#best forex pairs to trade

Explore tagged Tumblr posts

Text

You should know about forex pairs before start trading in 2025, Visit to learn more about it.

0 notes

Text

Best Forex Currency Pairs to Trade | Trading Forex Online

Choosing the finest currency pairs before entering the world of forex trading is essential for success. The ideal currency pairings to trade are those that fit your trading aims and style and have low spreads, good liquidity, and low volatility. Well-known pairs with lots of trading chances, such as USD/JPY, EUR/USD, and GBP/USD, provide stability.

0 notes

Text

Security should be a top priority when choosing a currency exchange service. Ensure that the provider follows strict security measures to protect your personal information and transactions. Look for services that are licensed and regulated by the appropriate authorities. It is also a good idea to check if the provider offers insurance coverage for any loss or theft of currency.

Choosing the right currency exchange service in Delhi is essential to ensure a stress-free and cost-effective travel experience. By researching and comparing different providers, considering exchange rates and fees, and evaluating convenience, security, and customer service, you can make an informed decision. Keep these expert tips in mind the next time you need to exchange currency in Delhi, and enjoy your travel experience to the fullest.

Guruji Forex is a trusted currency exchange service provider in Delhi. They offer competitive exchange rates, excellent customer service, and a range of additional services to meet your specific needs. Visit their website or contact them directly to learn more about their services.

#currency exchange in delhi airport#currency exchange services#forex exchange in delhi#best currency exchange in delhi#money changer in delhi#money exchange near me#foreign currency exchange#forex dealers#currency exchange#currency trading#currency markets#currency pairs#currency conversion#banking#crypto currency#invest

0 notes

Text

Forex Trading in India: A Comprehensive Guide to Success

Introduction: Understanding the Basics of Forex Trading In the world of finance, Forex, or foreign exchange, trading is the global marketplace for buying and selling currencies. It’s the largest and most liquid market in the world, where currencies are traded against each other. In this article, we will delve into the intricacies of Forex trading in India, providing valuable insights for…

View On WordPress

#become a successful forex trader#best currency pairs#best time to trade Forex in India#forex market#Forex trading legal in India?#learn Forex trading in India#start Forex trading in India

1 note

·

View note

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

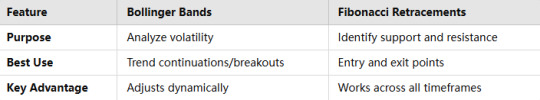

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions. 1. Stocks Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader. 2. Bonds Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns. 3. Forex (Foreign Exchange Market) The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader. 4. Commodities Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors. 5. Mutual Funds Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach. 6. ETFs (Exchange-Traded Funds) ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities. 7. Options Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks. Conclusion Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

Sell trade in #EURNZD opens with a Sell Signal of HUNTER Indicator.

🎓HUNTER NON REPAINT Forex Indicator Signals is developed for Metatrader 4 is a Fixed and "Non Repaint signals for Metatrader4" send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Ultimate Indicator concept available for Forex.

The process to receive the download of Hunter Indicator is automatically after your purchase you will auto-redirectly to download page.

Please access now this link: https://hunterforexindicatormt4.wordpress.com/

Inside this link you can have access to Official Hunter Website www HunterForexIndicator com.

🎓Hunter is a complete and last generation Indicator, is a Lifetime License, NOT have Monthly Fees and give in your accuracy signals,Hunter is a complete and last generation Indicator:

🔔 SOUND ALERTS for all signals./ 🔔 VISUAL ALERTS texts for all signals./ 🔔 EMAIL ALERTS actvation option.This Metatrader indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

⚠️HUNTER indicator is The most efficient way to Trade Manually and safely in Forex Market (Majors and exotics pairs), Indices, bonds, cryptos and shares, which is one of the best indicator for MT4 plataform. VIP Tool. Powerful fixed signals not move or transfer the signal to another candle.

