#blockchain protocol list

Explore tagged Tumblr posts

Text

ERC20 token generator

Ever wanted to create your own cryptocurrency? Thanks to the ERC20 Token Generator, it’s more accessible than ever. Dive into the world of blockchain and see how simple it can be.

What is an ERC20 Token?

ERC20 tokens are digital assets built on the Ethereum blockchain. They follow a specific standard, allowing them to interact seamlessly with platforms and other tokens.

Benefits of ERC20 Tokens:

Interoperability: All ERC20 tokens adhere to the same protocol.

Widespread Acceptance: Many platforms on Ethereum support these tokens.

Developer Support: Extensive documentation and community support.

How Does the ERC20 Token Generator Work?

Creating a token might sound complex, but the ERC20 Token Generator simplifies the process. Here’s a step-by-step guide:

Define Your Token:

Choose a name and symbol.

Set the total supply.

Access the Generator:

Use online tools designed for token creation.

Input your token details.

Deploy to the Blockchain:

Confirm your details.

Launch your token on the Ethereum network.

Key Features of ERC20 Tokens

These tokens offer various features that make them attractive for both developers and investors:

Standardized Functions: Such as balance checking and transfers.

Smart Contract Integration: Seamlessly integrate with smart contracts.

Security: Built on the robust Ethereum blockchain.

Why Create an ERC20 Token?

Creating your own token can offer several advantages:

Fundraising: Launch your own ICO (Initial Coin Offering).

Community Building: Reward loyal customers or followers.

Innovation: Develop new applications and uses for blockchain.

Potential Challenges

Despite the ease of creation, there are challenges:

Technical Knowledge: Basic understanding of blockchain is required.

Security Risks: Vulnerabilities can lead to exploitation.

Regulatory Issues: Compliance with local laws is crucial.

Best Practices for Creating ERC20 Tokens

To ensure success, follow these guidelines:

Audit Your Code: Ensure there are no security loopholes.

Engage with the Community: Gather feedback and make improvements.

Stay Informed: Keep up with blockchain trends and regulations.

Conclusion

The ERC20 Token Generator opens doors to the exciting world of cryptocurrency creation. Whether you're an entrepreneur, developer, or enthusiast, it offers an innovative way to engage with blockchain technology.

Final Thoughts

Creating an ERC20 token can be a game-changer. It empowers you to participate in the digital economy and experiment with new ideas.

FAQs

1. What is an ERC20 Token Generator?

An ERC20 Token Generator is a tool that simplifies the creation of custom tokens on the Ethereum blockchain.

2. Is technical knowledge necessary to create a token?

Basic blockchain understanding is helpful, but many generators offer user-friendly interfaces.

3. Can I sell my ERC20 tokens?

Yes, you can list them on cryptocurrency exchanges or sell directly to users.

4. Are there costs associated with creating a token?

Yes, deploying tokens on Ethereum requires gas fees, paid in Ether.

5. How do I ensure my token is secure?

Regular code audits and following best practices can enhance security.

Source : https://www.altcoinator.com/

#erc20#erc20 token development company#erc#erc20tokengenerator#token#token generator#token creation#ethereum#bitcoin

57 notes

·

View notes

Text

Best Web3 Social Media Platforms of 2025

Web3 has come of age.

Just a couple of years ago, in 2023, most so-called “decentralized” social platforms were still finding their footing. User interfaces were rough, communities were small, and widespread adoption felt more like hype than reality. Fast forward to 2025, and the landscape has dramatically shifted.

Today’s top Web3 social platforms aren’t just niche hubs for crypto enthusiasts—they’re vibrant, evolving ecosystems where users grow real audiences, exchange ideas, and even earn rewards. Some resemble a calmer, community-first version of Twitter. Others channel the spirit of Reddit, but with user ownership baked in. What ties them all together is a shared belief: users should control their content, identity, and data.

At MediaX Agency, we collaborate with the builders, creators, and innovators pushing the Web3 space forward. That’s why we’ve taken a close look at the platforms that are actually making an impact this year.

Here’s our curated list of standout Web3 social platforms in 2025—and why they’re changing the game.

1. Lens Protocol: The Leading Web3 Social Graph in 2025

Lens Protocol has come a long way since its early experiments.

Built on Polygon and created by the Aave team, Lens isn’t just a platform, it’s a protocol. That means it powers multiple apps that all connect to a shared social graph. Users own their content, their profiles, even their followers. It’s like Twitter, but you carry your audience with you, wherever you go.

In 2025, Lens powers apps like Lenster, Orb, and Buttrfly - all of which offer clean, intuitive experiences. Some feel like traditional social media, while others lean into NFTs, DAOs, or creator monetization.

What makes Lens unique is how seamless everything feels now. Posts are on-chain, but gasless thanks to relayers. You can mint your content, earn through tipping or subscriptions, and take part in community voting through profile NFTs.

For anyone serious about Web3 social presence, Lens is the backbone.

And if you're building a brand or campaign in this space, remember: communication matters. As we wrote in Crypto, Blockchain & Web3 Success Starts with Clear Communication, the platforms may be decentralized but messaging still needs clarity and consistency.

2. Farcaster: The Most Active Decentralized Social Network

If Lens is the social graph, Farcaster is the social feed.

Built for speed and simplicity, Farcaster offers a familiar posting experience - somewhat like Twitter but with a decentralized core. It's built on an open protocol where users control their identity through on-chain keys, but most activity happens off-chain for speed and scale.

In 2025, Farcaster isn’t niche anymore. It’s buzzing with builders, founders, VCs, and creators. Think of it as Twitter, but for crypto-native professionals, minus the spam and bots.The key innovation?

Frames: Game Changer

These are interactive posts that let users mint NFTs, vote in DAOs, donate crypto, or claim rewards - directly inside the feed. No need to click out. No wallet popups.

If you're in Web3 and still tweeting into the void, you might be shouting in the wrong room.

Farcaster has also embraced wallet logins, smoother onboarding, and channels that work like Discord but live inside the platform. It’s sticky. It’s growing. And it’s open-source.

Many creators we work with at MediaX are using Farcaster as their go-to social home.

3. Nostr: The Minimalist, Censorship-Resistant Network

Nostr is different. Where Lens and Farcaster lean into crypto UX, Nostr strips everything back. It’s a protocol, not a platform - based on simple, decentralized relays. There are no tokens, no chains, and no corporate servers. Just pure peer-to-peer communication.

You might’ve heard of Nostr in the Bitcoin crowd. That’s where it first caught on. But in 2025, it's grown quietly into a serious network for those who value free speech and long-term data control.

Clients like Damus, Amethyst, and Iris offer stripped-back experiences. No fancy UIs, but fast and focused. Ideal for users who want to speak freely without fear of deplatforming. Sure, it’s not as polished as other Web3 socials. But for activists, developers, and privacy-conscious users, it’s one of the most powerful spaces online.

