing Nigeria’s assets worldwide until the last cent of the arbitration awards has been paid," the source added. The luxury jet in question was originally purchased by Dan Etete, a former Nigerian oil minister who reportedly gained over $350 million from the controversial sale of the OPL 245 oil field in 2010. The Nigerian government seized the aircraft from Etete in 2016 and held it in Dubai before relocating it to Canada in 2020, where it was placed under custody at Montreal's main airport. In 2023, Zhongshang moved to enforce the arbitration awards by seizing the jet. Judge David Collier of the Superior Court of Quebec ruled in favor of Zhongshang, dismissing Nigeria’s sovereign immunity claims, in line with a recent arbitration ruling in the UK. This development is part of a broader trend, as Zhongshang has successfully seized Nigerian assets in multiple countries, including the UK, France, and Canada. Despite losing legal challenges in at least five countries, Nigeria continues to assert that it has committed no wrongdoing in the disputes, which originate from a mismanaged free trade zone contract in Ogun State.

0 notes

Text

CFS Jets is a premier provider of private jet charter services, offering luxurious aircraft for both business and leisure travel. With a strong emphasis on safety, reliability, and exceptional customer service, CFS Jets guarantees a seamless and comfortable flying experience for all clients.

0 notes

Text

TCMS Market Size, Share & Forecast 2024-2030

On 2024-7-11 Global Info Research released【Global TCMS Market 2024 by Manufacturers, Regions, Type and Application, Forecast to 2030】. This report includes an overview of the development of the TCMS industry chain, the market status of Consumer Electronics (Nickel-Zinc Ferrite Core, Mn-Zn Ferrite Core), Household Appliances (Nickel-Zinc Ferrite Core, Mn-Zn Ferrite Core), and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot applications and market trends of TCMS. According to our (Global Info Research) latest study, the global TCMS market size was valued at USD million in 2023 and is forecast to a readjusted size of USD million by 2030 with a CAGR of % during review period. The global train control systems market is segmented by component into vehicle control unit, mobile communication gateway, human machine interface, and others. The train control systems market is driven by factors such as growing population and urbanization in developing countries such as India and China and availability of high-speed communication systems. The Global Info Research report includes an overview of the development of the TCMS industry chain, the market status of Metros & High-Speed Trains (Vehicle Control Unit, Mobile Communication Gateway), Electric Multiple Units (Vehicle Control Unit, Mobile Communication Gateway), and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot applications and market trends of TCMS. Regionally, the report analyzes the TCMS markets in key regions. North America and Europe are experiencing steady growth, driven by government initiatives and increasing consumer awareness. Asia-Pacific, particularly China, leads the global TCMS market, with robust domestic demand, supportive policies, and a strong manufacturing base. Market segment by Type: Vehicle Control Unit、Mobile Communication Gateway、Human Machine Interface、Others Market segment by Application:Metros & High-Speed Trains、Electric Multiple Units、Diesel Multiple Units Major players covered: Bombardier、Siemens、Toshiba、Mitsubishi Electric、Hitachi、Knorr-Bremse、Alstom、CAF、Strukton、ABB、Thales、China Railway Signal & Communicat、Aselsan、Quester Tangent

Market segment by region, regional analysis covers: North America (United States, Canada and Mexico), Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe), Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia),South America (Brazil, Argentina, Colombia, and Rest of South America),Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa). The content of the study subjects, includes a total of 15 chapters: Chapter 1, to describe TCMS product scope, market overview, market estimation caveats and base year. Chapter 2, to profile the top manufacturers of TCMS, with price, sales, revenue and global market share of TCMS from 2019 to 2024. Chapter 3, the TCMS competitive situation, sales quantity, revenue and global market share of top manufacturers are analyzed emphatically by landscape contrast. Chapter 4, the TCMS breakdown data are shown at the regional level, to show the sales quantity, consumption value and growth by regions, from 2019 to 2030. Chapter 5 and 6, to segment the sales by Type and application, with sales market share and growth rate by type, application, from 2019 to 2030. Chapter 7, 8, 9, 10 and 11, to break the sales data at the country level, with sales quantity, consumption value and market share for key countries in the world, from 2017 to 2023.and TCMS market forecast, by regions, type and application, with sales and revenue, from 2025 to 2030. Chapter 12, market dynamics, drivers, restraints, trends and Porters Five Forces analysis. Chapter 13, the key raw materials and key suppliers, and industry chain of TCMS. Chapter 14 and 15, to describe TCMS sales channel, distributors, customers, research findings and conclusion.

