#best pharmaceutical exporter in bulgaria

Explore tagged Tumblr posts

Text

Ikris Pharmaceutical in Brazil Health sector

We, Ikris Pharma International, are pharmaceutical distributors from Bulgaria. We supply products to all the people involved in the supply chain of Healthcare distribution throughout the world. We supply medicines and other medical products to wholesalers, distributors, resellers, clinics, NGOs and Pharmacies. Ikris is a GDP certified company having licenses for both wholesale and retail drugs. The supply chain of Healthcare distribution is different from other industries. Each product needs different storage conditions. We do not compromise with the quality of the product hence we store and transport them under required storage conditions.

In the Brazil Health sector, Ikris Pharma is reaching new heights in supplying medicines and medical aids from India to Brazil from the previous two years. Especially during the Coronavirus pandemic outbreak, Ikris Pharma gave its best shot to supply medicines and services in Brazil when most of the transportation facilities were at halt. Being the international pharmaceutical wholesaler and distributor we supply at global level with best quality products. India is one of the largest producers and providers of generic drugs at global level. We have the highest number of FDA approved manufacturing plants in the world. As Ikris Pharma, we specialize in exporting generic medicines from India to across the world. Our all products are manufactured by certified and reputed Indian manufacturers, compatible and consistent with FDA standards.

Ikris Pharma helps patients / Clinicians and Hospitals in accessing Indian generic medicine and specialized medicines which are used in rare diseases. Ikris Pharma has supplied more than 100+ products to patients / Hospitals in Brazil. Here are some of our product supplied in Brazil:

We deal in numerous medicines related to oncology (different kinds of cancers), hematology (leukemia and lymphoma, multiple myeloma), hepatitis (hepatitis B, hepatitis C), immunotherapy (eliglustat, xeljanz, etc.), transplant medicine, vaccines (such as cholera vaccine, ONCO BCG, etc.). We are aiming to supply every kind of rare medicine in Brazil.

We are becoming a major pharmaceutical supplier in Brazil, with time we are aiming to become the most reliable and trustworthy supplier of pharmaceutical products to Brazil and other Latin American markets. We understand the needs of the patient, our turnaround time is less. We supply medicine at the shortest possible time. And we do business with one mantra that is each life counts and is precious for us. We have been in this Pharmaceutical business for 25 plus years as one of the trusted brands in the supply chain of medicinal products overseas.

#top pharmaceutical companies in bulgaria#Global Access to Medicines#Pharmaceutical exporter in bulgaria#pharmaceutical exporter in latin america#Ikris to promote exports to Latin American countries#generic medicine supplier in bulgaria#pharmaceutical distributors in belgium#generic medicine exporters in europe to latin america#pharmaceutical exporter in belgium to latin america#Pharmaceutical Exports from Belgium#best pharmaceutical exporter in bulgaria

0 notes

Text

Complete Bottle Packaging Line

Company Overview: Shiv Shakti Machtech is a Manufacturer, Supplier, and Exporter of Complete Bottle Packaging Line. A Complete Bottle Packaging Line is a fully integrated, automated system that handles all stages of bottle packaging, including filling, capping, labeling, sealing, and packing. It ensures the smooth, efficient, and high-speed packaging of products, reducing labor costs, improving product quality, and enhancing production throughput. Other Name of the Machine: Integrated Bottle Packaging System, Bottle Packaging and Filling Line, Automated Bottle Packaging Line, Turnkey Bottle Packaging Solution, Complete Bottling and Packaging Line, Bottle Packing Automation System, Fully Automatic Bottle Packaging Line, End-to-End Bottle Packaging System, Custom Bottle Packaging Line, Industrial Bottling. The Process of a Complete Bottle Packaging Line: Bottle Feeding: Bottles are fed into the system through automated conveyors. Filling: Filling machines fill bottles with liquids such as beverages, pharmaceuticals, or chemicals with precision. This step ensures accurate volume measurements for each bottle. Capping: Capping machines seal bottles after filling to prevent leaks and preserve the product. Labeling: Machines apply labels to the bottles for branding and product information, including barcodes, batch numbers, and other relevant details. Sealing: Sealing machines tightly secure the bottle caps for additional safety. Inspection and Quality Control: Automated inspection machines check for any defects in the bottles, such as underfilled or damaged ones. Packing: The finished bottles are packaged into boxes, trays, or pallets for shipping and distribution. Applications: Food and Beverage Industry Pharmaceutical Industry Cosmetic Industry Chemical Industry What industries can benefit from a bottle packaging line? Industries such as food and beverages, pharmaceuticals, cosmetics, chemicals, and e-liquids can all benefit from a complete bottle packaging line. How do I determine the right type of packaging line for my business? The right packaging line depends on your production volume, bottle size and type, and the level of automation you need. Our team can help you choose the best solution based on your requirements. Shiv Shakti Machtech is a Complete Bottle Packaging Line and an exporter worldwide, including to Algeria, Angola, Antigua, Barbuda, Argentina, Armenia, Australia, Austria, The Bahamas, Bahrain, Bangladesh, Belarus, Belgium, Belize, Benin, Bhutan, Bolivia, Botswana, Brazil, Brunei, Bulgaria, Burkina Faso, Cambodia, Cameroon, Canada, Central African Republic, Chad, Chile, Colombia, Congo, Democratic Republic of the Congo, Costa Rica, Cuba, Cyprus, Denmark, Dominica, Ecuador, Egypt, Guinea, Ethiopia, Fiji, Finland, France, The Gambia, Georgia, Germany, Ghana, Greece, Guyana, Hungary, Iceland, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, South Korea, North Korea, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Libya, Malawi, Malaysia, Maldives, Mali, Mauritania, Mauritius, Mexico, Moldova, Monaco, Mongolia, Morocco, Mozambique, Myanmar (Burma), Namibia, Nepal, Netherlands, New Zealand, Niger, Nigeria, Norway, Oman, Panama, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Rwanda, Saint Lucia, Saudi Arabia, Senegal, Serbia, Singapore, Slovakia, Somalia, South Africa, Spain, Sri Lanka, Sudan, South Sudan, Sweden, Switzerland, Syria, Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tunisia, Turkey, Uganda, Ukraine, United Arab Emirates (UAE), United Kingdom, United States, Uruguay, Uzbekistan, Vanuatu, Vatican City, Venezuela, Vietnam, Yemen, Zambia, Zimbabwe. For further details or inquiries, feel free to reach out to us. View Product: Click Here Read the full article

#Ahmedabad#Algeria#Angola#Antigua#Argentina#Armenia#Australia#Austria#Bahrain#Bangladesh#Barbuda#Belarus#Belgium#Belize#Benin#Bhutan#Bolivia#Botswana#Brazil#Brunei#Bulgaria#BurkinaFaso#Cambodia#Cameroon#Canada#CentralAfricanRepublic#Chad#Chile#Colombia#CompleteBottlePackagingLine

1 note

·

View note

Text

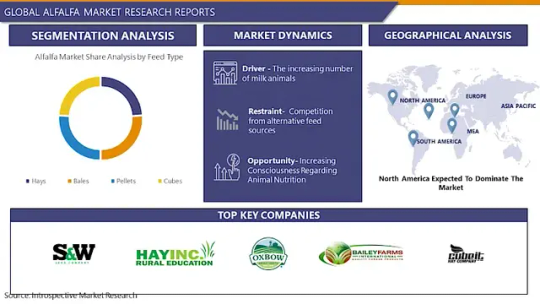

Alfalfa Market: Global Industry Analysis and Forecast 2023 – 2030

Global Alfalfa Market Size Was Valued at USD 265.33 metric tons In 2022 And Is Projected to Reach USD 426.11 metric tons By 2030, Growing at A CAGR of 16.2% From 2023 To 2030.

