#billease loan

Explore tagged Tumblr posts

Text

Kim Chiu Awes Billease Executives

The popularity of Kim Chiu thanks to her regular hosting tint at ‘It’s Showtime’ as well as her anti-hero protagonist turn in ‘Linlang’ has led to many brand deals left and right, some with her current “love team partner” Paulo Avelino. Her newest endorsement is with Billease. She is the first brand ambassador of the fintech company and will be so until the year 2025. The premier BNPL (buy now,…

View On WordPress

#billease#billease app#billease loan#billease login#billease review#Kim Chiu#kim chiu age#kim chiu and paulo avelino#kim chiu it&039;s showtime#kim chiu shows

0 notes

Text

Celebrate Billease Anniversary with Up to 12 Months Installments and Discounts! 🎉💻

Don't miss out on these amazing deals! For Billease’s Anniversary, enjoy up to 12 months of easy installments and exclusive discounts on laptops. Whether you’re after the student laptops, gaming laptops, or office laptops, now’s the perfect time to upgrade! 👉 Check this out

1 note

·

View note

Text

Good morning!

Good news guys! Closed na yung Lazpaylater ko! <3 Hindi ko alam kung marereactivate pa yun, pero okay na din na hindi, more motivation para gastusin ng tama ang pinaghirapan na pera at matuto mag-ipon knowing na baka walang asahan.

Ang bigat pa nung mga naiwan na loans, Tala yung pinakamalaki at pinakasakit ng ulo ko. Praying hard, and working hard na yung BillEase maclose ko na next month. Tapos target ko yung mga oans related sa shopee. Umuusad naman ako, tuloy tuloy lang. I pray for kalakasan ng katawan. Matatapos din to. Fighting!!!

23 notes

·

View notes

Text

tbh. ang laki ng tulong sakin ni billease like those months na wala akong work, don ako nakuha ng pang bayad sa insurance, wifi, pang gastos pang apply etc. talagang inaalagaan ko tong loan app na to.

dati nunh kinekwento pa to ng friend ko sakin na itry ko daw, takot pa ako mag try nang mga ganito kasi sa mga nababalita sa tv na pinapahiya ka kapag hindi ka nagbabayad or late ka magbayad (nale-late payment lang naman ako ng 1-2 days hahaha) hanggang sa nag sign-up na ako dati hahaha at ang unang purchase ko using billease money is dalawang mechanical keyboard wahahahaha!

ngayon, im planning to purchase an item. na magagamit ko sa small business ko. which is printer!!!! saka excited ako sumali sa mga sticker exhibit u know. kapag ganon dapat madami na akong item na nakalabas diba. like talagang fino-focus ko din yung self ko sa mga business ko kasi ito ang fallback ko if tamarin or ayaw ko na mag onsite job eh. talagang iniisip ko na ang possible ways kung paano ako kikita nang malaki kapag ito na yunh trabaho ko.

2 notes

·

View notes

Text

Billease tala loan app Philippines Income Move forward

Articles Simple to register Simple to calculate a obligations Easy to pay Billease can be an shopping online monetary agreement that allows you to order gifts without paying to them immediately. It truely does work as a pawnshop though not as trouble. The request were built with a loan calculator to determine any repayments prior to a new BNPL order. Continue reading Billease tala loan app…

View On WordPress

0 notes

Text

PESOHAUS LOAN APP — 'UULIT KA PA!?'

Hindi naman lahat ng online lending app ay ganito. Suki ako ng iba’t ibang online lending app tulad ng BILLEASE, MONEYCAT at TALA na malaking tulong sakin kapag kailangan ko ng GCASH. Ito na naman ako, magbabahagi na naman ako ng isang katangahan na hindi ko na napagpulutan ng aral! Sa ilang click! magugulo na naman agad ang pagkatao mo, at ang malala, mauuwi ka na naman sa isang mga pakiramdam…

View On WordPress

0 notes

Text

BNPL firms are raising funding round to accelerate their growth amid growing consumer demand

The buy now pay later (BNPL) industry has experienced a severe downturn in 2022, after enjoying a high-growth period over the last few years. Amid the tussle with regulators globally and declining valuations due to the current macroeconomic environment, BNPL firms have found it difficult to reach profitability. However, amid the mounting losses for these firms, the bigger trend for the sector remains positive due to the surging demand for payment options among consumers globally. Notably, the rising cost of living and inflation rates have again created the perfect environment for BNPL consumer adoption and spending.

