#authorised economic operator

Explore tagged Tumblr posts

Text

Best Bank Loan Liaisoning Service Providers in Hyderabad: Helping You Secure Your Financial Future

In today’s dynamic business environment, securing the right funding is often the key to growth, expansion, or overcoming financial hurdles. Whether you're a startup in Madhapur, a small business, or an established company, obtaining a bank loan can be a vital step towards achieving your financial goals. However, navigating the complex loan application process can be challenging. This is where bank loan liaisoning service providers in Hyderabad, such as Steadfast Business Consultants LLP (SBC), step in to provide expert assistance.

In this blog, we will explore how professional loan liaisoning services can help you secure the financial support your business needs, and why SBC stands out as one of the best service providers in Hyderabad.

What is Bank Loan Liaisoning?

Bank loan liaisoning is the process of acting as an intermediary between individuals or businesses and financial institutions (banks) to facilitate the approval and disbursement of loans. Loan liaisoning service providers handle all aspects of the loan application, from gathering necessary documents to liaising with the bank for timely approval. Their role is essential for ensuring that the loan process is smooth, fast, and free of complications.

Why You Need a Bank Loan Liaisoning Service

Securing a bank loan involves more than just filling out forms. The process requires an understanding of bank policies, loan terms, eligibility criteria, and various documentation requirements. Here’s how professional bank loan liaisoning service providers in Hyderabad can simplify the process for you:

Expert Guidance on Loan Types There are many different types of loans available, including working capital loans, term loans, business loans, and more. Understanding which loan best suits your needs can be overwhelming. Loan liaisoning experts help you identify the most appropriate loan product based on your financial situation and business objectives.

Streamlined Loan Application The documentation required for a loan application can be extensive, and small errors can delay the process or lead to rejections. Bank loan liaisoning service providers ensure that your application is complete, accurate, and meets the bank’s requirements, reducing the chances of rejection.

Improved Loan Approval Chances With their deep knowledge of how banks operate, loan liaisoning experts understand what makes an application more likely to succeed. They know how to present your business in the best light, addressing any concerns that the bank might have about your financial standing or creditworthiness.

Negotiating the Best Terms Liaisoning experts not only help you secure the loan but also assist in negotiating the best possible loan terms, such as interest rates, repayment schedules, and processing fees. They can provide insights into how to structure the loan for your business’s benefit.

Time and Effort Savings Loan liaisoning service providers handle the entire process, from preparing the application to following up with the bank, saving you significant time and effort. This allows you to focus on running your business, while experts work to secure the financing you need.

Why Choose Steadfast Business Consultants LLP (SBC)?

Steadfast Business Consultants LLP (SBC), based in Madhapur, Hyderabad, is one of the leading bank loan liaisoning service providers in Hyderabad, offering tailored solutions for businesses looking to secure financing. Here's why SBC stands out:

Comprehensive Loan Services SBC offers a wide range of loan liaisoning services, including assistance with business loans, working capital loans, and project financing. Whether you're looking for a short-term loan to meet immediate needs or long-term financing for expansion, SBC has the expertise to guide you through the process.

In-Depth Knowledge of Bank Processes SBC’s team is well-versed in the processes, policies, and documentation requirements of multiple banks. This knowledge enables them to streamline the loan application process, ensuring that your loan request is presented in the best possible way.

Personalized Approach SBC understands that every business has unique financial needs. Their team takes a personalized approach, analyzing your financial situation and guiding you through the loan process that is best suited to your business goals. Whether you're a small startup or a large corporation, SBC tailors its services to meet your specific requirements.

Expert Negotiation One of the key advantages of working with SBC is their ability to negotiate favorable loan terms on your behalf. Their team is experienced in handling complex negotiations with banks, ensuring that you get the best rates and terms available.

Timely and Efficient Service SBC is committed to providing timely and efficient services to its clients. They understand the urgency of securing financing and work diligently to ensure that the loan process is completed as quickly as possible.

How SBC Can Help You Secure the Right Loan

The process of securing a loan can be intimidating, especially for small businesses or startups. With Steadfast Business Consultants LLP (SBC) by your side, you gain access to expert advice and professional representation, ensuring a smoother path to obtaining the financing you need. SBC helps you with:

Assessing your loan eligibility

Preparing all necessary documents

Submitting your loan application to the right banks

Communicating with banks and following up on your application

Negotiating favorable terms

Contact SBC Today for Loan Liaisoning Services

If you’re looking for professional bank loan liaisoning service providers in Hyderabad, Steadfast Business Consultants LLP (SBC) is your trusted partner in securing financial support for your business. Whether you're seeking a loan for working capital, expansion, or any other business need, SBC’s expertise ensures that you get the best possible loan with the most favorable terms.

Contact SBC today and take the first step towards securing the financial future of your business.

Phone: 040-48555182 Location: Madhapur, Hyderabad

With Steadfast Business Consultants LLP (SBC), you can be confident that your loan application will be handled professionally, efficiently, and successfully, helping you secure the financing your business deserves.

#auditors in hyderabad#auditors in madhapur#authorised economic operator#authority of advance ruling representation services#bank loan liasioning service providers in hyderabad

0 notes

Text

Customs Conducts Onsite Audit, Validation for AEO Pilot Companies

Customs Conducts Onsite Audit, Validation for AEO Pilot Companies In line with President Bola Tinubu’s Trade policy initiatives to secure national economic interests and ease the cost of doing business in Nigeria, the Comptroller-General of Customs (CGC), Adewale Adeniyi, is unwavering in his commitment to streamline clearance processes and facilitate legitimate trade across Nigeria’s borders.…

#Adewale Adeniyi#Authorised Economic Operators#Comptroller-General of Customs (CGC)#Nigeria Customs Service

0 notes

Text

The AEO is the Status certification that provides international recognition to a business entity involved in the International supply chain; it certifies an entity as a secure and reliable trade partner. There are four AEO Tier introduced under the AEO Programme team. AEO T1, T2, and T3 for the importer and exporter, and AEO LO for logistic providers. If you are searching for AEO Certification in India you can contact us at +91 88601-90008 or can visit our website at AEO Certification in India

