#bharat petroleum

Explore tagged Tumblr posts

Text

https://www.bharatpetroleum.in/

Explore Bharat Petroleum's extensive network of over 20,000 fuel stations across India, serving 20 million customers daily. From quality fuel to SAP certification and cutting-edge research, BPCL is committed to energizing your journeys. Visit now to learn more and join the millions who trust BPCL for their fuel needs.

#bharat petroleum near me#petrol price in Mumbai#bpcl smartfleet#petrol price up today#diesel price in up today#bpcl full form#petrol pump near me

2 notes

·

View notes

Text

From Search to Submission: How to Bid on Bharat Electronics Limited and Bharat Petroleum Corporation Limited Tenders Effectively

Securing Bharat Electronics Limited (BEL) and Bharat Petroleum Corporation Limited (BPCL) tenders can be highly beneficial for your business. To increase your chances of success, regularly monitor tender portals, thoroughly review tender documents, and ensure your bids are well-structured, addressing both technical and financial requirements. Prepare necessary documentation, meet all eligibility criteria, and ensure compliance with submission deadlines. Consulting with a tender advisor can also help streamline the process and improve your bid quality. By following these steps and focusing on accurate, competitive bids, you can maximize your potential to secure valuable government contracts. For more details, visit: From Search to Submission: How to Bid on Bharat Electronics Limited and Bharat Petroleum Corporation Limited Tenders Effectively

1 note

·

View note

Text

0 notes

Text

Major Commercial LPG Providers in India

While households and individuals need Liquified Petroleum Gas or LPG cylinders at home for cooking and related purposes, there’re also commercial establishments that require the facility.

These commercial establishments include hotels, restaurants and canteens as well as industries of various sizes. While some of these commercial establishments such as restaurants use LPG cylinders for preparing food, others use them for use with Oxyacetylene and other gases for welding or running certain types of machinery.

Thankfully, India has five major commercial LPG providers located across the country. These large corporations provide commercial-use LPG cylinders at competitive rates to consumers. Actually, there’s a slight difference in the commercial LPG cylinders that these companies supply for domestic or household consumption and the ones provided to commercial establishments.

Therefore, let’s first understand the basic differences between the LPG gas cylinders provided for domestic and commercial uses.

Differences Between LPG Gas Cylinders for Domestic & Commercial Use

There are several differences between an LPG cylinder for commercial use and those for households. However, the contents of both remain the same, which is Liquified Petroleum Gas or LPG.

Remember, LPG should not be mistaken for Liquified Natural Gas or LNG which is also sold in cylinders in some parts of India and usually piped to homes and commercial establishments in megacities including Mumbai and New Delhi, among others.

To begin with, LPG cylinders for commercial use come in two sizes: 19kg and 47.5kg. In some places, you might get an LPG gas cylinder for commercial use whose weight would vary slightly from the ones I mention here. However, this difference would generally be less than 1kg per cylinder.

The second prominent difference lies in the appearance of commercial LPG cylinders. While those for domestic uses are painted fully red, their commercial variants usually carry two or more colors. For example, a commercial LPG cylinder from Bharat Gas will be painted red from the middle to bottom while its topside will be yellow. Other companies use a combination of blue and red or red and white and so on.

The third and perhaps the most significant difference is the pricing. Commercial use LPG cylinders cost more than their domestic variants. The price of a commercial LPG cylinder is dictated by global crude oil prices and their fluctuations.

Hence, manufacturers price them to buffer against any such fluctuations in crude oil rates. This means, the price of a commercial LPG cylinder is always higher than their domestic variants. Furthermore, domestic LPG cylinders attract subsidies from the Indian government, which keeps prices low. There’re no subsidies for commercial LPG cylinders.

While you can get a domestic LPG connection from Bharat Gas and others free of cost under the Pradhan Mantri Ujwala Yojana, there are no such schemes for free commercial LPG cylinders.

And finally, its easier to get a domestic LPG cylinder refill because companies such as Bharat Gas have a network of tens of thousands of local distributors. Unfortunately, not many distributors stock and sell refills for commercial LPG cylinders. This scenario however is changing rapidly as more and more LPG distributors across India are witnessing a surge in demand for commercial LPG cylinders too.

Usually, domestic LPG consumers can get home delivery of their refill cylinder while commercial LPG users might often have to fetch one from their nearest dealership or the company depot.

Top Commercial LPG Providers in India

Now, if you wish to avail a commercial LPG connection in India, there’re as many as five major providers you could choose from. Earlier, domestic and commercial LPG cylinders were a state-owned monopoly.

Thanks to the liberalization of the Indian economy over the last 10 years, a few private sector players are now also actively engaged in this field. This has made the domestic and commercial LPG market in India more competitive, with consumers getting better service as companies vie for a larger slice of the market share.

Here are the five main players in India’s commercial LPG cylinder industry.

Bharat Gas

Bharat Gas is the brand name for LPG cylinders and service of the Maharatna company, Bharat Petroleum Corporation Ltd (BPCL). As a matter of fact, Bharat Gas also holds the title as being India’s first and oldest LPG supplier.

The company began providing LPG cylinders in 1955 under the erstwhile brand, Burmah Shell and commonly called Burshane. In those days, there were only two LPG suppliers in India with Burmah Shell (Bharat Gas) holding one side of the market and Esso, a brand of ExxonMobil and processed by Indian Oil domestically. Esso was eventually bought over in India by the Central government.

Indane

Indane is the brand name of the second oldest and largest supplier of LPG gas cylinders in the country, Indian Oil Corporation or IOCL. The company is owned by the Indian government and also ranks among its Maharatna portfolio. Indane supplies both, domestic and commercial LPG to consumers across the country. It has an enviable network of distributors across India.

Indane is the successor of the earlier foreign brand of LPG cylinders that were sold under the brand name Esso. Upon nationalization by the Indian government, Esso became part of Indane. Though Esso gas is now extinct in India, bulk of its consumers were successfully migrated to Indane, Hindustan Petroleum, and Bharat Gas.

Hindustan Petroleum

Another Maharatna company, Hindustan Petroleum Corporation Ltd or HPCL entered the LPG market in 1979. Hindustan Petroleum took over a company known as Kosan and took over part of the operations of the erstwhile Esso along with Indian Oil.

HPs entry in the commercial and domestic market was much awaited by consumers since an acute shortage of LPG cylinders was being witnessed across India and people in some areas had to wait for as long as a fortnight to get a refill. This has led to a flourishing black market in the domestic and commercial LPG refill market. HPs entry into the market effectively ended the black market.

Supergas

Supergas is a relatively new player in the commercial and domestic LPG cylinder market in India. The company began operations in 1996 with a small presence in Gujarat state and since has spread to various other states in the country.

Supergas also took over Maha Gas and has been building new facilities in Maharashtra and Gujarat among other places. Supergas is owned by SHV Energy Pvt. Ltd. If you live in an area covered by Supergas, explore the various kinds of commercial and domestic gas connections they offer. As a private sector player in the market, this company has made rapid strides and captured a sizeable chunk of consumers.

Difference in LPG and LNG

In India, there’s a lot of talk about piped gas replacing the traditional and decades-old system of LPG cylinders for domestic and commercial uses. Indeed, the shift from gas cylinders to piped gas is occurring, albeit at a slower pace than expected. Primarily, the metros of India including megacities, and Tier-1 and Tier-2 cities are the first ones that would be seeing piped gas. That’s because of the high demand which makes it easier to build gas supply networks compared to rural parts where the population lives over a scattered area.

LPG or Liquified Petroleum Gas is sold in cylinders while that piped to your home would be Liquified Natural Gas. The two are totally different and come from different sources. LNG is said to be a green gas and hence, environment friendly. Using LNG could help India reduce its global carbon footprint. LPG on the other hand is a combination of two gases, Propane and Butane. LNG is generally Methane and some trace gases. Worldwide, there is a significant acceptance of LNG as the awareness of environmental preservation grows.

Wrap Up

As we can see, there are four main providers of LPG cylinders for commercial users in India. These four providers help fuel Indian restaurants, canteens, hotels, hospitals, military installations, and other businesses.

Three of the providers are Maharatna companies owned by the Indian government while one is a private sector enterprise. Interestingly, we might not see any newcomers in the LPG commercial and domestic cylinder business anymore.

