#best life insurance companies uk

Explore tagged Tumblr posts

Text

0 notes

Text

Also preserved in our archive

A disgustingly economic discussion that is far more clear about the realities of covid than what our governments are telling us

“There is a huge delusion at the moment that COVID is over and when we talk about it, we say ‘when the pandemic happened’ but actually it is still happening,” he said. “So, insurance companies need to be very conscious of that and to be thinking ahead. Swiss Re has a powerful role across the market to make sure that this is being thought about. “In our view, there are a range of scenarios, but most of them anticipate a return to normality in five to 10 years, depending on your level of optimism. And we think that because of the other more fundamental movements happening around cancer, lifestyle risk and eventually Alzheimer's, to name the three biggest ones, that mortality improvements will also return over the longer term.”

By Mia Wallace

“COVID-19 is far from over.”

A recent Swiss Re report suggested potential excess mortality in the general population of up to 3% in the US and 2.5% in the UK by 2033 in a pessimistic scenario, highlighting the lingering impact of COVID-19 – both as a direct cause of death and as a contributor to cardiovascular mortality.

Discussing the report with Re-Insurance Business, Paul Murray (pictured), CEO of L&H Reinsurance at Swiss Re, outlined some of the key ageing and mortality trends shaping the life and health reinsurance market today. “Of course, we saw excess mortality when we were locked down and experiencing the pandemic but now we’ve returned to normal life, we think it’s over and it’s not. People are still getting ill with the COVID infection and they’re still dying.”

The debate for the market now is how long that trend is likely to continue, and whether its impact will fade over time – with Swiss Re’s recent report offering multiple scenarios into the reinsurance giant’s viewpoint on that question. Top of mind is understanding the key factors driving future mortality trends and changing life expectancy statistics – and how these influencing factors may change going forward.

What are the top trends driving future mortality trends? Pinpointing some of the key considerations driving future mortality trends, Murray underscored the need to look at historical data. “The headline for me is always that there has been a phenomenal period of mortality improvements, of life expectancy extending. This is probably one of the biggest social transformations that the human race has been through.

“One of the main drivers of that has been cardiovascular improvements. Smoking cessation helped a lot towards that in the 20th century and is continuing now as well. There’s also new technology that enables low-intervention cardiovascular surgery, like stents. We’ve shifted from a lot of surgery having to be open-heart and high-risk in an operating theatre to in-and-out in a day with injected stents. It has been completely transformational.”

Where do medical advances go next? The ”plumbing” of the human body and the way it’s protected and healed by modern medicine has been largely optimised, he said, but now some of the benefits of that is starting to level off. Looking to the future, he sees that there is still the potential for some further improvements as a factor driving increased life expectancy, particularly amid improving access to information and education about healthy living choices – and improving intervention techniques.

“When we look forward, I anticipate the area where we have the best chance of improvements is on the cancer side,” he said. “Comparatively to cardiovascular risk, improvements to cancer treatments have been relatively low in the past. Of course, it’s very complex as 'cancer' is a bucket term which combines 200-plus types, but we are seeing some very promising technologies emerging here that will help address that.

“Take mRNA vaccines, for instance, which are not new but became very prominent in the pandemic, specifically as it helped us develop vaccines very quickly. mRNA capabilities, combined with immunotherapy, are currently in trials, and showing very significant improvements in outcomes for cancer patients in specific causes. And we've only really started scratching the surface of that. Looking 10-to-30 years out, which is the duration we have to think about as life insurers, we think that’s a prominent contributor to future improvement.”

Alzheimer's is another pressing area for consideration, he said, as, with people generally living longer, this is becoming a much more significant risk. Due to a myriad of reasons, more people than ever are living with Alzheimer’s today and society is being increasingly challenged to deal with it and to support those living with the disease. “Again, improvements in dealing with Alzheimer's historically have not been that great, and I think this is one area where there's the potential for a meaningful breakthrough, and we're starting to see some signs of that in scientific research.”

Understanding the impact of lifestyle factors on future mortality trends An interesting element shaping discourse in the life and health reinsurance market is the question of the impact of lifestyle factors on future mortality trends. Murray noted that if you characterize overall mortality rates into lifestyle or non-communicable diseases, between 30-40% of mortality is driven by lifestyle choices – including such factors as what you eat, whether you smoke, whether you exercise, how much sugar you eat, and how you manage your stress.

The insured population are typically quite happy to engage with that, he said, and Swiss Re is seeing improvement on those metrics, but there remain large swathes of the overall population who don’t engage in that conversation. As more data emerges over time, he believes the market will start to see stronger connections between activity and outcomes which, in turn, will help it to drive better results.

“An interesting area here is diabetes and Swiss Re is taking a leadership position on this globally,” he said. “We regularly engage with policymakers around the world – with doctors and thinkers on nutrition and food policy in particular – to [highlight] how your diet has a big impact on your health, but also to assess whether the current advice is appropriate for the future.

“Obesity and diabetes continue to increase. That debate has a long way to go, but if it continues to evolve positively, it will have a positive impact on mortality.”

Poor metabolic health drives obesity and diabetes, which are offsetting previous advances made by treating cardiovascular diseases and smoking cessation. The emergence of GLP-1/GIP weight loss injectables has shown early promise in reducing weight and improving baseline clinical risk factors, when combined with long-term lifestyle alterations. Although long-term data doesn’t yet exist on the impact of GLP-1 drugs, in the short term these medications are showing positive results in reducing all-causes, and specifically cardiovascular mortality. In addition, the drugs appear to positively affect a range of other conditions such as cancer, liver and kidney diseases, and even neurodegenerative diseases.

When will excess mortality return to pre-pandemic levels? Underpinning the broader conversation is the big question on the minds of many across the life and health reinsurance market – when, or if, excess mortality will return to pre-pandemic levels. Swiss Re’s recent paper posited both a pessimistic and an optimistic scenario because its role is not to say what will happen, but rather to encourage people to think about the tail risk of the COVID crisis and how it might play out.

“There is a huge delusion at the moment that COVID is over and when we talk about it, we say ‘when the pandemic happened’ but actually it is still happening,” he said. “So, insurance companies need to be very conscious of that and to be thinking ahead. Swiss Re has a powerful role across the market to make sure that this is being thought about.

“In our view, there are a range of scenarios, but most of them anticipate a return to normality in five to 10 years, depending on your level of optimism. And we think that because of the other more fundamental movements happening around cancer, lifestyle risk and eventually Alzheimer's, to name the three biggest ones, that mortality improvements will also return over the longer term.”

Study link: www.swissre.com/institute/research/topics-and-risk-dialogues/health-and-longevity/covid-19-pandemic-synonymous-excess-mortality.html

#mask up#public health#wear a mask#pandemic#wear a respirator#covid#covid 19#still coviding#coronavirus#sars cov 2

54 notes

·

View notes

Text

I Thought So Matt Sturniolo x Reader One Shot

You walked out of the Star Market with a messy bun, oversized tee and sweatpants and you looked as dreadful as you felt. You had a strawberry-flavoured sucker hanging out of your mouth and you were digging through your bag to find your keys.

Just as you found your car keys, the bottom of your plastic bag tore open from the weight of your shopping and its contents fell to the ground. “Fuck.”

You dropped to your knees and started picking up your shopping. Milk, 2 energy drinks, a tub of ice cream, a loaf of bread, Twizzlers, some beef jerky and eggs that were surely all broken.

“Do you need some help?” you heard a voice approaching from behind you.

“I’m fine,” you replied, annoyed that someone was watching this.