Visit at: - https://www.mbgcorp.com/in/aeo-programme/

0 notes

Text

New research by the Landworkers’ Alliance, Sustain and others has raised serious concerns about exploitation of Nepalese workers in the UK horticulture sector. The 60-page report, called “Debt. Migration and Exploitation”, examines the recruitment practices and working conditions of seasonal fruit and veg pickers employed under the UK government’s Seasonal Worker scheme. Some Nepalese workers are having to pay extortionate, illegal broker fees of around £4,300 to third-party recruitment agencies in their home countries to secure a visa. One young woman paid £12,000, according to worker testimony included in the study. This means after paying for accommodation, subsistence and travel costs, they are left out of pocket and pay more to come to the UK and work than the retained income they take home. The report includes an extended interview with a former Nepalese worker recruited to work in the UK via a Seasonal Worker scheme visa, who says around 70-80% of workers are paying illegal broker fees. The worker states: “Many people do not know how to use the internet for applications, how to use it properly, how the process works. There is a lack of information everywhere about recruitment, and a lack of education. The brokers are 10 steps ahead of the candidates. The brokers make them victims, they take people for fools." The report also includes a supply chain analysis carried out by the New Economics Foundation, of a fruit farm in Kent. It estimates migrant seasonal workers picking soft fruit receive an average of 7.6% of the total retail price of this farm’s produce. The supermarket receives 54.7% of the value, while the farm receives 26.2%. In 2022, Nepalese migrants accounted for 8% of Seasonal Worker scheme recruits. Ukraine supplied the most workers (20%), down from 90% in 2019 due to the ongoing conflict with Russia. The report concludes with key recommendations for the UK government, labour market enforcement bodies, supermarkets, trade unions and social movements. These include recruiting through one authorised department of the origin countries of workers, cutting out brokers and middlemen, and the establishment of information centres to spread correct information on the process. A UK government spokesperson said “The welfare of visa holders is of paramount importance, including in the Seasonal Workers scheme, and we are clamping down on poor working conditions and exploitation. We work closely with scheme operators who have responsibility for ensuring the welfare of migrant workers, requiring them to provide at least 32 hours paid employment per week and managing the recruitment process overseas. We will always take decisive action where we believe abusive practices are taking place or the conditions of the route are not met"

Love that the government's response seems to be "look we're trying to fix it honest we are"

10 notes

·

View notes

Text

“Asking for what you need is proof of self-worth.” Amanda Goetz

I know it’s a truism, or put more bluntly, “bloody obvious", that what people do to us - how they treat us - is indicative of how much we are valued by them, but when it comes to the actions and behaviour of political parties and large corporations we English tend to pretend otherwise. We turn a blind eye to the actions of political parties and corporations that are insulting, offensive and often life-threatening, actions that if inflicted on us by an individual we would find totally unacceptable.

In her excellent piece, “In the Spite House”, by A.L. Kennedy, written for “A Point of View" (BBC RADIO 4), she discusses the “unfriendly”, “unpopular” and "personally offensive" policies of government and powerful business entities. Although not purposely designed to target any of us individually, certain policies never the less have a profound effect on us personally.

When decisions made in government allow the mainly foreign-owned water companies to discharge excrement into our waterways and onto our beaches it "feels" personal because when you or your child end up squelching through raw sewage, it IS personal.

It is personal when train stations are redesigned for more and more machines, that we have to operate, with not a single rail employee in sight. Policies like these are” unfriendly, even dangerous” and are a sign that we, the paying customer are being "ignored.”

Kennedy reminds us that as individuals, although we may not currently need a care home, a hospital bed, a police station or an affordable home, when we do, we REALLY do. The building of schools and hospitals with short-life concrete (RAAC), and the subsequent refusal of our Prime Minister when Chancellor to authorise sufficient funding for repairs, tells us how we, the personal users of public services are valued.

What does cramming people into tower blocks fitted with inflammable cladding tell us about how corporations and politicians regard the worth of vulnerable tenants? What does the massive increase in UK child poverty tell us about the government’s attitude towards children? Why are wages deliberately kept low in the UK? Are working people not worth a decent living wage? Why does the UK have the lowest pension rates in Europe? Having worked hard all their lives do old people not deserve a decent income? Obviously not!

Political and economic decisions are not made in a vacuum. They don’t just appear. Individuals design them, individual approve them, individuals enforce them, and they affect us at an individual level.

It is time we took the policy decisions of politicians and corporations personally. The property developer who cuts safety corners to make a few extra pounds in profit is being personally selfish. The wealthy politicians who vote against a wealth tax are being personally selfish. The rich individuals who use private health care are being personally selfish. The wealthy families who use tax exempt private schools for their children are being personally selfish. The CEO’s of corporations who pollute our environment, who hoard building land, who over-charge for their products, who pay themselves millions in bonuses, are being personally selfish.

Isn’t it time we too began to take things a little more personally?

#uk politics#personal greed#selfishness#self-wroth#poor. pensioners#child poverty#low wages. bonuses#wealth tax#poor housing

2 notes

·

View notes

Text

offshore companies in mauritius

Offshore Companies in Mauritius: Your Gateway to Global Business

Mauritius has become a leading destination for offshore company formation, thanks to its strategic location, investor-friendly policies, and robust legal framework. Known for its stable economy and attractive tax benefits, Mauritius offers businesses an ideal environment for global expansion, asset protection, and efficient tax planning. In this article, we explore the key features, benefits, and process of setting up offshore companies in Mauritius.

What Are Offshore Companies in Mauritius?

Offshore companies in Mauritius are legal entities established under the Mauritius Companies Act and regulated by the Financial Services Commission (FSC). These entities are designed for conducting international business activities and benefit from Mauritius’s wide network of double taxation treaties, making them ideal for trade, investment, and wealth management.

Types of Offshore Companies in Mauritius

Global Business Companies (GBCs):

Suitable for businesses requiring access to Mauritius’s tax treaty network.