If your brand or project deals with open-source tech or financial sovereignty, consider Nostr part of your outreach mix.

4. ThreadsXYZ and Web3 Threads: Bridging Web2 Creators to Web3

One big problem Web3 social had in the past? Getting Web2 creators to switch.

ThreadsXYZ (not to be confused with Meta's Threads) and Web3 Threads solve this by offering onboarding tools that feel like Substack or Medium but with blockchain benefits underneath.

In 2025, these platforms offer blog-style publishing, token-gated content, and tipping options via ETH, USDC, or native tokens. They're also integrated with Lens or Farcaster, so posts show up across decentralized feeds automatically.

What makes them useful is the low learning curve. Writers don’t need to understand wallets or blockchains to get started. Yet they can later mint their work as NFTs, earn from readership, and even share ownership with loyal fans.

At MediaX, we often guide thought leaders through this transition. Tools like these give creators full control without overwhelming them.

5. Yup: A Web3 Reputation Layer for Social Platforms

Yup isn’t a platform in the traditional sense. It’s a reputation protocol.

It tracks user activity likes, comments, upvotes in across platforms like Farcaster, Twitter, Reddit, and Lens, and turns that into a social reputation score. Kind of like a decentralized Klout score, but built for creators, curators, and communities.

In 2025, Yup is helping DAOs, NFT projects, and even DeFi apps identify key community members. Are you an early supporter? An active participant? A signal booster? Yup scores can unlock access, rewards, and trust.

If you're planning to build long-term community engagement, integrating with something like Yup helps you see your top fans. And reward them accordingly.This overlaps with what we shared in AI - The Superpower of Marketing, that the smartest growth tools are the ones that help you understand behavior at scale.

6. Other Rising Platforms Worth Watching in 2025

While Lens and Farcaster dominate, the Web3 social scene is full of rising contenders:

CyberConnect is now the default social graph in Asia, thanks to its integration with major wallet apps and NFT tools.

DeSo has finally delivered fast feeds and real token rewards, though adoption remains niche.

Phaver combines lifestyle content with Web3 identity - think Instagram, but with Soulbound Tokens.

Minds, which began years ago as a censorship-free platform, is now leaning into crypto identity and monetization.

These platforms show just how diverse Web3 social media is becoming. And that’s the point, it’s not one-size-fits-all anymore.

Whether you're building a product or a personal brand, the key is to find the communities that match your tone, your message, and your values.

Conclusion

In 2025, Web3 social media is finally delivering on its early promises. Instead of being “the future,” it’s becoming the present. With platforms like Lens and Farcaster leading the way, and others like Nostr, Threads, and Yup filling vital roles, users now have choices. Real ones. Built on values like ownership, freedom, and transparency.

At MediaX Agency, we help brands navigate this new world - crafting strategies that make sense on-chain and off-chain. Whether you’re moving away from Twitter or launching directly into decentralized networks, we’ve got your back.

Want help choosing the right Web3 platform? Let’s chat.

2 notes

·

View notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

ok lets get into the creator league stuff (local essay andy is back)

I mean first and foremost what Is the creator league

its an esports tournament ran by eFuse and presented by Mr Beast. its designed as this kind of interactive league allowing fans to play with and for their favourite creators. their trailers on instagram claim that theres gonna be a full years worth of content, however Mr Beasts recent video claims the event will happen across a 10 month time frame.

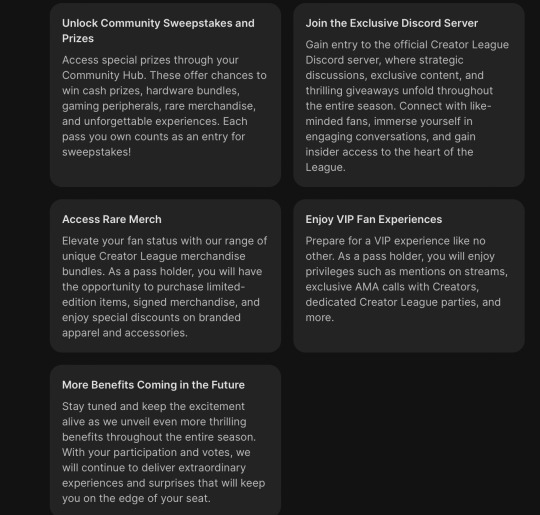

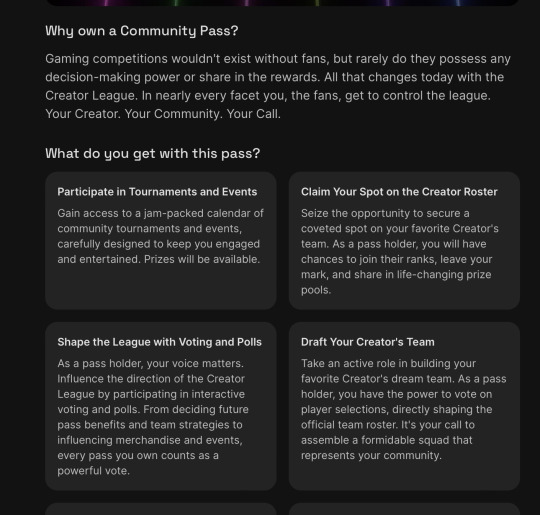

so the ting that makes this event 'special' is that the creators are not listed as players in the event but as 'team managers'- which is where the creator pass comes in. Each creator has a 'pass' that allows you as a fan and viewer to join their team and participate in the league events. Each pass costs around $20 and from what ive read I believe you can only sign up to participate on behalf of one player.

obviously for reasons of fairness, not everyone who buys a pass will be able to officially compete- there is a limited number of spaces on each team and the places are won via an open qualifier Fortnite tournament where they will also be competing for a $50 k prize- although im yet to find any comment from creator league or any articles on how this money is split. But don't worry even if you don't qualify youre still entitled to a free box of mr beasts chocolate should you buy a pass before September 9th. yey.

so what's the problem with this.

I mean first of all. creators arent even required to play. they can fully just let their team do all the work in every event which might work for people like Vinnie Hacker I guess. This might be a way to try and 'even the playing field' by not giving creators with gaming backgrounds any advantage, however it makes the marketing of 'playing with your favourite creator' a little meh. also as a viewer, id be more interested in watching an event that my creator was an active participant in than just watching my streamer watch other people play on their behalf.

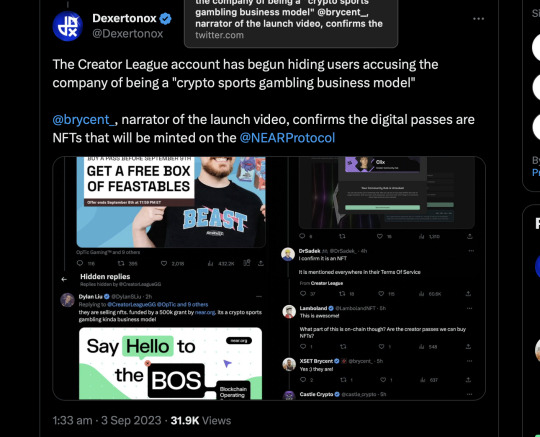

the other huge thing that everyone is really waiting to hear about in this post is the nft situation. so recently the narrator of the creator league announcement video, brycent, conformed that the passes are nfts to be minted on the blockchain operating system Near Protocol. so obviously people are extremely concerned about this discovered involvement in NFTs and crypto currency.

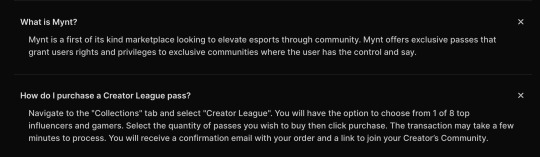

so I went to investigate the website to see what its looks like when you purchase a creator pass and unsurprisingly there is no mention on nfts anywhere. The passes are sold on mynt.gg , which according to their faqs is a 'first of its kind marketplace looking to evaluate esports through community' just have a look actually

so no mention of the passes actually being nft purchase here's . if we go to the check out as well this is what we see for the descriptors

so . people who are purchasing this have no way of actually knowing they are purchasing an nft. you also need an account to add a pass to your basket and im not willing to make an account so im unaware if at any time during the payment process people are made aware of what they are purchasing. its listed and discussed more like a membership than anything, and in a way it is there are benefits to it, however with no information as to what people are actually buying its extremely sketchy and a literally misleading purchase perhaps a scam even . since the fact that they've just purchased an not isn't listed anywhere on mynt.gg prior to purchase. and after going through a few more articles .

so theyre definitely trying to hide it from you. as mentioned you need an account to purchase anything. and you only get to know what youre purchasing if you go through the TOC, which most people don't read lets be real.

it's worth noting as well creator league is the only collection available on mynt.gg at the minute, it seems like this entire business was started FOR creator league.

after reading through the faqs again I want to correct myself and say that yes you can buy more than one pass, but only for one creator. so this seems to me like a pay to win scheme.

im not going to go super in depth into this bit bc its a topic that has already been discussed in detail but obviously a lot of people are not happy with the inclusion of nfts because of their environmental impact, the secrecy and dedication to hiding this fact that the company is involving crypto in the event itself is a little weird if u ask me. oh yeah theres been reports on twitter too that they have been blocking and deleting replies to their posts that accuse them on using crypto.

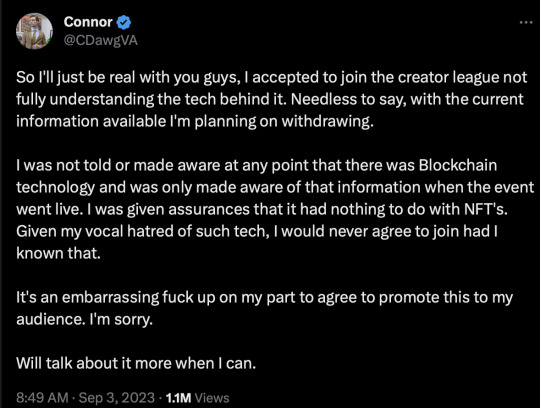

so theyre lying to you as the viewer about what they are and what youre purchasing. but it seems like theyre lying to the creators too.

again. crypto and nfts is not mentioned anywhere at all. not in the trailer, not on the website not in any announcements . only discovered when people were paying for passes bc they wanted to support their fave creators.

recently one of the listed creators Connor CDawgVA released a twitter statement conforming that he was completely blindsided by the fact that there was cryptocurrency involved in the event- if u haven't seen his tweet here

so this raises the question were creators told about their involvement with Near, or was it written using jargon that people unfamiliar with crypto would not pick up on.

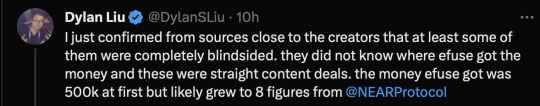

CEO of TAMU Esports Dylan Liu also weighed in on the creator league misleading their creators as well here's his statements too

this isn't everything Dylan has had to say hes done a lot of discussions with people on blockchains and of the event itself as someone who has known about the event for a while, id recommend checking out his twitter if you have time he goes into depth about how much funding theyre getting from near and way more issues with creator league than I have time to explore rn .

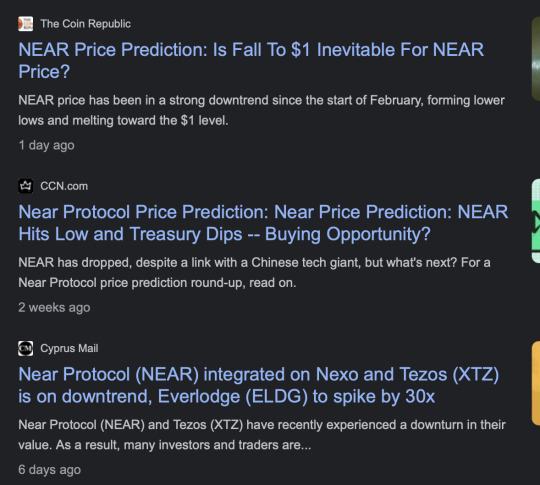

but it really does seem that the Creator League and eFuse have gone out of their way to try and hide the fact that they are using cryptocurrency from everyone possible. This is a marketing scheme to try and trick people into buying into their market- and if you google Near Protocol right now you see that they are declining so they actively need more people to buy into their schemes.

investors are leaving Near right now. Theyre tricking people into buying into their organisation. At least thats my understanding of it im not hugely knowledgeable about crypto.

I have a headache lets just wrap this up

this is super sketchy . as of right now CDawgVA is the only creator to have withdrawn from the event, but I hope a lot of creators follow suit. its unknown to us the details of their contracts but from what we know of the event they have done everything to hide the genuine content of creator pass purchases from the viewers- making a lot of people rightfully angry that the event is trying to pull the wool over fans eyes. hiding tweets and refusing to acknowledge their involvement in crypto programmes to the point where its unclear if people like Mr Beast and any of the participating creators are aware of it is super suspicious activity. Especially with how vague their promotions have been on the event, very little information has been available on their instagram and I think it was yesterday that we actually got some kind of timeline of the event. its supposed to start like next week and so many people are still so unsure of what is actually happening in the event or what prizes theyre actually getting if they participate. there has been no redeeming quality in the way that this event has been conceived and executed and I really do hope to see that the event is cancelled or that creators start to speak out against the way that the event is being run and support the fans who feel cheated and blindsided by the organisers . I will say I do not believe any of the creators willingly involved themselves in a cryptocurrency scheme, it's all just too sketchy . and no I did not proofread this nor can I be bothered to .

51 notes

·

View notes

Text

A potential bidding war to buy TikTok has begun, less than a month after President Joe Biden signed legislation that would force the app’s Chinese parent company ByteDance to divest, or face a ban in the United States within a year.

The latest suitor to emerge is the real estate billionaire Frank McCourt, who announced this week he’s assembling a group of investors to acquire TikTok and has brought on financial advisers from Guggenheim Securities and the law firm Kirkland & Ellis to help. The app could be worth $100 billion, according to some estimates, though McCourt said it’s too early to discuss potential valuations.

What exactly McCourt would do with TikTok remains unclear, but in an interview with Time Magazine, he said that “the user experience wouldn’t change much.” He was not deterred by the prospect of the Chinese government preventing him from buying TikTok’s core algorithm, which is responsible for determining what content users see on the app.

“Of course, TikTok isn't worth as much without the algorithm. I get that. That’s pretty plain,” McCourt said. “But we’re talking about a different design, which requires people to move on from the mindset and the paradigm we’re in now.”

McCourt, who was previously the owner of the Los Angeles Dodgers, says he has already poured $500 million into an existing social media and technology initiative called Project Liberty, which aims to reduce the power that Silicon Valley giants like Meta and Google have over the internet. One of its main focuses has been building and deploying a blockchain-based protocol that Project Liberty claims will give people more control over their data online.

McCourt also previously invested in another social network called MeWe, a privacy-focused platform that became popular with far-right users after Facebook and Twitter deactivated many of their accounts in the wake of the US Capitol riot on January 6. In 2022, MeWe announced it was migrating its entire platform over to Project Liberty’s decentralized social networking protocol, and it’s possible McCourt could do the same thing with TikTok.

Anna Feagan, a spokesperson for Project Liberty, says McCourt and his team are currently focused on putting together their bid for TikTok, but are committed to finding the right technological solutions for the platform. She adds that so far, they have not been in contact with ByteDance.

New York University professor Jonathan Haidt, a leading voice of the movement arguing that smartphones and social media are causing grave harm to children, says he supports McCourt’s plan for TikTok. “What a creative approach to changing social media: Assemble a consortium to buy TikTok and make it better, on an architecture that respects users' rights,” he said in a post on X.

TikTok, however, has made it clear that it does not want to sell its US operations, and is fighting the legality of the new divest-or-ban law in court. TikTok did not respond to a request for comment about the acquisition plans announced by McCourt and other investors.

This has done little to deter a growing list of other business moguls who have also expressed interest in acquiring the app, which has been under government scrutiny in the US for four years over alleged national security concerns stemming from its Chinese ownership. One of them is former Treasury secretary Steven Mnuchin, who said earlier this week he too was assembling a group of investors to make a bid for TikTok. He first hinted about the plan in March before the divestiture bill passed into law.

Mnuchin told Bloomberg he understands that the Chinese government is unlikely to allow ByteDance to sell TikTok’s algorithm, but he planned to “rebuild the technology.” That would be quite a lofty endeavor, especially given that TikTok competitors like YouTube and Meta have been trying to copy its product for years with only mixed success.

There’s at least one existing business connection between Mnuchin and TikTok: They are both backed by Japan’s SoftBank, which has stakes in ByteDance and in Liberty Strategic Capital, the private equity firm Mnuchin set up after he left office. A representative from Liberty Strategic Capital did not immediately return a request for comment about Mnuchin’s TikTok acquisition strategy.

Former Activision CEO Bobby Kotick has reportedly considered buying TikTok as well. He even floated the idea to Zhang Yiming, the former CEO of ByteDance who retains a roughly 20 percent stake in the company, the Wall Street Journal reported in March. Around the same time, Canadian businessman and Shark Tank judge Kevin O'Leary told Fox News that the app is “not going to get banned, ’cause I’m gonna buy it.”

O’Leary did not immediately return a request for comment about whether he was seriously interested in TikTok. Kotick could not be reached for comment.

All of TikTok’s potential suitors would be facing an uphill battle to close a deal. The first challenge will be raising enough money. Only a small number of the world’s largest companies likely have enough cash on hand to acquire the app outright, and so far, they haven’t publicly voiced an interest in the platform. That’s a big change from four years ago when then-president Donald Trump first tried to force ByteDance to sell TikTok. At the time, Microsoft, Oracle, and Walmart were among the most promising buyers for the app.

But the even bigger problem that investors face is the fact that TikTok doesn’t seem to think a sale would even be possible, let alone desirable. In a lawsuit it filed against the US government last week, TikTok argued the divestiture bill violated the First Amendment and claimed severing its American operations from ByteDance was “not commercially, technologically, or legally feasible.”

TikTok noted that the Chinese government has “made clear” that it would not permit the company to sell its recommendation algorithm to a foreign buyer, citing regulations that Beijing introduced after Trump first targeted TikTok in 2020. The measures put limits on the export of certain technologies such as “personal interactive data algorithms.”

Even if a sale were politically possible, TikTok argued the move would “disconnect Americans from the rest of the global community” on the platform, in possibly the same way that the Chinese version of the app is restricted only to people in China. TikTok added that it would take a team of new engineers years to sift through its source code and “gain sufficient familiarity” with it to run the app effectively.

A group of TikTok creators filed a separate lawsuit against the federal government earlier this week arguing that the divest bill violated their free speech rights. (TikTok is paying their legal fees.) Separating TikTok from ByteDance, they said, “is infeasible, as the company has stated and as the publicly available record confirms.”

9 notes

·

View notes

Text

Asset Tokenization on Blockchain

Asset Tokenization on Blockchain: A Detailed Tutorial

Introduction

The digitization of rights into tokens that represent ownership on the blockchain is called asset tokenization. This new use of blockchain technology will provide asset management and trading with transparency, security, and efficiency. In effect, the democratization of asset management from conventional real estate to art, commodities, and intellectual property is becoming possible through asset tokenization. This tutorial serves as a complete guide to asset tokenization: its concept, advantages, steps, and practical points.

Benefits of Asset Tokenization

The full list of the merits of asset tokenization includes fractional ownership, increased liquidity, transparency and security, cost efficiency, and worldwide accessibility. With fractional ownership, larger chunks of assets can become available to a wider investor base than buying a whole luxury property, such as owning something smaller than that, for example. In increased liquidity,research ownership of tokenized assets can be traded on secondary markets; therefore illiquid assets such as real estate or fine art qualify for liquidity. Therefore, property ownership would be confidential and secure due to blockchain's immutable ledger that holds.

Such advantages are that it is likely to, among several others, reduce the intermediaries involved, thus minimizing transaction costs and time delay while ensuring access to international investors, breaking the geographical barrier in terms of access.

Key Components of Asset Tokenization

Asset tokenization consists of core components such as blockchain platforms: like Ethereum or Binance Smart Chain or Polygon and Tezos; smart contracts; token standards; and the legal framework. These open-source platforms provide the technology substrate for tokenization. The choice depends on factors such as scalability, transaction costs, and community support. Automated contracts are smart contracts that determine how the tokenized asset is defined, that enforce compliance with the regulations and asset agreement stipulations, and reference terms and conditions. Token standards typically define the asset's divisibility or uniqueness, with ERC-20 specifying fungible tokens and ERC-721 or ERC-1155 non-fungible tokens. Finally, the legal system should define rights, obligations, and governance structures for token holders so that tokenization does not run into legal issues.

Step-by-Step Process of Asset Tokenization

Step 1: Asset Selection

Identify the asset to be tokenized. Analyze its value, ownership and demand on the market.

Step 2: Select Blockchain Platform

Select a blockchain platform capable of meeting the scalability, security, and cost objectives suitable for this project in tokenization.

Step 3: Smart Contract Development

Write smart contracts defining characteristics for tokens, such as supply, ownership rules, and protocols for transfer.

Step 4: Token Minting

Develop digital tokens that represent the asset. Use standards like ERC-20 for fungible assets or ERC-721 for unique assets.

Step 5: Legal and Regulatory Compliance

Ensure KYC/AML and other jurisdictional and legal compliances.

Step 6: Management of Assets and Custodianship

Secure custody of the tangible or intangible asset tokenized.

Step 7: Token Distribution

Distribute tokens via private sales, crowdfunding platforms, or Initial Token Offering (ITO).

Step 8: Enable Secondary Market Trading

Enable trading by a digital/centralized exchange or other means to enhance liquidity.

👉 Learn More About the Top Asset Tokenization Companies

Use Cases of Asset Tokenization

There are various use cases of asset tokenization, and a few are as follows: real estate, art and collectibles, commodities, intellectual property, equity, and debt. For example, in real estate, tokenizing a building enables an investor to buy a fractional share in income generated from that property. Collectibles and highly valuable artworks can be tokenized, so that the owner gets a share of the profits generated from their sale. Tokenization can also be done on commodities such as gold, oil, and agricultural products to enable efficient trade. Intellectual property such as patents, copyrights, and trademarks may also be tokenized for easier licensing and sharing of revenues. Companies can also raise capital by tokenizing their shares or bonds. There are many other applications for this innovative technology.

Challenges in Asset Tokenization

Although asset tokenization brings many advantages, it suffers from major challenges such as regulatory uncertainty, technological complexity, market adoption, asset valuation, and security risks. Different regulations can make compliance across jurisdictions complicated while developing and maintaining expertise in the use of blockchain-based solutions. It may be difficult to gain trust and adoption in the traditional investor space, and the fair market value of an asset for tokenization purposes can prove hard to interpret. Furthermore, protection from hacking and secure custody of the asset are also fundamental to the success of tokenization initiatives.

Conclusion

Asset tokenization is gearing up to revolutionize asset management and trading-increasing the phenomenal efficiency, transparency, and accessibility of the involved process. Following these steps and overcoming the outlined challenges will create new scenarios for the individual and the collective organization in the digital economy. Today, as an investor, entrepreneur, or developer, being equipped with the knowledge of asset tokenization is going to be quite a valuable skill in the very fast-changing financial landscape. So start your tokenization journey and discover the infinite possibilities that blockchain technology has for you.

1 note

·

View note

Text

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

WEEX has become the initial CEX collaboration platform for Shibarium and will work together with Shibarium's top-tier projects in the ecosystem on Launchpad

BlockBeats news, on June 11, the crypto trading platform WEEX announced a strategic partnership with the Ethereum L2 project Shibarium, and will select high-quality targets from the thousands of projects on the Shibarium chain for Launchpad and coin listing cooperation to support the development of the Shiba Inu (SHIB) community. Shiba Inu development advocates have agreed to use WEEX as the preferred CEX cooperation platform for Shibarium hackathons and qualified new projects in the global developer community.

In addition, in August this year, WEEX Global VP Andrew Weiner will attend the "Blockchain Futurist Conference" co-hosted by Shiba Inu and K9 Finance DAO. K9 Finance DAO (KNINE) will be the first cooperation project and will be the beginning of their deep partnership.

Shibarium is an Ethereum Layer 2 scaling solution that aims to solve the high gas fees and slow transaction speeds in the Shiba Inu ecosystem. It uses Bone ShibaSwap (BONE) tokens as gas fees and provides faster transaction speeds and lower costs. K9 Finance DAO is the official DeFi protocol of SHIB, which aims to introduce decentralized finance to Shibarium and incentivize developers to build products on Shibarium through rewards. It is expected that up to 1,000 projects will be created on Shibarium in the next 12 months. WEEX Launchpad is one of the important use cases of WEEX platform currency WXT, which will provide exclusive airdrops for popular projects to WXT holders. What is WEEX WXT:

Know WXT: https://markets.businessinsider.com/news/stocks/weex-launches-wxt-presale-affiliates-can-purchase-at-a-30-discount-with-invitation-points-1033442484

2 notes

·

View notes

Text

How to Reclaim Lost Money from Bitcoin and Other Cryptocurrency Scams

Technology plays a pivotal role in the successful recovery of lost Bitcoin assets, with advanced tools and techniques enabling efficient and thorough retrieval processes. By using machine learning techniques, Recuva Hacker Solutions expedites the detection and retrieval of misplaced Bitcoin assets, cutting down on the time and resources needed for recovery operations. Recuva Hacker Solutions leverages artificial intelligence to improve its recovery procedures. Recuva Hacker Solutions tracking capabilities and digital ledger analytics enable it to painstakingly locate and retrieve misplaced Bitcoin holdings. With the use of these sophisticated tools, they can precisely explore the complex blockchain network and help their clients retrieve their digital funds. Offering revolutionary solutions to counter the growing issue of cryptocurrency theft, Recuva Hacker Solutions is a top service provider that specializes in the recovery of stolen Bitcoin holdings. Recuva Hacker Solutions is at the forefront of the industry, committed to protecting digital assets and providing peace of mind to individuals and organizations impacted by cybercrime. The main services offered by Recuva Hacker Solutions are examined in detail in this article, along with successful case studies of recovered stolen Bitcoin and professional advice on improving security protocols. Recuva Hacker Solutions mission is crystal clear: to assist clients in recovering stolen Bitcoin holdings efficiently and effectively. Their objectives revolve around providing top-tier services, employing innovative strategies, and ultimately bringing a sense of justice to those affected by cryptocurrency theft. When the wallet service I was utilizing went permanently offline, I was unable to access my cryptocurrency. I have thus been having trouble trying to figure out how to get back into my wallet for months. After a lot of effort, Recuva Hacker Solutions came to my rescue. You can communicate with them for help with the information listed below. Contact Details: Email: recuvahackersolutions @ inbox . lv WhatsApp: +1 (315) (756) (1228)

2 notes

·

View notes

Text

Bitcoin: The Only Truly Decentralized Cryptocurrency

In the rapidly evolving landscape of cryptocurrencies, decentralization is often touted as a core principle. However, not all digital currencies live up to this ideal. Among thousands of cryptocurrencies, Bitcoin stands out as the only one that truly exhibits decentralization, making it unique and invaluable.

What is Decentralization?

Decentralization refers to a system where control isn’t held by a single entity or small group. In cryptocurrency, this concept ensures that no government, organization, or individual has undue influence over the network. Decentralization brings crucial benefits, such as increased security, censorship resistance, and transparency.

Bitcoin’s Decentralized Foundations

Bitcoin, conceived in 2008 by Satoshi Nakamoto, was designed to operate in a decentralized manner from the outset. Key elements like its peer-to-peer network, proof-of-work consensus, and distributed ledger ensure that control over Bitcoin is not concentrated.

Peer-to-Peer Network: Every node in the Bitcoin network has equal status, contributing to the validation of transactions.

Proof-of-Work: Bitcoin mining uses proof-of-work to secure the network through computational power, preventing any single entity from dominating.

Distributed Ledger: Bitcoin’s blockchain is maintained by thousands of nodes globally, ensuring the ledger remains tamper-resistant and transparent.

Contrasting Other Cryptocurrencies

Despite claims of decentralization, many cryptocurrencies exhibit centralized control due to their governance models, development teams, or token distribution.

Ripple (XRP):

Ripple Labs holds a significant portion of the total XRP supply and directly controls the development and direction of the network. Its consensus protocol relies on a trusted list of validators chosen by the company, creating a stark contrast with Bitcoin’s permissionless network.

Binance Coin (BNB):

As the in-house token of the centralized Binance exchange, Binance Coin’s governance and supply are influenced by Binance itself. The company determines how and when to burn tokens, directly impacting supply.

Cardano (ADA):

Cardano’s governance is centralized through three key organizations: the Cardano Foundation, IOHK, and Emurgo. While the network employs staking pools for validation, the concentration of control remains within these organizations.

Tether (USDT):

Tether is managed centrally by Tether Limited, which controls the issuance and redemption of the stablecoin. Recent controversies over reserve transparency highlight the risks of centralization.

Risks of Centralization

Centralization poses various risks to cryptocurrency networks. Systems controlled by a small group or entity are vulnerable to:

Regulation: Governments can easily target centralized entities, limiting the currency’s usage.

Single Points of Failure: Centralized systems can suffer catastrophic failures if the controlling entity is compromised.

Market Manipulation: Central entities can manipulate supply or governance decisions to their advantage.

Bitcoin’s Decentralization in Practice

Bitcoin’s decentralized nature has protected it from censorship and interference, allowing it to thrive even under intense scrutiny. Its open network ensures that anyone can participate and contribute to securing the blockchain, making it resilient against regulatory and market pressures.

Conclusion

Bitcoin remains the most decentralized cryptocurrency, setting the standard for how digital currencies should operate. It offers a model that ensures fairness, transparency, and security, while others still rely on centralized control to varying degrees. Investors should consider this aspect carefully, recognizing the value of true decentralization when navigating the cryptocurrency landscape.

#Bitcoin#Cryptocurrency#Decentralization#Blockchain#Ripple#Binance#Cardano#Tether#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoNews#unplugged financial#financial education#financial empowerment#finance#financial experts

4 notes

·

View notes

Text

Top 5 AI Meme Coins for 2024

Explore the most promising AI-driven meme coins of 2024. We've curated a selection of top AI meme coins for you to consider investing in this year. Uncover their unique features and more in this article.

The AI Meme Coins Trend

Artificial intelligence (AI) is rapidly permeating various sectors, from technology to blockchain. This expansion into the crypto world has been notably well-received, bringing a fresh perspective to the market. AI's integration with meme coins is now captivating even the most experienced traders.

Unlike Dogecoin and Shiba Inu, which have faced substantial criticism, this emerging trend in AI meme coins is generating positive buzz and substantial excitement. Analysts believe that merging AI with meme coins could potentially transform the industry.

AI enhances user experience, scalability, and blockchain security, drawing significant interest from the crypto community. AI crypto tokens are now widely adopted for diverse applications such as portfolio management, decentralized marketplaces, and blockchain governance.

Let’s delve into the top five AI meme coins making waves in 2024:

1. BUSAI: A Panda Powered-Meme Project 2024

First and foremost, you can't overlook BUSAI, an innovative digital asset built on the Solana blockchain, distinguishing itself as a premier AI meme coin in 2024.

The project is designed to integrate artificial intelligence (AI) with blockchain technology, focusing on stimulating AI development and fostering creative content creation within a vibrant community. BUSAI’s unique approach and robust infrastructure position it as a promising investment opportunity this year.

Currently, the BUSAI community is buzzing with excitement and experiencing a FOMO frenzy due to numerous pre-listing projects, allowing everyone to hunt for tokens for free. Additionally, there are two presale rounds, offering a golden opportunity to purchase tokens at lower prices before the anticipated price surge upon listing.

2. Arbdoge AI: A Community-Driven Revolution

Arbdoge AI, the most ambitious project within the Arbitrum ecosystem, stands out for its community-centric approach. Unlike many other ventures, it is not funded by venture capitalists nor does it allocate shares to a specific team. Instead, all tokens are equitably distributed among community members, marking a bold move in the crypto space.

The dedicated team behind Arbdoge AI is committed to collaborating with the community to develop a comprehensive suite of products leveraging artificial intelligence and Web3 technology.

3. KAI: The Crypto Cat's Comeback

KAI, a former feline-themed cryptocurrency, is making a playful yet strategic return to challenge major market players. The project blends humor with real-world utility, offering staking rewards and business opportunities.

4. Byte: AI Memecoin With Cryptonote Protocol

Bytecoin leverages the Cryptonote protocol for private transactions, prioritizing user privacy. Transactions occur on a decentralized Bytecoin blockchain, enabling direct user-to-user transactions without intermediaries, maintaining participants' anonymity.

5. Turbo: Once an AI-Based Meme Coin for 2023

Turbo Coin is designed for rapid and seamless transactions, living up to its name with fast processing speeds within its blockchain network. The technology ensures scalability and quick transaction verification through an efficient consensus mechanism.

Turbo Coin may introduce the Lightning Network as a Layer 2 solution for real-time micropayments, enhancing speed and usability. In the competitive crypto market, Turbo Coin aims to provide a fast and reliable payment system for all users.

Source: Compiled

The BUSAI Official Channel: Website | Twitter | Telegram

1 note

·

View note

Text

🎙️ UniLend Finance

#UniLend’s V2 Permissionless Lending & Borrowing DApp is now listed on DappRadar! 🎉

🗺 DappRadar is the World’s dapp store, and the starting point for the discovery of decentralized applications (dapps) across all blockchains and product categories.

📊Seamlessly track, conduct in-depth analysis, and gain insights into UniLend V2 permissionless protocol.

📲Track dApp here:

https://dappradar.com/dapp/unilend-v2

🗣 For more Information on #UniLend

🌎 https://unilend.finance/

#Crypto #DeFi #Web3 #Blockchain #UniLendV2 #altcoins #GEM #buy #HODL #UFT $UFT 🚀🚀

#UnilendV2Mainnet 🚀🚀

#blockchain#crypto#defi#marketing#investing#cryptocommunity#cryptocurency news#cryptocurrency#cryptocurreny trading#unilendv2

2 notes

·

View notes

Text

25 Python Projects to Supercharge Your Job Search in 2024

Introduction: In the competitive world of technology, a strong portfolio of practical projects can make all the difference in landing your dream job. As a Python enthusiast, building a diverse range of projects not only showcases your skills but also demonstrates your ability to tackle real-world challenges. In this blog post, we'll explore 25 Python projects that can help you stand out and secure that coveted position in 2024.

1. Personal Portfolio Website

Create a dynamic portfolio website that highlights your skills, projects, and resume. Showcase your creativity and design skills to make a lasting impression.

2. Blog with User Authentication

Build a fully functional blog with features like user authentication and comments. This project demonstrates your understanding of web development and security.

3. E-Commerce Site

Develop a simple online store with product listings, shopping cart functionality, and a secure checkout process. Showcase your skills in building robust web applications.

4. Predictive Modeling

Create a predictive model for a relevant field, such as stock prices, weather forecasts, or sales predictions. Showcase your data science and machine learning prowess.

5. Natural Language Processing (NLP)

Build a sentiment analysis tool or a text summarizer using NLP techniques. Highlight your skills in processing and understanding human language.

6. Image Recognition

Develop an image recognition system capable of classifying objects. Demonstrate your proficiency in computer vision and deep learning.

7. Automation Scripts

Write scripts to automate repetitive tasks, such as file organization, data cleaning, or downloading files from the internet. Showcase your ability to improve efficiency through automation.

8. Web Scraping

Create a web scraper to extract data from websites. This project highlights your skills in data extraction and manipulation.

9. Pygame-based Game

Develop a simple game using Pygame or any other Python game library. Showcase your creativity and game development skills.

10. Text-based Adventure Game

Build a text-based adventure game or a quiz application. This project demonstrates your ability to create engaging user experiences.

11. RESTful API

Create a RESTful API for a service or application using Flask or Django. Highlight your skills in API development and integration.

12. Integration with External APIs

Develop a project that interacts with external APIs, such as social media platforms or weather services. Showcase your ability to integrate diverse systems.

13. Home Automation System

Build a home automation system using IoT concepts. Demonstrate your understanding of connecting devices and creating smart environments.

14. Weather Station

Create a weather station that collects and displays data from various sensors. Showcase your skills in data acquisition and analysis.

15. Distributed Chat Application

Build a distributed chat application using a messaging protocol like MQTT. Highlight your skills in distributed systems.

16. Blockchain or Cryptocurrency Tracker

Develop a simple blockchain or a cryptocurrency tracker. Showcase your understanding of blockchain technology.

17. Open Source Contributions

Contribute to open source projects on platforms like GitHub. Demonstrate your collaboration and teamwork skills.

18. Network or Vulnerability Scanner

Build a network or vulnerability scanner to showcase your skills in cybersecurity.

19. Decentralized Application (DApp)

Create a decentralized application using a blockchain platform like Ethereum. Showcase your skills in developing applications on decentralized networks.

20. Machine Learning Model Deployment

Deploy a machine learning model as a web service using frameworks like Flask or FastAPI. Demonstrate your skills in model deployment and integration.

21. Financial Calculator

Build a financial calculator that incorporates relevant mathematical and financial concepts. Showcase your ability to create practical tools.

22. Command-Line Tools

Develop command-line tools for tasks like file manipulation, data processing, or system monitoring. Highlight your skills in creating efficient and user-friendly command-line applications.

23. IoT-Based Health Monitoring System

Create an IoT-based health monitoring system that collects and analyzes health-related data. Showcase your ability to work on projects with social impact.

24. Facial Recognition System

Build a facial recognition system using Python and computer vision libraries. Showcase your skills in biometric technology.

25. Social Media Dashboard

Develop a social media dashboard that aggregates and displays data from various platforms. Highlight your skills in data visualization and integration.

Conclusion: As you embark on your job search in 2024, remember that a well-rounded portfolio is key to showcasing your skills and standing out from the crowd. These 25 Python projects cover a diverse range of domains, allowing you to tailor your portfolio to match your interests and the specific requirements of your dream job.

If you want to know more, Click here:https://analyticsjobs.in/question/what-are-the-best-python-projects-to-land-a-great-job-in-2024/

#python projects#top python projects#best python projects#analytics jobs#python#coding#programming#machine learning

2 notes

·

View notes

Text

What is Bullion Coin (BLO)?

Bullion is a cutting-edge DeFi platform that is designed and introduced to help you grow your cryptocurrencies effortlessly. With Bullion, you can earn passive income like never before. Our innovative protocols provide opportunities for yield farming, staking, and liquidity provision, all while ensuring the utmost security and transparency.

Be a Bullioniare!

Introducing you to the all-new Bullion Coin (BLO asset) which is a powerful standard multi-chain cryptocurrency backed by bullion assets such as gold, silver, and platinum for you to boost your earnings up to 100X. This asset is issued by Bullion Defi — a decentralised finance platform for you to lend, borrow, and earn interest in order to stake bullion assets.

BLO coin was developed and introduced to offer a secure, transparent, and scalable platform to imply bullion trading and get better investment options. The asset denotes the value of its decentralized application and serves as a mechanism in terms of utility in the ecosystem. This asset is planned to be released in different standard blockchains including BEP20, ERC20, SOL51, POLYGON, etc.

Some of the functionalities, opportunities, and benefits of Bullion Coin BLO are as follows:

- It is pegged to the value of bullion assets that gets stored in safe vaults and audited on serial regular basis.

- It has low volatility giving a user high liquidity due to the easy exchange of bullion assets or any other cryptocurrencies.

- It provides high returns for staking where you can earn much interest/rewards by locking your owned/held BLO coins in smart contracts.