With the demand rising among consumers, BNPL players have further started to expand their presence through strategic partnerships. Firms, such as Klarna are forging an alliance with food delivery platforms like Deliveroo, as consumers find it difficult to even fund their food purchases. Furthermore, amid these testing times for consumers, the demand for BNPL has also increased in the healthcare and education sector, where the ticket sizes are usually higher compared to other sectors. Overall, the consumer demand for BNPL is high and firms are responding to this demand by raising capital. For instance,

In August 2022, Tabby, one of the leading BNPL players in the Middle East region, announced that the firm had raised US$150 million. While the firm acknowledged that rising inflation and looming recession fears have impacted BNPL players in developed markets, the demand for BNPL in the Gulf region is expected to further grow among consumers.

The demand for BNPL is also high in the region because access to credit is scarce. According to Tabby, 20% of the population in Saudi Arabia has access to credit compared to 70% in the United States. This has supported the growth of Tabby and in H1 2022, wherein the firm recorded a growth of eight times in its active customer base, when compared to H1 2021.

The demand for Tabby is expected to further increase in the region and consequently, the firm had raised US$150 million to support the rising demand. Notably, the firm is planning to keep its focus on the core markets, including the United Arab Emirates, Saudi Arabia, and Kuwait. However, it also has plans to expand operations in Egypt. Unlike players in the developed market, the firm is also nearing profitability and therefore, has been able to raise huge capital under the current market conditions.

Notably, Tabby is not the only player in the region that has attracted investment from global players. Many other firms have raised funding rounds to further scale their operations and support the growing demand among consumers. For instance,

In August 2022, Tamara, the Saudi Arabia-based BNPL firm, announced that the firm had secured US$100 million in a Series B funding round. The firm is planning to use the capital to further drive its growth and expansion of product offerings across shopping and payments. As of August 2022, the firm had onboarded over three million users and has partnered with 4,000 merchants across the region.

The trend of raising capital is also evident in other markets, including Southeast Asia as well as Europe, where the B2B BNPL business model has grown into significant prominence in 2022. For instance,

In September 2022, BillEase, one of the leading BNPL players in the Philippines, announced that the firm had raised approximately US$20 million in a debt facility. This funding round will allow the firm to further grow and expand its loan portfolio, amid the rising demand for BNPL among consumers. In H1 2022, the firm has recorded a growth of 5 times in volumes compared to H1 2021.

In June 2022, Zilch, the United Kingdom-based BNPL firm, also announced a capital round of US$50 million, bringing its Series C investment to US$160 million. The firm is planning to use the capital to further accelerate its growth, especially in the United States. Notably, in the United States, the firm is experiencing high traction among consumers, with over 150,000 pre-registered customers.

From the short to medium-term perspective, PayNXT360 expects more global BNPL firms to raise capital to further support the growing demand among consumers. While the sector is projected to remain under pressure due to the macroeconomic condition, consumer demand is expected to keep driving the transaction value and volume for these BNPL players over the next few quarters. Furthermore, the upcoming holiday season should also assist the consumer BNPL spending.

To know more and gain a deeper understanding of the global buy now pay later market, click here.

0 notes

Text

Financial firms extend payment deadlines amid quarantine

#PHnews: Financial firms extend payment deadlines amid quarantine

MANILA – Several banks have announced their decision on payment extensions on loan products after the government placed Luzon under an enhanced community quarantine until April 12.