You had just broken up with your boyfriend, your parents had just moved back to Minnesota and your best friend was on a 6-week trip in the UK with her boyfriend. As much as you missed them, you were glad they were gone. You just wanted to be alone and wallow in your old self-pity.

You felt some knee down beside you and hand you the cylindrical can of peanuts that had rolled halfway across the parking lot. Thanks, you said and he handed the can to you. You look at his for the first time and…. Damn.

For someone who wasn’t looking for anyone at the moment, you couldn’t skip all of the self-pitying bed rotting that was what the next 5 weeks of your life would look like for one date with this man.

He extended a hand, “I’m Matt.”

You took his hand and shook before he helped you up, admiring the rings on his fingers. He looked so effortlessly put together you began to regret not taking a shower or brushing your hair before you left the house.

He smile, almost as if he were waiting for you to say something. He was staring a little too intently at your mouth or your cheek. As he raised his hand toward your cheek you thought he was going in. Who on earth had that sort of confidence? Matt. That’s who.

And who on earth were you to let some stranger mack on with you in the carpark of a Star Market at 10 pm on a random Tuesday in the fall after the worst breakup of your life. Apparently you.

His fingers brushed your cheek and entangled themselves in your hair and then with a gentle tug, he was holding the sucker you had just purchased from the store. In the chaos of the bag splitting it must have gotten stuck in your hair. You felt your face turn red. He just smiled and handed you the sucker.

“What’s your name?” he said.

Shit. You were so taken by the rings and the air and the black t-shirt, the tattoos and the near kiss that your brain forgot how conversations work. He told you his name and you stayed silent. Idiot.

“I’m Y/n” you replied, laughing off the embarrassment. “Thanks,” you said gesturing to the groceries that now sat in a neat pile in your trunk.

“No problem,” he said, burying his hands in his pockets and nodding awkwardly.

After what felt like an age of your bother staring and nodding and then breaking eye contact you pointed to the car, “I should get going…”

“Oh, of course,” Matt said has he gently closed your boot.

Then he paused and you caught his side profile and could have fallen into a puddle right there. “Oh,” was all he managed.

“What?” you asked, somewhat concerned by his tone.

He looked at you cautiously. “You have a flat tyre,” he said, pointing to your back tyre.

If he wasn’t here you would have fallen into a heap on the ground and cried your eyes out. It was the rotten cherry ontop of an already moulding cake.

“Do you have insurance?” he asked.

“Yeah, you said as you scrolled through your phone trying to find their information. “You can go… I’ll be fine”.

“Are you sure?” he asked.

“I’m sure. Thank you,” you replied.

He gestured an awkward wave and tight-lipped smile before heading into the Grocery Store. You dialled the number for the insurance company and waited on hold for what felt like an hour. You sat on the tailgate of your car and waited. It was as if half of the Massachusets needed roadside assistance tonight.

Finally, you got through to a human and they said someone should be out within the hour and you knew that meant that you could be here all night.

As you scrolled through TikTok, Matt was done with his shopping and piled it into the back of his Kia.

“Any luck?” he asked. “They’ll be here soon,” you assured him.

He stood there a few seconds longer than normal, rocking back on his heels. “Well, I hope they can sort you out quick,” he mentioned before he headed around to the driver's side door.

You were never this bold but, something about him made you feel calm. “Matt?” you asked.

“Yeah?” he said.

“Did you maybe want to wait with me?” you asked. Instantly regretting it.

“What?” he said, laughing out of awkwardness.

“You don’t have to. I was just thinking that I have a tub of ice cream that’s melting by the minute and…” You didn’t know what else to say. You knew that you looked like an idiot. Who wanted to eat ice cream with a stranger in a car park?

Before you could stutter through another excuse he said, “Sure.”

For what felt like hours, you and Matt sat in the trunk of your car eating ice cream and Cheetos and talking about all of your embarrassing moments.

He told you about the time he went to kiss a girl but, tripped and their heads knocked together. She got a nosebleed and never spoke to him again after that.

You told him about the time that your Dad was taking a family picture at the park and he slipped and fell into the duck pond.

You laughed about sibling fights and Thanksgiving day mishaps. He told you about his time in California and you told him about Minnesota.

Matt was nothing at all like the guy who dumped you 3 weeks ago on the evening of your birthday. At least, he didn’t seem that way but, then again all men are the same.

But, Matt made you feel comfortable and he gave you his number and he didn’t put any pressure on you to catch up again.

After the roadside assistance crew came and changed your tyre, you and Matt were the only two people in the carpark.

Before he said goodnight, you closed the gap between you both and reached up to place a kiss on his lip. His arm snaked around your waist and when you pulled away there was an inquisitive look on his face.

He wasn’t shocked, or freaked out, or disgusted but, there was a flirty glint in his eye. “I thought so,” you smiled and you walked back to your car. “Good night,” he called after you.

As you drove away, glancing in the rearview mirror to see him still standing there, you couldn’t help but smile to yourself—maybe, just maybe, tonight wasn’t the worst night after all.

#Matt#matt sturniolo#matthew sturniolo#sturniolo triplets#matthew bernard sturniolo#the sturniolo triplets x reader#matt sturniolo x reader#matthew sturniolo x reader#matt sturniolo imagine#matthew sturniolo imagine#sturniolo#nick sturniolo fan fic#chris sturniolo fan fic#matt sturniolo fan fic#nicolas sturniolo fan fic#christopher sturniolo fan fic#matthew sturniolo fan fic#chris sturniolo one shot#matt sturniolo one shot#nick sturniolo one shot

27 notes

·

View notes

Text

Stanley Booth

American music journalist who chronicled ‘the mystery of the Rolling Stones’ in their pomp

As a group of Hells Angels beat and stabbed a Black teenager to death a few feet away from where the Rolling Stones were playing on warm evening in California in 1969, the writer Stanley Booth watched the mayhem from a vantage point next to his friend Keith Richards’s guitar amplifiers.

The murder of 18-year-old Meredith Hunter by thugs hired to act as security men for the Stones’ free concert at Altamont Speedway marked an end to the peace-and-love idyll of the 1960s. It also gave Booth a dramatic climax to the book he would write about the Stones and their rise from London’s clubs to worldwide success and notoriety.

The Stones embraced Booth, who has died aged 82, not least because he represented an authentic connection to the blues music from which they had taken their inspiration. He had been brought up in Memphis, Tennessee, one of the music’s centres, and knew many of the musicians whose work they admired and imitated.

Long-haired, silk-scarved and thoroughly familiar with mood-altering substances, he was perfectly in sync with the social currents they embodied. He met them when, having established himself as a contributor to major American magazines, he travelled to London in 1968 to cover the trial of their founder, Brian Jones, who had been charged with possession of cannabis. “I wrote a story,” he recalled many years later, “but I had only glimpsed – in Brian’s eyes as he glanced up from the dock – the mystery of the Rolling Stones.”

That mystery was the subject of the book he planned to write when he joined the Stones on tour in the US the following year. He slipped so easily into their inner circle that soon they were inviting him to share not just their confidences – Anita Pallenberg told him that Jones had missed shows and recording sessions because he had broken his hand while hitting her – but their drugs. When a fan handed Charlie Watts a yellow-green LSD tab, Booth wrote that “Charlie asked, ‘D’you want it?’ ‘I ain’t too sure about this street acid,’ I said. ‘Maybe Keith will want it.’”

Published in 1974 as Dance With the Devil, and republished in the UK in 1985 as The True Adventures of the Rolling Stones, his book brought to bear an observant eye and literary skills that elegantly stripped the varnish off the story, leaving posterity with a faithful eye-witness account of the group’s activities and their social milieu during their prime years.