This is due to the growing use of LNG and piped gas in India. Furthermore, India is buying bulk LNG through long-term deals with Qatar and the US. More deals with other major LNG producers, especially Iran and Russia can be expected in the near future.

#lpg gas#lpgcylinder#bharat petroleum corporation limited fortune 500 oil company#bharat#oil and gas

1 note

·

View note

Text

Tata and BPCL collaborate to add 7000 Public Charging Stations across India

Bharat Petroleum Corporation Limited (BPCL), a Fortune 500 and a Fully Integrated Maharatna Energy Company and Tata Passenger Electric Mobility Ltd. (TPEM), known for pioneering India’s electric vehicle revolution, have signed an MOU to collaborate in establishing public charging stations across India. The collaboration will leverage BPCL’s widespread fuel stations network and TPEM’s insights…

View On WordPress

0 notes

Text

The Inspiring Journey of Krishnakumar Gopalan: From Humble Beginning to Business Success- BPCL Chairman

Krishnakumar Gopalan’s journey from humble beginnings to business success serves as a testament to the power of persistence and resilience. His story inspires individuals from all walks of life to pursue their dreams with unwavering determination, demonstrating that with hard work and vision, anything is attainable. He is an Electrical Engineer from NIT (erstwhile Regional Engineering College),…

View On WordPress

1 note

·

View note

Text

Medhaavi Engineering Scholarship Program 2023-24: last date, online apply

The Medhaavi Engineering Scholarship Program 2023-24 is a remarkable Corporate Social Responsibility (CSR) initiative by Bharat Petroleum Corporation Limited (BPCL). This program is designed to provide invaluable financial support to underprivileged students pursuing undergraduate engineering degrees at 20 prestigious National Institutes of Technology (NITs) across India. The primary goal is to…

View On WordPress

#Bharat Petroleum Engineering Scholarship#BPCL Medhaavi Engineering Scholarship#Medhaavi Engineering Scholarship Program 2023-24

0 notes

Text

[ad_1] The Ministry of Petroleum & Natural Gas is concerned with exploration and production of Oil & Natural Gas, refining, distribution and marketing, import, export and conservation of petroleum products. Oil and Gas being the important import for our economy, many initiatives have been taken by the Ministry for increasing production and exploitation of all domestic petroleum resources to address the priorities like Energy Access, Energy Efficiency, Energy Sustainability and Energy Security. The progress of various schemes undertaken by Ministry in last one year is shares as follows: PRADHAN MANTRI UJJWALA YOJANA (PMUY) Ujjwala is today a 10.33 crore strong family Since the inception of the Scheme about 222 crore LPG refills have been delivered to the PMUY households. Also about 13 lakh refills are being taken daily.A targeted subsidy of Rs. 300/cylinder is being given to all Ujjwala beneficiaries.Government’s efforts have led to uptick in LPG consumption by Ujjwala families. Per Capita Consumption, terms of number of 14.2 kg domestic LPG cylinder, has gone up from 3.01 in 2019-20 to 3.95 in 2023-24. In current year, which is still under progress, the PCC (per capita consumption) has reached 4.34 (Pro-rata basis refills till October 2024). LPG COVERAGE Since April 2014, the number of LPG connections have gone up from 14.52 crores to 32.83 crores (as on 01.11.2024), a growth of above 100 %.As on 01.11.2024, approx. 30.43 crore LPG consumers are enrolled under the PAHAL scheme. Till date, more than 1.14 crore customers have given up their LPG subsidy under ‘GiveltUp’ campaign.Since 2014, LPG Distributors have increased from 13,896 to 25,532 as on 01.11.2024 enhancing LPG access and availability. It is worth mentioning that more than 90 % of new distributors are catering to rural areas. FACILITIES Under Promotion of Digital Payment infrastructure at Retail Outlets (ROs), as on 01.12.2024, 1,03,224 e-wallet facilities have been provided at 84,203 ROs across the country. 84,203 ROs have been enabled with BHIM UPI.Under Swachchh Bharat Mission, toilet facilities are ensured at every retail outlets. As on 01.12.2024, 83618 ROs have toilet facility which includes 66026 ROs having separate toilet facility for male and female.As on 01.12.2024, Oil Marketing Companies (OMCs) have commissioned total 3,097 Door to Door Delivery (DDD) Bowsers through Dealers and Start-ups.Electric Vehicle Charging Stations (EVCS) are being provided at Oil Marketing Companies (OMCs) ROs. As on 01.12.2024, OMCs have installed 17,939 EV charging stations and 206 battery swapping Station across India. NATURAL GAS PIPELINES The length of operational Natural Gas Pipeline in the country has increased from 15,340 Km in 2014 to 24,945 Kms as on 30.09.2024. Further, development of about 10,805 Kms Natural Gas Pipeline is under execution. With the completion of these pipelines authorized by PNGRB/GoI, the national gas grid would be completed and would connect all major demand and supply centre in India. This would ensure easy availability of natural gas across all regions and also help to achieve uniform economic and social progress. UNIFIED PIPELINE TARIFF The Petroleum and Natural Gas Regulatory Board (“PNGRB”) has amended PNGRB (Determination of Natural Gas Pipeline Tariff) Regulations to incorporate the regulations pertaining to Unified Tariff for natural gas pipelines with a mission of “One Nation, One Grid and One tariff”.PNGRB has notified a levelized Unified Tariff of Rs.80.97/MMBTU w.e.f. 01.07.2024 and created three tariff zones for Unified Tariff, where the first zone is up to a distance of 300 kms from gas source, second zone is 300 – 1200 kms and third zone is beyond 1200 kms.The national gas grid covers all the interconnected pipeline networks owned and operated by entities viz. Indian Oil Corporation Limited, Oil and Natural Gas Corporation Limited, GAIL (India) Limited, Pipeline Infrastructure Limited,

Gujarat State Petronet Limited, Gujarat Gas Limited, Reliance Gas Pipelines Limited, GSPL India Gasnet Limited and GSPL India Transco Limited.The reform will specially benefit the consumers located in the far-flung areas where currently the additive tariff is applicable and facilitate development of gas markets and vision of government to increase the gas utilisation in the country. CITY GAS DISTRIBUTION (CGD) COVERAGE PNGRB has authorized 307 Geographical Areas for development of CGD infrastructure with a potential coverage of about 100% of country’s area and 100 % of the population. As on 30.09.2024, the total number of PNG (D) connections and CNG Stations in the country was 1.36 Cr and 7259, respectively. SATAT INITIATIVES SATAT initiative was launched on 1st October 2018, to promote an ecosystem for production and utilization of Compressed Bio Gas (CBG).· As on 30.11.2024, 80 CBG plants have been commissioned and 72 CBG plants are at various stages of construction. · The Ministry has issued guidelines for synchronization of CBG with CNG in CGD Network; · A scheme for the development of pipeline infrastructure (DPI) for injection of CBG into the City Gas Distribution (CGD) network has been launchedto provide financial support for extending pipeline connectivity from CBG plant to the city gas distribution grid. · Online portal for receiving application under DPI Scheme has been activated w.e.f. 1st September, 2024. · Ministry has also issued detailed guidelines for procurement of Biomass Aggregation Machinery (BAM) on 2nd February 2024. The Scheme envisages financial support to the CBG producers for procuring Biomass Aggregation Machineries. · Government has announced phase wise mandatory selling of CBG in CNG (T) and PNG (D) segment of CGD network to promote the production and utilization of CBG.CBG Obligation (CBO) is presently voluntary till FY 2024-2025 and mandatory selling obligation would start from FY 2025-26. CBO shall be kept as 1%, 3% and 4% of total CNG/PNG consumption for FY 2025-26, 2026-27 and 2027-28 respectively. From 2028-29 onwards CBO will be 5%. REVIEW DOMESTIC GAS ALLOCATION FOR CGD ENTITIES To cater the growing demand of CGD sector and to protect the common people from price volatility, the Government has released new CGD sector Gas allocation Guidelines wherein the allocation of PNG (Domestic) segment was increased (i.e. 105% of PNGD consumption in the previous quarter) and balance available volume to be supplied to CNG (T) segment on prorate basis.The revised methodology has been helpful for the CGD entity as the lag between the allocation and reference period has been reduced from average of 6 months to average of 3 months which reflects a more realistic consumption data. DOMESTIC GAS PRICING Revised guidelines have been issued in April 2023 for gas produced from nomination fields of ONGC/OIL, New Exploration Licensing Policy (NELP) blocks and pre-NELP blocks, where Production Sharing Contract (PSC) provides for Government’s approval of prices.The price of such natural gas shall be 10% of the monthly average of Indian Crude Basket and shall be notified on a monthly basis and shall have a floor and a ceiling.The reduced gas price shall positively impact the domestic, Fertilizer and power consumers. BIO FUELS AND ETHANOL BLENDING Under Ethanol Blended Petrol (EBP) Programme, supplies of ethanol has increased from 38 crore litres in Ethanol Supply Year (ESY) 2013-14 to 707.40 crore litres in ESY 2023-24, thereby achieving an average blending of 14.60% ethanol in Petrol. For the ongoing ESY (2024-2025), Ethanol blending have further improved to 16.23% as on 29.12.2024. The Public Sector OMCs have started dispensing E20 petrol (20% ethanol in petrol) at more than 17,400 retail outlets across the country. In the last ten years, EBP programme has translated into forex impact of over Rs.1,08,600/- crore, net CO2 reduction of 557 Lakh Metric Tonnes (LMT) and expeditious payment to farmers to a tune of over Rs.