- It allows you to access the global market and wide opportunities for bullion trading and investment where you can feasibly interact with other participants on the blockchain network.

- It supports the development and exploration of the bullion industry while leveraging the adoption of blockchain technology as well as great innovation in the sector.

Bullion DeFi project is on the verge of building, innovating, and exploring one of the biggest and strongest communities that will believe in the core intention, and potential of the project. The team and project consider the community not to be only the holder of the BLO assets but also to hold the right to share technical/promotional suggestions getting all involved in the decision-making activities and betterment of the project.

This project intends to develop, initiate, and promote the BLO ecosystem to eventually dedicate its resources to research, development, and governance. Bullion Coin is a utility token which is not supposed to hold any value outside the BLO ecosystem.

Total Supply: 20 million (20,000,000 BLO)

· Seed Sale: 6%

· Presale: 4%

· Staking: 36%

· Scheduled minting: 30%

· Marketing: 5%

· Development: 5%

· Team Reserve: 3%

· Initial Developers reserve: 1%

· Contract Royalty: 10%

To buy Bullion Coin BLO, follow the below-mentioned steps:

Step 1: Apply and get a compatible wallet to store BLO coins. You have the option to download the official Bullion Defi wallet from the official website or apply to any other wallet supporting ERC-20 tokens.

Step 2: Hold some cryptocurrency in your wallet, as BLO coins are deployed and support the Ether blockchain protocols. So, you hold some cryptocurrency exchange from Coinbase or Binance.

Step 3: Swap your Ethereum assets for BLO coins on a decentralized exchange that lists BLO coins like Uniswap or say SushiSwap. Check out the contract address and the token symbol of BLO coins from the Bullion Defi official portal.

Step 4: Finally, confirm the transaction and wait for the time period to get processed by the blockchain network. Once approved, you get the amount of BLO coins in your wallet balance.

If you are interested and want to learn more about Bullion Coin (BLO) and the Bullion Defi project, you can visit the official website or read out the whitepaper. You can also follow the team on social media channels like Twitter and Telegram.

website: https://www.bulliondefi.com/

Twitter: https://twitter.com/bulliondefi

Facebook: https://www.facebook.com/BullionDefi

Telegram: https://t.me/bulliondefi

Reddit: https://www.reddit.com/user/bulliondefi

#Bullion Defi#Bullion Coins#Defi#Blo#blockchain#Blo Tokenomics#Bullion#Bullion Defi Swap#Bullion Dex#Defi Earning

2 notes

·

View notes

Text

Tokenomics Explained: How DAVE Ensures Long-Term Sustainability

In the ever-evolving world of decentralized finance (DeFi), tokenomics stands at the core of a project’s success. More than just numbers or supply metrics, it represents the economic engine that drives user behavior, value creation, and long-term project sustainability.

At DAVE Token (Decentralized Asset Value Exchange), tokenomics isn't an afterthought — it's the blueprint for building a resilient, community-driven, and transparent financial future. In this blog, we’ll unpack what tokenomics means, why it’s crucial, and how DAVE’s model is designed to support sustainable growth for years to come.

🔍 What Is Tokenomics?

Tokenomics is a combination of “token” and “economics,” referring to the economic model behind a blockchain-based token. It encompasses:

Token supply & distribution

Utility and use cases

Incentive structures

Burn mechanisms

Governance rights

Market behavior control

Effective tokenomics align incentives for all stakeholders — from early adopters to long-term holders, developers, and investors — while ensuring the project remains viable and scalable.

💡 DAVE Token: Built for Real-World Utility

Unlike meme coins or hype-driven tokens, DAVE Token is grounded in real utility and market integration. It aims to tokenize traditional financial markets — from forex to equities — by making them accessible, efficient, and borderless.

To fulfill this mission, DAVE’s tokenomics model is crafted around five pillars of sustainability:

1. 🎯 Controlled Supply & Transparent Allocation

DAVE Token has a fixed total supply, preventing inflation and maintaining scarcity — a key factor in long-term value appreciation.

Supply Breakdown:

Allocation AreaPercentageEcosystem Development30%Community Incentives25%Strategic Partnerships15%Team & Advisors15%Liquidity & Exchanges10%Reserve Fund5%

Each allocation is time-locked and vested, ensuring no sudden dumps and aligning team incentives with project milestones.

2. ⚙️ Real Utility Drives Demand

DAVE Token isn’t just a speculative asset. It powers an entire ecosystem:

Transaction Fees: Used for trades, tokenization, and swaps on the DAVE platform.

Governance Rights: Token holders propose and vote on platform upgrades, listing decisions, and treasury allocations.

Access to Premium Features: Traders using DAVE tokens receive discounts and exclusive tools.

Staking & Yield: Long-term holders earn passive income by staking their tokens and securing the network.

This organic demand builds buying pressure as the platform grows, supporting token value over time.

3. 🔥 Deflationary Burn Mechanism

To counteract token dilution and encourage long-term holding, DAVE has implemented a strategic burn mechanism.

A portion of all platform fees are used to buy back and burn tokens from the open market.

This decreases the circulating supply, creating a deflationary pressure that rewards loyal holders.

Regular burns are transparent and verifiable on-chain, ensuring full accountability.

4. 🧠 Incentives for Growth & Loyalty

DAVE’s community and partner ecosystem play a vital role in platform adoption. That’s why the tokenomics model includes:

Referral & Ambassador Programs: Earn DAVE tokens for driving traffic, onboarding users, or creating content.

Play-to-Earn Models: Integration with gamified experiences like the tapping game encourages engagement.

Liquidity Rewards: LP providers are incentivized with extra tokens to ensure smooth on-chain trading.

These strategies turn users into stakeholders, encouraging long-term involvement and viral growth.

5. 🏛️ Community-Centric Governance

DAVE is built for decentralization. Token holders have the power to:

Vote on major roadmap decisions

Elect governance council members

Approve protocol upgrades

This community-first approach makes DAVE more than a product — it's a participatory economy where users shape the future.

📈 Designed to Weather the Market

While many projects fail to survive after the hype fades, DAVE’s model is built for resilience:

Slow, strategic vesting schedules

Revenue-generating platform use cases

Deflationary mechanisms

Active governance and roadmap execution

The result is a token that isn’t just a currency — it’s a stake in the next generation of decentralized finance.

🚀 Conclusion: Long-Term Vision Meets Practical Design

DAVE’s tokenomics go beyond basic supply mechanics. They reflect a holistic strategy to:

✅ Encourage adoption ✅ Reward participation ✅ Maintain scarcity ✅ Enable governance ✅ Drive sustainable value

Whether you're an investor, developer, or early adopter, understanding DAVE’s tokenomics gives you confidence in its long-term potential.

Ready to be part of the future of finance?

👉 Join the DAVE community today and help reshape the way the world trades.

0 notes