Booth was born in Waycross, Georgia, near the Okefenokee swamp, a vast wetland straddling the border with Florida. His father, Irving, was the vice-president of an insurance company, while his mother, Ruby (nee McClellan), was a schoolteacher. He studied English at Memphis State University and remembered being thrown out of a Ray Charles show for sharing a table with some Black fellow students. He began postgraduate studies at Tulane University in New Orleans before breaking off in 1964 to return to Memphis, where he began his career as a journalist.

His background, his love of music and his social circle gave him access to local subjects that interested the editors of national magazines. In 1968 Esquire published his description of Elvis Presley’s life among his courtiers: “When he puts the cigar between his teeth a wall of flame erupts before him. Momentarily startled, he peers into the blaze of matches and lighters offered by willing hands. With a nod, he designates one of the crowd, who steps forward, shaking, and then, his moment of glory, of service to the King, at an end, he retires into anonymity. ‘Thank ya very much,’ says Elvis.”

Typically, the real interest comes when Booth aims slightly away from the target. The source of the best Elvis anecdotes is Dewey Phillips, the first radio DJ to play Presley’s records, found by the author working in a furniture store 20 years after his heyday. One of those tales, involving the actress Natalie Wood, was too ripe for the Esquire piece but is included in Rythm Oil, a collection of Booth’s magazine pieces published in 1994.

The book’s UK edition opened with a mood-setting series of colour photographs taken by William Eggleston, Booth’s friend and fellow Memphian: freight trains, cotton fields, diners and lonesome highways. The pieces included portraits of other local musicians, including the bluesman Furry Lewis, who had spent decades sweeping the city’s streets, and the ill-starred jazz pianist Phineas Newborn.

For all his warm empathy with most of the musicians he encountered, there was also evidence of the essential splinter of ice in the writer’s heart. About his piece for Rolling Stone on Janis Joplin’s poorly received visit to Memphis in 1969, he later reflected: “She died, so I hear, bearing me ill will. Can’t please everyone.”

With a reputation, according to the Memphis Commercial Appeal newspaper, as “a libertine and a wild man”, in 1971 he was fined for growing his own marijuana and broke his back a few years later after falling down a waterfall in Georgia while high on LSD. A second collection of pieces, Red Hot and Blue, was published in 2019 and he leaves an unfinished memoir and unpublished biographies of the songwriter Johnny Mercer and the singer Gram Parsons, a friend who was also from Waycross.

Booth was married three times. After the death in 2014 of his third wife, the poet Diann Blakely, with whom he had lived in Georgia and Florida, he returned to Memphis. He is survived by a daughter, Ruby Booth, from another relationship.

🔔 Stanley Booth (Irvin Stanley Booth Jr), writer, born 5 January 1942; died 19 December 2024

Daily inspiration. Discover more photos at Just for Books…?

6 notes

·

View notes

Text

It is a movement founded on predictive algorithms, mathematical calculations of human behaviour. Surveillance capitalists “sell certainty to business customers who would like to know with certainty what we do. Targeted adverts, yes, but also businesses want to know whether to sell us a mortgage, insurance, what to charge us, do we drive safely? They want to know the maximum they can extract from us in an exchange. They want to know how we will behave in order to know how to best intervene in our behaviour.” The best way to make your predictions desirable to customers is to ensure they come true: “to tune and herd and shape and push us in the direction that creates the highest probability of their business success”. There’s no way “to dress this up as anything but behavioural modification”. In 2012 and 2013, Facebook conducted “massive-scale contagion experiments” to see if they could “affect real-world emotions and behaviour, in ways that bypassed user awareness”.

. . .

"Yes, like Google Nest [Google’s home security system]: ‘Oh we’re so sorry, we put a microphone in the Nest surveillance system and we forgot! We forgot to put it in the schematic.” (This story broke in February, and Google described its failure to put the microphone on tech specs as “an error”.)

. . .

I felt I was up against the clock of social amnesia, psychic numbing – people were losing their sense of astonishment.” Yes, she agrees that “Snowden made a huge contribution to waking people up. The tech companies were implicated.” Leaked documents showed the NSA collecting data from Yahoo, Google, Facebook and Microsoft. And the Cambridge Analytica scandal?

“Carole Cadwalladr’s work is heroic. And Chris Wylie [the Cambridge Analytica whistleblower] revealed that every aspect of Cambridge Analytica’s operations was simply mimicking a day in the life of a surveillance capitalist.” Instead of behavioural modification for commercial ends, the ends become political? Voting instead of buying?

“Democracy is on the ropes in the UK, US, many other countries. Not in small measure because of the operations of surveillance capitalism.”

2 notes

·

View notes

Text

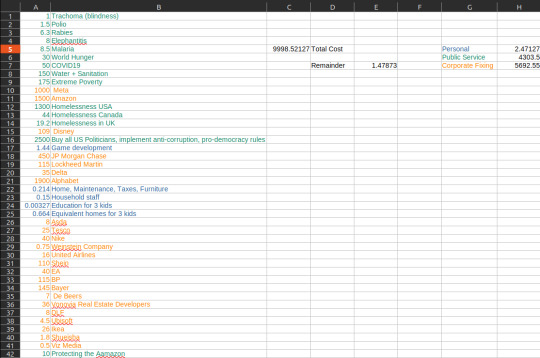

What to do with 10 trillion dollars

I spent way too much time actually answering a reddit question of "How would you spend 10 trillion dollars if you needed to in 20 years. You will die after 20 years." So, I figured I'd share it here.

With only $10 trillion dollars you can't stabilize greenhouse gases or get rid of fossil fuels, which are 13t and 44t respectively. I'm using a variety of sources, so don't expect citations.

I did slightly overpay for things, strategically, partially because I can only imagine doing the things I would do would make it more expensive than it would otherwise be. You'll see.

I'm presuming I don't get assassinated.

What you can do (I did the math) figures are in Billions:

Personal (2.44/10000):

1.44 on remaking 8 games as mid-line AAA games (I chose Legend of Dragoon, FF8, Witcher 1, and the Legacy of Kain series).

.214 on 50 years of housing and buying yourself a $130,000,000 home in NYC. Includes taxes, maintenance, and furniture.

.15 on household staff for 50 years, with at double the normal pay

.000327 to put 3 kids through the best pre-k and best college in the country

.664 setting up each of those 3 kids with their own equivalent home and staff setup

Public Service (4303/10000):

Big one out of the way. 2500bn in lobbying/buying up American politicians to enact structural reforms I want to see. You would think this would be way too much, since the presidential election in 2020 only had 14.4 in it. This amounts to averaging 250 in spending every election cycle, even off-year. I counter with the global commercial banking market having a market cap of 2800 in 2023. The defense industry is almost 480. Health insurance in the US is 1600. This is an expensive, long-drawn fight. This is likely the single most important thing on the list. Anti-corruption measures, labor rights, pro-democracy reforms, including ultimately making it illegal for other people to buy more elections.

a cumulative total of 1803 spent on:

curing the most common cause of blindness worldwide

eradicating polio, rabies, elephantitis, malaria, world hunger, COVID19 issues, Water + Sanitation access, extreme poverty, homelessness in USA, Canada, and UK (I looked for China, Indonesia, Nigeria, Egypt, and Pakistan but couldn't find real numbers),

protecting the Amazon rainforest

Corporate Fixing (5692/10000):

Buying up and changing (converting to Co-Ops, converting to non-profits, dissolving, or something in line with those:

Meta

Amazon

Disney

JP Morgan Chase

Lockheed Martin

Delta

Alphabet

Asda

Tesco

Nike

The Weinstein Company

United Airlines

Shein

EA

BP

Bayer (side-note: they own/are Monsanto now)

De Beers

Vonovia Real Estate Developers

DLE

Ubisoft

Ikea

Shueisha

and Viz Media

It leaves me with 1.4bn left over. I'm comfortable with saying an additional billion would likely be used up administratively as things get a bit more expensive than I thought they would.