Alfalfa is a tonic plant rich in proteins, minerals, enzymes, and vitamins. A bulk quantity of the whole plant is required in the pharmaceutical industries, especially for homeopathic pharmacies. The increasing awareness regarding animal nutrition among the people is one of the important key factors driving the growth of the market. This can be attributed to the increasing consumer demand for chemical-free meat and milk-based products. Product manufacturers are using innovative processing and harvesting machinery to produce long-fiber hay cubes and hay products with enhanced fiber content.

In the US, beef industries have the most influence over alfalfa and hay prices. In terms of regional analysis, North America, particularly the US is the largest producer as well as exporter of alfalfa owing to the country's excellent geographical conditions. The country is known for its various best-quality alfalfa products.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

https://introspectivemarketresearch.com/request/14112

The latest research on the Alfalfa market provides a comprehensive overview of the market for the years 2023 to 2030. It gives a comprehensive picture of the global Alfalfa industry, considering all significant industry trends, market dynamics, competitive landscape, and market analysis tools such as Porter's five forces analysis, Industry Value chain analysis, and PESTEL analysis of the Alfalfa market. Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years. The report is designed to help readers find information and make decisions that will help them grow their businesses. The study is written with a specific goal in mind: to give business insights and consultancy to help customers make smart business decisions and achieve long-term success in their particular market areas.

Leading players involved in the Alfalfa Market include:

S&W Seed (US), Hay USA Inc. (US), Oxbow Animal Health (US), Bailey Farms International (US), Haykingdom Inc (US), Mc Cracken Hay (US), Cubeit Hay (US), Standlee Hay (US), Al Dahra ACX Global Inc. (US), Anderson Hay & Grain (US), Green Prairie International Inc- (Canada), Carli Group (Italy), Border Valley (India), Riverina (Australia)

If You Have Any Query Alfalfa Market Report, Visit:

https://introspectivemarketresearch.com/inquiry/14112

Segmentation of Alfalfa Market:

By Feed Type

Hays

Bales

Pellets

Cubes

By Application

Dairy Cow Feed

Cattle and Sheep Feed

Pig Feed

Horse Feed

Poultry Feed

By Animal Type

Cattle

Horse

By Regions: -

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

What to Expect in Our Report?

(1) A complete section of the Alfalfa market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the Alfalfa market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the Alfalfa market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the Alfalfa market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Alfalfa Market report.

Our study encompasses major growth determinants and drivers, along with extensive segmentation areas. Through in-depth analysis of supply and sales channels, including upstream and downstream fundamentals, we present a complete market ecosystem.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Acquire This Reports: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=14112

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyse extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email: [email protected]

#Alfalfa#Alfalfa Market#Alfalfa Market Size#Alfalfa Market Share#Alfalfa Market Growth#Alfalfa Market Trend#Alfalfa Market segment#Alfalfa Market Opportunity#Alfalfa Market Analysis 2023

0 notes

Text

Pharmaceutical Caps Manufactures, Exporters, Suppliers of UK , Canada, Japan, Indonesia, Malaysia, Germany, France, Italy, Spain, Greece. Switzerland, Netherlands, Poland, Croatia, Austria, Belgium, Ukraine, Sweden, Norway, Iceland, Malta, Czechia

We manufacturing, supplying, trading and exporting of Packaging Materials like Pharmaceuticals bottles manufacturers, Pharmaceuticals container exporters, Pharmaceuticals container suppliers, Pharmaceuticals containers, pharma containers, pharma bottle, pharmaceutical bottles, pharmaceutical containers, pharmaceutical glass bottles, pharmaceutical glass vials, hdpe bottles for pharmaceutical, plastic containers for pharmaceutical use, pharmaceutical plastic bottles, pharma plastic bottles, pharmaceutical plastic containers, pharma pet bottles, pharma glass bottles, hermetic container pharmacy, plastic medicine bottle manufacturers, pharma glass bottle manufacturers, pharmaceutical glass containers, plastic bottle for pharmaceutical use, pharmaceutical storage containers, pharmaceutical dropper bottles, pharmaceutical pill bottles, pharmaceutical grade plastic containers, pharma plastic bottle manufacturer, precis pharma containers, pharmaceutical spray bottles, pharmaceutical bottles wholesale, plastic medicine bottle suppliers, pharmaceutical pet bottles, 18 x 12 mm ROPP CAPS, 20 x 12 mm ROPP CAPS, 22 x 15 mm ROPP CAPS, 25 x 17 mm ROPP CAPS, 28 x 18 mm ROPP CAPS, 28 x 15.5 mm ROPP CAPS, 31.5 x 18 mm ROPP CAPS, 31.5 x 24 mm ROPP CAPS, 30 x 24 mm ROPP CAPS etc. Our continuing investments in equipment and personnel ensure the very highest quality of products and service.