Subject to a low effective tax rate of 3%.

Can conduct a variety of global trade and investment activities.

Authorised Companies (ACs):

Designed for businesses with operations entirely outside Mauritius.

Exempt from paying local taxes but cannot benefit from tax treaties.

Provides greater confidentiality for shareholders and directors.

Key Benefits of Offshore Companies in Mauritius

Tax Efficiency:

Low corporate tax rates and access to over 40 double taxation treaties.

No capital gains tax, inheritance tax, or withholding tax on dividends and royalties.

Ease of Incorporation:

Quick and straightforward setup process, often completed within 3-5 business days.

Flexible share capital requirements with no minimum capital.

Confidentiality and Privacy:

Mauritius offers a high level of confidentiality, with minimal public disclosure of company information.

Shareholder and director details are protected under privacy laws.

Stable Business Environment:

Politically and economically stable jurisdiction with a strong legal framework.

Member of international organizations like the African Union and Commonwealth, adding credibility.

Wide Business Scope:

Suitable for international trade, investment holding, intellectual property management, and wealth structuring.

Steps to Set Up an Offshore Company in Mauritius

Engage a Management Company:

Offshore companies must be incorporated through a licensed management company in Mauritius, which acts as a registered agent.

Choose a Business Structure:

Decide whether to form a GBC or an AC based on your business objectives and tax considerations.

Submit Required Documents:

Shareholder and director identification (passport copies and proof of address).

Business plan outlining the intended activities.

Company name and structure details.

Incorporation Filing:

The management company submits the application to the Financial Services Commission (FSC).

Obtain License and Certificate:

Once approved, the company receives a Certificate of Incorporation and, for GBCs, a Global Business License.

Open a Corporate Bank Account:

Establish a business bank account in Mauritius or internationally to manage financial operations.

Compliance Requirements for Offshore Companies

Annual Filings: Submit audited financial statements and annual returns (for GBCs).

Registered Office: Maintain a registered office address and a local management company.

Ongoing Fees: Pay annual license fees to keep the company in good standing.

Who Should Consider Mauritius Offshore Companies?

Offshore companies in Mauritius are ideal for:

Global investors and entrepreneurs seeking tax-efficient structures.

Multinational corporations looking to establish regional headquarters.

Wealth managers and family offices for asset protection.

E-commerce and tech companies conducting cross-border activities.

Conclusion

Mauritius offers a compelling jurisdiction for offshore company formation, combining tax efficiency, ease of operation, and global credibility. Whether you are an entrepreneur, investor, or multinational corporation, Mauritius provides the tools to expand and protect your global business interests. With its strategic location, strong regulatory framework, and business-friendly policies, Mauritius continues to be a top choice for offshore incorporation.

Ready to start your journey with an offshore company in Mauritius? Partner with a licensed management company today to ensure a seamless setup process and access to global opportunities.

0 notes

Text

How to Get GST Registration in Coimbatore Fast

Coimbatore, known as the Manchester of South India, is a thriving hub of commerce and industry. With a strong presence in textile, manufacturing, and IT industries, businesses in Coimbatore are integral to the economic landscape of Tamil Nadu. Understanding the process of GST Registration in Coimbatore is crucial for companies to facilitate smooth operations and compliance with tax laws.

What is GST?

GST is a unified, multi-stage, destination-based tax levied on every value addition. It has replaced many indirect taxes previously imposed by the central and state governments, thereby simplifying the tax structure and fostering a common national market.

Who Needs GST Registration?

Businesses with a Turnover Exceeding Threshold Limits: Any business whose aggregate turnover exceeds ₹40 lakhs (₹20 lakhs for particular category states) in a financial year is required to register for GST.

Interstate Suppliers: Businesses involved in supplying goods and services across state borders need to register, regardless of turnover.

E-commerce Operators: Platforms facilitating the supply of goods and services also need to be registered.

Casual Taxable Persons: Individuals who supply goods or services occasionally.

Voluntary Registration: Businesses can also voluntarily register under GST to avail of the benefits.

Benefits of GST Registration

Legitimacy to Business: GST registration gives your business a legal identity as a supplier of goods or services.

Input Tax Credit: Registered businesses can claim Input Tax Credit on purchases, reducing the overall tax burden.

Competitive Advantage: Being GST-compliant can enhance your business reputation and widen your customer base.

Ease of Interstate Sales: GST registration simplifies the process of selling goods and services across state borders.

GST Registration Process in Coimbatore

Step 1: Gather Required Documents

Before initiating the registration process, ensure you have the following documents:

PAN Card of the business or applicant.

Proof of Business Registration or Incorporation Certificate.

Identity and Address Proof of Promoters/Directors with photographs.

Address Proof of the place of business.

Bank Account Statement/Canceled Cheque.

Digital Signature (required for companies and LLPs).

Letter of Authorization or Board Resolution for authorised signatory.

Step 2: Visit the GST Portal

Go to the GST official portal at www.gst.gov.in.

Step 3: Fill the Application Form

Part A: Please fill in basic details like your PAN, mobile number, and email address. An OTP will be sent for verification.

Part B: Use the received Temporary Reference Number (TRN) to fill out the application. Provide details of the business, promoters, and authorised signatory, along with the place of business and goods/services to be supplied.

Step 4: Upload Documents

Upload the necessary documents as mentioned above in the specified formats.

Step 5: Verification and ARN Generation

Once the application is submitted, the GST officers will verify it. If everything is in order, an Application Reference Number (ARN) will be generated. You can use the ARN to track the status of your application.

Step 6: GSTIN Allotment

Upon successful verification, a GSTIN (Goods and Services Tax Identification Number) will be issued, and you will be notified via email and SMS. You can then download the GST registration certificate from the GST portal.

Conclusion

GST Registration in Coimbatore is a vital step for businesses aiming for growth and compliance. It not only legitimises your business but also offers numerous benefits, including tax credits and simplified tax filing processes. By following the outlined steps and maintaining compliance, businesses can contribute to a streamlined and efficient tax system in India.

