#best startups

Explore tagged Tumblr posts

Text

explaining modern brand names to a Victorian

me: so just like. a word, usually.

Victorian: a word related to the product, or-

me: no just a random word

Victorian: huh. because I'd have thought

me: yeah

Victorian: a word related to the product's alleged best qualities

me: no no it's just any word really. the founder might have some reason behind it, but it only makes sense to them most of the time

Victorian: interesting

me:

Victorian:

Victorian: but definitely misspelled right

me: oh EXTREMELY misspelled

#history#marketing#brand names#victorian#a bread company called Bakk'd-Best shaking hands with a tech startup called Wandr or something#there is literally a software company called Salsify. like the root vegetable. please explain this to me#only don't because there is no POSSIBLE way to make that a logical name. for a software company

318 notes

·

View notes

Text

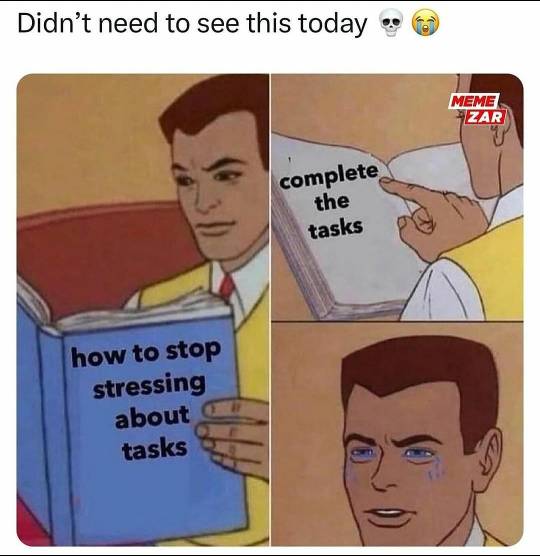

Wednesday motivation meme 😅

Sad but true

#get motivated#motivating quotes#tumblr memes#funny memes#best memes#business#artists on tumblr#entrepreneur#branding#startup

88 notes

·

View notes

Text

#youtube#redlettermedia#red letter media#rich evans#jay bauman#gorilla interrupted#half in the bag#mike stoklasa#best of the worst#jack packard#startrek#starwars#star trek#star wars#honkai star rail#starv1ng#stardew valley#stars#in stars and time#ensemble stars#starscream#brawl stars#stars lb#ringo starr#star rail#star rambles#antony starr#starry night#open starter#startup

12 notes

·

View notes

Text

...

#funny#haha#lol#humor#funny memes#funny shit#funny stuff#relatable memes#best memes#meme#castiel#supernatural beings#dean winchester#supernatural encounters#supernatural rp#supernatural#sarcasm#so true#startup#spnfandom#spn#spn rp#spn fanart#spnedit#deancas#sam winchester#bobby singer#supernatural gif#supernatural fanart#supernatural family

27 notes

·

View notes

Text

🚫 Don't sleep 😴 on LetYouKnow.com! 💸

youtube

💸 Bid your own price, all dealer fees included, plus no awkward negotiations! For a limited time, save $1,000 more on a new car! Register @ LetYouKnow.com/SocialPromo

#trendingshorts#trending#comedy#comedyshorts#virals#viral#fyp#fypツ#fypviral#fyp tumblr#fyp 2024#viral shorts#youtube#tiktok#tiktok videos#new videos#new tiktok#funny videos#innovation#best deals#deals#innovative technology#savings#startups#genz#comedy shorts#capcut#memes#funny memes#tumblr memes

7 notes

·

View notes

Text

Looking for reliable and affordable Shared Hosting in India? Website Buddy offers top-notch shared hosting solutions tailored to meet the needs of Indian businesses and individuals. With 99.9% uptime, free SSL certificates, and 24/7 expert support, our hosting plans are perfect for startups, bloggers, and small businesses. Experience seamless website performance and easy management through our user-friendly control panel. At Website Buddy, we prioritize quality and affordability, making us your trusted partner for Shared Hosting in India. Whether you're launching a new website or upgrading your hosting, we’ve got you covered!