Our Major Markets are Afghanistan, Albania, Algeria, Andorra, Angola, Anguilla, Antigua & Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bermuda, Bhutan, Bolivia, Bosnia & Herzegovina, Botswana, Brazil, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi, Cambodia, Cameroon, Canada, Cape Verde, Cayman Islands, Central African Republic, Chad, Chile, China, China - Hong Kong / Macau, Colombia, Comoros, Congo, Congo Democratic Republic of (DRC), Costa Rica, Croatia, Cuba, Cyprus, Czech Republic, Denmark, Djibouti, Dominica, Dominican Republic, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Estonia, Ethiopia, Fiji, Finland, France, French Guiana, Gabon,Gambia, Georgia, Germany, Ghana, Great Britain, Greece, Grenada, Guadeloupe, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Hungary, Iceland, India, Indonesia, Iran, Iraq, Israel and the Occupied Territories, Italy, Ivory Coast (Cote d'Ivoire), Jamaica, Japan, Jordan, Kazakhstan, Kenya, Korea, Democratic Republic of (North Korea), Korea, Republic of (South Korea), Kosovo, Kuwait, Kyrgyz Republic (Kyrgyzstan), Laos, Latvia, Lebanon, Lesotho, Liberia, Libya, Liechtenstein, Lithuania, Luxembourg, Madagascar, Malawi, Malaysia, Maldives, Mali, Malta, Martinique, Mauritania, Mauritius, Mayotte, Mexico, Moldova, Republic of, Monaco, Mongolia, Montenegro, Montserrat, Morocco, Mozambique, Myanmar/Burma, Namibia, Nepal, New Zealand, Nicaragua, Niger, Nigeria, North Macedonia, Republic of, Norway, Oman, Pacific Islands, Pakistan, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Puerto Rico, Qatar, Reunion, Romania, Russian Federation, Rwanda, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, Sao Tome and Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovak Republic (Slovakia), Slovenia, Solomon Islands, Somalia, South Africa, South Sudan, Spain, Sri Lanka, Sudan, Suriname, Swaziland, Sweden, Switzerland, Syria, Tajikistan, Tanzania, Thailand, Netherlands, Timor Leste, Togo, Trinidad & Tobago, Tunisia, Turkey, Turkmenistan, Turks & Caicos Islands, Uganda, Ukraine, United Arab Emirates, United States of America (USA), Uruguay, Uzbekistan, Venezuela, Vietnam, Virgin Islands (UK), Virgin Islands (US), Yemen, Zambia, Zimbabwe etc.Please visit our website at http://passageoverseas.com/ for more information. With Best regards, Sunny Gupta Cell phone : + 91 7389715797 e mail: [email protected]

#pharmaceutical caps#pharma caps#pharma closure#pharma capsules#pharmaceutical closure#pharmaceutical capsules#ropp caps#flipoff caps#tearoff caps

0 notes

Text

HOW AN ISLAND IN THE ANTIPODES BECAME THE WORLD'S LEADING SUPPLIER OF LICIT OPIOIDS

PETER ANDREY SMITH

UPDATED:JUL 24, 2019 ORIGINAL:JUL 11, 2019

Pharmaceutical companies exploited a regulatory loophole that allowed for a decades-long boom in licit opioid production fueled by Tasmanian-grown poppies. Here's what the island can tell us—and why supply matters for solving the third wave of the overdose crisis.

This story was supported by the Pulitzer Center on Crisis Reporting.

Heading into the highlands of Tasmania, some 250 miles south of the Australian mainland, narrow black-topped roads meander through a wide river valley bounded by distant mountain bluffs. Two-track paths splinter off into grassy pastures, past skeletal trees bleached by sun and drought. All along the way, small signs dangle from wire fence lines: Danger Prohibited Area Poison. Little else would suggest that these fields represent the nucleus of the global opioid supply chain—the starting point for one of the world's largest drug markets.

In Bothwell, a village where trucks packed with sheep idle outside a gas station, I met a farmer named Will Bignell. Bignell, a boyish guy in his thirties, with tousled hair and bright green eyes, was something of a reluctant seventh-generation farmer. He'd left his family's farm in the midst of a prolonged drought, moved to Hobart, Tasmania's capital city, and started a family. Then, in 2009, Bignell began making the hour-long commute up to the farm. Instead of raising livestock, Bignell plowed up pasture land and planted his first crop of opium poppies—a particular varietal, in fact, custom-tailored for pharmaceutical drug manufacturers.

He had a contract to grow these specialized poppies with Tasmanian Alkaloids, which, until it was sold in 2016, was the only agricultural research and development facility in Johnson & Johnson's sprawling pharmaceutical empire. For a time, Tasmanian Alkaloids offered tens of thousands of dollars in cash incentives to farmers. Growers also reported receiving Mercedes-Benzes and BMWs for producing the highest yields of drug compounds. Across the island, Bignell saw how the potential long-term profits on investment had drawn young professionals away from desk jobs on the Australian mainland back to the island.

"If it was just bloody Merinos and fine wool, I doubt they'd come back." With poppies, Bignell says, farmers could support a young family. "You get the bloody price reward. It's every farmer's dream."

Once harvested, the dried poppy plants are processed into a crude extract, and this so-called "narcotic raw material" is flown to manufacturing facilities. The active compounds found in the poppy, known as opioid alkaloids, are turned into active pharmaceutical ingredients, which are then formulated into analgesic medications that are prescribed to treat pain; manufacturers utilize the same starting material to synthesize compounds that can be used to reverse opioid overdoses and treat addiction, such as naloxone and buprenorphine.

Tasmania quietly emerged as the world's leading supplier of licit opioids, at least initially, because of a breakthrough in plant breeding. In 1994, chemists tweaked the opium poppy so that the plant produced higher yields of thebaine, a chemical precursor for making oxycodone. More importantly, this transformation enabled United States manufacturers to evade a long-standing regulatory cap. Historian William B. McAllister, author of Drug Diplomacy in the Twentieth Century, suggests that thebaine may be a case of "regulatory entrepreneurship," where pharmaceutical companies attempt to figure out ways of getting around international drug controls to gain market share. Tasmanian Alkaloids, a pharmaceutical company based in Australia, followed by other firms, was able to ship thebaine despite the formal agreements because Drug Enforcement Administration rules governed the importation of morphine but, by 2000, clearly did not apply to thebaine. This regulatory regime was an unheralded but necessary precondition for the explosive growth of opioid production and oversupply in the last 25 years.

In a statement, Janssen Pharmaceuticals, Inc., says Johnson & Johnson previously owned two subsidiaries, Noramco, Inc., and Tasmanian Alkaloids, which were involved in producing the active ingredients found in opioid-based painkillers. "This manufacturing process is strictly regulated, limited, and monitored by the DEA and global authorities. They enforce regulations and set distribution quotas based on their assessment of the need for medicines containing these substances, and our businesses always complied with these rules." In its statement, Janssen adds, "We no longer own these subsidiaries, and we do not promote any opioid pain medications in the United States."

Because global drug policy overwhelmingly focuses on supply shocks to the illicit market—such as efforts to eradicate poppies and to punish people who produce illegal drugs—the licit side of the ledger receives disproportionately scant attention. But historically, Kathleen J. Frydl writes in The Drug Wars in America, 1940-1973, "one of the best ways to discipline the illicit market was to regulate the licit one," that is, through deterrence policies that jeopardize a doctor's or drugmaker's access to the licit supply, and through criminal sanctions.

Dried poppy capsules contain opium alkaloids, which provide the raw material for manufacturing dozens of pharmaceutical drugs.

In this case, international regulators and the DEA noticed Tasmanian suppliers were sidestepping the spirit of the original rules, but rather than closing the supply loophole, the DEA did what pharmaceutical lobbyists had been asking for and left the oxycodone pipeline wide open.