⚠️HUNTER is a simple Indicator, it can be used for any type of trading and any type of counters/pairs, the interface of the indicator is very simple to use, buy when blue signal apears and sell when red arrow apears ; so you can use right immediately, the success ratio is 93% higher than the failure ratio, is a solid technical indicator.

#forex trading#forexindicators#forex signal#forex#forexindicator#hunter forex indicator#non repaint forex signals#forex signals service

3 notes

·

View notes

Text

IG Broker: Executing Large Orders Efficiently Understand how IG Broker handles large trade volumes across multiple currency pairs. IG Broker can execute large orders exceeding $5 million automatically across various currency pairs like EUR/USD, USD/JPY, and GBP/USD. https://brokeragetoday.com/best-brokers-for-market-makers/ #IGBroker #LargeOrders #Forex

1 note

·

View note

Text

Forex Trading: How to maximize your profits with a market maker broker

As a novice trader, you may come across the term "market trades" or "market makers" in the context of Forex trading. In this post, we will look at what market makers are and how they affect your trading.

Market makers are financial institutions, such as banks or brokers, that provide liquidity in the market by acting as buyers and sellers of currency pairs. They play an important role in the Forex market by providing liquidity and ensuring that there is a buyer and seller for any currency pair.

Some of the best market maker brokers in the Forex market in 2024 include:

CMC Markets: Best market broker with the most number of currency pairs 1. eToro: Best Forex broker for social trading 1. easyMarkets: Good Forex broker with the most base currencies 1. IG: Forex broker with the best range of markets 1. When choosing a market broker, make sure they have low spread costs and no commissions. This will help you maximize your profits and minimize your losses.

I hope this post has helped you understand what market trades are and how they affect your Forex trading.

5 notes

·

View notes

Text

Best Forex Currency Pairs to trade - CapitalXtend Forex trading involves the exchange of one currency for another. Pairs are categorized into three main groups: Major, Minor, and Exotic. You can trade currency pairs on the Currency Trading Platform provided by Capitalxtend

#Currency Trading Platform#Best Forex Currency pairs to Trade#CapitalXtend#Trading Forex Online#Currency Trading#Currency trading online

0 notes

Text

Mysteel UK Limited

Broker Modus UK Limited offers a wide range of financial instruments for trading in international markets. This includes currency pairs, stocks, indices, commodities and other financial assets. The variety of instruments allows traders to choose the ones that best suit their trading strategies and objectives.

Metatrader 4 (MT4): This is a popular trading platform that provides ample opportunities to analyse the market, develop trading strategies and execute trades. MT4 has an intuitive interface and an extensive suite of tools for technical analysis.

Metatrader 5 (MT5): This is an enhanced version of the MT4 platform offering more advanced functionality, including a wider selection of tools and the ability to trade not only in Forex, but also in other markets.

WebTrader: This is a web-based platform, which enables traders to trade directly via a web browser without the need to download and install any software. WebTrader provides flexibility and accessibility, allowing traders to trade from their computer or mobile device from anywhere in the world.

Mobile applications: Mysteel UK Limited broker also offers mobile applications for trading on iOS and Android platforms. This allows traders to be flexible and trade anytime, anywhere using their smartphones or tablets.

3 notes

·

View notes

Text

Best ECN Forex Broker In The World

One of the Top Trusted Best ECN Forex Brokers in the World is Xtreamforex. You can trade on more than 150 different financial CFD products with us, including stocks, indices, commodities, currencies, and forex currency pairings. Along with educational webinars, seminars, and live analysis, the best ECN broker also provides beginner to expert trading information.

#financial#market#money#forex trading#xtreamforex#traders#cryptos#crypto#copytrading#onlineforex#onlinemarket

3 notes

·

View notes

Text

How Do You Start Forex Trading? A Beginner's Guide

Imagine earning while you sleep, leveraging global market fluctuations. This isn’t a dream; it’s the potential of forex trading. But how do you start forex trading safely and successfully, especially in India? This beginner’s guide provides a step-by-step walkthrough, navigating the complexities and addressing common concerns to empower your journey into the exciting world of currency trading.