In an advisory, BDO said it is giving qualified credit card, auto, home, small and medium enterprise (SME), and personal loans customers with due dates of up to April 15, 2020, a 60-day payment extension.

“Please expect an e-mail and SMS from us regarding this matter,” it said.

The Philippine Savings Bank (PSBank) is giving a 30-day grace period on payments for a qualified auto loan, home and personal loan borrowers, who will be notified about this payment extension through electronic mails.

“Amidst the challenges we are all facing with Covid-19 (coronavirus disease 2019) and consistent with our Simple Lang, Maaasahan service promise, we are providing assistance to our valued customers as we believe that health and safety should be the focus of everyone during these trying times,” it said.

CIMB Bank is also extending by a month the due date for personal loan borrowers who need to pay their loans by April 1, 2020.

“Rest assured that no late fees and no additional interest will be added to your due payment,” it said in an advisory.

The Security Bank Corporation (Security Bank) said a 30-day extension will be given to credit card, home, personal, auto, business mortgage, and business express loan borrowers with no past-due balance and have due dates as of March 16, 2020.

“Meanwhile, new product applications such as loans will but put on hold all scheduled releases will be appropriately re-scheduled. We will provide updates on new scheduling in the coming days. For everyone's safety, please refrain from going to the branches without a confirmed releasing schedule,” it said.

The bank is also waiving the transaction fees for EGiveCash and automated teller machine (ATM) fees for Security Bank ATM cardholders nationwide even if they withdraw from other banks’ machines.

“We will continue to update our Facebook page: fb.com/SecurityBank for additional services that we will offer to our clients during this period,” it added.

First Digital Finance Corporation (FDFC) said its financial technology firm, Billease, is extending installment payment dues for free and will waive fees to those who have already received their payment notification prior to the enhanced community quarantine (ECQ) announcement.

The payment leeway is meant for qualified customers with dates from March 17 to April 12, although it was not specified until when the extension period will be.

“Likewise, the company is urging customers to practice social distancing and use online banking and online payment channels such as Coins.ph and GCash for those who still wish to pay their dues,” the company said.

FDFC chief executive officer Georg Steiger said their customers may still avail loans and use installment payment to select merchants like Lazada even during the ECQ period and assured clients that the company’s support teams are on duty from 9 a.m. to 6 p.m. from Monday to Saturday. (PNA)

***

References:

* Philippine News Agency. "Financial firms extend payment deadlines amid quarantine." Philippine News Agency. https://www.pna.gov.ph/articles/1097016 (accessed March 19, 2020 at 12:37AM UTC+14).

* Philippine News Agency. "Financial firms extend payment deadlines amid quarantine." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1097016 (archived).

0 notes

Text

Madami akong natutunan sa experience na to. AS IN.

1. Don’t judge.

-hindi natin alam kung bakit naging ganon ang desisyon nung tao kaya lumobo ang loans (UNLESS SUGAL EKIS YAN SAKEN)

In my case, natakot ako sa overdue, sa bad record. Mas gusto ko pa magbayad ng malaking interes kesa magkaroon ako ng late record. BIGGEST MISTAKE EVER. Top katangahan pala yan. At the end of the day, mas nakakatakot pala if lahat ng pwedeng utangan inutangan mo tapos sabay sabay nag overdue SAKET BHIE :’(

2. It was a very bad cycle of: ayaw ko magkalate record, bayad na lang interes, hindi ako hihiram sa friends ko, pag may extra ako reward ko sarili ko. HAY. So hindi ako nakaahon sa loan dahil kada sahod reward, tapos ANG LAKI PA NUNG INTERES SHUTA. So ayun, lumobo ng lumobo. Umabot sa point na sobrang nakakadepress, ang ginawa kong strategy para di ako mamotivate nakafocus lang ako sa dues ko sa susunod na buwan ganon lang. Hindi ko tinitignan yung total, grabe ang laki na pala. Naawa ako sa sarili ko sa part na yan. Sino may kasalanan? Ako. Sino ang nagsuffer? Ako.