Honestly, I could likely blow it on close friends and family who need it. If you have an issue with the house spending being for 50 years instead of 30, that can just be shuffled around a bit to include more people in my personal life to meet the same number.

Leaving me with 470 million to spend elsewhere in the next 20 years. Expensive vacations, nice cars, donating to "smaller" issues as I see worthwhile, giving family and friends money for their ventures/dreams, etc. make me think it wouldn't actually be hard to lose track of that much money in those many years.

Hell, if I want to I can probably spend a million bucks on food a year just for my family. Probably more, if I actively try to do so.

9 notes

·

View notes

Text

Top Industries Hiring International Graduates in the UK

The UK is home to some of the world’s most prestigious universities and has become a prime destination for international students seeking quality education and career opportunities. Once their academic journey is complete, many graduates are eager to explore the diverse career opportunities in the UK, especially in industries that are not only thriving but also welcoming to international talent. Below are some of the top industries actively hiring international graduates in the UK.

1. Technology and IT

The tech sector in the UK is booming, with companies ranging from startups to tech giants such as Google, Microsoft, and Amazon, all offering numerous career opportunities. The rise of AI, data science, cloud computing, and software development has created a high demand for skilled professionals. Graduates with a background in computer science, engineering, or data analysis will find plenty of openings, especially in cities like London, Manchester, and Edinburgh.

The UK government has also introduced initiatives to encourage global talent in the tech industry. For example, the Tech Nation Visa Scheme allows international graduates to work in the UK's tech industry, which has greatly expanded opportunities for non-EU graduates.

2. Finance and Banking

The UK is one of the financial hubs of the world, with London being a major global financial center. International graduates with a degree in finance, accounting, economics, or business management have a wide range of career opportunities in the finance sector. Major banks such as HSBC, Barclays, and Lloyds Banking Group, as well as a variety of consultancy and insurance firms, are constantly looking for fresh talent.

In addition to traditional roles, the fintech industry is growing rapidly, offering opportunities for graduates to work in innovative startups and disruptors in financial technology.

3. Healthcare and Life Sciences

The UK's healthcare system, especially the National Health Service (NHS), employs a large number of graduates each year. The country also has a strong focus on life sciences, pharmaceutical companies, and healthcare innovation. Graduates in fields such as medicine, nursing, pharmacy, biology, and biotechnology will find many career paths in this sector. Additionally, the ongoing research and development in medical technologies create exciting prospects for international graduates.

With the increasing global demand for healthcare professionals, the UK remains one of the best countries for graduates in the health sector to establish their careers.

4. Engineering

Engineering is another field that offers significant career opportunities in the UK. From civil and mechanical engineering to aerospace and electrical engineering, there is a constant need for talented engineers to work on a variety of large-scale projects. The UK’s infrastructure development, renewable energy initiatives, and engineering advancements in space and technology require skilled graduates who can bring innovative ideas to the table.

Graduates with strong engineering backgrounds are highly sought after by major companies in both private and public sectors.

5. Marketing and Digital Media

In today’s digital age, the demand for marketing and digital media professionals is stronger than ever. The UK’s advertising, media, and PR industries are booming, with leading companies like BBC, ITV, and various digital agencies hiring international graduates for roles in content creation, SEO, social media, brand management, and marketing strategy.

The rise of e-commerce and digital transformation has made the digital marketing landscape especially vibrant, opening the door for graduates with a creative mindset and analytical skills.

6. Consultancy and Management

Consulting firms, especially those in the management, financial, and IT sectors, continue to thrive in the UK. Leading firms like McKinsey & Company, Deloitte, PwC, and EY often seek international graduates for roles in consultancy, project management, and business strategy. The skills that international graduates bring to the table—such as diverse perspectives, multilingual abilities, and global insight—are highly valued by employers in this industry.

Management consultancy, in particular, offers graduates the opportunity to work across different industries, providing varied and stimulating career paths.

7. Education and Research

The education sector in the UK is another key area of employment for international graduates. Universities, schools, and research institutions constantly seek highly skilled individuals to contribute to teaching, academic research, and administrative roles. Graduates with expertise in specialized subjects can also explore opportunities in research positions at world-renowned universities.

Moreover, UK universities often offer post-graduate programs that open the door for international students to stay and work in the country, thus fostering long-term career growth in the education sector.

8. Hospitality and Tourism

The UK's hospitality and tourism sector remains a key part of the economy. With the country’s rich history, world-class attractions, and vibrant tourism industry, international graduates with backgrounds in hotel management, tourism, and event planning are in high demand. Cities like London, Edinburgh, and Oxford offer ample career opportunities in this sector.

Graduates can find roles in hotel management, travel agencies, event coordination, and tourism marketing.

9. Creative Industries

The UK is renowned for its thriving creative industries, including fashion, film, music, and design. International graduates who have a passion for creativity and innovation can find exciting opportunities in London, the creative capital of the country. Fashion houses, film production companies, advertising agencies, and design studios often look for fresh perspectives from international graduates to enhance their creative output.

Whether in fashion design, visual arts, or film production, the UK offers a variety of opportunities for graduates to build their careers.

Conclusion

The UK provides an array of career opportunities for international graduates across a range of thriving industries. From technology and finance to healthcare and the creative arts, there is no shortage of pathways to success for those who are qualified and eager to make their mark. For international students looking to explore career opportunities in the UK, it’s essential to stay updated on industry trends, network with professionals, and consider job opportunities that align with their academic background and career goals.

To explore more about career opportunities in the UK, check out detailed resources available to help guide you on your journey to securing a fulfilling role.

0 notes

Text

Understanding the Personal Injury Claims Process in the UK

Unfortunately, sometimes even the most careful person can get into an injury, on the other hand, somebody else caused it deliberately or by carelessness you might be able to sue. Auto body money recovery aids bring money to the victims whose accidents and injuries left them financially and emotionally bereft. If you’re thinking of submitting a claim in the UK, it is important that you learn about it. As a result, this guide will be with you every step by the way and help you be clear and confident about your case.

What Is a Personal Injury Claim?

Personal injury claim can be understood as a legal procedure which is aimed at receiving compensation for the harm done by one person to another person. These claims cover a wide range of incidents, including:

Road traffic accidents

Workplace injuries

Medical negligence

Slip, trip, or fall accidents

Criminal assaults

It aims to promote equal protection of physical and mental injuries together with material damages caused by the occurrence of an event.

Who is entitled to file a personal injury suit?

To file a claim in the UK, you need to meet certain criteria:

Injury Caused by Negligence: It has to be an accident or an injury that happened through nobody’s default, but as a result of somebody else’s negligence or recklessness.

Time Limit: Pleadings must in the general run of cases be presented within three years from the date of the occurrence. Exceptions include:

Where the victim is a child the period runs from his eighteenth birthday.

These time limits may be prolonged if the victim has a disabled person’s lack of capacity.

Proof of Damage: You need to furnish proof of your injuries and how they affected your life.

Putting together the best strategy to file for a personal injury case

Filing claims can be confusing and daunting, but I’ve found it useful to simplify it by dividing recommendations based on its steps.

1. Gather Evidence

Medical Records: Make sure you get comprehensive medical reports concerning your or your client injuries.

Photographs: Take photographs of the accident scene, the harm caused or any property damage.

Witness Statements: Get the phone numbers or addresses and the statements of the witnesses.