By 2011, J&J claimed in a report to Australia's Therapeutic Goods Administration that Tasmanian Alkaloids' high-thebaine poppy was providing 80 percent of the global market for oxycodone raw materials. Oxycodone, a chemical cousin of heroin, helped set the first wave of the overdose crisis in motion. Oxycodone made from Tasmanian-grown thebaine was formulated into brand-name OxyContin sold by Purdue Pharma. Today, some addiction specialists argue that a doubling-down on law enforcement and border security, combined with efforts to reduce prescriptions and to stem the diversion of legal pharmaceuticals, has left many people who use opioids at the whim of a changing market. Without a proportionate increase in evidence-based medications and treatment, experts such as Dan Ciccarone, a researcher at the University of California–San Francisco, warn that an approach that squeezes the licit balloon compels people who use opioids to turn to poisoned products, such as fentanyl and other synthetics contaminating the black-market heroin supply.

Stefano Berterame, an official at the secretariat to the International Narcotics Control Board, a quasi-judicial watchdog that tracks supply and demand, tells me that the U.S. policy on opioids permitted prescribing that "was not rational." But the INCB requires governments to establish their own national estimates, and traditionally put its faith in the U.S. authorities, rubber-stamping the ballooning manufacturing quotas set by the DEA. "In the U.S., they have a good understanding of the national need," Stefano says. "We are in no position to challenge the estimates produced by the U.S."

HOW TASMANIA THWARTED REGULATION AND TURNED THE OPIOID ECONOMY UPSIDE DOWN

Tasmania's ascendency in the global opioid market is often attributed to the island's location: Its "remoteness, small population, and limited arable agricultural land," as a 1989 report to the U.S. House of Representatives Committee on Foreign Affairs puts it, "enhances security and places a natural limit on expansion of opium cultivation." But Brian Hartnett, a former executive at Tasmanian Alkaloids, says the real reason poppies grown for pharmaceutical production were marooned in the antipodes has everything to do with American actions.

"It's really a reflection of U.S. government policy," Hartnett says.

American farmers could grow opium poppies, but under the 1961 United Nations Single Convention on Narcotic Drugs, and subsequent international drug control treaties, the U.S. agreed to continue outsourcing poppy cultivation primarily to what are known as "traditional suppliers," which were initially defined as India, Turkey, Yugoslavia, Afghanistan, Burma, Bulgaria, Iran, Pakistan, Vietnam, and the U.S.S.R. By the late 1970s, as state officials in Tasmania encouraged farmers to expand from experimental plots to broad-acre production, Australia, a non-traditional supplier, created a glut of narcotic raw materials that the U.N. Commission on Narcotic Drugs determined was, as the 1989 report later put it, "in excess of the world's legitimate needs." If U.S. drugmakers favored Tasmanian suppliers, then that would undermine U.S. treaty obligations, and so, in 1981, policymakers implemented what one Tasmanian Alkaloids executive referred to as the "infamous 80/20 rule."

The 80/20 rule requires U.S. manufacturers to import 80 percent of all narcotic raw materials from India and Turkey, providing favored market access to these state-run monopolies. (The rule reinforces broader foreign policy objectives. It excludes other traditional poppy-growing regions, such as Afghanistan, from the licit marketplace for failing to curtail production of illicit drug crops.) Furthermore, the rule acts as a governor, or a cap, leaving just 20 percent of the U.S. market open to the seven multinationals exporting raw materials from industrial-scale operations in Australia, Hungary, Poland, France, and, until 2008, the former Yugoslavia (which has since been replaced by Spain)—that is, until Tasmania came along with the thebaine poppy.

Because morphine is difficult and expensive to convert into a class of drugs that includes oxycodone, the 80/20 rule effectively limited thebaine production, which, in turn, constrained production of these so-called semi-synthetic pharmaceutical painkillers. Then, in 1994, a Tasmanian Alkaloids researcher named Tony Fist dipped thousands of poppy seeds into a chemical solution and discovered a mutant poppy plant he called the "Norman" (a play on "no morphine").

"It was a bit of luck, really," Fist says. The mutant poppy produced thebaine instead of morphine, and, Fist says, it more than halved the costs of making oxycodone. Farmers planted the first commercial crop of Norman poppies in 1997, just as Purdue Pharma aggressively ramped up production of OxyContin, its patented oxycodone pill.

OxyContin being counted at a Walgreens drugstore on August 21st, 2001, in Brookline, Massachusetts.

"If they didn't get that thebaine," Fist says, "they wouldn't have been able to meet the demand for oxycodone." The significance wasn't lost on Tasmanian officials. Thebaine skirted the 80/20 rule, and, as one state official told Australia's ABC radio, "there is no doubt whatsoever that demand for thebaine will increase, and the Americans particularly will take all we can provide."

Which is exactly what happened: Between 1993 and 2015, the DEA's annual aggregate production quotas—the total amount of opioids to be manufactured—increased threefold. (Over the same time period, Willem Scholten, a drug-control policy consultant in Lopik, in the Netherlands, estimates that the consumption of seven commonly prescribed strong Schedule II opioid analgesics—expressed in terms of morphine milligram equivalents—increased sevenfold.) The oxycodone production quota alone climbed from around 3.5 tons annually to over 150 tons. According to data from the Centers for Disease Control and Prevention, between 1999 and 2015, the average dose size per person nearly tripled.

The underlying causes of addiction are complex, and often result from repeated drug exposure. There are many social factors; some addiction specialists hypothesize that people self-medicate with opioids as a refuge from physical and psychological trauma, despair, and inequality. Patients prescribed opioids for long periods of time, and at high doses, run the risk of developing a physical dependence, and so, while the oversupply of opioids does not necessarily lead to addiction, dramatic shifts in supply made illicitly diverted pharmaceuticals, such as oxycodone, oxymorphone, and other painkillers, the drugs of choice in many communities.

By 2001, OxyContin, the poster pill of the crisis, had earned a reputation for being "hillbilly heroin." In 2017, the pharmaceutical company Mallinckrodt agreed to pay $35 million to settle a Department of Justice lawsuit alleging that it had failed to meet its obligations to detect and to notify the DEA of suspiciously large orders of generic oxycodone. (Mallinckrodt denies the allegations, and the settlement contained no admission of wrongdoing.)

Back in 1999, a Tasmanian state official said in a broadcast interview that U.S. federal regulators considered closing off the loophole and extending the 20 percent cap to cover thebaine from Australia and other non-traditional suppliers.

"The DEA explored changing the 80/20 rule," Christine A. Sannerud, a DEA scientific adviser (who has since left the agency), says, "and sent notification to the companies, and then we decided to leave [the rule] as-is." Alongside broader decades-long shifts, such as the breakdown of trade barriers and a liberalization in pain management, the DEA had, under pressure from pharmaceutical interests, relinquished a traditional tool for regulating opioid supply.

"That decision stands in contradistinction to the whole legacy of narcotic regulation," says Frydl, the drug-war historian. "For the DEA to make that decision is completely nonsensical in my eyes." (In response to a records request, the DEA produced no documents relating to the decision to leave thebaine exempt, although, in a 2016 letter to a Canadian firm, the agency affirmed the U.S. treaty obligations to support traditional suppliers.) In fact, DEA officials argue its import quotas for thebaine were justified, based on legitimate need, and came in response to a shift in prescribing practice.