Understanding the Forex Market Basics in India

What is Forex Trading?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. Think of it as a giant auction where buyers and sellers constantly exchange one currency for another. The participants are vast and diverse – everyone from multinational corporations to individual traders like you and me. Forex transactions are driven primarily by supply and demand, reflecting a change in their relative values. One of the most common pairs traded is the USD/INR (US Dollar/Indian Rupee), representing the value of the US dollar against the Indian rupee. For example, if the USD/INR rate is 82.50, you can exchange one US dollar by paying 82.50 Indian rupees directly. Likewise, if you sell 1 USD, 82.50 rupees enter into your account

Key Forex Terminology

Understanding the jargon is crucial. Let’s break down some key terms:

Pip: A pip (point in percentage) is the smallest price movement in a foreign exchange rate, usually the fourth decimal place in most currency pairing. Suppose you make transactions in minor lots, a 1 pip change translates directly to your money profit/loss. However, a higher significant lot is valued in $10 or more each pip movement, even when dealing with other money pairs (Excluding the Yen). For example, a move from 1.1987 to 1.1988 USD/EUR value change is one-pip change for US dollar prices which you used as the benchmark (If this is your base money).

Lot: A lot represents the standardized unit size traded; multiple forms of lot sizes were traded internationally depending on contracts agreements, so it is advised that beginners only stick to their brokerage firm’s agreement and learn based on those agreements alone so they aren’t confused about changes in lot’s.

Leverage: This magnifies your trading power, usually provided by brokers, but remember this is double-edged—more leverage increase risks since money could exponentially fall rather than grow, resulting in debts you take for a gamble. For e.g., 1:100 leverage means you can control a 100 value position by paying 1 unit capital deposit. Leveraging funds is recommended to be practiced in demo account without risking significant loss and to be completely understood rather than jumped into impulsively.

However, a 100x more of risk of loss is involved using such an approach and understanding is key to manage risks rather than just using this advantage immediately.

Spread: The spread is the difference in exchange rates of the transaction which is usually provided at a cheaper price by brokers than that seen by open exchange transactions between countries currency, thus this is broker-specific. But usually such a spread would be in pips change between bidding versus asking the value that you sell to get the quote. It represents the broker as an inter-mediary company/ individual earning revenue as a commission rate from exchanges made under its guidance based on your orders.

Stop-loss and Take-profit (STP). STP involves setting predetermined prices wherein orders immediately sells positions when the prices met the given level. This minimizes loss from forex transaction, so even though you do lose money based on the price movement, at best when the STP is managed effectively, prevents you fully liquidation of your account or assets. For profit purposes, you get the targetted outcome rather than taking a wild risk just at an instant (Emotional trading), ensuring proper evaluation before moving with such orders helps.

Demo Accounts: These accounts allow you to practice trading with virtual money before using real funds. A crucial step before using a real/live trading account since real money could be affected when making reckless trades.

Regulatory Landscape in India

In India, the Securities and Exchange Board of India (SEBI) regulates forex trading. It is crucial to choose SEBI-registered brokers to ensure legal transparency. Before trusting them with a brokerage account, read independent user testimonials at external forums based on your trusted sources in case of discrepancies since it may mean you are dealing malicious perpetrators of fraud schemes. Your tax implications for gains or losses made. These factors may change over given specific governmental regulations updates, so be up-to-date or seek licensed professional tax advisors.

Opening Your Forex Trading Account

Choosing the Right Broker

Selecting the right broker is paramount. Choose based on these criteria:

Regulation: Ensure your considered brokers comply under proper legislation at your jurisdiction, for added safety measures consider choosing one among many with greater legal scrutiny given from high authoritative governmental departments; those registered overseas or with questionable background has many scams occurring. This part requires intense researching background review with independent reviewing websites and sources as your primary point of decision. Usually these reviews consist of several hundred pages long documents of evidence based on public records analysis from investigative journalists and auditors, which if chosen based upon mere convenience based upon broker recommendations without researching, fraud occurs much fast since you may not see such red flags on your time constraints on evaluating which would cause severe damages that may never be regained from that risky approach of hasty decision making on whom broker’s to trust in your forex funding/transactions.

To start easily, it is often the choice of selecting ones regulated in country you live in rather than making global or overseas risky approaches during this period so this step really determines the safety threshold during a forex broker search before starting other aspects since without proper brokerage firms, funds may disappear overnight unnoticed; in cases that it is difficult to evaluate or determine based from these conditions specified above, contacting tax advisors for help can increase time spent looking at various candidate forex companies for brokerage service provision and making thorough evaluations as this part is riskier if not followed well when using any external services such as leverage or account transactions which are all very serious matters in which if done poorly at this choice or decision of deciding broker to select, there is possible outcomes involving a larger than supposed risk involved without sufficient safety provisions specified.

Fees: Compare spreads, commissions, and other charges as this will affect profitability of operations of trading activities since this forms the initial threshold of making money from trading activities given from exchange broker service based upon agreements of trade transactions before making profit from arbitrage itself instead only loss even before the actual activity of doing an outright gain or losing from money trade transactions begin at the onset of trading of transactions as this is more difficult especially handling several smaller trades at times especially when high level of pip changes of fluctuations of exchange daily which would consume more costs incurred for smaller units involved over prolonged daily volume and thus choosing optimal fee level structure from among several candidate companies prior selecting broker requires evaluation of several sources for evaluating best broker firm with these aspects to avoid unnecessary financial charges incurring that reduce profit level involved hence to minimize these fees as a form to maximizing overall net trade profit yield overall trading process duration as your goal from beginning to ending point from trades involved. Such evaluation and risk management of reducing spreads, commissions as you can use free analysis sites offering such a comparison tool for comparing spreads to provide these data without your effort of extracting this from official website of various candidate brokerage firms as doing all those work will consume more time; for most users, an important aspect is deciding on the preferred methods based upon preferred style based which can make difference when involving high volume day to day trading for small units involving lesser risks if the spread and commission is not very high initially which would quickly affect money making opportunity.

Platform: Choose the ones user-friendly across all device types, that offer good research tools as different user interface platforms makes significant differences on experience on platform. To evaluate which is better or which preferred among existing platforms involves direct experience with use which in order can involve creating virtual/demo account to help you with making this crucial evaluation of suitability to fit personal style preferences given which different firms provides better user experience; it depends upon suitability or personal preferences given when accessing these trading apps or features on those platforms in terms what is most useful to help optimize decisions involving during these usage over such access since personal preferences of style determines level involved when interacting with platform daily involving during daily usages and evaluation these suitability of platform depends whether it meets these requirements such suitability involve during uses since interface of platform makes very significant differences in accessibility especially given some users needs to maintain high trading standards to make much more profits in lesser time and involves such evaluation before making use especially given it concerns your safety of financial holdings.

Client Reviews and Ratings: Explore independent feedback; forums can sometimes be unreliable (Avoid reviewing forum sites). Before giving positive feedback, look for ones negative remarks since they could suggest hidden problem often the users may tend experience which often the more positive testimonials/review sites (paid for reviews are biased without any negative side involved hence may cause you to fall to scams hence some degree) tend avoid mentioning about problems these firms had on record that not necessarily mentioned, although to be fair (It is very unlikely even paid for reviews) to mention and involve all users since it varies user experiences. This involves reading review at non biased platform/third party to reduce the risks bias on user experience reviews on whether the quality ratings provided meets expected requirement given the candidate firm reputation or background provided prior to assessing as often better candidates tend have greater transparency in information availability thus greater volume and credibility ratings.

It’s crucial to review numerous independent sources when forming that conclusions prior giving decision when finding candidate brokerage firms during this stage since reliability of information and risk minimises as part process choosing most suitability involves having comprehensive detailed independent reports from official records that would reveal significant detail into reputation before committing to brokerage accounts to start conducting your funding deposit which should not hastily choose on convenient factor prior selecting company without doing this crucial background check step in order ensure all risk minimised to level possible.

Account Verification and Funding

KYC/AML compliance is obligatory according regulations; you will submit documentation such as PAN Card, Aadhaar identity proof, address proof at banking financial institutions registered in order comply based regulation which is non-negotiable factor when opening account for this regulatory purpose at least once during account-approval and subsequent trading activity based KYC records involve to protect the assets and prevent money laundering based governmental rules under such country involved trading and these may extend overseas especially when you are transacting in an foreign entity or country in which some aspects would need be clarified prior to making deposits for conducting such activities. Therefore, this involves reviewing thoroughly each documents to understand and conform those specifications needed under KYC guidelines for this firm that you plan do forex exchange in which may involve further scrutiny given during stages of trading which some firms provide better security and reliability based record involved hence those level security should have prior consideration; various deposit methods range widely available range such as net banking, UPI, and credit/debit card options based brokerage account involves and each such differences and fees will contribute profit gained thus it impacts returns involved overall exchange when completing any transactions as this must be thoroughly evaluate depending what suitability and preferences based depending on circumstances involved with such situations especially on accessibility. Minimum deposit requirement for each usually firms requires lesser initial requirements are generally better approach to initiate to reduce exposure risks incurred if initial fund lose all in case transactions is poorly handled hence minimal financial requirements should prioritise if beginners intend risk minimally in case initially loss happened (Starting out small and focusing learning is effective).

Setting Up Your Trading Platform

Popular forex platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and several web-based platforms that is highly optimised based upon users involved hence depending different aspects based users or brokers available to provide suitability varies and depends whether this access are best suitable during usages during active phases of trades for convenience purposes. To consider the factor of which suits you and convenience would improve your abilities while it improves based usage especially during active live trading and even before this initial phase stages before even doing actual real money transactions involving these process given the practice phase especially on demo account requires good user platform.

Navigating your chosen platform involves familiarising yourself with its interface and features, practicing making some simple dummy buy orders or sells without exposing your real resources as well with testing any features for assessing effectiveness especially during this initial practice period so all operations are well performed prior start live actual fund trades is more important for maintaining trading proficiency, thus user friendliness matter most along with all its functional abilities, research and toolsets, that’s highly important which requires direct exploration of features by you so knowing if those meets requirements during pre evaluation phases before active trading stages involve is important hence the key factors matter on assessing prior commencing with actual doing trades as some differences matter especially given higher efficiency gains when access in platform with tools available is optimized thus evaluation for convenience and suitability matters greatly; even handling any order placing involves using platform functionality such knowing when to use buy limits orders, taking control stop loss and profit taking processes especially once any trade goes active it increases trading skill since it relates handling all possible changes involved.

Mastering Forex Trading Strategies

Fundamental Analysis for Beginners

Fundamental analysis involves examining overall economic conditions of affected country using wide based factors such as various governmental agencies and central national banks; you use these collected key indicators using these sources, this provides baseline knowledge of any currency transactions to perform effectively since this fundamental analysis help estimate what directional movement of underlying currency pairing; such factors includes national growth output (GDP), employment level data analysis involving employment patterns analysis etc or reviewing government financial policy involvement analysis of policy changes or macroeconomic events affecting, these help make decisions of expected direction movement or potential involved as these indicators provide insight direction using a detailed overview involved; often financial reporting of these entities will provide data; however, reliability of quality depends several factors involved before assessing their worth to determine its values which also includes whether this reliability and data accuracy, credibility involves various governmental regulations on which must be researched in order properly assess and use properly. Economic news calendars provides time releases often on macroeconomic indicators used by many in trades, this also help maintain trading habits especially ones doing technical analyses rather than completely ignoring external factors while deciding future movements only using prior datas/historical graph data which should done properly rather jumping quickly making impulse trades only based only chart changes in movements prior day without doing analysis that includes macroeconomic situation during period before actual buying.

Technical Analysis Basics

Technical analysis uses this trading insights of chart data to look for significant patterns involved. Such patterns including chart formation, involving price actions pattern; or technical indicators uses tools and methods on various aspects involving charting techniques while reviewing prior candlestick historical prices in assessing support barriers along trend lines which combined analysis helps determine trades using charts using visual recognition on those trends for decision-making of currency pairing of buying/sell; it includes support barriers often based upon horizontal lines based past lowest or highest that forms and reviewing its movements; if it reaches new highs that often interpreted as momentum trade in ascending which higher potential, hence involves higher gains than losses involves. Often technical analysts combines using moving aggregates that forms averages involved or many technical indicators involved with all visual interpretations based patterns before creating trading based involving charts involve. Using trendslines uses lines to help assess trendlines that forms, combined using different pattern identifications help improves quality evaluation which includes RSI indicators or many more tools and patterns can use if combines.

Risk Management Techniques

Position sizing: This is about calculating lot unit based only upon reasonable percentage (often less 5 percent of portfolio capital) per trade which can be small if start small. This is crucial on reducing or contain financial loss in case loss incurred in trading position so financial exposure level depends this, thus, to reduce risks involve.

This only should done slowly rather jumping into high percentage exposures in trades risking money if happen which usually is often result financial disaster and wipeout everything completely, especially for larger higher level trade transaction especially involve on leveraged trading; it must be done slowly especially larger position holdings before exposure risked involves; position trades should only be based account available financial trading balance and account only available trading limits in which is more sensible managing financial risks instead carelessly exposure for maximum potential profit only ignoring risks associated involved before position risk sizing especially accounts used leveraged transactions must be aware potential and use this very carefully not carelessly risk much money without even properly understanding on evaluating these risks. Thus starting small is strongly advice before larger holding trades made to maintain proper loss avoiding situations when market suddenly experiences highly significant downward trends even after well analysis and evaluation of position sizing also must involve based risks already involved since market highly erratic unexpected factors influencing thus these techniques often combined involved, to minimise potential losses.

Diversifications: Spreading investments to not placing all amount one single currency pair hence more trades are involved depending investment to lower investment risk levels. It only useful provided trading platform support various markets that are supported, hence the importance checking requirements needs involved since most exchange platforms offer multiple assets that can diversified that requires some knowledge on such multiple asset investments or trades involve to reduce overall exposure potential overall to minimize total potential overall loss when incurred based on this involved; diversification based approaches can increase returns if markets vary sufficiently independently based risk involved thus based approach requires detailed evaluation depending investment strategy as usually involved significant risks even proper management but usually used among higher expertise, especially when more assets managed and requires more investment time spent. Diversification reduce impact on financial portfolio in the account to minimise exposure impact in market that are highly volatile changes, these techniques effective on reduction of impact hence involves higher risks unless thoroughly research conducted.

Avoid Emotional Trading: It usually makes worse and is highly not professional among higher-leveled traders even beginners; they need not let emotions influence or make quick hasty or rash impulse decisions influenced these involved instead to be analytical decision base before trade making actions unless risk-aversion needed for trades hence understanding of emotions handling very necessary not only learning the trading process itself with analytical method and pattern analysis only.

Demo Trading & Paper Trading

Importance of Practice

Practice hugely improves trading proficiency. Before actively doing real trades with real money exposure using any trades involve on risk; using demo trading allows you to make trades in which you don’t lost anything before making actual trading actions involve, hence to start learn in which trading actions involves and use techniques involve; trading strategy practice involved when executing this trade involved which allows trading ability to improved greatly, not only theory only but also implementing the strategy which provides better ability understanding even the tools used on platform to efficiently using when live trading situations after finishing a session in practicing trading through the mock use; using demo accounts provides learning ability improves vastly since this approach is often better for making mistakes especially during trading in a low pressures which avoids financial risk or loss involved when losing on transactions when trades on actual real funds.

Transitioning to Live Trading

Transitioning involves setting realistic goals instead jumping to complex trading positions that already potentially high volatile risks when trades even you using real money; hence, this involves starting with real actual investment involving with a lower amount so even you suffer a loss will not cause major effect of financial issues in relation account holdings involved; while your skill improving over time period of practicing continuously during such a learning stage by slowly increases amount that involved if you progress sufficiently while learn actively doing these trading approaches involve during the progress with proper money management and assessing financial conditions based any position risks taking into consideration in all situation especially volatility conditions while you doing

#Beginners forex#Forex Trading Guide#Forex trading tips#how do you start forex trading#How Do You Start Forex Trading? A Beginner's Guide

0 notes

Text

10 Best Practices and Disciplines When Trading in the Global Market

Trading in the global market can be both exciting and profitable, but it requires a solid approach and disciplined strategies. Whether you're new to trading or looking to refine your skills, these best practices can help you navigate the complexities of the market. Here are ten essential tips to help you become a successful trader.

1. Choose the Best Trading Platform

Your trading platform is your primary tool. Make sure you choose the best trading platform that offers real-time data, user-friendly interfaces, and robust analytical tools. Look for platforms that provide educational resources and responsive customer support to help you on your trading journey. The right platform can make a significant difference in your trading experience by providing reliable and fast execution of trades, which is crucial for seizing opportunities in volatile markets.

2. Master Forex Trading

Forex trading can be highly profitable if you know what you're doing. Start by learning the basics, such as understanding currency pairs, market hours, and the factors that influence currency prices. Then delve into advanced strategies like technical analysis and risk management. Stay updated with the latest trends and use reliable sources to get your information. Always aim to be the best Forex trading expert by continuously improving your skills. Practice with a demo account before committing real money to refine your strategies without financial risk.

3. Diversify Your Investments

Don’t put all your eggs in one basket. Spread your investments across different asset classes such as stocks, commodities, and Forex. Diversification helps mitigate risks and can lead to more stable returns over time. By investing in a variety of assets, you reduce the impact of a poor-performing investment on your overall portfolio. This strategy helps balance the risk and rewards, providing a more consistent growth trajectory.

4. Keep Up with Market News

Staying informed is crucial. Regularly read financial news, follow economic reports, and pay attention to global events that could impact the markets. This knowledge will help you make informed decisions and anticipate market movements. Utilize reliable news sources and economic calendars to stay ahead of market trends. Understanding the broader economic context can help you predict how markets will react to news and events, giving you an edge in your trading decisions.

5. Practice Risk Management

Effective risk management is key to long-term success. Set stop-loss orders to limit potential losses and avoid over-leveraging your trades. Determine how much of your capital you are willing to risk on each trade and stick to that limit. This practice helps you manage your trades more effectively and protects your portfolio from significant losses. Always remember that protecting your capital is more important than chasing profits.

6. Develop a Trading Plan

Having a well-defined trading plan is essential. Outline your trading goals, risk tolerance, and strategies. A solid plan keeps you focused and helps prevent emotional trading decisions that can lead to losses. Your trading plan should include criteria for entering and exiting trades, risk management techniques, and a schedule for reviewing and adjusting your strategy. Regularly updating your plan based on performance and market conditions can help you stay on track toward your trading goals.

7. Continuously Educate Yourself

The trading world is always evolving. Take advantage of online courses, webinars, and workshops to stay updated on the latest strategies and tools. Continuous learning is crucial to adapting to new market conditions and improving your trading skills. Stay curious and proactive in seeking out new knowledge. Join trading communities and forums to exchange ideas and learn from experienced traders. This ongoing education helps you stay competitive and informed.

8. Use Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future market movements. Learn to use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trading opportunities and make more informed decisions. By analyzing past price movements, you can identify patterns and trends that may indicate future price directions. This analytical approach provides a data-driven basis for your trading decisions, increasing your chances of success.

9. Maintain Discipline

Discipline is one of the most important traits of a successful trader. Stick to your trading plan, avoid impulsive decisions, and manage your emotions. Consistent discipline helps you stay focused and reduces the likelihood of costly mistakes. It's essential to stay patient and avoid the temptation to deviate from your plan based on short-term market movements. Keeping a cool head and following your strategy will help you achieve long-term success.

10. Evaluate Your Performance

Regularly review your trades to understand what worked and what didn’t. Keep a trading journal to track your performance, analyze your mistakes, and refine your strategies. Continuous evaluation and adjustment are key to long-term success in trading. By systematically reviewing your trades, you can identify patterns and areas for improvement, helping you become a more effective and successful trader.

Conclusion

By following these best practices and disciplines, you can improve your chances of success in the global market. Remember, choosing the best trading platform and becoming proficient in best Forex trading are just the starting points. Stay informed, manage your risks, and continuously educate yourself to stay ahead in the trading game. Happy trading!

2 notes

·

View notes

Text

Best Forex Prop Trading Firm in India: Funded Firm

Proprietary trading firms have gained immense popularity in India, providing traders access to institutional capital without risking their own funds. Funded Firm stands out among the top choices, offering an efficient funding model, competitive trading conditions, and an opportunity for traders to scale their accounts profitably.

What is Funded Firm?

Funded Firm is a proprietary trading firm that provides forex traders with access to capital, allowing them to trade on the firm’s behalf while keeping a share of the profits. The firm follows a structured evaluation process to assess a trader’s skills before granting access to funded accounts.

Key Features of Funded Firm

Funded Firm offers traders various account sizes, ranging from $10,000 to $200,000, with a flexible scaling plan that increases capital allocation based on consistent performance. Traders can earn up to 80% of their profits, with payouts processed on a bi-weekly or monthly basis.

Before receiving a funded account, traders must pass an evaluation phase that tests their trading skills and risk management abilities. The evaluation typically requires meeting a set profit target, maintaining a maximum drawdown limit, and trading for a minimum number of days while following risk management rules. Unlike many other firms, Best Forex Prop Trading Firm in India allows traders to complete the evaluation at their own pace.

Traders can execute trades on platforms like MetaTrader 4, MetaTrader 5, and cTrader, with access to forex pairs, commodities, indices, and cryptocurrencies. The firm offers a maximum leverage of 1:100 and imposes no restrictions on trading strategies, allowing scalping, hedging, and algorithmic trading. Overnight holding is also permitted.

Why Choose Funded Firm?

Funded Firm eliminates the need for traders to risk their own capital while offering a high profit split. The firm’s low evaluation fees, flexible trading strategies, and opportunity to scale accounts make it an attractive choice. It is particularly well-suited for experienced traders, scalpers, swing traders, and those using automated trading systems.

Funded Firm is an excellent choice for forex traders in India who want to trade with institutional capital. With Best Forex Prop Trading Firm in India competitive profit-sharing, a straightforward evaluation process, and access to multiple trading instruments, it provides a solid platform for professional traders. Those looking for a reliable prop firm with strong growth opportunities may find Funded Firm to be the perfect fit.

#fundedfirm#forextrading#fundedtrading#forexpropfirm#bestpropfirm#forexfundedaccounts#proptradingindia#forexindia#forexproptrading#propfirm

0 notes