Receipts and Invoices: For example, save receipt of expenditure for medical bill or cost of transport among other expenses.

2. Seek Legal Advice

This helps in presenting the case in the right manner, as a professional personal injury solicitor will assure you. First, they will determine if you have a valid claim, second they will judge probable compensation, and third, they’ll explain how the legal system works.

3. Notify the Responsible Party

Your solicitor will write a letter to the party at fault or their insurance company indicating all the details of your case.

4. What Type of Investigation Do Investigators Engage In and Liability Assessment?

The claim will be pursued by the party, or their insurance provider, to establish who was at fault. Your solicitor will then endeavour to prove negligence.

5. Negotiation and Settlement

They added that most of the personal injury claims are resolved and closed out of court. Your solicitor will obtain reasonable compensation by discussing with the insurance company.

6. Judicial Case (Where Needed)

If the above-stated conditions cannot be met, the case may go to court. Your solicitor will be on your side, offering proof to secure a good result.

This article will discuss No Win No Fee Agreements

In the UK, nearly all of the personal injury solicitors take cases on an NO WIN NO FEE basis. This means:

You pay nothing upfront.

In case you lose your claim, it will cost you nothing.

If successful, a certain percentage of your compensation goes to the lawyer fees that was agreed before.

This arrangement also guarantees that anybody in the Kenyan society can get justice without necessarily paying for the service.

What Does Compensation Cover?

Compensation in personal injury claims typically includes:

1. General Damages

The injury and the damages arising from the injury.

Physical and mental impairments which may result in the loss of the ability to fully enjoy life.

2. Special Damages

Medical Expenses: Those that have been incurred in the past and that are likely to be incurred in future.

Lost Income: The earnings that have to be skipped while away from work.

Travel Costs: Transporation to medical appointments.

Future Care Needs: Cost for permanent treatment or recovery from a disease, injury or disability.

Common Challenges in Personal Injury Claims

While the process is designed to be straightforward, some challenges may arise:

Delays in Processing: They involve reviewing and investigating the insurance claims and thus might take sometime.

Disputes Over Liability: The responsible party may deny that they are at all to blame for the incident.

Insufficient Evidence: Lack of proper documentation may also have an ability to decrease them.

Tips to Overcome These Challenges:

Make and maintain records of all accident information.

Minimally work alongside a skilled solicitor or get a legal professional to represent you.

Please keep on looking for legal advice and remain as patient as you could.

Why should you Work with a Personal Injury Solicitor?

A solicitor represents you and seeks to safeguard your interests and make a success of the case. Benefits of hiring a solicitor include:

Expert Guidance: Simplifying the legal entanglements that exist in the world today.

Stronger Case Representation: While presenting the evidence.

Fair Compensation: Settling for as favourable a result as is physically feasible.

General tips when deciding which solicitor to hire are that you need to hire experienced solicitor with good reviews and reasonable fees.

Conclusion

Understanding the personal injury claims process in the UK empowers you to seek justice confidently. From gathering evidence to working with a solicitor, each step is crucial to ensuring fair compensation for your injuries. If you believe you have a valid claim, don’t delay. Seek legal advice today and take the first step toward securing the compensation you deserve.

1 note

·

View note

Text

What are the requirements for the UK Spouse Visa?

To apply for a UK Spouse Visa, you and your spouse must be at least eighteen years old. Your partner must be a British or Irish citizen, have a certain type of visa, or have made the UK their home.

To apply as a spouse, your relationship must be legally recognized in the UK. You need to provide a marriage certificate. If you're not married but have lived together in a relationship similar to marriage for at least two years, you can apply for an Unmarried Partner Visa.

You’ll need to demonstrate that you meet the following requirements:

Financial:

The sponsoring partner must prove they can support you both without relying on public funds. The minimum income requirement is currently £29,000. You can meet the financial requirement with income from various sources, including employment, savings over £16,000, or pensions. Income from employment before tax and National Insurance, self-employment, serving as a director of a limited company in the UK, dividends, and rent are all acceptable income sources.

Accommodation:

If you and your partner want to live together in the UK, you must show proof of appropriate housing. It will be your responsibility to demonstrate that the lodging is fit for living, safe, and not overcrowded.

English Language:

You’ll need to prove your knowledge of English, usually by passing an approved English language test at CEFR level A1. You have to show that you can communicate well in English. If you are over 65, from a nation where English is the primary language, or have a degree that was taught in English, you may be excluded from this requirement.

You may show that you are proficient in the English language by completing tests like the IELTS UKVI Life Skills exam. The necessary English proficiency level for individuals asking for an extension who are already in the UK is CEFR A2.

For settlement, it's CEFR B1.

Suitability and Other:

You also need to meet suitability requirements regarding your character and immigration history. You may also need to provide a tuberculosis test certificate, depending on your country of origin.

If you are unable to pay the application cost because of a variety of circumstances, the UK government offers fee exemptions. You can apply to get your visa extended before it expires. Extending your family visa allows you to stay in the UK for an additional two years and six months.

After five years on a spouse visa, you can apply for indefinite leave to remain, sometimes known as settlement. This would allow you to live in the UK permanently.

You must apply for the Spouse Visa online. Those applying from outside the UK will usually get a decision within 12 weeks. For those applying from inside the UK, if you meet the financial requirements and English language requirements, you’ll usually get a decision within 8 weeks.

However, if you don’t meet these requirements, it can take about 12 months to make a decision. There is a faster decision option available for an additional fee.

It is strongly recommended to consult with an immigration lawyer, such as The Smartmove2UK, for expert guidance on your specific situation.

They can streamline the application procedure, assist you in obtaining the required paperwork, and clarify what is needed. Even though immigration processes are complicated, knowledgeable immigration advisers can help you understand the financial, language, and other criteria as well as help you avoid frequent mistakes made throughout the application process.

Questions in your mind for UK Spouse Visa Like below, then Read: Everything About UK Spouse Visa

Best UK Qualified Spouse Visa Expert in India.

Who Can Apply for a UK Spouse Visa

UK Spouse Visa Requirements

Required Documents for a UK Spouse Visa Application

Financial Requirements for a UK Spouse Visa

English Language Requirements for UK Spouse Visa

How to Apply for a UK Spouse Visa

Time Required for UK Spouse Visa

Trusted Immigration Support for Your Spouse Visa UK Application

UK Spouse Visa Fees and Associated Costs

What Happens If Your UK Spouse Visa Application Is Refused

Life After Obtaining a UK Spouse Visa

Your Path to a Successful UK Spouse Visa

How long does a UK Spouse Visa last

What if I don’t meet the financial requirements

Can I extend my UK Spouse Visa

Is the UK spouse visa a settlement visa?

What if I extend my stay on a UK Spouse visa?

How can my wife on a UK spouse visa become a British citizen?

What is the fee for an extension of a UK Spouse visa?

Entry Clearance Application for the UK Spouse visa?

Meeting the minimum income requirement for Spouse visa UK

Can dependants enter the UK on a spouse visa?

UK Spouse Visa refused? What next? When to re-apply?

Can I apply to switch to a UK Spouse Visa?

Can I work in the UK on my UK Spousal Visa?

UK immigration rules are subject to change. If you require advice specific to your UK Spouse Visa circumstances, reach out to our UK Spouse Visa Consultant.

#uk spouse visa#uk spouse visa processing time#uk spouse visa requirements#uk visa#smartmove2uk#uk immigration#uk immigration solicitors#uk immigration lawyer

0 notes

Text

Best Life Insurance Companies UK: Ensuring Your Future with Future Proof Ltd

Discover unparalleled peace of mind with Future Proof Ltd, a leader among the best life insurance companies in the UK. Our bespoke advisory service connects you with the best life insurance company for your unique needs, ensuring a secure future for you and your loved ones. Experience the Future Proof Ltd difference with tailored solutions, expert guidance, and a commitment to excellence that sets us apart in the UK life insurance landscape. Secure your legacy with Future Proof Ltd.