92,400/- crores.During April to November 2024, OMCs have procured 36.68 crore litres of biodiesel for the bio-diesel blending programme as against 29.25 crore litres during April to November 2023.Green Hydrogen: Oil & Gas PSU have planned for 900 KTPA Green Hydrogen Projects (EPC & BOO mode) by 2030. 42 KTPA tenders have been floated by PSU refineries, which are likely to be awarded by March 2025. Approximately 128 KTPA tenders will be issued by PSU refineries based on the outcome of the ongoing tenders.The Government has set an indicative target of 1%, 2% and 5% blending of SAF in Aviation Turbine Fuel (ATF) initially for international flights with effect from 2027, 2028 and 2030, respectively.The PM JI-VAN Yojana has been amended vide notification dated 21.08.2024, incorporating key changes, such as Inclusion of advance biofuels in place of “2G ethanol.”, Eligibility for bolt-on and brownfield projects and Extension of the scheme’s timeline up to FY 2028-29. REFINING CAPACITY The country has 22 operating refineries with a total refining capacity of 256.8 Million Metric Tonnes Per Annum (MMTPA).Eighteen refineries are in public sector, three are in private sector and one as a joint venture. Out of the total refining capacity of 256.8 MMTPA, 157.3 MMTPA is in the public sector, 11.3 MMTPA in joint venture, and the balance 88.2 MMTPA is in the private sector. Further, refining capacity is likely to increase from 256.80 MMTPA to 309.50 MMTPA by 2028 on account of refinery capacity expansion projects being implemented in 11 PSU refineries as well as setting up of new grassroot refinery. EXPLORATION AND PRODUCTION Hydrocarbon Exploration Licensing Policy (HELP): To exploit the huge potential of oil and gas in Indian sedimentary basins, the government launched the Open Acreage Licensing Program (OALP) as a part of the Hydrocarbon Exploration Licensing Policy (HELP) in March 2016. The new exploration policy provides for a paradigm shift from Production Sharing Contract (PSC) regime to Revenue Sharing Contract (RSC) regime. Total 144 blocks covering more than 2,42,056 Sq. Km. area have been allocated to the companies in eight concluded OALP Bid Rounds with committed investment of ~ 3.137 billion USD. Till date, 13 hydrocarbon discoveries have been made in blocks awarded under OALP and one discovery is already producing gas (0.44 MMSCMD) in Gujarat while other discoveries are under appraisal phase. Further in round IX of OALP, area of approximately 1,36,596 Sq. Km. spread over 8 sedimentary basins was offered and the same has received a very good response from the bidders. The bids received are under evaluation and Blocks will be awarded to successful bidders very soon. Thereafter, an area of 1,91,986.21 Sq. Km. have been finalized for International Competitive Bidding in OALP Bid Round-X.Further, a total of 741 (132 exploratory and 609 development) wells have been drilled in FY 2023-24. The gas production has increased from 34.45 BCM in FY 2022-23 to 36.44 BCM in FY 2023-24. A total of 12 discoveries have been made in nomination and contractual regimes in FY 2023-24. A total of 16645.31 LKM of 2D seismic and 15701.17 SKM of 3D seismic surveys have been conducted during FY 2023-24. Moreover, during FY 2023-24, under Airborne Gravity Gradiometry and Gravity Magnetic Survey (AGG & GM) Survey, a total of 42,944 Flight LKM 2D Seismic Data was also acquired.Discovered Small Field Policy (DSF) Policy: Government introduced DSF Policy in Year 2015. Three Rounds of DSF Bidding concluded till date and 85 Contracts signed whereas 55 Contracts are currently active. 5 fields are on Production and cumulative production till March 2024 is 520 Mbbl Oil and 138 MMSCM Gas. DSF Rounds has brought 15 New Players. CBM in India: With 15 Blocks and a production rate of 1.8 MMSCMD, CBM has achieved a cumulative production of ~6.38 BCM, with more than USD 2.46 billion investment received till date. More blocks are being identified for offer in future bid rounds.

No-Go areas opened for E&P: Around 99% of erstwhile ‘No-Go’ area of the Exclusive Economic Zone (EEZ) which were blocked exploration for decades have been opened for E&P. After the release of ‘No-Go’ areas, so far bids/expression of interests for 1,52,325 Sq. Km. area have been received. Two gas discoveries have also been made by ONGC in Mahanadi offshore recently in a block having 94% area in ‘No-Go’ area. Andaman offshore area has also been opened for exploration and production activities after a long-time post removal of restrictions imposed by defense and space agencies. Government Funded Programs for E&P: The Government is committed to increase exploration in Indian sedimentary basins. An investment of around Rs. 7,500 crore is planned for acquisition of new seismic data, including that of the Exclusive Economic Zone (EEZ), financing stratigraphic wells and acquiring aerial survey data in difficult terrains in the recently launched Mission Anveshan and Extended Continental Shelf Survey Schemes. Stratigraphic Wells: Four offshore stratigraphic wells in Category-II and Category-III basins, namely Mahanadi, Bengal, Saurashtra and Andamans, with the outlay of Rs 3200 crores will help us understand the sub surface geology better in these basins where prospectivity is yet to be commercially established. [figure Rs.3200 crore is included in the figure of Rs.7500 crore mentioned in the above point]National Data Repository: In July 2017, Government of India has set up an E&P data bank, National Data Repository (NDR), with state-of-the-art facilities and infrastructure for preservation, upkeep and dissemination of data to enable its systematic use for future exploration and development. Having an NDR for India has helped in enhancing prospects of petroleum exploration and facilitating the Bidding Rounds by improving the availability of quality data. National Data Repository (NDR) is being upgraded to a cloud based NDR, which will enable instant dissemination of seismic, well and production data. The project is expected to be completed by the end of this financial year. National Seismic Program: Government formulated National Seismic Programme (NSP) in October, 2016 to appraise the unappraised areas in all sedimentary basins of India where no/scanty data was available. Under the programme, Government approved the proposal for conducting 2D seismic survey for data Acquisition, Processing and Interpretation (API) of 48,243 Line Kilo Metres (LKM). A total of 46,960 LKM (~97%) 2D seismic data could be acquired out of the target 48,243 LKM. Processing and interpretation of 46,960 LKM data has been completed and the data has been submitted to National Data Repository (NDR) along with reports. INTERNATIONAL CO-OPERATION Diversification of Oil & Gas Sources: In the financial year 2023-24, the Ministry of Petroleum and Natural Gas undertook robust measures to strengthen India’s energy security. We expanded our crude oil sourcing, reducing dependency on specific geographies.To transition towards a gas-based economy and diversification, Indian PSUs IOCL and GAIL executed long-term LNG supply agreements with ADNOC, UAE, securing approximately 2.7 MMT of LNG annually. Global Biofuels Alliance: The Global Biofuels Alliance (GBA), launched in September 2023 by the Hon’ble Prime Minister during the G20 Summit, has seen remarkable growth, with 28 member countries and 12 international organizations joining the alliance and continues to expand. Additionally, GBA signed Head Quarters Agreement with Government of India in October 2024 for establishment of the GBA Secretariat in India underscores our commitment to global leadership in clean energy. Engagement with Neighbouring countries: India has proactively fostered energy linkages with neighboring countries. For instance, with Nepal, Government of India signed a G2G MoU in May 2023 for development of petroleum infrastructure, followed by a commercial B2B agreement between IOCL and NOC of Nepal in October 2024.