In the end, the deregulation of the licit market, and a booming black market for illicit opioids increasingly laced with fentanyl, had one thing in common: Both compromised public health in the quest for profit.

Then, in 2011, Dan Ciccarone, the UCSF researcher who studies opioid market dynamics and leads a long-running National Institutes of Health-funded study called Heroin in Transition, saw the effects firsthand. He had flown to Philadelphia to do some field work. He wasn't looking for dope but quickly bumped into a man who was. The guy was furious because, as Ciccarone remembers it, his doctor had recently cut him off.

He immediately called his colleagues to say, "I've just made a discovery that's going to blow your mind."

Ciccarone's team spoke to dozens of people who transitioned to heroin when they couldn't find pills, particularly after OxyContin was reformulated in 2010, and became harder to crush and snort. Their studywas ongoing in 2012, just as the first wave of overdose crisis, which traced to prescription painkillers, gave way to a second wave, where deaths due to heroin increased. Since then, the U.S. has entered a third wave, wherein fentanyl and illicitly manufactured opioids have tainted the heroin supply, driving the number of fatal overdoses in the U.S. to more than 70,000 in 2017. While people who use heroin experience a range of preferences, Ciccarone and his colleagues find that many do not deliberately choose fentanyl. Before its recent supply influx, he says, demand for fentanyl was practically non-existent.

With regard to the current fentanyl crisis, as Ciccarone put it recently, "supply matters more than demand."

A RECKONING

In 2016, SK Capital Partners, a private-equity firm, purchased Noramco and Tasmanian Alkaloids, the former J&J subsidiaries involved in the opioid supply chain. That year, Aaron Davenport, a managing director at SK, said he saw Tasmania's designer poppies as a crucial asset for continued growth in abuse-deterrent formulations and the international market. (The terms of the sale are confidential, but the firm was not named in a string of recent state lawsuits filed against companies involved in the opioid supply chain.)

In early 2019, the Oklahoma attorney general called J&J an opioid "kingpin" in court filings for his lawsuit accusing the company of creating a "public nuisance" by deceptively marketing pharmaceutical opioids. The trial, currently underway, is expected to last two months. J&J denies any wrongdoing. Lawyers representing the company argue that the public nuisance statute is being misused, and say that the company can neither be held liable for selling government-regulated products nor for manufacturing, selling, or marketing Food and Drug Administration-approved medications made by other companies using their narcotic raw materials. "Our actions in the marketing and promotion of these important prescription pain medications were appropriate and responsible," Janssen Pharmaceuticals says in a prepared statement. "The allegations made against our company are baseless and unsubstantiated." The argument is that drug manufacturers cannot be held liable because regulatory authorities abdicated their duties.

Meanwhile, the FDA continues to encourage manufacturers to develop abuse-deterrent formulations. Researchers suggest that the strategy of making prescription opioids harder to crush up and tamper with, while being sometimes effective, can come with paradoxical, and unwanted, results. The continued deference to market forces asks the public to trust that existing regulations and restrictions would solve the current crisis, as surely as OxyContin, and other long-acting painkillers, had proven addiction-proof, and as surely as the saturation of communities with pharmaceutical-grade opioids had provided pain relief without leading to tens of thousands of accidental deaths.

For decades, the licit supply has gone largely overlooked, like a secret hidden in plain sight. In policy circles, the conventional wisdom once held that counternarcotics strategies that focused on reducing drug supply mattered more than demand, but public-health experts contend that supply-side interventions often backfire; and today, when the leading experts in academic medicine address the opioid crisis, their emphasis is increasingly on demand controls, including treatment, prevention, and other health-care and harm-reduction strategies. As one prominent policy expert at Carnegie Mellon University wrote in a 2015 commentary (in the context of illicit cocaine supply): "One of the very few things the field believed it could say with confidence was that supply control efforts cannot meaningfully reduce the use of a drug whose markets were already well established."

Despite a market exclusivity for licit opioids, and the blanket prohibition on heroin and illicitly manufactured fentanyl, these policies failed to curtail addiction and the widespread use of drugs. Yet politicians keep turning to supply-side solutions.

Beginning in 2015, for the first time in nearly two decades, DEA regulators decreased aggregate production quotas for several classes of opioid painkillers; the agency has also reduced the total volume of thebaine U.S. manufacturers are allowed to import. The 2018 SUPPORT for Patients and Communities Act, the bipartisan opioid bill that was recently signed into law, mandates additional review of the DEA's quota; the law also requires an "explanation of why the public health benefits of increasing the quota clearly outweigh the consequences of having an increased volume." But, in an interview with Pharmacy Times, a former DEA official-turned-whistleblower predicted that reductions to the quota will lead to drug shortages, thereby cutting off legitimate pain patients.

Like many proposed responses to the overdose crisis, reducing the availability of prescription opioids might seem like a good idea. But it comes at a time when legacy pain patients are reportedly being denied access to medical care, and some doctors are refusing legitimate requests over fears of disciplinary reviews. Even if a cap on opioids, combined with state-level drug-monitoring programs, leads to a massive downturn in opioid availability, public-health experts worry that, without committing additional resources for medication-assisted treatment, suppressive strategies will worsen the overdose crisis. A 2018 study published by researchers at Stanford University suggests that such reductions could potentially save lives over the long term by reducing the number of people who become addicted, but that the reductions are currently on track to kill a lot more people in the next five years. Physicians argue that these policies punish the powerless and harm individuals who are pushed toward increasingly contaminated illicit drugs.

Back in Bothwell, Tasmania, the rural village some 3,000 feet above sea level, nobody stayed connected with his customers on the other side of the world quite like Will Bignell did: He beamed a wireless signal off a nearby hillside and logged into online forums to chat with other hobby pilots. Bignell flew drones over his farm, and pored over aerial images at such high resolution that he could zoom in and see an individual tire tread—all in an attempt to coax higher yields of drug compounds out of his poppy crop.

Poppies had played a central role in Bignell's decision to move back to the family farm, where he now lives and works full time. "Living the dream," he tells me when I call in late 2017. Bignell was out plowing his fields that day. Over time, it dawned on him that his livelihood was being called into question. One day, he'd struck up a conversation with a friend in Florida whom he'd met online, who asked him, "You grow opium?"

"Yeah, grow a lot of it," Bignell says. "One of the world's biggest suppliers. We supply America with a fair chunk of it."

"Whoa, I don't know how I feel about that. You know my sister died of overdose three years ago."

On our call, the line went quiet. Then, Bignell told me, "That shit makes you really sad when you hear that." In the background, I could hear the whir of machinery. Bignell rode along at a steady pace, turning over soil for next year's crop. He had his hands off the wheel, and rumbled forward on autopilot. ❖

Author: Peter Andrey Smith is a freelance reporter based in New York. His work has appeared in Outside, Harper's, The New York Times Magazine, and others.

