#blockchain breakdown

Explore tagged Tumblr posts

Text

Best Crypto Podcast to Listen to in 2023 India

1. The Pomp Podcast - Hosted by Anthony "Pomp" Pompliano, this podcast covers the latest news and trends in the crypto space, with interviews from prominent figures in the industry.

2. Unchained - Hosted by Laura Shin, Unchained provides in-depth discussions on the latest developments in the crypto world, featuring expert guests and thought leaders.

3. The Crypto Street Podcast - This podcast features casual conversations among crypto traders and enthusiasts, discussing market trends, investment strategies, and current events.

4. Epicenter - Hosted by Sebastien Couture and Meher Roy, Epicenter explores the cutting-edge technologies and projects that are shaping the future of the crypto space.

5. Crypto 101 - Perfect for beginners, Crypto 101 covers the basics of cryptocurrency, blockchain, and digital assets in an easy-to-understand format, with expert guests and insights.

0 notes

Text

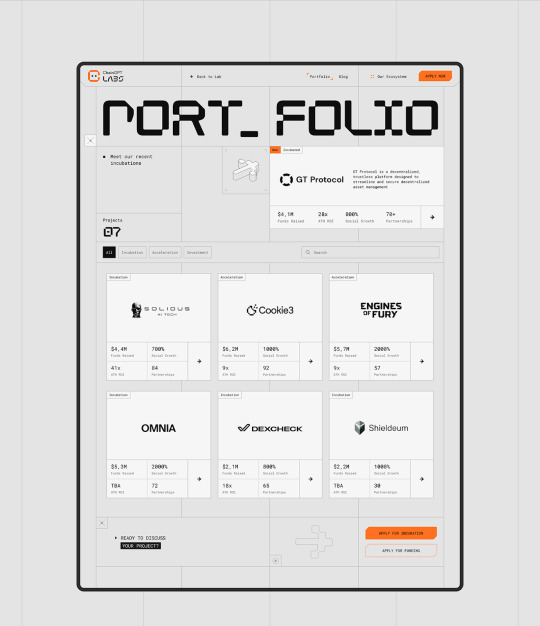

🚀 Explore ChainGPT Labs' Web3 Brand Identity & Web Design! 🌐

ChainGPT Labs has set a new standard in Web3 design with their sleek, futuristic brand identity and web design. This project combines cutting-edge technology with a clean, minimalist aesthetic, perfectly reflecting the world of blockchain and AI. 💡🔗

Check out the full breakdown of their design journey on Abduzeedo and get inspired by how they've visually communicated the power of Web3!

👉 Read more: https://abduzeedo.com/explore-chaingpt-labs-web3-brand-identity-web-design

8 notes

·

View notes

Text

Staking STON Tokens: What It Means and Why It Matters

Let’s simplify staking. If you’ve ever wondered how to make your crypto holdings more productive, staking is the answer. And if you hold STON tokens, you’re in for something unique and rewarding. Here’s a breakdown that’s easy to follow and directly relevant to you.

What is Staking

Picture this: you have money that could either sit idle or earn interest if deposited in a savings account. Staking works in a similar way. Instead of cash, you “lock up” your cryptocurrency to help support a blockchain network.

By staking your tokens, you’re essentially lending them to the blockchain to ensure it functions efficiently. In return, you earn rewards—like getting interest for parking your money in a high-yield account.

Why Stake STON Tokens

Staking STON tokens isn’t just about earning rewards—it’s about becoming part of a growing, innovative community. Here are the key benefits:

1. ARKENSTON: A Badge of Membership

When you stake STON tokens, you receive ARKENSTON, a unique soulbound NFT. Think of ARKENSTON as your personal access card that’s permanently tied to your wallet.

What makes ARKENSTON special

It’s yours forever—you can’t sell it or transfer it.

It gives you exclusive access to the STON.fi DAO, where you can actively participate in decisions shaping the future of the platform.

This is more than just holding tokens; it’s about being part of a decision-making body that drives innovation.

2. GEMSTON: Your Reward Token

Another perk of staking STON tokens is earning GEMSTON, a valuable token within the STON.fi ecosystem. GEMSTON is not just a reward—it’s a tradable asset with real utility.

Here’s why GEMSTON stands out:

You can trade it on STON.fi and other exchanges.

Its future uses and value will evolve as determined by the DAO community, meaning you have a say in its trajectory.

And to make things even easier, the STON.fi platform includes a calculator that lets you estimate how much GEMSTON you’ll earn before you stake. It’s like knowing exactly how much return you’ll get on your investment upfront.

How to Stake Your STON Tokens

The process of staking STON tokens is simple and user-friendly:

1. Visit STON.fi: Head over to the ‘Stake’ section on the platform.

2. Click ‘Stake STON’: This opens up the staking menu.

3. Customize Your Staking: Choose the amount of STON you want to stake and set the duration.

4. Preview Your Rewards: Use the reward calculator to see how much GEMSTON you’ll earn.

5. Confirm Your Stake: Once everything looks good, confirm and start earning.

Why Staking is More Than Just Rewards

Think of staking as joining a cooperative. Everyone contributes something to keep the system running—whether it’s resources, time, or support. In return, everyone benefits.

By staking STON, you’re not just earning rewards. You’re actively helping to secure the blockchain and grow the STON.fi ecosystem. It’s about playing an integral role in something bigger than yourself.

Final Thoughts

Staking STON tokens is simple, rewarding, and meaningful. You’re not just parking your tokens; you’re unlocking new opportunities, gaining influence, and becoming a part of a vibrant community shaping the future of decentralized finance.

If your crypto is sitting idle, why not put it to work? With STON.fi, you’re earning rewards and building something extraordinary. Your next step is easy: visit the platform, stake your STON, and watch as your contributions make a real impact.

It’s not just about staking—it’s about belonging.

3 notes

·

View notes

Text

How STON.fi and Web3 Are Shaping the Future of the Internet

I know the terms Web3 and blockchain might sound intimidating at first, but stick with me. Today, I’m going to break it all down and show you how STON.fi is helping make this new internet simple, accessible, and beneficial for you. Let’s dive into what Web3 is, why it matters, and how STON.fi is changing the game in ways that could make your online life better.

What Exactly is Web3, and Why Does It Matter?

Imagine you’re at a café, and you’re paying for your coffee with your debit card. Normally, the café needs to check with your bank to ensure the payment goes through. That’s two parties involved—your bank and the café. Web3 is about cutting out these intermediaries, so you can make transactions directly and safely with others online, without needing someone to verify it for you.

In Web3, you’re in control. You own your data, your assets, and your interactions. It’s like owning your own house instead of renting from someone else. You don’t have to ask for permission to access things—everything is at your fingertips, and you get to decide what to do with it.

The Power of Blockchain: The Backbone of Web3

To understand Web3, you need to get familiar with blockchain. Think of blockchain like a public ledger or notebook. But instead of one person keeping the notes, everyone in the network has a copy. Once something is written in that notebook, it can't be changed, ensuring that everything is transparent and trustworthy.

What makes blockchain special is that it removes the need for middlemen. In the world of Web2 (the current internet), companies like banks and social media giants act as the gatekeepers. They control how we interact and who can access our data. Blockchain, however, lets everyone participate on a level playing field, without relying on centralized authority.