0 notes

Text

G.K. Kedia & Co.: Your Trusted Partner for Company Formation in India.

A Comprehensive Guide to Company Formation in India

India is one of the world’s fastest-growing economies, offering a dynamic market for businesses of all sizes. Whether you’re an entrepreneur, a startup, or an established entity, setting up a company in India can unlock immense opportunities. However, the process of company formation in India requires a clear understanding of legal, financial, and procedural aspects. This blog will walk you through the essentials of forming a company in India and how to navigate the process effectively.

Why Choose India for Your Business?

India provides a favourable environment for businesses due to:

Large Market Size: With over 1.4 billion people, India is a massive market for products and services.

Economic Growth: India’s GDP is consistently growing, making it a hotspot for investment.

Startup Ecosystem: Government initiatives like Startup India encourage entrepreneurship.

Skilled Workforce: The country boasts a highly skilled and cost-effective workforce.

Types of Business Entities in India

Before diving into the process, you must decide on the type of company you want to establish. Common types include:

Private Limited Company: Ideal for small to medium-sized businesses; offers limited liability and a separate legal identity.

Public Limited Company: Suitable for large-scale businesses planning to raise funds from the public.

Limited Liability Partnership (LLP): Combines the benefits of a partnership and a corporation.

Sole proprietorship: best for small-scale, single-owner businesses.

One Person Company (OPC): A unique option for individual entrepreneurs.

Steps to Company Formation in India

Forming a company in India involves multiple steps. Here’s a simplified breakdown:

1. Choose a Business Structure

Selecting the right entity depends on your business goals, scale, and investment plans.

2. Obtain Digital Signature Certificate (DSC)

The DSC is required for all online filings with the Ministry of Corporate Affairs (MCA). Authorised signatories must have valid DSCs.

3. Apply for Director Identification Number (DIN)

Directors need a DIN, which is a unique identification number issued by the MCA.

4. Reserve Your Company Name

Submit your preferred company names to the MCA using the RUN (Reserve Unique Name) service. Ensure the name aligns with naming guidelines and is unique.

5. Draft Incorporation Documents

Key documents include:

Memorandum of Association (MoA)

Articles of Association (AoA)

These define the company’s scope, purpose, and operational rules.

6. File for Incorporation

File the incorporation application (Form SPICe+) with the MCA, attaching the necessary documents and paying the required fees.

7. Obtain PAN and TAN

The company must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN). These are mandatory for taxation purposes.

8. Open a Bank Account

After incorporation, open a bank account in the company’s name for financial transactions.

Key Compliance Requirements

After incorporation, companies must adhere to several regulatory requirements, including:

Filing annual returns and financial statements.

Conducting annual general meetings (AGMs).

Maintaining proper books of accounts.

Paying applicable taxes (GST, income tax, etc.).

Challenges in Company Formation

While the process may seem straightforward, several challenges can arise, such as:

Understanding complex legal requirements.

Ensuring compliance with evolving regulations.

Addressing documentation errors.

How Professional Assistance Simplifies the Process

Partnering with experts like G.K. Kedia & Co. can make company formation in India seamless. From choosing the right business structure to handling documentation and compliance, professionals ensure a smooth setup process, saving you time and effort.

Conclusion

Setting up a company in India is a strategic move for tapping into one of the world’s most promising markets. By understanding the legal and procedural aspects, you can ensure a successful incorporation process. For hassle-free company formation in India, seek guidance from experienced professionals who can help you navigate the complexities and set your business up for success.

0 notes

Text

Essential Renault Car Parts: Tips For Choosing And Maintaining Your Vehicle

Introduction

Renault has long been celebrated for its innovative designs, reliable engineering, and unique approach to automotive technology. However, maintaining a Renault vehicle in prime condition requires more than just regular servicing; it also demands high-quality Renault car parts. Understanding the crucial components, where to source authentic parts, and how to care for them can greatly improve your vehicle’s performance and lifespan. This guide will cover the essentials for choosing and maintaining the right parts for your Renault.

Key Components of a Renault Car

Owning a Renault involves staying informed about the parts that play a significant role in your vehicle’s performance. Below, we outline some essential parts and their functions in your Renault.

Engine Parts

The engine is often referred to as the heart of any vehicle. Renault’s engine parts include everything from the timing belt to the fuel injectors, each contributing to the smooth operation of your vehicle. Choosing them ensures that these elements function optimally, providing better fuel efficiency and lower emissions.

Suspension System

Renault vehicles are known for their smooth ride quality, largely thanks to a well-engineered suspension system. From shocks to struts, each part needs to be properly maintained to keep your Renault running smoothly. Quality suspension components help maintain stability, especially on rough or uneven roads.

Brake Components

Brakes are critical for any car, ensuring safety on the road. In Renault models, brake pads, rotors, and discs should be regularly inspected and replaced when needed. Opting for genuine parts here not only ensures compatibility but also enhances safety during critical braking situations.

Tips for Selecting Renault Car Parts

When it comes to purchasing Renault parts, there are several factors to keep in mind to ensure you get quality products that suit your needs.

Authenticity and Quality

When buying Renault parts, it's essential to prioritise authenticity. Only certified suppliers or reputable dealerships can guarantee genuine parts that are compatible with your vehicle. Fake or low-quality parts may initially seem economical but can lead to long-term damage and increased repair costs.

Compatibility

Renault has multiple models and variations, meaning not all parts are universal. Always check for model-specific parts, as compatibility is essential to maintain the vehicle’s performance. Consult with a Renault specialist or use an authorised Renault parts catalogue to identify the correct components for your car.

Maintaining Your Renault with Quality Car Parts

Once you have the right Renault parts installed, maintaining them properly is the next step to keeping your vehicle in top condition.

Regular Inspection and Servicing

Regular inspection of your Renault’s components can prevent major breakdowns and prolong the life of your car. Scheduling consistent servicing with a trained technician ensures that parts like the engine, brakes, and suspension are functioning as they should.