Additionally, Government of India signed a landmark MoU with Bhutan for the supply of petroleum products. International partnership on clean energy and Hydrocarbon Sector: India and the United States continued to deepen their partnership through the Strategic Clean Energy Partnership (SCEP), aligning with the India-US Climate & Clean Energy Agenda 2030. The September 2024 Ministerial Meeting marked significant advancements in clean energy collaboration. In November 2024, during the Hon’ble Prime Minister’s state visit, India and Guyana entered into a landmark agreement to strengthen cooperation in the hydrocarbon sector. India’s commitment to clean energy extends to 2G/3G biofuels, green hydrogen, and other emerging fuels. Recently in June 2024, India signed a Letter of Intent (LOI) with Italy for collaboration in green hydrogen and sustainable biofuels.Hon’ble Minister PNG along with Minister of Mines and Energy of Brazil issued a joint statement on Sustainable Aviation Fuel for coordinated position at international forum to promote SAF. STRATEGIC PETROLEUM RESERVES Hon’ble Prime Minister in February 2019 dedicated 5.33 MMT of strategic crude oil storage in SPR Phase-I (1.5 MMT SPR facility in Mangalore and 2.5 MMT SPR facility in Padur and 1.3 MMT SPR facility in Vishakhapatnam).Under Phase II of the petroleum reserve programme, Government has given approval in July 2021 for establishing two additional commercial-cum-strategic facilities with total storage capacity of 6.5 MMT (underground storages at Chandikhol (4 MMT) and Padur (2.5 MMT)) on PPP mode. Indian Strategic Petroleum Reserve Limited (ISPRL) had completed the Detailed Feasibility Report (DFR) and geotechnical surveys for the project site in Chandikhol, District Jajpur, Odisha. Environmental Impact Assessment (EIA) for the project has also been carried out by National Environmental Engineering Research Institute (NEERI), Nagpur.In December 2022, Government of Odisha requested ISPRL to explore other sites in Odisha. In view of anticipated delay in pursuing alternate land and need for carrying out feasibility studies once again, Government of Odisha has been requested to allocate the same land at Chandikhol for which ISPRL had earlier submitted application and completed feasibility studies. HYDROCARBON PROJECTS & INVESTMENTS Oil and Gas sector is a key driver of economic growth and, therefore, infrastructure projects provide a boost to the national economy and would contribute towards job creation, material movement, etc. As of October 2024, there are 283 projects under implementation of the Oil & Gas CPSEs costing ₹ 5 crore & above with a total anticipated cost of ₹ 5.70 lakh crore. The targeted expenditure on these projects in FY 2024-25 is ₹ 79,264 crore against which Rs.37,138 crore is the actual expenditure as of October, 2024. These projects, inter-alia, include Refinery projects, Bio Refineries, E&P Projects, Marketing infrastructure projects, Pipelines, CGD projects, drilling/survey activities, etc. Out of 283 projects, 89 are major projects costing ₹500 crore & above with an anticipated cost of ₹ 5.51 lakh crore. 50 projects have been completed in the current FY 2024-25 with an anticipated cumulative cost of ₹ 4,519 crore. Reducing Energy Dependence: Government has adopted a multi-pronged strategy to reduce the import dependency on oil & gas which, inter alia, includes demand substitution by promoting the usage of natural gas as fuel/feedstock across the country towards increasing the share of natural gas in the economy and moving towards gas-based economy, promotion of renewable and alternate fuels like ethanol, second-generation ethanol, compressed biogas and biodiesel, refinery process improvements, promoting energy efficiency and conservation, efforts for increasing production of oil and natural gas through various policies initiatives, etc. The Government has been promoting the blending of ethanol in petrol under the Ethanol Blended Petrol (EBP) Programme.

Blending of Petrol has reached approximately 14.6% during Ethanol Supply Year (ESY) 2023-24. During the last ten years, EBP Programme helped in expeditious payment of approx. Rs. 92,409 crore to the farmers as on 30.09.2024. During the same period, EBP programme has also resulted in approximate savings of more than Rs. 1,08,655 crore of foreign exchange, crude oil substitution of 185 lakh metric tonnes and net CO2 reduction of about 557 lakh metric tonnes. It is anticipated that 20% ethanol blending in petrol is likely to result in payment of more than Rs. 35,000 crore annually to the farmers. For promoting the use of Compressed Bio Gas (CBG) as automotive fuel, the ustainable Alternative Towards Affordable Transportation (SATAT) initiative has also been launched. Financial performance of Oil PSUs Financial performance of Oil PSUs: Total budgeted Internal and Extra Budgetary Resources (IEBR) for CPSEs’ under the Ministry of Petroleum and Natural Gas in FY 2024-25 is ₹ 1,18,499 crore against which Rs 97,667 crore is the actual expenditure as on 30.11.2024 which is 82.4 % of the budgeted IEBR. During the same period of FY 2023-24, against IEBR of Rs 1,06,401 crore, actual expenditure was Rs.75418 crore which was 70.9% of the budgeted IEBR. FLAGSHIP PROGRAMMES StartUp India: The PSUs under the Ministry of Petroleum and Natural Gas have created startup funds aggregating to Rs. 547.35 Crore. At present, a total no. of 303 Startups have been funded by Oil and Gas PSUs with disbursed fund value of approximately Rs. 286.36 Crores. Skill Development: Skill Development Institutes (SDls) for hydrocarbon sector have been set up at six cities viz Bhubaneswar, Vizag, Kochi, Ahmedabad, Guwahati and Raebareli by IOCL,HPCL, BPCL,ONGC,OIL and GAIL respectively. Till Nov’24, more than 41547 trainees have been trained in these SDIs. Several high priority trades have been identified in consultation with the Industry members for National Occupational Standard (NOS)/ Qualification Pack (QP) development. Till date, 55 QPs have been approved by National Skill Qualification Committee (NSQC). [ad_2] Source link

0 notes

Text

[ad_1] The Ministry of Petroleum & Natural Gas is concerned with exploration and production of Oil & Natural Gas, refining, distribution and marketing, import, export and conservation of petroleum products. Oil and Gas being the important import for our economy, many initiatives have been taken by the Ministry for increasing production and exploitation of all domestic petroleum resources to address the priorities like Energy Access, Energy Efficiency, Energy Sustainability and Energy Security. The progress of various schemes undertaken by Ministry in last one year is shares as follows: PRADHAN MANTRI UJJWALA YOJANA (PMUY) Ujjwala is today a 10.33 crore strong family Since the inception of the Scheme about 222 crore LPG refills have been delivered to the PMUY households. Also about 13 lakh refills are being taken daily.A targeted subsidy of Rs. 300/cylinder is being given to all Ujjwala beneficiaries.Government’s efforts have led to uptick in LPG consumption by Ujjwala families. Per Capita Consumption, terms of number of 14.2 kg domestic LPG cylinder, has gone up from 3.01 in 2019-20 to 3.95 in 2023-24. In current year, which is still under progress, the PCC (per capita consumption) has reached 4.34 (Pro-rata basis refills till October 2024). LPG COVERAGE Since April 2014, the number of LPG connections have gone up from 14.52 crores to 32.83 crores (as on 01.11.2024), a growth of above 100 %.As on 01.11.2024, approx. 30.43 crore LPG consumers are enrolled under the PAHAL scheme. Till date, more than 1.14 crore customers have given up their LPG subsidy under ‘GiveltUp’ campaign.Since 2014, LPG Distributors have increased from 13,896 to 25,532 as on 01.11.2024 enhancing LPG access and availability. It is worth mentioning that more than 90 % of new distributors are catering to rural areas. FACILITIES Under Promotion of Digital Payment infrastructure at Retail Outlets (ROs), as on 01.12.2024, 1,03,224 e-wallet facilities have been provided at 84,203 ROs across the country. 84,203 ROs have been enabled with BHIM UPI.Under Swachchh Bharat Mission, toilet facilities are ensured at every retail outlets. As on 01.12.2024, 83618 ROs have toilet facility which includes 66026 ROs having separate toilet facility for male and female.As on 01.12.2024, Oil Marketing Companies (OMCs) have commissioned total 3,097 Door to Door Delivery (DDD) Bowsers through Dealers and Start-ups.Electric Vehicle Charging Stations (EVCS) are being provided at Oil Marketing Companies (OMCs) ROs. As on 01.12.2024, OMCs have installed 17,939 EV charging stations and 206 battery swapping Station across India. NATURAL GAS PIPELINES The length of operational Natural Gas Pipeline in the country has increased from 15,340 Km in 2014 to 24,945 Kms as on 30.09.2024. Further, development of about 10,805 Kms Natural Gas Pipeline is under execution. With the completion of these pipelines authorized by PNGRB/GoI, the national gas grid would be completed and would connect all major demand and supply centre in India. This would ensure easy availability of natural gas across all regions and also help to achieve uniform economic and social progress. UNIFIED PIPELINE TARIFF The Petroleum and Natural Gas Regulatory Board (“PNGRB”) has amended PNGRB (Determination of Natural Gas Pipeline Tariff) Regulations to incorporate the regulations pertaining to Unified Tariff for natural gas pipelines with a mission of “One Nation, One Grid and One tariff”.PNGRB has notified a levelized Unified Tariff of Rs.80.97/MMBTU w.e.f. 01.07.2024 and created three tariff zones for Unified Tariff, where the first zone is up to a distance of 300 kms from gas source, second zone is 300 – 1200 kms and third zone is beyond 1200 kms.The national gas grid covers all the interconnected pipeline networks owned and operated by entities viz. Indian Oil Corporation Limited, Oil and Natural Gas Corporation Limited, GAIL (India) Limited, Pipeline Infrastructure Limited,