TON Blockchain: Fast, Reliable, and Built for Web3

Now that you understand Web3 and blockchain, let me introduce you to TON (The Open Network). Think of TON as a highway built for the future of Web3. Older blockchains can get clogged with traffic, but TON adapts to handle whatever’s coming its way. It’s built to scale, which means no matter how many people are using it, the network will keep running smoothly.

With TON, you don’t have to worry about slow speeds or high costs. It’s designed to provide a seamless experience, making it ideal for decentralized platforms like STON.fi.

What is STON.fi?

This is where it gets really exciting. STON.fi is a decentralized exchange (DEX) built on the TON blockchain. If you’ve ever used a stock broker or exchange to buy or sell something, you’ve likely dealt with a middleman. STON.fi cuts that out. You interact directly with other users, with no one in between taking a cut. It’s like a farmers' market where you’re buying directly from the producer, not a middleman.

By using STON.fi, you have more control, lower fees, and more security. You’re not relying on anyone else to hold your funds or make trades for you—it’s all in your hands.

Why Should You Care About STON.fi and Web3?

Here’s the big question: Why does all of this matter to you? Well, Web3 is about taking back control. Right now, when you use online services, you don’t truly own your data or the transactions you make. Platforms like Facebook, Google, and even your bank control what happens to your information.

Web3 changes that. It gives you ownership over your data, and when you use a platform like STON.fi, you’re able to make decisions without needing a middleman. It’s like you’re owning the house rather than renting from someone else. Your assets, your money, your identity—they’re all in your hands, and you get to decide how they’re used.

How STON.fi Benefits You

Here’s a breakdown of how STON.fi can make a real difference in your financial life:

1. Decentralized Control: No one company controls the platform. You’re trading directly with others, keeping the process simple and transparent.

2. Lower Fees: Because there’s no middleman, fees are much lower, making trading more affordable for you.

3. Increased Security and Transparency: Every transaction on STON.fi is recorded on the blockchain, meaning you can track it and know your assets are secure.

4. Opportunities to Earn: With liquidity pools on STON.fi, you can earn passive income just by helping to provide liquidity to the platform.

Why You Should Be Paying Attention to Web3 and STON.fi

Web3 is more than just a buzzword. It’s the future of the internet, and platforms like STON.fi are leading the charge. You no longer have to depend on banks, tech giants, or even governments to manage your finances. You control your online life in a way that wasn’t possible before.

The beauty of Web3—and STON.fi—is that it’s available to everyone. You don’t need to be a tech expert to take advantage of these changes. Whether you’re investing in crypto, trading assets, or just looking for more control over your data, Web3 is the way forward.

Web3 isn’t some far-off concept for tech enthusiasts or big companies. It’s something you can be a part of right now, and STON.fi is making it easier than ever to get involved. By embracing decentralized platforms, you’re not just participating in the future of the internet—you’re shaping it.

So, the next time you hear someone talk about Web3 or decentralized exchanges, remember: it’s all about you. Your control, your assets, your choices. This is the future, and it’s happening today. Welcome to the new internet!

5 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap

The native token $SX powers both Sonicxswap and Sonicx.fun, enabling governance, rewards, and ecosystem participation. Here’s the breakdown of its allocation:

Presale (4%): Early investors can purchase $SX at a discounted rate.

Farm & Staking (45%): Rewards to incentivize user participation.

Liquidity (12%): Ensures stability and seamless trading.

Team (8%): Reserved for development and operations.

Exchange Listings (5%): Liquidity for centralized exchanges.

Audit & Marketing (6%): Builds trust and promotes adoption.

Airdrop & Bounty Program (5%): Rewards for community engagement.

Partner Funding (6%): Supports ecosystem partnerships.

Future Development (9%): Funds long-term platform upgrades.

This balanced allocation ensures sustainability and growth while prioritizing community rewards and long-term value creation.

Why Sonicxswap & Sonicx.fun Are Poised for Success

Both platforms have a robust roadmap and a vision that aligns with the future of blockchain. Here’s why they are destined to thrive:

Innovative Ecosystem: Combining a DEX and launchpad creates a seamless user experience.

Deflationary Model: Constant buybacks and burns of $SX ensure scarcity and value appreciation.

Community-Driven Governance: Token holders play a pivotal role in decision-making.

First-Mover Advantage: As one of the first projects on the Sonic blockchain, SonicxSwap is well-positioned to dominate.

Comprehensive Roadmap: From high-APR pools to cross-chain bridges, the platforms have ambitious plans for growth.

What’s Next for Sonicxswap and Sonicx.fun?

The journey is just beginning, and there’s much to look forward to. Here’s what’s on the horizon:

$SX Token Presale: A chance for early investors to secure tokens at discounted rates.

Mainnet Launch: Both platforms will go live when the Sonic blockchain launches in December 2024.

Airdrops & Partnerships: Rewarding the community and forming strategic collaborations.

Expansions: Bridging to Ethereum and Solana, and introducing prediction markets and perpetual trading.

Join Us on This Revolutionary Journey

Sonicxswap and Sonicx.fun are more than just platforms; they are a movement toward a decentralized, community-driven financial future. Whether you’re an investor, developer, or DeFi enthusiast, now is the time to get involved.

Get Started Today

Visit our websites: Sonicxswap and Sonicx.fun.

Follow us on social media for updates.

Linktree : https://linktr.ee/sonicxswap

Participate in the $SX presale to become a part of this transformative journey.

The future is Sonic. The future is decentralized. Join us today.

2 notes

·

View notes

Text

Introducing Sonicxswap & Sonicx.fun: First Dex & Launchpad on Sonic Blockchain

SonicxSwap

Follow on X https://x.com/SonicXswap

Join Telegram https://t.me/SonicxSwap

The Dawn of a New Era in DeFi

Decentralized Finance (DeFi) has transformed the financial landscape, offering users global access to financial tools without intermediaries. However, challenges like high fees, limited scalability, and lack of innovation continue to plague the ecosystem. Enter Sonicxswap and Sonicx.fun — two revolutionary platforms built on the cutting-edge Sonic blockchain. Together, they aim to redefine the DeFi experience by empowering users, developers, and communities like never before.

In this blog, we’ll explore how these platforms work, their unique features, and why they are set to lead the next wave of blockchain innovation.

What is Sonicxswap?

Sonicxswap is a next-generation decentralized exchange (DEX) built on the Sonic blockchain. Designed to provide lightning-fast transactions, ultra-low fees, and seamless user experience, Sonicxswap offers a comprehensive suite of DeFi tools, including:

Token Swapping: Effortless and secure trading of tokens with minimal fees.

Yield Farming: Earn rewards by providing liquidity to the platform.

Staking Pools: Lock your tokens to earn high annual percentage returns (APRs) while supporting network security.

Launchpad Integration: A direct connection to Sonicx.fun for early access to high-potential projects.

Why Sonicxswap Stands Out

Deflationary Tokenomics: Sonicxswap uses 80% of all fees collected to buy back and burn its native token, $SX, creating a constant upward pressure on its value.

User-Focused Features: From prediction markets to limit orders, Sonicxswap is designed with users in mind.

Cross-Chain Compatibility: Future expansions include bridging to Ethereum and Solana, making Sonicxswap a truly versatile platform.

Sonicx.fun: The Launchpad for Innovation

Every groundbreaking project needs a launchpad, and Sonicx.fun serves exactly that purpose. This decentralized platform is built for developers looking to launch their tokens with ease and transparency.

Key Features of Sonicx.fun

Token Creation Made Simple: Developers can launch tokens in minutes with low fees.

Liquidity Solutions: Automatic liquidity addition ensures a strong market foundation.

Deflationary Mechanisms: Fees collected are used to buy back and burn $SX, reducing the overall supply.

For investors, Sonicx.fun offers early access to promising projects, ensuring they are always ahead of the curve.

Why Sonic Blockchain?

Both Sonicxswap and Sonicx.fun are powered by the Sonic blockchain, a high-performance network designed to solve the key limitations of existing blockchains. Here’s why Sonic is the perfect foundation:

Scalability: Process thousands of transactions per second without network congestion.

Low Transaction Fees: Affordable fees make DeFi accessible to everyone.

Developer Incentives: Attractive rewards encourage developers to build on the Sonic ecosystem.

With the mainnet launch scheduled for December 2024, early adopters of Sonic-based platforms are positioned to gain significant advantages.

Tokenomics: $SX, The Backbone of Sonicxswap

The native token $SX powers both Sonicxswap and Sonicx.fun, enabling governance, rewards, and ecosystem participation. Here’s the breakdown of its allocation:

Presale (4%): Early investors can purchase $SX at a discounted rate.

Farm & Staking (45%): Rewards to incentivize user participation.

Liquidity (12%): Ensures stability and seamless trading.

Team (8%): Reserved for development and operations.

Exchange Listings (5%): Liquidity for centralized exchanges.

Audit & Marketing (6%): Builds trust and promotes adoption.

Airdrop & Bounty Program (5%): Rewards for community engagement.

Partner Funding (6%): Supports ecosystem partnerships.

Future Development (9%): Funds long-term platform upgrades.

This balanced allocation ensures sustainability and growth while prioritizing community rewards and long-term value creation.

Why Sonicxswap & Sonicx.fun Are Poised for Success

Both platforms have a robust roadmap and a vision that aligns with the future of blockchain. Here’s why they are destined to thrive:

Innovative Ecosystem: Combining a DEX and launchpad creates a seamless user experience.

Deflationary Model: Constant buybacks and burns of $SX ensure scarcity and value appreciation.

Community-Driven Governance: Token holders play a pivotal role in decision-making.

First-Mover Advantage: As one of the first projects on the Sonic blockchain, SonicxSwap is well-positioned to dominate.

Comprehensive Roadmap: From high-APR pools to cross-chain bridges, the platforms have ambitious plans for growth.

What’s Next for Sonicxswap and Sonicx.fun?

The journey is just beginning, and there’s much to look forward to. Here’s what’s on the horizon:

$SX Token Presale: A chance for early investors to secure tokens at discounted rates.

Mainnet Launch: Both platforms will go live when the Sonic blockchain launches in December 2024.

Airdrops & Partnerships: Rewarding the community and forming strategic collaborations.

Expansions: Bridging to Ethereum and Solana, and introducing prediction markets and perpetual trading.

Join Us on This Revolutionary Journey

Sonicxswap and Sonicx.fun are more than just platforms; they are a movement toward a decentralized, community-driven financial future. Whether you’re an investor, developer, or DeFi enthusiast, now is the time to get involved.

Get Started Today

Visit our websites: Sonicxswap and Sonicx.fun.

Follow us on social media for updates.

Linktree : https://linktr.ee/sonicxswap

Participate in the $SX presale to become a part of this transformative journey.

The future is Sonic. The future is decentralized. Join us today.

2 notes

·

View notes

Text

DEAR BROKE MILLENNIALS AND CRYPTO CURIOUS, THIS IS YOUR FINANCIAL UPRISING

Listen up. I'm about to drop some truth that'll make your traditional banker sweat.

THE OLD FINANCIAL SYSTEM:

A Toxic Relationship

Remember when "investing" meant drowning in boring bank terms and collecting pennies in interest? Yeah, me too. I was in a dead-end relationship with traditional finance, and it was time for a breakup.

Enter XBANKING. My financial soulmate.

THE COLD, HARD (AWESOME) FACTS

This Isn't Your Grandpa's Investment platform.

- 35+ Blockchain Networks (Global domination, anyone?)

- 140+ Supported Tokens (Choice is power)

- 74 Web3 Wallets (Flexibility is sexy)

- $1,000,000,000+ Total Value Locked (Billion. With a B.)

THE XB TOKEN:

Your Financial Middle Finger to The System

Forget everything you know about investments. The XB token is like that rebellious friend who actually knows how to make money work:

16% Annual Returns (Bye, 0.02% bank interest)

Daily Token Airdrops (Free money, literally)

Community Governance (We make the rules now)

Future-Proof Investing

RESTAKING:

The Financial Cheat Code

Imagine your money having a side hustle. That's restaking.

How it works:- Your tokens earn initial rewards- Those rewards generate MORE rewards- It's basically money inception

The Tokenomics Breakdown (No MBA Required)

Total XB Tokens: 10,500,000- Strategically distributed- No corporate BS- Designed for actual growth

My Rebellion Story was the classic broke millennial.

Scrolling through finance posts, feeling hopeless.

Then XBANKING happened.

Timeline of My Financial Awakening:

- Day 1: Skeptical AF

- Week 1: Cautiously intrigued

- Month 3: Full-blown crypto evangelist

getting started:

Easier than your last tinder date

1. Buy XB tokens on Raydium DEX2.

Drop them in XBANKING's liquidity pool

3. Hold for 30 days

4. Watch passive income roll in

Why XBANKING Is Different

- 24/7 Support (They actually mean 24/7)

- Transparent as hell

- Community

-driven

- No corporate overlords

The Future is Decentralized (And Awesome)XBANKING isn't just a platform. It's a movement:

- Crypto Wallet Coming Soon

- Continuous Innovation

- Financial Freedom for All

Real Talk: Why I'm Committed After months of research, testing, and crypto therapy, XBANKING feels like home.

Join the Revolution:

- 🌐 Website: https://xbanking.org

- 💬 Telegram: https://t.me/xbanking

- 🐦 Twitter: https://x.com/xbanking_org

Disclaimer: This is my journey. Crypto is wild. Do your homework.

The Ultimate Plot Twist XBANKING isn't selling dreams. They're handing you the tools to build your own.Are you ready to stop being a passenger and start driving your financial future?

Attention broke millennials, crypto skeptics, and financial rebels:

Your time is NOW.

P.S. Future you will send a thank you text for reading this. I promise.

#CryptoRebellion #FinancialFreedom #XBANKINGRevolution

2 notes

·

View notes

Text

How to Select the Best Cryptocurrency Development Services Provider Near You?

Choosing the right cryptocurrency development services provider is crucial for the success of your blockchain project. Whether you're launching a new cryptocurrency, developing a decentralized application (dApp), or planning an Initial Coin Offering (ICO), finding a reliable and competent development team can make all the difference. Here’s a comprehensive guide to help you navigate this important decision.

1. Define Your Project Requirements

Before you start looking for a cryptocurrency development services provider, it’s essential to clearly define your project requirements. Outline the scope of your project, including technical specifications, desired features, security considerations, and any regulatory compliance requirements. Understanding your project needs will help you evaluate potential providers more effectively.

2. Evaluate Technical Expertise

One of the most critical factors in selecting a cryptocurrency development services provider is their technical expertise. Look for a team that has a proven track record in blockchain development, particularly in the specific technologies and platforms you intend to use (e.g., Ethereum, Hyperledger, Stellar). Verify their experience through case studies, client testimonials, and their portfolio of completed projects.

3. Assess Security Measures

Security is paramount in the cryptocurrency and blockchain space due to the high value of digital assets and the prevalence of cyber threats. Ensure that the development services provider has robust security protocols in place, including adherence to best practices such as code audits, multi-layered encryption, secure smart contract development, and regular security updates.

4. Check Regulatory Compliance

Regulatory compliance is another critical consideration, especially if your project involves tokens or involves financial transactions. Ensure that the development team is well-versed in relevant regulatory frameworks (e.g., KYC/AML regulations) and can implement compliance measures effectively. A reputable provider should prioritize legal compliance to mitigate regulatory risks.

5. Evaluate Development Methodologies

Understand the development methodologies and processes employed by the cryptocurrency development services provider. Agile methodologies are often preferred in blockchain development for their flexibility and iterative approach. Ensure that the provider emphasizes transparency, regular communication, and milestone-based deliverables to keep your project on track.

6. Review Client Support and Maintenance

Post-launch support and maintenance are crucial for the long-term success of your blockchain project. Inquire about the provider’s support services, including troubleshooting, bug fixes, and updates. A reliable provider should offer ongoing maintenance to address evolving technological and security needs, ensuring the continued functionality and security of your platform.

7. Consider Industry Reputation and Reviews

Research the reputation of potential cryptocurrency development services providers within the industry. Seek reviews from past clients and industry experts to gauge their reliability, professionalism, and overall satisfaction with the services provided. Online platforms, forums, and social media can provide valuable insights into the provider’s reputation and client relationships.

8. Evaluate Cost and Budget

While cost shouldn’t be the sole determining factor, it’s important to consider your budget and compare pricing among different providers. Beware of overly low-cost offers that may compromise quality or lack transparency in pricing structure. Look for a provider that offers competitive pricing aligned with the scope and complexity of your project, with a clear breakdown of costs.

9. Assess Communication and Collaboration

Effective communication and collaboration are essential when working with a cryptocurrency development services provider. Evaluate their responsiveness, clarity in communication, and willingness to understand your project vision. A provider who values collaboration and offers proactive suggestions can contribute significantly to the success of your blockchain venture.

10. Seek Customization and Scalability

Every blockchain project is unique, requiring tailored solutions to meet specific objectives. Ensure that the development services provider offers customization options and scalability to accommodate future growth and evolving market demands. Whether you’re launching a startup or expanding an existing platform, scalability should be a key consideration in your provider selection.

Conclusion

Selecting the best cryptocurrency development services provider near you involves careful evaluation of technical expertise, security measures, regulatory compliance, support services, reputation, cost, and collaboration capabilities. By thoroughly assessing these factors and aligning them with your project requirements, you can make an informed decision that sets the foundation for a successful blockchain venture.

Choosing the right partner is not just about finding a development team but selecting a strategic ally committed to your project’s success from inception through implementation and beyond.

#Cryptocurrency Development Services#Cryptocurrency Development#Cryptocurrency#Crypto#Cryptocurrency Development Solutions#Cryptocurrency Development Company#Cryptocurrency Development Agency

2 notes

·

View notes

Text

Understanding Bitcoin: A Deep Dive

Introduction

Bitcoin has become a buzzword in the financial world, often hailed as the future of money. But what exactly is Bitcoin, and why should you care? This post aims to provide a comprehensive understanding of Bitcoin, its origins, how it works, its advantages and challenges, and its role in the current and future financial landscape.

History of Bitcoin

Bitcoin was introduced in 2008 by an anonymous entity known as Satoshi Nakamoto through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." The first Bitcoin transaction occurred in 2009, marking the birth of the first decentralized cryptocurrency. Early adopters were primarily tech enthusiasts and libertarians, who saw Bitcoin as a revolutionary way to conduct transactions without relying on traditional financial institutions.

How Bitcoin Works

Bitcoin operates on a technology called blockchain, a decentralized ledger that records all transactions across a network of computers. Here's a simplified breakdown:

Blockchain Technology: The blockchain is a public ledger that records every Bitcoin transaction ever made. It is maintained by a network of nodes (computers) that validate and record transactions.

Mining: New Bitcoins are created through a process called mining, where powerful computers solve complex mathematical problems. Miners are rewarded with newly created Bitcoins for their efforts. Mining involves solving cryptographic puzzles, which ensures the security and integrity of the blockchain. This process is energy-intensive and requires significant computational power.

Supply Cap: Bitcoin has a fixed supply cap of 21 million coins, meaning that no more than 21 million Bitcoins will ever be created. This scarcity is designed to increase the value of Bitcoin over time as demand grows.

Halving: Approximately every four years, the reward for mining new blocks is halved, an event known as "halving." This reduces the rate at which new Bitcoins are created, further ensuring scarcity. The most recent halving occurred on April 19, 2024, reducing the block reward from 6.25 to 3.125 Bitcoins.

Advantages of Bitcoin

Decentralization: Bitcoin is not controlled by any single entity, making it resistant to censorship and interference.

Security: The cryptographic nature of Bitcoin provides a high level of security, making it difficult to counterfeit or double-spend.

Financial Inclusion: Bitcoin provides access to financial services for the unbanked and underbanked populations, particularly in regions with unstable financial systems.

Challenges and Criticisms

Volatility: Bitcoin's price is highly volatile, making it a risky investment and a challenging medium of exchange for everyday transactions.

Regulatory Concerns: Governments and regulatory bodies are still grappling with how to regulate Bitcoin, leading to uncertainty and potential legal issues.

Environmental Impact: Bitcoin mining consumes a significant amount of energy, raising concerns about its environmental footprint.

Current Financial Landscape

Bitcoin has come a long way since its inception, gaining acceptance from businesses and institutions worldwide. It is often compared to traditional fiat currencies, with debates focusing on its potential to replace or complement existing financial systems. Major companies like Tesla and Square have invested in Bitcoin, while countries like El Salvador have adopted it as legal tender.

Future of Bitcoin

The future of Bitcoin is a topic of much speculation. Some see it becoming a mainstream currency, while others believe it will remain a niche asset. Technological advancements, such as the Lightning Network, aim to improve Bitcoin's scalability and transaction speed. As the world moves towards digital finance, Bitcoin's role will likely continue to evolve.

Conclusion

Bitcoin represents a groundbreaking innovation in the world of finance. Its decentralized nature, security features, and potential for financial inclusion make it a significant player in the current and future financial landscape. However, challenges like volatility, regulatory concerns, and environmental impact cannot be overlooked. Understanding Bitcoin is crucial for anyone interested in the future of money.

Additional Resources

Further Reading:

"Bitcoin: A Peer-to-Peer Electronic Cash System" by Satoshi Nakamoto

"The Bitcoin Standard" by Saifedean Ammous

Videos and Documentaries:

"Bitcoin: The End of Money as We Know It"

"Banking on Bitcoin"

Influential Voices in the Bitcoin Community:

Andreas M. Antonopoulos

Michael Saylor

Caitlin Long

#Bitcoin#cryptocurrency#blockchain#digitalcurrency#Bitcoinmining#supplycap#Bitcoinhalving#decentralizedfinance#financialinclusion#SatoshiNakamoto#Bitcoinhistory#cryptocurrencyinvestment#Bitcointechnology#futureofmoney#financialinnovation#cryptomarket#Bitcoinadoption#Bitcoinsecurity#Bitcoinvolatility#environmentalimpactofBitcoin#financial education#financial empowerment#financial experts#finance#unplugged financial#globaleconomy

5 notes

·

View notes

Photo

Sibling Breakdown

"Hhope you like being broken downn for my BLOCKCHAIN" "Ugh you're such a loser" After seeing Thorn get his revenge on Nova earlier, Zabre decided to step in and MESS THINGS UP AS USUAL. For sonicality

Posted using PostyBirb

2 notes

·

View notes

Text

Ethereum News: Latest Updates and Insights from Coin Pulse HQ

Ethereum, the second-largest cryptocurrency thru market capitalization, keeps to make waves in the blockchain organisation business organisation. Known for its pioneering function in introducing clever contracts, Ethereum has turn out to be a cornerstone of decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 innovation. At Coin Pulse HQ, we offer in-depth evaluation, breaking facts, and professional insights to maintain you informed approximately all subjects Ethereum. This article delves into the contemporary inclinations, tendencies, and updates shaping Ethereum's surroundings.

Ethereum 2.Zero: A Game-Changer for Blockchain Scalability One of the most large milestones for Ethereum in cutting-edge-day years is the transition to Ethereum 2.Zero, furthermore known as the Merge. This enhance shifted Ethereum from a proof-of-paintings (PoW) to a evidence-of-stake (PoS) consensus mechanism, considerably lowering power consumption and enhancing scalability. Coin Pulse HQ has been cautiously monitoring the Merge's impact, highlighting key benefits which embody:

Energy Efficiency: Ethereum's strength intake has dropped thru over ninety nine%, addressing number one environmental issues.

Increased Security: The PoS model enhances network safety through using incentivizing sincere validator participation.

Scalability Enhancements: Future improvements, like sharding, promise to increase transaction throughput and reduce prices.

Our professionals moreover find out the disturbing situations associated with Ethereum 2.Zero, which include validator centralization risks and adoption hurdles. Stay tuned to Coin Pulse HQ for complete analyses on the ones subjects.

The Rise of Layer 2 Solutions As Ethereum's recognition grows, so does the decision for for quicker and lots much less expensive transactions. Enter Layer 2 solutions like Arbitrum, Optimism, and zkSync, which cause to relieve congestion on the Ethereum mainnet. These scaling answers art work with the beneficial aid of processing transactions off-chain whilst retaining Ethereum’s protection guarantees.

Coin Pulse HQ gives particular coverage of:

Technology Breakdown: How Layer 2 solutions artwork and their integration with Ethereum.

Adoption Trends: Projects leveraging Layer 2 for DeFi, gaming, and NFT applications.

Future Prospects: Predictions for Layer 2’s role in Ethereum’s growth.

Our Ethereum News phase is your bypass-to useful aid for staying updated on the evolution of Layer 2 technology.

Ethereum in Decentralized Finance (DeFi) Ethereum stays the spine of the DeFi surroundings, net website hosting a majority of decentralized programs (dApps) like Uniswap, Aave, and Compound. Coin Pulse HQ often examines how Ethereum's upgrades are influencing DeFi adoption and innovation.

Key highlights embody:

TVL (Total Value Locked): Tracking the capital invested in Ethereum-primarily based completely absolutely DeFi protocols.

Regulatory Landscape: Analyzing how worldwide hints are shaping the DeFi vicinity.

Emerging Trends: From yield farming to liquid staking, find out the current traits the usage of DeFi’s growth.

Our group of analysts also evaluates risks like smart settlement vulnerabilities and market volatility, supporting you navigate the complexities of DeFi with self guarantee.

NFTs and Ethereum: A Perfect Match Ethereum has been instrumental inside the upward thrust of NFTs, permitting creators to tokenize paintings, music, and one of a kind digital property. The ERC-721 and ERC-1155 necessities have set the volume for innovation in gaming, virtual actual assets, and further.

At Coin Pulse HQ, we cowl:

Market Insights: Trends in NFT income quantity, pinnacle marketplaces, and growing obligations.

Use Cases: Innovative applications of NFTs beyond artwork, along facet ticketing and identification verification.

Challenges and Opportunities: Addressing troubles like scalability, environmental effect, and copyright infringement.

Stay informed approximately the extremely-modern NFT trends on Ethereum with Coin Pulse HQ’s in-depth articles.

Ethereum’s Role in Web3 Development Web3, the decentralized net of the destiny, owes masses of its development to Ethereum. From DAOs (Decentralized Autonomous Organizations) to decentralized identification answers, Ethereum’s infrastructure lets in a massive choice of Web3 programs.

Coin Pulse HQ explores:

DAO Innovations: How Ethereum-powered DAOs are reshaping governance models.

Web3 Startups: Profiles of promising projects leveraging Ethereum.

Developer Ecosystem: Resources and gear for building on Ethereum, along with Solidity and the Ethereum Virtual Machine (EVM).

Our platform gives a one-stop hold for anyone interested in Ethereum’s function in shaping the destiny of the net.

Ethereum Price Analysis and Market Trends Understanding Ethereum’s marketplace performance is vital for buyers and fans alike. Coin Pulse HQ gives actual-time price evaluation, historical facts, and professional predictions to help you make informed picks.

Recent tendencies include:

Institutional Adoption: Analyzing the impact of institutional investments on Ethereum’s fee balance.

ETH Staking: Insights into staking rewards and the way they have got an effect on market dynamics.

Market Sentiment: Evaluating the function of macroeconomic factors, together with inflation and hobby fees, on Ethereum’s overall performance.

Our Ethereum News segment guarantees you live earlier of the curve with actionable insights.

Conclusion Ethereum keeps to manual the blockchain revolution, using innovation in the course of a couple of domains. At Coin Pulse HQ, our assignment is to supply correct, well timed, and insightful records to maintain you up to date on Ethereum’s ever-evolving landscape. Whether you’re a developer, investor, or blockchain fanatic, our complete coverage ensures you in no manner skip over a beat.

For the today's Ethereum updates, go to Coin Pulse HQ’s Ethereum News phase and be part of our community of in advance-wondering people shaping the future of decentralized generation.

0 notes

Text

How to Make Your Crypto Work Smarter with Farming on STON.fi

When I first heard about crypto farming, I’ll admit it sounded a bit intimidating. But once I dug deeper, I realized it’s one of the simplest ways to make your assets grow. Imagine putting your money into a savings account where you earn interest, but instead of just leaving it there, you play an active role in making the system better. That’s what farming on a decentralized exchange (DEX) like STON.fi feels like.

Let’s break this down together and make it as relatable and easy to understand as possible.

What Is Crypto Farming: Think of It Like Planting Seeds

Picture this: You own a small garden. Instead of letting it sit idle, you plant seeds. Over time, those seeds grow into fruits or vegetables, which you can harvest and enjoy. That’s farming, right?

Crypto farming works similarly. Instead of seeds, you provide your tokens as liquidity to a DEX. Instead of fruits, you earn rewards—additional tokens for supporting the ecosystem. It’s as straightforward as that.

By “planting” your tokens in a farm pool, you’re helping the platform maintain liquidity, ensuring trades can happen seamlessly. In return, you’re rewarded for your contribution.

What Are Farm Pools, and Why Do They Matter

Farm pools are like community gardens. Everyone brings their resources (tokens) and works together to keep the garden flourishing. On a platform like STON.fi, these pools are essential for ensuring there’s enough liquidity for traders to swap tokens.

Your contribution is more than just a deposit; it’s a way to keep the ecosystem alive and growing. And just like in a garden, the more you contribute, the more you stand to gain.

Farming on STON.fi: Why It’s a Game-Changer

STON.fi makes farming simple, even if you’re new to crypto. The platform is designed with users in mind, providing clear instructions and straightforward processes. It’s not about navigating complex systems but about empowering you to make your assets work smarter.

Here’s what sets STON.fi apart:

1. User-Friendly Interface: You don’t need to be a tech wizard. Everything is intuitive.

2. Flexible Options: Choose pools based on your goals—whether you’re in it for quick rewards or long-term growth.

3. Transparent Processes: No hidden terms or complicated jargon. You know exactly what you’re getting into.

Available Farming Pools on STON.fi

Here’s a breakdown of the farming opportunities currently available:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Farming Period: Until December 30

Lock-Up Period: 15 days

JetTon Games is a blockchain gaming platform. By farming here, you’re not only earning rewards but also supporting the growth of blockchain-based gaming.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Farming Period: Until December 24

Lock-Up Period: None

This pool is perfect if you’re looking for flexibility. No lock-up means you can withdraw your tokens anytime while still earning rewards.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Farming Period: Until December 24

Lock-Up Period: None

High rewards with no lock-up? It’s an opportunity to grow your assets without committing them long-term.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Farming Period: Until January 16

Lock-Up Period: None

This pool supports TON staking. If you believe in the TON ecosystem’s future, this is a great way to contribute while earning.

Farm tokens now

Lessons I’ve Learned from Farming

Farming isn’t just about earning tokens; it’s about building a strategy. Here are a few things I’ve picked up:

Start Small: When I first started, I didn’t dive in headfirst. I tested the waters with a small amount to understand how it works.

Stay Informed: Before joining any pool, I took the time to read about it—what tokens are involved, the rewards, and the lock-up period.

Diversify: Just like in traditional finance, I learned not to put all my eggs in one basket. Spreading my assets across different pools minimized my risks.

Why You Should Consider Farming

If you’ve been letting your tokens sit idle in your wallet, farming is a great way to put them to work. Think of it like opening a high-interest account at a bank. Your money doesn’t just sit there—it grows.

The best part? You’re contributing to the broader DeFi ecosystem. Every token you provide helps create a more robust and efficient platform for everyone involved.

How to Start Farming on STON.fi

Getting started is easier than you might think. Here’s how I approached it:

1. Choose a Pool: Look at the available options and pick one that aligns with your goals.

2. Provide Liquidity: Deposit the required token pairs. STON.fi automatically issues LP tokens for you.

3. Start Earning: Sit back and watch your rewards grow as the system does the heavy lifting.

Final Thoughts: Make Your Assets Work for You

Crypto farming isn’t as complicated as it sounds. Platforms like STON.fi have made it accessible for everyone, whether you’re a seasoned trader or just starting your journey.

What I love most about farming is that it aligns with a mindset of financial growth. It’s not about taking unnecessary risks but about making informed decisions and letting your assets do the work.

If you’ve been curious about farming but hesitant to start, I encourage you to take that first step. Begin small, learn as you go, and discover the rewards of being an active participant in the crypto space. Trust me, it’s worth it.

3 notes

·

View notes

Text

What is Traceability? Unpacking the Mystery Behind the Buzzword

If you’ve stumbled upon the term "traceability" and found yourself scratching your head, you’re not alone. At first glance, it might sound like something out of a sci-fi movie. But don’t worry—this blog will break down what is traceability, why it matters, and how it’s woven into the fabric of our everyday lives (yes, even yours). Spoiler alert: it’s a lot cooler than it sounds!

What is Traceability and Why Should You Care?

Let’s start with the basics. What is traceability? In simple terms, it’s the ability to track the journey of a product, component, or material through its lifecycle—from origin to final destination. Think of it like having a GPS for your coffee beans, sneakers, or even your favorite chocolate bar.

Now, why should you care? Because traceability means transparency. It ensures that products are safe, sustainable, and ethically sourced. Imagine knowing exactly where your avocado came from, how it was harvested, and whether the farmer was fairly compensated. Pretty empowering, right?

A Brief History of Traceability

Traceability isn’t a new concept. Ancient civilizations, like the Egyptians, used rudimentary systems to track grain storage and trade routes. Fast forward to the modern era, and traceability has evolved into a high-tech affair involving barcodes, RFID tags, and blockchain technology.

In today’s world, traceability is a critical component in industries ranging from food and fashion to pharmaceuticals and electronics. Why? Because consumers (that’s you and me) are demanding accountability. We want to know that our purchases align with our values—whether that means cruelty-free, environmentally friendly, or free of exploitative labor practices.

Types of Traceability: Breaking It Down

To truly grasp what is traceability, we need to understand its different forms. Here are the main types:

1. Upstream Traceability

This tracks the journey of raw materials from their source to the manufacturer. For example, tracing the cotton in your T-shirt back to the farm where it was grown.

2. Internal Traceability

This involves tracking components and processes within a single organization. Think of a car manufacturer keeping tabs on each part of a vehicle during assembly.

3. Downstream Traceability

This follows the finished product from the manufacturer to the end consumer. For instance, tracking your smartphone from the factory to the retailer where you bought it.

By combining these three types, companies can achieve end-to-end traceability—a holy grail for many industries.

Why Is Traceability So Important?

Alright, so we’ve covered the basics of what is traceability. But why is it such a big deal? Here are some compelling reasons:

1. Safety First

In industries like food and pharmaceuticals, traceability can literally save lives. It ensures that contaminated or defective products can be identified and recalled quickly, minimizing harm.

2. Ethical Accountability

Traceability sheds light on the supply chain, helping consumers avoid products linked to unethical practices like child labor, deforestation, or animal cruelty.

3. Sustainability

With climate change on everyone’s radar, traceability plays a key role in promoting sustainable practices. It enables companies to track and reduce their carbon footprint.

4. Fraud Prevention

Counterfeit goods are a global problem, especially in industries like luxury fashion and electronics. Traceability helps verify the authenticity of products.

5. Consumer Trust

In today’s hyper-connected world, trust is everything. Brands that embrace traceability can win over consumers by proving their commitment to transparency and integrity.

How Does Traceability Work?

Now that you know what is traceability and why it matters, let’s demystify how it actually works. Here’s a simplified breakdown:

Step 1: Data Collection

Every step of the supply chain generates data—from harvesting raw materials to shipping finished products. This data is collected using tools like barcodes, QR codes, RFID tags, and sensors.

Step 2: Data Integration

All the collected data is stored in a centralized system, often powered by technologies like blockchain or cloud computing. This ensures that the information is secure, tamper-proof, and easily accessible.

Step 3: Data Analysis

The data is analyzed to identify patterns, detect anomalies, and ensure compliance with regulations. Advanced analytics tools can even predict potential issues before they occur.

Step 4: Data Sharing

Finally, the data is shared with stakeholders—manufacturers, retailers, and consumers—to provide a transparent view of the product’s journey.

Real-Life Examples of Traceability

Still wondering, “What is traceability” in action? Here are some real-world examples to make it crystal clear:

1. Farm-to-Table Dining

Many restaurants now provide QR codes that let diners trace their meal’s ingredients back to the farm. Talk about a conversation starter over dinner!

2. Fashion Transparency

Brands like Patagonia and Everlane are leading the charge in fashion traceability, offering detailed insights into their supply chains.

3. Medical Safety

Pharmaceutical companies use traceability to ensure that medications are safe, effective, and free from contamination. This is especially crucial for vaccines and other life-saving drugs.

The Future of Traceability

So, what’s next for traceability? AI and machine learning could take predictive analytics to new heights, while blockchain could make supply chains even more transparent and secure.

In the not-so-distant future, you might be able to scan a product in a store and instantly access its entire history on your smartphone. How cool is that?

Conclusion

So, what is traceability? At its core, it’s about creating a world where products are safer, supply chains are more transparent, and consumers are more empowered. Whether you’re a coffee lover, a tech enthusiast, or a sustainability advocate, traceability impacts your life in ways you might not have realized.

By understanding and supporting traceability, we can all contribute to a better, more ethical world. And that’s something worth celebrating.

FAQs

1. What is traceability in simple terms?

Traceability is the ability to track a product’s journey from its origin to its final destination.

2. Why is traceability important?

It ensures product safety, promotes ethical practices, prevents fraud, and builds consumer trust.

3. Which industries use traceability?

Almost all industries, including food, fashion, pharmaceuticals, electronics, and automotive, rely on traceability.

4. How does technology support traceability?

Technologies like barcodes, RFID, blockchain, and cloud computing enable efficient data collection, storage, and sharing.

5. Can consumers benefit from traceability?

Absolutely! Traceability empowers consumers to make informed choices that align with their values.

Now, go forth and impress your friends with your newfound knowledge of what is traceability. Who knew a seemingly mundane concept could be so fascinating?

0 notes

Text

Shiba Inu’s price could achieve a remarkable 696% surge in 2024

The chairman of the CIFDAQ Blockchain Ecosystem, Himanshu Maradiya, believes that Shiba Inu could attain $0.0001 in 2024. This is a 696% surge from the current price of $0.00001436.

According to Maradiya, the meme coin could deliver more substantial returns by next year. He highlighted that SHIB enthusiasts can hope for an upper target of $0.0003 by this year or, at most, 2025.

In the past couple of days, Shiba Inu’s price has been lackluster as it navigates the recovery phase following a recent downturn. Shiba Inu’s current price shows a 2.49% increase over the last 24 hours.

However, since its plunge to $0.00001087 last Monday, the meme coin has rebounded by almost 30%. This is because the entire crypto market experienced a sell-off last weekend, which briefly drove Bitcoin below $50k and Ethereum back below $2,500.

As Shiba Inu continues its recovery, several experts are reviewing the potential future directions for the SHIB price in a less bearish market.

According to data from TradingView, the moving averages could be defended since a break and close above them will open the doors for a rally to the breakdown level of $0.000020. Such a move would signal that the markets have rejected the lower levels.

0 notes

Text

Top Reasons to Choose Malgo for Cryptocurrency Development Services in 2025

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of money secured by cryptography, making it nearly impossible to counterfeit. Unlike traditional currencies controlled by central authorities, cryptocurrencies operate on decentralized networks based on blockchain technology. Popular examples include Bitcoin, Ethereum, and Litecoin. These assets enable fast, secure, and borderless transactions, gaining significant traction for personal and business use.

What is Cryptocurrency Development?

Cryptocurrency development refers to the process of creating digital currencies and blockchain-based solutions. This involves building the technical framework for tokens, wallets, and blockchain infrastructure while ensuring security and compliance. The development process can also include designing features for scalability, privacy, and interoperability to meet specific business or industry needs.

Why Should You Choose a Cryptocurrency Development Company? Key Considerations

Choosing a professional cryptocurrency development company is crucial for several reasons. First, these companies have specialized expertise in handling the complexities of blockchain technology. Second, they ensure the solutions are secure and compliant with regulations. Finally, a reputable firm provides end-to-end services, from planning and development to deployment and ongoing support. Working with an experienced partner saves time, minimizes risks, and ensures quality.

Types of Cryptocurrencies: A Breakdown for Businesses

Understanding the types of cryptocurrencies can help businesses choose the right ones for their operations. The main categories include:

Payment Coins: These include Bitcoin and Litecoin, primarily used for transactions.

Utility Tokens: Examples like Ethereum’s ETH allow access to blockchain applications or services.

Security Tokens: These represent ownership in assets or companies and are subject to securities regulations.

Stablecoins: Pegged to traditional currencies like USD, these are less volatile and ideal for trading or savings.

Meme Coins: Popularized by internet culture, such as Dogecoin, often speculative but with growing adoption.

Businesses can leverage these categories to align with their goals, whether facilitating payments or accessing blockchain-based services.

Can Malgo Help with Regulatory Compliance for Cryptocurrency Projects? A Clear Answer

Malgo provides thorough support for regulatory compliance in cryptocurrency projects. Their team stays updated with global and regional regulations, including anti-money laundering (AML) and know-your-customer (KYC) policies. They help businesses follow legal rules to avoid fines and penalties. By ensuring compliance at every step, Malgo protects businesses from potential regulatory risks.

Does Malgo Provide Post-Launch Support for Cryptocurrency Projects?

Absolutely. Malgo offers continuous support even after the launch of your cryptocurrency project. This includes updates, troubleshooting, feature enhancements, and addressing security vulnerabilities. Their commitment ensures that your project remains functional, secure, and competitive in a fast-moving industry. Post-launch support also includes performance monitoring and user feedback integration to meet evolving demands.

Reasons: Why Malgo Is the Best Choice for Your Cryptocurrency Development Needs?

Malgo stands out as a leader in cryptocurrency development services for the following reasons:

1. Extensive Expertise

With years of experience,Malgo has delivered successful blockchain and cryptocurrency projects. Their team of skilled developers understands the nuances of the industry and applies this knowledge to create reliable solutions.

2. Customizable Solutions

Malgo works closely with clients to create solutions that fit their specific requirements. Whether you need a new cryptocurrency, wallet, or blockchain application, they offer flexible options tailored to your needs.

3. Focus on Security

Security is a top priority for Malgo. Their development process includes implementing advanced encryption, secure coding practices, and thorough testing. This ensures the protection of sensitive data and reduces the risk of breaches.

4. Regulatory Awareness

Staying compliant with laws and regulations is crucial for any cryptocurrency project. Malgo’s team is well-versed in global regulatory landscapes and provides guidance to ensure compliance from the start.

5. Comprehensive Services

From ideation to deployment and beyond, Malgo offers end-to-end services. Their support extends to integrating third-party services, optimizing blockchain performance, and ensuring seamless operation.

6. Innovative Features

Malgo stays ahead by incorporating the latest trends and technologies. They offer features like multi-signature wallets, decentralized applications (dApps), and smart contracts to give your project a competitive edge.

7. Transparent Communication

Malgo’s team values clear communication throughout the development process. They keep clients informed about progress, challenges, and updates, ensuring a collaborative and efficient experience.

8. Client-Centric Approach

Every project is treated uniquely at Malgo. Their team prioritizes client satisfaction by delivering solutions that align with business goals and exceed expectations.

Choosing Malgo for cryptocurrency development in 2025 offers expertise, reliability, and a focus on clients. Supercharge Your Crypto Project with Malgo's Expert Team. From understanding your business needs to providing comprehensive post-launch support, Their team ensures your cryptocurrency project succeeds in every aspect. Whether you’re venturing into payments, blockchain applications, or innovative token solutions, Malgo is equipped to turn your vision into reality.

0 notes

Text

Types of Cryptocurrency Exchanges: Which is Right for Your Business?

The world of cryptocurrency exchange Development is booming, and let’s face it—it can be overwhelming. If you're exploring options for your business or even just curious about how these platforms work, you've come to the right place. In this guide, we'll break down the different types of cryptocurrency exchanges, their pros and cons, and which one might suit your needs best. Let’s dive in, shall we?

What Are Cryptocurrency Exchanges?

Before we get into the types, let’s clear the basics. Cryptocurrency exchanges are online platforms where users can buy, sell, and trade digital currencies like Bitcoin, Ethereum, and countless others. Think of them like the stock market, but for digital coins.

Why Should Businesses Care About Cryptocurrency Exchanges?

You might be wondering, “Why does my business need to care about crypto exchanges?” Well, accepting cryptocurrency payments or even venturing into trading can open doors to a global audience, faster transactions, and lower fees. Plus, being part of the crypto revolution? It’s like catching the internet boom in the ’90s—exciting and game-changing.

Types of Cryptocurrency Exchanges

Now, let’s get to the good stuff. Cryptocurrency exchanges come in different flavors, and choosing the right one depends on your goals. Here’s the breakdown:

1. Centralized Exchanges (CEXs)

What Are They?

Centralized exchanges are the most common type of crypto platform. These are run by companies that act as intermediaries for your transactions. Popular examples? Coinbase, Binance, and Kraken.

How Do They Work?

Think of them like banks—they store your funds and handle the trades for you. They’re user-friendly and offer a smooth experience for beginners.

Pros

Easy to Use: Perfect for newbies.

Liquidity: Tons of trading activity means your transactions are quick.

Support: Customer service is usually top-notch.

Cons

Centralized Control: Your funds are stored by the exchange, not you.

Hacks: Centralized platforms are prime targets for cyberattacks.

2. Decentralized Exchanges (DEXs)

What Are They?

Decentralized exchanges are the polar opposite of CEXs. Here, there’s no middleman; trades are peer-to-peer. Think platforms like Uniswap or PancakeSwap.

How Do They Work?

Using blockchain technology, DEXs let users trade directly from their wallets. It’s like swapping baseball cards with friends—no need for a shopkeeper.

Pros

No Middleman: You control your funds.

Privacy: No personal information is needed.

Global Access: No geographic restrictions.

Cons

Complex for Beginners: Not as user-friendly.

Lower Liquidity: Trading can be slower and pricier.

3. Hybrid Exchanges

What Are They?

As the name suggests, hybrid exchanges combine the best of both centralized and decentralized worlds. They aim to offer the user-friendliness of CEXs with the security and control of DEXs.

How Do They Work?

Hybrid exchanges use both off-chain (centralized) and on-chain (decentralized) mechanisms to manage trades.

Pros

Balance: You get a mix of security and ease of use.

Faster Transactions: Combines the speed of CEXs and the privacy of DEXs.

Cons

Still Evolving: A relatively new concept.

Limited Options: Few hybrid exchanges exist compared to CEXs or DEXs.

4. Peer-to-Peer (P2P) Exchanges

What Are They?

P2P exchanges connect buyers and sellers directly, allowing them to negotiate trades without a middleman.

How Do They Work?

Think Craigslist, but for crypto. You post what you want to sell or buy, and someone reaches out. Platforms like Paxful or LocalBitcoins are popular examples.

Pros

Custom Deals: You can negotiate terms.

Local Options: Great for cash trades or region-specific needs.

Cons

Scams: Trust is a big issue.

Limited Liquidity: Trades can be slow.

5. Instant Exchange Platforms

What Are They?

Instant exchanges focus on speed and simplicity. They allow you to swap one cryptocurrency for another in seconds without signing up or creating an account. Examples include Changelly and ShapeShift.

How Do They Work?

You specify the coin you’re swapping and the one you want. The platform handles the exchange instantly.

Pros

Quick Trades: Perfect for when you're in a rush.

No Accounts: Stay anonymous.

Cons

Higher Fees: Convenience comes at a price.

No Advanced Features: Not ideal for serious traders.

Key Features to Consider When Choosing an Exchange

Now that we’ve covered the types, let’s discuss what makes an exchange stand out. Here are some key features to consider:

Security

Is the platform secure? Look for features like two-factor authentication (2FA), encryption, and cold storage of funds.

Fees

What’s the cost of trading? Some platforms charge flat fees, while others take a percentage.

User Experience

Is the platform easy to navigate? A confusing interface can make trading a nightmare, especially for beginners.

Liquidity

High liquidity means faster and more efficient trades. Look for platforms with a large user base.

Supported Currencies

Does the exchange support the cryptocurrencies you’re interested in? Not all platforms offer a wide range of options.

Which Exchange Is Right for Your Business?

Here’s the million-dollar question: which one should you choose? It all depends on your business goals:

If You’re a Beginner

Start with a centralized exchange like Coinbase. It’s user-friendly and offers excellent customer support.

If You Value Privacy

Go for a decentralized exchange like Uniswap. It gives you full control over your funds and personal data.

If You’re All About Speed

Instant exchanges are your best bet. Platforms like Changelly make quick trades a breeze.

If You Want Full Control

Peer-to-peer exchanges let you call the shots. Just be cautious of scams.

How to Stay Safe on Cryptocurrency Exchanges

The crypto world can be a bit like the Wild West, but with the right precautions, you can stay safe. Here are some tips:

Use Strong Passwords

Don’t make it easy for hackers. Use a mix of letters, numbers, and symbols.

Enable Two-Factor Authentication

Add an extra layer of security by enabling 2FA.

Research the Exchange

Not all platforms are created equal. Read reviews and ensure the exchange has a good track record.

Avoid Public Wi-Fi

Trading on public Wi-Fi? That’s like leaving your front door wide open. Stick to secure networks.

The Future of Cryptocurrency Exchanges

The crypto world is ever-changing, and exchanges are evolving along with it. We’re seeing new trends like decentralized finance (DeFi) and tokenized assets. As blockchain technology becomes more sophisticated, we can expect even more innovative exchanges to emerge.

Final Thoughts

Choosing the right cryptocurrency exchange development isn’t just about what’s trendy—it’s about what works for your business. Whether you’re just dipping your toes into the crypto waters or planning to dive in headfirst, there’s an exchange out there for you.

So, are you ready to find your perfect match?

0 notes