Why Life Insurance is Essential

Life insurance is more than just a financial product; it's a safety net for your loved ones, ensuring their financial stability in the face of life's uncertainties. Whether it's to cover outstanding debts, provide for your family's living expenses, or secure your children's future education, the right life insurance policy can be a beacon of hope during challenging times.

The Hallmarks of the Best Life Insurance Companies in the UK

What sets the best life insurance companies apart? It boils down to a few critical factors: comprehensive coverage options, competitive pricing, exceptional customer service, and a straightforward claims process. Future Proof Ltd partners with providers who exemplify these qualities, ensuring that you're not just purchasing a policy, but a promise of support when it matters most.

Tailored Solutions for Every Need

Understanding that one size does not fit all in life insurance, Future Proof Ltd prides itself on offering personalized advice. Whether you're a young professional starting your career, a parent planning for your family's future, or approaching retirement, we have the expertise to match you with the perfect policy. From term life insurance, which provides protection for a specified period, to whole life policies that offer lifelong coverage and can accumulate cash value, our advisors are skilled at navigating the complexities of the market to find your ideal fit.

The Future Proof Ltd Difference

What makes Future Proof Ltd stand out in the crowded UK life insurance market? It's our unwavering commitment to transparency, education, and customer-centric service. We believe that informed customers make the best decisions, and our advisors are dedicated to providing you with all the information you need, free from industry jargon or sales pressure.

Streamlining the Selection Process

Choosing the best life insurance company in the UK should not feel like a daunting task. Future Proof Ltd simplifies this process by doing the heavy lifting for you. Our rigorous vetting process evaluates insurance providers on various metrics, including financial stability, customer satisfaction ratings, and policy flexibility. This meticulous approach ensures that we recommend only the most reliable and customer-friendly companies.

A Partner You Can Trust

In an industry where trust is paramount, Future Proof Ltd has built a reputation as a reliable partner. Our advisors are not just insurance experts; they're compassionate individuals who understand the weight of the decisions you're making. We're here to guide you, support you, and provide clarity in a complex landscape.

Conclusion

In the search for the best life insurance company in the UK, it's easy to feel overwhelmed by the myriad of options and conflicting advice. Future Proof Ltd stands as a beacon of clarity and reliability, committed to helping you secure the best possible protection for your loved ones. With our guidance, you can navigate the life insurance landscape with confidence, knowing that you're making an informed decision that's tailored to your life's unique blueprint. Choose Future Proof Ltd, and take the first step towards a future that's not just insured, but truly future-proofed.

To learn more Visit us: https://www.futureproofinsurance.co.uk/life-insurance/best-life-insurance/

0 notes

Text

Vaillant Boiler Insurance: Why It’s Essential for Your Home

Every modern home will require a boiler as these are integral parts responsible for the warmth and hot water in your property throughout the year. Among some of the UK's most reliable and efficient boilers, one top pick for homeowners is a Vaillant boiler. Nevertheless, like anything that can go wrong it will, and all home boilers themselves are susceptible to faults over time. The solution: Vaillant boiler insurance, a scheme intended to offer reassurance that if your appliance breaks down, you're protected. Therefore, this blog will explain why it is important to have Vaillant boiler insurance by detailing what does and does not come with the cover and why in the long run it can benefit you.

What is a Vaillant Boiler Cover?

Vaillant boiler insurance is a policy which will provide you the money for repairs, maintenance, or breakdowns to your Vaillant boilers. Having this insurance may as well save lives because, otherwise, it would be impossible to know when holes are available for watering your plants or that no one is going to fix a leak for free. By choosing this insurance, you are making certain your Vaillant boiler is consistently doing work perfectly rather than going to cost a fortune when one thing goes entirely wrong.

Benefits of Cover for Vaillant Boilers

Below are some reasons why getting Vaillant boiler insurance is a wise thing to do for:-

1.Low cost of Repairs: Boiler repairs can be pricey when you are dealing with broken and crucial parts. You also typically are covered for both parts and labor with Vaillant boilers insurance, so having this cover can save you money in the long run.

2. Priority service: Especially during the colder months, a broken boiler is at best uncomfortable and at worst dangerous. The good news is, the majority insurances will prioritize their customers, leaving you to simply wait until your boiler comes back on.

3. Yearly servicing: Maintenance can go far in preserving your boiler. The majority of Vaillant boiler insurance policies include an annual service -this helps to prolong the life-span of your boiler and keep it running efficiently.

4. 24-hour emergency service: One benefit of some insurance companies is the ability to get help any time, even during emergencies; this might give you more peace of mind if anything goes wrong.

Vaillant Boiler Insurance – What Will It Cover?

So based on this, it is very essential for you to know what all your Vaillant boiler insurance actually covers.

Policies differ depending on the provider, but generally have these common elements:-

Boiler breakdowns: If your boiler fails, and you are covered by insurance, then the cost of repair will be met along with reimbursement for replacement parts or labor.

Vaillant boiler replacement: If your instance is so severe that your Vaillant gas fuelled or electric equipment can not be fixed, this plan might assist cover the prices of a brand-new combi heating system.

Annual service: Nearly all Vaillant boiler insurance plans offer a free annual service for the first year to make sure your Vaillant boiler is working both safely and effectively. This routine maintenance prevents future breakdowns and maintains the optimal performance of your boiler.

Radiator and pipework repairs: Some policies will also cover problems with different parts of your central heating system, radiators, or pipe repair, which means that the full-system is protected by an insurance policy.

Why Vaillant Boiler Insurance?

However, by far one of the top rated members is without a doubt Vaillant boiler insurance. The upfront benefit is of course a service that is designed specifically for Vaillant boilers, so any maintenance and repairs will be completed by experienced people who know the boiler inside out. Secondly, is that it takes a more preventative approach to looking after the boiler. This insurance also helps in eliminating future breakdown issues, adds a check-up every 6 months so you can avoid last minute surprises and out of pocket expenses.

In addition, you will make big savings if you choose Vaillant boiler insurance. The insurance policy being a paid service albeit, it helps cut down on expenses in the long-term. A faulty boiler can break the bank with repairs, ranging from hundreds to thousands of pounds and if you do not have insurance you could be stung by all of it.

What is the Best Vaillant Boiler Insurance:

When you choose a Vaillant boiler cover, be sure of the type of policy that works best for your requirements.

Let's look at some of the key areas:-

Policy limitations: read the small print to understand what you are not allowed from your policy. This may include, for example, a condition that places an age limit of over 15 years on boilers in terms of inclusion or pricing.

Response times: In case your boiler breaks, how soon can you expect the repairs to be carried out? You will want a policy that promises rapid response, especially in the high-demand winter months.

Additional features: Certain plans offer extras such as plumbing repairs or central heating upkeep. Think about whether these are services your home needs

Conclusion

You rely on your boiler to keep you comfortable and safe, making Vaillant Boiler Insurance a necessity for when things go wrong. Ranging from vehicle repairs to servicing, this insurance has your back on all counts and its benefits are twofold- protection and peace of mind. Picking the ideal plan tailored to your needs, will let you feel reassured that if something goes wrong with your heater — there is nothing to worry about as it has all been taken care of_unit you actually need us.

Here at Vaillant Boiler Service Experts Notting Hill, we take great care to keep your boiler running smoothly. Get Vaillant Boiler Insurance Now, Protect Your Home and Wallet!

0 notes

Text

Seeking Justice: Accident Claims Experts and Birth Injury Claims in the UK

Birth injuries and accidents can change a victim's life and affect their relatives as well. Knowing that legal ways of support are accessible in trying times helps one to find consolation. Whether it's a terrible birth injury or an unfortunate accident, experts in accident claims can help people negotiate the legal system to guarantee they receive the compensation they are due. Likewise, birth injury claims UK give families a means of pursuing compensation for injuries resulting from medical malpractice during delivery.

The Role of Accident Claims Experts

Whether a road collision, an occupational injury, a public responsibility lawsuit, or another type of accident, accident claims experts are rather important in guiding the sufferer through the sometimes difficult claims process. These experts focus in evaluating the circumstances, assigning responsibility, and helping claimants over the whole legal process. Not only do accident claims professionals offer legal counsel, but they also guarantee that the victim's best interests are advocated. Their knowledge enables people to grasp their possible pay—for emotional suffering, lost income, or medical bills. Having an expert on their side could make a big difference in the result of the claim for people not familiar with the legal system.

Why Expert Guidance is Essential for Accident Claims

Accidents can cause emotional as well as physical suffering; knowing the legal choices at hand can be intimidating. By providing customized advice and support, accident claims professionals streamline this procedure so that no element of the claim is missed. These experts help manage correspondence with insurance companies and opposing parties, therefore enabling victims to concentrate on their recuperation. Working with a claims specialist helps everyone engaged in an accident to more likely receive the compensation they are entitled to. Professional advice guarantees a more seamless and effective claims process regardless of the little injury or life-changing event.

Understanding Birth Injury Claims in the UK

Regarding medical malpractice, birth injuries rank among the most upsetting occurrences. Long-lasting consequences of a birth injury might affect the child as well as their family. Birth injury claims UK provide a means for families to get paid when a medical practitioner's carelessness causes injury during delivery. From injuries brought on by incorrect instrument usage during delivery to failure in recognizing or managing complications, these claims might include a broad spectrum of problems. By submitting a birth injury claim, families can pursue financial reimbursement for other necessary care for the wounded child as well as for therapy and medical bills. Apart from financial support, these assertions increase awareness and promote improved medical procedures, therefore promoting better practices and helping to prevent next negligent events.

The Importance of Birth Injury Claims for Families

Pursuing birth injury claims UK typically goes beyond simply financial recovery for families impacted by birth trauma. It's about getting justice for the damage done to their child and making medical practitioners answerable for their deeds. These assertions give families closure and help to ensure that other families avoid suffering the same fate by guaranteeing advances in medical treatments.

Conclusion

Whether you are seeking justice for a birth injury or handling a personal injury resulting from an accident, the help of accident claims experts and the possibility to submit birth injury claims UK can make all the difference.

0 notes

Text

Best Removal Services and Packing Unpacking Solutions in London and Huntingdon

When it comes to moving, the process can often feel overwhelming. Whether you're relocating to a new home or transferring your office, the task of packing up your entire life and ensuring everything arrives safely at your new destination requires a trusted partner. For residents and businesses in London and Huntingdon, NJ Removals offers top-notch removal services that guarantee a smooth and stress-free transition.

Comprehensive Removal Services

At NJ Removals, we understand that every move is unique, which is why we offer a range of tailored services designed to meet your specific needs. Our comprehensive removal services cover every aspect of the moving process, ensuring that nothing is left to chance. From the initial consultation to the final delivery of your belongings, we handle every detail with care and professionalism.

Whether you're moving within London, across the UK, or even internationally, our experienced team is equipped to manage all types of relocations. We take pride in offering the best removal services in the area, combining efficiency with a personal touch that ensures your move is as seamless as possible. Our fleet of modern vehicles is designed to accommodate moves of all sizes, from small apartments to large family homes and corporate offices.

Expert Packing and Unpacking Services

One of the most time-consuming and stressful aspects of moving is packing. Properly securing your belongings to prevent damage during transit requires expertise and the right materials. At NJ Removals, we offer professional packing services that take the burden off your shoulders. Our trained packers use high-quality packing materials and techniques to ensure your items are safe and secure for the journey ahead.

We understand that your possessions are valuable and often carry sentimental worth, which is why we treat each item with the utmost care. From fragile glassware to bulky furniture, we have the experience and know-how to pack everything efficiently. Our packing services are flexible, allowing you to choose full packing, partial packing, or just the packing of delicate items, depending on your needs.

Once you arrive at your new location, the last thing you want to do is spend hours unpacking boxes. Our unpacking services are designed to help you settle into your new space quickly and effortlessly. We can unpack and organize your belongings according to your preferences, ensuring that your new home or office is set up exactly how you want it. This service not only saves you time but also reduces the stress of moving, allowing you to start enjoying your new surroundings immediately.

Serving London and Huntingdon

NJ Removals is proud to serve the vibrant communities of London and Huntingdon. Our deep understanding of these areas allows us to navigate the challenges of moving in busy urban environments as well as more rural settings. In London, where traffic and parking can be major hurdles, our team is experienced in planning and executing moves with precision, ensuring minimal disruption to your schedule.

In Huntingdon, we bring the same level of expertise and dedication to every move. Whether you're moving within the town or relocating to or from London, our services are designed to meet the unique needs of each client. Our local knowledge and commitment to customer satisfaction set us apart from other removal companies.

Why Choose NJ Removals?

Choosing the right removal company is crucial to the success of your move. At NJ Removals, we stand out for our professionalism, reliability, and customer-focused approach. Our team is fully trained, insured, and dedicated to providing the highest level of service. We understand that moving can be a stressful experience, which is why we aim to make the process as smooth and hassle-free as possible.

Our clients trust us to handle their moves because of our commitment to excellence and our proven track record of delivering results. When you choose NJ Removals, you can rest assured that you're working with a company that values your satisfaction and takes pride in every move we complete.

Conclusion

Moving doesn't have to be a daunting task. With NJ Removals by your side, you can enjoy a stress-free moving experience, whether you're relocating within London, Huntingdon, or beyond. Our best-in-class removal services combined with expert packing and unpacking solutions ensure that your move is handled with care from start to finish. Contact us today to learn more about how we can assist with your next move.

0 notes

Video

youtube

Safeguard Your Pension Fund: Strategies to Survive a Stock Market Crash

How to Protect Your Pension Fund from a Stock Market Crash

Worried about the impact of a stock market crash on your pension fund? You're not alone. Market volatility can significantly affect your retirement savings, but there are strategies you can implement to safeguard your investments. Watch video https://youtu.be/e2iiYBYCUOw?si=enFe6LD0M8jt3hQG

1. Diversify Your Portfolio: One of the best ways to protect your pension fund is through diversification. By spreading your investments across different asset classes—such as bonds, real estate, and cash—you reduce the risk of a market downturn affecting your entire portfolio. Diversification ensures that even if one asset class takes a hit, others may remain stable or even gain value.

2. Regularly Rebalance Your Portfolio: Market conditions change over time, so it's crucial to regularly review and rebalance your portfolio. This involves adjusting your asset allocation to maintain your desired level of risk. Rebalancing helps you lock in gains from outperforming assets and reinvest them into underperforming ones, maintaining a balanced risk exposure.

3. Consider Safe Haven Assets: Investing in safe haven assets like gold, government bonds, or cash equivalents can provide stability during market crashes. These assets tend to hold their value or even appreciate when stock markets decline, offering protection for your pension fund.

4. Stay Informed and Seek Professional Advice: Keeping up with market trends and seeking advice from a financial advisor can help you make informed decisions. A professional can guide you on how to adjust your pension investments to minimize risks during turbulent times.