Cleaning and Care

Taking care of Renault parts involves more than replacement. Routine cleaning can prevent build-up and corrosion, especially for parts exposed to harsh weather. Clean engine components, wash and polish exterior body parts, and keep an eye on the condition of tyres and suspension to extend their longevity.

Conclusion

Using authentic Renault car parts and following a careful maintenance routine are key to ensuring a smooth, safe, and long-lasting driving experience. By understanding the main components, knowing how to select the right parts, and maintaining them properly, you can maximise the performance and value of your Renault. With the right approach, you’ll keep your Renault running efficiently for years to come.

0 notes

Text

Navigating the Authority of Advance Ruling (AAR) Representation Services: A Complete Guide

For businesses operating in India, staying compliant with tax laws and regulations is crucial for smooth operations. One of the most important mechanisms to ensure compliance is seeking clarity on tax-related matters through the Authority for Advance Ruling (AAR). AAR provides binding rulings on specific tax matters, helping businesses avoid litigation and manage their tax liabilities effectively.

For businesses in Madhapur, Hyderabad, Steadfast Business Consultants LLP (SBC) offers expert Authority of Advance Ruling representation services to guide companies through the complex process of obtaining rulings from the tax authorities. In this blog, we will explore what AAR is, why businesses need it, and how SBC can assist in navigating this process.

What is the Authority for Advance Ruling (AAR)?

The Authority for Advance Ruling (AAR) is an independent body established under the Goods and Services Tax (GST) and Income Tax laws to provide clarity on tax matters. It is a mechanism where taxpayers (individuals or businesses) can seek advance rulings on specific tax issues. Once the ruling is provided, it is binding on both the applicant and the tax authorities, which can help avoid disputes or confusion in the future.

The rulings issued by the AAR are important because they clarify the application of tax laws to specific transactions or business operations, ensuring that businesses are not caught off guard by tax liabilities or penalties. The AAR can cover various tax-related queries, such as:

GST applicability on specific goods or services

Classification of goods or services under GST

Determining whether a transaction is exempt from tax

Tax treatment of cross-border transactions

Why Do Businesses Need AAR Representation?

Seeking an advance ruling from the AAR provides businesses with several key benefits:

Clarity on Tax Matters Businesses often encounter complex tax scenarios where it’s unclear how specific provisions of tax law should apply. A ruling from the AAR helps clear up ambiguities and provides a legal interpretation, giving businesses the confidence to make decisions based on clear guidelines.

Avoidance of Litigation By obtaining a ruling in advance, businesses can proactively avoid potential disputes with tax authorities. A ruling provides the certainty needed to comply with tax laws, reducing the risk of penalties or lengthy legal battles.

Tax Planning and Compliance Advanced rulings can help businesses plan their tax strategies better, ensuring that they do not face unexpected tax liabilities. This is particularly useful for businesses involved in cross-border transactions or operating in niche sectors with complex tax implications.

Cost and Time Efficiency Instead of spending time and resources on extended litigation, businesses can resolve tax-related issues swiftly through the AAR process. This leads to better resource allocation and faster decision-making.

AAR Representation Services by SBC

Steadfast Business Consultants LLP (SBC) offers Authority of Advance Ruling (AAR) representation services for businesses in Madhapur, Hyderabad, and beyond. With years of expertise in handling complex tax issues, SBC ensures that your application for an advance ruling is prepared meticulously, increasing your chances of a favorable outcome. Here's how SBC can assist:

Expert Consultation SBC’s team of professionals provides detailed consultation on whether applying for an AAR is the right approach for your business. They assess your situation, identify the relevant legal issues, and prepare a strategy that aligns with your business objectives.

Application Preparation The process of applying for an advance ruling can be intricate, requiring accurate information and a clear presentation of your tax-related issues. SBC handles the entire application process, ensuring that all necessary documents and details are submitted correctly to the AAR.

Representation Before the AAR SBC provides expert representation before the Authority of Advance Ruling, presenting your case in a manner that maximizes your chances of obtaining a favorable ruling. Their experienced team ensures that all queries are addressed comprehensively and in line with the legal provisions.

Post-Ruling Support Once the ruling is issued, SBC offers post-ruling support, helping businesses understand the implications of the decision and how to implement the ruling effectively in their operations. If necessary, they also guide businesses through the appeals process in case of a ruling that is not favorable.

How SBC Helps Businesses in Madhapur

Madhapur, being a thriving business hub in Hyderabad, is home to numerous enterprises, particularly in the IT, manufacturing, and services sectors. These businesses often face unique tax challenges, particularly with the introduction of GST and changes in direct tax laws. Steadfast Business Consultants LLP (SBC) provides businesses in Madhapur with expert guidance on navigating these tax complexities, ensuring they make informed decisions based on reliable legal interpretations from the AAR.

Why Choose Steadfast Business Consultants LLP (SBC)?

SBC’s team of experienced tax professionals has an in-depth understanding of India’s tax regulations and is equipped to handle AAR representation with the utmost precision. Whether you are a small business, a startup, or an established enterprise, SBC’s personalized services ensure that your application is handled efficiently and effectively.

Contact SBC for AAR Representation Services

For businesses in Madhapur, Hyderabad, looking to gain clarity on their tax matters through Authority of Advance Ruling (AAR) representation services, Steadfast Business Consultants LLP (SBC) is the trusted partner you need.

Contact SBC today to schedule a consultation and ensure that your business is well-equipped to navigate the complexities of tax law with confidence.

Phone: 040-48555182 Location: Madhapur, Hyderabad

With Steadfast Business Consultants LLP (SBC) by your side, you can rest assured that your business will receive accurate, timely, and professional assistance in obtaining an advance ruling from the tax authorities.