Photographer: Stephen Dupont is a photographer based in Sydney, Australia. He has produced photo essays from dozens of countries, including Afghanistan, Angola, Burma, Burundi, Cambodia, India, Israel, Iraq, Rwanda, Somalia, and Zaire. He is the author of several books, including Steam: India's Last Steam Trains and Fight, a visual anthology of traditional wrestling around the world.

Editor: Ted Scheinman Researcher: Jack Denton Picture Editor: Ian Hurley Copy Editor: Leah Angstman

Pacific Standard's Ideas section is your destination for idea-driven features, voracious culture coverage, sharp opinion, and enlightening conversation. Help us shape our ongoing coverage by responding to a short reader survey.

down in the middle of his economically depressed ancestral village.

© 2019 The Social Justice Foundation

0 notes

Text

Cannabis Production in Europe!

Europe is waking up to the massive potential of cannabis production

Europe is on the forefront of major change in the production and distribution of medical cannabis. International Cannabis Corp. (ICC) is standing at the precipice of that change, a catalyst in the areas of medical marijuana production, manufacturing and distribution in Europe. Every aspect thoughtfully engineered to solidify ICC and its partners as strongholds in the European and global cannabis market.

Europe is aligned to become the fastest growing cannabis market globally. With double the population of Northern America and growth numbers for the past year totaling the previous six years combined, Europe is a sleeping giant that has far from shown the full extent of its strength. This has not always been the case.

Most countries in Europe have taken a more conservative view on cannabis and marijuana production. Many have understood the benefit of producing hemp for industrial and textile purposes but placed cannabis on the list of illegal drugs.

Ironically, in 2001 Portugal became the first country, not only in Europe but globally, to decriminalize marijuana. Uruguay was the first to fully legalize marijuana in 2013, but European countries were not so quick to follow. Canada and South Africa were the next to legalize cannabis as recently as last year, others decriminalizing and legalizing medical marijuana.

Europe has not warmed to the idea of regulated recreational marijuana use as quickly as Canada and some states in the US have, but it is starting to see the potential, both in the health benefits and revenue stream, of medical cannabis. Consultancy.eu reported that over €500 million has been invested in the cannabis industry, with France, the United Kingdom, Spain, Germany, Italy and the Netherlands leading the charge in what is projected to become a €123 billion industry by 2028. The focus in Europe is now on creating legislation and expanding the pharmaceutical programs and distribution reach already in place.

The growth potential of medical cannabis in Europe

According to Prohibition Partners, the European population is 745 million, with a healthcare expenditure of €2.3 trillion. Of these, 25 million are cannabis users, and this is in a relatively conservative market in the current day. The medicinal cannabis market in Europe is still very much in the upturn, not near to reaching its full growth potential. By 2028, the estimated medicinal marijuana market in Europe is suggested to reach €58 billion.

It is one thing to look at how legalization of medical marijuana will affect the growth of the market itself, but data suggests that may be just a drop in the bucket for the country that can focus on cannabis production. Medical marijuana production, legalization and distribution can lead to an increased number of employment opportunities and increased income into the country, if export opportunities are explored. Although the data is new and based on the recent legalization in the United States and Canada, early signs show huge positive economic growth potential for Europe.

What if recreational marijuana production was explored?

If the thinking around recreational marijuana could be expanded into a legal framework, the potential revenue for the market would double to over €115 billion within 10 years. The medical benefits of marijuana have been explored, but recreational usage is still faced with cynicism and is a polarizing and contentious debate in most countries still.

Legalization of recreational use is not off the table however, with many hoping that global legalization will result in the disbandment of the marijuana black market and any criminal element still left within the industry. The proceeds of recreational marijuana production are better spent on strengthening the economy of the country than lining criminal pockets. Europe will continue to follow reports coming from the US, from states like Colorado, which is now into it its fifth year of legalization, and from Canada, which is still in early stages of development, but is already seeing the economic benefits.

Germany, Denmark, Malta, Italy and Greece are the most open to a fully regulated cannabis market and will likely be the first within Europe to explore this route, with Luxembourg who has made steps for a fully legalized market for adults by 2023.

ICC stands poised to supply demand in all potential sectors of the market in Europe

In cannabidiol (CBD) production, International Cannabis Corp. (ICC) recently announced their partnership with Wayland Group. The companies will introduce extraction, distillation processes and finished dose manufacturing into their CBD product plan for the European market. ICC also has holdings in Germany, Poland, Portugal, Greece, Italy, Malta, Macedonia, and Bulgaria with goals of increasing CBD production ten-fold in those countries, and to distribute to 160 clients in over 16 European countries through Marathon Global and Cosmos Holdings.

In medical marijuana production, ICC holds licenses in Denmark, with a 100-acre land package and allowance of bulk exports out of the country. Through their partnership with Theros Pharma Ltd., ICC successfully imports into the UK for patients holding a prescription for medical cannabis. In Switzerland ICC is the only company to import THC distillates into Switzerland from Canada. In partnership with BBI and Hilti in the country, ICC is poised to be the first commercial production THC license holder in Switzerland, the same is true for Italy. ICC holds a medical cannabis cultivation license in Greece, and to manufacture finished-dose medical cannabis in Malta. In the Balkans, ICC has exclusive license to cultivate, manufacture and export medical cannabis.

ICC is partnering with Alkaloid AD Skopje in Macedonia to explore modern developments in pharmaceutical grade marijuana. Alkaloid AD Skopje also has many years of experience in cosmetics, which may lead to a new edge in the cannabis production market.

Ultimately, ICC’s CBD market is well-developed and cemented in Europe, ready to expand as the new users start to learn the benefits of CBD products. ICC is ready to take on the potential monstrous demand of Europe’s medicinal marijuana needs as they grow, with cultivation, production, extraction, manufacturing and distribution stations set up across Europe. All these facilities are also easily able to focus on recreational cannabis production if this became a new focus in Europe or globally.

The chains of resistance are starting to fall in Europe

Europe has been held back by a lack of knowledge and understanding of the benefits of medical cannabis, as well as the stigma of cannabis being deemed illegal and labeled the same as harmful narcotics like heroine and cocaine. In most European countries the laws need to be revised. Even if the perception of the country has changed, this can take years. New industries can also take several years to become fully established, licensed and regulated.

Europe is playing catch up to a modern thinking. As resistance has started to fall aside to make way for understanding and consideration of the medical and economic benefits of cannabis, ICC has been working to research the best strains, implement successful processes, build facilities and manufacturing support, and establish distribution channels ready to go as each country gives the green light.

Europe is certainly no longer denying the prospects of the cannabis market. The sleeping giant has only opened one eye to the potential growth of the cannabis sector. ICC is ready to partner with Europe as it awakens fully to the sheer magnitude of the market it is sitting on.