Gujarat State Petronet Limited, Gujarat Gas Limited, Reliance Gas Pipelines Limited, GSPL India Gasnet Limited and GSPL India Transco Limited.The reform will specially benefit the consumers located in the far-flung areas where currently the additive tariff is applicable and facilitate development of gas markets and vision of government to increase the gas utilisation in the country. CITY GAS DISTRIBUTION (CGD) COVERAGE PNGRB has authorized 307 Geographical Areas for development of CGD infrastructure with a potential coverage of about 100% of country’s area and 100 % of the population. As on 30.09.2024, the total number of PNG (D) connections and CNG Stations in the country was 1.36 Cr and 7259, respectively. SATAT INITIATIVES SATAT initiative was launched on 1st October 2018, to promote an ecosystem for production and utilization of Compressed Bio Gas (CBG).· As on 30.11.2024, 80 CBG plants have been commissioned and 72 CBG plants are at various stages of construction. · The Ministry has issued guidelines for synchronization of CBG with CNG in CGD Network; · A scheme for the development of pipeline infrastructure (DPI) for injection of CBG into the City Gas Distribution (CGD) network has been launchedto provide financial support for extending pipeline connectivity from CBG plant to the city gas distribution grid. · Online portal for receiving application under DPI Scheme has been activated w.e.f. 1st September, 2024. · Ministry has also issued detailed guidelines for procurement of Biomass Aggregation Machinery (BAM) on 2nd February 2024. The Scheme envisages financial support to the CBG producers for procuring Biomass Aggregation Machineries. · Government has announced phase wise mandatory selling of CBG in CNG (T) and PNG (D) segment of CGD network to promote the production and utilization of CBG.CBG Obligation (CBO) is presently voluntary till FY 2024-2025 and mandatory selling obligation would start from FY 2025-26. CBO shall be kept as 1%, 3% and 4% of total CNG/PNG consumption for FY 2025-26, 2026-27 and 2027-28 respectively. From 2028-29 onwards CBO will be 5%. REVIEW DOMESTIC GAS ALLOCATION FOR CGD ENTITIES To cater the growing demand of CGD sector and to protect the common people from price volatility, the Government has released new CGD sector Gas allocation Guidelines wherein the allocation of PNG (Domestic) segment was increased (i.e. 105% of PNGD consumption in the previous quarter) and balance available volume to be supplied to CNG (T) segment on prorate basis.The revised methodology has been helpful for the CGD entity as the lag between the allocation and reference period has been reduced from average of 6 months to average of 3 months which reflects a more realistic consumption data. DOMESTIC GAS PRICING Revised guidelines have been issued in April 2023 for gas produced from nomination fields of ONGC/OIL, New Exploration Licensing Policy (NELP) blocks and pre-NELP blocks, where Production Sharing Contract (PSC) provides for Government’s approval of prices.The price of such natural gas shall be 10% of the monthly average of Indian Crude Basket and shall be notified on a monthly basis and shall have a floor and a ceiling.The reduced gas price shall positively impact the domestic, Fertilizer and power consumers. BIO FUELS AND ETHANOL BLENDING Under Ethanol Blended Petrol (EBP) Programme, supplies of ethanol has increased from 38 crore litres in Ethanol Supply Year (ESY) 2013-14 to 707.40 crore litres in ESY 2023-24, thereby achieving an average blending of 14.60% ethanol in Petrol. For the ongoing ESY (2024-2025), Ethanol blending have further improved to 16.23% as on 29.12.2024. The Public Sector OMCs have started dispensing E20 petrol (20% ethanol in petrol) at more than 17,400 retail outlets across the country. In the last ten years, EBP programme has translated into forex impact of over Rs.1,08,600/- crore, net CO2 reduction of 557 Lakh Metric Tonnes (LMT) and expeditious payment to farmers to a tune of over Rs.

92,400/- crores.During April to November 2024, OMCs have procured 36.68 crore litres of biodiesel for the bio-diesel blending programme as against 29.25 crore litres during April to November 2023.Green Hydrogen: Oil & Gas PSU have planned for 900 KTPA Green Hydrogen Projects (EPC & BOO mode) by 2030. 42 KTPA tenders have been floated by PSU refineries, which are likely to be awarded by March 2025. Approximately 128 KTPA tenders will be issued by PSU refineries based on the outcome of the ongoing tenders.The Government has set an indicative target of 1%, 2% and 5% blending of SAF in Aviation Turbine Fuel (ATF) initially for international flights with effect from 2027, 2028 and 2030, respectively.The PM JI-VAN Yojana has been amended vide notification dated 21.08.2024, incorporating key changes, such as Inclusion of advance biofuels in place of “2G ethanol.”, Eligibility for bolt-on and brownfield projects and Extension of the scheme’s timeline up to FY 2028-29. REFINING CAPACITY The country has 22 operating refineries with a total refining capacity of 256.8 Million Metric Tonnes Per Annum (MMTPA).Eighteen refineries are in public sector, three are in private sector and one as a joint venture. Out of the total refining capacity of 256.8 MMTPA, 157.3 MMTPA is in the public sector, 11.3 MMTPA in joint venture, and the balance 88.2 MMTPA is in the private sector. Further, refining capacity is likely to increase from 256.80 MMTPA to 309.50 MMTPA by 2028 on account of refinery capacity expansion projects being implemented in 11 PSU refineries as well as setting up of new grassroot refinery. EXPLORATION AND PRODUCTION Hydrocarbon Exploration Licensing Policy (HELP): To exploit the huge potential of oil and gas in Indian sedimentary basins, the government launched the Open Acreage Licensing Program (OALP) as a part of the Hydrocarbon Exploration Licensing Policy (HELP) in March 2016. The new exploration policy provides for a paradigm shift from Production Sharing Contract (PSC) regime to Revenue Sharing Contract (RSC) regime. Total 144 blocks covering more than 2,42,056 Sq. Km. area have been allocated to the companies in eight concluded OALP Bid Rounds with committed investment of ~ 3.137 billion USD. Till date, 13 hydrocarbon discoveries have been made in blocks awarded under OALP and one discovery is already producing gas (0.44 MMSCMD) in Gujarat while other discoveries are under appraisal phase. Further in round IX of OALP, area of approximately 1,36,596 Sq. Km. spread over 8 sedimentary basins was offered and the same has received a very good response from the bidders. The bids received are under evaluation and Blocks will be awarded to successful bidders very soon. Thereafter, an area of 1,91,986.21 Sq. Km. have been finalized for International Competitive Bidding in OALP Bid Round-X.Further, a total of 741 (132 exploratory and 609 development) wells have been drilled in FY 2023-24. The gas production has increased from 34.45 BCM in FY 2022-23 to 36.44 BCM in FY 2023-24. A total of 12 discoveries have been made in nomination and contractual regimes in FY 2023-24. A total of 16645.31 LKM of 2D seismic and 15701.17 SKM of 3D seismic surveys have been conducted during FY 2023-24. Moreover, during FY 2023-24, under Airborne Gravity Gradiometry and Gravity Magnetic Survey (AGG & GM) Survey, a total of 42,944 Flight LKM 2D Seismic Data was also acquired.Discovered Small Field Policy (DSF) Policy: Government introduced DSF Policy in Year 2015. Three Rounds of DSF Bidding concluded till date and 85 Contracts signed whereas 55 Contracts are currently active. 5 fields are on Production and cumulative production till March 2024 is 520 Mbbl Oil and 138 MMSCM Gas. DSF Rounds has brought 15 New Players. CBM in India: With 15 Blocks and a production rate of 1.8 MMSCMD, CBM has achieved a cumulative production of ~6.38 BCM, with more than USD 2.46 billion investment received till date. More blocks are being identified for offer in future bid rounds.