#auditors in hyderabad#auditors in madhapur#authorised economic operator#authority of advance ruling representation services#bank loan liasioning service providers in hyderabad

0 notes

Text

Events 11.12 (before 1970)

954 – The 13-year-old Lothair III is crowned at the Abbey of Saint-Remi as king of the West Frankish Kingdom. 1028 – Future Byzantine empress Zoe takes the throne as empress consort to Romanos III Argyros. 1330 – Battle of Posada ends: Wallachian Voievode Basarab I defeats the Hungarian army by ambush. 1439 – Plymouth becomes the first town incorporated by the English Parliament. 1835 – Construction is completed on the Wilberforce Monument in Kingston Upon Hull. 1892 – Pudge Heffelfinger becomes the first professional American football player on record, participating in his first paid game for the Allegheny Athletic Association. 1893 – Abdur Rahman Khan accepts the Durand Line as the border between the Emirate of Afghanistan and the British Raj. 1905 – Norway holds a referendum resulting in popular approval of the Storting's decision to authorise the government to make the offer of the throne of the newly independent country. 1912 – First Balkan War: King George I of Greece makes a triumphal entry into Thessaloniki after its liberation from 482 years of Ottoman rule. 1912 – The frozen bodies of Robert Scott and his men are found on the Ross Ice Shelf in Antarctica. 1918 – Dissolution of Austria-Hungary: Austria becomes a republic. After the proclamation, a coup attempt by the communist Red Guard is defeated by the social-democratic Volkswehr. 1920 – The 1920 Cork hunger strike by Irish republicans ends after three deaths. 1920 – Italy and the Kingdom of Serbs, Croats and Slovenes sign the Treaty of Rapallo. 1927 – Leon Trotsky is expelled from the Soviet Communist Party, leaving Joseph Stalin in undisputed control of the Soviet Union. 1928 – SS Vestris sinks approximately 200 miles (320 km) off Hampton Roads, Virginia, killing at least 110 passengers, mostly women and children who die after the vessel is abandoned. 1933 – Nazi Germany uses a referendum to ratify its withdrawal from the League of Nations. 1936 – In California, the San Francisco–Oakland Bay Bridge opens to traffic. 1938 – Nazi Germany issues the Decree on the Elimination of Jews from Economic Life prohibiting Jews from selling goods and services or working in a trade, totally segregating Jews from the German economy. 1940 – World War II: The Battle of Gabon ends as Free French Forces take Libreville, Gabon, and all of French Equatorial Africa from Vichy French forces. 1940 – World War II: Soviet Foreign Minister Vyacheslav Molotov arrives in Berlin to discuss the possibility of the Soviet Union joining the Axis Powers. 1941 – World War II: Temperatures around Moscow drop to −12 °C (10 °F) as the Soviet Union launches ski troops for the first time against the freezing German forces near the city. 1941 – World War II: The Soviet cruiser Chervona Ukraina is destroyed during the Battle of Sevastopol. 1942 – World War II: Naval Battle of Guadalcanal between Japanese and American forces begins near Guadalcanal. The battle lasts for three days and ends with an American victory. 1944 – World War II: The Royal Air Force launches 29 Avro Lancaster bombers, which sink the German battleship Tirpitz, with 12,000 lb Tallboy bombs off Tromsø, Norway. 1948 – Aftermath of World War II: In Tokyo, the International Military Tribunal for the Far East sentences seven Japanese military and government officials, including General Hideki Tojo, to death for their roles in World War II. 1954 – Ellis Island ceases operations. 1956 – Morocco, Sudan and Tunisia join the United Nations. 1956 – In the midst of the Suez Crisis, Palestinian refugees are shot dead in Rafah by Israel Defense Force soldiers following the invasion of the Gaza Strip. 1958 – A team of rock climbers led by Warren Harding completes the first ascent of The Nose on El Capitan in Yosemite Valley. 1961 – Terry Jo Duperrault is the sole survivor of a series of brutal murders aboard the ketch Bluebelle. 1969 – Vietnam War: Independent investigative journalist Seymour Hersh breaks the story of the My Lai Massacre.

0 notes

Text

EU court dismisses banks’ appeal against state aid to Madeira

The EU General Court on Wednesday rejected an appeal by Millennium BCP Participações and BCP África, upholding Brussels’ ruling that state aid was illegal in the Madeira Free Trade Zone (MFZ), Euractiv reports.

In a statement, the court rejected the companies’ claims, saying that the European Commission had correctly concluded that the state aid they received was illegal.

Court officials pointed out that both companies had failed to fulfil the requirement to create or retain jobs and did not fall under any exception to this condition of state aid.

On the other hand, the judgement rejected the claim that Brussels had breached the principle of protecting legitimate expectations and concluded that there had been no breach of the principle of legal certainty.

According to the judgement, the companies were authorised to operate in the MFZ in 1998 in the case of the pre-Millennium BCP company and in 1996 in the case of the pre-BCP Africa company.

Both companies ceased to be subject to Regime III on December 31, 2020 and their licences to operate in the MFZ were maintained until mid-2021. Neither company had any employees during the Regime III period.

GCUE has already rejected a number of Portuguese appeals against state aid in the MFZ. The Regional Aid III scheme was designed to attract investment and job creation in Madeira.

To ensure that the aid scheme would overcome the structural weaknesses of companies in these regions, the Commission’s approval decisions made it clear that aid should be granted to companies that generate economic activity and real jobs in the Madeira region.

In 2018, Brussels launched a formal investigation into Scheme III of this state aid to MFZs, as it had doubts about the application of tax incentives to income from activities actually and substantially carried out in Madeira and the link between the amount of aid and the creation or maintenance of real jobs in the region.

In 2020, he declared the aid scheme incompatible with the common market on the grounds that Portugal had applied it illegally. He demanded the immediate and effective recovery of aid from beneficiaries, the cancellation of the scheme and the cancellation of all outstanding aid payments. Portugal was given eight months to comply with the judgement.

According to the Court of Auditors’ opinion on the general public account (CGE) for 2023, published in October, the amount of contributions already paid by tax authorities to free zone companies found to have received illegal state aid is €525 million, but only €66 million has been paid.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#madeira#madeira island#mfz

0 notes

Text

Avoid Common Mistakes in Chennai Company Registration

Introduction

Chennai, a significant economic and cultural hub in India, offers a vibrant environment for business growth. Registering a company in Chennai involves several steps, ensuring your business is legally recognised and compliant with regulatory standards. Whether you're starting a new venture or expanding an existing one, understanding the company registration in Chennai is crucial.