Protect your retirement savings by taking proactive steps today!

See also:

Why Are UK Taxes So High? 10 Easy Tips To Drastically Reduce Your Tax Liability – Legally - https://youtu.be/PZ9IFiI2Tio

How will Labour’s new Renters Rights Bill 2024 affect buy-to-let landlords?

The Labour Party’s Renters' Rights Bill 2024 is poised to bring significant changes to the UK’s rental market, impacting both tenants and buy-to-let landlords. Understanding these changes is crucial for landlords to navigate the evolving landscape effectively.

Watch video version - https://youtu.be/Wx1HXgVW1bM

A Lifetime of taxes

Income tax, VAT, Council Tax, Car Tax, Insurance and Travel Tax, Green Energy Taxes, BBC Licence Tax, Stamp Duty, Capital Gains Tax, Section 24, Business Taxes and the final kicker; Inheritance Tax for your dependents!

You can legally reduce and mitigate your taxes and inheritance tax for your dependents.

Wills and Trusts

New research from Canada Life reveals that over half of UK adults (51%)1 have not written a will, nor are they currently in the process of writing one. This includes 13% of people who state they have no intention to write a will in the future.

Section 24 Landlord Tax Hike

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24, Wills and Trusts.

Watch video now: https://youtu.be/aMuGs_ek17s

#UKTaxes #TaxTips #CharlesKellyMoneyTips #FinancialFreedom #LegalTaxReduction #section24 #stampduty #PensionFundProtection #StockMarketCrash #RetirementPlanning #FinancialSecurity #Diversification #SafeHavenAssets #InvestingWisely #MoneyTips #CharlesKellyMoneyTips #FinancialAdvice

0 notes

Text

Finding the Right Life Insurance in the UK: A Guide To Top Providers and Mortgage Coverage

Choosing the right life insurance policy is one of the most important decisions that one has to make towards the security of the family. The fact is that many providers offer different programs, so it is necessary to know the peculiarities of their products and what they can provide to the clients. First, let us consider some vital aspects when selecting the most suitable life insurance company, the current market of life insurance companies in the UK, and more on mortgage life insurance coverage.

Selecting the Best Life Insurance Company

Thus, when choosing the Best Life Insurance Provider, several important aspects should be taken into consideration, including insurance coverage, premiums, and other services. The best providers usually have a variety of products, which include term insurance, whole insurance, and universal insurance. They should also have easy payment plans and the possibility to adjust the policies according to your preferences.

It may also be helpful to read customer reviews and consult financial advisers when looking for a reliable life insurance company that provides comprehensive coverage.

UK Life Insurance Providers Overview

In the UK, there are numerous life insurance providers each with unique features and benefits. Among the top Life Insurance Providers U.K. are Aviva, Legal & General, and Prudential. All these companies have a reputation for being financially stable; they offer diverse products as well as having a good customer support department. Also, most of them add other benefits like critical illness cover to their schemes aimed at enhancing policyholder safety. Comparing different quotes and policies from several providers can help you get the right fit for your specific needs.

Explanation of Mortgage Life Insurance Cover

Mortgage Life Insurance Coverallows your mortgage to be paid off if you die so that your family can continue living in their home without worrying about money issues; it is known as mortgage protection insurance. Such type of an insurance plan is commonly referred to as a decreasing term policy because its amount reduces over time in line with the remaining balance on a mortgage. Some of the things that one should take into account while considering mortgage life insurance include how long the term will last, what the face value of the policy originally, and any other extra services provided by such type of cover.

To help enhance the customer’s offering, particularly when it comes to all-inclusive coverage, several life insurance companies in the UK provide mortgage life insurance in their array of products.

Conclusion

Selecting a suitable life insurance plan requires taking into account various factors; such as finding the best life insurer and comprehending what different players offer. One of these vital components is mortgage life insurance cover that will ensure your home is safe for your loved ones upon your demise. Thorough research on different providers and their policies followed by comparisons can guarantee you make a well-informed choice that suits your requirements best thus giving you peace of mind for yourself and your family members.

Finding the Right Life Insurance in the UK: A Guide To Top Providers and Mortgage Coverage

1 note

·

View note

Text

Sanjiv Bajaj: A Visionary Leader Transforming India's Financial Landscape

Early Life and Education

Sanjiv Bajaj was born into the illustrious Bajaj family, known for their significant contributions to Indian industry and business. He is the son of Rahul Bajaj, a legendary industrialist, and the younger brother of Rajiv Bajaj. Growing up in such a dynamic environment, Sanjiv was exposed to the world of business and finance from an early age.

Sanjiv Bajaj pursued his higher education with a strong focus on finance and business management. He earned a Bachelor’s degree in Mechanical Engineering from the University of Pune. He then went on to obtain a Master’s degree in Manufacturing Systems Engineering from the University of Warwick, UK. To further hone his business acumen, he completed an MBA from Harvard Business School.

Career and Achievements

Bajaj Finserv

Sanjiv Bajaj is best known for his leadership of Bajaj Finserv, a financial services company that has become a powerhouse under his guidance. Bajaj Finserv operates in various sectors, including lending, insurance, and wealth management.

Key Achievements:

Diversification: Under Sanjiv’s leadership, Bajaj Finserv has significantly diversified its product offerings, expanding into new areas of financial services.

Innovation: He has driven a culture of innovation within the company, leveraging technology to enhance customer experience and streamline operations.

Growth: Sanjiv has overseen tremendous growth in the company’s market capitalization and profitability, making it one of the leading financial services companies in India.

Bajaj Finance

Sanjiv Bajaj also plays a crucial role in the success of Bajaj Finance, the lending arm of Bajaj Finserv. Bajaj Finance has emerged as one of the most valuable non-banking financial companies (NBFCs) in India, known for its customer-centric approach and wide range of loan products.

Key Achievements:

Customer Base Expansion: Under his leadership, Bajaj Finance has expanded its customer base exponentially, catering to both urban and rural markets.

Technology Integration: Sanjiv has emphasized the integration of advanced technologies like AI and machine learning to improve risk management and customer service.

Strong Financial Performance: The company has consistently delivered strong financial performance, with impressive revenue and profit growth.

Leadership Style and Philosophy

Sanjiv Bajaj is known for his visionary leadership and strategic thinking. He believes in fostering a culture of innovation and continuous improvement within the organization. His leadership style is characterized by:

Customer Focus: Placing the customer at the center of all business decisions.

Innovation: Encouraging the adoption of new technologies and innovative practices.

Employee Development: Investing in the development and growth of employees, recognizing them as the company’s most valuable assets.

Sustainable Growth: Focusing on long-term, sustainable growth rather than short-term gains.

Awards and Recognitions

Sanjiv Bajaj’s contributions to the financial sector have been widely recognized. He has received several prestigious awards and accolades, including:

Ernst & Young Entrepreneur of the Year Award (2017)

Economic Times Business Leader of the Year (2018)

CNBC Asia’s India Business Leader of the Year (2019)

Personal Life

Despite his demanding career, Sanjiv Bajaj maintains a balance between his professional and personal life. He is known for his humility and down-to-earth personality. He is also actively involved in various philanthropic activities, contributing to the betterment of society.

Conclusion

Sanjiv Bajaj’s journey is a testament to his visionary leadership and relentless pursuit of excellence. Through his strategic initiatives and innovative approach, he has transformed Bajaj Finserv and Bajaj Finance into leading players in the financial services industry. His contributions continue to shape the future of India’s financial landscape, making him a true inspiration for aspiring entrepreneurs and business leaders. Also Read-https://voiceofentrepreneur.life/

0 notes