No-Go areas opened for E&P: Around 99% of erstwhile ‘No-Go’ area of the Exclusive Economic Zone (EEZ) which were blocked exploration for decades have been opened for E&P. After the release of ‘No-Go’ areas, so far bids/expression of interests for 1,52,325 Sq. Km. area have been received. Two gas discoveries have also been made by ONGC in Mahanadi offshore recently in a block having 94% area in ‘No-Go’ area. Andaman offshore area has also been opened for exploration and production activities after a long-time post removal of restrictions imposed by defense and space agencies. Government Funded Programs for E&P: The Government is committed to increase exploration in Indian sedimentary basins. An investment of around Rs. 7,500 crore is planned for acquisition of new seismic data, including that of the Exclusive Economic Zone (EEZ), financing stratigraphic wells and acquiring aerial survey data in difficult terrains in the recently launched Mission Anveshan and Extended Continental Shelf Survey Schemes. Stratigraphic Wells: Four offshore stratigraphic wells in Category-II and Category-III basins, namely Mahanadi, Bengal, Saurashtra and Andamans, with the outlay of Rs 3200 crores will help us understand the sub surface geology better in these basins where prospectivity is yet to be commercially established. [figure Rs.3200 crore is included in the figure of Rs.7500 crore mentioned in the above point]National Data Repository: In July 2017, Government of India has set up an E&P data bank, National Data Repository (NDR), with state-of-the-art facilities and infrastructure for preservation, upkeep and dissemination of data to enable its systematic use for future exploration and development. Having an NDR for India has helped in enhancing prospects of petroleum exploration and facilitating the Bidding Rounds by improving the availability of quality data. National Data Repository (NDR) is being upgraded to a cloud based NDR, which will enable instant dissemination of seismic, well and production data. The project is expected to be completed by the end of this financial year. National Seismic Program: Government formulated National Seismic Programme (NSP) in October, 2016 to appraise the unappraised areas in all sedimentary basins of India where no/scanty data was available. Under the programme, Government approved the proposal for conducting 2D seismic survey for data Acquisition, Processing and Interpretation (API) of 48,243 Line Kilo Metres (LKM). A total of 46,960 LKM (~97%) 2D seismic data could be acquired out of the target 48,243 LKM. Processing and interpretation of 46,960 LKM data has been completed and the data has been submitted to National Data Repository (NDR) along with reports. INTERNATIONAL CO-OPERATION Diversification of Oil & Gas Sources: In the financial year 2023-24, the Ministry of Petroleum and Natural Gas undertook robust measures to strengthen India’s energy security. We expanded our crude oil sourcing, reducing dependency on specific geographies.To transition towards a gas-based economy and diversification, Indian PSUs IOCL and GAIL executed long-term LNG supply agreements with ADNOC, UAE, securing approximately 2.7 MMT of LNG annually. Global Biofuels Alliance: The Global Biofuels Alliance (GBA), launched in September 2023 by the Hon’ble Prime Minister during the G20 Summit, has seen remarkable growth, with 28 member countries and 12 international organizations joining the alliance and continues to expand. Additionally, GBA signed Head Quarters Agreement with Government of India in October 2024 for establishment of the GBA Secretariat in India underscores our commitment to global leadership in clean energy. Engagement with Neighbouring countries: India has proactively fostered energy linkages with neighboring countries. For instance, with Nepal, Government of India signed a G2G MoU in May 2023 for development of petroleum infrastructure, followed by a commercial B2B agreement between IOCL and NOC of Nepal in October 2024.

Additionally, Government of India signed a landmark MoU with Bhutan for the supply of petroleum products. International partnership on clean energy and Hydrocarbon Sector: India and the United States continued to deepen their partnership through the Strategic Clean Energy Partnership (SCEP), aligning with the India-US Climate & Clean Energy Agenda 2030. The September 2024 Ministerial Meeting marked significant advancements in clean energy collaboration. In November 2024, during the Hon’ble Prime Minister’s state visit, India and Guyana entered into a landmark agreement to strengthen cooperation in the hydrocarbon sector. India’s commitment to clean energy extends to 2G/3G biofuels, green hydrogen, and other emerging fuels. Recently in June 2024, India signed a Letter of Intent (LOI) with Italy for collaboration in green hydrogen and sustainable biofuels.Hon’ble Minister PNG along with Minister of Mines and Energy of Brazil issued a joint statement on Sustainable Aviation Fuel for coordinated position at international forum to promote SAF. STRATEGIC PETROLEUM RESERVES Hon’ble Prime Minister in February 2019 dedicated 5.33 MMT of strategic crude oil storage in SPR Phase-I (1.5 MMT SPR facility in Mangalore and 2.5 MMT SPR facility in Padur and 1.3 MMT SPR facility in Vishakhapatnam).Under Phase II of the petroleum reserve programme, Government has given approval in July 2021 for establishing two additional commercial-cum-strategic facilities with total storage capacity of 6.5 MMT (underground storages at Chandikhol (4 MMT) and Padur (2.5 MMT)) on PPP mode. Indian Strategic Petroleum Reserve Limited (ISPRL) had completed the Detailed Feasibility Report (DFR) and geotechnical surveys for the project site in Chandikhol, District Jajpur, Odisha. Environmental Impact Assessment (EIA) for the project has also been carried out by National Environmental Engineering Research Institute (NEERI), Nagpur.In December 2022, Government of Odisha requested ISPRL to explore other sites in Odisha. In view of anticipated delay in pursuing alternate land and need for carrying out feasibility studies once again, Government of Odisha has been requested to allocate the same land at Chandikhol for which ISPRL had earlier submitted application and completed feasibility studies. HYDROCARBON PROJECTS & INVESTMENTS Oil and Gas sector is a key driver of economic growth and, therefore, infrastructure projects provide a boost to the national economy and would contribute towards job creation, material movement, etc. As of October 2024, there are 283 projects under implementation of the Oil & Gas CPSEs costing ₹ 5 crore & above with a total anticipated cost of ₹ 5.70 lakh crore. The targeted expenditure on these projects in FY 2024-25 is ₹ 79,264 crore against which Rs.37,138 crore is the actual expenditure as of October, 2024. These projects, inter-alia, include Refinery projects, Bio Refineries, E&P Projects, Marketing infrastructure projects, Pipelines, CGD projects, drilling/survey activities, etc. Out of 283 projects, 89 are major projects costing ₹500 crore & above with an anticipated cost of ₹ 5.51 lakh crore. 50 projects have been completed in the current FY 2024-25 with an anticipated cumulative cost of ₹ 4,519 crore. Reducing Energy Dependence: Government has adopted a multi-pronged strategy to reduce the import dependency on oil & gas which, inter alia, includes demand substitution by promoting the usage of natural gas as fuel/feedstock across the country towards increasing the share of natural gas in the economy and moving towards gas-based economy, promotion of renewable and alternate fuels like ethanol, second-generation ethanol, compressed biogas and biodiesel, refinery process improvements, promoting energy efficiency and conservation, efforts for increasing production of oil and natural gas through various policies initiatives, etc. The Government has been promoting the blending of ethanol in petrol under the Ethanol Blended Petrol (EBP) Programme.