Types of Companies

In Chennai, businesses can choose from various types of companies based on their structure and needs:

Private Limited Company (PLC): PLCs are suitable for small—to medium-sized businesses. They offer limited liability to shareholders and have a separate legal entity status.

Public Limited Company (PLC): Ideal for larger businesses, this type allows shares to be publicly traded and has more stringent regulatory requirements.

Limited Liability Partnership (LLP): A hybrid between a partnership and a company, LLPs offer limited liability to partners while maintaining operational flexibility.

One-Person Company (OPC): Designed for single entrepreneurs, OPCs combine the benefits of a company with the simplicity of sole proprietorship.

Registration Process

Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for the company's directors and authorised signatories. This is essential for filing documents electronically with the Registrar of Companies (RoC).

Obtain Director Identification Number (DIN): Each director of the company must obtain a DIN, a unique identification number issued by the Ministry of Corporate Affairs (MCA).

Name Reservation: Propose a name for your company and apply for its reservation through the MCA portal. Ensure the name complies with naming regulations and is unique.

Draft Memorandum and Articles of Association (MOA and AOA): Prepare the MOA and AOA, which define the company's objectives and rules governing its operations.

File Incorporation Documents: Submit the incorporation documents, including MOA, AOA, DIN, and DSC, to the RoC through the MCA portal and pay the required registration fee.

Obtain Certificate of Incorporation: Upon successful processing of documents, the RoC issues a Certificate of Incorporation, officially recognising your company as a legal entity.

Apply for PAN and TAN: After incorporation, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

Open a Bank Account: Open a bank account in the company’s name to handle business transactions and maintain financial records.

Compliance and Post-Registration Requirements

Annual Filings: Companies must file annual financial statements and annual returns with the RoC.

Board Meetings: Hold regular board meetings and maintain minutes as per legal requirements.

Statutory Registers: Maintain statutory registers such as the register of members, directors, and shareholders.

Conclusion

Company Registration in Chennai involves several steps, from obtaining necessary certificates to complying with regulatory requirements. It is advisable to seek professional assistance from company secretaries, chartered accountants, or legal experts to navigate the process smoothly and ensure compliance with all legal obligations. With a well-structured approach, you can establish a successful business presence in one of India's most dynamic cities.

0 notes

Text

Central African Republic ECTN and Sustainability

In the Central African Republic (CAR), the Electronic Cargo Tracking Note (ECTN) system can play an important role in sustainability. ECTN can contribute to environmental and social sustainability by enabling trade to be conducted in a more efficient, transparent and secure manner. Here are some of the main points in this regard:

1. Efficient Use of Resources

Digitalisation: ECTN allows documents to be managed digitally, which reduces the use of paper, minimising the cutting of trees and the consumption of natural resources. Fast Processes: Digital processes enable faster processing of loads, which reduces transport times and reduces unnecessary fuel consumption.

2. Transparency and Traceability

Supply Chain Management: ECTN allows tracking where cargoes are and what stages they go through. This supports sustainable sourcing and more ethical management of the supply chain. Legal Compliance: Transparency facilitates the implementation of laws and environmental protection regulations. This can help control environmental impacts.

3. Environmental Impact

Less Waste: By encouraging the provision of accurate documentation and information, ECTN contributes to the reduction of incorrect submissions and waste. Promotion of Sustainable Products: ECTN can help environmentally friendly and sustainable products enter the market more easily.

4. Supporting Local Economies

SME Support: The ECTN system contributes to strengthening local economies by facilitating access to international markets for small and medium-sized enterprises (SMEs). Training and Awareness: Trainings on ECTN practices ensure that local businesses are familiarised with sustainable practices.

5. Social Sustainability

Job Creation: The ECTN system can create new jobs in the local customs and trade sector. Social Awareness: Training programmes can contribute to social sustainability by raising sustainability awareness in communities.

The integration of the ECTN in the Central African Republic can promote not only business processes, but also environmental and social sustainability. The effective implementation of this system can contribute to both economic growth and the achievement of environmental and social objectives. Therefore, it is important to develop and promote ECTN in the context of sustainability.

ECTN integration in logistics processes

ECTN (Electronic Cargo Tracking Note) integration can provide a significant transformation in logistics processes. Effective integration of this system helps processes to become more efficient, reliable and transparent. Here are the main aspects of ECTN integration in logistics processes:

1. Data Management

Digital Documents: ECTN enables documents to be managed digitally, which reduces the risk of documents being lost and provides quick access. Data Sharing: Facilitates data sharing between logistics service providers, customs authorities and other stakeholders, speeding up workflow.

2. Traceability and Transparency

Real-Time Tracking: ECTN allows tracking where loads are and what stages they go through. This provides transparency throughout the supply chain. Customer Information: Customers can track the status of their loads instantly, which increases customer satisfaction.

3. Acceleration of Customs Processes

Pre-Approval Process: ECTN facilitates document preparation processes by enabling fast clearance of cargo through customs. Fast Authorisations: Pre-submission of customs documents helps speed up customs clearances.

4. Reducing the Error Rate

Automatic Data Entry: Reduces the entry of incorrect information by using automated data entry systems to minimise human error. Standardised Documents: ECTN improves the consistency of processes by encouraging the use of standardised documents.

5. Cost Savings

Operational Efficiency: Digitalisation of processes reduces paper costs and saves labour. Reduced Transport Times: Faster customs clearance and cargo tracking reduces costs by shortening overall transport times.

6. Training and Awareness

Training Programmes: Organising trainings on the ECTN system for logistics companies and their employees ensures the effective use of the system. Awareness Raising: Organising campaigns explaining the advantages and requirements of ECTN can encourage more businesses to switch to this system.

7. Sustainability

Environmental Impacts: The digitalisation of ECTN contributes to environmental sustainability by reducing the use of paper. More Efficient Resource Utilisation: Better traceability encourages more efficient use of resources.