0 notes

Text

The Cannabis Production Landscape in Bulgaria

Bulgaria: A country known for forging some of the most beautiful pieces of jewellery throughout history, has become the crown of cannabis production within Eastern Europe.

The history of cannabis production in Bulgaria

Bulgaria has a tumultuous history, dating as far back as 100 AD. The unrest continued even after they declared their independence from the Turkish empire in 1908. Through wars and coups, poverty and discontent, the country has maintained its culture, its beautiful artistry, and resplendent landscape.

Up until recently, cannabis was grown in the tomato gardens of pensioners, and the task of Marijuana Distribution fell, illegally, to their adult children. One third of the Bulgarian population is over the age of 55. As a result, there is much interest in the pain relieving and anti-inflammatory properties of medicinal cannabis.

Bulgaria has focused on tourism as a recent source of revenue. Now it seems that medical marijuana production could be the next source of support for the once heavily impoverished country. Cannabis Production would certainly make use of the temperate climate and arable land. The arability conditions needed to grow high quality cannabis accounts for over 30% of Bulgaria’s total land hectares. This ensures that Bulgaria has plenty of room to grow as a leader in the hemp and medical cannabis markets.

Opportunities for Medical Marijuana Processing and Distribution in Bulgaria

While many countries have become well accustomed to the idea of medical marijuana processing and distribution. Bulgaria is only starting to establish their roots in the market. Bulgaria’s pharmaceutical market size is €1.42 billion, with 85% of pharmaceuticals imported. The population of Bulgaria is 7 million. With the large population, including elderly, and proximity to the rest of the eastern European countries, Bulgaria would make an ideal medical marijuana metropolis.

Bulgaria offers low income and corporate tax (10%). Coupled with the EU pledge of €600 million on railway infrastructure between Macedonia and Bulgaria, the opportunities for expanding cannabis distribution further are ripe. The railway line provides access to a pharmaceutical market potential of €6.46 billion with the inclusion of Macedonia and Greece. Bulgaria’s 11-year membership in the EU will ensure that medical cannabis distribution across Europe will operate smoothly.

International Cannabis Corp.’s role in cannabis production and distribution in Bulgaria

Balkan Cannabis, a holding of International Cannabis Corp., holds a 50% interest in a Bulgarian subsidiary. This subsidiary controls licenses for the production, manufacturing and export of both hemp and medical cannabis. The remaining 50% is held by a prominent Bulgarian business leader. This subsidiary gives Balkan Cannabis access to a 15,000-hectare parcel of land, with a two-year option to gain another 15,000 hectares. A land parcel of this size is a strong footing in the European market. It allows for mass hemp and medical marijuana production and distribution.

Bulgaria has been rated as the sixth best country for doing business in Eastern Europe and Central Asia. A T Kearney ranks the country first in Europe for outsourcing. Bulgaria may be the threshold to one day distributing to the Asian markets.

Conclusion: ICC, Bulgaria and Europe moving forward in medical cannabis production

International Cannabis Corp. offers Bulgaria high quality strains and an elite end-product. This ensures that the work of medical marijuana processing is rewarding for the country and its residents. The Balkans make the ideal hub from which to export superior medical marijuana into an increasingly accepting European market. The United States medical marijuana industry is estimated to be worth $75 billion by 2025. The European market, at a population twice the size of the US, potentially stands to make $150 billion as legalization advances across all European countries.

Bulgaria was home to one of the oldest and most advanced civilizations on earth, with an eye for quality, craftmanship and fine design. These values live on in the people of the country today. International Cannabis Corp. will uphold these traditions in its approach to cannabis processing in Bulgaria. It is indeed how ICC approaches every aspect of its cannabis production. Across the world, from breeding and cultivation, to extraction and distribution, ICC’s model is one to aspire to.

With ICC’s Balkan centerpiece, and Europe warming to the use of medical marijuana in the treatment of painful, inflammatory and seizure-based illnesses, the potential revenue stream could soon be overflowing. Six new countries have legalized between June and December 2018. Medical marijuana usage in Europe grows by 40% each month. As the rest of Europe opens their doors to legalizing cannabis, ICC is poised to support and lead them in the world market.

0 notes

Text

Pharmaceutical Supplier in Brazil

During the Covid-19 crisis, many countries ran out of rare medicines for patients suffering from chronic diseases like cancers, HIV, etc. India came forward to help such countries by supplying rare drugs to different countries worldwide. India is known as the largest generic medicine. Ikris Pharma Network is a fast-growing global pharmaceutical consultancy and service company dedicated to delivering hard-to-access drugs to needy patients to save their lives. Ikris is also emerging as the best pharmaceutical supplier in Brazil, mainly after it supplied medicines during the pandemic, and IPN is continuously supplying drugs in the Brazilian pharmaceutical sector. It has already provided more than 150 products to Brazil. IPN is a GDP-certified pharmaceutical organization for wholesale as well as retail drugs. We supply to pharmacies, hospitals, pharmacy organizations and many more. It is a reliable brand Worldwide for providing the best quality pharma products. It only works through legal channels in delivering products and works as per the FDA guidelines.

#generic medicine supplier in bulgaria#generic medicine exporters bulgaria to latin america#best pharmaceutical exporter in bulgaria#Global Access to Medicines

0 notes

Text

Single Head Bottle Capper Machine

Company Overview: Shiv Shakti Machtech is Manufacturer, Exporter and Supplier of Single Head Bottle Capper Machine. This Machine uses a single head or chuck to apply caps onto bottles or containers with precision and consistency. It operates by placing a bottle under the capping head, where the cap is automatically fed, positioned, and screwed or sealed onto the bottle. These machines typically suit moderate-speed production lines and work best for small to medium-scale packaging operations. The machine is highly adaptable and can handle different types of caps, including screw caps, press-on caps, and crown caps, depending on the specific needs of the product. Its efficiency and precision make it a popular choice in industries requiring fast and reliable capping solutions. Other Names for the Product: Single-Head Screw Capper, Automatic Chuck Capping, Single-Head Bottle Capper, Precision Screw Capper Equipment, Single-Station Capping, Chuck-Style Cap Sealing , Single-Head Cap Tightening Machine, Rotary Screw Capper Machine, Automatic Screw Capping Machine, Single Head Bottle Screw Capper Features: Automated Capping: Reduces manual labor and enhances production efficiency. Versatile Cap Compatibility: Handles screw, flip-top, and crown caps. Precise Torque Control: Ensures secure cap application without damage. Adjustable Settings: Allows customization for cap height, torque, and speed. Compact Design: Space-efficient, ideal for smaller production spaces. Hygienic Operation: Easy to clean, suitable for food, beverage, and pharmaceutical industries. What is a Single Head Bottle Capper Machine? A Single Head Bottle Capper Machine automatically or semi-automatically applies caps to bottles using a single capping head, which applies caps one at a time. How does a Machine work? The machine feeds bottles into the capping station, places a cap, and secures it using a rotating or linear mechanism. It applies torque control to tighten the cap to the correct pressure. What types of caps can a Single Head Bottle Capper handle? A Single Head Bottle Capper can handle a variety of caps, including screw caps, press-on caps, flip-top caps, and spout caps. Shiv Shakti Machtech is a Single Head Bottle Capper Machine and an exporter worldwide, including to Algeria, Angola, Antigua, Barbuda, Argentina, Armenia, Australia, Austria, The Bahamas, Bahrain, Bangladesh, Belarus, Belgium, Belize, Benin, Bhutan, Bolivia, Botswana, Brazil, Brunei, Bulgaria, Burkina Faso, Cambodia, Cameroon, Canada, Central African Republic, Chad, Chile, Colombia, Congo, Democratic Republic of the Congo, Costa Rica, Cuba, Cyprus, Denmark, Dominica, Ecuador, Egypt, Guinea, Ethiopia, Fiji, Finland, France, The Gambia, Georgia, Germany, Ghana, Greece, Guyana, Hungary, Iceland, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, South Korea, North Korea, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Libya, Malawi, Malaysia, Maldives, Mali, Mauritania, Mauritius, Mexico, Moldova, Monaco, Mongolia, Morocco, Mozambique, Myanmar (Burma), Namibia, Nepal, Netherlands, New Zealand, Niger, Nigeria, Norway, Oman, Panama, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Rwanda, Saint Lucia, Saudi Arabia, Senegal, Serbia, Singapore, Slovakia, Somalia, South Africa, Spain, Sri Lanka, Sudan, South Sudan, Sweden, Switzerland, Syria, Taiwan, Tajikistan, Tanzania, Thailand, Togo, Tunisia, Turkey, Uganda, Ukraine, United Arab Emirates (UAE), United Kingdom, United States, Uruguay, Uzbekistan, Vanuatu, Vatican City, Venezuela, Vietnam, Yemen, Zambia, and Zimbabwe. For further details or inquiries, feel free to reach out to us. View Product: Click Here Read the full article

#Ahmedabad#Algeria#Angola#Antigua#Argentina#Armenia#Australia#Austria#Bahrain#Bangladesh#Barbuda#Belarus#Belgium#Belize#Benin#Bhutan#Bolivia#Botswana#Brazil#Brunei#Bulgaria#BurkinaFaso#Cambodia#Cameroon#Canada#CentralAfricanRepublic#Chad#Chile#Colombia#Congo

1 note

·

View note

Text

New Post has been published on

New Post has been published on http://gogetthelook.com/2017/03/20/male-enhancement-pills-male-enhancing-pills-testosterone-booster-sex-drive-pills-libido-support-for-men-sexual-support-enlargement-pills-increase-stamina-size-energy-endurance-pills/

Male Enhancement Pills, Male Enhancing Pills, Testosterone Booster, Sex Drive Pills, Libido Support for Men, Sexual Support, Enlargement Pills, Increase Stamina, Size, Energy, Endurance Pills

Product Description Male Enchantment Pills Mr. Thick is an herbal supplement specially designed to enhance your sexual adventuring. It lives up to its Mr. Thick name by allowing your body to relax and encourages blood flow in your loins to give your partner a truly satisfying sexual experience. Arousal can be achieved much easier and you can stay in the thick zone for longer than you have done before. You will feel you feel the power of the legendary catuaba bark and muira pama. These Brazilian herbs have been used for centuries to increase sex drive, passion, and sexual intensity. The twin ingredients are the secret behind every Latin lover and are now yours to be unleashed. You'll find yourself with a deeper sexual appetite, more inventiveness and vigor in the bedroom, and a deeper attraction to your partner. Recent studies with these ingredients have found that they make you more receptive to dopamine - a hormone that is released during sex. Sex will come more naturally to you and every touch and flutter will be felt all that more ferociously. This male enhancing supplement contains the organic supplements boron and astragalus which are both widely used by athletes as a quick way of increasing sporting performance? If it's good enough for athletes then why not you? Mr. Thick contains over ten activating ingredients which have been chosen to complement each other to be the one-stop sexual enhancement that you need. All ingredients are natural so there are no nasty surprises and they are a safe and easy way to boost your sex life. Mr.Thick Male Enhancement pill bottle color may vary.

Price: $24.95

Male Enhancement Pills, Extra Strength

Thicker, Longer, Stronger!

Testosterone Booster

Libido Support for Men

Sexual Support, Semen Volumizer

Penis Enlargement Pills – Herbal Erection Pills

youtube

The penis enlargement pills for erection, male enhancement, strong penis size, thick penis size and especially for diabetes patients in sex to satisfy his partner, to know more check out – http://www.jaguaarpills.com/how-to-increase-penis-size.php

Most studies have proved that men are worried about the size of their penis. Most men don’t consider their penis ‘normal’ in size. However, there is no sure proof of the ‘normal’ size of the penis but the markets are full of male enhancement products including Pennies Enlargement Pills, Penis Enlargement creams and Tablets. Apart from various medicines, there are a lot of non-surgical methods that claim to grow the penis size. These medications and techniques offer to increase the length and width of penis.

As it is a very sensitive issue, most men are conscious of talking about it openly. For them, Internet offers various solutions. Men think that an enhanced size of the penis will improve their sexual relationship. One can get every bit of information that is available through the medium of internet. Apart from various options in medicines, it offers various other solutions which don’t require any surgery. There are exercises and stretching exercises too which claim to improve the size of the penis.

Amongst the Non-surgical methods to grow penis, most popular are Penis Enlargement Creams and pills. Penis Growth Creams and pills are a popular method of male enhancement as they can save one from the surgical knife. They contain herbs, vitamins, minerals and hormones which can help to enhance the size of the penis but it always necessary to consult a doctor before taking these medicines.

Most of these medicines are used to increase the blood flow to the penis. It is considered that an improved blood flow can also improve the size of the penis by expanding erectile chamber. These pills are taken to have stronger, harder and bigger erections and more powerful ejaculations. They can also be used to enhance the libido and sex drive.

A2ZePharma can offer you effective and best quality Penis Enlargement Pills & creams. It is a renowned Exporter and Supplier of Eye Drops, Generic Drugs, Sexual Health Medicines, Women’s and Men’s Health Care Medicines. Its products offer a quick relief at a reasonable price. It has its clients all over the world including countries like Russia, Ukraine, USA, UK, Bulgaria, EU Countries and China. All its products are made complying with the quality standards and are delivered with quality packaging. It also offers generic and herbal products at reasonable prices listing its name amongst well recognized Generic Medicine Suppliers. To place your orders for Sex pills and Generic Pharmaceutical Drugs, you can also log on to http://www.genericepharma.com

A2ZePharma is reliable Generic Drug Supplier from countries like USA, Russia, Ukraine and China and offer Generic Anti Cancer Medicine and Sex Health Medicines,Buy Sildenafil Tablets,Buy Super P Force Pills etc.

0 notes