Data Sources:

Via authorized organizations:customs statistics, industrial associations, relevant international societies, and academic publications etc.

Via trusted Internet sources.Such as industry news, publications on this industry, annual reports of public companies, Bloomberg Business, Wind Info, Hoovers, Factiva (Dow Jones & Company), Trading Economics, News Network, Statista, Federal Reserve Economic Data, BIS Statistics, ICIS, Companies House Documentsm, investor presentations, SEC filings of companies, etc.

Via interviews. Our interviewees includes manufacturers, related companies, industry experts, distributors, business (sales) staff, directors, CEO, marketing executives, executives from related industries/organizations, customers and raw material suppliers to obtain the latest information on the primary market;

Via data exchange. We have been consulting in this industry for 16 years and have collaborations with the players in this field. Thus, we get access to (part of) their unpublished data, by exchanging with them the data we have.

From our partners.We have information agencies as partners and they are located worldwide, thus we get (or purchase) the latest data from them.

Via our long-term tracking and gathering of data from this industry.We have a database that contains history data regarding the market.

Global Info Research is a company that digs deep into global industry information to support enterprises with market strategies and in-depth market development analysis reports. We provides market information consulting services in the global region to support enterprise strategic planning and official information reporting, and focuses on customized research, management consulting, IPO consulting, industry chain research, database and top industry services. At the same time, Global Info Research is also a report publisher, a customer and an interest-based suppliers, and is trusted by more than 30,000 companies around the world. We will always carry out all aspects of our business with excellent expertise and experience.

0 notes

Text

The B-47 that flew the largest Nuclear Bomb ever built to Spain

Designed to meet a 1944 requirement, the first XB-47 prototype flew in December 1947, performing far beyond its competitors. It incorporated many advanced features for the time, including swept wings, jet engines in underwing pods, fuselage mounted main landing gear and automated systems that reduced the standard crew size to three.

SR-71 T-Shirts

CLICK HERE to see The Aviation Geek Club contributor Linda Sheffield’s T-shirt designs! Linda has a personal relationship with the SR-71 because her father Butch Sheffield flew the Blackbird from test flight in 1965 until 1973. Butch’s Granddaughter’s Lisa Burroughs and Susan Miller are graphic designers. They designed most of the merchandise that is for sale on Threadless. A percentage of the profits go to Flight Test Museum at Edwards Air Force Base. This nonprofit charity is personal to the Sheffield family because they are raising money to house SR-71, #955. This was the first Blackbird that Butch Sheffield flew on Oct. 4, 1965.

In May 1951 the B-47 began replacing the propeller-driven B-29s and B-50s in US Air Force Strategic Air Command (SAC)’s medium bomber units. While it could carry about the same bomb tonnage as the aircraft it replaced, the B-47’s top speed was more than 200 mph faster.

B-47 Stratojet nuclear bomber

As a result of its capabilities, the B-47 Stratojet became an essential component of the SAC during the 1950s and early 1960s, both as a nuclear bomber and a reconnaissance aircraft.

Since the B-47 did not have the range of SAC’s heavy bombers (the B-36 and later the B-52), Stratojet units regularly deployed to forward air bases around the world on temporary duty, as my father Richard “Butch” Sheffield (former B-47 navigator/bombardier, former B-58 navigator/bombardier and former SR-71 Reconnaissance Systems Officer (RSO)) recalls in his unpublished book “The Very First.”

B-47 navigator/bombardier recalls when his Stratojet flew the largest Nuclear Bomb ever built to Spain

Richard “Butch” Sheffield is on the far right in the photo. His crew was named Best B-47 crew in 1960

Flying to Spain with Mark 36

‘In the summer of 1959, our Wing moved its overseas operating location from Fairford, Royal Air Force Base, in the United Kingdom (UK) to a Spanish Air Force Base at Moron, Spain near Seville.

‘In order to get our nuclear weapons to Spain we just flew them in our B-47’s. This way we did not have to down load them from our alert status in the UK. Our primary weapon was the Mark 36. It weighed twenty thousand pounds, completely filled the B-47 bomb bay and had a seven-megaton yield. This was the largest nuclear bomb ever produced.

‘The normal way of moving nuclear weapons was by Military Air Lift. The weapons were safe, off loaded from the bombers, place into heavy lift aircraft like C-130, C-97 or later, C-5’s.