3. STOP THE BLEEDING. Pag narealize mo na na nababaon ka na, wag na pumikit! Wag matakot sa bad record, lalong wag matatakot sa mga nagtetext.

In my experience, Tala and BillEase ang very very fair. Cashalo okay but makulit, Shopee and Laz magmiss payment ka lang ban na agad sayang naman. Yung iba? Illegal na yon. Mga digido, juanhand etc, PAPATAYIN KA SA INTERES. I guess ito yung loan shark na tinatawag. Sobrang unfair talaga nila at wag mo na asahan na magiging fair sila dahil hindi sila regulated. Pag nandun ka sa point na walang wala ka na, wala na makain (been there) kakapit ka talaga sa patalim. Kung ganito rin lang? Mas okay pa mangutang sa tindahan. Nakakahiya man pero at least di ka madedepress sa interes at penalties nila sayo.

4. Forgive yourself. Pag nagising ka na, pagnilayan mo kung san ka nagkamali, bakit naging ganito yung mga desisyon mo, ano sana yung inayos mo. Forgive. Forgive. Forgive. Do better next time. Since tapos na phase na tinanggap natin ang pagkakamali, next part is solve the problem and STAY CONSISTENT. Mahaba itong part na to pero kumapit ka. Matatapos din to.

5. Unahin yung mga illegal hahaha nakakatawa pero oo unahin yun kasi malaki interes nila eh, also unreasonable sila. Makipag coordinate sa iba like tala and billease, if may loan sa bank or cc makipagcoordinate din. Kasi madalas nagooffer sila ng option. Wag sa collecting agencies, sa bank mismo. If possible na magrefinance, go. Make sure na pag nagrefinance sa mababang interes ha.

6. Pray. If di naniniwala sa ganyan, okay sige mag journal. Mahirap magshare ng ganito sa friend. Basta ilabas mo yan, pag hindi, high chance na madepress at mademotivate. Stay positive. Mind over matter. Tandaan na walang nakukulong sa utang. Bad record yes sure yan pero naaayos yan. Ang nakukulong lang sa estafa yung nagpapanggap na may business at naglikom ng pera from investors tsaka yung mga tumatalbok na cheke.

Kaya mo yan!!! 💪🏼💪🏼💪🏼

14 notes

·

View notes

Text

So ito na nga ang chika ano. Tina-try ko i-open yung Twitter account ko kaso hindi ko na ma-open HAHAHAHA! 2-mos na ata ako naka deactivate (?) alam ko 30-days lang dapat na naka deact eh (?) but anyway, makiki-chismis lang naman ako sa friends kong madadaldal don HAHAHAHHA

Ngayon, kino-consider ko na mag apply sa onsite bhi3! Sinabi ko don sa friend ko bhi3 na parang gusto ko ulit mag on-site. Kitang-kita naman sa posts ko na INIP NA INIP NA AKO DIBA HAHAHHAHAHAHAHHAHAHAHHAHA! And sabi ko kay Lester na namimiss ko na makipag socialize :( ayon sabi ng friend ko, "akala ko ba ayaw mo na mag office?" sabi ko naman, PEOPLE CHANGE hahahahahhahahahaha! Totoo naman eh. It means, we are growing lol

Pero it depends pa rin naman. Kasi nag aapply ako sa WFH jobs and on-site jobs. Kung san nalang palarin. Dahil ang bills po natin walang emotion. Hindi nadadaan sa awa :( U know. Saka gusto ko na bumili ng gaming chair :(

Atsaka pinagbabayaran ko na yung loan ko sa Billease and Spay Later HAHAHHAHAHAHA! Waiting nalang ako mag April para sa Pru Life ko. Kailangan ko lang ng work na din para hindi ko masagad yung funds ko :( Bukod sa need ko ng money to pay bills. Need ko din ng money para sa mga future endeavors ko and sa house & lot :(

Atsaka may Puerto Galera pa kami nung friend ko mars!!!!!!! Matagal na naka plan itu at gusto ko na din mamasyal sa malayo. Wala na nga work, may gana pang mag bakasyon ano? HAHAHAHA! Saka huy mag bbday na ako sa April. Pangit naman kung walang work :( :(

0 notes

Text

Happy Sahod day!

Liit ng sinahod ko ubos na agad haha. Bumili ako ng gatas ni baby, yung birch tree na 1800g. Tetestingin ko kung ilan yung itatagal. Bali sumahod ako ng 3700, bumili ako ng gatas na 790, nagbayad ako ng 1835 na loan, tapos 1200 na lang natira sakin. Pagkakasyahin namin for 10 days. Hay. Di ko alam kung magkano pa yung pera na hawak ng partner ko ngayon. At kailangan ko pa ng pamasahe paluwas ng 22. Kasya na ba yung 1k? So 200 yung pagkakasyahin namin for 10 days? Grabe na to. Jesus take the wheel.

Good news kasi nakabawas na ulit ako ng isang loan. 4 yung loan ko sa SLoan, naclose ko na yung isa :) 3 more to go!

Bad news is, overdue na yung tatlo, kahit yung spaylater ko magooverdue na din. Wala pang bayad yung motor this month. 3 months na walang bayad yung insurance ni baby at phone ko. Magbabayaran na rin yung insurance ko next month. Over due na rin yung BillEase ko at 3 loan sa ggives. Bali lahat naman yun nakapagpartial payment ako so may movement naman sa account kaso siyempre hindi enough para mabayaran yung balance.

Nakakatawa nga eh kailangan ko ng 70k next sahudan para maging on-time yung payments ko haha. If may 70k ako next month, marami akong loans na macclose. Pero san naman ako kukuha nun?

Praying for more clients. Tiis lang. Makakaraos din. Para sa nakakabasa ng journey ko simula nung nagpost ako about sa utang ko, may pag-asa pa. Haha di ako nawawalan ng pag-asa. Back to work!

11 notes

·

View notes

Text

Life update | 8.24.2023

Sahod na ulit bukas. Hindi ko ulit nameet yung targets ko this month kasi ang daming nangyari. Hay. Sobrang nakakalungkot pero kailangan kong tanggapin na ginagawa ko naman talaga yung best ko. May 2 days na sumakit yung tiyan ko this month, 2 days na tinrangkaso ako, nag-asikaso ako ng TV tsaka nung mga gamit na kailangan para sa materyales ng cabinet. Bukas onti na naman work ko kasi magpapacheck up naman ako. Half pa lang sa target ko ang naitatrabaho ko, at 24th na. Clearly hindi na aabot pero susubukan ko pa rin sa abot ng makakaya ko. Target ko sanang sahod bukas 10k pero naging 7k na lang. Kulang na kulang pa para sa pambayad sa 2 months na overdue nung motor. Sasahod pa naman ulit ako sa katapusan. Hay. Sobrang bagal pero at least my usad.

Next sahod naman icclose ko na yung BillEase tsaka yung Lazpay. Hindi ko alam kung ano na mangyayari dun sa iba kong overdue loan, pero working on it. :( :)

6 notes

·

View notes

Text

Sahod day!

Gusto kong sabihing Happy Sahod Day pero haha di ko magawang ngumiti kasi kulang yung mga pambayad ko. Nagbayad ako ng BillEase kanina 5k, kaso yung penalties ko 2.7k na. Ouch, bigat kasi parang half lang yung nabawas ko. Well, on the bright side, at least nabawasan. STILL A LONG WAY TO GO, but I'm moving forward. Hindi ko na dinagdagan tong mga loan na to simula nung tinanggap ko na na lalo lang ako malulubog kakatapal ko. Yung next sahod ko sa motor ko naman ibabayad dahil 2 months na akong overdue don. So meaning, para sa aking ibang loans sa September sahudan na ulit ako makakapagstart na magmove forward.

Ang target ko maclose ko na yung Lazpaylater next month kasi 1k na lang yun. Ang mabigat lang kasi sabay sabay yung malalaking due, pero kung tutuusin sabay sabay din yung tapos nila halos, and if everything stays on track, by December mas maganda na yung financial standing ko. Hoping for the best! Work work work!

6 notes

·

View notes

Text

Journal | 7.7.2023 10:26 AM

Happy sahod day! Actually di ako super saya kasi siyempre kulang pa rin yung mga pambayad ko, pero sobrang nagpapasalamat ako na kahit papaano umuusad naman. Hindi pa rin sapat yung mga pambayad ko sa hulugan. Marami pa rin akong magiging overdue this month pero ayaw ko na dagdagan yung utang ko. Pag humiram ako ulit para makaiwas sa overdue walang mangyayari sakin. PROGRESS: BillEase: Paid 4/6 (ito ang priority ko), Tala and Maya - pakli mode pa ako dito, Ggives, SLoan, SpayLater (ang dami pa nito ayaw ko na lang magtalk), Lazpaylater (last 1k yey! next month laya na ako dito), BPI credit card (ito yung last ko babayaran sa lahat, maintaining lang nababayaran ko kasi yun lang talaga yung kaya), BPI loan - kanina nakabayad na ulit ako ng isa, mahaba haba pa to pero laban. Phone - matatapos na to sa december pero 3 months na ako hindi nakakabayad hay. Motor - makakahulog ata ako this month kasi may parating pa akong sahod sana sana. Makakaraos din. Praying na this year makabayad na para next naman ibalik yung mga hiniram kong pera kay baby at kay mama para mabayaran yang mga utang na yan hay. Natatawa na lang ako parang nagtatapon ng hard earned money.

4 notes

·

View notes

Text

SELF-REFLECTION // 02.2023

What are your three biggest goals?

To be debt-free

Ang dami kong utang nakakaiyak, pero gaya ng sabi ko kasalanan ko to. Dalhin may bay na ako, mananatili akong positive. This too shall pass. Kaya to nangyayari kasi kulang ako sa disiplina.

Gcredit. BillEase. Spaylater. Sloan. BPI Credit Card. BPI Personal Loan. Tala. Lazpay. Maya Credit. Motortrade.

Lumobo na yung utang ko, dahil na rin sa pagiging magastos ko kaya ganito. Pero sa totoo lang kaya naman eh, yun nga lang kailangan ng disiplina. Iba pa yung utang ko sa ipon ko, kay baby, at kay mama. Claiming na makabawas ako ng 80% this year. Hopefully yung motor na lang maiwan.

2. Save money

Goal ko is maibalik yung pera ni baby at madagdagan yun kasama na yung mga money na dapat nakalaan for her. Gusto ko rin mabuo yung emergency fund ko pero alam ko mahirap pa sa ngayon, kahit mabuo man lang yung pera ni baby malaking bagay.

3. Increase income

Currently planning to apply to other online jobs pero hindi ko alam kung ako sa conviction at parang nacocold feet ako. Yung sa financial advisor parang wala pa rin akong tiwala na kaya ko pero feeling ko inooverthink ko lang din. Etong sa rarejob sabi ko hindi ko rin kaya dati, utang lang nagpush sakin hahha.

What did you do today to be one step closer to achieving them?

I worked today. Hindi sapat pero I'm glad I did. Hindi tulad nung mga nakaraang buwan, onting kibot no work at all. Pero ngayon I'm trying naman and I acknowledge that. May mga factors lang din talaga na nakapekto sa pagkumpleto ang isang 8 hr shift.

What is currently not helping you and needs to be removed from the list?

EXCUSES. Yun lang. Ang dami kong dahilan. First, kailangan gumising ng maaga - ang dami kong excuse na kesyo puyat ganyan. Laban inahan. Second, katamaran or mga ibang bagay na gustong gawin pero hindi naman importante. Third, social media - kailangan ko pa to bawasan and monitor ang usage.

Here's to a more productive 2023.

1 note

·

View note

Photo

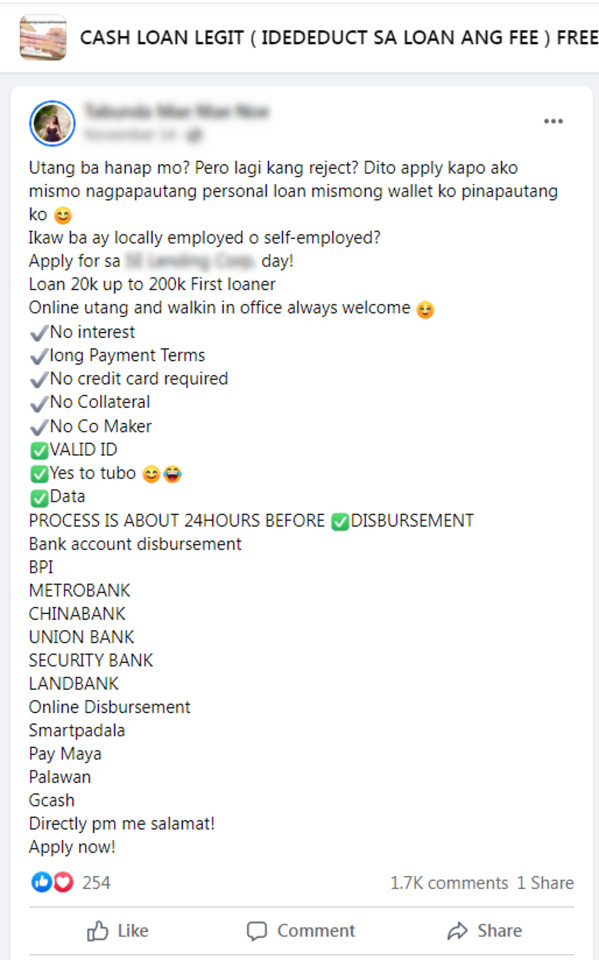

#OneNETnewsInvestigates: Loan Scams in the PH on Social Media takes its toll for a Miscellaneous Fee of Nonsense [EXCLUSIVE]

DUMAGUETE, NEGROS ORIENTAL -- Getting your personal and emergency needs with your trusted and legitimate lender organization per examples of BillEase, Tala, Tonik, Unacash and CIMB Bank. Social media is almost everywhere what you have seen in local and national advertisement posts via Facebook and Telegram.

Our exclusive undercover investigation from our news team of OneNETnews, we cover some of the worst scammers that we offer a requested loan amount in 3rd parties so you don't really have to online.

Between the both worlds in a strictest vs. simplified requirements... Some of them are totally legit, while scammers in unlicensed online lenders are not. Additionally, qualified registrants for Facebook and Telegram users based from a system of free advertisement group posts, all borrowers that you owe a current loan amount needs to pay you upfront and was subjected for an approval in as early within a few days or less. Disbursement amounts can be done in full via electronic online wallets like GCash, Maya (formerly PayMaya) and Coins.PH.

Loans are kinda like a temporal cash for your Personal and Emergency needs, as well as specific expenses. There a lot of benefits such as little to no interest rates, longer payment terms and many more. But, there is a catch... Loan sharks in exchange to public and private harassment, kills you over time in a coming months with a ton of violent rampage of yelling, anger, murder and illegal possession of firearms & shotguns, making it hard for a borrower to come up with enough funds to repay their loan per month overdue amount. The Securities and Exchange Commission (SEC) must strictly regulate under the Philippine law.

Simplified loan requirements on social media between Facebook and Telegram are made easier as scammers, even nearly legitimate by offering PHP20,000 to PHP200,000, along with your scheduled monthly payment terms ranging from 24 months to 48 months (2-4yrs.) or more.

According to Atty. Gaby Concepcion of "Unang Hirit's Kapuso sa Batas" segment of GMA News, the social media lender will not receive any kind of loan amount in an unlicensed 3rd party lender which leads to a total red flag and never received on time. Loan scams are a type of advance and miscellaneous fees is an absolutely dangerous fraud meaning the victim can only be committed to yourself when the money that you pay for goes into a sand dust of none. In short, it's a bit of cesspool money to waste. However, if the 3rd party unlicensed lender declares a legitimate loan payer to your borrower's request the said loan approval, it will safely disburse your loan money thru online e-wallets in the Philippines.

Loan scammer(s) and optional harassments can face a lot of charges in a physical world of Republic Act #10175 or Cybercrime Prevention Act of 2012, Republic Act #10173 or Data Privacy Act of 2012 and Article 282, 286 and/or 287: Section 3 of the Revised Penal Code; including Facebook's Terms of Service: Section 4.2 and Community Standards: Section 1.5, and followed by an additional violation of Memorandum Circular #18: Series of 2019 or Prohibition on Unfair Debt Collection Practices of Financing and Lending Companies issued by the SEC. Violators may face a 2-month suspension per unlicensed social media lender with a PHP1M fine, a total revocation for Certificate of Authority to operate as a Financing/Lending Company or both.

The National Bureau of Investigation (NBI), Philippine National Police - Anti-Cybercrime Group (PNP-ACG), Mynt Fintech Innovations Inc. (GCash-MFI), Maya Bank Inc. (MBI, former e-wallet brand of PayMaya), Coins.PH (a Crypto-based e-wallet) and Meta Platforms Inc. (MPI-FB) are working together to combat these loan scammers and other illegal activities online, in connection by asking a fee of nonsense. Free advertisers in 3rd party loan advert posts without a consent of transparency, legitimacy and trust, including a repetitious spam and scams are subject to a permanent suspension on social medias (including the evasive use of VPN or Virtual Private Network) without a parole.

Lender organization officials told OneNETnews, you can only loan in any specific amount, along with your complete requirements and a purpose of the loan at the authorized online lending apps and physical banks instead like the examples of CIMB Bank and Union Bank.

Mostly sometimes, if it's good to be true when deducted a fee per 3rd party loan amount or anything nonsense to the public, you will fall automatically a bad payer victim whether its free or paid fee regardless of its credit history. Per conclusion of this undercover investigation on our digital news team, it will not be trusted this much and it was a total loan scam. Your dreams will be crushed for your loan benefits in an instant without a repayment.

STOCK PHOTO for REPRESENTATION: Google Images

SOURCE: *https://www.facebook.com/groups/1080500259136815/posts/1524188301434673 [Referenced FB Group Posts #1 from a Concealed Loan Scammer Suspect] *https://www.facebook.com/groups/3194453137464362/posts/3413230465586627 [Referenced FB Group Posts #2 from a Concealed Loan Scammer Suspect] *https://www.facebook.com/groups/3194453137464362/posts/3419795594930114 [Referenced FB Group Posts #3 from a Concealed Loan Scammer Suspect] *https://www.facebook.com/groups/3194453137464362/posts/3419924451583895 [Referenced FB Group Posts #4f from a Concealed Loan Scammer Suspect] *https://www.youtube.com/watch?v=vRUU9G4orLA [Referenced YT Video from GMA Public Affairs] *https://transparency.fb.com/policies/community-standards/fraud-deception/ *https://www.facebook.com/legal/terms *https://lawphil.net/statutes/repacts/ra2012/ra_10173_2012.html *https://lawphil.net/statutes/repacts/ra2012/ra_10175_2012.html *https://lawphil.net/statutes/acts/act_3815_1930.html and *https://www.sec.gov.ph/wp-content/uploads/2019/10/2019MCNo18.pdf

-- OneNETnews Team

#national news#loan scams#scam alert#scams#exclusive#first and exclusive#issue#online lending#illegal#awareness#social media#investigates#investigative journalism#cybercrime#crime stoppers#loan harassment#OnlyOnOneNETnews#OneNETnews

0 notes