Blending of Petrol has reached approximately 14.6% during Ethanol Supply Year (ESY) 2023-24. During the last ten years, EBP Programme helped in expeditious payment of approx. Rs. 92,409 crore to the farmers as on 30.09.2024. During the same period, EBP programme has also resulted in approximate savings of more than Rs. 1,08,655 crore of foreign exchange, crude oil substitution of 185 lakh metric tonnes and net CO2 reduction of about 557 lakh metric tonnes. It is anticipated that 20% ethanol blending in petrol is likely to result in payment of more than Rs. 35,000 crore annually to the farmers. For promoting the use of Compressed Bio Gas (CBG) as automotive fuel, the ustainable Alternative Towards Affordable Transportation (SATAT) initiative has also been launched. Financial performance of Oil PSUs Financial performance of Oil PSUs: Total budgeted Internal and Extra Budgetary Resources (IEBR) for CPSEs’ under the Ministry of Petroleum and Natural Gas in FY 2024-25 is ₹ 1,18,499 crore against which Rs 97,667 crore is the actual expenditure as on 30.11.2024 which is 82.4 % of the budgeted IEBR. During the same period of FY 2023-24, against IEBR of Rs 1,06,401 crore, actual expenditure was Rs.75418 crore which was 70.9% of the budgeted IEBR. FLAGSHIP PROGRAMMES StartUp India: The PSUs under the Ministry of Petroleum and Natural Gas have created startup funds aggregating to Rs. 547.35 Crore. At present, a total no. of 303 Startups have been funded by Oil and Gas PSUs with disbursed fund value of approximately Rs. 286.36 Crores. Skill Development: Skill Development Institutes (SDls) for hydrocarbon sector have been set up at six cities viz Bhubaneswar, Vizag, Kochi, Ahmedabad, Guwahati and Raebareli by IOCL,HPCL, BPCL,ONGC,OIL and GAIL respectively. Till Nov’24, more than 41547 trainees have been trained in these SDIs. Several high priority trades have been identified in consultation with the Industry members for National Occupational Standard (NOS)/ Qualification Pack (QP) development. Till date, 55 QPs have been approved by National Skill Qualification Committee (NSQC). [ad_2] Source link

0 notes

Text

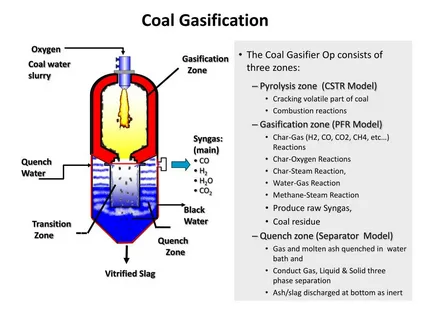

Global Coal Gasification Market 2024-2034: Technology, Feedstock & Growth

The Coal Gasification market report is predicted to develop at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2034, when global Coal Gasification market forecast size is projected to reach USD 38.63 Billion in 2034, based on an average growth pattern. The global Coal Gasification market revenue is estimated to reach a value of USD 23.36 Billion in 2024

𝐂𝐥𝐚𝐢𝐦 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐢𝐧𝐬𝐭𝐚𝐧𝐭𝐥𝐲:

https://wemarketresearch.com/reports/request-free-sample-pdf/coal-gasification-market/1624

Globally, and particularly in Asia Pacific, the coal gasification industry is producing excellent quantities of chemicals, fertilizers, and hydrogen. Future market expansion is also anticipated to be accelerated by the increasing number of methanol-infused fuels utilized in hybrid cars and aircraft. Traditional coal-fired power plants burn the majority of coal, but it can also be transformed into other energy products like gas, electricity, and hydrogen.

Market Drivers for Coal Gasification

Rising Energy Demand: As the global population grows and industrial activities expand, the demand for energy continues to increase. While renewable energy sources like wind and solar are gaining traction, they cannot yet meet the global energy demand on their own. Coal gasification offers a way to utilize the world’s vast coal reserves more efficiently and with lower emissions compared to traditional coal combustion.

Environmental Concerns: With increasing pressure to reduce greenhouse gas emissions and combat climate change, coal gasification presents a promising solution. By capturing carbon emissions and enabling the production of cleaner fuels, coal gasification can help achieve environmental goals while still utilizing existing coal resources. Governments and corporations are also investing in technologies like carbon capture and storage (CCS) to make coal gasification even more environmentally friendly.

Coal Gasification Market Growth Factors

The increase of coal reserves in developing nations encourages the market to expand throughout the ensuing years.

Growing emphasis on clean and efficient energy sources and decreasing dependency on natural gas and fossil fuels are the main factors propelling the coal gasification market's growth throughout the forecast period.

The demand for coal gasification is expected to increase during the forecast period due to the rising urbanization and industrialization.

Underground coal gasification (UCG), which turns coal into valuable gases without the need for mining, is being adopted quickly, which is expected to drive market growth.

Opportunity: Supportive government investment and initiatives

The market for coal gasification is expected to rise throughout the forecast period thanks to increased government initiatives and investment. The government is aggressively working to develop sustainable and environmentally friendly methods of producing electricity.

Coal Gasification Market Segmentation

By Technology

Fixed-Bed Gasifiers

Moving Bed

Dry Ash

Fluidized-Bed Gasifiers

Bubbling Fluidized Bed

Circulating Fluidized Bed

Entrained-Flow Gasifiers

Single-Stage

Multi-Stage

Plasma Gasification

High-Temperature Gasification

Plasma Arc Technology

Integrated Gasification Combined Cycle (IGCC)

By Feedstock

Sub-Bituminous Coal

Bituminous Coal

Anthracite

Petroleum Coke

Biomass/Coal Blends

Municipal Solid Waste (MSW)

Others

By Gas Output

Synthetic Gas (Syngas)

Methane-Rich Gas

Hydrogen-Rich Gas

By End-use Industry

Energy and Utilities

Chemicals and Petrochemicals

Oil and Gas

Metals and Mining

Transportation

Others

Key Market Players

General Electric (GE)

Royal Dutch Shell

Siemens Energy

ThyssenKrupp AG

Air Products and Chemicals, Inc.

KBR Inc.

Mitsubishi Heavy Industries

Synthesis Energy Systems

Huaneng Clean Energy Research Institute

China Coal Energy Group

Sasol Limited

Air Liquide

BHEL (Bharat Heavy Electricals Limited)

Key Benefits For Stakeholders

The report provides exclusive and comprehensive analysis of the global coal gasification market scope, trends along with the coal gasification market forecast.

The report elucidates the coal gasification market trends along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

The report entailing the coal gasification market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

The data in this report aims on market dynamics, trends, and developments affecting the coal gasification market demand.

Conclusion

The coal gasification market is poised for growth as it offers a potential solution to the global energy crisis while addressing environmental concerns. With its ability to produce cleaner energy and enable carbon capture, this Technology Presents a way to utilize the world’s vast coal reserves in a more sustainable manner. While challenges remain, ongoing technological advancements and investments in research and development are likely to drive the evolution of coal gasification, making it a key player in the energy landscape for years to come.

0 notes

Text

HPCL, BPCL, and IOC Tenders and Contracts

HPCL, BPCL, and IOC Tenders and Contracts Key Opportunities in India’s Energy Sector In India’s dynamic energy sector, HPCL (Hindustan Petroleum Corporation Limited), BPCL (Bharat Petroleum Corporation Limited), and IOC (Indian Oil Corporation) are three of the country’s largest public sector enterprises. These oil giants have extensive operations in refining, marketing, and distribution of petroleum products. Their ongoing tenders and contracts play a significant role in shaping India’s energy infrastructure, offering a wealth of business opportunities for suppliers, contractors, and service providers across various industries.

0 notes

Text

#Bharat Petroleum Corporation Limited#eMobility#electricvehiclesnews#evnews#evtimes#autoevtimes#evbusiness

0 notes

Text

Events 1.2 (after 1950)

1954 – India establishes its highest civilian awards, the Bharat Ratna and the Padma Vibhushan. 1955 – Following the assassination of the Panamanian president José Antonio Remón Cantera, his deputy, José Ramón Guizado, takes power, but is quickly deposed after his involvement in Cantera's death is discovered. 1959 – Luna 1, the first spacecraft to reach the vicinity of the Moon and to orbit the Sun, is launched by the Soviet Union. 1963 – Vietnam War: The Viet Cong wins its first major victory, at the Battle of Ap Bac. 1967 – Ronald Reagan, past movie actor and future President of the United States, is sworn in as Governor of California. 1971 – The second Ibrox disaster kills 66 fans at a Rangers-Celtic association football (soccer) match. 1974 – United States President Richard Nixon signs a bill lowering the maximum U.S. speed limit to 55 mph in order to conserve gasoline during an OPEC embargo. 1975 – At the opening of a new railway line, a bomb blast at Samastipur, Bihar, India, fatally wounds Lalit Narayan Mishra, Minister of Railways. 1975 – The Federal Rules of Evidence are approved by the United States Congress. 1976 – The Gale of January 1976 begins, resulting in coastal flooding around the southern North Sea coasts, affecting countries from Ireland to Yugoslavia and causing at least 82 deaths and US$1.3 billion in damage. 1978 – On the orders of the President of Pakistan, Muhammad Zia-ul-Haq, paramilitary forces opened fire on peaceful protesting workers in Multan, Pakistan; it is known as 1978 massacre at Multan Colony Textile Mills. 1981 – One of the largest investigations by a British police force ends when serial killer Peter Sutcliffe, the "Yorkshire Ripper", is arrested in Sheffield, South Yorkshire. 1988 – Condor Flugdienst Flight 3782 crashes near Seferihisar, Turkey, killing 16 people. 1991 – Sharon Pratt Dixon becomes the first African American woman mayor of a major city and first woman Mayor of the District of Columbia. 1993 – Sri Lankan Civil War: The Sri Lanka Navy kill 35–100 civilians on the Jaffna Lagoon. 2004 – Stardust successfully flies past Comet Wild 2, collecting samples that are returned to Earth. 2019 – Adventist Health System and its subsidiaries rebranded to AdventHealth. 2022 – Massive nationwide protests and unrest break out in Kazakhstan over the sudden increase of liquefied petroleum gas prices, leaving over 200 people dead and thousands injured. 2024 – Two aircraft collide on a runway at Haneda Airport in Tokyo, killing 5 and injuring 15.

0 notes

Text

Global markets mixed at Christmas

Commodity prices were mixed over the Christmas week, looking for direction amid political developments, while markets were dominated by the perception of high risk ahead of President-elect Donald Trump taking office and his promised increase in tariffs on China.

US 10-year bond futures hit their highest since May, rising to 4.26 per cent, after the Federal Reserve signalled that next year’s rate-cutting cycle may be slower than expected. The US dollar index held near a near two-year high, rising to 108.3 last week and ending trading at 108.0.

Analysts believe geopolitical tensions and central bank gold purchases will continue after Trump returns to the presidency in January, and political uncertainty will persist.

Gold fell 0.3 per cent an ounce amid rising bonds and markets’ focus on the impact of Trump’s policies and the Fed’s future roadmap. Silver and palladium were down 0.6 per cent and 0.9 per cent respectively, while platinum rose 0.6 per cent an ounce last week.

Meanwhile, copper rose 0.8% as the Chinese government announced it would reduce import tariffs on processed copper and aluminium from January 1.

China’s finance minister said the decision was to encourage imports of high-grade products and expand domestic demand as the China-Maldives Free Trade Agreement (FTA) comes into effect on the first day of the new year.

On Monday, El Salvador’s legislature lifted a seven-year ban on metal mining. President Nayib Bukele backed lifting the ban to boost economic growth, while environmental groups criticised.

Chile’s environmental body SMA filed four charges against Anglo American-controlled Los Bronces copper mine for failing to comply with environmental permits, resulting in a $17.2 million fine.

Chile’s Cadelco has applied to extend the life of its Gabriela Mistral copper mine by more than 25 years with an investment of $800 million. The mine is scheduled to extend its life from 2028 to 2055 and the use of local groundwater will be phased out by 2035.

Aluminium rose 0.8% and zinc rose 1.3%, while lead fell 1.4% and nickel fell 1% over the past week.

Energy sector prices

As for the energy sector, Brent crude ended the week up 1%, rising to a weekly record high thanks to a larger-than-expected decline in US crude inventories. Greece and Israel concluded an agreement to promote regional energy stability and innovative energy projects in the Eastern Mediterranean and the EU.

India’s Bharat Petroleum announced plans to invest $11 billion in a new refinery and petrochemical project in Andhra Pradesh state in the south of the country to meet growing fuel demand.

Russia’s Gazprom chief Alexei Miller said natural gas production will increase by 61 billion cubic metres to 416 billion cubic metres this year. The Venture Bayou tanker of US-based Venture Global LNG has set sail from its export facility in Louisiana to deliver its first cargo to Germany.

Grain prices

China has also launched a 10-year action plan to boost grain consumption and develop the sector through higher standards, research and international co-operation to enhance food security.

According to the plan, by 2035, China’s grain awareness and consumption should match the country’s economic and social development by 2035.

Soybeans rose 1.1 per cent after Brazilian Supreme Court Justice Flavio Dino suspended a law that would have eliminated tax breaks for companies following an agreement not to buy soybeans from deforested areas of the Amazon rainforest. The law would have taken effect on January 1 in the western state of Mato Grosso, the country’s largest soybean producer.

On the Chicago Mercantile Exchange, the price of a bushel of corn rose 1.7 per cent and rice fell 2.2 per cent.

The price of sugar fell 0.8 per cent due to lower sugarcane yields in India following last year’s drought and this year’s heavy rains, which could bring the country’s sugar production below consumption for the first time in eight years.

The price of a tonne of cocoa ended the week down 15.31% from record highs on concerns about the possible impact of the Harmattan wind on Ivory Coast’s cocoa crop, which could dry out the soil and damage the fruit.

Read more HERE

#world news#news#world politics#global market#economy#economics#economic growth#economic development#economic impact#aluminium#chile#china#usa#gold#prices#christmas

0 notes

Text

$BPCL.NS: Bharat Petroleum Corp. can't secure needed Russian crude, impacting their January supply chain.

0 notes

Text

BPCL's Bina Refinery Honored with Indian CSR Award 2024 for 'Best Aid for Sports Initiative of the Year'

Bharat Petroleum Corporation Limited (BPCL) proudly announces that its Bina Refinery has received the prestigious Indian CSR Award 2024 in the Public Sector Undertaking (PSU) category for 'Best Aid for Sports Initiative of the Year'. This recognition celebrates the success of Project Lakshya, a transformative rural sports initiative aimed at fostering gender parity and social change through sports.

About Project Lakshya

Project Lakshya is a flagship CSR initiative launched by BPCL's Bina Refinery to empower rural youth through structured sports training. The program targets 500 youth from 22 villages, with an impressive 60% of participants being girls, making it a landmark initiative for promoting inclusivity and gender equality in sports.

Participants receive professional training in:

Chess

Wrestling

Athletics

Beyond training, the program takes a holistic approach, ensuring athletes are fully supported with:

Expert Coaching: Delivered by professional trainers to hone athletic skills.

Nutrition Plans: Tailored to maintain athletes’ health and performance.

Sports Equipment: Providing essential tools and gear to excel in their chosen sport.

Competition Support: Covering costs and logistics for participation at state and national levels.

This comprehensive model has resulted in exceptional achievements, with several athletes earning accolades at state and national championships. A notable few have been selected to train at the prestigious Sports Authority of India (SAI) in Bhopal, marking significant progress for grassroots talent in the region.

Project Lakshya is more than a sports initiative; it is a vehicle for social transformation. By encouraging family involvement and offering scholarships to deserving athletes, the program ensures financial constraints do not hinder talent development. The initiative promotes an inclusive ecosystem where young athletes—especially girls—can pursue their dreams and contribute to community upliftment.

About the Indian CSR Awards

The Indian CSR Awards, organized by Marketing & Brand Honchos and supported by the Ministry of Social Justice & Empowerment, honour outstanding contributions to societal development through impactful CSR initiatives. The awards are widely regarded as a benchmark for excellence in corporate social responsibility.

Project Lakshya’s recognition highlights BPCL’s dedication to driving meaningful change in rural communities by leveraging sports to empower youth and promote gender equality.

Award Ceremony

The award was presented during a high-profile event attended by leading public and corporate figures. Representing BPCL, the accolade was received by:

Shri Hariom Mishra, Associate Executive (HR-CSR), Bina Refinery.

This recognition is a testament to the commitment and efforts of the Bina Refinery team in delivering impactful CSR initiatives.

BPCL’s Commitment to Social Responsibility

BPCL is committed to transforming lives through its CSR programs, focusing on education, health, livelihood, and community development. Project Lakshya exemplifies this commitment by blending sports excellence with social empowerment, particularly in underprivileged rural areas.

Through such initiatives, BPCL continues to play a pivotal role in building stronger, more inclusive communities, paving the way for a brighter future.

1 note

·

View note