Carrying the largest Nuclear Bomb ever produced

‘So, flying them in the bomber was very unusual. Also, when the B-47 was full of fuel, with tip tanks fully loaded and the Mark 36 loaded our center of gravity (CG) was far aft of normal. We could not land with the bomb onboard and fuel in the tip tanks. We have to burn the fuel out of the tip tanks or drop the bomb to get the CG forward to land.

‘The route to Moron took us right over the Capital City of Spain, Madrid. As I flew over Madrid with this very large Hydrogen bomb, I could help but think, what do those people on the ground think is flying over them today? We even made a simulated bomb run on them.’

B-47 navigator/bombardier recalls when his Stratojet flew the largest Nuclear Bomb ever built to Spain

Mark 36 nuclear bomb

Flying home over Bermuda Triangle

‘Dad used to have a perplexed look on his face when he would talk about flying through the Bermuda triangle telling me that there really was something strange about it.

‘When it came time to rotate back home to Little Rock, my CO-pilot, Jim McCracken, and I came up with a way to get home sooner than normal. We would land at the Azores; refuel than were going to fly all the way home on one tank of gas going over Bermuda.

‘Everything was going well, right on fuel plans until we passed Bermuda, than we ran into the jet stream, two hundred-knot head winds, that were not forecast. We were lucky to make it to the East Coast. I have never seen, before or sense, headwinds like that. The jet stream never goes that far South.

‘We landed at Hunter, AFB, SC. on the East Coast. Flew home to Little Rock the next day.’

Be sure to check out Linda Sheffield Miller (Col Richard (Butch) Sheffield’s daughter, Col. Sheffield was an SR-71 Reconnaissance Systems Officer) Twitter Page Habubrats SR-71 and Facebook Page Born into the Wilde Blue Yonder for awesome Blackbird’s photos and stories.

B-47 navigator/bombardier recalls when his Stratojet flew the largest Nuclear Bomb ever built to Spain

Photo credit: U.S. Air Force and Linda Sheffield Miller

Linda Sheffield Miller

Grew up at Beale Air Force Base, California. I am a Habubrat. Graduated from North Dakota State University. Former Public School Substitute Teacher, (all subjects all grades). Member of the DAR (Daughters of the Revolutionary War). I am interested in History, especially the history of SR-71. Married, Mother of three wonderful daughters and four extremely handsome grandsons. I live near Washington, DC.

@Habubrats71 via X

8 notes

·

View notes

Text

The Failures of the Pashas (The Three Swords)

Joe Chill: Joseph Chilton, was a successful Macedonian mercenary, for generations, during the Punic Wars; the wars against Carthage, over the control of the white bloodline, held as sport and rape by "blacks", those of Sub-Saharan blood. A "Chinee", a Chinese prostitute incapable of Islam, a true Sunni, held bed to Joseph Chilton, and birthed Joseph Chill, a "junior"; the opposite of his father, a Rosecrucian, the order of Centurions. Mithras, the seizure of women as prostitutes, for a night, a guaranteed orgasm, and a child and lands and pastures, to make them women off of the street, having lost their fathers through war. An inclusion into Rome. Jesus, tucked in his right thumb, called an "imami", the slur for a homosexual, and broke rules, within law non-legalized, the code of the Gauls. You called him "Jesus"; prizefights, police badges, and wine bets, the origin of the athletics leagues, breeding the constable. The origin of the military tribunal, to kill him.

Adolf Hitler: Adolf Hitler, was the son of a military engineer, having outed a Catholic Cardinal for pederasty, the conversion of one of the Hitlers to Rabbinical order; however, the Rabbinical having Romalian blood, an "Azaz", angels, having jumped and bounded, in a living agony, despite having all the attributes of the Stasi, the Huns and Uighurs and Boers and Amish and Americans and Germans, the sacred points against Napoleon Bonaparte. A "Sheriff", the term for a political deacon, hired by any international actor, a politician, under Realpolitik's rules, out of embassy, those of Bismarck. Fire marshal, the mark of the Swastika, on the left pectoral or breast, breast if a woman, the father of Adolf having slain one, his son gay, under Calvinist code, not replied in type print of law, but in fact of transvestite observation. A homosexual dominatrix. Adolf, tucked his in his elbow at court's oath, called a "Jewish doctor", under code of testimony, and created a movement of beer swillers, killing Ernst Rohm, the "Boelyn", an innocent panda fighter, the creator of all of German culture and ales. You called him "Fuhrer"; creator of film arts, cinema, and psychiatric film, the creation of the movie part to determine medicine, a cop's drama. The origin of the castration clinic, having been stolen of semen by prostitute.