#Shared Hosting in India#Affordable shared hosting India#Best shared hosting services#Website Buddy shared hosting#Reliable web hosting India#Hosting for startups in India

3 notes

·

View notes

Text

Boost Your Business with Professional Mobile App Developers in Indore – Young Decade

In today’s digital world, having a mobile app is essential for business growth. If you’re looking for professional mobile app developers in Indore, Young Decade is the perfect partner to turn your vision into reality. We specialize in custom mobile app development for Android, iOS, and cross-platform applications, ensuring your business reaches a wider audience with a seamless digital experience.

Why Choose Young Decade for Mobile App Development?

✔ Expert Team – Our skilled developers have years of experience in Flutter, React Native, Swift, and Kotlin. ✔ Custom Solutions – We build tailor-made mobile apps to match your business needs. ✔ User-Centric Designs – Get intuitive UI/UX designs that boost user engagement and retention. ✔ Scalable & Secure Apps – Our apps are future-ready, ensuring performance and security. ✔ Affordable Pricing – High-quality app development at cost-effective rates.

Take Your Business to the Next Level

At Young Decade, we help businesses transform their ideas into powerful mobile applications. Whether you need an eCommerce, healthcare, or enterprise app, our top mobile app developers in Indore are ready to build a feature-rich, high-performing solution.

📞 Contact Young Decade today to hire expert mobile app developers and scale your business with a custom-built mobile app! 🚀

#best android app development company#app development company#developers & startups#software development company#android app developers#software development#top mobile app development company in Indore#flutter app development company in indore

2 notes

·

View notes

Text

Social CRM: Engaging Customers Across Platforms for Better Relationships

In today’s digital landscape, where consumers engage with brands across various social channels, the importance of Social Customer Relationship Management (Social CRM) cannot be overstated. By effectively utilizing Social CRM strategies, businesses can foster deeper relationships with customers, enhance engagement, and drive loyalty, all while navigating the complexities of multiple platforms.…

#best practices for brand management#Branding strategies for small businesses#building brand loyalty#business growth strategies#corporate social responsibility#creating a strong brand identity#CRM#customer relationship management#Customers#digital marketing for startups#e-commerce tips for businesses#Engaging#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Platforms#Relationships#small business funding options#Social#top business trends 2024

2 notes

·

View notes

Text

Clothes ironing service hyderabad

Experience the best clothes ironing service in Hyderabad, designed to keep your garments looking sharp and polished. Our professional team uses advanced techniques to ensure every piece is expertly pressed, removing wrinkles and enhancing the fabric's appearance. With convenient pick-up and delivery options, you can enjoy hassle-free service right at your doorstep. Whether it's everyday wear or special occasion outfits, our clothes ironing service guarantees quality results that save you time and effort. Trust us to keep your wardrobe looking its best.

#hyderabad#startup#tumblr milestone#laundry#steam press near me#cloth iron shop near me#clothes iron shop near me#steam iron service near me#cloth iron service near me#Best ironing service hyderabad#ironing service near me pickup#laundry iron near me#clothes iron services near me

2 notes

·

View notes

Text

.:Please:.

You're all probably annoyed at seeing this and I am sorry! I am just trying to make 1/3 of my goal so I can actually get my products packaged and shipped!

NO PREDATORY COMMENTS OR DMs. THIS MEANS PEOPLE TELLING ME TO MESSAGE SO AND SO AND THE LIKE. I HAVE NO MONEY, SO WHAT MAKES YOU THINK I WILL PAY YOU TO SHARE THIS? STOP. IMAGINE BEING THAT PREDATORY TO SOMEONE WHO JUST LOST A FAMILY MEMBER, OR NEEDS END OF LIFE CARE ASSISTANCE.

And the whole "Gotta Spend Money To Make Money" bullshit. Read the damned gofundme. You'll see that i spent 3k of what i scraped together for this.

I'll be real: I was forced to resign from my job because of a severe health issue that is ongoing and makes it hard to even just walk my hall in my apartment. I am homeschooling my lil girl because she has special needs and they were not being met in public schooling, unfortunately. I want to work, but i can't and i also have broken my body for 20 years. I think, with all said and done with my health and all that, it's time that i do something I know i am good at and enjoy. It's either that or try to be on SSI but that is a long process and we still do not know what is going on with my health.

I have donated to various causes, including the horrendous bs that is happening on the otherside of the world, before I had to resign. So, yes, the guilt of having a gofundme to help support my family (by helping me with my small business) is there when there is so much shit going on in this world, but i know that I've done what I can and I use my platform on instagram to amplify and help expose of the atrocities that take place, hourly.

Sorry for the rant and the imploring.

Thank you.

Please consider donating. If you can't, please share?

#gofundme#mun talks#small business#perfume#silent hill#startup#candles#crowdfunding#trying my best#trying to be positive#overwhelmed#neil gaiman#the owl house#bee and puppycat

8 notes

·

View notes

Text

USAID Audit in India

We provide the best Grant Audit in India, Grant Audit in New Delhi, and USAID Audit in India in New Delhi. PK Chopra gives you the qualitative Auditing Service in India USAID Audit in India | Grant Audit in India | USAID Audit Delhi | Auditing Service

#internal audit in india#usaid audit in india#best due diligence services in india#best usaid audit in india#due diligence services in india#architecture#art#celebrities#developers & startups#menswear

2 notes

·

View notes

Text

This agency promises guaranteed yet affordable features in The Hollywood Reporter. Actors and celebrities looking to get featured should leaverage this opportunity.

2 notes

·

View notes

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Text

Best Affordable Mobile App Development Solutions in Indore, India – Young Decade

Looking for affordable mobile app development solutions in Indore, India? Young Decade is your go-to company for high-quality, budget-friendly app development. We specialize in creating custom Android and iOS applications that help businesses grow without exceeding their budget.

Why Choose Young Decade?

✅ Cost-Effective Solutions – High-performance apps at the best prices. ✅ Custom Mobile Apps – Tailored solutions to meet your business goals. ✅ Android & iOS Development – Native and cross-platform app expertise. ✅ Scalable & Secure Apps – Future-ready applications for long-term success. ✅ On-Time Delivery – Fast, efficient, and reliable app development.

At Young Decade, we focus on creating user-friendly, feature-rich, and scalable apps for startups, enterprises, and small businesses. Our experienced developers use the latest React Native, Flutter, and Native Development technologies to deliver powerful mobile solutions.

Let’s Build Your App Today!

If you need affordable mobile app development in Indore, India, Young Decade is here to help. Get in touch with us and turn your ideas into a high-quality mobile app at the best price!

#app development company#best android app development company#software development company#android app developers#developers & startups#software development#Top mobile app development company in Indore#flutter app development company in Indore

2 notes

·

View notes

Text

im going to do it for real this time (drop out and get a job)

#my bro got himself a job at some idk tech startup that works w u.s. moving companies and theyre still hiring so im thinking like#what the hell ill give it a shot id have to get training first anyways so if i dont like it ill just say 'this isnt for me buh bye'#and i mean. i could always quit after a few months etc. but uni?? im quitting that shit for good i am NOT coming back...#ill just wait till october and then just. not enroll for the next year..#which also gives me time to use the lovely student benefits (health insurance) before i drop out...#ive been putting off making those appointments so like. best to take advantage of it while i still can#and also the plan is to take a graphic design course or sth so i can have at least an online certificate or sth for employability#so if all else fails im going into graphic design and illustration NOT CLICKBAIT. hopefully some ppl i know could even get me into somewher#hashtag networking pays off#piksla.txt

7 notes

·

View notes