The integration of ECTN into logistics processes increases operational efficiency and creates a sustainable trade environment by ensuring transparency and security. Successful integration of this system will increase the competitiveness of logistics companies and increase customer satisfaction.

0 notes

Text

Step-by-Step Guide to Obtaining a Mainland License in Dubai

Dubai is one of the most dynamic cities in the world, and it provides a promising climate for the business activity of many companies from all over the globe. A mainland license is essential to companies operating in the Emirate, as it gives the authorisation to undertake different business activities. Here's a comprehensive guide to help you navigate the process of obtaining a license for a mainland business setup in Dubai:

Mainland Licenses

A mainland license is obtained from the Department of Economic Development (DED) in Dubai, which permits business activity in the mainland area of the Emirate. It offers access to the local market, government tenders, and international trade.

The Main Steps to Get a Mainland License

Step 1: Before you get a mainland license first, choose your business activity.

Find out the extent of specialisation of your business.

Take into consideration the type of licence, for example, a commercial, professional, or industrial licence, and so on.

Look into your market and competitors in the area of specialisation that you want to undertake.

Step 2: Select a legal structure.

Find out the legal structure of the business best suited for your company.

You can choose between a limited liability company (LLC), sole trader, or partnership.

Consider factors like ownership, legal responsibility, and taxation.

Step 3: Reserve your trade name.

Select a unique and memorable trade name for your business.

Make sure that it does not violate any DED regulation and has not been registered yet.

Make an application for a reservation to the DED.

Step 4: Secure a Local Service Agent (LSA)

An LSA might be required for some business operations.

An LSA is a UAE national who provides local support to your business by being a local partner.

Step 5: Obtain initial approval.

File the required documents with the DED for initial approval, such as the trade name reservation and the LSA agreement.

This approval means that your mainland business setup in Dubai is now legal.

Step 6: Get external approvals.

Depending on the nature of your business activity, you might require approval from other government departments, including the Ministry of Economy, Department of Health, or Dubai Municipality.

Step 7: Rent an office space.

Acquire your own space in the mainland area of Dubai.

Give the DED a tenancy contract and Ejari registration, a rental agreement registration system.

Step 8: Submit final documents and pay fees.

Upload the necessary paperwork, which includes the first approval, tenancy agreement, and other approvals if available.

A license fee is payable to the DED as per the applicable rates.

Step 9: Receive Your Mainland License:

After your application has been reviewed, and accepted, and fees have been paid, you will obtain your mainland license.

Additional Considerations

Here are a few more points to keep in mind:

If you are an investor from another country, look for immigration requirements that will allow you to set up a base in Dubai.

Learn the general and specific regulations and requirements that apply to the business activity.

It is advisable to seek the company formation services UAE of a business setup consultant to help in the process.

Conclusion

It is important for any business that has intentions of operating in the Emirate to apply for a mainland license in Dubai. If the above steps are followed and the requirements highlighted above are met, you can easily go through the process to obtain the authorisation to trade within the mainland of Dubai.

Do not forget to consult your legal advisor and do your homework to make sure that you follow all the rules and regulations and get the most out of your mainland license.

0 notes

Text

2024-09-20

Singapore

Singaporean man arrested in Thailand for drug trafficking deported back here

Homegrown bookstore & SingLit bastion Epigram Books to cease operations of its SAM bookshop next year in Jan

1st prosecution of "99-to-1" property purchase: mother & son charged with giving false info to IRAS - more of such scumbags need to be punished! ✊🏻

FBI arrests 20-year-old Singaporean man in US over $297m crypto heist - they should just execute him 'cos we don't want criminal scum like him coming back to our country!

4% interest floor rate on CPF Special, MediSave & Retirement accounts extended to end-2025

Society

Japanese schoolboy living in China stabbed to death - this is scumbag megalomaniac Xi Jinping's f***ing China, where nationalism ramped up 1000% via propaganda has caused dumb, brainwashed citizens to murder in the name of patriotism!!! 😡🖕🏻

Shopping

Singapore: ~110 people seen queueing outside Apple Store on Orchard Road at 6am this morning, ahead of iPhone 16’s launch - the 1st person in the queue said he'd taken leave from work just to queue for the phone (which he isn't even particularly a fan of!); he'd got there at 3am to “experience the queueing atmosphere” ...this guy's idiocy is stupefying, seriously 🫨🫨🫨

Business

Every member of 23andMe's board except the CEO just resigned in disgust

Finance

Who knew you could earn money from Listerine royalties?! - you heard me right!

Health

1 in 3 youth in Singapore reported very poor mental health, says IMH survey

Economy

Malaysia unveils zero tax for family offices in Forest City, in bid to revive Johor project - "the 2,800ha development, backed by Chinese developer Country Garden Holdings, was designated a special financial zone (SFZ) in August 2023 to boost foreign investment & economic growth in the area"

Environment

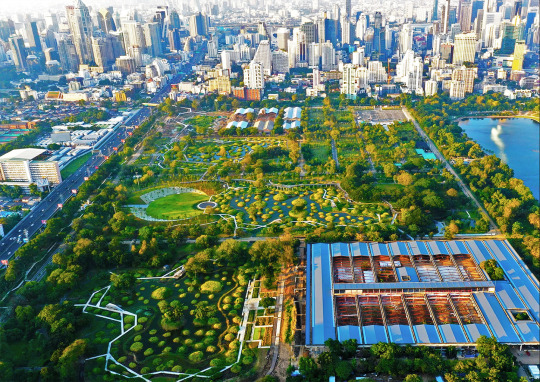

^ Bangkok turns to urban forests to beat worsening floods

Politics

Elon Musk got fooled into sharing Putin-backed propaganda meme - he needs to start using a fact-checker bot!

Travel

Singaporeans will soon need electronic travel authorisation (ETA) permit to visit Thailand - pilot phase will begin in December, with a full rollout by June next year; it is free of charge & mandatory for citizens of 93 countries who currently enjoy visa-free travel to Thailand for stays of up to 60 days for the purpose of tourism

0 notes