Ted Bundy: Theodore Charlebois, was removed from the Bombardiers, Philip J. Morris, and born through the McMahons, the World Wrestling Federation, the sales of cigarettes and Atavan, for pilots and from cats, a High House of Enver Pasha; that of the Harpoon brewing fortune, microbrews and state universities, all of the State Police, the Reserve Officers Training Corps, and the COBRA cop and teacher funds and court date appraisals, at his fingertips. He was CIA from birth, a child soldier, as marked on his DMV license, but was a whaling expert; spotting his market declined, he wrote nautical penmanship as "Buddy", the blood of Booth, the actor's stage wright, hunted by Israeli intelligence services, "Meir", since birth, "Fillmore Lodge"; the Rotary Association associated with strip malls, malls, and prison labor, a proper cop among the households of United States Presidencies, the intelligence adjuncts of the United States. The criminal guilds, this one being CRASH. He supborned a book on Spider-Man, early in the publication's run, teaching writers how to write backwards, a past news edifice, instead of forwards, and intended pattern of treaty, and therefore, to create a predictable pattern, a procedure drama. This was a pedophile, by judgement of his family, the Charleboises, and he was expelled, hunted by MI-6 assassin Alice O'Neill, Army intelligence Jeffrey Dahmer, Catholic friar Steven Charlebois, and Los Angeles police detective Richard Ramirez. Ted Bundy mastered print, and with it, the Grand Ol' Party turned to pederasty, with international scandal breaking out at dozens of murderers running through prostitutes circuits at the writer's duels, luring them into his realm, the written pen. In the end, he was seized, having killed a child for NAMBLA, and was put to death, by his conjugal liaison, a beautiful temptress in his mind, however the sex unsatisfying. It was his first, and last sex, having refused to see a hooker. His mark was the "Spider", a Hopkins, the middle and ring fingers tucked in, but he wasn't a Ludlow; he was a Charlebois, the name meaning "Cain"; the first murderer, the Inquistor's Oath.

0 notes

Text

Low-Carbon Propulsion Market Research & Forecast till 2033

Low-Carbon Propulsion Market is expected to grow at a CAGR of 21.5% during the forecasting period 2024-2033.

The competitive analysis of the Low-Carbon Propulsion Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Market projections and forecasts are underpinned by extensive primary research, further validated through precise secondary research specific to the Low-Carbon Propulsion Market. Our research analysts have dedicated substantial time and effort to curate essential industry insights from key industry participants, including Original Equipment Manufacturers (OEMs), top-tier suppliers, distributors, and relevant government entities.

Receive the FREE Sample Report of Low-Carbon Propulsion Market Research Insights @ https://stringentdatalytics.com/sample-request/low-carbon-propulsion-market/13361/

Market Segmentations:

Global Low-Carbon Propulsion Market: By Company • Tesla • BYD Company Ltd. • YUTONG • Nissan • Bombardier • Siemens • Alstom • Toyota • Honda Motor Co. Ltd. • Hyundai Motor Group Global Low-Carbon Propulsion Market: By Type • Heavy-Duty Vehicle • Light-Duty Vehicle Global Low-Carbon Propulsion Market: By Fuel Type • Compressed Natural Gas (CNG) • Liquefied Natural Gas (LNG) • Ethanol • Hydrogen • Electric

Regional Analysis of Global Low-Carbon Propulsion Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Low-Carbon Propulsion market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Low-Carbon Propulsion Market Research Report @ https://stringentdatalytics.com/purchase/low-carbon-propulsion-market/13361/?license=single

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Report includes Competitor's Landscape:

➊ Major trends and growth projections by region and country ➋ Key winning strategies followed by the competitors ➌ Who are the key competitors in this industry? ➍ What shall be the potential of this industry over the forecast tenure? ➎ What are the factors propelling the demand for the Low-Carbon Propulsion? ➏ What are the opportunities that shall aid in significant proliferation of the market growth? ➐ What are the regional and country wise regulations that shall either hamper or boost the demand for Low-Carbon Propulsion? ➑ How has the covid-19 impacted the growth of the market? ➒ Has the supply chain disruption caused changes in the entire value chain? Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes