#best automated trading bot

Explore tagged Tumblr posts

Text

How good is Stock Trading Bot for Indian share market? - Best Trading Bot

In recent years, the Indian stock market has seen a surge in the number of investors and traders, thanks to technological advancements and the ease of access to the internet. With the advent of online trading platforms and the availability of information, stock trading has become more accessible than ever. Along with these developments, stock trading bots have also emerged as a popular tool for traders. In this article, we will explore how good stock trading bots are for the Indian share market.

What is a Stock Trading Bot?

A stock trading bot is Best automated trading bot software program designed to execute trades in the stock market. It uses algorithms and artificial intelligence to analyze market data, identify trends, and make trading decisions. Trading bots can be programmed to execute trades based on predetermined rules or can use machine learning to make decisions based on market conditions.

Advantages of Using a Stock Trading Bot

Speed and Accuracy: One of the biggest advantages of using a trading bot is speed and accuracy. Unlike humans, trading bots can analyze data in real-time and execute trades within milliseconds. This means that traders can take advantage of market movements and capitalize on opportunities that may otherwise be missed.

Emotionless Trading: Another advantage of using a trading bot is that it is emotionless. Trading bots do not get influenced by emotions like fear or greed, which can often cloud human judgement. This allows for more objective decision-making, resulting in better trading outcomes.

Backtesting and Optimization: Trading bot India can be programmed to backtest and optimize trading strategies. This means that traders can test their strategies on historical data to see how they would have performed in the past. They can then tweak their strategies to maximize profits and minimize risks.

24/7 Trading: Trading bots can trade 24/7, which means that traders can take advantage of opportunities even when they are not actively monitoring the market. This is particularly useful for traders who have other commitments and cannot monitor the market all the time.

Disadvantages of Using a Stock Trading Bot

Complexity: Trading bots can be complex to set up and require technical expertise. Traders need to have a good understanding of programming and algorithms to set up and optimize their trading bots.

Risk of Malfunction: Trading bots are not foolproof and can malfunction. This can result in significant losses if not detected and rectified in time. Traders need to monitor their trading bots regularly and have contingency plans in place to mitigate risks.

Dependence on Technology: Trading bots rely on technology, which means that they are susceptible to technical glitches and internet connectivity issues. Traders need to have a reliable internet connection and backup systems in place to ensure that their trading bots function properly.

Are Stock Trading Bots Good for the Indian Share Market?

The Indian share market is unique and presents its own set of challenges for traders. It is highly volatile and influenced by various factors like political and economic developments, global events, and company-specific news. In such a scenario, can trading bots be effective in the Indian share market?

The answer is yes. Stock trading bots can be effective in the Indian share market, provided they are programmed and optimized correctly. India has a large and diverse stock market, with over 5,000 listed companies across various sectors. Trading bots can help traders analyze this vast amount of data and identify trading opportunities that may be missed by human traders.

However, traders need to be aware of the risks and challenges of using trading bots in the Indian share market. The market is highly dynamic and can experience sudden and unexpected movements, which can result in losses. Traders need to monitor their trading bots regularly and have contingency plans in place to mitigate risks.

Conclusion

Algo trading bots can be an effective tool for traders in the Indian share market. They offer speed, accuracy, and emotionless trading. Master bot from Trading Masters is one such bot which is in trend because of it’s Algo and superb result. The bot do trading without any human interference and with 99% accuracy.

#trading bot india#best trading bot software#best trading bot#algo trading bot software#algo trading bot#stock trading bot#best automated trading bot

1 note

·

View note

Text

Now Trade Made Easy with Glimcy, the automated trading bot

Glimcy is a trusted automated trading bot designed for effortless, 24/7 trading. Fully autonomous, it opens and closes orders while you sleep, offering real-time tracking, customizable crypto screens, and AI-powered strategies. With advanced security, seamless integration via Telegram, Discord, or the Web, and lightning-fast execution, Glimcy scales with your needs, ensuring secure, profitable trading backed by expert support.

#automated trading bot#best professional trading bot for beginners#cryptocurreny trading#stock market#cryptocurrency#trading system#crypto

2 notes

·

View notes

Text

Transform Your Forex Trading with Mybottrading: The Ultimate Trading Experience

Welcome to Mybottrading, the premier platform for revolutionizing your forex trading journey. Whether you're new to trading or a seasoned professional, Mybottrading and Mybotfx offer state-of-the-art tools and resources to help you succeed. In this blog, we’ll explore how Mybottrading provides the best forex robots, live trading bots, and comprehensive forex training to elevate your trading strategies.

Why Choose Mybottrading?

Mybottrading is dedicated to empowering traders with advanced technologies and expert insights. Our platform integrates sophisticated algorithms and user-friendly interfaces to ensure you have everything you need to excel in the forex market. Here’s what makes Mybottrading stand out:

Innovative Technology: Our cutting-edge tools are designed to enhance your trading efficiency.

Comprehensive Support: From beginner tips to advanced strategies, we provide the resources you need to succeed.

Reliable Performance: With Mybottrading, you can count on consistent and dependable results.

Unveiling the Power of Mybotfx

Mybotfx is at the core of the Mybottrading experience, offering robust and reliable trading solutions. Here’s why Mybotfx is the preferred choice for traders:

Advanced Algorithms: Mybotfx leverages advanced algorithms to analyze market trends and execute trades with precision.

User-Friendly Design: The platform is designed to be intuitive and easy to use, making it accessible for traders of all levels.

Consistent Results: With Mybotfx, you can expect consistent and reliable performance, helping you make informed trading decisions.

Experience Robot Trading Live with Mybottrading

Robot trading live is a game-changer in the forex market, and Mybottrading offers the best solutions to take advantage of this technology. Our live trading bots operate in real-time, executing trades based on current market data. Here’s why robot trading live is essential for modern traders:

Instant Trade Execution: Real-time execution ensures that your trades are always timely and relevant.

24/7 Market Monitoring: Robot trading live means your trading strategies are implemented continuously, even when you’re not actively monitoring the market.

Accurate Market Analysis: Our bots use advanced algorithms to provide precise market analysis, helping you make informed trading decisions.

Discover the Best Forex Robots at Mybottrading

At Mybottrading, we pride ourselves on offering the best forex robots available. Our robots are designed to enhance your trading strategy and improve your results. Here’s what sets our forex robots apart:

Customizable Parameters: Tailor the robot’s settings to match your trading style and risk tolerance.

Proven Performance: Our robots have a track record of delivering consistent results in various market conditions.

Easy Integration: Setting up the best forex robots is straightforward, allowing you to start trading quickly and efficiently.

Boost Your Skills with Comprehensive Forex Training

Knowledge is key to successful trading, and Mybottrading offers extensive forex training to help you stay ahead. Our training programs cover everything from the basics to advanced strategies, providing you with the tools you need to succeed. Here’s what you’ll gain from our forex training:

Fundamental Concepts: Understand the core principles of forex trading and market dynamics.

Advanced Strategies: Learn sophisticated trading techniques that can give you a competitive edge.

Practical Applications: Apply your knowledge with hands-on training and real-world trading scenarios.

Conclusion

Mybottrading and Mybotfx are your ultimate partners in the world of forex trading. With our advanced robot trading solutions, live trading capabilities, and comprehensive forex training, you’ll be well-equipped to navigate the complexities of the forex market. Join Mybottrading today and discover how our platform can transform your trading journey with the best forex robots, robot trading live, and unparalleled support.

Start your trading journey with Mybottrading and achieve new levels of success!

#best forex robots#forex training#trading bot#mybotfx#forex robots for automated trading#mybottrading

0 notes

Text

The world of cryptocurrency trading can be complex and overwhelming, especially for those who are new to the market. However, by using the right technical tools and strategies, traders can automate their trading strategies, identify potential entry and exit points for trades, and gain a more comprehensive understanding of market trends and momentum. Automated trading platforms, such as Cornix, can be a valuable tool for traders who want to take advantage of market opportunities but do not have the time or expertise to execute trades manually. Charting tools, such as TradingView, can help traders to visualize market trends and identify potential entry and exit points for trades.

#automated trading platform#best crypto trading bot for beginners#best social trading platform#cryptocurrency trading platform#trade crypto online

0 notes

Text

Something that mod packs like better than wolves or games like vintage story don't seem to understand is that suffering in video games is fine, but there needs to be SOME kind of pay off to getting through the suffering.

Progression is an important part of survival/open world games, there needs to be some level of "you've passed B milestone so now the A tasks are considerably easier but you've also unlocked C tasks which match A tasks original difficulty but allow you to work towards D milestone which unlocks E tasks etc etc etc"

Minecraft does an ok enough job of this even though BTWtards will pretend otherwise for reddit updoots. But, as can be said about any topic around video games, factorio does it best. Start off hand crafting, move to hand feeding, then basic automation, oil processing, alternative power sources, logic circuits, trains, scaling up, beacons and modules, robots, artillery, spidertrons.

Each of these paths are not only unlocked through the overall progression but are made easier by embracing the other paths. Scaling up is easier once you start using bots, trains or move to nuclear power. Which are all easier once you embrace advanced oil processing. Beacons and modules can make pretty much anything easier but require sizable automation to use at bigger scales. Robots are such a huge milestone they essentially divide the game into pre and post bot but you can also go the entire game without crafting a single one.

At the start of the game realizing you need another belt of iron plates when your current iron latch can't support another belt is a big task. You need to locate a new patch, manually take out the biters with a tank or turrent creep. Manually build a new mining post on the ore patch, bring all the ore back somehow (trains or belts, which both bring their own time to build). And then you need to actually smelt the iron which means a building a new furnace stack by hand which means either more power drain or more load on your coal patch which it might not be able to support which starts this whole process over again.

By the end or even late game it's a whole new scenario, noticing you need a new belt of iron is never more than three blueprints and a spidertron away from a solution. You can have everything building and running in the background while you work on more stuff that takes more thought than basic copy and pasting. By the end game you spend more time designing than actively building.

Minecraft does ok at this even though some milestones are laughibly easy. Making a mob farm makes collecting stuff like gunpowder easy. Making an iron farm makes building anything big that uses hoppers actually viable. Villager trading halls turn good enchantments into something you can work toward rather than rolling the dice at the enchantment table 400 times.

Trash like better than wolves fails at this. You will be scrounging and toiling away for food every single in game day until you beat it, there's never a point in progression where some core part of the game becomes a non-issue, if you're lucky it just gets 0.5% easier. What once was a task you had to sit and hold right click for five minutes while holding an item can now be accomplished by right clicking a block once and waiting four minutes. Whoop dee fucking doo.

7 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

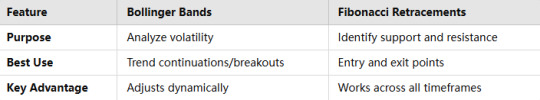

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case:

A trading bot can automatically place orders when specific market criteria are met, eliminating the need for manual intervention.

3. Multi-Exchange Connectivity

Crypto APIs allow platforms to connect with multiple exchanges, aggregating liquidity and providing users with the best trading options.

Use Case:

Traders can access a broader range of cryptocurrencies and trading pairs without switching between platforms.

4. Enhanced User Experience

By integrating APIs, businesses can offer features like secure wallet connections, fast transaction processing, and detailed analytics, improving the overall user experience.

Use Case:

Users can track their portfolio performance in real-time and manage assets directly through the platform.

5. Increased Scalability

API integration allows trading platforms to handle a higher volume of users and transactions efficiently, ensuring smooth operations during peak trading hours.

Use Case:

Exchanges can scale seamlessly to accommodate growth in user demand.

Essential Features of Crypto Exchange API Integration

1. Trading Functionality

APIs must support core trading actions, such as placing market and limit orders, canceling trades, and retrieving order statuses.

2. Wallet Integration

Securely connect wallets for seamless deposits, withdrawals, and balance tracking.

3. Market Data Access

Provide real-time updates on cryptocurrency prices, trading volumes, and historical data for analysis.

4. Account Management

Allow users to manage their accounts, view transaction history, and set preferences through the API.

5. Security Features

Integrate encryption, two-factor authentication (2FA), and API keys to safeguard user data and funds.

Steps to Integrate Crypto Exchange APIs

1. Define Your Requirements

Determine the functionalities you need, such as trading, wallet integration, or market data retrieval.

2. Choose the Right API Provider

Select a provider that aligns with your platform’s requirements. Popular providers include:

Binance API: Known for real-time data and extensive trading options.

Coinbase API: Ideal for wallet integration and payment processing.

Kraken API: Offers advanced trading tools for institutional users.

3. Implement API Integration

Use REST APIs for basic functionalities like fetching market data.

Implement WebSocket APIs for real-time updates and faster trading processes.

4. Test and Optimize

Conduct thorough testing to ensure the API integration performs seamlessly under different scenarios, including high traffic.

5. Launch and Monitor

Deploy the integrated platform and monitor its performance to address any issues promptly.

Challenges in Crypto Exchange API Integration

1. Security Risks

APIs are vulnerable to breaches if not properly secured. Implement robust encryption, authentication, and monitoring tools to mitigate risks.

2. Latency Issues

High latency can disrupt real-time trading. Opt for APIs with low latency to ensure a smooth user experience.

3. Regulatory Compliance

Ensure the integration adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

The Role of Crypto Exchange Platform Development Services

Partnering with a professional crypto exchange platform development service ensures your platform leverages the full potential of API integration.

What Development Services Offer:

Custom API Solutions: Tailored to your platform’s specific needs.

Enhanced Security: Implementing advanced security measures like API key management and encryption.

Real-Time Capabilities: Optimizing APIs for high-speed data transfers and trading.

Regulatory Compliance: Ensuring the platform meets global legal standards.

Scalability: Building infrastructure that grows with your user base and transaction volume.

Real-World Examples of Successful API Integration

1. Binance

Features: Offers REST and WebSocket APIs for real-time market data and trading.

Impact: Enables developers to build high-performance trading bots and analytics tools.

2. Coinbase

Features: Provides secure wallet management APIs and payment processing tools.

Impact: Streamlines crypto payments and wallet integration for businesses.

3. Kraken

Features: Advanced trading APIs for institutional and professional traders.

Impact: Supports multi-currency trading with low-latency data feeds.

Conclusion

Crypto exchange API integration is a game-changer for businesses looking to streamline trading processes and enhance user experience. From enabling real-time data access to automating trades and managing wallets, APIs unlock endless possibilities for innovation in cryptocurrency trading platforms.

By partnering with expert crypto exchange platform development services, you can ensure secure, scalable, and efficient API integration tailored to your platform’s needs. In the ever-evolving world of cryptocurrency, seamless API integration is not just an advantage—it’s a necessity for staying ahead of the competition.

Are you ready to take your crypto exchange platform to the next level?

#cryptocurrencyexchange#crypto exchange platform development company#crypto exchange development company#white label crypto exchange development#cryptocurrency exchange development service#cryptoexchange

2 notes

·

View notes

Text

How Can Forex Help You Make More Money?

Global Financial Solutions Asia Most excellent service provider. Forex is by some estimates the largest financial market in the globe, given the sheer amount of dollars and other currencies available. This makes Forex trading both alluring in potential and intimidating in raw magnitude. Before you begin entering the fray, or if you want to improve your current game, read on into this article for some insights that can help you navigate the trading waters.

To earn more money, look for more profitable offers. The best offers include offers with a recurring revenue, for instance supplies that people will order regularly. You should also look for products that are going to be upgraded later or require new supplies to keep on functioning - for instance, new ink cartridges for a printer.

In forex trading you need to identify successful patterns and stick to them. This is not about using automated scripts or bots to make your sales and purchases. The key to forex success is to define situations in which you have a winning strategy and to always deploys that strategy when the proper situation arises.

A great tip when participating in forex trading is to start off small. When you are a new trader, you do not want to dive in headfirst with large amounts of money. Instead, you should be a small trader for a year. At the end of that year, analyze your good and bad trades, and you can go from there.

When trading with a broker, it is important that you choose an account package that fits your expectations, as well as, your knowledge level. Meeting with your broker and deciding what is the best move can be tricky, so always go with the lowest leverage when just starting out.

Global Financial Solutions Asia Best service provider. Study your prior trades, both the good and the bad. The best way to learn what works is to study your successes and failures in the market. Look for patterns in your trades to see what strategies work best for you. Try keeping a diary of your trades and mark down what the results are.

Do not place protective stops on round numbers. When placing protective stops on long positions, place your protective stop below round numbers and for short positions set the protective stop above round numbers. This strategy decreases risk and increases the possibility of high profits in all your forex trades.

A great Forex trading tip is to be patient and take things one step at a time. You won't become a trading genius overnight. Mastering how to minimize your losses while maximizing your profits takes time. As long as you are patient, you're likely to see gains.

The next thing you should do is one of the most important tasks you can do when entering the foreign exchange market. You should always carefully research and hire a broker. An inexperienced broker won't be able to help you in certain market situations as well as an experienced one can, and a fraudulent broker will cause your gains to diminish.

Global Financial Solutions Asia Proficient tips provider. If you cannot find a deal you feel comfortable making on the forex market, relax. Deciding not to trade is a trading decision in itself, and oftentimes a very wise one. If the state of the market does not suit your current expectations, it is better to bide your time than to make risky trades you are not comfortable with.

To succeed with forex trading, you need to set boundaries for your investment budget and then further research which markets that you understand. Taking some extra time to research companies you know about, will help you to produce a sound investment strategy. Make sure that you are not investing more than you need to survive, as you may find you need those extra funds for an emergency.

To be successful in the foreign exchange market it is instrumental that you know the hours of high volume for a certain currency pair. Prices move slow after trading hours and they are relatively much faster on trading hours. It is good to know what time these trades happen to make good money.

It has been proven that you should avoid trading on Mondays and Fridays. The best days to get in on the market are Tuesday, Wednesday, and Thursday. The market is more stable than in the beginning and the end of the week and easier to determine the positive and negative trends.

Global Financial Solutions Asia Most excellent service provider. Withdraw some of your winnings regularly. If you do not take the time to enjoy what you have won, you will be more likely to take unnecessary risks. Do not reinvest it all back into trades hoping to double your winnings, or you may find yourself broke and out of the game.

Every Forex trader is going to have some sort of trading failure at one point or another, but it is how you learn from your failures that will make you a better trader. Always analyze your failures and start some sort of log so that you can eventually notice a recurring pattern in your bad trades.

When trading in the foreign exchange market, trade for the present, not for the future. The market in its current state may not be the same as the market in the future, so concentrate on currency pairs at the current moment. Also, don't add to positions that are in the red.

Learn about support and resistance. They are the cause of the price moves and once you have a great understanding of support and resistance, you will better understand the reasoning behind the movements that prices make and will better be able to judge where they are going to go. This will allow you to make better trade decisions.

Global Financial Solutions Asia Proficient tips provider. The foreign exchange industry is almost always open since the sun shines always on countries with currencies somewhere with an open market. Keep in mind the advices you have read in this article, and you can start capitalizing on Forex trades almost immediately. Apply these tips to your trades and watch your earnings grow.

2 notes

·

View notes

Text

The Hidden Science of Market Chaos: How Trend Following Algorithms Dominate the Volatility Index Why Volatility Is Your Best Friend (If You Know How to Handle It) Most traders treat market volatility like an overcaffeinated toddler—unpredictable, chaotic, and capable of wrecking everything in sight. But the pros? They see volatility as an opportunity-generating machine. The Volatility Index (VIX), often called the "fear gauge," measures market uncertainty. The higher the VIX, the wilder the price swings, and the greater the chance for trend following algorithms to capitalize on momentum. Think of volatility as the ocean: while most traders are stuck dog-paddling through market noise, trend-following algorithms are the high-tech surfboards that ride those waves with precision. The trick isn’t fearing volatility—it’s learning to control and exploit it. The Algorithmic Mindset: Why Most Traders Are Still Stuck in the Past Retail traders often fall for outdated strategies that rely on intuition rather than logic. How many times have you heard someone say, "I just have a gut feeling about this trade"? That’s about as effective as choosing stocks based on your horoscope. In contrast, professional traders and hedge funds use sophisticated trend-following algorithms that remove emotion from trading. These algorithms aren’t just executing trades—they’re analyzing volatility spikes, adjusting risk parameters, and making split-second decisions based on data. How Trend Following Algorithms Profit From Market Volatility Instead of resisting volatility, these algorithms embrace it. Here’s how they work: - Identifying Emerging Trends – Algorithms scan massive amounts of price data to detect breakouts, reversals, and momentum shifts. Unlike humans, they don’t second-guess their decisions. - Dynamic Position Sizing – During high-volatility periods, they adjust position sizes to optimize risk and reward. This is the difference between a controlled, calculated move and an all-in casino bet. - Adaptive Risk Management – Algorithms constantly adjust stop-loss levels and risk exposure based on volatility conditions. If the market is erratic, they tighten their exits. If it’s trending, they let profits run. - Statistical Edge Over Emotion – Unlike traders who panic-sell when the market drops, these bots execute precise entries and exits based on statistical probabilities. The Secret Sauce: Hidden Patterns in the VIX That Smart Traders Exploit Most traders only look at price action and ignore the volatility index. Big mistake. The VIX holds hidden clues about future price moves. Here’s what smart traders know: - VIX Divergences Matter – If stocks are rallying but the VIX is rising too, smart money might be hedging. That’s a red flag. - Mean Reversion at Extremes – A sky-high VIX often precedes a major reversal. Trend following algorithms monitor these levels to anticipate market shifts. - VIX Spikes Fuel Trend Breakouts – When volatility explodes, algorithms capitalize on trend continuation trades. This is where momentum strategies shine. Why Retail Traders Keep Losing (And How You Can Avoid It) Most traders fail because they fight the trend instead of following it. They overtrade, ignore volatility signals, and rely on lagging indicators. Meanwhile, hedge funds use sophisticated trend-following models that adapt in real time. Want to level up? Ditch the emotional trading and start using volatility-based strategies. If you're serious about evolving your trading game, check out these resources: - Stay Ahead of Market Moves: Get real-time Forex updates and key economic indicators at StarseedFX Forex News. - Master Trend Following Strategies: Take your skills to the next level with our Free Forex Courses. - Trade With the Pros: Join our community for daily alerts, live trading insights, and exclusive strategies at StarseedFX Community. - Track Your Edge: Optimize your trading performance with our Free Trading Journal. - Automate Your Risk Management: Use our Smart Trading Tool to refine your trade execution with advanced automation at StarseedFX Smart Trading Tool. Final Takeaway: The Market Rewards the Prepared If you’re still trading based on outdated methods, the market will eat you alive. Trend-following algorithms, when paired with volatility insights, offer an unfair advantage that most traders never even consider. It’s time to trade smarter, not harder. Are you ready to embrace volatility and ride the trends like the pros? —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

EASY_SetAnalyzeDB()

EASY_SetAnalyzeDB() EASY Set Analyze isn’t just a fancy tale. There’s a real ecosystem behind it, complete with actual databases and complex integrations. We use Big Data technology to store and process every trade our EASY Bots make 🤖 How does it work? Inside our database, we have a special table that creates a rating for set files. We record info for each operation, including which parameters were used, the final outcome, and which bot made the trade. Then a rating is formed: profitable settings become favorites, while losing ones go into the “needs improvement” category. When a bot initializes, it requests the “best” set file from the database and automatically loads it. The whole process — from updating data to applying new settings — is fully automated ⚡️ For experienced developers, this might not sound super magical — big companies have used similar tools in analytics for a long time. But in the world of trading robots, almost no one has offered this functionality yet. A simple MQL5 script can’t do it: you need web development skills, database management, and server infrastructure knowledge. We’ve spent years building this system so it works like clockwork. Now you don’t have to reinvent the wheel — our EASY Bots already have all the “gear” they need for analysis and auto-tuning. Just install your trading robot, pick the parameters, and the system takes care of the rest. Less routine, more clarity, no “fairy tales” — everything has been tested in real practice. Want to see it in action? Send a message to @forexroboteasybot — we’ll show you real examples! // #EasySetAnalyze #EASYBots #forex #algorithmictrading #mt5bot #EASYServices

0 notes

Text

Indian stock market and use of AI bot in trading - Best Trading Bot Software

The Indian stock market is one of the fastest-growing and dynamic markets in the world, offering a diverse range of investment opportunities to investors. With the rise of technology and digitalization, the Indian stock market has witnessed a significant shift in the way trading is done. One such technological advancement that has changed the way trading is done in the Indian stock market is the use of AI bots.

AI bots are computer programs that use artificial intelligence algorithms to analyze market data and make trading decisions. They have been widely adopted in the Indian stock market due to their ability to analyze vast amounts of data and make accurate predictions. These bots are designed to identify market trends, analyze stock patterns, and execute trades based on predetermined parameters.

The use of AI bots has become increasingly popular among traders as they offer several benefits. Firstly, AI bots can analyze large volumes of data in real-time, which is almost impossible for human traders to do. This means that AI bots can identify market trends and patterns much faster than humans can, allowing traders to make quick decisions and capitalize on market opportunities.

Secondly, AI bots can operate 24/7, allowing traders to take advantage of trading opportunities even when they are not actively monitoring the market. This means that traders can set their bots to execute trades automatically based on specific criteria, without having to be present at their computer.

Thirdly, AI bots can eliminate human emotion from trading decisions, which is one of the most significant challenges faced by human traders. Emotion-based decisions can lead to irrational trading behavior, resulting in poor investment decisions. AI bots, on the other hand, make decisions based on data and predefined rules, eliminating the emotional bias that can often lead to poor trading decisions.

Lastly, Algo trading bots can improve trading efficiency by executing trades much faster than humans can. This can result in better prices and more profitable trades.

Use of AI bots in the Indian stock market

The use of AI bots in the Indian stock market has been significant in recent years, with many traders using them to supplement their trading strategies. However, it is important to note that AI bots are not a magic bullet for trading success. They are only as effective as the strategies and parameters that are programmed into them. Additionally, AI bots require significant initial investment in terms of time and money to develop and test effective strategies.

Despite these challenges, the use of AI bots in the Indian stock market is expected to continue to grow in the coming years. The Indian government has recognized the potential of AI and has taken several steps to promote its development and adoption in various sectors, including the stock market.

One of the key areas where Trading bot India is being used in the Indian stock market is algorithmic trading. Algorithmic trading refers to the use of computer programs to execute trades automatically based on predetermined rules and criteria. Algorithmic trading is particularly popular among institutional investors and hedge funds who use AI bots to execute trades on a large scale.

Another area where AI bots are being used is in robo-advisory services. Robo-advisory services are automated investment platforms that use AI algorithms to provide investment advice and portfolio management services. These services are becoming increasingly popular among retail investors who are looking for low-cost investment options.

The Indian stock market has also witnessed the rise of several startups that are using AI bots to provide innovative trading solutions. These startups are leveraging AI and machine learning to develop trading algorithms that can identify market trends and make investment decisions based on real-time data.

One such startup is Trading Master, a Delhi NCR based company that provides AI-powered trading solutions to retail investors. Best Trading bot from Trading master uses machine learning algorithms to analyze market data and provide investment recommendations to its clients. The company's AI bots can also execute trades automatically based on predefined parameters, allowing clients to take advantage of market opportunities without having to actively monitor the market.

#trading bot india#best trading bot#best trading bot software#best automated trading bot#algo trading software in india#algo trading bot#stock trading bot#trading software In india

1 note

·

View note

Text

Glimcy is an advanced professional trading bot by Top Funds

Glimcy ensures 24/7 uptime, real-time tracking, and secure API-only access to your exchange account. With seamless integration via Telegram, Discord, or the Web, Glimcy includes a customizable Crypto Screener, backtesting tools, and expert support to optimize your trading experience. Top funds trust this professional trading bot. It offers fully autonomous trading with AI-powered strategies.

#professional trading bots#how to choose a professional trading bot for crypto#best professional trading bot for beginners#automated trading bot#crypto#cryptocurrency#cryptocurreny trading#stock market#trading system

0 notes

Text

The Best Forex Robots: Automated Trading for Today's Investors

In today's fast-paced financial scene, the appeal of automatic trading via best forex robots has captured the interest of investors all over the world. These advanced algorithms promise to manage the forex market's complexity with unprecedented efficiency and precision. But, in the middle of so many possibilities, which forex robots stand out as the best?

Understanding the Best Forex Robots.

Best Forex robots, also known as Expert Advisors (EAs), are software programs that automate trading choices for traders. Mybottrading uses predetermined algorithms and strategies to execute trades without requiring continual human supervision. Mybottrading automation seeks to profit on market opportunities quickly and consistently by leveraging speed and data analysis capabilities that exceed human competence.

Best Forex Robot Requirements

1. Performance and Consistency: The best forex robot for mybottrading is known for its capacity to provide steady performance over an extended period of time. This covers indicators for profitability, the efficacy of risk management, and trading strategy adherence.

2. Customization and Strategy: the best forex robots provide a variety of techniques that are adapted to various market circumstances. They ought to be adaptable enough to accommodate different people's trading preferences and levels of risk tolerance.

3. Transparency and Support: best forex robots offer transparent trading operations through mybottrading live trading performance, back test data, and detailed documentation of trading techniques. Reliable customer service is also essential for quickly resolving problems.

4. User-Friendliness: The best forex robots are simple to set up, keep track of, and modify as necessary, thanks to their intuitive and user-friendly design. Conclusion

Finding the best forex robots requires carefully weighing factors including performance, strategy, usability, and transparency. Using the best forex robots can greatly improve your trading experience and possibly increase your profitability, regardless of your level of experience with investing or forex trading. Keeping up with the most recent developments in mybottrading automated trading technology will be essential to being competitive as the forex market continues to change.

#robot trading live#mybottrading#best forex robots#forex trading robot#mybotfx#forex robots for automated trading#forex training#trading bot

0 notes

Text

The Top Cryptocurrency Exchange Development Trends for 2025

Cryptocurrency exchanges have evolved significantly over the years, playing a crucial role in the adoption and growth of digital assets. As the industry moves forward into 2025, new technological advancements, regulatory shifts, and market demands are shaping the way exchanges are built and operated. Whether centralized (CEX) or decentralized (DEX), crypto exchanges must adapt to these emerging trends to stay competitive.

In this blog, we will explore the key developments expected in cryptocurrency exchange development in 2025 and how they will influence the future of digital asset trading.

1. Hybrid Crypto Exchanges: The Best of Both Worlds

One of the most significant developments in crypto exchange Development technology is the rise of hybrid exchanges, which combine the advantages of centralized (CEX) and decentralized (DEX) platforms. These platforms offer:

Security & Transparency – Utilizing blockchain-based smart contracts for order execution and settlement while maintaining centralized speed.

Liquidity Solutions – Hybrid models enable better liquidity than traditional DEXs by integrating with liquidity pools.

Regulatory Compliance – These exchanges can implement Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance without compromising decentralization principles.

Hybrid exchanges will gain traction in 2025 as traders demand both control over their assets and seamless user experiences.

2. AI-Powered Trading & Automated Market Making (AMM)

AI and machine learning are becoming critical in cryptocurrency trading. In 2025, exchanges will integrate AI-powered bots and Automated Market Makers (AMM) to enhance trading efficiency.

AI-Powered Trading Bots – These intelligent bots analyze market trends, predict price movements, and execute trades on behalf of users, improving profitability.

Sentiment Analysis – AI tools will assess market sentiment using data from social media, news, and blockchain transactions to predict market trends.

Automated Market Making (AMM) – Smart contract-based liquidity providers will continue evolving to reduce slippage and improve trade execution in decentralized environments.

The use of AI will make cryptocurrency exchanges smarter, more efficient, and less dependent on human intervention.

3. Regulatory-Ready Exchange Development

With increasing global regulations, crypto exchanges in 2025 must prioritize compliance to ensure longevity and trust. Several developments in regulatory compliance include:

On-Chain Identity Verification – Decentralized identity solutions (DID) will enhance user verification while maintaining privacy.

Compliance with MiCA & SEC Guidelines – European Markets in Crypto Assets (MiCA) and U.S. SEC regulations will shape exchange policies.

Smart Contract Auditing & Legal Frameworks – Exchanges will integrate auditing tools to ensure compliance and minimize risks of fraud or exploits.

Governments worldwide are pushing for stricter crypto regulations, and exchanges that proactively comply will have a competitive advantage.

4. Decentralized Exchange (DEX) Evolution

Decentralized exchanges (DEXs) will continue to evolve in 2025, making them more user-friendly, scalable, and liquid. The main innovations in this space include:

Layer 2 Scaling Solutions – Rollups, such as Optimistic and ZK-rollups, will reduce gas fees and improve transaction speed.

Cross-Chain Trading & Interoperability – Blockchain bridges will enable seamless asset swaps across multiple chains.

DAO Governance for DEXs – Community-driven decision-making through Decentralized Autonomous Organizations (DAOs) will increase in adoption.

DEXs are becoming a preferred alternative to CEXs due to their permissionless nature, and in 2025, they will rival centralized exchanges in functionality.

5. Tokenized Asset Exchanges

With the rise of Real World Asset (RWA) tokenization, crypto exchanges will integrate tokenized versions of traditional assets such as:

Stocks & Bonds – Blockchain-based securities will gain mainstream adoption.

Real Estate Tokenization – Investors will trade fractionalized property assets on exchanges.

Commodities & Gold – Tokenized gold and commodities will offer an alternative to traditional derivatives markets.

Tokenization bridges the gap between traditional finance and crypto, making it a vital component of exchange development in 2025.

6. Enhanced Security & Cybersecurity Measures

As hacking threats increase, exchanges must improve their security infrastructure. The top security advancements in 2025 will include:

Multi-Party Computation (MPC) Wallets – Secure transactions without exposing private keys.

AI-Based Fraud Detection – AI-driven security systems to detect and prevent suspicious trading activity.

Zero-Knowledge Proofs (ZKPs) – Privacy-enhancing cryptographic techniques for transactions and user data protection.

With regulatory pressure and increased cyber threats, exchanges that prioritize security will build trust and attract more users.

7. Lightning-Fast Transactions & Scalability

Scalability is a persistent issue for crypto exchanges, but in 2025, new solutions will enhance transaction speeds and efficiency:

Layer 2 Networks – Ethereum’s rollups and Bitcoin’s Lightning Network will make transactions instant and cost-effective.

High-Performance Blockchain Protocols – New blockchains with sub-second finality will power ultra-fast trading.

Decentralized Order Books – Off-chain order matching combined with on-chain settlement will ensure efficiency.

Exchanges that integrate high-speed trading mechanisms will dominate the market by providing seamless user experiences.

8. Institutional Adoption of Crypto Exchanges

2025 will see an influx of institutional investors into cryptocurrency trading, driving demand for institutional-grade exchanges with:

Custodial Services & Insurance Protection – Secure storage solutions to protect large crypto holdings.

Regulated Derivatives & Futures Trading – Institutional products such as crypto ETFs and futures contracts will gain traction.

AI-Driven Portfolio Management – Hedge funds and asset managers will leverage AI to optimize crypto investment strategies.

The institutionalization of cryptocurrency trading will bring mainstream credibility to the industry.

9. Social Trading & Community-Driven Exchanges

Social trading features will redefine user engagement in 2025, allowing traders to:

Copy Trade Experts – Beginners can follow top traders' strategies automatically.

Earn by Sharing Strategies – Influential traders can monetize their trading strategies.

Community-Backed Tokens – Users will have governance rights over exchange decisions through DAO models.

By integrating social features, exchanges will boost user engagement and adoption.

10. The Role of AI in Customer Support & UX

AI-powered chatbots and automation will enhance customer support and user experience in crypto exchanges. The innovations include:

24/7 AI Chatbots – Automated responses for instant issue resolution.

Personalized User Experience – AI-driven recommendations for trading pairs and strategies.

Smart KYC & Verification – AI-assisted KYC processes to enhance compliance and user onboarding.

A seamless user experience will be a differentiator for successful exchanges in 2025.

Conclusion: The Future of Crypto Exchange Development

Cryptocurrency exchanges in 2025 will be more efficient, secure, scalable, and user-friendly than ever before. With innovations like AI-powered trading, hybrid models, RWA tokenization, and institutional adoption, the industry is poised for exponential growth.

For businesses and entrepreneurs looking to build the next-generation crypto exchange, staying ahead of these trends is critical. Whether you’re developing a CEX, DEX, hybrid platform, or tokenized asset exchange, ensuring security, compliance, and scalability will be the key to success in 2025 and beyond.

0 notes

Text

Forex EA

Download the best Forex tick data for free, including Forex trading robots, EA bots, and cracked EAs. Explore Forex strategies, calculators and backtesting tools.

Forex EA

About Company:- Founded in 2015, TheDailyFX.com has dedicated the past decade to advancing fully automated algorithmic trading. Our team boasts a collective expertise exceeding 75 years in professional trading. Each of our Algorithmic Trading Systems undergoes Tickdata Backtest analysis dating back to 2010 and possesses live track records verified by 3rd party.Beyond our utilization of the MetaTrader platform, we actively engage in project development for platforms like eSignal, NinjaTrader, and TradingView.

Click Here For More info-: https://thedailyfx.com/beetle-ea/

0 notes

Text

How do I know if a Forex signal provider is trustworthy?

The Forex market is fast-paced and highly volatile, making it challenging for traders to consistently make profitable decisions. Forex signals can provide valuable trading insights, but with countless signal providers available, distinguishing the trustworthy ones from scams is crucial.

This guide will help you understand Forex signals, identify reliable signal providers, and ensure you make informed choices.

What Are Forex Signals?

Forex signals are trading recommendations that suggest potential buy or sell opportunities in the currency market. These signals are based on various analyses, including technical indicators, fundamental news, and market sentiment. A Forex signal typically includes:

Currency pair

Entry price

Stop-loss and take-profit levels

Additional notes on trade rationale

Signals can be generated manually by professional traders or through automated algorithms and AI-driven trading bots.

Who Are Forex Signal Providers?

Forex signal providers are individuals or companies that generate and distribute trading signals to help traders execute profitable trades. They may use different strategies and methods to generate signals, including:

Professional Traders: Experienced Forex traders who share their insights and trades with followers.

Algorithmic Systems: AI-driven or automated trading systems that analyze market trends and generate signals.

How to Identify a Trustworthy Forex Signal Provider:

1. Look for a Proven Track Record

A reliable provider will have a history of success. Check their past performance—look for consistent results, not just a few lucky wins. Be cautious of providers who avoid sharing performance data or make exaggerated claims.

2. Read Genuine Reviews

Don’t just rely on the provider’s website. Look for independent reviews and testimonials from real users. Pay attention to feedback about accuracy, customer support, and overall reliability. If something sounds too good to be true, it probably is.

3. Test Their Signals

Many trustworthy providers offer free trials or demo accounts. Use this opportunity to see how their signals perform in real-time. Are they accurate? Are they delivered on time? Testing their service firsthand is the best way to gauge their reliability.

4. Check Their Transparency

A good provider will be upfront about how they generate their signals. Do they use technical analysis, fundamental analysis, or both? Are their strategies clearly explained? Avoid providers who are vague or secretive about their methods.

5. Evaluate Their Risk Management

Forex trading is risky, and a reliable provider will prioritize risk management. Their signals should include stop-loss and take-profit levels to help you protect your capital. Steer clear of providers that encourage reckless trading or fail to provide risk guidelines.

6. Ensure Timely Delivery

In Forex, timing is everything. A trustworthy provider will deliver signals in real-time, so you don’t miss out on opportunities. Make sure their delivery method (e.g., Telegram, email, or app) works seamlessly for you.

9. Compare Costs and Value

While free signals might seem tempting, they often lack the depth and accuracy of paid services. Compare the pricing of different providers and consider what’s included—educational resources, additional tools, or access to a trading community can add significant value.

Final Thoughts

Finding a trustworthy Forex signal provider takes time and research, but it’s worth the effort. By focusing on transparency, performance, and risk management, you can find a provider that aligns with your trading goals.

Remember, Forex signals are a tool—not a magic solution. Pair them with your own knowledge and strategy, and you’ll be well on your way to successful trading.

#Forex Signal Provider#Signal Providers#Best Forex Signals#SureShotFX#SSF#forextrading#currency markets

0 notes